Attached files

| file | filename |

|---|---|

| 8-K - Delek US Holdings, Inc. | a8-kinvestorpresentationfi.htm |

Investor Presentation January 2012

Safe Harbor Provision 2 Delek US Holdings is traded on the New York Stock Exchange in the United States under the symbol “DK” and, as such, is governed by the rules and regulations of the United States Securities and Exchange Commission. This presentation may contain forward-looking statements that are based upon current expectations and involve a number of risks and uncertainties. Statements concerning our current estimates, expectations and projections about our future results, performance, prospects and opportunities and other statements, concerns, or matters that are not historical facts are “forward-looking statements,” as that term is defined under United States securities laws. Investors are cautioned that the following important factors, among others, may affect these forward-looking statements. These factors include but are not limited to: management’s ability to execute its strategy of growth through acquisitions and transactional risks in acquisitions; our competitive position and the effects of competition; the projected growth of the industry in which we operate; changes in the scope, costs, and/or timing of capital projects; losses from derivative instruments; general economic and business conditions, particularly levels of spending relating to travel and tourism or conditions affecting the southeastern United States; risks and uncertainties with the respect to the quantities and costs of crude oil, the costs to acquire feedstocks and the price of the refined petroleum products we ultimately sell; potential conflicts of interest between our majority stockholder and other stockholders; and other risks contained in our filings with the Securities and Exchange Commission. Forward-looking statements should not be read as a guarantee of future performance or results and will not be accurate indications of the times at, or by which such performance or results will be achieved. Forward-looking information is based on information available at the time and/or management’s good faith belief with respect to future events, and is subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the statements. Delek US undertakes no obligation to update or revise any such forward-looking statements.

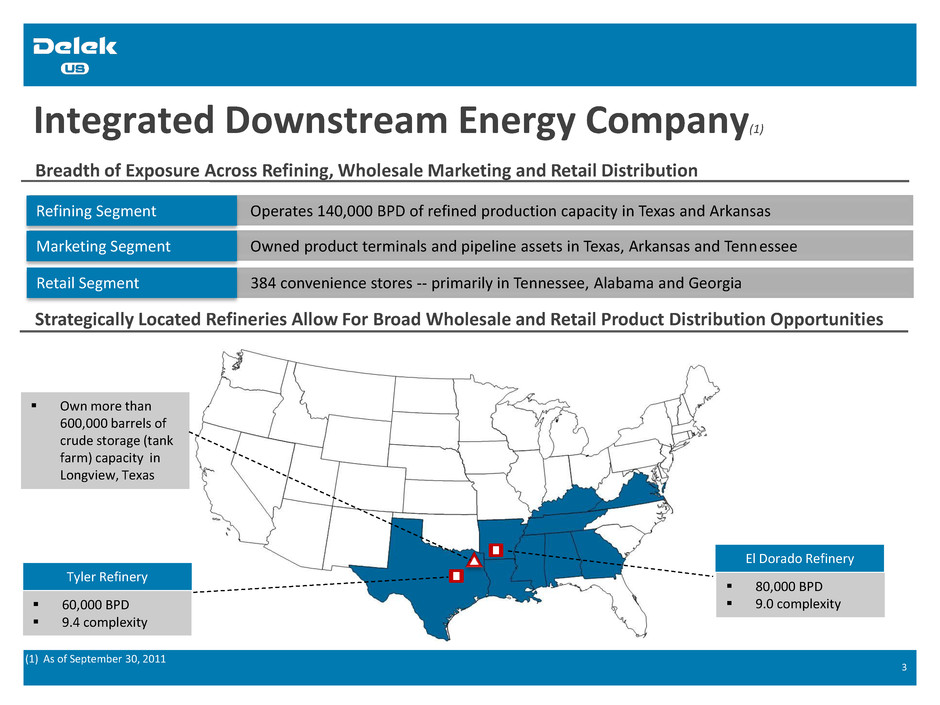

Integrated Downstream Energy Company(1) Breadth of Exposure Across Refining, Wholesale Marketing and Retail Distribution Operates 140,000 BPD of refined production capacity in Texas and Arkansas Refining Segment ) Owned product terminals and pipeline assets in Texas, Arkansas and Tennessee Marketing Segment 384 convenience stores -- primarily in Tennessee, Alabama and Georgia Retail Segment 3 60,000 BPD 9.4 complexity (1) As of September 30, 2011 Tyler Refinery 80,000 BPD 9.0 complexity El Dorado Refinery Strategically Located Refineries Allow For Broad Wholesale and Retail Product Distribution Opportunities Own more than 600,000 barrels of crude storage (tank farm) capacity in Longview, Texas

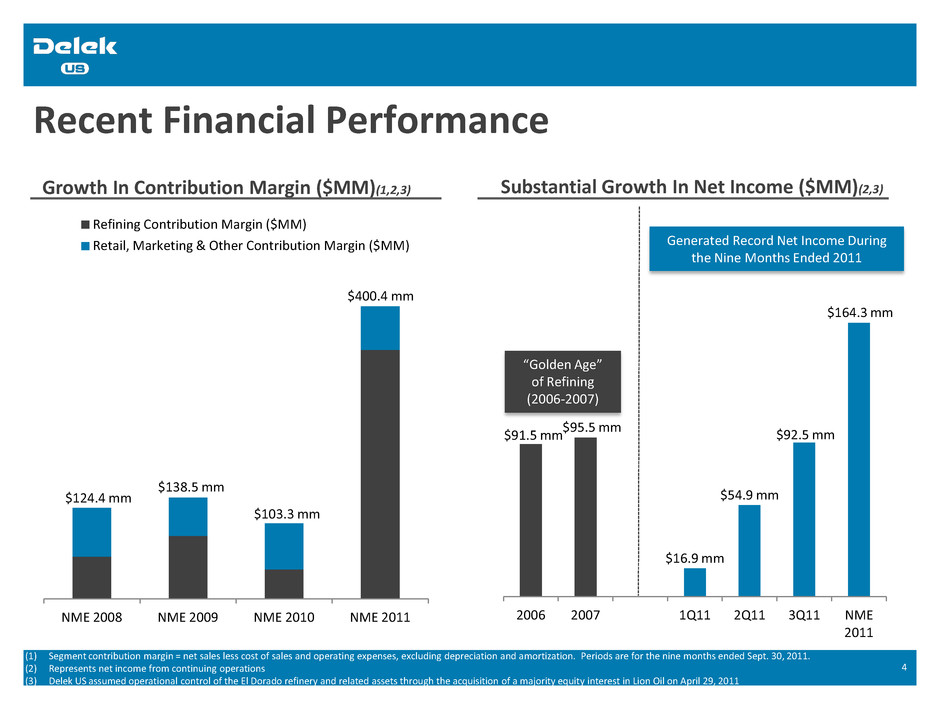

Recent Financial Performance 4 Growth In Contribution Margin ($MM)(1,2,3) (1) Segment contribution margin = net sales less cost of sales and operating expenses, excluding depreciation and amortization. Periods are for the nine months ended Sept. 30, 2011. (2) Represents net income from continuing operations (3) Delek US assumed operational control of the El Dorado refinery and related assets through the acquisition of a majority equity interest in Lion Oil on April 29, 2011 Substantial Growth In Net Income ($MM)(2,3) NME 2008 NME 2009 NME 2010 NME 2011 Refining Contribution Margin ($MM) Retail, Marketing & Other Contribution Margin ($MM) $124.4 mm $400.4 mm $103.3 mm $138.5 mm $91.5 mm $95.5 mm $16.9 mm $54.9 mm $92.5 mm $164.3 mm 2006 2007 1Q11 2Q11 3Q11 NME 2011 “Golden Age” of Refining (2006-2007) Generated Record Net Income During the Nine Months Ended 2011

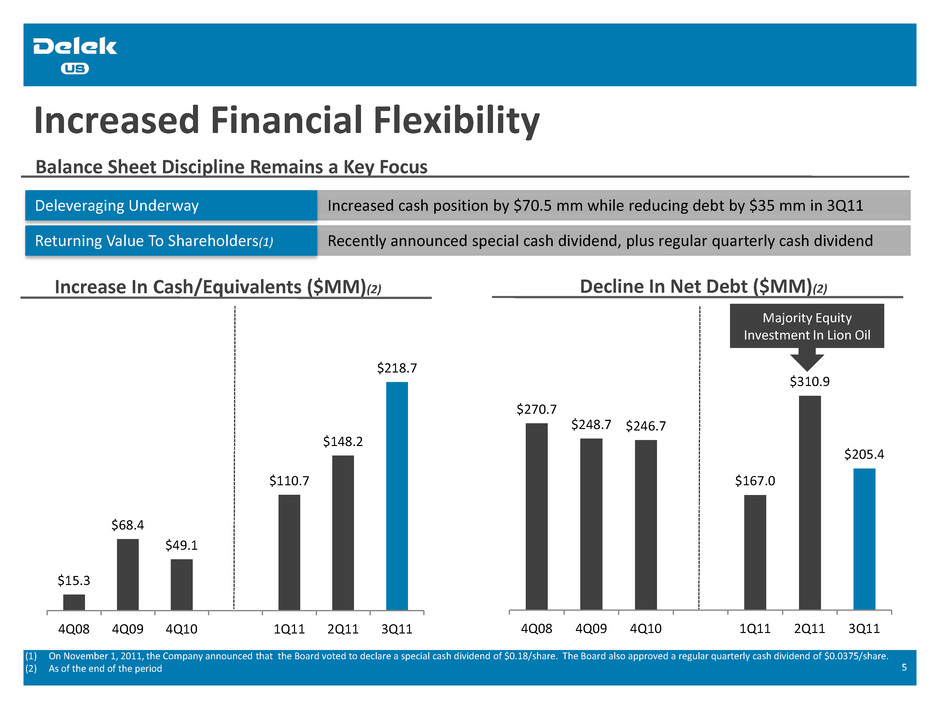

Increased Financial Flexibility 5 (1) On November 1, 2011, the Company announced that the Board voted to declare a special cash dividend of $0.18/share. The Board also approved a regular quarterly cash dividend of $0.0375/share. (2) As of the end of the period Increase In Cash/Equivalents ($MM)(2) Decline In Net Debt ($MM)(2) $15.3 $68.4 $49.1 $110.7 $148.2 $218.7 4Q08 4Q09 4Q10 1Q11 2Q11 3Q11 $270.7 $248.7 $246.7 $167.0 $310.9 $205.4 4Q08 4Q09 4Q10 1Q11 2Q11 3Q11 Balance Sheet Discipline Remains a Key Focus Increased cash position by $70.5 mm while reducing debt by $35 mm in 3Q11 Deleveraging Underway Recently announced special cash dividend, plus regular quarterly cash dividend Returning Value To Shareholders(1) Majority Equity Investment In Lion Oil

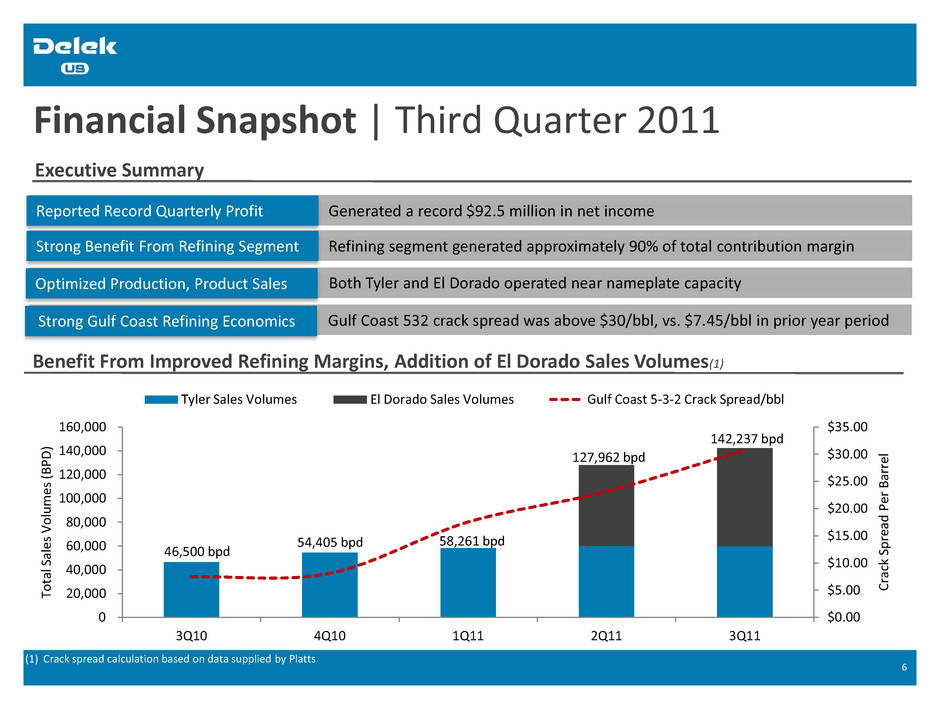

Financial Snapshot | Third Quarter 2011 6 Generated a record $92.5 million in net income Reported Record Quarterly Profit Refining segment generated approximately 90% of total contribution margin Strong Benefit From Refining Segment Both Tyler and El Dorado operated near nameplate capacity Executive Summary Optimized Production, Product Sales Gulf Coast 532 crack spread was above $30/bbl, vs. $7.45/bbl in prior year period Strong Gulf Coast Refining Economics Benefit From Improved Refining Margins, Addition of El Dorado Sales Volumes(1) $0.00 $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 $35.00 0 20,000 40,000 60,000 80,000 100,000 120,000 140,000 160,000 3Q10 4Q10 1Q11 2Q11 3Q11 Cr ac k Spr e ad P e r B arr e l To tal S ales V o lu m es (B P D ) Tyler Sales Volumes El Dorado Sales Volumes Gulf Coast 5-3-2 Crack Spread/bbl 46,500 bpd 127,962 bpd 58,261 bpd 54,405 bpd 142,237 bpd (1) Crack spread calculation based on data supplied by Platts

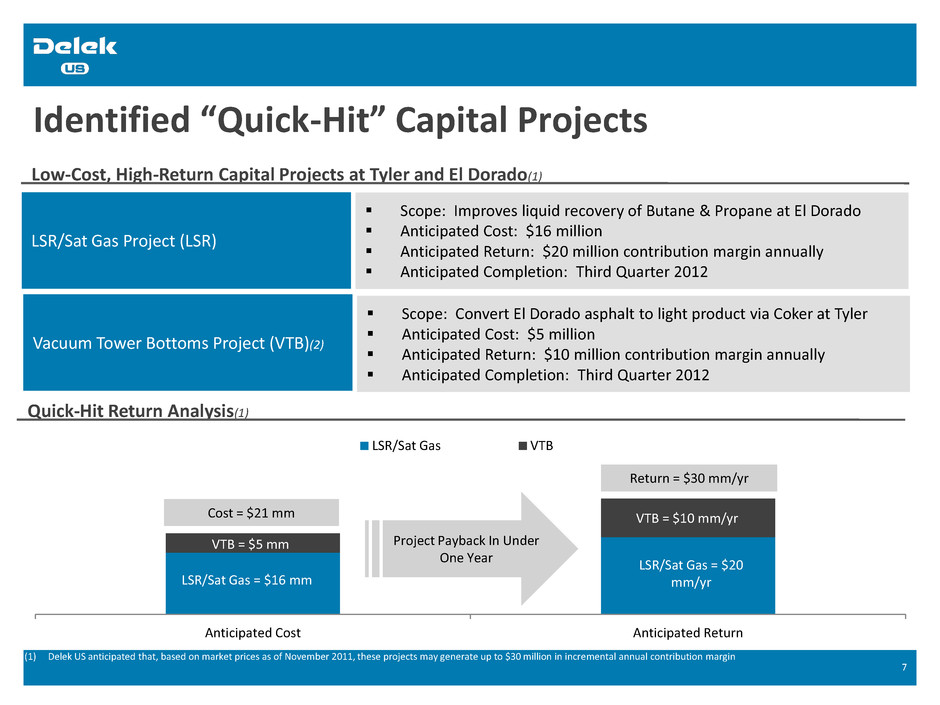

Identified “Quick-Hit” Capital Projects 7 Low-Cost, High-Return Capital Projects at Tyler and El Dorado(1) LSR/Sat Gas Project (LSR) Scope: Improves liquid recovery of Butane & Propane at El Dorado Anticipated Cost: $16 million Anticipated Return: $20 million contribution margin annually Anticipated Completion: Third Quarter 2012 Vacuum Tower Bottoms Project (VTB)(2) Scope: Convert El Dorado asphalt to light product via Coker at Tyler Anticipated Cost: $5 million Anticipated Return: $10 million contribution margin annually Anticipated Completion: Third Quarter 2012 Quick-Hit Return Analysis(1) Anticipated Cost Anticipated Return LSR/Sat Gas VTB LSR/Sat Gas = $16 mm VTB = $5 mm Cost = $21 mm LSR/Sat Gas = $20 mm/yr VTB = $10 mm/yr Return = $30 mm/yr Project Payback In Under One Year (1) Delek US anticipated that, based on market prices as of November 2011, these projects may generate up to $30 million in incremental annual contribution margin

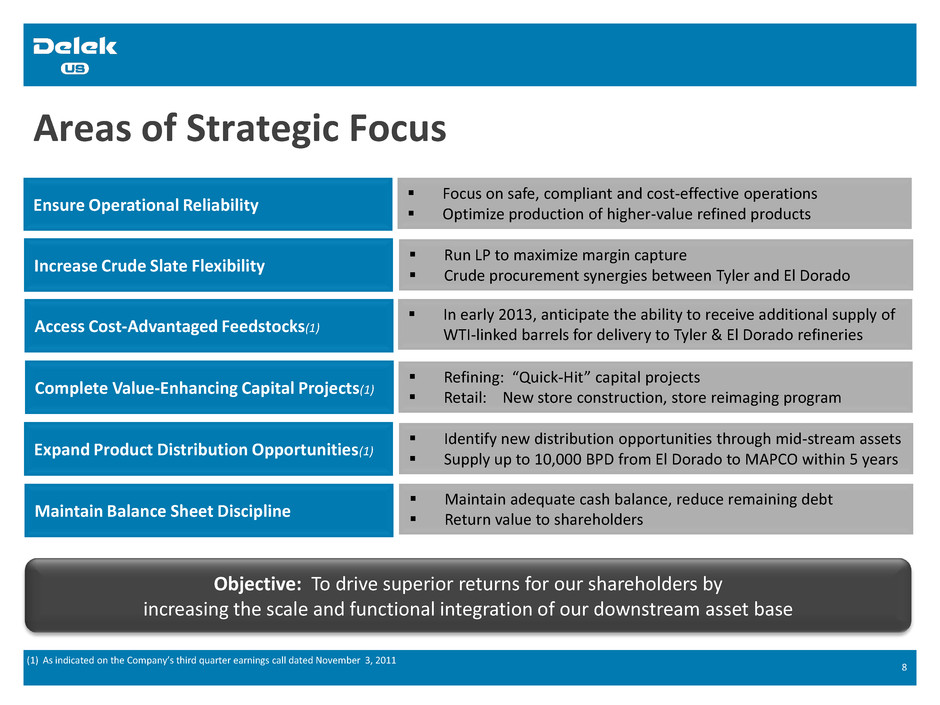

8 Increase Crude Slate Flexibility Ensure Operational Reliability Access Cost-Advantaged Feedstocks(1) Complete Value-Enhancing Capital Projects(1) Expand Product Distribution Opportunities(1) Maintain Balance Sheet Discipline Objective: To drive superior returns for our shareholders by increasing the scale and functional integration of our downstream asset base Areas of Strategic Focus Focus on safe, compliant and cost-effective operations Optimize production of higher-value refined products Run LP to maximize margin capture Crude procurement synergies between Tyler and El Dorado In early 2013, anticipate the ability to receive additional supply of WTI-linked barrels for delivery to Tyler & El Dorado refineries Refining: “Quick-Hit” capital projects Retail: New store construction, store reimaging program Identify new distribution opportunities through mid-stream assets Supply up to 10,000 BPD from El Dorado to MAPCO within 5 years Maintain adequate cash balance, reduce remaining debt Return value to shareholders (1) As indicated on the Company’s third quarter earnings call dated November 3, 2011

Lion Oil Company Acquisition Summary

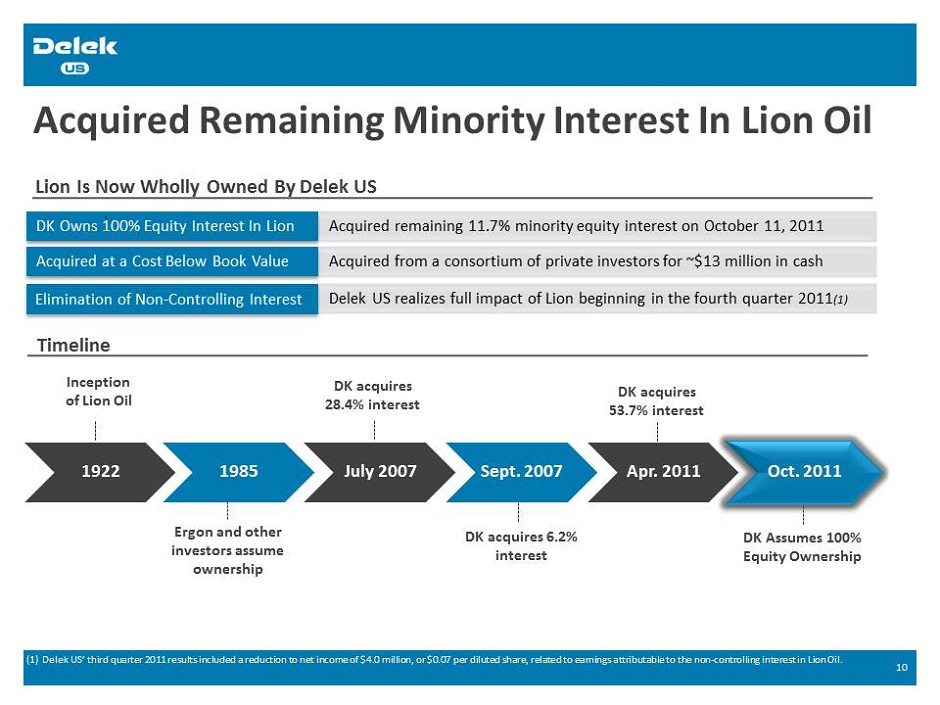

Acquired Remaining Minority Interest In Lion Oil Timeline Lion Is Now Wholly Owned By Delek US 10 Inception of Lion Oil Ergon and other investors assume ownership DK acquires 28.4% interest DK acquires 6.2% interest DK acquires 53.7% interest DK Assumes 100% Equity Ownership Acquired remaining 11.7% minority equity interest on October 11, 2011 DK Owns 100% Equity Interest In Lion Acquired from a consortium of private investors for ~$13 million in cash Acquired at a Cost Below Book Value Delek US realizes full impact of Lion beginning in the fourth quarter 2011(1) Elimination of Non-Controlling Interest (1) Delek US’ third quarter 2011 results included a reduction to net income of $4.0 million, or $0.07 per diluted share, related to earnings attributable to the non-controlling interest in Lion Oil.

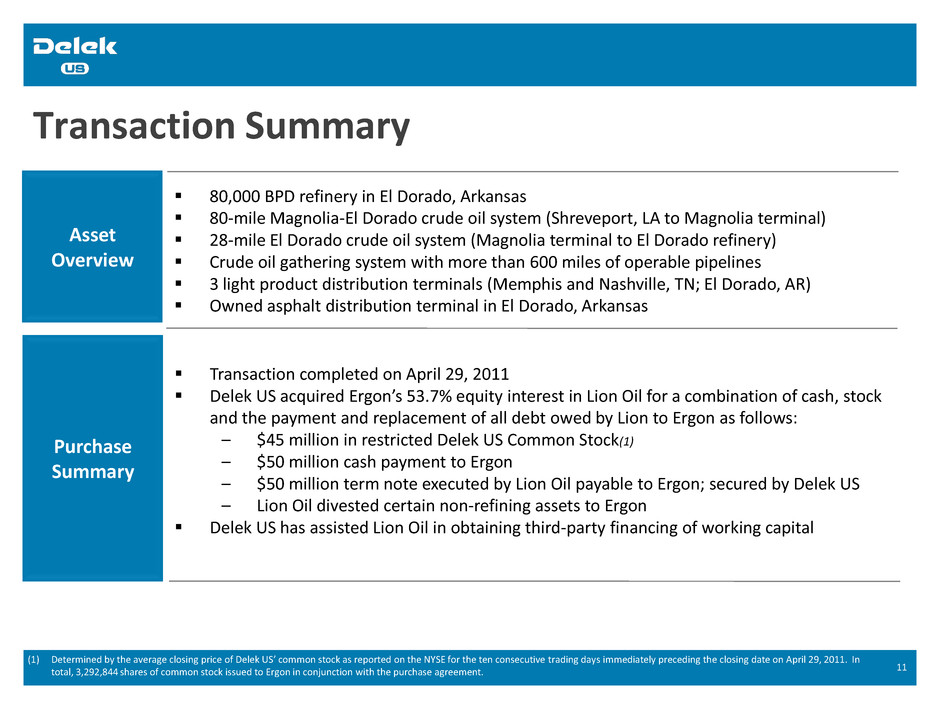

Transaction Summary Asset Overview Purchase Summary 80,000 BPD refinery in El Dorado, Arkansas 80-mile Magnolia-El Dorado crude oil system (Shreveport, LA to Magnolia terminal) 28-mile El Dorado crude oil system (Magnolia terminal to El Dorado refinery) Crude oil gathering system with more than 600 miles of operable pipelines 3 light product distribution terminals (Memphis and Nashville, TN; El Dorado, AR) Owned asphalt distribution terminal in El Dorado, Arkansas Transaction completed on April 29, 2011 Delek US acquired Ergon’s 53.7% equity interest in Lion Oil for a combination of cash, stock and the payment and replacement of all debt owed by Lion to Ergon as follows: – $45 million in restricted Delek US Common Stock(1) – $50 million cash payment to Ergon – $50 million term note executed by Lion Oil payable to Ergon; secured by Delek US – Lion Oil divested certain non-refining assets to Ergon Delek US has assisted Lion Oil in obtaining third-party financing of working capital 11 (1) Determined by the average closing price of Delek US’ common stock as reported on the NYSE for the ten consecutive trading days immediately preceding the closing date on April 29, 2011. In total, 3,292,844 shares of common stock issued to Ergon in conjunction with the purchase agreement.

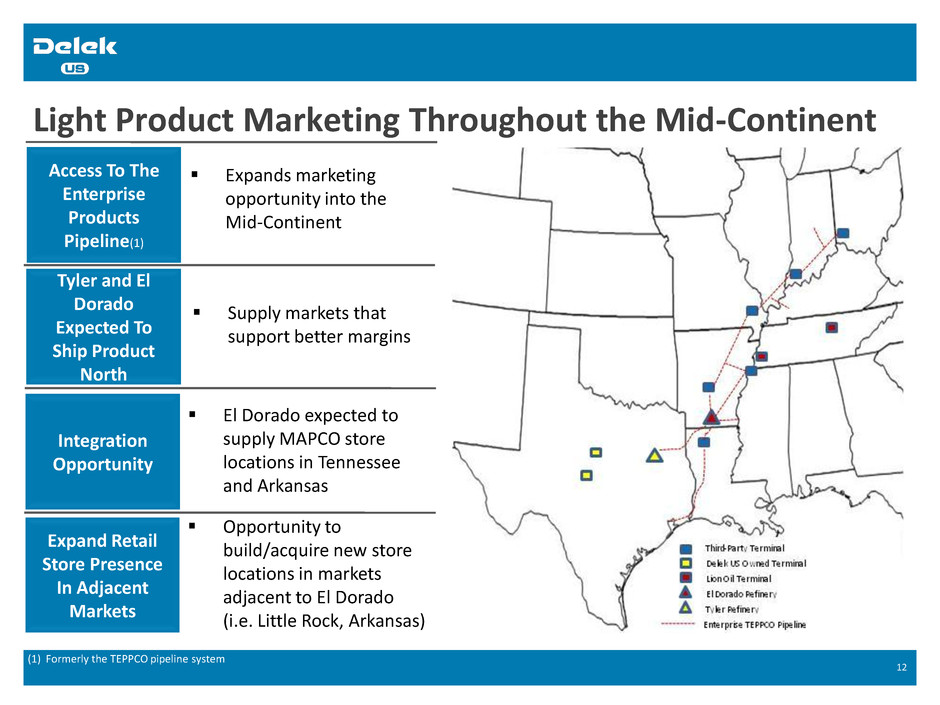

Light Product Marketing Throughout the Mid-Continent 12 Access To The Enterprise Products Pipeline(1) Integration Opportunity Expands marketing opportunity into the Mid-Continent El Dorado expected to supply MAPCO store locations in Tennessee and Arkansas Tyler and El Dorado Expected To Ship Product North Supply markets that support better margins Expand Retail Store Presence In Adjacent Markets Opportunity to build/acquire new store locations in markets adjacent to El Dorado (i.e. Little Rock, Arkansas) (1) Formerly the TEPPCO pipeline system

Refining Segment Operational Update

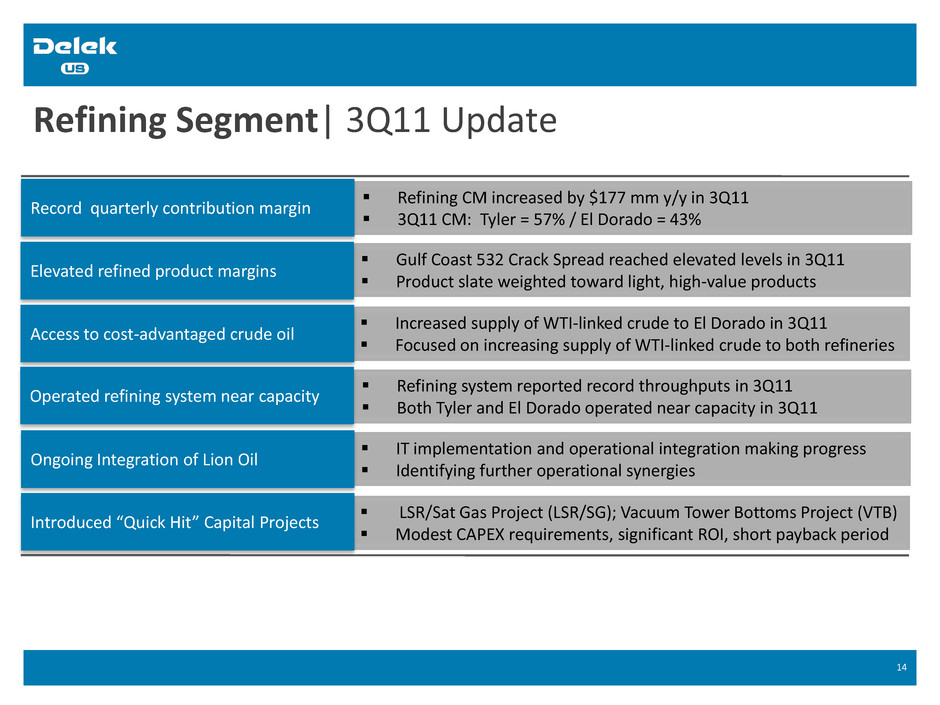

Refining Segment| 3Q11 Update Gulf Coast 532 Crack Spread reached elevated levels in 3Q11 Product slate weighted toward light, high-value products 14 Elevated refined product margins Refining CM increased by $177 mm y/y in 3Q11 3Q11 CM: Tyler = 57% / El Dorado = 43% Record quarterly contribution margin Increased supply of WTI-linked crude to El Dorado in 3Q11 Focused on increasing supply of WTI-linked crude to both refineries Access to cost-advantaged crude oil Refining system reported record throughputs in 3Q11 Both Tyler and El Dorado operated near capacity in 3Q11 Operated refining system near capacity IT implementation and operational integration making progress Identifying further operational synergies Ongoing Integration of Lion Oil LSR/Sat Gas Project (LSR/SG); Vacuum Tower Bottoms Project (VTB) Modest CAPEX requirements, significant ROI, short payback period Introduced “Quick Hit” Capital Projects

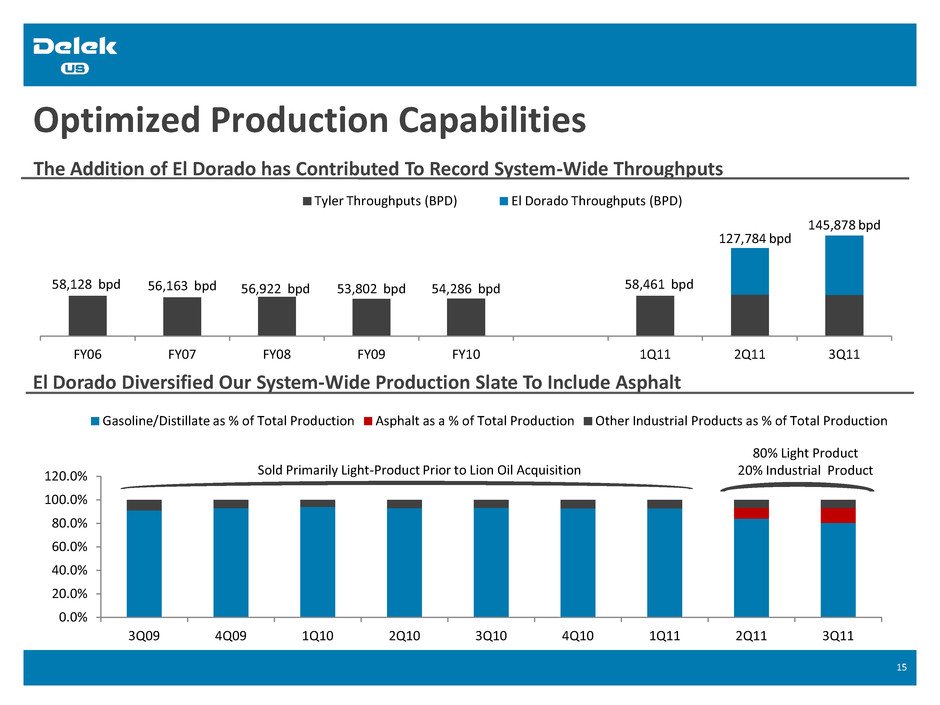

Optimized Production Capabilities 15 The Addition of El Dorado has Contributed To Record System-Wide Throughputs El Dorado Diversified Our System-Wide Production Slate To Include Asphalt 0.0% 20.0% 40.0% 60.0% 80.0% 100.0% 120.0% 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 Gasoline/Distillate as % of Total Production Asphalt as a % of Total Production Other Industrial Products as % of Total Production 80% Light Product 20% Industrial Product 58,128 bpd 56,163 bpd 56,922 bpd 53,802 bpd 54,286 bpd 58,461 bpd 127,784 bpd 145,878 bpd FY06 FY07 FY08 FY09 FY10 1Q11 2Q11 3Q11 Tyler Throughputs (BPD) El Dorado Throughputs (BPD) Sold Primarily Light-Product Prior to Lion Oil Acquisition

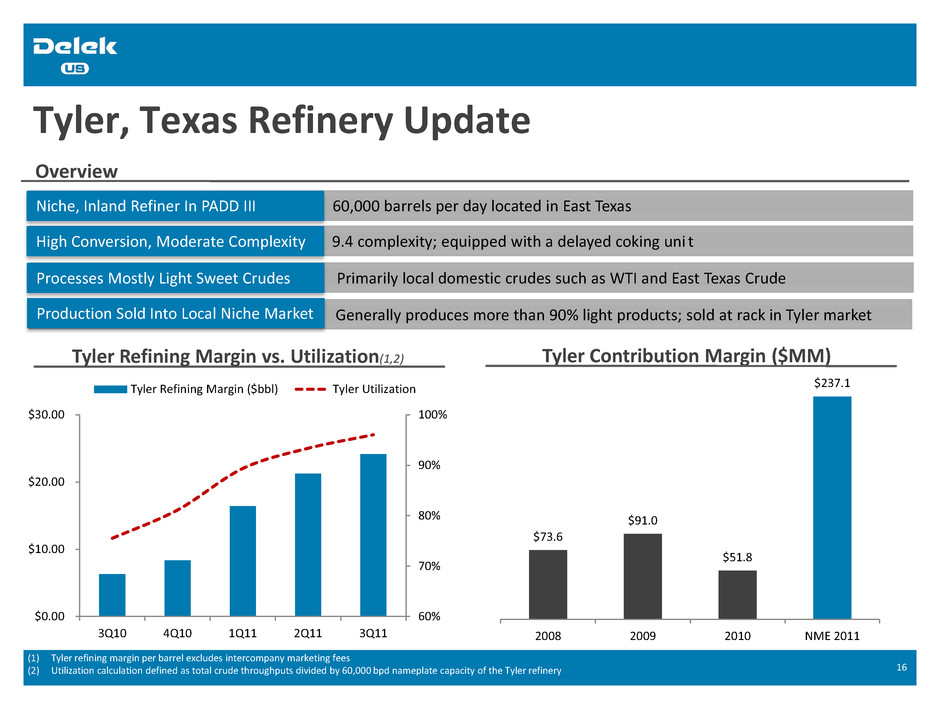

Tyler, Texas Refinery Update Overview 60,000 barrels per day located in East Texas Niche, Inland Refiner In PADD III ) 9.4 complexity; equipped with a delayed coking uni t High Conversion, Moderate Complexity Primarily local domestic crudes such as WTI and East Texas Crude Processes Mostly Light Sweet Crudes 16 Generally produces more than 90% light products; sold at rack in Tyler market Production Sold Into Local Niche Market Tyler Contribution Margin ($MM) Tyler Refining Margin vs. Utilization(1,2) 60% 70% 80% 90% 100% $0.00 $10.00 $20.00 $30.00 3Q10 4Q10 1Q11 2Q11 3Q11 Tyler Refining Margin ($bbl) Tyler Utilization $73.6 $91.0 $51.8 $237.1 2008 2009 2010 NME 2011 (1) Tyler refining margin per barrel excludes intercompany marketing fees (2) Utilization calculation defined as total crude throughputs divided by 60,000 bpd nameplate capacity of the Tyler refinery

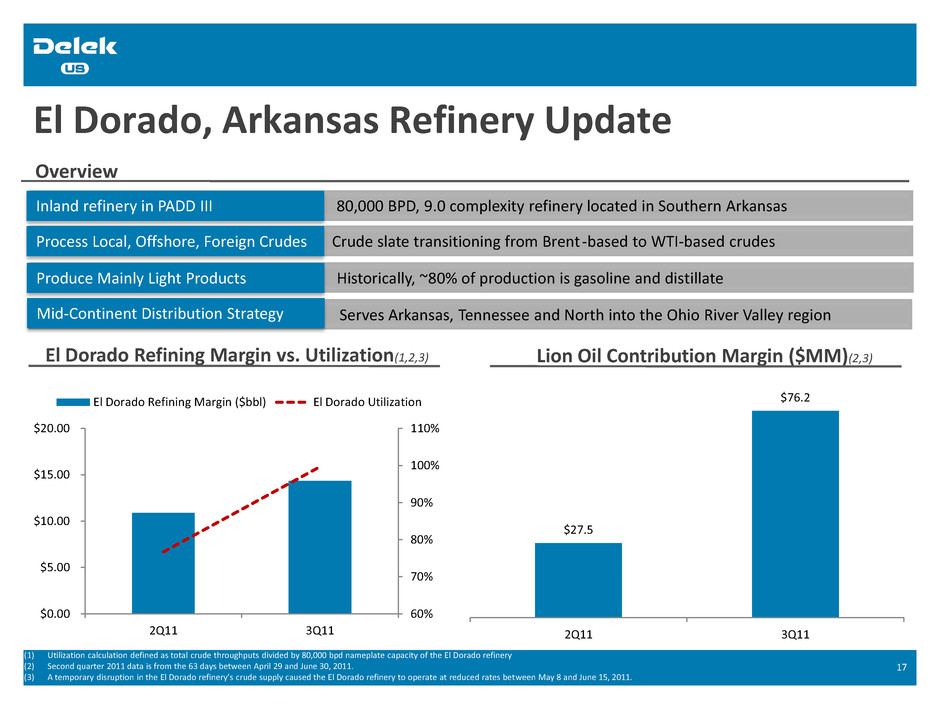

El Dorado, Arkansas Refinery Update Overview 80,000 BPD, 9.0 complexity refinery located in Southern Arkansas Inland refinery in PADD III ) Crude slate transitioning from Brent -based to WTI-based crudes Process Local, Offshore, Foreign Crudes Historically, ~80% of production is gasoline and distillate Produce Mainly Light Products 17 Serves Arkansas, Tennessee and North into the Ohio River Valley region Mid-Continent Distribution Strategy (1) Utilization calculation defined as total crude throughputs divided by 80,000 bpd nameplate capacity of the El Dorado refinery (2) Second quarter 2011 data is from the 63 days between April 29 and June 30, 2011. (3) A temporary disruption in the El Dorado refinery’s crude supply caused the El Dorado refinery to operate at reduced rates between May 8 and June 15, 2011. El Dorado Refining Margin vs. Utilization(1,2,3) Lion Oil Contribution Margin ($MM)(2,3) 60% 70% 80% 90% 100% 110% $0.00 $5.00 $10.00 $15.00 $20.00 2Q11 3Q11 El Dorado Refining Margin ($bbl) El Dorado Utilization $27.5 $76.2 2Q11 3Q11

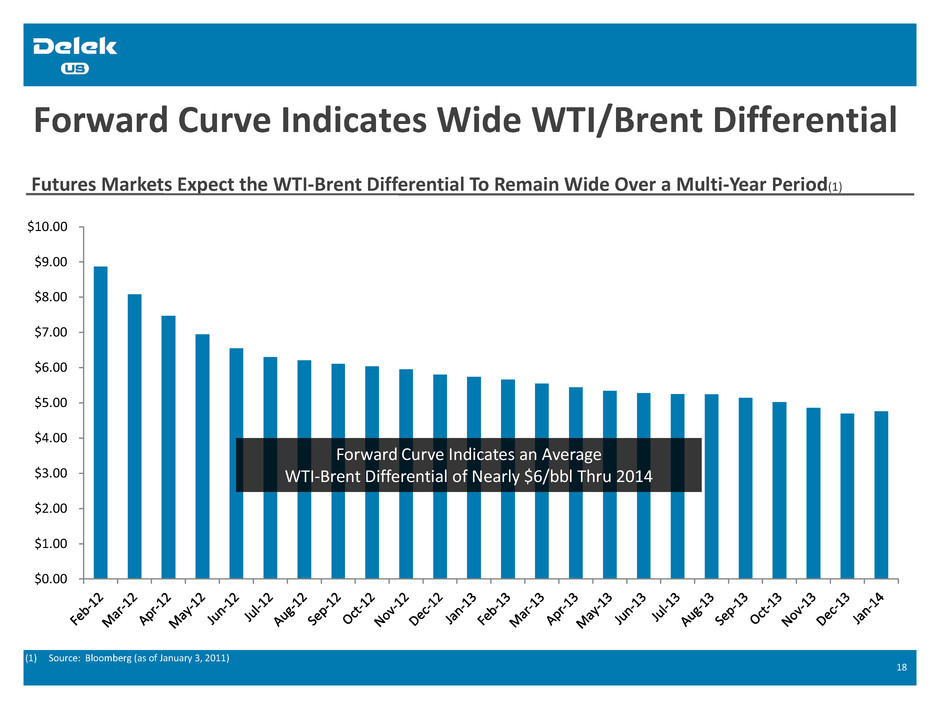

Forward Curve Indicates Wide WTI/Brent Differential 18 Futures Markets Expect the WTI-Brent Differential To Remain Wide Over a Multi-Year Period(1) (1) Source: Bloomberg (as of January 3, 2011) $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 $8.00 $9.00 $10.00 Forward Curve Indicates an Average WTI-Brent Differential of Nearly $6/bbl Thru 2014

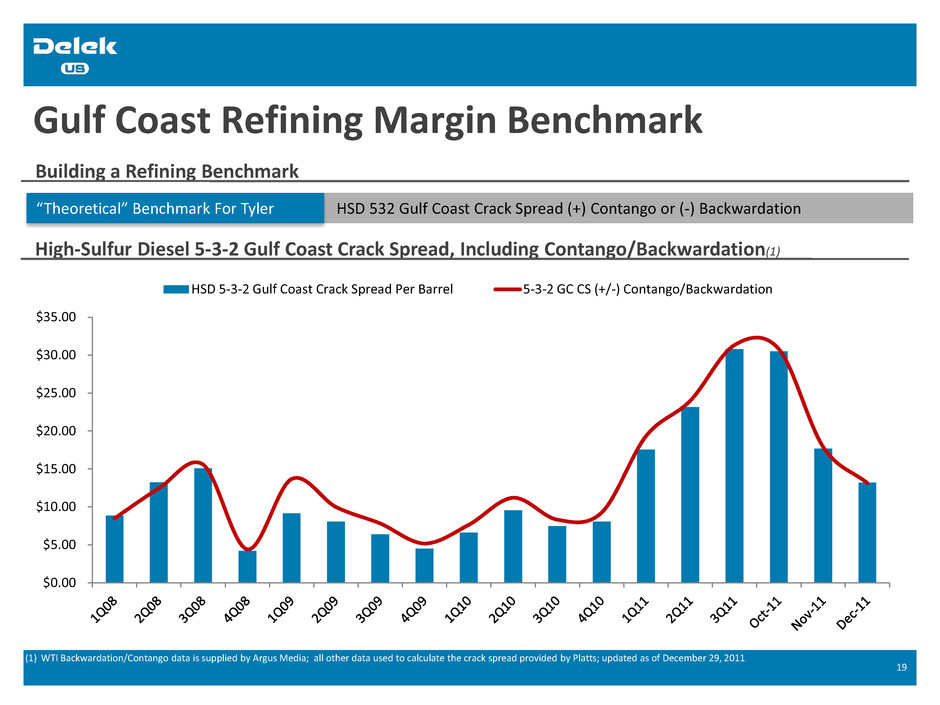

Gulf Coast Refining Margin Benchmark Building a Refining Benchmark HSD 532 Gulf Coast Crack Spread (+) Contango or (-) Backwardation “Theoretical” Benchmark For Tyler 19 High-Sulfur Diesel 5-3-2 Gulf Coast Crack Spread, Including Contango/Backwardation(1) (1) WTI Backwardation/Contango data is supplied by Argus Media; all other data used to calculate the crack spread provided by Platts; updated as of December 29, 2011 $0.00 $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 $35.00 HSD 5-3-2 Gulf Coast Crack Spread Per Barrel 5-3-2 GC CS (+/-) Contango/Backwardation

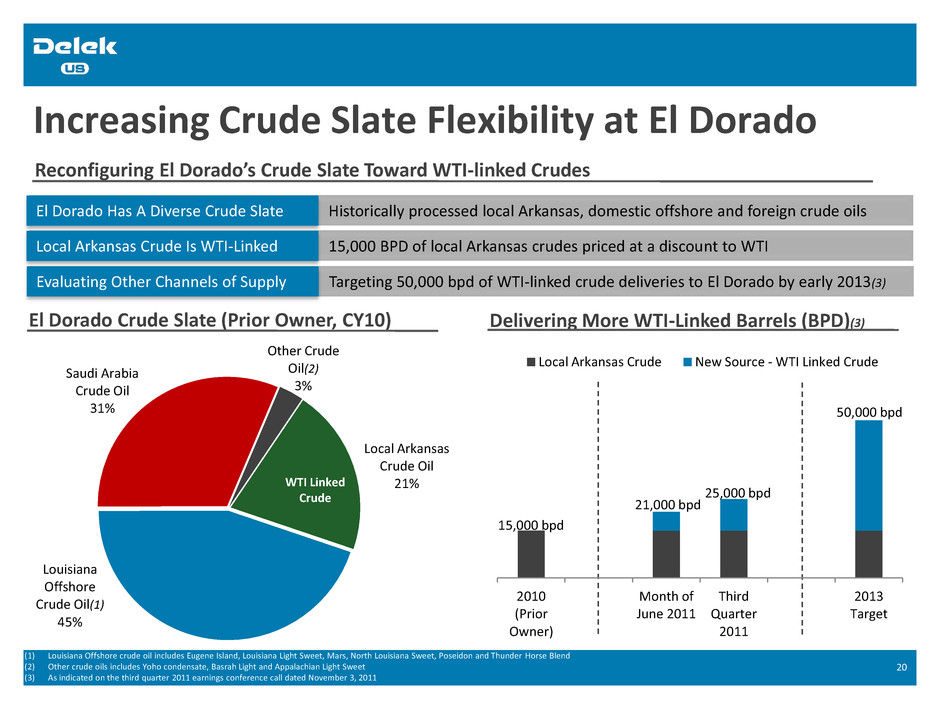

Increasing Crude Slate Flexibility at El Dorado 20 (1) Louisiana Offshore crude oil includes Eugene Island, Louisiana Light Sweet, Mars, North Louisiana Sweet, Poseidon and Thunder Horse Blend (2) Other crude oils includes Yoho condensate, Basrah Light and Appalachian Light Sweet (3) As indicated on the third quarter 2011 earnings conference call dated November 3, 2011 Local Arkansas Crude Oil 21% Louisiana Offshore Crude Oil(1) 45% Saudi Arabia Crude Oil 31% Other Crude Oil(2) 3% WTI Linked Crude El Dorado Crude Slate (Prior Owner, CY10) Delivering More WTI-Linked Barrels (BPD)(3) Historically processed local Arkansas, domestic offshore and foreign crude oils El Dorado Has A Diverse Crude Slate 15,000 BPD of local Arkansas crudes priced at a discount to WTI Local Arkansas Crude Is WTI-Linked Reconfiguring El Dorado’s Crude Slate Toward WTI-linked Crudes Targeting 50,000 bpd of WTI-linked crude deliveries to El Dorado by early 2013(3) Evaluating Other Channels of Supply 2010 (Prior Owner) Month of June 2011 Third Quarter 2011 2013 Target Local Arkansas Crude New Source - WTI Linked Crude 15,000 bpd 21,000 bpd 25,000 bpd 50,000 bpd

Retail Segment Operational Update

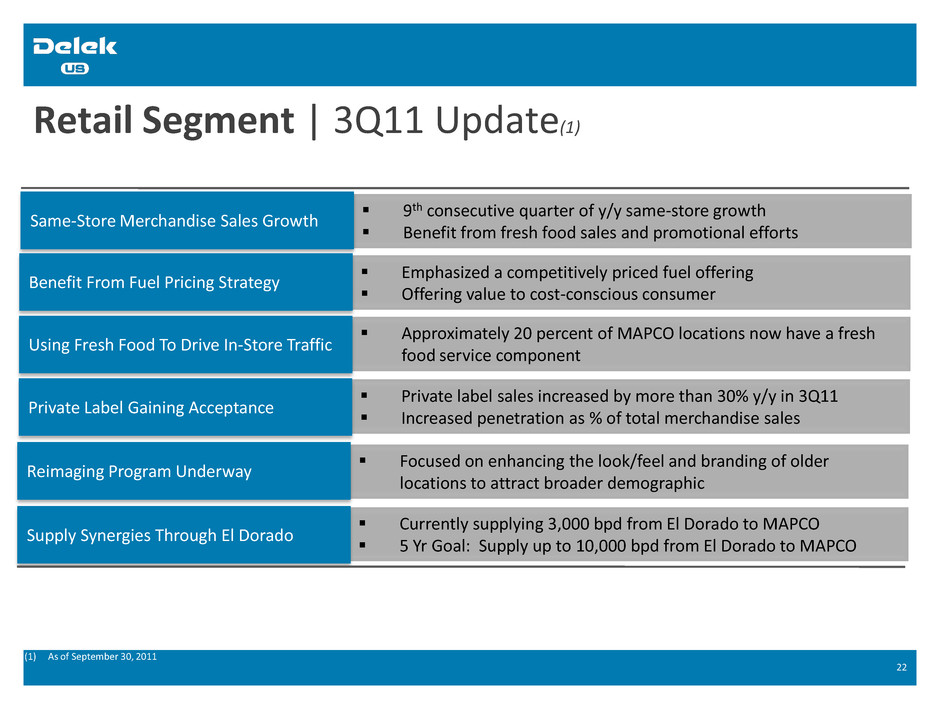

Retail Segment | 3Q11 Update(1) 9th consecutive quarter of y/y same-store growth Benefit from fresh food sales and promotional efforts 22 Same-Store Merchandise Sales Growth Emphasized a competitively priced fuel offering Offering value to cost-conscious consumer Benefit From Fuel Pricing Strategy Approximately 20 percent of MAPCO locations now have a fresh food service component Using Fresh Food To Drive In-Store Traffic Private label sales increased by more than 30% y/y in 3Q11 Increased penetration as % of total merchandise sales Private Label Gaining Acceptance Focused on enhancing the look/feel and branding of older locations to attract broader demographic Reimaging Program Underway Currently supplying 3,000 bpd from El Dorado to MAPCO 5 Yr Goal: Supply up to 10,000 bpd from El Dorado to MAPCO Supply Synergies Through El Dorado (1) As of September 30, 2011

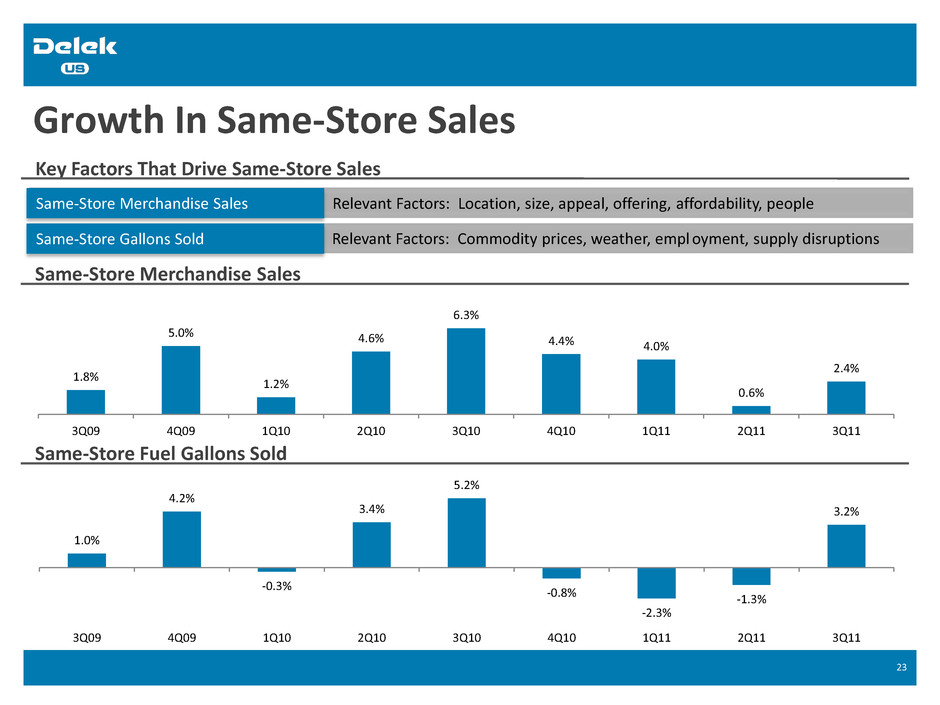

Growth In Same-Store Sales Key Factors That Drive Same-Store Sales Relevant Factors: Location, size, appeal, offering, affordability, people Same-Store Merchandise Sales ) Relevant Factors: Commodity prices, weather, empl oyment, supply disruptions Same-Store Gallons Sold 23 Same-Store Merchandise Sales Same-Store Fuel Gallons Sold 1.0% 4.2% -0.3% 3.4% 5.2% -0.8% -2.3% -1.3% 3.2% 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 1.8% 5.0% 1.2% 4.6% 6.3% 4.4% 4.0% 0.6% 2.4% 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11

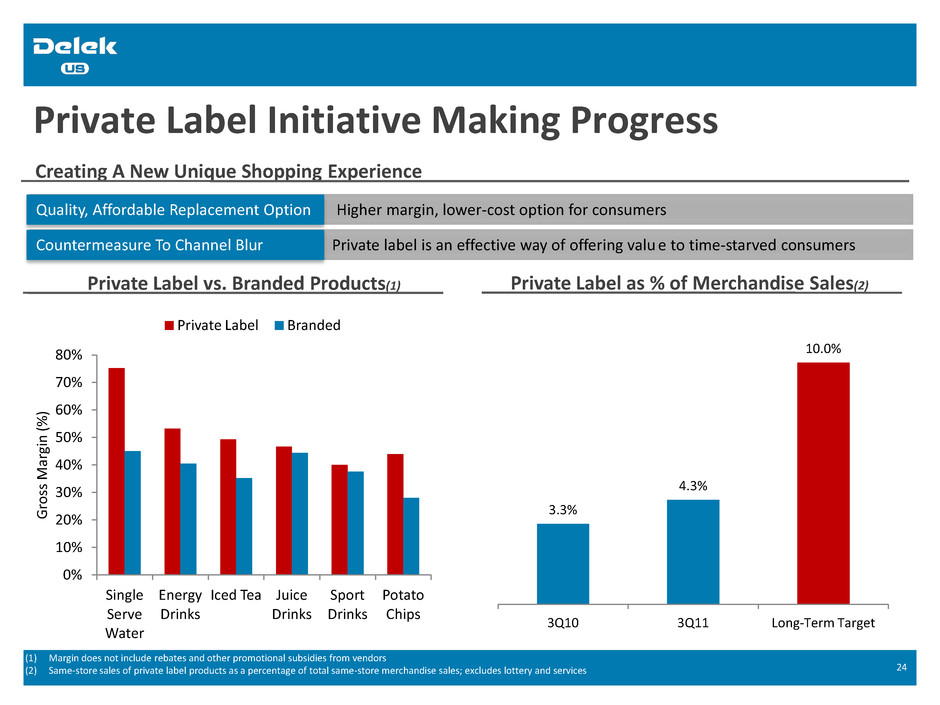

Private Label Initiative Making Progress Creating A New Unique Shopping Experience Higher margin, lower-cost option for consumers Quality, Affordable Replacement Option ) Private label is an effective way of offering valu e to time-starved consumers Countermeasure To Channel Blur 24 Private Label vs. Branded Products(1) (1) Margin does not include rebates and other promotional subsidies from vendors (2) Same-store sales of private label products as a percentage of total same-store merchandise sales; excludes lottery and services 0% 10% 20% 30% 40% 50% 60% 70% 80% Single Serve Water Energy Drinks Iced Tea Juice Drinks Sport Drinks Potato Chips G ro ss M ar gi n ( % ) Private Label Branded Private Label as % of Merchandise Sales(2) 3.3% 4.3% 10.0% 3Q10 3Q11 Long-Term Target

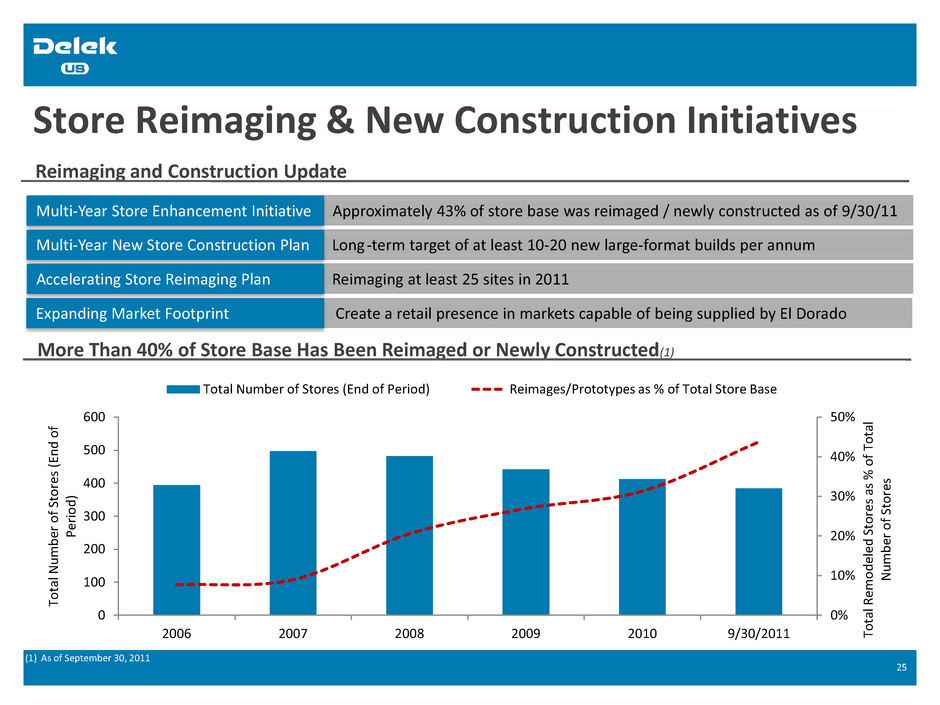

Store Reimaging & New Construction Initiatives Reimaging and Construction Update Approximately 43% of store base was reimaged / newly constructed as of 9/30/11 Multi-Year Store Enhancement Initiative ) Long-term target of at least 10-20 new large-format builds per annum Multi-Year New Store Construction Plan 25 More Than 40% of Store Base Has Been Reimaged or Newly Constructed(1) Create a retail presence in markets capable of being supplied by El Dorado Expanding Market Footprint (1) As of September 30, 2011 ) Reimaging at least 25 sites in 2011 Accelerating Store Reimaging Plan 0% 10% 20% 30% 40% 50% 0 100 200 300 400 500 600 2006 2007 2008 2009 2010 9/30/2011 To tal Re m o d eled St o res as % o f To tal N u m b er o f St o re s To tal N u m b er o f St o res (En d o f P eri o d ) Total Number of Stores (End of Period) Reimages/Prototypes as % of Total Store Base

Marketing Segment Operational Update

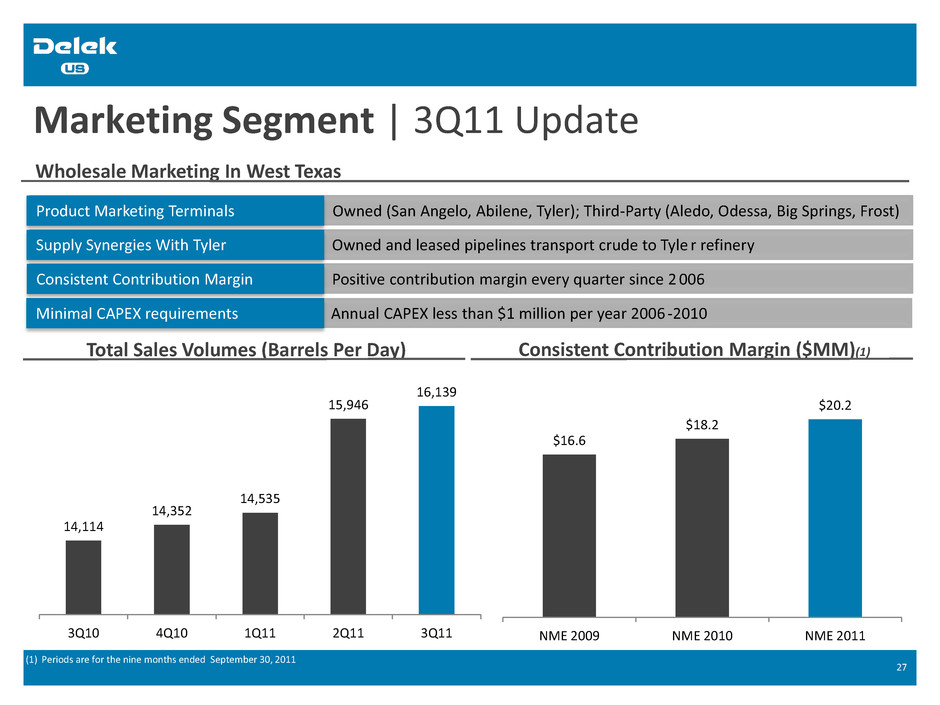

Marketing Segment | 3Q11 Update Wholesale Marketing In West Texas Owned (San Angelo, Abilene, Tyler); Third-Party (Aledo, Odessa, Big Springs, Frost) Product Marketing Terminals ) Owned and leased pipelines transport crude to Tyle r refinery Supply Synergies With Tyler 27 ) Annual CAPEX less than $1 million per year 2006 -2010 Minimal CAPEX requirements ) Positive contribution margin every quarter since 2 006 Consistent Contribution Margin Total Sales Volumes (Barrels Per Day) Consistent Contribution Margin ($MM)(1) (1) Periods are for the nine months ended September 30, 2011 14,114 14,352 14,535 15,946 16,139 3Q10 4Q10 1Q11 2Q11 3Q11 $16.6 $18.2 $20.2 NME 2009 NME 2010 NME 2011

Appendix Additional Data

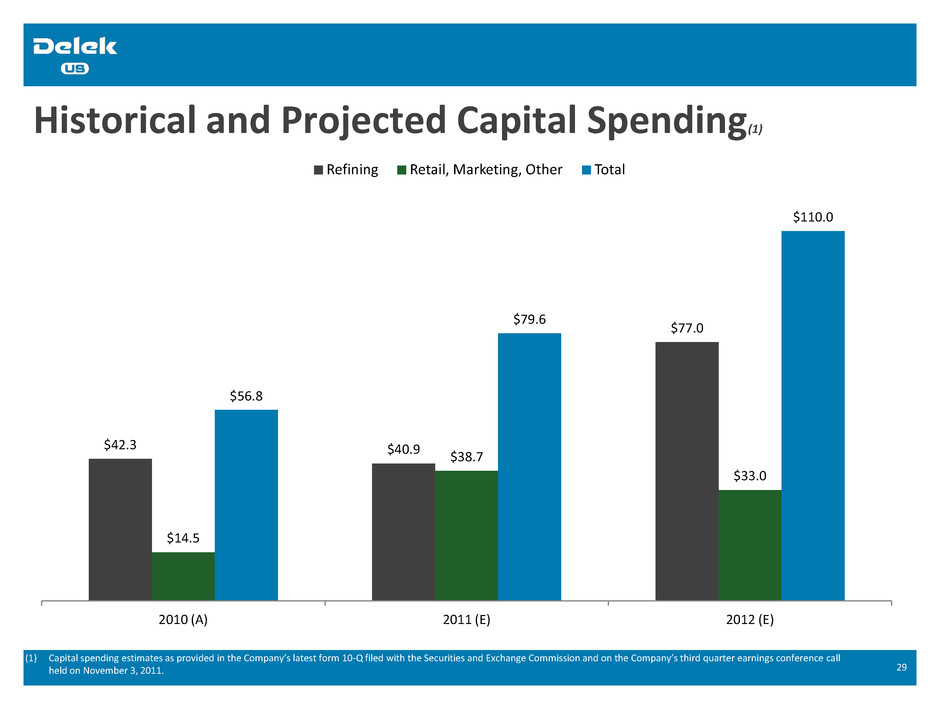

Historical and Projected Capital Spending(1) 29 (1) Capital spending estimates as provided in the Company’s latest form 10-Q filed with the Securities and Exchange Commission and on the Company’s third quarter earnings conference call held on November 3, 2011. $42.3 $40.9 $77.0 $14.5 $38.7 $33.0 $56.8 $79.6 $110.0 2010 (A) 2011 (E) 2012 (E) Refining Retail, Marketing, Other Total