Attached files

| file | filename |

|---|---|

| 8-K - 8-K - McEwen Mining Inc. | a11-26765_18k.htm |

Exhibit 99.1

|

|

September 20, 2011 |

NEWS RELEASE

EL GALLO INFILL DRILL RESULTS

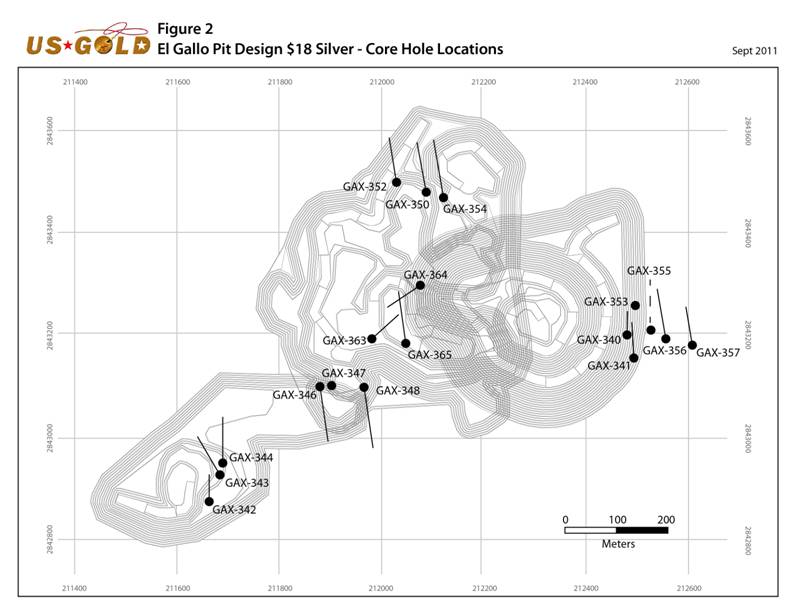

TORONTO, ONTARIO (September 20, 2011) US GOLD CORPORATION (NYSE: UXG) (TSX: UXG) is pleased to announce infill drill results from the El Gallo Complex, located in Sinaloa State, Mexico, where Phase 1 mining is planned for mid-2012. Drilling focused on confirming the resource and converting inferred mineralization to the measured and indicated categories. Drilling at the El Gallo deposit occurred in three areas: 1) Main Zone, 2) Eastern Area and 3) along the outer limits of the known resource. This drilling was completed in order to help prepare an initial reserve estimate for the project.

1) Main Zone — Infill Drilling

Results highlighted below are from the last set of infill holes currently scheduled for the Main Zone. The results continue to show good grades and thicknesses, starting at or near surface and have successfully met the company’s expectations. The holes were completed inside of the proposed pit and designed to increase the confidence associated with the mineralization and convert inferred resources to the measured and indicated categories, which is required for reserve reporting purposes.

|

Hole # |

|

Silver |

|

Length |

|

From |

|

Silver |

|

Length |

|

From |

|

|

|

|

(gpt) |

|

(meters) |

|

(meters) |

|

(opt) |

|

(feet) |

|

(feet) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-348 |

|

408.7 |

|

1.8 |

|

41.8 |

|

11.9 |

|

5.9 |

|

137.1 |

|

|

Including |

|

1,695.0 |

|

0.4 |

|

41.8 |

|

49.4 |

|

1.3 |

|

137.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-363 |

|

140.9 |

|

10.1 |

|

0.0 |

|

4.1 |

|

33.1 |

|

0.0 |

|

|

And |

|

64.5 |

|

16.1 |

|

21.4 |

|

1.9 |

|

52.8 |

|

70.2 |

|

|

And |

|

105.6 |

|

4.9 |

|

49.7 |

|

3.1 |

|

16.1 |

|

163.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-364 |

|

109.8 |

|

20.4 |

|

0.0 |

|

3.2 |

|

66.9 |

|

0.0 |

|

|

Including |

|

859.0 |

|

1.1 |

|

14.2 |

|

25.1 |

|

3.6 |

|

46.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-365 |

|

113.7 |

|

11.7 |

|

54.9 |

|

3.3 |

|

38.4 |

|

180.1 |

|

|

Including |

|

692.0 |

|

1.0 |

|

57.7 |

|

20.2 |

|

3.3 |

|

189.3 |

|

2) Eastern Area - Infill Drilling

The second area where infill drilling focused is located along the eastern limits of the resource and outside of the proposed pit design. In the PEA (Preliminary Economic Study — which used a silver price of $18 per ounce) published in February, this mineralization was classified as inferred and deemed to be uneconomic. However, the drill results highlighted below have intersected higher than anticipated silver grades, which may improve the profitability of this mineralization.

|

Hole # |

|

Silver |

|

Length |

|

From |

|

Silver |

|

Length |

|

From |

|

|

|

|

(gpt) |

|

(meters) |

|

(meters) |

|

(opt) |

|

(feet) |

|

(feet) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-340 |

|

98.6 |

|

5.8 |

|

64.4 |

|

2.9 |

|

19.0 |

|

211.3 |

|

|

Including |

|

323.0 |

|

0.7 |

|

64.4 |

|

9.4 |

|

2.3 |

|

211.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-341 |

|

51.7 |

|

18.1 |

|

73.2 |

|

1.5 |

|

59.4 |

|

240.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-353 |

|

107.4 |

|

17.6 |

|

26.2 |

|

3.1 |

|

57.7 |

|

86.0 |

|

|

Including |

|

686.7 |

|

1.5 |

|

26.2 |

|

20.0 |

|

4.9 |

|

86.0 |

|

3) Infill Drilling Along the Outer Limits of the Resource

The third area where infill drilling focused was on lower grade resources, currently classified as inferred. This mineralization occurs along the outer edges of the deposit. Although lower grade and representing a small portion of the overall project, testing has shown that this mineralization can be recovered by a heap leach recovery method and could be potentially economic to mine. More drilling to define the zone is required and is currently underway.

|

Hole # |

|

Silver |

|

Length |

|

From |

|

Silver |

|

Length |

|

From |

|

|

|

|

(gpt) |

|

(meters) |

|

(meters) |

|

(opt) |

|

(feet) |

|

(feet) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-346 |

|

39.1 |

|

6.9 |

|

33.6 |

|

1.1 |

|

22.6 |

|

110.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-350 |

|

40.9 |

|

33.6 |

|

0.0 |

|

1.2 |

|

110.2 |

|

0.0 |

|

|

Including |

|

330.0 |

|

2.0 |

|

22.0 |

|

9.6 |

|

6.6 |

|

72.2 |

|

|

Including |

|

113.0 |

|

1.4 |

|

32.2 |

|

3.3 |

|

4.6 |

|

105.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-352 |

|

22.9 |

|

9.9 |

|

0.0 |

|

0.7 |

|

32.4 |

|

0.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-354 |

|

19.5 |

|

18.9 |

|

0.0 |

|

0.6 |

|

62.0 |

|

0.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-355 |

|

31.6 |

|

24.0 |

|

50.6 |

|

0.9 |

|

78.7 |

|

166.0 |

|

|

Including |

|

320.0 |

|

1.0 |

|

71.6 |

|

9.3 |

|

3.3 |

|

234.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-356 |

|

36.7 |

|

12.6 |

|

59.3 |

|

1.1 |

|

41.3 |

|

194.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-357 |

|

25.8 |

|

9.9 |

|

85.5 |

|

0.8 |

|

32.5 |

|

280.5 |

|

PHASE 1 MINING SCHEDULED FOR MID-2012

On August 31st, US Gold announced the approval of Phase 1 development at the El Gallo Complex, with mining expected to commence mid-2012. The El Gallo Complex includes the El Gallo and Palmarito silver deposits and the Magistral gold deposits, located within a 13 km (8 mile) radius. Phase 1 will focus on the permitted satellite gold deposits at the project and is expected to produce 30,000 ounces of gold per year after initial ramp up. Capital costs have been estimated at $15 million and the projected cash flow will help fund Phase 2, which is forecasted to produce an additional 5 million ounces of silver per year, beginning in 2014.

ABOUT US GOLD (www.usgold.com)

US Gold’s objective is to qualify for inclusion in the S&P 500 by 2015. US Gold explores for gold and silver in the Americas and is advancing its El Gallo Complex in Mexico and its Gold Bar Project in Nevada towards production. US Gold’s shares are listed on the NYSE and the TSX under the symbol UXG, trading 2.3 million shares daily during the past twelve months. US Gold’s shares are included in S&P/TSX and Russell indices and Van Eck’s Junior Gold Miners ETF. Rob McEwen, Chairman and CEO, owns 20% of the shares of US Gold. On June 14, 2011 the Company announced that Mr. McEwen proposed to combine the Company with Minera Andes to create a high growth, low-cost, mid-tier silver producer operating in the Americas. Each Minera Andes shareholder would receive 0.45 of a US Gold share for every Minera Andes share held.

This news release has been viewed and approved by John Read, CPG, US Gold’s consulting geologist, who is a Qualified Person as defined by National Instrument 43-101 and is responsible for program design and quality control of exploration undertaken by the Company at its Mexican exploration properties.

Samples from the core drilling were split on-site at the Company’s El Gallo Complex. One quarter to one half of the split drill core is shipped to ALS Chemex for sample preparation and analysis by 4-acid digestion with ICP determination for silver and fire assay for gold. Samples returning greater than 1500 ppm silver or 10 ppm gold were re-analyzed using gravimetric fire assay. Standards and blanks were inserted every 20 samples.

All holes were drilled with HQ bits and reduced to NTW where required. Samples were taken based on lithologic and/or mineralized intervals and vary in length. The true width of the mineral zone has not been determined.

For additional information about the El Gallo project see the “Preliminary Economic Assessment for the El Gallo District, Sinaloa State Mexico” dated February 11, 2011 and prepared by Paul Gates, PE, Richard Addison, PE, Aaron McMahon, PG of Pincock Allen & Holt of Denver, Colorado (“El Gallo PEA”). All three individuals are Qualified Persons as defined by NI 43-101 and are independent of US Gold Corporation as defined in Section 1.4 of NI 43-101 and Section 3.5 of Companion Policy 43-101CP. Mr. McMahon verified the mineral resource data contained in the El Gallo PEA by conducting a site visit, which included verifying drill hole locations and survey data, reviewing sampling handling, data collection procedures, partial audit of the assay database, review of the QA/QC data and analysis of core recovery and drill logs and their relations to assay values. The El Gallo PEA is available on SEDAR (www.sedar.com).

Certain statements contained herein and subsequent oral statements made by and on behalf of the Company may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements may be identified by words such as “intends,” “anticipates,” “believes,” “expects” and “hopes” and include, without limitation, statements regarding the Company’s results of exploration, plan of business operations, potential contractual arrangements, receipt of working capital, anticipated revenues and related expenditures. Factors that could cause actual results to differ materially include, among others, those set forth in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2010 and other filings with the Securities and Exchange Commission, under the caption “Risk Factors”. Most of these factors are outside the control of the Company. Investors are cautioned not to put undue reliance on forward-looking statements. Except as otherwise required by applicable securities statutes or regulations, the Company disclaims any intent or obligation to update publicly these forward looking statements, whether as a result of new information, future events or otherwise.

|

For further information contact: |

|

|

|

|

|

Jenya Mescheryakova |

Mailing Address |

|

Investor Relations |

99 George Street, 3rd Floor |

|

Tel: (647) 258-0395 |

Toronto, ON M5A 2N4 |

|

Toll Free: (866) 441-0690 |

E-mail: info@usgold.com |

|

Fax: (647) 258-0408 |

|

|

Table 1. Drill Results: Core Holes Assays |

September 2011 |

|

Hole # |

|

Silver |

|

Gold |

|

Length |

|

From |

|

Azimuth |

|

Dip |

|

Easting |

|

Northing |

|

|

|

|

(gpt) |

|

(gpt) |

|

(meters) |

|

(meters) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

El Gallo |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-340 |

|

98.6 |

|

0.1 |

|

5.8 |

|

64.4 |

|

350° |

|

-75° |

|

212483 |

|

2843199 |

|

|

Including |

|

323.0 |

|

— |

|

0.7 |

|

64.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-341 |

|

51.7 |

|

0.1 |

|

18.1 |

|

73.2 |

|

350° |

|

-75° |

|

212491 |

|

2843152 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-342 |

|

31.7 |

|

— |

|

3.1 |

|

0.0 |

|

360° |

|

-50° |

|

211663 |

|

2842872 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-343 |

|

34.6 |

|

— |

|

1.5 |

|

76.6 |

|

330° |

|

-45° |

|

211684 |

|

2842924 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-344 |

|

— |

|

— |

|

— |

|

— |

|

360° |

|

-45° |

|

211689 |

|

2842951 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-346 |

|

39.1 |

|

0.1 |

|

6.9 |

|

33.6 |

|

170° |

|

-50° |

|

211878 |

|

2843094 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-347 |

|

— |

|

— |

|

— |

|

— |

|

0° |

|

-90° |

|

211901 |

|

2843098 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-348 |

|

408.7 |

|

— |

|

1.8 |

|

41.8 |

|

170° |

|

-50° |

|

211964 |

|

2843094 |

|

|

Including |

|

1,695.0 |

|

0.4 |

|

0.4 |

|

41.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-350 |

|

40.9 |

|

— |

|

33.6 |

|

0.0 |

|

350° |

|

-50° |

|

212087 |

|

2843477 |

|

|

Including |

|

330.0 |

|

— |

|

2.0 |

|

22.0 |

|

|

|

|

|

|

|

|

|

|

Including |

|

113.0 |

|

— |

|

1.4 |

|

32.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-352 |

|

22.9 |

|

— |

|

9.9 |

|

0.0 |

|

350° |

|

-50° |

|

212027 |

|

2843493 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-353 |

|

107.4 |

|

— |

|

17.6 |

|

26.2 |

|

0° |

|

-90° |

|

212496 |

|

2843256 |

|

|

Including |

|

686.7 |

|

— |

|

1.5 |

|

26.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-354 |

|

19.5 |

|

— |

|

18.9 |

|

0.0 |

|

350° |

|

-50° |

|

212122 |

|

2843467 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-355 |

|

31.6 |

|

0.1 |

|

24.0 |

|

50.6 |

|

0° |

|

-90° |

|

212526 |

|

2843209 |

|

|

Including |

|

320.0 |

|

|

|

1.0 |

|

71.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-356 |

|

36.7 |

|

— |

|

12.6 |

|

59.3 |

|

350° |

|

-65° |

|

212554 |

|

2843193 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-357 |

|

25.8 |

|

— |

|

9.9 |

|

85.5 |

|

350° |

|

-70° |

|

212607 |

|

2843180 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-363 |

|

140.9 |

|

0.9 |

|

10.1 |

|

0.0 |

|

50° |

|

-70° |

|

211981 |

|

2843191 |

|

|

And |

|

64.5 |

|

0.1 |

|

16.1 |

|

21.4 |

|

|

|

|

|

|

|

|

|

|

And |

|

105.6 |

|

0.0 |

|

4.9 |

|

49.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-364 |

|

109.8 |

|

0.1 |

|

20.4 |

|

0.0 |

|

230° |

|

-65° |

|

212076 |

|

2843296 |

|

|

Including |

|

859.0 |

|

— |

|

1.1 |

|

14.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAX-365 |

|

113.7 |

|

— |

|

11.7 |

|

54.9 |

|

350° |

|

-60° |

|

212048 |

|

2843180 |

|

|

Including |

|

692.0 |

|

0.1 |

|

1.0 |

|

57.7 |

|

|

|

|

|

|

|

|

|

|

And |

|

81.6 |

|

— |

|

3.4 |

|

99.3 |

|

|

|

|

|

|

|

|

|