Attached files

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

———————

FORM

10-K

———————

þ

ANNUAL REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended December 31, 2009

OR

o

TRANSITION REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For the

transition period from: _____________ to _____________

001-34525

(Commission

File Number)

| PACIFIC ASIA PETROLEUM, INC. |

| (Exact name of registrant as specified in its charter) |

|

Delaware

|

30-0349798

|

|

|

(State

or Other Jurisdiction

|

(I.R.S.

Employer

|

|

|

of

Incorporation or Organization)

|

Identification

No.)

|

| 250 East Hartsdale Ave., Suite 47, Hartsdale, New York 10530 |

| (Address of Principal Executive Office) (Zip Code) |

| (914) 472-6070 |

| (Registrant’s telephone number, including area code) |

Securities

registered pursuant to Section 12(b) of the Act:

None

Securities

registered pursuant to Section 12(g) of the Act:

Common

Stock, $0.001 par value.

———————

Indicate by check mark if the

registrant is a well-known seasoned issuer, as defined in Rule 405 of the

Securities Act. Yes ¨ No þ

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes þ

No ¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (§229.405 of this chapter) is not contained herein, and will not

be contained, to the best of registrant’s knowledge, in definitive proxy

or information statements incorporated by reference in Part III of

this Form 10-K or any amendment to this Form 10-K. ¨

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every

Interactive Data File required to be submitted and posted pursuant to Rule 405

of Regulation S-T (§ 232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post

such files). Yes o

No ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

definition of “large accelerated filer”, “accelerated filer”, “non-accelerated

filer” and ”smaller reporting company” in Rule 12b-2 of the Exchange Act.

(Check one):

| Large accelerated filer o | Accelerated filer þ | Non-accelerated filer þ | Small reporting company o |

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act). Yes ¨

No þ

The

aggregate market value of the voting and non-voting common equity held by

non-affiliates of the registrant as of the last business day of the registrant’s

most recently completed second fiscal quarter (June 30, 2009) was approximately

$53,900,873 (based on $1.98 per share, the last price of the common stock as

reported on the OTC Bulletin Board on such date). For purposes of the

foregoing calculation only, all directors, executive officers and 10% beneficial

owners have been deemed affiliates. As of March 1,

2010, there were 48,257,896 shares of Common Stock

outstanding.

DOCUMENTS

INCORPORATED BY REFERENCE

Portions

of the definitive Proxy Statement relating to the Company’s Annual Meeting of

Stockholders to be held on June 9, 2010 are incorporated by reference in Part

III of this report.

CAUTIONARY STATEMENT RELEVANT TO FORWARD-LOOKING INFORMATION

All

statements, other than statements of historical fact, included in this Form

10-K, including without limitation the statements under “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” and “Description

of Business,” are, or may be deemed to be, forward-looking statements. Such

forward-looking statements involve assumptions, known and unknown risks,

uncertainties and other factors, which may cause the actual results, performance

or achievements of Pacific Asia Petroleum, Inc. and its subsidiaries and

joint-ventures, (i) Pacific Asia Petroleum, Limited, (ii) Inner Mongolia

Production Company (HK) Limited, (iii) Pacific Asia Petroleum (HK) Limited, (iv)

Inner Mongolia Sunrise Petroleum Co. Ltd., (v) Pacific

Asia Petroleum Energy Limited, (vi) Beijing Dong Fang Ya Zhou Petroleum

Technology Service Company Limited, and (vii) CAMAC Petroleum Limited

(collectively, the “Company”), to be materially different from any future

results, performance or achievements expressed or implied by such

forward-looking statements contained in this Form 10-K.

In our

capacity as Company management, we may from time to time make written or oral

forward-looking statements with respect to our long-term objectives or

expectations which may be included in our filings with the Securities and

Exchange Commission (the “SEC”), reports to stockholders and information

provided in our web site.

The words

or phrases “will likely,” “are expected to,” “is anticipated,” “is predicted,”

“forecast,” “estimate,” “project,” “plans to continue,” “believes,” or similar

expressions identify “forward-looking statements.” Such

forward-looking statements are subject to certain risks and uncertainties that

could cause actual results to differ materially from historical earnings and

those presently anticipated or projected. We wish to caution you not

to place undue reliance on any such forward-looking statements, which speak only

as of the date made. We are calling to your attention important

factors that could affect our financial performance and could cause actual

results for future periods to differ materially from any opinions or statements

expressed with respect to future periods in any current statements.

The

following list of important factors may not be all-inclusive, and we

specifically decline to undertake an obligation to publicly revise any

forward-looking statements that have been made to reflect events or

circumstances after the date of such statements or to reflect the occurrence of

anticipated or unanticipated events. Among the factors that could

have an impact on our ability to achieve expected operating results and growth

plan goals and/or affect the market price of our stock are:

|

·

|

Lack

of meaningful operating history, operating revenue or earnings

history.

|

|

·

|

Dependence

on key personnel.

|

|

·

|

Fluctuation

in quarterly operating results and seasonality in certain of our

markets.

|

|

·

|

Possible

significant influence over corporate affairs by significant

shareholders.

|

|

·

|

Our

ability to enter into definitive agreements to formalize foreign energy

ventures and secure necessary exploitation

rights.

|

|

·

|

Our

ability to raise capital to fund our

operations.

|

|

·

|

Our

ability to successfully integrate and operate acquired or newly formed

entities and multiple foreign energy ventures and

subsidiaries.

|

|

·

|

Competition

from large petroleum and other energy

interests.

|

|

·

|

Changes

in laws and regulations that affect our operations and the energy industry

in general.

|

|

·

|

Risks

and uncertainties associated with exploration, development and production

of oil and gas, drilling and production

risks.

|

|

·

|

Expropriation

and other risks associated with foreign

operations.

|

|

·

|

Risks

associated with anticipated and ongoing third party pipeline construction

and transportation of oil and gas.

|

|

·

|

The

lack of availability of oil and gas field goods and

services.

|

|

·

|

Environmental

risks, economic conditions.

|

CERTAIN

DEFINED TERMS

Throughout

this Annual Report on Form 10-K, the terms “we,” “us,” “our,” ” Company,” and

“our Company” refer to Pacific Asia Petroleum, Inc. (“PAP”), a Delaware

corporation, and its present and former subsidiaries, including Pacific Asia

Petroleum, Limited (“PAPL”), Pacific Asia Petroleum Energy Limited (“PAPE”),

Inner Mongolia Production Co (HK) Limited (“IMPCO HK”), Pacific Asia Petroleum

(HK) Limited (“PAP HK”), Inner Mongolia Sunrise Petroleum Co.

Ltd.(“IMPCO Sunrise”), Beijing Dong Fang Ya Zhou Petroleum Technology Service

Company Limited (”Dong Fang”), and CAMAC Petroleum Limited (“CPL,”

and collectively, the “Company”). References to “PAP” refer to Pacific Asia

Petroleum, Inc. prior to the mergers of Inner Mongolia Production Company LLC

(“IMPCO”) and Advanced Drilling Services, LLC (“ADS”) into wholly-owned

subsidiaries thereof, effective May 7, 2007. Historical financial

results presented herein are the results of IMPCO from inception on August 25,

2005 to May 6, 2007 and the consolidated entity Pacific Asia Petroleum, Inc.

from May 7, 2007 forward, which is considered to be the continuation of IMPCO as

Pacific Asia Petroleum, Inc.

2

PART

I

ITEM

1. DESCRIPTION OF BUSINESS

General

Pacific

Asia Petroleum, Inc. is a development stage company formed to develop new energy

ventures, directly and through joint ventures and other partnerships in which it

may participate. Members of the Company’s senior management team have experience

in the fields of petroleum engineering, geology, field development and

production, operations, international business development and

finance. Members of the Company’s management team have held

management and executive positions with Texaco Inc. and other international

energy companies and have managed energy projects in the People’s Republic of

China (the “PRC” or “China”) and elsewhere. Members of the Company’s management

team also have experience in oil drilling, operations, geology, engineering,

government relations and sales in China’s energy sector. The Company

considers itself currently to be engaged in a single business segment--oil and

gas exploration, development and production.

The

Zijinshan Production Sharing Contract

On

October 26, 2007, Pacific Asia Petroleum, Limited (“PAPL”), a wholly-owned

subsidiary of the Company, entered into a Production Sharing Contract (“ PSC”)

with China United Coalbed Methane Co., Ltd. (“CUCBM”) (the Chinese

Government-designated company holding exclusive rights to negotiate with foreign

companies with respect to coalbed methane (“CBM”) production in

China) exclusive rights to a large contract area located in the

Shanxi Province of China ( the “CUCBM Contract Area”), for the exploitation of

CBM resources (the "Zijinshan PSC"). The Zijinshan PSC provides, among other

things, that PAPL, following approval of the Zijinshan PSC by the Ministry of

Commerce of China, has a minimum commitment for the first three years

to drill three exploration wells and to carry out 50 km of 2-D seismic data

acquisition (an estimated expenditure of $2.8 million), and in the fourth and

fifth years PAPL will drill four pilot development wells at an

estimated cost of $2 million (in each case subject to PAPL’s right to terminate

the Zijinshan PSC). That five year period constitutes the exploration period,

which is subject to extension. After the exploration period, but

before commencement of the development and production period, CUCBM will have

the right to acquire a 40% participating interest and to work jointly

and pay its participating share of costs to develop and produce CBM

under the Zijinshan PSC. Pursuant to the Zijinshan PSC, all CBM resources

(including all other hydrocarbon resources) produced from the CUCBM Contract

Area are shared as follows: (i) 70% of production is provided to PAPL

and CUCBM for recovery of all costs incurred; (ii) PAPL has the first right to

recover all of its exploration costs from such 70% and then development costs

are recovered by PAPL and CUCBM pursuant to their respective participating

interests; and (iii) the remainder of the production is split with

CUCBM and PAPL collectively receiving between 99% and 90% of such remainder

depending on the actual producing rates (a sliding scale) and the balance of the

remainder (between 1% and 10%) is provided to the Government of

China.

The

Zijinshan PSC has a term of 30 years and was approved in April 2008 by the

Ministry of Commerce of China. In December 2008, the Company and CUCBM finalized

a mutually agreed work program pursuant to which the Company has now commenced

exploration operations under the Zijinshan PSC. The Zijinshan PSC is in close

proximity to the major West-East and the Ordos-Beijing gas pipelines which link

the gas reserves in China’s western provinces to the markets of Beijing and the

Yangtze River Delta, including Shanghai. The Zijinshan PSC covers an area of

approximately 175,000 acres.

3

During

2009, the Company completed seismic data acquisition operations on the Zijinshan

Block and spent approximately $1.5 million to shoot 162 kilometers of seismic

under the work program. Based on the seismic interpretation, four

potential well locations were identified. A regional environmental

impact assessment study (“EIA”) has also been completed. Following

completion of a site-specific EIA study, the Company spudded well ZJS 001 on

September 30, 2009. This well intersected 4/5 coal seams in the

Shanxi formation and 8/9 coal seams in the Taiyuan formation as

anticipated. The well reached total depth in mid-November

2009. Core samples have undergone laboratory testing, including tests

for gas content, gas saturation and coal characteristics. Based on

the results of these tests, at the latest Zijinshan PSC Joint

Management Committee (JMC) meeting, the Company agreed to a 2010 work program

which includes undertaking further technical studies related to the CUCBM

Contract Area and drilling at least two additional wells there.

The

Chifeng Oil Opportunity

Through

Inner Mongolia Sunrise Petroleum Co. Ltd. (“IMPCO Sunrise”), the Company in 2006

commenced operational activities in China and successfully drilled its first

well in a prospective area in Inner Mongolia in cooperation with Chifeng

Zhongtong Oil and Natural Gas Co. (“Chifeng”) pursuant to a Contract for

Cooperation and Joint Development (the “Chifeng Agreement”) (described in

greater detail under “Principal Business Strategy” of this

section). The Company’s drilling operations in this area have been

suspended pending receipt of a production license from the Chinese

government. The Company is pursuing a combination of strategies to

have such production license awarded, including a possible renegotiation of the

Chifeng Agreement with the goal of increasing the financial incentives to all

the parties involved, and the Company is also pursuing a strategy focused on

entering into negotiations with respect to an opportunity to participate in the

existing production from the 22 sq. km. Kerqing Oilfield. Participation in the

Kerqing Oilfield could significantly enhance the Chifeng Agreement in scale and

value. As of December 31, 2009, there was no certainty that any of

these strategies will ultimately succeed in obtaining a production license for

the Chifeng area, but the Company intends to continue in these

efforts.

Handan

Gas Distribution Venture

The

Company entered into a Letter of Intent in November 2008, to potentially acquire

a 51% ownership interest in Handan Chang Yuan Natural Gas Co., Ltd. (“HGC”) from

the Beijing Tai He Sheng Ye Investment Company Limited. HGC owns and

operates gas distribution assets in and around Handan City, China. HGC was

founded in May 2001, and is the primary gas distributer in Handan City, which is

located 250 miles south of Beijing, in the Hebei Province of the People’s

Republic of China. HGC has over 300,000 customers and owns 35 miles of a main

gas pipeline, and more than 450 miles of delivery gas pipelines, with a delivery

capacity of 300 million cubic meters per day. HGC also owns an 80,000

sq. ft. field distribution facility. Gas is being supplied by Sinopec and

PetroChina from two separate sources. On July 7, 2009, the

Company entered into a revised Letter of Intent with Handan Hua Ying

Company Limited (“Handan”) relating to the possible acquisition of a 49%

interest in HGC. The Company will continue its evaluation of this potential

acquisition including the possibility of bringing in partners.

Enhanced

Oil Recovery and Production (“EORP”)

On May

13, 2009, PAP and its wholly-owned Hong Kong subsidiary, PAPE, entered into a

Letter of Understanding (“LOU”), which was amended and further detailed in

various other associated agreements that were executed on June 7, 2009, with Mr.

Li Xiangdong (“LXD”) and Mr. Ho Chi Kong (“HCK”), pursuant to which the parties

agreed to form Beijing Dong Fang Ya Zhou Petroleum Technology Service Company

Limited(“Dong Fang”) as a new Chinese joint venture company, to be 75.5% owned

by PAPE and 24.5% owned by LXD, into which LXD would assign certain

pending patent rights related to chemical enhanced oil recovery (the “LXD

Patents”). Dong Fang was officially incorporated under Chinese law on

September 24, 2009. As required by the LOU, and pursuant to that certain

Agreement on Cooperation, dated June 7, 2009, and as amended on June 25, 2009

(the “AOC”), entered into by and between PAPE and LXD, upon the effectiveness of

the assignment of the LXD Patents to Dong Fong by LXD on November 27, 2009, (i)

the Company paid LXD and HCK $100,000 each, (ii) PAP has issued shares of PAPE

to Best Source Group Holdings Limited, a Hong Kong company designated by HCK

(“BSG”), to provide BSG with a 30% ownership interest in PAPE, with the Company

retaining the balance 70% ownership interest in PAPE, and (iii) the Company has

issued to HCK’s designee 100,000 shares of Common Stock of the Company and

options to purchase up to 400,000 additional shares of Common Stock of the

Company. These options were approved for issuance by the Board of Directors at

an exercise price of $4.62 per share, which was the closing sale price of the

Company’s Common Stock at that date the Company’s issuance obligation was

triggered upon achievement of the applicable milestone under the LOU on November

27, 2009 as reported by NYSE Amex. The Company has also agreed to issue 300,000

more shares of Company Common Stock to HCK or his designee upon the signing of

certain contracts by Dong Fang with respect to the Fulaerjiqu

oilfield. All the options granted to HCK do not vest

immediately; vesting will be contingent upon the achievement of certain

milestones related to the entry by Dong Fang into certain EORP-related

development contracts pertaining to oilfield projects in the Fulaerjiqu

Oilfield. These contracts are anticipated to each deliver to Dong Fang a

significant percentage of the incremental oil production and/or fixed fees per

ton for the incremental production which results from using the technology

covered by the LXD Patents.

4

In

addition, LXD has been engaged as a consultant by Dong Fang to provide research

and development services, training, and assistance in promoting certain other

opportunities developed by him that target the application of the technology

embodied in the LXD Patents, including assistance with entering into a contract

with respect to the Liaohe Oilfield (the “Liaohe Contract”), and helping to

develop projects in both the Shandong Province and the Xinjiang autonomous

region of the People’s Republic of China for the provision and application of

technology and chemicals developed by LXD.

The

Company has agreed to loan up to $5 million to PAPE, which may then invest up to

RMB 30,000,000 (approximately $4.4 million) into Dong Fang, with a portion of

this being a requirement to invest RMB 22,650,000 as PAPE’s share of the

registered capital of Dong Fang, when and to the extent required under

applicable law. PAPE’s capital investment will be used by Dong Fang

to carry out work projects, fund operations, and to make, together with PAPE,

aggregate payments of up to $1.5 million in cash to LXD and HCK. The payments of

up to $1.5 million in cash to LXD and HCK are subject to the

achievement of certain milestones pursuant to the LOU, including the formation

of Dong Fang, the transfer of the LXD Patents to Dong Fang, and the signing of

the contracts with respect to the Fularjiqu Oilfield and the Liaohe Contract by

Dong Fang, as well as certain production-based milestones resulting from the

implementation of these contracts. As of December 31, 2009, $500,000 of

milestone payments had been paid or accrued by PAPE. The loan from the Company

to PAPE will be repaid from funds distributed to PAPE by way of dividends or

other appropriate payments from Dong Fang. As of December 31, 2009,

the Company has loaned a total of $1.3 million to PAPE, and PAPE has invested a

total of RMB 4.8 million (approximately US$700,000) into Dong Fang.

In

accordance with the terms of the LOU, as amended on June 7, 2009, PAPE, LXD and

the Company’s existing Chinese joint venture company, Inner Mongolia Sunrise

Petroleum Co. Ltd. (“IMPCO Sunrise”), entered into an Assignment Agreement of

Application Right for Patent, Consulting Engagement Agreement, and an Interest

Assignment Agreement. Upon formation of Dong Fang on September 24,

2009, all these and other agreements entered into by IMPCO Sunrise on behalf of

Dong Fang were assigned by IMPCO Sunrise to Dong Fang.

With

these EORP-related agreements signed and in place, the Company through Dong Fang

has commenced operations in various oil fields located in the Liaoning,

Shandong, and Xinjiang Provinces in China. In the year ended December

31, 2009, the Company recorded initial revenues, cost of sales and expenses from

the EORP business activities.

Oyo

Field Production Sharing Contract Interest

On

November 18, 2009, the Company entered into the Purchase and Sale Agreement (the

“Purchase and Sale Agreement”) with CAMAC Energy Holdings Limited and certain of

its affiliates (“CAMAC”) pursuant to which the Company agreed to acquire all of

CAMAC’s 60% interest in production sharing contract rights with respect to that

certain oilfield asset known as the Oyo Field (the “Contract Rights”) and the

transactions contemplated thereby, including the election of directors of the

Company (the “Transaction”). The Purchase Agreement, provides that,

among other things: (i) CAMAC will transfer the Contract Rights to CAMAC

Petroleum Limited, a newly-formed Nigerian entity wholly-owned by the Company,

in consideration for the Company’s payment of $38.84 million in cash

(subject to possible reduction pursuant to the agreement in principle

between CAMAC and the Company which will reduce such payment amount

by a portion of CAMAC’s net cash flow generated by production from the Oyo Field

through the closing of the Transaction) and the issuance of the Company’s Common

Stock, par value $0.001 per share, equal to 62.74% of the Company’s issued and

outstanding Common Stock, after giving effect to the Transaction; and (ii) for a

period commencing on the closing of the transactions contemplated by the

Purchase and Sale Agreement (the “Closing”) and ending the date that is one year

following the Closing, the Company’s Board of Directors will consist of seven

members, four of whom will be nominated by CAMAC.

5

The

Transaction is expected to close during the first quarter of 2010, and is

subject to the satisfaction of customary and other conditions to Closing,

including, without limitation: (i) the negotiation and entry by the

parties into certain other agreements as set forth in the Purchase and Sale

Agreement in forms reasonably satisfactory to the parties; (ii) the Company’s

consummation of a financing on terms reasonably acceptable to CAMAC resulting in

gross proceeds of at least $45 million to the Company; and (iii) the approval of

the Company’s stockholders of the Purchase and Sale Agreement and the

transactions contemplated thereby. The Purchase and Sale Agreement also

contains other customary terms, including, but not limited to, representations

and warranties, indemnification and limitation of liability provisions,

termination rights, and break-up fees if either party terminates under

certain circumstances. The Company has already raised $20

million in a financing (disclosed below) and plans to raise an additional $25

million in connection with its obligation under the Purchase and Sale

Agreement. However, if the Company is unable to consummate such

additional financing, agree upon the terms of the other required agreements

between the parties or satisfy any of the other closing conditions set forth in

the Purchase and Sale Agreement, the Company may be unable to consummate the

Purchase and Sale Agreement.

At the

Closing of the Transaction, and subject to stockholder approval prior to

Closing, the Company’s name will be changed to CAMAC Energy Inc. The

Transaction, if consummated, will result in a change of control of the

Company.

Registered

Direct Offering

On

February 16, 2010, the Company consummated the offer and sale of 5,000,000

shares (the "Shares") of its common stock, par value $0.001 per share ("Common

Stock"), for an aggregate purchase price of $20 million, or $4.00 per share (the

"Purchase Price"), pursuant to a Securities Purchase Agreement, dated February

10, 2010, among the Company and certain purchasers signatory thereto (the

“Purchasers”). In addition, the Company issued to the Purchasers (1)

warrants to purchase up to an additional 2,000,000 shares of Common Stock of the

Company, in the aggregate, at an exercise price of $4.50 (subject to

customary adjustments), exercisable commencing 6 months following the closing

for a period of 36 months after such commencement date (the “Series A

Warrants”); and (2) warrants to purchase up to an additional

2,000,000 shares of Common Stock of the Company, in the aggregate, at an

exercise price $4.00 per share (subject to customary adjustments), exercisable

immediately at the closing until November 1, 2010 (the “Series B Warrants” and

together with the Series A Warrants, the “Warrants”). If all the

Warrants are exercised, the Company would receive additional gross proceeds of

$17 million. The Shares and the Warrant Shares are to be sold pursuant to a

shelf registration statement on Form S-3 declared effective by the SEC on

February 3, 2010 (File No. 333-163869), as amended by the prospectus supplement

filed with the SEC on February 12, 2010 and delivered to the

Purchasers.

Rodman

& Renshaw, LLC (“Rodman”) served as the Company’s exclusive placement agent

in connection with the offering. As consideration for its services as

placement agent, Rodman received a cash fee equal to 6.0% of the gross proceeds

of the offering ($1,200,000), as well as a 5-year warrant to purchase shares of

Common Stock of the Company equal to 3.0% of the aggregate number of shares sold

in the offering (150,000 shares of Common Stock), plus any shares underlying the

Warrants. Rodman’s warrant has the same terms as the Warrants issued to the

Purchasers in the offering except that the warrant is not exercisable until the

6-month anniversary of the closing and the exercise price is 125% of the per

share purchase price of the shares issued in the offering ($5.00 per

share). In addition, subject to compliance with Financial Industry

Regulatory Authority ("FINRA") Rule 5110(f)(2)(D), the Company reimbursed

Rodman’s out-of-pocket accountable expenses actually incurred in the amount of

$25,000.

Net

proceeds from the offering are planned to be used by the Company for working

capital purposes, and also may be used by the Company to fund the Company’s

acquisition from CAMAC of the Contract Rights with respect to the Oyo Field,

which began production in December 2009.

6

Our History and Corporate

Structure

General

The

Company was incorporated in the State of Delaware in 1979 under the name “Gemini

Marketing Associates, Inc.” In 1994, the Company changed its name

from “Gemini Marketing Associates, Inc.” to “Big Smith Brands,

Inc.”; in 2006 it again changed its name to “Pacific East Advisors,

Inc.”; and in 2007 it again changed its name to “Pacific Asia

Petroleum, Inc.” As Big Smith Brands, Inc., the Company operated as an apparel

company engaged primarily in the manufacture and sale of work apparel, and was

listed on the Nasdaq Stock Market’s Small-Cap Market from 1995 until December 4,

1997, and the Pacific Stock Exchange from 1995 until April 1,

1999. In 1999, the Company sold all of its assets related to its

workwear business to Walls Industries, Inc., and in 1999 filed for voluntary

bankruptcy under Chapter 11 of the United States Bankruptcy Code. The final

bankruptcy decree was entered on August 8, 2001, and thereafter the Company

existed as a “shell company,” but not a “blank check” company, under regulations

promulgated by the SEC and had no business operations and only nominal assets

until May 2007, when it consummated the mergers of Inner Mongolia Production

Company LLC (“IMPCO”) and Advanced Drilling Services, LLC (“ADS”) into

wholly-owned subsidiaries of the Company. See “The Mergers”

below. In December 2007, the Company merged these wholly-owned

subsidiaries into the parent company, resulting in the cessation of the separate

corporate existence of each of IMPCO and ADS and the assumption by the Company

of the businesses of IMPCO and ADS. In connection with the mergers,

the Company changed its name from “Pacific East Advisors, Inc.” to “Pacific Asia

Petroleum, Inc.” In July 2008, the Company consummated the merger of

Navitas Corporation, a Nevada corporation whose sole assets were comprised of

Company Common Stock and certain deferred tax assets, with and into the Company,

and the separate corporate existence of Navitas Corporation ceased upon

effectiveness of the merger. On November 5, 2009, the Company’s

common stock became listed on the NYSE Amex under the symbol “PAP.”

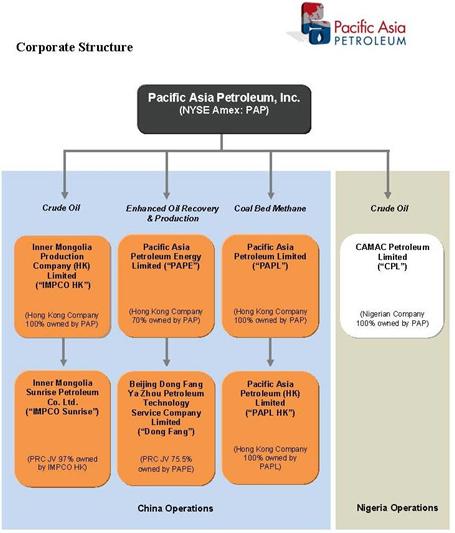

Subsidiaries and Joint

Ventures

The

following summarizes the corporate structure of PAP and its subsidiaries (“we,”

“our,” “us,” or the “Company”), and its joint venture partner.

Inner Mongolia Production Company

(HK) Limited

– In December 2005, the

Company formed a Hong Kong corporation, Inner Mongolia Production Company (HK)

Limited, which is a wholly-owned subsidiary of the Company (“IMPCO HK”), for the

purpose of entering into certain business transactions in

China. IMPCO HK is a joint venture partner in Inner Mongolia Sunrise

Petroleum Co. Ltd., described in more detail below.

Inner Mongolia Sunrise Petroleum Co.

Ltd. and Beijing Jinrun Hongda Technology Co., Limited – In March 2006, the Company

formed Inner Mongolia Sunrise Petroleum Co. Ltd.(“IMPCO Sunrise”), a Chinese

joint venture company which is owned 97% by IMPCO HK and 3% by Beijing Jinrun

Hongda Technology Co., Ltd. (“BJHTC”), an unaffiliated Chinese

corporation. The Company formed IMPCO Sunrise as an indirect

subsidiary to engage in Chinese energy ventures. Under Chinese law, a

foreign-controlled Chinese joint venture company must have a Chinese partner.

BJHTC is IMPCO HK’s Chinese partner in IMPCO Sunrise. IMPCO Sunrise is governed

and managed by a Board of Directors comprised of three members, two of whom are

appointed by IMPCO HK and one by BJHTC. Through December 31, 2008

IMPCO HK advanced a total of $400,507 to BJHTC, which then invested that amount

in IMPCO Sunrise and issued notes to IMPCO HK for that amount. The notes a were

repayable in Chinese yuan (“RMB”). As of December 31, 2008, IMPCO HK

recorded an impairment adjustment of $273,618 on these notes to reduce the

carrying amount to $386,415. Based upon the delay in achieving net income in

IMPCO Sunrise, the impact of the significant decline in the price of oil in the

second half of 2008, the amount of uncollected interest on the note, and the

required date for repayment, it was determined in the fourth quarter of 2008

that the note was impaired. The impairment adjustment included the write-off of

accrued interest included in the principal balance. BJHTC is

obligated to apply any remittances received from IMPCO Sunrise directly to IMPCO

HK. IMPCO Sunrise is authorized to pay these remittances directly to IMPCO HK on

BJHTC’s behalf, until the debt is satisfied. On December 31, 2009 the total

recorded capital of IMPCO Sunrise was reduced by agreement among IMPCO Sunrise

and its owners, and the reduction (including the BJHTC share) was reclassified

as an intercompany loan from IMPCO HK to IMPCO Sunrise. The outside

note receivable of IMPCO HK from BJHTC was reduced as a result, without

recording any additional impairment adjustment. The recorded

balance for this note receivable was $33,015 at December 31,

2009. IMPCO Sunrise is a party to the Chifeng Agreement and is

pursuing the Chifeng

opportunity as described above.

7

Pacific Asia Petroleum, Limited –

In September 2007, the Company formed Pacific Asia Petroleum, Limited

(“PAPL”) as a wholly-owned Hong Kong corporate subsidiary of the Company for the

purpose of entering into certain business transactions in China. The

Company is the sole shareholder of PAPL.

Pacific Asia Petroleum (HK) Limited

– In May 2008, the Company formed a Hong Kong corporation, Pacific Asia

Petroleum (HK) Limited, which is a wholly-owned subsidiary of the Company (“PAP

HK”), for the purpose of entering into certain business transactions in

China. PAP HK has not entered into any transactions to

date.

Pacific Asia Petroleum Energy

Limited – In April 2009, the Company formed a Hong Kong corporation,

Pacific Asia Petroleum Energy Limited (“PAPE”), which, after the transfer of

PAPE shares to BSG, is 70% owned by PAP and 30% owned by BSG, in connection with

the establishment of the Company’s Enhanced Oil Recovery and Production program

and operations (“EORP”), as described in greater detail below.

Beijing Dong Fang Ya Zhou Petroleum

Technology Service Company Limited – In September 2009, the Company

formed Beijing Dong Fang Ya Zhou Petroleum Technology Service Company Limited

(“Dong Fang”), a Chinese joint venture company which is owned 75.5% by PAPE and

24.5% by LXD. Dong Fang was formed in connection with the Company’s

EORP program and operations, as described in greater detail below.

CAMAC Petroleum Limited – In

December 2009, the Company formed a Nigerian corporation, CAMAC Petroleum

Limited, which is a wholly-owned subsidiary of the Company, for the purpose of

acquiring the Oyo Field production sharing contract interest as described

elsewhere in this report.

8

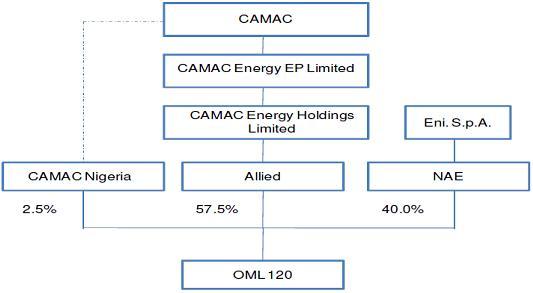

The

following chart reflects our current corporate organizational

structure:

Our

executive offices are located at 250 East Hartsdale Ave., Suite 47, Hartsdale,

New York 10530 and our telephone number is (914) 472-6070. We also have an

office located in Beijing, China. We maintain a website at www.papetroleum.com

that contains information about us, but that information is not a part of this

report.

The

Company’s annual reports on Form 10-K, quarterly reports on Form 10-Q, current

reports on Form 8-K, and amendments to those reports filed or furnished pursuant

to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”) are available on the Company’s website free of charge as

soon as practicable after such reports are electronically filed or furnished to

the SEC. Investors may also register on the Company’s website to

receive updates about the Company.

Our

Industry

China’s

Oil and Gas Industry

After

slowing in 2008 and early 2009, economic growth in China accelerated in recent

quarters and is expected to continue at a faster pace than in the countries of

the Organization of Economic Cooperation and Development (“OECD”) and most other

developing countries, as will China’s consumption of increasing amounts of

energy. Despite significant recent improvements in energy efficiency, China’s

economy is still less energy-efficient than the U.S.’s economy, requiring nearly

twice as many BTUs per dollar of Gross Domestic Product (“GDP”). As a

result, China's growth is expected to continue to amplify the country’s

increasing energy demand for some time (U.S. Department of Energy: International Energy Annual

& International

Petroleum Monthly). China’s GDP grew to

$4.33 trillion in 2008 at market exchange rates (World Bank data), making China

the 3rd

largest economy in the world, with output only 12% below that of

Japan. China passed Japan in late 2003 to become the world’s second

largest petroleum consumer. According to data from the U.S. Department of

Energy, between 2000 and 2008, oil use in China grew by an average of 6.3% per

year. In 2008, Chinese demand reached 7.8 million barrels per day, more than

one-third the level in the United States. At the same time, domestic crude oil

output in China has grown more slowly over the past five years, forcing imports

to expand rapidly to meet demand. Since 2000, China’s oil imports have more than

doubled, growing from 1.4 million barrels per day to 3.6 million barrels per day

in 2008, when they accounted for nearly half of Chinese oil demand.

9

According

to testimony by Jeffrey Logan, Senior Energy Analyst and China Program Manager

at the International Energy Agency, to the U.S. Senate Committee on Energy and

Natural Resources on February 3, 2005, China has become an economic superpower

and now plays a key role in the supply and demand of many global commodity

markets, including oil. He indicated that while China’s historical growth was

not dependent on energy, its growth was now very dependent on the development

and growth of oil and gas, with every one percent increase in GDP causing energy

demand to grow by over 1.5 percent. Although the Chinese government

has set a goal of reducing per-GDP energy consumption by 20% between 2005 and

2010, the strong linkage between energy and China’s economic growth is reflected

in the forecasts of the International Energy Agency (“IEA”). In its

2008 World Energy Outlook, the IEA projected that China’s petroleum demand would

continue to grow at 3.5% per year through 2030, increasing by 9 million barrels

per day and accounting for 43% of global oil demand growth over this period. Nor

is the energy impact of China’s growth confined to oil. In its latest

forecast, the IEA expects China and India together to account for more than half

of all incremental global energy demand through 2030, including over 1.3 million

MW of new power generation in China, along with a rapid increase in natural gas

consumption.

Natural

gas represents a particularly under-utilized energy source in China, supplying

only 3% of the country’s energy needs, compared with 23% globally and in the

U.S. We believe that its low emissions, combined with the low cost and high

efficiency of gas turbines, make gas an attractive fuel for meeting China’s

future electric power demand. This will be particularly important in light of

China's newly-announced goal of reducing the carbon-intensity of its economy by

40-45% by 2020, compared to 2005, in light of the much lower emissions from

gas-fired power plants relative to those burning coal. The Chinese government

has indicated that it would like to expand gas use significantly, and the

National Development and Reform Commission has set a goal of increasing gas’

share of the market to 5.3% by 2010 (U.S. Department of Energy: International Energy Annual & International Petroleum

Monthly). China’s

domestic natural gas production increased to 76 billion cubic meters (2.7

trillion cubic feet) in 2008 (China National Bureau of Statistics) and is

planned to double to 160 billion cubic meters (5.7 trillion cubic feet) by 2015

(China Daily, quoting

an official of the Ministry of Land and Resources). In spite of this

expansion, some sources foresee a gas supply shortfall as large at 90 billion

cubic meters per year by 2020.

The

government of China has taken a number of steps to encourage the exploitation of

oil and gas within its own borders to meet the growing demand for oil and to try

to reduce its dependency on foreign oil. Notably, the government has reduced

complicated restrictions on foreign ownership of oil exploitation projects and

has passed legislation encouraging foreign investment and exploitation of oil

and gas.

Through

successive “Five Year Plans,” China has undertaken a strategic reorganization in

the oil industry by means of market liberalization, internalization,

cost-effectiveness, scientific and technological breakthrough and sustainable

development. Changes were made in the structures of oil reservation and

exploration such as permitting more oil imports into the domestic market and

allocating a greater percentage of oil and gas in non-renewable energy

consumption. The reorganization was aimed at ensuring a smooth and sustainable

oil supply, at low cost and meeting a goal for sound economic growth. The

guiding principles of reform focused on developing the domestic market by

expanding exploration efforts while practicing conservation and building oil

reserves. These efforts focused on building key infrastructure for oil and gas

transportation and storage by targeting the development of oil and gas pipelines

to a target of 14,500 km in total length, and building storage facilities,

including a strategic petroleum reserve of approximately 100 million barrels and

facilities for 1.14 billion cubic meters of gas (40 billion cubic feet). In

order to further technical development and innovation, substantial resources

were devoted to oil and gas exploration.

10

Chinese

policymakers and state-owned oil companies have embarked on a multi-pronged

approach to improve oil security by diversifying suppliers, building strategic

oil reserves, purchasing equity oil stakes abroad, and enacting new policies to

lower demand. When it became a net oil importer in 1993, almost all of China’s

crude imports came from Indonesia, Oman and Yemen. After diversifying global oil

purchases over the past decade, Chinese crude imports now come from a much wider

range of suppliers. In 2008, Saudi Arabia was China’s largest supplier,

accounting for 20 percent of imports, followed by Angola, Iran, Oman and

Russia. 50% of China’s crude oil imports come from the Middle East,

and 30% from Africa (U.S. Department of Energy: China Country Analysis

Brief.) The

three major government-owned oil companies in China are (i) China Petroleum

& Chemical Company, or “Sinopec,” (ii) China National Offshore Oil

Corporation, or “CNOOC,” and (iii) PetroChina Company Limited, or “PetroChina”

(also sometimes referred to as “China National Petroleum Corporation” or “CNPC,”

which is the government company owning the majority of PetroChina). PetroChina

is China’s largest producer of crude oil and natural gas and has operations in

29 other countries. Sinopec is China’s largest refining, storage and

transmission company. CNOOC is China’s largest offshore oil and gas exploration

and development company. Each of these companies has been granted a charter by

the Chinese government to engage in various stages of oil and gas procurement,

transportation and production in China. Substantially all oil and gas

exploration, storage and transportation by foreign entities in China must be

conducted via joint ventures with one of these companies, or with another

Chinese company that has entered into an arrangement with one of these companies

and been authorized by the appropriate government authorities to engage in such

activities in China.

Unlike

the developed petroleum markets of the member countries of the OECD, the oil

market in China still includes important elements of central planning. Each

year, the National Development and Reform Commission publishes the projected

target for the production and sale of crude oil by the three state oil

companies, based on the domestic consumption estimates submitted by domestic

producers, including PetroChina, Sinopec and CNOOC, the production capacity of

these companies, and the forecast of international crude oil prices. The actual

production levels are determined by the producers themselves and may vary from

the submitted estimates. PetroChina and Sinopec set their crude oil median

prices each month based on the average Singapore market FOB prices for crude oil

of different grades in the previous month. In addition, PetroChina and Sinopec

negotiate a premium or discount to reflect transportation costs, the differences

in oil quality, and market supply and demand. The National Development and

Reform Commission will mediate if PetroChina and Sinopec cannot agree on the

amount of premium or discount.

While the

barriers to entry for foreign entities to engage in the development of oil and

gas resources in China have recently eased, we believe that many small companies

still face significant hurdles due to their lack of experience in the Chinese

petroleum industry. Development requires specialized grants and permits,

experience with operating in and China and dealing with challenging cultural and

political environments in remote regions and the ability to manage projects

efficiently during times of resource shortages. The Company hopes to take

advantage of the energy development opportunities that exist in China today by

leveraging its management team’s prior exploration experiences in China and

existing relationships with oil industry executives and government officials in

China. In addition, we believe that members of the Company’s production team

have the hands-on experience with projects in Asia that we believe is essential

to any successful petroleum project in China.

China’s

economic growth has been affected by the global financial crisis and recession,

declining to a year-on-year rate of 6.8% in the fourth quarter of

2008. However, by the third quarter of 2009 growth had rebounded to

8.9%, due in large part to a government fiscal stimulus amounting to 4 trillion

RMB ($586 billion), which included investment in energy infrastructure (World

Bank: China Quarterly Update,

December 2008 and November 2009). Estimates indicate growth

should average 8% for 2009 and continue at or above that level into 2010 (World

Bank website.) We believe China remains a very attractive investment opportunity

as the global economy begins to recover.

11

The

Nigerian Oil and Gas Industry

If the

closing occurs on our acquisition of the Contract Rights from CAMAC with respect

to the Oyo Field, we will also have an interest in the Nigerian oil and gas

industry. Nigeria is classified as an emerging market, and is rapidly

approaching middle income status, with its abundant supply of resources,

well-developed financial, legal, communications, transport sectors and stock

exchange (the Nigerian Stock Exchange), which is the second largest in Africa.

Nigeria is ranked 37th in the world in terms of GDP (PPP) as of 2007. Nigeria is

the United States' largest trading partner in sub-Saharan Africa and supplies a

fifth of the U.S.’s imported oil (11% of oil imports). It has the

seventh-largest trade surplus with the U.S. of any country worldwide. Nigeria is

currently the 50th-largest export market for U.S. goods and the 14th-largest

exporter of goods to the U.S. The United States is the country's largest foreign

investor. The bulk of economic activity is centered in four main cities: Lagos,

Kaduna, Port Harcourt, and Abuja. Beyond these four economic centers,

development is marginal.

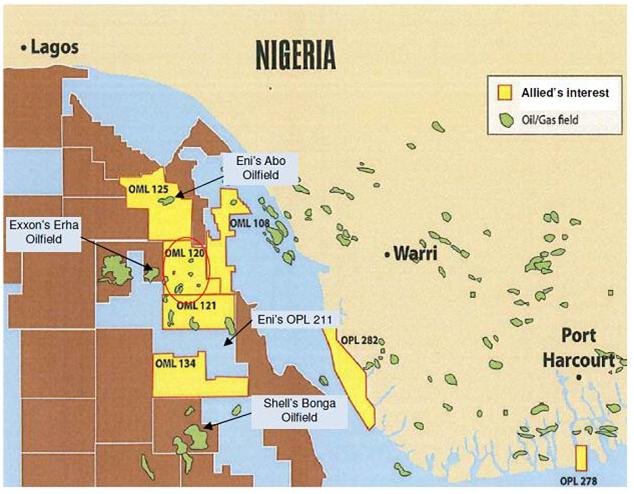

According

to Oil and Gas Journal (“OGJ”), Nigeria had an estimated 36.2 billion barrels of

proven oil reserves as of January 2009. The majority of reserves are found along

the country’s Niger River Delta and offshore in the Bight of Benin, the Gulf of

Guinea and the Bight of Bonny. Current exploration activities are mostly focused

in the deep and ultra-deep offshore with some activities planned in the Chad

basin, located in the northeast of the country.

Nigeria

is an important oil supplier to the United States. Over half of the country’s

oil production is exported to the United States (see exports below) and the

light, sweet quality crude is a preferred gasoline feedstock. Consequently,

disruptions to Nigerian oil production impacts trading patterns and refinery

operations in North America and often affect world oil market

prices.

Since

December 2005, Nigeria has experienced increased pipeline vandalism, kidnappings

and militant takeovers of oil facilities in the Niger Delta. The Movement for

the Emancipation of the Niger Delta (“MEND”) is the main militant organization

attacking oil infrastructure for political objectives, claiming to seek a

redistribution of oil wealth and greater local control of the sector.

Additionally, kidnappings of oil workers for ransom are also common and security

concerns have led some oil services firms to pull out of the country and oil

workers unions threatening to strike over security issues for their

members.

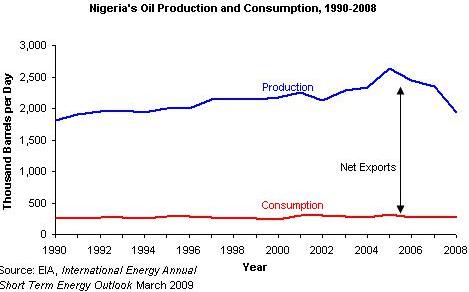

The

instability in the Niger Delta has caused significant amounts of shut-in

production and several companies declaring force majeure on oil

shipments. The U.S. Energy Information Administration (“EIA”)

estimates Nigeria’s effective oil production capacity to be around 2.7 million

barrels per day (bbl/d) but as a result of attacks on oil infrastructure, 2008

monthly oil production ranged between 1.8 million bbl/d and 2.1 million bbl/d.

Additional supply disruptions for the year were the result of worker strikes

carried out by the Petroleum and Natural Gas Senior Staff Association of Nigeria

(“PENGASSAN”) that shut-in 800,000 bbl/d of ExxonMobil’s production for about 10

days in late April/early May.

In 2008,

Nigerian crude oil production averaged 1.94 million bbl/d, making it the largest

crude oil producer in Africa. If current shut-in capacity were to have been

online, EIA estimates that Nigerian production could have reached 2.7 million

bbl/d in 2008. As a member of the Organization of Petroleum Exporting Countries

(“OPEC”), Nigeria has agreed to abide by allotted crude production limits that

have varied over the years but do not appear to have an impact on production

volumes or investment decisions to the same degree as unrest in the Niger

Delta.

The major

foreign producers in Nigeria are Shell, Chevron, ExxonMobil, Total, and

Eni/Agip. Recent developments in the upstream sector include the start up of the

Chevron-operated Agbami field in September 2008, with expected peak production

of 250,000 bbl/d by the end of 2009.

12

Non-crude

petroleum production was about 230,000 bbl/d in 2008, bringing total oil

production to 2.17 million bbl/d for the year. This amount should increase in

the short-term with Total’s Akpo condensate field coming onstream in 2009 and

expected to peak at 180,000 bbl/d.

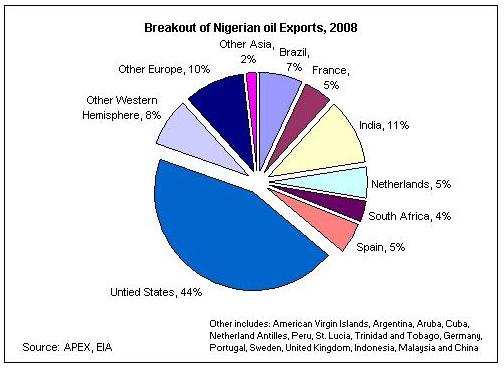

In 2008,

Nigerian exported most of its 2.17 million bbl/d of oil production

(approximately 1.9 million bbl/d were exported). Of this, 990,000 bbl/d (44

percent) was exported to the United States, making Nigeria the 5th largest

foreign oil supplier to the United States. Over the past year, volatility in

Nigerian oil supplies has led some U.S. refiners to stop purchasing Nigerian

crudes.

Additional

importers of Nigerian crude oil include Europe (25 percent), Brazil (7 percent),

India (11 percent) and South Africa (4 percent). Despite shut-in production,

Nigerian trade patterns appear to have remained stable over the past year, most

of which can be attributed to capacity additions from the Chevron-operated

Agbami oilfield in September 2008 combined with slightly decreasing domestic

consumption and declining world demand.

13

Nigeria

has six export terminals including Forcados and Bonny (operated by Shell);

Escravos and Pennington (Chevron); Qua Iboe (ExxonMobil) and Brass (Agip) with

deeper offshore production being exported directly from the Floating Production

Storage and Offloading (“FPSO”) vessels. According to the Energy Intelligence

Group’s International Crude Oil Market Handbook, Nigeria’s export blends are

light, sweet crudes, with gravities ranging from API 29 – 47 degrees and low

sulfur contents of 0.05 – 0.3 percent. Most Nigerian crudes trade at a premium

to Brent, the North Sea benchmark crude.

Principal

Business Strategy

The

Company is a development-stage company formed to develop new energy ventures,

directly and through joint ventures and other partnerships in which it may

participate.

China

Strategy

In 2006,

the Company commenced operations in China and is currently engaged in the

business of oil and gas exploration, development, production and distribution in

China. The Company has entered into a production sharing contract for CBM, an

oil development opportunity, letters of intent for joint cooperation on a gas

distribution venture, and agreements related to EORP activities in

China. The Company has also entered into a contract for the

acquisition of an interest in a production sharing contract on an oilfield in

Nigeria called the Oyo Oil Field, discussed elsewhere in this

report.

The

Zijinshan PSC

On

October 26, 2007, PAPL entered into the Zijinshan PSC with CUCBM, the Chinese

Government-designated company holding exclusive rights to negotiate with foreign

companies with respect to CBM production, covering an area in the Shanxi

Province of China referred to as the Zijinshan Block (the “CUCBM Contract

Area”). The CUCBM Contract Area is approximately 175,000 acres, and

is in proximity to the major West-East gas pipeline and the Ordos-Beijing gas

pipelines which link the gas reserves in China’s western provinces to the

markets of the Yangtze River Delta, including Shanghai. The PSC provides, among

other things, that PAPL, following approval of the PSC by the Ministry of

Commerce of China, has a minimum commitment for the first three years to drill

three exploration wells and to carry out 50 km of 2-D seismic data

acquisition (an estimated expenditure of $2.8 million), and in the

fourth and fifth years PAPL will drill four pilot development wells

at an estimated cost of $2 million (in each case subject to PAPL’s right to

terminate the Zijinshan PSC). That five year period constitutes the exploration

period, which is subject to extension. During the development and production

period, CUCBM will have the right to acquire a 40% participating interest and to

work jointly and pay its participating share of costs to develop and produce CBM

under the Zijinshan PSC. Pursuant to the Zijinshan PSC, all CBM

resources (including all other hydrocarbon resources) produced from the CUCBM

Contract Area are to be shared as follows: (i) 70% of production is

provided to PAPL and CUCBM for recovery of all costs incurred; (ii) PAPL has the

first right to recover all of its exploration costs from such 70% and then

development costs are recovered by PAPL and CUCBM pursuant to their respective

participating interests; and (iii) the remainder of the production is split by

CUCBM and PAPL receiving between 99% and 90% of such remainder depending on the

actual producing rates (a sliding scale) and the balance of the remainder

(between 1% and 10%) is provided to the government of China. The

Zijinshan PSC has a term of 30 years and was approved by the Ministry of

Commerce of China in April 2008. In December 2008, the Company and

CUCBM finalized a mutually agreed work program pursuant to which the Company may

immediately commence exploration operations under the Zijinshan

PSC.

14

During

2009, the Company completed seismic data acquisition operations on the Zijinshan

Block and spent approximately $1.5 million to shoot 162 kilometers of seismic

under the work program. Based on the seismic interpretation, four

potential well locations were identified. A regional environmental

impact assessment study (“EIA”) has also been completed. Following

completion of a site-specific EIA study, the Company spudded well ZJS 001 on

September 30, 2009. This well intersected 4/5 coal seams in the

Shanxi formation and 8/9 coal seams in the Taiyuan formation as

anticipated. The well reached total depth in mid-November

2009. Core samples have undergone laboratory testing, including tests

for gas content, gas saturation and coal characteristics. Based on

the results of these tests, at the latest Zijinshan PSC Joint

Management Committee (JMC) meeting, the Company agreed to a 2010 work program

which includes undertaking further technical studies related to the CUCBM

Contract Area and drilling at least two additional wells there.

Chifeng

Oil Development Opportunity in Inner Mongolia

Inner

Mongolia, China’s northern border autonomous region, features a long, narrow

strip of land sloping from northeast to southwest. It stretches 2,400 km from

west to east and 1,700 km from north to south. Inner Mongolia traverses between

northeast, north, and northwest China. The third largest among China’s

provinces, municipalities, and autonomous regions, the region covers an area of

1.18 million square km, or 12.3% of the country’s territory. It neighbors eight

provinces and regions in its south, east and west and Mongolia and Russia in the

north, with a borderline of 4,200 km. In 2005 China and the Inner Mongolia

Municipality awarded to Chifeng the exclusive authority to develop and exploit

oil resources in the area known as the “ShaoGen Contract Area,” an area of

approximately 353 square kilometers located in Chifeng, China. In 2005 and 2006,

Chifeng drilled several wells throughout the ShaoGen Contract Area and

discovered oil.

In July

2006, the Company’s management began discussions with Chifeng and hired an

independent Chinese oil consultant to conduct a feasibility study on the

Company’s behalf. This feasibility study concluded that based on “investigation

and research in-depth for oil resources, exploitative environment and

international markets, it is feasible for exploitation of oil and gas . . .” The

report contained the following conclusions:

|

·

|

There

is a very high potential for oil resources with excellent geological

conditions for petroleum;

|

|

·

|

A

very significant oil field (part of the Liahoe oilfield, known as the

Kerqing oilfield) was discovered in the area, which makes drilling in the

ShaoGen Contract Area favorable;

and

|

|

·

|

The

petroleum system has been proved as there are existing wells in the area

with tested transmission infrastructure in

place.

|

In August

2006, the Company (through IMPCO Sunrise) and Chifeng entered into a Contract

for Cooperation and Joint Development (the “Chifeng Agreement”), setting forth

the terms and conditions for carrying out work and exploiting the development

acreage in the ShaoGen Contract Area owned by Chifeng (the “Development Area”).

Under the Chifeng Agreement:

15

|

·

|

Chifeng

is responsible for selecting well locations in consultation with the

Company;

|

|

·

|

Chifeng

has overall authority, responsibility and management over the Development

Area and all operations in the

field;

|

|

·

|

Chifeng

is responsible for drilling successive wells until there is a completed

successful well (defined as a well having produced at a minimum average

rate of 2-3 tons/day of crude oil over the first 60-day period, with the

Company owning 100% of the oil produced within such 60-day

period);

|

|

·

|

The

Company paid Chifeng 50% of the cost to drill the initial well (1,500,000

RMB, or approximately US$200,000 at the time of payment) as a

deposit;

|

|

·

|

The

Company is required to pay: (a) the same amount for the next two wells

after each successful well has been drilled, which at December 31, 2009

was approximately US$220,000; and (b) 1,500,000 RMB (about $220,000) for

each successful well; and (c) a 5% royalty/management fee from the gross

production of crude oil, which shall be paid “in kind” to

Chifeng;

|

|

·

|

The

balance of oil production will be owned by the Company. The Company is

obligated to provide the balance of the oil produced to Chifeng and

Chifeng is obligated to sell such oil on behalf of the

Company. Chifeng is obligated to pay the Company for such oil

at the same price as the oil is sold by Chifeng to a third

party;

|

|

·

|

The

funds paid by the Company to Chifeng under the Chifeng Agreement shall be

the total cost to be paid to Chifeng for carrying out the drilling and

other operations for a period of 20

years;

|

|

·

|

All

cost overruns in carrying out the work under the Chifeng Agreement are

required to be borne by Chifeng. This is a turnkey contract with a

guaranteed cost;

|

|

·

|

The

Company will continue to receive the revenues from the production of such

wells for a term of 20 years from the date that each well is determined to

be successful; and

|

|

·

|

Chifeng

is responsible for all health and safety matters, and for obtaining

insurance covering personnel and

equipment.

|

Pursuant

to the Chifeng Agreement, drilling operations commenced in October

2006. The first well drilled by Chifeng discovered oil and has been

completed as a producing well, but production operations were suspended in 2007

pending receipt of a production license from the Chinese government. Chifeng has

accounted for the Company’s share of the production revenue from the first

producing well in the form of a credit, which will be allocated to the Company

retroactively when and if the Production License is issued. Operations are

anticipated to resume when and if the Production License is received. To date,

the total production from the well has been approximately 400 tons of crude oil

(all of which has been sold) and total producing revenues credited to the

Company (after costs and royalties) were approximately $135,000. If a Production

License is not received, the Company will seek, but is not contractually

guaranteed, reimbursement from Chifeng for the Company’s outstanding

costs.

The

Company is pursuing a combination of strategies to have such production license

awarded, including a possible renegotiation of the Chifeng Agreement with the

goal of increasing the financial incentives to all the parties involved, and the

Company is also pursuing a strategy focused on entering into negotiations with

respect to an opportunity to participate in the existing production from the 22

sq. km. Kerqing Oilfield. Participation in the Kerqing Oilfield could

significantly enhance the Chifeng Agreement in scale and value. If

this Production License is not issued, the opportunities to drill additional

long-term production wells under the contract, including future production from

this first well, will be at risk. At December 31, 2009, there was no certainty

that any of these strategies will ultimately succeed in the Company obtaining a

Production License for the Chifeng area, but the Company intends to continue in

these efforts. Due to these significant uncertainties, the Company recorded an

impairment loss on its Chifeng investment in the fourth quarter of

2009.

16

Gas Distribution

Network

The

Company entered into a Letter of Intent in November 2008, to possibly acquire a

51% ownership interest in the Handan Chang Yuan Natural Gas Co., Ltd. (“HGC”)

from the Beijing Tai He Sheng Ye Investment Company Limited. HGC owns and

operates gas distribution assets in and around Handan City, China. HGC was

founded in May 2001, and is the primary gas distributer in Handan City, which is

located 250 miles south of Beijing, in the Hebei Province of the People’s

Republic of China. HGC has over 300,000 customers and owns 35 miles of a main

gas pipeline, and more than 450 miles of delivery gas pipelines, with a delivery

capacity of 300 million cubic meters per day. HGC also owns an 80,000

sq. ft. field distribution facility. Gas is being supplied by Sinopec and

PetroChina from two separate sources. On July 7, 2009 the Company

entered into a revised Letter of Intent with Handan Hua Ying Company Limited

(“Handan”) relating to the possible acquisition of a 49% ownership interest in

HGC. The Company will continue its evaluation of this possible

acquisition including the possibility of bringing in partners.

Enhanced

Oil Recovery and Production (“EORP”)

On May

13, 2009, PAP and its wholly-owned Hong Kong subsidiary, PAPE, entered into a

Letter of Understanding (“LOU”), which was amended and further detailed in

various other associated agreements that were executed on June 7, 2009, with Mr.

Li Xiangdong (“LXD”) and Mr. Ho Chi Kong (“HCK”), pursuant to which the parties

agreed to form Beijing Dong Fang Ya Zhou Petroleum Technology Service Company

Limited(“Dong Fang”) as a new Chinese joint venture company, to be 75.5% owned

by PAPE and 24.5% owned by LXD, into which LXD would assign certain

pending patent rights related to chemical enhanced oil recovery (the “LXD

Patents”). Dong Fang was officially incorporated under Chinese law on

September 24, 2009. As required by the LOU, and pursuant to that certain

Agreement on Cooperation, dated June 7, 2009, and as amended on June 25, 2009

(the “AOC”), entered into by and between PAPE and LXD, upon the effectiveness of

the assignment of the LXD Patents to Dong Fong by LXD on November 27, 2009, (i)

the Company paid LXD and HCK $100,000 each, (ii) PAP has issued shares of PAPE

to Best Source Group Holdings Limited, a Hong Kong company designated by HCK

(“BSG”), to provide BSG with a 30% ownership interest in PAPE, with the Company

retaining the balance 70% ownership interest in PAPE, and (iii) the Company has

issued to HCK’s designee 100,000 shares of Common Stock of the Company and

options to purchase up to 400,000 additional shares of Common Stock of the

Company. These options were approved for issuance by the Board of Directors on

January 21, 2010 at an exercise price of $4.62 per share, which was the closing

sale price of the Company’s Common Stock at that date the Company’s issuance

obligation was triggered upon achievement of the applicable milestone under the

LOU on November 27, 2009 as reported by NYSE Amex. The Company has also agreed

to issue 300,000 more shares of Company Common Stock to HCK or his designee upon

the signing of certain contracts by Dong Fang with respect to the Fulaerjiqu

oilfield. All the options granted to HCK do not vest

immediately; vesting will be contingent upon the achievement of certain

milestones related to the entry by Dong Fang into certain EORP-related

development contracts pertaining to oilfield projects in the Fulaerjiqu

Oilfield. These contracts are anticipated to each deliver to Dong Fang a

significant percentage of the incremental oil production and/or fixed fees per

ton for the incremental production which results from using the technology

covered by the LXD Patents.

In

addition, LXD has been engaged as a consultant by Dong Fang to provide research

and development services, training, and assistance in promoting certain other

opportunities developed by him that target the application of the technology

embodied in the LXD Patents, including assistance with entering into a contract

with respect to the Liaohe Oilfield (the “Liaohe Contract”), and helping to

develop projects in both the Shandong Province and the Xinjiang autonomous

region of the People’s Republic of China for the provision and application of

technology and chemicals developed by LXD.

The

Company has agreed to loan up to $5 million to PAPE, which may then invest up to

RMB 30,000,000 (approximately $ 4.4 million) into Dong Fang, with a portion of

this being a requirement to invest RMB 22,650,000 as PAPE’s share of the

registered capital of Dong Fang, when and to the extent required under

applicable law. PAPE’s capital investment will be used by Dong Fang

to carry out work projects, fund operations, and to make, together with PAPE,

aggregate payments of up to $1.5 million in cash to LXD and HCK. The payments of

up to $1.5 million in cash to LXD and HCK are subject to the

achievement of certain milestones pursuant to the LOU, including the formation

of Dong Fang, the transfer of the LXD Patents to Dong Fang, and the signing of

the contracts with respect to the Fularjiqu Oilfield and the Liaohe Contract by

Dong Fang, as well as certain production-based milestones resulting from the

implementation of these contracts. As of December 31, 2009, $500,000 of

milestone payments had been paid or accrued by PAPE. The loan from the Company

to PAPE will be repaid from funds distributed to PAPE by way of dividends or

other appropriate payments from Dong Fang. As of December 31, 2009,

the Company has loaned a total of $1.3 million to PAPE, and PAPE has invested a

total of RMB 4.8 million (approximately US$700,000) into Dong Fang.

17

In

accordance with the terms of the LOU, as amended on June 7, 2009, PAPE, LXD and

the Company’s existing Chinese joint venture company, Inner Mongolia Sunrise

Petroleum Co. Ltd. (“IMPCO Sunrise”), entered into an Assignment Agreement of

Application Right for Patent, Consulting Engagement Agreement, and an Interest

Assignment Agreement. Upon formation of Dong Fang on September 24,

2009, all these and other agreements entered into by IMPCO Sunrise on behalf of

Dong Fang were assigned by IMPCO Sunrise to Dong Fang.

With

these EORP-related agreements signed and in place, the Company through Dong Fang

has commenced operations in various oil fields located in the Liaoning,

Shandong, and Xinjiang Provinces in China. In the

year ended December 31, 2009, the Company recorded initial revenues,

cost of sales and expenses from the EORP business activities.

Strategy

in Nigeria

Oyo

Field Production Sharing Contract Interest

On

November 18, 2009, the Company entered into the Purchase and Sale Agreement (the

“Purchase and Sale Agreement”) with CAMAC Energy Holdings Limited and certain of

its affiliates (“CAMAC”) pursuant to which the Company agreed to acquire all of

CAMAC’s 60% interest in production sharing contract rights with respect to that

certain oilfield asset known as the Oyo Field (the “Contract Rights”) and the

transactions contemplated thereby, including the election of directors of the

Company (the “Transaction”). The Purchase and Sale Agreement,

provides that, among other things: (i) CAMAC will transfer the Contract Rights

to CAMAC Petroleum Limited, a newly-formed Nigerian entity wholly-owned by the

Company, in consideration for the Company’s payment of $38.84 million

in cash (subject to possible reduction pursuant to the agreement in

principle between CAMAC and the Company which will reduce such

payment amount by a portion of CAMAC’s net cash flow generated by

production from the Oyo Field through the closing of the Transaction) and the

issuance of the Company’s Common Stock, par value $0.001 per share, equal to

62.74% of the Company’s issued and outstanding Common Stock, after giving effect

to the Transaction; and (ii) for a period commencing on the closing of the

transactions contemplated by the Purchase and Sale Agreement (the “Closing”) and

ending the date that is one year following the Closing, the Company’s Board of

Directors will consist of seven members, four of whom will be nominated by

CAMAC.

The

Transaction is expected to close during the first quarter of 2010, and is

subject to the satisfaction of customary and other conditions to Closing,

including, without limitation: (i) the negotiation and entry by the

parties into certain other agreements as set forth in the Purchase and Sale

Agreement in forms reasonably satisfactory to the parties; (ii) the Company’s

consummation of a financing on terms reasonably acceptable to CAMAC resulting in

gross proceeds of at least $45 million to the Company ; and (iii) the approval

of the Company’s stockholders of the Purchase and Sale Agreement and the

transactions contemplated thereby. The Purchase and Sale Agreement also

contains other customary terms, including, but not limited to, representations

and warranties, indemnification and limitation of liability provisions,

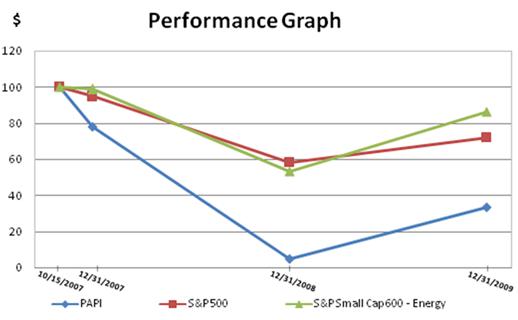

termination rights, and break-up fees if either