Attached files

| file | filename |

|---|---|

| 8-K - 8-K - McEwen Mining Inc. | a11-28556_18k.htm |

Exhibit 99.1

|

|

October 25, 2011 |

NEWS RELEASE

EL GALLO DRILLING INTERSECTS IMPRESSIVE SILVER MINERALIZATION

461.7 GPT SILVER OVER 11.3 METERS

309.7 GPT SILVER OVER 10.3 METERS

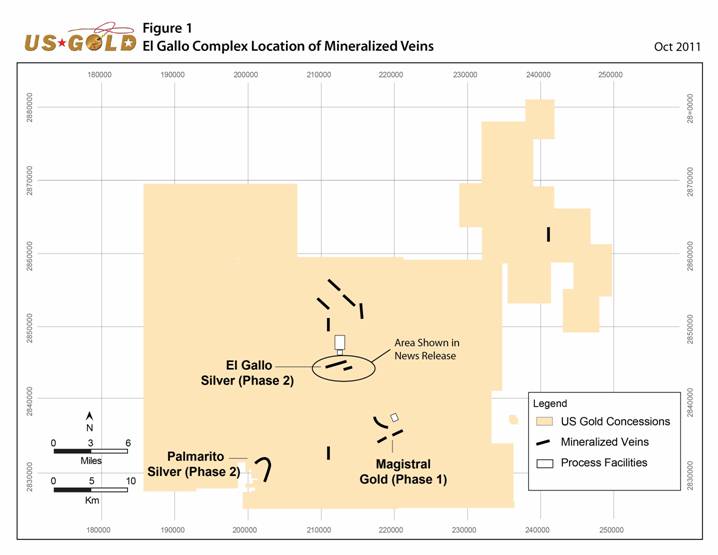

TORONTO, ONTARIO (October 25, 2011) US GOLD CORPORATION (NYSE: UXG) (TSX: UXG) is pleased to announce new drill results from the El Gallo Complex, in Sinaloa State, Mexico. Drill results contained in this news release were completed in order to increase the size of the silver and gold resources at El Gallo. Highlights include: 309.7 grams per tonne (gpt) silver over 10.3 meters (m), 727.7 gpt silver, 5.0 gpt gold over 2.7 m, 130.9 gpt silver over 19.0 m and 461.7 gpt silver over 11.3 m, with the last intersection occurring 20 m below the proposed pit bottom.

“Since making the El Gallo discovery in 2009, we have completed an aggressive exploration program of 165,000 meters of core drilling and we still have not found the limits of the system. Impressive intersections of near surface silver mineralization continue to be encountered. In addition, I believe the proposed merger with Minera Andes will create an attractive, high growth, low cost mid-tier silver producer. The fundamentals look exceptionally bright for the company, despite the current share price decline,” stated Rob McEwen, Chairman and CEO.

Impressive Drill Intersections

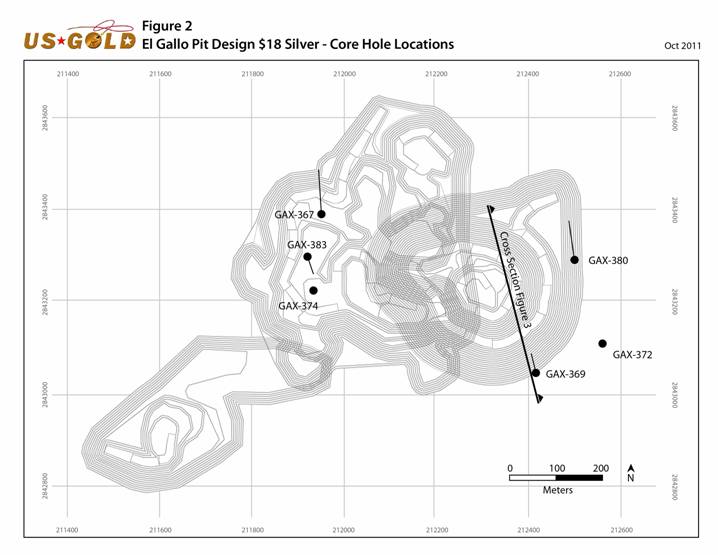

Drilling in order to expand the size of the resource focused on three areas: 1) east, 2) south and, 3) below the planned pit (Fig. 2). Each of the holes encountered impressive intersections of silver mineralization. Drilling to follow on these results is underway:

1) East of Proposed Pit: GAX-380 intersected two zones. The first zone returned 727.7 gpt silver, 5.0 gpt gold over 2.7 m, including 2,260 gpt silver, 16.2 gpt gold over 0.8 m. This intercept is the up-dip extension of the Main Zone. The result demonstrates that the mineralization continues to surface. The second intersection came from the Lower Zone, which continues to be defined and expanded, returning 309.7 gpt silver over 10.3 m, including 3,510 gpt silver over 0.7 m. Both intersections occur approximately 120 m east of the proposed pit design, released in February as part of the Preliminary Economic Assessment (PEA) (Fig. 2).

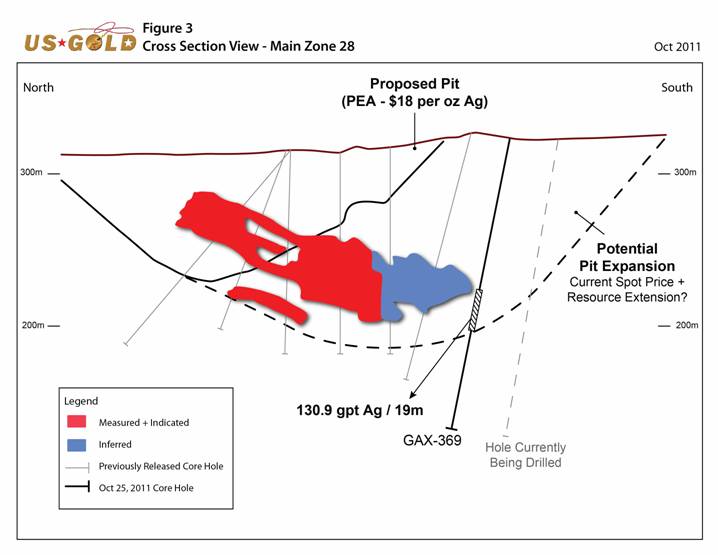

2) South of Proposed Pit: GAX-369 intersected 130.9 gpt silver over 19.0 m in an area that was believed to have limited expansion potential. This hole encountered a much wider zone of better than expected grade. The intersection occurs 125 m south of the PEA pit design (Fig. 2 & 3).

3) Below the Proposed Pit: GAX-374 successfully encountered 461.7 gpt silver over 11.3 m, including 1,945.6 gpt silver over 2.4 m, 20 m below the present PEA pit bottom. This hole was drilled with the belief that a high-grade cross-cutting structure is present through this portion of the Main Zone. This hole helps confirm US Gold’s geological model, as well as providing down-dip continuity to several other high-grade intersections in the area (Fig. 2).

Other notable results from the recent expansion drilling included 113.5 gpt silver over 8.5 m and 92.9 gpt silver over 7.5 m from hole GAX-383. This hole is located in the North Zone and was drilled through inferred mineralization in order to upgrade the resources to the indicated category and further extend the inferred resource. Holes GAX-367 and GAX-372 were drilled to increase the lower grade heap leachable mineralization. These holes encountered 47.5 gpt silver over 8.0 m and 28.7 gpt silver over 33.2 m, respectively (Fig. 2).

PHASE 1 MINING SCHEDULED FOR Q2 2012

Phase 1 mining at the El Gallo Complex is expected to commence during the second quarter 2012. The El Gallo Complex includes the El Gallo and Palmarito silver deposits and the Magistral gold deposits, which are located within a 13 km (8 mile) radius. Phase 1 will focus on the permitted gold deposits and is expected to produce 30,000 ounces of gold per year after initial ramp up. Capital costs have been estimated at $15 million and the projected cash flow will help fund Phase 2, which is forecasted to produce an additional 5 million ounces of silver per year, beginning in 2014. Readers should note that mineral resources that are not mineral reserves do not have demonstrated economic viability.

ABOUT US GOLD (www.usgold.com)

US Gold’s objective is to qualify for inclusion in the S&P 500 by 2015. US Gold explores for gold and silver in the Americas and is advancing its El Gallo Complex in Mexico and its Gold Bar Project in Nevada towards production. US Gold’s shares are listed on the NYSE and the TSX under the symbol UXG, trading 2.5 million shares daily during the past twelve months. US Gold’s shares are included in S&P/TSX and Russell indices and Van Eck’s Junior Gold Miners ETF. Rob McEwen, Chairman and CEO, owns 20% of the shares of US Gold. On June 14, 2011 the Company announced that Mr. McEwen proposed to combine the Company with Minera Andes to create a high growth, low-cost, mid-tier silver producer operating in the Americas. Each Minera Andes shareholder would receive 0.45 of a US Gold share for every Minera Andes share held.

TECHNICAL INFORMATION

This news release has been viewed and approved by John Read, CPG, US Gold’s consulting geologist, who is a Qualified Person as defined by National Instrument 43-101 and is responsible for program design and quality control of exploration undertaken by the Company at its Mexican exploration properties.

Samples from the core drilling were split on-site at the Company’s El Gallo Complex. One quarter to one half of the split drill core is shipped to ALS Chemex for sample preparation and analysis by 4-acid digestion with ICP determination for silver and fire assay for gold. Samples returning greater than 1500 ppm silver or 10 ppm gold were re-analyzed using gravimetric fire assay. Standards and blanks were inserted every 20 samples.

All holes were drilled with HQ bits and reduced to NTW where required. Samples were taken based on lithologic and/or mineralized intervals and vary in length. The true width of the mineral zone has not been determined in some locations.

For additional information about the El Gallo project see the “Preliminary Economic Assessment for the El Gallo District, Sinaloa State Mexico” dated February 11, 2011 and prepared by Paul Gates, PE, Richard Addison, PE, Aaron McMahon, PG of Pincock Allen & Holt of Denver, Colorado (“El Gallo PEA”). All three individuals are Qualified Persons as defined by NI 43-101 and are independent of US Gold Corporation as defined in Section 1.4 of NI 43-101 and Section 3.5 of Companion Policy 43-101CP. Mr. McMahon verified the mineral resource data contained in the El Gallo PEA by conducting a site visit, which included verifying drill hole locations and survey data, reviewing sampling handling, data collection procedures, partial audit of the assay database, review of the QA/QC data and analysis of core recovery and drill logs and their relations to assay values. The El Gallo PEA is available on SEDAR (www.sedar.com).

Cautionary Note to US Investors

US Gold (including in its preparation of the El Gallo PEA) prepares its resource estimates in accordance with standards of the Canadian Institute of Mining, Metallurgy and Petroleum referred to in Canadian National Instrument 43-101 (NI 43-101). These standards are different from the standards generally permitted in reports filed with the SEC. Under NI 43-101, US Gold reports measured, indicated and inferred resources, measurements which are generally not permitted in filings made with the SEC. The estimation of measured resources and indicated resources involve greater uncertainty as to their existence and economic feasibility than the estimation of proven and probable reserves. U.S. investors are cautioned not to assume that any part of measured or indicated resources will ever be converted into economically mineable reserves. The estimation of inferred resources involves far greater uncertainty as to their existence and economic viability than the estimation of other categories of resources.

Canadian regulations permit the disclosure of resources in terms of “contained ounces”; however, the SEC only permits issuers to report “mineralized material” in tonnage and grade without reference to contained ounces. Under U.S. regulations the tonnage and grade described herein under the “measured” and “indicated” categories would be characterized as mineralized material. The disclosure herein is being made by US Gold to provide a means of comparing its project to those of other companies in the mining industry, many of which are Canadian and report pursuant to NI 43-101, and to comply with applicable disclosure requirements. U.S. investors should be aware that the issuer has no “reserves” as defined by Guide 7 and are cautioned not to assume that any part or all of the potential target mineral resources will ever be confirmed or converted into Guide 7 compliant “reserves”.

Forward LOOKING STATEMENTS

Certain statements contained herein and subsequent oral statements made by and on behalf of the Company may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements may be identified by words such as “intends,” “anticipates,” “believes,” “expects” and “hopes” and include, without limitation, statements regarding the Company’s results of exploration, plan of business operations, potential contractual arrangements, receipt of working capital, anticipated revenues and related expenditures. Factors that could cause actual results to differ materially include, among others, those set forth in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2010 and other filings with the Securities and Exchange Commission, under the caption “Risk Factors”. Most of these factors are outside the control of the Company. Investors are cautioned not to put undue reliance on forward-looking statements. Except as otherwise required by applicable securities statutes or regulations, the Company disclaims any intent or obligation to update publicly these forward looking statements, whether as a result of new information, future events or otherwise.

|

For further information contact: |

|

|

|

|

|

|

|

Jenya Mescheryakova Investor Relations Tel: (647) 258-0395 Toll Free: (866) 441-0690 Fax: (647) 258-0408 |

|

Mailing Address 181 Bay Street Bay Wellington Tower Suite 4750, P.O. Box 792 Toronto, ON M5J 2T3 E-mail: info@usgold.com |

Table 1. Drill Results: Core Holes Assays

October 2011

Metric Table

|

Hole # |

|

Silver |

|

Length |

|

From |

|

Azimuth |

|

Dip |

|

Northing |

|

Easting |

|

El Gallo |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-367 |

|

47.5 |

|

8.0 |

|

2.0 |

|

350° |

|

-60° |

|

211961 |

|

2843393 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-369 |

|

130.9 |

|

19.0 |

|

98.7 |

|

350° |

|

-80° |

|

212416 |

|

2843058 |

|

Including |

|

270.8 |

|

7.0 |

|

110.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-372 |

|

28.7 |

|

33.2 |

|

114.8 |

|

0° |

|

-90° |

|

212565 |

|

2843123 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-374 |

|

461.7 |

|

11.3 |

|

64.7 |

|

0° |

|

-90° |

|

211937 |

|

2843233 |

|

Including |

|

1,945.6 |

|

2.4 |

|

72.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-380 |

|

727.7 |

|

2.7 |

|

19.1 |

|

350° |

|

-65° |

|

212504 |

|

2843286 |

|

Including |

|

2,260.0 |

|

0.8 |

|

19.1 |

|

|

|

|

|

|

|

|

|

And |

|

309.7 |

|

10.3 |

|

124.8 |

|

|

|

|

|

|

|

|

|

Including |

|

3,510.0 |

|

0.7 |

|

129.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-383 |

|

113.5 |

|

8.5 |

|

5.0 |

|

170° |

|

-70° |

|

211926 |

|

2843307 |

|

And |

|

92.9 |

|

7.5 |

|

44.0 |

|

|

|

|

|

|

|

|

Imperial Table

|

Hole # |

|

Silver |

|

Length |

|

From |

|

Azimuth |

|

Dip |

|

Northing |

|

Easting |

|

El Gallo |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-367 |

|

1.4 |

|

26.2 |

|

6.6 |

|

350° |

|

-60° |

|

211961 |

|

2843393 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-369 |

|

3.8 |

|

62.3 |

|

323.8 |

|

350° |

|

-80° |

|

212416 |

|

2843058 |

|

Including |

|

7.9 |

|

23.0 |

|

362.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-372 |

|

0.8 |

|

108.9 |

|

376.6 |

|

0° |

|

-90° |

|

212565 |

|

2843123 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-374 |

|

13.5 |

|

37.1 |

|

212.3 |

|

0° |

|

-90° |

|

211937 |

|

2843233 |

|

Including |

|

56.7 |

|

7.9 |

|

236.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-380 |

|

21.2 |

|

8.9 |

|

62.7 |

|

350° |

|

-65° |

|

212504 |

|

2843286 |

|

Including |

|

65.9 |

|

2.6 |

|

62.7 |

|

|

|

|

|

|

|

|

|

And |

|

9.0 |

|

33.8 |

|

409.4 |

|

|

|

|

|

|

|

|

|

Including |

|

102.4 |

|

2.3 |

|

425.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-383 |

|

3.3 |

|

27.9 |

|

16.4 |

|

170° |

|

-70° |

|

211926 |

|

2843307 |

|

And |

|

2.7 |

|

24.6 |

|

144.4 |

|

|

|

|

|

|

|

|