Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - MAXIMUS, INC. | a50066971ex99-1.htm |

| 8-K - MAXIMUS, INC. 8-K - MAXIMUS, INC. | a50066971.htm |

Exhibit 99.2

FINAL TRANSCRIPT

Conference Call Transcript

MMS - Q4 2011 Maximus Inc Earnings Conference Call

Event Date/Time: Nov 10, 2011 / 02:00PM GMT

1

FINAL TRANSCRIPT

|

Nov 10, 2011 / 02:00PM GMT, MMS - Q4 2011 Maximus Inc Earnings Conference Call

|

CORPORATE PARTICIPANTS

Lisa Miles

Maximus Inc - IR

David Walker

Maximus Inc - CFO

Rich Montoni

Maximus Inc - President, CEO

Bruce Caswell

Maximus Inc - President, Health Services

CONFERENCE CALL PARTICIPANTS

Torin Eastburn

CJS Securities - Analyst

James Kumpel

BB&T Capital Markets - Analyst

Constantine Davides

JMP Securities - Analyst

Brian Kinstlinger

Sidoti & Company - Analyst

Brian Gesuale

Raymond James & Associates - Analyst

PRESENTATION

Operator

Greetings and welcome to the Maximus fiscal 2011 fourth quarter and year-end conference call. At this time all participants are in a listen-only mode. A brief question-and-answer session will follow the formal presentation. (Operator Instructions) As a reminder, this conference is being recorded. It is now my pleasure to introduce your host, Lisa Miles, Vice President of Investor Relations for Maximus. Thank you, Ms. Miles, you may begin.

Lisa Miles - Maximus Inc - IR

Good morning. Thank you for joining us on today's conference call. I would like to point out that we've posted a presentation to our website under the Investor Relations page to assist you in following along with today's call. With me today is Rich Montoni, Chief Executive Officer; and David Walker, Chief Financial Officer. Following Rich's prepared comments, we will open the call up for Q&A.

Before we begin, I would like to remind everyone that a number of statements being made today will be forward-looking in nature. Please remember that such statements are only predictions and actual events or results may differ materially as a result of risks we face including those discussed in Exhibit 99.1 out of our SEC filings. We encourage you to review the summary of these risks in our most recent 10K filed with the SEC. The Company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances. And with that, I'll turn the call over to Dave.

David Walker - Maximus Inc - CFO

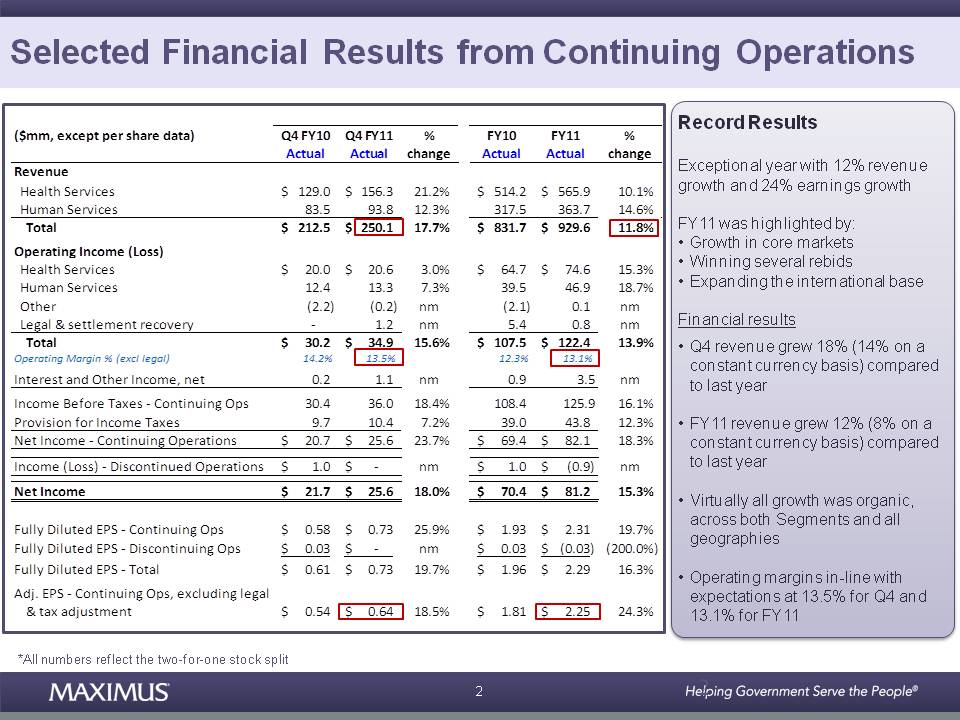

Thanks, Lisa. This morning, Maximus reported record revenue and earnings for the fourth quarter and fiscal 2011. Maximus delivered another exceptional fiscal year with revenue increasing 12% and adjusted earnings growing 24%. Our results reflect the long term visibility and predictability of a strong healthy portfolio. The management team remains firmly committed to growing the business by bringing on new profitable work as we continue to deliver long term shareholder value. The year was highlighted by strong growth in core markets winning several important rebids and further expanding our international business space, which now account for 32% of total Maximus revenue.

2

So let's move into the financial details for the quarter and the full year. For the fourth quarter, total Company revenue from continuing operations grew 18% or 14% on a constant currency basis to $250.1 million. Maximus exited fiscal 2011 with full-year revenue of $929.6 million, a 12% increase over fiscal 2010 or 8% on a constant currency basis. Virtually all revenue growth was organic. We experienced growth across both segments and all geographies, driven by new work and expansion on existing contractions in major markets. Operating margins were strong and in line with expectations at 13.5% for the fourth quarter and 13.1% for the full fiscal year, with both segments contributing to the strength of margins in fiscal 2011.

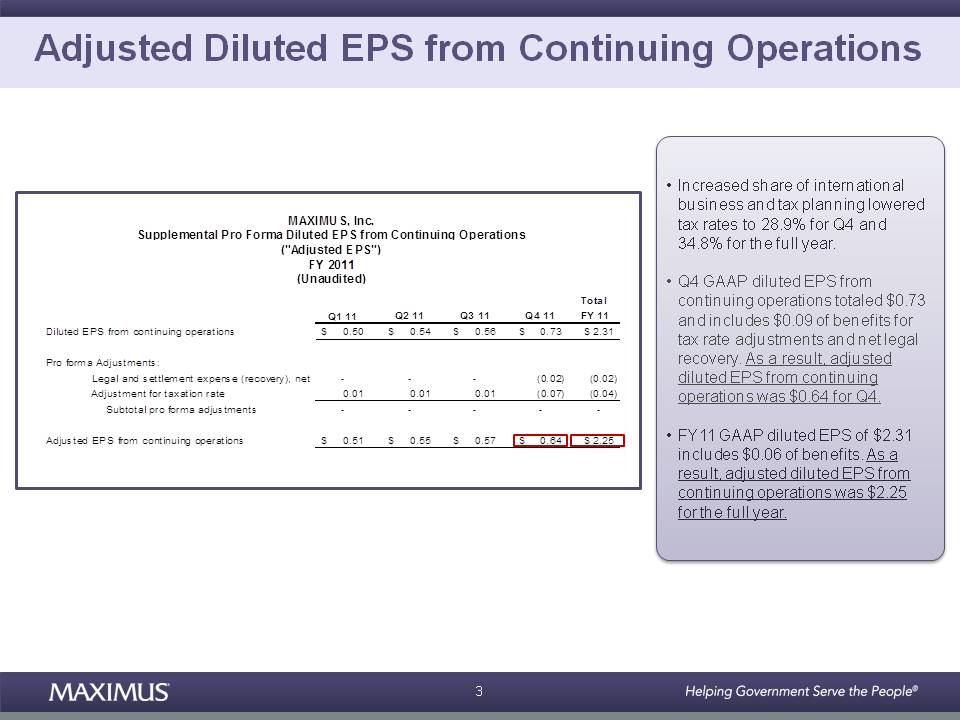

Year-end tax adjustments related to our mix of business in lower tax jurisdictions overseas and year-end tax planning resulted in fourth quarter tax adjustments, which lowered the tax rates to 28.9% for the fourth quarter and 34.8% for the full year. As a result, fourth quarter GAAP income and continuing operations net of taxes totaled $25.6 million or $0.73 per diluted share, which included approximately $0.09 of benefits related to the year-end tax adjustments and a net legal recovery. For the full fiscal year, GAAP income from continuing operations net of taxes totaled $82.1 million or $2.31 per diluted share and included approximately $0.06 of benefits. Excluding these benefits, adjusted diluted EPS from continuing operations was $0.64 for the fourth quarter, and $2.25 for the full year. Since adjusted EPS is a non-GAAP view of our earnings, we have included a normalization table in the financial schedules of the press release providing details of our adjustments.

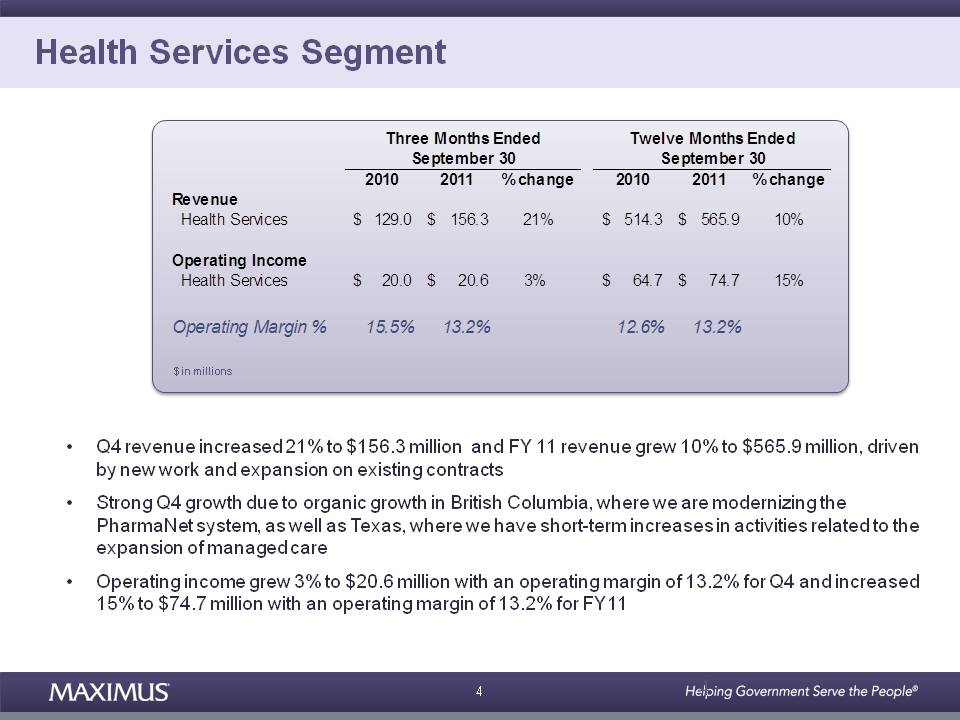

Let's jump into results by segment starting with health services. The health services segment continues to deliver consistently solid results. For the fourth quarter, revenue increased 21% to $156.3 million compared to the same period last year. And for fiscal 2011, revenue grew 10% to $565.9 million driven by new work and expansion on existing contracts. Most notably, growth in the fourth quarter was exceptionally strong due to organic growth in British Columbia where we are working with the province to help modernize its pharma net system as well as the expansion of managed care in Texas.

In Texas, we are experiencing an increase in transaction-based activity in Medicaid and CHIP as the state is shifting new populations into managed care plans and offering a variety of new plans to current populations. These enrollments are sparking short-term increases in certain activities such as the number of enrollment packets mailed and call-center volumes related to beneficiary outreach and education. As a result, starting in the fourth quarter, we experienced a temporary spike in revenue, which is expected to carry into the first half of fiscal 2012. Once these activities are completed, we expect the program to return to a more normalized run rate in the last half of the year but with modest expansion over the fiscal 2011 run rate.

For the fourth quarter of 2011, operating income for the health services segment grew 3% to $20.6 million with an operating margin of 13.2%. Revenue growth outpaced income growth mostly due to the expansion in Texas where the contract is cost reimbursable and since it has lower risk, carries a lower margin. For the full fiscal year, health services segment revenue increased 10% compared to fiscal 2010. Year over year revenue growth was driven by new work, as well as volume and scope increases in existing programs. As a result of strong top line growth in fiscal 2011, health services segment operating income grew, 15% to $74.7 million and provided an operating margin of 13.2% for the full fiscal year.

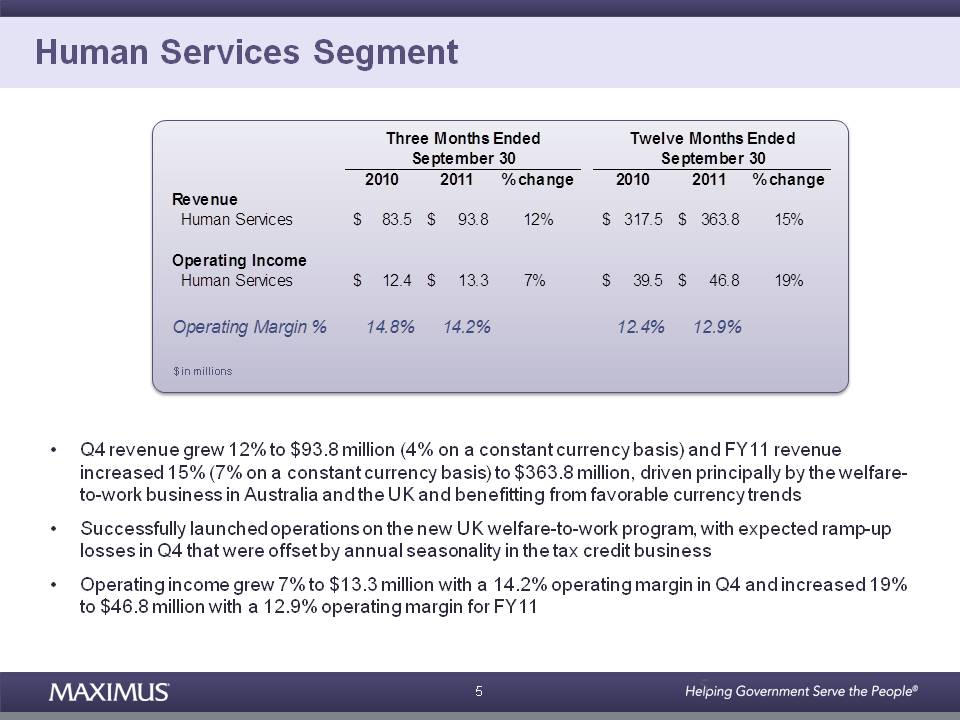

Let's turn our attention to financial results for the human services segment. For the fourth quarter, revenue for the human services segment grew 12% to $93.8 million or 4% on a constant currency basis compared to last year. For the full fiscal year, revenue grew 15% or 7% on a constant currency basis to $363.8 million compared to fiscal 2010. Revenue growth was driven principally by case load growth and favorable currency trends in the international welfare-to-work business in Australia and the United Kingdom.

During the quarter, we successfully launched operations on the new welfare-to-work program in the UK. As expected, the program had ramp-up losses in the fourth quarter that were offset by annual seasonality largely from the tax credit business. Despite the startup, the segment delivered another solid quarter of operating income. Compared to last year, the segment's operating income grew 7% to $13.3 million in the fourth quarter delivering a 14.2% operating margin. For the full fiscal year, operating income for the segment increased 19% to $46.8 million, and operating margin expanded to 12.9% compared to the last fiscal year.

Moving on to cash flow and balance sheet items, another quarter of solid net income contributed to strong cash flows for the fiscal year. As a result of strong earnings and low day sales outstanding of 56 days, cash flow in the fourth quarter was better than our expectations. For the full fiscal year, cash provided by operating activities from continuing operations totaled $97.6 million with free cash flow of $71.5 million; and for the quarter, cash provided from operating activities from continuing operations totalled $27.1 million with free cash flow of $17.6 million.

3

Fiscal 2011 was highlighted by several investor-friendly activities including a 2-for-1 stock split, an increased dividend payment, and ongoing share repurchases. In the fourth quarter alone we took advantage of market declines to aggressively repurchase 1,083,700 shares of Maximus common stock for $39.6 million. This brings our total repurchases for fiscal 2011 to approximately 1.6 million shares. Total cash used for repurchases in fiscal 2011 was $56.6 million.

We continued our buybacks after quarter close and for the month of October, we purchased approximately 210,000 shares for $7.7 million. And on November 8, the Maximus Board of Directors increased our share repurchase authorization to $125 million. Our cash deployment activities will continue to include dividends and repurchases, but we are also very focused on seeking strategic acquisitions. Our balance sheet remains healthy and we exited the fiscal year with cash and cash equivalents totaling $172.9 million.

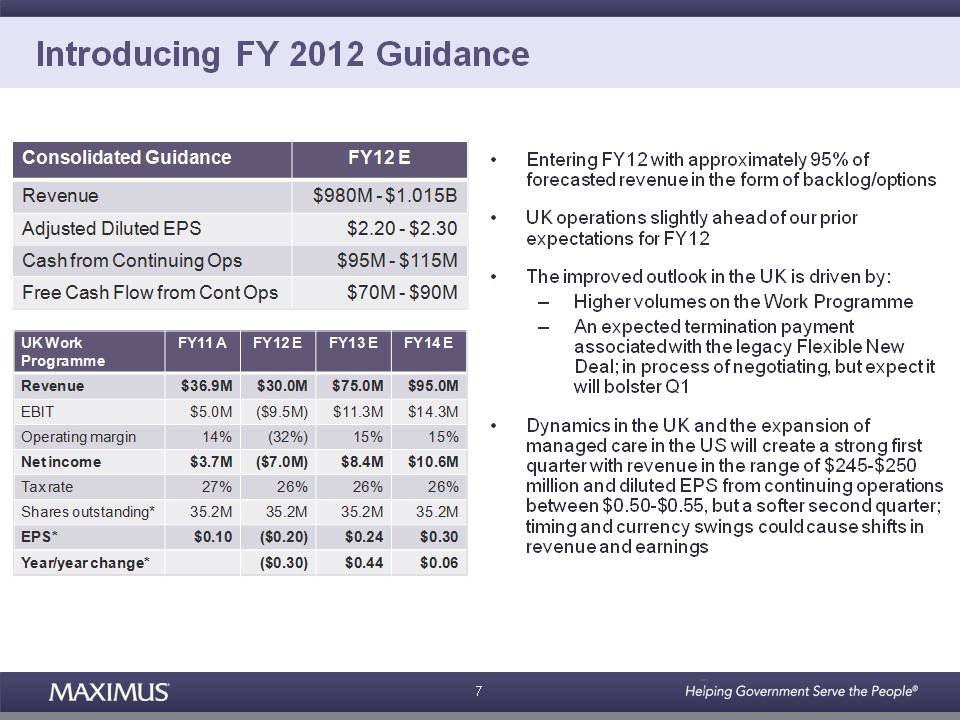

Moving on to guidance. For fiscal 2012, we expect revenue to grow between 5% and 9% with an expected range of $980 million to $1.015 billion driven mostly by growth in the health segment. We enter fiscal 2012 with approximately 95% of this forecasted revenue in the form of backlog or contract option periods. On the bottom line, we expect adjusted diluted EPS from continuing operations to range between $2.20 and $2.30 for fiscal 2012. For modeling purposes, the normalized tax rate for fiscal '12 is expected to be 37% impacted by the anticipated UK ramp-up losses.

As noted in this morning's press release, our UK operations for fiscal 2012 will be slightly ahead of our prior expectations. We now expect revenue of approximately $30 million and losses of approximately $9.5 million. Our improved outlook is driven by higher volumes on the work program, and an expected termination payment associated with the legacy flexible new deal that we expect to recognize in Q1. We are currently in the process of negotiating the termination payment, which we expect will bolster the first quarter.

As a result, we also think it is important to provide greater visibility into the first quarter since we have a couple of dynamics, most notably from the UK, as well as the expansion of managed care in the US that will create a strong first quarter but a softer second quarter. Specifically, we expect the first quarter revenue range will be between $245 million and $250 million, and Q1 earnings will be considerably stronger than Q2 with diluted first quarter EPS to range between $0.50 and $0.55 per diluted share. It is also important to note that we are providing you forecast based upon current information today and it is always possible that timing and currency swings could cause shifts in revenue and earnings. Recent currency trends have been somewhat unfavorable so we've based our forecast upon trends in the last 90 days.

Moving on to cash flow guidance, we expect cash provided by operating activities derived from continuing operations to be in the range of $95 million to $115 million for fiscal 2012. We expect free cash flow from continuing operations of $70 million to $90 million. So, all in all, Maximus wrapped up another year of great financial results. Thanks for your continued support. And now I'll turn the call over to Rich.

Rich Montoni - Maximus Inc - President, CEO

Thank you, David. And good morning, everyone. Maximum achieved another year of record results for both revenue and earnings. And we've kept our sights on creating the foundation for growth over the next three years and beyond. To this end, we successfully added new work and won several key rebids in fiscal 2011.

We won 98% of the total contract value up for rebid, securing some of our most important projects for the next several years. These included a five year extension to our California Healthy Families contract, and the renewal of our Texas eligibility support services contract. And through commendable star ratings in Australia, we've picked up several new sites that will bring in an additional $5 million a year and we remain on track for the $450 million extension of our job services contract. At the same time, we established a presence in the health insurance exchange market place through our strategic alliance with Connecture and we launched operations for two new eligibility and enrollment modernization programs that are blueprints for exchanges. The most recent highlights of fiscal 2011 are the successful launch of operations under the new work program in the UK, and the notification award for strategic new work in Canada.

On the international side, let's start our discussion with an update on the UK. First, we're in final negotiations to complete the wind down of the flexible new deal and as David noted, we expect resolution in the first quarter of fiscal '12. In the meantime, the new work program continues to rollout on target. With four months of operations under our belt, total case volumes are slightly ahead of expectations and the team is working diligently to hit our longer-term sustained employment outcomes. Some of the most exciting developments over the last two months relate to expansion in Canada where we expect three new awards to add approximately $20 million of annual revenue once operational later in the year.

We are in final negotiations on all three contracts, so we currently expect all of them will provide partial year contributions in fiscal 2012. The first win is on the human services side where we recently received notification of award for our first work force services project in Canada. This is a strategic win and an important first step in establishing a foothold in the Canadian welfare-to-work market. Under the new employment program of British Columbia, Maximus will be delivering a wide range of employment services in the city of Colona.

4

The second award is in the health services segment where we received notification of some exciting add-on work to our existing contract in British Columbia. We will be helping the Ministry of Health and other stakeholders with a high-priority program to develop, manage, and implement a new province wide health card. The card will offer citizens improved security, increased fraud prevention, and enhanced identity protection. Since Maximus manages all the health and pharmacy records for the province, we were the natural partner for helping the rollout of this new initiative. We will provide additional details about this work once the contract is executed.

And as I mentioned last quarter, we also won a small but important contract to implement a new drug information system for Nova Scotia, and we expect those operations to get underway in the coming weeks. With three new wins secured in just a few short months, we are very excited about our growth prospects in Canada. On the broader international front, we continue to receive requests from countries to help them address the fiscal challenges they face with public benefit programs. Austerity and reform measures, particularly those in Europe create opportunities for our services in areas such as welfare-to-work, healthcare, and program eligibility. We are seeing an increase in government's openness to outsourcing with a specific attention to the US and Australian models. As we've mentioned before, we rigorously review each opportunity for the risk that is inherent in any international expansion. However, we remain cautiously optimistic about the potential to enter new geographies and will provide you with more specific updates once the fully developed.

Turning now to our domestic operations, with the trend of shifting Medicaid recipients from fee-for-service into managed care plans continues to be a growth driver. The Kaiser Family Foundation recently issued its annual Medicaid budget survey report. This report confirmed that 11 states in fiscal '11 and 24 states in fiscal '12 reported that they were expanding the areas and populations covered by managed care programs. Some states are moving distinct populations like seniors and persons with disabilities into managed care plans. Other states are implementing a broader movement into managed care including expanding service areas and bringing in historical waiver populations.

Regardless of the approach, we are seeing expansion on several of our health services contracts in California, Colorado, New York, and Michigan. But the most meaningful changes are in Texas, where the state is expanding managed care and re-enrolling current Medicaid beneficiaries into recently re-procured managed care organization plans. As David mentioned, this is creating a surge of activity under our contract as we support the state through this expansion. We've started notifying beneficiaries of the upcoming changes and are gearing up for a number of high volume mailings as part of this initiative. As beneficiaries begin receiving these packets over the next several weeks, we are preparing for increased call volumes and related activities. We've brought on some temporary staff in Austin, we've established an online enrollment channel for CHIP health and dental plans. And we've enhanced our relationships with the local community-based organizations. So, activities are well underway to support the state with this cost saving initiative.

Last quarter we announced the notification of a contract award to provide enrollment broker services for Louisiana. With a signed contract now in place, we will launch operations on December 15th when our call center staff begins to provide choice counseling enrollment and disenrollment services for approximately 900,000 beneficiaries of Bayou Health. This is the state's Medicaid managed care program. The three year base contract is expected to contribute approximately $12 million in total revenue.

Now let's move on to some new initiative to expand our federal operations. During the quarter, we put several building blocks in place as we seek to broaden our presence in the federal market. As we announced last week, under the leadership of Bruce Caswell, we've brought in Tom Romeo to lead our federal services initiatives. Tom brings nearly 20 years of extensive government contracting, IT, and management experience to the team. Prior to joining Maximus Tom managed high profile projects for large federal agencies as well as developed and executed the federal healthcare strategy for another large firm. Maximus is enhancing its efforts in the federal space to better promote or core service offerings. This would include customer contact centers and case management to a wider set of agencies and programs.

We recently won a new federal contract to administer the federal external review process, which is mandated by the Affordable Care Act and this is for the office of personal management and the Department of Health and Human Services. Under the five year $8 million contract, we will review denials of healthcare services and benefits for enrollees of self-insured health plans, as well as denials for enrollees in areas that do not have a qualified state-sponsored review program. We bring demonstrated experience to this latest contract, drawing on our work providing review services for more than 30 states.

We are also progressing forward with our efforts to prepare for healthcare reform in the establishment of exchanges. The Kaiser Family Foundation has reported that states continue to plan for ACA implementation even as they face budget challenges. Since last quarter, additional states have passed legislation and others are starting to issue RFIs or requests for information mainly for technology components of the exchange. The Maximus Connecture team has responded to 10 RFIs in areas that correspond with our core services and have met with and demonstrated our exchange solution state advantage to more than 30 states.

5

We are pleased to have an established seat at the table as states conduct their planning work and seek qualified vendors to support them. As expected, the overall healthcare reform market is diverse and the different procurements are rolling out in stages. Much like the RFIs, the first round of RFPs or request for proposal are primarily for system design and development. However, some states will provide an option in these technology bids to subsequently procure administrative services such as customer contact center support. As a result, we are positioning Maximus as a desirable partner on these initial procurements. We anticipate that RFPs for business process outsourcing and program administration will follow, perhaps as early as the spring or summer of 2012.

Last week, a variety of news publications reported that state officials and insurers are urging CMS to plan for delays in launching some functions of exchanges. They are sighting short time frames, and limited vendor capacity to create the marketplaces as reasons to extend the planning process. However, we remain confident about our prospects under healthcare reform regardless of the myriad of potential political, legislative, and legal outcomes. We believe that many of the early states that are already down the preparation path will likely continue to move forward with transformational activities and other market reforms, which may include exchanges that vary from the ACA model. Widespread support remains for the fundamental idea of creating a market that enables consumer choice, increases competition, and leverages buying power. The essential need to address quality, cost, and access remains. And this will lead to continued demand for more efficient and effective health and human services programs.

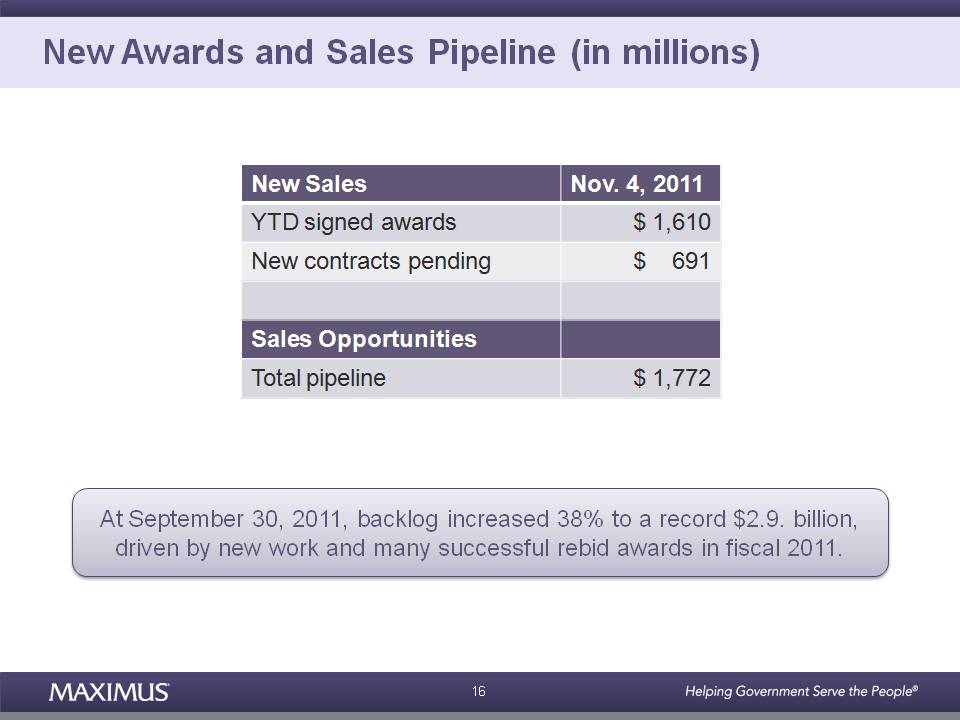

Turning now to backlog, new awards in sales pipeline. At September 30, 2011, backlog increased 38% to a record $2.9 billion compared to $2.1 billion in the prior year. The increase in backlog was driven by new work and many successful rebid awards in fiscal 2011. At September 30th, we had $1.6 billion of new signed awards and $691 million in awarded but unsigned contracts. At November 4th, our total pipeline remained robust at 1.8 billion. We're quite pleased with this level of opportunities and this underscores our confidence for growth in fiscal 2012.

In summary, I'm very pleased with the progress we've made in further positioning the business to capitalize on new growth prospects. At the start of fiscal 2011, we established three main goals for driving long-term growth. One, expanding our global operations. Two, further positioning our domestic operations for new opportunities. And three, growing our federal book of business. And over the past 12 months, we achieved several key milestones to these goals and we will continue our progress towards growing the business in fiscal 2012 and beyond in creating long-term shareholder value.

Our near-term goals for the fiscal year include successfully ramping up our UK operations and getting them to break even by the end of the year; securing our fair share of new work under healthcare reform initiatives; and finally, aggressively searching qualified acquisition position targets that will help us grow strategically as we strive to expand our services in core geographies. But overall, the need for high quality, efficient social services is a universal one, and we believe there will continue to be demand for world-class administration of government programs from vendors who can deliver results. With our fiscal 2012 guidance now in place, we look forward to driving results for our clients and our shareholders.

Before I close today's call, I'd like to recognize our employees for their contributions to our success this fiscal year. The high quality services they provide play an important part of maintaining positive client relationships and driving financial performance. Our most recent annual client satisfaction survey yielded record results with an average overall score of 4.49 out of 5 and 26 perfect scores. So, thanks to all of our dedicated employees for their diligent focused on client service and adding value to the public programs we administer. And with that, let's open it up for questions. Operator?

QUESTION AND ANSWER

Operator

Thank you. We will now be conducting a question-and-answer session. (Operator Instructions) Our first question comes from the line of Torin Eastburn from CJS Securities. Please proceed with your question.

Torin Eastburn - CJS Securities - Analyst

My first question is on the insurance exchanges. Rich, can you provide any thoughts on what you think a reasonable market share might be or if that's a bit tough, at least how it might shake out relative to your currently and enrollment ineligibility?

6

Rich Montoni - Maximus Inc - President, CEO

Boy, Torin, in the whole concept of insurance exchanges, which is an important subset of healthcare reform; and before we talk about specifically that subset, it is important to realize the platform is a pretty shaky one at this point in time. All of healthcare reform is embroiled in quite a swirl of politics and deficit spending and debt modifications and managing debt from a federal perspective, state perspective. All of that immersed with some pretty serious social issues that we have a responsibility to take care of.

So as you can sense from the headlines on a daily basis, it's very topical. When you get into the subset, it even becomes more difficult to predict what is happening. Maximus is spending an awful lot of time to be in the middle and have a front seat at the table as the concept of health insurance exchanges is discussed. It's very, very much under the spotlight today. Bruce Caswell is here with me. He spent the better part of last two days at a national session where healthcare and health insurance exchanges was front and center.

In the past, we have estimated the market for health insurance exchanges, I think, to be in the territory of $500 million. That's probably as good an estimate as any, but you need to recognize it is an estimate made in a very uncertain environment. Bruce, any comments as it relates to this?

Bruce Caswell - Maximus Inc - President, Health Services

I think that is correct, Rich. We are seeing continued, as you noted in your initial remarks, continued progress by states that have been either recipients of early innovator funding and-or had initiatives underway outside of the early innovator program to be pacesetter states progressing with their exchange planning. And our view is that we will continue to share our value proposition with our clients that consists of building on the infrastructures they've already established, the program models, the business processes that have given us a significant share in the managed care and CHIP space; and we'd hope to be equally successful as we move forward with the exchange opportunities.

Rich Montoni - Maximus Inc - President, CEO

Two observations I'd make in parallel with that. I do think that there is very significant momentum at the state level to build and operate health insurance exchanges. Regardless of what happens at the federal level, I think several states are committed to having insurance exchanges, and I also think there is an accepted resolve that it is best to build on the existing infrastructure, the existing platforms, the existing capabilities.

There will be significant new systems built around health insurance exchanges, but I think they will stand in parallel with the existing infrastructure. And also keep in mind, our primary interest is in the business process outsourcing of health insurance exchanges, not to be a systems integrator. So I think over the next year you're going to see RFIs related to building out systems that are necessary for health insurance exchanges. We'll play a secondary role in that whole environment and then following that will be the operation of these exchanges, which is where we want to be taking a primary role. Is that helpful, Torin?

Torin Eastburn - CJS Securities - Analyst

Yes, that is. My next question, the work program contract you won in British Columbia, how does that position you or how does that bode for wins in other parts of that country?

Rich Montoni - Maximus Inc - President, CEO

We think it positions us extremely well. As we hypothesized that there -- this whole issue of world class workforce management programs is front and center now with many, many countries. It's a very significant program in Canada, has been for quite some time. We are always happy to have the projects up in British Columbia related to the administration of the health program; and you may recall, we have a child-support program there as well.

So it's great to have the addition of a workforce services program in British Columbia. This is just a piece of British Columbia; and next time around, perhaps, we will pick up some additional work as the country starts to compare performance amongst providers. But it also positions us well for growth opportunities in other parts of Canada.

7

Torin Eastburn - CJS Securities - Analyst

Thank you.

Operator

Our next question comes from the line of James Kumpel from BB&T Capital Markets. Please proceed with your question.

James Kumpel - BB&T Capital Markets - Analyst

Hi. Good morning. Dave, can you actually address in the new guidance of 220 to 230, if you're including the expected negotiated transition team in from the UK in there?

David Walker - Maximus Inc - CFO

We are.

James Kumpel - BB&T Capital Markets - Analyst

Okay.

David Walker - Maximus Inc - CFO

In fact, we specifically are.

James Kumpel - BB&T Capital Markets - Analyst

Okay, and that's one of the reasons for the unusually high EPS in the first quarter and then the sequential downtick in the second quarter.

David Walker - Maximus Inc - CFO

That's exactly right. You have it.

James Kumpel - BB&T Capital Markets - Analyst

Okay. But you don't want size that at this moment?

David Walker - Maximus Inc - CFO

Well, it's a negotiation.

James Kumpel - BB&T Capital Markets - Analyst

Okay. Okay. And for the tax rate, which presumably is going to be skewed a little bit because the UK, you're guiding to about a 37% rate on every quarter or a blended average for the year?

8

David Walker - Maximus Inc - CFO

It will blend out for the year. So we will use that full-year rate every quarter and it is driven substantially by the UK. So, if you think about it, the tax rate in the UK, which was making -- in our slides, we show you making an EBIT of about $5 million at 27%, which is a lower benefit than the overall average in the US, right? And next year, you actually have a loss and the tax rate goes down to 26%. So, you actually get less tax benefit on the loss. So, year-over-year it has the effect of driving up the weighted average rate. Does that make sense?

James Kumpel - BB&T Capital Markets - Analyst

I think so.

David Walker - Maximus Inc - CFO

Okay.

James Kumpel - BB&T Capital Markets - Analyst

Can you give sort of a sense for what the incremental uptick was on interest and other income in the quarter? Is $1.1 million a good number to be using or is it closer to the kind of $500,000 to $900,000 that you had earlier in the year.

David Walker - Maximus Inc - CFO

Interest income? Just a minute.

James Kumpel - BB&T Capital Markets - Analyst

Interest and other income. Did you find some higher rate CDs we're just not aware of?

David Walker - Maximus Inc - CFO

Yes. Well, if you're talking sequentially, quarter-over-quarter or year-over-year?

James Kumpel - BB&T Capital Markets - Analyst

Well, sequentially it is up from like the $900,000 range, right?

David Walker - Maximus Inc - CFO

That's right. $961,000 to about $1.1 million, right. And that's largely coming from overseas. Last year was ranging more like a couple hundred thousand dollars. So.

James Kumpel - BB&T Capital Markets - Analyst

Okay. And then just a little bit more strategically. Rich, can you comment about what if any major rebid do you expect in 2012. Looks like you got the bulk of it taken care of this past year.

Rich Montoni - Maximus Inc - President, CEO

Yes, that's a great question. In terms of rebids -- first off, fiscal '11 was a great year. As you know, it was a big year for rebid and very fortunate, and maybe it is a sign of the times where clients instead of going to rebid are just extending contracts. I think in part some of our government clients are focused on other things, they are apprehensive to change vendors on the eve of healthcare reform and health insurance exchanges. And I think that makes an awful lot sense.

9

So, we were fortunate in fiscal '11 not only with the wins in terms of rebid percentage and options; but for example, the extension of California Healthy Families was a great thing, and we had some Texas work that was extended as well. So interesting as we go into fiscal '12, it shapes up to be a fairly light year. We have specifically -- when we add it up we have 14 contracts that are up for rebid in fiscal '12 and the total contract value of those 14 contracts is $414 million.

James Kumpel - BB&T Capital Markets - Analyst

Yes. On average over like a three to five year period?

Rich Montoni - Maximus Inc - President, CEO

Yes, they average three to five years, but interesting, we also run the math in terms of what does it means to fiscal '12 revenue and it is nominal. The total fiscal '12 revenue up for rebid is $42 million, of the 41 because the rebids happen throughout their year. And interestingly enough, already, we have won one of those for $8.2 million of the $414 million, and we've received extensions on 3 of them, Jim, for up to about $108 million. So at this point in time, of the 14 we have 10 left; we've won 4 effectively of the 14. We have 10 left for TCV of about $298 million and a fiscal '12 revenue of $17.4 million. So it's really shaping up to be a great situation from a rebid perspective.

James Kumpel - BB&T Capital Markets - Analyst

With regard to the UK, can you just clarify if in that $9.5 million expected drag in 2012, if that includes the benefit of that transition payment?

David Walker - Maximus Inc - CFO

I'm sorry the answer is yes. Yes it does.

James Kumpel - BB&T Capital Markets - Analyst

Okay. And then finally, again, Bruce, can you offer up some perspective about the state of mind of the bulk of the states with regard to exchanges? You are talking about delays and requests for information phases as opposed to RFPs, but is it just that they are burdened with so much stuff that they haven't gotten around to the meat of it? Or is it just that there is so much uncertainty in an election year that they are going to await the results of that and-or the Supreme Court decisions on health reform before they methodically move forward?

Bruce Caswell - Maximus Inc - President, Health Services

Jim, I think the first way to look at that is just the legislative status across the states, and we talked about this a little bit about this a little bit on the last call. And I'll give you kind of an updated snapshot. As of today, there are 31 states that have either signed legislation, have implemented a workaround, have a live bill that they are considering, or have a bill that is on hold in the legislature yet to be resolved. And so that leaves, including the District of Columbia, 20 states that -- where the legislation is either dead or they don't have a bill all.

And interestingly though, even in some of those 20 states, there are very significant planning and execution activities underway because they anticipate bringing the legislature back, either getting a bill through or working to administrative workarounds and executive orders. So that's kind of an objective view of it from a legislative perspective. I would actually say that having spent time, as Rich mentioned, over the last few days looking very closely at this with a number of current and prospective clients, states are not backing off of their activities at all. They see that they have a very heavy lift in front of them and they are eager to get a number of the major issues resolved from a regulatory perspective.

The federal government has just recently accepted the first set of comments on the regs that were published in July and then extended the comment period, which only means that the final rules won't come out as timely as originally anticipated and states are very hungry for those final rules as they relate to areas like the essential benefit package and so forth. So, I would actually say that states have turned -- those states that have the money from the federal grants and that have programs underway have now turned very much toward implementation activities and the work plan associated with that; and in many ways, they are -- if they are calling for any type of delay in implementation, it is because of the lack of available time to execute fairly complex procurements that need to occur to get this in place.

10

There's only 22 months between now and when these exchanges go live, and you could easily see 10 months consumed in conducting a procurement and another remaining 12 in implementing the solution. So that's the state of mind of the states. They are very, very pragmatic and practical and focused on what they need to do to get it implemented.

Operator

Our next question comes from the line of Constantine Davides from JMP Securities. Please proceed with your question.

Constantine Davides - JMP Securities - Analyst

One follow-up on the UK -- the transition or termination payment. David, is that going to be an item that is recognized in revenue or is it in adjustment to operating expense? Where is exactly is that going to hit?

David Walker - Maximus Inc - CFO

A little of both. A little of both. So a piece of it relates to past services so we're getting payment for what the revenue would have been had they just run out. So that notionally goes through revenue. And some of them, it is a reimbursement or paying us for costs that we would otherwise incur such as lease termination so to offset expenses that we'll have to pay. And there also is some subcontractor costs. So we end up with a piece of the revenue relates to the subcontractor, so we run it through the revenue and we push it through the cost.

Constantine Davides - JMP Securities - Analyst

And the $5 million delta between what you guided to at the analyst day on the UK and I think that $30 million you've laid out for us, does that contemplate the payment or is that just a function of the volumes coming in a little bit better?

David Walker - Maximus Inc - CFO

It contemplates the payment.

Constantine Davides - JMP Securities - Analyst

Okay. And then I guess just on that note, when you say volumes are coming a little bit strongly --

David Walker - Maximus Inc - CFO

It's both, Constantine. So the volumes as we are tracking are coming in a little higher, so we track volumes by job stream. We also track outcomes and it is early days on the outcomes; but in job placements, our models are working quite well, but our volumes are up a little bit from what we expected. So, internally, we've pushed up a little bit our numbers for that as well as this anticipated settlement.

Constantine Davides - JMP Securities - Analyst

Okay. And then last thing on the UK, just any sense for if they are going to start implementing the type of transparency blueprint that Australia has adopted? And I guess similarly, I'd appreciate your comments on how Canada is thinking about structuring that program, as well?

11

David Walker - Maximus Inc - CFO

Well, my understanding is they are certainly going through and keeping score unlike the Australians. They don't plan to make it a public scoring.

Rich Montoni - Maximus Inc - President, CEO

At this point in time, not that we know. I think they will give all of the providers a bit of a window to perform and what we've heard is 18 months from the beginning. So I think they will have a more formal look-see at performance and contemplate reallocations 18 months out and I think the start date officially was July 1st. So, but they are tracking score, we're aware of our scores, we're very pleased that were doing extremely well from a qualitative perspective and getting the job done. I think we are leader of the pack in that context.

So, it does set up an opportunity in the future. Realistically in terms of reallocation, it is more likely to be at that 18 month window, Constantine. As it relates to Canada, their formalities are not nearly as elaborated as the UK and certainly not as far advanced as Australia; but I just believe that in this performance-based environment, as governments are pressured to deliver outcomes that matter, these governments are very much focused on metrics.

And I would expect that we will see a leaning in Canada towards delivering the outcomes that matter, but they are not nearly as formalized or they have not articulated their plans at this point in time. So, we'll have to stay tuned and watch that one.

David Walker - Maximus Inc - CFO

At this point, it's more of a traditional fee-for-service in Canada. But we're going to -- I think you're going to see these trends to correlate outcomes to pay much more still worldwide as governments need to. So we are actually encouraged.

On the revenue too, and I will point this out and it's broader than the UK, currency has actually had a dampening effect the other way. So the UK as well as the Australian dollar and the Canadian currency, have all dropped in the last 90 days from about August to October timeframe, which we look at for forecasting. So it is pushing down what we otherwise would have been forecasting had we been looking at the end of the quarter by about $7 million of which the UK is about $1 million. So not to say currencies will stay there, that is just what we had at the time we did our forecast. If that helps.

Constantine Davides - JMP Securities - Analyst

Yes, that's helpful. Two questions on guidance and I'll let somebody else jump in. But first, does guidance factor in any repurchases beyond what you've disclosed in the month of October? And then also can you just give us a little bit more color on how to model the health and human services segments in terms of the topline for fiscal '12?

Rich Montoni - Maximus Inc - President, CEO

I'm going to ask Dave Walker to respond to the first, and I'll take the second part of your question.

David Walker - Maximus Inc - CFO

Yes, the only repurchases we normally forecast are just enough to keep restricted stock units from coming -- from being dilutive. So we keep it neutral.

Rich Montoni - Maximus Inc - President, CEO

Okay. On the second part of your question, which was for some added color as it relates to fiscal '12. There are several pieces that we need to put on -- I need to focus on here, Constantine. Let me first talk about revenue and in fiscal '12, we believe that revenue is going to be driven by our health services segment and the growth there is going to be attributable to new work in managed care expansion and that is in a number of programs as we've talked about in our call notes.

12

So, from a health services segment, we expect the revenue is going to be stronger in the first half of the year; and again, that's mostly -- that's driven mostly by a spike in the managed care expansion. And then on human services, when we look at the human services side for the full year, we expect that that segments revenue will be likely flat to somewhat up compared to fiscal '11. And factors you need to be aware of that would be behind that would be obviously the year-over-year decrease in revenue for the United Kingdom, we see positive growth pressures or opportunities in Canada as we talked about, I do think the US itself is going to be relatively soft. And we do expect that Australia will grow but not as fast as it has grown in the last couple of years, which has just been off the charts type growth.

I do also want to add on the human services side, it is important to note that the quarterly revenue is expected to take a sizable step down in the first half of the year, compared to our fourth quarter of 2011. We expect that run rate to decrease the first half of the year and that is mostly a result of the start up in the United Kingdom; and in the second half of the year, we expect that it is going to ramp back up. So, when you take all of this and put it together and start to form a consolidated view, we think that revenue is going to be fairly consistent quarter to quarter in fiscal '12. And, so those are my comments on the revenue side.

On the earnings side, and I know you're well aware of this, but you're very well aware that the bottom line earnings will be tempered in '12 by the UK startup. The startup losses in the UK are expected to be pretty much in line with what we shared with you before. We refined it, but $0.20 per diluted share in '12. As a reminder, it was $0.10 in earnings so we really have a $0.30 negative swing, '12 over '11. And on a normalized basis when we take a look at that, if the UK simply contributed the same earnings in '12 as it did in '11, then we would be looking at 13% earnings growth year-over-year based upon the midpoint of our guidance range today.

The last point I want to make, and this is important because we entered into the UK contract not because of the expected results in '11 or '12, but rather for the results in '13 and beyond. It really does set up a great opportunity in fiscal '13. The slingshot effect we expect is going to contribute $0.24 in '13. It creates a slingshot effect of about $0.44 per share, so it sets up a real great '13 and beyond. Constantine, does that help in terms of some views on the segment level? He may not be there.

Lisa Miles - Maximus Inc - IR

Operator, can we go to the next question please?

Operator

(Operator Instructions) Our next question comes from the line of Brian Kinstlinger from Sidoti & Company. Please proceed with your question.

Brian Kinstlinger - Sidoti & Company - Analyst

Thanks. Good morning, guys. The first question I had is related to the international slide you mentioned in your prepared remarks. You also talked about in the analyst day the welfare-to-work opportunities and named a couple of countries. So, I guess I'm wondering, with the austerity that's going on in Europe, when do you expect some of these opportunities would materialize is it 6, are we talking 12, maybe 18 months before we hear something; or are you in discussions would help?

Rich Montoni - Maximus Inc - President, CEO

I think it is a great question, Brian. I tend to not talk about specific countries because it is interesting as we go through this process, and look at different countries and opportunities, it's a bit of fits and starts. We will have an opportunity that we think has a lot of momentum to it and is moving post-haste and looks like it could either go to bid or close within a relatively short period of time; and given the size of these programs and the complexity and sometimes elongated procurement process and contracting process, as you well know they can take 12 months to 18 months to really go from concept to operation.

But we'll have some situations that will get accelerated. So, as we mentioned I think four countries on analyst day; and as we proceed and work with these and visit these countries and look at opportunities, the mix changes from month to month. So it's not helpful to handicap each country quarter to quarter, but I would say this. We have some where we are in active discussions. We have one opportunity in particular that if it works out, it could be operational in three months.

13

On the other hand, we have some countries that I really do think it's going to take 12 to 18 months before we really have significant revenue. So, for purposes of modeling today, we have not assumed any of these to be meaningful contributors to revenue in fiscal '12. It's not to say it won't happen, it could happen; but I really think that these are going to contribute more to fiscal '13 and beyond as opposed to '12.

David Walker - Maximus Inc - CFO

And I've might say, Brian, this is David Walker, a lot of these countries tend to do these in pilot programs. So they start out a little tepid and that's when we start to get more insight into what we're thinking and so the trick is to be there during the pilot phase, and to be in on the ground floor.

Brian Kinstlinger - Sidoti & Company - Analyst

If you want a pilot, would you announce that or no?

Rich Montoni - Maximus Inc - President, CEO

I think they would. The pilots themselves can be quite substantial.

Brian Kinstlinger - Sidoti & Company - Analyst

And are meaningful for future --

Rich Montoni - Maximus Inc - President, CEO

Exactly, and that's the point. Exactly right. If it were a de minimis pilot, we're more likely not to announce it but -- unless we felt it had strategic value. But we will be very communicative about these, more so when they start to break and become real awarded but unsigned or contracts.

Brian Kinstlinger - Sidoti & Company - Analyst

Great, and then a follow-up in Canada. We talked about your positioning, are you in discussions with other provinces? I mean you've won nearly a deal for most of your different businesses now in there, are you in active discussions with other provinces?

Rich Montoni - Maximus Inc - President, CEO

That business reports up to Bruce and he's here so let's have him comment on it.

Bruce Caswell - Maximus Inc - President, Health Services

Sure. We do see a great deal of opportunity across Canada, as Rich mentioned in his remarks, and we're optimistic that the continued work we do, particularly in the drug information system area has additional legs with other larger provinces going forward. We also think the fundamental premise of our BPO model and the coupling of the technology that DeltaWare provides with our BPO services can enable us to expand in other provinces. So we are marketing, as you would imagine into those other governments.

Brian Kinstlinger - Sidoti & Company - Analyst

Great. And then you talked about managed care in several states, Texas being the largest, as benefiting you right now. Can you sort of talk about that shift specifically, collectively not just Texas? How much it is contributing to growth in revenues maybe in fiscal '12 versus fiscal '11?

14

Rich Montoni - Maximus Inc - President, CEO

Bruce?

Bruce Caswell - Maximus Inc - President, Health Services

Sure. We're seeing a blended growth rate of about 5% outside of the Texas contract. I'll say, our other contract base about 5% year-over-year contribution, and we expect that to continue. The states are clearly looking at that as a major lever to help control costs going forward. And really moving actively to bring populations as we've mentioned, ABD populations and other waiver populations into the program. So, that's a fairly meaningful and I think sustainable trend in the market.

Brian Kinstlinger - Sidoti & Company - Analyst

How does 5% split between managed care growth in shifting versus increases or enrollments of people that didn't have Medicaid originally?

Bruce Caswell - Maximus Inc - President, Health Services

Actually, I think Medicaid enrollments nationally are down year-over-year. So, this is more a reflection of the shift in delivery model.

Brian Kinstlinger - Sidoti & Company - Analyst

Yes. And then you mentioned the federal external review, the small contract you won there, is this the same client that is going to handle dispute resolutions for health exchanges or will that be run by the state level -- at the state level?

Bruce Caswell - Maximus Inc - President, Health Services

At present, I don't think that's been decided by the federal government. This contract would certainly present a viable platform for handling appeals for the exchanges and we would like to see it move in that direction. I think that the federal government, though, is in the planning stages and they've recently awarded a very small consulting contract to look at what that appeals process -- the form that process might take prior to then deciding which agency and at what level of government they will be handled.

Brian Kinstlinger - Sidoti & Company - Analyst

Two more questions. The first one is a competition question you got. If I look at the exchanges, that are -- that need to be operated, that you're hoping that opportunity comes to you, is the competition any different than what was in Medicaid enrollments, or for example, are there more participants that are looking to get into this market?

Rich Montoni - Maximus Inc - President, CEO

I think you have to break the market into two pieces. There's a systems integrator market to design and build any new systems that are necessary and then there is a business process outsourcing market, which as you know, the BPO's our primary interest. I don't see any significant new players in the BPO side of things. That tends to be one where you've had trusted providers who've been through lots of new federal programs and built out systems that are operating systems.

So come on the BPO side, I don't see any significant new entrants into the market. We also need to add the software vendors where we're seeing a lot of software solutions come to market and try to grab market share on the technology side of it in tandem with the system integrators. I think we do see the typical competitors on the systems integrator side, and I think we've got some others who are also stepping up in that context. So, I think that one's fairly competitive on the system integrator side, but you're going to have some very large firms that are well established with the states, with the federal government on the system integrator side.

15

Brian Kinstlinger - Sidoti & Company - Analyst

And then the last question I had. It's one of the first times I didn't see you break out the pipeline, can you just break it out in pending preparation and tracking?

Rich Montoni - Maximus Inc - President, CEO

Yes, we can do that. Lisa, do you have that data?

Lisa Miles - Maximus Inc - IR

It's in the press release, Brian,

Brian Kinstlinger - Sidoti & Company - Analyst

Oh. See that? I can get that then as long as it's in there. No worries.

Rich Montoni - Maximus Inc - President, CEO

Okay. It's in the press release. Any other questions, Brian?

Brian Kinstlinger - Sidoti & Company - Analyst

No, that's it. Thank you very much.

Lisa Miles - Maximus Inc - IR

Thanks Brian.

Operator

Our last question comes line of Brian Gesuale from Raymond James. Please proceed with your question.

Brian Gesuale - Raymond James & Associates - Analyst

Hey, guys. Wanted to see if we could dig into the pipeline a little bit more. Maybe look longer term and kind of gauge where the segment growth and geographic growth is going to come from; and if you could maybe just -- maybe give us some qualitative details on the pipeline by geography and then by segment, please?

Rich Montoni - Maximus Inc - President, CEO

I can give you some commentary on the pipeline. We don't -- we have not historically published pipeline by geography, by segment. So, we'll have to limit it to commentary for the moment, Brian.

But from a summary level perspective, we're seeing growth in the pipeline opportunities in both segments and in all geographies. I do sense -- I believe and I'm very pleased that we are identifying additional opportunities. So, I feel pretty comfortable that the opportunities are in front of us. I don't sense a dramatic shift from one segment to another segment, one geography to another geography.

16

I would give an edge to the international opportunities. Such that United Kingdom, Canada, probably from an international perspective would have greater proportionate opportunities. I 'd also say that on the US side of things, we're very pleased that we are experiencing growth and expect to have growth on -- in the health segment in fiscal '12 and that is driven as we've discussed by the shift to managed care.

But I also sense that there is pent up and I do think it will continue to be pent up demand in the US. There is a bit of an apprehension to go and build out new systems outside healthcare reform; and hence, I think we have some pent-up demand we are going to continue to experience. And I think the elections probably will keep that pent-up through fiscal '12, but thereafter I think we're going to see some pretty significant development to the US because of healthcare reform and also I think the election impact.

Brian Gesuale - Raymond James & Associates - Analyst

Okay. Great, that's helpful. And if I could just maybe ask a question on the UK for the seventh or eighth time, here? Can you just help me maybe with the quarterly progression of operating loss, and maybe I guess the starting point was with the termination payment, how close to breakeven does that get you to in Q1 and then maybe just what the progression might look like as we move through the year?

Rich Montoni - Maximus Inc - President, CEO

Dave Walker is beating in on his quarterly metrics that you asked about, so with one minute, I'll jump into it.

David Walker - Maximus Inc - CFO

I mean it doesn't, what it does is takes what would've been a bigger loss and makes it a smaller loss in Q1. And it returns back to a good sized loss in Q2. Where you get to breakeven by Q4. So without the settlement, you would've had a pretty progressive starting with a big loss all the way to breakeven by Q4. And what you really have is an offset to Q1 is the way to think about it, but it is still a loss. About half of it is in Q2.

Rich Montoni - Maximus Inc - President, CEO

Still a loss in Q1, a larger loss in Q2, and then at that point in Q2, that's the quarter in which we start to get some of these outcome payments, so the operating income starts to improve in Q2. So Q3 is improved over Q2 and then all along we've said we are looking to get damn close to breakeven in Q4; and that still remains our goal.

Brian Gesuale - Raymond James & Associates - Analyst

Okay, terrific. And then maybe just one final question for me is, can you give us the most recent news on what is happening in New York on the Medicaid side?

Rich Montoni - Maximus Inc - President, CEO

Sure. Bruce?

Bruce Caswell - Maximus Inc - President, Health Services

Sure. In New York, as you are aware, they continue to expand Medicaid and particularly managed care and they've expanded both the service areas. New York has always had a fairly high penetration rate of managed care but they've kind of continued that expansion into their remaining counties, as well as they've brought in populations that historically were exempted from managed care; and they've also shortened the number of effectively repeatable waivers that you could get to be exempt for managed care. So the overall effect is to increase obviously the number of clients that we are serving and serving through our enrollment broker contract.

17

Brian Gesuale - Raymond James & Associates - Analyst

Okay. Great. Thanks a lot, guys.

Rich Montoni - Maximus Inc - President, CEO

Thank you, Brian.

Operator

This concludes today's teleconference. You may disconnect your lines at this time. Thank you for your participation.

|

DISCLAIMER

|

|

Thomson Reuters reserves the right to make changes to documents, content, or other information on this web site without obligation to notify any person of such changes.

|

|

In the conference calls upon which Event Transcripts are based, companies may make projections or other forward-looking statements regarding a variety of items. Such forward-looking statements are based upon current expectations and involve risks and uncertainties. Actual results may differ materially from those stated in any forward-looking statement based on a number of important factors and risks, which are more specifically identified in the companies' most recent SEC filings. Although the companies mayindicate and believe that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate or incorrect and, therefore, there can be no assurance that the results contemplated in the forward-looking statements will be realized.

|

|

THE INFORMATION CONTAINED IN EVENT TRANSCRIPTS IS A TEXTUAL REPRESENTATION OF THE APPLICABLE COMPANY'S CONFERENCE CALL AND WHILE EFFORTS ARE MADE TO PROVIDE AN ACCURATE TRANSCRIPTION, THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES IN THE REPORTING OF THE SUBSTANCE OF THE CONFERENCE CALLS. IN NO WAY DOES THOMSON REUTERS OR THE APPLICABLE COMPANY OR THE APPLICABLE COMPANY ASSUME ANY RESPONSIBILITY FOR ANY INVESTMENT OR OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED ON THIS WEB SITE OR IN ANY EVENT TRANSCRIPT. USERS ARE ADVISED TO REVIEW THE APPLICABLE COMPANY'S CONFERENCE CALL ITSELF AND THE APPLICABLE COMPANY'S SEC FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER DECISIONS.

|

|

© 2011 Thomson Reuters. All Rights Reserved.

|

18

David N. Walker Chief Financial Officer and Treasurer November 10, 2011 Fiscal 2011 Fourth Quarter & Full Year Earnings A number of statements being made today will be forward-looking in nature. Such statements are only predictions and actual events or results may differ materially as a result of risks we face, including those discussed in our SEC filings. We encourage you to review the summary of these risks in Exhibit 99.1 to our most recent Form 10-K filed with the SEC. The Company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances. Note: All share and per share data has been adjusted to reflect the two-for-one stock split effective June 30, 2011.

Selected Financial Results from Continuing Operations *All numbers reflect the two-for-one stock split Record ResultsExceptional year with 12% revenue growth and 24% earnings growthFY11 was highlighted by:Growth in core marketsWinning several rebids Expanding the international baseFinancial resultsQ4 revenue grew 18% (14% on a constant currency basis) compared to last yearFY11 revenue grew 12% (8% on a constant currency basis) compared to last yearVirtually all growth was organic, across both Segments and all geographiesOperating margins in-line with expectations at 13.5% for Q4 and 13.1% for FY11

Adjusted Diluted EPS from Continuing Operations Increased share of international business and tax planning lowered tax rates to 28.9% for Q4 and 34.8% for the full year.Q4 GAAP diluted EPS from continuing operations totaled $0.73 and includes $0.09 of benefits for tax rate adjustments and net legal recovery. As a result, adjusted diluted EPS from continuing operations was $0.64 for Q4.FY11 GAAP diluted EPS of $2.31 includes $0.06 of benefits. As a result, adjusted diluted EPS from continuing operations was $2.25 for the full year.

Health Services Segment Q4 revenue increased 21% to $156.3 million and FY 11 revenue grew 10% to $565.9 million, driven by new work and expansion on existing contractsStrong Q4 growth due to organic growth in British Columbia, where we are modernizing the PharmaNet system, as well as Texas, where we have short-term increases in activities related to the expansion of managed careOperating income grew 3% to $20.6 million with an operating margin of 13.2% for Q4 and increased 15% to $74.7 million with an operating margin of 13.2% for FY11 $ in millions

Human Services Segment Q4 revenue grew 12% to $93.8 million (4% on a constant currency basis) and FY11 revenue increased 15% (7% on a constant currency basis) to $363.8 million, driven principally by the welfare-to-work business in Australia and the UK and benefitting from favorable currency trendsSuccessfully launched operations on the new UK welfare-to-work program, with expected ramp-up losses in Q4 that were offset by annual seasonality in the tax credit business Operating income grew 7% to $13.3 million with a 14.2% operating margin in Q4 and increased 19% to $46.8 million with a 12.9% operating margin for FY11 $ in millions

Balance Sheet and Cash Flows Other Placeholder: Solid net income contributed to strong cash flows for the fiscal year; strong collections and low DSOs of 56 days led to better-than-expected Q4 cash flowCash provided by operating activities from continuing operations totaled $27.1 million with free cash flow* of $17.6 million in Q4; cash provided by operating activities from continuing operations totaled $97.6 million with free cash flow* of $71.5 million in FY11 Several investor-friendly activities in FY11 include the 2:1 stock split, an increased dividend payment and ongoing share repurchasesRepurchased 1,083,700 shares of MAXIMUS common stock for $39.6 million in Q4 with total repurchases in FY11 of approximately 1.6 million shares; total cash used for repurchases in FY11 totaled $56.6 million, with $77.8 million remaining at September 30, 2011 Continued buybacks and purchased another 210,000 shares for $7.7 million in OctoberOn November 8, 2011, increased our share repurchase authorization to $125 millionBalance sheet remains healthy with cash and cash equivalents totaling $173.0 million *The Company defines free cash flow as cash provided by operating activities less cash paid for property, plant and equipment and capitalized software We remain committed to the right balance of capital deployment to drive long-term, sustainable growth and shareholder value.

Introducing FY 2012 Guidance Entering FY12 with approximately 95% of forecasted revenue in the form of backlog/optionsUK operations slightly ahead of our prior expectations for FY12The improved outlook in the UK is driven by:Higher volumes on the Work ProgrammeAn expected termination payment associated with the legacy Flexible New Deal; in process of negotiating, but expect it will bolster Q1 Dynamics in the UK and the expansion of managed care in the US will create a strong first quarter with revenue in the range of $245-$250 million and diluted EPS from continuing operations between $0.50-$0.55, but a softer second quarter; timing and currency swings could cause shifts in revenue and earnings

Richard A. Montoni President and Chief Executive Officer November 11, 2011 Fiscal 2011 Fourth Quarter & Full Year Earnings

Another year of record results for both revenue and earnings; kept our sights on creating the foundation for growth over the next three years and beyond Successfully added new work and won 98% of the total contract value up for rebid, securing some of our most important projects for the next several yearsCommendable STAR ratings in Australia resulted in several new sites that will bring in an additional $5 million a year; remain on track for $450 million extension of our Job Services contract Established a presence in health insurance exchange marketplace through strategic alliance with ConnectureLaunched operations for two new eligibility and enrollment modernization programs and the new Work Programme in the UK Received notification of award for strategic, new work in Canada Record Results Create a Foundation for Growth

In final negotiations to complete the wind down of the Flexible New DealExpect resolution in the first quarter of fiscal 12Work Programme continues to roll out on targetFour months of operations under our belt; case volumes slightly ahead of expectationsUK team is working diligently to hit longer-term sustained employment outcomes Update on FND and Work Programme in the UK

Three new awards to add approximately $20 million of annual revenue once operational later in the year; expect partial year contributions in FY12 Received notification of award for our first workforce services project in Canada to deliver employment services in the city of Kelowna under the new Employment Program of British Columbia; a strategic win and important first step in establishing a new foothold in the Canadian welfare-to-work market Received notification of add-on work to existing contract in British Columbia for a high-priority program to develop, manage and implement a new province-wide health card to help the province; the card offers citizens improved security, increased fraud prevention, and enhanced identity protectionAs mentioned last quarter, also won a small but important contract to implement a new Drug Information System for Nova Scotia and expect those operations to get underway in the coming weeks Exciting Developments in Canada

Continue to receive requests from countries to help address fiscal challenges with public benefits programsAusterity and reform measures, particularly those in Europe, create opportunities in welfare-to-work, health care and program eligibilitySeeing an increase in governments’ openness to outsourcing, with specific attention to the US and Australian models As mentioned before, rigorously review each opportunity for the risk that’s inherent in any international expansionRemain cautiously optimistic about the potential to enter new geographies and will provide more specific updates once they fully develop International Opportunities for MAXIMUS

Kaiser Family Foundation report states that 11 states in fiscal 11 and 24 states in fiscal 12 are expanding the areas and populations covered by managed care programs; we are seeing expansion of our health services contracts in CA, CO, NY and MI Most notable expansion is in TX, where the state is expanding managed care and re-enrolling current beneficiaries into MCO plansWe are preparing for an increase of inbound call volume and adding capacity to our operations: hired temporary staff in Austin; established an online enrollment channel for CHIP health and dental plans; and enhanced relationships with local community-based organizationsSigned a new three-year, $12M contract for Medicaid enrollment in Louisiana; operations launch on Dec. 15 Domestic Growth from Expanded Managed Care

Several building blocks in place as we seek to broaden our presence in the federal marketBrought in Tom Romeo to lead our Federal Services initiatives; Tom brings nearly 20 years of experience, managing high-profile projects for large federal agencies and developing and executing federal healthcare strategy MAXIMUS is enhancing its efforts in the federal space to better promote our core service offerings to a wider set of agencies and programs Won new five-year, $8M contract to administer the Federal External Review Process, which is mandated by the Affordable Care Act, for the Office of Personnel Management and the Department of Health and Human Services Broadening the MAXIMUS Federal Presence

States continue to plan for ACA implementation, even as they face budget challenges, passing legislation and issuing RFIs, mainly for technology components of the exchangeMAXIMUS-Connecture team responded to 10 RFIs in areas that correspond with core services and have met with and demonstrated StateAdvantage to more than 30 states; pleased to have an established seat at the table as states conduct planning work and seek qualified vendors First round of RFPs are primarily for system design and development, but some provide an option to subsequently procure administrative services; positioning MAXIMUS as a desirable partner on these initial procurements and anticipate that RFPs for program administration will follow, perhaps as early as Spring/Summer 2012 State officials and insurers urging CMS to plan for delays in launching some functions of exchanges; however, we remain confident about our prospects and believe that states already down the preparation path will likely continue to move forward with transformational activities and other market reformsWidespread support remains for the fundamental idea of creating a market that enables consumer choice, increases competition, and leverages buying power; essential need to address quality, cost and access remains, and will lead to continued demand for more efficient and effective programs Moving Ahead with Health Care Reform

New Awards and Sales Pipeline (in millions) At September 30, 2011, backlog increased 38% to a record $2.9. billion, driven by new work and many successful rebid awards in fiscal 2011.

Three main goals for driving longer-term growth:Expanding our global operations Further positioning our domestic operations for new opportunitiesGrowing our federal book of business Achieved several key milestones in FY11 and will continue our progress towards growing the business in FY12 and beyond and creating long-term shareholder value Our near-term goals for the fiscal year include:Successfully ramping up our UK operations and getting them to breakeven by the end of the yearSecuring our fair share of health care reform work Aggressively searching for qualified acquisition targets that will help us grow strategically Positioned to Capitalize on New Opportunities

The need for high quality, efficient social services is a universal one; there will continue to be demand for world-class administration of government programs from vendors who can deliver results With fiscal 12 guidance in place, we look forward to driving results for our clients and our shareholders A special thank you to our employees for their contributions to our success this fiscal year; the high quality services they provide play an important part of maintaining positive client relationships and driving financial performance Conclusion