Attached files

| file | filename |

|---|---|

| EX-10.32 - SERVIER TERMINATION LETTER - PHARMACYCLICS INC | exhibit1032servierterminat.htm |

| EXCEL - IDEA: XBRL DOCUMENT - PHARMACYCLICS INC | Financial_Report.xls |

| EX-10.34 - CCO OFFER LETTER - PHARMACYCLICS INC | exhibit1034cooofferletter.htm |

| EX-10.33 - SERVIER TERMINATION COMMITMENT - PHARMACYCLICS INC | exhibit1033servierterminat.htm |

| EX-23.1 - CONSENT - PHARMACYCLICS INC | exhibit231consent201410-k1.htm |

| EX-31.1 - CERTIFICATION OF PRINCIPAL EXECUTIVE OFFICER - PHARMACYCLICS INC | pcyc20141231exhibit3111.htm |

| EX-31.2 - CERTIFICATION OF CHIEF FINANCIAL OFFICER - PHARMACYCLICS INC | pcyc20141231exhibit3121.htm |

| EX-21 - SUBSIDIARY LISTING - PHARMACYCLICS INC | exhibit21-subsidiarylistin.htm |

| EX-10.9 - FORM OF OPTION AGREEMENT - PHARMACYCLICS INC | exhibit109formofoptionagr.htm |

| EX-32.1 - CERTIFICATION OF PRINCIPAL EXECUTIVE OFFICER AND PRINCIPAL FINANCIAL OFFICER - PHARMACYCLICS INC | pcyc20141231exhibit3211.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

____________________________________

FORM 10-K

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

Commission File Number: 000-26658

Pharmacyclics, Inc.

(Exact name of Registrant as specified in its charter)

Delaware | 94-3148201 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

995 E. Arques Avenue, Sunnyvale, CA | 94085-4521 |

(Address of principal executive offices) | (Zip code) |

Registrant’s telephone number, including area code: (408) 774-0330

____________________________________

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange On Which Registered | |

Common Stock, $.0001 Par Value | Nasdaq Capital Market | |

Securities registered pursuant to Section 12(g) of the Act: None

(Title of Class)

____________________________________

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý

No o

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter)

during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files) Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendments to this Form 10-K. o

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. Check one:

Large accelerated filer ý Accelerated filer o Non-accelerated filer o Smaller reporting company o

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

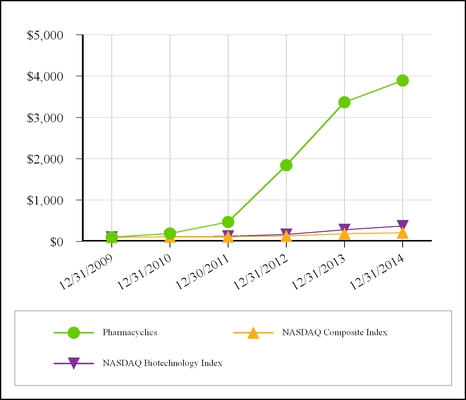

As of June 30, 2014, the aggregate market value of the voting and non-voting stock held by non-affiliates of the Registrant was $4,026,965,098 based on the closing sale price of the Registrant's common stock on The NASDAQ Stock Market LLC on that date. Shares of the Registrant's common stock beneficially owned by each executive officer and director of the Registrant and by each person known by the Registrant to beneficially own 10% or more of its outstanding common stock have been excluded, in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes. The number of outstanding shares of the Registrant’s common stock as of February 12, 2015 was 76,016,912.

____________________________________

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the following document are incorporated by reference into Part III of this Form 10-K: the Definitive Proxy Statement for the Registrant’s 2015 Annual Meeting of Stockholders which will be filed with the Securities and Exchange Commission within 120 days after the end of the Registrant’s fiscal year ended December 31, 2014.

ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2014

TABLE OF CONTENTS

Page | ||||||

PART I | ||||||

Item | 1 | Business | ||||

Item | 1A. | Risk Factors | ||||

Item | 1B. | Unresolved Staff Comments | ||||

Item | 2 | Properties | ||||

Item | 3 | Legal Proceedings | ||||

Item | 4 | Mine Safety Disclosures | ||||

PART II | ||||||

Item | 5 | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | ||||

Item | 6 | Selected Financial Data | ||||

Item | 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations | ||||

Item | 7A. | Quantitative and Qualitative Disclosures About Market Risk | ||||

Item | 8 | Financial Statements and Supplementary Data | ||||

Item | 9 | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | ||||

Item | 9A. | Controls and Procedures | ||||

Item | 9B. | Other Information | ||||

PART III | ||||||

Item | 10 | Directors, Executive Officers and Corporate Governance | ||||

Item | 11 | Executive Compensation | ||||

Item | 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | ||||

Item | 13 | Certain Relationships and Related Transactions and Director Independence | ||||

Item | 14 | Principal Accountant Fees and Services | ||||

PART IV | ||||||

Item | 15 | Exhibits and Financial Statement Schedules | ||||

Signatures | ||||||

Exhibits Index | ||||||

Part I

Important Factors Regarding Forward-Looking Statements

This report contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “goal,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “should” or “will” or the negative of such terms or other comparable terminology. In particular, forward-looking statements include:

• | statements about our future capital requirements and the sufficiency of our cash, cash equivalents, marketable securities and other financing proceeds to meet these requirements; |

• | information concerning possible or assumed future results of operations, trends in financial results and business plans; |

• | statements about our product development schedule; |

• | statements about our expectations for and timing of regulatory approvals for any of our product candidates; |

• | statements about the level of our expected revenues, costs and expenses; |

• | statements about the potential results of ongoing or future clinical trials; |

• | other statements about our plans, objectives, expectations and intentions; and |

• | other statements that are not historical fact. |

From time to time, we also may provide oral or written forward-looking statements in other materials we release to the public. Forward-looking statements are only predictions that provide our current expectations or forecasts of future events. Any or all of our forward-looking statements in this report and in any other public statements are subject to unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, performance or achievements. You should not place undue reliance on these forward-looking statements.

We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise. You are advised, however, to consult any further disclosures we make on related subjects in our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Also note that we provide a cautionary discussion of risks, uncertainties, assumptions and other factors relevant to our business under the caption Risk Factors and elsewhere in this report. These are risks that we think could cause our actual results to differ materially from expected or historical results.

Item 1. Business

Company Overview

We are a fully integrated biopharmaceutical company focused on developing and commercializing novel therapies for the treatment of cancer and immune-mediated diseases. We are currently an approximately 630-person company with in-house research and development, commercial and third-party contracted manufacturing capabilities and a growing U.S. footprint and global presence. Our goal is to make available therapies intended to improve quality of life, increase duration of life, and resolve serious unmet medical needs for patients. We will do this by identifying and controlling promising product candidates based on our scientific development and administrational expertise, developing our products in a rapid, cost-efficient manner, and by pursuing commercialization and/or development partners when and where appropriate. To that end, Pharmacyclics is at the forefront at transforming the speed by which innovative, high-quality medicines can advance from bench to bedside. Our first commercial product, IMBRUVICA® (ibrutinib), was developed and commercialized in 4.5 years from the start of its first clinical trial in 2009.

IMBRUVICA is a first-in-class, oral, once-daily, single-agent therapy which has demonstrated a survival advantage over an approved, standard-of-care therapy in a difficult-to-treat blood cancer. IMBRUVICA inhibits a protein called Bruton's tyrosine kinase (BTK), a key signaling molecule in the B-cell receptor signaling complex that plays an important role in the survival and spread of malignant B-cells. IMBRUVICA blocks signals that tell malignant B-cells to multiply and spread uncontrollably.

We market IMBRUVICA in the United States (U.S.) for our four FDA-approved indications for the treatment of patients with: chronic lymphocytic leukemia (CLL) who have received at least one prior therapy; all lines of CLL with deletion of the short arm of chromosome 17 (del 17p CLL); mantle cell lymphoma (MCL) who have received at least one prior therapy; and all lines of Waldenström's macroglobulinemia (WM).

Accelerated approval was granted for the MCL indication based on overall response rate (ORR). Improvements in survival or disease symptoms have not been established. Continued approval for the MCL indication may be contingent upon verification of clinical benefit in confirmatory trials. IMBRUVICA is the only medicine approved to treat patients with del 17p CLL and WM.

IMBRUVICA was one of the first medicines to receive FDA approval via the new Breakthrough Therapy Designation pathway, and is the only product to have received three Breakthrough Therapy Designations. In the U.S., IMBRUVICA received its first four FDA approvals in a period of less than fifteen months, ranging from November 2013 through January 2015, echoing the same speed by which the product was developed (see IMBRUVICA Regulatory Updates). IMBRUVICA currently is approved for use in approximately 40 countries including the U.S., Canada, and the 28 countries which comprise the European Union (EU).

We believe that IMBRUVICA is helping to transform the management of blood cancers, and we are encouraged by the high clinical adoption rate we have seen in our approved indications. In fact, IMBRUVICA currently occupies the position of one of the most successful oncology drug launches in history based on launch revenue trajectories.

In commercial use and in the clinical trial setting, IMBRUVICA has demonstrated -- and continues to demonstrate -- a favorable efficacy, safety, toxicity, and durability of response profile. To date, over 5,600 patients have been treated in Company-sponsored IMBRUVICA trials conducted in over 35 countries involving more than 800 investigators. We are continuing to investigate how IMBRUVICA may benefit a broader group of patients in the future. Our development program has several clinical trials underway studying IMBRUVICA alone and in combination with other therapies in several blood cancers including in CLL, which is a clinical development program that currently includes seven Phase III trials and covers all lines of therapy and various combinations of treatments. Additional blood cancers we are investigating in which we believe IMBRUVICA may have a benefit include: small lymphocytic leukemia (SLL), MCL, WM, diffuse large B-cell lymphoma (DLBCL), follicular lymphoma (FL), multiple myeloma (MM), and other forms of cancer. A clinical trial is also underway studying IMBRUVICA in Graft versus host disease (GvHD). In addition, we are beginning the exploration of IMBRUVICA in select solid tumor types. As of December 31, 2014, 13 Phase III trials have been initiated with IMBRUVICA and approximately 58 trials are registered on www.clinicaltrials.gov. Information found on this website is not incorporated by reference into this report.

We are conducting this research together with our partner Janssen Biotech Inc. and its affiliates (Janssen), one of the Janssen Pharmaceutical companies of Johnson & Johnson, under our 2011 worldwide collaboration and license agreement (the Agreement). However, we recently have formed a number of strategic collaborations with other world-class companies including Amgen Inc., AstraZeneca, Bristol-Myers Squibb Co., Celgene Corp., and F. Hoffmann-La

1

Roche Ltd. (Roche) in order to explore the potential of IMBRUVICA as a combination agent and a backbone of therapy for certain blood cancers and solid tumors.

Under the Agreement, we and our partner Janssen are jointly commercializing IMBRUVICA in the U.S. Janssen is commercializing IMBRUVICA outside the U.S.

In addition to IMBRUVICA, we have other product candidates in clinical development and several pre-clinical molecules in lead optimization. We will continue to pioneer research into the development of next-generation BTK inhibitors. Our pre-clinical molecules include BTK inhibitors for autoimmune disorders, such as rheumatoid arthritis. We remain committed to high standards of ethics, scientific rigor, and operational efficiency throughout our development efforts.

We are headquartered in Sunnyvale, California and are listed on NASDAQ under the symbol PCYC. To learn more about how Pharmacyclics advances science to improve human healthcare visit us at http://www.pharmacyclics.com. Information found on our website is not incorporated by reference into this report.

Our Business Strategy

The five key elements of our business strategy are to:

• | Extend IMBRUVICA’s reach and enhance our leadership position across hematology. We intend to continue to grow our IMBRUVICA business, further strengthen our market leadership within our approved indications, and expand the use of IMBRUVICA. We have established fully integrated commercial and manufacturing capabilities to address key areas for the successful ongoing commercialization of our product in the U.S., as well as to support the commercial needs of our partner outside of the U.S. In addition, we are developing future indications for IMBRUVICA across a variety of other blood cancers through a mix of the development efforts we undertake ourselves and with other world-class companies through strategic clinical and drug supply collaborations. We intend to expand the use of our key product through ongoing label expansion efforts in areas of need that will allow us to maintain leadership positions in those markets. |

• | Establish IMBRUVICA in multiple solid tumor indications. Based on early data, IMBRUVICA demonstrates promise in its ability to inhibit growth of breast cancer and non-small cell lung cancer cell lines due to the inhibition of HER-2 and epidermal growth factor receptor (EGFR) inhibitor. In addition, pre-clinical experiments suggest that the combination of IMBRUVICA and an antibody targeting PD-L1 causes improved inhibition of tumor growth. This potentially synergistic combination effect, along with the provocative single-agent activity, has provided the basis for our further exploration of the utility of IMBRUVICA in solid tumors in several trials, one of which is being conducted through a strategic clinical and drug supply collaboration with world-class companies. |

• | Develop next-generation BTK inhibitors as a new standard-of-care for immune-mediated diseases. Based on our expertise in chemistry, biology and clinical development that has led to the success of IMBRUVICA and the acknowledgment of the importance of BTK and BCR pathway signals, we are continuing to create novel, patentable, differentiated drug candidates that address areas of unmet medical need for the treatment of immune-mediated diseases. Proof-of-concept data in immune-mediated diseases demonstrates compelling evidence of the potential of our candidate to modify the activity of destructive cells involved in these two conditions. |

• | Leverage our core capabilities to ensure accelerated innovation and long-term growth. With our particular expertise in BTK and kinase inhibition, we are making strategic investments to sustain ongoing innovation and fuel our long-term growth, namely in the area of strategic collaborations with like-minded companies who also want to lead in innovation. Moreover, we enjoy a broad intellectual property (IP) portfolio to protect our pre-clinical insights. |

• | Focus on profitability while investing to expand and sustain our business for the future. We have a record of steady revenue growth and a solid cash position with a goal of maintaining profitability while investing wisely in IMBRUVICA and product candidate pipeline. |

BTK Inhibitor Program

We are pioneers in the development of orally bioavailable inhibitors of BTK, a signaling protein that is critically important for the activity of B-cells (immune cells that can develop into antibody producing cells). B-cell lymphomas

2

and leukemias, which are common blood cancers, result from mutations acquired during B-cell development that lead to uncontrolled B-cell proliferation. Additionally, when B-cells are overactive, the immune system can produce antibodies that begin to attack the body's own tissue, leading to autoimmune diseases. Both autoimmune diseases and B-cell malignancies are thought to be driven by overactive signaling and activation of the B-cell antigen receptor (BCR), a process that is dependent on BTK.

To date, we have developed and commercialized IMBRUVICA in four indications, for the treatment of patients with: CLL who have received at least one prior therapy; all lines of del 17p CLL; MCL who have received one prior therapy; and all lines of WM. We continue to develop IMBRUVICA, which has demonstrated novel activity in pre-clinical studies across a variety of B-cell malignancies and solid tumors. We are pursuing multiple indications as part of our clinical development plan for IMBRUVICA, which include the following B-cell malignancies: CLL, SLL, MCL, FL, DLBCL, MM, WM, marginal zone lymphoma (MZL), acute lymphoblastic leukemia (ALL), acute myeloid leukemia (AML) and other cancer types. We are also pursuing the development of IMBRUVICA for GvHD. In addition, we have a pre-clinical testing program underway to develop novel inhibitors of BTK for inflammatory and autoimmune diseases.

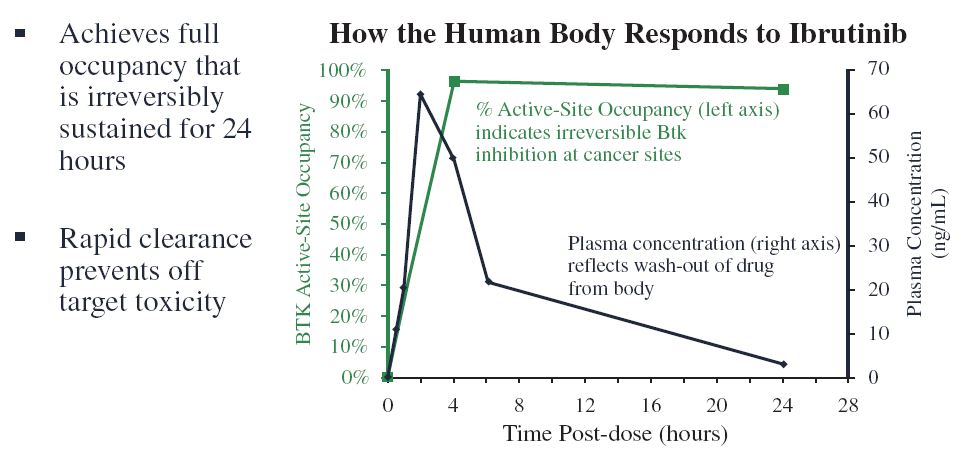

IMBRUVICA Mechanism of Action

IMBRUVICA is a potent and selective small molecule inhibitor of BTK, a signaling kinase expressed in B-cells. BTK is an enzyme that functions downstream of the BCR, which is present on the surface of B-cells. When engaged, the BCR signaling pathway causes the B-cell to grow and develop. In a study funded entirely by Pharmacyclics, we found that selective inhibition of BTK with IMBRUVICA blocks BCR signaling and prevents B-cell activation (Honigberg et al., Proc Natl Acad Sci USA, 2010; 107: 13075-80). IMBRUVICA binds covalently to an unpaired cysteine residue (cysteine-481) in the ATP-binding site of BTK, thereby inhibiting the activity of BTK (IC50 of 0.5 nM). With few exceptions, IMBRUVICA does not appear to bind to other cellular proteins as strongly or as rapidly as it does to BTK in vivo. Importantly, new evidence has demonstrated IMBRUVICA inhibits B-cell lymphoma adhesion in vitro (Chang et al, Blood 2013; de Rooij et al; Blood, 2012), which may be related to the rapid lymphocytosis that is observed clinically following administration of the drug (Advani et al., JCO; 2012). In humans, the levels of IMBRUVICA in the blood are reduced by half within 2 to 4 hours of peak exposure. With the combination of irreversible “on-target” kinase inhibition and rapid elimination from the blood, we achieve 24-hour BTK inhibition with once-daily dosing while reducing the duration of reversible inhibition of many “off-target” kinases.

In CLL, multiple studies have documented evidence of enhanced BCR signaling, especially in patients with immunoglobulin variable heavy chain (IgVH) unmutated disease or those with increased ZAP-70 expression, which are predictors of poor prognosis to cytotoxic chemotherapy. It has been published that IMBRUVICA promotes apoptosis, inhibits proliferation, and prevents CLL cells from responding to survival stimuli provided by the microenvironment (Herman et al, Blood, 2011; 117:6287-6296). In this study, treatment of activated CLL cells with IMBRUVICA inhibited the phosphorylation activity of BTK and effectively abrogated BTK-dependent downstream survival pathways including those involving ERK1/2, PI3K and NF-κB. Additionally, IMBRUVICA inhibited activation-induced proliferation of CLL cells in vitro, effectively blocking survival signals provided externally to CLL cells by components of the microenvironment including soluble factors (CD40L, BAFF, IL-6, IL-4 and TNF-α), fibronectin engagement, and stromal cell contact.

3

Several lines of evidence suggest that signaling through the BCR pathway is necessary to sustain the viability of B-cell lymphomas, and BTK was identified in a conventionally-designed small interfering RNA compounds (siRNA) screen as an essential kinase for survival in a subset of DLBCLs driven by activated BCR. In these cells, chronic active BCR signaling drives constitutive NF-κB signaling blocking apoptosis; blocking BTK with IMBRUVICA was shown to promote apoptosis in these cells (Davis et al., Nature, 2010; 463: 88-94).

IMBRUVICA Resistance

Clinically effective cancer therapies are typically associated with escape mechanisms and resistance. Pharmacyclics is committed to understanding the underlying reason for patients who initially respond to IMBRUVICA, who subsequently regress. To this end, we have studied (1) tumor cell lines that have been selected to become resistant to IMBRUVICA and blood samples from the small number of CLL patients who have acquired resistance to IMBRUVICA over time.

As reported at the International Workshop on CLL (IWCLL) meeting in September 2013, at a median follow up of 22.1 months, the estimated median progression-free survival (PFS) rates in our PCYC-1102-CA study were: 96% for treatment-naive CLL patients (n=31), 92% for relapsed/refractory CLL patients excluding high-risk patients with del 17p and del 11q (n=29), and 74% for relapsed/refractory patients including high risk patients (n=85) at 26 months. In patients with CLL, the development of therapeutic resistance has been uncommon so far. Nevertheless, early research has revealed the acquisition of specific point mutations in B-cell receptor pathway genes, including BTK and its downstream mediator PLCgamma, in several patients with acquired IMBRUVICA resistance (Woyach NEJM 2014). These mutations may help to explain the therapeutic resistance and have validated BTK as a relevant target of IMBRUVICA in CLL.

As reported at the European Hematology Association (EHA) meeting in June 2013, our PCYC-1104-CA study of IMBRUVICA in MCL patients (n=111) had an estimated median progression-free survival of 13.9 months. In addition, as reported in an abstract at the American Society of Hematology (ASH) annual meeting in December 2012, our PCYC-1106 study of IMBRUVICA in DLBCL patients (n=70) had an estimated median progression-free survival of 1.6 months. The rate of acquired resistance is higher in MCL and DLBCL patients compared to CLL patients. Research using MCL lines has revealed several potential mechanisms of resistance, including the activation of alternate B-cell signaling pathways inside the cell. Samples from MCL patients have also been evaluated and genes such as PIM1 and Erb4 have been noted to be mutated more frequent in patients with progressive disease compared with those who were not resistant to therapy (ASH 2014). Further, data presented at ASH 2014 and the EHA 2013 has implicated CARD11, MYD88, and Bcl-2 as possible resistance-associated genes in DLBCL.

We do not yet understand the full scope of these mechanisms in cancer patients who relapse, nor do we understand the full breadth of mutations that may underlie acquired resistance to IMBRUVICA in the different B-cell malignancies. We intend to actively study this beginning in 2015.

BTK Inhibitor Market Opportunity

There are significant and distinct areas of unmet medical needs across the B-cell malignancies. Within the indolent lymphomas, we believe a need still exists for active therapies that avoid the toxicities typically seen with conventional chemotherapies. Such active therapies are needed as part of effective combinations early in the course of treatment, and as effective single-agent treatments later in the course of disease progression. In particular, drugs are needed that are well tolerated and which do not limit subsequent treatment options because of bone marrow or other organ toxicity. In the aggressive lymphomas, it is our belief that the need exists for agents that can combine with standard therapies to improve cure rates and that are effective in patients who fail potentially curative therapy. While advances have been made in the treatment of MM, patients still need effective and tolerable therapies as there currently is no cure. To that end, we are actively evaluating IMBRUVICA in combination with established MM therapies.

Our comprehensive clinical development program addresses a broad range of B-cell malignancies as well as select solid tumors.

Commercialization of IMBRUVICA

IMBRUVICA is available in approximately 40 countries including the U.S., Canada, and the 28 countries which comprise the EU. In the U.S., IMBRUVICA is approved by the U.S. Food and Drug Administration (FDA) as an oral single agent drug for four indications for the treatment of patients with: CLL who have received at least one prior therapy; all lines of del 17p CLL; MCL who have received at least one prior therapy; and all lines of WM. In the 28 member countries of the EU, IMBRUVICA is approved for the treatment of adult patients with relapsed or refractory

4

(R/R) MCL, or patients with CLL who have received at least one prior therapy, or in first line CLL patients in the presence of a del 17p or TP53 mutation in patients unsuitable for chemotherapy.

Pharmacyclics leads the U.S. commercial activities together with Janssen. IMBRUVICA is being marketed by a Commercial team which has extensive and relevant expertise in the promotion, distribution, and reimbursement of oncology/hematology therapies. The Commercial team covers sales, brand marketing, strategy and analytics, reimbursement and distribution, training, business analytics, forecasting, and operations, as well as medical affairs. Pharmacyclics and Janssen participate equally and collaboratively in the U.S. sales activities and we believe that the size of our U.S. sales organization, which is supplemented by Janssen’s oncology sales organization who is involved in co-promoting IMBRUVICA, is appropriate to effectively reach our target audience. Our Marketing team develops strategic positioning and messaging that communicate the efficacy and safety of IMBRUVICA, and has developed creative campaigns for each indication to support the necessary promotional and educational activities.

Sales of pharmaceutical products depend, in significant part, on the coverage and reimbursement policies of government programs, including Medicare and Medicaid in the U.S., and other third-party payers. All third-party payers are sensitive to the cost of drugs and have taken efforts to control those costs and will continue to do so in the future. Private health insurance plans may restrict coverage of some products by using payer formularies under which only selected drugs are covered, variable co-payments that make drugs that are not preferred by the payer more expensive for patients, and by using utilization management controls, such as requirements for prior authorization or prior failure on another type of treatment. Payers may especially impose these obstacles with respect to coverage for higher priced drugs, and consequently IMBRUVICA may be subject to payer-driven restrictions. Therefore, our Market Access team covers Medicare, Medicaid, Commercial Health Plans, Federal Markets, Trade, Pricing, Policy, Contracting and Patient Access Services. Our Market Access team created several effective and comprehensive access and affordability programs which are dedicated to helping appropriate patients receive access to IMBRUVICA.

Our Medical Affairs group is well established at Pharmacyclics and consists of teams focused on Medical Science, Medical Communications and Medical Information. In 2015, we are operationalizing a team of Clinical Educators with advanced degrees and clinical experience who will be focused on the community setting to further educate healthcare providers on IMBRUVICA, connect community physicians to Medical Affairs resources, and to launch our informCLL™ registry.

MCL, CLL and WM are considered orphan diseases. Today, it is estimated that there are approximately 13,300 MCL patients, 121,200 CLL patients and 12,000 WM patients living with these diseases in the U.S. (Note: this information is an estimate derived from the use of information under license from the following IMS Health Incorporated information service: IMS Oncology Tracking Reports for the period July 2013 to June 2014. IMS expressly reserves all rights, including rights of copying, distribution and republication). Many of these patients cycle through multiple lines of treatments often requiring combination therapy with extensive supportive care. During September 2014, we increased the price of IMBRUVICA by 7%. For patients with MCL, the approved dose is four 140 mg pills of IMBRUVICA once daily for an initial cost of approximately $11,699 for a 30-day supply. For patients with CLL (including del 17p CLL) and WM, the approved dose is three 140 mg pills of IMBRUVICA once daily for an initial cost of approximately $8,774 for a 30-day supply. We have a well established and comprehensive Patient Access Support program to ensure access for patients in need of IMBRUVICA.

IMBRUVICA IMPORTANT SAFETY INFORMATION

In accordance with U.S. federal law, when information is presented about a prescription drug product’s intended use and makes claims about its benefit for a disease or medical condition, a company is required to provide a fair balance of information about the drug’s risk compared to its benefits. This means that the drug’s most important risks must be appropriately similar in prominence to the information being presented about its benefits. This information, which is referred to as Important Safety Information, is derived directly from the IMBRUVICA product label and should not be altered. It is intended for use by physicians who rely on this information to help inform and guide patient treatment and care.

Warnings and Precautions

Hemorrhage - Fatal bleeding events have occurred in patients treated with IMBRUVICA. Grade 3 or higher bleeding events (subdural hematoma, gastrointestinal bleeding, hematuria, and post-procedural hemorrhage) have occurred in up to 6% of patients. Bleeding events of any grade, including bruising and petechiae, occurred in approximately half of patients treated with IMBRUVICA.

5

The mechanism for the bleeding events is not well understood. IMBRUVICA may increase the risk of hemorrhage in patients receiving antiplatelet or anticoagulant therapies. Consider the benefit-risk of withholding IMBRUVICA for at least 3 to 7 days pre and post-surgery depending upon the type of surgery and the risk of bleeding.

Infections - Fatal and non-fatal infections have occurred with IMBRUVICA therapy. Grade 3 or greater infections occurred in 14% to 26% of patients. Cases of progressive multifocal leukoencephalopathy (PML) have occurred in patients treated with IMBRUVICA. Monitor patients for fever and infections and evaluate promptly.

Cytopenias - Treatment-emergent Grade 3 or 4 cytopenias including neutropenia (range, 19 to 29%), thrombocytopenia (range, 5 to 17%), and anemia (range, 0 to 9%) occurred in patients treated with IMBRUVICA. Monitor complete blood counts monthly.

Atrial Fibrillation - Atrial fibrillation and atrial flutter (range, 6 to 9%) have occurred in patients treated with IMBRUVICA, particularly in patients with cardiac risk factors, acute infections, and a previous history of atrial fibrillation. Periodically monitor patients clinically for atrial fibrillation. Patients who develop arrhythmic symptoms (e.g. palpitations, lightheadedness) or new-onset dyspnea should have an ECG performed. If atrial fibrillation persists, consider the risks and benefits of IMBRUVICA treatment and dose modification.

Second Primary Malignancies - Other malignancies (range, 5 to 14%) including non-skin carcinomas (range, 1 to 3%) have occurred in patients treated with IMBRUVICA. The most frequent second primary malignancy was non-melanoma skin cancer (range, 4 to 11%).

Tumor Lysis Syndrome - Tumor lysis syndrome has been reported with IMBRUVICA therapy. Monitor patients closely and take appropriate precautions in patients at risk for tumor lysis syndrome (e.g. high tumor burden).

Embryo-Fetal Toxicity - Based on findings in animals, IMBRUVICA can cause fetal harm when administered to a pregnant woman. Advise women to avoid becoming pregnant while taking IMBRUVICA. If this drug is used during pregnancy or if the patient becomes pregnant while taking this drug, the patient should be apprised of the potential hazard to a fetus.

Adverse Reactions

The most common adverse reactions (≥25%) in patients with B-cell malignancies (MCL, CLL, WM) were thrombocytopenia, neutropenia, diarrhea, anemia, fatigue, musculoskeletal pain, bruising, nausea, upper respiratory tract infection, and rash. Seven percent of patients receiving IMBRUVICA discontinued treatment due to adverse events.

Drug Interactions

CYP3A Inhibitors - Avoid co-administration with strong and moderate CYP3A inhibitors. If a moderate CYP3A inhibitor must be used, reduce the IMBRUVICA dose.

CYP3A Inducers - Avoid co-administration with strong CYP3A inducers.

Specific Populations

Hepatic Impairment - Avoid use in patients with moderate or severe baseline hepatic impairment. In patients with mild impairment, reduce IMBRUVICA dose.

For additional important safety information, please see Full Prescribing Information at http://www.imbruvica.com/downloads/Prescribing_Information.pdf.

Patient Access to IMBRUVICA

Patients who are prescribed IMBRUVICA can receive access support through several distinct programs:

• | The YOU&i Start™ program enables eligible patients who are experiencing insurance coverage delays to access free product for a limited time. |

• | The YOU&i Access™ Instant Savings Program helps commercially insured, eligible patients who have difficulties with out-of-pocket expenses for IMBRUVICA. Eligible patients may receive support to reduce their monthly out-of-pocket costs to $10 per month*. |

- *Month refers to a 30-day supply. Subject to a maximum benefit, 12 months after activation or 12 monthly fills (1-year supply), whichever comes first, unless the maximum dollar benefit has been

6

reach.

- Not valid for patients enrolled in Medicare or Medicaid.

• | The YOU&i Access Service Center assists patients with all access-related administration issues. |

• | Pharmacyclics makes donations to the Johnson & Johnson Patient Assistance Foundation (JJPAF), an independent, non-profit organization that provides assistance to patients who need access to IMBRUVICA who are eligible based on financial need and if they are uninsured. |

• | Pharmacyclics is supporting third-party foundations, organizations and other efforts to help patients in need get access to appropriate care. |

Customers

We sell IMBRUVICA directly to some customers who have in-house dispensing capabilities, specialty pharmacies that sell to individual patients, specialty distributors that sell to hospital pharmacies and other organizations that we have contracted with. For details on our customers, refer to Notes 2 and 3 to the consolidated financial statements.

Competition

There are many companies focused on the development of small molecules and antibodies for treating B-cell malignancies. Companies such as AbbVie Inc., Celgene Corp., Gilead Sciences Inc., Roche and others are known to be active in the development and/or commercialization of therapies for B-cell malignancies.

Our potential competitors include major pharmaceutical and biotechnology companies, clinical reference laboratories and government agencies, as well as academic research institutions that are pursuing research activities similar to ours. Many of our potential competitors have significantly more financial and other resources, larger research and development staffs, lower labor costs, and/or more extensive marketing and manufacturing organizations and other resources than we do, which may allow them to have a competitive advantage.

Many of these companies and organizations have significant experience in pre-clinical testing, human clinical trials, product manufacturing, marketing, sales and distribution and other regulatory approval and commercial procedures. They may also have a greater number of significant patents and greater legal resources to seek remedies for cases of alleged infringement of their patents by us to block, delay or compromise our own drug development process.

The markets for which we have and intend to pursue regulatory approval of IMBRUVICA are highly competitive. We are aware of products in research or development by our competitors that are intended to treat the B-cell malignancies we are targeting, and any of these products may compete with IMBRUVICA and/or be combined with IMBRUVICA to improve patient outcomes. Our competitors may succeed in obtaining approvals for their products more rapidly than we do from the FDA or from regulatory agencies in other regions of the world, or developing products that are more effective than IMBRUVICA. These products or technologies might render our technology obsolete or noncompetitive. There may also be drug candidates of which we are not aware at earlier stages of development that may compete with IMBRUVICA. In addition, IMBRUVICA competes with existing therapies that have long histories of use, such as chemotherapy used in cancer indications.

Our Pipeline

Our current clinical development program examines product candidates that are small-molecule enzyme inhibitors designed to target key biochemical pathways involved in life-threatening human diseases. IMBRUVICA, our first product to market, is indicated for the treatment of specific subsets of CLL, MCL and WM patients. We are continuing the development of IMBRUVICA across a variety of B-cell malignancies as well as in solid tumors and certain immune-mediated diseases. In addition to IMBRUVICA, we currently have other product candidates in clinical development and several pre-clinical molecules in lead optimization; including a BTK inhibitor currently in a Phase I study in rheumatoid arthritis (RA) patients, an inhibitor of Factor VIIa (PCI-27483) and a HDAC inhibitor, abexinostat (formerly known as PCI-24781). Our BTK inhibitor program, consisting of several novel BTK inhibitors, has been established to continue our clinical development and commercial success in oncology and immune-mediated diseases and support long-term growth.

Status of Products Currently in Pre-Clinical and Clinical Development

The table below summarizes our pre-clinical programs and clinical product candidates and their stage of development:

7

Product Candidates/Programs | Disease Indication | Development Status(1) | ||

IMBRUVICA BTK Inhibitor | • Chronic lymphocytic leukemia (CLL) | Multiple trials (Phase I, II, III) in | ||

• Small lymphocytic lymphoma (SLL) | treatment naive and in relapsed/ | |||

• Mantle cell lymphoma (MCL) | refractory patients | |||

• Diffuse large B-cell lymphoma (DLBCL) | ||||

• Follicular lymphoma (FL) | ||||

• Multiple myeloma (MM) | ||||

• Waldenström's macroglobulinemia (WM) | ||||

• Marginal zone lymphoma (MZL) | ||||

• Graft versus host disease (GvHD) | ||||

• Acute Lymphoblastic Leukemia (ALL) | ||||

• Acute Myeloid Leukemia (AML) | ||||

• Solid tumors and others | ||||

BTK Inhibitor Program | Autoimmune | Pre-clinical testing, Phase I | ||

Abexinostat HDAC Inhibitor (PCI-24781) | Relapsed/refractory lymphomas and solid tumors | Multiple trials (Phase I, II) | ||

Factor VIIa Inhibitor (PCI-27483) | Cancer | Phase II complete/program under review | ||

(1) "Phase I" means initial human clinical trials designed to establish the safety, dose tolerance, pharmacokinetics (i.e., absorption, metabolism, excretion) and pharmacodynamics (i.e. biological markers for activity) of a compound. "Phase II" means human clinical trials designed to establish safety, optimal dosage and preliminary activity of a compound in a patient population. "Phase III" means human clinical trials designed to establish the safety and efficacy of a compound. These are the most important trials required by the FDA and are done to rigorously establish the clinical benefit and safety profile of a drug in a particular patient population. "Pre-clinical" means the stage of drug development prior to human clinical trials in which a molecule is optimized for "drug like" properties and evaluated for efficacy, pharmacokinetics, pharmacodynamics and safety.

IMBRUVICA for Solid Tumors

Based on early data, IMBRUVICA demonstrates promise in its ability to inhibit growth of HER-2 breast cancer cells as a potent epidermal growth factor receptor (EGFR) inhibitor. In addition, early data suggest that in combination with PD-L1, IMBRUVICA enhances the checkpoint inhibitor’s ability to attack tumors and allow the immune response to fight the cancer. The enhanced effects observed with the combination, along with the provocative single-agent activity, has provided the basis for our further exploration of the utility of IMBRUVICA in solid tumors in several trials, one of which is being conducted through a strategic clinical and drug supply collaborations with world-class companies.

BTK Inhibitor for Autoimmune Diseases

In animal models of RA, we have observed that once-daily oral administration of our proprietary BTK inhibitors lead to regression of established disease. Based on data from a study funded entirely by Pharmacyclics, we reported that our BTK inhibitors reduce cytokine releases from human monocytes in cell culture and reduced inflammatory synovitis, pannus formation, synovial fluid cytokines, cartilage damage and bone erosion in mice with collagen-induced arthritis (Chang et al., ACR Annual Meeting Abstracts, 2010). In 2014, we continued working on a series of BTK inhibitors which were optimized pre-clinically for eventual treatment of patients with anti-inflammatory and autoimmune diseases, including RA. In January 2014, we filed an investigational new drug application (IND) for our lead molecule for anti-inflammatory and autoimmune diseases. This IND was deemed safe to proceed by the FDA in mid-February 2014.

IMBRUVICA Recent Clinical Development Updates

During the year ended December 31, 2014, we provided updates on several of our clinical programs at various scientific conferences including the 56th ASH Annual Meeting in San Francisco from December 5-9, 2014 and the

8

50th Annual Meeting of the American Society of Clinical Oncology (ASCO) in Chicago, IL from May 30-June 3, 2014.

The following are abstracts presented at ASH and ASCO during 2014 that were made available in our press releases and filings with the SEC:

Selected Abstracts from the ASH 2014 Annual Meeting:

Efficacy and Safety of Ibrutinib in Patients with Relapsed or Refractory Chronic Lymphocytic Leukemia or Small Lymphocytic Leukemia with 17p Deletion: Results from the Phase II RESONATE-17 Trial (Oral Presentation - ASH Abstract # 327)

Results were presented from the Phase II open-label, single-arm, multi-center RESONATE-17 (PCYC-1117) trial in which 144 del 17p patients (95% with CLL, 5% with SLL) received single-agent IMBRUVICA once-daily until progression. The primary endpoint was ORR, as determined by an independent review committee (IRC). Key secondary endpoints were duration of response (DOR), PFS and safety. The investigator-assessed ORR was 83% with 17% of these patients achieving a PR-L including 1% who achieved a CR. The IRC-assessed ORR was 65%. Neither the median PFS nor DOR had been reached with a median follow-up of 11.5 months. Seventy-nine percent of patients were alive and had not progressed at 11.5 months, with an overall survival (OS) rate of 84%.

At the time of the data cut, the median time on study (treatment duration) was 11.5 months, and 101 of 144 patients (70%) continued to take IMBRUVICA.

The most common Grade 3 or 4 AEs in the RESONATE-17 trial (occurring in ≥5% of IMBRUVICA patients) were neutropenia (14%), anemia (8%), and hypertension (8%). The most frequently reported AEs of any grade were: diarrhea (36%); fatigue (31% ); cough (24%); and, arthralgia (22%). Atrial fibrillation of any grade was reported in 11 patients (8%). Major bleeding was reported in seven patients taking IMBRUVICA (5%).

Ibrutinib, Single Agent or in Combination with Dexamethasone, in Patients with Relapsed or Relapsed/Refractory Multiple Myeloma (MM): Preliminary Phase II Results (Oral Presentation - ASH Abstract # 31)

Data from an open-label, Phase II dose escalation trial evaluated potential IMBRUVICA dosing regimens either as a monotherapy or in combination with dexamethasone 40 mg in the treatment of 69 heavily pre-treated (relapsed or relapsed/refractory) patients. Efficacy and safety were assessed at four-week intervals using the International Myeloma Working Group (IMWG) response criteria for efficacy results and Common Terminology Criteria for AEs (CTCAE) to evaluate safety.

Heavily pre-treated patients (median of 4.5 prior lines of therapy) who received IMBRUVICA 840 mg daily in combination with dexamethasone 40 mg weekly (n=20) experienced the highest clinical benefit rate of 25%, including one partial response (PR) and four minor responses (MR). Also, an additional five patients (25%) showed sustained stable disease (SD; >4 cycles). IMBRUVICA-treatment in combination with dexamethasone resulted in positive responses and disease stabilization which led to a median progression-free survival of 5.6 months. As a result of this trend toward improved efficacy and manageable toxicities, investigators expanded the treatment group per protocol design. Twenty-three additional patients are currently enrolled in this cohort; follow-up is ongoing. Based on these encouraging data, IMBRUVICA is currently being evaluated as a combination agent to treat relapsed/refractory multiple myeloma with agents such as carfilzomib.

The safety profile of IMBRUVICA was tolerable, with similar AE rates across dosing cohorts. Across all cohorts, 57% of patients experienced Grade 3 or greater adverse events (AEs). The most commonly reported non-hematologic AEs of any grade were: diarrhea (51%); fatigue (41%); nausea (35%); dizziness (25%); and muscle spasms (23%). Myelosuppression had an overall incidence of any grade anemia (29%), thrombocytopenia (23%), and neutropenia (7%), with 16%, 9% and 4% being Grade 3, respectively. Notably, there were no clinically meaningful differences among dose levels. Thirty-three percent of patients experienced a treatment-emergent serious AE. At the time of data cut-off, 4 patients remained on treatment; the most common reason for treatment discontinuation in 47% was progressive disease.

Ibrutinib and Rituximab are an Efficacious and Safe Combination in Relapsed Mantle Cell Lymphoma: Preliminary Results from a Phase II Clinical Trial (Oral Presentation - ASH Abstract # 627)

IMBRUVICA was combined with rituximab in a single-center, Phase II trial in 50 relapsed/refractory MCL patients. After a median follow-up of 11 months (range 4-16 months) among 34 evaluable patients with lower levels (< 50) of the Ki-67 protein, a known marker associated with cell growth, the ORR was 100% (56% CRs and 44% partial

9

responses [PRs]). Among 12 evaluable patients with higher Ki-67 (≥ 50%) protein levels, the ORR was 50% (8% CRs, 42% PRs).

The median duration of response and progression-free survival have not yet been reached.

Ten patients discontinued treatment during the study due to progressive MCL, all of whom had Ki67 levels greater than 60% (range 50-100%). There were no deaths due to toxicity. Grade 1 hematologic toxicity events included anemia (30%) and thrombocytopenia (25%). The most common treatment-emergent, non-hematologic adverse events (occurring in > 15% of patients treated with IMBRUVICA plus rituximab) included fatigue, diarrhea, myalgia and dyspnea. This combination has been well tolerated.

Addition of Rituximab Abrogates Ibrutinib-Induced Lymphocytosis and Promotes More Rapid Decrease in Absolute Lymphocyte Counts in Patients with Relapsed Chronic Lymphocytic Leukemia (Poster Presentation - ASH Abstract # 1998)

Data from a multi-center, Phase Ib/II trial also suggest that when IMBRUVICA and rituximab are combined in patients with relapsed CLL, short-term lymphocytosis, which sometimes is associated with IMBRUVICA treatment, decreased and patients experienced faster clearing of leukemia cells from the bloodstream versus patients who received IMBRUVICA alone. These data were presented in a poster presentation on Saturday, December 6th by Ekaterina Kim, M.S. from The University of Texas MD Anderson Cancer Center.

The median absolute lymphocyte count (ALC) during pre-treatment was similar in the IMBRUVICA single-agent and combination treatment arms (25 and 27.6 K/µl, respectively). In the IMBRUVICA single-agent arm, ALC levels rose immediately after treatment was started and began to stabilize. After four months of follow-up, patients in the combination therapy arm experienced a more rapid decrease in ALC levels, suggesting the combination decreased lymphocytosis over this period. Plasma levels of chemokines CCL3 and CCL4 are known to reflect the activation status of CLL cells. Concentration of both chemokines was significantly reduced after a week of treatment in both arms. Further analysis of the CCL3 and CCL4 patterns is still in progress. No additional safety findings were reported.

Updated Efficacy Including Genetic and Clinical Subgroup Analysis and Overall Safety in the Phase III RESONATE™ Trial of Ibrutinib Versus Ofatumumab in Previously Treated Chronic Lymphocytic Leukemia/Small Lymphocytic Lymphoma (Poster Presentation - ASH Abstract # 3331)

Researchers presented median 16-month follow-up data from the pivotal Phase III RESONATE (PCYC-1112) trial studying IMBRUVICA versus ofatumumab (n=391; 195 IMBRUVICA, 196 ofatumumab). The patient population was heavily pretreated (a median of three prior therapies in the IMBRUVICA patients vs. a median of two prior therapies in the ofatumumab patients) and largely elderly, often with baseline comorbidities. At 12 months, 84% of IMBRUVICA-treated patients were progression free versus 18% of patients receiving ofatumumab (hazard ratio = 0.106; 95% confidence interval: 0.073, 0.153; P<0.001). The median overall survival in patients taking IMBRUVICA has not been reached with 168 of 195 patients (86%) alive. One hundred twenty-two patients (62%) randomized to ofatumumab crossed over to IMBRUVICA; the best ORR for single-agent IMBRUVICA was 90% versus 25% for ofatumumab, with 74% of IMBRUVICA patients achieving a partial response (PR), 8% partial responses with lymphocytosis (PR-L) and 4% complete responses (CR).

Patients who had received only one prior therapy before receiving IMBRUVICA had higher PFS and ORR rates than those who had received two or more prior therapies. At 12 months, 94% of IMBRUVICA patients who received one prior therapy, 84% who received two prior therapies and 80% who received three or more prior therapies, were progression free (P=0.0001). The ORR for patients who had received one prior therapy was 100%, while the ORR for patients who received two and three or more prior therapies was 79% and 78% (P=0.0001).

The most frequent Grade 3 or 4 adverse events (AEs) in the RESONATE trial analysis occurring in IMBRUVICA patients were: neutropenia (18%); pneumonia (9%); thrombocytopenia (6%); anemia (6%); and, hypertension (6%). Overall, at a median follow-up of 16 months 47 patients (24%) discontinued IMBRUVICA: 17 due to progressive disease (9%), 13 for AEs (7%) and 10 due to death (5%).

Hematologic and Immunologic Function and Patient Well-Being for the Phase III RESONATE™ Study of Ibrutinib vs. Ofatumumab in Relapsed/Refractory Chronic Lymphocytic Leukemia/Small Lymphoma (Poster Presentation - ASH Abstract # 4696)

IMBRUVICA’s impact on patient well-being also was presented from a sub-analysis of the Phase III RESONATE trial showing that IMBRUVICA was associated with improvements in hematologic function and disease burden in previously treated CLL/SLL patients versus those treated with ofatumumab. The data suggest the survival benefit

10

afforded by IMBRUVICA, combined with sustained improvements in key endpoints of the trial including patient-reported outcomes, may enhance patient quality of life while also prolonging survival. More patients taking IMBRUVICA experienced clinically meaningful improvement in EORTC QLQ-C30* global health scores than patients taking ofatumumab (47%, n=117 vs. 40%, n=87, respectively). At week 24, IMBRUVICA was associated with a greater improvement (≥ 3 points) in FACiT-F (FACiT fatigue; a measure of therapy-fatigue in patients with chronic illnesses1) than patients taking ofatumumab (56% vs. 43%). An IRC-assessment also observed a ≥50% reduction in lymph node size in 92% of the evaluable IMBRUVICA patients, as compared with a 14% reduction for patients in the ofatumumab-treatment arm.

Baseline disease-related symptoms were similar between the IMBRUVICA and ofatumumab groups; however, IMBRUVICA was associated with improvements over ofatumumab in weight loss (100% vs. 87%); fatigue (79% vs. 64%); night sweats (89% vs. 77%); abdominal pain/discomfort (96% vs. 75%); and, anorexia (100% vs. 64%). While rates of overall medical resource use was comparable for growth factors, IMBRUVICA patients experienced longer median treatment duration than ofatumumab patients (16 months vs. 5 months). Hospitalizations in the first 30 days occurred less frequently with IMBRUVICA than with ofatumumab (0.087 vs. 0.184 events/patient).

Single-Agent Ibrutinib Demonstrates Safety and Durability of Response at 2 Years Follow-up in Patients with Relapsed or Refractory Mantle Cell Lymphoma: Updated Results of an International, Multi-center, Open-Label Phase II Study (Poster Presentation - ASH Abstract # 4453)

In the Phase II, multi-center, single-arm, open-label trial (PCYC-1104) in patients with relapsed/refractory mantle cell lymphoma, patients received IMBRUVICA once daily until disease progression or unacceptable toxicity (n=111). Patients were allowed to continue treatment through a long-term extension trial. While the median treatment duration in the trial was 8.3 months, 46% of patients received treatment for more than one year and 20% continued on treatment in the extension trial for more than two years. At 24 months, approximately one-third of patients (31%) remained progression-free and almost half (47%) remained alive. The median overall survival was 22.5 months and the median progression-free survival was 13 months. Investigators observed a 67% overall response rate (ORR), which was the primary endpoint of the trial, and 23% of patients experienced a complete response. The median response time was less than two months (1.9 months) and the median duration of response was 17.5 months.

Data from the follow-up analysis were consistent with earlier results from the trial. With an estimated median follow up of 26.7 months, the most common Grade 3 or greater AEs in the trial were infection (28%), diarrhea (5%) and bleeding (6%). Serious adverse events (SAEs (≥ 2), regardless of attribution, included: disease progression (10%); pneumonia (7%); atrial fibrillation (6%); and, urinary tract infection (4%). SAEs occurred in 21% of patients and generally both grade ≥ 3 and SAE infections decreased over time.

Efficacy and Safety of Single-Agent Ibrutinib in Patients with Mantle Cell Lymphoma Who Progressed after Bortezomib Therapy (Poster Presentation - ASH Abstract # 4471)

Data was presented highlighting the results from a Phase II, multi-center, single-arm trial (MCL2001), which investigated once-daily IMBRUVICA in patients with relapsed/refractory MCL who previously had received a rituximab-containing treatment regimen and had progressed after at least two cycles of bortezomib (n=120). An Independent Review Committee (IRC) found the ORR, which was the primary endpoint of the trial, was 63% after a median follow-up of 14.9 months and 21% of patients achieved a complete response. Secondary endpoints included DOR, PFS, OS and safety. The median DOR based on IRC assessment was 14.9 months and the median time to first response was 2.1 months. The median PFS was 10.5 months, with 47% of patients remaining progression-free at one year. The median PFS has not yet been reached. The OS rate at 18 months was 61%.

The most frequently reported AEs of any grade were fatigue (43%) and diarrhea (43%). Diarrhea, when observed generally occurred early after initial treatment, but resolved quickly and was not treatment limiting. The majority of AEs were grade 1 and 2. The most common AEs ≥ grade 3 were neutropenia (21%), thrombocytopenia (13%) and pneumonia (13%). Atrial fibrillation was reported in 13 patients (11%); six patients (5%) experienced Grade 3 or 4 atrial fibrillation which resolved in 1 to 4 days. Five of these six patients had a history of atrial fibrillation.

Selected Abstracts from the ASCO 2014 Annual Meeting:

Randomized Comparison of Ibrutinib Versus Ofatumumab in Relapsed or Refractory Chronic Lymphocytic Leukemia/Small Lymphocytic Lymphoma: Results From the Phase III RESONATETM Trial (Oral Presentation - ASCO Abstract #LBA7008)

11

IMBRUVICA significantly prolonged progression-free survival in patients with relapsed/refractory (R/R) CLL in comparison to those randomized to receive ofatumumab. Patients treated with IMBRUVICA experienced a 78% reduction in risk of progression or death versus patients receiving ofatumumab (HR 0.215, 95% CI, 0.146 to 0.317, p<0.0001) per Independent Review Committee (IRC) evaluation. The median PFS for IMBRUVICA was not reached with a median time on study of 9.4 months. The median PFS for ofatumumab was 8.1 months. IMBRUVICA significantly prolonged overall survival compared with ofatumumab. IMBRUVICA reduced the risk of death by 57% (HR=0.434, 95% CI, 0.238 to 0.789; p<0.005) compared to the ofatumumab arm. This was observed despite a total of 57 patients who were initially randomized to ofatumumab crossing over to receive IMBRUVICA prior to the analysis. Patient characteristics were well balanced between arms: patients receiving IMBRUVICA had a median of 3 prior therapies with 32% del 17p, a mutation typically associated with poor prognosis, and 56% RAI stage III/IV (indicative of high risk CLL patients) versus patients receiving ofatumumab who had a median of 2 prior therapies with 33% del 17p and 58% RAI stage III/IV.

ORR was significantly higher in patients receiving IMBRUVICA by both investigator and IRC evaluations. Investigator assessed ORR (including complete responses (CR), partial responses (PR) and partial responses with lymphocytosis (PR+L)) was 85 % for IMBRUVICA and 23% for patients receiving ofatumumab, evaluated by the investigators based on the International Workshop on CLL (IWCLL) response criteria. The RESONATE study also had the IRC evaluate sequential CT scans (performed per protocol, approximately 12 weeks apart) to assess and confirm response. With this analysis, 63% of IMBRUVICA patients achieved a partial response (PR or a PR+L) compared to only 4% of patients receiving ofatumumab (p<0.0001). Significant benefit measured by PFS, OS and response rates were observed in the IMBRUVICA arm consistently across all subgroups by baseline disease risk factors, including those patients with del 17p or those whose disease was considered refractory to purine analogue therapy. Only 3% of the patients receiving IMBRUVICA experienced progressive disease as a best response versus 10% receiving ofatumumab as evaluated by the IRC.

The most commonly occurring adverse events (AE) independent of Grade (AEs in 20% or more of patients) were diarrhea (48% vs. 18%), fatigue (28% vs. 30%), pyrexia (fever; 24% vs. 15%), nausea (26% vs.18%), anemia (23% vs. 17%) and neutropenia (22% vs. 15%). Hematologic AEs that were Grade 3 or 4 in the RESONATE trial were neutropenia (decreased amount of white blood cells; 16% in the IMBRUVICA arm vs. 14% in the ofatumumab arm), thrombocytopenia (decrease in platelets in the blood; 6% vs. 4%), and anemia (5% vs. 8%). Atrial fibrillation of any Grade was noted more frequently in patients receiving IMBRUVICA (5% versus 0.5% with ofatumumab), these events were manageable and lead to discontinuation for only 1 patient. There was no difference in major bleeding between the IMBRUVICA or ofatumumab arms (reported in 2 patients randomized to IMBRUVICA and 3 patients receiving ofatumumab). The incidence of Grade 3 or higher infection was 24% for the IMBRUVICA arm and 22% for the ofatumumab arm. Richter’s Transformation (RT) occurred in 2 patients in the IMBRUVICA arm and in 2 patients in the ofatumumab arm.

With a median follow-up of 9.6 months, patients receiving IMBRUVICA showed a discontinuation rate due to progressive disease, adverse events or death of 13%, with 86% of patients continuing on therapy. Patients receiving ofatumumab showed a discontinuation rate due to progressive disease, adverse events or death of 28%.

Independent Evaluation of Ibrutinib Efficacy 3 Years Post-Initiation of Monotherapy in Patients With Chronic Lymphocytic Leukemia/Small Lymphocytic Leukemia Including Deletion 17p Disease (Oral Presentation - ASCO Abstract #7014)

In the treatment naïve group, 31 CLL patients, aged 65 years or older, received single agent IMBRUVICA once daily and were followed in the study for a median time of 32.1 months. The ORR, as assessed by the Investigator, was 87% (CR 13%, nodular PR (nPR) 3%, PR 65%, PR+L 6%). Only one patient had progressive disease during the median follow up of 32.1 months and the PFS at 30 months was 96%. The OS for these patients at 30 months was 97%.

In the R/R group, 101 patients with CLL/SLL (median of 4 prior therapies, 57% Rai stage III or IV (indicative of high risk CLL patients), 69% of patients had the high-risk characteristics of deletion of short arm of chromosome 17 or 11 (del 17p or del 11q)) received single-agent IMBRUVICA once daily and were followed in the study for a median time of 26.6 months. Overall 90% of patients achieved a best response of PR+L or higher. For patients without del 17p or del 11q, the estimated PFS was 89% at 30 months. The median PFS for del 17p patients was 28.1 months and for patients with del 11q the median PFS had not been reached and was estimated to be 74% at 30 months. The estimated OS for these R/R patients was 79.9%.

12

Following all the patients in this study for up to 3 years, the percentage of patients with AEs as a primary reason leading to discontinuation decreased over time, with 8% in the first year, 2% in the second year and 3% in the third year. Similarly, the percentage of patients who experienced a death on the study decreased over time, with 5% in the first year, 4% in the second year and 3% in the third year.

A Phase Ib/II study evaluating activity and tolerability of the BTK inhibitor ibrutinib in combination with ofatumumab in patients with chronic lymphocytic leukemia/small lymphocytic lymphoma (CLL/SLL) and related diseases (Poster Presentation - ASCO Abstract #7009)

The study design consisted of three dosing cohorts, group 1 received one month of IMBRUVICA monotherapy followed by IMBRUVICA and ofatumumab in combination thereafter, group 2 received IMBRUVICA and ofatumumab in combination from the outset, and group 3 received two months of ofatumumab monotherapy followed by IMBRUVICA and ofatumumab thereafter. Seventy-one (71) patients with R/R CLL/SLL/Prolymphocytic Leukemia (PLL) and RT, with a median of 3 prior therapies, were enrolled in the study (27, 20 and 24 in groups 1, 2 and 3 respectively). Sixty-one percent (61%) of patients had RAI stage III/IV and were considered high risk, 44% had del 17p, and 31% had del11q, genetic mutations typically associated with poor prognosis.

The overall response (including CR, PR and PR+L) in CLL/SLL/PLL patients was 100%, 84%, and 75% in groups 1, 2 and 3 respectively, which were achieved within a median of 4.6 months during the study. At the study end, 90% (52 of 58) of responders were progression free with a follow up of 16, 12 and 11 months for groups 1, 2 and 3, respectively. At 12 months, the PFS was 89%, 85%, and 75% in groups 1, 2 and 3, respectively.

The AEs for all 3 cohorts combined were mostly Grade 1 or 2. The most frequent events reported in 15% or more of patients were diarrhea (68%, 5 cases of Grade ≥ 3), infusion related reaction (45%, 1 case of Grade ≥ 3), peripheral sensory neuropathy (42%, 2 cases of Grade ≥ 3), and stomatitis (37%, 2 cases of Grade ≥ 3). The Grade 3 or higher AE, reported in 15% or more of patients, was neutropenia (22.5%, 16 cases). Of all 71 patients, 6 patients had AEs leading to IMBRUVICA discontinuation.

IMBRUVICA Selected Clinical Trials

Chronic Lymphocytic Leukemia/ Small Lymphocytic Lymphoma (CLL/SLL)

• | RESONATE™ (PCYC-1112): Phase III study of IMBRUVICA versus ofatumumab in patients with relapsed/refractory (R/R) CLL/SLL was initiated in the first quarter of 2012. This was a randomized, multi-center, open-label Phase III trial of IMBRUVICA administered as monotherapy. This 391 patient study met its primary end point of PFS as well as a key secondary endpoint of OS at the pre-planned interim analysis in January 2014. This study confirmed IMBRUVICA’s clinical benefit in CLL patients who have received one prior therapy, resulting in regular (full) FDA approval for this patient population on July 28, 2014. |

• | RESONATE™-17 (PCYC-1117): Open-label, single-arm, Phase II study of IMBRUVICA as a single agent in patients with CLL who have deletion of chromosome 17p and who did not respond to or relapsed after at least one prior treatment (a high unmet need population) was initiated in the first quarter of 2013. The primary endpoint of the study is ORR. This study completed enrollment of 111 patients worldwide in the third quarter of 2013. Data was presented at the 56th ASH Annual Meeting on December 9, 2014. |

• | RESONATE™-2 (PCYC-1115): Phase III study of IMBRUVICA versus chlorambucil in newly diagnosed elderly CLL/SLL patients was initiated in the first quarter of 2013. This is a randomized, multi-center, open-label trial of IMBRUVICA as a monotherapy versus chlorambucil in patients 65 years or older with treatment naïve CLL/SLL. The study design was agreed upon with the FDA under a Special Protocol Assessment (SPA). The primary objective of the study is to demonstrate a clinically significant improvement in PFS when compared to chlorambucil. This study completed enrollment of 273 patients worldwide in the first quarter of 2014. |

• | ILLUMINATE (PCYC-1130): Phase III study of IMBRUVICA in combination with GAZYVA® versus chlorambucil in combination with GAZYVA in newly diagnosed CLL/SLL patients was initiated in the fourth quarter of 2014. This is a randomized, multi-center, open-label trial in patients 18 years or older with treatment naïve CLL/SLL. The primary objective of the study is to demonstrate a clinically significant improvement in PFS when compared to chlorambucil plus GAZYVA. The enrollment target of this study is 212 patients. |

13

• | HELIOS (CLL3001): Phase III study of IMBRUVICA in combination with bendamustine and rituximab in patients with R/R CLL/SLL was initiated in the third quarter of 2012. This is a randomized, multi-center, double-blinded, placebo-controlled trial of IMBRUVICA in combination with bendamustine and rituximab versus placebo in combination with bendamustine and rituximab (BR) in R/R CLL/SLL patients who have received at least one line of prior therapy. The primary objective of the study is to demonstrate a clinically significant improvement in PFS when compared to bendamustine and rituximab. This study completed enrollment of 578 patients worldwide in the first quarter of 2014. |

• | BRILLIANCE (CLL3002): Phase III study of IMBRUVICA versus rituximab in patients with R/R CLL/SLL was initiated in the fourth quarter of 2013. This is a randomized, open-label, multi-center study to evaluate the efficacy and safety of IMBRUVICA versus rituximab in adult Asia Pacific region patients with R/R CLL or SLL with active disease requiring treatment, who have failed at least one prior line of therapy and are not considered appropriate candidates for treatment or retreatment with purine analog-based therapy or combination chemoimmunotherapy. The primary objective of the study is to demonstrate a clinically significant improvement in PFS. The enrollment target of this study is 150 patients. |

• | Third-party sponsored: Phase III study of IMBRUVICA versus IMBRUVICA + rituximab versus bendamustine + rituximab in frontline newly diagnosed elderly (≥ 65 Years of Age) CLL/SLL patients (Alliance A041202) was initiated by the National Cancer Institute in the fourth quarter of 2013. This is a randomized, multi-center study designed to evaluate the improvement in PFS of IMBRUVICA with or without rituximab vs bendamustine and rituximab. Secondary outcome measures include OS and duration of response. The enrollment target of this multi-center study is 523 patients. |

• | Third-party sponsored: Phase III study in treatment-naive, young fit patients with CLL, comparing the combination of IMBRUVICA and Rituxan to chemoimmunotherapy of FCR (fludarabine, cyclophosphamide, and rituximab), (ECOG1912), was initiated by the Eastern Cooperative Oncology Group in the first quarter of 2014. This is a randomized study designed to evaluate the improvement in PFS of IMBRUVICA with rituximab vs FCR. Secondary outcome measures include OS and adverse events. The enrollment target of this multi-center study is 519 patients. |

• | Third-party sponsored: Phase III study in untreated, intermediate and high-risk patients with CLL, comparing monotherapy IMBRUVICA to placebo or no therapy, (CLL12), was initiated by the German Study Group in the first quarter of 2014. This is a randomized study designed to evaluate the improvement in event-free survival (EFS) of IMBRUVICA vs. watch and waiting. Secondary outcome measures include ORR and PFS. The enrollment target of this multi-center study is 302 patients. |

Mantle Cell Lymphoma (MCL)

• | RAY (MCL3001): Phase III study of IMBRUVICA versus temsirolimus in R/R MCL patients was initiated in the fourth quarter of 2012. This is a randomized, multi-center, open-label trial of IMBRUVICA as a monotherapy versus temsirolimus in R/R MCL patients who received at least one prior rituximab-containing chemotherapy regimen. The primary endpoint of the study is PFS. This ex-U.S. study completed enrollment of 280 patients in the fourth quarter of 2013. |

• | SHINE (MCL3002): Phase III study of IMBRUVICA in combination with BR in elderly patients with newly diagnosed MCL was initiated in the second quarter of 2013. This is a randomized, multi-center, double-blinded, placebo-controlled trial of IMBRUVICA plus BR versus placebo plus BR in patients 65 years or older with newly diagnosed MCL. The primary endpoint of the study is PFS. The enrollment target of this global study is 520 patients. |

Waldenström's Macroglobulinemia (WM)

• | INNOVATE (PCYC-1127): Phase III study of IMBRUVICA or placebo in combination with rituximab in patients with previously treated WM was initiated in the second quarter of 2014. This is a randomized, multi-center, double-blinded, placebo-controlled trial of IMBRUVICA. The primary outcome measure of this study is PFS. The secondary outcome measures include ORR, time to next treatment, OS and the number of participants with AEs as a measure of safety and tolerability within each treatment arm. The enrollment target of this study is 180 patients. |

Diffuse Large B-cell Lymphoma (DLBCL)

14

• | PHOENIX (DBL3001): Phase III study of IMBRUVICA in combination with R-CHOP (rituximab, cyclophosphamide, doxorubicin, vincristine, and prednisone) in patients with newly diagnosed non-GCB subtype of DLBCL was initiated in the third quarter of 2013. This is a randomized, multi-center, double-blinded, controlled trial of IMBRUVICA plus rituximab, cyclophosphamide, doxorubicin, vincristine, and prednisone (R-CHOP) versus R-CHOP in patients with newly diagnosed non-GCB subtype DLBCL. The primary endpoint of the study is to demonstrate a clinically significant improvement in EFS when compared to R-CHOP. The enrollment target of this global study is 800 patients. |

• | PCYC-1123: Phase Ib/II randomized, multi-center, open-label, study of IMBRUVICA, in combination with lenalidomide with or without rituximab in relapsed or refractory patients with diffuse large b-cell lymphoma was initiated in the first quarter of 2014. The primary endpoint of the Phase IIb portion of this study is maximum tolerated dose of the investigational combination regimen and the primary endpoint of the Phase II portion is ORR. The enrollment target of this study is 130 patients. |

• | PCYC-1124: Phase Ib/II randomized, multi-center, open-label, study of IMBRUVICA, in combination with dose adjusted EPOCH-R in relapsed or refractory patients with diffuse large b-cell lymphoma was initiated in the second quarter of 2014. The primary endpoint of the Phase IIb portion of this study is maximum tolerated dose of the investigational combination regimen and the primary endpoint of the Phase II portion is ORR. The enrollment target of this study is 56 patients. |

Follicular Lymphoma (FL)

• | PCYC-1125: Phase II multi-center, open-label, study of IMBRUVICA, in combination with rituximab in previously untreated patients with follicular lymphoma was initiated in the fourth quarter of 2013. The primary endpoint of this study is ORR. The enrollment target of this study is 80 patients. |

• | DAWN (FLR2002): Phase II study of IMBRUVICA in patients with R/R FL was initiated in the second quarter of 2013. This is a multi-center, open-label, single-arm, global trial of IMBRUVICA in patients with chemoimmunotherapy-resistant FL, whose disease has relapsed from at least two prior lines of therapy, including at least one rituximab combination chemotherapy regimen. The primary endpoint of this study is ORR. This study completed enrollment of 111 patients worldwide in the second quarter of 2014. |

• | SELENE (FLR3001): Phase III study of IMBRUVICA in patients with R/R FL and marginal zone lymphoma was initiated in the first quarter of 2014. This is a randomized, multi-center, placebo-controlled trial in combination with either BR or R-CHOP in patients with previously treated indolent Non-Hodgkin Lymphoma (iNHL). The primary endpoint of this study is PFS. The enrollment target of this global study is 400 patients. |

Marginal Zone Lymphoma (MZL)