Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - Xinde Technology Co | v235799_ex31-1.htm |

| EX-32.1 - EXHIBIT 32.1 - Xinde Technology Co | v235799_ex32-1.htm |

| EX-32.2 - EXHIBIT 32.2 - Xinde Technology Co | v235799_ex32-2.htm |

| EX-31.2 - EXHIBIT 31.2 - Xinde Technology Co | v235799_ex31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

x

|

ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended: June 30, 2011

or

|

o

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ______ to __________

Commission file number: 000-53672

XINDE TECHNOLOGY COMPANY

(Exact name of registrant as specified in its charter)

|

Nevada

|

20-8121712

|

|

|

(State or other jurisdiction of

|

(IRS Employer

|

|

|

incorporation or organization)

|

Identification No.)

|

Number 363, Sheng Li West Street, Weifang, Shandong Province,

The People’s Republic of China

(Address of principal executive offices)

(011) 86-536-8322068

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class: None

|

Name of each exchange on which registered: None

|

|

Securities registered pursuant to Section 12(g) of the Act:

|

|

|

Common Stock, par value $0.001 per share

|

|

|

(Title of class)

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

|

Large Accelerated Filer o

|

Accelerated Filer o

|

Non-Accelerated Filer o

|

Smaller Reporting Company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $65,348,000

Indicate the numbers of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: As of September 27, 2011 (post 4-for-1 forward stock split on April 14, 2011), the registrant had 240,000,000 shares of common stock, par value $0.001 per share, issued and outstanding.

Documents incorporated by reference: None

TABLE OF CONTENTS

|

PART I

|

|

|

ITEM 1. BUSINESS.

|

3

|

|

ITEM 2. PROPERTIES.

|

13

|

|

ITEM 3. LEGAL PROCEEDINGS.

|

14

|

|

ITEM 4. (REMOVED AND RESERVED).

|

14

|

|

PART II

|

|

|

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

|

15

|

|

ITEM 6. SELECTED FINANCIAL DATA.

|

17

|

|

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

|

17

|

|

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

|

27

|

|

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

|

27

|

|

ITEM 9. CHANGES AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE.

|

28

|

|

ITEM 9A. CONTROLS AND PROCEDURES.

|

28

|

|

PART III

|

|

|

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE.

|

30

|

|

ITEM 11. EXECUTIVE COMPENSATION.

|

35

|

|

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS.

|

36

|

|

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE.

|

37

|

|

ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES.

|

37

|

|

PART IV

|

|

|

ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES.

|

37

|

2

XINDE TECHNOLOGY COMPANY

Forward Looking Statements

The following Annual Report on Form 10-K (this “Report”) of Xinde Technology Company (the “Company”, “Xinde”, the “Registrant”, “we”, “us”, or “our”) contains forward-looking statements. Generally, the words “believes”, “anticipates”, “may”, “will”, “should”, “expect”, “intend”, “estimate”, “continue” and similar expressions or the negative thereof or comparable terminology are intended to identify forward-looking statements. Such statements are subject to certain risks and uncertainties, including the matters set forth in this Report or other reports or documents we file with the SEC from time to time, which could cause actual results or outcomes to differ materially from those projected. Undue reliance should not be placed on these forward-looking statements which speak only as of the date hereof. We undertake no obligation to update these forward-looking statements except as otherwise required by law.

ITEM 1. BUSINESS

The December 2009 Share Exchange Transaction

On December 28, 2009, the Company entered into a share exchange agreement, or the Exchange Agreement, with Jolly Promise Limited, an investment holding company organized under the laws of the British Virgin Islands (“Jolly”) and the stockholder of Jolly, Welldone Pacific Limited, a limited company organized under the laws of the British Virgin Islands (“Welldone” or the “Stockholder”). As a result of the share exchange, or the Exchange, the Company acquired all of the issued and outstanding securities of Jolly from Welldone in exchange for 42,000,000 newly-issued shares of the Company’s common stock, par value $0.001 per share (“Common Stock”). Immediately following the Exchange, the Stockholder owned 70% of the 60,000,000 then-issued and outstanding shares of voting capital stock of the Company (as of the date hereof, the Company has 240,000,000 shares issued and outstanding as a result of a 4-for-1 forward stock split of the Common Stock effective on April 14, 2011). As a result of the Exchange, Jolly became a wholly-owned subsidiary of the Company.

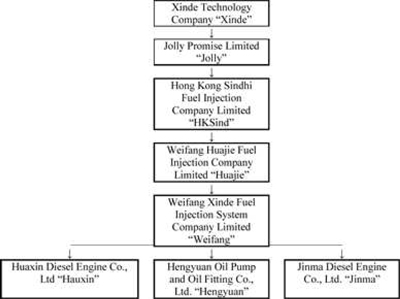

Following the Exchange, the corporate structure of the Company consisted of Jolly, a wholly-owned subsidiary of the Company, Jolly’s wholly-owned subsidiary, Hong Kong Sindhi Fuel Injection Company Limited, a Hong Kong company (“HKSind”), HKSind’s wholly-owned subsidiary, Weifang Huajie Fuel Injection Company Limited, a People’s Republic of China or PRC company (“Huajie”), Huajie’s wholly-owned subsidiary, Weifang Xinde Fuel Injection System Company Limited, a PRC company (“Weifang”) and Weifang’s wholly-owned subsidiaries, Huaxin Diesel Engine Co., Ltd., a PRC company (“Huaxin”), Hengyuan Oil Pump and Oil Fitting Co., Ltd., a PRC company (“Hengyuan”) and Jinma Diesel Engine Co., Ltd., a PRC company (“Jinma” and together with Jolly, HKSind, Huajie, Weifang, Huaxin and Hengyuan, the “Subsidiaries”). The principal business activities of the Company and its Subsidiaries consist of the production and marketing of fuel injection systems, non-vehicle diesel engines, and diesel generator technology. The above described corporate structure is illustrated below:

3

On April 22, 2010, the Company held a special meeting of its stockholders. At the special meeting, the Company’s stockholders approved, by the requisite number of votes, to change the Company’s name from “Wasatch Food Services, Inc.” to “Xinde Technology Company”.

On April 7, 2011, the Company held a special meeting of its stockholders whereby the stockholders approved, by the requisite number of votes, (a) the proposal to increase the amount of the Company’s Common Stock from 150,000,000 shares to 350,000,000 shares and (b) the proposal to effect a 4-for-1 forward stock split of the Company’s outstanding Common Stock. The forward stock split became effective on April 14, 2011.

Summary of the Company’s Current Business

The Company operates in one business segment, the design, development, manufacture, and commercialization of fuel injection pumps, injectors, multi-cylinder diesel engines and small generator units mainly in the People’s Republic of China. However, our products compete in three primary product segments, namely (1) fuel injection system products, (2) diesel engine products and (3) generator products. We believe our broad range of products (including non-vehicle diesel engines, diesel generators, injection pumps, injectors and three-coupling components, and agricultural machinery and construction machinery) increases our competitiveness.

The Company is based in China’s Shandong Province in the city of Weifang where many large and medium-sized diesel engine enterprises and related products and components manufacturers are located. Weifang is also an important traffic center on the east coast in northern China. We believe our location makes the purchase of raw materials and sales of our products very convenient and reduces the costs associated with sales while reducing freight costs.

We have developed fuel injection system products that we believe will meet the Euro III Emissions Standard, which will become most relevant in light of China’s initiative to implement the Euro III Emissions Standard in 2010. Furthermore, we believe that we are China’s only company with exclusive intellectual property rights for fuel injection systems meeting such Euro III Emissions Standard which could lead to broad market appeal. Due to our strict technical standards and quality control in production process, our products have become well-known brands in their markets throughout China. Our Company has always placed quality control first and we received our ISO9001 certification in 2005.

Our products feature a cost and price advantage arising from our independently owned intellectual property. For example, our integrated electromechanical electronically-controlled high-pressure fuel injection system with common rail sells for RMB7,000 (US$1,029) per set as compared with products produced by some of our largest competitors (BOSCH and DENSO) which offer comparable products for RMB15,000 (US$2,011) per set. As a result, we believe such products will gain market share and be instrumental in improving our competitive position and brand influence.

4

We also have a long-term relationship with Tianjin University’s Combustion Laboratory of Combustion Engines, a national key laboratory located in Tianjin, China, which contributes to our growing expertise and reputation in the field of integrated electromechanical electronically-controlled high-pressure fuel injection systems with common rail in China. In addition, we have an experienced team of in-house technicians which contributes to our product’s technical content and ultimately, our core competitiveness.

Through independent development, cooperation and introduction, we have developed a variety of diesel engine injector assemblies for Sitair, 170, 190 and 105 models as well as multi-cylinder No. 1, BX, BXD, IIW and DT12/24-10X (electronic regulator) injection pump assemblies and oil transfer pumps. In addition, we have fully acquired the production process and technology for EGR (Exhaust Gas Recirculation) diesel engines and gas power generators that are in growing demand in the marketplace.

Each of our Subsidiaries has its own marketing network. The Company’s goal is to utilize each of such networks to create a countrywide network. The Company has made its after-sales service a priority, setting up a special after-sales service management department to provide users with after-sales services.

Our principal offices are located at Number 363, Sheng Li West Street, Weifang, Shandong Province, The People’s Republic of China, Telephone: (86) 536-8322068, Facsimile: (86) 852-28450504. Our Company website is located at http://www.chinaxinde.cn/

Our Products

General

The Company’s existing products consist of ten series of more than 100 models, including a multi-cylinder oil pump assembly, an electronically-controlled multi-cylinder injection pump assembly, a single-cylinder injection pump assembly, an injection assembly, an oil-transfer pump assembly, coupling plungers, coupling injectors, coupling delivery valves, offset press and multi-cylinder diesel engines (including a diesel generator set, construction machinery, agricultural machinery, air compressors and rigidly-fixed power machines). The Company has developed a variety of diesel engine injector assemblies and multi-cylinder I, BX, BXD, IIW, DT12/24-10X (electron speed regulator) injector assemblies and oil transfer pumps. Set forth below is a brief description of our fuel injection system, diesel engine and generator products.

Fuel Injection System Products

Our fuel injection system products are a core component of diesel engines and are used in heavy, medium and light-duty vehicle diesel engines (including those used in mining, agricultural and construction machinery). We were recognized as a leader with respect to the technology of oil pump and fuel injection systems by the China Diesel Industrial Catalog 2007. For example, our DG-T2 digital electronically-controlled oil pump has sold very well since its development four years ago, with over 30,000 sets being sold from June 30, 2010 to June 30, 2011. The product can reduce oil consumption and pollution emissions of diesel engines and has become a new-generation oil supply product for modern diesel engines.

One of our main fuel injection system products is our electronically-controlled fuel system with common rail which we developed in conjunction with Tianjin University. In order to resolve traditional problems with respect to diesel engines such as high noise and hazardous tailpipe gas emissions, the European community, the U.S. and Japan have applied electronic control technology to vehicle diesel engines. Compared with traditional diesel engines, electronically-controlled diesel engines exhibit improvements in power performance, economic efficiency, emissions and noise indexes. Furthermore, high-pressure “common rail” technology is an oil supply method that separates injection pressure generation from the injection process in a closed loop system composed of high-pressure oil pumps, pressure sensors and electronic control units. In this method, a high-pressure oil pump transmits pressed fuel to common fuel supply lines and exhibits precise control over fuel pressure to realize fuel line pressure independent of the revolution speed of the engine. This technology considerably reduces the change of fuel supply pressure on the revolution speed of engines and, ultimately, remedies the drawbacks of traditional diesel engines with respect to high noise and hazardous emissions.

5

As governments begin to pay more attention to environmental protection concerns, stricter requirements are being established for the performance of diesel engines with regard to their pollutant emissions and economic fuel efficiency. Emissions standards are requirements that set specific limits to the amount of pollutants that can be released into the environment. The European Union has its own set of emissions standards that all new vehicles must meet, commonly referred to as Euro Standards. Currently, emissions standards are set for all road vehicles, trains, barges and non-road mobile machinery (such as tractors). As China’s wealth expands, the number of coal power plants and cars on China’s roads is also growing, creating an ongoing pollution problem. China enacted its first emissions controls on automobiles in 2000 which were equivalent to the Euro I Standard. China’s State Environmental Protection Administration, or SEPA, upgraded emission controls again on July 1, 2004 to the Euro II Emissions Standard. A more stringent emission standard, National Standard III, the equivalent of Euro III Emissions Standard, went into effect on July 1, 2007.

The Euro IV Emissions Standard is scheduled to take effect in 2012. Beijing introduced the Euro IV Emissions Standard on January 1, 2008, and thus became the first city in mainland China to adopt this standard. Due the fact that our product has passed all of the applicable professional tests administered by the Chinese National Laboratory, we believe that our integrated electromechanical high-pressure electronically-controlled fuel injection system with common rail will fully meet the Euro III Emissions Standard in China once fully implemented. We hold exclusive intellectual property rights to the technology. We believe that only our electronically-controlled fuel injection systems with common rail can currently meet the Euro III and IV Emission Standards. With extensive implementation of the Euro III Standard in China, we believe that our products will be well positioned. We intend to achieve even higher standards (such as Euro IV and V Emission Standards) through technological up-grading. Furthermore, in light of the fact that the most comparable products used in China are produced by foreign companies such as BOSCH and DENSO, we believe there is no compatible domestic product has been put into production in China.

Diesel Engine Products

Our vehicle diesel engines with electronic protective units feature automatic protection for abnormal situations in the vehicle’s running process, including over-speed protection, low oil pressure protection, high water temperature protection, overload protection and low voltage protection. This can ensure an effective operation of the diesel engine without it being monitored. We have manufactured vehicle diesel engine products in small volume to supply the international market, and our technology has reached internationally advanced levels having achieved ISO9001 qualification. In the near future, we intend to strengthen our marketing and sales efforts in the international market for these products. Our diesel engine products generated 34 %, 36% and 51% of the Company’s revenues in the fiscal years ended June 30, 2011, 2010 and 2009, respectively.

We are currently devoting significant efforts to develop electronically-controlled non-vehicle diesel engines, including engines with electronic protecting units. Both are small and medium-sized non-vehicle diesel engines (12kW~250kW). Our non-vehicle diesel engine products currently include four-cylinder and six-cylinder engines, with output power ranging from 15kW to 250kW. These products have been widely used to power generators, agricultural machinery and construction machinery. Our product models are as follows:

• For power generators: K4100D\K4100ZD\R6105ZD\R6113ZLD\HR6126CD

• For construction machinery: K4100G\K4100G2\R6105G\R4100Y\HR6126G

• For agricultural machinery: R4105T\R6105K

Due to intense market competition with respect to vehicle diesel engines, some large diesel engine enterprises such as Weichai Power Co., Ltd. and Shanghai Diesel Engine Co., Ltd. focus on producing vehicle diesel engines. We have not been able to identify any leading enterprises that produce non-vehicle diesel engines in China according to our research regarding the national industrial market. Therefore, the Company intends to create such a market through the production of small and medium-sized non-vehicle diesel engines. In April 2010, the Company launched its new Huaxin “Zhongkang” 6CT/6LT product line which consists of smaller, lighter highly reliable and fuel efficient diesel engines. Till June 30,2011, over 1,100 generator construction machineries had been produced by the product line and contribute $8,449,259 of the revenue.

6

Diesel generators have traditionally been in a short supply in China. From 2004 to 2005, diesel generators were out of stock in the Chinese market and remained a scarce commodity as described in China Statistical Yearbook 2005. In China, the annual demand for diesel generators was approximately 800,000 sets according to national industrial market research in 2009. Our Company receives orders for 80,000 sets each year however our production capacity is only about 20,000 sets each year. Therefore, the demand for our generator products greatly exceeds the supply. Our generator products generated 18%, 27% and 3% of the Company’s revenues in the fiscal years ended June 30, 2011, 2010 and 2009, respectively.

Furthermore, the net profit of such product can reach approximately 18%, so we believe the profit margin is very attractive. According to an authoritative investigation, China’s power demand has increased by 20% each year however the power supply increased only by 2% each year over the past 5 years quoted from the China industrial Statistical Yearbook. We are therefore optimistic that demand for diesel engines for power generation and engineering construction may see significant growth over the next ten years. Our diesel generator set can meet extensive service requirements and may be used for:

• basic energy supply of public facilities to meet power demands;

• emergency power supply of public facilities to provide uninterrupted power supply to workshops, public utilities and commercial mansions;

• mobile and portable power supply;

• auxiliary power supply for ships to meet power needs of auxiliary devices;

• peak load absorption units to absorb peak loads at peak hours; and

• joint power and heat supply units to provide power, heat and cold energy to office buildings.

We are currently developing an “intelligent” generator set which is a fully automatic intelligent power station that integrates self-monitoring, site machine room monitoring and remote computer monitoring. Such generator implements full automatic control at the start-up phase, shut-down phase, state monitoring and on-line control. This product is suitable for self-closing unit control systems under unmanned operation or remote computer operations. Its specific advantages are as follows:

• Automatic start or the occurrence of electricity failure and automatic connection with civil power network. When the external power supply recovers, the product will automatically shut down. As a result, it is suitable for use in hospitals, banks, machine rooms, communities and hotels;

• Four self-protection functions. In the event of excessively high water temperature, high oil temperature, low oil pressure, over-speed, overload on account of loss of pressure, or short circuit and start failure, the protection device will give sound and light warnings and automatically stop the machine.

• Remote control function. The unit has a remote control interface and effectuates remote control, remote measurement and remote communication. This can automate office control of the unit “operation” and automated power station without human monitoring.

• Intelligent fully-automatic remote control power station with low noise (green power supply). This unit is suitable for the user who requires strict noise control. The unit mute shell is made of high-quality steel plate, resistant to corrosion, with high-efficient acoustical material inside. This can effectively reduce noise. In addition, shock pack is installed at bottom of each unit to reduce the shock of unit.

Distribution Methods

We have established nationwide marketing and after-sale service networks in China. We have established more than 20 branches throughout China, including branches in Fu’an, Guangzhou, Dongguan, Jiangdu, Chengdu, Chongqing, Kunming, Taiyuan, Shenyang, Changsha and Urumchi. The Company employs agents throughout China, who receive commissions on the amount of products that they help the Company to sell. Agreements with such agents are generally formed during national trade fairs or other types of trade exhibitions. We pay for transportation expenses and the products are generally delivered via road vehicles.

7

Mobile technicians operate our after-sales network. Each is assigned to a different geographical area.

For the fiscal years ended June 30, 2009, 2010 and 2011, distribution of our products through our 3 largest distributors accounted for approximately 7.4%, 9.4% and 7.5 % of our total annual sales, respectively.

Sources and Availability of Raw Materials from Suppliers

For the fiscal years ended June 30, 2011, we had one supplier accounted slightly over 10% of the Company’s purchases, which was 10.4%, and no single supplier accounted for more than 10% of the Company’s accounts payable in the same time period. No single supplier accounted for more than 10% of the Company’s purchases and accounts payable for the years ended June 30, 2011.

Key Customers

No single customer accounted for more than 10% of the Company’s total revenue or accounts receivable for the years ended June 30, 2011 and 2010.

Competition and Market Share

The following sections discuss the competitive environment that the Company navigates with respect to its fuel injection system, diesel engine and diesel generator products.

Fuel Injection Systems Market

According to our market research, there are more than 70 companies that produce fuel injection systems in China (with the exception of small enterprises that are specialized in rough manufacturing for the large and medium-sized oil pump and nozzle enterprises). From January to November in 2010, the whole industrial sector manufactured 6,760,000 multi-cylinder injection pumps, to an increase of 15.43%.

In recent years, there were considerable heavy-duty truck overloads in many districts (trucks filled beyond their mandatory capacity limit). In order to maintain the restrictions on overruns and overloads, China’s Ministry of Transport has stressed the importance of strengthening restrictions on overruns and overloads so that greater safety may be achieved. Undoubtedly, such news favors the market of 12~19t which had not been prosperous in the past.

The rural transport markets and urban logistics markets have great demand for light trucks, specifically special light trucks. The light trucks are becoming a popular form of rural transporting because they are environment friendly, have high maneuverability and good safety records. This contributes to the increase in the sales volume of light trucks. In addition, the upgrading of agricultural trucks and an increase in income of farmers may improve the demand for medium-sized trucks. As coal, power and oil industries continue to expand, the demand for heavy and medium-duty trucks is likely to expand. Moreover, China’s heavy-duty trucks have high performance-price ratios, and the prices present an advantage in the global market.

China strengthened the construction and improvement of its public bus system, which may contribute to an increase in the development of urban buses. In addition, the tourism industry has become increasingly prosperous in China, which promotes a demand for tourist buses. The majority of public and tourist buses are large-scale passenger buses, and as a result of our products usefulness for these vehicles, we believe that our products will continue to sell well for such purposes.

Despite rapid growth of China’s diesel engine vehicles, the fuel injection systems mostly adopt foreign technology and imports from foreign countries. And now, some Chinese manufacturers are developing diesel engines for cars, but there will be quite a few years before industrial production occurs. Therefore, our future objective is to realize localization of fuel injection systems and lead the market.

8

As emission controls become stricter, electronically-controlled fuel injection systems will likely be in great demand. In China, some universities and hi-tech enterprises have conducted experimental research in electronically-controlled fuel injection systems, but few have achieved substantial progress. According to an analysis report generated from http://www.cndata100.com, it is estimated that there will be an increase in production of electronically-controlled fuel injection system products in the following three to seven years.

We do not hold a significant or reportable share of the fuel injection system market. Currently, domestic fuel injection systems face competition from large international enterprises. BOSCH Automotive Diesel Systems Co., Ltd. is a joint stock company invested by BOSCH and Weifu Group, which produces injector assemblies, injection coupling components and electronically-controlled fuel injection systems. Depending on advanced technology and strong capital strength, BOSCH Automotive Diesel Systems Co., Ltd. has a dominant position in China’s fuel injection system market. In addition, DENSO (Japan) and Shanghai Yiwei jointly invested to establish DENSO (Shanghai) Fuel Injection System Co., Ltd. Once the Chinese market needs electronically-controlled fuel injection system products, DENSO will hold the aforesaid company and its products will enter into Chinese market through such company. Meanwhile, Delphi Corporation is also seeking opportunities to establish a wholly-controlled or joint venture company. These large international companies are all attracted to the Chinese market. However, due to high prices of their products, we believe this leaves a tremendous opportunity for our products.

Diesel Engine Market

Diesel engines are the main power source for automobiles, agricultural machinery, construction machinery, ships, diesel locomotives, geological and oil drilling, military equipment, general-purpose machinery, mobile and spare power stations. As a result, the development of the diesel engine industry has an important impact on China’s industry, agriculture, transportation, national defense, construction and the life of urban and rural residents.

We do not hold a significant or reportable share of China’s diesel engine manufacturing market. However, we believe that the demand for energy saving and emissions reduction bring tremendous opportunity to the diesel engine industry and our business. Electronically-controlled fuel injection systems are the heart of diesel engines and they directly control the emissions level and comprehensive performance of engine. With China’s formal implementation of the National Standard III Emission regulation (the Euro III Emissions Standard equivalent in China) on July 1, 2007, electronically-controlled fuel injection systems are likely to replace mechanical fuel injection systems. Driven by the continuously increasing diesel engine market, the demand for electronically-controlled fuel injection systems for diesel engines keeps growing. As a result of the issuance of the national supporting policy and measures and the improvement of laws and regulations, we believe that the domestic market of electronically-controlled fuel injection system of diesel engines have a great development opportunity.

According to the Chinese government’s working report regarding its Eleventh Five-Year Plan, the annual demand for single-cylinder diesel engines is about 9,000,000~10,000,000 sets; the annual demand for multi-cylinder diesel engines installed in agricultural vehicles, large and medium-sized tractor and large agricultural machinery is approximately 880,000 ~ 1,100,000 sets; for automobiles, about 2,400,000~2,500,000 sets; large and medium-sized construction machinery, about 500,000 sets; large and medium-power ship and generators, approximately 500,000~700,000 sets. Further, it is expected that the diesel engine market will remain at a growth rate of ten percent (10%) during the Twelfth Five-Year Plan.

Our energy-saving diesel engines are mostly aimed at small agricultural machinery, construction machinery, small and medium-sized ship and generator sets. However, we believe that under the promotion of China’s policy for stimulating domestic demand and improving rural labor force, the market demand for diesel engines will keep increasing with the increase in the need of the abovementioned equipment.

Agricultural Machinery

According a report from http://www.cnki.com.cn , the total demand for large and medium-sized tractors continued to rise in 2011.In the first half year of 2011, the accumulated production value of tractors has reached 130 billion RMB, which increased by 20% from the same period in the previous year. The combustion engine market grew in coordination with agricultural, livestock, processing, transporting and construction machinery.

9

Since 2008, the Chinese central government has issued policies in favor of agriculture. This pushed forward the development of the market. The government subsidy for agricultural machinery stimulated market demand. Since China’s implementation of a subsidy policy for purchasing agricultural machinery in 2004, the central financial subsidy was increased by 190.48% every year on average, and exceeded RMB15 billion in 2010, with the subsidy’s scope expanding from sixty-six main grain production counties in sixteen provinces, regions and municipalities in 2004 to all agricultural livestock counties (farms) in 2010. More farmers and herdsmen benefited from the subsidy, and the types of subsidized implements increased to nine varieties including thirty-three types. Moreover, local governments are permitted to include on their own five other types of implements into the subsidy list. In 2010, most provinces further expanded the tractor subsidy to 25~30 horsepower medium-power and walking tractors and some increased subsidies for corn harvesters and transplanters. This promoted a rapid growth in the sales volume of large and medium tractors, walking tractors, rice harvesters, corn harvesters and transplanters in 2010.

In addition, the farmers’ purchasing power has increased during recent years. With an increase in farmers’ incomes and purchasing power, a tide of renewing agricultural machinery emerged in many districts.

Having analyzed the economic environment and development of the agricultural machinery market in the world and in China, we believe that the economic environment with respect to agricultural machinery will be more favorable in the future.

We believe that the main drivers promoting the growth of agricultural machinery market will include: (1) subsidies to agricultural machinery which will promote a continuous growth in the demand for large-power tractors; (2) the gradient replacement of small tractors with large and medium-power tractors will be an important driving force in the market; and (3) remote regions will be in rising demand.

Construction Machinery

The following is our analysis with respect to several industrial investments that have played a major role in promoting the construction machinery market development, from which we may see the demand tendency of the construction machinery market in China.

Railway Construction

There was an investment of RMB200 billion into the Beijing-Shanghai High-speed Railway in 2008, the basic construction of which was completed in July 2010. In addition, twelve more railways, including the Beijing-Shijiazhuang, Shijiazhuang-Wuhan and Tianjin-Qinhuangdao railways, began construction, one after another starting in 2009, covering total miles of 4,100km. Tracks are now being laid for special passenger transportation lines including Wuhan-Guangzhou, Shijiazhuang-Taiyuan, Yichang-Wanzhou, Ningbo-Taizhou-Wenzhou, Wenzhou-Xiamen, Qingdao-Jinan which travel at speeds of 300km/h and above. The tracking mileage for these trains will reach 13,000km.

China’s total railway mileage has increased from 78,000km in 2008 to over 90,000km in 2010. Special passenger lines with speeds exceeding 200km/h are 7,000km long and total constructed passenger lines have reached 9,700km.

Rural Road Construction

With respect to rural road construction, during the Eleventh Five-Year Plan, the Ministry of Transport will carry out a construction project worth RMB100 billion to rebuild more than 500,000km asphalt roads. The government will also invest RMB40 billion to implement a project that will result in roads being built in all suitable towns and villages. It is estimated that in the following five years, the mileage of roads built in rural areas will reach 810,000km, including approximately 200,000km in eastern China, about 500,000km in central China and about 110,000km in western China (excluding village to village roads).

According to the plan, in 2020, asphalt roads will be built in all suitable towns and villages and the total mileage of rural roads will reach 3,700,000km, with 600,000km road newly added.

Water Conservation and Hydroelectricity

We believe that by 2015, water conservation and hydroelectricity will be still at a peak. The Middle and Long-term Development Planning for Renewable Energy report prepared by the National Development and Reform Commission, has planned for an increase in China’s hydroelectricity installed capacity to 190,000,000 kW in 2010 and 300,000,000kW in 2020.

10

During the Eleventh Five-Year Plan, RMB800 billion will be invested in water conservation and hydroelectricity construction, in which construction equipment procurement will account for 30% of total investment. Generally, the construction period of large-scale water conservation is about 6~7 years, the long term plan makes it less affected by macroscopic economic adjustments.

Civil and Urbanization Construction

In order to resolve the traffic problem which exists in developed cities, urban track construction (subway and light track) is becoming a hot bed of civil construction. Until 2011, many second-tier cities, such as Chongqing, Zhengzhou and Wuhan, have initiated track construction projects.

In 2010, the World Exposition was held in Shanghai where significant civil construction took place. For Expo Shanghai 2010, the total floor area of exhibition halls reached 800,000m2, and RMB10 billion was invested, plus RMB20 billion invested in site development. The total investment in Expo Shanghai 2010 reached RMB30 billion.

Petrochemical Projects

According to China’s national planning, China will construct 30 sets of ethane projects (1 million t/a) and 30 sets of oil refining projects (10 million t/a) in the next ten years. In addition, as a result of a shortage in oil, the central government is providing support to the coal chemical industry. Currently, there are fewer than ten sets of ethane production units each with 1 million t/a production capacity in China. There will be two sets of production units constructed each year in the future. Similarly, there are only about ten sets of oil refining units each with 10 million t/a production capacity in China, and in the following several years, there will be two sets of production units constructed each year. We believe that the construction machinery used in such construction projects is an ample market for our products.

As a result of the national economy and the foreign economic environment, the industry of construction machinery has experienced rapid development. According to an estimate made by China Construction Machinery Association, the sales revenue of construction machinery in the first half year of 2011 have increased41.42%from the same period in the previous year .

From the above data, the demand for diesel engines installed in construction machinery has been increasing and will likely continue to increase for the next three to five years.

Diesel Generator Market

In China, a series of factors, including (1) the policy for stimulating domestic demand, (2) accelerating development in Central and Northern China, (3) promoting urbanization, (4) reconstruction after national disasters and (5) the upgrading of railways and power grids will likely result in an increase in investment in China which in turn will undoubtedly promote the development of the equipment industry. According to the China Machinery Industry Association’s report, in China, the demand for diesel generators will increase by 20% each year, and the annual market demand should be 2,000,000 sets. Demand for power increases by 20% every year, but power supply increases only by 2%. As a result, diesel engines for power generation and construction could be prevalent in the next 10 years.

As of the date of this Report, the Company does not hold a significant or reportable share of China’s generator manufacturing market.

From 2004 through 2005, diesel generator sets have been out-of-stock in the Chinese market and still today, there is a high demand for diesel generator sets. China’s annual demand for diesel engines is approximately 500,000 sets. Our annual orders are for 80,000 sets, despite our present production capacity of 20,000 sets. Therefore, our diesel engine production cannot meet market demand.

11

Employees

As of June 30, 2011, the Company had 580 full-time employees and 800 total employees.

Intellectual Property

The Company holds the exclusive right to use the electronic control fuel injection system with common rail technology which was developed with Tianjing University. On December 29, 2003, the Company entered into a Business Proposal on Co-development for the Electronically-Controlled Fuel Injection System with Common Rail for Diesel Engines with the State Key Laboratory for Internal Combustion Engine and Combustion of Tianjin University. Such agreement was supplemented on December 12, 2009. Such agreement, in reliance on the Certificate for Patent of Utility Model “New Model of Electronically-Controlled Fuel Injection System with Common Rail” held by Tianjin University, has granted to the Company an exclusive right to use the patent of the utility model for the life of the patent.

The Company holds the rights to a character mark, which has been registered with the proper regulatory authority in China.

The Company also holds the rights to the website address located at http://www.chinaxinde.cn/

Compliance with Environmental Regulations and Other Laws

Environmental Regulations

The Industrial Development Policy for Automobiles issued by the State-owned Assets Supervision and Administration Commission in 2009 stated that attention should be focused on the development of diesel engine technology for car in automobile industry with consideration of the national strategy for adjustment of energy structure and the requirements for emission standard. Apparently, this is a recognition and support for the development direction of diesel oil-consumed cars. Also, in the Technical Policy for Prevention and Treatment of Pollutant Emission by Diesel Engine Vehicle issued by the Ministry of Environmental Protection in 2003, it stated that no discriminative policy should be adopted with regard to the production and use of diesel engines that have advanced technology and low pollutant emission. This reflects the Chinese government’s encouragement for the development of reliable diesel engine vehicles with low-energy consumption and low pollution and also gives powerful support to diesel engine vehicles that use advanced technology and meet emission standards. At the same time, the aforesaid Technical Policy also stresses that in regarding the adverse effects of the emission of diesel engine vehicles and the pollutants produced by its secondary reaction in air on human health and ecological environment, the emission of new diesel engine vehicles and vehicle diesel engines must meet the national or local emission standards, or it may not be manufactured, sold, or used. Presently, China’s emission standard for diesel engine vehicleS is only equivalent to the Euro I Standard, which is behind the international level and must be enhanced gradually.

We believe that China’s central government will keep strengthening the requirements for control over the pollutant emission of diesel engine vehicles to reduce environmental pollution. The Technical Policy required the Euro III Standard to be reached in 2008 and the international level after 2010. This shows China’s intent for emission laws to meet the international standard. China’s emission control is ten years behind other developed countries, so there is a big gap between China’s standard and the standard. On the other hand, it will be a great task to improve the technical levels, apply electronic control, develop outboard processing technology and upgrade fuel quality. The Technical Policy clearly states that China will adopt preferential tax and other economic policies to encourage the production and use of diesel engine vehicles and diesel engines that can meet the emission standard ahead of time. This means enterprises may be partly exempt from tax on account of producing advanced diesel engine vehicles or diesel engine.

The policy-based subsidy to purchase agricultural machinery sharply increased from RMB70 million (US$50 million) in 2004 to RMB15 billion (US$2.1 billion) in 2010. Under the promotion of high capital subsidy, China’s agricultural equipment industry plays a benign role in the market of agricultural engine, thus pushing forward the whole development of the diesel engine industry.

12

General Business Licenses

According to certain corporate laws of the PRC, in order to be a lawfully established company in China, the relevant corporate registration authority shall issue a business license, the date of which shall be the date of the establishment of the company. The company business license must state the name, domicile, registered capital, actually paid capital, business scope and the name of the legal representative of such company. If any of the items as stated in the business license is changed, the company must modify the company’s registration, and the company registration authority shall issue a new business license. We believe we have all business licenses to operate our business and that all such business licenses are in good order in accordance with the applicable PRC corporate laws.

Environmental Reports, Certifications and Licenses

According to certain environmental laws and regulations in China, the Department of Environmental Protection Administration under the State Council shall, in accordance with the national standards for environment quality and China’s economic and technological conditions, establish the national standards for the discharge of pollutants. The People’s Governments of Provinces, Autonomous Regions and Municipalities directly under the Central Government may establish their local standards for the discharge of pollutants for items not specified in the national standards. With regard to items already specified in the national standards, they may set local standards, which are more stringent than the national standards, and report the local ones to the Department of Environmental Protection Administration under the State Council for the record. Units that discharge pollutants in areas where the local standards for the discharge of pollutants have been established shall observe such local standards.

The Construction Project Environmental Impact Report Form, which is the environment license applicable to the Company’s common rail electronic control fuel injection system manufacturing program, was approved as satisfying the national and local environmental standards by the Economic and Technological Development Zone of Weifang City as of December 2007.

ITEM 2. PROPERTIES

Under Chinese law, all land in China is owned by the State or rural collective economic organizations. Individuals and companies are permitted to acquire rights to use land or land use rights for specific purposes. In the case of land used for industrial purposes, the land use rights are granted for a period of fifty years. This period may be renewed at the expiration of the initial and any subsequent terms. Granted land use rights are transferable and may be used as security for borrowings and other obligations.

The Company currently holds land use rights with respect to three properties. Hengyuan holds that certain certificate granting to the Company the right to utilize the real property located at No. 363 Shengli West Road, Weicheng District, Weifang, China, which encompasses 11,403 square meters, expiring March 28, 2052. Hengyuan holds that certain certificate granting to the Company the right to utilize the real property located at Wolong Qiao Village, Beiguan Sub-District, Weicheng District, Shandong, China, which encompasses 5,443 square meters, expiring March 28, 2052. Jinma holds that certain certificate granting to the Company the right to utilize the real property located at Northern to Yuqing West Street, Eastern to Caihong Road, Shandong, China, which encompasses 20,645 square meters, expiring July 24, 2056. The Administrative Committee of Foreign Investment and Development Zone of Weifang has granted to Huaxin the right to utilize a section of real property located west of Tengfei Road and south of Industry No. 1 Street, Shandong, China, which encompasses 40,000 square meters and the land use right certificate applicable to such property is currently being processed.

The Company owns six buildings. Of these six buildings, five are recorded in the name of Hengyuan, such buildings located at (a) the north section of Shengli Branch Road, Weicheng District, Weifang, Shandong, China, having 931.97 square meters, (b) the north section of Shengli Branch Road, Weicheng District, Weifang, Shandong, having 111.84 square meters, (c) No. 36 Building, No. 363 Shengli West Road, Weicheng District, Weifang, Shandong, China, having 635.43 square meters, (d) No. 363 Shengli West Road, Weicheng District, Weifang, Shandong, China, having 1,398.65 square meters, and (e) No. 363 Shengli West Road, Weicheng District, Weifang, Shandong, China, having 1,503.53 square meters. The sixth building is recorded in the name of Jinma and is located at No. 2 Yuqing West Street No. 7, Weicheng Economic Development Zone, Weifang, Shandong, China, having 2,873.51 square meters. Also, applications for ownership certificates with respect to eleven buildings are in progress.

13

As of June 30, 2011, the legal title to five of the Company’s motor vehicles and two office buildings were registered in the names of management members of the Company. On October 27, 2009, legal title to one of the motor vehicles was transferred to the Company. The Company estimates the transfer of the legal titles of the five motor vehicles and two office buildings will be completed by the end of December 2011. Also, as of June 30, 2011, two land use rights were registered in the names of two management members of the Company. The Company estimates that the application for the transfer of the certificates of these two land use rights will be completed by the end of 2011.

ITEM 3. LEGAL PROCEEDINGS.

In the normal course of business, we are named as the defendant in lawsuits in which claims are asserted against us. In our opinion, the liabilities, if any, which may ultimately result from such lawsuits, are not expected to have a material adverse effect on our financial position, results of operations or cash flows. As of the June 30, 2011, there was no pending or outstanding material litigation with the Company.

ITEM 4. (REMOVED AND RESERVED).

14

PART II

|

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

Market Information

Our Common Stock is quoted on the OTCQB under the symbol “WTFS.OB”.

On April 7, 2011, the Company held a special meeting of its stockholders whereby the stockholders approved, by the requisite number of votes, (a) the proposal to increase the amount of the Company’s Common Stock from 150,000,000 shares to 350,000,000 shares and (b) the proposal to effect a 4-for-1 forward stock split of the Company’s outstanding Common Stock. The forward stock split became effective on April 14, 2011. As of September 27, 2011, we had 240,000,000 common shares outstanding.

Set forth below is a table showing the high and low closing bids for the periods indicated from which information is available as provided to us from Pink Sheets, LLC (figures below have been adjusted for the 4-for-1 forward stock split):

|

High ($)

|

Low ($)

|

|||||||

|

Year Ended June 30, 2011

|

||||||||

|

April 14, 2011 - June 30, 2011 (post 4-for-1 forward stock split)

|

0.19 | 0.02 | ||||||

|

April 1, 2011 – April 13, 2011 (pre 4-for-1 forward stock split)

|

0.54 | 0.38 | ||||||

|

January 3, 2011 - March 31, 2011

|

1.23 | 0.54 | ||||||

|

October 1, 2010 – December 31, 2010

|

1.28 | 1.06 | ||||||

|

July 1, 2010 – September 30, 2010

|

1.29 | 1.01 | ||||||

|

Year Ended June 30, 2010

|

||||||||

|

April 1, 2010 - June 30, 2010

|

1.04 | 1.01 | ||||||

|

January 4, 2010 - March 31, 2010

|

1.05 | 0.88 | ||||||

|

October 1, 2009 – December 31, 2009

|

0.81 | 0.01 | ||||||

|

July 1, 2009 – September 30, 2009

|

None

|

None

|

||||||

Dividends

Dividends, if any, will be contingent upon our revenues and earnings, if any, capital requirements and financial conditions. The payment of dividends, if any, will be within the discretion of the Board. We presently intend to retain all earnings, if any, for use in our business operations and accordingly, the Board does not anticipate declaring any cash dividends for the foreseeable future.

Dividends payable relating to dividends declared prior to July 1, 2009 were $92,072 at June 30, 2009 and $3,990,235 at June 30, 2008. The Company had settled these dividends at 2009 and 2010 respectively.

Holders of Common Equity

As of September 27, 2011, we have issued 240,000,000 shares of our Common Stock to 43 holders of record.

See also the “Security Ownership of Certain Beneficial Owners and Management” below for a table setting forth (a) each person known by us to be the beneficial owner of 5% or more of our Common Stock and (b) all directors and officers individually and all directors and officers as a group as of the date of this Report.

Securities Authorized for Issuance under Equity Compensation Plans

As of the date of this Report, we have no compensation plans (including individual compensation arrangements) under which the Company’s equity securities are authorized for issuance.

15

Recent Sales of Unregistered Securities

During the fiscal year ended June 30, 2011, there were no issuances or sales of any of the Company’s unregistered securities, with the exception of the shares of Common Stock issued pursuant to the Exchange on December 28, 2009. We have never utilized an underwriter for an offering of our securities.

DESCRIPTION OF SECURITIES

As of the date of this Report, our authorized capital stock currently consists of 350,000,000 shares of Common Stock, par value $0.001 per share, of which there are 240,000,000 issued and outstanding and 10,000,000 shares of preferred stock, par value $0.001 per share, of which there are zero (0) shares issued or outstanding. The following statements set forth the material terms of our capital stock; however, reference is made to the more detailed provisions of, and these statements are qualified in their entirety by reference to, the Company’s Articles of Incorporation and Bylaws, copies of which are referenced as Exhibits herein, and the provisions of Nevada General Corporation Law. There are no provisions in the Company’s Articles of Incorporation or Bylaws that would delay, defer or prevent a change in our control.

Common Stock

As of the date of this Report, we had 240,000,000 shares of Common Stock outstanding. Except as otherwise required by applicable law and subject to the preferential rights of the any outstanding preferred stock, all voting rights are vested in and exercised by the holders of Common Stock with each share of Common Stock being entitled to one vote. In the event of liquidation, holders of Common Stock are entitled to share ratably in the distribution of assets remaining after payment of liabilities, if any. Holders of Common Stock have no cumulative voting rights. Holders of Common Stock have no preemptive or other rights to subscribe for shares. Holders of Common Stock are entitled to such dividends as may be declared by the Board out of funds legally available therefor.

Blank Check Preferred Stock

Our Board is empowered, without further action by stockholders, to issue from time to time one or more series of preferred stock, with such designations, rights, preferences and limitations as the Board may determine by resolution. The rights, preferences and limitations of separate series of preferred stock may differ with respect to such matters among such series as may be determined by the Board, including, without limitation, the rate of dividends, method and nature of payment of dividends, terms of redemption, amounts payable on liquidation, sinking fund provisions (if any), conversion rights (if any) and voting rights. Certain issuances of preferred stock may have the effect of delaying or preventing a change in control of our Company that some stockholders may believe is not in their interest.

Penny Stock Rules

Our common stock may be considered to be a “penny stock” if it does not qualify for one of the exemptions from the definition of “penny stock” under Section 3a51-1 of the Exchange Act. Our Common Stock may be a “penny stock” if it meets one or more of the following conditions (i) the stock trades at a price less than $5.00 per share; (ii) it is NOT traded on a “recognized” national exchange; (iii) it is NOT quoted on the Nasdaq Capital Market, or even if so, has a price less than $5.00 per share; or (iv) is issued by a company that has been in business less than three years with net tangible assets less than $5 million.

The principal result or effect of being designated a “penny stock” is that securities broker-dealers participating in sales of our common stock will be subject to the “penny stock” regulations set forth in Rules 15-2 through 15g-9 promulgated under the Exchange Act. For example, Rule 15g-2 requires broker-dealers dealing in penny stocks to provide potential investors with a document disclosing the risks of penny stocks and to obtain a manually signed and dated written receipt of the document at least two business days before effecting any transaction in a penny stock for the investor’s account. Moreover, Rule 15g-9 requires broker-dealers in penny stocks to approve the account of any investor for transactions in such stocks before selling any penny stock to that investor. This procedure requires the broker-dealer to (i) obtain from the investor information concerning his or her financial situation, investment experience and investment objectives; (ii) reasonably determine, based on that information, that transactions in penny stocks are suitable for the investor and that the investor has sufficient knowledge and experience as to be reasonably capable of evaluating the risks of penny stock transactions; (iii) provide the investor with a written statement setting forth the basis on which the broker-dealer made the determination in (ii) above; and (iv) receive a signed and dated copy of such statement from the investor, confirming that it accurately reflects the investor’s financial situation, investment experience and investment objectives. Compliance with these requirements may make it more difficult and time consuming for holders of our common stock to resell their shares to third parties or to otherwise dispose of them in the market or otherwise.

16

Warrants

There are no outstanding warrants to purchase our securities.

Options

There are no options to purchase our securities outstanding. We may in the future establish an incentive stock option plan for our directors, employees and consultants.

Transfer Agent

Action Stock Transfer Corp., 7069 South Highland Dr., Suite 300, Salt Lake City, Utah 84121, telephone (801) 274-1088, fax (801) 271-1099, currently serves as the transfer agent and registrar for the Company.

ITEM 6. SELECTED FINANCIAL DATA

As a smaller reporting company, the Company is not required to provide the information required by this Item.

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

The following discussion should be read in conjunction with the information contained in the consolidated financial statements of the Company and the notes thereto appearing elsewhere herein. Readers should carefully review the risk factors disclosed in this Report and other documents filed by the Company with the SEC.

Summary of Significant Accounting Policies

This section should be read together with the Summary of Significant Accounting Policies in the attached consolidated financial statements included in this Report.

Economic and Political Risks

The Company’s operations are conducted in the PRC. Accordingly, the Company’s business, financial condition and results of operations may be influenced by the political, economic and legal environment in the PRC, and by the general state of the PRC economy.

The Company’s operations in the PRC are subject to special considerations and significant risks not typically associated with companies in North America and Western Europe. These include risks associated with, among others, the political, economic and legal environment and foreign currency exchange. The Company’s results may be adversely affected by changes in the political and social conditions in the PRC, and by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion, remittances abroad, and rates and methods of taxation, among other things.

Fair Value of Financial Instruments

ASC 820-10 (formerly SFAS No. 157, Fair Value Measurements) establishes a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair value. The hierarchy prioritizes the inputs into three levels based on the extent to which inputs used in measuring fair value are observable in the market.

17

• Level 1—defined as observable inputs such as quoted prices in active markets;

• Level 2—defined as inputs other than quoted prices in active markets that are either directly or indirectly observable; and

• Level 3—defined as unobservable inputs in which little or no market data exists, therefore requiring an entity to develop its own assumptions.

The assets measured at fair value on a recurring basis subject to the disclosure requirements of ASC 820-10 as of June 30, 2011 are as follows:

|

Fair Value Measurements at Reporting Date Using

|

||||||||||||||||

|

Carrying

Value as of

June 30, 2010

|

Quoted Prices in

Active Markets for

Identical Assets

(Level 1)

|

Significant

Other

Observable

Inputs

(Level 2)

|

Significant

Unobservable

Inputs

(Level 3)

|

|||||||||||||

|

Bank acceptance notes

|

$ | 4,485,186 | $ | 4,485,186 | $ | - | $ | - | ||||||||

|

Long-term notes payable

|

$ | 221,667 | $ | - | $ | 221,667 | $ | - | ||||||||

The carrying amounts of financial assets and liabilities, such as cash and cash equivalents, accounts receivable, notes receivable, prepayments for goods, short-term bank loans, accounts payable, customer deposits, short-term notes payable, due to employee, due to related parties and other payables, approximate their fair values because of the short maturity of these instruments. The fair value of the Company’s long-term notes payable is estimated based on the current rates offered to the Company for debt of similar terms and maturities. Under this method, the Company’s fair value of long-term notes payable was not significantly different from the carrying value at June 30, 2011.

Cash and Cash Equivalents

For financial reporting purposes, the Company considers highly liquid investments purchased with original maturity of three months or less to be cash equivalents.

Inventories

Inventories are stated at the lower of cost or net realizable value. The cost of raw materials is determined on the basis of weighted average. The cost of finished goods is determined on the weighted average basis and comprises direct materials, direct labor and an appropriate proportion of overhead.

Net realizable value is based on estimated selling prices less any further costs expected to be incurred for completion and disposal.

Plant and Equipment

Plant and equipment are carried at cost less accumulated depreciation and amortization. Depreciation is provided over their estimated useful lives, using the straight-line method. Leasehold improvements are amortized over the life of the asset or the term of the lease, whichever is shorter. Estimated useful lives are as follows:

|

Buildings:

|

30 years

|

|

Machinery:

|

10 years

|

|

Motor vehicles:

|

5 years

|

|

Office equipment:

|

5 years

|

The cost and related accumulated depreciation of assets sold or otherwise retired are eliminated from the accounts and any gain or loss is included in the statement of income. The cost of maintenance and repairs is charged to expense as incurred, whereas significant renewals and betterments are capitalized.

18

Under Chinese law land is owned by the state or rural collective economic organizations. The state issues to the land users the land use right certificate. Land use rights can be revoked and the land users forced to vacate at any time when redevelopment of the land is in the public interest. The public interest rationale is interpreted quite broadly and the process of land appropriation may be less than transparent. The land use right granted to the Company is being amortized using the straight-line method over the lease term of fifty years.

Revenue Recognition

Revenue represents the invoiced value of goods sold, recognized upon the shipment of goods to customers. Revenue is recognized when all of the following criteria are met:

-Persuasive evidence of an arrangement exists,

-Delivery has occurred or services have been rendered,

-The seller's price to the buyer is fixed or determinable, and

-Collectability is reasonably assured.

The majority of the Company’s revenue results from sales contracts with distributors and revenue are recorded upon the shipment of goods. Management conducts credit background checks for new customers as a means to reduce the subjectivity of collectability.

The Company offers warranties on its products for periods between six and twelve months after the sale. The Company estimates the warranty reserves based on historical records and identical or similar types on the market. Warranty expenses related to product sales are charged to the consolidated statements of income and comprehensive income in the period in which sales is recognized. During the years ended June 30, 2011 and 2010, warranty expense was $406,772 and $640,404, respectively, and is included in selling and marketing expenses in the accompanying consolidated statements of income and comprehensive income.

Foreign Currency Translation

The accompanying consolidated financial statements are presented in United States dollars. The functional currency of the Company is the Renminbi (RMB). Capital accounts of the consolidated financial statements are translated into United States dollars from RMB at their historical exchange rates when the capital transactions occurred. Assets and liabilities are translated at the exchange rates as of balance sheet date. Income and expenditures are translated at the average exchange rate of the quarter.

|

June 30, 2011

|

June 30, 2011

|

|||||||

|

Year end RMB : US$ exchange rate

|

6.4635 | 6.8086 | ||||||

|

Year average RMB : US$ exchange rate

|

6.6278 | 6.8267 | ||||||

The RMB is not freely convertible into foreign currency and all foreign exchange transactions must take place through authorized institutions. No representation is made that the RMB amounts could have been, or could be, converted into US$ at the rates used in translation.

Segment

The Company operates in one business segment, the design, development, manufacture and commercialization of fuel injection pumps, injectors, multi-cylinder diesel engines and small generator units mainly in the PRC. The sales of the Company outside of the PRC were insignificant for the years ended June 30, 2011 and 2010.

Recent Accounting Pronouncements

There are no new accounting pronouncements that have not been adopted by the Company that would have a material adverse effect on the consolidated financial statements.

19

Results of Operations for the Year Ended June 30, 2011 as Compared to the Year Ended June 30, 2010

The following table sets forth the amounts and the percentage relationship to revenues of certain items in our consolidated statements of income for the years ended June 30, 2011 and 2010:

|

2011

|

2010

|

Comparisons

|

||||||||||||||||||||||

|

Amount

|

% of

Revenues

|

Amount

|

% of

Revenues

|

Change in

Amount

|

Change in

%

|

|||||||||||||||||||

|

$

|

$

|

$

|

||||||||||||||||||||||

|

REVENUES, NET

|

141,686,826 | 100 | % | 123,305,388 | 100 | % | 18,381,438 | 15 | % | |||||||||||||||

|

COST OF GOODS SOLD

|

(112,126,036 | ) | (79 | )% | (108,438,204 | ) | (88 | )% | (3,687,832 | ) | 3 | % | ||||||||||||

|

GROSS PROFIT

|

29,560,790 | 21 | % | 14,867,184 | 12 | % | 14,693,606 | 99 | % | |||||||||||||||

|

Selling and marketing

|

(2,950,077 | ) | (2 | )% | (2,813,270 | ) | (2 | )% | (136,807 | ) | 5 | % | ||||||||||||

|

General and administrative

|

(2,565,280 | ) | (2 | )% | (2,303,965 | ) | (2 | )% | (261,315 | ) | 11 | % | ||||||||||||

|

Bad debt recoveries

|

710,330 | 0.5 | % | - | - | 710,330 | - | |||||||||||||||||

|

INCOME FROM OPERATIONS

|

24,755,763 | 17.5 | % | 9,749,949 | 8 | % | 15,005,814 | 154 | % | |||||||||||||||

|

Interest expense, net

|

(439,991 | ) | (0.3 | )% | (345,172 | ) | (0.3 | )% | (94,819 | ) | 27 | % | ||||||||||||

|

Other income (expense), net

|

204,422 | 0.1 | % | (15,020 | ) | - | 219,442 | (1461 | )% | |||||||||||||||

|

Refunded value added tax

|

3,305,512 | 2.3 | % | 12,085,158 | 9.8 | % | (8,779,646 | ) | (73 | )% | ||||||||||||||

|

INCOME FROM OPERATIONS BEFORE INCOME TAXES

|

27,825,706 | 19.6 | % | 21,474,915 | 17.5 | % | 6,350,791 | 30 | % | |||||||||||||||

|

INCOME TAXES

|

(5,343,329 | ) | (3.7 | )% | (1,560,419 | ) | (1.3 | )% | (3,782,910 | ) | 242 | % | ||||||||||||

|

NET INCOME

|

22,482,377 | 15.9 | % | 19,914,496 | 16.2 | % | 2,567,881 | 13 | % | |||||||||||||||

|

OTHER COMPREHENSIVE INCOME

|

||||||||||||||||||||||||

|

Foreign currency translation gain

|

3,513,972 | 2 | % | 226,719 | 0.1 | % | 3,287,253 | 1450 | % | |||||||||||||||

|

COMPREHENSIVE INCOME

|

25,996,349 | 18 | % | 20,141,215 | 16 | % | 5,855,134 | 29 | % | |||||||||||||||

20

Revenues

Our revenues are derived from the design, development, manufacture, and commercialization of fuel injection pumps, injectors, multi-cylinder diesel engines and small generator units for the PRC and overseas markets. The table below sets forth a breakdown of our revenues by product for the years indicated:

|

For the Years Ended June 30,

|

||||||||||||||||||||||||

|

2011

|

2010

|

Comparisons

|

||||||||||||||||||||||

|

Amount

|

% of

Revenues

|

Amount

|

% of

Revenues

|

Change in

Amount

|

Change in

%

|

|||||||||||||||||||

|

$

|

$

|

$

|

||||||||||||||||||||||

|

Revenues:

|

||||||||||||||||||||||||

|

Electricity pumps

|

14,164,854 | 10 | % | 7,576,060 | 6 | % | 6,588,794 | 87 | % | |||||||||||||||

|

Multi-cylinder pumps

|

39,745,570 | 28 | % | 26,310,440 | 21 | % | 13,435,130 | 51 | % | |||||||||||||||

|

Single-cylinder pumps

|

2,838,881 | 2 | % | 1,867,004 | 1.5 | % | 971,877 | 52 | % | |||||||||||||||

|

Fuel muzzle

|

8,237,534 | 6 | % | 5,603,823 | 4.5 | % | 2,633,711 | 47 | % | |||||||||||||||

|

Parts

|

1,245,844 | 1 | % | 626,265 | 1 | % | 619,579 | 99 | % | |||||||||||||||

|

Diesel engines

|

48,087,706 | 34 | % | 44,160,042 | 36 | % | 3,927,664 | 9 | % | |||||||||||||||

|

Generator sets

|

24,946,865 | 18 | % | 33,205,321 | 27 | % | (8,258,456 | ) | (25 | )% | ||||||||||||||

|

Accessories

|

2,458,178 | 1 | % | 3,983,636 | 3 | % | (1,525,458 | ) | (38 | )% | ||||||||||||||

|

Less: sales tax

|

(38,606 | ) | - | (27,203 | ) | - | (11,403 | ) | 42 | % | ||||||||||||||

|

Total

|

141,686,826 | 100 | % | 123,305,388 | 100 | % | 18,381,438 | 15 | % | |||||||||||||||

Our revenues increased by 15%, or $18,381,438, to $141,686,826 for the year ended June 30, 2011 from $123,305,388 for the year ended June 30, 2010. This increase was primarily attributable to an increase in sales of multi-cylinder pumps, which increased by 51% and accounted for 28% of the Company’s total revenues in 2011, and an increase in revenues of electricity pumps by 87% to $14,164,854 for the year ended June 30, 2011 from $7,576,060 for the year ended June 30, 2010, which was partially offset by the decrease in the sales of generator sets by $8,258,456 which accounted for 27% of our total revenues for the year ended June 30, 2011. The main reason for this increase was attributable to the fact that high-end products with greater power are becoming the focus products of the diesel engine industry in the PRC. The Company has adjusted its product structure to introduce more products with greater engine power to accommodate this new trend.

Cost of Revenues

The principal components of our cost of goods sold are the cost of product sales, which is mainly affected by the cost of direct material and salaries. Our cost of goods sold increased in line with the growth of our revenues in 2011. The following table sets forth a breakdown of our cost of goods sold by product for the years indicated:

|

For the Years Ended June 30,

|

||||||||||||||||||||||||

|

2011

|

2010

|

Comparisons

|

||||||||||||||||||||||

|

Amount

|

% of

Revenues

|

Amount

|

% of

Revenues

|

Change in

Amount

|

Change in

%

|

|||||||||||||||||||

|

$

|

$

|

$

|

||||||||||||||||||||||

|

Costs of Goods Sold:

|

||||||||||||||||||||||||

|

Electricity pumps

|

9,974,906 | 7 | % | 5,744,147 | 5 | % | 4,230,759 | 74 | % | |||||||||||||||

|

Multi-cylinder pumps

|

26,544,209 | 19 | % | 19,960,447 | 16 | % | 6,583,762 | 33 | % | |||||||||||||||

|

Single-cylinder pumps

|

2,251,284 | 1 | % | 1,822,754 | 2 | % | 428,530 | 24 | % | |||||||||||||||

|

Fuel muzzle

|

6,957,490 | 5 | % | 5,285,468 | 5 | % | 1,672,022 | 32 | % | |||||||||||||||

|

Parts

|

1,109,276 | 1 | % | 591,004 | - | 518,272 | 88 | % | ||||||||||||||||

|

Diesel engines

|

42,544,860 | 30 | % | 41,167,595 | 33 | % | 1,377,265 | 3 | % | |||||||||||||||

|

Generator sets

|