Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Erin Energy Corp. | d230265d8k.htm |

Rodman & Renshaw

Annual Global Investment Conference

September 2011

Partnering for Success

Exhibit 99.1 |

Forward Looking Statements

2

This

Presentation

contains

forward-looking

statements

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995,

Section

27A

of

the

Securities

Act

of

1933

and

Section

21E

of

the

Securities

Exchange

Act

of

1934.These

forward

looking

statements

are

based

on

our

current

expectations

about

our

company,

our

properties,

our

estimates

of

required

capital

expenditures

and

our

industry.

You

can

identify

these

forward-looking

statements

when

you

see

us

using

words

such

as

"expect",

"will",

"anticipate,"

"indicate,"

"estimate,"

"believes,"

"plans"

and

other

similar

expressions.

It

is

important

to

note

that

any

such

forward-looking

statements

are

not

guarantees

of

future

performance

and

involve

a

number

of

risks

and

uncertainties.

Actual

results

could

differ

materially

from

those

projected

in

such

forward-looking

statements.

Factors

that

could

cause

actual

results

to

differ

materially

from

those

projected

in

such

forward-looking

statement

include:

the

preliminary

nature

of

well

data,

including

permeability

and

gas

content,

and

commercial

viability

of

the

wells;

risk

and

uncertainties

associated

with

exploration,

development

and

production

of

oil

and

gas;

drilling

and

production

risks;

our

lack

of

operating

history;

limited

and

potentially

inadequate

cash

resources;

expropriation

and

other

risks

associated

with

foreign

operations;

anticipated

pipeline

construction

and

transportation

of

gas;

matters

affecting

the

oil

and

gas

industry

generally;

lack

of

oil

and

gas

field

goods

and

services;

environmental

risks;

changes

in

laws

or

regulations

affecting

our

operations,

as

well

as

other

risks

described

in

our

Annual

Report

on

Form

10-K,

Quarterly

Reports

filed

on

Form

10-Q,

and

subsequent

filings

with

the

Securities

and

Exchange

Commission

("SEC").

We

undertake

no

obligation

to

publicly

update

any

forward-looking

statements

for

any

reason,

even

if

new

information

becomes

available

or

other

events

occur

in

the

future.

We

caution

you

not

to

place

undue

reliance

on

those

statements.

We

may

use

certain

terms

in

this

presentation

such

as

"oil

in

place,"

"oil

zones,"

"gas

zones,"

"prospective

resources"

and

"projected

barrels

of

crude

oil",

or

other

descriptions

of

volumes

of

reserves

which

imply

the

existence

of

quantities

of

resources.

These

estimates

are

by

their

nature

more

speculative

than

estimates

of

proved

reserves

and

accordingly,

are

subject

to

substantially

greater

risk

of

being

actually

realized

by

the

Company.

Prospective

resources

are

those

quantities

of

petroleum

which

are

estimated,

as

of

a

given

date,

to

be

potentially

recoverable

from

undiscovered

accumulations

by

application

of

future

development

projects.

The

prospective

resources

included

in

the

Netherland

Sewell

and

Associates

Resources

Report

indicate

exploration

opportunities

and

development

potential

in

the

event

a

petroleum

discovery

is

made

and

should

not

be

construed

as

reserves

or

contingent

reserves.

This

document

is

not

an

offer

to

sell

securities

and

is

not

soliciting

an

offer

to

buy

securities

in

any

jurisdiction

where

the

offer

or

sale

is

not

permitted.

Investors

are

urged

to

consider

closely

the

disclosure

in

our

SEC

filings,

available

from

us

at

1330

Post

Oak

Blvd.,

Suite

2575,

Houston,

Texas

77056;

Telephone:

(832)

209-1404.

These

filings

can

also

be

obtained

from

the

SEC

via

the

internet

at

www.sec.gov. |

May 2007 -

goes public as Pacific Asia Petroleum (PAP)

November 2009 -

listed NYSE Amex

April 2010 -

PAP acquires interest in Oyo Field in Block 120 Offshore Nigeria from CAMAC

International, changes name to CAMAC Energy Inc. (NYSE Amex:

CAK) February 2011 –

CAMAC Energy acquires remaining interest in OMLs 120/121 offshore

blocks from CAMAC International

Unrisked oil prospective resources best estimate 627 MMBbls (NSAI as of

12/31/10) Undiscovered OOIP best estimate 1,908 MMBbls (NSAI as of

12/31/10) About CAMAC Energy

3

History

Major Exploration Potential in Prolific Deep Water Nigerian Basin

Exploration opportunity to prove gas reserves in Zijinshan Gas Block in

China Experienced Management team and distinguished Board of Directors

|

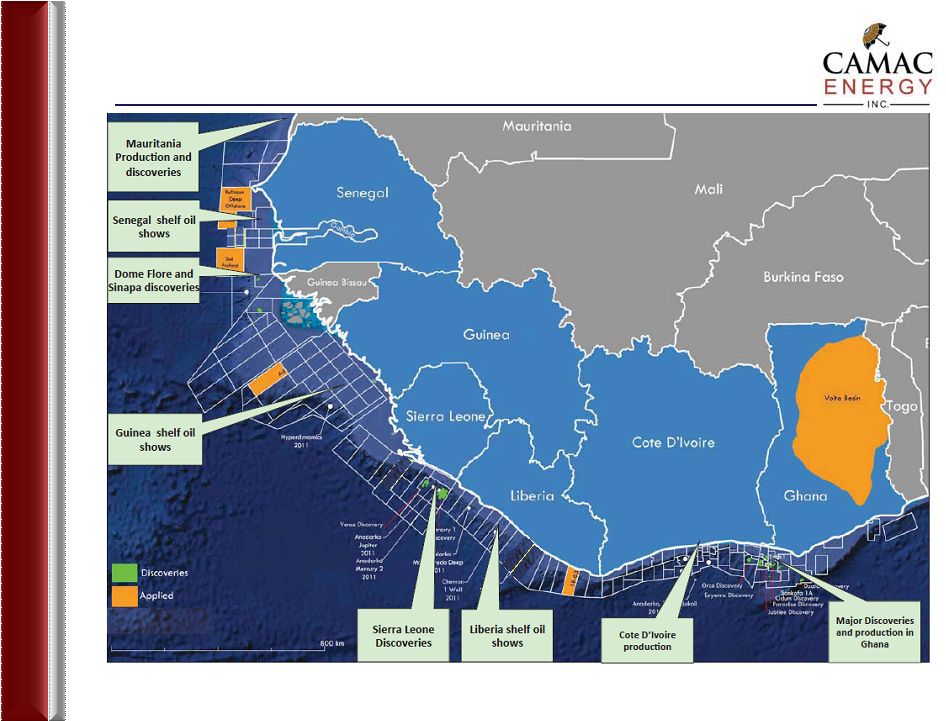

Unique Exposure to African Deal Flow

Ability to leverage over 25 years of African relationships and business

experience through the Company’s Chairman and CEO and its majority

shareholder CAMAC International Nigerian indigenous operator status

o

Local Content Laws encourage Majors to divest to indigenous

operators o

Majors currently in process of divesting producing assets in Nigeria (i.e.

Shell, etc.) Existing integrated local organization able to quickly

assimilate new opportunities Frontier African Opportunities

Recent discoveries opening new African resource frontiers (i.e. Ghana, Sierra

Leone, Liberia, Mozambique, etc.)

o

Governments

seeking

regional

indigenous

operators

to

participate

in

value

creation

Company representatives in Africa identifying attractive prospective

acreage China

Local, experienced management with strong relationships with private and

government partners

No significant debt burden

Competitive Advantage

4

Nigeria |

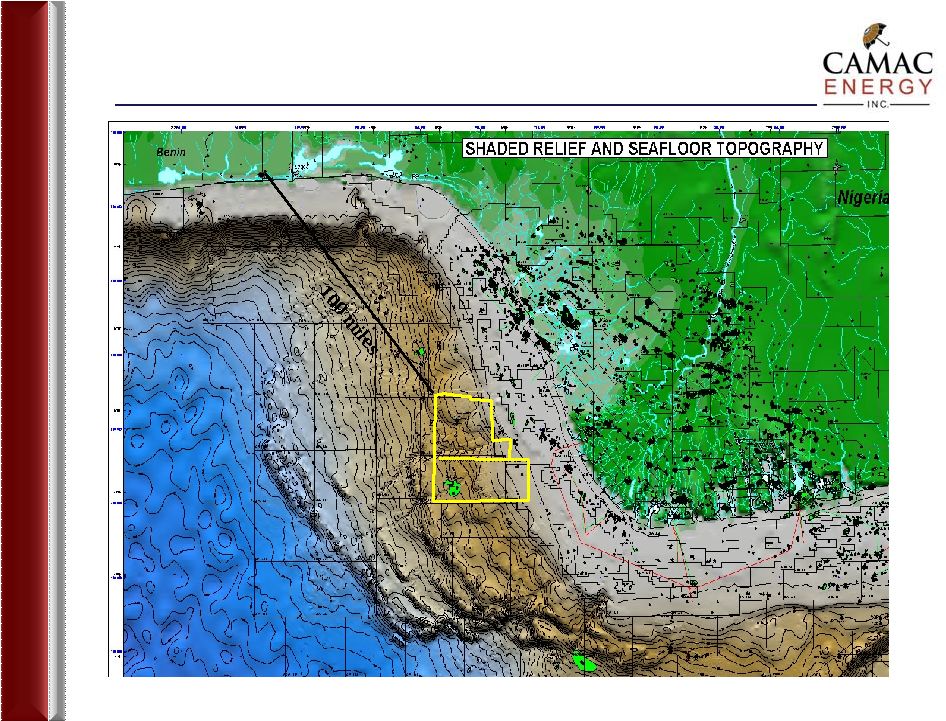

AFRICA

5 |

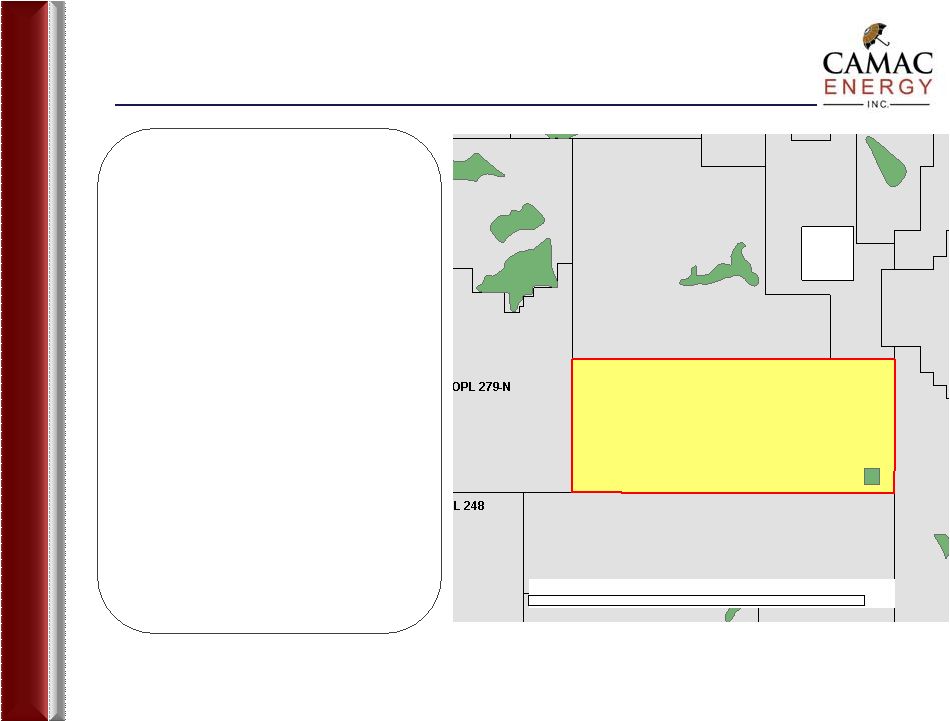

Lagos

OML 120/121

Oil Exploration Blocks

OML 120

OML 121

6 |

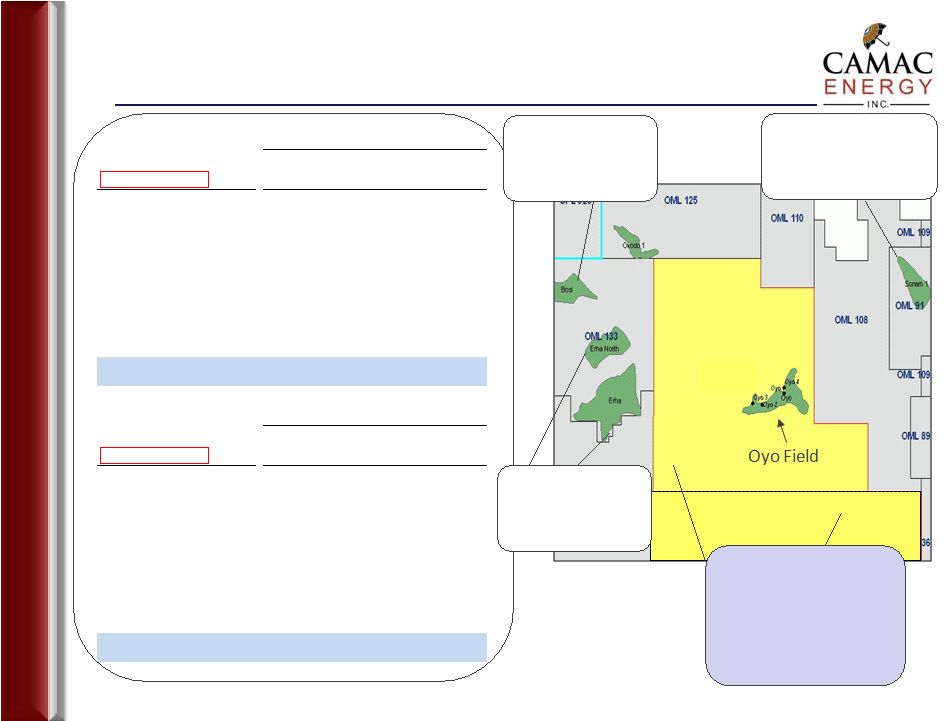

Nigeria Asset Summary

Major Exploration Potential in OML 120 & OML 121

Prolific Deep Water Nigerian Basin

Netherland Sewell & Associates Best Estimates of Unrisked Prospective

Resources: o

Oil : 627 million barrels; high estimate of 2.2 billion barrels

o

Gas : 2 tcf; high estimate of 6.6 tcf

Lower risk exploration prospects & leads all defined by 3D seismic

Oyo Field in OML 120

Netherland,

Sewell

&

Associates

Proved

+

Probable

+

Possible

Oil

Reserves

of

47.9 million barrels (gross)

Oyo Field began commercial production in December 2009

At least two additional development well locations identified

Development

wells

tied

back

to

FPSO

“Armada

Perdana”

with

storage

capacity

of

1MMBbl,

oil

processing

capacity

of

40,000

bopd

and

gas

compression

for

re-injection

capacity

of

60MMScfd

7 |

Niger Delta Deep Water –

Play Summary

8 |

OML 120/121 Prospect Map |

OML 120

Exploration Block with Oil Production

10

•

Block

size

917

sq

km

in

shelf

to

deep

water

•

Water

depths

of

150

-

1,000meters

•

Governed

by

Production

Sharing

Contract

(PSC)

with

ENI,

11

th

largest

oil

company

in

the

world

•

Entire

block

covered

with

3D

seismic

•

7

wells

drilled;

all

found

hydrocarbons

•

6

in

Oyo

Field

•

1

in

Ewo

•

CAK

has

a

60%

contractual

interest

•

5-7%

economic

interest

without

participation

•

Up

to

30%

economic

interest

with

participation

•

Carried through development, but participated

100%

in

recent

$55MM

workover

on

Oyo

#5

well

•

Oyo

Field

began

producing

oil

in

December

2009

•

Gross

avg.

production

4,109

Bopd

in

2Q11 |

OML 121

Exploration Block

•

Block size 887 sq km in shelf to deep water

•

Water depths of 150-1,000m

•

Governed by the same PSC as OML 120

with ENI

•

Located directly south of OML 120

•

Covered by 3D seismic

•

Ebolibo Field

•

Encountered more than 90 feet of

gas in the Pliocene

•

Ebolibo-1 drilled in 2007

•

CAK has a 60% contractual interest

•

5-7% economic interest without

participation

•

Up to 30% economic interest with

participation

11

Erha

Erha North

Oyo

Ebolibo 1

Sonam 1

OML 120

OML 121

OML 108

OML 89

OML 91

OML 110

OPL 284-DO

OML 133

30

Miles

. |

OML

120/121 Resource Potential OML 120

Bosi Field

500 MMBbls

Miocene Play

ExxonMobil

OML 121

Erha Fields

500 MMBbls

Miocene Play

ExxonMobil

Sonam Field

1tcf Gas Condensate

Miocene Play

Chevron

OML 120/121

Best Estimate of

627 MMBbls of

Unrisked Prospective

Resources

(1)

(1)

(1)

(1) Per Netherland Sewell &

Associates Resources Estimate Report as of 12/31/10; all prospects seismically defined

OML120/121

Unrisked Oil Prospective Resources

In MMBBLs

Best

High

16 Prospects/Leads

Estimate

Estimate

Ereng Prospect

129.6

515.1

Kigbo Prospect

95.2

299.7

Eba Prospect

91.1

354.2

Ewo Deep Prospect

76.4

349.3

Ewo P Prospect

38.7

81.3

Other 11 Prospects/Leads

195.7

631.7

TOTAL

626.7

2,231.3

OML120/121

Undiscovered Oil In Place

In MMBBLs

Best

High

16 Prospects/Leads

Estimate

Estimate

Ereng Prospect

393.1

1,442.9

Kigbo Prospect

288.1

825.9

Eba Prospect

277.6

1,002.8

Ewo Deep Prospect

231.6

988.7

Ewo P Prospect

117.3

211.9

Other 11 Prospects/Leads

600.2

1,783.6

TOTAL

1,907.9

6,255.8

12 |

Frontier Opportunities

13

Kuyere-1

201mmboe

Opuyei-1

150 mmboe

*Windjammer-1

528mmboe

*Barquentine-1

528mmboe

*Lagosta-1

528mmboe

Ironclad-1

59mmboe

Source: Renaissance Capital, BP and Wood Mackenzie

Mercury-1

300mmboe

Cabaca SE-1

270mmboe

Mpungi-1

66mmboe

Owo-1

200mmboe

Dzara-1

100mmboe

*Chewa-1

176mmboe

*Pweza

1.1Tcf

Tanzania

Mozambique

Nigeria

Angola

Ghana

Sierra Leone

Mpyo

50mmboe

Uganda

Marine -2

50mmboe

Marine -3

50mmboe

Congo

Estimated reserves provided

* Indicated primarily gas find

Major 2010 African Discoveries!!! |

Current West African Activity

14

Source: African Petroleum Presentation, August 2011

|

CHINA OPERATIONS

15 |

Zijinshan Location

16 |

•

100% interest in the exploration phase

•

60% interest in the development phase

•

Partnered with PetroChina CBM

•

175,000 net acres or 708.1Km

2

•

Ordos Basin, Shanxi Province –

the 2

nd

largest oil and gas basin in China

•

Significant gas pipeline infrastructure

•

Drilled ZJS#’s 1, 2, 3 & 4

Gas shows at several intervals

in wells ZJS#’s 2,3 & 4

•

Three more wells to be drilled 2011-2013

o

Well ZJS#5 scheduled for late 2011

•

The Company estimates recoverable gas

resource of 300 Bcf for the entire block

based on volumetric calculations using

regional data assumptions and preliminary

Zijinshan field-specific data

Zijinshan Exploration Block

17 |

LX0001

+

+

+

+

+

+

+

—

+

+

+

+

+

+

ZJS1

The block is structurally divided into 3 parts:

Western folded belt, Central depression, and Eastern faulted folds

Structure Map of Shanxi Formation

18 |

Work

with

partner

to

fast

track

development

and

exploration

program

on

OML

120/121

Execute

opportunistic

and

accretive

acquisitions

of

marginal

producing

fields

with

development

upside

o

Leverage

5

year

ROFR

with

affiliated

Nigerian

Oil

&

Gas

Co.

Allied

Energy,

PLC

Form

strategic

partnerships

to

participate

in

the

Majors’

asset

divestiture

programs

Use

existing

integrated

local

organization

to

manage

opportunities

Operate

acquired

fields

to

leverage

and

build

upon

technical

capabilities

Identify

promising

assets

in

West,

Central

&

East

Africa

Execute

accretive

acquisitions

of

producing

fields

with

development

upside

Leverage

relationships

and

indigenous

status

for

positions

in

prime

exploration

acreage

China

De-risk

Chinese

gas

asset

through

low

cost

exploration

program

for

near

term

monetization

and

reinvest

proceeds

in

core

African

opportunities

Growth Strategy

19

Nigeria

Frontier African Opportunities |

Ticker (NYSE Amex):

CAK

Market Capitalization (8/31/11)

$128 million

52 Week Price Range:

$0.74 -

$3.95

Average Daily Volume (last 90 days)

568,503

Shares Outstanding

154.2 million

Management, Directors & Affiliates

58%

Company Profile

20 |

Dr. Kase Lawal

Chairman &

Chief Executive Officer

Over 25 years as CEO & Chairman of CAMAC International,, a private

African-focused diversified energy co. Commissioner on the Port of

Houston Authority Vice Chairman of Houston Airport Development System

Corp. Member of President Obama’s White House Advisory Committee for

Trade Policy and Negotiation Member

of

Presidential

Trade

Advisory

Committee

on

Africa

during

both

President

Bush’s

and

Clinton’s

Administrations

Member of Nigerian President Jonathan’s 26 Member Presidential Advisory

Council Ed Caminos

Senior Vice President &

Chief Financial Officer

Former Chief Financial Officer of BPZ Resources, a publicly traded independent

oil & gas company focused on South America

Over 15 years of international energy industry related experience with

Schlumberger, Reliant Energy & Duke Energy

Began

career

with

international

public

accounting

firm

KPMG

Peat

Marwick

Certified Public Accountant

Alan Halsey

Senior Vice President of

Exploration & Production

Former Vice President and COO of Transmeridian Exploration, an independent oil

and gas co. in Houston, TX Over 21 years at Texaco; most recently as

Chairman and Managing Director of Texaco Upstream Companies in

Nigeria

Former General Manager of Texaco’s Angola oil and gas operations

Former President of Texaco’s affiliate in Colombia, South America

Degree in Oil Technology from Imperial College of Science and Technology, London

University Management

21 |

Board of Directors

Dr. Kase Lawal

Chairman

and

CEO

of

CAMAC

Energy

Inc.

Commissioner

on

the

Port

of

Houston

Authority

Vice

Chairman

of

Houston

Airport

Development

System

Corp.

Member

of

President

Obama’s

White

House

Advisory

Committee

for

Trade

Policy

and

Negotiation

Member

of

Presidential

Trade

Advisory

Committee

on

Africa

during

both

President

Bush’s

and

Clinton’s

Administrations

Member

of

Nigerian

President

Jonathan’s

26

Member

Presidential

Advisory

Council

Dr. Lee Patrick

Brown

Chairman

of

the

Board

of

Unity

National

Bank

Former

Mayor

of

Houston

Former

Commissioner

of

the

New

York,

Atlanta,

and

Houston

Police

departments

Former

Director

of

the

White

House

Office

of

National

Drug

Control

Policy

under

President

Clinton

William Campbell

Principal and Managing Director of PPPCo-CB Energy, LLC; private oil and gas

exploration co. Nearly

thirty

years

of

diverse

management

in

finance,

legal,

land

and

marketing

J. Kent Friedman

Partner

in

Public

Law

Group

in

Houston

Office

of

Haynes

and

Boone,

LLP

Vice

Chairman

of

the

Board

and

General

Counsel

of

MAXXAM

Inc.;

a

diversified

public

holding

company

John Hofmeister

Head

of

Citizens

for

Affordable

Energy

Former

President

of

Shell

Oil

Company

Hazel O’Leary

President

of

Fisk

University

Former

Secretary

of

Energy

under

President

Clinton

Ira Wayne

McConnell

Managing

Partner

and

Founder

of

McConnell

&

Jones

LLP;

Certified

Public

Accountants

Former

Chairman

of

the

Audit

Committee

of

the

American

Heart

Association

22 |

Houston Office

1330 Post Oak Boulevard, Suite 2575,

Houston, Texas USA 77056

Tel: 832-209-1404 Fax: 832-201-1786

Nigeria Office

Plot 1649, Olosa Street, Victoria Island

Lagos, Nigeria

Tel: +234-1-4603340-2 Fax: +234-1-2704271

Beijing Office

Suite 508-510, Nexus Centre, 19A Dong San Huan Bei Lu, Chaoyang District,

Beijing, 100020, People’s Republic of China

Tel: +86 10 5967 0444

Fax: +86 10 5967 0488

CAMAC Energy Corporate Website

www.camacenergy.com

Email: IR@camacenergy.com

Contact Information

23 |

THANK YOU

24 |