Attached files

| file | filename |

|---|---|

| 8-K - STERLING FINANCIAL CORPORATION 8-K - STERLING FINANCIAL CORP /WA/ | a50058800.htm |

| EX-99.1 - EXHIBIT 99.1 - STERLING FINANCIAL CORP /WA/ | a50058800ex99-1.htm |

Exhibit 99.2

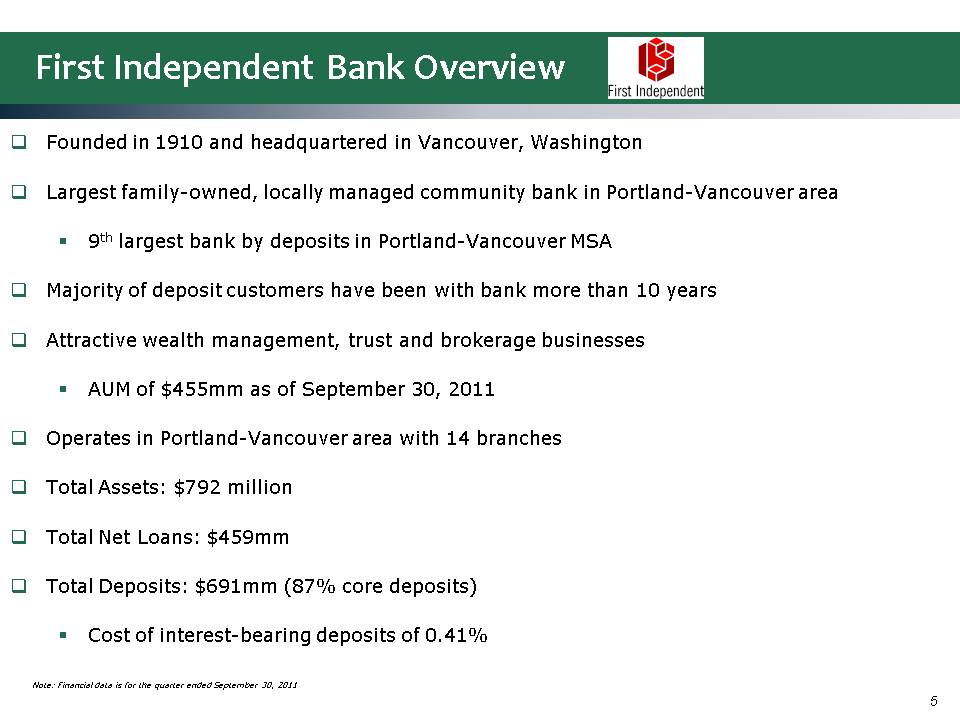

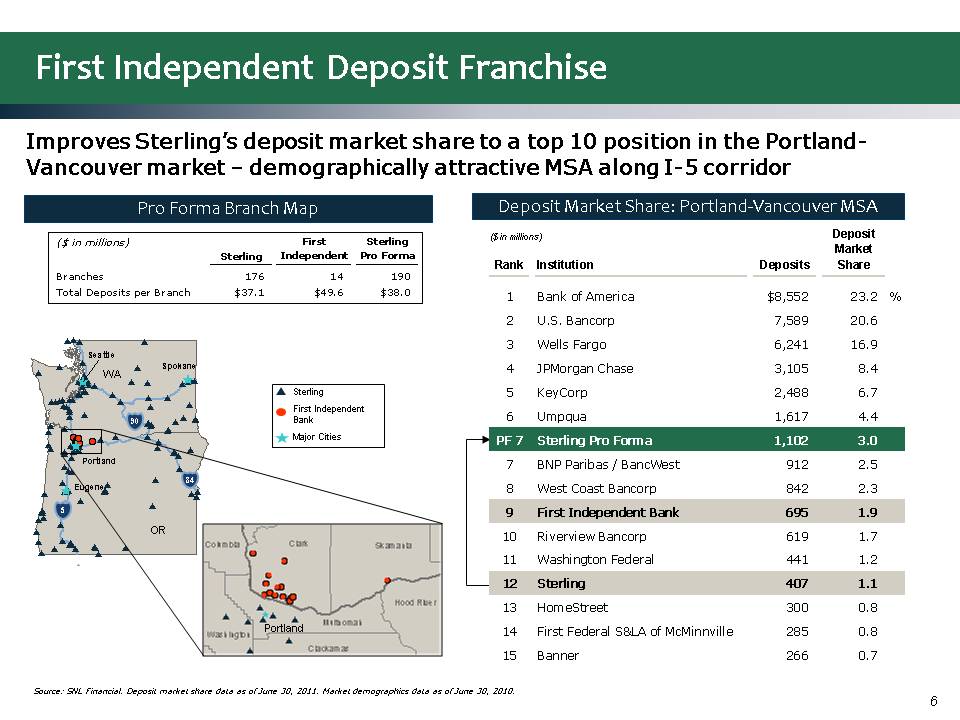

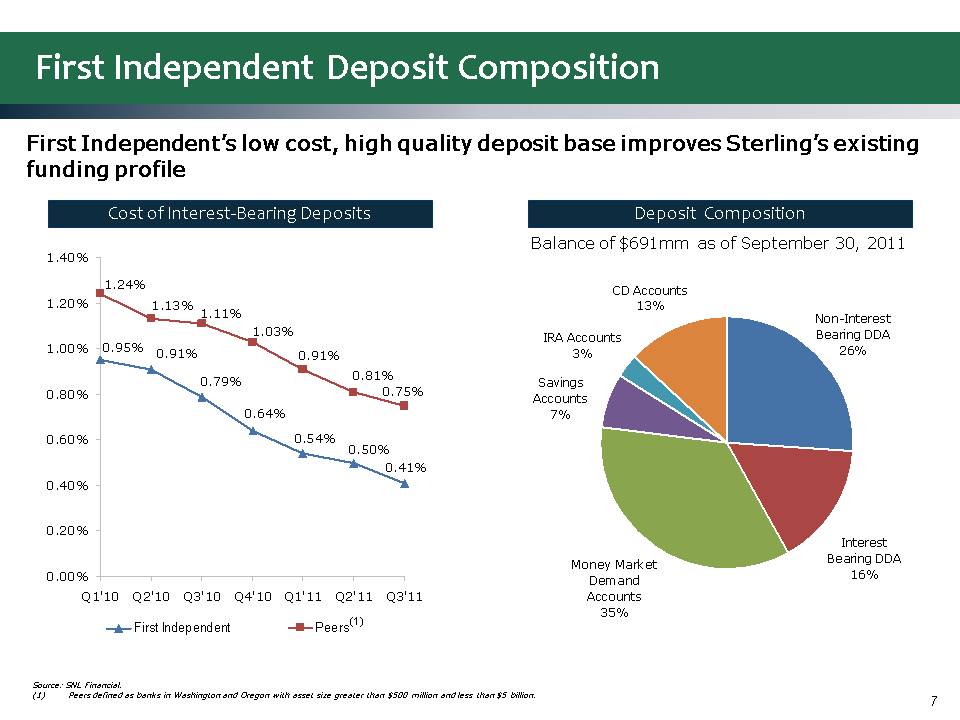

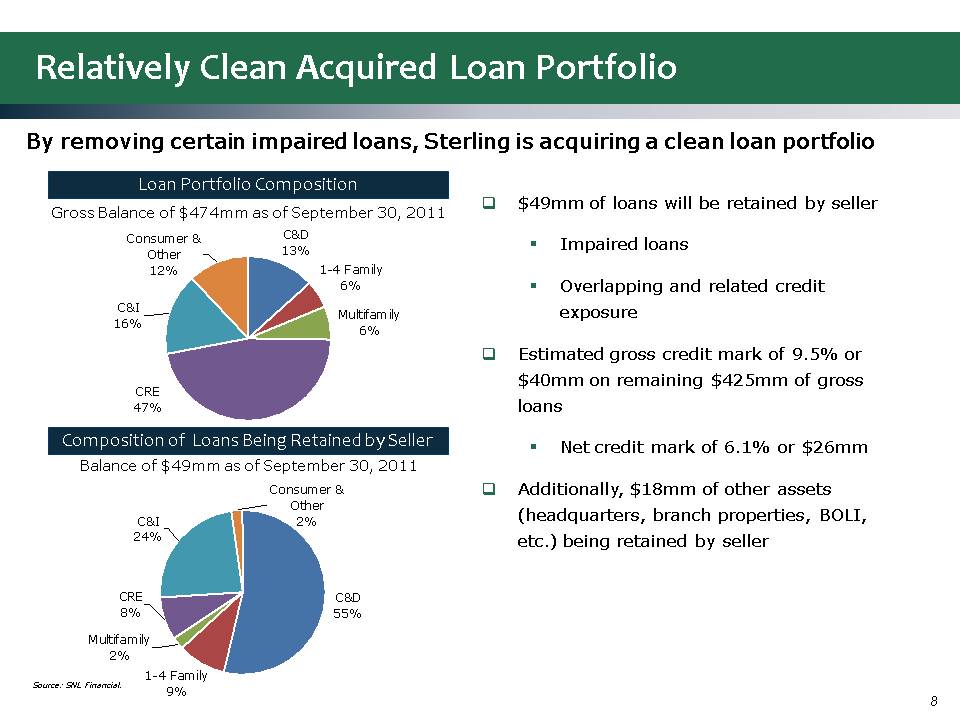

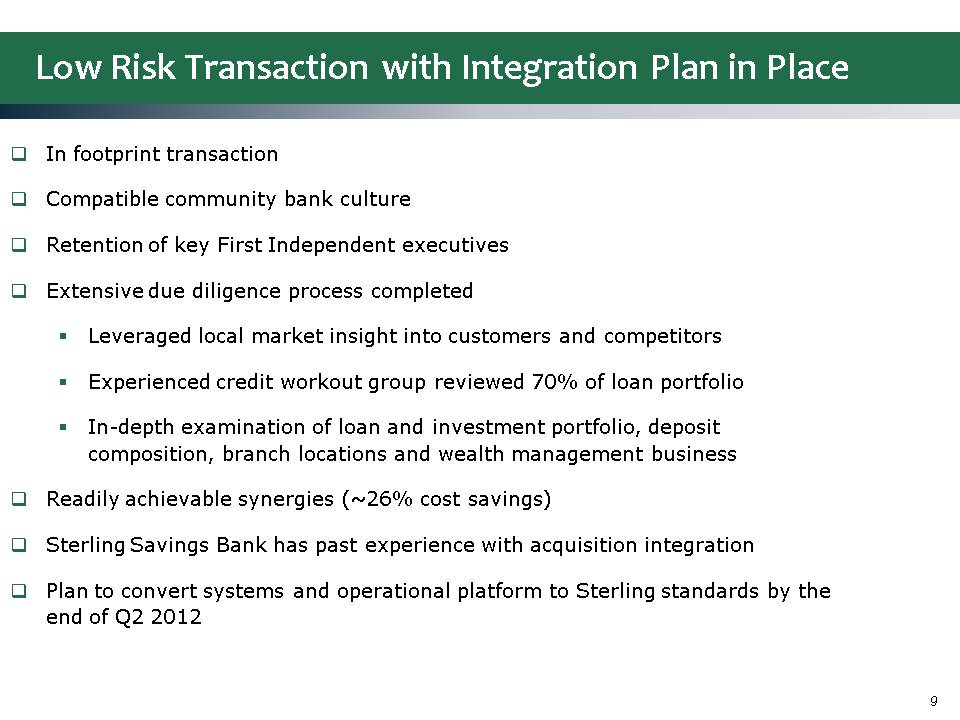

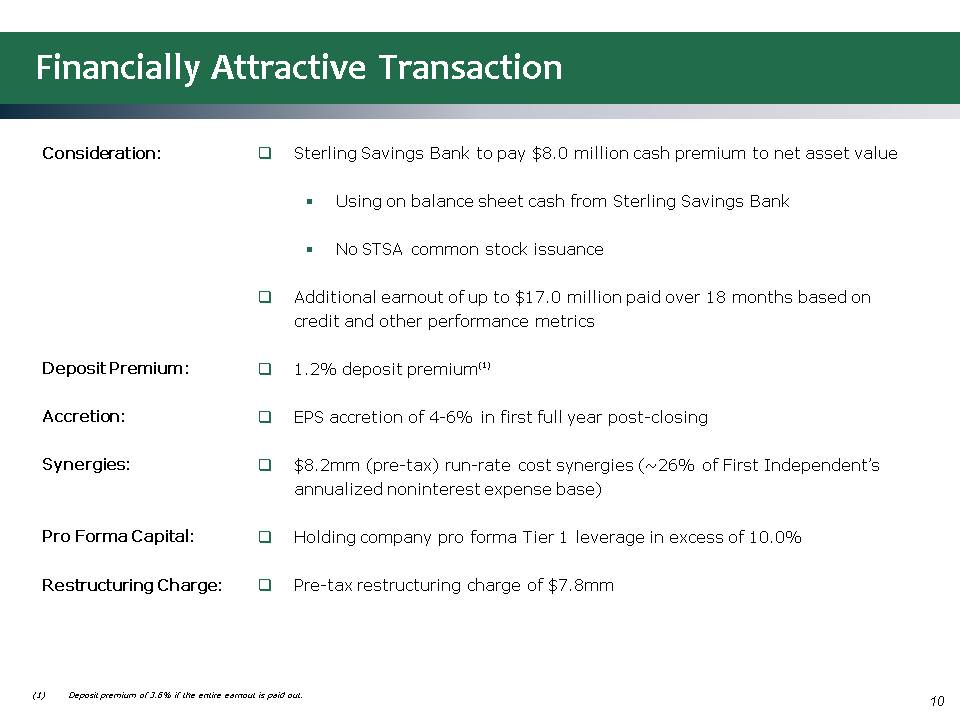

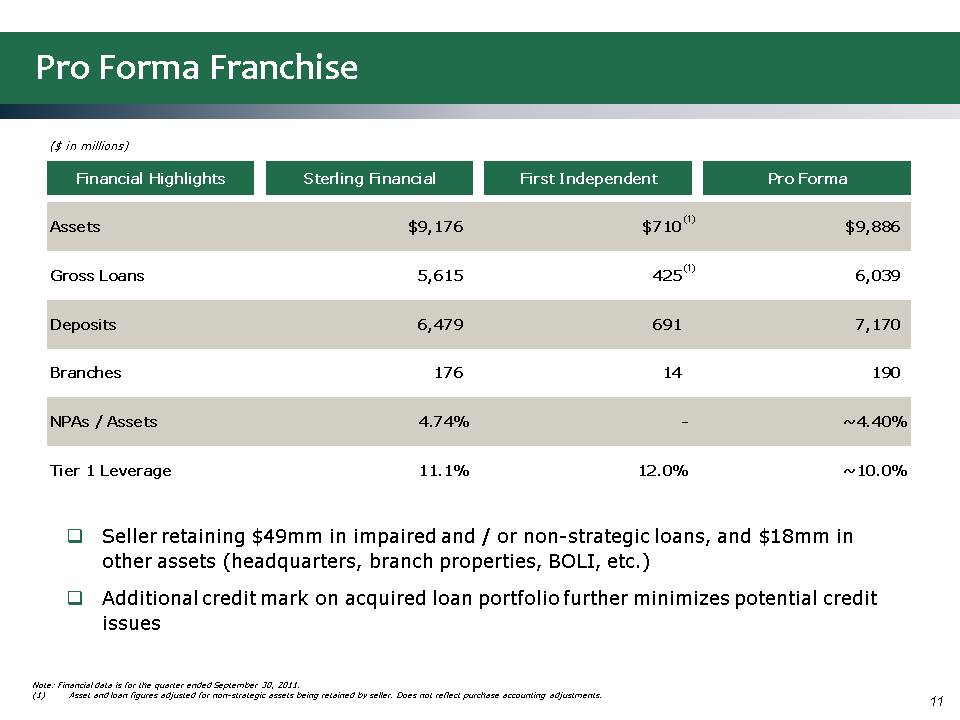

Acquisition of Selected Assets and Operations and Assumption of Deposits of First Independent Bank Ticker: STSA Spokane, Washington www sterlingfinancialcorporation spokane com Safe Harbor In the course of our presentation, we may discuss matters that are deemed to be forward-looking statements, which are intended to be covered by the safe harbor for forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995 (the “Reform Act”)(1). Forward-looking statements involve substantial risks and uncertainties, many of which are difficult to predict and are generally beyond our control. Actual results may differ materially and adversely from projected results. We assume no obligation to update any forward-looking statements (including any projections) to reflect any changes or events occurring after the date hereof. Additional information about risks of achieving results suggested by any forward-looking statements may be found in Sterling’s 10-K forward Sterling s 10 K, 10-Q and other SEC filings, including under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” This presentation contains certain non-GAAP financial measures. (1) The Reform Act defines the term "forward-looking statements" to include: statements of management plans and objectives, statements regarding the future economic performance, and projections of revenues and other financial data, among others. The Reform Act precludes liability for oral or written forward-looking statements if the statement is identified as such and accompanied by "meaningful cautionary statements identifying important factors that could cause actual results to differ materially from those made in the forward-looking statements." 2 Strategically Compelling, Low Risk and Financially Attractive Transaction y .. Improves Sterling’s deposit market share in the Portland-Vancouver MSA to #7 from #12 (largest market in Oregon) .. Relatively low risk transaction .. Seller retaining non-strategic assets (selected loans and other assets) .. In-market transaction with achievable synergies .. executives Retention of key .. Enhances Sterling’s business mix .. Transaction and Money Market Demand accounts represent 76% of total .. Addition of wealth management, trust and brokerage services .. Adds business lending teams in Portland-Vancouver MSA .. Improves Sterling’s overall asset quality and deposit costs .. Attractive pricing (1.2% deposit premium) and returns (accretive to earnings in first full year post-closing(1)) .. Transaction size and structure provides Sterling the flexibility to pursue potential future acquisitions 3 (1) Excluding one-time restructuring charges. Transaction Highlights and Summary .. Sterling Savings Bank to purchase onlyselected assets and operations and assume deposits of First Independent Bank Transaction Structure .. Seller retaining certain loans (some are impaired), other assets and nondeposit liabilities .. Purchase and assumption transaction structure limits credit risk and preserves Sterling’s DTA .. Sterling Savings Bank to pay $8 million cash premium to net asset value at close .. Additional earnout of up to $17 million paid over 18 months based on credit and other performance metrics .. Earnout is incrementally value accretive to Sterling Transaction .. Due diligence completed .. Regulatory approval required – FDIC and Washington DFI .. No additional approvals required from Sterling or First Independent shareholders Terms 4 pp q g p .. Anticipated closing in early 2012 First Independent Bank Overview .. Founded in 1910 and headquartered in Vancouver, Washington .. Largest family-owned, locally managed community bank in Portland-Vancouver area .. 9th largest bank by deposits in Portland-Vancouver MSA .. Majority of deposit customers have been with bank more than 10 years .. Attractive wealth management, trust and brokerage businesses .. AUM of $455mm as of September 30, 2011 .. Operates in Portland-Vancouver area with 14 branches .. Total Assets: $792 million .. Total Net Loans: $459mm .. Total Deposits: $691mm (87% core deposits) .. Cost of interest-bearing deposits of 0.41% 5 Note: Financial data is for the quarter ended September 30, 2011 First Independent Deposit Franchise Improves Sterling’s deposit market share to a top 10 position in the Portland- Vancouver market – demographically attractive MSA along I-5 corridor Deposit Market Share: Portland Vancouver MSA Portland-Pro Forma Branch Map Rank Institution Deposits Deposit Market Share 1 Bank of America $8,552 23.2 % ($ in millions) ($ in millions) Sterling First Independent Sterling Pro Forma Branches 176 14 190 Total Deposits per Branch $37.1 $49.6 $38.0 Spokane Seattle WA Sterling Independent 2 U.S. Bancorp 7,589 20.6 3 Wells Fargo 6,241 16.9 4 JPMorgan Chase 3,105 8.4 5 KeyCorp 2,488 6.7 6 6 Portland Eugene B 84 90 5 First Bank Major Cities Umpqua 1,617 4.4 PF 7 Sterling Pro Forma 1,102 3.0 7 BNP Paribas / BancWest 912 2.5 8 West Coast Bancorp 842 2.3 9 Bank 695 1 9 .. OR Columbia Hood River Clark Skamania First Independent 1.9 10 Riverview Bancorp 619 1.7 11 Washington Federal 441 1.2 12 Sterling 407 1.1 13 HomeStreet 300 0.8 6 Source: SNL Financial. Deposit market share data as of June 30, 2011. Market demographics data as of June 30, 2010. Washington Multnomah Clackamas Portland 14 First Federal S&LA of McMinnville 285 0.8 15 Banner 266 0.7 First Independent Deposit Composition First Independent’s low cost, high quality deposit base improves Sterling’s existing funding profile 1.24% 1 11% 1 13% 1.20% 1.40% Deposit Composition Cost of Interest-Bearing Deposits Balance of $691mm as of September 30, 2011 CD Accounts 13% 0.91% 0.79% 0 64% 0.95% 0.81% 0.91% 1.03% 1.11% 1.13% 0.75% 0.80% 1.00% IRA Accounts 3% Non-Interest Bearing DDA 26% Savings Accounts 7% 0.64% 0.54% 0.50% 0.41% 0.40% 0.60% 0.00% 0.20% Q1'10 Q2'10 Q3'10 Q4'10 Q1'11 Q2'11 Q3'11 Money Market Demand Accounts 35% Interest Bearing DDA 16% First Independent Peers 7 Source: SNL Financial. (1) Peers defined as banks in Washington and Oregon with asset size greater than $500 million and less than $5 billion. (1) Relatively Clean Acquired Loan Portfolio By removing certain impaired loans, Sterling is acquiring a clean loan portfolio Loan Portfolio Composition .. $49mm of loans retained by seller Gross Balance of $474mm as of September 30, 2011 will be .. Impaired loans .. Overlapping and related credit exposure C&I 1-4 Family 6% C&D 13% Consumer & Other 12% .. Estimated gross credit mark of 9.5% or $40mm on remaining $425mm of gross loans 16% Multifamily 6% CRE 47% .. Net credit mark of 6.1% or $26mm .. Additionally, $18mm of other assets (headquarters branch properties BOLI Consumer & Other Composition of Loans Being Retained by Seller Balance of $49mm as of September 30, 2011 headquarters, properties, BOLI, etc.) being retained by seller C&I 24% 2% C&D 55% CRE 8% 8 Source: SNL Financial. Multifamily 2% 1-4 Family 9% Low Risk Transaction with Integration Plan in Place .. In footprint transaction .. bank culture Compatible community .. Retention of key First Independent executives .. Extensive due diligence process completed .. Leveraged local market insight into customers and competitors .. Experienced credit workout group reviewed 70% of loan portfolio .. In-depth examination of loan and investment portfolio, deposit composition, branch locations and wealth management business .. Readily achievable synergies (~26% cost savings) .. Sterling Savings Bank has past experience with acquisition integration .. Plan to convert systems and operational platform to Sterling standards by the end of Q2 2012 9 Financially Attractive Transaction .. Sterling Savings Bank to pay $8.0 million cash premium to net asset value .. Using on sheet cash from Sterling Savings Bank Consideration: balance .. No STSA common stock issuance .. Additional earnout of up to $17.0 million paid over 18 months based on credit and other performance metrics .. 1.2% deposit premium(1) EPS i f 4 6% i fi f ll l i Deposit Premium: A ti .. accretion of 4-in first full year post-closing .. $8.2mm (pre-tax) run-rate cost synergies (~26% of First Independent’s annualized noninterest expense base) Accretion: Synergies: .. Holding company pro forma Tier 1 leverage in excess of 10.0% .. Pre-tax restructuring charge of $7.8mm Pro Forma Capital: Restructuring Charge: 10 (1) Deposit premium of 3.6% if the entire earnout is paid out. Pro Forma Franchise ($ in millions) Financial Highlights Sterling Financial First Independent Pro Forma Assets $9,176 $710 $9,886 Gross Loans 5,615 425 6,039 (1) (1) Deposits 6,479 691 7,170 Branches 176 14 190 NPAs / Assets 4.74% - ~4.40% Tier 1 Leverage 11.1% 12.0% ~10.0% .. Seller retaining $49mm in impaired and / or non-strategic loans, and $18mm in other assets (headquarters, branch properties, BOLI, etc.) .. Additional credit mark on acquired loan portfolio further minimizes potential credit i 11 Note: Financial data is for the quarter ended September 30, 2011. (1) Asset and loan figures adjusted for non-strategic assets being retained by seller. Does not reflect purchase accounting adjustments. issues Key Takeaways .. Improves Sterling’s deposit market share in the Portland-Vancouver MSA .. Lower risk transaction .. Seller retaining non-strategic assets .. In-market transaction with achievable synergies .. executives Retention of key .. Enhances Sterling’s business mix .. Positive transaction account composition .. Addition of wealth management, trust and brokerage services .. Addition of business lending teams .. Provides platform for further key market development in a strategic .. Attractive deposit franchise with low cost deposit base and high quality loans .. Financially attractive returns .. Transaction size and structure provides Sterling the flexibility to pursue potential future acquisitions 12 Ticker: STSA Spokane, Washington www.sterlingfinancialcorporation-spokane.com Investor Media Contact Contacts Patrick Rusnak Cara Coon Chief Financial Officer VP/Communications and Public Affairs Director (509) 227-0961 (509) 626-5348 patrick.rusnak@sterlingsavings.com cara.coon@sterlingsavings.com Daniel Byrne EVP/Corporate Development Director (509) 458-3711 dan sterlingsavings dan.byrne@sterlingsavings.com 13