Attached files

| file | filename |

|---|---|

| 8-K - HGR ANNUAL SHAREHOLDER MEETING 2011 - HGR Liquidating Trust | hgrshareholdermtg2011_8k.htm |

Exhibit 99.1

2011 Shareholder Meeting

Hines Global REIT

Charles Hazen

President and CEO

Investment Strategy Overview

§ Total Return

§ Pay regular cash distributions

§ Achieve attractive total returns upon the ultimate liquidity event

§ U.S. and International

§ International properties play an important role in well-diversified real estate

portfolios

portfolios

§ International diversification of property types, geographic areas as well as

currencies

currencies

§ Up to 50% of our portfolio may be international

§ Multi Asset Classes

§ Office

§ Retail

§ Industrial

§ Multi-family residential

§ Moderate Leverage

Hines Global REIT 2011 Shareholder Meeting

2

Portfolio Overview

§ Raised approximately $750M+ to date in current public offering

§ Current distribution rate of 7% on $10 share price

§ Current portfolio includes:

– Institutional-quality office properties

– Mixed-use

– Industrial/Flex Office Space

§ Current Leverage of 42% with weighted average interest rate of 4.2%

§ Currently owns interests in seven properties plus three pending acquisitions:

– 3.8M square feet1

– Leased 98%1

Hines Global REIT 2011 Shareholder Meeting

3

1. Statistics have been updated assuming that the pending acquisitions of Gogolevsky 11, The Campus at Marlborough and 250 Royall

Street have been completed. There will be no assurance that these pending acquisitions will be completed.

Street have been completed. There will be no assurance that these pending acquisitions will be completed.

Current Challenges

§ Significant capital pursuing high-quality, well located assets

§ Aggressive competition driving pricing higher and decreasing returns

§ Difficult to deploy capital which is causing increased idle cash

– Consolidated cash balance of $250.2M as of June 30, 2011

§ Challenging conditions may not allow us to maintain our current rate of

distributions

distributions

4

Hines Global REIT 2011 Shareholder Meeting

Geographical and Asset Class Diversification

5

Hines Global REIT 2011 Shareholder Meeting

GEOGRAPHIC REGIONS

50% Domestic/50% International1

1

1

1

Lease Expirations and Tenant Diversification

6

Hines Global REIT 2011 Shareholder Meeting

Schedule of Lease Expirations1

% OF TOTAL LEASABLE SQUARE FEET IN CURRENT PORTFOLIO

TENANT INDUSTRY MIX1,2,

% OF TOTAL PORTFOLIO—BASED ON SQUARE FOOTAGE

1. Statistics have been updated assuming that the pending acquisitions of Gogolevsky 11, The Campus at Marlborough and 250 Royall

Street have been completed. There can be no assurance that these pending acquisitions will be completed.

Street have been completed. There can be no assurance that these pending acquisitions will be completed.

2. Weighted by the Hines Global REIT’s effective ownership (by purchase price)

Investment Portfolio

7

Hines Global REIT 2011 Shareholder Meeting

17600 Gillette - Irvine, CA - acquired June 2010

§ $20.4 million

§ 98,925 square feet, two-level office building

§ Close proximity to John Wayne airport

§ 100% leased through 2016 to DraftFCB (with two, 5-year renewal options)

§ Estimated going-in cap rate: 13.40%

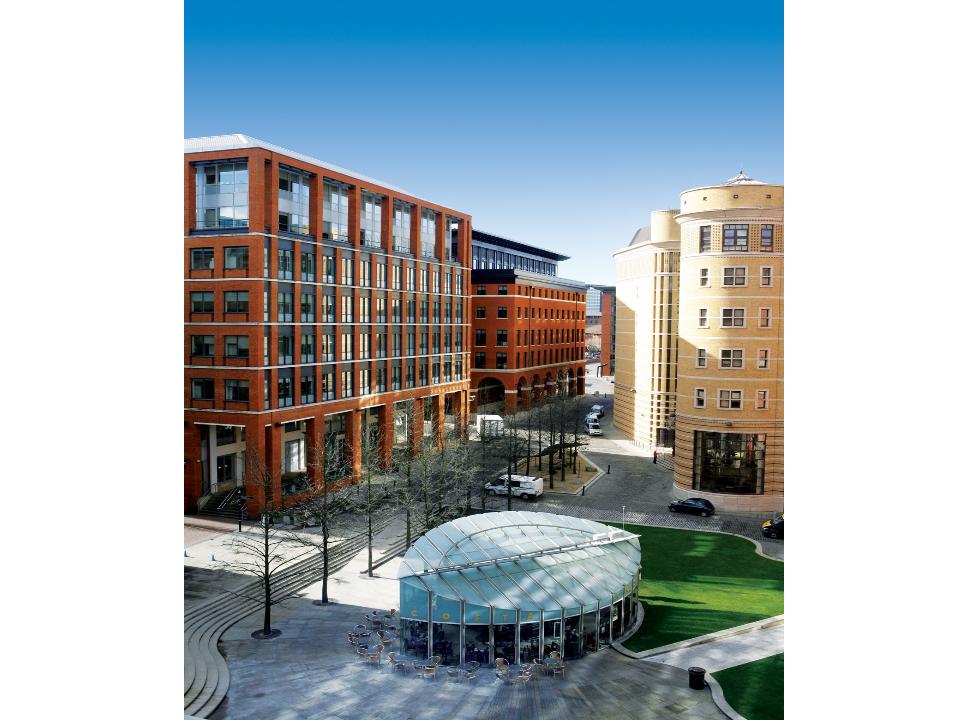

Brindleyplace - Birmingham, England - acquired July 2010

§ $282.5 million/£186.2 million, JV-60% Hines Global REIT/40% Moorfield

§ 560,207 square feet consists of five office buildings plus retail, theatre and restaurant space

and a multi-story parking garage

and a multi-story parking garage

§ 96% leased

§ Major tenants include British Telecom, The Royal Bank of Scotland, and Deloitte LLP

§ $183.7 million, 75% fixed at 3.89%; 25% floating at LIBOR + 1.60%

§ Estimated going-in cap rate: 7.0%

Investment Portfolio

8

Hines Global REIT 2011 Shareholder Meeting

Hock Plaza - Durham, NC - acquired September 2010

§ $97.9 million with a $80 million loan assumption at 5.58%

§ 327,160 square feet 12 story office building

§ 99% leased

§ Major tenants include Duke University & Duke University Health System

§ $80 million, 5.58% fixed

§ Estimated going-in cap rate: 7.20%

Southpark - Austin, TX - acquired October 2010

§ $31.2 million with a $18 million loan assumption at 5.67%

§ 372,125 square feet - four buildings, primarily office with one distribution facility

§ 94% leased

§ Major tenants include Travis Association for the Blind, AT&T, Inc. and Zarlink

Semiconductor, Inc.

Semiconductor, Inc.

§ Estimated going-in cap rate: 8.50%

Investment Portfolio

9

Hines Global REIT 2011 Shareholder Meeting

Stonecutter Court - London, UK - acquired March 2011

§ $146.8 million/£90.9 million

§ 152,829 square feet consisting of a core office building with two adjacent ancillary buildings

§ 100% leased: Deloitte LLP leases 92% through April 2019

§ $92 million, 4.79% fixed via interest rate swap

§ Estimated going-in cap rate: 6.76%

FM Logistic Industrial Park - Moscow, RUS - acquired April 2011

§ $70.8 million; all equity

§ 9-buildings, 748,578 square feet industrial/warehouse space

§ 100% leased to FM Logistic through March 2016

§ Estimated going-in cap rate: 11.15%

Potential Acquisitions1

10

Hines Global REIT 2011 Shareholder Meeting

Gogolevsky 11 - Moscow, RUS

§ $96.1 million; $56.1 million equity

§ 85,740 square foot Class A office building

§ 100% leased

§ Major tenant is Cameron McKenna

§ $40 million debt, with Fibersoft Limited; LIBOR + 6.25%; matures April 2021

Campus Marlborough - Boston, MA

§ $103 million; $45.1 million equity

§ 589,084 square foot office campus including 56,798 square feet of amenity space

§ 100% leased

§ Major tenants include Hologic, Hewlett Packard and Wellington Management

§ $57.9 million debt; 5.21%, matures December 2014

250 Royall Street - Canton, MA

§ $57.0 million; all equity

§ 185,171 square foot office building

§ 100% leased to Computershare Limited

1. There can be no assurance that these acquisitions will be completed.