Attached files

| file | filename |

|---|---|

| EX-23.2 - CONSENT OF NETHERLAND, SEWELL & ASSOCIATES, INC. - Erin Energy Corp. | cak_ex232.htm |

| EX-20.1 - SUBSIDIARIES OF THE COMPANY - Erin Energy Corp. | cak_ex211.htm |

| EX-32.1 - CERTIFICATION - Erin Energy Corp. | cak_ex321.htm |

| EX-32.2 - CERTIFICATION - Erin Energy Corp. | cak_ex322.htm |

| EX-31.2 - CERTIFICATION - Erin Energy Corp. | cak_ex312.htm |

| EX-31.1 - CERTIFICATION - Erin Energy Corp. | cak_ex311.htm |

| EX-99.1 - Erin Energy Corp. | cak_ex991.htm |

| EX-23.1 - CONSENT OF RBSM LLP - Erin Energy Corp. | cak_ex231.htm |

| EX-1.37 - AMENDED AND RESTATED EMPLOYMENT AGREEMENT - Erin Energy Corp. | cak_ex1037.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

———————

FORM 10-K

———————

þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from: _____________ to _____________

001-34525

(Commission File Number)

CAMAC ENERGY INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

30-0349798

|

|

|

(State or Other Jurisdiction

|

(I.R.S. Employer

|

|

|

of Incorporation or Organization)

|

Identification No.)

|

1330 Post Oak Blvd., Suite 2575, Houston, TX 77056

(Address of Principal Executive Office) (Zip Code)

(713) 797-2940

(Registrant’s telephone number, including area code)

———————

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 par value.

———————

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer”, “non-accelerated filer” and ”smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o Accelerated filer þ Non-accelerated filer ¨ Small reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of the last business day of the registrant’s most recently completed second fiscal quarter (June 30, 2010) was approximately $225,191,980 (based on $3.73 per share, the last price of the common stock as reported on the NYSE Amex on such date). For purposes of the foregoing calculation only, all directors, executive officers and 10% beneficial owners have been deemed affiliates. As of March 7, 2011, there were 153,773,599 shares of Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement or Form 10-K/A relating to the Company’s Annual Meeting of Stockholders to be held on June 24, 2011 are incorporated by reference in Part III of this report.

CAMAC Energy Inc.

(Formerly Pacific Asia Petroleum, Inc.)

FORM 10-K

|

Page

|

|||||

|

PART I

|

|||||

| Cautionary Statement Relevant to Forward-Looking Information | |||||

| Certain Defined Terms | |||||

| Item 1. |

Description of Business

|

4 | |||

| Item 1A. |

Risk Factors

|

16 | |||

| Item 1B. |

Unresolved Staff Comments

|

32 | |||

| Item 2. |

Properties

|

32 | |||

| Item 3. |

Legal Proceedings

|

32 | |||

| Item 4. |

Removed and Reserved

|

32 | |||

|

PART II

|

|||||

| Item 5. |

Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

33 | |||

| Item 6. |

Selected Financial Data

|

37 | |||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

38 | |||

| Item 7A. |

Quantitative and Qualitative Disclosures About Market Risk

|

52 | |||

| Item 8. |

Financial Statements and Supplemental Data

|

53 | |||

| Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

87 | |||

| Item 9A. |

Controls and Procedures

|

87 | |||

| Item 9B. |

Other Information

|

89 | |||

|

PART III

|

|||||

| Item 10. |

Directors, Executive Officers and Corporate Governance

|

90 | |||

| Item 11. |

Executive Compensation

|

90 | |||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

90 | |||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence

|

90 | |||

| Item 14. |

Principal Accountant Fees and Services

|

90 | |||

|

PART IV

|

|||||

| Item 15. |

Exhibits and Financial Statement Schedules

|

91 | |||

|

Signatures

|

|||||

2

CAUTIONARY STATEMENT RELEVANT TO FORWARD-LOOKING INFORMATION

All statements, other than statements of historical fact, included in this Form 10-K, including without limitation the statements under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Description of Business,” are, or may be deemed to be, forward-looking statements. Such forward-looking statements involve assumptions, known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements of CAMAC Energy Inc. (formerly Pacific Asia Petroleum, Inc. ) and its subsidiaries and joint-ventures, (i) Pacific Asia Petroleum, Limited, (ii) Inner Mongolia Production Company (HK) Limited, (iii) Pacific Asia Petroleum (HK) Limited, (iv) Inner Mongolia Sunrise Petroleum Co. Ltd., (v) Pacific Asia Petroleum Energy Limited, (vi) Beijing Dong Fang Ya Zhou Petroleum Technology Service Company Limited, and (vii) CAMAC Petroleum Limited (collectively, the “Company”), to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements contained in this Form 10-K.

In our capacity as Company management, we may from time to time make written or oral forward-looking statements with respect to our long-term objectives or expectations which may be included in our filings with the Securities and Exchange Commission (the “SEC”), reports to stockholders and information provided in our web site.

The words or phrases “will likely,” “are expected to,” “is anticipated,” “is predicted,” “forecast,” “estimate,” “project,” “plans to continue,” “believes,” or similar expressions identify “forward-looking statements.” Such forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical earnings and those presently anticipated or projected. We wish to caution you not to place undue reliance on any such forward-looking statements, which speak only as of the date made. We are calling to your attention important factors that could affect our financial performance and could cause actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods in any current statements.

The following list of important factors may not be all-inclusive, and we specifically decline to undertake an obligation to publicly revise any forward-looking statements that have been made to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. Among the factors that could have an impact on our ability to achieve expected operating results and growth plan goals and/or affect the market price of our stock are:

|

●

|

Limited operating history, operating revenue or earnings history.

|

|

●

|

Ability to raise capital to fund our operations on terms and conditions acceptable to the Company.

|

|

●

|

Ability to develop oil and gas reserves.

|

|

●

|

Dependence on key personnel, technical services and contractor support.

|

|

●

|

Fluctuation in quarterly operating results.

|

|

●

|

Possible significant influence over corporate affairs by significant stockholders.

|

|

●

|

Ability to enter into definitive agreements to formalize foreign energy ventures and secure necessary exploitation rights.

|

|

●

|

Ability to successfully integrate and operate acquired or newly formed entities and multiple foreign energy ventures and subsidiaries.

|

|

●

|

Competition from large petroleum and other energy interests.

|

|

●

|

Changes in laws and regulations that affect our operations and the energy industry in general.

|

|

●

|

Risks and uncertainties associated with exploration, development and production of oil and gas, and drilling and production risks.

|

|

●

|

Expropriation and other risks associated with foreign operations.

|

|

●

|

Risks associated with anticipated and ongoing third party pipeline construction and transportation of oil and gas.

|

|

●

|

The lack of availability of oil and gas field goods and services.

|

|

●

|

Environmental risks and changing economic conditions.

|

3

CERTAIN DEFINED TERMS

Throughout this Annual Report on Form 10-K, the terms “we,” “us,” “our,” ” Company,” and “our Company” refer to CAMAC Energy Inc. (“CAMAC”), formerly Pacific Asia Petroleum, Inc. (“PAP”), a Delaware corporation, and its present and former subsidiaries, including Pacific Asia Petroleum, Limited (“PAPL”), Pacific Asia Petroleum Energy Limited (“PAPE”), Inner Mongolia Production Company (HK) Limited (“IMPCO HK”), Pacific Asia Petroleum (HK) Limited (“PAP HK”), Inner Mongolia Sunrise Petroleum Co. Ltd. (“IMPCO Sunrise”), Beijing Dong Fang Ya Zhou Petroleum Technology Service Company Limited (“Dong Fang”), and CAMAC Petroleum Limited (“CPL”) and collectively, the “Company”. References to "CAMAC" as a corporate entity refer to CAMAC Energy Inc. (formerly Pacific Asia Petroleum, Inc.) prior to the mergers of Inner Mongolia Production Company LLC ("IMPCO") and Advanced Drilling Services, LLC ("ADS") into wholly-owned subsidiaries of CAMAC Energy Inc. However, historical financial results presented herein are those of IMPCO from inception on August 25, 2005 to May 6, 2007, and the consolidated entity CAMAC Energy Inc. from May 7, 2007 forward, which is considered to be the continuation of IMPCO as CAMAC Energy Inc. for accounting purposes.

PART I

ITEM 1. DESCRIPTION OF BUSINESS

General

CAMAC is a publicly traded company which seeks to develop new energy ventures outside the U.S., directly and through joint ventures and other partnerships in which it may participate. Members of the Company’s senior management team have experience in the fields of international business development, geology, petroleum engineering, strategy, government relations, and finance. Members of the Company’s management team previously held positions in oil and gas development and screening roles with domestic and international energy companies and will seek to utilize their experience, expertise and contacts to create value for shareholders. The Company’s focus is oil and gas exploration and production operations, which are managed geographically. Our current operations are in Nigeria and the People’s Republic of China. The second quarter 2010 was our first reporting period out of the development stage company basis. Our shares are traded on the on the NYSE Amex under the symbol “CAK”.

Our executive offices are located at 1330 Post Oak Boulevard, Suite 2575, Houston, Texas 77056 and our telephone number is (713) 797-2940.

Available Information

We file annual, quarterly and current reports, proxy statements and other documents with the SEC under the Securities Exchange Act of 1934 (“Exchange Act”). The public may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street NE, Washington, DC 20549-0213. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Also, the SEC maintains an Internet website that contains reports, proxy and information statements, and other information regarding issuers, including us, that file electronically with the SEC. The public can obtain any documents that we file with the SEC at http://www.sec.gov.

We also make available, free of charge on or through our Internet website (http://www.camacenergy.com), our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and if applicable, amendments to those reports filed or furnished pursuant to Section 13(a) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Forms 3, 4 and 5 filed with respect to our equity securities under Section 16(a) of the Exchange Act are also available on our website. In addition, we have adopted a Code of Ethics and Business Conduct that applies to all of our employees, including our chief executive officer, principal financial officer and principal accounting officer. The text of the Code of Ethics and Business Conduct has been posted on the Corporate Governance section of our website. Additionally, the Code of Ethics and Business Conduct is available in print to any person who requests the information. Individuals wishing to obtain this printed material should submit a request to CAMAC Energy Inc., 1330 Post Oak Boulevard, Suite 2575, Houston TX 77056, Attention: Investor Relations.

4

Executive Summary of 2010

Oyo Field Production Sharing Contract Interest

On November 18, 2009, the Company entered into the Purchase and Sale Agreement with CAMAC Energy Holdings Limited and certain of its affiliates (collectively “CEHL”) pursuant to which the Company agreed to acquire all of CEHL’s interest in a Production Sharing Contract (the “OML 120/121 PSC”) with respect to the oilfield asset known as the Oyo Field (the “Oyo Contract Rights”) and agreed to the related transactions contemplated thereby, including the election of certain directors of the Company. The OML 120/121 PSC governing the Oyo Field is by and among Allied Energy Plc. (“Allied”), an affiliate of CEHL, CAMAC International (Nigeria) Limited (“CINL”), an affiliate of CEHL, and Nigerian Agip Exploration Limited (“NAE”).

As consideration for the Oyo Contract Rights, on April 7, 2010 the Company paid CAMAC Energy Holdings Limited $32 million in cash consideration (the “Cash Consideration”) and issued to CAMAC Energy Holdings Limited 89,467,120 shares of Company Common Stock, par value $0.001, representing approximately 62.74% of the Company’s issued and outstanding Common Stock at closing (the “Consideration Shares”). In addition, if certain issued and outstanding warrants and options exercisable for an aggregate of 7,991,948 shares of Company Common Stock were exercised following the closing, the Company was obligated to issue up to an additional 13,457,188 Consideration Shares to CAMAC Energy Holdings Limited to maintain CAMAC Energy Holdings Limited’s approximately 62.74% interest in the Company. As of December 31, 2010 the maximum potential additional Consideration Shares issuable had been reduced to 7,484,983 due to expiration of certain unexercised warrants. As additional Cash Consideration, the Company agreed to pay CAMAC Energy Holdings Limited $6.84 million on the earlier of sufficient receipt of oil proceeds from the Oyo Field or six months from the closing date. This amount was paid in July 2010.

In February and March 2010, the Company raised $37.5 million in two registered direct offerings (described below), $32 million of which proceeds were used by the Company to satisfy the cash purchase price requirement under the Purchase and Sale Agreement, as amended.

Registered Direct Offerings of Securities

In year 2010, the Company completed three registered direct offerings for combined sales of Company Common Stock and warrants, under which the following securities were issued:

February 16, 2010:

-5,000,000 shares of Common Stock at $4.00 per share – aggregate proceeds of $20 million

-Warrants to purchase 2,000,000 shares of Common Stock at $4.50 per share, expiring August 2013

-Warrants to purchase 2,000,000 shares of Common Stock at $4.00 per share, expired November 2010

-Placement agent warrants to purchase 150,000 shares of Common Stock at $5.00 per share, expiring February 2015

March 5, 2010:

-4,146,922 shares of Common Stock at $4.22 per share – aggregate proceeds of $17.5 million

-Warrants to purchase 1,658,769 shares of Common Stock at $4.50 per share, expiring September 2013

-Warrants to purchase 1,658,769 shares of Common Stock at $4.12 per share, expired December 2010

-Placement agent warrants to purchase 124,408 shares of Common Stock at $5.275 per share, expiring February 2015

5

December 28, 2010:

-9,319,102 shares of Common Stock at $2.20 per share – aggregate proceeds of $20.5 million

-Warrants to purchase 4,659,551 shares of Common Stock at $2.20 per share, increased to $2.62 per share 31 days after the closing, expiring December 2015

-Placement agent warrants to purchase 279,573 shares of Common Stock at $2.75 per share, expiring February 2015

Net proceeds from the February and March 2010 offerings have been used by the Company for working capital purposes, and to fund the Company’s acquisition from CEHL of the Oyo Contract Rights in April 2010. Net proceeds from the December 2010 offering will be used to fund a portion of the cost of the workover on well #5 in the Oyo Field and for working capital purposes.

OML 120/121 Transaction

On December 13, 2010, the Company entered into a Purchase and Continuation Agreement (the “Purchase Agreement”) with CEHL, superseding earlier related agreements. Pursuant to the Purchase Agreement, the Company agreed to acquire CEHL’s full remaining interest (the “OML 120/121 Transaction”) in the OML 120/121 PSC (the “Non-Oyo Contract Rights”). In April 2010 the Company had acquired from CEHL the Oyo Contract Rights in the OML 120/121 PSC. The OML 120/121 Transaction closed on February 15, 2011. Upon consummation of the acquisition of the Non-Oyo Contract Rights under the Purchase Agreement, the Company acquired CEHL’s full interest in the OML 120/121 PSC.

In exchange for the Non-Oyo Contract Rights, the Company agreed to an option-based consideration structure and paid $5.0 million in cash to Allied upon the closing of the OML 120/121 Transaction on February 15, 2011. The Company has the option to elect to retain the Non-Oyo Contract Rights upon payment of additional consideration to Allied as follows:

|

a.

|

First Milestone: Upon commencement of drilling of the first well outside of the Oyo Field under the PSC, the Company may elect to retain the Non-Oyo Contract Rights upon payment to CEHL of $5 million (either in cash, or at Allied’s option, in shares);

|

|

b.

|

Second Milestone: Upon discovery of hydrocarbons outside of the Oyo Field under the PSC in sufficient quantities to warrant the commercial development thereof, the Company may elect to retain the Non-Oyo Contract Rights upon payment to CEHL of $5 million (either in cash, or at Allied’s option, in shares);

|

|

c.

|

Third Milestone: Upon the approval by the Management Committee (as defined in the PSC) of a Field Development Plan with respect to the development of non-Oyo Field areas under the PSC, as approved by the Company, the Company may elect to retain the Non-Oyo Contract Rights upon payment to Allied of $20 million (either in cash, or at Allied’s option, in shares); and

|

|

d.

|

Fourth Milestone: Upon commencement of commercial hydrocarbon production outside of the Oyo Field under the PSC, the Company may elect to retain the Non-Oyo Contract Rights (with no additional milestones or consideration required thereafter following payment in full of the following consideration) upon payment to Allied, at Allied’s option of (i) $25 million in shares, or (ii) $25 million in cash through payment of up to 50% of the Company’s net cash flows received from non-Oyo Field production under the PSC.

|

If any of the above milestones are reached and the Company elects not to retain the Non-Oyo Contract Rights at that time, then all the Non-Oyo Contract Rights will automatically revert back to CEHL without any compensation due to the Company and with CEHL retaining all consideration paid by the Company to date.

6

The Purchase Agreement contained the following conditions to the closing of the Transaction: (i) CPL, CAMAC International (Nigeria) Limited (“CINL”), Allied, and Nigerian Agip Exploration Limited (“NAE”) must enter into a Novation Agreement in a form satisfactory to the Company and CEHL and that contains a waiver by NAE of the enforcement of Section 8.1(e) of the OML 120/121 PSC (providing for the continued waiver by NAE of its entitlement to “profit oil” in favor of Allied), and that notwithstanding anything to the contrary contained in the OML 120/121 PSC, the profit sharing allocation set forth in the OML 120/121 PSC shall be maintained after the consummation of the OML 120/121 Transaction; (ii) the Company, and CEHL must enter into a registration rights agreement with respect to any shares issued by the Company to Allied at its election as consideration upon the occurrence of any of the above-described milestone events, in a form satisfactory to the Company and CEHL; and (iii) the Oyo Field Agreement, dated April 7, 2010, by and among the Company, CEHL and Allied, must be amended in order to remove certain indemnities with respect to Non-Oyo Operating Costs (as defined therein). In addition, CEHL must deliver the certain data and certain equipment to the Company in as-is condition. The Company agreed to limited waivers of certain of these closing conditions under the Limited Waiver Agreement. See Note 20 to our consolidated financial statements for more information regarding the Limited Waiver Agreement.

Dr. Kase Lawal, the Company’s Non-Executive Chairman and member of the Board of Directors, is a director of each of CEHL, CINL, and Allied. Dr. Lawal also owns 27.7% of CAMAC International Limited, which indirectly owns 100% of CEHL. As a result, Dr. Lawal may be deemed to have an indirect material interest in the transaction contemplated by the OML 120/121 Agreement. Chairman Lawal recused himself from participating in the consideration and approval by the Company’s Board of Directors of the OML 120/121 Transaction.

Oyo Field Well #5 Workover

During December 2010 and January 2011, the Company incurred approximately $55 million in total costs relative to the workover to reduce gas production rising from the #5 well in the Oyo Field with the objective of increasing crude oil production from this well. By joint agreement with Allied, the Company will pay for the workover. To the extent the Company funds these costs, it will be entitled to cost recovery of such costs as non-capital costs from Cost Oil, as defined in the terms of the OML 120/121 PSC, subject to future production levels. For purposes of Cost Oil recovery on each sale of production, non-capital costs are allocated for recovery prior to capital costs. We expect to recover these costs as revenue in 2011and 2012.

Operations

Africa - OML 120/121 Production Sharing Contract

On December 15, 2009, NAE, a subsidiary of Italy's ENI SpA, and CEHL announced that they had commenced production of the Oyo Field. The Oyo Field has been producing from two subsea wells in a water depth of greater than 300 meters, which are connected to the Armada Perdana Floating Production Storage and Offloading (“FPSO”) vessel. The FPSO has a treatment capacity of 40,000 barrels of liquids per day, with gas treatment and re-injection facilities, and is capable of storing up to one million barrels of crude oil. The first lifting (sale) of crude oil was in February 2010. The associated gas has been largely re-injected into the Oyo Field reservoir by a third well, to minimize flaring and to maximize oil recovery. During December 2010 and January 2011, the Company incurred approximately $55 million in costs relative to the workover to reduce gas production rising from the #5 well in the Oyo Field with the objective of increasing crude oil production from this well. By joint agreement with Allied, the Company will pay for the workover. We expect to recover these costs as revenue in 2011 and 2012.

7

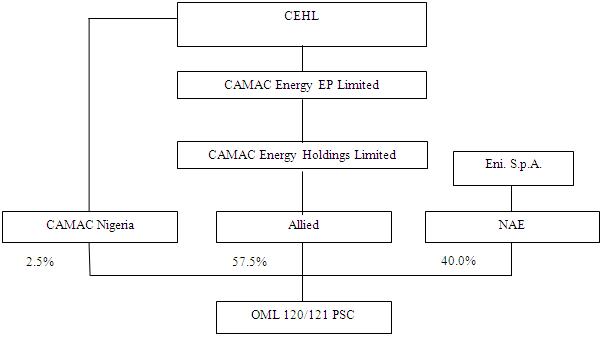

On July 22, 2005, a Production Sharing Contract (the “OML 120/121 PSC”) was signed among CEHL affiliates (including Allied) and NAE. Pursuant to the OML 120/121 PSC, NAE assumed the rights and obligations as the Operating Contractor to the petroleum operations in the Oyo field and was assigned an undivided 40% interest, with Allied retaining an undivided 60% interest. However, these percentages are not indicative of the actual allocation of proceeds from production of oil or other hydrocarbons under the Oyo Contract Rights and the recently acquired Non-Oyo Contract Rights because such allocations are affected by the amount of participation in funding of OML 120/121 PSC operating and capital costs. The parties to the OML 120 /121 PSC are represented by the above chart.

As Nigerian crude oil is readily marketable in international markets we are not dependent upon a single or a small number of customers.

The allocation between the parties of oil production is governed by the OML 120/121 PSC, available crude oil is allocated to four categories of oil: royalty oil (“Royalty Oil”), cost oil (“Cost Oil”), tax oil (“Tax Oil”) and profit oil (“Profit Oil”), in that order. Proceeds from available crude oil are first used to pay royalty (“Royalty Oil”), recover Operating Costs and Capital Cost (“Cost Oil”) and pay tax (“Tax Oil”). The rest of the proceeds are distributed as Profit Oil to Contractors and First Party as shown in the chart below. The allocation procedure is shown in the chart below. The Company receives the share allocable to Allied for the Oyo Contract Rights and will receive Allied’s share for the Non-Oyo Contract Rights. The complete Production Sharing Contract was filed as Annex E to the Company’s proxy filed with the SEC on March 19, 2010.

8

Profit oil is allocated to the parties according to the following schedule:

*Petroleum profit tax of 50% plus education tax of 2%, chargeable on the total remainder oil after deduction of amortization and investment allowance.

**Y-Factor: NAE and Allied will share the Profit Oil to Contractor based on their contribution on Capital Costs and Non-Capital Costs.

9

Nigeria Oil Industry

Nigeria is classified as an emerging market with its abundant supply of resources, developing financial, legal, communications, transport sectors and stock exchange (the Nigerian Stock Exchange), which is the second largest in Africa. Nigeria was ranked 33rd in the world in terms of Gross Domestic Product as of 2009. Nigeria is the United States' largest trading partner in sub-Saharan Africa and supplies a fifth of the U.S.’s imported oil . It has the sixth-largest trade surplus with the U.S. of any country worldwide. Nigeria is currently the 42nd-largest export market for U.S. goods and the 14th-largest exporter of goods to the U.S. The U.S. is the country's largest foreign investor. The bulk of economic activity is centered in four main cities: Lagos, Kaduna, Port Harcourt, and Abuja. Beyond these four economic centers, development is marginal.

According to the Oil and Gas Journal, Nigeria had an estimated 37.2 billion barrels of proven oil reserves as of January 2010. The majority of reserves are found along the country’s Niger River Delta and offshore in the Bight of Benin, the Gulf of Guinea and the Bight of Bonny. Current exploration activities are mostly focused in the deep and ultra-deep offshore with some activities in the Chad basin, located in northeast Nigeria.

Since December 2005, Nigeria has experienced increased pipeline vandalism, kidnappings and militant takeovers of oil facilities in the Niger Delta. The Movement for the Emancipation of the Niger Delta (MEND) is the main group attacking oil infrastructure for political objectives, claiming to seek a redistribution of oil wealth and greater local control of the sector. Additionally, kidnappings of oil workers for ransom are common. Security concerns have led some oil services firms to pull out of the country and oil workers unions to threaten strikes over security issues. The instability in the Niger Delta has caused shut-in production and several companies to declare force majeure on oil shipments.

Nigeria is an important oil supplier to the United States. A significant portion of the country’s oil production is exported to the United States and the light, sweet quality crude is a preferred gasoline feedstock. Consequently, disruptions to Nigerian oil production impacts trading patterns and refinery operations in North America and often affect world oil market prices.

In 2009, total oil production in Nigeria was slightly over 2.2 million barrels of oil per day (“bbl/d”), making it the largest oil producer in Africa. Crude oil production averaged 1.8 million bbl/d for the year. Recent offshore oil developments combined with the restart of some shut-in onshore production have boosted crude production to an average of 2.35 million bbl/d for the second quarter of 2010.

Asia - Zijinshan Production Sharing Contract

In 2007, we entered into a production sharing contract with China United Coalbed Methane Co., Ltd., (“CUCBM”) for exclusive rights to a large contract area located in the Shanxi Province of China (the “CUCBM Contract Area”), for the exploitation of gas resources (the “Zijinshan PSC”). CUCBM is owned 50/50 by China Coal Energy Group and China National Petroleum Corporation (“CNPC” and “PetroChina”). In 2008, PetroChina withdrew from the CUCBM partnership. As a result, 50% of the assets, including Zijinshan PSC, have become the asset of PetroChina. The change of ownership of these assets is subject to Chinese Government approval. The approval was formally granted in December 2010. Currently, a modification to the Zijinshan PSC has been proposed to formalize the change of partnership from CUCBM to PetroChina. Upon signing of the modification agreement, the Zijinshan PSC will be administrated by PetroChina Coal Bed Methane Corporation which is a wholly owned subsidiary of PetroChina (“PCCBM”). The Zijinshan PSC covers an area of approximately 175,000 acres (“Zijinshan Block”). The Zijinshan PSC has a term of 30 years and was approved in 2008 by the Ministry of Commerce of China.The Zijinshan PSC provides, among other things, that PAPL, following approval of the Zijinshan PSC by the Ministry of Commerce of China, has a minimum commitment for the first three years to drill three exploration wells and to carry out 50 km of 2-D seismic data acquisition and in the fourth and fifth years to drill four pilot development wells (in each case subject to PAPL’s right to terminate the Zijinshan PSC). That five year period constitutes the exploration period, which is subject to extension. After the exploration period, but before commencement of the development and production period, PCCBM will have the right to acquire a 40% participating interest and work jointly and pay its participating share of costs to develop and produce gas. The Zijinshan PSC provides for cost recovery and profit sharing from production under a specified formula after commencement of production.

10

The Zijinshan PSC area is in close proximity to the major West-East and the Ordos-Beijing gas pipelines which link the gas reserves in China’s western provinces to the markets of Beijing and the Yangtze River Delta, including Shanghai.

During 2009, the Company completed seismic data acquisition operations on the Zijinshan Block and spent approximately $1.5 million to shoot 162 kilometers of seismic under the work program. Based on the seismic interpretation, four potential well locations were identified. A regional environmental impact assessment study has also been completed. Following completion of a site-specific environmental impact study, the Company spudded well ZJS 001 on September 30, 2009. This well intersected 4/5 coal seams in the Shanxi formation and 8/9 coal seams in the Taiyuan formation as anticipated. The well reached total depth in mid-November 2009. Core samples have undergone laboratory testing, including tests for gas content, gas saturation and coal characteristics. Based on the results of these tests, the Company agreed to a planned 2010 work program to include further technical studies related to the CUCBM Contract Area and drilling at least two additional wells there. Drilling commenced on well ZJS 002 in August and was completed on the downthrown block in November 2010. Mud logs during drilling confirmed the presence of gas at several intervals ranging in depth from 1,471 to 1,742 meters. However, no flow tests were conducted due to the deteriorated hole condition, and therefore all exploratory costs were expensed.

Further drilling and analysis will be necessary to determine whether the Zijinshan Block contains sufficient quantities of gas that are commercially recoverable under existing economic and operating conditions. Drilling of well ZJS 003 on the larger upthrown block is now planned for the first half of 2011, with an additional two wells planned for later in 2011. There have been no proved reserves assigned to the Zijinshan PSC to date.

Enhanced Oil Recovery and Production (“EORP”)

In May and June 2009, the Company entered into certain agreements with Mr. Li Xiangdong (“LXD”) and Mr. Ho Chi Kong (“HCK”), pursuant to which the parties in September 2009 formed a Chinese joint venture company, Dong Fang. Dong Fang is 75.5% owned by PAPE and 24.5% owned by LXD, and LXD agreed to assign certain pending patent rights related to chemical enhanced oil recovery thereto. PAPE is 70% owned by the Company and 30% owned by Best Source Group Holdings Limited, a company designated by HCK for his interest.

In late 2009, the Company commenced limited EORP operations in the Liaoning Province through the treatment of three pilot test wells in the Liaohe Oilfield utilizing the chemical treatment technology acquired by Dong Fang. Results of these efforts, which resulted in incremental production, have been evaluated by the Company.

In the fourth quarter of 2010, the Company decided it would explore all alternatives including the potential sale of the EORP business due to the lack of progress in establishing a significant business and the likelihood that further progress will be difficult to achieve under the existing local operating environment. The assets of the EORP operations are not material in terms of the Company’s total assets and the minority interest is reflected as a noncontrolling interest in our consolidated financial statements. All active operations have ceased, including consideration of the Chifeng agreement area in Inner Mongolia for a possible EORP project. In February 2011, the Board of Directors of Dong Fang approved dissolution of Dong Fang, the operating company.

China Oil and Gas Industry

China is the world's most populous country and has a rapidly growing economy. China is also the world’s second largest petroleum consumer. According to the Energy Information Agency (“EIA”), in 2009, Chinese consumption for petroleum reached 8.2 million bbl/d, with only 4.0 million bbl/d of total oil production, making China a net importer of 4.2 million bbl/d. Since 2000, China’s oil imports tripled, growing from 1.4 million bbl/d to 4.2 million bbl/d in 2009.

Natural gas represents a particularly under-utilized energy source in China, supplying only 3% of the country’s energy needs (EIA), compared with 23% globally and in the U.S. We believe that its low emissions, combined with the low cost and high efficiency of gas turbines, make gas an attractive fuel for meeting China’s future electric power demand. This will be particularly important in light of China's newly-announced goal of reducing the carbon-intensity of its economy by 40-45% by 2020, compared to 2005, in light of the much lower emissions from gas-fired power plants relative to those burning coal. The Chinese government has indicated that it would like to expand gas use significantly. China’s domestic natural gas production increased to 2.9 trillion cubic feet in 2009 (EIA) and is planned to double to 5.7 trillion cubic feet by 2015 (China Daily, quoting an official of the Ministry of Land and Resources).

11

The government of China has taken a number of steps to encourage the exploitation of oil and gas within its own borders to meet the growing demand for oil and to try to reduce its dependency on foreign oil. Notably, the government has reduced complicated restrictions on foreign ownership of oil exploitation projects and has passed legislation encouraging foreign investment and exploitation of oil and gas. While the barriers to entry for foreign entities to engage in the development of oil and gas resources in China have recently eased, we believe that many small companies still face significant hurdles due to their lack of experience in the Chinese petroleum industry. Development requires specialized grants and permits, experience with operating in China and dealing with challenging cultural and political environments in remote regions and the ability to manage projects efficiently during times of resource shortages. The Company hopes to take advantage of the energy development opportunities that exist in China today by leveraging its management team’s prior exploration experiences in China and existing relationships with oil industry executives and government officials in China. In addition, we believe that members of the Company’s production team have the hands-on experience with projects in Asia that we believe is essential to any successful petroleum project in China.

Reserves

The information included in this Annual Report on Form 10-K about our proved reserves represents evaluations prepared by Netherland, Sewell & Associates, Inc., independent petroleum consultants (“NSAI”). NSAI has prepared evaluations on 100 percent of our proved reserves on a valuation basis, and the estimates of proved crude oil reserves attributable to our net interests in oil and gas properties as of December 31, 2010. The scope and results of NSAI’s procedures are summarized in a letter which is included as an exhibit to this Annual Report on Form 10-K. For further information on reserves, including information on future net cash flows and the standardized measure of discounted future net cash flows, see “Item 8. - Financial Statements and Supplemental Data –Supplemental Data on Oil and Gas Exploration and Producing Activities.”

Internal Controls for Reserve Estimation

The reserve estimates prepared by NSAI are reviewed and approved by our contracted reservoir engineer and management. The process performed by NSAI to prepare reserve amounts included the estimation of reserve quantities, future producing rates, future net revenue and the present value of such future net revenue. NSAI also prepared estimates with respect to reserve categorization, using the definitions for proved reserves set forth in Regulation S-X Rule 4-10(a) and subsequent SEC staff interpretations and guidance. In the conduct of their preparation of the reserve estimates, NSAI did not independently verify the accuracy and completeness of information and data furnished by us with respect to ownership interests, oil production, well test data, historical costs of operation and development, product prices or any agreements relating to current and future operations of the properties and sales of production. However, if in the course of its work, something came to its attention which brought into question the validity or sufficiency of any such information or data, NSAI did not rely on such information or data until they had satisfactorily resolved their questions relating thereto.

Technologies Used in Reserves Estimates

Proved reserves are those quantities of oil, which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible from a given date forward, from known reservoirs, and under existing economic conditions, operating methods, and government regulations. The term “reasonable certainty” implies a high degree of confidence that the quantities of oil and/or natural gas actually recovered will equal or exceed the estimate. To achieve reasonable certainty, our independent petroleum consultants employed technologies that have been demonstrated to yield results with consistency and repeatability. The technologies and economic data used in the estimation of our proved reserves include, but are not limited to, well logs, geologic maps, seismic data, well test data, production data, historical price and cost information and property ownership interests. The accuracy of the estimates of our reserves is a function of:

|

●

|

the quality and quantity of available data and the engineering and geological interpretation of that data;

|

|

●

|

estimates regarding the amount and timing of future operating costs, taxes, development costs and workovers, and our estimated participation in funding of future operating costs and capital expenditures, all of which may vary considerably from actual results;

|

|

●

|

the accuracy of various mandated economic assumptions such as the future prices of oil and natural gas; and

|

|

●

|

the judgment of the persons preparing the estimates.

|

Because these estimates depend on many assumptions, any or all of which may differ substantially from actual results, reserve estimates may be different from the quantities of oil and natural gas that are ultimately recovered.

12

Qualifications of Reserves Preparers and Auditors

We obtain services of contracted reservoir engineers with extensive industry experience who meets the professional qualifications of reserves estimators and reserves auditors as defined by the “Standards Pertaining to the Estimating and Auditing of Oil and Gas Reserves Information,” approved by the Board of the Society of Petroleum Engineers in 2001 and revised in 2007.

Our contracted reservoir engineer Mr. Babatunde Olusegun Omidele is primarily responsible for overseeing the preparation of our internal reserve estimates and for the coordination of the third-party reserve report provided by NSAI. Mr. Babatunde Olusegun Omidele has over 28 years of experience and is a graduate of University of Ibadan, Nigeria with a Bachelor of Science degree and from University of Houston, Texas with a Master of Science in Petroleum Engineering. He is a member of the Society of Petroleum Engineers. Mr. Babatunde Olusegun Omidele is Senior Vice President, Exploration & Production with Allied Energy Corp.

The reserves estimates shown herein have been independently prepared by NSAI, a worldwide leader of petroleum property analysis for industry and financial organizations and government agencies. NSAI was founded in 1961 and performs consulting petroleum engineering services under Texas Board of Professional Engineers Registration No. F-002699. Within NSAI, the technical persons primarily responsible for preparing the estimates set forth in the NSAI reserves report incorporated herein are Mr. Connor Riseden and Mr. Patrick Higgs. Mr. Riseden has been practicing consulting petroleum engineering at NSAI since 2006. Mr. Riseden is a Registered Professional Engineer in the State of Texas (License No. 100566) and has over nine years of practical experience in petroleum engineering, with over four years experience in the estimation and evaluation of reserves. Mr. Higgs has been practicing consulting petroleum geology at NSAI since 1996. Mr. Higgs is a Certified Petroleum Geologist and Geophysicist in the State of Texas (License No. 985) and has over 34 years of practical experience in petroleum geosciences, with over 14 years experience in the estimation and evaluation of reserves. Both technical principals meet or exceed the education, training, and experience requirements set forth in the Standards Pertaining to the Estimating and Auditing of Oil and Gas Reserves Information promulgated by the Society of Petroleum Engineers.

Summary of Crude Oil Reserves at December 31, 2010

The following estimates of the net proved oil reserves of our oil and gas properties located in Nigeria are based on evaluations prepared by NSAI. Reserves were estimated in accordance with guidelines established by the SEC and the Financial Accounting Standards Board (“FASB”), which require that reserve estimates be prepared under existing economic and operating conditions with no provisions for price and cost changes except by contractual arrangements. Reserve estimates are inherently imprecise and estimates of new discoveries are more imprecise than those of producing oil and gas properties. Accordingly, reserve estimates are expected to change as additional performance data becomes available. The Company presently has no reserves in China.

Crude Oil Reserves as of December 31, 2010

|

|

Crude Oil (MBbls)

|

PV-10

(in thousands)(1)

|

||||||

|

Proved

|

||||||||

|

Developed

|

387 | |||||||

|

Undeveloped

|

4,901 | |||||||

|

Total Proved

|

5,288 | $ | 95,696 | |||||

|

(1)

|

PV-10 reflects the present value of our estimated future net revenues to be generated from the production of proved reserves, determined in accordance with the rules and regulations of the SEC (using the average of the first-day-of-the-month commodity prices during the 12-month period ended on December 31, 2010) without giving effect to non-property related expenses such as DD&A expense and discounted at 10 percent per year before income taxes. The average of the first-day-of-the-month commodity prices during the 12-month period ending on December 31, 2010 was $79.21 per barrel of oil, including differentials.

|

13

Development of Proved Undeveloped Reserves

None of our proved undeveloped reserves currently have remained undeveloped for more than five years from the date of initial recognition as proved undeveloped.

Oil and Gas Production, Prices and Production Costs — Significant Fields

The Oyo field in Nigeria contains our entire total proved reserves as of December 31, 2010. In 2010, our share of average daily net production was 396 barrels per day (excluding royalty), average sales price was $85.16 per barrel and production cost of barrels sold was $34.54 per barrel. The Company had no production during 2009 and 2008 in Nigeria.

Drilling Activity

During 2010, the Company did not drill any development or exploratory wells in the Oyo Field, Nigeria. In China, the Company drilled one (gross and net) exploratory well in both 2010 and 2009, which were both determined to be dry wells.

Present Activities

The Company intends to participate in drilling a development well in the Oyo Field, Nigeria during 2011. In China, drilling of an exploratory well is planned in the first half of 2011, with an additional two wells planned for the second half of 2011 in the Zijinshan Block.

Delivery Commitments

As of December 31, 2010, the Company had no delivery commitments.

Productive Wells

At December 31, 2010, the Company had two gross productive wells in Nigeria. The number of net productive wells (net economic interest) in Nigeria at that date under our Production Sharing Contract is less than one net well; this is affected by our participation percentage in funding of expenditures.

Acreage

Interests in developed and undeveloped acreage follow.

|

December 31, 2010

|

||||||||||||||||||||||||

|

|

Developed Acres

|

Undeveloped Acres

|

Total Acres

|

|||||||||||||||||||||

|

|

Gross

|

Net

|

Gross

|

Net

|

Gross

|

Net

|

||||||||||||||||||

|

China

|

- | - | 175,000 | 175,000 | 175,000 | 175,000 | ||||||||||||||||||

|

Nigeria

|

8,600 | 5,200 | - | - | 8,600 | 5,200 | ||||||||||||||||||

|

Total

|

8,600 | 5,200 | 175,000 | 175,000 | 183,600 | 180,200 | ||||||||||||||||||

The Company has no acreage on which leases are scheduled to expire within the three years after December 31, 2010.

14

Regulation

General

Our operations and our ability to finance and fund our growth strategy are affected by political developments and laws and regulations in the areas in which we operate. In particular, oil and natural gas production operations and economics are affected by:

|

●

|

change in governments;

|

|

●

|

civil unrest;

|

|

●

|

price and currency controls;

|

|

●

|

limitations on oil and natural gas production;

|

|

●

|

tax, environmental, safety and other laws relating to the petroleum industry;

|

|

●

|

changes in laws relating to the petroleum industry;

|

|

●

|

changes in administrative regulations and the interpretation and application of such rules and regulations; and

|

|

●

|

changes in contract interpretation and policies of contract adherence.

|

In any country in which we may do business, the oil and natural gas industry legislation and agency regulation are periodically changed, sometimes retroactively, for a variety of political, economic, environmental and other reasons. Numerous governmental departments and agencies issue rules and regulations binding on the oil and natural gas industry, some of which carry substantial penalties for the failure to comply. The regulatory burden on the oil and natural gas industry increases our cost of doing business and our potential for economic loss.

Competition

The Company competes with numerous large international oil companies and smaller oil companies that target opportunities in markets similar to the Company’s, including the natural gas and petroleum markets. Many of these companies have far greater economic, political and material resources at their disposal than the Company. The Company’s management team has prior experience in the fields of petroleum engineering, geology, field development and production, operations, international business development, and finance and experience in management and executive positions with international energy companies. Nevertheless, the markets in which we operate and plan to operate are highly competitive and the Company may not be able to compete successfully against its current and future competitors. See Part I, Item 1A. Risk Factors - Risks Related to the Company’s Industry - for risk factors associated with competition in the oil and gas industry.

15

Environmental Regulation

Various federal, state, local and international laws and regulations relating to the discharge of materials into the environment, the disposal of oil and natural gas wastes, or otherwise relating to the protection of the environment may affect our operations and costs. We are committed to the protection of the environment and believe we are in substantial compliance with the applicable laws and regulations. However, regulatory requirements may, and often do, change and become more stringent, and there can be no assurance that future regulations will not have a material adverse effect on our financial position, results of operations and cash flows.

Employees

At December 31, 2010 the Company had 13 full-time employees in the United States, 14 full-time employees in China, and two part-time employees in China. There were no employees in Nigeria as of December 31, 2010 as the Company’s interests there were being handled through a contracted technical services agreement with an affiliate company.

In order for us to attract and retain quality personnel, we will have to offer competitive salaries to future employees. During 2011, the Company expects to hire additional personnel in certain operational and other areas as required for its expansion efforts, and to maintain focus on its then-existing and new projects. The number and skill sets of individual employees will be primarily dependent on the relative rates of growth of the Company’s different projects, and the extent to which operations and development are executed internally or contracted to outside parties. Subject to the availability of sufficient working capital and assuming initiation of additional projects, the Company currently plans to further increase full-time staffing to a level adequate to execute the Company’s growth plans. As we continue to expand, we will incur additional cost for personnel. In the case of Nigeria, the additional personnel cost will be partially offset by a decrease in the contracted technical services charges that we currently incur.

Intellectual Property

The Company through its subsidiary, Dong Fang, owns Patent Application Rights with respect to six patents pending before the PRC Patent Administration which covering certain enhanced oil recovery technologies to be used in connection with EORP operations. As mentioned above, our Board of Directors has approved the dissolution of Dong Fang.

ITEM 1A. RISK FACTORS

The Company’s operations and its securities are subject to a number of risks. The Company has described below all the material risks that are known to the Company that could materially impact the Company’s financial results of operations or financial condition. If any of the following risks actually occur, the business, financial condition or operating results of the Company and the trading price or value of its securities could be materially adversely affected.

Risks Related to the Company’s Business

The Company’s limited operating history makes it difficult to predict future results and raises substantial doubt as to its ability to successfully develop profitable business operations.

The Company’s limited operating history makes it difficult to evaluate its current business and prospects or to accurately predict its future revenue or results of operations, and raises substantial doubt as to its ability to successfully develop profitable business operations beyond the Oyo Field interest we acquired in April 2010 (the Oyo Contract Rights) and the Non-Oyo Contract Rights acquired in February 2011. We have no previous operating history in the Africa area. The Company’s revenue and income potential are unproven. As a result of its early stage of operations, and to keep up with the frequent changes in the energy industry, it is necessary for the Company to analyze and revise its business strategy on an ongoing basis. Companies in early stages of operations are generally more vulnerable to risks, uncertainties, expenses and difficulties than more established companies.

16

The Company was until recently a development stage company and may continue to incur losses for a significant period of time.

The Company was until recently a development stage company with minimal revenues. In April 2010, we acquired the Oyo Contract Rights from CEHL and, as a result of this acquisition, we ceased reporting as a development stage company and now we are an operating company generating significant revenues. We expect to continue to incur significant expenses relating to our identification of new ventures and investment costs relating to these ventures. Additionally, fixed commitments, including salaries and fees for employees and consultants, rent and other contractual commitments may be substantial and are likely to increase as additional ventures are entered into and personnel are retained prior to the generation of significant revenue. Energy ventures, such as oil well drilling projects, generally require a significant period of time before they produce resources and in turn generate profits. The Oyo and Non-Oyo Contract Rights may or may not result in net earnings in excess of our losses on other ventures under development or in the start-up phase. We may not achieve or sustain profitability on a quarterly or annual basis, or at all.

The Company’s ability to diversify risks by participating in multiple projects and joint ventures depends upon its ability to raise capital and the availability of suitable prospects, and any failure to raise needed capital and secure suitable projects would negatively affect the Company’s ability to operate.

The Company’s business strategy includes spreading the risk of oil and natural gas exploration, development and drilling, and ownership of interests in oil and natural gas properties, by participating in multiple projects and joint ventures, in particular with major Chinese government-owned oil and gas companies as joint venture partners. If the Company is unable to secure sufficient attractive projects as a result of its inability to raise sufficient capital or otherwise, the average quality of the projects and joint venture opportunities may decline and the risk of the Company’s overall operations could increase.

The loss of key employees could adversely affect the Company’s ability to operate.

The Company believes that its success depends on the continued service of its key employees, as well as the Company’s ability to hire additional key employees, when and as needed. Each of Byron A. Dunn, the Company’s Chief Executive Officer and Abiola L. Lawal, its Chief Financial Officer, has the right to terminate his employment at any time without penalty under his employment agreement. The unexpected loss of the services of either Mr. Dunn or Mr. Lawal, or any other key employee, or the Company’s failure to find suitable replacements within a reasonable period of time thereafter, could have a material adverse effect on the Company’s ability to execute its business plan and therefore, on its financial condition and results of operations.

The Company may not be able to raise the additional capital necessary to execute its business strategy, which could result in the curtailment or cessation of the Company’s operations.

The Company will need to raise substantial additional funds to fully fund its existing operations, consummate all of its current asset transfer and acquisition opportunities currently contemplated and for the development, production, trading and expansion of its business. The Company expects to utilize a term credit facility of $25 million from an affiliated company to meet a substantial portion of its cash obligations for workover expenses on Oyo Field well #5. The credit facility provides for an annual interest rate based on 30 day Libor plus two percentage points with all amounts due and payable within 24 months from the closing date, expected in March 2011. The Company has no other current arrangements with respect to additional source of financing, if needed. If additional sources of financing are needed it may not be available on commercially reasonable terms on a timely basis, or at all. The inability to obtain additional financing, when needed, would have a negative effect on the Company, including possibly requiring it to curtail or cease operations. If any future financing involves the sale of the Company’s equity securities, the shares of Common Stock held by its stockholders could be substantially diluted. If the Company borrows money or issues debt securities, it will be subject to the risks associated with indebtedness, including the risk that interest rates may fluctuate and the possibility that it may not be able to pay principal and interest on the indebtedness when due.

Insufficient funds will prevent the Company from implementing its business plan and will require it to delay, scale back, or eliminate certain of its programs or to license to third parties rights to commercialize rights in fields that it would otherwise seek to develop itself.

17

Failure by the Company to generate sufficient cash flow from operations could eventually result in the cessation of the Company’s operations and require the Company to seek outside financing or discontinue operations.

The Company’s business activities require substantial capital from outside sources as well as from internally-generated sources. The Company’s ability to finance a portion of its working capital and capital expenditure requirements with cash flow from operations will be subject to a number of variables, such as:

|

●

|

the level of production from existing wells;

|

|

●

|

prices of oil and natural gas;

|

|

●

|

the success and timing of development of proved undeveloped reserves;

|

|

●

|

cost overruns;

|

|

●

|

remedial work to improve a well’s producing capability;

|

|

●

|

direct costs and general and administrative expenses of operations;

|

|

●

|

reserves, including a reserve for the estimated costs of eventually plugging and abandoning the wells;

|

|

●

|

indemnification obligations of the Company for losses or liabilities incurred in connection with the Company’s activities; and

|

|

●

|

general economic, financial, competitive, legislative, regulatory and other factors beyond the Company’s control.

|

The Company might not generate or sustain cash flow at sufficient levels to finance its business activities. When and if the Company generates significant revenues, if such revenues were to decrease due to lower oil and natural gas prices, decreased production or other factors, and if the Company were unable to obtain capital through reasonable financing arrangements, such as a credit line, or otherwise, its ability to execute its business plan would be limited and it could be required to discontinue operations.

The Company’s failure to capitalize on existing definitive production agreements and/or enter into additional agreements could result in an inability by the Company to generate sufficient revenues and continue operations.

The Company has active interests in definitive production contracts for (i) the Oyo and Non-Oyo Contract Rights and (ii) Zijinshan PSC. The Company has not entered into definitive agreements with respect to any other ventures. The Company’s ability to consummate one or more additional ventures is subject to, among other things, (i) the amount of capital the Company raises in the future; (ii) the availability of land for exploration and development in the geographical regions in which the Company’s business is focused; (iii) the nature and number of competitive offers for the same projects on which the Company is bidding; and (iv) approval by government and industry officials. The Company may not be successful in executing definitive agreements in connection with any other ventures, or otherwise be able to secure any additional ventures it pursues in the future. Failure of the Company to capitalize on its existing contracts and/or to secure one or more additional business opportunities would have a material adverse effect on the Company’s business and results of operations, and could result in the cessation of the Company’s business operations.

18

Our estimated proved reserves are based on many assumptions that may turn out to be inaccurate. Any significant inaccuracies in these reserve estimates or underlying assumptions will materially affect the quantities and present value of our reserves. A significant percentage of our total estimated proved reserves at December 31, 2010 were proved undeveloped reserves which ultimately may be less than currently estimated.

The process of estimating oil and natural gas reserves is complex. It requires interpretations of available technical data and many assumptions, including assumptions relating to current and future economic conditions and commodity prices. Any significant inaccuracies in these interpretations or assumptions could materially affect the estimated quantities. In the case of production sharing contracts, the quantities allocable to a part-interest owner’s share are affected by the assumptions of that owner’s future participation in funding of operating and capital costs. Actual future production, prices, revenues, taxes, development expenditures, operating expenses and quantities of recoverable oil and natural gas reserves will vary from estimates. Any significant variance could materially affect the estimated quantities and present value of reserves disclosed. In addition, estimates of proved reserves reflect production history, results of exploration and development, prevailing prices and other factors, many of which are beyond our control. Due to the limited production history of our undeveloped acreage, the estimates of future production associated with such properties may be subject to greater variance to actual production than would be the case with properties having a longer production history.

The Company’s oil and gas operations will involve many operating risks that can cause substantial losses.

The Company expects to produce, transport and market potentially toxic materials, and purchase, handle and dispose of other potentially toxic materials in the course of its business. The Company’s operations will produce byproducts, which may be considered pollutants. Any of these activities could result in liability, either as a result of an accidental, unlawful discharge or as a result of new findings on the effects the Company’s operations on human health or the environment. Additionally, the Company’s oil and gas operations may also involve one or more of the following risks:

|

●

|

fires;

|

|

●

|

explosions;

|

|

●

|

blow-outs;

|

|

●

|

uncontrollable flows of oil, gas, formation water, or drilling fluids;

|

|

●

|

natural disasters;

|

|

●

|

pipe or cement failures;

|

|

●

|

casing collapses;

|

|

●

|

embedded oilfield drilling and service tools;

|

|

●

|

abnormally pressured formations;

|

|

●

|

damages caused by vandalism and terrorist acts; and

|

|

●

|

environmental hazards such as oil spills, natural gas leaks, pipeline ruptures and discharges of toxic gases.

|

In the event that any of the foregoing events occur, the Company could incur substantial losses as a result of (i) injury or loss of life; (ii) severe damage or destruction of property, natural resources or equipment; (iii) pollution and other environmental damage; (iv) investigatory and clean-up responsibilities; (v) regulatory investigation and penalties; (vi) suspension of its operations; or (vii) repairs to resume operations. If the Company experiences any of these problems, its ability to conduct operations could be adversely affected. Additionally, offshore operations are subject to a variety of operating risks, such as capsizing, collisions and damage or loss from typhoons or other adverse weather conditions. These conditions can cause substantial damage to facilities and interrupt production.

19

The Company may not be able to manage our anticipated growth and through the first quarter of 2011 may rely substantially on a services agreement with an affiliate of CEHL.The objectives of the affiliate may not be in line with the Company’s objectives and could result in the disruption of our operations and prevent us from generating meaningful revenue.

Subject to our receipt of additional capital, we plan to significantly expand operations to accommodate additional development projects and other opportunities. This expansion may strain our management, operations, systems and financial resources. In connection with the acquisition of the Oyo Contract rights we entered into a services agreement with Allied, pursuant to which Allied agreed to provide services relating to the Oyo Field consistent with its prior performance of those duties. If Allied fails to perform the services as agreed, or if we fail to secure similar agreements in connection with future assets before we improve and expand our operational, management and financial systems and staff, the profitability and results of operations could be adversely affected and future growth may be impeded. We may need to hire additional personnel in certain operational and other areas during 2011 and future years. The services agreement is expected to be terminated by March 31, 2011.

We will depend on NAE as the operator under the OML 120/121 PSC, which may result in operating costs, methods and timing of operations and expenditures beyond our control, and potential delays or the discontinuation of operations and production.

As operator under the OML 120/121 PSC, NAE manages all of the physical development and operations under the OML 120/121 PSC, including, but not limited to, the timing of drilling, production and related operations, the timing and amount of operational costs, the technology and service providers employed. We would be materially adversely affected if NAE does not properly and efficiently manage operational and production matters, or becomes unable or unwilling to continue acting as the operating contractor under the OML 120/121 PSC.

The Company will be dependent upon others for the storage and transportation of oil and gas, which could result in significant operational costs to the Company and depletion of capital.

The Company does not own storage or transportation facilities and, therefore, will depend upon third parties to store and transport all of its oil and gas resources when and if produced. The Company will likely be subject to price changes and termination provisions in any contracts it may enter into with these third-party service providers. The Company may not be able to identify such third-parties for any particular project. Even if such sources are initially identified, the Company may not be able to identify alternative storage and transportation providers in the event of contract price increases or termination. In the event the Company is unable to find acceptable third-party service providers, it would be required to contract for its own storage facilities and employees to transport the Company’s resources. The Company may not have sufficient capital available to assume these obligations, and its inability to do so could result in the cessation of its business.

An interruption in the supply of materials, resources and services the Company plans to obtain from third party sources could limit the Company’s operations and cause unprofitability.

Once it has identified, financed, and acquired projects, the Company will need to obtain other materials, resources and services, including, but not limited to, specialized chemicals and specialty muds and drilling fluids, pipe, drill-string, geological and geophysical mapping and interruption services. There may be only a limited number of manufacturers and suppliers of these materials, resources and services. These manufacturers and suppliers may experience difficulty in supplying such materials, resources and services to the Company sufficient to meet its needs or may terminate or fail to renew contracts for supplying these materials, resources or services on terms the Company finds acceptable including, without limitation, acceptable pricing terms. Any significant interruption in the supply of any of these materials, resources or services, or significant increases in the amounts the Company is required to pay for these materials, resources or services, could result in a lack of profitability, or the cessation of operations, if unable to replace any material sources in a reasonable period of time.

20

The Company does not presently carry liability insurance and business interruption insurance policies in Nigeria and China and will be at risk of incurring personal injury claims for its employees and subcontractors, and incurring business interruption loss due to theft, accidents or natural disasters.

The Company does not presently carry any policies of insurance in Nigeria and China to cover the risks discussed above. In the event that the Company were to incur substantial liabilities or business interruption losses with respect to one or more incidents, this could adversely affect its operations and it may not have the necessary capital to pay its portion of such costs and maintain business operations.

The Company is exposed to concentration of credit risk, which may result in losses in the future.

The Company is exposed to concentration of credit risk with respect to cash, cash equivalents, short-term investments, long-term investments, and long-term advances. At December 31, 2010, 68% ($19.6 million) of the Company’s total cash and cash equivalents was on deposit at JP Morgan Chase in the U.S. At December 31, 2009, 65% ($1,291,000) of the Company’s total cash was on deposit at HSBC in China and Hong Kong. Also at December 31, 2009, 64% ($1,029,000) of the Company’s total cash equivalents was invested in a single money market fund in the U.S.

Our business partner, CEHL, is a related party, and our non-executive chairman is a principal owner and one of the directors of CEHL, which may result in real or perceived conflicts of interest.

Our majority shareholder, CAMAC Energy Holdings Limited, is one of the entities constituting our business partner, CEHL. Dr. Kase Lawal, the Company’s Non-Executive Chairman and member of the Board of Directors, is a director of CAMAC Energy Holdings Limited as well as CINL and Allied, also entities constituting CEHL. Dr. Lawal also owns 27.7% of CAMAC International Limited, which indirectly owns 100% of CEHL, and CINL and Allied are each wholly-owned subsidiaries of CEHL. As a result, Dr. Lawal may be deemed to have an indirect material interest in any transactions with CEHL including the agreements entered into with CEHL in April 2010 and the OML 120/121 Transaction. As a result, Dr. Lawal may be deemed to have an indirect material interest in the above agreements. These relationships may result in conflicts of interest. We may not be able to prove that these agreements are equivalent to arm’s length transactions. Should our transactions not provide the value equivalent of arm’s length transactions, our results of operations may suffer and we may be subject to costly shareholder litigation.

If we lose our status as an indigenous Nigerian oil and gas operator, we would no longer be eligible for preferential treatment in the acquisition of oil and gas assets and oil and gas licensing rounds in Nigeria.

We are considered an indigenous Nigerian oil and gas operator by virtue of our majority stockholder, CAMAC Energy Holdings Limited, which is an indigenous Nigerian oil and gas company. This status makes us eligible for preferential treatment under the Nigerian Content Development Act with respect to the acquisition of oil and gas assets and in oil and gas licensing rounds in Nigeria. If CAMAC Energy Holdings Limited were to lose its status as an indigenous Nigerian oil and gas company due to its affiliation with our U.S. based company or otherwise, or if CAMAC Energy Holdings Limited’s majority interest in us were to be diluted or reduce due to additional issuances of equity by the Company, CAMAC Energy Holdings Limited’s sale or transfer of its interest in the Company or otherwise, we may lose our status as an indigenous Nigerian oil and gas operator. As a result, we would lose one of our key advantages in the Nigerian oil and gas market and our results of operations could materially suffer.