Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GLOBALSCAPE INC | d281461d8k.htm |

Recent Business Highlights

Association for Corporate Growth –

Austin

Jim Morris, CEO, GlobalSCAPE

January 11, 2012

Exhibit 99.1 |

This

presentation

contains

forward-looking

statements

within

the

meaning

of

Section

27A

of

the

Securities

Act

of

1933

and

Section

21E

of

the

Securities

Exchange

Act

of

1934.

The

words

“would,”

“exceed,”

“should,”

“anticipates,”

“believe,”

“steady,”

“dramatic,”

and

variations

of

such

words

and

similar

expressions

identify

forward-looking

statements,

but

their

absence

does

not

mean

that

a

statement

is

not

a

forward-looking

statement.

These

forward-looking

statements

are

based

upon

the

Company’s

current

expectations

and

are

subject

to

a

number

of

risks,

uncertainties

and

assumptions.

The

Company

undertakes

no

obligation

to

update

any

forward-looking

statements,

whether

as

a

result

of

new

information,

future

events

or

otherwise.

Among

the

important

factors

that

could

cause

actual

results

to

differ

significantly

from

those

expressed

or

implied

by

such

forward-looking

statements

are

risks

that

are

detailed

in

the

Company’s

Annual

Report

on

Form

10-K

for

the

2010

calendar

year,

as

filed

with

the

Security

Exchange

Commission

on

March

29,

2011.

Safe Harbor Statement

2 |

Today’s Discussion

Market growth drivers

–

Security and compliance

–

Cloud

–

Big data

–

Mobile file access and sharing

GlobalSCAPE at a glance

Growth into adjacent markets

Recent financial highlights

investment

acquisition

3 |

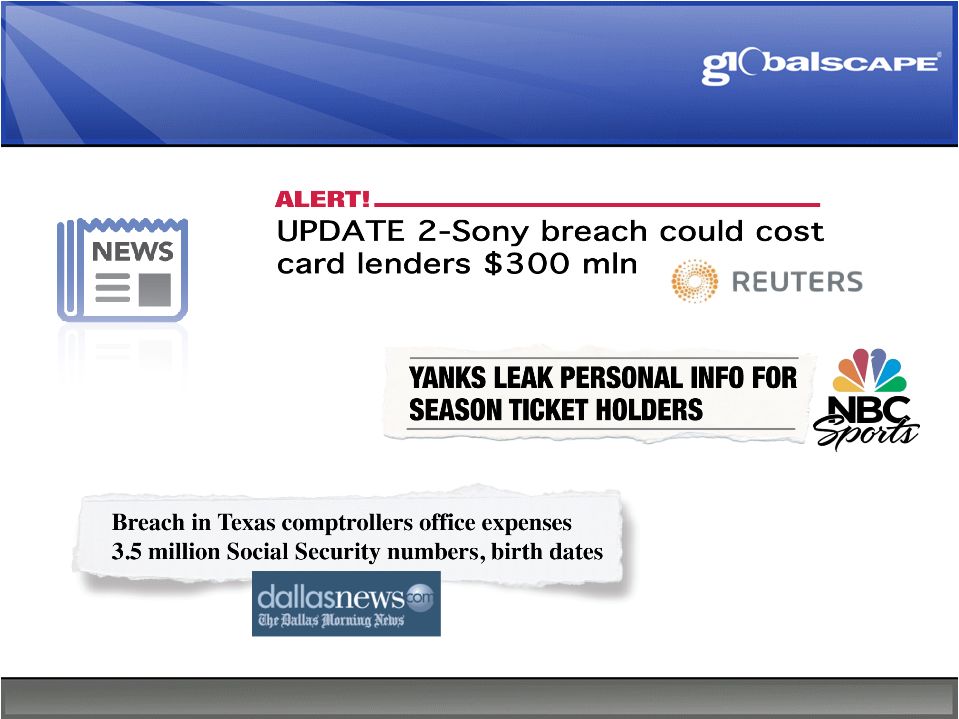

Data

loss incidents creating buzz 4 |

Regulations and Compliance

Sarbanes-Oxley Act

Health Insurance Portability and Accountability Act of 1996 (HIPAA)

Gramm–Leach–Bliley Act (GLBA)

EU Data Protection Directive

Payment Card Industry Data Security Standard (PCI DSS)

Federal Information Security Management Act (FISMA)

5 |

Business relies on secure data transfers

Need to securely and efficiently exchange business data

with partners or customers on a global basis

Need data transfers automated

to keep business moving

Need to send very large files via email to meet a

deadline Need to provide full compliance and

auditing reporting Need to seamlessly connect to

existing backend systems like procurement, fulfillment, accounting,

customer, inventory, and support

6 |

Expensive and under utilized data centers

“Pay as you go”

service instead of buying and supporting software,

hardware servers, power, patches, upgrades

Main benefit is cost reduction

–

Example –

Library of Congress data multiple times over

•

Buy hardware and equipment: $1.7M *

•

Outsource the storage: $130K *

Main concern is security

U.S. government “Cloud First”

policy

Moving to the cloud

* Source: Investors Business Daily “How To Overcome The Data

Tsunami”. February 28, 2011. 7 |

Mobile file access and sharing

8

Your personal and business life, in one place. |

Company at a glance

Overview

We provide secure information exchange software and services

for enterprises and consumers

Headquartered in San Antonio, Texas, with 94 full-time employees plus 14 paid

consultants

Founded 1996; publicly traded on NYSE Amex under ticker symbol

‘GSB’ Business Highlights

GlobalSCAPE has over 15,000 enterprise customers in over 150 countries; 2M

licenses

issued

for

CuteFTP

®

;

deployed

by

majority

of

Fortune

100

Recognized as leader and innovator in the Information Security and Managed File

Transfer Sectors by Gartner Group and others

Profitable for 28 of the past 30 quarters (as of 9/30/2011); CAGR of 25+%

during 2005 –

2009 (resulting in Deloitte Technology Fast 500 recognition in 2009 and

2010);

Named

to

Russell

Microcap

®

Index

Outstanding company culture recognized by Computerworld and Texas

publications as a Top 100 Workplace

9 |

10

Select Customers |

Broward County CSI

11 |

US

Army 12 |

13

Trended Financial Results

($ in thousands)

Q4 2010

Q1 2011

Q2 2011

Q3 2011

Revenue

4,917

$

4,644

$

5,710

$

5,417

$

Gross Margin

4,704

4,275

5,181

4,966

Gross Margin

95.7%

92.1%

90.7%

91.7%

Operating Expenses

R&D

813

785

762

811

SG&A

3,367

3,194

3,511

3,450

Operating Income (Loss)

268

92

728

540

Net Income

150

59

471

611

Adjusted EBITDA *

778

555

1,166

980

Cash and Short Term Investments

11,087

11,413

12,615

13,404

* Excludes stock-based compensation |

Foundation Fueling Growth

Optimized organizational construct

Added seasoned key leadership

Broadened market-driven product roadmap

Expanded go-to-market model domestically/internationally

Invested resources and capital for future growth

Developed a culture and brand of excellence

Our

focus

since

2008

has

enabled

organic

growth

and

potential

growth

through

the

investment

and

acquisition.

14 |

Market Size ($mm)

Growth Rate

Representative Companies

$554

23.0%

Secure File Transfer Leader

Recognized global leader

in the Managed File

Transfer market

15 |

Growth into Email Security

Launched email-based

secure file transfer in

August 2010

16

Market

Size

($mm)

Growth Rate

Representative Companies

$1,929

17.8% |

Growth into Cloud Services

Launched cloud-based

services for exchanging business

data in July 2010 and Feb. 2011

17

Market

Size

($mm)

Growth Rate

Representative Companies

$68,300

20.5% |

Market

Size

($mm)

Growth Rate

Representative Companies

$9,246

11.0%

Growth into Endpoint Security

Investment in CoreTrace

®

in

December 2009; Announced

ongoing development of

consumer security product

18 |

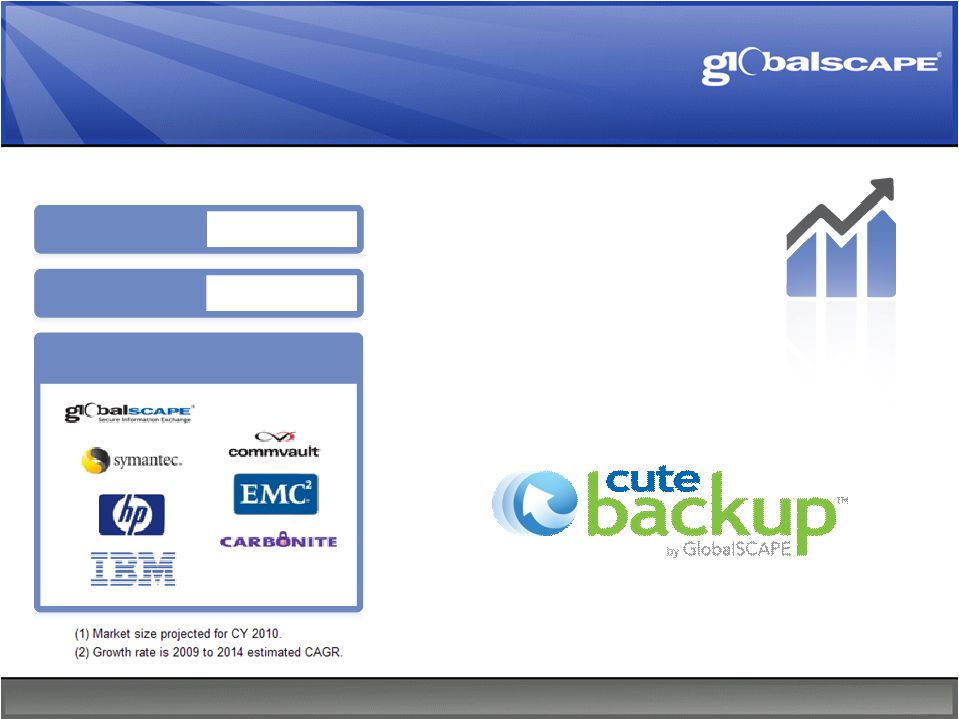

Growth into Backup & Recovery

Launched CuteBackup

in June 2011 for consumers.

19

Market

Size

($mm)

Growth Rate

Representative Companies

$3,100

4.6% |

Market

Size

($mm)

Growth Rate

Representative Companies

$6,000

15.0%

Growth into Content Mobility

Acquired TappIn as subsidiary

December 2011.

20 |

Secure Information Exchange

21

Continued Leverage and Integration in 2012 and

Expanded Growth in 2013

Managed File

Transfer

Cloud

Computing

Mobile Content

Access & Sharing

Backup &

Recovery

Endpoint

Security

Email

Security |

TappIn Acquisition –

December 2011

TappIn is a wholly-owned GlobalSCAPE subsidiary

Combining GlobalSCAPE’s leadership in secure

information exchange with TappIn’s strength in secure

digital content mobility

Users are looking for a trusted solution for easily and

securely sharing digital content

We continue to remove barriers between users and their

content, stored in multiple locations, while maintaining

privacy and security regardless of the devices being used

Explosive growth in tablet and smartphone market driving

demand for TappIn

22 |

Personal and Professional Devices

Cloud

Computing

Content is Everywhere

23 |

MORE STORAGE

MORE APPS

MORE MOBILE

5.3B mobile

subscriptions in 2010.

Equivalent to 77% of the

world population

More mobile Internet

users than PC Internet

users by 2014

March 2011, Facebook

tops Google for weekly

traffic in the U.S.

MORE SOCIAL

•

90% of the world has access to a mobile network; 70% of internet access through

mobile devices •

The amount of data shared globally each month will more than double between 2010 and

2014, from 5 exabytes/mo to 10+ •

The world's data is more than doubling every 2 years-with a colossal 1.8

zettabytes to be created and replicated in 2012 Global Market Drivers

Large and Growing Market Opportunity

24

Recently Apple

surpassed 10 billion app

downloads

with billions

more expected for

Apple, Android and

BlackBerry

®

Personal Content in the

average home storing

nearly nine terabytes of

content by 2013 |

TappIn Connects Content and People

25 |

Convenient and Simple Access

26 |

•

Must upload anything you want in

order to access

•

Have to decide what to upload

•

Always a subset of your content

•

Security & Trust issues

•

Just another place to store content

•

Pay based on volume of content

•

Computer does not need to be on

Cloud Storage with

Proprietary Software

Upload

Large File Transfer

•

Must upload anything you want

to share

•

Adequate security

•

No computer access and run

programs

•

No storage to buy

•

Pay for each file sent

•

Mobile phone use is difficult

•

Computer does not to be on

•

No sharing capabilities

•

Adequate security

•

Full computer access and run

programs

•

No storage to buy

•

Pay for each computer accessed

•

Mobile phone use is difficult

•

Computer must be on (always)

Computer Remote Control

Upload

Competitive Landscape

27 |

Going Forward

28

Thanks for your time today. |