Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - IRIS INTERNATIONAL INC | d272326d8k.htm |

Exhibit 10.1

Triple Net Industrial Lease

by and between

PDG CARLSBAD 47 & 48, LP

a California limited partnership

as Landlord

and

IRIS INTERNATIONAL, INC,

a Delaware corporation

as Tenant

Property located at

1891 Rutherford Road, Suite 200, Carlsbad, CA 92008

TABLE OF CONTENTS

| Page | ||||||

| ARTICLE 1 DESCRIPTION OF PREMISES |

1 | |||||

| 1.1 Premises |

1 | |||||

| 1.2 Tenant Improvements |

1 | |||||

| ARTICLE 2 TERM |

1 | |||||

| 2.1 Lease Term |

1 | |||||

| 2.2 Anticipated Commencement Date |

1 | |||||

| 2.3 Delay in Possession |

2 | |||||

| 2.4 Supplemental Agreement |

2 | |||||

| ARTICLE 3 RENT |

2 | |||||

| 3.1 Base Monthly Rental |

2 | |||||

| 3.2 Proration of Rent |

3 | |||||

| 3.3 Annual Adjustments |

3 | |||||

| 3.4 Additional Rent, Expenses and Costs |

3 | |||||

| 3.5 Late Fees |

3 | |||||

| 3.6 Security Deposit |

3 | |||||

| ARTICLE 4 TENANT IMPROVEMENTS |

4 | |||||

| 4.1 Tenant Improvements |

4 | |||||

| 4.2 Acceptance of Premises |

4 | |||||

| ARTICLE 5 USE |

5 | |||||

| 5.1 Permitted Use of Premises |

5 | |||||

| 5.2 Compliance with Laws |

5 | |||||

| 5.3 Prohibited Uses |

5 | |||||

| 5.4 Rules and Regulations |

6 | |||||

| ARTICLE 6 ALTERATIONS AND ADDITIONS |

6 | |||||

| 6.1 Prohibited Alterations |

6 | |||||

| 6.2 Notice of Commencement |

6 | |||||

| 6.3 Trade Fixtures |

7 | |||||

| ARTICLE 7 SURRENDER OF PREMISES |

7 | |||||

| 7.1 Conditions upon Surrender |

7 | |||||

| ARTICLE 8 UTILITIES AND SERVICES |

7 | |||||

| 8.1 Utilities |

7 | |||||

| 8.2 Landlord Service |

8 | |||||

| ARTICLE 9 INDEMNIFICATION BY TENANT |

9 | |||||

| 9.1 Indemnity of Landlord |

9 | |||||

| 9.2 Waiver of Claims |

9 | |||||

| 9.3 Indemnity of Tenant |

9 | |||||

i

| ARTICLE 10 INSURANCE |

9 | |||||

| 10.1 Landlord’s Insurance |

9 | |||||

| 10.2 Payment |

10 | |||||

| 10.3 Tenant’s Insurance |

10 | |||||

| 10.4 Release of Subrogation Rights |

12 | |||||

| ARTICLE 11 CARE OF THE PREMISES |

12 | |||||

| 11.1 Care of Premises |

12 | |||||

| 11.2 Maintenance of Equipment |

12 | |||||

| 11.3 Roof and Structural |

13 | |||||

| 11.4 Compliance with Governmental Regulations |

13 | |||||

| 11.5 Action by Landlord if Tenant Fails to Maintain |

13 | |||||

| 11.6 Action by Tenant if Landlord Fails to Perform |

13 | |||||

| ARTICLE 12 TAXES |

14 | |||||

| 12.1 Personal Property Taxes |

14 | |||||

| 12.2 Real Property Taxes |

14 | |||||

| 12.3 Definition of Taxes |

14 | |||||

| ARTICLE 13 COMMON AREAS |

15 | |||||

| 13.1 Common Area |

15 | |||||

| 13.2 Maintenance |

15 | |||||

| 13.3 Tenant’s Costs |

16 | |||||

| 13.4 Tenant’s Rights |

16 | |||||

| ARTICLE 14 SIGNS AND ADVERTISING |

17 | |||||

| 14.1 Signs |

17 | |||||

| ARTICLE 15 ENTRY BY LANDLORD |

17 | |||||

| 15.1 Entry by Landlord |

17 | |||||

| 15.2 Entry to Relet Premises |

17 | |||||

| 15.3 No Liability |

17 | |||||

| ARTICLE 16 ASSIGNMENT AND SUBLETTING |

18 | |||||

| 16.1 Assignment and Subletting |

18 | |||||

| 16.2 Notice to Landlord |

18 | |||||

| 16.3 Excess Rent |

18 | |||||

| 16.4 No Release of Liability |

19 | |||||

| ARTICLE 17 ABANDONMENT |

19 | |||||

| 17.1 No Abandonment |

19 | |||||

| ARTICLE 18 BREACH BY TENANT |

19 | |||||

| 18.1 Events of Default |

19 | |||||

| 18.2 Five-Day Notice |

20 | |||||

| 18.3 No Waiver |

20 | |||||

ii

| ARTICLE 19 REMEDIES UPON BREACH |

20 | |||||

| 19.1 Landlord’s Remedies |

20 | |||||

| 19.2 Forfeiture |

21 | |||||

| ARTICLE 20 DAMAGE OR DESTRUCTION |

21 | |||||

| 20.1 Landlord’s Obligation to Rebuild |

21 | |||||

| 20.2 Landlord’s Right to Terminate |

21 | |||||

| 20.3 Limited Obligation to Repair |

22 | |||||

| 20.4 Abatement of Rent |

22 | |||||

| ARTICLE 21 CONDEMNATION |

23 | |||||

| 21.1 Total Taking—Termination |

23 | |||||

| 21.2 Partial Taking |

23 | |||||

| 21.3 No Apportionment of Award |

23 | |||||

| 21.4 Temporary Taking |

23 | |||||

| 21.5 Sale Under Threat of Condemnation |

23 | |||||

| ARTICLE 22 SURRENDER OF LEASE |

24 | |||||

| 22.1 Surrender of Lease |

24 | |||||

| ARTICLE 23 ATTORNEYS’ FEES |

24 | |||||

| 23.1 Attorneys’ Fees |

24 | |||||

| ARTICLE 24 SALE OF THE PREMISES BY LANDLORD |

24 | |||||

| 24.1 Sale of Premises |

24 | |||||

| ARTICLE 25 QUIET ENJOYMENT |

24 | |||||

| 25.1 Quite Enjoyment |

24 | |||||

| ARTICLE 26 ESTOPPEL CERTIFICATES AND FINANCIAL STATEMENTS |

25 | |||||

| 26.1 Tenant Estoppel Certificate |

25 | |||||

| 26.2 Tenant Financial Statements |

25 | |||||

| ARTICLE 27 SUBORDINATION AND ATTORNMENT |

25 | |||||

| 27.1 Subordination of Lease |

25 | |||||

| 27.2 Attornment to Lender |

26 | |||||

| ARTICLE 28 HOLDING OVER |

26 | |||||

| 28.1 Holding Over |

26 | |||||

| ARTICLE 29 MORTGAGEE PROTECTION |

26 | |||||

| 29.1 Mortgagee Protection |

26 | |||||

| ARTICLE 30 LIABILITY OF SUCCESSORS |

27 | |||||

| 30.1 Successors Liability |

27 | |||||

| ARTICLE 31 EASEMENTS |

27 | |||||

| 31.1 Easements |

27 | |||||

iii

| ARTICLE 32 COVENANTS, CONDITIONS AND RESTRICTIONS |

27 | |||||

| 32.1 Compliance with Covenants, Conditions and Restrictions |

27 | |||||

| 32.2 Associations |

27 | |||||

| 32.3 Association Fees |

28 | |||||

| ARTICLE 33 QUITCLAIM DEED |

28 | |||||

| 33.1 Quitclaim Deed |

28 | |||||

| ARTICLE 34 HAZARDOUS MATERIALS |

28 | |||||

| 34.1 Definitions |

28 | |||||

| 34.2 Tenant’s Obligations |

28 | |||||

| ARTICLE 35 MISCELLANEOUS |

31 | |||||

| 35.1 Gender |

31 | |||||

| 35.2 Headings |

31 | |||||

| 35.3 Integration |

31 | |||||

| 35.4 Choice of Laws |

31 | |||||

| 35.5 Severability |

31 | |||||

| 35.6 Amendment for Financing |

31 | |||||

| 35.7 Payments |

31 | |||||

| 35.8 Time of Essence |

31 | |||||

| 35.9 Force Majeure |

31 | |||||

| 35.10 Notices |

32 | |||||

| 35.11 Brokers |

32 | |||||

| 35.12 Special Provisions |

32 | |||||

| ARTICLE 36 OPTION TO EXTEND |

34 | |||||

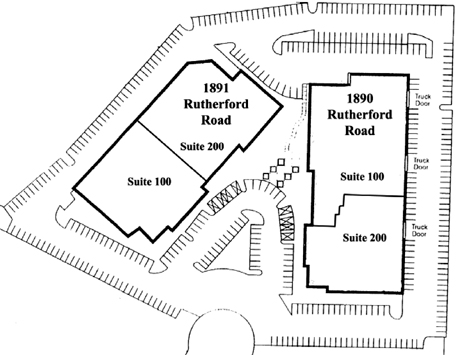

EXHIBIT A PREMISES

EXHIBIT B BUILDING

EXHIBIT C TENANT IMPROVEMENTS

iv

LEASE AGREEMENT

THIS LEASE is entered into as of December 5, 2011, by and between PDG CARLSBAD 47 & 48, LP, a California limited partnership, (the “Landlord”) and IRIS INTERNATIONAL, INC., a Delaware corporation, (the “Tenant”).

ARTICLE 1

DESCRIPTION OF PREMISES

1.1 Premises. Landlord hereby leases to Tenant and Tenant hires from Landlord, pursuant to the terms, conditions and uses herein set forth, that certain real property commonly known as 1891 Rutherford Road, Suite 200, Carlsbad, California and more particularly described in Exhibit “A” attached hereto (the “Premises”), including a building located on the Premises containing approximately 25,776 rentable square feet, as shown on the drawing attached hereto as Exhibit “B” (the “Premises” or “Building”).

1.2 Tenant Improvements. In addition to the existing improvements, the Premises shall be improved with certain tenant improvements (the “Improvements”) as more fully described in Section 4.1 and Exhibit “C” attached hereto.

ARTICLE 2

TERM

2.1 Lease Term. The term of this Lease shall be for Eighty Four (84) months commencing on the earlier of (i) date which is ten (10) days after Landlord notifies Tenant that the Improvements are completed and the Premises are ready for occupancy (and such notice is factually accurate), or (ii) the date on which Tenant shall take occupancy of the Premises and commences to conduct business operations therefrom (the “Commencement Date”). If the Commencement Date occurs on other than the first day of a month, the term of this Lease shall be extended by the number of days remaining in the first calendar month of occupancy.

2.2 Anticipated Commencement Date. The anticipated date on which the term shall commence is May 1, 2012, (the “Anticipated Commencement Date”). If Landlord, for any reason, cannot deliver possession of the Premises to Tenant on said date with the Improvements completed, Landlord shall not be subject to any liability therefor, nor shall such failure affect the validity of this Lease or the obligations of Tenant hereunder; provided that, Tenant shall not be obligated to pay rent until possession of the Premises is tendered to Tenant with the Improvements completed, except to the extent any such delay is the result of a Tenant Delay (defined below) in which case, the Tenant shall be obligated to commence payment of the Rent on the date the Improvements would have been completed but for the Tenant Delay. The term “Tenant Delay” shall mean an actual delay resulting from the failure of Tenant to comply with its obligations under this Lease or Tenant unreasonably interfering with the completion of the Improvements; provided that no Tenant Delay shall be deemed to have occurred unless Tenant has failed to cure the Tenant Delay within one (1) business days following written notice thereof from Landlord.

1

2.3 Delay in Possession. In the event Landlord shall not have delivered possession of the Premises with the Improvements completed within two (2) months from the Anticipated Commencement Date set forth in Section 2.2, plus periods occurring as a result of any Tenant Delay or any delays which are beyond Landlord’s reasonable control, including, but not limited, inclement weather, strikes, acts of God, inability to obtain labor or materials, ability to secure governmental approvals or permits, governmental restrictions, civil commotion, fire or similar causes (not to exceed sixty (60) days), Tenant may, by written notice to Landlord within ten (10) days after the expiration of said two-month period, either (i) elect to receive two (2) days of rental abatement for each day beyond the end of such two-month period until the Improvements are so completed and the Premises is delivered to Tenant, or (ii) terminate this Lease and, upon Landlord’s return of any monies previously deposited by Tenant, the parties shall have no further rights or liabilities towards each other. Provided further, however, that if such written notice of Tenant is not given to Landlord within said ten (10) day period, Tenant’s right to cancel this Lease under this Section 2.3 shall terminate and be of no further force or effect.

2.4 Supplemental Agreement. Tenant agrees to execute a supplemental agreement within ten (10) days after receipt in form requested by Landlord which shall confirm the Commencement Date of this Lease.

ARTICLE 3

RENT

3.1 Base Monthly Rental. Tenant shall pay to Landlord at the address set forth in Section 35.10, or such other address as Landlord may advise Tenant in writing, without deduction, offset or prior notice or demand (except as otherwise provided herein), and Landlord shall accept, as rent for the Premises the sum outlined below, per month, in lawful money of the United States payable in advance on the first day of each month of the term of this Lease. Said monthly installments shall hereinafter be referred to as the “Base Monthly Rental.” Tenant has delivered to Landlord the Base Monthly Rental for the first month of the term hereof upon execution and delivery of this Lease.

| Month 1 Month 2 Months 3-12 Months 13-24 Months 25-36 Months 37-48 Months 49-60 Months 61-72 Months 73-84 |

$26,250 Abated (Tenant to pay CAM charges pursuant to Article 13) $26,250 $32,445 $38,988 $42,454 $43,940 $45,478 $47,070 |

2

3.2 Proration of Rent. In the event that the Commencement Date is not on the first day of the month, Tenant shall pay to Landlord prior to the first day of the second full calendar month following the Commencement Date, in lieu of the Base Monthly Rental for such second month, an amount equal to the Base Monthly Rental multiplied by a factor having as its numerator the number of days remaining from and after the Commencement Date in the month in which the Commencement Date occurs and as its denominator the number thirty. Thereafter, rent shall be payable in accordance with the terms of Section 3.1.

3.3 Annual Adjustments. [Intentionally Blank]

3.4 Additional Rent, Expenses and Costs. Tenant shall pay as additional rent (“Additional Rent”) insurance pursuant to Section 10, taxes pursuant to Section 12, maintenance, roof and structural repairs pursuant to Sections 11.2 and 11.3, or other charges, expenses and cost provided for herein, as described and in the manner provided in Article 13. Landlord shall have the right to reasonably estimate and collect from Tenant in advance on a monthly basis any such Additional Rent.

3.5 Late Fees. Tenant acknowledges that late payment by Tenant to Landlord of the Base Monthly Rental or other charges incurred under this Lease will cause Landlord to incur costs not contemplated by this Lease, the exact amount of such costs being extremely difficult and impracticable to fix. Such costs include, without limitation, processing, administrative and accounting charges, and late charges that may be imposed on Landlord by the terms of any note secured by any mortgage encumbering the Premises. If any payment of Base Monthly Rental, Excess Operating Expenses, or other charges due from Tenant is not received by Landlord within three (3) business days following the delivery of written notice to Tenant that same is due, Tenant shall pay to Landlord an additional sum of the greater of (i) five percent (5%) of the overdue rent or (ii) Fifteen Dollars ($15.00) as a late charge. Late charges shall constitute Additional Rent. The parties agree that the late charge represents a fair and reasonable estimate of the costs that Landlord will incur by reason of late payment by Tenant. Acceptance of any late charge shall not constitute a waiver of Tenant’s default with respect to the overdue amount, or prevent Landlord from exercising any of the other rights and remedies available to Landlord hereunder. Notwithstanding the foregoing, no late fee shall be due and owing with respect to the first late payment during every calendar year of this Lease unless Tenant continues to fail to pay the required amount due and owing to Landlord within ten (10) business days after Tenant’s receipt of written notice from Landlord.

3.6 Security Deposit. Tenant has deposited with Landlord the sum of Forty Seven Thousand Seventy Dollars ($47,070.00), receipt of which is hereby acknowledged, as security for the full performance of the obligations of Tenant under this Lease.

3.6.1 If Tenant shall be in default with respect to the payment of the Base Monthly Rental or any other covenant contained herein, after the expiration of all applicable notice and cure periods, Landlord may use or retain all or any part of the security deposit for the payment of any sum in default, or for the payment of any amount which Landlord may spend or become obligated to spend by reason of Tenant’s default. If any portion of said security deposit be so applied or used, Tenant shall, within five (5) business days after written notice thereof, deposit an additional amount with Landlord sufficient to restore said security deposit to the amount set forth above and Tenant’s failure to do so shall constitute a breach of this Lease.

3

3.6.2 If Tenant is not in default at the expiration or earlier termination of this Lease, Landlord shall return said security deposit to Tenant within two (2) weeks after said expiration or termination of this Lease, less any amounts required, as a result of Tenant’s failure to comply with its restoration obligations hereunder, to restore the Premises to good condition and repair, reasonable wear and tear excepted, including damage resulting from the removal by Tenant of its trade fixtures or equipment.

3.6.3 Landlord’s obligation with respect to any security deposit is that of a debtor and not as a trustee, consequently, such sums may be commingled with rental receipts or dissipated and no interest shall accrue thereon.

3.6.4 In the event of the sale of the real property of which the Premises constitute a part, Landlord or its agents shall pay over to Landlord’s successor in interest the sums held as security or advance rent and notify Tenant in writing setting forth the particularity of such transfer, including the successor’s name and address. Upon such written notification, (and provided Landlord’s successor-in-interest in fact received said security deposit), Tenant shall have no further claim against Landlord with respect to any such security deposit and hereby waives all rights against Landlord in such regard.

3.6.5 In the event of foreclosure by the holder of any mortgage or deed of trust encumbering the Premises, Landlord shall continue to be liable for any security deposit and any such mortgagee shall have no liability or responsibility therefor.

3.7 Tenant shall have the right to, prior to the Commencement Date, remeasure the Premises in accordance with the standards set forth in ANSI Z65.1-1996, as promulgated by the Building Owners and Managers Association (“BOMA Standard”), including allocation of common areas, and in the event that subsequent remeasurement of the Premises by Tenant produces a square footage number in excess of or lower than the square footage number which would have resulted had the BOMA Standard been utilized, any payments due to Landlord from Tenant based upon the amount of square feet contained in the Premises shall be proportionally, retroactively and prospectively reduced or increased, as appropriate, to reflect the actual number of square feet as remeasured under the BOMA Standard.

ARTICLE 4

TENANT IMPROVEMENTS

4.1 Tenant Improvements. Subject to the provisions of Exhibit “C” of this Lease, Landlord shall cause to be constructed, for the mutual benefit of Tenant and Landlord, certain modifications and improvements to the Premises as more fully described in Exhibit “C” attached hereto.

4.2 Acceptance of Premises. Subject to Landlord’s other obligations under this Lease (including the completion of the Improvements), Tenant shall accept the Premises in a boom clean, “As Is” condition, with all personal property of Landlord and any prior tenant removed.

4

However, prior to the Commencement Date, Landlord, at Landlord’s sole cost, shall provide that the roof, existing HVAC systems, mechanical, fire/life/safety, electrical and plumbing systems serving the Premises and Building are in good working condition and shall ensure that the Premises, Building and parking areas, in their current condition and build-out, meet and, other than as a result of modifications or improvements made by Tenant, continue to meet during the term of this Lease all current laws, codes and conditions including Building, fire and life safety and applicable Americans With Disabilities Act requirements. Prior to the Commencement Date, Landlord shall provide Tenant with a current Phase I Environmental Assessment of the Premises and shall remediate any environmental violations described therein at its sole cost. Such Phase I Environmental Assessment shall be the baseline for the pre-lease environmental condition of the Premises under the lease. The parties agree that a Phase I Environmental Assessment prepared for Isis Pharmaceuticals within six (6) months prior to the Commencement Date, with a peer review by Kasai Consulting, shall qualify as an acceptable Phase I Environmental Assessment for purposes of this paragraph (hereinafter, the “Existing Phase I”). Landlord prior to Tenant’s occupancy shall perform testing to ensure that the gas lines are in sound condition and free of leaks and promptly provide said results to Tenant. In addition, Landlord shall provide Tenant with confirmation that the underground sewer system is in sound condition and free of leaks.

ARTICLE 5

USE

5.1 Permitted Use of Premises. The Premises shall be used and occupied by Tenant solely for pharmaceutical, medical and biotechnology laboratory, research and development uses and any other uses permitted under applicable law and zoning, including but not limited to general office space.

The Premises are to be used for no other purposes without first obtaining the consent of Landlord. Tenant shall not commit or permit any nuisance, act or other thing which may disturb the quiet enjoyment of the other tenants of the Building.

5.2 Compliance with Laws. Tenant, at Tenant’s sole expense, shall promptly comply, or cause compliance, with all laws, ordinances, zoning restrictions, rules, regulations, orders and requirements of any duly constituted public authorities now or hereafter affecting the use, safety, cleanliness and occupation of the Premises; provided that Tenant shall have no obligation to perform any structural repairs or other capital improvements (unless resulting from alterations performed by Tenant or from Tenant’s particular use).

5.3 Prohibited Uses. Tenant shall not do, bring or keep anything in or about the Premises that will cause a cancellation of any insurance covering the Premises or the Building. Tenant shall not use the Premises in any manner that will constitute waste, nuisance or unreasonable annoyance to owners or occupants of nearby properties, provided that Tenant’s proper and lawful use of the Premises for the contemplated use shall not constitute any such nuisance or annoyance. Subject to the foregoing, Tenant shall not use the Premises for sleeping, cooking, washing clothes, or the preparation, manufacture, or mixing of anything that might emit any odor or objectionable noises or lights onto nearby properties, nor shall any animals or birds

5

be brought in or kept in or about the Premises. Tenant shall not do anything on the Premises that will cause damage to the Building. Tenant shall place no loads upon the floors, walls or ceiling of the Building in excess of the maximum designed load specified by Landlord or which may damage the Building. No machinery, apparatus, or other appliance shall be used or operated in or on the Premises that will in any manner injure, the Premises.

5.4 Rules and Regulations. Provided Tenant receives reasonable advance notice of the same and Tenant’s use of the Premises is not impaired as a result, Tenant shall comply with all nondiscriminatory rules and regulations (the “Rules and Regulations”) from time to time reasonably adopted by Landlord with respect to the Premises.

ARTICLE 6

ALTERATIONS AND ADDITIONS

6.1 Prohibited Alterations. Tenant shall not make any alterations, improvements or additions to the Premises, except for non-structural alterations not exceeding Fifty Thousand Dollars ($50,000) in aggregate cost per annum over the Term of the Lease, without obtaining Landlord’s prior written consent, which consent shall not be unreasonably withheld or delayed. Any such improvements, excepting movable furniture and trade fixtures, shall become part of the realty and belong to Landlord. All alterations and improvements shall be installed at Tenant’s sole cost, by a licensed contractor, in a good and workmanlike manner, and in conformity with the laws of all applicable duly constituted public authorities.

6.2 Notice of Commencement. At least twenty (20) days prior to commencing any work relating to any alterations, improvements or additions approved by Landlord, Tenant shall notify Landlord in writing of the expected date of commencement. Landlord shall have the right at any time thereafter to post and maintain on the Premises such notices as Landlord reasonably deems necessary to protect Landlord and the Premises from mechanics’ liens, materialmen’s liens or any other liens. Tenant shall pay, when due, all claims for labor or materials furnished to or for Tenant for use in improving the Premises. Tenant shall not permit any mechanics’ or materialmen’s liens to be levied against the Premises arising out of work performed, materials furnished, or obligations to have been performed on the Premises by or at the request of Tenant. Tenant hereby indemnifies and holds Landlord harmless against loss, damage, attorneys’ fees and all other expenses on account of claims of lien of laborers or materialmen or others for work performed or materials or supplies furnished for Tenant or its contractors, agents or employees. If Tenant fails to remove or bond any lien(s) filed against the Premises in connection with any work performed or any work claimed to have been performed by or at the direction of Tenant within ten (10) business days from the date of the lien(s) filing, Landlord may remove such lien(s) at Tenant’s expense and Tenant shall reimburse Landlord for all costs incurred by Landlord in connection with the removal of the lien(s), which amount shall be deemed Additional Rent, and shall include, without limitation, all sums disbursed, incurred or deposited by Landlord, including Landlord’s costs, expenses and actual attorneys’ fees, with interest thereon, at ten percent (10%) per annum from the date of expenditure.

6

6.3 Trade Fixtures. Tenant may install trade fixtures, machinery or other trade equipment in conformance with the ordinances of all applicable duly constituted public authorities. Tenant may remove any of such trade fixtures or machinery upon the termination of this Lease. In the event that Tenant installs improvements, machinery or trade fixtures following the Commencement Date, Tenant shall, at Landlord’s election (which must have been communicated to Tenant concurrently with Landlord’s approval of any such improvements, to the extent such approval is required), return the Premises on termination of this Lease to the same condition as existed at the Commencement Date, reasonable wear and tear excepted, including the removal of improvements approved by Landlord in Section 6.1, if Landlord’s approval was conditioned upon Tenant’s removal of said improvements. Tenant shall, in any event, repair any damage resulting from the removal of machinery or trade fixtures of Tenant.

ARTICLE 7

SURRENDER OF PREMISES

7.1 Conditions upon Surrender. Upon the expiration, or earlier termination, of this Lease, Tenant shall surrender the Premises to Landlord in its condition existing as of the Commencement Date, normal wear and tear and acts of God excepted, with all interior walls in good repair and repainted if marked, all carpets shampooed and cleaned, the HVAC equipment, plumbing, electrical and other mechanical installations in good operating order, and all floors stripped, cleaned and waxed, all to the reasonable satisfaction of Landlord. Tenant shall remove from Premises all of Tenant’s alterations which Landlord requires Tenant to remove pursuant to Section 6.3 and all Tenant’s personal property and shall repair any damage and perform any restoration work caused by such removal. If Tenant fails to remove such alterations and Tenant’s personal property pursuant to the above, and such failure continues for more than ten (10) business days after the termination of the Lease, Landlord may retain such property and all rights of Tenant with respect to it shall cease, or Landlord may place all or any portion of such property in public storage for Tenant’s account. Tenant shall pay to Landlord upon demand costs of removal of such alterations and Tenant’s personal property and storage and transportation costs of same, and the cost of repairing and restoring the Premises, together with attorneys’ fees and interest on said amounts, from the date of expenditure by Landlord. If the Premises are not so surrendered at the termination of this Lease, Tenant hereby agree to indemnify Landlord and its agents against all loss or liability resulting from such delay Tenant in so surrendering the Premises, including, without limitation, any claims made by any succeeding Tenant, losses to Landlord due to lost opportunity to lease to succeeding tenants, actual attorneys’ fees and costs.

ARTICLE 8

UTILITIES AND SERVICES

8.1 Utilities. Tenant shall make all arrangements for and pay for all water, sewer, gas, heat, light, power, telephone service and any other service or utility Tenant requires at the Premises. Except as provided in Section 8.3 below, Landlord shall not be liable for any failure or interruption of any utility service being furnished to the Premises, and no such failure or interruption shall entitle Tenant to terminate this Lease.

7

8.2 Landlord Service. In the event that any utilities are furnished by Landlord, Tenant shall pay to Landlord the cost thereof in the manner set forth in Section 13.3. Tenant’s cost shall be the total cost shown on utility meters servicing the Premises and Landlord’s actual, out-of-pocket costs incurred in connection with any extraordinary use which may be made by Tenant.

8.3 Abatement for Untenantability. In the event that Tenant is reasonably prevented from using the Premises or any material portion thereof and does not use the same, as a result of (a) any entry by Landlord into the Premises, or alteration or construction in the common areas or affecting the Building structure or Building systems, or any other repair, maintenance or alteration which is performed by Landlord, or which is required hereunder to be performed by Landlord and which Landlord failed to perform after the Commencement Date, which materially interferes with Tenant’s use or occupancy of the Premises (or the applicable portion thereof), (b) any failure, for any reason within the Building to provide access to the Premises or any failure caused by Landlord to provide services or utilities to the Premises, in either case to the extent such failure materially impairs Tenant’s use or occupancy of the Premises, or (c) the presence of Hazardous Materials which have been conclusively determined to have not been brought on the Premises by Tenant which materially impairs Tenant’s use or occupancy of the Premises (any such set of circumstances as set forth in items (a), (b) or (c), above, to be known as an “Abatement Event”), then Tenant shall give Landlord notice of such Abatement Event, and if such Abatement Event continues for three (3) consecutive business days or seven (7) non-consecutive business days in any twelve (12) month period (the “Eligibility Period”), then the Base Monthly Rent and all other Rent payable by Tenant hereunder on a periodic basis (collectively, “Periodic Rent”), shall be abated or reduced, as the case may be, from the commencement of the Eligibility Period for such time that Tenant continues to be so prevented from using and does not use the Premises or a portion thereof, in the proportion that the rentable area of the portion of the Premises that Tenant is prevented from using and does not use bears to the total rentable area of the Premises (provided, that if Tenant is prevented from using a portion of the Premises for a period of time in excess of the Eligibility Period and the remaining portion of the Premises is not sufficient to allow Tenant to effectively conduct its business therein and Tenant in fact does not conduct business therein, then after expiration of the Eligibility Period, and for such time that Tenant continues to be so prevented from effectively conducting its business in any portion of the Premises, Tenant’s obligations to pay Periodic Rent for the entire Premises shall be abated for such time as Tenant continues to be so prevented from using the Premises). If Landlord has not cured an Abatement Event within two hundred seventy (270) days after Landlord’s receipt of written notice of the Abatement Event from Tenant and such Abatement Event materially interferes with Tenant’s use of the Premises, Tenant shall have the right to terminate this Lease during the first fifteen (15) business days of the first full calendar month following the end of such two hundred seventy (270) day period, which right may be exercised only by delivery of notice to Landlord (the “Abatement Event Termination Notice”) during such five (5) business-day period, and shall be effective as of the date set forth in the Abatement Event Termination Notice (the “Abatement Event Termination Date”), which Abatement Event Termination Date shall not be less than thirty (30) days, and not more than six (6) months, following the date on which Tenant delivers to Landlord an Abatement Event Termination Notice.

8

ARTICLE 9

INDEMNIFICATION BY TENANT

9.1 Indemnity of Landlord. Tenant hereby agrees to indemnify, defend (with attorneys’ approved by Landlord), protect, and hold Landlord and Landlord’s agents harmless from any and all liabilities, costs, expenses and losses by reason of injury to person or property, from whatever cause, to the extent resulting from Tenant’s use of the Premises, including without limitation, any liability for injury to the person or property of Tenant, its agents, officers, employees, or invitees, but excepting any loss or injury resulting from the acts or negligence of Landlord or its agents, representatives or employees. Tenant shall, at Tenant’s sole expense, resist and defend any such action, suit, or proceeding or cause the same to be resisted or defended by counsel designated by Tenant and approved by Landlord. Tenant’s obligation hereunder shall survive the termination of this Lease if the incident requiring such defense occurred during the lease term.

9.2 Waiver of Claims. Tenant, as a material part of the consideration rendered to Landlord in entering into this Lease, hereby waives all claims against Landlord for damages to goods, wares, machinery and trade fixtures in, upon and about the Premises and for injury to Tenant, its agents, employees, invitees, or any third person in or about the Premises from any cause at any time, except to the extent resulting from any gross negligence or willful misconduct of Landlord or Landlord’s breach of this Lease.

9.3 Indemnity of Tenant. Landlord hereby agrees to indemnify, defend (with attorneys’ approved by Tenant), protect, and hold Tenant and Tenant’s agents harmless from any and all liabilities, costs, expenses and losses by reason of injury to person or property, from whatever cause, to the extent resulting from Landlord’s breach of this Lease, negligence or willful misconduct, but excepting any loss or injury resulting from the acts or gross negligence of Tenant or its agents, representatives or employees. Landlord shall, at Landlord’s sole expense, resist and defend any such action, suit, or proceeding or cause the same to be resisted or defended by counsel designated by Landlord and approved by Tenant. Landlord’s obligation hereunder shall survive the termination of this Lease if the incident requiring such defense occurred during the lease term.

ARTICLE 10

INSURANCE

10.1 Landlord’s Insurance. Landlord shall maintain, at Tenant’s sole expense, which Tenant shall pay to Landlord as Additional Rent in the manner set forth in Section 13.3 a policy or policies of insurance protecting Landlord against the following:

9

10.1.1 Property Insurance—Building, Improvements. Landlord shall obtain and keep in force a policy or policies of insurance in the name of Landlord with loss payable to Landlord and to any Lender insuring loss or damage to the Building and/or Project. The amount of such insurance shall be equal to the full replacement cost of the Building and/or Project, as the same shall exist from time to time, or the amount required by any Lender, but in no event more than the available insurable value thereof. If the coverage is available and commercially appropriate, such policy or policies by Landlord shall insure against all risks of direct physical loss or damage to include earthquake; (flood may be included if required by a Lender), including coverage for debris removal and the enforcement of any Applicable Requirements requiring the upgrading, demolition, reconstruction or replacement of any portion of the Premises as the result of a covered loss. Said policy or policies by Landlord shall also contain an agreed valuation provision in lieu of any coinsurance clause, waiver of subrogation, and inflation guard protection causing an increase in the annual property insurance coverage amount by a factor of not less than the adjusted U.S. Department of Labor Consumer Price Index for All Urban Consumers for the city nearest to where the Premises are located and other endorsements which Landlord may elect to maintain and which may be reasonably required by the first mortgagee or beneficiary of a deed of trust encumbering real property of which the Premises constitute a part (“Mortgagee”). If such insurance coverage has a deductible clause, the deductible amount shall not exceed $5,000 per occurrence.

10.1.2 Property Insurance—Loss of Rents. Landlord shall also obtain and keep in force a policy or policies in the name of Landlord with loss payable to Landlord insuring the loss of the full Rent for one year with an extended period of indemnity for an additional 365 days (“Loss of Rents”). Said insurance shall contain an agreed valuation provision in lieu of any coinsurance clause, and the amount of coverage shall be adjusted annually to reflect the projected Rent otherwise payable by Tenant, for the next 12 month period.

10.1.3 Liability Insurance—Commercial General Liability. Commercial General Liability policy of insurance protecting Landlord against claims for bodily injury, personal injury and property damage based upon or arising out of the ownership, use, occupancy or maintenance of the Premises and all areas appurtenant thereto. Such insurance shall be on an occurrence basis providing single limit coverage in an amount not less than $1,000,000 per occurrence with an annual aggregate of not less than $2,000,000.

10.2 Payment. Tenant shall pay to Landlord in the manner set forth in Section 13.3, the cost of insurance required in Section 10.1.

10.3 Tenant’s Insurance. Tenant shall maintain at its sole cost and expense, in force a policy or policies of insurance protecting Landlord and Tenant against each of the following:

10.3.1 Liability Insurance—Commercial General Liability. Tenant shall obtain and keep in force a Commercial General Liability policy of insurance protecting Tenant and Landlord as an additional insured against claims for bodily injury, personal injury and property damage based upon or arising out of the ownership, use, occupancy or maintenance of the Premises and all areas appurtenant thereto. Such insurance shall be on an occurrence basis providing single limit coverage in an amount not less than $1,000,000 per occurrence with an annual aggregate of not less than $2,000,000. Tenant shall add Landlord as an additional insured by means of an endorsement at least as broad as the Insurance Service Organization’s “Additional Insured-Managers or Landlords of Premises” Endorsement and coverage shall also

10

be extended to include damage caused by heat, smoke or fumes from a hostile fire. The policy shall not contain any intra-insured exclusions as between insured persons or organizations, but shall include coverage for liability assumed under this Lease as an “insured contract” for the performance of Tenant’s indemnity obligations under this Lease. The limits of said insurance shall not, however, limit the liability of Tenant nor relieve Tenant of any obligation hereunder. Tenant shall provide an endorsement on its liability policy(ies) which provides that its insurance shall be primary to and not contributory with any similar insurance carried by Landlord, whose insurance shall be considered excess insurance only.

The amount of such Commercial General Liability insurance shall be increased from time to time as Landlord may reasonably determine. All such bodily injury and property damage insurance shall specifically insure the performance by Tenant of the indemnity agreement as to personal injury or property damage contained in Section 9.

10.3.2 Property; Business Interruption Insurance; Property Damage. Tenant shall obtain and maintain insurance coverage on Tenant’s alterations permitted under Section 7, all of Tenant’s personal property and trade fixtures. Such insurance shall be full replacement cost coverage with a deductible of not to exceed $10,000 per occurrence and contain an agreed amount clause. The proceeds from any such insurance shall be used by Tenant for the replacement of personal property, trade fixtures and Tenant’s alterations. Tenant shall provide Landlord with written evidence that such insurance is in force.

10.3.3 Business Interruption. Tenant shall obtain and maintain loss of income and extra expense insurance in amounts as will reimburse Tenant for direct or indirect loss of earnings attributable to all perils commonly insured against by prudent Tenants in the business of Tenant or attributable to prevention of access to the Premises as a result of such perils.

10.3.4 Workers Compensation Insurance. Tenant shall obtain and maintain Worker’s Compensation Insurance in such amount as may be required by Applicable Requirements. Coverage shall contain a waiver of subrogation clause in favor of Landlord.

10.3.5 No Representation of Adequate Coverage. Landlord makes no representation that the limits or forms of coverage of insurance specified herein are adequate to cover Tenant’s property, business operations or obligations under this Lease.

10.3.6 Insurance Policies. All policies of insurance to be provided by Tenant shall be issued by insurance companies, with general policy holder’s rating of not less than A- and a financial rating of not less than Class A as rated in the most current available “Best’s” Insurance Reports, and qualified to do business in the State of California or such other rating as may be required by a Lender. Such policies shall be issued in the names of Landlord and Tenant and, if requested by Landlord, any mortgagee. The policies provided by Tenant shall be for the mutual and joint benefit and protection of Landlord, Tenant and any mortgagee. Tenant shall not do or permit to be done anything which invalidates the required insurance policies. Tenant shall, prior to the Commencement Date, deliver to Landlord certified copies of policies of such insurance or certificates with copies of the required endorsements evidencing the existence and amounts of the required insurance. No such policy shall be cancelable or subject to modification except after ten (10) days prior written notice to Landlord. Tenant shall, prior to the expiration

11

of such policies, furnish Landlord with evidence of renewals or “insurance binders” evidencing renewal thereof, or Landlord may order such insurance and charge the cost thereof to Tenant, which amount shall be payable by Tenant to Landlord upon demand. Such policies shall be for a term of at least one year, or the length of the remaining term of this Lease, whichever is less. If either Party shall fail to procure and maintain the insurance required to be carried by it, the other Party may, but shall not be required to, procure and maintain the same.

10.3.7 Notwithstanding anything to the contrary, Tenant’s obligation to carry the insurance described in this Section may be brought within the coverage of a so-called blanket policy or policies of insurance carried and maintained by the Tenant, provided that (i) Landlord and any mortgagee shall be named as an additional insured thereunder as their interests may appear, (ii) the coverage afforded Landlord will not be reduced or diminished by reason of the use of such blanket policy of insurance, and (iii) the requirements set forth herein are otherwise satisfied. Tenant agrees to permit Landlord at all reasonable time to inspect the policies of insurance of Tenant covering the Premises for policies which are not required to be delivered to Landlord.

10.4 Release of Subrogation Rights. Landlord and Tenant hereby mutually release each other from liability and waive all right to recover against each other for any loss from perils insured against under their respective property insurance policies, including any extended coverage and special form endorsements to said policies; provided, however, this Section shall be inapplicable if it would have the effect, but only to the extent that it would have the effect, of invalidating any insurance coverage of Landlord or Tenant. The parties shall obtain, if available, from their respective insurance companies, a waiver of any right of subrogation which said insurance company may have against the Landlord or the Tenant, as the case may be.

ARTICLE 11

CARE OF THE PREMISES

11.1 Care of Premises. Tenant shall, at its sole cost and expense keep the Premises and exterior and interior portions of windows, doors, and all other glass or plate glass fixtures in a working neat, clean, sanitary and safe condition, and shall keep the Premises free from trash, rubbish and dirt. Tenant shall make all repairs or replacements thereon or thereto, whether ordinary or extraordinary.

11.2 Maintenance of Equipment. Tenant shall, at its sole cost and expense, keep and maintain all fixtures and mechanical equipment used by Tenant in good working order, condition and repair. Said items shall include, but are not limited to, all plumbing or sewage facilities in the Premises, doors, locks and closing devices, windows, including glass, lights, electric systems and equipment, heating and air conditioning systems and equipment and, all other appliances and equipment of every kind. Landlord shall enter into a maintenance agreement for the maintenance of any heating and/or air conditioning units servicing the Premises with a reputable maintenance service company and Tenant shall pay to Landlord as Additional Rent in the manner set forth in Section 13.3, the cost of any such maintenance agreement.

12

11.3 Roof and Structural and Other Maintenance Obligations of Landlord. Landlord shall keep in good condition and repair the foundations, exterior walls, fire/life/safety systems, roof and structural components of the Building, but the cost thereof (other than any capital expenditures which shall be amortized over the life of the improvement with the amount charged to Tenant limited to the period of the remaining term of the Lease) shall be paid by Tenant as Additional Rent in accordance with the manner set forth in Section 13.3. Landlord shall have no obligation to make any such repairs until Landlord has received written notice from Tenant with respect to the need for such repairs. Landlord shall not be deemed to be in default with respect with its obligation to repair unless and until Landlord has (i) received said written notice and (ii) failed to make such repairs within a reasonable period following the receipt of said notice. Landlord shall, after receiving written notice, exercise due diligence in making such repairs. Tenant hereby waives any provisions of law permitting Tenant to make repairs at Landlord’s expense. Landlord shall enforce any construction warranties for the benefit of Tenant to the extent that they are available.

11.4 Compliance with Governmental Regulations. Tenant shall, at its sole cost and expense, promptly and properly observe and comply with, including the making by Tenant of any alterations to the Premises, all present and future orders, regulations, directions, rules, laws ordinances, and requirements of all governmental authorities (including, without limitation, state, municipal, county and federal governments and their departments, bureaus, boards and officials) arising from the use of the Premises (provided Tenant shall have no responsibility for any structural improvements or capital expenditures, except to the extent resulting from alterations by Tenant or Tenant’s particular use).

11.5 Action by Landlord if Tenant Fails to Maintain. If Tenant refuses or neglects to repair or maintain the Premises as required by Sections 11.1, 11.2, 11.3 and 11.4 to the reasonable satisfaction of Landlord, Landlord, at any time following fifteen (15) days from the date on which Landlord shall make written demand on Tenant to affect such repair or maintenance, may, but shall not have the obligation to, make such repair and/or maintenance (without liability to Tenant for any loss or damage which may occur to Tenant’s merchandise, fixtures or other personal property, or to Tenant’s business by reason thereof) and upon completion thereof, Tenant shall pay to Landlord as Additional Rent Landlord’s costs for making such repairs, plus interest at ten percent (10%) per annum upon demand therefor. Moreover, Tenant’s failure to pay any of the charges in connection with the performance of its maintenance and repair obligations under this Lease will constitute a material default under the Lease.

11.6 Action by Tenant if Landlord Fails to Perform. Notwithstanding anything to the contrary contained in this Lease, if Tenant provides written notice to Landlord of an event or circumstance which requires the action of Landlord with respect to repair and/or maintenance of the Premises which Landlord is required to provide pursuant to this Lease, and Landlord fails to commence such action within five (5) business days following the delivery of two (2) successive written notices from Tenant and thereafter diligently prosecute the same to completion (except in the event of an emergency with an imminent threat to the health or safety of Tenant’s employees, or an imminent threat of substantial damage to Tenant’s property, then within two (2) business days), then, Tenant shall have the right to perform the required action of Landlord, and Landlord shall reimburse Tenant for the costs thereof within thirty (30) days after presentation of a reasonably detailed invoice demonstrating the expenses incurred by Tenant. If Landlord fails to

13

reimburse Tenant within such thirty (30) day period, then Tenant shall be entitled to deduct from rent the costs incurred by Tenant in connection with the repair work performed by Tenant pursuant to this Section 11.6. Notwithstanding anything to the contrary contained herein, in the event Tenant takes any repair action pursuant to this Section 11.6, and such work will affect the structural integrity or exterior appearance of the Building, or materially affects the Building systems, Tenant shall use only those contractors designated by Landlord for such work (provided Landlord has notified Tenant of such contractors and such contractors are available).

ARTICLE 12

TAXES

12.1 Personal Property Taxes. Tenant shall pay, as Additional Rent, prior to delinquency all taxes, assessments, license fees, and other public charges levied, assessed or imposed or which become payable during the term of this Lease upon any trade fixtures, furnishings, equipment and all other personal property of Tenant installed or located in the Premises. Whenever possible, Tenant shall cause said trade fixtures, furnishings, equipment and personal property to be separately assessed. If, however, any or all of said items shall be assessed and taxed with the real property, Tenant shall pay to Landlord such taxes as are attributable to Tenant’s trade fixtures, furnishings, equipment and personal property within fifteen (15) days after receipt of an invoice from Landlord advising Tenant of the taxes applicable to Tenant’s property.

12.2 Real Property Taxes. Tenant shall also pay in the manner set forth in Section 13.3 any and all real estate taxes, as defined in Section 12.3, assessed or imposed, or which become a lien upon or become chargeable against or payable in connection with the Premises, including Tenant’s equitable proportion of such charges which are attributable to common areas. In the event that the Premises and common areas are not separately assessed, Tenant shall pay an equitable proportion of the real estate taxes and assessments for all the land and improvements included within the tax parcel(s) assessed, such proportion shall be determined by Landlord from the respective valuations assigned in the Assessor’s worksheets and such other information as is reasonably available to Landlord, including Tenant’s proportionate share of square feet in the Building and any special improvements constructed for the benefit of Tenant. Real estate taxes for the last year of the term of this Lease shall be prorated between Landlord and Tenant as of the expiration date of the term. With respect to any assessments which may be levied against or upon the Premises, or which under the laws then in force may be evidenced by improvement or other bonds and may be paid in annual installments, only the amount of such annual installment, with appropriate proration for any partial year, and interest thereon, shall be included within a computation of taxes and assessments levied against the Premises.

12.3 Definition of Taxes. For purposes of this Lease, “taxes” shall also include each of the following:

12.3.1 Any form of assessment, license fee, license tax, bond or improvement bond, business license tax, commercial rental tax, levy, charge, penalty, or tax, imposed by any authority having the direct power to tax, including any city, county, state or federal government,

14

or any school, agricultural, lighting, drainage or other improvement or special district thereof, as against any legal or equitable interest of Landlord in the Premises or the real property of which the Premises constitute a part;

12.3.2 Any tax on Landlord’s right to rent or other income from the Premises or as against Landlord’s business of leasing the Premises;

12.3.3 Any assessment, tax, fee, levy or charge in substitution, partially or totally, of any assessment, tax, fee, levy or charge previously included with the definition of real property tax, it being acknowledged by Tenant and Landlord that Proposition 13 was adopted by the voters of the State of California in the June 1978 election and that assessments, taxes, fees, levies and charges may be imposed by governmental agencies for such services as fire protection, street, sidewalk and road maintenance, refuse removal and for other governmental services formerly provided without charge to property owners or occupants. It is the intention of Tenant and Landlord that all such new and increased assessments, taxes, fees, levies and charges and all similar assessments, taxes, fees, levies and charges be included within the definition of real property tax for purposes of this Lease;

12.3.4 Any tax allocable to or measured by the area of the Premises or the rental payable hereunder, including without limitation, any gross income tax or excise tax levied by the State, any political subdivision thereof, city, or federal government, with respect to the receipt of such rental, or upon or with respect to the possession, leasing, operating, management, maintenance, alteration, repair, use of occupancy by Tenant of the Premises, or any portion thereof;

12.3.5 Any tax upon this transaction or any document to which Tenant is a party, creating or transferring an interest or an estate in the Premises; and

12.3.6 “Real estate taxes” shall not include Landlord’s federal or state income, franchise, inheritance or estate taxes.

ARTICLE 13

COMMON AREAS

13.1 Common Area. Common areas shall include all areas within the Premises outside the exterior boundaries of the buildings situated thereon, including, but not limited to, streets, driveways, parking areas, truckways, delivery passages, loading doors, sidewalks, ramps, open and closed courts and malls, landscaped and planted areas, exterior stairways, bus stops, retaining and decorative walls and planters, and other areas provided by Landlord for the common use of Landlord and Tenants, their employees and invitees. Notwithstanding the foregoing, Tenant shall be entitled to 77 onsite, non-reserved parking spaces available to Tenant at no additional rental charge.

13.2 Maintenance. Landlord shall maintain said common areas in a neat, clean and orderly condition, properly lighted and landscaped as Landlord, in its reasonable discretion, shall reasonably determine. Tenant shall pay to Landlord in the manner set forth in Section 13.3

15

Tenant’s pro rata share of expenses in connection with the maintenance of common areas. Tenant’s pro rata share of expenses in connection with the maintenance of common areas shall be that proportion which the gross floor area of the Premises bears to the gross floor area in the Building plus any additional costs arising from special requirements uniquely created by Tenant’s use of the Premises (and with respect to which Landlord has provided Tenant with prior written notice). It is understood and agreed that the phrase “expenses in connection with the maintenance of common areas” shall include, but shall not be limited to, all sums expended in connection with said common areas for all general maintenance, repairs, pest control, resurfacing, painting, restriping, cleaning, sweeping and trash removal; maintenance and repair of sidewalks, curbs and Building signs; sprinkler systems, planting and landscaping; lighting, water, music and other utilities; directional signs and other markers and bumpers; maintenance and repair of any fire protection systems, automatic sprinkler systems, lighting systems, storm drainage systems and any other utility systems; personnel to implement such service and to police the common areas; police and fire protection services; depreciation and maintenance on operating machinery and equipment (if owned) and rental paid for such machinery and equipment (if rented); rental for electric and service rooms based upon the average rate in the Building; any surcharges or any other costs levied or assessed by local, state or federal government agencies in connection with the use of the parking facilities (specifically excluding any parking charges levied by Landlord) and, property management costs. Such costs and expenses shall not include any allowance for depreciation of common area improvements. Landlord may cause any or all of said service to be provided by an independent contractor or contractors. The property management costs, as set forth in this Section, shall not exceed amounts which are usual and customary for such services in the County of San Diego.

13.3 Tenant’s Costs. Within sixty (60) days of the Commencement Date, Landlord shall give Tenant a written estimate of Tenant’s share of the cost of utilities, if not separately metered, insurance provided by Landlord, roof and structural repairs, taxes, and expenses in connection with maintenance of common areas. Tenant shall pay such estimated amount to Landlord in equal monthly installments, in advance. Within ninety (90) days after the end of each calendar year, Landlord shall furnish to Tenant a statement showing in reasonable detail the costs incurred by Landlord for the operation and maintenance of the Premises during such year (a “Reconciliation Statement”), and Tenant shall pay to Landlord Tenant’s proportionate share of the cost incurred in excess of the payments made by Tenant within ten (10) days of receipt of such Reconciliation Statement. In the event that the payments made by Tenant for the operation and maintenance of the Premises exceed Tenant’s share of the cost of same, such amount shall be credited by Landlord to the rent or other charges next due and owing, provided that, if the Lease term has expired, Landlord shall accompany said Reconciliation Statement with the amount due Tenant. Tenant shall have the right to audit any Reconciliation Statement.

13.4 Tenant’s Rights. Tenant shall have for its use and benefit the non-exclusive right in common with Landlord and future owners, other Tenants, and their agents, employees, customers, licensees and subtenants to use said common areas from time to time existing during the entire term of this Lease, or any extension thereof, for ingress and egress, roadway, automobile parking and sidewalks. Tenant’s use of common areas shall be subject to and in accordance with such Rules and Regulations as may be reasonably adopted by Landlord in accordance with Section 5.4.

16

ARTICLE 14

SIGNS AND ADVERTISING

14.1 Signs. Landlord and Tenant shall mutually agree upon the location on the Premises for one (1) or more exterior Tenant identification sign(s). Tenant shall have no right to maintain Tenant identification sign(s) in any of the locations in, on or about the Premises and shall not display or erect any other signs, displays, or other advertising materials that are visible from the exterior of the building. The size, design, and other physical aspects of the permitted sign(s) shall be subject to the Landlord’s written approval prior to installation, which approval will not unreasonably be withheld, any covenants, conditions, or restrictions encumbering the Premises (including but not limited to the Carlsbad Research Center Design Guidelines), any applicable municipal or other governmental permits and approvals. The cost of the sign(s), including the installation, maintenance and removal thereof shall be at Tenant’s sole cost and expense. If Tenant fails to maintain its sign(s), or if Tenant fails to remove such sign(s) upon termination of the Lease, and repair any damage caused by such removal (including without limitation, painting the building, if reasonably required by Landlord) Landlord may do so at Tenant’s expense. Tenant shall reimburse Landlord for all reasonable, out-of-pocket costs incurred by Landlord to effect such removal, which amounts shall be deemed Additional Rent and shall include without limitation, all sums disbursed, incurred or deposited by Landlord, including Landlord’s costs, expenses and actual attorneys’ fees with interest thereon.

ARTICLE 15

ENTRY BY LANDLORD

15.1 Entry by Landlord. Tenant shall permit Landlord and Landlord’s agents and contractors to enter the Premises at all reasonable times, upon giving Tenant at least one (1) business day prior notice, except in the event of an emergency in which case the one (1) business day notice is not required; (i) for the purpose of inspecting the same, (ii) for the purpose of maintenance, repairs, alterations, or additions to any portion of the Building, including the erection and maintenance of such scaffolding, canopies, fences, and props as may be required, or (iii) for the purpose of posting notices of non-responsibility for alterations, additions, or repairs.

15.2 Entry to Relet Premises. Landlord may, during reasonable business hours and upon reasonable prior notice within sixty (60) days prior to the expiration of this Lease, enter the Premises for the purpose of allowing prospective tenants to view the Premises.

15.3 No Liability. Landlord shall be permitted to enter the Premises for any of the purposes stated herein without any liability to Tenant for any loss of occupation of quiet enjoyment of the Premises resulting therefrom.

17

ARTICLE 16

ASSIGNMENT AND SUBLETTING

16.1 Assignment and Subletting. Tenant shall not either voluntarily or by operation of law, assign, sell, encumber, pledge or otherwise transfer all or any part of Tenant’s leasehold estate hereunder, or permit the Premises to be occupied by anyone other than Tenant or Tenant’s employees, or sublet the Premises or any portion thereof, without Landlord’s prior written consent in each instance, which consent shall not be unreasonably withheld or delayed. Any purported assignment or subletting contrary to these provisions shall be void. Landlord’s consent shall be based upon a determination that the same type, class, nature and quality of business, service, management, and financial soundness of ownership shall exist after such assignment or subletting and, provided further, that each and every covenant, condition or obligation imposed upon Tenant by this Lease is assumed by such assignee or subtenant and each and every right, remedy or benefit afforded Landlord by this Lease is not thereby impaired or diminished. Consent by Landlord to one or more assignments of this Lease or to one or more sublettings of the Premises shall not operate to exhaust Landlord’s rights under this Section. For purposes of this Lease the transfer, assignment, or hypothecation of any stock or interest in Tenant in the aggregate in excess of twenty-five (25%), or liquidation thereof, shall be deemed an assignment.

16.2 Notice to Landlord. If Tenant desires at any time to assign this Lease or to sublet the Premises or any portion thereof, it shall first notify Landlord of its desire to do so and shall submit in writing to Landlord (i) the name of the proposed Subtenant or assignee; (ii) the nature of the proposed Subtenant’s or assignee’s business to be carried on in the Premises; (iii) the terms and provisions of the proposed sublease or assignment; and (iv) such reasonable financial information as Landlord may request concerning the proposed Subtenant or assignee. Tenant agrees to reimburse Landlord for Landlord’s actual costs and attorneys’ fees (not to exceed $2,500) incurred in conjunction with the processing and documentation of any such requested assignment, subletting, transfer, change or ownership or hypothecation of this Lease.

16.3 Excess Rent. If in connection with any assignment or sublease, Tenant receives rent or other consideration either initially or over the term of the sublease or assignment in excess of (i) the Monthly Rent called for hereunder, plus (ii) Tenant’s direct out-of-pocket costs which Tenant certifies to Landlord to have been incurred in connection with any sublease or assignment or otherwise in connection with providing occupancy related services to any such subtenant or assignee of a nature commonly provided by Landlords of similar space, then promptly following its receipt thereof, Tenant shall pay to Landlord, as Additional Rent hereunder, fifty percent (50%) of such excess as and when received.

16.4 Notwithstanding anything contained in this Lease to the contrary, Tenant may assign this Lease or sublet all or a portion of the Premises to any entity controlling Tenant, controlled by Tenant or under common control with Tenant, any entity with which Tenant has merged or consolidated, or any entity which acquires or succeeds to all or substantially all of the assets or business of Tenant (each, a “Tenant Affiliate”), without the prior written consent of Landlord; provided, however, Tenant shall not be released from liability hereunder on account of any such assignment or sublease and Tenant shall provide Landlord with notice of such assignment or sublease within a reasonable period of time following its effective date.

18

16.5 No Release of Liability. No subletting, even with the consent of Landlord, shall relieve Tenant of its obligation to pay the rent and perform all the other obligations to be performed by Tenant hereunder. The acceptance of rent by Landlord from any other person shall not be deemed to be a waiver by Landlord of any provision of this Lease or to be a consent to any assignment or subletting.

ARTICLE 17

ABANDONMENT

17.1 No Abandonment. Tenant shall not abandon the Premises at any time during the term of this Lease. If Tenant shall abandon or surrender the Premises, or be disposed by process of law, or otherwise, Landlord may terminate this Lease, retake possession of the Premises, pursue its remedies provided herein, and any personal property or trade fixtures belonging to Tenant and left on the Premises shall, at the option of Landlord, be deemed abandoned. In such case, Landlord may dispose of said personal property in any manner and is hereby relieved of all liability for doing so.

ARTICLE 18

BREACH BY TENANT

18.1 Events of Default. The occurrence of any of the following shall constitute a breach and material default of this Lease by Tenant:

18.1.1 The failure of Tenant to pay or cause to be paid when due any Base Monthly Rental, Additional Rent, monies, or charges required by this Lease to be paid by Tenant when such failure continues for a period of five (5) business days after written notice thereof from Landlord to Tenant;

18.1.2 The abandonment of the Premises by Tenant;

18.1.3 The failure of Tenant to perform any term, covenant or condition, other than payment of rent, monies or charges, required by this Lease and Tenant shall have failed to cure such failure within thirty (30) days after written notice from Landlord; provided, however, that where such failure cannot reasonably be cured within the thirty (30) day period, the Tenant shall not be in default if it has commenced such cure within the same thirty (30) day period and diligently thereafter prosecutes the same to completion which in all events must occur within ninety (90) days thereafter;

19

18.1.4 To the extent permitted by applicable law, any act of bankruptcy cause, suffered or permitted by Tenant. For purposes of this Lease, “act of bankruptcy” shall include any of the following:

18.1.4.1. Any general assignment or general arrangement for the benefit of creditors;

18.1.4.2. The filing of any petition by or against Tenant to have Tenant adjudged a bankrupt or a petition for reorganization or arrangement under any law relating to bankruptcy, unless such petition is filed against Tenant and same is dismissed within sixty (60) days;

18.1.4.3. The appointment of a trustee or receiver to take possession of substantially all of Tenant’s assets located in the Premises or of Tenant’s interest in this Lease; or,

18.1.4.4. The attachment, execution or other judicial seizure of substantially all of Tenant’s assets located at the Premises or of Tenant’s interest in this Lease.

18.2 Five-Day Notice. In the event that Landlord issues a five (5) business day notice, notice of abandonment or comparable document by reason of Tenant’s breach, and Tenant cures such default, Tenant agrees to pay to Landlord, the reasonable cost of preparation and delivery of same.

18.3 No Waiver. The acceptance by Landlord of rent due hereunder after breach by Tenant will not constitute a waiver of such breach, unless a writing to that effect has been delivered to Tenant.

ARTICLE 19

REMEDIES UPON BREACH

19.1 Landlord’s Remedies. In the event of any breach by Tenant, in addition to other rights or remedies of Landlord at law or in equity, Landlord shall have the following remedies:

19.1.1 Landlord may recover from Tenant the Rent, including without limitation Additional Rent, as it becomes due and any other amount necessary to compensate Landlord for all detriment proximately caused by Tenant’s failure to perform its obligations under this Lease or which in the ordinary course of things would be likely to result therefrom. Landlord may sue monthly, annually or after such equal or unequal periods as Landlord desires for amounts due under this Section 19.1.1. The right to collect rent as it becomes due shall terminate upon the termination by Landlord of Tenant’s right to possession. Tenant’s right to possession shall not be terminated unless and until Landlord delivers to Tenant written notice thereof; and

19.1.2 Landlord, either as an alternative or subsequent to exercising the remedies set forth in Section 19.1.1, may terminate Tenant’s right to possession of the Premises by and upon delivery to Tenant of written notice of termination. Landlord may then immediately reenter the Premises and take possession thereof pursuant to legal proceedings and remove all persons and property from the Premises; such property may be removed and stored in a public warehouse or elsewhere at the cost of and for the account of Tenant. No notice of termination shall be necessary in the event that Tenant has abandoned the Premises. In the event that Landlord elects to terminate Tenant’s right of possession, Landlord may recover the following:

20

19.1.2.1. The worth at the time of the award of the unpaid rent which had been earned at the time of termination. “Worth at the time of award” shall be computed by allowing interest at ten percent (10%) per annum from the first day the breach occurs;

19.1.2.2. The worth at the time of award of the amount by which the unpaid rent which would have been earned after termination until the time of award exceeds the amount of such rental loss that the Tenant proves could have been reasonably avoided. “Worth at the time of award” shall be determined by allowing interest at the rate of ten percent (10%) per annum from the first day a breach occurs;

19.1.2.3. The worth at the time of award of the amount by which the unpaid rent for the balance of the term after the time of award exceeds the amount of such rental loss that the Tenant proves could be reasonably avoided. “Worth at the time of award” shall be computed by discounting such amount at the discount rate at the Federal Reserve Bank of San Francisco at the time of award plus one percent (1%); and

19.1.2.4. Any other amount necessary to compensate Landlord for all the detriment proximately caused by Tenant’s failure to perform its obligations under the Lease or which in the ordinary course of things would be likely to result therefrom including, but not limited to, commissions and expenses of reletting, attorneys’ fees, costs of alterations and repairs, recording fees, filing fees and any other expenses customarily resulting from obtaining possession of leased premises and re-leasing.

19.2 Forfeiture. It is understood that all covenants made by Tenant herein are conditions of this Lease; therefore, in the event of any default by Tenant in fulfilling any of the same, Landlord may at any time thereafter at its option declare a forfeiture of this Lease, and any holding over thereafter shall be construed to be a tenancy from month-to-month only, for the same rental and the same conditions, except as to term, as set forth in this Lease.

ARTICLE 20

DAMAGE OR DESTRUCTION

20.1 Landlord’s Obligation to Rebuild. If the Premises are damaged or destroyed, Landlord shall promptly and diligently repair the Premises unless it has the right to terminate this Lease as provided in Section 20.2 below and it elects to so terminate.

20.2 Landlord’s Right to Terminate. Landlord shall have the right to terminate this Lease following damage to or destruction of the Premises if any of the following occurs: (i) insurance proceeds together with additional amounts Tenant agrees to contribute are not available to Landlord to pay one hundred percent (100%) of the cost to fully repair the damaged Premises, excluding the deductible for which Landlord shall be responsible; (ii) the Premises cannot, with reasonable diligence, be substantially repaired by Landlord within two hundred seventy (270) days after the date of the damage or destruction; (iii) the Premises cannot be safely

21

repaired because of the presence of hazardous factors, including, but not limited to, earthquake faults, radiation, chemical waste and other similar dangers; or (iv) the Premises are destroyed or damaged during the last twelve (12) months of the Term. In addition, Tenant shall have the right to terminate this Lease following damage to or destruction of the Premises if any of the following occurs: (A) the Premises cannot be or are not, with reasonable diligence, substantially repaired by Landlord within two hundred seventy (270) days after the date of the damage or destruction or (B) the Premises are destroyed or damaged during the last twelve (12) months of the Term. Landlord shall provide Tenant with a good faith written estimate prepared by Landlord’s contractor of the period of time required for restoration within 30 days following the date of the casualty.

If Landlord elects to terminate this Lease, Landlord may give Tenant written notice of its election to terminate within thirty (30) days after it has knowledge of such damage or destruction, and this Lease shall terminate fifteen (15) days after the date Tenant receives such notice. If this Lease is terminated, Landlord shall, subject to the rights of its lender(s), be entitled to receive and retain all the insurance proceeds resulting from such damage, except for those proceeds payable under policies obtained by Tenant. If Landlord elects not to terminate the Lease, Landlord shall, promptly following the date of such damage or destruction and receipt of any amounts provided by Tenant pursuant to Section 20.2(i) above, commence the process of obtaining necessary permits and approvals, and shall commence repair of the Premises as soon as practicable and thereafter prosecute the same diligently to completion, in which event this Lease will continue in full force and effect.

20.3 Limited Obligation to Repair. Landlord’s obligation, should it elect or be obligated to repair or rebuild, shall be limited to the Premises and Tenant Improvements and Tenant shall, at its expense, replace or fully repair all Tenant’s personal property and any alterations installed by Tenant existing at the time of such damage or destruction (except to the extent Landlord’s insurance proceeds cover said alterations). If the Premises are to be repaired in accordance with the foregoing, Landlord shall make available to Tenant any portion of insurance proceeds it receives which are allocable to the alterations constructed by Tenant pursuant to this Lease provided Tenant is not then in default, after the expiration of all applicable notice and cure periods.