Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - STERLING BANCORP | d284397d8k.htm |

| EX-99.1 - PRESS RELEASE DATED JANUARY 18, 2012 - STERLING BANCORP | d284397dex991.htm |

Strategic Growth Initiative in NYC:

Acquisition of Gotham Bank of New York

Investor Presentation

Exhibit 99.2

January 18, 2012 |

Disclaimer

We make forward-looking statements in this presentation including, but not

limited to, statements related to the price, timing and strategic and

financial benefits of the pending transaction with Gotham Bank, as well as future expense savings, future

synergies, and other future financial or business performance, conditions,

strategies, expectations or goals. All statements that are not

descriptions of historical facts are forward-looking statements, based on management’s estimates, assumptions

and projections that are subject to risks and uncertainties. These statements

can generally be identified by the use of forward-looking terminology

such as “believes,” “expects,”

“intends,”

“may,”

“will,”

“should,”

or “anticipates”

or similar

terminology.

Actual results could differ materially from those currently anticipated due to a

number of factors, including among other things: uncertainties as to

whether or when our anticipated Gotham Bank acquisition will be consummated; Provident

Bank’s success in implementing its strategic, financial and operational

initiatives and in successfully executing the Gotham Bank acquisition,

including the ability to timely and fully realize contemplated cost savings and revenues, extent of customer

retention and generation, and difficulties in integrating operations within the

periods, to the degree and at the cost anticipated; costs and availability

of financing on favorable terms and future capital needs; and uncertainties associated with

regulatory policies and approvals.

There are a number of additional important factors described in documents filed by

the Provident New York Bancorp with the Securities and Exchange Commission

and other factors that could cause our actual results to differ materially from those

contemplated by such forward-looking statements. We undertake no obligation to

publicly release the results of any revisions to those forward-looking

statements which may be made to reflect events or circumstances after the date of this

release or to reflect the occurrence of unanticipated events. You should not place

undue reliance on our forward-looking statements, which apply only as of

the date of this presentation. 1 |

Transaction Overview

The acquisition of Gotham Bank of New York provides a strategic expansion into the

metro New York City market and provides a strong platform to grow our middle

market business through both organic growth and M&A opportunities.

Gotham Bank is a one branch business bank in NYC with $169 million of loans and

$335 million of deposits (as of September 30, 2011). Gotham Bank is

conservatively managed with strong credit quality.

Initiates the new Provident strategy in NYC in conjunction with the hiring of David

Bagatelle and the deployment of middle-market banking teams.

Platform includes a core asset and deposit base, a long-term

client

base,

advantageous

location

in

midtown

Manhattan

and

an

initial

legacy

client

relationship team.

Provides

access

to

the

lucrative

NYC

market

and

the

potential

to

leverage

existing

clients

and

gain

market positioning.

Attractive transaction economics: immediately accretive to earnings per share,

limited dilution to tangible book value, earnback in 3 years and strong pro

forma capital levels to support the growth strategy.

Good fit with the long term overall strategic plans of Provident.

2 |

Transaction Pricing & Structure

Merger consideration: 125% of adjusted tangible net worth near closing. As of

9/30/11, tangible net worth at Gotham Bank was $31.5 million.

Core

deposit

premium

estimated

to

be

approximately

3.3%

based

on

forecasted

pro

forma

numbers

at closing.

100% cash consideration.

Seller stock options: settled in cash to the extent unexercised.

Seller cash dividends: payable in ordinary course of business.

Termination fee payable by Gotham Bank: $2 million.

Anticipated Closing Date: Third Quarter.

3 |

Transaction Economics

Immediately accretive to earnings per share, excluding one-time transaction

costs. Tangible book value dilution of 5% at closing. Pro forma TBV

dilution earned back in 3 years versus Provident’s estimated standalone

TBV. Targeted pro forma capital level greater than 8% (TCE / TA) at

closing. Expected cost savings in excess of 40%. Ability to leverage

expense base as growth strategy accelerates.

Targeted pro forma efficiency ratio in the lower 60%-range.

Note:

Provident

EPS

forecasts

based

on

FactSet

median

estimates

of

$0.37

for

FY

2012

and

$0.47

for

FY

2013.

The

use

of

FactSet

numbers

is

for

illustrative purposes only; Provident does not adopt these estimates for any other

purpose. 4 |

Jumbo Time

28%

Non-Interest

Bearing

23%

Brokered

21%

MMDA and

Savings

20%

Retail Time

8%

Total Deposits (9/30/11): $335M

Commercial &

Industrial

49%

Commercial

Real Estate

33%

Residential

Mortgage

8.5%

Multi-Family

7%

Construction /

Development

2%

Other

0.5%

Gross Loans (9/30/11): $169M

Strategic Rationale: Market-Entry Platform

Background on Gotham Bank

Branch Location in Midtown Manhattan

Loan Composition

Deposit Composition

New York state-chartered and Fed member

banking corporation established in 1980.

Thirty-year track record of profitability,

conservative management and strong credit

quality.

Strong deposit franchise with approximately

65% core deposits.

Robust C&I platform with strong growth

potential and strong client relationships.

Advantageous location in midtown Manhattan.

5 |

Focused Business Strategy

Gotham

Bank

is

a

healthy,

sound

institution

that

will

serve

as

a

platform

to

complement

Provident’s

expansion in the Greater New York metro area.

Grow organically through Provident’s team-based delivery model.

Continue to focus on opportunistic, strategic acquisitions.

Goal is to create the premier relationship-based business bank in the New York

Metropolitan area. David Bagatelle and his banking teams will lead our growth

strategy in the Greater New York metro area.

Mr. Bagatelle was the Primary Founder, President and CEO of Herald National Bank

and Co-Founder and EVP of Signature Bank NY, two start-up New York

middle market banks. Prior to that, he was a senior executive at

Republic National Bank. Provident plans to hire 3 to 5 NYC-based banking

teams which will be teamed up with the legacy Gotham relationship team to

create a leading middle-market franchise. 6

|

Pro

Forma Branch Map Provident Bank

Gotham Bank

7 |

Pro

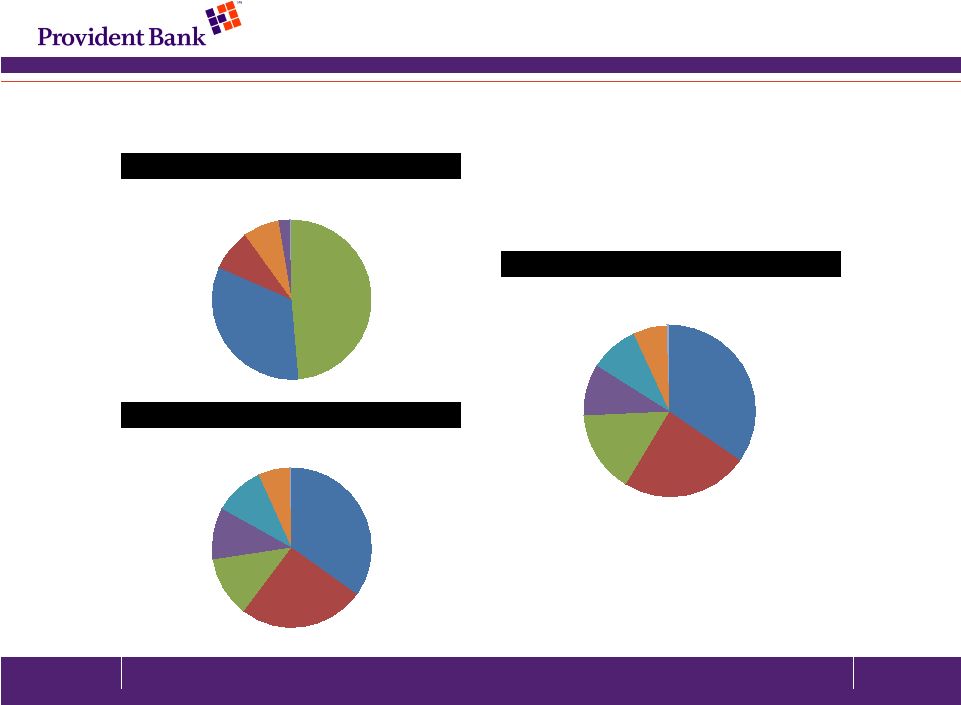

Forma Loan Composition 8

Commercial

Real Estate

35%

Residential

Mortgage

26%

Commercial &

Industrial

12%

Construction /

Development

10%

Home Equity

10%

Other

1%

Multi

-Family

6%

Gross Loans (9/30/11): $1.7B

Commercial &

Industrial

49%

Commercial

Real Estate

33%

Residential

Mortgage

8.5%

Multi-Family

7%

Construction /

Development

2%

Other

0.5%

Gross Loans (9/30/11): $169M

Gotham Bank

Provident Bank

Pro Forma

Commercial

Real Estate

35%

Residential

Mortgage

24%

Commercial &

Industrial

15.5%

Construction /

Development

10%

Home Equity

9%

Other

0.5%

Multi-Family

6%

Gross Loans (Pro Forma): $1.9B |

Pro

Forma Deposit Composition 9

MMDA and

Savings

58%

Non-Interest

Bearing

28%

Retail Time

10%

Jumbo Time

3%

Brokered

1%

Total Deposits (9/30/11): $2.3B

Jumbo Time

28%

Non-Interest

Bearing

23%

Brokered

21%

MMDA and

Savings

20%

Retail Time

8%

Total Deposits (9/30/11): $335M

Gotham Bank

Provident Bank

Pro Forma

MMDA and

Savings

53%

Non-Interest

Bearing

28%

Retail Time

9%

Jumbo Time

7%

Brokered

3%

Total Deposits (Pro Forma): $2.6B |

Summary & the Path Forward

Gotham Bank will serve as Provident’s market-entry vehicle in New York

City and the initial base for our growth strategy in this market along with

the hiring of David Bagatelle and his NYC-based relationship banking

teams. Gotham has a record of profitability, conservative management and

solid credit quality. Attractive transaction economics: core deposit premium

of approximately 3.3% at closing, immediately accretive to earnings per

share and limited tangible book value dilution with earnback in 3 years.

Focused business strategy in the Greater New York metro area, utilizing

Provident’s proven team- based relationship delivery model.

Provident

will

use

Gotham

as

the

base

for

acquisition

of

banking

teams

and

growth

of

the

middle

market segment in New York City.

10 |

Advisors to Parties

Provident New York Bancorp:

Legal: Arnold & Porter LLP

Financial: Endicott Financial Advisors, L.L.C.

Gotham Bank of New York:

Legal: Davis Polk & Wardwell LLP

Financial: Lutz Advisors Inc.

11 |