Attached files

| file | filename |

|---|---|

| EX-21 - WINNER MEDICAL GROUP INC | v168276_ex21.htm |

| EX-32.2 - WINNER MEDICAL GROUP INC | v168276_ex32-2.htm |

| EX-31.2 - WINNER MEDICAL GROUP INC | v168276_ex31-2.htm |

| EX-32.1 - WINNER MEDICAL GROUP INC | v168276_ex32-1.htm |

| EX-23.1 - WINNER MEDICAL GROUP INC | v168276_ex23-1.htm |

| EX-31.1 - WINNER MEDICAL GROUP INC | v168276_ex31-1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-K

ANNUAL

REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF

THE SECURITIES EXCHANGE ACT OF 1934

(Mark

One)

|

x

|

ANNUAL REPORT PURSUANT TO

SECTION 13 OR

15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For

the fiscal year ended September 30, 2009

Or

| o |

¨

|

TRANSITION REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For

the transition period

from to

Commission

file number: 000-16547

WINNER

MEDICAL GROUP INC.

(Exact

Name of Registrant as Specified in Its Charter)

|

Nevada

|

33-0215298

|

|

(State

or other jurisdiction of incorporation or

|

(I.R.S.

Employer

|

|

organization)

|

Identification

No.)

|

Winner

Industrial Park, Bulong Road

Longhua,

Shenzhen City, 518109

People’s

Republic of China

(Address

of principal executive offices)

Registrant’s

telephone number, including area code: (86) 755-28138888

Securities

registered pursuant to Section 12(b) of the Act:

None

Securities

registered pursuant to Section 12(g) of the Act:

Common

stock, $.001 par value

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act.

Yes o No x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act. Yes o

No x

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days.

Yes x No o

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. x

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, or a non-accelerated filer or a small reporting company. See

definition of “large accelerated filer”, “accelerated filer” and “small

reporting company” in Rule 12b-2 of the Securities Exchange Act of

1934.

|

Large

accelerated filer

o

|

Accelerated

filer

o

|

Non-accelerated

filer

o

|

Small

reporting company

x

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Securities Exchange Act). Yes o

No x

As of

December 7, 2009, there were 22,363,675 shares of the Registrant’s common stock

outstanding.

WINNER

MEDICAL GROUP INC.

FORM

10-K

For

the Fiscal Year Ended September 30, 2009

|

Number

|

Page

|

||

|

PART I

|

|||

|

Item 1.

|

Description

of Business

|

4

|

|

|

Item 1A.

|

Risk

Factors

|

13

|

|

|

Item 1B.

|

Unresolved

Staff Comments

|

19

|

|

|

Item 2.

|

Properties

|

19

|

|

|

Item 3.

|

Legal

Proceedings

|

21

|

|

|

Item 4.

|

Submission

of Matters to a Vote of Security Holders

|

21

|

|

|

PART II

|

|||

|

Item 5.

|

Market

for Registrant’s Common Equity, Related Stockholder Matters and

Issuer Purchases of Equity Securities

|

22

|

|

|

Item 6.

|

Selected

Financial Data

|

22

|

|

|

Item 7.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

24

|

|

|

Item 7A.

|

Quantitative

and Qualitative Disclosures about Market Risk

|

36

|

|

|

Item 8.

|

Financial

Statements and Supplementary Data

|

36

|

|

|

Item 9.

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosure

|

37

|

|

|

Item 9A.

|

Controls

and Procedures

|

37

|

|

|

Item 9B.

|

Other

Information

|

38

|

|

|

PART III

|

|||

|

Item 10.

|

Directors

and Executive Officers of the Registrant

|

38

|

|

|

Item 11.

|

Executive

Compensation

|

40

|

|

|

Item 12.

|

Security

Ownership of Certain Beneficial Owners and Management

|

45

|

|

|

Item 13.

|

Certain

Relationships and Related Transactions

|

46

|

|

|

Item 14.

|

Principal

Accountant Fees and Services

|

46

|

|

|

PART IV

|

|||

|

Item 15.

|

Exhibits

and Financial Statement Schedules

|

48

|

2

Use

of Terms

Except as

otherwise indicated by the context, references in this report to “Winner

Medical”, the “Company” “we”, “us”, or “our”, are references to the combined

business of Winner Medical Group Inc. and its wholly-owned subsidiary, Winner

Group Limited, along with Winner Group Limited’s wholly-owned subsidiaries which

include Winner Industries (Shenzhen) Co., Ltd., Winner Medical & Textile

Ltd. Zhuhai, Winner Medical & Textile Ltd. Jingmen, Hubei Winner Textiles

Co. Ltd., Winner Medical & Textile Ltd. Yichang, Winner Medical &

Textile Ltd. Jiayu, Winner Medical & Textile Ltd. Chongyang and Winner

Medical (Huanggang) Co., Ltd. and Winner Group Limited’s majority owned

subsidiary Shanghai Winner Medical Apparatus Co., Ltd. and Winner Medical (Hong

Kong) Limited. References to “Winner Group Limited” or “Winner Group”

are references to Winner Group Limited and its subsidiaries listed above.

References to “China” and the “PRC” are references to the “People’s Republic of

China.” References to “U.S.” are references to the United States of America.

References to “RMB” are to Renminbi, the legal currency of China, and all

references to “$” are to the legal currency of the United States.

Forward-Looking

Statement

Statements

contained in this Annual Report on Form 10-K include “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. Forward-looking statements

involve known and unknown risks, uncertainties and other factors which could

cause actual financial or operating results, performances or achievements

expressed or implied by such forward-looking statements not to occur or be

realized. Forward-looking statements may be identified by the use of

forward-looking terminology such as “may”, “will”, “could”, “should”, “project”,

“expect”, “believe”, “estimate”, “anticipate”, “intend”, “continue”,

“potential”, “opportunity” or similar terms, variations of those terms or the

negative of those terms or other variations of those terms or comparable words

or expressions. Potential risks and uncertainties include, among other things,

such factors as:

|

|

·

|

the Company’s dependence upon international

customers;

|

|

|

·

|

international trade

restrictions;

|

|

|

·

|

foreign currency

fluctuation;

|

|

|

·

|

developments in the healthcare

industry;

|

|

|

·

|

the Company’s dependence on patent and trade

secret laws;

|

|

|

·

|

the Company’s revenues are highly concentrated

in a single customer;

|

|

|

·

|

uncertainties with respect to the

PRC legal and regulatory

environment;

|

|

|

·

|

the Company’s ability to adequately finance

the significant costs associated with the development of new medical

products;

|

|

|

·

|

potential product liability

claims for which the

Company does not

have insurance coverage; and

|

|

|

·

|

other risks identified in this

Report and the

Company other

filings with the SEC.

|

Readers

are urged to carefully review and consider the various disclosures made by the

Company in this Annual Report on Form 10-K and the Company’s other filings with

the SEC. These reports attempt to advise interested parties of the risks and

factors that may affect the Company’s business, financial condition and results

of operations and prospects. The forward-looking statements made in this Form

10-K speak only as of the date hereof and the Company disclaims any obligation

to provide updates, revisions or amendments to any forward-looking statements to

reflect changes in the Company’s expectations or future events.

3

PART

I

Item

1. Description of

Business

Recent

Events

On

October 6, 2009, the Company’s Board of Directors approved and authorized the

Company to complete a one-for-two reverse split of the Company’s common stock,

decreasing the Company’s authorized capital to 247,500,000 shares of common

stock and 2,500,000 shares of preferred stock, par value $0.001 per share.

Pursuant to the Nevada Revised Statues, shareholder approval of this action was

not required.

Background

The

Company was originally incorporated under the name Birch Enterprises, Inc. in

the state of Nevada in August 1986. On

September 14, 1987, the Company consummated a business combination transaction

with Las Vegas Resort Investments whereby Las Vegas Resort Investments became

the Company’s wholly-owned subsidiary. Concurrent with this transaction, the

Company changed its corporate name to Las Vegas Resorts Corporation. During

September 1992 all of the Company’s operations ceased. The Company had no active

operations from then until December 16, 2005, when it completed a reverse

acquisition transaction, discussed below under “—Acquisition of Winner Group

Limited,” with Winner Group Limited, a Cayman Islands corporation, whose

subsidiary companies originally commenced business in February

1991.

Winner is

a technology-driven medical dressings and medical disposables manufacturer based

in China. Winner became the Company’s wholly-owned subsidiary in connection with

the reverse acquisition transaction and is the holding company for all of the

Company’s commercial operations.

On

February 13, 2006, the Company amended its Articles of Incorporation to change

its name from Las Vegas Resorts Corporation to Winner Medical Group

Inc. The Company changed its name to reflect its new business and the

names of its subsidiary companies.

Acquisition

of Winner Group Limited

On

December 16, 2005, the Company completed a reverse acquisition transaction with

Winner Group Limited whereby the Company issued to the stockholders of Winner

Group Limited 42,280,840 shares of its common stock in exchange for all of the

issued and outstanding capital stock of Winner Group Limited. These 42,280,840

shares had been restated to 21,140,420 shares in the Company’s financial

statements to reflect a reverse stock split of 1 new share of common stock for 2

old shares of common stock on October 6, 2009. Winner Group Limited thereby

became the Company’s wholly-owned subsidiary and the former stockholders of

Winner Group Limited became the Company’s controlling stockholders.

For

accounting purposes, the share exchange transaction was treated as a reverse

acquisition with Winner Group Limited as the acquirer and Winner Medical Group

Inc. as the acquired party. When the Company refers in this prospectus to

business and financial information for periods prior to the consummation of the

reverse acquisition, the Company is referring to the business and financial

information of Winner Group Limited on a consolidated basis unless the context

suggests otherwise.

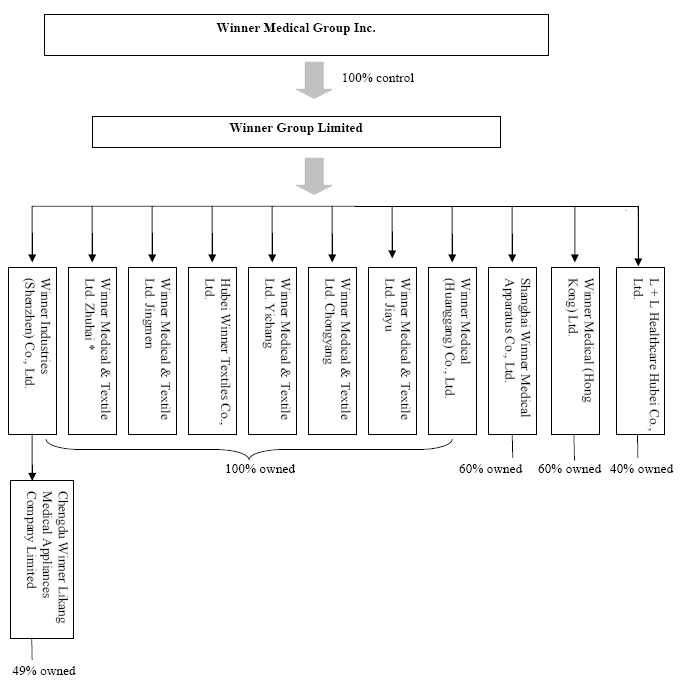

Winner

Group Limited’s operations began with Winner Medical & Textile Ltd. Zhuhai,

which was incorporated in China in February 1991 by the Company’s CEO, President

and director Mr. Jianquan Li. Winner Group Limited was incorporated as a Limited

Liability Exempted Company in the Cayman Islands in April 2003 and is the

holding company of all of the Company’s business operations. Below is the

Company’s holding company structure.

4

* On

February 1, 2008, the Company stopped all the business operations of Winner

Medical & Textile Ltd. Zhuhai, “Winner Zhuhai”, and filed for the

deregistration of Winner Zhuhai with various government authorities in the PRC.

As of June 30, 2009, Winner Zhuhai received approvals from various government

authorities in the PRC regarding its application for deregistration, except the

relevant tax bureau clearance is still on-going.

The

Company’s Business

Through

its subsidiary Winner Group Limited, the Company’s business consists of research

and development, manufacturing and marketing of medical dressings and medical

disposables. The Company has seven wholly-owned operating subsidiaries and four

joint venture companies, and it established several integrated manufacturing and

processing lines for its core products. The Company’s product offerings include

medical care products, wound care products, home care products and PurCotton

products, a new product of nonwoven fabric made from 100% natural

cotton.

The

Company is one of the leading manufacturers of medical dressings and medical

disposables in China. The products are sold worldwide, with Europe, the United

States and Japan serving as the top three markets. Certain of the Company’s

medical device products are registered and listed with the U.S. Food and Drug

Administration or FDA, giving the Company the approval to export those

sterilized products directly to the United States.

5

The

Company’s Strategy

The

Company’s primary business strategy is to achieve annual growth in revenue by

building its brand and reputation. The Company seeks to implement its business

strategy by focusing on:

Marketing

Own Brand Product in China

The

surgical dressing and medical disposables market in China is expanding quickly.

According to Research and Markets http://www.researchandmarkets.com/,

certain marketing researches showed that the demand for disposable medical

products has experienced rapid growth. In the future, the medical

market in China will become increasingly regulated due to the Chinese

government’s efforts to reform its medical care system. These factors create

opportunities for companies, such as Winner Medical, that had already followed

such strict conduct and quality control regulations.

During

fiscal year 2009, approximately 16.87% of the Company’s sales revenue was

generated domestically in China, and this percentage is expected to increase.

The Company’s sales channel in China includes: hospitals, local distributors,

and Over-The-Counter, or OTC, drugstore chains.

PurCotton

Products

The

PurCotton product, new spunlace cotton nonwoven products, combines the

superior characteristics of both natural cotton and materials made using

nonwoven technology. It is expected to have advantages over woven cotton or

synthetic nonwoven fabric, such as it is natural, safe, strong, durable,

healthy, environmentally friendly, and of higher quality. The Company intends to

utilize its patented manufacture process to enable it to produce PurCotton at a

lower cost than woven cotton products, so it believes the launch of the cotton

nonwoven spunlace products will provide a significant advantage to the Company.

Patent applications covering the invention of spunlace cotton nonwoven process

have been made in more than 50 countries. Patents have been granted in China,

the United States, Russia, Singapore, South Africa, Mexico, Nigeria,

Philippines, and member states of the European Patent Office.

To

execute its strategy, the Company entered into an agreement in 2005 with the

local government agency of Huanggang to acquire 564,742 square meters,

approximately 140 acre, of land that will mostly be dedicated to the

construction of 100% cotton spunlaced nonwoven fabric production facilities in

the Company’s subsidiary Winner Medical (Huanggang) Co., Ltd., “Winner

Huanggang”. Land use right certificates of this land were issued to the Company

in November 2005 and July 2007. As of September 30, 2009, the first two

PurCotton manufacturing lines are producing in full capacity; compared to the

third quarter, the third manufacturing line has completed testing and started

production, and its production is expected to increase. In August 2009, the

Company entered into a contract with a machine producer in China to purchase new

machineries for the fourth production line, these machineries are expected to

start production in the second quarter of 2010. The Company started selling

PurCotton products to customers in China, the United States, Europe and Japan

for both consumer and medical use. During fiscal year 2009 and 2008, gross

profit from these products reached approximately $1,452,000 and $95,000

respectively.

Providing

High Quality Products

The

Company’s goal is to manufacture and sell products that are of the highest

quality in the industry and in accordance with established industry standards.

The Company’s quality management system is certified by the International

Organization for Standardization and is registered under ISO 9001 ISO

13485:2003. Currently, over 90% of the Company’s products have obtained EU CE

Certificates. The Company has 30 types of products registered and listed with

the FDA in the U.S., where it is proud to be authorized by the FDA to export

sterilized products directly. Among those products are sterilization pouches and

face masks, which have 510(k) FDA certificates. Japanese certificates,

which are awarded to individual factories, have been granted to Winner Medical’s

Shenzhen factory, Jiayu Factory, and Chongyang Factory, which are all qualified

and entitled to export products to Japan directly.

Providing

Customers with a Complete Product Line – One Stop Procurement

Services

The

Company provides to customers all over the world specialized medical dressing

products that are intended to address a number of customer issues and needs. The

Company’s products are designed to meet a wide variety of its client’s product

configuration demands. The Company employs manufacturing equipment, including

gauze sponge bleaching equipment, sterile packaging machines, auto-gauze sponges

folding machines, nonwoven sponge folding machines, and steam sterilization and

ethylene oxide, or ETO, sterilization processing which it believes allow the

Company to produce its products in a cost efficient manner.

Developing

Products Through Research and Development

The

Company’s research and development efforts are aimed at finding new varieties of

products, improving existing products, improving product quality and reducing

production costs.

The

Company intends to focus significant efforts on opening new opportunities for

its new products. The Company believes the following products will contribute to

its growth.

6

Implementing

Advanced Information Technology System

The

Company has implemented the Enterprise Resources Planning, “ERP”, software

provided by a Systems Applications and Products company, “SAP”, or SAP ERP

system, which integrates all of the core business operations of each of its

subsidiaries-from production, supply, and sales to financial records-into one

system. Looking forward, the Company’s goal is to build a platform on which

the Company can share information with its customers, including raw material

preparation, production status, inventory, and transportation.

Managing

Business Effectively Through Strong Management Team

Each

member of the Company’s management team has an average of ten years of

experience in the industry. Under their leadership, the Company has a

demonstrated record of rapid and orderly growth. The Company intends

to capitalize on the acumen and industry experience of several members

of its management team to grow its business.

Building

a Broad Customer Base

The

Company has many customers in all major regions throughout the world. The

Company’s customers are located in China, Japan, Germany, North America, Italy,

Australia, France, the United Kingdom, the Netherlands, South America, Africa,

the Middle East and other places around the globe. Its largest markets are

currently Japan, the Europe and the United States. The Company intends to

broaden its customer base by diversifying its sales and marketing

efforts.

Developing and Expanding the

Company’s Logistics

Capabilities

Logistics

capability is an important aspect of the Company’s strategy. The Company

believes it is important to have warehouses in large transportation ports and

near central cities. The Company’s use of modern logistics management methods is

designed to enhance its service levels, including its ability to deliver

products to customers in a timely fashion, and the Company strives to handle

customer service inquiries quickly and accurately. Information on purchase order

confirmation, production or order status and shipping advice is readily

available. The Company also offers its customers a variety of payment terms to

facilitate international purchases.

The Company’s Products

The

Company’s products can be divided into the following four categories

according to their functions:

Medical

care products

Include

operating room products, procedural packs, protective products and

gauze.

Wound

care products

Include

dressing pads, cotton products, retention products and dental

products.

Home

care products

Include

cosmetic products, handkerchiefs, sweat pads and bathing sets.

PurCotton

products

New

spunlace 100% cotton nonwoven products. Include jumbo rolls as consumer raw

materials, operating room towels, lap sponges, swabs and surgical gowns, as well

as finished consumer products such as wipes and cosmetic cotton

products.

The

Company continuously focuses on the development and launch of high value added

products, and on increasing its sales volume of innovative new products, which

have a higher profit rate.

The

Company plans to continue to penetrate the medical and health care market for

medical disposable products, particularly in Japan, Europe and the U.S., which

are the main markets for medical disposable products. It has established trade

relationships with Sakai Shorten of Japan, which was its largest clients in

fiscal year 2009, with total sales of approximately $14.54 million. The Company

sells its products through Molnlycke Healthcare in Sweden, Covidien in the US,

Artsana in Italy, Richardson in the UK, BSN Medical in Germany, and Medeco in

Netherlands. In order to adapt the demand of increasing international orders,

the Company has also established production systems designed to address

international product demands, which include a one hundred thousand grade

purification room and modern manufacturing equipment.

The

Company also focuses on quality control. Its products have met the requirements

of major international medical product quality tests, and it continuously seeks

to improve its production systems and processes.

The Company’s Intellectual

Property

The

Company currently has twenty five issued patents. Below are the brief

descriptions of these patents:

7

|

Description of Patent

|

Patent No.

|

Type

|

Status

|

|||

|

Manufacture

Method of the Spunlace Non-Woven Cloth With X-Ray Detectable Element

Produced Thereby

|

ZL 200510033576.9 (China)

|

Invention

|

Granted

|

|||

|

Manufacture

method of the 100% cotton non-woven medical dressings

|

ZL 200510033147.1 (China)

|

Invention

|

Granted

|

|||

|

Colored

non-woven cloth with special coat

|

ZL 200620013847.4 (China)

|

Utility Model

|

Granted

|

|||

|

Colored

100% cotton gauze

|

ZL 200620132922.9 (China)

|

Utility Model

|

Granted

|

|||

|

100%

cotton gauze with protective function

|

ZL 200620132920.X (China)

|

Utility Model

|

Granted

|

|||

|

A

medical dressing resists penetration and adhesion

|

ZL 200620132921.4 (China)

|

Utility Model

|

Granted

|

|||

|

An

ancillary fight code machine

|

ZL 200620017009.4 (China)

|

Utility Model

|

Granted

|

|||

|

A

safety medical gauze with detective device

|

ZL 200620014971.2 (China)

|

Utility Model

|

Granted

|

|||

|

Wipes

box

|

ZL 200630060318.5 (China)

|

Appearance design

|

Granted

|

|||

|

Spunlace

non-woven cloth with special coat and protective function

|

ZL 200620013845.5 (China)

|

Utility Model

|

Granted

|

|||

|

A

testing equipment for cloth

|

ZL 200820091990.4 (China)

|

Utility Model

|

Granted

|

|||

|

Wound

dressing

|

ZL 200820092733.2 (China)

|

Utility Model

|

Granted

|

|||

|

Petrolatum

dressing

|

ZL 200820105164.0 (China)

|

Utility Model

|

Granted

|

|||

|

Product

of and Method for hydrophobic 100% cotton non-woven cloth

|

ZL 200820093952.2 (China)

|

Utility Model

|

Granted

|

|||

|

Packing

device for medical dressing products

|

ZL 200820094531.1 (China)

|

Utility Model

|

Granted

|

|||

|

Draw

out wipes box

|

ZL 200520035670.3 (China)

|

Utility Model

|

Granted

|

|||

|

Medical

product box

|

ZL 200820207244.7 (China)

|

Utility Model

|

Granted

|

|||

|

Embossed

non-woven cloth

|

ZL 2008201397530 (China)

|

Utility Model

|

Granted

|

|||

|

A

care package

|

ZL 200820235800.1 (China)

|

Utility Model

|

Granted

|

|||

|

A

bondage

|

ZL 200920129524.5 (China)

|

Utility Model

|

Granted

|

|||

|

A

protective facemask

|

ZL 200920135220.X (China)

|

Utility Model

|

Granted

|

|||

|

Disposable

medical compound eye-protective face mask

|

ZL 03273570.7 (China)

|

Utility Model

|

Granted

|

|||

|

Method

For Producing Spunlace Non-Woven Cloth, Method For Producing Spunlace

Non-Woven Cloth With X-Ray Detectable Element, Spunlace Non-Woven Cloth

With X-Ray Detectable Element Produced Thereby

|

1-2007-501648 (Philippine)

|

Invention

|

Granted

|

|||

|

Method

For Producing Spunlace Non-Woven Cloth, Method For Producing Spunlace

Non-Woven Cloth With X-Ray Detectable Element, Spunlace Non-Woven Cloth

With X-Ray Detectable Element Produced Thereby

|

2007/7583 (South Africa)

|

Invention

|

Granted

|

|||

|

Method

For Producing Spunlace Non-Woven Cloth, Method For Producing Spunlace

Non-Woven Cloth With X-Ray Detectable Element, Spunlace Non-Woven Cloth

With X-Ray Detectable Element Produced Thereby

|

NG/C/2007/774 (Nigeria)

|

Invention

|

Granted

|

8

The

Company has licensed from Jianquan Li, the Company’s CEO, President and

Director, his rights under six patent and related technologies for nonwoven

fabric manufacturing on a perpetual, worldwide royalty-free

basis. Below are the brief descriptions of these patent and patent

applications:

|

Description of Patent licensed from Jianquan Li

|

Patent No.

|

Type

|

Status

|

|||

|

Method

For Producing Spunlace Non-Woven Cloth, Method For Producing Spunlace

Non-Woven Cloth With X-Ray Detectable Element, Spunlace Non-Woven Cloth

With X-Ray Detectable Element Produced Thereby

|

US 7049753 B2 (U.S.)

|

Invention

|

Granted

|

|||

|

Method

For Producing Spunlace Non-Woven Cloth, Method For Producing Spunlace

Non-Woven Cloth With X-Ray Detectable Element, Spunlace Non-Woven Cloth

With X-Ray Detectable Element Produced Thereby

|

05013515.1 (E.U.)

|

Invention

|

Granted

|

|||

|

Method

For Producing Spunlace Non-Woven Cloth, Method For Producing Spunlace

Non-Woven Cloth With X-Ray Detectable Element, Spunlace Non-Woven Cloth

With X-Ray Detectable Element Produced Thereby

|

2005118845 (Russia)

|

Invention

|

Granted

|

|||

|

Method

For Producing Spunlace Non-Woven Cloth, Method For Producing Spunlace

Non-Woven Cloth With X-Ray Detectable Element, Spunlace Non-Woven Cloth

With X-Ray Detectable Element Produced Thereby

|

200503941-7 (Singapore)

|

Invention

|

Granted

|

|||

|

Method

For Producing Spunlace Non-Woven Cloth, Method For Producing Spunlace

Non-Woven Cloth With X-Ray Detectable Element, Spunlace Non-Woven Cloth

With X-Ray Detectable Element Produced Thereby

|

PA/a/2005/009218 (Mexico)

|

Invention

|

Granted

|

|||

|

Spunlace

Non-Woven Cloth With X-Ray Detectable Element Produced

Thereby. The Company added X-Ray detectable elements into the

spunlace non-woven cloth so that it can be easily detected by X-ray,

thereby avoiding leaving medical dressings in patient’s

body

|

ZL 200520055659.3 (China)

|

Utility Model

|

Granted

|

The

Company also has registered the trademark for the word “Winner” in China, the

United States, Canada, Singapore, Libya, Jordan, the United Arab Emirates, Saudi

Arabia, Thailand, Yemen, Chile, Cambodia and Hong Kong, and this trademark has

passed the registration application in the member countries of the Madrid

Agreement such as Germany, France, Italy, Russia, Switzerland, Australia, and

etc. The trademark of “PurCotton” has also passed the registration in China,

Hong Kong, the United States, European Union, Japan, Australia, Barisal, South

Africa, Philippine, Russia, Egypt, and etc. Other trademarks, including

“Winwin”, “Winband” in English and Chinese, and “SoftTouch”, have also been

registered by the Company.

9

In

addition, the Company has registered thirty six domain names, including

www.winnermedical.com (currently in use), www.purcotton.com.cn,

www.winnersofttouch.com, www.winner-industries.com, www.winner-shenzhen.com,

www.winner-shanghai.com, and www.winner-beijing.com, and etc.

Where

appropriate for the Company’s business strategy, the Company will continue to

take steps to protect its intellectual property rights.

The

Company’s Research and Development Efforts

The

Company spent approximately $1,663,000, $1,802,000, and $2,050,000 on research

and development in fiscal years 2009, 2008 and 2007, respectively.

The

Company’s research and development in 2009 was mainly focused on developing new

finished PurCotton products for consumer use, and researching new coating

technology for PurCotton products. Such coating technology will be applied on

the production of PurCotton products to reduce the production cost and improve

product quality.

PurCotton

is a type of cotton products that is made of 100% cotton using nonwoven

technology. As a natural product, it is environmentally friendly, reproducible,

comfortable, non-allergenic and static-free.

With this

new technology, the Company can produce environmentally friendly 100% cotton

nonwoven at a lower cost. The Company’s new technology modifies the conventional

manufacturing method of nonwoven cloth. The Company refined the production

equipment and reduced the number of steps in making nonwoven cloth. As a result,

the new technology allows the Company to minimize raw material waste, save

production costs, and improve production efficiency.

The

Company’s research and development activities adhere to strict procedures and

utilize standardized processes. The Company is focused on further improving its

core manufacturing technologies so that it can reduce waste and overall

costs.

In

addition, the Company uses advanced automatic equipment as part of its

processing system, including folding machines, plastic absorbing machines and

sterilization systems. These improvements not only reduce production costs, but

also enable the Company to further diversify its product lines.

The

Company’s Marketing

Efforts

The

Company’s products are sold in all major regions internally through a network of

distributors, wholesalers, manufactures, whereby it provides each of its

customers with a customized product that is then sold by such customer under its

brand name, and manufacturers’ representatives. The Company’s major target

markets are China, Japan, Europe and North and South America. In light of its

existing production capacity constraints, the Company plans to meet the demands

from international markets, and at the same time expand its sales to the Chinese

market.

Since

there are different requirements in different geographic markets, the Company

has adopted marketing strategies that are market specific. For developed markets

such as the U.S., Japan and the EU, the Company acts as supplier for its

clients, providing each of them with a customized products in which the design,

size, type and scale of the products is decided by its customers. This approach

enables the Company to capitalize on its customers’ branding strengths and

established market channels. In order to gain market share, the Company attempts

to leverage its customers’ strong brand names, efficient distribution networks

and market presence. The Company believes it is a better strategy for it to team

up with large, well-known companies than to compete directly with them. Most of

the Company’s sales in developed countries are conducted by direct marketing. In

addition, the Company also conducts sales through third-party manufacturers’

representatives, who are compensated through payment of sales

commissions.

In China

and other developing countries, the Company sells its products under the

“Winner” brand name. As the economies of China and other developing countries

grow, the Company expected that there will be a significant increase in demand

for medical products, including demand for the Company’s medical dressings and

other medical disposable products. The Company believes its products are

generally price-competitive with products from the U.S., Japan and the European

countries. Competition can also come from local producers in the developing

countries, but the Company attempts to compete with local manufacturers based on

the quality of its products. Under these circumstances, the Company

believes it has successfully established a reputation for its own brand

based on low prices and high quality. The Company employs manufacturers’

representatives and actively participate in formal bid contracts organized by

local governments and organizations. The Company believes it has built its

brand reputation and market share in these markets and “Winner” has become a

recognized brand in local hospitals, the home health care sector and retail

markets in many developing countries.

10

Raw

Materials

The

Company depends on external suppliers for all of the raw materials it uses to

produce its products. The principal raw materials used for the Company’s

products are cotton, non-woven cloth and packaging materials, each of which it

purchases from a limited number of suppliers. The Company’s major supplier of

cotton, non-woven cloth and packaging materials are Louis Dreyfus Beijing

Trading Co. Ltd. (China) and Sino Protection (HeFei) Sanitary Material Co.,

Ltd. (China). The Company’s purchases from individual suppliers were less

than 5% of its total purchase amount in fiscal year 2009. The Company believes

it is not over-reliant on any of these suppliers.

Given the

importance of key raw materials to the Company’s business, the Company carefully

manages its purchasing efforts and has established company policies involving

raw material procurement. The cost of raw materials, excluding the

semi-process materials purchased, amounts to almost 55% of the Company’s total

production cost.

Supplier

Management System

The

Company has established a strict supplier management system to comprehensively

assess suppliers on the basis of quality and improvement, purchasing cycles,

management systems, price and delivery cycles. Suppliers are formally evaluated

twice a year. The quality of the suppliers determines how much business they

receive from the Company in subsequent months. The Company also hosts an annual

suppliers’ conference, during which it communicates directly with its suppliers

its needs and service level demands. The Company undertakes an open and

transparent purchasing practice, which is well received by most

suppliers.

Purchasing

Procedures

Purchasing

transactions are conducted in accordance with a procedure termed

“inquiry-comparison-negotiation.” Potential suppliers make initial offers that

are compared objectively according to relevant guidelines. After validation of

the various suppliers’ service and quality capabilities, the Company acquires

the needed materials from the supplier offering the highest quality product at a

reasonable cost. The Company’s financial department establishes an oversight

process by appointing individuals to conduct independent market research of key

price points. The research findings are announced periodically. The Company’s

auditing department and quality assurance department also provide oversight to

assure that it strictly adheres to all purchasing procedures.

The

Company’s Major Customers

The

Company has customers in approximately 80 countries throughout the world,

including Japan, Germany, the United States, Italy, the Netherlands, the United

Kingdom, Australia, France, China, as well as countries in South America, Africa

and the Middle East. Some of the Company’s customers are large-scale

producers and distributors with well known brand names, while others are import

and export firms or wholesalers with trade expertise and established sales

channels. The Company has long-term relationships with most of its

customers.

No

customer, other than Sakai Shoten Co., Ltd. accounted for more than 10% of

the Company’s revenues in fiscal year 2009. Sakai Shoten Co., Ltd. accounted for

approximately 14.78% and 15.66% of the Company’s revenue in fiscal years 2009

and 2008, respectively. Sakai Shoten Co., Ltd. acts as a purchasing agent for a

large number of ultimate consumers of the Company’s products in Japan. If the

Company loses this customer and is unable to replace this customer with other

customers that purchase a similar amount of its products, the Company’s revenues

and net income may decline considerably.

The

Company’s Competition

The

Company is subject to intense competition. Some of the Company’s competitors

have greater financial resources, larger staff and more established market

recognition than the Company does in the domestic Chinese market and

international markets. Increased competition in the medical disposable product

market could put pressure on the price at which the Company sells its

products, resulting in reduced profitability for the Company.

In the

Company’s industry, the Company competes based on manufacturing capacity,

product quality, product cost, ability to produce a diverse range of products

and logistics capabilities.

The

Company’s competitors include medical dressing and other medical disposable

product manufacturers around the world. Below is a list by geographic area of

the companies that the Company views as its most significant competitors in the

major markets in which it sells its products.

Competitors

based in China

The

Company’s competitors based in China primarily include: Shenzhen Aumei, Zhejiang

Zhende Medical Dressing Co., Ltd., Jiangsu Province Jianerkang Medical Dressing

Co., Ltd., and Qingdao Hartmann Medical Dressing Co., Ltd.

The

Company’s China-based competitors tend to have lower labor costs, and the

Company believes that their products are of lower quality and often lack

diversity, and they are weak in brand building and management.

Competitors

based in Asia (Outside of China)

Competitors

based in this area mainly come from India and countries in Southeast Asia, such

as Premier Enterprise and Sri Ram Products, whose main business is

weaving.

11

These

competitors lack of interconnected businesses, suppliers within the local

industry; and they tend to have lower employee and management quality, as

well as lower product quality.

Competitors

based in Europe and North America

Competitors

based in Europe and North America include: Bastos Viegas, S.A. (Portugal),

Intergaz, S.R.O. (Czech Republic), and TZMO S.A. (Poland).

The

Company’s competitors from Europe may have a geographic advantage in the EU

market, but the Company believes they have less product diversity and higher

production costs.

Regulation

The

Company is subject to complex and stringent governmental laws and regulations

relating to the manufacture and sale of medical dressings and medical

disposables in China and in many other countries in which it sells its products.

These laws and regulations in the major markets in which it competes are

discussed further below. All of the regulatory laws and regulations may be

revised or reinterpreted, or new laws and regulations may become applicable that

could have a negative effect on the Company’s business and results of

operations. See Item 1A. “Risk Factors — Risks Related to the Company’s Industry

— the Company’s failure to comply with ongoing governmental regulations could

impair its operations and reduce its market share.”

China

In China,

medical sanitary materials and dressings, including medical gauzes, absorbent

cottons, bandages and disposable surgical suits, are regulated as medical

devices and are administered by the Department of Medical Devices of the State

Drug Administration of China. The technology and specifications of these

products must be consistent with the Regulations for the Supervision and

Administration of Medical Devices and relevant laws and standards.

The

Company’s business is regulated by a number of provincial authorities that

license the production of, and register, products such as those the Company

manufactures. Eight of the Company’s wholly-owned subsidiaries, which require

licenses from these authorities, operate under current licenses.

Other

Countries

In

addition, since the Company sells its products in the international markets, its

products are subject to regulations imposed by various governmental agencies in

the markets where the Company’s products are sold. All of the Company’s products

exported to European countries must have a CE certificate, CE-certification or

CE Marking, which is a conformity marking consisting of the letters “CE”. The CE

Marking applies to products regulated by certain European health, safety and

environmental protection legislation. The CE Marking is obligatory for products

it applies to and the manufacturer affixes the marking in order to be allowed to

sell his products in the European market.

In Japan,

the Company needs a Certificate of Foreign Manufacture from the Pharmaceuticals

and Medical Devices Agency of Ministry of Health, Labor and Welfare of Japan in

order to sell its products in the Japanese market. The Company has reached the

applicable standards and obtained the required certificates in the Europe and

Japan.

In the

U.S., some of the Company’s products are considered medical devices. The FDA

regulates the design, manufacture, distribution, quality standards and marketing

of medical devices. Accordingly, the Company’s product development, testing,

labeling, manufacturing processes and promotional activities for certain

products that are considered medical devices are regulated extensively in the

U.S. by the FDA. The FDA has given the Company clearance to market such products

within the U.S.

Under the

U.S. Federal Food, Drug, and Cosmetic Act, or “FFDCA”, medical devices are

classified into one of three classifications, each of which is subject to

different levels of regulatory control, with Class I being the least stringent

and Class III being subject to most control. Class III devices, which are life

supporting or life sustaining, or which are of substantial importance in

preventing impairment of human health, are generally subject to a clinical

evaluation program before receiving pre-market approval, or PMA, from the FDA

for commercial distribution. Class II devices are subject in some cases to

performance standards that are typically developed through the joint efforts of

the FDA and manufacturers, but do not require clinical evaluation and pre-market

approval by the FDA. Instead, these products require a pre-market notification

to the FDA and in most cases a showing of substantial equivalence to an existing

product under Section 510(k) of the FFDCA. Class I devices are subject only to

general controls, such as labeling and record-keeping regulations, and are

generally exempt from pre-market notification or approval under Section 510(k)

of the FFDCA, although they are required to be listed with the FDA. The

Company’s medical device products are generally considered Class I devices;

therefore, they are exempt from pre-market notification or approval

requirements. The Company has listed all of its relevant products with the FDA

pursuant to the FFDAC.

If a

510(k) pre-market notification is required for a medical device, then such

device cannot be commercially distributed until the FDA issues a letter of

substantial equivalence, approving the sale of the product. Certain of the

Company’s surgical face masks and sterilization pouches are subject to the

510(k) pre-market notification requirements. The Company has already received

the necessary approvals from the FDA for such products.

12

The

Company’s medical device products are also subject to the general labeling

requirements under the FDA medical device labeling regulations. As of September

30, 2009, the Company has labeled all of its medical device products

and was not subject of any enforcement action initiated by the

FDA.

In

addition, manufacturers of medical devices distributed in the U.S. are subject

to various regulations, which include establishment registration, medical device

listing, quality system regulation (QSR) and medical device reporting. Under

FFDAC, any foreign establishment that manufactures, prepares, propagates,

compounds or processes a medical device that is imported, or offered for import,

into the U.S. is required to register its establishment with the FDA. In

addition, any foreign establishment that engages in manufacturing, preparation,

compounding, assembly or processing of a medical device intended for commercial

distribution in the U.S. is required to list its devices with the FDA. The

Company’s subsidiary Winner Shenzhen, which exports all its products, has

registered its establishment with the FDA and has listed 31 medical and dental

devices.

The

Company’s manufacturing processes are required to comply with the applicable

portions of the QSR, which covers the methods and documentation of the design,

testing, production, processes, controls, quality assurance, labeling, packaging

and shipping of its medical device products. The QSR, among other things,

requires maintenance of a device master record, device history record and

complaint files. As of September 30, 2009, the Company was not the subject of

any enforcement actions initiated by the FDA.

The

Company is also required to report to the FDA if its products cause or

contribute to a death or serious injury or malfunction in a way that would

likely cause or contribute to death or serious injury were the malfunction to

recur. The FDA can require the recall of products in the event of material

defects or deficiencies in design or manufacturing. The FDA can withdraw or

limit the Company’s product approvals or clearances in the event of serious,

unanticipated health or safety concerns. The Company may also be required

to submit reports to the FDA of corrections and removals. As of September 30,

2009, the Company had not received any complaints that any of its products had

contributed to a death or serious injury, or that they suffered any such

malfunctions or defects.

The FDA

has broad regulatory and enforcement powers. If the FDA determines that the

Company has failed to comply with applicable regulatory requirements, it can

impose a variety of enforcement actions ranging from public warning letters,

fines, injunctions, consent decrees and civil penalties to suspension or delayed

issuance of approvals, seizure or recall of the Company’s products, total or

partial shutdown of production, withdrawal of approvals or clearances already

granted and criminal prosecution. The FDA can also require the Company to

repair, replace or refund the cost of devices that it manufactured or

distributed. The Company’s failure to meet any of these requirements may cause

the FDA to detain its products automatically when they are presented for entry

into the U.S. If any of these events occur, it could create a material adverse

impact on the Company. As of September 30, 2009, the Company was not the subject

of any enforcement actions initiated by FDA.

The

Company’s Employees

As of

September 30, 2009, the Company employed approximately 4,459 full-time

employees. The Company believes that it maintains a satisfactory working

relationship with its employees and it has no significant labor disputes or any

difficulty in recruiting staff for its operations.

As

required by applicable Chinese law, the Company has entered into employment

contracts with all of its officers, managers and employees.

The

Company’s employees in China participate in a state pension scheme organized by

the Chinese municipal and provincial governments. The Company is required to

contribute to the scheme at rates ranging from 8% to 29% of the average monthly

salary. The expenses related to this scheme were $626,606, $515,232, and

$356,113 for fiscal years 2009, 2008 and 2007 respectively.

Item

1A. Risk

Factors

You

should carefully consider the following risks, as well as the other information

contained in this annual report, before investing in the Company’s securities.

If any of the following risks actually occurs, the Company’s business could be

harmed. You should refer to the other information set forth or referred to in

the Company’s annual report, including its consolidated financial statements and

the related notes incorporated by reference herein.

RISKS

RELATED TO THE COMPANY’S BUSINESS

The

Company’s dependence upon international customers may impede its ability to

supply products

During

fiscal year 2009, approximately 83% of the Company’s products were sold

internationally. As a result, the Company is subject to risks

associated with shipping products across borders, including shipping

delay. If the Company cannot deliver its products on a competitive

and timely basis, its relationships with international customers may be damaged

and its financial condition could be harmed.

13

The

Company engages in international sales, which expose it to trade

restrictions

As a

result of the Company’s product sales in various geographic regions, the Company

may be subject to the risks associated with customs duties, export quotas and

other trade restrictions that could have a significant impact on its revenue and

profitability. While the Company has not encountered significant

difficulties in connection with the sales of its products in international

markets, the future imposition of, or significant increases in the level of,

custom duties, export quotas or other trade restrictions could have an adverse

effect on the Company. Further, the Company cannot assure that the

laws of foreign jurisdictions where it sells and seeks to sell its products

afford similar or any protection of its intellectual property rights as may be

available under U.S. laws. The Company is directly impacted by the

political, economic, military and other conditions in the countries where it

sells or seeks to sell its products.

Expansion

of the Company’s business may put added pressure on its management, financial

resources and operational infrastructure, impeding the Company’s ability to meet

any increased demand for its medical products and possibly impairing its

operating results

The

Company’s business plan is to significantly grow its operations to meet

anticipated growth in demand for existing products, and by the introduction of

new product offerings. The Company’s planned growth includes the

construction of several new production lines to be put into operation over the

next five years. Growth in the Company’s business may place a

significant strain on its personnel, management, financial systems and other

resources. The Company may be unable to successfully and rapidly

expand sales to potential customers in response to potentially increasing demand

or control costs associated with its growth.

To

accommodate any such growth and compete effectively, the Company may need to

obtain additional funding to improve information systems, procedures and

controls and expand, train, motivate and manage its employees, and such funding

may not be available in sufficient quantities. If the Company is not

able to manage these activities and implement these strategies successfully

to expand to meet any increased demand, the Company’s operating results could

suffer.

The

Company relies on patent and trade secret laws that are complex and difficult to

enforce

The

validity and breadth of claims in medical technology patents involve complex

legal and factual questions and, therefore, the extent of their enforceability

and protection is highly uncertain. Issued patents or patents based

on pending patent applications or any future patent applications may not exclude

competitors or may not provide a competitive advantage to the

Company. In addition, patents issued or licensed to the Company may

not be held valid if subsequently challenged and others may claim rights in or

ownership of such patents. Furthermore, the Company cannot assure

that its competitors have not developed or will not develop similar products,

will not duplicate the Company’s products, or will not design around any patents

issued to or licensed by the Company.

The

Company depends on key personnel, and turnover of key employees and senior

management could harm its business

The

Company’s future business and results of operations depend in significant part

upon the continued contributions of its key technical and senior management

personnel, including Jianquan Li, Xiuyuan Fang, Jiagan Chen and Nianfu Huo, who

hold the titles of CEO, President and Chairman, CFO and Vice President, Vice

President of Project Management and Senior Vice President and Chairman of

Supervisory Board, respectively. They also depend in significant part

upon the Company’s ability to attract and retain additional qualified

management, technical, marketing and sales and support personnel for its

operations. If the Company loses a key employee or if a key employee

fails to perform in his or her current position, or if the Company is unable to

attract and retain skilled employees as needed, the Company’s business could

suffer. Significant turnover in the Company’s senior management could

significantly deplete the Company’s institutional knowledge held by its existing

senior management team. The Company depends on the skills and

abilities of these key employees in managing the manufacturing, technical,

marketing and sales aspects of its business, any part of which could be harmed

by further turnover.

The

Company’s revenues are highly concentrated in a single customer and the

Company’s business will be harmed if this customer reduces its orders from the

Company

In fiscal

year 2009, almost 14.78% of the Company’s business comes from just one customer,

Sakai Shoten Co., Ltd, which acts as a purchasing agent for a large number of

ultimate consumers of the Company’s products in Japan. If the Company

loses this customer and is unable to replace this customer with other customers

that purchase a similar amount of the Company’s products, the Company’s revenues

and net income would decline considerably.

The

Company is subject to potential product liability claims for which it does not

have insurance coverage

Defects

in the Company’s products could subject to potential product liability claims

that its products are ineffective or cause some harm to the human

body. The Company does not have product liability

insurance. Plaintiffs may advance claims that the Company’s products

or actions resulted in some harm. A successful claim brought against

the Company could significantly harm its business and financial

condition.

14

The

Company may not be able to adequately finance the significant costs associated

with the development of new medical products

The

medical products in the medical dressings and medical disposables market change

dramatically with new technological advancements. The Company is

currently conducting research and development on a number of new products, which

require a substantial outlay of capital. To remain competitive, the

Company must continue to incur significant costs in product development,

equipment, facilities and invest in research and development of new

products. These costs may increase, resulting in greater fixed costs

and operating expenses.

In

addition to research and development costs, the Company could be required to

expend substantial funds for and commit significant resources to the

following:

|

|

·

|

additional engineering and other

technical personnel;

|

|

|

·

|

advanced design, production and

test equipment;

|

|

|

·

|

manufacturing services that meet

changing customer needs;

|

|

|

·

|

technological changes in

manufacturing processes; and

|

|

|

·

|

manufacturing

capacity.

|

The

Company’s future operating results will depend to a significant extent on its

ability to continue to provide new products that compare favorably on the basis

of cost and performance with the design and manufacturing capabilities of

competitive third-party suppliers and technologies. The Company will

need to sufficiently increase its net sales to offset these increased costs, the

failure of which would negatively affect the Company’s operating

results.

The

current global financial crisis may have a negative impact on the Company’s

business and financial condition, especially on the market acceptance of the

Company’s new PurCotton products

The

current worldwide economic crisis has created significant reductions in

available capital and liquidity from banks and other providers of credit, which

may adversely affect the Company’s customers’ ability to buy the Company’s new

PurCotton products and fulfill their obligations to the

Company. Additionally, many of the effects and consequences of the

current global financial crisis and a broader global economic downturn are

currently unknown; any one or all of them could potentially have a material

adverse effect on the Company’s customers' or the Company’s own liquidity and

capital resources, or otherwise negatively impact the Company’s business and

financial results.

The

Company’s PurCotton products may be adversely affected by price reductions of

raw materials of the Company’s competitive products

Markets

for all of the Company’s products, especially the Company’s PurCotton products,

are extremely competitive. The Company competes based upon a variety of factors,

including cost of production and raw materials. It is possible that the

Company’s competitors have lowered their cost of production due to price

decrease in rayon and polyester and engage in price competition through

aggressive pricing policies to secure a greater market share to the Company’s

detriment. The Company’s PurCotton business may be adversely affected by

competition, and the Company may not be able to maintain its profitability if

the competitive environment worsens.

In

order to grow at the pace expected by management, the Company will require

additional capital to support its long-term business plan. If the Company is

unable to obtain additional capital in future years, it may be unable to proceed

with its long-term business plan and the Company may be forced to curtail or

cease its operations

The

Company will require additional working capital to support its long-term

business plan, which includes identifying suitable targets for horizontal or

vertical mergers or acquisitions, so as to enhance the overall productivity and

benefit from economies of scale. The Company’s working capital requirements and

the cash flow provided by future operating activities, if any, will vary greatly

from quarter to quarter, depending on the volume of business during the period

and payment terms with its customers. The Company may not be able to obtain

adequate levels of additional financing, whether through equity financing,

debt financing or other sources. Additional financings could result in

significant dilution to the Company’s earnings per share or the issuance of

securities with rights superior to the Company’s current outstanding securities.

In addition, the Company may grant registration rights to investors

purchasing its equity or debt securities in the future. If the Company is unable

to raise additional financing, it may be unable to implement its long-term

business plan, develop or enhance its products and services, take advantage of

future opportunities or respond to competitive pressures on a timely basis, if

at all. In addition, a lack of additional financing could force the Company to

substantially curtail or cease operations.

The

Company may be exposed to potential risks relating to its internal controls over

financial reporting and its ability to have those controls attested to by its

independent auditors

As

directed by Section 404 of the Sarbanes-Oxley Act of 2002 or SOX 404, the

Securities and Exchange Commission adopted rules requiring public companies to

include a report of management on the companies’ internal controls over

financial reporting in their annual reports, including Form

10-K. These requirements first applied to the Company in connection

with the Report for the fiscal year ended September 30, 2009. Management’s

report on internal control over financial reporting is set out in Item 9A

“Controls and Procedures.” of the 2009 Form 10-K. In addition, the independent

registered public accounting firm auditing a company’s financial statements must

also attest to and report on management’s assessment of the effectiveness of the

company’s internal controls over financial reporting as well as the operating

effectiveness of the company’s internal controls. The Company can provide no

assurance that it will be able to comply with all of the requirements imposed

thereby. The requirement for the auditor’s attestation in connection

with the Report will be effected to the Company for the fiscal year ended

September 30, 2010. There can be no assurance that the Company will receive

a positive attestation from its independent auditors. If significant

deficiencies or material weaknesses in the Company’s internal controls are

identified, the Company may not be able to remediate in a timely manner. In such

case, investors and others may lose confidence in the reliability of the

Company’s financial statements.

15

The

Company’s holding company structure and Chinese accounting standards and

regulations may limit the payment of dividends

The

Company has no direct business operations other than ownership of its

subsidiaries. While the Company has no current intention of paying

dividends, should it decide in the future to do so, as a holding company, its

ability to pay dividends and meet other obligations depends upon the receipt of

dividends or other payments from its operating subsidiaries and other holdings

and investments. In addition, the Company’s operating subsidiaries,

from time to time, may be subject to restrictions on their ability to make

distributions to the Company, including as a result of restrictive covenants in

loan agreements, restrictions on the conversion of local currency into U.S.

dollars or other hard currency and other regulatory restrictions as discussed

below. If future dividends are paid in Renminbi, fluctuations in the

exchange rate for the conversion of Renminbi into U.S. dollars may reduce the

amount received by U.S. stockholders upon conversion of the dividend payment

into U.S. dollars.

Chinese

regulations currently permit the payment of dividends only out of accumulated

profits as determined in accordance with Chinese accounting standards and

regulations. The Company’s subsidiaries in China are required to set

aside a portion of their after tax profits according to Chinese accounting

standards and regulations to fund certain reserve funds. Currently,

the Company’s subsidiaries in China are the only sources of revenues or

investment holdings for the payment of dividends. If they do not

accumulate sufficient profits under Chinese accounting standards and regulations

to first fund certain reserve funds as required by Chinese accounting standards,

the Company will be unable to pay any dividends.

The

Company may be subject to fines and legal sanctions imposed by State

Administration of Foreign Exchange(SAFE) or other Chinese government authorities

if it or its Chinese directors or employees fail to comply with recent Chinese

regulations relating to employee share options or shares granted by offshore

listed companies to Chinese domestic individuals

On

December 25, 2006, the People’s Bank of China, or PBOC, issued the

Administration Measures on Individual Foreign Exchange Control, and the

corresponding Implementation Rules were issued by SAFE on January 5, 2007.

Both of these regulations became effective on February 1, 2007. According

to these regulations, all foreign exchange matters relating to employee stock

holding plans, share option plans or similar plans with Chinese domestic

individuals’ participation require approval from the SAFE or its authorized

branch. On March 28, 2007, the SAFE issued the Application Procedure of

Foreign Exchange Administration for Domestic Individuals Participating in

Employee Stock Holding Plan or Stock Option Plan of Overseas-Listed Company, or

the Stock Option Rule. Under the Stock Option Rule, Chinese domestic individuals

who are granted share options or shares by an offshore listed company are

required, through a Chinese agent or Chinese subsidiary of the offshore listed

company, to register with the SAFE and complete certain other procedures. As the

Company is an offshore listed company, its Chinese domestic directors and

employees who may be granted share options or shares shall become subject to the

Stock Option Rule. Under the Stock Option Rule, employees stock holding plans,

share option plans or similar plans of offshore listed companies with Chinese

domestic individuals’ participation must be filed with the SAFE. After the

Chinese domestic directors or employees exercise their options, they must apply

for the amendment to the registration with the SAFE. The Company is reviewing

the procedures for such SAFE registration. If the Company or its Chinese

domestic directors or employees fail to comply with these regulations, the

Company or its Chinese domestic directors or employees may be subject to fines

or other legal sanctions imposed by the SAFE or other Chinese government

authorities.

RISKS

RELATED TO THE COMPANY’S INDUSTRY

The

Company may not be able to maintain or improve its competitive position because

of strong competition in the medical dressing and medical disposable industry,

and the Company expects this competition to continue to intensify

The

medical dressing and medical disposable industry is highly

competitive. The Company faces competition from medical dressing and

medical disposable manufacturers around the world. Some of the

Company’s international competitors are larger than the Company and possess

greater name recognition, assets, personnel, sales and financial

resources. These entities may be able to respond more quickly to

changing market conditions by developing new products and services that meet

customer requirements or are otherwise superior to the Company’s products

and services and may be able to more effectively market their products than

the Company can because they have significantly greater financial, technical and

marketing resources than the Company does. They may also be able to

devote greater resources than the Company can to the development, promotion

and sale of their products. Increased competition could require the

Company to reduce its prices, resulting in fewer customer orders, and loss of

market share. The Company cannot assure that it will be able to

distinguish itself in a competitive market. To the extent that the

Company is unable to successfully compete against existing and future

competitors, the Company’s business, operating results and financial condition

would face material adverse effects.

16

Cost

containment measures that are prevalent in the healthcare industry may result in

lower margins

The

health care market accounts for most of the demand for medical disposables

products. The health care market was typified in recent years by

strict cost containment measures imposed by governmental agencies, private

insurers and other “third party” payers of medical costs. In response

to these economic pressures, virtually all segments of the health care market

have become extremely cost sensitive and in many cases hospitals and other

health care providers have become affiliated with purchasing consortiums that

obtain large quantities of needed products and thus can sell at much lower

cost. These factors in combination have hindered suppliers and

manufacturers like the Company who may not be able to supply the large

quantities sought by the purchasing consortiums or who are unable to respond to