Attached files

| file | filename |

|---|---|

| EX-3.4 - PHARMACYCLICS INC | ex34to10k07380_06302011.htm |

| EX-23.1 - PHARMACYCLICS INC | ex231to10k07380_06302011.htm |

| EX-31.1 - PHARMACYCLICS INC | ex311to10k07380_06302011.htm |

| EX-32.1 - PHARMACYCLICS INC | ex321to10k07380_06302011.htm |

| EX-31.2 - PHARMACYCLICS INC | ex312to10k07380_06302011.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

____________________________________

FORM 10-K

|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

|

|

|

SECURITIES EXCHANGE ACT OF 1934

|

For the Fiscal Year Ended June 30, 2011

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

|

|

|

SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from _________ to _________.

Commission File Number: 000-26658

Pharmacyclics, Inc.

(Exact name of Registrant as specified in its charter)

|

Delaware

|

94-3148201

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

995 E. Arques Avenue, Sunnyvale, CA

|

94085-4521

|

|

(Address of principal executive offices)

|

(Zip code)

|

Registrant’s telephone number, including area code: (408) 774-0330

____________________________________

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Name of Each Exchange On Which Registered

|

|

|

Common Stock, $.0001 Par Value

|

Nasdaq Capital Market

|

Securities registered pursuant to Section 12(g) of the Act: None

(Title of Class)

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files) Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendments to this Form 10-K. o

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. Check one:

Large accelerated filer o Accelerated filer x Non-accelerated filer o Smaller reporting company o

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the voting and non-voting stock held by non-affiliates of the Registrant was $279,356,921 based on the closing sale price of the Registrant's common stock on The NASDAQ Stock Market LLC on the last business day of the Registrant's most recently completed second fiscal quarter. Shares of the Registrant's common stock beneficially owned by each executive officer and director of the Registrant and by each person known by the Registrant to beneficially own 10% or more of its outstanding common stock have been excluded, in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes. The

number of outstanding shares of the Registrant’s common stock as of August 31, 2011 was 68,400,558.

____________________________________

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the following document are incorporated by reference into Part III of this Form 10-K: the Definitive Proxy Statement for the Registrant’s 2011 Annual Meeting of Stockholders which will be filed with the Securities and Exchange Commission within 120 days after the end of the Registrant’s fiscal year.

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED JUNE 30, 2011

TABLE OF CONTENTS

|

Page

|

|||

|

2

|

|||

|

23

|

|||

|

37

|

|||

|

37

|

|||

|

37

|

|||

|

37

|

|||

|

37

|

|||

|

39

|

|||

|

40

|

|||

|

50

|

|||

|

51

|

|||

|

83

|

|||

|

83

|

|||

|

83

|

|||

|

84

|

|||

|

84

|

|||

|

84

|

|||

|

84

|

|||

|

84

|

|||

|

85

|

|||

|

86

|

|||

|

87

|

|||

Part I

Important Factors Regarding Forward-Looking Statements

This report contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “should” or “will” or the negative of such terms or other comparable terminology. In particular, forward-looking statements include:

|

·

|

statements about our future capital requirements and the sufficiency of our cash, cash equivalents, marketable securities and other financing proceeds to meet these requirements;

|

|

·

|

information concerning possible or assumed future results of operations, trends in financial results and business plans;

|

|

·

|

statements about our product development schedule;

|

|

·

|

statements about our expectations for and timing of regulatory approvals for any of our product candidates;

|

|

·

|

statements about the level of our expected costs and operating expenses;

|

|

·

|

statements about the potential results of ongoing or future clinical trials;

|

|

·

|

other statements about our plans, objectives, expectations and intentions; and

|

|

·

|

other statements that are not historical fact.

|

From time to time, we also may provide oral or written forward-looking statements in other materials we release to the public. Forward-looking statements are only predictions that provide our current expectations or forecasts of future events. Any or all of our forward-looking statements in this report and in any other public statements are subject to unknown risks, uncertainties and other factors may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we

cannot guarantee future results, performance or achievements. You should not place undue reliance on these forward-looking statements.

We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise. You are advised, however, to consult any further disclosures we make on related subjects in our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Also note that we provide a cautionary discussion of risks, uncertainties, assumptions and other factors relevant to our business under the caption Risk Factors and elsewhere in this report. These are risks that we think could cause our actual results to differ materially from expected or historical results.

|

Item 1.

|

Business

|

Company Overview

We are a clinical-stage biopharmaceutical company focused on developing and commercializing innovative small-molecule drugs for the treatment of cancer and immune mediated diseases. Our mission and goal is to build a viable biopharmaceutical company that designs, develops and commercializes novel therapies intended to improve quality of life, increase duration of life and resolve serious unmet medial healthcare needs. We identify promising product candidates using our scientific development expertise, develop our products in a rapid, cost-efficient manner and pursue commercialization and/or development partners when and where appropriate.

In 2006, we acquired multiple small molecule drug candidates for the treatment of cancer and other diseases from Celera Genomics, an Applera Corporation business (now Celera Corporation - a subsidiary of Quest Diagnostics Incorporated), including technology and intellectual property relating to drugs that target histone deacetylase (HDAC) enzymes, selective HDAC enzymes, a Factor VIIa inhibitor targeting a tumor signaling pathway involved in angiogenesis, tumor growth and metastases, and B-cell associated tyrosine kinase inhibitors potentially useful for the treatment of lymphomas and autoimmune diseases. Since that time we have advanced these programs by bringing several product candidates into

clinical development.

Presently, we have three product candidates in clinical development and several preclinical molecules in lead optimization. We are committed to high standards of ethics, scientific rigor, and operational efficiency as we move each of these programs to viable commercialization. To date, substantially all of our resources have been dedicated to the research and development of our products, and we have not generated any commercial revenues from the sale of our products. We do not anticipate the generation of any product commercial revenues until we receive the necessary regulatory and marketing approvals to launch one of our products.

We are headquartered in Sunnyvale, California and are listed on NASDAQ under the symbol PCYC. To learn more about how Pharmacyclics advances science to improve human healthcare visit us at http://www.pharmacyclics.com. Information found on our website is not incorporated by reference into this report.

Our Pipeline

Our clinical development and product candidates are small-molecule enzyme inhibitors designed to target key biochemical pathways involved in human diseases with critical unmet needs. We currently have three proprietary drug candidates under clinical development and several preclinical lead molecules. This includes: an inhibitor of Bruton’s tyrosine kinase (Btk) (PCI-32765) currently in Phase II studies in hematologic malignancies; a Btk inhibitor lead optimization program targeting autoimmune indications, an inhibitor of Factor VIIa (PCI-27483) in a Phase II clinical trial in pancreatic cancer and a histone deacetylase (HDAC) inhibitor (PCI-24781) currently in Phase I and II clinical

trials in solid tumors and hematological malignancies.

Status of Products in Pre-Clinical and Clinical Development

The table below summarizes our pre-clinical programs and clinical product candidates and their stage of development:

|

Product Candidates

|

Disease Indication

|

Development Status(1)

|

||

|

PCI-32765

Bruton’s Tyrosine Kinase (Btk) Inhibitor

|

B-cell lymphomas:

· chronic lymphocytic leukemia

· mantle cell lymphoma

· diffuse large B cell lymphoma

Multiple myeloma

|

Multiple Phase II trials – enrolling

Phase II - in preparation

|

||

|

Bruton’s Tyrosine Kinase (Btk) Inhibitor lead optimization program

|

Autoimmune disease

|

Lead optimization and preclinical testing

|

||

|

PCI-27483

Factor VIIa Inhibitor

|

Pancreatic cancer

|

Phase II – enrolling

|

||

|

PCI-24781

HDAC Inhibitor

|

Recurrent lymphomas

Soft tissue sarcoma

|

Phase II – enrolling

Phase I/II – enrolling

|

||

|

HDAC8 Inhibitor Program

|

Cancer

|

Lead optimization and preclinical testing

|

|

(1)

|

“Phase I” means initial human clinical trials designed to establish the safety, dose tolerance, pharmacokinetics (i.e. absorption, metabolism, excretion), and pharmacodynamics (i.e. surrogate markers for activity) of a compound. “Phase II” means human clinical trials designed to establish safety, optimal dosage and preliminary activity of a compound in a patient population. “Preclinical” means the stage of drug development prior to human clinical trials in which a molecule is optimized for “drug like” properties and evaluated for efficacy, pharmacokinetics, pharmacodynamics and safety.

|

Our Drug Development Programs

Btk Inhibitor Program

We are pioneering the development of orally bioavailable inhibitors of Bruton’s tyrosine kinase (Btk), a signaling protein that is critically important for the activity of B cells (cells that can develop into antibody producing cells). When B cells are overactive, the immune system can produce antibodies that begin to attack the body’s own tissue, leading to autoimmune diseases. Also, B-cell lymphomas and leukemias, which are common blood cancers, result from mutations acquired during B-cell development that lead to uncontrolled B-cell proliferation. Both autoimmune diseases and B-cell malignancies are thought to be driven by overactive signaling and activation of the B-cell antigen receptor, a process

that is dependent on Btk.

We have development programs for B-cell malignancies and autoimmune diseases. For malignant indications we have developed PCI-32765, which has demonstrated clinical activity and tolerability in Phase I and Phase II clinical trials in a variety of B-cell malignancies, including chronic lymphocytic leukemia (CLL) and a number of non-Hodgkin’s lymphoma (NHL) subtypes. CLL, mantle cell lymphoma (MCL), follicular lymphoma (FL), diffuse large B cell lymphoma (DLBCL) and multiple myeloma (MM) are specific indications of our current or planned Phase II development. We are currently optimizing inhibitors of Btk for autoimmune diseases.

Pharmacodynamic Probe Assay

We have developed an assay to measure occupancy of Btk in PBMCs (described in Honigberg et al., Proc Natl Acad Sci USA, 2010; 107: 13075-80) using a cell-permeable fluorescently-labeled derivative of PCI-32765. This probe assay has demonstrated full occupancy of Btk by PCI-32765 in cancer patients at 4 and 24 hours post-dose beginning at the 2.5 mg/kg dose level, at AUC >200ng hr/mL. See below for an example of probe assay data from a clinical trial patient.

Mechanism of Action

PCI-32765 is a potent and selective small molecule inhibitor of Btk, a signaling kinase expressed in B cells that functions downstream of the B cell antigen receptor (BCR). Selective inhibition of Btk by PCI-32765 blocks B-cell receptor signaling and prevents B cell activation (Honigberg et al., Proc Natl Acad Sci USA, 2010; 107: 13075-80). PCI-32765 binds irreversibly to the active site of Btk, thereby inhibiting the activity of Btk (IC50 of 0.5 nM). Importantly, as Btk is not found in T cells, in vitro application of PCI-32765 to T cells shows that PCI-32765 does not affect T-cell function. PCI-32765 is a selective inhibitor and does not appear to bind to other cellular proteins, with few exceptions, as

strongly and as rapidly as it does to Btk. In humans, the levels of PCI-32765 in the blood are reduced by half within 1.5 to 2.5 hours. The unique combination of irreversible binding and rapid elimination reduces the likelihood of “off-target” effects of PCI-32765. This has clinical relevance, as often off-target interactions contribute to the toxicity of drugs.

Several lines of evidence suggest that signaling through the BCR pathway is necessary to sustain the viability of B-cell lymphomas, and Btk recently was identified in an siRNA screen as an essential kinase for survival in a subset of diffuse large cell lymphomas driven by activated BCR. In these cells, chronic active BCR signaling drives constitutive NF-κB signaling blocking apoptosis; blocking Btk with PCI-32765 was shown to promote apoptosis in these cells (Davis et al., Nature, 2010; 463: 88-94).

In chronic lymphocytic leukemia (CLL), multiple studies have documented evidence of enhanced BCR signaling, especially in patients with IgVH unmutated disease or those with increased ZAP-70 expression. We have recently published a detailed study demonstrating that PCI-32765 promotes apoptosis, inhibits proliferation, and also prevents CLL cells from responding to survival stimuli provided by the microenvironment (Herman et al, Blood, 2011; 117:6287-6296). In this study, treatment of CD40 or BCR activated CLL cells with PCI-32765 resulted in inhibition of Btk tyrosine phosphorylation and also effectively abrogated downstream survival

pathways activated by this kinase including ERK1/2, PI3K, and NF-κB. Additionally, PCI-32765 inhibited activation-induced proliferation of CLL cells in vitro, effectively blocking survival signals provided externally to CLL cells from the microenvironment including soluble factors (CD40L, BAFF, IL-6, IL-4, and TNF-α), fibronectin engagement and stromal cell contact.

Btk Inhibitor PCI-32765 Clinical Development Update

At the 2011 Annual Meeting of the American Society of Clinical Oncology (ASCO), we presented interim results of our Phase IB/II study in CLL/SLL patients. The presentation included interim data from a single-agent, multi-cohort study evaluating PCI-32765 in CLL/SLL patients with relapsed/ refractory disease or with treatment-naive disease, who were 65 years of age or older. A daily oral dose of 420mg was tested initially, and an additional cohort of patients with relapsed/ refractory disease treated with 840mg daily was enrolled following closure of the 420mg QD relapsed/ refractory cohort. This group of patients had a shorter median follow-up time and was included only for initial response

assessment and summary safety data.

As described in this ASCO presentation, PCI-32765 was well-tolerated overall; discontinuation of treatment for adverse events occurred in 3 of 83 patients. Diarrhea, nausea/ vomiting, and dyspepsia were the most frequently reported events and were typically of modest severity. Significant neutropenia and thrombocytopenia were uncommon in the 420mg qD cohorts, but more frequently observed (18%, 9% respectively) in the 840mg qD cohort in spite of the shorter follow-up. As previously reported, a characteristic pattern of response occurred in the CLL patients, with rapid reduction of lymph node disease and a corresponding initial phase of lymphocytosis. The resolution of lymphocytosis was more rapid in treatment-naive

versus relapsed/ refractory patients, corresponding to a more rapid evolution of overall response per standard criteria in treatment-naive patients. At a median follow-up of 6.3 months, 67% of patients with treatment-naive disease had achieved an overall objective response by standard criteria, with an additional 19% of patients achieving a nodal response (a reduction of lymph node disease). At a median follow-up of 7.8 months in the cohort of relapsed/ refractory patients treated with 420mg qD, the rate of overall objective response was 48% with an additional 41% of patients having achieved a nodal response. The initial response assessment at 2 months in patients with relapsed/ refractory disease appeared similar between the 420mg qD and 840mg qD doses. Additionally, achieving response appeared to be independent of poor-risk features, such as del (17p), del (11q), and lack of mutation

in the immunoglobulin heavy chain variable region gene. Through June 30, 2011, three patients have experienced disease progression, and 81% of relapsed/ refractory patients in the more mature 420mg qD cohort are on treatment and free-of-progression at 6 months.

At the 11th International Conference on Malignant Lymphomas in Lugano, Switzerland in June, 2011, we reported an update on our Phase IA trial of PCI-32765 in patients with relapsed or refractory B-cell malignancies. No significant changes in the safety profile have emerged with longer follow-up of this trial. Low-grade diarrhea, fatigue, cough, nausea, and headache were the most frequently reported adverse events; significant neutropenia and thrombocytopenia were uncommon. With longer follow-up, the objective response rate in evaluable patients with CLL/SLL (now 11/14, 79%) and follicular lymphoma (now 6/13, 46%) improved as compared to

December 2010. Twenty-two patients remain on the treatment, including five of the nine mantle cell lymphoma patients enrolled in the study. Objective response rates in MCL and DLBCL were also reported, with MCL at 78% (7 out of 9 patients, with an additional 1 with stable disease on treatment greater than 20 months) and DLBCL at 23% (2 out of 7 patients).

In August 2011, we entered into a five-year Cooperative Research and Development Agreement with the National Cancer Institute (NCI) to collaborate on the development of PCI-32765. Under the Agreement, the NCI's Division of Cancer Treatment and Diagnosis plans to sponsor Phase I and Phase II trials of PCI-32765 in various hematologic malignancies.

Chronic Lymphocytic Leukemia / Small Lymphocytic Lymphoma

Two ongoing studies, initiated in calendar Q1 2011, are evaluating PCI-32765 in combination with standard therapies for CLL/SLL (PCI-32765 in combination with ofatumumab (PCYC-1109) or with bendamustine and rituximab (PCYC-1108). We expect to be able to analyze initial 3-month safety data for the combinations being evaluated in these studies before the end of calendar 2011.

Based on the significant single-agent activity demonstrated in CLL/SLL from the Phase I and Phase II trials, and contingent upon the demonstration of safety of combining PCI-32765 with other commonly used CLL regimens, Phase III planning is currently underway.

Mantle Cell Lymphoma (MCL)

In February 2011 a Phase II study of single-agent PCI-32765 in relapsed or refractory MCL (PCYC-1104) began enrollment. We submitted an abstract for presentation at the 2011 American Society of Hematology Annual Meeting (San Diego, CA, December 10 – 13). Based on the significant single-agent activity demonstrated in MCL from the Phase IA trial and contingent upon the ongoing analysis of the Phase II trial, Phase III planning is currently underway.

Diffuse Large B-Cell Lymphoma (DLBCL)

A multicenter, open-label, Phase II study of PCI-32765 in patients with relapsed or refractory DLBCL (PCYC-1106) began enrollment in Q2 2011. This study is designed to assess the activity of PCI-32765 in two genetically distinct subtypes of DLBCL, the activated B-cell (ABC) subtype and the germinal center (GC) subtype. Other trials evaluating the combination of PCI-32765 with chemotherapy in DLBCL are under development.

A separate pilot study of PCI-32765 in 10 patients with ABC subtype DLBCL is currently being conducted at the NIH Clinical Center. A preliminary analysis of this study has been submitted for presentation at the 2011 American Society of Hematology Annual (San Diego, CA, December 10 – 13).

Follicular Lymphoma (FL)

We are encouraged by the preliminary signals from our Phase IA trial and are currently developing a Phase II program in this histology.

Multiple Myeloma (MM)

Ongoing pre-clinical studies, both internally as well as through external collaborations, have suggested a vital role for Btk in both malignant plasma cells and osteoclasts, the principal effectors of the bone complications of this disease. Based on this preclinical data, we believe that Btk represents a viable therapeutic target in MM, and we are currently developing a Phase II trial of PCI-32765 in MM.

PCI-32765 Patents

PCI-32765 and other Btk inhibitors (as compounds, in pharmaceutical compositions, PD markers, methods, and in uses for treating a variety of diseases) are covered by US patent applications (issued and pending) and PCT national phase patent applications in fifteen ex-US jurisdictions, including Europe, Canada, Mexico, Japan, China, India, South Korea, Australia, Brazil, etc. The projected expiration of global coverage is through December 2026 and beyond, excluding patent term extensions in the various territories which can be up to five years.

Btk Inhibitor Market Opportunity

There are significant and distinct areas of unmet medical need across the NHL subtypes. Within the indolent lymphomas, we believe a need exists for active therapies that avoid the toxicities typically seen with conventional chemotherapies. Such active therapies are needed as part of effective combinations early in the course of treatment, and also as effective single-agent treatments later in the course of disease progression. In particular, drugs which are well tolerated and which do not limit subsequent treatment options because of bone marrow or other organ toxicity are demanded. In the aggressive lymphomas, it is our belief that the need exists for agents that can combine with

standard therapies to improve cure rate, and for agents that are effective in patients that fail potentially curative therapy.

In the major pharmaceutical markets in the US, Europe and Japan, Decision Resources, Inc. estimates the following for 2011: There are 305,440 prevalent cases living with DLBCL, with 50,180 patients estimated to be in the first line setting and 34,320 patients estimated to be in the relapsed/refractory setting. Prevalence is defined as people living with a history of the disease at a particular point in time. CLL/SLL constitutes about one-third of the B-cell malignancy population. There are 172,630 prevalent cases living with CLL, with 39,390 patients estimated to be in the first line setting and 33,550 patients estimated to be in the relapsed/refractory CLL setting. Follicular lymphoma (FL) constitutes

about 20% of the B-cell malignancy population and is considered an indolent, yet incurable, disease. There are 136,450 prevalent cases living with FL, with 21,050 patients estimated to be in the first line setting and 14,270 patients estimated to be in the relapsed/refractory setting. MCL, generally an aggressive form of lymphoma, comprises approximately 5% of the newly diagnosed B-cell malignancies. There are 32,180 prevalent cases living with MCL, with 5,300 patients estimated to be in the first line setting and 4,140 patients estimated to be in the relapsed/refractory setting.

There are many distinct substypes of B-cell malignancies; the common ones include the following: follicular lymphoma, chronic lymphocytic leukemia/small lymphocytic lymphoma, diffuse large B-cell lymphoma and mantle cell lymphoma. The NHL therapy market will experience robust annual growth (7.6% per year) and more than double in size over the years 2009-2019 from approximately $4.1 billion in 2009 to approximately $8.4 billion in 2019, as forecasted by Decision Resources, Inc. in the Non-Hodgkin’s Lymphoma Onks Study, April 2001.

Btk Inhibitor for Autoimmune Diseases Pre-Clinical Development

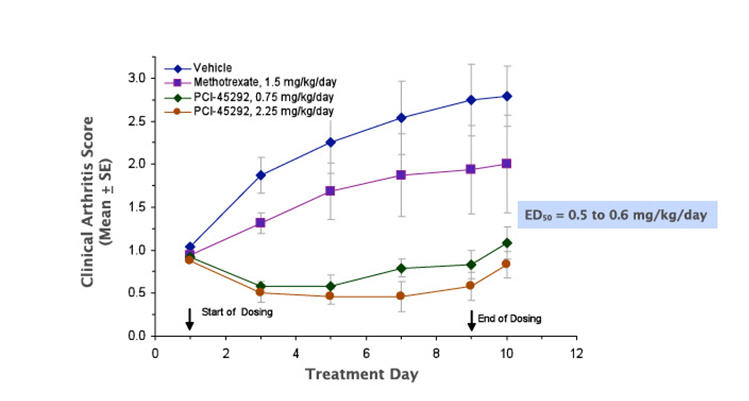

In animal models of rheumatoid arthritis, we have observed that oral administration of Btk inhibitors leads to regression of established disease. Currently we are working on a second series of patented Btk inhibitors with the goal of optimizing the molecules for potency, pharmacokinetics, and safety. In March 2011 we stopped further advancement of our previous preclinical development molecule, PCI-45292, following the results from preclinical toxicology studies. PCI-45292 was characterized as having increased selectivity for Btk inhibition, a reduced potential for off-target protein binding, and improved metabolic stability. Also, as shown in the figure below,

PCI-45292 ameliorated inflammation in collagen-induced arthritis models at very low doses. Therefore we believe that 2nd generation Btk compounds like PCI-45292 have the required characteristics to become a new oral disease modifying anti-rheumatic drug (DMARD).

PCI-45292 completely suppresses arthritic inflammation in a Collagen-induced Arthritis Model

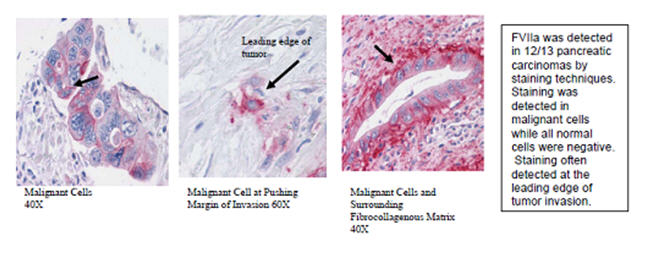

Factor VIIa Inhibitor Program

Factor VIIis aproteolytic enzyme that becomes activated (FVIIa) by binding to the cell surface protein tissue factor (TF). TF is over expressed in many cancers including gastric, breast, colon, lung, prostate, ovarian, and pancreatic cancers. In these tumors, the FVIIa/TF complex induces intracellular signaling pathways by activating PAR-2. This in turn increases the expression of interleukin-8 (IL-8) and vascular endothelial growth factor (VEGF), two proteins that play an important role in tumor growth and metastases

as well as angiogenesis. FVIIa also initiates the coagulation processes implicated in the high incidence of thromboembolic complications seen in cancer patients. Thromboembolic events are a major cause of death in patients with cancer, and anticoagulant treatment has been shown to improve survival in a variety of cancers (Klerk et al. JCO. 2005).

PCI-27483 Factor VIIa Inhibitor

Our Factor VIIa inhibitor PCI-27483 is a novel first-in-human small molecule inhibitor that selectively targets FVIIa. As an inhibitor of FVIIa, PCI-27483 has two potential mechanisms of action: 1) inhibition of intracellular signaling involved in tumor growth and metastases and 2) inhibition of early coagulation processes associated with thromboembolism.

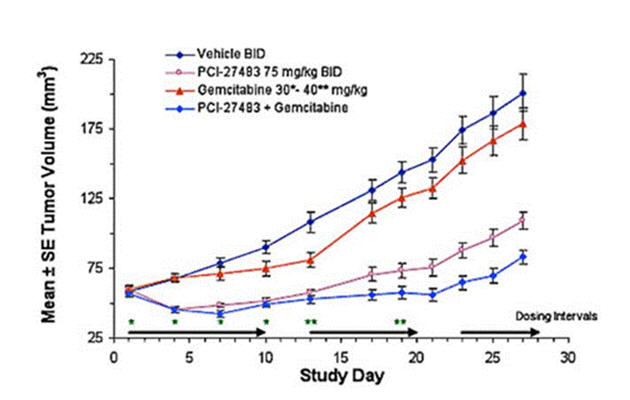

PCI-27483 Anti-Tumor Effects in a Pancreatic Tumor Xenograft Model

Preclinical studies have shown PCI-27483 to significantly inhibit tumor growth in human pancreatic xenograft mice models, with or without gemcitabine.

Tumor growth inhibition

|

·

|

16.7% with gemcitabine alone

|

|

·

|

71.3% with PCI-27483 alone

|

|

·

|

89.7% with PCI-27483 plus gemcitabine

|

In cancer, the Factor VIIa: TF complex triggers a host of physiologic processes that facilitate tumor angiogenesis, growth, and metastases. Laboratory studies and animal models indicate that PCI-27483 inhibits tumor angiogenesis, growth and metastases.

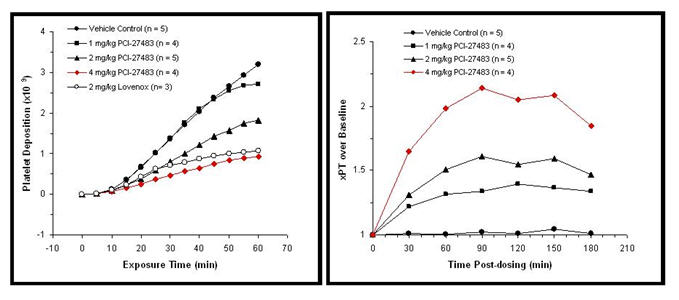

PCI-27483 Anti-Thrombotic Effects in an Arterial Thrombosis Model

The anti-thrombotic effects of PCI-27483 were determined in a baboon model of arterial thrombosis. In this model, PCI-27483 showed dose-dependent inhibition of thrombus formation, fibrin accumulation, and prothrombin time, and 4mg/kg PCI-27483 demonstrated comparable anti-coagulation effects as 2mg/kg Lovenox.

Factor VIIa PCI-27483 Clinical Development Update

We have completed our initial Phase I testing of PCI-27483 in healthy volunteers. The primary objective of the ascending dose study was to assess the pharmacodynamic and pharmacokinetic profiles of PCI-27483 following a single, subcutaneous injection. In addition, the safety and tolerability of PCI-27483 was evaluated. The drug was well tolerated and no adverse event was observed at any dose level. The International Normalized Ratio (INR) of prothrombin time, a laboratory test for coagulation, was used to measure pharmacodynamic effect at dose levels of 0.05, 0.20, 0.80 and 2.0 mg/kg. A mean peak INR of 2.7 was achieved without adverse effects at the highest dose level administered.

The target INR range for oral anti-coagulants i.e. Coumadin, is between 2 and 3. The half-life of PCI-27483 was 9 to 10 hours, which compares favorably to the single-dose half-life of the low molecular weight heparin products Lovenox (4.5 hours) and Fragmin (3 to 5 hours).

In a multicenter Phase I/II study, PCI-27483 is being evaluated in combination with gemcitabine for its safety and its potential to delay tumor progression and increase overall survival in patients with locally advanced or metastatic ductal adenocarcinoma of the pancreas. Secondary endpoints include effect on levels of circulating tissue factor and frequency of venous thrombotic complications. The Phase II portion of the study is randomized, with patients receiving gemcitabine alone or gemcitabine plus PCI-27483.

PCI-27483 Patents

PCI-27483 is covered by US patent applications (issued and pending) and national phase patent applications (issued and pending) in fourteen ex-US jurisdictions, including Europe, Canada, Mexico, Japan, China, India, South Korea, Australia and Brazil. The projected expiration of this coverage is through December 2023 and beyond, excluding patent term extensions in the various territories which can be up to five years.

Factor VIIa Inhibitor Market Opportunity

Each year 230,000 individuals worldwide are diagnosed with pancreatic cancer (UK Cancer Research) (in the US more than 36,640 are diagnosed each year) (Decision Resources PatientBase 2010). Worldwide incidence of other cancers types that also have been shown to have high TF expression include: colon; ovarian; breast; prostate, and lung cancer.

Histone Deacetylase Inhibitor Program

Histone deacetylases (HDACs) are well-validated drug targets in a number of disease areas, particularly cancer, but also in autoimmune and neurodegenerative diseases. These enzymes control several vital cellular processes, such as transcription, cell cycle progression, protein transport and degradation etc, and their activity is often dysregulated in cancer. Classically, the major function of these enzymes is controlling the expression of genes, i.e. whether genes are turned “on” or “off”. In cancer, HDACs are often hyper-active, resulting in expression changes that favor a tumor’s ability to multiply, to avoid apoptosis (i.e. programmed cell death) or to become

resistant to chemotherapy. Treatment with HDAC inhibitors reverses these changes, resulting in cancer cell death in vitro (i.e. in cultured cells) and tumor growth inhibition in vivo (i.e. in animals) at non-toxic concentrations.

PCI-24781 (Pan-HDAC Inhibitor)

PCI-24781 is a novel, broad spectrum, hydroxamic acid-based small molecule HDACi that is under evaluation in phase I and II clinical trials for refractory solid tumors and lymphoma by Pharmacyclics and its global partner, Les Laboratories Servier of Paris, France (Servier). PCI-24781 has shown strong anti-tumor activity in vitro and in vivo (Buggy et al Mol Cancer Ther 2006; 5: 1309-17). In the clinic, PCI-24781 has also demonstrated activity as a single agent in several subtypes of lymphoma (see below).

PCI-24781 treatment leads to synergistic efficacy in tumor cells in combination with many cancer therapeutics, such as bortezomib, as well as DNA-damaging agents such as radiation (Banuelos et al Clin Cancer Res 2007 13:6816-26) and chemotherapy agents such as doxorubicin (Lopez et al, Clin Cancer Res 2009 15:3472-83, Yang et al, Anticancer Res. 2011 31:1115-23). In lymphoma cells, PCI-24781 together with bortezomib greatly enhances proteasome and NF-kB inhibition, increases oxidative stress, causes cell cycle arrest and results in increased cell death (Bhalla et al Clin Cancer Res 2009 15:3354-65). In solid tumor cells, we have shown that PCI-24781 inhibits DNA repair following

damage by radiation or chemotheraputic agents, thereby enhancing the efficacy of these anti-cancer agents. The mechanism of the synergy may involve inhibition homologous recombination pathway, a major double-strand break (DSB) repair pathway. We have also shown that PCI-24781 also effectively synergizes with inhibitors of single-strand break repair such as PARP inhibitors (Adimoolam et al 2007). Recently, it was shown that PCI-24781 was the most active HDACi tested as a single agent in MPNST (Malignant Peripheral Nerve Sheath Tumor), a subtype of sarcoma (Lopez et al 2011). Furthermore, PCI-24781 demonstrated highly synergistic growth inhibition of chemotherapy-resistant tumors in combination with chloroquine (an inhibitor of autophagy, a protective mechanism in cells under stress).

Recently, one of our collaborators, Dr. Pamela Munster at the University of San Francisco, showed that PCI-24781 can potentiate tamoxifen treatment in estrogen receptor positive (ER+) breast cancer (below). Though about 70% of breast cancers are ER+, endocrine therapy using the anti-estrogen tamoxifen or other anti-ER pathway strategies provide benefit only in about half of these patients. Moreover, most ER+ patients that initially respond to tamoxifen eventually acquire resistance. Dr. Munster and her colleagues also showed that PCI-24781 can reverse tamoxifen resistance. In tamoxifen-resistant (TamR) breast cancer cells, the combination of clinically feasible concentrations of

PCI-24781 with tamoxifen attenuated the proliferation of the TamR cells and also induced cell death. This research was recently presented in a poster presentation at the American Association for Cancer Research Annual Meeting in April 2011.

Proprietary Predictive Assays

When tumor cells are treated with DNA damaging radiation and chemotherapeutics, they often turn on DNA repair genes such as RAD51, which is frequently over expressed in tumors, to help them repair the damage and thereby develop resistance to these agents. PCI-24781 can turn off RAD51 (and other DNA repair genes), effectively blocking the ability of the tumor to repair its damaged DNA, sensitizing the tumor to chemotherapy and radiation. We have patented the predictive use of RAD51 as a clinically applicable biomarker for prediction of sensitivity to HDAC inhibitors such as PCI-24781, and for predicting potential synergy with DNA damaging agents. This research was published in the Proceedings of

the National Academy of Sciences (Adimoolam et al., Proc Natl Acad Sci U S A. 2007; 104:19482-7. Epub 2007 Nov 27).

As mentioned, we have shown that PCI-24781 has growth inhibitory activity against several human primary tumors, including colon and ovarian cancers. However, due to the adaptability of the cancer genome, it is possible that in the clinic, patients’ tumors could have or develop resistance to treatment with PCI-24781. In order to identify biomarkers that could predict resistant tumors, we analyzed primary colon tumors that had differential treatment sensitivity to PCI-24781 by whole genome expression analysis, and developed a set of biomarkers that could potentially help segregate patients more likely to respond to PCI-24781 treatment in the clinic. Parts of this research were

presented as a seminar at the American Association for Cancer Research Annual Meeting in 2009. We have patented the predictive use of these biomarkers in colon as well as in other types of cancer.

HDAC Inhibitor PCI-24781 Clinical Development Update

PCI 24781 is currently in a Phase I/II trial in patients with recurrent lymphomas. The Phase I arm of this study has been completed and the results were published as a poster at the American Society for Hematology (ASH) Annual Meeting in December 2009 (Evens et al., Blood 2009; 114: 2726). As reported, one complete response, four partial responses and seven patients with stable disease were observed, with two of the responding patients still continuing on treatment for over two years. Reversible thrombocytopenia (reduced platelet count) was the most commonly observed adverse event in this trial, and based on the results of the Phase I arm, dose scheduling changes were implemented to minimize this effect. The

recommended Phase II dose and schedule was established as 45mg/m2, twice a day, 7 days on/7 days off in 4 week cycles.

Based upon the responses observed in the Phase I arm, the Phase II portion of the trial PCYC-0403 was commenced in two histologies, which are follicular and mantle cell lymphomas.

In solid tumors, a Phase I/II trial testing PCI-24781 in combination with doxorubicin in patients with soft tissue sarcoma is underway. This trial is co-sponsored by prominent investigators at Massachusetts General Hospital and Dana-Farber/Harvard Cancer Center, including Drs. George Demetri and Edwin Choy.

In addition to these trials, our ex-US partner Servier is also conducting an extensive series of clinical trials testing PCI-24781 as a single agent and in combination with other chemotherapeutic agents in lymphoma and various solid tumors. To date five clinical trials have been initiated by Servier and have shown encouraging clinical activity and safety. Servier is planning to conduct further combination trials with PCI -24781 in the near future.

Partnering

In April 2009, we entered into a collaboration agreement with Servier, pursuant to which we granted Servier an exclusive license for our pan-HDAC inhibitors, including PCI-24781, for territories throughout the world excluding the United States and its possessions. Under the terms of the agreement, Servier will pay us for reaching various development and regulatory milestones and a royalty on sales outside of the United States. We will continue to own all rights within the United States.

Patents

PCI-24781 and pan-HDAC inhibitors patents; covering their composition, pharmaceutical formulation, methods of uses, biomarkers; are issued or pending with coverage through 2024 and beyond in US and fifteen other international territories including Europe, Canada, Mexico, Japan, China, India and Brazil. In addition, we have also patented the predictive use of RAD51 biomarker, as well as the predictive methods of determining resistance to PCI-24781 in several territories. These patents would be subject to territorial patent term extensions of up to five years.

Pan-HDAC Inhibitor Market Opportunity for Combination Therapy

Pan-HDAC inhibitors may have the potential for broad anti-cancer indications in hematologic and solid malignancies when used in combination with numerous chemotherapeutic drugs and radiation. Agents such as doxorubicin and cisplatin are commonly used to treat many types of cancer including lymphoma, breast, ovarian, lung and liver cancer, each of which afflicts tens of thousands of patients in the US alone. Many of these patients develop resistance to the primary treatment, and refractory tumors represent a large unmet medical need in many of these tumor types. An agent such as PCI-24781 that can effectively synergize with and potentiate many of these therapies could find wide application in

combination strategies.

HDAC8-specific Inhibitor Program

Our scientists have been in the forefront of research into inhibitors for specific HDAC enzymes beginning with the cloning of the human HDAC8 in 2000 (Buggy et al., Biochem.J 2000; 350(1):199-205). Since then, we were the first to publish the crystal structure of a human HDAC (HDAC8) in 2004 (Somoza et al., Structure 2004;12:1325-34), the first to publish the most selective inhibitor of human HDAC8 (PCI-34051) in 2008 (Balasubramanian et al., Leukemia 2008, 22:1026-34), and the first to discover a novel anti-inflammatory activity of a HDAC8 inhibitor (Balasubramanian et al., Blood [ASH Annual Meeting Abstracts], Nov 2008; 112: 2581; manuscript in preparation). We continue to strengthen our intellectual

property position in HDAC8 inhibitors, with multiple patents on the gene, protein, the use and a large selective inhibitor panel.

Using our unique knowledge of the crystal structure of HDAC8 complex with multiple pan- and selective inhibitors, we had previously discovered a novel HDAC8 selective inhibitor, PCI-34051, which inhibits HDAC8 with a Ki of 10 nM (a measure of potency) with >200 fold selectivity over the other HDACs tested. Based on preclinical optimization efforts, we have identified two completely novel scaffolds that provided new leads with better pharmacokinetic (PK) properties while maintaining the HDAC8 selectivity and potency.

HDAC8 inhibitors possess certain unique activities across a range of clinical indications, including T-cell malignancies, neuroblastoma and inflammation as indicated below. We showed that HDAC8 selective inhibitor PCI-34051 induces growth arrest and apoptosis in cell lines derived from T-cell lymphomas and leukemias, but not in any other hematologic and most solid tumor cell lines (Balasubramanian et al., Leukemia 2008; 22:1026-1034). We have since shown that primary tumor cells obtained from patients suffering from cutaneous T-cell lymphoma (CTCL) can also be inhibited from proliferating and killed specifically with HDAC8 inhibitors.

HDAC8, uniquely among all HDAC enzymes, is over expressed in pediatric neuroblastoma tumors, and a high HDAC8 expression level is strongly associated with a poor prognosis (Oehme et al., Clin Cancer Res 2009, 15: 91-99). HDAC8-specific inhibitors induce growth inhibition of neuroblastoma cells and eventually lead to cell cycle arrest, and death or terminal differentiation into non-cancerous cells.

We have discovered that PCI-34051 inhibits the secretion of many pro-inflammatory proteins from blood cells (Balasubramanian et al., Blood [ASH Annual Meeting Abstracts], Nov 2008; 112:2581). PCI-34051 is particularly effective at modulating the proteins interleukin-1 beta (IL1b) and interleukin-18, both of which are associated with many autoimmune disorders. Anti-IL1b protein therapeutics have proven effective in treatment of RA and systemic juvenile RA (Pascual et al., J Exp.Med 2005; 201:1479-1486). We have also shown that PCI-34051 is effective at reducing IL1b secretion from blood cells of patients with RA and psoriasis.

Our Business Strategy

Our mission is to build a viable biopharmaceutical company that designs, develops and commercializes novel therapies intended to improve quality of life, increase duration of life and resolve serious medical healthcare needs. The key elements of our business strategy include:

|

·

|

Focusing on creating novel, patentable, differentiated biopharmaceutical products. We are leveraging our expertise in chemistry, biology and clinical development to create multiple novel drug candidates.

|

|

·

|

Focusing on proprietary drugs that address large markets of unmet medical need for the treatment of oncology and immune mediated diseases. Although our versatile technology platform can be used to develop a wide range of pharmaceutical agents, we have focused most of our initial efforts in oncology and immune mediated diseases where we have established strength in preclinical and clinical development.

|

|

·

|

Utilize biomarkers and predictive pharmacodynamic assays wherever possible. Targeting the right drug to the right patient at the right time with the right dose has the potential to greatly expedite intelligent clinical development and reduce the time, cost and risk of clinical programs.

|

|

·

|

Provide major pharmaceutical companies access to validated drug candidates. Major pharmaceutical companies have a need for promising drug candidates, which still may require large clinical trials. We focus on satisfying this need for novel, first in class or best in class drugs. A partnership with Pharmacyclics may provide these companies the opportunity to leverage the innovation and excellence of a creative, focused and experienced scientific team.

|

|

·

|

Establish strategic alliances and collaborations. Except for the ex-US pan-HDAC rights which we licensed to Servier, we own the worldwide rights to our multiple product candidates. When, as and if appropriate we maintain the option to establish strategic alliances and collaborations for the development and commercialization of our products.

|

|

·

|

Leverage development with outsourcing. We utilize outside vendors with expertise and capability in manufacturing and clinical development to more efficiently develop our multiple product candidates.

|

|

·

|

Create a large clinical pipeline. We improve our probability of success by taking multiple “shots on goal.”

|

We are subject to risks common to pharmaceutical companies developing products, including risks inherent in our research, development and commercialization efforts, preclinical testing, clinical trials, uncertainty of regulatory and marketing approvals, uncertainty of market acceptance of our products, history of and expectation of future operating losses, reliance on collaborative partners, enforcement of patent and proprietary rights, and the need for future capital. In order for a product to be commercialized, we must conduct preclinical tests and clinical trials, demonstrate efficacy and safety of our product candidates to the satisfaction of regulatory authorities, obtain marketing approval, enter

into manufacturing, distribution and marketing arrangements, build U.S. commercial capability, obtain market acceptance and, in many cases, obtain adequate coverage of and reimbursement for our products from government and private insurers. We cannot provide assurance that we will generate revenues or achieve and sustain profitability in the future.

Collaboration and License Agreements, Acquired Products

Collaboration and License Agreement with Servier. In April 2009, we entered into a collaboration and license agreement with Servier to research, develop and commercialize PCI-24781, an orally active, novel, small molecule inhibitor of pan-HDAC enzymes. Servier is the leading independent pharmaceutical company in France. Under the terms of the agreement, Servier acquired the exclusive right to develop and commercialize the pan-HDAC inhibitor product worldwide except for the United States and its possessions. Pharmacyclics will continue to own all rights

within the United States.

In May 2009, we received an upfront payment of $11,000,000 ($10,450,000 net of withholding taxes) from Servier and received an additional $4,000,000 for research collaboration which was paid over a twenty-four month period through April 2011. In April 2011, we also received a $7,000,000 advance development milestone payment from Servier. Under the agreement, we could receive an additional amount of approximately $17,500,000 upon the achievement of certain future development and regulatory milestones, as well as royalty payments. Servier is solely responsible for conducting and paying for all development activities outside the United States.

The collaboration and license agreement continues until the later of the expiration of any patent rights licensed under the license agreement and the expiration of all periods of market exclusivity with respect to licensed compounds. Either Servier or we can terminate the agreement under certain circumstances, including material breach and insolvency. Servier can terminate the agreement at any time due to safety or public health issues or after the second anniversary of the effective date of the agreement.

Celera Corporation. In April 2006, we acquired multiple small molecule drug candidates for the treatment of cancer and other diseases from Celera Genomics, an Applera Corporation business (now Celera Corporation - a subsidiary of Quest Diagnostics Incorporated). Future milestone payments under the agreement, as amended, could total as much as approximately $97,000,000, although we currently cannot predict if or when any of the milestones will be achieved. Approximately two-thirds of the milestone payments relate to our HDAC Inhibitor program and approximately one-third relates to our Factor VIIa program.

Approximately 90% of the potential future milestone payments would be paid to Celera after obtaining regulatory approval in various countries. There are no milestone payments related to our Btk program. In addition to the milestone payments, Celera will be entitled to royalty payments based on annual sales of drugs commercialized from our HDAC Inhibitor, Factor VIIa inhibitor and certain Btk Inhibitor programs.

The University of Texas License. In 1991, we entered into a license agreement with the University of Texas under which we received the exclusive worldwide rights to develop and commercialize porphyrins, expanded porphyrins (e.g. motexafin gadolinium) and other porphyrin-like substances covered by their patents. In consideration for the license, we have paid a total of $300,000. We are obligated to pay royalties based on net sales of products that utilize the licensed technology. The term of the license agreement ends upon the last to expire of the patents covered by the license. We have royalty obligations under the

license as long as valid and unexpired patents covering the licensed technology exist. Currently, the dates the last United States and ex-United States (international) patents covered by the agreement expire are 2020 and 2014, respectively. Under this agreement, we must be attempting to commercialize one or more products covered by the licensed technology. In the event we fail to attempt to commercialize one or more products covered by the licensed technology, the University of Texas may convert the exclusive license into a non-exclusive license.

Patents and Proprietary Technology

We believe our success depends in part on our ability to protect and defend our proprietary technology and product candidates through patents and trade secret protection. We, therefore, aggressively pursue, prosecute, protect and defend patent applications, issued patents, trade secrets, and licensed patent and trade secret rights covering certain aspects of our technology. The evaluation of the patentability of United States and foreign patent applications can take years to complete and can involve considerable expense.

We have a number of patents and patent applications related to our compounds but we cannot be certain that issued patents will be enforceable or provide adequate protection or that pending patent applications will issue as patents. Even if patents are issued and maintained, these patents may not be of adequate scope to benefit us, or may be held invalid and unenforceable against third parties.

Our patents, patent applications, and licensed patent rights cover various compounds, pharmaceutical formulations and methods of use. Pharmacyclics owns or licenses rights to:

|

·

|

42 issued U.S. patents; and

|

|

·

|

35 other pending U.S. patent applications.

|

These issued U.S. patents expire at various times depending on product programs (see above program sections). In addition, Pharmacyclics owns or licenses approximately 72 issued foreign patents, 3 Patent Cooperation Treaty (“PCT”) patent applications, and more than 126 pending non-U.S. patent applications filed with the European Patent Office, and nationally in Canada, Japan, China, Australia and other international territories.

All of these issued patents would be subject to potential patent term extensions in the U.S. and non-U.S. international territories (up to five years depending on territory).

We may be unsuccessful in prosecuting our patent applications or patents may not issue from our patent applications. Even if patents are issued and maintained, these patents may not be of adequate scope to benefit us, or may be held invalid and unenforceable against third parties.

We also rely upon trade secrets, technical know-how and continuing technological innovation to develop and maintain our competitive position. We require all of our employees, consultants, advisors and the like to execute appropriate confidentiality and assignment-of-inventions agreements. These agreements typically provide that all materials and confidential information developed or made known to the individual during the course of the individual's relationship with us is to be kept confidential and not disclosed to third parties, except in specific circumstances, and that all inventions arising out of the relationship with Pharmacyclics shall be our exclusive property.

Research and Development

The majority of our operating expenses to date have been related to research and development, or R&D. R&D expenses consist of independent R&D costs and costs associated with collaborative R&D. R&D expenses were $34,482,000 in fiscal 2011, $17,358,000 in fiscal 2010 and $13,954,000 in fiscal 2009.

Marketing and Sales

We currently are not directly pursuing marketing, sales, or distribution activities.

Manufacturing

We use third parties to manufacture various components of our products under development. We have entered into several commercial supply agreements with manufacturers.

Competition

We face intense competition for each of our drug targets from pharmaceutical companies, universities, governmental entities and others in the development of therapeutic and diagnostic agents for the treatment of diseases which we target. See "Risk Factors — Risks Related to Our Industry – We face rapid technological change and intense competition."

In addition, see the section titled “Our Drug Development Programs” for further information on some of the competition for our drug programs.

Government Regulation and Product Approval

The FDA and comparable regulatory agencies in state and local jurisdictions and in foreign countries impose substantial requirements upon the clinical development, manufacture and marketing of pharmaceutical products. These agencies and other federal, state and local entities regulate research and development activities and the testing, manufacture, quality control, safety, effectiveness, labeling, storage, record keeping, approval, advertising and promotion of our product candidates. Failure to comply with FDA requirements, both before and after product approval, may subject us to administrative or judicial sanctions, including but not limited to, FDA refusal to approve pending applications, warning letters,

product recalls, product seizures, or total or partial suspension of production or distribution, fines, injunctions, or civil or criminal penalties.

The process required by the FDA before our products may be marketed in the U.S. generally involves the following:

|

·

|

completion of preclinical laboratory and animal tests;

|

|

·

|

submission of an Investigational New Drug (IND) application, which must become effective before clinical trials may begin;

|

|

·

|

performance of adequate and well-controlled human clinical trials to establish the safety and efficacy for each intended use;

|

|

·

|

submission to the FDA of a New Drug Application (NDA); and

|

|

·

|

satisfactory completion of an FDA pre-approval inspection of the manufacturing facility or facilities at which the product candidate is made to assess compliance with the FDA’s current good manufacturing practice (cGMP) regulations.

|

The testing and approval process requires substantial time, effort, and financial resources; and we cannot be certain that any approval will be granted on a timely basis, if at all.

Preclinical tests include laboratory evaluation of the product, its chemistry, formulation and stability, as well as animal studies to assess the potential safety and efficacy of the product. We then submit the results of the preclinical tests, together with manufacturing information and analytical data, to the FDA as part of an IND, which must become effective before we may begin human clinical trials. The IND automatically becomes effective 30 days after receipt by the FDA, unless the FDA, within the 30-day time period, raises concerns or questions about the conduct of the trials as outlined in the IND, including concerns that human research subjects will be exposed to unreasonable health risks. In such a case,

the IND sponsor and the FDA must resolve any outstanding concerns before clinical trials can begin. Our submission of an IND may not result in FDA authorization to commence clinical trials. Further, an independent Institutional Review Board at the medical center proposing to conduct the clinical trials must review and approve any clinical study.

Human clinical trials are typically conducted in three sequential phases which may overlap:

|

·

|

Phase I: The drug is initially introduced into healthy human subjects or patients and tested for safety, dosage tolerance, absorption, metabolism, distribution and excretion.

|

|

·

|

Phase II: Involves studies in a limited patient population to identify possible adverse effects and safety risks, to evaluate preliminarily the efficacy of the product for specific targeted diseases and to determine dosage tolerance and optimal dosage.

|

|

·

|

Phase III: When Phase II evaluations demonstrate that a dosage range of the product may be effective and has an acceptable safety profile, Phase lll trials are undertaken to further evaluate dosage and clinical efficacy and to further test for safety in an expanded patient population at geographically dispersed clinical study sites.

|

In the case of products for severe or life-threatening diseases such as cancer, the initial human testing is often conducted in patients rather than in healthy volunteers. Since these patients already have the target disease, these studies may provide initial evidence of efficacy traditionally obtained in Phase II trials and thus these trials are frequently referred to as Phase I/II trials. We cannot be certain that we will successfully complete Phase I, Phase II or Phase III testing of our product candidates within any specific time period, if at all. Furthermore, the FDA, the relevant Institutional Review Board or the sponsor may suspend clinical trials at any time on various grounds, including

a finding that the subjects or patients are being exposed to an unacceptable health risk.

The results of product development, preclinical studies and clinical studies are submitted to the FDA as part of a New Drug Application, or NDA, for approval of the marketing and commercial shipment of the product. The FDA may not accept the NDA for review if the applicable regulatory criteria are not satisfied or may require additional clinical data. Even if such data are accepted for filing, the FDA may ultimately decide that the NDA does not satisfy the criteria for approval. In addition, before approving an NDA, the FDA will inspect the facilities at which the product is manufactured and will not approve the product unless the facility is in substantial compliance with cGMP regulations. Once issued, the FDA may

withdraw product approval if compliance with regulatory standards is not maintained or if problems occur after the product reaches the market. In addition, the FDA may require testing and surveillance programs to monitor the effect of approved products which have been commercialized, and the agency has the power to prevent or limit further marketing of a product based on the results of these post-marketing programs.

Satisfaction of the above FDA requirements or similar requirements of state, local and foreign regulatory agencies typically takes several years and the actual time required may vary substantially, based upon the type, complexity and novelty of the pharmaceutical product. Government regulation may delay or prevent marketing of potential products for a considerable period of time and impose costly procedures upon our activities. We cannot be certain that the FDA or any other regulatory agency will grant approval for any of our products under development on a timely basis, if at all. Success in preclinical or early stage clinical trials does not assure success in later stage clinical trials. Data obtained from

preclinical and clinical activities is not always conclusive and may be susceptible to varying interpretations which could delay, limit or prevent regulatory approval. Even if a product receives regulatory approval, the approval may be significantly limited to specific indications. Further, even after regulatory approval is obtained, later discovery of previously unknown problems with a product may result in restrictions on the product or even complete withdrawal of the product from the market. Delays in obtaining, or failures to obtain regulatory approvals would have a material adverse effect on our business. Marketing our products abroad will require similar regulatory approvals and is subject to similar risks. In addition, we cannot predict what adverse governmental regulations may arise from future U.S. or foreign governmental action.

Any products manufactured or distributed by us pursuant to FDA approvals are subject to pervasive and continuing regulation by the FDA, including record-keeping requirements and reporting of adverse experiences with the drug. Drug manufacturers and their subcontractors are required to register their establishments with the FDA and certain state agencies, and are subject to periodic unannounced inspections by the FDA and certain state agencies for compliance with Good Manufacturing Practice regulations, which impose certain procedural and documentation requirements upon us and our third-party manufacturers. We cannot be certain that we or our present or future suppliers will be able to comply with the current Good

Manufacturing Practice, or cGMP, regulations and other FDA regulatory requirements.

The FDA regulates drug labeling and promotion activities. The FDA has actively enforced regulations prohibiting the marketing of products for unapproved uses. The FDA will permit the promotion of a drug for an unapproved use in certain circumstances, but subject to very stringent requirements. We and our products are also subject to a variety of state laws and regulations in those states or localities where our products are or will be marketed. Any applicable state or local regulations may hinder our ability to market our products in those states or localities. We are also subject to numerous federal, state and local laws relating to such matters as safe working conditions, manufacturing practices, environmental

protection, fire hazard control, and disposal of hazardous or potentially hazardous substances. We may incur significant costs to comply with such laws and regulations now or in the future.

The FDA's policies may change and additional government regulations may be enacted which could prevent or delay regulatory approval of our potential products. Moreover, increased attention to the containment of health care costs in the U.S. and in foreign markets could result in new government regulations which could have a material adverse effect on our business. We cannot predict the likelihood, nature or extent of adverse governmental regulation which might arise from future legislative or administrative action, either in the U.S. or abroad.

Employees

As of June 30, 2011, we had 77 employees, all of whom were full-time employees. Fifty-seven of our employees are engaged in research, development, preclinical and clinical testing, manufacturing, quality assurance and quality control and regulatory affairs and 20 are in finance and administration. Seventeen of our employees have an M.D. or Ph.D. degree. Our future performance depends in significant part upon the continued service of our key scientific, technical and senior management personnel, none of whom is bound by an employment agreement requiring service for any defined period of time. The loss of the services of one or more of our key employees could harm our business. None of our

employees are represented by a labor union. We consider our relations with our employees to be good.

Available Information

We were incorporated in Delaware in 1991 and commenced operations in 1992.

We file electronically with the Securities and Exchange Commission, or SEC, our annual reports on Form 10-K, quarterly interim reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934. We maintain a site on the worldwide web at www.pharmacyclics.com; however, information found on our website is not incorporated by reference into this report. We make our SEC filings available free of charge on or through our website, including our annual report on Form 10-K, quarterly interim reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the

Exchange Act of 1934 as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Further, a copy of this annual report on Form 10-K is located at the Securities and Exchange Commission’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Information on the operation of the Public Reference Room can be obtained by calling the Securities and Exchange Commission at 1-800-SEC-0330. The Securities and Exchange Commission maintains a website that contains reports, proxy and information statements and other information regarding our filings at www.sec.gov.

In 2004, we adopted a code of ethics that applies to our officers, directors and employees, including our principal executive officer, principal financial officer and principal accounting officer. We have posted the text of our code of ethics on our website at www.pcyc.com in connection with “Investor” materials. In addition, we intend to promptly disclose (1) the nature of any amendment to our code of ethics that applies to our principal executive officer, principal financial officer, principal accounting officer, or persons performing similar functions and (2) the nature of any waiver, including an implicit waiver, from a provision of our code of ethics that is granted to one of these specified

officers, the name of such person who is granted the waiver and the date of the waiver on our website in the future.

|

Item 1A.

|

Risk Factors

|

An investment in our securities involves a high degree of risk. Anyone who is making an investment decision regarding our securities should carefully consider the following risk factors, as well as the other information contained or incorporated by reference in this report. The risks and uncertainties described below are those that we currently believe may materially affect our company or your investment. Other risks and uncertainties that we do not presently consider to be material, or of which we are not presently aware, may become important factors that adversely affect our security holders or us in the future. If any of the risks discussed below actually materialize, then our business,

financial condition, operating results, cash flows and future prospects, or your investment in our securities, could be materially and adversely affected, resulting in a loss of all or part of your investment.

Risks Relating to Pharmacyclics

We will need substantial additional financing and we may have difficulty raising needed capital in the future.

We have expended and will continue to expend substantial funds to complete the research, development and clinical testing of our products. We are unable to entirely fund these efforts with our current financial resources. We may also raise additional funds through the public or private sale of securities, bank debt, collaborations or otherwise. If we are unable to secure additional funds, whether through additional partnership collaborations or sale of our securities, we will have to delay, reduce the scope of or discontinue one or more of our product development programs. Based upon the current status of our product development plans, we believe that our cash, cash equivalents and marketable

securities, will be adequate to satisfy our capital needs for at least the next twelve months. We may, however, choose to raise additional funds before then. Our actual capital requirements will depend on many factors, including:

|

·

|

progress with preclinical studies and clinical trials;

|

|

·

|

the time and costs involved in obtaining regulatory approval;

|

|

·

|

continued progress of our research and development programs;

|

|

·

|

our ability to establish and maintain collaborative arrangements with third parties;

|

|

·

|

the costs involved in preparing, filing, prosecuting, maintaining and enforcing patent claims;

|

|

·

|

the amount and timing of capital equipment purchases; and

|

|

·

|

competing technological and market developments.

|

In addition, our ability to raise additional capital may be dependent upon our stock being quoted on the NASDAQ Capital Market. In the past, our stock price has fallen below the $1.00 minimum bid price requirement for continued listing set forth in NASDAQ Marketplace Rule 4450(a) (5). While we have since regained compliance with Marketplace Rule 4450(a) (5), we cannot assure you that our stock price will continue to remain above the required minimum bid price. If we do not remain in compliance with the $1.00 minimum bid price requirement or any other NASDAQ listing requirement, our stock may be delisted by NASDAQ.

We also expect to raise any necessary additional funds through the public or private sale of securities, bank debt financings, collaborative arrangements with corporate partners or other sources that may be highly dilutive or otherwise disadvantageous, to existing stockholders or subject us to restrictive covenants. In addition, in the event that additional funds are obtained through arrangements with collaborative partners or other sources, such arrangements may require us to relinquish rights to some of our technologies, product candidates or products under development that we would otherwise seek to develop or commercialize ourselves. Additional funds may not be available on acceptable terms, if at all. Our

failure to raise capital when needed and on acceptable terms would require us to reduce our operating expenses, delay or reduce the scope of or eliminate one or more of our research or development programs and would limit our ability to respond to competitive pressures or unanticipated requirements and to continue operations. Any one of the foregoing would have a material adverse effect on our business, financial condition and results of operations.

Failure to obtain product approvals or comply with ongoing governmental regulations could adversely affect our business.

The manufacture and marketing of our products and our research and development activities are subject to extensive regulation for safety, efficacy and quality by numerous government authorities in the United States and abroad. Before receiving FDA approval to market a product, we will have to demonstrate to the satisfaction of the FDA that the product is safe and effective for the patient population and for the diseases that will be treated. Clinical trials, and the manufacturing and marketing of products, are subject to the rigorous testing and approval process of the FDA and equivalent foreign regulatory authorities. The Federal Food, Drug and Cosmetic Act and other federal, state and foreign statutes and

regulations govern and influence the testing, manufacture, labeling, advertising, distribution and promotion of drugs and medical devices. As a result, clinical trials and regulatory approval can take a number of years to accomplish and require the expenditure of substantial resources. Data obtained from clinical trials are susceptible to varying interpretations that could delay, limit or prevent regulatory approvals.

In addition, we may encounter delays or rejections based upon additional government regulation from future legislation or administrative action or changes in FDA policy during the period of product development, clinical trials and FDA regulatory review. We may encounter similar delays in foreign countries. We may be unable to obtain requisite approvals from the FDA and foreign regulatory authorities and even if obtained, such approvals may not be received on a timely basis, or they may not cover the clinical uses that we specify.

Furthermore, regulatory approval may entail ongoing requirements for post-marketing studies. The manufacture and marketing of drugs are subject to continuing FDA and foreign regulatory review and later discovery of previously unknown problems with a product, manufacturer or facility may result in restrictions, including withdrawal of the product from the market. Any of the following events, if they were to occur, could delay or preclude us from further developing, marketing or realizing full commercial use of our products, which in turn would have a material adverse effect on our business, financial condition and results of operations:

|

·

|

failure to obtain and thereafter maintain requisite governmental approvals;

|

|

·

|

failure to obtain approvals for specific indications of our products under development; or

|

|

·

|

identification of serious and unanticipated adverse side effects in our products under development.

|