Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TRANSATLANTIC PETROLEUM LTD. | d8k.htm |

| EX-99.1 - PRESS RELEASE - TRANSATLANTIC PETROLEUM LTD. | dex991.htm |

Second

Quarter 2011 Investor Update Exhibit 99.2 |

Disclaimer

2

Forward-Looking Statements

Outlooks, projections, estimates, targets, and business plans in this presentation or any

related subsequent discussions are forward-looking statements. Actual future

results, including TransAtlantic Petroleum Ltd.’s own production growth and mix; financial results; the amount and mix

of capital expenditures; resource additions and recoveries; finding and development costs;

project and drilling plans, timing, costs, and capacities; revenue enhancements and cost

efficiencies; industry margins; margin enhancements and integration benefits; and the impact of technology

could differ materially due to a number of factors. These include changes in long-term oil

or gas prices or other market conditions affecting the oil, gas, and petrochemical

industries; reservoir performance; timely completion of development projects; war and other political or security

disturbances; changes in law or government regulation; the outcome of commercial negotiations;

the actions of competitors; unexpected technological developments; the occurrence and

duration of economic recessions; unforeseen technical difficulties; and other factors discussed

here and under the heading “Risk Factors" in our Annual Report on Form 10-K

for the year ended December 31, 2010 and our Quarterly Report on Form 10-Q for the

quarter ended March 31, 2011, and our Quarterly Report on Form 10-Q for the quarter ended June 30, 2011 available at our

website at www.transatlanticpetroleum.com and www.sec.gov. See also TransAtlantic’s 2010

audited financial statements and the accompanying management discussion and analysis.

Forward-looking statements are based on management’s knowledge and reasonable

expectations on the date hereof, and we assume no duty to update these statements as of any

future date. The information set forth in this presentation does not constitute

an offer, solicitation or recommendation to sell or an offer to buy any securities of

the Company. The information published herein is provided for informational purposes only. The Company makes no representation that the

information and opinions expressed herein are accurate, complete or current. The information

contained herein is current as of the date hereof, but may become outdated or

subsequently may change. Nothing contained herein constitutes financial, legal, tax, or other advice.

Barrels of oil equivalent, or Boe, is derived by converting natural gas to oil in the ratio of

six thousand cubic feet (mcf) of natural gas to one barrel (bbl) of oil. Boe may

be misleading, particularly if used in isolation. A boe conversion ratio of 6 mcf to 1 bbl is based on an energy equivalency

conversion method primarily applicable at the burner tip and does not represent a value

equivalency at the wellhead. |

Second

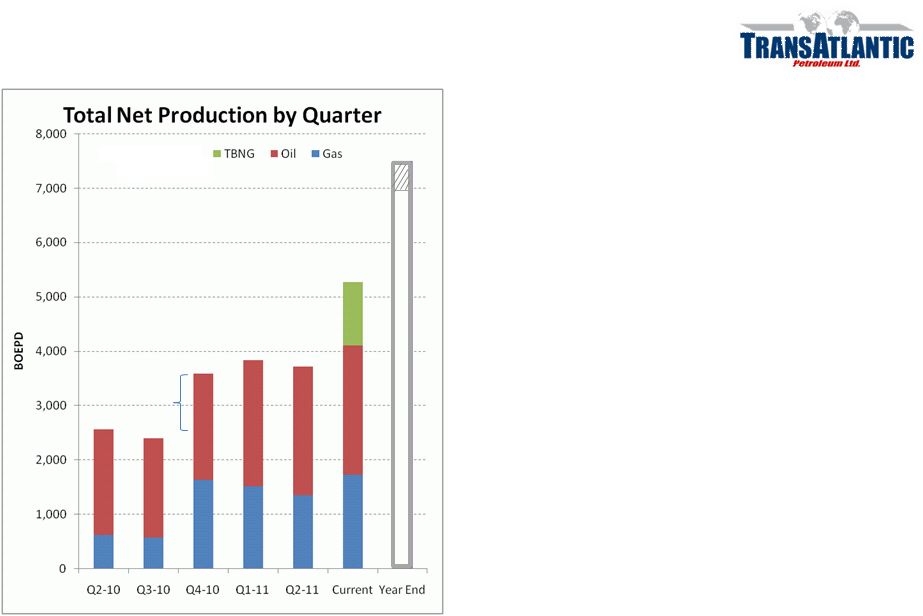

Quarter 2011 Highlights •

Production Increase

Total

production

up

59%

to

362

Mboe

(3,935

boe/d)

over

Q2

2010,

up

2%

over

Q1

2011

Total

oil

production

up

29%

to

220

Mbbls

over

Q2

2010,

and

flat

over

Q1

2011

Natural Gas from Thrace basin* increase 90% over Q2 2010, decreased (18%) over Q1 2011

•

Revenue and EBITDAX Increase

Revenues up 91% to $35.5 million from Q2 2010, up 10% over Q1 2011

EBITDAX increased to $14.5 million in Q2 2011 from $5.5 million Q2 2010 and $12.1

million Q1 2011

Net cash provided by operating activities from continuing operations was $19.1 million in Q2

2011, from $5.6 million in Q1 2011.

3

Note: Does not include TBNG

Note: See definition and reconciliation of EBITDAX in Appendix. EBITDAX is a

non-GAAP financial measure. |

Second

Quarter Financial and Operating Results * See definition and reconciliation of EBITDAX

in Appendix. EBITDAX is a non-GAAP financial measure. 4

Three Months

Six Months

(in millions, except per share)

Q2

Q2

30-Jun

30-Jun

2011

2010

2011

2010

Revenues (millions)

$ 35.51

$ 18.60

$ 67.71

$ 31.00

Production & LOE Expense

$ 4.16

$ 4.70

$ 8.26

$ 8.89

Exploration Expense

$ 11.13

$ 8.12

$ 24.91

$ 15.51

Revaluation of contingent consideration

$ 1.25

$ -

$ 1.25

$

- General & Administrative Expense

$ 10.25

$ 6.77

$ 20.50

$ 12.55

Depletion, Depreciation & Amortization

$ 13.14

$ 4.30

$ 21.64

$ 7.34

Total Cost & Expense

$ 39.92

$ 23.90

$ 76.56

$ 44.28

Net Operating Loss

$ 4.41

$ 5.29

$ 8.85

$ 13.29

Net loss from continuing operations

$ 8.95

$ 4.61

$ 27.30

$ 13.49

Net loss from continuing operations per share

$ 0.03

$ 0.02

$ 0.08

$ 0.04

EBITDAX (non-GAAP) Gain *

$ 14.46

$ 5.48

$ 27.31

$ 5.59

EBITDAX (non-GAAP) per diluted share Gain*

$ 0.04

$ 0.02

$ 0.08

$ 0.02

From continuing operations, including TBNG |

Exchange /

Ticker NYSE-AMEX / TAT

TSX / TNP

Acreage Position

Turkey

6.4 MM Gross

6.0 MM Net

Morocco

0.65 MM Gross/Net

Bulgaria

0.6 MM Gross/Net

Romania

1.0 MM Gross

0.5 MM Net

2011 estimated

CAPEX

$37 million

TAPCOR Overview

Enterprise Value $537 MM

3,657 Boe/d Q2 production (net, after royalty)

•

65% Oil

2,393 bbls/d Selmo/Arpatepe

•

35% Natural Gas

7,581 Mcf/d Thrace Basin*

* Does not include TBNG

Note: Enterprise value is equal to market capitalization using the closing price of $1.10 per

share as of 8/8/11, plus net debt as of 6/30/11. Thrace Basin

Both conventional/unconventional play

Deep prospects with large structural

closures

3.5 Mmboe of proved reserves

SE Basin

Directional Pad drilling at Selmo

Seismic completed

Drilling work under way at Arpatepe

13.1 Mmboe of proved reserves

5 |

6

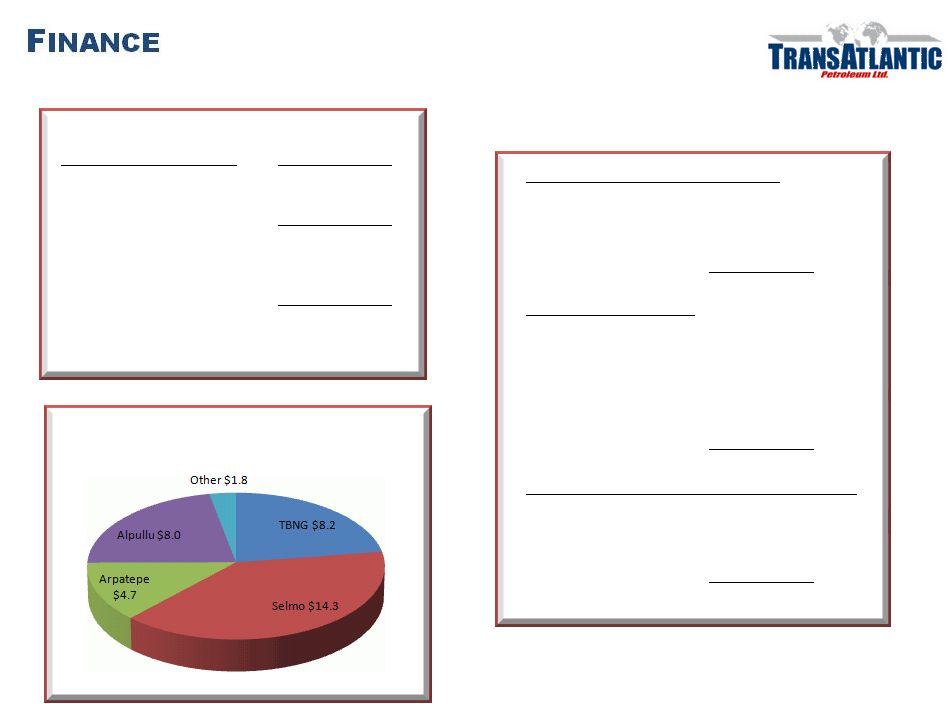

Sources and Uses for July-December 2011

* At retail

** Assumes $90 oil and $7.50 gas

Debt Maturity

As of June 30

(in thousands)

Short Term

Dalea & Viking Note

$ 77,932

Other

15,046

Total Short Term Debt

$ 92,978

Long Term

RBL and Other

$ 67,931

Viking Long Term Debt

$ 426

Total Long Term Debt

$ 68,357

Total Debt

$ 161,335

Sources and Uses for Remainder of 2011 (July-Dec)

(in thousands)

Capex

-$37,000

Cash at 6/30

$26,300

Credit Line Availability

$29,000

TBNG Borrowing Capacity

$10,000

Available Cash from Operations

$39,500

Excess

$67,800

2011 Cash Model (July-December)

Estimated Revenue

(includes third party service

revenue)

$80,000

LOE at $12/boe

-$12,000

Cost of Services

-$8,000

Cash G&A

-$16,000

Interest Expense and debt service

-$7,500

Income Tax

-$5,000

Available Cash

$31,500

TransAtlantic at 7,500 boepd net (est. year end 2011 run rate)

Annual Revenue at 45/55 oil/gas mix

$178,500

LOE at $10/boe

-$24,000

Cash G&A

-$25,000

Interest Expense

-$16,000

Income Tax

-$12,000

Available Cash for CAPEX

$101,500

Assume $90 oil and $7.50 gas

2011 Capital Budget $37 million

(August –

December, on cash cost basis) |

Revised YE

Target = 7,000 to 7,500 BOEPD •

Program Deferrals –

Poor results on lead wells

•

Amity –

False amplitudes

•

Alpullu –

Tight sands

•

Edirne –

Wet structural plays

•

Delays at

•

Gocerler –

3D –

Dev & Expl. drilling

•

Bakuk –

PKK activity –

deferred drilling

Decision to defer made:

•

In consultation with New Expl.

Mgmt. Team

•

Considering new inventories w/ new 3Ds

Already constructed new inventory on 4861/Aplullu

•

Prospects with potential to add material results

Redeployment of capital to higher return opportunities

YE Target

AMITY

Acqusition

Total Net Production

7 |

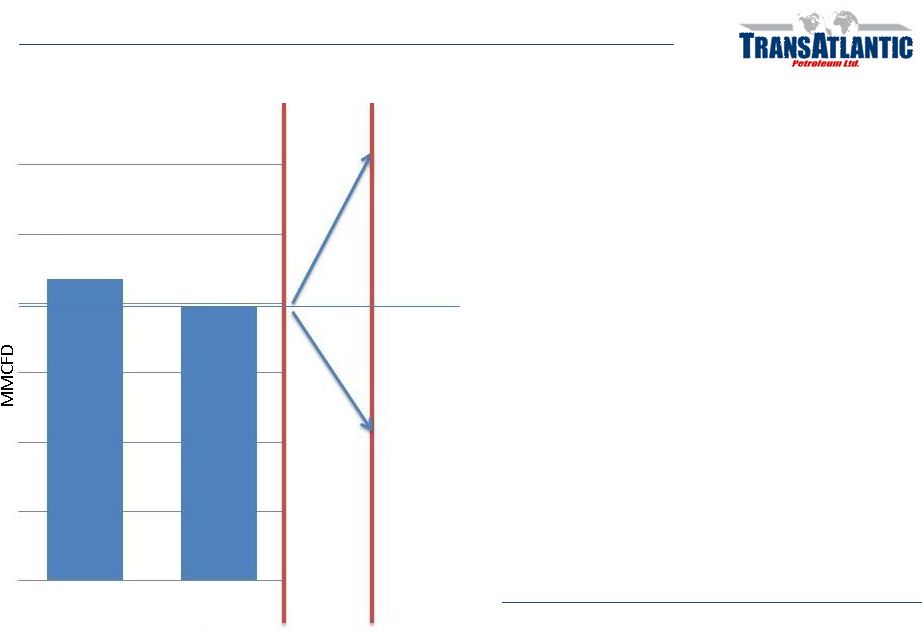

TBNG

2H 2011 Re-Development / Exploration Plan

Closed June 7, 2011

•

Partners –

Valeura & Pinnacle Group

•

TAT Retained 41.5 % WI

2H 2011 Expl & Drilling Program

•

41 Recompletes

—

8

performed for 3.2 mmcfd

•

2

3D

Surveys

of

460

km

2

underway

—

Tekirdag & Hayrabolu

•

High graded Rigline 2D Prospects

•

50 Re Entry Frac Candidates

Work Programs to Offset 90% Base Decline

Q1 2012 New 3D Based Prospect Inventory

JAN

2011

DEC

2011

Closed

6/7/2011

10 mmcfd

Drilling

+ Fracs

Recompletes

4 mmcfd

+6

-4

90%

Base

Decline

8

NET SALES

8.7

7.9

Q1

Q2 |

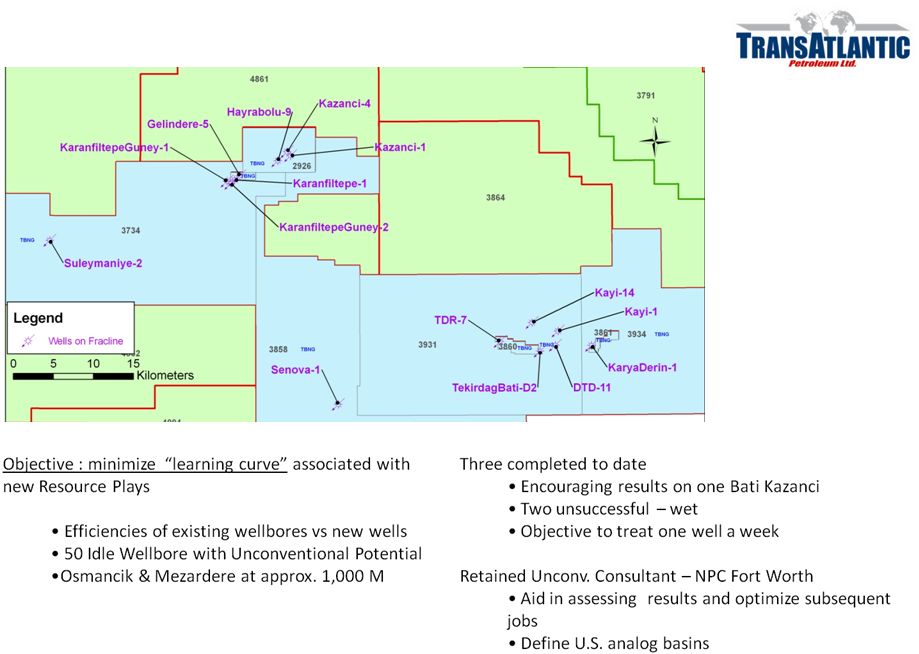

TBNG

Re-Entry Frac Program

9 |

10

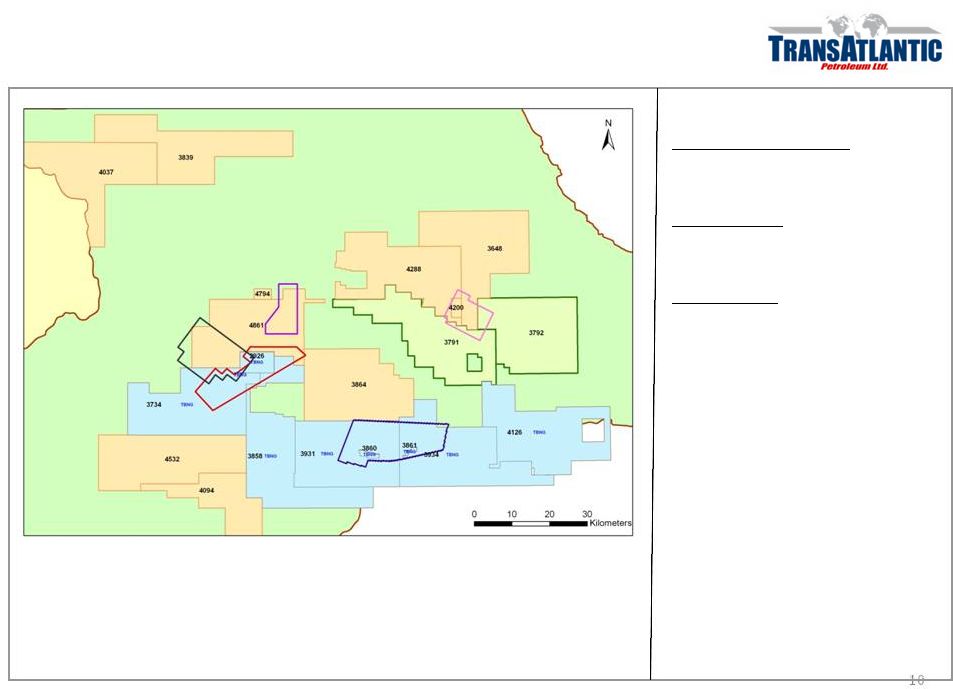

Thrace New Seismic DataSets Supporting New Prospect Inventories

4861 Exploration License

-

Temrez E : 166-sqkm 3D

-

Temrez S : 192-sqkm 3D

TBNG Licenses

-

Tekirdag

3D: 263-sqkm

-

Hayrabolu 3D: 200-sqkm

Amity Licenses

-

Gocerler 4D: 97-sqkm |

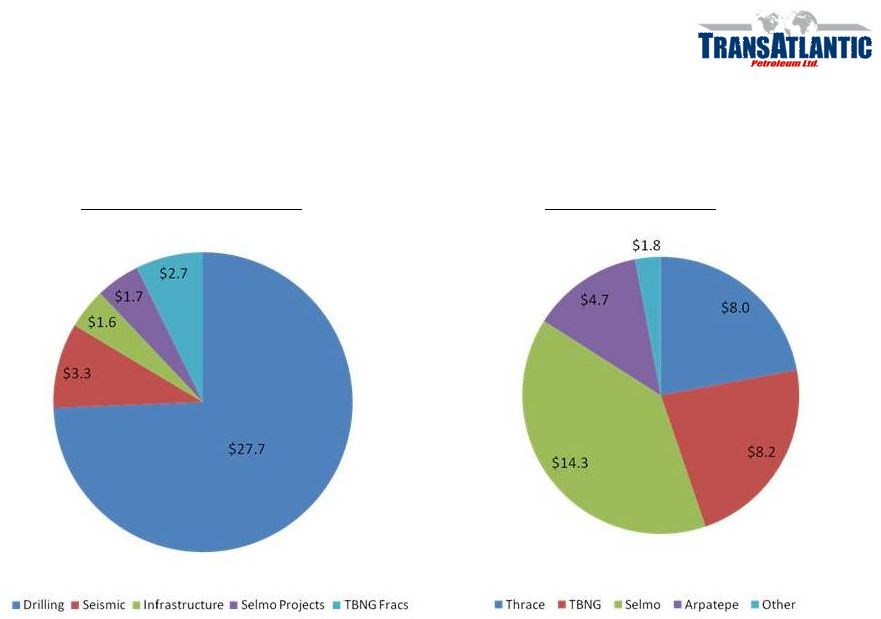

2011 Capital Budget $37 Million

Budget by Activities

Budget by Area

2011

Net Capital Budget

(Cost Basis)

11 |

Turkey Drilling

Update January Through June 2011 (Wells Spud)

July through December 2011 (Planned Wells)

Activity

Activity

Selmo

9

Selmo

8

Arpatepe

2

Arpatepe

4

Thrace-

TAT

11

Thrace-TAT

15

Morocco

1

Thrace-TBNG

10

Total

23

Total

37

12 |

Key TransAtlantic

E&P Management New Hires 13

(TBN) –

Giving Notice

Exploration Manager

Start date September 15, 2011

More than 25 years experience

Exploration & Geophysical

Mgr

Major Independent

Dan Hawe

Reservoir Engineering Manager

Start date June 1, 2011

BS Petroleum Engineer

Worked w/ ExxonMobil, Newfield and Laredo

35 years experience in the reservoir

engineering

Experience in all most unconventional U.S.

basins

Mitch Elkins

International Drilling Engineering Manager

Start date August 1, 2011

Formally

Unocal Permission Drilling

Apache Offshore Drilling Mgr

26 years in various engineering, supervisory

and management positions, including 14

years with Unocal.

Darcy Dorscher

Vice President of Operations

Start date June 1, 2011

BS Chemical Engineer

28 years experience in all engineering

disciplines and has managed “green field

projects”

in Russia, India, Kazakhstan, Qatar

and North America |

Operations

New Operations / Exploration

Management Team

2H 2011 Redevelopment / Exploration

Program at TBNG

Unconventional

Re-Entry Program To

“Crack The Code”

TAT Thrace Basin (4861) 3D Datasets /

Inventory Growth

1st Energy Marketing

–

Risk Reducer

Turkey & Bulgaria

Arpatepe Exploration / Development

Drilling Initiatives

Complete Pipeline / Infrastructure

Projects

Corporate

Restructure service company

Extend maturity of short term debt

Resume consolidation growth strategy

Cost cutting initiatives

Execution Plan 2011

14 |

Appendix

Cash Flow Information and EBITDAX Reconciliation |

Cash

Flow Statement 16

U.S. dollars in thousands

June 30, 2011

March 31, 2011

Net cash provided by operating activities from continuing operations

$ 19,054

$ 5,630

Net cash used in investing activities from continuing operations

(11,802)

(23,418)

Net cash (used in) provided by financing activities from continuing operations

(832)

7,248

Net cash used in discontinued operations

(105)

(4,098)

Effect of exchange rate changes on cash and cash equivalents

(211)

162

Net increase (decrease) in cash and cash equivalents

$ 6,104

$ (14,476)

Cash flow from operations before working capital changes, non-recurring other operating

items, early termination of derivatives and adjustments for settlements of

derivative financial instruments with a financing element are presented because management believes it is a useful financial indicator for companies in our

industry. This non-GAAP disclosure is widely accepted as a measure of an oil and natural

gas company’s ability to generate cash used to fund development and acquisition

activities and service debt or pay dividends. Operating cash flow is not a measure of financial performance pursuant to GAAP and should not be used

as an alternative to cash flows from operating, investing, or financing activities. We have

also elected to exclude the adjustment for derivative financial instruments with

a financing element as this adjustment simply reclassifies settlements from operating cash flows to financing activities. Management believes

these settlements should be included in this non-GAAP measure to conform to the intended

measure of our ability to generate cash to fund operations and development activities.

Non-recurring other operating items and early termination of derivatives have been excluded as they do not reflect our on-going

operating activities.

|

EBITDAX

reconciliation (unaudited) Q2-11

Q2-10

Q1-11

Net Loss from continuing operations

($8,948)

($4,609)

($18,356)

Add back:

Income tax

$1,127

$1,475

$531

Interest expense

$3,695

$654

$3,776

Interest and other income

($200)

($126)

($196)

Share-based compensation / rsu & options

$400

$397

$557

Exploration, abandonment and impairment

$4,463

$4,149

$7,232

Seismic and other exploration expense

$939

$2,273

$1,489

Gain/loss on commodity derivative contracts

($154)

($3,034)

$8,607

Depreciation, depletion and accretion

$13,135

$4,302

$8,505

EBITDAX For the Period Ended

$14,457

$5,481

$12,145

17 |

This

presentation references estimated EBITDAX, which is a non-GAAP financial measure that represents earnings

from continuing operations before income taxes, interest, depreciation, depletion,

amortization, impairment, abandonment and exploration expense.

The Company believes EBITDAX assists management and investors in

comparing the Company’s performance and

ability to fund capital expenditures and working capital requirements on a consistent basis

without regard to depreciation, depletion and amortization, impairment of natural gas

and oil properties and exploration expenses, which can vary significantly from period

to period. In addition, management uses EBITDAX as a financial measure to

evaluate the Company’s operating performance. EBITDAX is also widely used by

investors and rating agencies. EBITDAX is not a measure of financial performance under

GAAP. Accordingly, it should not be considered as a substitute for net income,

income from operations, or cash flow provided by operating activities prepared in

accordance with GAAP. Information regarding income taxes, interest, depreciation,

depletion, amortization, impairment, abandonment and exploration expense is unavailable

on a forward looking basis. Net income, income from operations, or cash flow provided

by operating activities may vary materially from EBITDAX. Investors should

carefully consider the specific items included in the computation of EBITDAX. The

Company has disclosed EBITDAX to permit a comparative analysis of its operating

performance and debt servicing ability relative to other companies. 18

|

Thank

you |