Attached files

| file | filename |

|---|---|

| EX-21 - EXHIBIT 21 - WINNER MEDICAL GROUP INC | v239545_ex21.htm |

| EX-31.1 - EXHIBIT 31.1 - WINNER MEDICAL GROUP INC | v239545_ex31-1.htm |

| EX-32.1 - EXHIBIT 32.1 - WINNER MEDICAL GROUP INC | v239545_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - WINNER MEDICAL GROUP INC | v239545_ex31-2.htm |

| EX-23.1 - EXHIBIT 23.1 - WINNER MEDICAL GROUP INC | v239545_ex23-1.htm |

| EX-32.2 - EXHIBIT 32.2 - WINNER MEDICAL GROUP INC | v239545_ex32-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended September 30, 2011

Or

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

Commission file number: 001-34484

WINNER MEDICAL GROUP INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Nevada

|

33-0215298

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

Winner Industrial Park, Bulong Road

Longhua, Shenzhen City, 518109

People’s Republic of China

(Address of principal executive offices)

Registrant’s telephone number, including area code: (86) 755-28138888

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

|

Common Stock, $.001 par value

|

Nasdaq Global Market

|

Securities registered pursuant to Section 12(g) of the Act:

|

None

|

||

|

(Title of class)

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

Non-accelerated filer ¨

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

At March 31, 2011, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $28,371,201, based on the last sale price of the registrant’s common stock.

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price of $3.17 per share of common stock at which the common equity was last sold on September 30, 2011, the last day of our most recently completed fourth fiscal quarter was $19,408,271.

As of November 30, 2011, there were 24,371,872 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE.

None.

WINNER MEDICAL GROUP INC.

FORM 10-K

For the Fiscal Year Ended September 30, 2011

|

Number

|

Page

|

|||

|

PART I

|

||||

|

Business.

|

4 | |||

|

Risk Factors.

|

15 | |||

|

Unresolved Staff Comments.

|

23 | |||

|

Item 2.

|

Properties.

|

23 | ||

|

Legal Proceedings.

|

24 | |||

|

(Removed and Reserved).

|

24 | |||

|

PART II

|

||||

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

25 | |||

|

Item 6.

|

Selected Financial Data.

|

26 | ||

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

27 | ||

|

Item 7A.

|

Quantitative and Qualitative Disclosures about Market Risk.

|

37 | ||

|

Item 8.

|

Financial Statements and Supplementary Data.

|

38 | ||

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure..

|

38 | ||

|

Item 9A.

|

Controls and Procedures.

|

38 | ||

|

Item 9B.

|

Other Information.

|

39 | ||

|

PART III

|

||||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance.

|

40 | ||

|

Item 11.

|

Executive Compensation.

|

42 | ||

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

|

48 | ||

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence.

|

49 | ||

|

Item 14.

|

Principal Accountant Fees and Services.

|

49 | ||

|

PART IV

|

||||

|

Item 15.

|

|

Exhibits, Financial Statement Schedules.

|

|

51 |

2

Use of Terms

Except as otherwise indicated by the context, references in this Report to “Winner Medical,” the “Company,” “we,” “us” or “our” are references to the combined business of Winner Medical Group Inc. and its wholly-owned subsidiary, Winner Group Limited, along with Winner Group Limited’s wholly-owned subsidiaries which include Winner Industries (Shenzhen) Co., Ltd., Winner Medical & Textile Ltd. Jingmen, Hubei Winner Textiles Co. Ltd., Winner Medical & Textile Ltd. Yichang, Winner Medical & Textile Ltd. Jiayu, Winner Medical & Textile Ltd. Chongyang, Shanghai Winner Medical Apparatus Co., Ltd., Winner Medical (Huanggang) Co., Ltd., Winner (Huanggang) Cotton Processing Co. Ltd., Shenzhen PurCotton Technology Co., Ltd., Beijing PurCotton Co., Ltd., Shanghai PurCotton Co., Ltd., Guanzhou PurCotton Co., Ltd. and HK PurCotton Co. Ltd. and Winner Group Limited’s majority owned subsidiaries, Winner Medical (Hong Kong) Co., Limited and Shenzhen PurCotton E-Commerce Co., Ltd. References to “Winner Group Limited” or “Winner Group” are references to Winner Group Limited and its subsidiaries listed above. References to “China” and the “PRC” are references to the People’s Republic of China. References to “U.S.” are references to the United States of America. References to “RMB” are to Renminbi, the legal currency of China, and all references to “$” are to the legal currency of the United States.

Forward-Looking Statements

Statements contained in this Annual Report on Form 10-K include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements involve known and unknown risks, uncertainties and other factors which could cause actual financial or operating results, performances or achievements expressed or implied by such forward-looking statements not to occur or be realized. Forward-looking statements may be identified by the use of forward-looking terminology such as “may,” “will,” “could,” “should,” “project,” “expect,” “believe,” “estimate,” “anticipate,” “intend,” “continue,” “potential,” “opportunity” or similar terms, variations of those terms or the negative of those terms or other variations of those terms or comparable words or expressions. Potential risks and uncertainties include, among other things, such factors as:

|

|

·

|

the effect of inflation in China;

|

|

|

·

|

losses from cotton futures trading;

|

|

|

·

|

international trade restrictions;

|

|

|

·

|

the Company’s dependence upon international customers;

|

|

|

·

|

Improper management of the expansion of the Company’s business models;

|

|

|

·

|

developments in the healthcare industry;

|

|

|

·

|

the Company’s dependence on patent and trade secret laws;

|

|

|

·

|

a high percentage of the Company’s revenues is from a few key customers;

|

|

|

·

|

uncertainties with respect to the PRC legal and regulatory environments;

|

|

|

·

|

the Company’s ability to adequately finance the significant costs associated with the development of new medical products;

|

|

|

·

|

potential product liability claims for which the Company does not have insurance coverage;

|

|

|

·

|

the effects of the global economic situation;

|

|

|

·

|

escalating pricing pressures from the Company’s customers;

|

|

|

·

|

the Company’s ability to employ and retain qualified employees;

|

|

|

·

|

competition and competitive factors in the markets in which the Company competes;

|

|

|

·

|

general economic and business conditions in China and in the local economies in which the Company regularly conducts business, which can affect demand for the Company’s products and services;

|

|

|

·

|

changes in laws, rules and regulations governing the business community in China in general, and the healthcare industry in particular;

|

|

|

·

|

other risks identified in this Report and the Company’s other filings with the SEC; and

|

|

|

·

|

the risks identified in Item 1A. “Risk Factors” included herein.

|

Readers are urged to carefully review and consider the various disclosures made by the Company in this Annual Report on Form 10-K and the Company’s other filings with the SEC. These reports attempt to advise interested parties of the risks and factors that may affect the Company’s business, financial condition and results of operations and prospects. The forward-looking statements made in this Form 10-K speak only as of the date hereof and the Company disclaims any obligation to provide updates, revisions or amendments to any forward-looking statements to reflect changes in the Company’s expectations or future events.

3

PART I

|

Item 1.

|

Business.

|

History

The Company was originally incorporated under another corporate name in the state of Nevada in August 1986. Winner Group Limited (which is now a wholly-owned subsidiary of the Company) began its operations as Winner Medical & Textile Ltd. Zhuhai, which was incorporated in China in February 1991 by the Company’s chief executive officer, president and director, Mr. Jianquan Li, and was deregistered in fiscal year 2009. Winner Group Limited was incorporated as a limited liability exempted company in the Cayman Islands in April 2003, and is the holding company of all of the Company’s business operations. On February 13, 2006, the Company amended its Articles of Incorporation to change its name from Las Vegas Resorts Corporation to Winner Medical Group Inc. to reflect its new business and to accord with the names of its subsidiary companies.

On October 6, 2009, the Company effected a reverse stock split in which 1 new share of common stock was issued for 2 old shares of common stock, thus exchanging 42,280,840 old shares for 21,140,420 new shares. This reverse stock split was reflected in the Company’s financial statements as of October 6, 2009. Upon effectiveness of the reverse stock split, the outstanding and issued shares were approximately 22,363,740 shares, after rounding up fractional shares.

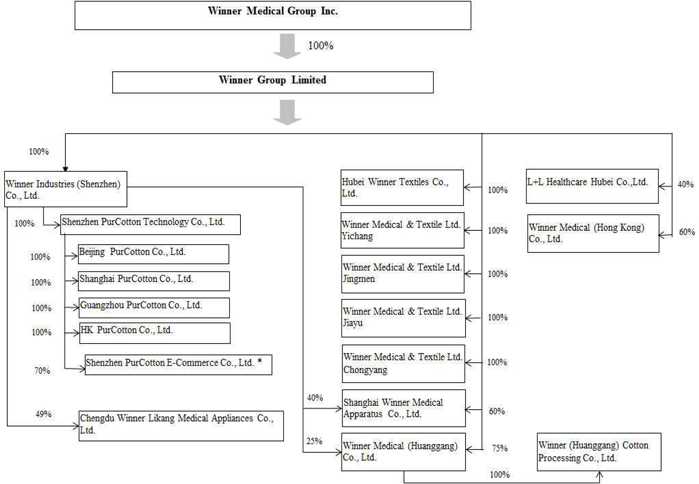

Below is the Company’s holding company structure as of the date of this Report.

|

|

*

|

Winner Medical holds 70% of Shenzhen PurCotton E-Commerce Co., Ltd. The other 30% is owned by two non-affiliated individuals who are experts in e-commerce.

|

Business

Winner Medical’s business operations consist of manufacturing, marketing, researching and developing cotton-base medical dressings and medical disposables and consumer products. The Company generates revenue through international and domestic (China) sales of a variety of medical dressings and medical disposables, including medical and wound care products, such as gauze, wound dressings, disposable drapes, surgical gowns, face masks and cotton balls, and PurCotton® jumbo rolls and consumer products, which are 100% natural cotton non-woven fabric made products such as dry and wet tissues, facial puffs, baby wears and cleansing wipes.

4

The Company has integrated manufacturing lines that provide its customers with the ability to procure certain products from a single supplier. The Company has fourteen wholly-owned manufacturing and sales subsidiaries and four joint ventures, all located in the PRC and Hong Kong. In the developed countries where it sells its products, mainly Europe, the United States and Japan, the Company provides customers with its specialized design, manufacturing and packaging services. By working with Winner Medical in this fashion, customers are able to select the design, size, type and scale of the products the Company manufactures for them. The Company sells its own “Winner” medical brand products in developing countries and regions, including the PRC, Hong Kong, the Middle East, South America and Southeast Asia, with distribution channels consisting of local distributors, chain drugstores and direct sales to a few hospitals (mostly in China). The Company sells its PurCotton® jumbo rolls in both China and abroad, and promotes its PurCotton® retail products via its own marketing and sales efforts in the China marketplace through chain stores, distributors (such as hypermarkets, supermarkets, department stores, convenience stores, etc.) and online sales.

Business Strategy

The Company’s primary business strategy is to achieve annual growth in revenue by building its brand and reputation. The Company seeks to implement its business strategy by focusing on:

Marketing Strategy

|

Ÿ

|

Marketing Its Own “Winner” Medical Branded Products in China. The surgical dressings and medical disposables market in China is quickly expanding. The Company believes that the demand for medical dressing and disposable products in China will experience rapid growth in the future as the Chinese government reforms the medical care system and the average age of Chinese continues to grow older. The Company believes that these factors will create opportunities for companies, such as Winner Medical, that already follow strict conduct and quality control regulations. During fiscal year 2011, approximately 10.98% of the Company’s medical sales revenue was generated in China, up from 10.59% in fiscal year 2010 (representing a 35.11% increase). The Company believes that the percentage of its business generated in China will increase in the future. The Company’s medical sales channels in China include local distributors, chain drugstores and hospitals. The Company expects that this business will be a driving force in its future business model.

|

|

Ÿ

|

Marketing and Expanding “PurCotton” Consumer Products. The Company believes that PurCotton, spunlace, cotton nonwoven products have advantages over woven cotton or synthetic nonwoven fabric products, as they are natural, safe, strong, durable, healthy, eco-friendly and of high quality. The Company believes that PurCotton products are particularly geared to target preferred customers, such as younger women and new mothers. The Company launched its retail business in December 2009, and has grown from medical products to consumer products, which are produced in a quality controlled, medical manufacturing environment. The Company’s retail distribution channel includes chain stores, distributors (such as hypermarkets, supermarkets, department stores, convenience stores, etc.) and online sales. Going forward, the Company believes it can continue to nurture distributors and online sales in order to produce sales growth, while selectively selling in chain stores to build brand awareness and expose potential customers to the Company’s products. At present, the Company is sustaining a net loss on its PurCotton retail business, due to necessary expenses related to start-up businesses. However, the Company expects this business model to generate positive cash flow and build sustainable growth in the long run. During fiscal year 2011, sales revenue from the Company’s PurCotton® retail sales in China reached approximately $5.0 million, or 3.34% of total sales revenue, which is up from $0.9 million, or 0.75% of total sales revenue, in fiscal year 2010 (representing a 474.78% increase).

|

Product Strategy

|

Ÿ

|

Focus on higher margin products. The Company is executing a long-term, systematic plan for marketing and selling higher margin products in terms of PurCotton® consumer products and higher value-added medical dressing products, such as surgical kits, advanced gowns and wet dressings. The Company’s research and development efforts are aimed at discovering new products, improving existing products and reducing production costs.

|

|

Ÿ

|

Providing High Quality Products. The Company’s goal is to manufacture and sell products that are of high quality and in accordance with established industry standards. The Company maintains strict and comprehensive quality assurance and quality control systems, and has already established ISO9001:2000, ISO13485:2003 and 21CFR Part 820 compliant quality management systems. Currently, the Company’s products have obtained European Union CE Certificates, U.S. Food and Drug Administration, “FDA,” certification, Russia health care certification and Japan’s Accreditation Certificate for Foreign Medical Device Manufacturers, which are awarded to individual factories that meet certain manufacturing standards. These certificates have been granted to Winner Medical’s Shenzhen, Jiayu, Chongyang and Jingmen factories. The Company intends to continue pursuing more certifications for its products or factories from developed and developing countries in order to promote its sales targets.

|

Manufacturing Strategy

|

Ÿ

|

Implement lean production and equipment technical improvements. The Company implements lean production management and equipment technical improvements among all subsidiaries to eliminate waste during production and increase efficiency. Through improving production techniques, the Company can reduce labor costs and increase efficiency by automation.

|

5

|

Providing Customers with a Complete Product Line—One Stop Procurement Services. The Company provides customers with specialized medical dressing products that are intended to address a number of customer issues and needs. The Company’s products are designed to meet a wide variety of its customers’ product configuration demands. The Company uses manufacturing equipment, including gauze sponge bleaching equipment, sterile packaging machines, auto-gauze sponges folding machines, nonwoven sponge folding machines and steam sterilization and ethylene oxide, “ETO,” for sterilization processing, which it believes allow the Company to produce its products in a cost efficient manner.

|

Management Strategy

|

Ÿ

|

Managing Business Effectively Through a Strong Management Team. To manage the medical and retail businesses, the Company assigns two management teams, due to the diverse customers and different marketing operation of these businesses. The Company retains senior management who has an average of ten years of work experience in the medical dressing industry. Under this team’s leadership, the Company has a demonstrated record of rapid and orderly growth. The Company employs a separate marketing and sales team for purposes of PurCotton retail sales, brand building and e-commerce.

|

|

Ÿ

|

Implementing Advanced Information Technology Systems and Logistical Capabilities. The Company has implemented the SAP Enterprise Resources Planning, “SAP ERP” system, which integrates all of the core business operations of each of its subsidiaries, such as purchasing, manufacturing, selling, expenses, financing, human resources and retailing, and records them on one system. The Company’s goal is to build a platform on which it can share information with its customers, including raw material preparation, production status, inventory and transportation. Development and expansion of the Company’s logistical capabilities are an important aspect of the Company’s strategy. The Company believes it is important to have warehouses in large transportation ports and near central cities. The Company’s use of modern logistics management methods is designed to enhance its service levels, including its ability to deliver products to customers in a timely fashion. Further, the Company strives to handle customer service inquiries quickly and accurately. Information on purchase order confirmation, production, order status and shipping advice is readily available. The Company also offers its customers a variety of payment terms to facilitate international purchases.

|

Products

The Company’s operations are mainly conducted through two operating business segments, which are the medical dressings and medical disposables segment and the spunlace 100% PurCotton® nonwoven consumer products segment. The Company’s operating decisions, on-site management, internal reporting and performance assessments are conducted within each of these two identified segments:

Medical dressings and medical disposables business segment

Medical dressings and medical disposals have two sub-categories, being typed according to function.

Medical care products – Include operating room products, procedural packs, protective products and gauze.

|

Surgical Drape

|

Gown

|

|

Face Mask

|

Surgical Dressing Pack

|

|

Sponge (including gauze and lap sponges)

|

Sterilization Pouch

|

|

Gauze Ball

|

Fluff Roll

|

|

Gauze Roll

|

Swab

|

Wound care products – Include dressing pads, cotton products, retention products and dental products.

|

First Aid

|

Tape

|

|

Adhesive Wound Dressing

|

Cotton Ball

|

|

Bandages (including elastic, gauze and cohesive flexible)

|

Q-tips

|

PurCotton consumer products business segment

PurCotton is a type of cotton product that is made of 100% natural cotton using spunlace nonwoven technology. The Company’s PurCotton products include jumbo rolls, as raw material supplies, and consumer products. The Company’s consumer products can be grouped into four categories (mother and baby care, feminine care, home care and medical care) and include:

|

Cotton Wet Wipes

|

|

|

Cosmetic Puff

|

Sanitary Napkin

|

|

Gauze Baby Wear

|

Gauze Baby Towel

|

|

Baby Reusable Diaper

|

Baby Handkerchiefs

|

|

Q-tips

|

Face Mask

|

|

Sport Bandage

|

Pajama

|

|

Bed Sheets

|

Gauze Bedclothes

|

Sales, Marketing and Customers

The Company’s medical dressing and disposable products are sold internationally through a network of distributors, wholesalers and manufacturers’ representatives as original equipment manufacturer, “OEM,” products. The Company’s major target markets are Japan, Europe and North and South America. While maintaining its traditional export-oriented business model, the Company has expanded into domestic sales in China through the use of local distributors into hospitals and chain drug stores and direct sales to hospitals under its own brand name, “Winner.” The Company plans to continue selling its PurCotton® consumer products in the China market through self-operated chain stores and Business-to-Customer (B2C) online platforms and distributors under its “PurCotton” brand name the Company defines PurCotton as its English product, patent application, trademark and chain store names.

6

Since there are different demands for different products in different geographic markets, the Company has adopted marketing strategies that are market-specific. For developed markets such as the United States, Japan and Europe, the Company offers OEM products under private label programs to supply medical suppliers. This approach enables the Company to capitalize on its customers’ branding strengths and established market channels. In order to gain more market share, the Company attempts to leverage its customers’ strong brand names, efficient distribution networks and market presence. The Company believes it is a better strategy to team up with large, well-known companies than to compete directly with them in developed markets. Most of the Company’s sales in developed countries are conducted by direct marketing. In addition, the Company also conducts sales through third-party manufacturers’ representatives, who are compensated through payment of sales commissions.

In China and other developing countries, the Company sells its medical dressing and disposable products under the “Winner” brand name. As the economies of China and other developing countries grow, the Company expects that there will be a significant increase in demand for medical products, including demand for the Company’s medical dressings and other medical disposable products. The Company believes its products are generally price-competitive with products from the United States, Japan and the European countries. Competition can also come from local producers in the developing countries, but the Company attempts to compete with those local manufacturers based on the quality of its products. The Company employs manufacturers’ representatives and actively participates in formal bid contracts organized by local organizations and hospitals. The Company is developing a distribution network to capture opportunities in China, mainly through local distributors, drugstore chains and direct sales to a few hospitals. In order to better develop its market, the Company’s officers are put in charge of communicating with local distributors in some major cities, such as Guangzhou, Fuzhou, Chengdu, Chongqing, Wuhan, Shanghai, Beijing and Shenyang. The Company also directly sells to hospitals in Hong Kong.

The Company believes that its material and manufacturing processes produce PurCotton® products that are healthy, soft, comfortable and environmentally-friendly. In August 2009, the Company started selling its jumbo rolls to manufacturers in China and Japan who produce consumer products. The Company believes that, as living standards improve and environmental protection awareness grows in China, people will desire products that are healthy, trusted, soft, comfortable and have less carbon emission. In order to launch its PurCotton® products and promote the “PurCotton” brand, the Company opened its first chain store in Shenzhen, China, on December 31, 2009. As of November 30, 2011, the Company has 44 chain stores in first and second-tier cities in China, which are mainly located in shopping malls. In order to broaden its customer base and increase sales, in July 2010, the Company opened a B2C website at Taobao.com http://purcotton.mall.taobao.com/, and launched its own B2C website www.purcotton.com in September 2010. Due to the operational differences between online and offline sales, the Company established Shenzhen PurCotton E-Commerce Co., Ltd. with two non-affiliated individuals who are experts in e-commerce (the Company owns 70% of the equity interest in this operating company, with the other 30% owned by the two individuals). However, the retail distribution channels require higher levels of capital expenditures for inventory, rent, deposits and salary for the sales forces than the Company’s medical business. As such, the Company’s net margins may be impacted in the short term, as this is a new business model and requires a significant level of start-up cost.

The Company has customers in approximately 80 countries throughout the world, including Japan, Germany, the United States, Italy, the Netherlands, the United Kingdom, Australia, France and China, as well as in South America, Africa and the Middle East. For its medical dressings and medical disposables business, some of the Company’s customers are large-scale producers and distributors with well-known brand names, while others are import and export firms or wholesalers with trade expertise and established sales channels. For its consumer products business, it targets female consumers with high income levels who are 25-45 years old and families who prefer to buy skin soft and healthy products.

Sakai Shoten Co., Ltd. accounted for approximately 11.54% and 12.16% of the Company’s revenue in fiscal years 2011 and 2010, respectively. Sakai Shoten Co., Ltd. acts as a purchasing agent for a large number of ultimate consumers of the Company’s products in Japan. Tyco Healthcare Co., Ltd accounted for 9.73% and 10.09% of the Company’s revenue in fiscal years 2011 and 2010, respectively. If the Company loses these customers without replacing them with other customers that purchase a similar amount of its products, the Company’s revenues and net income may decline considerably.

Raw Materials and Manufacturing

The Company depends on external suppliers to supply raw materials to produce its products. The principal raw materials used for the Company’s products are cotton, non-woven cloth and packaging materials, each of which it purchases from a limited number of suppliers. In the past, the Company has not experienced a problem in securing raw materials. Its principal cotton raw material for medical products is produced mainly in China, and for PurCotton products it is imported from the United States. The Company’s major suppliers of packaging materials and cotton are Safe Secure Packing (Shenzhen) Co., Ltd and China National Cotton Reserves Corporation. The Company’s raw material purchases from any individual supplier did not exceed 5% of its total raw material purchases in fiscal year 2011. The Company believes it is not over reliant on any of these suppliers.

7

Cotton is the Company’s primary raw material used in its manufacturing process. As a result of rising global demand, cotton prices have been rapidly increasing and fluctuating in the last few years. Under this rising cost environment, the Company cannot secure stable price quotes from cotton suppliers, resulting in inconsistency in the prices quoted to the Company’s customers. Therefore, the Company, through its wholly-owned subsidiary Winner Industries (Shenzhen) Co., Ltd., “Winner Shenzhen,” has entered into cotton futures transactions in order to limit the volatility of cotton prices on production. In order to reduce risk from trading, the Company has hired a professional and experienced team to conduct cotton futures and spot markets transactions in order to firmly tie the transaction to the sales plan and built up stringent operational policies and process controls for futures and spot trading.

During the second fiscal quarter ended March 31, 2011, Winner Shenzhen’s transactions in cotton futures resulted in a net loss of approximately $1,577,000, which was charged to “realized loss on commodity financial instruments.” The loss was a result of significant increases and fluctuation in cotton prices since January 2011. During this period, based on management’s expectation that cotton prices would experience a downward correction, Winner Shenzhen acquired a short position to hedge against price corrections. However, contrary to management’s expectation, the price increase continued. In order to minimize further losses, management closed its short position, generating a loss for the period.

In order to shift risk away from the Company during the initial period of cotton futures trading and better protect the interests of the Company’s stockholders, the chief executive officer of the Company, Mr. Jianquan Li, signed agreements with Winner Shenzhen effective January 1, 2011 that expired on September 30, 2011. Under these agreements, Mr. Li agreed that, on September 30, 2011, he will assume all net losses, if any, incurred by Winner Shenzhen from cotton futures trading from January 1, 2011 to September 30, 2011. If, however, there were a net gain from trading activities, it would have been retained by Winner Shenzhen. More details regarding this undertaking by Mr. Jianquan Li were disclosed in the “Recent Developments” section of the Company’s Quarterly Report on Form 10-Q for the three-month period ended March 31, 2011 as filed with the Securities and Exchange Commission.

On September 30, 2011, the net losses incurred by Winner Shenzhen from cotton futures trading from January 1, 2011 to September 30, 2011 were $1,718,031 (or RMB10,925,415). Accordingly, Mr. Jianquan Li deposited an equivalent amount in cash into Winner Shenzhen’s accounts. This deposit resulted in an increase to the Company’s Cash and an increase in the Company’s Stockholders’ equity, and the cash received was credited as a contribution to Additional Paid-in Capital when it was received. The agreements between Winner Shenzhen and Mr. Jianquan Li expired on September 30, 2011 after this reimbursement for losses realized from cotton futures trading was received.

With the objective of managing the Company’s risk from cotton futures trading, the Company established new department, a Commodity Trading Center, “CTC,” on July 1, 2011, with the goal of monitoring futures and spot trading and integrating cotton futures trading into the Company’s sales plan. Management has made on-going assessments of the CTC’s trading performance and has established stringent trading procedures and policies for entering into cotton futures transactions, along with consultation with the board of directors on these efforts.

Given the importance of key raw materials to the Company’s business, the Company manages its purchasing efforts and has established policies on the procurement of raw materials.

|

|

Ÿ

|

Supplier Management System. The Company has established a strict supplier management system to comprehensively assess suppliers on the basis of quality, price, purchasing terms, management systems delivery cycles. Suppliers are formally evaluated twice a year. The quality of the suppliers determines how much business they receive from the Company in subsequent months. The Company also hosts an annual suppliers’ conference, during which it communicates directly with its suppliers to discuss its needs and service level demands. The Company undertakes an open and transparent purchasing practice.

|

|

|

Ÿ

|

Purchasing Procedures. Purchasing transactions are conducted in accordance with a procedure termed inquiry-comparison-negotiation. Potential suppliers make initial offers that are compared objectively according to relevant guidelines. After validation of the various suppliers’ service and quality capabilities, the Company acquires the needed materials from the supplier offering the highest quality product at a reasonable cost. The Company’s finance department establishes an oversight process by appointing individuals to conduct independent market research of key price points. The research findings are announced periodically. The Company’s internal audit department and quality assurance department also provide oversight to assure that it strictly adheres to all purchasing procedures.

|

The Company’s production is vertically integrated, from raw material processing to semi finished products to finished products, which is able to control the entire manufacturing processes to maintain product quality. The Company has nine wholly owned manufacturing subsidiaries which are primarily located in Hubei province (and to a lesser extent in other parts of China). These manufacturing subsidiaries are as follows:

|

|

Ÿ

|

Winner Industries (Shenzhen) Co., Ltd. is a final procedure packaging center, sterilize center and a logistics center of the Company, and is located at Winner Industrial Park, Bulong Road, Longhua, Shenzhen City, China.

|

|

|

Ÿ

|

Winner Medical (Huanggang) Co., Ltd. produces PurCotton jumbo roll and PurCotton related products, and is located at Pearl Avenue, Huanggang High-Tech Park, Huanggang City, Hubei Province, China.

|

|

|

Ÿ

|

Winner (Huanggang) Cotton Processing Co., Ltd. processes seed cotton into billet cotton as raw materials to support the Company’s manufacture and is located at Pearl Avenue, Huanggang High-Tech Park, Huanggang City, Hubei Province, China.

|

|

|

Ÿ

|

Hubei Winner Textile Co., Ltd. produces gauze, swabs and cotton filled sponges, etc., and is located at No. 47 South Road of Jianshe, Yuekou Town of Tianmen City, Hubei Province.

|

|

|

Ÿ

|

Winner Medical & Textile Ltd. Jiayu is in charge of producing cast padding, cotton swab, cotton ball, ABD pad, dental roll, zig-zag cotton and cotton pound roll, etc., and is located at No. 172 Phoenix Avenue, Yuyue Town, Jiayu County, Hubei Province.

|

8

|

|

Ÿ

|

Winner Medical & Textile Ltd. Jingmen mainly manufactures lap sponges, gauze bandage, fluff roll and baby wear, and is located at Te 1 Hangkong Road, Pailou Town, Jingmen City, Hubei Province.

|

|

|

Ÿ

|

Winner Medical & Textile Ltd. Yichang weaves gauze and supplies gauze to the Companies other factories, and is located at No. 20 Jiangxia Avenue, Jiangkou Town, Zhijiang City, Hubei Province.

|

|

|

Ÿ

|

Winner Medical & Textile Ltd. Chongyang weaves and produces gauze sponge, gauze roll and gauze ball, and is located at Qingshan Park, Chongyang County, Hubei Province.

|

|

|

Shanghai Winner Medical Apparatus Co., Ltd. produces self-adhesive and adhesive bandages, and is located at 98 Jiechen Road, Songjiang District, Shanghai.

|

To execute its PurCotton business, the Company entered into an agreement in 2005 with the local government agency of Huanggang to acquire 564,742 square meters of land (approximately 140 acres) that will mostly be dedicated to the construction of production facilities for 100% cotton spunlace nonwoven fabric in the Company’s subsidiary Winner Medical (Huanggang) Co., Ltd., “Winner Huanggang”. Land use right certificates were issued to the Company in November 2005 and July 2007. As of September 30, 2011, the Company has four PurCotton manufacturing lines which are producing at almost 100% capacity, with a total production capacity of 430 tons per month. The Company purchased one sanitary napkin manufacturing line, which produces PurCotton top layer sanitary napkins. This line started trial production at the end of October 2011. The Company estimates that sanitary napkins will be mainly sold through distributors to hypermarkets, supermarkets, convenience stores and mother and baby stores. In January 2011, the Company established Winner (Huanggang) Cotton Processing, Co. Ltd. to process seed cotton into billet cotton as raw material to support the Company’s production, which the Company expects will provide it with more stringent quality control and reduce raw material production costs. This cotton processing line is currently meeting approximately 30% of the Company’s total annual cotton demand.

Competition

The Company is subject to intense competition. Some of the Company’s competitors have greater financial resources, better marketing approaches and more established market recognition than the Company does in international and Chinese domestic markets. Increased competition in the medical dressings and disposables could put pressure on the price at which the Company sells its products, resulting in reduced profitability for the Company. In the Company’s industry, the Company competes based on manufacturing capacity, product quality, customer service, product cost, ability to produce a diverse range of products and logistics capabilities.

For the international sales of medical dressings and medical disposables competitors, the Company views the below companies as its most significant competitors in the major markets in which it sells its products:

|

|

Ÿ

|

Competitors based in China. For overseas market, the Company’s competitors based in China primarily include: Shenzhen Aumei, Zhejiang Zhende Medical Dressing Co., Ltd., Jiangsu Province Jianerkang Medical Dressing Co., Ltd. and Qingdao Hartmann Medical Dressing Co., Ltd. These competitors tend to have lower labor costs. However, the Company believes that their products are of lower quality and they often lack product diversity, and that these competitors are not as strong in brand building and management.

|

|

|

Ÿ

|

Competitors based in Asia (Outside of China). Competitors based in this area mainly come from India and countries in Southeast Asia, such as Premier Enterprise and Sri Ram Products, whose main business is weaving. These competitors lack interconnected businesses and suppliers within the local industry and tend to be understaffed and have a lower quality of management, as well as a lower product quality.

|

|

|

Ÿ

|

Competitors based in Europe. Competitors based in Europe include: Bastos Viegas, S.A. (Portugal), Intergaz, S.R.O. (Czech Republic), and TZMO S.A. (Poland). The Company’s competitors from Europe may have a geographic advantage in the European market, but the Company believes they have less product diversity and higher production costs.

|

For China domestic medical sales, the Company’s core competitor is Henan Piao’an Group Co., Ltd., which tends to maintain stronger relationship with hospitals since its operation is larger and more established in the Chinese market. However, the Company’s believes that its quality control system and sterilization technology tend to be better accepted by Chinese hospitals.

For the PurCotton business, the Company believes that its material and manufacturing processes produce products that are healthy, soft, comfortable and environmentally-friendly. The Company targets mid- to high-end female consumers and families with babies who are concerned about their skin and health and would prefer to buy premium products. However, the PurCotton retail business is relatively new to the market, and the Company has to spend a significant amount of time and effort cultivating its customers. Furthermore, the Company believes PurCotton raw material could replace medical gauze and medical synthetic nonwoven products. However, due to the need for clinical examinations and certificate approvals, the Company projects that it will take more time to secure product acceptance from hospitals.

The Company’s customers in the medical industry employ high quality standards, since product quality and safety are their primary consideration. They perform strict factory and production system verification and product quality testing on their target suppliers. Once a supplier passes these tests, it is costly to switch to another. Compared with its competitors, the Company’s competitive advantages include the following:

9

|

|

Ÿ

|

Sound quality management system and certificates obtained. The Company has already established three quality management systems: ISO9001:2000 quality management system, ISO13485:2003 medical devices quality control system and 21CFR Part 820, Medical Device Quality System Regulation. Japanese certificates, which are awarded to individual factories, have been granted to Winner Medical’s Shenzhen, Jiayu, Chongyang and Jingmen factories, all of which are qualified and entitled to export products directly to Japan. The Company’s products imported into the United States are registered with the U.S. Food and Drug Administration, “FDA.” The Company has 45 types of products listed with the FDA, and it is proud to have FDA clearance to import sterilized products into the United States. Among those products are sterilization pouches and face masks, for which 510(k) premarket notifications were filed and which have received orders of substantial equivalence from the FDA. Currently, most of the Company’s products have obtained European Union CE Certificates. The Company’s other products are not required to obtain European Union CE certificates because these products are either non-medical related products or sold only in China. As of September 30, 2011, the Company has 61 products registered under the Russian Federal Service of Health Care and Social Development Control.

|

|

|

Ÿ

|

Quality control on vertically integrated production capacities. The Company has shaped its integrated manufacturing lines to meet customer preferences for procuring a range of products from a single trusted supplier. The Company’s services range from raw material processing, spinning, bleaching, folding, packaging and sterilization to finished product delivery. The Company maintains stringent quality control throughout each stage. The Company has factories in Hubei, Shenzhen and Shanghai. The production plants in Hubei province are primarily focused on upstream manufacturing, while the facilities in Shenzhen are focused on higher value-added processing to finished products. The Company’s Shanghai facilities are mainly concentrated on manufacturing and marketing self-adhesive bandages.

|

|

|

Ÿ

|

Innovation. The Company is dedicated to investing in research and development to drive innovation. The Company concentrates on innovation in value-added features for its medical dressings and medical disposables as well as PurCotton consumer products. It also focuses on the PurCotton manufacturing process to improve product quality and enhance efficiency, and continues to expand its PurCotton production line through line extensions and value-added features. The Company utilizes its patented, spunlace manufacturing process, which forms raw cotton into nonwoven cotton fabric to produce PurCotton® products at a lower cost than woven cotton products. The Company believes that this spunlace process provides a significant advantage. Patents covering the invention of the spunlace method of forming raw cotton into nonwoven process have been granted in more than 42 countries and regions (including China, the United States, Russia, Singapore, South Africa, Mexico, Nigeria, Canada, Egypt, Vietnam, the Philippines and member states of the European Patent Office).

|

The Company currently has 50 issued patents. Below are brief descriptions of these patents.

|

Description of Patent

|

Patent No.

|

Type

|

||

|

Manufacturing method for the spunlace non-woven cloth with X-ray detectable element thereby produced

|

ZL 200510033576.9 (China)

|

Invention

|

||

|

Manufacture method of the 100% cotton non-woven medical dressings

|

ZL 200510033147.1 (China)

|

Invention

|

||

|

Colored non-woven cloth with special coat

|

ZL 200620013847.4 (China)

|

Utility Model

|

||

|

Colored 100% cotton gauze

|

ZL 200620132922.9 (China)

|

Utility Model

|

||

|

100% cotton gauze with protective function

|

ZL 200620132920.X (China)

|

Utility Model

|

||

|

A medical dressing resists penetration and adhesion

|

ZL 200620132921.4 (China)

|

Utility Model

|

||

|

Description of Patent

|

Patent No.

|

Type

|

||

|

An ancillary fight code machine

|

ZL 200620017009.4 (China)

|

Utility Model

|

||

|

A safety medical gauze with detective device

|

ZL 200620014971.2 (China)

|

Utility Model

|

||

|

Wipes box

|

ZL 200630060318.5 (China)

|

Appearance design

|

||

|

Spunlace non-woven cloth with special coat and protective function

|

ZL 200620013845.5 (China)

|

Utility Model

|

||

|

A testing equipment for cloth

|

ZL 200820091990.4 (China)

|

Utility Model

|

||

|

Wound dressing

|

ZL 200820092733.2 (China)

|

Utility Model

|

||

|

Petrolatum dressing

|

ZL 200820105164.0 (China)

|

Utility Model

|

||

|

ZL 200820093952.2 (China)

|

Utility Model

|

|||

|

Packing device for medical dressing products

|

ZL 200820094531.1 (China)

|

Utility Model

|

||

|

Draw out wipes box

|

ZL 200520035670.3 (China)

|

Utility Model

|

||

|

Medical product box

|

ZL 200820207244.7 (China)

|

Utility Model

|

||

|

Embossed non-woven cloth

|

ZL 200820139753.0 (China)

|

Utility Model

|

||

|

A care package

|

ZL 200820235800.1 (China)

|

Utility Model

|

||

|

A bondage

|

ZL 200920129524.5 (China)

|

Utility Model

|

||

|

A protective facemask

|

ZL 200920135220.X (China)

|

Utility Model

|

10

|

A spunlace non-woven and its devices

|

ZL 200920131414.2 (China)

|

Utility Model

|

||

|

A kind of medical dressing

|

ZL 200920132228.0 (China)

|

Utility Model

|

||

|

A multi-material lab sponge and operating sheet

|

ZL 200920134448.7 (China)

|

Utility Model

|

||

|

Sanitary napkin #326

|

ZL 201030227804.8 (China)

|

Appearance design

|

||

|

A medical and hygiene device with pure cotton spunlace surface

|

ZL 200920260990.7 (China)

|

Utility Model

|

||

|

A breathable pure cotton medical protective cloth

|

ZL 201020153332.0 (China)

|

Utility Model

|

||

|

Pure cotton layer sanitary napkin and pure cotton layer disposable underpants

|

ZL 201020186577.3 (China)

|

Utility Model

|

||

|

A safety X-ray detectable medical dressing

|

ZL 200510033022.9 (China)

|

Invention

|

||

|

A safety medical operating gauze

|

ZL 200610062853.3 (China)

|

Invention

|

||

|

A medical dressing with surface X-ray development detectable element thereby produced

|

200810065677.8 (China)

|

Invention

|

||

|

Manufacture method for a single-side moisture transported PurCotton thereby produced

|

200910239652.X (China)

|

Invention

|

||

|

A packaging bag for hygiene products

|

201020508162.3 (China)

|

Utility

|

||

|

A type of baby diaper

|

201020540770.2 (China)

|

Utility

|

||

|

A type of baby diaper

|

201020554574.0 (China)

|

Utility

|

||

|

A type of baby diaper

|

201020579219.9 (China)

|

Utility

|

||

|

A type of medical dressing

|

201020686693.1 (China)

|

Utility

|

||

|

A safety dressing for surgical operation and its recognition system

|

201020695829.5 (China)

|

Utility

|

||

|

A type of medical dressing

|

201120026272 (China)

|

Utility

|

||

|

A type of medical alginic acid dressing

|

201120033668.8 (China)

|

Utility

|

||

|

A type of hygiene product

|

201120122161.X (China)

|

Utility

|

||

|

A type of non-woven medical dressing

|

201120190406.2 (China)

|

Utility

|

||

|

Method for producing spunlace non-woven cloth, method for producing spunlace non-woven cloth with X-ray detectable element, spunlace non-woven cloth with X-ray detectable element produced thereby

|

1688522 (E.U.)

|

Invention

|

||

|

Method for producing spunlace non-woven cloth, method for producing spunlace non-woven cloth with X-ray detectable element, spunlace non-woven cloth with X-ray detectable element produced thereby

|

1-2007-501648 (the Philippines)

|

Invention

|

||

|

Method for producing spunlace non-woven cloth, method for producing spunlace non-woven cloth with X-ray detectable element, spunlace non-woven cloth with X-ray detectable element produced thereby

|

270370 (Mexico)

|

Invention

|

11

|

Description of Patent

|

Patent No.

|

Type

|

||

|

Method for producing spunlace non-woven cloth, method for producing spunlace non-woven cloth with X-ray detectable element, spunlace non-woven cloth with X-ray detectable element produced thereby

|

2007/7583 (South Africa)

|

Invention

|

||

|

Method for producing spunlace non-woven cloth, method for producing spunlace non-woven cloth with X-ray detectable element, spunlace non-woven cloth with X-ray detectable element produced thereby

|

NG/C/2007/774 (Nigeria)

|

Invention

|

||

|

Method for producing spunlace non-woven cloth, method for producing spunlace non-woven cloth with X-ray detectable element, spunlace non-woven cloth with X-ray detectable element produced thereby

|

2, 510, 995 (Canada)

|

Invention

|

||

|

Method for producing spunlace non-woven cloth, method for producing spunlace non-woven cloth with X-ray detectable element, spunlace non-woven cloth with X-ray detectable element produced thereby

|

24725 (Egypt)

|

Invention

|

||

|

Method for producing spunlace non-woven cloth, method for producing spunlace non-woven cloth with X-ray detectable element, spunlace non-woven cloth with X-ray detectable element produced thereby

|

1-2007-01745 (Vietnam)

|

Invention

|

The Company has licensed from Jianquan Li, the Company’s CEO, President and Director, his rights to four patent and related technologies grants for nonwoven fabric manufacturing on a perpetual, worldwide royalty-free basis. The Company is not contractually required to pay a license fee to Mr. Li to use these patents. Below are the brief descriptions of these patents:

|

Description of Patents Licensed from Jianquan Li

|

Patent No.

|

Type

|

||

|

Method for producing spunlace non-woven cloth, method for producing spunlace non-woven cloth with X-ray detectable element, spunlace non-woven cloth with X-ray detectable element produced thereby

|

US 7049753 B2 (U.S.)

|

Invention

|

||

|

Method for producing spunlace non-woven cloth, method for producing spunlace non-woven cloth with X-ray detectable element, spunlace non-woven cloth with X-ray detectable element produced thereby

|

RU2326191C2 (Russia)

|

Invention

|

||

|

Method for producing spunlace non-woven cloth, method for producing spunlace non-woven cloth with X-ray detectable element, spunlace non-woven cloth with X-ray detectable element produced thereby

|

125160 (Singapore)

|

Invention

|

||

|

Spunlace non-woven cloth with X-ray detectable element

|

ZL 200520055659.3 (China)

|

Utility Model

|

The Company also has registered the trademark for the word “Winner” in China, the United States, Canada, Singapore, Libya, Jordan, the United Arab Emirates, Saudi Arabia, Thailand, Yemen, Chile, Cambodia and Hong Kong, and this trademark has passed the registration application in China, Hong Kong, Canada, Singapore, the United States and in the member countries of the Madrid Agreement such as Germany, France, Italy, Russia, Switzerland and Australia. The trademark of “PurCotton” has also been registered, or application for registration has been made, in China, Hong Kong, the United States, Europe, Japan, Australia, Brazil, South Africa, the Philippines, Russia, India, Turkey and Venezuela. Other trademarks, including “Winwin,” “Winband” in English and Chinese, “Nice Series” including “Nice”, “Nice Queen”, “Nice Princess”, ”Nice Prince”, ”Nice Life” etc., in Chinese, “SoftTouch” and “COTTONEA” have also been registered by the Company.

In addition, the Company has registered seventy-nine domain names both in English and Chinese, including www.winnermedical.com, www.purecotton.cn, www.purecotton.net.cn, www.purecotton.hk, www.softtouch.hk, www.winner-industries.com, www.winner-beijing.com, www.winner-shanghai.com, www.winner-shenzhen.com, www.purcotton.com, www.purcotton.cn, www.purcotton.hk, www.purcotton.asia, www.purcotton.net.cn, www.purcotton.com.cn, www.winnermedical.name, www.winnermedical.info, www.winnermedical.hk, www.winnermedical.net.cn, www.winnermedical.cn, www.winnermedical.net, www.winnermedical.org and www.winnermedical.mobi, www.purcottononline.com, www.purcottononline.cn, www.purcottonoline.com.cn, www.purcottononline.net, www.purcotton.net.cn, www.purcottononline.hk, www.purcotton-online.com, www.purcotton-online.cn, www.purcotton-online.com.cn, www.purcotton-online.net, www.purcotton-online.net.cn and www.purcotton-online.hk.

Where appropriate for the Company’s business strategy, the Company will continue to take steps to protect its intellectual property rights.

Research and Development Efforts

The Company spent approximately $1,988,000 and $1,767,000 on research and development in fiscal years 2011 and 2010, respectively.

12

The Company’s research and development in 2011 was mainly focused on developing new PurCotton® products for consumer use to broaden and diversify its product types to support its chain store sale and online sale, and researching value-added features for its medical dressings and medical disposables.

The Company’s research and development activities adhere to strict procedures and utilize standardized processes. The Company is focused on further improving its core manufacturing technologies so that it can reduce waste and overall costs. In addition, the Company uses advanced automatic equipment as part of its processing system, including folding machines, plastic absorbing machines and sterilization systems. These improvements not only reduce production costs, but also enable the Company to further diversify its product lines.

The Company is subject to complex and stringent governmental laws and regulations relating to the manufacture and sale of medical dressings and medical disposables in China and in many other countries in which it sells its products. These laws and regulations in the major markets in which it competes are discussed further below. All of the regulatory laws and regulations may be revised or reinterpreted, or new laws and regulations may become applicable, which could have a negative effect on the Company’s business and results of operations. See “Risk Factors —Risks Related to the Company’s Business.” The Company’s failure to comply with ongoing governmental regulations could impair its operations and reduce its market share.”

|

|

Ÿ

|

China . In China, medical materials and dressings, including medical gauzes, absorbent cottons, bandages and disposable surgical suits, are regulated as medical devices and are administered by the State Food and Drug Administration of China. The technology and specifications of these products must be consistent with the Regulations for the Supervision and Administration of Medical Devices and relevant laws and standards. PurCotton® consumer products are administered by the General Administration of Quality Supervision, Inspection and Quarantine of China. The specifications and manufacturing of such products are subject to stringent laws and regulations in relation to sterilization, chemical residual and heavy metal residual.

|

The Company’s business is regulated by a number of provincial authorities that license the production and registration of products such as those the Company manufactures. All of the Company’s wholly-owned manufacturing subsidiaries, which require licenses from these authorities, operate under current licenses.

|

|

Ÿ

|

Other Countries . Since the Company sells its products in international markets, its products are subject to regulations imposed by various governmental agencies in the markets where the Company’s products are sold.

|

All of the Company’s products exported to European countries must have a CE certificate, CE-certification or CE Marking, which is a conformity marking consisting of the letters “CE.” The CE Marking applies to products regulated by certain European health, safety and environmental protection legislation. The CE Marking is obligatory for products it applies to and the manufacturer affixes the marking in order to be allowed to sell its products in the European market.

In Japan, the Company needs a Certificate of Foreign Manufacture from the Pharmaceuticals and Medical Devices Agency of the Ministry of Health, Labor and Welfare of Japan in order to sell its products in the Japanese market. The Company has met applicable standards and obtained the required certificates in Europe and Japan.

In the United States, some of the Company’s products are considered medical devices. The FDA regulates the design, manufacture, distribution, quality standards and marketing of medical devices. Accordingly, the Company’s product development, testing, labeling, manufacturing processes and promotional activities for certain products that are considered medical devices are regulated extensively by the FDA. The FDA has given the Company clearance to market such products within the United States.

Under the U.S. Federal Food, Drug, and Cosmetic Act (“FDCA”), medical devices are classified into one of three classifications, each of which is subject to different levels of regulatory control, with Class I being the least stringent and Class III being subject to the tightest control. Class III devices, which are life supporting or life sustaining, or which are of substantial importance in preventing harm to human health, are generally subject to a clinical evaluation program before receiving pre-market approval, PMA, from the FDA for commercial distribution. Class II devices do not require clinical evaluation and pre-market approval by the FDA. Instead, it requires a pre-market notification to the FDA and in most cases its requirement is substantially equivalent to an existing product under Section 510(k) of the FDCA. Class I devices are subject only to general controls, such as labeling and record-keeping regulations, and are generally exempt from pre-market notification or approval under Section 510(k) of the FFDCA, although they are required to be listed with the FDA. The Company’s medical device products are generally considered Class I devices, and are therefore exempt from pre-market notification or approval requirements. The Company has listed all of its relevant products with the FDA pursuant to the FDAC.

If a 510(k) pre-market notification is required for a medical device, the device cannot be commercially distributed in the US until the FDA issues a letter to permit the sale of the product. Certain of the Company’s surgical face masks and sterilization pouches are subject to the 510(k) pre-market notification requirements. The Company has already received the necessary clearance from the FDA for such products.

The Company’s medical device products are also subject to the general labeling requirements under the FDA medical device labeling regulations. As of the date of this Report, the Company has labeled all of its medical device products and has not been the subject of any enforcement action initiated by the FDA.

13

In addition, manufacturers of medical devices distributed in the United States are subject to various other regulations, which include establishment registration, medical device listing, quality system regulation (“QSR”) and medical device reporting. Under the FDCA, any foreign establishment that manufactures, prepares, propagates, compounds or processes a medical device that is imported, or offered for import, into the United States is required to register its establishment with the FDA. In addition, any foreign establishment that engages in the manufacturing, preparation, assembly or processing of a medical device intended for commercial distribution in the United States is required to list its devices with the FDA. The Company’s subsidiary Winner Shenzhen, which exports all of its products, has registered its establishment with the FDA and has listed 45 medical and dental devices.

The Company’s manufacturing processes are required to comply with the applicable portions of the QSR, which cover the methods and documentation of the design, testing, production, processes, controls, quality assurance, labeling, packaging and shipping of its medical device products. The QSR, among other things, requires maintenance of a device master record, device history record and complaint files. As of the date of this Report, the Company does not have any enforcement actions initiated by the FDA.

The Company is also required to report to the FDA if its products cause or contribute to a death or serious injury or malfunction in a way that would likely cause death or serious injury. The FDA can require companies to recall products which have material defects or deficiencies in design or manufacturing. The FDA can withdraw or limit the Company’s product clearances in the event of serious, unanticipated health or safety concerns. The Company may also be required to submit reports to the FDA of corrections and removals. As of the date of this Report, the Company had not received any complaints that any of its products had caused death or serious injury.

The FDA has broad regulatory and enforcement powers. If the FDA determines that the Company has failed to comply with applicable regulatory requirements, it can impose a variety of enforcement actions ranging from public warning letters, fines, injunctions, consent decrees and civil penalties to suspension or delayed issuance of approvals, seizures or recall of the Company’s products, total or partial shutdown of production, withdrawal of approvals or clearances already granted and criminal prosecution. The FDA can also require the Company to repair, replace or refund the cost of devices that it manufactured or distributed. The Company’s failure to meet any of these requirements may cause the FDA to detain its products automatically when they are presented for entry into the United States. If any of these events occur, it could result in a material adverse impact on the Company. As of the date of this Report, the Company was not the subject of any enforcement actions initiated by the FDA.

Environmental Compliance

The Company is subject to the requirements of U.S. federal, state, local and non-U.S., including China’s, environmental and occupational safety and health laws and regulations. As the Company has no operations in the United States, U.S. environmental and occupational safety and health laws and regulations did not have any impact on the Company during this reporting period. In China, applicable environmental and occupational safety and health laws include laws regulating air emissions, water discharge and waste management. The Company has an environmental management structure designed to facilitate and support its compliance with these requirements. Although it is the Company’s intent to comply with all such requirements and regulations, it cannot provide assurance that it is at all times in compliance. The Company has made and will continue to make capital and other expenditures to comply with environmental requirements, although such expenditures were not material during the past two years. Environmental requirements are complex, frequently change and tend to become more stringent over time. Accordingly, the Company cannot assure investors that environmental requirements will not change or become more stringent over time or that potential environmental cost and liabilities will not be material.

During fiscal year 2011, the Company did not make any material capital expenditures relating to environmental compliance.

Employees

As of September 30, 2011, the Company employed approximately 4,581 full-time employees. The Company believes that it maintains a satisfactory working relationship with its employees and it has no significant labor disputes or any difficulty in recruiting staff for its operations.

As required by applicable Chinese law, the Company has entered into employment contracts with all of its officers, managers and employees. The Company’s employees in China participate in a state social insurance scheme organized by the Chinese municipal and provincial governments. The Company is required to contribute to the scheme at rates ranging from 8% to 29% of the average monthly salary. The expenses related to this scheme were $1,461,000 and $1,223,000 for fiscal years 2011 and 2010, respectively.

Available information

The Company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K and other information are available free for charge from the Securities and Exchange Commission (the “SEC”) website. These materials can be inspected and copied at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. Information also can be obtained by mail at prescribed rates from the SEC’s Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of the SEC’s Internet site is http://www. sec.gov.

14

The Company’s Internet website, http:// winnermedical.investorroom.com , provides information relating to its corporate governance, which includes Corporate Governance Guidelines, Code of Business Conduct and Ethics and Winner Medical’s executive officers, directors and Board committees, including committee charters. The website also includes the Company’s Annual Reports, most recent Quarterly Reports, Current Reports, any Proxy Statements filed and any amendments to such reports as soon as reasonably practicable following the electronic filing of such reports with the SEC. In addition, the Company provides electronic or paper copies of its filings free of charge upon request.

|

Item 1A.

|

Risk Factors

|

An investment in the Company’s common stock involves a high degree of risk. In addition to the following risk factors, you should carefully consider the risks, uncertainties and assumptions discussed herein, and in other documents that the Company subsequently files with the SEC that update, supplement or supersede such information for which documents are incorporated by reference into this Report. Additional risks not presently known to the Company, or which the Company considers immaterial based on information currently available, may also materially adversely affect the Company’s business. If any of the events anticipated by the risks described herein occur, the Company’s business, cash flow, results of operations and financial condition could be adversely affected, which could result in a decline in the market price of the Company’s common stock, causing you to lose all or part of your investment.

Risk Related to the Company’s Business

|

|

Ÿ

|

The Company may be adversely affected by inflation in China.

|

China’s economic growth in the past few years has been fueled, in substantial part, by the issuance of debt. Large issuances of debt can lead to growth in the money supply, which can cause inflation. If prices for the Company’s products rise at a rate that is insufficient to compensate for the rise in the cost of supplies and personnel, it may harm the Company’s profitability.

In order to control inflation, the Chinese government has imposed controls on bank credit, limits on loans and restrictions on state bank lending. Such policies have lead to a slowing of economic growth in China. Further controls on lending, or interest rate increases by the central bank, may further slow economic activity in China, which could, in turn, materially increase the Company’s costs while, at the same time, reduce demand for the Company’s products.

In addition, the markets in which the Company sells its products are extremely competitive. The Company competes based upon a variety of factors, including cost of production and cost of raw materials. As all of the Company’s manufacturing is done in China, interest rate increases and labor and raw material inflation in that market can adversely affect the Company’s ability to provide quality products at a competitive price. It is possible that Company’s competitors, either in China or in other countries, have lowered or will soon lower their cost of production due to relative price decreases in their home markets, and have engaged or will engage in price competition through aggressive pricing policies to secure a greater market share. The Company’s business may be adversely affected by this competition, and the Company may not be able to maintain its profitability if the inflationary environment in China worsens.

|

|

Ÿ

|

The Company may suffer losses through its cotton futures trading.

|

Cotton is the Company’s primary raw material used in its manufacturing process. In order to mitigate against inflation and price fluctuations in the cost of this core raw material, the Company has engaged in cotton futures trading through its wholly-owned subsidiary Winner Industries (Shenzhen) Co., Ltd., “Winner Shenzhen.”

Cotton futures trading has a high risk that it may result in losses to the Company despite management’s efforts to limit such risk. While the Company has made on-going assessments of its trading performance and implemented operational policies and process controls for the futures trading, these efforts may prove insufficient in limiting the downside risk inherently present in this type of trading activity. If the Company’s exposure to cotton futures trading results in significant losses, stockholders’ equity and/or the Company’s profitability may be adversely impacted.

|

|

Ÿ

|

The Company engages in international sales, which expose it to trade restrictions.

|

The Company is a China-based manufacturer that exports products to various geographic regions. As such, the Company may be subject to risks associated with customs duties, export quotas and other trade restrictions that could have a significant impact on its revenue and profitability. While the Company has not encountered significant difficulties in connection with the sales of its products in international markets, the future imposition of, or significant increases in the level of, custom duties, export quotas or other trade restrictions could have an adverse effect on the Company. Further, the Company cannot assure that the laws of foreign jurisdictions where it sells and seeks to sell its products afford similar or any protection of its intellectual property rights as may be available under U.S. laws. The Company is directly impacted by the political, economic, military and other conditions in the countries where it sells or seeks to sell its products.

15

|

|

Ÿ

|