Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - WILLIAMS PARTNERS L.P. | d292771d8k.htm |

| EX-99.2 - UPDATED PART I, ITEM 2 - WILLIAMS PARTNERS L.P. | d292771dex992.htm |

Exhibit 99.1

| ITEM 1. | Business |

Unless the context otherwise requires, references in this report to the “Partnership,” “we,” “our,” “us” or like terms, when used in a historical context, refer to the financial results of Chesapeake Midstream Partners, L.L.C. from its inception on September 30, 2009 through the closing date of our initial public offering (“IPO”) on August 3, 2010 and to Chesapeake Midstream Partners, L.P. (NYSE: CHKM) and its subsidiaries thereafter. Our “predecessor” refers to Chesapeake Midstream Development, L.P., which held substantially all of our assets as well as other midstream assets prior to September 30, 2009. “Chesapeake” refers to Chesapeake Energy Corporation (NYSE: CHK) and, where context requires, its subsidiaries, and “GIP” refers to Global Infrastructure Partners – A, L.P., and affiliated funds managed by Global Infrastructure Management, LLC, and certain of their respective subsidiaries and affiliates. “Chesapeake Midstream Ventures” refers to Chesapeake Midstream Ventures, L.L.C., the sole member of our general partner. “Total”, when discussing the upstream joint venture with Chesapeake, refers to Total E&P USA, Inc., a wholly owned subsidiary of Total S.A. (NYSE: TOT, FP: FP), and when discussing our gas gathering agreement and related matters, refers to Total E&P USA, Inc. and Total Gas & Power North America, Inc., a wholly owned subsidiary of Total S.A.

General

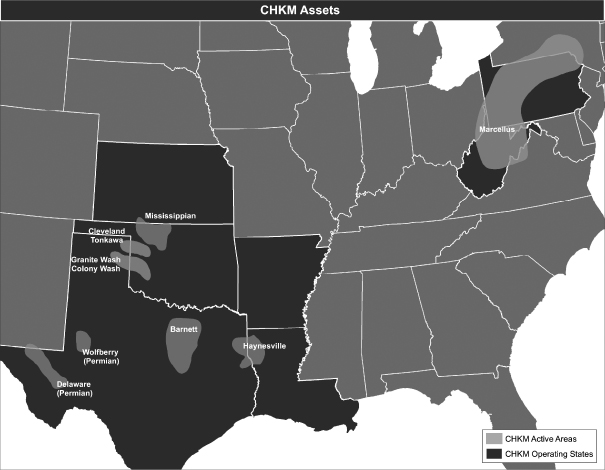

We are a growth-oriented publicly traded Delaware limited partnership formed by Chesapeake and GIP to own, operate, develop and acquire natural gas, natural gas liquids and oil gathering systems and other midstream energy assets. We are principally focused on natural gas gathering, the first segment of midstream energy infrastructure that connects natural gas produced at the wellhead to third-party takeaway pipelines. The following diagram illustrates our area of focus in the natural gas value chain:

We provide gathering, treating and compression services to Chesapeake, Total and other leading producers under long-term, fixed-fee contracts. Our gathering systems operate in our Barnett Shale region in north-central Texas, our Haynesville Shale region in northwest Louisiana, our Marcellus Shale region in Pennsylvania and West Virginia, and our Mid-Continent region which includes the Anadarko, Arkoma, Delaware and Permian Basins. We generate the majority of our operating income in our Barnett Shale region, where we service approximately 2,102 wells in the core of the prolific Barnett Shale. Our Springridge gathering system services approximately 213 wells in one of the core areas of the Haynesville Shale. In our Mid-Continent region, we have an enhanced focus on the unconventional resources located in the Colony Granite Wash and Texas Panhandle Granite Wash plays of the Anadarko Basin. In total, as of September 30, 2011, our systems consisted of approximately 3,511 miles of gathering pipelines, servicing approximately 4,799 natural gas wells. For the year ended December 31, 2010 and the nine months ended September 30, 2011, our assets gathered approximately 1.6 billion cubic feet (“Bcf”) and 2.1 Bcf of natural gas per day, respectively. On December 29, 2011, we acquired 100% of Appalachia Midstream Services, L.L.C. (“Appalachia Midstream”), which operates 100% of and owns an approximate average 47% interest in an integrated system of gas gathering assets in the Marcellus Shale. The Marcellus gathering systems service approximately 250 wells in Pennsylvania and West Virginia with gross throughput of approximately 1.0 Bcf of natural gas per day (approximately 470 million cubic feet (“Mmcf”) per day net to us) at the date of acquisition.

Our gas gathering systems primarily collect natural gas from unconventional resource plays, a growing source of U.S. natural gas supply that is generally characterized by low finding and development costs compared to conventional resource plays. These systems were historically operated by Chesapeake and are integral to Chesapeake’s operations in our Barnett Shale, Haynesville Shale, Marcellus Shale and Mid-Continent regions.

We generate substantially all of our revenues through long-term, fixed-fee natural gas gathering, treating and compression contracts that limit our direct commodity price exposure. We are party to (i) a 20-year gas gathering agreement with respect to the Barnett Shale and the Mid-Continent region with certain subsidiaries of Chesapeake that was entered into in connection with the creation of our predecessor in September 2009, (ii) a 20-year gas gathering agreement with respect to the Barnett Shale with Total that was entered into in connection with an upstream joint venture transaction between Chesapeake and Total E&P in January 2010, (iii) a 10-year gas gathering agreement with certain subsidiaries of Chesapeake that was entered into concurrent with the closing of our acquisition of the Springridge gas gathering system in December 2010 and (iv) through Appalachia Midstream, 15-year gas gathering agreements with certain subsidiaries of Chesapeake, Statoil ASA (“Statoil”), Anadarko Petroleum Corporation (“Anadarko”), Epsilon Energy Ltd. (“Epsilon”), Mitsui & Co. Ltd. (“Mitsui”) and Chief Oil & Gas LLC (“Chief”) that we acquired in connection with our acquisition of Appalachia Midstream in December 2011. Pursuant to these gas gathering agreements, we have been provided with extensive acreage dedications in our operating regions. These agreements generally contain the following terms:

| • | opportunity to connect natural gas drilling pads and wells of the counterparties of these agreements within our acreage dedications to our gathering systems in all of our regions; |

| • | minimum volume commitments for 10 years in our Barnett Shale region and for three years in our Haynesville Shale region, which mitigate throughput volume variability; |

| • | fee redetermination mechanisms, which are designed to support a return on invested capital and allow our gathering rates to be adjusted, subject to specified caps in certain cases, to account for variability in revenues, capital expenditures and compression and certain other expenses; and |

| • | price escalators in our Barnett Shale, Haynesville Shale and Mid-Continent regions, which annually increase our gathering rates. |

Acquisition of Appalachia Midstream Services, L.L.C.

On December 29, 2011, we acquired from Chesapeake Midstream Development, L.P. (“CMD”) and certain of its affiliates all of the issued and outstanding common units of Appalachia Midstream for total consideration, which is subject to a customary post-closing working capital adjustment, of $879 million, consisting of 9,791,605 common units and $600 million in cash that was financed with a draw on our revolving credit facility. Through the acquisition of Appalachia Midstream, we operate 100% of and own an approximate average 47% interest in an integrated system of gas gathering assets that consist of approximately 200 miles of gas gathering pipeline in the Marcellus Shale. The remaining 53% interest in these assets is owned primarily by Statoil, Anadarko, Epsilon and Mitsui. Gross throughput for these assets at the date of acquisition was approximately 1.0 Bcf per day. Appalachia Midstream operates the assets under 15-year fixed fee gathering agreements. The gathering agreements include significant acreage dedications and annual fee redeterminations. In addition, CMD has committed to pay us quarterly any shortfall between the actual EBITDA from these assets and specified quarterly targets, which targets add up to a total of $100 million in 2012 and $150 million in 2013.

Our Assets and Areas of Operation

Barnett Shale Region

General. Our gathering systems in our Barnett Shale region are primarily located in Tarrant, Johnson and Dallas counties in Texas in the Core and Tier 1 areas of the Barnett Shale and currently consist of 25 interconnected gathering systems and 855 miles of pipeline. The Core and Tier 1 areas are characterized by thicker natural gas bearing geological zones, which results in higher initial production rates. Typically, gas produced in Core and Tier 1 areas is characterized as “lean” and needs little to no treatment to remove contaminants.

Our assets in the Barnett region have been designed and developed to accommodate their urban setting in and around the greater Dallas/Fort Worth, Texas metropolitan area. Average throughput on our Barnett Shale gathering system for the nine months ended September 30, 2011, was 1.03 Bcf per day. We connect our gathering systems to receipt points that are either at the individual wellhead or at central receipt points into which production from multiple wells are gathered. Due to Chesapeake’s practice of drilling multiple wells on an individual drilling pad, a significant number of our receipt points in the Barnett Shale collect production from multiple producing wells. Our Barnett Shale system has pipeline diameters ranging from four-inch well connection lines to 24-inch major trunk lines and is connected to 102 compressor units providing a combined 156,260 horsepower of compression.

Delivery Points. Our Barnett Shale gathering system is connected to the following downstream transportation pipelines:

| • | Atmos Pipeline Texas—natural gas delivered into this pipeline system serves the greater Dallas/Fort Worth metropolitan area and south, east and west Texas markets at the Katy, Carthage and Waha hubs; |

| • | Energy Transfer Pipeline Texas—natural gas delivered into this pipeline system serves the greater Dallas/Fort Worth metropolitan area and southeastern and northeastern U.S. markets supplied by the Midcontinent Express Pipeline, Centerpoint CP Expansion Pipeline and Gulf South 42” Expansion Pipeline; and |

| • | Enterprise Texas Pipeline—natural gas delivered into this pipeline system serves the greater Dallas/Fort Worth metropolitan area and southeastern and northeastern U.S. markets supplied by the Gulf Crossing Pipeline. |

Haynesville Shale Region

General. Our Springridge gas gathering system in the Haynesville Shale region is primarily located in Caddo and DeSoto Parishes, Louisiana, in one of the core areas of the Haynesville Shale and currently consists of 254 miles of pipeline. The core areas are characterized by thicker natural gas bearing geological zones, which results in higher initial production rates. Haynesville Shale gas production is characterized as “lean” and typically needs to be treated to remove small amounts of carbon dioxide and hydrogen sulfide.

A portion of our assets in the Springridge gathering system have been designed and developed to accommodate their urban setting in and around the city of Shreveport, Louisiana. Average throughput on our Springridge gathering system for the nine-month period ended September 30, 2011 was 545 Mmcf per day. We connect our gathering systems to receipt points that are either at the individual wellhead or at central receipt points into which production from multiple wells is gathered. Chesapeake’s pad drilling concept is used extensively around the Springridge gathering system. Our Springridge gathering system has pipeline diameters ranging from four-inch well connection lines to a 24-inch major trunk line and is connected to seven compressor units providing a combined 21,970 horsepower of compression.

Delivery Points. Our Springridge gathering system is connected to the following downstream transportation pipelines:

| • | Centerpoint Energy Gas Transmission—natural gas delivered into this 42” diameter pipeline can be received at the Carthage, Texas and Perryville, Louisiana hubs and is connected to numerous interstate pipelines; |

| • | ETC Tiger Pipeline—natural gas delivered into this 42” diameter pipeline can also be received at the Carthage and Perryville hubs. ETC Tiger Pipeline provides deliveries to seven interstate pipelines and one intrastate pipeline for ultimate delivery to the Midwest and Northeast; and |

| • | Texas Gas Transmission Pipeline—natural gas delivered into this pipeline can move to on-system markets in the Midwest and to off-system markets in the Northeast via interconnections with third-party pipelines or it can be received at the Carthage hub in East Texas. |

Marcellus Shale Region

General. Through Appalachia Midstream, we operate 100% of and own an approximate average 47% interest in an integrated system of gas gathering assets that consist of approximately 200 miles of gathering pipeline in the Marcellus Shale region located in northern Pennsylvania, southwestern Pennsylvania and the northwestern panhandle of West Virginia, in one of the core areas of the Marcellus Shale. The core areas are characterized by thicker natural gas bearing geological zones, which results in higher initial production rates. Marcellus Shale gas production can be characterized as “lean” dry gas or wet gas depending on its location. In general, the gas in the northern Marcellus Shale is lean and typically requires little to no treatment to remove contaminants. Southern Marcellus Shale gas is wet and typically requires treatment and processing from third parties to remove natural gas liquids (“NGLs”) prior to delivery into the pipeline grid.

Gross throughput for these assets at the date of acquisition was approximately 1.0 Bcf per day. These gathering systems are connected to receipt points that are either at the individual wellhead or at central receipt points into which production from multiple wells are gathered.

Mid-Continent Region

Our Mid-Continent gathering systems extend across portions of Oklahoma, Texas (excluding the Barnett Shale), Arkansas (excluding the Fayetteville Shale) and Kansas. Included in our Mid-Continent region are three treating facilities located in Beckham and Grady Counties, Oklahoma, and Reeves County, Texas, that are designed to remove contaminants from the natural gas stream.

Anadarko Basin and Northwest Oklahoma

General. Our assets within the Anadarko Basin and Northwest Oklahoma region are located in northwestern Oklahoma and the northeastern portion of the Texas Panhandle and consist of approximately 1,501 miles of pipeline. Our Anadarko Basin and Northwest Oklahoma region gathering systems had an average throughput for the nine months ended September 30, 2011 of 375 Mmcf per day. These systems are connected to 61 compressor units providing a combined 55,994 horsepower of compression.

Within the Anadarko Basin, we are primarily focused on servicing Chesapeake’s production from the Colony Granite Wash and Texas Panhandle Granite Wash plays. Natural gas production from these areas of the Anadarko Basin typically contains a significant amount of NGLs and requires processing prior to delivery to end-markets. In addition, we operate an amine treater with sulfur removal capabilities at our Mayfield facility in Beckham County, Oklahoma. Our Mayfield gathering and treating system primarily gathers Deep Springer natural gas production and treats the natural gas to remove carbon dioxide and hydrogen sulfide to meet the quality specifications of downstream transportation pipelines.

Delivery Points. Our Anadarko Basin and Northwest Oklahoma systems are connected to a significant majority of the major transportation pipelines transporting natural gas out of the region, including pipelines owned by Enbridge and Atlas Pipelines, as well as local market pipelines such as those owned by Enogex. These pipelines provide access to Midwest and northeastern U.S. markets as well as intrastate markets.

Permian Basin

General. Our Permian Basin assets are located in west Texas and consist of approximately 331 miles of pipeline across the Permian and Delaware basins. Average throughput on our gathering systems for the nine months ended September 30, 2011, was 69 Mmcf per day. The systems have pipeline diameters ranging from four inches to 16 inches and are connected to 19 compressor units providing a combined 15,980 horsepower of compression.

Delivery Points. Our Permian Basin gathering systems are connected to pipelines in the area owned by Southern Union, Enterprise, West Texas Gas, CDP Midstream and Regency. Natural gas delivered into these transportation pipelines is re-delivered into the Waha hub and El Paso Gas Transmission. The Waha hub serves the Texas intrastate electric power plants and heating market, as well as the Houston Ship Channel chemical and refining markets. El Paso Gas Transmission serves western U.S. markets.

Other Mid-Continent Region

Our other Mid-Continent region assets consist of systems in the Ardmore Basin in Oklahoma, the Arkoma Basin in eastern Oklahoma and western Arkansas and the East Texas and Gulf Coast regions of Texas. The other Mid-Continent assets include approximately 570 miles of pipeline. These gathering systems are generally localized systems gathering specific production for re-delivery into established pipeline markets. Average throughput on these gathering systems for the nine months ended September 30, 2011 was 109 Mmcf per day. The systems have pipeline diameters ranging from four inches to 24 inches and are connected to 39 compressor units providing a combined 21,682 horsepower of compression.

General Trends

The recent natural gas price environment has resulted in lower drilling activity in dry gas generally, resulting in fewer new well connections and, in some cases, temporary curtailments of production throughout the areas in which we operate. Since 2010, we have observed a shift in drilling activity by Chesapeake and other producers from dry gas shale plays such as the Barnett Shale and Haynesville Shale to liquids-rich plays. We believe this trend is likely to continue for the foreseeable future. For example, Chesapeake previously announced its intention to increase operations in liquids-rich areas and, more recently, in response to historically low natural gas prices, Chesapeake announced that it is reducing dry gas drilling, completions, production and leasehold expenditures wherever feasible, including by operating fewer drilling rigs in the Barnett Shale, Haynesville Shale and Marcellus Shale regions. Decreases in production in these regions will generally be offset as our business model and contractual structure, such as minimum volume commitments and rate redeterminations, work to maintain our financial performance, although our ability to achieve near-term significant growth in those areas may be limited.

We believe this trend may present investment opportunities in our liquids-rich areas of operations, including the Mid-Continent region and an may present an opportunity for us to enter the market of processing NGLs and gathering and transporting oil as we believe those services fit well with our current business model.

A continued low gas price environment may result in further reductions in drilling activity or temporary curtailments of production. We have no control over this activity. In addition, further decline in commodity prices could affect production rates and the level of capital invested by Chesapeake and other producers in the exploration for and development of new natural gas reserves. Our success in connecting new wells to our systems is dependent on natural gas producers and shippers.

Competition

Given that substantially all of the natural gas gathered and transported through our systems is owned by Chesapeake, Total, other third-party producers and their working interest partners within our acreage dedications, we do not currently face significant competition for our natural gas volumes. In addition, Chesapeake and Total have dedicated all of their natural gas produced from existing and future wells located on lands within our acreage dedication in the Barnett Shale region, and Chesapeake has made a similar dedication in our Haynesville and Mid-Continent regions. Chesapeake and other third-party producers have provided long-term acreage dedications in the Marcellus Shale region.

In the future, we may face competition for Chesapeake’s production drilled outside of our acreage dedication and in attracting third-party volumes to our systems. Additionally, to the extent we make acquisitions from third parties we could face incremental competition. Competition for natural gas volumes is primarily based on reputation, commercial terms, reliability, service levels, location, available capacity, capital expenditures and fuel efficiencies. We currently anticipate that our competitors in each region would include:

| • | Barnett Shale—Energy Transfer Partners, Crosstex Energy, Crestwood Midstream Partners, Freedom Pipeline, Peregrine Pipeline, XTO Energy, EOG Resources, DFW Mid-Stream and Enbridge Energy Partners; |

| • | Haynesville Shale—TGGT Holdings, Enterprise Products Partners, Kinderhawk Field Services, CenterPoint Field Services, and Energy Transfer Partners; |

| • | Marcellus Shale—Williams Partners, Penn Virginia Resource Partners, Caiman Energy, MarkWest Energy Partners and Talisman Energy; and |

| • | Mid-Continent—Enogex, Atlas Pipeline Partners, Enbridge and DCP Midstream. |

Employees

At every level of our operations, our employees are critical to our success and committed to operational excellence. Our senior management team has impressive experience building, acquiring and managing midstream and other assets. Their focus is on optimizing our business and expanding operations. On an operations level, our supervisory and field personnel are empowered with the training, tools and confidence required to succeed in their jobs.

The officers of our general partner manage our operations and activities. As of September 30, 2011 (including the effect of the acquisition of Appalachia Midstream), our general partner and Chesapeake jointly employed approximately 434 people who operate our business pursuant to an employee secondment agreement between our general partner and Chesapeake and certain of Chesapeake’s affiliates and, with respect to our Chief Executive Officer, pursuant to a shared services agreement between our general partner and Chesapeake. None of these employees are covered by collective bargaining agreements and our general partner and Chesapeake consider their employee relations to be good.

Safety and Maintenance

We are subject to regulation by the Pipeline and Hazardous Materials Safety Administration (“PHMSA”) of the Department of Transportation (“DOT”) pursuant to the Natural Gas Pipeline Safety Act of 1968 (“NGPSA”) and the Pipeline Safety Improvement Act of 2002 (“PSIA”) which was reauthorized and amended by the Pipeline Inspection, Protection, Enforcement and Safety Act of 2006. The NGPSA regulates safety requirements in the design, construction, operation and maintenance of gas pipeline facilities, while the PSIA establishes mandatory inspections for all U.S. oil and natural gas transportation pipelines and some gathering lines in high-consequence areas. The PHMSA has developed regulations implementing the PSIA that require transportation pipeline operators to implement integrity management programs, including more frequent inspections and other measures to ensure pipeline safety in “high consequence areas,” such as high population areas, areas unusually sensitive to environmental damage and commercially navigable waterways.

We or the entities in which we own an interest inspect our pipelines regularly using equipment rented from third-party suppliers. Third parties also assist us in interpreting the results of the inspections.

States are largely preempted by federal law from regulating pipeline safety for interstate lines but most are certified by the DOT to assume responsibility for enforcing federal intrastate pipeline regulations and inspection of intrastate pipelines. In practice, because states can adopt stricter standards for intrastate pipelines than those imposed by the federal government for interstate lines, states vary considerably in their authority and capacity to address pipeline safety. We do not anticipate any significant difficulty in complying with applicable state laws and regulations. Our natural gas pipelines have continuous inspection and compliance programs designed to keep the facilities in compliance with pipeline safety and pollution control requirements.

In addition, we are subject to a number of federal and state laws and regulations, including the federal Occupational Safety and Health Act (“OSHA”) and comparable state statutes, the purposes of which are to protect the health and safety of workers, both generally and within the pipeline industry. In addition, the OSHA hazard communication standard, the Environmental Protection Agency (“EPA”) community right-to-know regulations under Title III of the federal Superfund Amendment and Reauthorization Act and comparable state statutes require that information be maintained concerning hazardous materials used or produced in our operations and that such information be provided to employees, state and local government authorities and citizens. We and the entities in which we own an interest are also subject to OSHA Process Safety Management regulations, which are designed to prevent or minimize the consequences of catastrophic releases of toxic, reactive, flammable or explosive chemicals. These regulations apply to any process which involves a chemical at or above the specified thresholds or any process which involves flammable liquid or gas, pressurized tanks, caverns and wells in excess of 10,000 pounds at various locations. Flammable liquids stored in atmospheric tanks below their normal boiling points without the benefit of chilling or refrigeration are exempt. We have an internal program of inspection designed to monitor and enforce compliance with worker safety requirements. We believe that we are in material compliance with all applicable laws and regulations relating to worker health and safety.

Regulation of Operations

Natural gas gathering and intrastate transportation facilities are exempt from the jurisdiction of the Federal Energy Regulatory Commission (“FERC”) under the Natural Gas Act (“NGA”). Although FERC has not made any formal determinations respecting any of our facilities, we believe that our natural gas pipelines and related facilities are engaged in exempt gathering and intrastate transportation and, therefore, are not subject to FERC jurisdiction.

FERC regulation affects our gathering and compression business generally. FERC’s policies and practices across the range of its natural gas regulatory activities, including, for example, its policies on open access transportation, market manipulation, ratemaking, capacity release and market transparency and market center promotion, directly and indirectly affect our gathering business. In addition, the distinction between FERC-regulated transmission facilities and federally unregulated gathering and intrastate transportation facilities is a fact-based determination made by FERC on a case by case basis; this distinction has also been the subject of regular litigation and change. The classification and regulation of our gathering and intrastate transportation facilities are subject to change based on future determinations by FERC, the courts or Congress.

Our natural gas gathering operations are subject to ratable take and common purchaser statutes in most of the states in which we operate. These statutes generally require our gathering pipelines to take natural gas without undue discrimination as to source of supply or producer. These statutes are designed to prohibit discrimination in favor of one producer over another producer or one source of supply over another source of supply. The regulations under these statutes can have the effect of imposing some restrictions on our ability as an owner of gathering facilities to decide with whom we contract to gather natural gas. The states in which we operate have adopted a complaint-based regulation of natural gas gathering activities, which allows natural gas producers and shippers to file complaints with state regulators in an effort to resolve grievances relating to gathering access and rate discrimination.

Environmental Matters

General

Our operation of pipelines, plants and other facilities for the gathering, treating and compressing of natural gas and other products is subject to stringent and complex federal, state and local laws and regulations relating to the protection of the environment. These laws and regulations can restrict or impact our business activities in many ways, such as:

| • | requiring the installation of pollution-control equipment or otherwise restricting the way we can handle or dispose of our wastes; |

| • | limiting or prohibiting construction activities in sensitive areas, such as wetlands, coastal regions or areas inhabited by endangered or threatened species; |

| • | requiring investigatory and remedial actions to limit pollution conditions caused by our operations or attributable to former operations; and |

| • | prohibiting the operations of facilities deemed to be in non-compliance with permits issued pursuant to such environmental laws and regulations. |

Failure to comply with these laws and regulations may trigger a variety of administrative, civil and criminal enforcement measures, including the assessment of monetary penalties, the imposition of remedial obligations, and the issuance of orders enjoining future operations or imposing additional compliance requirements. Certain environmental statutes impose strict, joint and several liability for costs required to clean up and restore sites where hazardous substances, hydrocarbons or wastes have been disposed or otherwise released. Moreover, it is not uncommon for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by the release of hazardous substances, hydrocarbons or other waste products into the environment.

The trend in environmental regulation is to place more restrictions and limitations on activities that may affect the environment. We try to anticipate future regulatory requirements that might be imposed and plan accordingly to remain in compliance with changing environmental laws and regulations and to minimize the costs of such compliance. We also actively participate in industry groups that help formulate recommendations for addressing existing or future regulations.

Below is a discussion of the material environmental laws and regulations that relate to our business. We believe that we are in substantial compliance with all of these environmental laws and regulations.

Hazardous Substances and Waste

Our operations are subject to environmental laws and regulations relating to the management and release of hazardous substances, solid and hazardous wastes, and petroleum hydrocarbons. These laws generally regulate the generation, storage, treatment, transportation and disposal of solid and hazardous waste and may impose strict, joint and several liability for the investigation and remediation of affected areas where hazardous substances may have been released or disposed. For instance, the Comprehensive Environmental Response, Compensation, and Liability Act (“CERCLA” or “Superfund law”) and comparable state laws impose liability, without regard to fault or the legality of the original conduct, on certain classes of persons that contributed to the release of a hazardous substance into the environment. These persons include current and prior owners or operators of the site where the release occurred and companies that disposed or arranged for the disposal of the hazardous substances found at the site. Under CERCLA, these persons may be subject to joint and several strict liability for the costs of cleaning up the hazardous substances that have been released into the environment, for damages to natural resources and for the costs of certain health studies. CERCLA also authorizes the EPA and, in some instances, third parties to act in response to threats to the public health or the environment and to seek to recover the costs they incur from the responsible classes of persons. It is not uncommon for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by hazardous substances or other pollutants released into the environment. Although natural gas is not classified as a hazardous substance under CERCLA, we may nonetheless handle hazardous substances within the meaning of CERCLA, or similar state statutes, in the course of our ordinary operations and, as a result, may be jointly and severally liable under CERCLA for all or part of the costs required to clean up sites at which these hazardous substances have been released into the environment.

We also generate solid wastes, including hazardous wastes, that are subject to the requirements of the Resource Conservation and Recovery Act (“RCRA”) and comparable state statutes. While RCRA regulates both solid and hazardous wastes, it imposes strict requirements relating to the generation, storage, treatment, transportation and disposal of hazardous wastes. Certain petroleum production wastes are excluded from RCRA’s hazardous waste regulations. However, it is possible that these wastes, which could include wastes currently generated during our operations, will in the future be designated as “hazardous wastes” and, therefore, be subject to more rigorous and costly disposal requirements. Any such changes in the laws and regulations could have a material adverse effect on our capital expenditures and operating expenses.

We currently own or lease, and our predecessor has in the past owned or leased, properties where hydrocarbons are being or have been handled for many years. Although we have utilized operating and disposal practices that were standard in the industry at the time, hydrocarbons or other wastes may have been disposed of or released on or under the properties owned or leased by us or on or under the other locations where these hydrocarbons and wastes have been transported for treatment or disposal. In addition, certain of these properties have been operated by third parties whose treatment and disposal or

release of hydrocarbons and other wastes was not under our control. These properties and the wastes disposed thereon may be subject to CERCLA, RCRA and analogous state laws. Under these laws, we could be required to remove or remediate previously disposed wastes (including wastes disposed of or released by prior owners or operators), to clean up contaminated property (including contaminated groundwater) or to perform remedial operations to prevent future contamination. We are not currently aware of any facts, events or conditions relating to such requirements that could materially impact our operations or financial condition.

Air Emissions

Our operations are subject to the federal Clean Air Act and comparable state laws and regulations. These laws and regulations regulate emissions of air pollutants from various industrial sources, including our compressor stations, and also impose various monitoring and reporting requirements. For example, the Texas Commission on Environmental Quality (“TCEQ”) has recently adopted new rules governing emissions of regulated pollutants from oil and natural gas facilities and continues to evaluate existing air regulations and proposed revisions to existing regulations as well as seek to promulgate new regulations that meet or exceed federal requirements. Such revised or new rules would establish new limits on emissions from some of our facilities as well as require implementation of best practices and/or technology and new monitoring and record keeping requirements. In addition, on July 28, 2011, the EPA published proposed New Source Performance Standards (“NSPS”) and National Emissions Standards for Hazardous Air Pollutants (“NESHAP”) that are expected to both amend existing NSPS and NESHAP standards for oil and gas facilities as well as create a new NSPS for oil and gas production, transmission and distribution facilities. Moreover, the federal Clean Air Act and analogous state laws and regulations may require that we obtain pre-approval for the construction or modification of certain projects or facilities expected to produce or significantly increase air emissions, obtain and strictly comply with air permits containing various emissions and operational limitations and utilize specific emission control technologies to limit emissions. Our failure to comply with these requirements could subject us to monetary penalties, injunctions, conditions or restrictions on operations and, potentially, criminal enforcement actions. We believe that we are in substantial compliance with these requirements. We may be required to incur certain capital expenditures in the future for air pollution control equipment in connection with obtaining and maintaining operating permits and approvals for air emissions.

Water Discharges

The Federal Water Pollution Control Act, or the Clean Water Act, and analogous state laws impose restrictions and strict controls regarding the discharge of pollutants into state waters as well as waters of the U.S. The discharge of pollutants into regulated waters is prohibited, except in accordance with the terms of a permit issued by the EPA or an analogous state agency. Spill prevention, control and countermeasure requirements of federal laws require appropriate containment berms and similar structures to help prevent the contamination of regulated waters in the event of a hydrocarbon tank spill, rupture or leak. In addition, the Clean Water Act and analogous state laws require individual permits or coverage under general permits for discharges of storm water runoff from certain types of facilities. These permits may require us to monitor and sample the storm water runoff from certain of our facilities. Some states also maintain groundwater protection programs that require permits for discharges or operations that may impact groundwater conditions. Federal and state regulatory agencies can impose administrative, civil and criminal penalties for non-compliance with discharge permits or other requirements of the Clean Water Act and analogous state laws and regulations. We believe that compliance with existing permits and compliance with foreseeable new permit requirements will not have a material adverse effect on our financial condition, results of operations or cash flow.

Hydraulic Fracturing

Hydraulic fracturing is an important and common practice that is used by our customers to stimulate production of hydrocarbons, particularly natural gas, from tight formations. The process involves the injection of water, sand and a small percentage of chemicals under pressure into the formation to fracture the surrounding rock and stimulate production. The process is regulated by state agencies, typically the state’s oil and gas commission. A number of federal agencies, including the EPA and the

U.S. Department of Energy, are analyzing, or have been requested to review, a variety of environmental issues associated with hydraulic fracturing. In addition, some states have adopted, and other states are considering adopting, regulations that could impose more stringent disclosure and/or well construction requirements on hydraulic fracturing operations. If new laws or regulations that significantly restrict hydraulic fracturing are adopted, such laws could make it more difficult or costly for our customers to perform fracturing to stimulate production from tight formations. Restrictions on hydraulic fracturing could also reduce the volume of natural gas that our customers produce, and could thereby adversely affect our revenues and results of operations. For further discussion, see “Risk Factors—Increased regulation of hydraulic fracturing could result in reductions or delays in natural gas production by our customers, which could adversely impact our revenues.”

Endangered Species

The Endangered Species Act, or ESA, restricts activities that may affect endangered or threatened species or their habitats. While some of our pipelines may be located in areas that are designated as habitats for endangered or threatened species, we believe that we are in substantial compliance with the ESA. However, the designation of previously unidentified endangered or threatened species could cause us to incur additional costs or become subject to operating restrictions or bans in the affected states.

Global Warming and Climate Change

In December 2009, the EPA determined that emissions of carbon dioxide, methane and other “greenhouse gases” present an endangerment to public health and the environment because emissions of such gases are, according to the EPA, contributing to warming of the earth’s atmosphere and other climatic changes. Based on these findings, the EPA has begun adopting and implementing regulations to restrict emissions of greenhouse gases under existing provisions of the federal Clean Air Act. The EPA recently adopted two sets of rules regulating greenhouse gas emissions under the Clean Air Act, one of which requires a reduction in emissions of greenhouse gases from motor vehicles and the other of which regulates emissions of greenhouse gases from certain large stationary sources, effective January 2, 2011. The EPA’s rules relating to emissions of greenhouse gases from large stationary sources of emissions are currently subject to a number of legal challenges, but the federal courts have thus far declined to issue any injunctions to prevent EPA from implementing, or requiring state environmental agencies to implement, the rules. With regard to the monitoring and reporting of greenhouse gases, on November 30, 2010, the EPA published a final rule expanding its existing greenhouse gas emissions reporting rule published in October 2009 to include natural gas processing, transmission, storage, and distribution activities, which may include certain of our operations, beginning in 2012 for emissions occurring in 2011. In addition, the United States Congress has from time to time considered adopting legislation to reduce emissions of greenhouse gases and some states, primarily outside of our areas of operations, have already taken legal measures to reduce emissions of greenhouse gases.

The adoption of legislation or regulatory programs to reduce emissions of greenhouse gases could require us to incur increased operating costs, such as costs to purchase and operate emissions control systems, to acquire emissions allowances or comply with new regulatory or reporting requirements. Any such legislation or regulatory programs could also increase the cost of consuming, and thereby reduce demand for, the natural gas we gather, treat and transport. Consequently, legislation and regulatory programs to reduce emissions of greenhouse gases could have an adverse effect on our business, financial condition and results of operations.

Title to Properties and Rights-of-Way

Our real property falls into two categories: (i) parcels that we own in fee and (ii) parcels in which our interest derives from leases, easements, rights-of-way, permits or licenses from landowners or governmental authorities, permitting the use of such land for our operations. Portions of the land on which our pipelines and facilities are located are owned by us in fee title, and we believe that we have satisfactory title to these lands. The remainder of the land on which our pipelines and facilities are located are held by us pursuant to surface leases between us, as lessee, and the fee owner of the lands, as

lessors. We, or our predecessor, have leased or owned much of these lands for many years without any material challenge known to us relating to the title to the land upon which the assets are located, and we believe that we have satisfactory leasehold estates or fee ownership to such lands. We have no knowledge of any challenge to the underlying fee title of any material lease, easement, right-of-way, permit or license held by us or to our title to any material lease, easement, right-of-way, permit or lease, and we believe that we have satisfactory title to all of our material leases, easements, rights-of-way, permits and licenses.

| ITEM 1A. | Risk Factors |

Risks Related to Our Business

We are dependent on Chesapeake for a substantial majority of our revenues. Therefore, we are indirectly subject to the business risks of Chesapeake. We have no control over Chesapeake’s business decisions and operations, and Chesapeake is under no obligation to adopt a business strategy that favors us.

Historically, we have provided substantially all of our natural gas gathering, treating and compression services to Chesapeake and its working interest partners. For the nine months ended September 30, 2011, Chesapeake and its working interest partners accounted for approximately 84.3 percent of the natural gas volumes on our gathering systems and 83.6 percent of our revenues. We expect to derive a substantial majority of our revenues from Chesapeake for the foreseeable future. Therefore, any event, whether in our area of operations or otherwise, that adversely affects Chesapeake’s production, financial condition, leverage, results of operations or cash flows may adversely affect our ability to sustain or increase cash distributions to our unitholders. Accordingly, we are indirectly subject to the business risks of Chesapeake, some of which are the following:

| • | the volatility of natural gas and oil prices, which could have a negative effect on the value of its oil and natural gas properties, its drilling programs or its ability to finance its operations; |

| • | the availability of capital on an economic basis to fund its exploration and development activities; |

| • | its ability to replace reserves, sustain production and begin production on certain leases that may otherwise expire; |

| • | uncertainties inherent in estimating quantities of natural gas and oil reserves and projecting future rates of production; |

| • | its drilling and operating risks, including potential environmental liabilities; |

| • | transportation capacity constraints and interruptions; |

| • | adverse effects of governmental and environmental regulation; and |

| • | losses from pending or future litigation. |

If Chesapeake, Total or other third-party producers do not increase the volumes of natural gas they provide to our gathering systems, our growth strategy and ability to increase cash distributions to our unitholders may be adversely affected. Chesapeake has recently announced plans to reduce drilling in certain of our areas of operation.

Our ability to increase the throughput on our gathering systems will be substantially dependent on receiving increased volumes from Chesapeake, Total and other third-party producers. Other than the scheduled increases in the minimum volume commitments provided for in our gas gathering agreements with Chesapeake and Total, our customers are not obligated to provide additional volumes to our

systems, and they may determine in the future that drilling activities in areas outside of our current areas of operation are strategically more attractive to them. For example, Chesapeake previously announced its intention to increase operations in liquids-rich areas and, more recently, in response to historically low natural gas prices, Chesapeake announced that it is reducing dry gas drilling, completions, production and leasehold expenditures wherever feasible, including by operating fewer drilling rigs in the Barnett Shale, Haynesville Shale and Marcellus Shale regions. A reduction in the natural gas volumes supplied by Chesapeake, Total or other third-party producers could result in reduced throughput on our systems and adversely impact our ability to grow our operations and increase cash distributions to our unitholders.

We may not have sufficient cash from operations following the establishment of cash reserves and payment of fees and expenses, including cost reimbursements to our general partner and its affiliates, to enable us to pay the minimum quarterly distribution to our unitholders.

We may not have sufficient available cash from operating surplus each quarter to enable us to pay the minimum quarterly distribution on each of our common units, subordinated units and the two percent general partner interest outstanding. The amount of cash we can distribute on our units principally depends upon the amount of cash we generate from our operations, which will fluctuate from quarter to quarter based on, among other things:

| • | the volume of natural gas we gather, treat and compress; |

| • | the level of production of, the demand for, and indirectly, the price of natural gas; |

| • | the level of our operating and general and administrative costs; |

| • | regulatory action affecting the supply of or demand for natural gas, our operations, the rates we can charge, how we contract for services, our existing contracts, our operating costs or our operating flexibility; and |

| • | prevailing economic conditions. |

In addition, the actual amount of cash we will have available for distribution will depend on other factors, some of which are beyond our control, including:

| • | the level of capital expenditures we make, including capital expenditures for connecting new operated drilling pads or new operated wells of Chesapeake, Total and other third-party producers in our acreage dedications as required by our gas gathering agreements; |

| • | the cost of acquisitions, if any; |

| • | our debt service requirements and other liabilities; |

| • | fluctuations in our working capital needs; |

| • | our ability to borrow funds and access capital markets; |

| • | restrictions contained in our debt agreements; |

| • | the amount of cash reserves established by our general partner; and |

| • | other business risks affecting our cash levels. |

The amount of cash available for distribution will also be reduced by the amount we reimburse Chesapeake for its provision of certain general and administrative services and any additional services we may request from Chesapeake, each pursuant to our services agreement with Chesapeake; the costs and expenses of employees seconded to us pursuant to the employee secondment agreement; and

certain costs and expenses incurred in connection with the services of Mr. Stice as the chief executive officer of our general partner pursuant to the shared services agreement. Other than the volumetric cap on general and administrative expenses included in the services agreement, our reimbursement obligations are uncapped. In addition, we will reimburse our general partner and its affiliates for all expenses they incur on our behalf. Under our partnership agreement, our general partner determines in good faith the amount of these expenses.

Chesapeake’s level of indebtedness could adversely affect our ability to grow our business, our ability to make cash distributions to our unitholders and our credit ratings and profile.

Chesapeake must devote a portion of its cash flows from operating activities to service its indebtedness, and such cash flows are therefore not available for further development activities, which may reduce the volumes Chesapeake delivers to our gathering systems. Furthermore, a higher level of indebtedness at Chesapeake increases the risk that it may default on its obligations, including under its gas gathering agreements with us. Such a default could occur after the conversion of the subordinated units as a result of our general partner’s ability, for purposes of testing whether the subordination period has ended, to include as “earned” in a particular quarter its prorated estimates of shortfall payments to be earned by the end of the then current calendar year under the minimum volume commitments contained in certain of our gas gathering agreements. As of September 30, 2011, Chesapeake had long-term indebtedness of approximately $11.8 billion, with $3.236 billion of outstanding borrowings drawn under its $4.0 billion revolving credit facility and $327 million of outstanding borrowings drawn under its $600 million midstream revolving credit facility. The covenants contained in the agreements governing Chesapeake’s outstanding and future indebtedness may limit its ability to borrow additional funds for development and make certain investments, which also may reduce the volumes Chesapeake delivers to our gathering systems.

Chesapeake’s debt ratings for its senior notes are currently below investment grade. If these ratings are lowered in the future, the interest rate and fees Chesapeake pays on its revolving credit facilities will increase. Credit rating agencies such as Standard & Poor’s and Moody’s will likely consider Chesapeake’s debt ratings when reviewing ours because of Chesapeake’s ownership interest in us, the significant commercial relationships between Chesapeake and us, and our reliance on Chesapeake for a substantial majority of our revenues. If one or more credit rating agencies were to downgrade the outstanding indebtedness of Chesapeake, we could experience an increase in our borrowing costs or difficulty accessing the capital markets. Such a development could adversely affect our ability to grow our business and to make cash distributions to our unitholders.

Our general partner may guarantee or pledge any or all of its assets (other than its general partner interest, except as permitted by the partnership agreement) to secure the indebtedness of any of its affiliates. If our general partner were required to honor its guarantee or if lenders foreclosed on our general partner’s assets, the ability of our general partner to manage our business might be adversely affected. If our general partner were unable to meet any obligations to such lenders, it might be required to file for bankruptcy, which would cause our dissolution under our partnership agreement and which might have other adverse effects.

In addition to Chesapeake, we are dependent on Total and other third-party producers for a significant amount of the natural gas that we gather, treat and compress. A material reduction in Total’s or one or more other third-party producers’ production gathered, treated or compressed by us may result in a material decline in our revenues and cash available for distribution.

We rely on Total and other third-party producers such as Statoil, Anadarko, Epsilon, Mitsui and Chief for a significant amount of the natural gas that we gather, treat and compress. These customers may suffer a decrease in production volumes in the areas serviced by us. We are also subject to the risk that one or more of these customers default on its obligations under its gas gathering agreement with us. Not all of our counterparties under our gas gathering agreements are rated by credit rating agencies. Accordingly, this risk may be more difficult to evaluate than it would be with a rated contract counterparty. A loss of a significant portion of the natural gas volumes supplied by Total or one or more other third-party producers, or any nonpayment or late payment by Total or one more other third-party producers of our fees, could result in a material decline in our revenues and our cash available for distribution.

Because of the natural decline in production from existing wells in our areas of operation, our success depends on our ability to obtain new sources of natural gas, which is dependent on factors beyond our control. Any decrease in the volumes of natural gas that we gather could adversely affect our business and operating results.

The volumes that support our business are dependent on the level of production from natural gas wells connected to our gathering systems, the production from which may be less than we expect and will naturally decline over time. As a result, our cash flows associated with these wells will also decline over time. In order to maintain or increase throughput levels on our gathering systems, we must obtain new sources of natural gas. The primary factors affecting our ability to obtain non-dedicated sources of natural gas include (i) the level of successful drilling activity near our systems and (ii) our ability to compete for volumes from successful new wells.

We have no control over the level of drilling activity in our areas of operation, the amount of reserves associated with wells connected to our gathering systems or the rate at which production from a well declines. In addition, we have no control over Chesapeake, Total or other third-party producers and their drilling or production decisions, which are affected by, among other things, the availability and cost of capital, prevailing and projected energy prices, demand for hydrocarbons, relative pricing of oil and natural gas, levels of reserves, geological considerations, environmental or other governmental regulations, the availability of drilling permits, the availability of drilling rigs, and other production and development costs.

Fluctuations in energy prices can also greatly affect the development of new natural gas reserves. In general terms, the prices of natural gas, oil and other hydrocarbon products fluctuate in response to changes in supply and demand, market uncertainty and a variety of additional factors that are beyond our control. These factors include worldwide economic conditions; worldwide political conditions, such as the recent instability in Africa and the Middle East; weather conditions and seasonal trends; the levels of domestic production and consumer demand; the availability of imported liquified natural gas (“LNG”); the availability of transportation systems with adequate capacity; the volatility and uncertainty of regional pricing differentials such as in the Mid-Continent region; the price and availability of alternative fuels; the effect of energy conservation measures; the nature and extent of governmental regulation and taxation; and the anticipated future prices of natural gas, LNG and other commodities. Declines in natural gas prices could have a negative impact on exploration, development and production activity and, if sustained, could lead to a material decrease in such activity. Sustained reductions in exploration or production activity in our areas of operation would lead to reduced utilization of our gathering and treating assets. Because of these factors, even if new natural gas reserves are known to exist in areas served by our assets, producers may choose not to develop those reserves. If reductions in drilling activity result in our inability to maintain levels of throughput, it could reduce our revenue and impair our ability to make cash distributions to our unitholders.

In addition, it may be more difficult to maintain or increase the current volumes on our gathering systems in unconventional resource plays, as the basins in those plays generally have higher initial production rates and steeper production decline curves than wells in more conventional basins. Accordingly, volumes on our systems serving unconventional resource plays may need to be replaced at a faster rate to maintain or grow the current volumes than may be the case in other regions of production. In addition to significant capital expenditures to support growth, the steeper production decline curves associated with unconventional resource plays may require us to estimate higher maintenance capital expenditures over time, which will reduce our cash available for distribution from operating surplus.

If one of our gas gathering agreements were to be terminated by a customer as a result of our failure to perform certain obligations under the agreement, and we were unable to secure comparable alternative arrangements, our financial condition, results of operations, cash flows and ability to make cash distributions to our unitholders would be adversely affected.

Our gas gathering agreements are terminable if we fail to perform any of our material obligations and fail to correct such non-performance within specified periods, although under certain of our gas gathering agreements if our failure to perform relates to only one or more facilities or gathering systems, such agreement is terminable only as to such facilities or systems. Additionally, if a gas gathering agreement is terminated as to only a particular Barnett Shale gathering system, the minimum volume commitment may be reduced for gas volumes that would have been gathered on the terminated gathering system. After the termination of a gas gathering agreement, a customer might not continue to contract with us to provide gathering services, the terms of any renegotiated agreements may not be as favorable as our existing agreements, and we may not be able to enter into comparable alternative arrangements with third parties. To the extent a customer terminates a gas gathering agreement or there is a reduction in our minimum volume commitments, our financial condition, results of operations, cash flows and ability to make cash distributions to our unitholders may be adversely affected.

Certain of the provisions contained in our gas gathering agreements may not operate as intended, including the volumetric-based cap associated with fuel, lost and unaccounted for gas, which could subject us to direct commodity price risk and adversely affect our financial condition, results of operations, cash flows and ability to make cash distributions to our unitholders.

Our gas gathering agreements contain provisions relating to, among other items, periodic fee redeterminations, changes in laws affecting our operations and fuel, lost and unaccounted for gas. These and other provisions of our gas gathering agreements might not operate as intended.

The fee redetermination and other provisions of our gas gathering agreements are intended to support the stability of our cash flows and were designed with the goal of supporting a return on our invested capital, which is not equivalent to ensuring that our business will generate a particular amount of cash flow. Our fee redetermination provisions do not take into consideration all expenses and other variables, including certain operating expenditures, that would affect our return on invested capital. In addition, our gathering rates may be adjusted upward or downward following a fee redetermination, subject to specified caps in certain cases. The change in law provisions contained in our gas gathering agreements are designed to provide for our reimbursement by customers of certain taxes, fees, assessments and other charges that we may incur as a result of changes in law. These change in law provisions may not cover all legal or regulatory changes that could have an adverse economic impact on our operations. We have also agreed with our customers on one million British thermal unit (“MMBtu”) based caps on fuel and lost and unaccounted for gas on certain of our systems. If we exceed a permitted cap in any covered period, we may incur significant expenses to replace the natural gas used as fuel, lost or unaccounted for in excess of such cap based on then current natural gas prices. Accordingly, this replacement obligation will subject us to direct commodity price risk.

If these or other provisions of our gas gathering agreements do not operate as intended, our financial condition, results of operations, cash flows and ability to make cash distributions to our unitholders could be adversely affected.

We do not obtain independent evaluations of natural gas reserves connected to our gathering systems; therefore, in the future, volumes of natural gas on our systems could be less than we currently anticipate.

We do not obtain independent evaluations of natural gas reserves connected to our systems. Accordingly, we do not have independent estimates of total reserves dedicated to our systems or the anticipated life of such reserves. Notwithstanding the contractual protections in certain of our gas gathering agreements, including minimum volume commitments in our Barnett Shale region (with respect to Chesapeake and Total), and Haynesville Shale region (with respect to Chesapeake), and fee redetermination provisions, if the total reserves or estimated life of the reserves connected to our gathering systems are less than we anticipate and we are unable to secure additional sources of natural gas, it could have a material adverse effect on our business, results of operations, financial condition and our ability to make cash distributions to our unitholders.

We are generally required to make capital expenditures under our gas gathering agreements. If we are unable to obtain needed capital or financing on satisfactory terms to fund required capital expenditures or capital expenditures to otherwise expand our asset base, our ability to grow cash distributions may be diminished or our financial leverage could increase.

Under our gas gathering agreements, upon the request of any of our customers, we are generally required to connect new operated drilling pads and new operated wells in our Barnett Shale and Haynesville Shale regions during the respective minimum volume commitment periods, and with respect to our Mid-Continent region prior to June 30, 2019, to use commercially reasonable efforts to do the same. In the Marcellus Shale region, we generally have the option to connect new operated drilling pads and new operated wells, but we may be required to connect by the customer under certain circumstances. In addition, in order to increase our overall asset base, we will need to make significant expansion capital expenditures in the future. If we do not make sufficient or effective expansion capital expenditures, including such new drilling pad and new well connections, we will be unable to expand our business operations and will be unable to raise the level of our future cash distributions. If we are delayed in making a connection to an operated drilling pad or well, Chesapeake or Total in the Barnett Shale acreage dedication or Chesapeake in the Haynesville Shale acreage dedication, as its sole remedy for such delayed connection, would be entitled to a delay in the minimum volume obligation for gas volumes that would have been produced from the delayed connections. Any delay in the minimum volume obligations for drilling pad or well connections could reduce our revenues under the gas gathering agreements and our cash distributions.

To the extent that our cash from operations is insufficient to fund our expansion capital expenditures, we may be required to incur borrowings or raise capital through public or private debt or equity offerings. Our ability to obtain bank financing or to access the capital markets may be limited by our financial condition at the time of any such financing or offering and by the covenants in our existing debt agreements, as well as by general economic and capital market conditions and contingencies and uncertainties that are beyond our control. Even if we are successful in obtaining the necessary funds, the terms of such financings could limit our ability to pay distributions to our unitholders. In addition, incurring additional debt may significantly increase our interest expense and financial leverage, and issuing additional common units may result in significant unitholder dilution and increase the aggregate amount of cash required to maintain the then-current distribution rate, which could materially decrease our ability to pay distributions at the then-current distribution rate.

We are required to deduct estimated maintenance capital expenditures from operating surplus, which may result in less cash available for distribution to unitholders than if actual maintenance capital expenditures were deducted.

Our partnership agreement requires us to deduct estimated, rather than actual, maintenance capital expenditures from operating surplus. The amount of estimated maintenance capital expenditures deducted from operating surplus will be subject to review and change by our conflicts committee at least once a year. In years when our estimated maintenance capital expenditures are higher than actual maintenance capital expenditures, the amount of cash available for distribution to unitholders will be lower than if actual maintenance capital expenditures were deducted from operating surplus. If we underestimate the appropriate level of estimated maintenance capital expenditures, we may have less cash available for distribution in future periods when actual capital expenditures begin to exceed our previous estimates. Over time, if we do not set aside sufficient cash reserves or have available sufficient sources of financing and make sufficient expenditures to maintain our asset base, we will be unable to pay distributions at the anticipated level and could be required to reduce our distributions.

We conduct certain operations through joint ventures that may limit our operational flexibility.

Our operations in the Marcellus Shale region are conducted through joint venture arrangements, and we may enter additional joint ventures in the future. In a joint venture arrangement, we have less operational flexibility, as actions must be taken in accordance with the applicable governing provisions of the joint venture. In certain cases:

| • | we have limited ability to influence or control certain day to day activities affecting the operations; |

| • | we cannot control the amount of capital expenditures that we are required to fund with respect to these operations; |

| • | we are dependent on third parties to fund their required share of capital expenditures; |

| • | we may be subject to restrictions or limitations on our ability to sell or transfer our interests in the jointly owned assets; and |

| • | we may be forced to offer rights of participation to other joint venture participants in the area of mutual interest. |

In addition, our joint venture participants may have obligations that are important to the success of the joint venture, such as the obligation to pay substantial carried costs pertaining to the joint venture and to pay their share of capital and other costs of the joint venture. The performance and ability of the third parties to satisfy their obligations under joint venture arrangements is outside our control. If these parties do not satisfy their obligations under these arrangements, our business may be adversely affected. Our joint venture partners may be in a position to take actions contrary to our instructions or requests or contrary to our policies or objectives, and disputes between us and our joint venture partners may result in delays, litigation or operational impasses. The risks described above or the failure to continue our joint ventures or to resolve disagreements with our joint venture partners could adversely affect our ability to conduct our Marcellus Shale operations or any other business that is the subject of a joint venture, which could in turn negatively affect our financial condition and results of operations.

Our industry is highly competitive, and increased competitive pressure could adversely affect our ability to execute our growth strategy.

We compete with similar enterprises in our areas of operation other than with respect to natural gas production dedicated to us pursuant to our gas gathering agreements with Chesapeake, Total and other third-party producers. Our competitors may expand or construct gathering systems and associated infrastructure that would create additional competition for the services we provide to our customers. Our ability to renew or replace existing contracts with our customers at rates sufficient to maintain current revenues and cash flow could be adversely affected by the activities of our competitors and our customers. All of these competitive pressures could have a material adverse effect on our business, results of operations, financial condition and ability to make cash distributions to our unitholders.

Part of our growth strategy is to attract volumes to our systems from unaffiliated third parties over time. However, we have historically provided gathering and related services to unaffiliated third parties on only a limited basis, and we may not be able to attract any material third-party volumes to our systems. Our efforts to attract new unaffiliated customers may be adversely affected by our need to prioritize allocating capital expenditures towards connecting new operated drilling pads and new operated wells for Chesapeake, Total and other third-party producers as well as our desire to provide our services pursuant to fixed-fee contracts. Our potential customers may prefer to obtain services under other forms of contractual arrangements pursuant to which we would be required to assume some direct commodity price exposure. In addition, we will need to establish a reputation with our potential customer base for providing high quality service in order to successfully attract material volumes from unaffiliated third parties.

If third-party pipelines or other facilities interconnected to our gathering systems become partially or fully unavailable, or if the volumes we gather do not meet the natural gas quality requirements of such pipelines or facilities, our revenues and cash available for distribution could be adversely affected.

Our natural gas gathering systems connect to other pipelines or facilities, the majority of which are owned by third parties. The continuing operation of such third-party pipelines or facilities is not within our control. These pipelines and other facilities may become unavailable because of testing, turnarounds, line repair, reduced operating pressure, lack of operating capacity, curtailments of receipt or deliveries due to insufficient capacity or for any other reason. If any of these pipelines or facilities become unable to transport natural gas, or if the volumes we gather or transport do not meet the natural gas quality requirements of such pipelines or facilities, our revenues and cash available for distribution could be adversely affected.

Our construction of new assets may not result in revenue increases and will be subject to regulatory, environmental, political, legal and economic risks, which could adversely affect our results of operations and financial condition.

One of the ways we intend to grow our business is through the construction of new midstream assets. The construction of additions or modifications to our existing systems and the construction of new midstream assets involve numerous regulatory, environmental, political, legal and economic uncertainties that are beyond our control. If we undertake these projects, they may not be completed on schedule, at the budgeted cost, or at all. Moreover, our revenues may not increase immediately upon the expenditure of funds on a particular project. For instance, if we expand one or more of our gathering systems, the construction may occur over an extended period of time, yet we will not receive any material increases in revenues until the project is completed. Moreover, we could construct facilities to capture anticipated future growth in production in a region in which such growth does not materialize. As a result, new facilities may not be able to attract enough throughput to achieve our expected investment return, which could adversely affect our results of operations and financial condition. In addition, the construction of additions to our existing gathering assets may require us to obtain new rights-of-way. We may be unable to obtain such rights-of-way and may, therefore, be unable to connect new natural gas volumes to our systems or capitalize on other attractive expansion opportunities. Additionally, it may become more expensive for us to obtain new rights-of-way or to renew existing rights-of-way. If the cost of renewing or obtaining new rights-of-way increases, our cash flows could be adversely affected.

If we are unable to make acquisitions on economically acceptable terms from Chesapeake or third parties, our future growth would be limited, and any acquisitions we make may reduce, rather than increase, our cash generated from operations on a per unit basis. We may fail to successfully integrate the Appalachia Midstream business with our existing business in a timely manner, which could have a material adverse effect on our business, financial condition, results of operations or cash flows, or fail to realize all of the expected benefits of the acquisition, which could negatively impact our future results of operations.

Our ability to grow depends, in part, on our ability to make acquisitions that increase our cash generated from operations on a per unit basis. The acquisition component of our strategy is based, in large part, on our expectation of ongoing divestitures of midstream energy assets by industry participants, including Chesapeake. A material decrease in such divestitures would limit our opportunities for future acquisitions and could adversely affect our ability to grow our operations and increase cash distributions to our unitholders. If we are unable to make such accretive acquisitions from Chesapeake or third parties, either because we are (i) unable to identify attractive acquisition candidates or negotiate acceptable purchase contracts, (ii) unable to obtain financing for these acquisitions on economically acceptable terms or (iii) outbid by competitors, then our future growth and ability to increase distributions will be limited. Furthermore, even if we complete acquisitions that we believe will be accretive, these acquisitions may nevertheless result in a decrease in the cash generated from operations on a per unit basis. If we consummate any future acquisitions, our capitalization and results of operations may change significantly.

Any acquisition involves potential risks, including, among other things:

| • | mistaken assumptions about volumes, revenues and costs, including synergies; |

| • | an inability to secure adequate customer commitments to use the acquired systems or facilities; |

| • | an inability to successfully integrate the assets or businesses we acquire; |

| • | the assumption of unknown liabilities; |

| • | limitations on rights to indemnity from the seller; |

| • | mistaken assumptions about the overall costs of equity or debt; |

| • | the diversion of management’s and employees’ attention from other business concerns; |

| • | operating a larger combined organization and adding operations; |