Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TIDEWATER INC | d239120d8k.htm |

| EX-99.2 - TRANSCRIPT OF THE PRESENTATION - TIDEWATER INC | d239120dex992.htm |

2011

JOHNSON RICE ENERGY CONFERENCE

2011 JOHNSON RICE

2011 JOHNSON RICE

ENERGY CONFERENCE

ENERGY CONFERENCE

Oct. 4, 2011

Oct. 4, 2011

Oct. 4, 2011

DEAN E. TAYLOR

DEAN E. TAYLOR

Chairman, President and CEO

Chairman, President and CEO

JOSEPH M. BENNETT

JOSEPH M. BENNETT

Executive

Executive

VP

VP

and

and

Chief

Chief

Investor Relations Officer

Investor Relations Officer

Exhibit 99.1 |

2

In accordance with the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995, the Company notes that certain statements set forth in this

presentation provide other than historical information and are forward looking. The

actual achievement of any forecasted results, or the unfolding of future economic or

business developments in a way anticipated or projected by the Company, involve

numerous risks and uncertainties that may cause the Company’s actual performance

to be materially different from that stated or implied in the forward-looking

statement. Among those risks and uncertainties, many of which are beyond the

control of the Company, include, without limitation, volatility in worldwide energy

demand and oil and gas prices; fleet additions by competitors and industry

overcapacity; changes in capital spending by customers in the energy industry for

offshore

exploration,

field

development

and

production;

changing

customer

demands

for vessel specifications, which may make some of our older vessels technologically

obsolete for certain customer projects or in certain markets; uncertainty of global

financial market conditions and difficulty in accessing credit or capital; acts of

terrorism and piracy; significant weather conditions; unsettled political conditions,

war, civil unrest and governmental actions, such as expropriation, especially in higher

risk countries where we operate; foreign currency fluctuations; labor influences

proposed by international conventions; increased regulatory burdens and oversight

following

the

Deepwater

Horizon

incident;

and

enforcement

of

laws

related

to

the

environment,

labor

and

foreign

corrupt

practices.

Readers

should

consider

all

of

these

risk factors as well as other information contained in this report.

Phone:

504.568.1010

Fax:

504.566.4580

Web:

www.tdw.com

Email:

connect@tdw.com

FORWARD-LOOKING STATEMENTS

FORWARD-LOOKING STATEMENTS

FORWARD-LOOKING STATEMENTS |

3

KEY TAKEAWAYS

KEY TAKEAWAYS

KEY TAKEAWAYS

•

Culture of safety & operating excellence

•

History of earnings growth and solid returns

•

Unmatched scale and scope of operations

•

World’s largest and newest fleet provides

basis for continued earnings growth

•

Strong balance sheet allows us to act upon

available opportunities |

4

SAFETY REMAINS A TOP PRIORITY

SAFETY REMAINS A TOP PRIORITY

SAFETY REMAINS A TOP PRIORITY |

5

SAFETY RECORD RIVALS

LEADING COMPANIES

SAFETY RECORD RIVALS

SAFETY RECORD RIVALS

LEADING COMPANIES

LEADING COMPANIES

0.00

0.10

0.20

0.30

0.40

0.50

0.60

0.70

0.80

2002

2003

2004

2005

2006

2007

2008

2009

2010

CALENDAR YEARS

TOTAL RECORDABLE INCIDENT RATES

TIDEWATER

DOW CHEMICAL

CHEVRON

EXXON/MOBIL |

6

**

EPS in Fiscal 2004 is exclusive of the $.30 per share after tax impairment charge.

EPS in Fiscal 2006 is exclusive of the $.74 per share after tax gain from

the

sale

of

six

KMAR

vessels.

EPS

in

Fiscal

2007

is

exclusive

of

$.37

per

share

of

after

tax

gains

from

the

sale

of

14

offshore

tugs.

EPS

in

Fiscal

2010

is

exclusive of $.66 per share Venezuelan provision, a $.70 per share tax benefit

related to favorable resolution of tax litigation and a $0.22 per share charge

for the proposed settlement with the SEC of the company’s FCPA matter. EPS in Fiscal 2011 is exclusive of total $0.21 per share charges for

settlements

with

DOJ

and

Government

of

Nigeria

for

FCPA

matters,

a

$0.08

per

share

charge

related

to

participation

in

a

multi-company

U.K.-based

pension plan and a $0.06 per share impairment charge related to certain

vessels. Adjusted Return

On Avg. Equity

4.3% 7.2%

12.4%

18.5% 18.3%

19.5%

11.4% 4.0%

Adjusted EPS**

Adjusted EPS**

HISTORY OF EARNINGS GROWTH

AND SOLID THROUGH-CYCLE RETURNS

HISTORY OF EARNINGS GROWTH

HISTORY OF EARNINGS GROWTH

AND SOLID THROUGH-CYCLE RETURNS

AND SOLID THROUGH-CYCLE RETURNS

$2.40

$5.20

$7.89

$1.03

$1.78

$3.33

$5.94

$6.39

$0.00

$2.00

$4.00

$6.00

$8.00

Fiscal

2004

Fiscal

2005

Fiscal

2006

Fiscal

2007

Fiscal

2008

Fiscal

2009

Fiscal

2010

Fiscal

2011 |

7

Unique global footprint

50+ years of Int’l experience

International (non U.S.) markets generally

characterized by:

•

More growth

•

Longer contracts

•

Better utilization

•

Higher dayrates

Solid customer base of NOC’s and IOC’s

INTERNATIONAL STRENGTH

INTERNATIONAL STRENGTH

INTERNATIONAL STRENGTH |

8

International / U.S.

2011: 94% / 6%

2000: 62% / 38%

OUR GLOBAL FOOTPRINT

Vessel Distribution by Region

(excludes stacked vessels –

as of 6/30/11)

OUR GLOBAL FOOTPRINT

OUR GLOBAL FOOTPRINT

Vessel Distribution by Region

Vessel Distribution by Region

(excludes stacked vessels –

(excludes stacked vessels –

as of 6/30/11)

as of 6/30/11)

Europe / M.E.

39

(15%)

Far East

28

(10%)

West Africa

125

(48%)

Central/South America

54

(21%)

North America

15

(6%) |

9

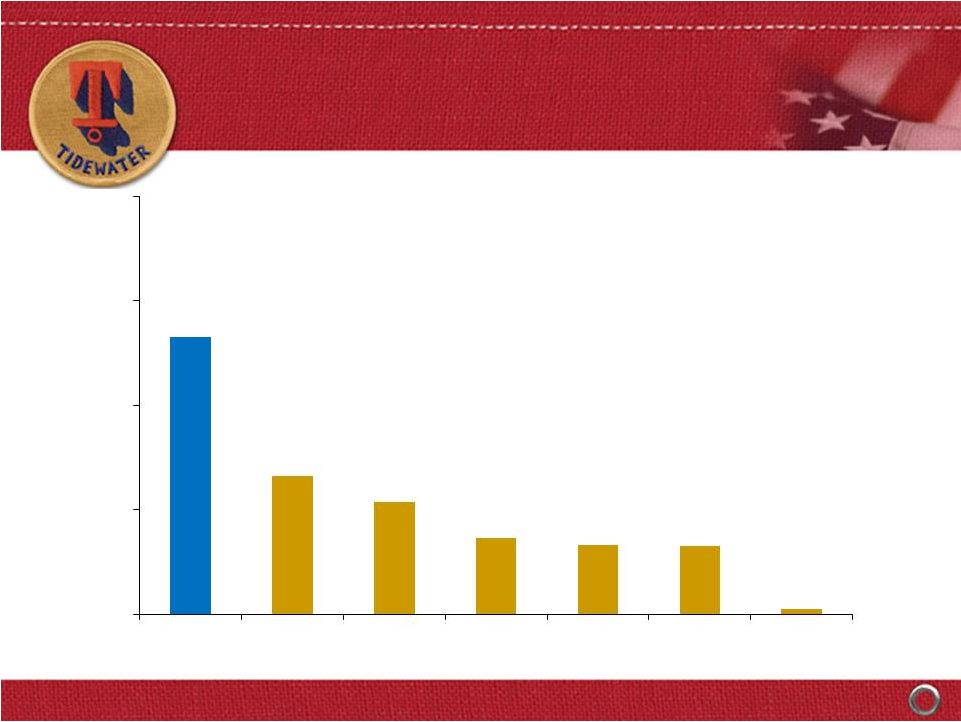

VESSEL POPULATION BY OWNER

(AHTS and PSV’s only) –

Estimated as of August 2011

VESSEL POPULATION BY OWNER

(AHTS and PSV’s only) –

Estimated as of August 2011

Source: ODS-Petrodata and Tidewater

Tidewater

Competitor #2

Competitor #3

Competitor #4

Competitor # 5

Competitor #1

Avg.

All Others (1,932 total

vessels for

350+ owners)

265

132

107

73

66

65

5

0

100

200

300

400

Tidewater AHTS and PSV fleet includes 145 vessel additions since 2000 |

10

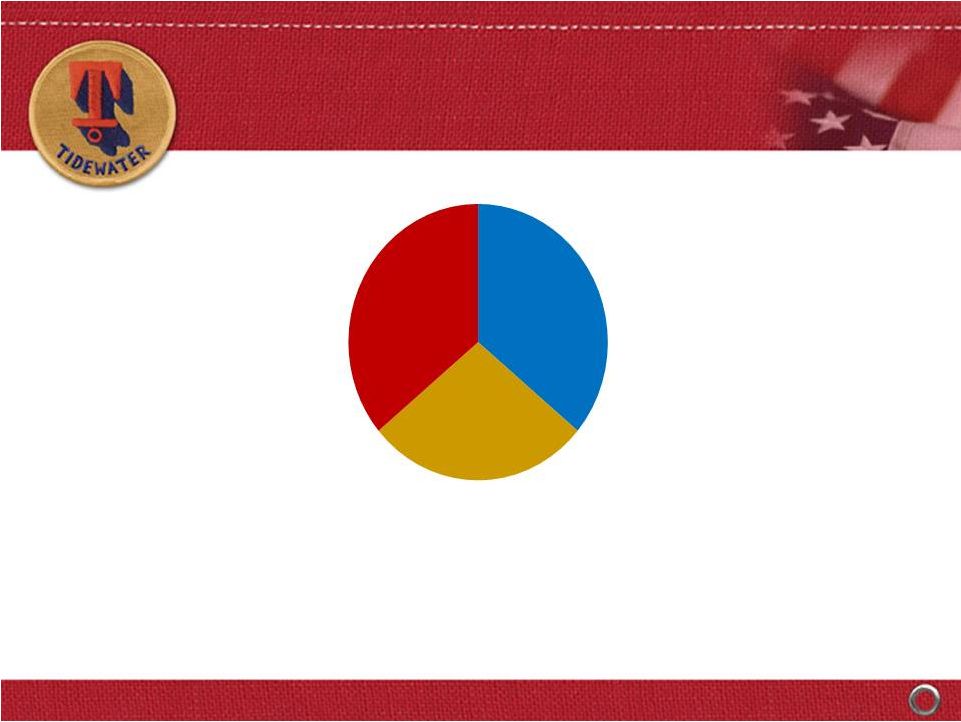

CURRENT REVENUE MIX

Quality of Customer Base

CURRENT REVENUE MIX

Quality of Customer Base

Our top 10 customers in Fiscal 2011 (5 Super Majors,

3 NOC’s and 2 large independents) accounted for 63% of our revenue

Super Majors

36%

NOC's

28%

Others

36% |

11

Vessel Count

Estimated Cost

AHTS

102

$1,793m

PSV’s

88

$1,843m

Crewboats & Tugs

67

$289m

TOTALS:

257

$3,925m

(1)

.

At 6/30/11, 196 new vessels were in our fleet with ~5.4 year average age

Vessel Commitments

Jan. ’00 –

June ‘11

(1)

$3,354m (85%) funded through 6/30/11

THE LARGEST MODERN OSV FLEET

IN THE INDUSTRY….

THE LARGEST MODERN OSV FLEET

THE LARGEST MODERN OSV FLEET

IN THE INDUSTRY….

IN THE INDUSTRY…. |

12

Count

AHTS

17

PSV

22

Crew and Tug

1

Total

40

Vessels Under Construction*

As of June 30, 2011

* Includes 12 new vessel purchase commitments at 6/30/11

CAPX

of

$400m

in

remainder

of

FY

‘12,

$147m

in

FY

‘13

and

$24m

in

FY

’14.

…. AND MORE TO COME

…. AND MORE TO COME

…. AND MORE TO COME

Estimated delivery schedule – 25 in FY ‘12, 11 in FY ‘13 and 4 thereafter. |

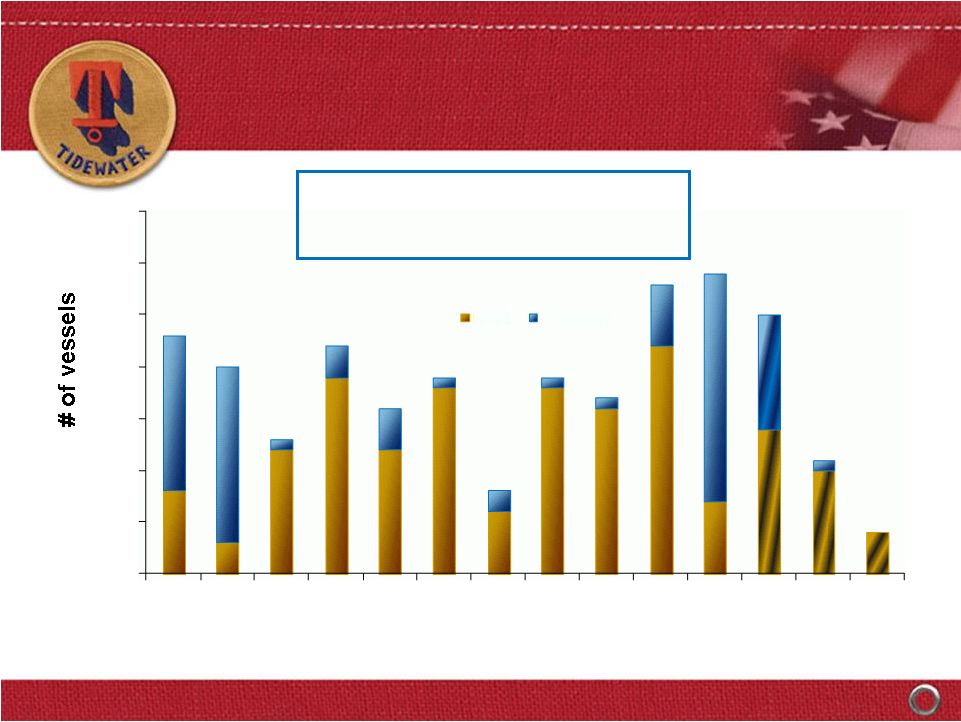

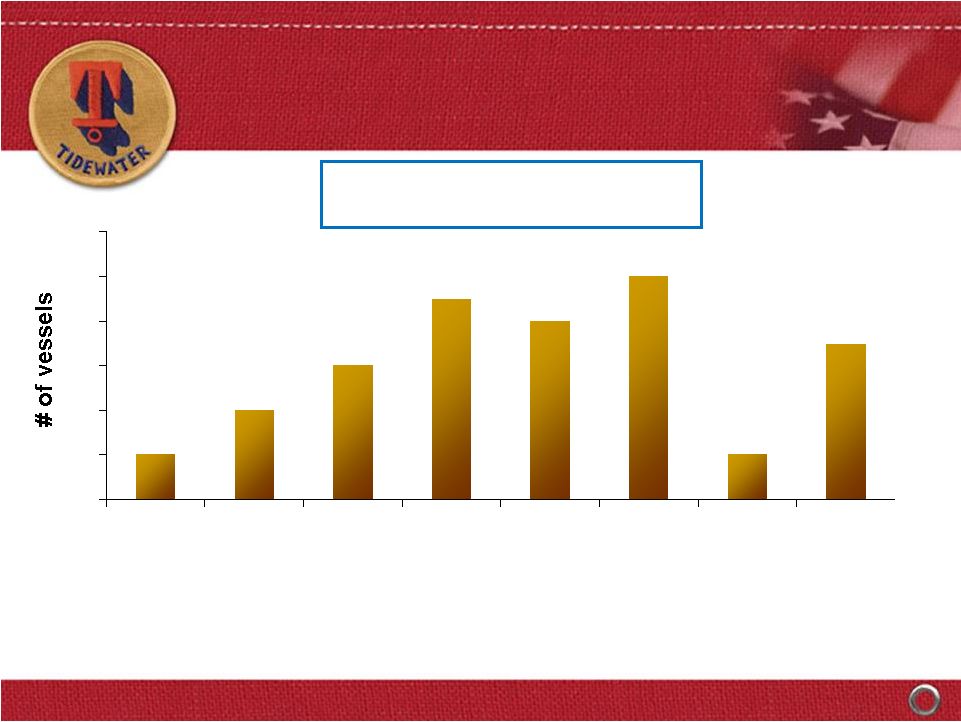

13

Fiscal Year

Actual vessel deliveries through 6/30/11; estimated vessel deliveries based on

commitments to build or acquire as of 6/30/11

THROUGH-CYCLE, EVA-BASED INVESTMENT;

BALANCE BETWEEN “BUY”

and “BUILD”

THROUGH-CYCLE, EVA-BASED INVESTMENT;

THROUGH-CYCLE, EVA-BASED INVESTMENT;

BALANCE BETWEEN “BUY”

BALANCE BETWEEN “BUY”

and “BUILD”

and “BUILD”

0

5

10

15

20

25

30

35

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

Built

Acquired

Through

6/30/11,

vessel

commitments

include

257

vessels

with

a

capital

cost

of

$3.925

billion |

14

RECENT VESSEL COMMITMENTS

RECENT VESSEL COMMITMENTS

RECENT VESSEL COMMITMENTS

0

2

4

6

8

10

12

9/30/09

Qtr

12/31/09

Qtr

3/31/10

Qtr

6/30/10

Qtr

9/30/10

Qtr

12/31/10

Qtr

3/31/11

Qtr

6/30/11

Qtr

Amounts

depict

vessel

count

and

total

cost

in

quarter

commitment

was

made

to

acquire

(not

when

delivery

or

payments

were

made)

$96M

$55M

$72M

$179M

1 MPSV

1 PSV

4 AHTS

6 AHTS

6 AHTS

3 PSV’s

48 vessels over last two years with

a total capital cost of $958 million

$177M

4 PSV’s

4 AHTS

1 PSV

9 AHTS

$139M

$101M

2 PSV’s

4 PSV

3 AHTS

$139M |

15

Over

a

12-year

period,

Tidewater

has

invested

$3.8

billion

in

CapEx

($3.3

billion

in

the

“new”

fleet),

and paid out $995 million through dividends and share repurchases. Over the

same period, CFFO and proceeds from dispositions were $3.4 billion and $690

million, respectively $0

$100

$200

$300

$400

$500

$600

$700

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

CAPX

Dividend

Share Repurchase

$ in millions

CFFO

Fiscal Year

FLEET RENEWAL & EXPANSION

FUNDED BY CFFO THROUGH FISCAL 2011

FLEET RENEWAL & EXPANSION

FLEET RENEWAL & EXPANSION

FUNDED BY CFFO THROUGH FISCAL 2011

FUNDED BY CFFO THROUGH FISCAL 2011 |

16

Senior Unsecured Notes

$590 million

Average Life to Maturity (as of 9/30/11)

~ 8.5 years

Weighted Average Coupon

4.30%

Term Loan

$125 million

Revolving Line of Credit

$450 million

Remaining Term

~ 4½

years

Interest Rate

LIBOR plus 1.5% to

2.25%, based on leverage

Private Placement Financings:

Private Placement Financings:

New Credit Facilities:

New Credit Facilities:

~ $40 million in senior notes maturities in Fiscal 2012 (July)

RECENT FINANCINGS WILL FUND GROWTH

AT AN ATTRACTIVE RELATIVE COST

RECENT FINANCINGS WILL FUND GROWTH

RECENT FINANCINGS WILL FUND GROWTH

AT AN ATTRACTIVE RELATIVE COST

AT AN ATTRACTIVE RELATIVE COST |

17

Pro Forma as of June 30, 2011 *

Cash & Cash Equivalents

$321 million

Total Debt

$825 million

Shareholders Equity

$2,528 million

Net Debt / Net Capitalization

17%

Total Debt / Capitalization

25%

* Pro forma based on (i) $165 million private placement financing completed in August

2011 and (ii) $40 million in senior note maturities in July 2011. Pro Forma

liquidity as of 6/30/11 of ~$900 million includes $575 million available under

bank credit facilities. STRONG FINANCIAL POSITION

PROVIDES STRATEGIC OPTIONALITY

STRONG FINANCIAL POSITION

STRONG FINANCIAL POSITION

PROVIDES STRATEGIC OPTIONALITY

PROVIDES STRATEGIC OPTIONALITY |

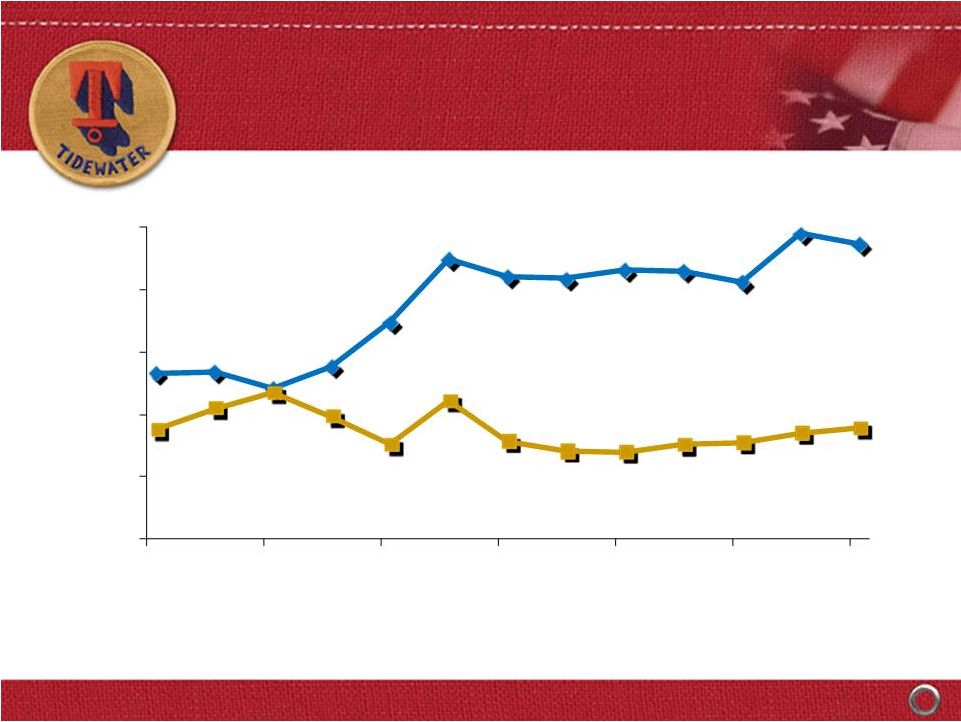

18

FLEET CASH OPERATING MARGINS

FLEET CASH OPERATING MARGINS

FLEET CASH OPERATING MARGINS

Traditional Vessels

New Vessels

Cash Oper Margin

38.6% 37.6% 46.5%

41.9%

36.9% 38.7% 49.1%

54.6%

51.9% 51.3% 46.8%

39.3%

Note:

Cash

operating

margins

are

defined

as

vessel

revenue

less

vessel

operating

expenses

Fiscal Years

$0

$100

$200

$300

$400

$500

$600

$700

$800

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011 |

19

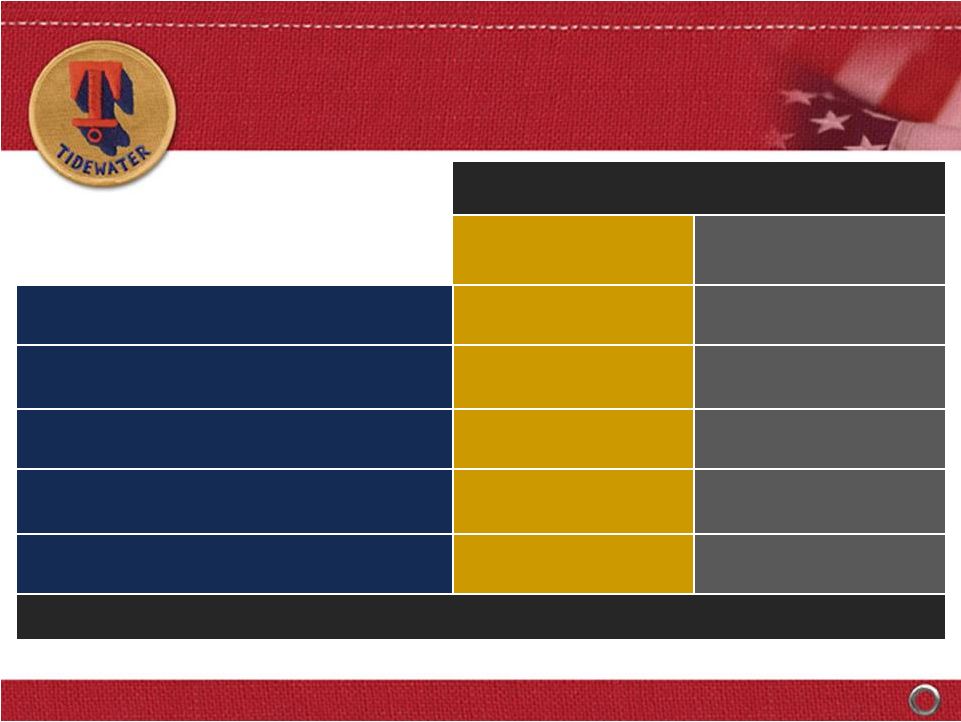

WHERE COULD FISCAL 2014 FIND US?

Potential for Earnings Acceleration

WHERE COULD FISCAL 2014 FIND US?

WHERE COULD FISCAL 2014 FIND US?

Potential for Earnings Acceleration

Potential for Earnings Acceleration

Avg. Dayrates

$14,091*

$15,500

(+ 10%)

$17,050

(+ 10%)

84.4%*

85.0%

90.0%

~$3.50

EPS

~$5.25

EPS

~$8.75

EPS

271 vessel assumption (196 current new vessels + 40 under construction + ~ 20

additional new vessels per year for two years).

* 6/30/11 quarterly actual stats

This info is not meant to be a

prediction of future earnings

performance, but simply an

indication of earning sensitivities

resulting from future fleet

additions and reductions and

varying operating assumptions

~$400M+

EBITDA

~$500M

EBITDA

~$700M

EBITDA |

20

FINANCIAL STRATEGY FOCUSED

ON CREATING LONG-TERM

SHAREHOLDER VALUE

FINANCIAL STRATEGY FOCUSED

FINANCIAL STRATEGY FOCUSED

ON CREATING LONG-TERM

ON CREATING LONG-TERM

SHAREHOLDER VALUE

SHAREHOLDER VALUE

Maintain

Maintain

Financial Strength

Financial Strength

EVA-Based Investments

EVA-Based Investments

On Through-cycle Basis

On Through-cycle Basis

Deliver Results

Deliver Results |

2011

JOHNSON RICE ENERGY CONFERENCE

Oct. 4, 2011

DEAN E. TAYLOR

DEAN E. TAYLOR

Chairman, President and CEO

Chairman, President and CEO

JOSEPH M. BENNETT

JOSEPH M. BENNETT

Executive VP and Chief

Executive VP and Chief

Investor Relations Officer

Investor Relations Officer |

22

APPENDIX |

23

Quarter Ended

6/30/11

6/30/10

Revenues

$255

$263

Net Earnings

$25

$40

EPS

$0.48

$0.77

Net Cash from Operations

$27

$53

Capital Expenditures

$70

$141

$ in Millions, Except Per Share Data

RECENT FINANCIAL RESULTS

REFLECT CYCLICAL DOWNTURN

RECENT FINANCIAL RESULTS

RECENT FINANCIAL RESULTS

REFLECT CYCLICAL DOWNTURN

REFLECT CYCLICAL DOWNTURN |

24

Source: ODS-Petrodata and Tidewater

GOM

accounts

for

34

of

the

54

working

jackup

count

variance

from

June

2008

(Peak) to August 2011 (post-Horizon)

GOM Semi & Drillship count drops by 7 units (from 31 to 24) between April 2010

and August 2011; offset by an increase of 23 units in the rest of world

Jackups

Semis

Drillships

Total

June 2008

(Peak)

379

145

30

554

Late-April 2010

(pre-Horizon)

323

150

46

519

August 2011

(post-Horizon)

325

159

53

537

WORKING RIG COUNTS

“Peak to Present”

WORKING RIG COUNTS

WORKING RIG COUNTS

“Peak to Present”

“Peak to Present” |

25

Other Operators

Top 10 Customers

Tidewater’s top 10 customers contract ~24% of the working worldwide

jackup fleet and ~50% of the working worldwide floater fleet

Jackups

(325 Working Rigs)

Floater Rigs

(212 Working Rigs)

78

247

107

Source: ODS-Petrodata and Tidewater

Other Operators

Top 10 customers

105

RIGS CONTRACTED BY OUR

RIGS CONTRACTED BY OUR

TOP 10 CUSTOMERS

TOP 10 CUSTOMERS

(Estimated as of August 2011)

(Estimated as of August 2011) |

26

Source: ODS-Petrodata and Tidewater

As of late-August 2011, there are approximately 456 additional AHTS and

PSV’s (~17% of the global fleet) under construction.

Vessels > 25 years old today

THE WORLDWIDE OSV FLEET –

RETIREMENTS

EXPECTED TO EXCEED NEW DELIVERIES

(Includes AHTS and PSV’s only) Estimated as of August 2011

0

50

100

150

200

250

300

1965

1970

1975

1980

1985

1990

1995

2000

2005

2010

Global fleet estimated at 2,640 vessels, including

348 vessels that are 30+ yrs old (13%), and another 410 vessels that are 25-29 yrs old (16%)

|

27

SIGNIFICANT AVERAGE

AGE IMPROVEMENT

SIGNIFICANT AVERAGE

SIGNIFICANT AVERAGE

AGE IMPROVEMENT

AGE IMPROVEMENT

Assumptions: 1) Average

45

vessel

disposals

per

year

in

future

(versus

an

average

of

52

vessel

dispositions

per

year

over

last

3

years).

20

16

6

0

5

10

15

20

3/31/06

3/31/07

3/31/08

12/31/08

12/31/09

12/31/10

12/31/11

12/31/12

12/31/13

12/31/14

Includes 40 vessels under construction, including 12 vessel purchase commitments (based on current

estimated delivery schedule), plus additional newbuilds/acquisitions of ~20 vessels per

year (approximately $500 million in new capital commitments per year). Tidewater is not committed to spending $500 million annually, but we use this

assumption in estimating average fleet age in the future.

2) |

28

* Dayrate and utilization information is for all classes of vessels operating

international $100 change in dayrate = ~$7.9M in annual revenue

1% change in utilization = ~$15.1M in annual revenue

INTERNATIONAL VESSELS

Dayrates and Utilization

INTERNATIONAL VESSELS

INTERNATIONAL VESSELS

Dayrates and Utilization

Dayrates and Utilization

50%

60%

70%

80%

90%

Dayrate

Utilization

$4,000

$6,000

$8,000

$10,000

$12

000

$14

,000

,

6/08

12/08

6/

09

12/09

6/

10

12/10

6/11 |

29

INTERNATIONAL VESSELS

INTERNATIONAL VESSELS

DAYRATES

DAYRATES

* Dayrate and utilization information is for all classes of vessels operating

international $3,000

$6,000

$9,000

$12,000

$15,000

$18,000

06/08

12/08

06/09

12/09

06/10

12/10

06/11

New Vessels

Traditional Vessels |

30

DOMESTIC VESSELS

Dayrates and Utilization

DOMESTIC VESSELS

DOMESTIC VESSELS

Dayrates and Utilization

Dayrates and Utilization

* Dayrate and utilization information is for all classes of vessels operating in the

U.S. $4,000

$9,000

$14,000

$19,000

30%

50%

70%

90%

6/08

12/08

6/09

12/09

6/10

12/10

6/11

Dayrate

Utilization |

31

DOMESTIC VESSEL DAYRATES

DOMESTIC VESSEL DAYRATES

DOMESTIC VESSEL DAYRATES

* Dayrate and utilization information is for all classes of vessels operating in the

U.S. $4,000

$8,000

$12,000

$16,000

$20,000

$24,000

06/08

12/08

06/09

12/09

06/10

12/10

06/11

New Vessels

Traditional Vessels |

32

OSX 42%

S&P 500 14%

DJIA 27%

TDW 18%

RETURNS vs the MARKET

FIVE YEAR STOCKHOLDER RETURN

RETURNS vs the MARKET

RETURNS vs the MARKET

FIVE YEAR STOCKHOLDER RETURN

FIVE YEAR STOCKHOLDER RETURN

-60.0%

-40.0%

-20.0%

0.0%

20.0%

40.0%

60.0%

80.0%

TDW

DJIA

S&P 500

OSX |