Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - TRANSATLANTIC PETROLEUM LTD. | tat-ex991_836.htm |

| EX-32.2 - EX-32.2 - TRANSATLANTIC PETROLEUM LTD. | tat-ex322_12.htm |

| EX-32.1 - EX-32.1 - TRANSATLANTIC PETROLEUM LTD. | tat-ex321_10.htm |

| EX-31.2 - EX-31.2 - TRANSATLANTIC PETROLEUM LTD. | tat-ex312_7.htm |

| EX-31.1 - EX-31.1 - TRANSATLANTIC PETROLEUM LTD. | tat-ex311_11.htm |

| EX-23.3 - EX-23.3 - TRANSATLANTIC PETROLEUM LTD. | tat-ex233_1148.htm |

| EX-23.2 - EX-23.2 - TRANSATLANTIC PETROLEUM LTD. | tat-ex232_981.htm |

| EX-23.1 - EX-23.1 - TRANSATLANTIC PETROLEUM LTD. | tat-ex231_1089.htm |

| EX-21.1 - EX-21.1 - TRANSATLANTIC PETROLEUM LTD. | tat-ex211_1090.htm |

| EX-10.22 - EX-10.22 - TRANSATLANTIC PETROLEUM LTD. | tat-ex1022_1151.htm |

| EX-10.21 - EX-10.21 - TRANSATLANTIC PETROLEUM LTD. | tat-ex1021_1149.htm |

| EX-10.20 - EX-10.20 - TRANSATLANTIC PETROLEUM LTD. | tat-ex1020_1150.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-34574

TRANSATLANTIC PETROLEUM LTD.

(Exact name of registrant as specified in its charter)

|

Bermuda |

|

None |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

16803 Dallas Parkway Addison, Texas |

|

75001 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (214) 220-4323

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

Common shares, par value $0.10 |

|

NYSE MKT |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|

|

|

|

|

|

Non-accelerated filer |

☐ (Do not check if a smaller reporting company) |

Smaller reporting company |

☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of common shares, par value $0.10 per share, held by non-affiliates of the registrant, based on the last sale price of the common shares on June 30, 2016 (the last business day of the registrant’s most recently completed second fiscal quarter), was approximately $22.3 million. For purposes of this computation, all officers, directors and 10% beneficial owners of the registrant are deemed to be affiliates. Such determination should not be deemed an admission that such officers, directors or 10% beneficial owners are, in fact, affiliates of the registrant.

As of March 17, 2017, there were 47,312,231 common shares outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this Annual Report on Form 10-K, to the extent not set forth herein, is incorporated by reference to the registrant’s definitive proxy statement relating to the 2017 Annual Meeting of Shareholders which will be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year to which this Annual Report on Form 10-K relates.

FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2016

INDEX

|

|

|

Page |

|

|

|

|

|

Item 1. |

5 |

|

|

Item 1A. |

12 |

|

|

Item 1B. |

21 |

|

|

Item 2. |

22 |

|

|

Item 3. |

37 |

|

|

Item 4. |

38 |

|

|

|

|

|

|

|

|

|

|

Item 5. |

39 |

|

|

Item 6. |

41 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

42 |

|

Item 7A. |

54 |

|

|

Item 8. |

55 |

|

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

55 |

|

Item 9A. |

55 |

|

|

Item 9B. |

56 |

|

|

|

|

|

|

|

|

|

|

Item 10. |

57 |

|

|

Item 11. |

57 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

57 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

57 |

|

Item 14. |

57 |

|

|

|

|

|

|

|

|

|

|

Item 15. |

58 |

Certain statements in this Annual Report on Form 10-K constitute “forward-looking statements” within the meaning of applicable U.S. and Canadian securities legislation. Additionally, forward-looking statements may be made orally or in press releases, conferences, reports, on our website or otherwise, in the future, by us or on our behalf. Such statements are generally identifiable by the terminology used such as “plans,” “expects,” “estimates,” “budgets,” “intends,” “anticipates,” “believes,” “projects,” “indicates,” “targets,” “objective,” “could,” “should,” “may” or other similar words.

By their very nature, forward-looking statements require us to make assumptions that may not materialize or that may not be accurate. Forward-looking statements are subject to known and unknown risks and uncertainties and other factors that may cause actual results, levels of activity and achievements to differ materially from those expressed or implied by such statements, including the factors discussed under Item 1A. Risk Factors in this Annual Report on Form 10-K. Such factors include, but are not limited to, the following: our ability to access sufficient capital to fund our operations; fluctuations in and volatility of the market prices for oil and natural gas products; the ability to produce and transport oil and natural gas; the results of exploration and development drilling and related activities; global economic conditions, particularly in the countries in which we carry on business, especially economic slowdowns; actions by governmental authorities including increases in taxes, legislative and regulatory initiatives related to fracture stimulation activities, changes in environmental and other regulations, and renegotiations of contracts; political uncertainty, including actions by insurgent groups or other conflicts; the negotiation and closing of material contracts or sale of assets; future capital requirements and the availability of financing; estimates and economic assumptions used in connection with our acquisitions; risks associated with drilling, operating and decommissioning wells; actions of third-party co-owners of interests in properties in which we also own an interest; our ability to effectively integrate companies and properties that we acquire; and the other factors discussed in other documents that we file with or furnish to the U.S. Securities and Exchange Commission (the “SEC”) and Canadian securities regulatory authorities. The impact of any one factor on a particular forward-looking statement is not determinable with certainty as such factors are interdependent upon other factors and our course of action would depend upon our assessment of the future, considering all information then available. In that regard, any statements as to: future oil or natural gas production levels; capital expenditures; asset sales; the allocation of capital expenditures to exploration and development activities; sources of funding for our capital expenditure programs or operations; drilling of new wells; demand for oil and natural gas products; expenditures and allowances relating to environmental matters; dates by which certain areas will be developed or will come on-stream; expected finding and development costs; future production rates; ultimate recoverability of reserves, including the ability to convert probable and possible reserves to proved reserves; dates by which transactions are expected to close; future cash flows, uses of cash flows, collectability of receivables and availability of trade credit; expected operating costs; changes in any of the foregoing and other statements using forward-looking terminology are forward-looking statements, and there can be no assurance that the expectations conveyed by such forward-looking statements will, in fact, be realized.

Although we believe that the expectations conveyed by the forward-looking statements are reasonable based on information available to us on the date such forward-looking statements were made, no assurances can be given as to future results, levels of activity, achievements or financial condition.

Readers should not place undue reliance on any forward-looking statement and should recognize that the statements are predictions of future results, which may not occur as anticipated. Actual results could differ materially from those anticipated in the forward-looking statements and from historical results, due to the risks and uncertainties described above, as well as others not now anticipated. The foregoing statements are not exclusive and further information concerning us, including factors that potentially could materially affect our financial results, may emerge from time to time. We do not intend to update forward-looking statements to reflect actual results or changes in factors or assumptions affecting such forward-looking statements, except as required by law.

Glossary of Selected Oil and Natural Gas Terms

The following are abbreviations and definitions of terms commonly used in the oil and natural gas industry and this Annual Report on Form 10-K.

2D seismic. Geophysical data that depict the subsurface strata in two dimensions.

3D seismic. Geophysical data that depict the subsurface strata in three dimensions. 3D seismic typically provides a more detailed and accurate interpretation of the subsurface strata than 2D seismic.

Appraisal wells. Wells drilled to convert an area or sub-region from the resource to the reserves category.

Bbl. One stock tank barrel, or 42 U.S. gallons liquid volume, used in reference to oil or other liquid hydrocarbons.

i

Bbl/d. Barrels of oil per day.

Bcf. One billion cubic feet of natural gas.

Boe. Barrels of oil equivalent. Boe is not included in the DeGolyer and MacNaughton reserves report and is derived by the Company by converting natural gas to oil in the ratio of six Mcf of natural gas to one Bbl of oil. The conversion factor is the current convention used by many oil and natural gas companies. Boe may be misleading, particularly if used in isolation. A Boe conversion ratio of six Mcf to one Bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead.

Boepd. Barrels of oil equivalent per day.

Commercial well; commercially productive well. An oil and natural gas well which produces oil and natural gas in sufficient quantities such that proceeds from the sale of such production exceed production expenses and taxes.

Completion. The installation of permanent equipment for the production of oil or natural gas or, in the case of a dry hole, the reporting of abandonment to the appropriate agency.

Developed acreage. The number of acres which are allocated or assignable to producing wells or wells capable of production.

Development well. A well drilled within the proved area of an oil or natural gas reservoir to the depth of a stratigraphic horizon known to be productive.

Directional drilling. The technique of drilling a well while varying the angle of direction of a well and changing the direction of a well to hit a specific target.

Dry hole; dry well. A well found to be incapable of producing either oil or natural gas in sufficient quantities to justify completion as an oil or natural gas well.

Exploitation. The continuing development of a known producing formation in a previously discovered field, including efforts to maximize the ultimate recovery of oil or natural gas from the field by development wells, secondary recovery equipment or other suitable processes and technology.

Exploratory well. A well drilled to find a new field or to find a new reservoir in a field previously found to be productive of oil or natural gas in another reservoir. Generally, an exploratory well is any well that is not a development well.

Farm-in or farm-out. An assignment of an interest in a drilling location and related acreage conditional upon the drilling of a well on that location, the completion of other work commitments related to that acreage, or some combination thereof.

Formation. A succession of sedimentary beds that were deposited under the same general geologic conditions.

Frac; fracture stimulation. A stimulation treatment involving the fracturing of a reservoir and then injecting water, sand and chemicals into the fractures under pressure to stimulate hydrocarbon production in low-permeability reservoirs.

Gross acres or gross wells. The total acres or wells, as the case may be, in which a working interest is owned.

Horizontal drilling. A technique used in certain formations where a well is drilled vertically to a certain depth and then drilled at a right angle with a specified interval.

Initial production rate. Generally, the maximum 24-hour production volume from a well.

Mbbl. One thousand stock tank barrels.

Mboe. One thousand barrels of oil equivalent.

Mboepd. One thousand barrels of oil equivalent per day.

Mcf. One thousand cubic feet of natural gas.

ii

Mcf/d. One thousand cubic feet of natural gas per day.

Mmbbl. One million stock tank barrels.

Mmboe. One million barrels of oil equivalent.

Mmcf. One million cubic feet of natural gas.

Mmcf/d. One million cubic feet of natural gas per day.

Net acres or net wells. The sum of the fractional working interests owned in gross acres or gross wells.

Overriding royalty interest. An interest in an oil or natural gas property entitling the owner to a share of oil and natural gas production free of costs of production.

Play. A term applied to a portion of the exploration and production cycle following the identification by geologists and geophysicists of areas with potential oil and natural gas reserves.

Present value of estimated future net revenues or PV-10. The present value of estimated future net revenues is an estimate of future net revenues from a property at the date indicated, without giving effect to derivative financial instrument activities, after deducting production and ad valorem taxes, future capital costs, abandonment costs and operating expenses, but before deducting future federal income taxes. The future net revenues have been discounted at an annual rate of 10% to determine their “present value.” The present value is shown to indicate the effect of time on the value of the net revenue stream and should not be construed as being the fair market value of the properties. Estimates have been made using constant oil and natural gas prices and operating and capital costs at the date indicated, at its acquisition date, or as otherwise indicated. We believe that the present value of estimated future net revenues before income taxes, while not a financial measure in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”), is an important financial measure used by investors and independent oil and natural gas producers for evaluating the relative significance of oil and natural gas properties and acquisitions because the tax characteristics of comparable companies can differ materially.

Productive well. A productive well is a well that is not a dry well.

Proved developed reserves. Developed oil and natural gas reserves are reserves of any category that can be expected to be recovered: (i) through existing wells with existing equipment and operating methods or in which the cost of the required equipment is relatively minor compared to the cost of a new well and (ii) through installed extraction equipment and infrastructure operational at the time of the reserves estimate.

Proved reserves. Those quantities of oil and natural gas, which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible, from a given date forward, from known reservoirs, and under existing economic conditions, operating methods, and government regulations, prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation. The project to extract the hydrocarbons must have commenced or the operator must be reasonably certain that it will commence the project within a reasonable time.

The area of the reservoir considered as proved includes: (i) the area identified by drilling and limited by fluid contacts, if any, and (ii) adjacent undrilled portions of the reservoir that can, with reasonable certainty, be judged to be continuous with it and to contain economically producible oil or natural gas on the basis of available geoscience and engineering data.

In the absence of data on fluid contacts, proved quantities in a reservoir are limited by the lowest known hydrocarbons as seen in a well penetration unless geoscience, engineering, or performance data and reliable technology establishes a lower contact with reasonable certainty. Where direct observation from well penetrations has defined a highest known oil elevation and the potential exists for an associated gas cap, proved oil reserves may be assigned in the structurally higher portions of the reservoir only if geoscience, engineering, or performance data and reliable technology establish the higher contact with reasonable certainty.

Reserves which can be produced economically through application of improved recovery techniques (including, but not limited to, fluid injection) are included in the proved classification when: (i) successful testing by a pilot project in an area of the reservoir with properties no more favorable than in the reservoir as a whole, the operation of an installed program in the reservoir or an analogous reservoir, or other evidence using reliable technology establishes the reasonable certainty of the engineering analysis on which the project or program was based and (ii) the project has been approved for development by all necessary parties and entities, including governmental entities.

iii

Existing economic conditions include prices and costs at which economic producibility from a reservoir is to be determined. The price shall be the average price during the twelve month period prior to the ending date of the period covered by the report, determined as an unweighted arithmetic average of the first-day-of-the-month price for each month within such period, unless prices are defined by contractual arrangements, excluding escalations based upon future conditions.

Proved undeveloped reserves. Reserves of any category that are expected to be recovered from new wells on undrilled acreage or from existing wells where a relatively major expenditure is required for recompletion.

Reserves on undrilled acreage shall be limited to those directly offsetting development spacing areas that are reasonably certain of production when drilled, unless evidence using reliable technology exists that establishes reasonable certainty of economic producibility at greater distances. Undrilled locations can be classified as having undeveloped reserves only if a development plan has been adopted indicating that they are scheduled to be drilled within five years, unless the specific circumstances justify a longer time.

Undrilled locations can be classified as having proved undeveloped reserves only if a development plan has been adopted indicating that they are scheduled to be drilled within five years, unless the specific circumstances justify a longer time.

Under no circumstances shall estimates for undeveloped reserves be attributable to any acreage for which an application of fluid injection or other improved recovery technique is contemplated, unless such techniques have been proved effective by actual projects in the same reservoir or an analogous reservoir or by other evidence using reliable technology establishing reasonable certainty.

Reasonable certainty. If deterministic methods are used, reasonable certainty means a high degree of confidence that the quantities will be recovered. If probabilistic methods are used, there should be at least a 90% probability that the quantities actually recovered will equal or exceed the estimate. A high degree of confidence exists if the quantity is much more likely to be achieved than not and, as changes due to increased availability of geoscience (geological, geophysical, and geochemical), engineering, and economic data are made to estimated ultimate recovery (“EUR”) with time, reasonably certain EUR is much more likely to increase or remain constant than to decrease.

Recompletion. An operation within an existing well bore to make the well produce oil or natural gas from a different, separately producible zone other than the zone from which the well had been producing.

Reservoir. A porous and permeable underground formation containing a natural accumulation of producible oil and/or natural gas that is confined by impermeable rock or water barriers and is individual and separate from other reservoirs.

Sales volumes. The amount of production of oil or natural gas sold after deducting royalties and working interests owned by third parties.

Shale. Fine-grained sedimentary rock composed mostly of consolidated clay or mud. Shale is one of the most frequently occurring sedimentary rocks.

Standardized measure of discounted future net cash flows or the Standardized Measure. Under the Standardized Measure, future cash flows for the years ended December 31, 2016, 2015 and 2014 are estimated by applying the simple average spot prices for the trailing twelve month period using the first day of each month beginning on January 1 and ending on December 1 of each respective year, adjusted for fixed and determinable escalations, to the estimated future production of year-end proved reserves. Future cash inflows are reduced by estimated future production and development costs based on period-end and future plugging and abandonment costs to determine pre-tax cash inflows. Future income taxes are computed by applying the statutory tax rate to the excess of pre-tax cash inflows over our tax basis in the associated properties. Future net cash inflows after income taxes are discounted using a 10% annual discount rate to arrive at the Standardized Measure.

Tcf. One trillion cubic feet of natural gas.

Undeveloped acreage. License or lease acreage on which wells have not been drilled or completed to a point that would permit the production of commercial quantities of oil and natural gas regardless of whether such acreage contains proved reserves.

Wellhead production. The volume of oil or natural gas produced after deducting royalties and working interests owned by third parties prior to any oil and natural gas lost or used from wellhead to market.

Working interest (“WI”). The operating interest that gives the owner the right to drill, produce and conduct activities on the property and a share of production.

iv

In this Annual Report on Form 10-K, references to “we,” “us,” “our,” or the “Company” refer to TransAtlantic Petroleum Ltd. and its subsidiaries on a consolidated basis. Unless stated otherwise, all sums of money stated in this Annual Report on Form 10-K are expressed in U.S. Dollars.

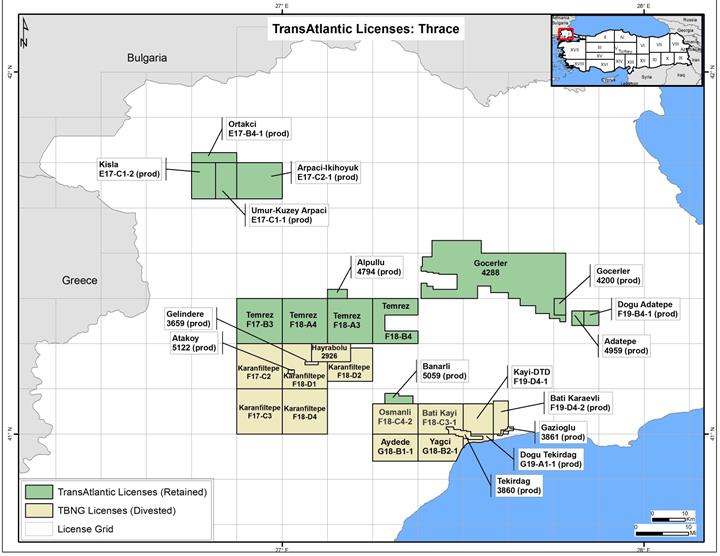

As of December 31, 2016, we held for sale the ownership interests in our subsidiary Thrace Basin Natural Gas (Turkiye) Corporation (“TBNG”). We completed the sale of TBNG in February 2017. In this Annual Report on Form 10-K, except as set forth in Management’s Discussion and Analysis of Financial Condition and Results of Operations, all references to our reserves, wells, production, and acreage in Turkey excludes the reserves, wells, production and acreage of TBNG.

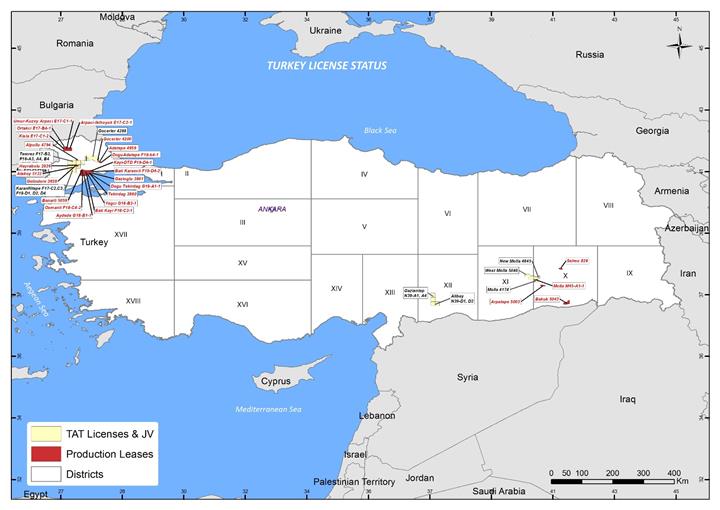

Our Business

We are an international oil and natural gas company engaged in acquisition, exploration, development and production. We have focused our operations in countries that have established, yet underexplored, petroleum systems, are net importers of petroleum, have an existing petroleum transportation infrastructure and provide favorable commodity pricing, royalty rates and tax rates to exploration and production companies. As of December 31, 2016, excluding TBNG, we held interests in approximately 395,000 and 165,000 net acres of developed and undeveloped oil and natural gas properties in Turkey and Bulgaria, respectively, and an operated interest in a joint venture in Albania. As of March 17, 2017, approximately 47% of our outstanding common shares were beneficially owned by N. Malone Mitchell 3rd, the chairman of our board of directors and our chief executive officer.

Based on the reserves report prepared by DeGolyer and MacNaughton, independent petroleum engineers, our estimated proved reserves at December 31, 2016 in Turkey, excluding TBNG, were approximately 13,599 Mboe, of which 93.6% was oil. Of these estimated proved reserves, 39.4% were proved developed reserves. As of December 31, 2016, the Standardized Measure and PV-10 of our proved reserves in Turkey, excluding TBNG, were $126.5 million and $137.5 million, respectively. See “Item 2. Properties—Value of Proved Reserves” for a reconciliation of PV-10 to the Standardized Measure.

Recent Developments

Sale of TBNG. On February 24, 2017, we sold TBNG for gross proceeds of $20.9 million, and approximate net cash proceeds of $16.3 million, effective as of March 31, 2016. The purchase price is subject to post-closing adjustments, and we agreed to escrow $3.1 million of the purchase price for 30 days to satisfy any agreed upon purchase price adjustments.

We used $2.7 million of the net proceeds from the sale to pay off our promissory note (as amended, the “Note”) with ANBE Holdings, L.P., (“ANBE”) an entity owned by the adult children of our chairman and chief executive officer, N. Malone Mitchell, 3rd, and controlled by an entity managed by Mr. Mitchell and his wife. Pursuant to the terms of the Note, we were required to repay it in full within five business days from the closing of the sale of TBNG.

Optional Redemption of 2017 Notes. On January 1, 2017 (the “Redemption Date”), we effected an optional redemption of $4.3 million in aggregate principal amount of our outstanding 13.0% Convertible Notes due 2017 (the “2017 Notes”) at a cash redemption price equal to 100% of the principal amount thereof plus accrued and unpaid interest thereon to the Redemption Date. After the optional redemption, we had $10.0 million of 2017 Notes outstanding.

Our Properties and Operations

Summary of Geographic Areas of Operations

The following table shows net reserves information as of December 31, 2016:

|

|

|

|

|

|

Proved |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proved Developed |

|

|

Undeveloped |

|

|

Total Proved |

|

|

Probable Reserves |

|

|

Possible Reserves |

|

|||||

|

|

Reserves (Mboe) |

|

|

Reserves (Mboe) |

|

|

Reserves (Mboe) |

|

|

(Mboe) |

|

|

(Mboe) |

|

|||||

|

Turkey |

|

5,353 |

|

|

|

8,246 |

|

|

|

13,599 |

|

|

|

12,069 |

|

|

|

20,393 |

|

|

Albania |

|

47 |

|

|

|

240 |

|

|

|

287 |

|

|

|

788 |

|

|

|

1,314 |

|

|

TBNG |

|

643 |

|

|

|

867 |

|

|

|

1,510 |

|

|

|

2,776 |

|

|

|

2,943 |

|

5

The following summary excludes TBNG:

As of December 31, 2016, we held interests in 11 onshore and offshore exploration licenses and 25 onshore production leases covering a total of approximately 507,000 gross acres (395,000 net acres) in Turkey. As of December 31, 2016, we had total net proved reserves of 12,730 Mbbl of oil and 5,212 Mmcf of natural gas, net probable reserves of 11,519 Mbbl of oil and 3,300 Mmcf of natural gas and net possible reserves of 11,579 Mbbl of oil and 52,881 Mmcf of natural gas in Turkey. During 2016, our average wellhead production was approximately 4,411 net Boepd of oil and natural gas in Turkey. See below for further discussion of our current and planned 2017 operations. The following summarizes our core producing properties in Turkey:

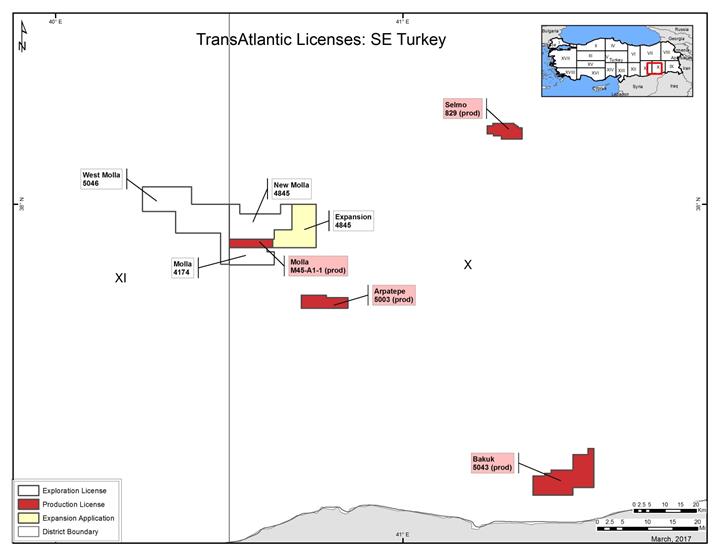

Southeastern Turkey. During 2016, substantially all of our oil production was concentrated in Southeastern Turkey, primarily in the Arpatepe, Bahar, Goksu and Selmo oil fields. These fields are located southwest of the Turkish portion of the North Arabian Basin. The North Arabian Basin includes prolific oil trends that extend from Iran and Iraq into Turkey.

We hold a 100% working interest in the Selmo production lease, which expires in June 2025. The Selmo oil field is the second largest oil field in Turkey in terms of historical cumulative production and is responsible for a large portion of our current crude oil production. We expanded our waterflood program and executed several low-cost production optimizations in the Selmo field in 2016. We believe secondary recovery will continue to increase production recovery from the field. For 2016, our net wellhead production of crude oil from the Selmo field was 735,562 Bbls at an average rate of approximately 2,010 Bbl/d. Turkiye Petrolleri Anonim Ortakligi (“TPAO”), a Turkish government-owned oil and natural gas company, and Türkiye Petrol Rafinerileri A.Ş. (“TUPRAS”), a privately-owned oil refinery in Turkey, purchase all of our crude oil production from the Selmo oil field, which is transported by truck to their neighboring facilities. At December 31, 2016, we had 53 gross and net producing wells in the Selmo oil field.

We hold a 100% working interest in each of our two Molla exploration licenses and one Molla production license, which contain the Goksu and Bahar oil fields. In the Molla licenses, we target Bedinan, Dadas, Hazro and Mardin formations, which produce on the licenses. For 2016, our wellhead production of crude oil from the Molla licenses was 584,047 Bbls at an average rate of approximately 1,596 Bbl/d. At December 31, 2016, we had eight gross and net producing wells on the Molla licenses.

We hold a 50% working interest in our Arpatepe production lease. For 2016, our wellhead production of crude oil from the Arpatepe field was 54,036 Bbls at an average rate of approximately 148 Bbl/d. At December 31, 2016, we had six gross (three net) producing wells on the Arpatepe production lease. We have operated the Arpatepe production lease since December 2015.

We hold a 50% working interest in the Bakuk production license. For 2016, our production was shut in.

Northwestern Turkey. Substantially all of our natural gas production is concentrated in the Thrace Basin, which is one of Turkey’s most productive onshore natural gas regions. It is located in northwestern Turkey near Istanbul. For 2016, our net wellhead production was 449 Mmcf at an average rate of approximately 1.2 Mmcf/d.

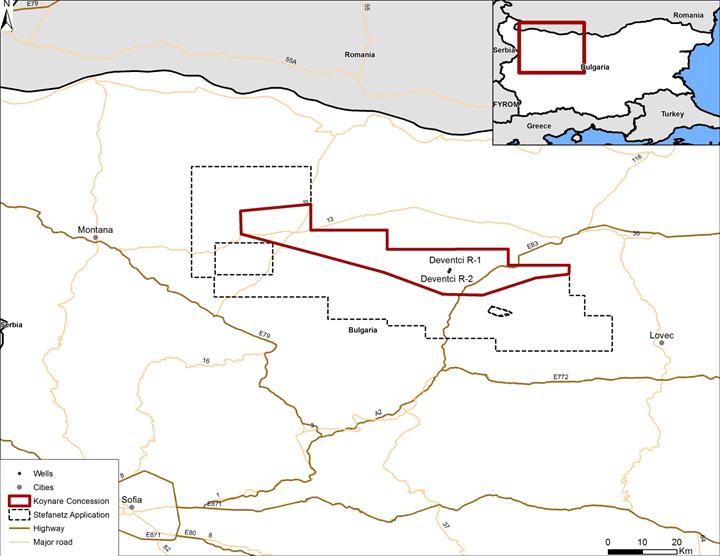

Bulgaria

As of December 31, 2016, we held interests in one production concession covering a total of approximately 165,000 net undeveloped acres in Bulgaria. During 2016, we had no production or reserves in Bulgaria. See below for further discussion of our planned 2017 operations.

Albania

As of December 31, 2016, we owned a 25% interest in one onshore gas field through a joint venture.

Current Operations

As of March 17, 2017, our year-to-date net wellhead production in Turkey was of approximately 3,630 Bbl/d, primarily from Selmo, Arpatepe and Molla, and approximately 5.2 Mmcf/d of natural gas, primarily from the Thrace Basin.

In January 2017, we spud the Bahar-11H well in the Bahar field in Southeastern Turkey. Drilling is ongoing, and we expect this to be completed in the Bahar structure. We expect to start completion operations in the second quarter of 2017. We have also continued construction of an enhanced production facility in the Bahar field and the electrification of the field via natural gas powered generators. We expect this project to be fully completed late in the first quarter of 2017. In the Selmo field in Southeastern Turkey, we have continued with low cost workovers and facility enhancements.

6

We expect our net field capital expenditures for 2017 to range between $25.0 million and $35.0 million. We expect net field capital expenditures during 2017 to include approximately $24.0 million of drilling and completion expense for between five and six gross wells, between $3.0 million and $4.5 million for 3D seismic, and $1.0 million in infrastructure improvements and other capital investments in Southeast Turkey. Most of the remaining 2017 expenditures are expected to be invested in our Selmo, Bahar and Molla areas of Southeast Turkey and the Koynare license in Bulgaria. We expect cash on hand and cash flow from operations will be sufficient to fund our 2017 net field capital expenditures. If not, we will either curtail our discretionary capital expenditures or seek other funding sources. Our projected 2017 capital expenditure budget is subject to change.

Principal Markets

In accordance with the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 280, Segment Reporting (“ASC 280”), we had two reportable geographic segments during 2016: Turkey and Bulgaria. For financial information about our operating segments and geographic areas, refer to “Note 12—Segment information” to our consolidated financial statements.

Customers

Oil. During 2016, 93.3% of our oil production, which is U.S. Dollar indexed, was concentrated in the Selmo and Bahar oil fields in Turkey. TUPRAS purchases the majority of our oil production. During 2016, we sold $52.2 million of oil to TUPRAS, representing approximately 76.1% of our total revenues. We sell all of our Southeastern Turkey oil to TUPRAS pursuant to a domestic crude oil purchase and sale agreement. Under the purchase and sale agreement, TUPRAS purchases oil produced by us and delivered to our Boru Hatlari ile Petrol Tasima A.S. (“BOTAŞ”) Batman tanks and to the BOTAŞ Dörtyol plant. The price of the oil delivered pursuant to the purchase and sale agreement is determined under the Petroleum Market Law No. 5015 under the laws of the Republic of Turkey. The purchase and sale agreement automatically renews for successive one-year terms unless earlier terminated in writing by either party. All payments for our oil production made by TUPRAS for the past eight years have been in full and on time. No other purchasers of our oil accounted for more than 10% of our total revenues.

Natural Gas. During 2016, no purchasers of our natural gas production, which is indexed on the New Turkish Lira (“TRY”), accounted for 10% or more of our total revenues.

Competition

We operate in the highly competitive areas of oil and natural gas exploration, development, production and acquisition with a number of other companies, including U.S.-based and international companies doing business in each of the countries in which we operate. We face competition from both major and other independent oil and natural gas companies in each of the following areas seeking oil and natural gas exploration licenses and production licenses and leases and acquiring desirable producing properties or new leases for future exploration.

Many of our competitors have substantially greater financial, managerial, technological and other resources than we do. To the extent competitors are able to pay more for properties than we are paying, we will be at a competitive disadvantage. Further, many of our competitors enjoy technological advantages over us and may be able to implement new technologies more rapidly than we can. Our ability to explore for and produce oil and natural gas prospects and to acquire additional properties in the future will depend upon our ability to successfully conduct operations, implement advanced technologies, evaluate and select suitable properties and consummate transactions in this highly competitive environment.

Fracture Stimulation Program

Oil and natural gas may be recovered from our properties through the use of fracture stimulation combined with modern drilling and completion techniques. Fracture stimulation involves the injection of water, sand and chemicals under pressure into formations to fracture the surrounding rock and stimulate production. We have successfully utilized fracture stimulation in our Thrace Basin, Molla and Selmo licenses and production leases.

7

For unconventional reservoirs, including the Mezardere formation in the Thrace Basin, a typical fracture stimulation consists of injecting between 20,000 and 100,000 gallons of fluid that contain between 10,000 and 150,000 pounds of sand per stage. Fluids vary depending on formation and treatment objective but, in general, are either slickwater (fresh water with salt and friction reducer) or a gelled fluid containing organic polymers with a 4% potassium chloride solution and required breakers. Fracture stimulations in Molla are conducted in a low permeability reservoir. These stimulations generally consist of injecting between 20,000 and 100,000 gallons of fluid that contain between 10,000 and 100,000 pounds of sand per stage. Fluids are generally a mixture of slickwater and gells, which is typical in stimulation. The size of fracture stimulation treatments is dependent on net pay thickness and the proximity of the hydrocarbon zones of interest to water bearing zones.

Although the cost of each well will vary, on average approximately 15% to 30% of the total cost of completing a well at Selmo is associated with stimulation activities. We account for these costs as typical drilling and completion costs and include them in our capital expenditure budget.

We diligently review best practices and industry standards in connection with fracture stimulation activities and strive to comply with all regulatory requirements in the protection of potable water sources. Protective practices include, but are not limited to, setting multiple strings of protection pipe across potable water sources, cementing surface casing from setting depth to surface and second string from setting depth up into the surface casing and, in some cases, to surface, continuously monitoring the fracture stimulation process in real time and disposing of all non-commercially produced fluids in certified disposal wells at depths below the potable water sources or at a certified water treatment plant. In Southeast Turkey, the base of potable water is generally 3,000 feet to 8,000 feet above the hydrocarbon zones. There have not been any incidents, citations or suits involving environmental concerns related to our fracture stimulation operations on our properties.

In the Thrace Basin, Selmo and Molla, we have access to water resources which we believe will be adequate to execute any stimulation activities that we may perform in the future. We also employ procedures for environmentally friendly disposal of fluids recovered from fracture stimulation, including recycling approximately 50% of these fluids.

For more information on the risks of fracture stimulation, please read “Item 1A. Risk Factors—Risks Related to the Oil and Natural Gas Industry—Our oil and natural gas operations are subject to extensive and complex laws and government regulation in the jurisdictions in which we operate and compliance with existing and future laws may increase our costs or impair our operations” and “Item 1A. Risk Factors—Risks Related to the Oil and Natural Gas Industry—Legislative and regulatory initiatives and increased public scrutiny relating to fracture stimulation activities could result in increased costs and additional operating restrictions or delays.”

Governmental Regulations

Government Regulations. Our current or future operations, including exploration and development activities on our properties, require permits from various governmental authorities, and such operations are and will be governed by laws and regulations concerning exploration, development, production, exports, taxes, labor laws and standards, occupational health, waste disposal, toxic substances, land use, environmental protection and other matters. Compliance with these requirements may prove to be difficult and expensive. Due to our international operations, we are subject to the following issues and uncertainties that can affect our operations adversely:

|

|

• |

the risk of expropriation, nationalization, war, revolution, political instability, border disputes, renegotiation or modification of existing contracts, and import, export and transportation regulations and tariffs; |

|

|

• |

laws of foreign governments affecting our ability to fracture stimulate oil or natural gas wells, such as the legislation enacted in Bulgaria in January 2012; |

|

|

• |

the risk of not being able to procure residency and work permits for our expatriate personnel; |

|

|

• |

taxation policies, including royalty and tax increases and retroactive tax claims; |

|

|

• |

exchange controls, currency fluctuations and other uncertainties arising out of foreign government sovereignty over international operations; |

|

|

• |

laws and policies of the United States affecting foreign trade, taxation and investment, including anti-bribery and anti-corruption laws; |

|

|

• |

the possibility of being subjected to the exclusive jurisdiction of foreign courts in connection with legal disputes and the possible inability to subject foreign persons to the jurisdiction of courts in the United States; and |

|

|

• |

the possibility of restrictions on repatriation of earnings or capital from foreign countries. |

8

Permits and Licenses. In order to carry out exploration and development of oil and natural gas interests or to place these into commercial production, we may require certain licenses and permits from various governmental authorities. There can be no guarantee that we will be able to obtain all necessary licenses and permits that may be required. In addition, such licenses and permits are subject to change and there can be no assurances that any application to renew any existing licenses or permits will be approved.

Repatriation of Earnings. Currently, there are no prohibitions on the repatriation of earnings or capital to foreign entities from Turkey, Albania or Bulgaria. However, there can be no assurance that any such prohibitions on repatriation of earnings or capital from the aforementioned countries or any other country where we may invest will not be imposed in the future. We may be liable for the payment of taxes upon repatriation of certain earnings from the aforementioned countries.

Environmental. The oil and natural gas industry is subject to extensive and varying environmental regulations in each of the jurisdictions in which we operate. Environmental regulations establish standards respecting health, safety and environmental matters and place restrictions and prohibitions on emissions of various substances produced concurrently with oil and natural gas. In most instances, the regulatory requirements relate to the handling and disposal of drilling and production waste products and waste created by water and air pollution control procedures. These regulations can have an impact on the selection of drilling locations and facilities, and potentially result in increased capital expenditures. In addition, environmental legislation may require those wells and production facilities to be abandoned and sites reclaimed to the satisfaction of local authorities. Such regulation has increased the cost of planning, designing, drilling, operating and, in some instances, abandoning wells. We are committed to complying with environmental and operational legislation wherever we operate.

Such laws and regulations not only expose us to liability for our own negligence, but may also expose us to liability for the conduct of others or for our actions that were in compliance with all applicable laws at the time those actions were taken. We may incur significant costs as a result of environmental accidents, such as oil spills, natural gas leaks, ruptures, or discharges of hazardous materials into the environment, including clean-up costs and fines or penalties. Additionally, we may incur significant costs in order to comply with environmental laws and regulations and may be forced to pay fines or penalties if we do not comply.

There has been a surge in interest among the media, government regulators and private citizens concerning the possible negative environmental and geological effects of fracture stimulation. Some have alleged that fracture stimulation results in the contamination of aquifers and may even contribute to seismic activity. In January 2012, the government of Bulgaria enacted legislation that banned the fracture stimulation of oil and natural gas wells in the Republic of Bulgaria and imposed large monetary penalties on companies that violate that ban. There is a risk that Turkey could at some point impose similar legislation or regulations. Such legislation or regulations could severely impact our ability to drill and complete wells, and could increase the cost of planning, designing, drilling, completing and operating wells. We are committed to complying with legislation and regulations involving fracture stimulation wherever we operate.

Insurance

We currently carry general liability insurance and excess liability insurance, including pollution insurance, with a combined annual limit of $22.0 million per occurrence and $24.0 million in the aggregate. These insurance policies contain maximum policy limits and are subject to customary exclusions and limitations. Our general liability insurance covers us and our subsidiaries for third-party claims and liabilities arising out of lease operations and related activities. The excess liability insurance is in addition to, and is triggered if, the general liability insurance per occurrence limit is reached. We also maintain control of well insurance. Our control of well insurance has a per occurrence and combined single limit of $15.0 million and is subject to deductibles ranging from $100,000 to $150,000 per occurrence. In addition, we carry a political risk policy, which covers our scheduled production facilities in the event of an act of terrorism with an annual limit of $16.8 million. This policy also contains business interruption coverage, with an annual limit of $29.1 million, if one or more of the production facilities lose production due to a political risk event. We will continue to monitor our insurance coverage and will maintain appropriate levels of insurance to satisfy applicable regulations, as well as maintain levels of insurance appropriate for prudent operations within the industry in which we operate.

We require our third-party service providers to sign master service agreements with us pursuant to which they agree to indemnify us for the personal injury and death of the service provider’s employees as well as subcontractors that are hired by the service provider. Similarly, we generally agree to indemnify our third-party service providers against similar claims regarding our employees and our other contractors.

We also require our third-party service providers that perform fracture stimulation operations for us to sign master service agreements containing the indemnification provisions noted above. We do not currently have any insurance policies in effect that are intended to provide coverage for losses solely related to fracture stimulation operations. We believe that our general liability, excess liability and pollution insurance policies would cover third-party claims related to fracture stimulation operations and associated legal expenses, in accordance with, and subject to, the terms of such policies. However, these policies may not cover fines, penalties or costs and expenses related to government-mandated environmental clean-up responsibilities.

9

As a Bermuda exempted company and under current Bermuda law, we are not subject to tax on profits, income or dividends, nor is there any capital gains tax applicable to us in Bermuda. Profits can be accumulated, and it is not obligatory for us to pay dividends.

Furthermore, we have received an assurance from the Minister of Finance of Bermuda under the Exempted Undertakings Tax Protection Act 1966, as amended, that in the event that Bermuda enacts any legislation imposing tax computed on profits, income, any capital asset, gain or appreciation, we and any of our operations or our shares, debentures or other obligations shall be exempt from the imposition of such tax until March 31, 2035, provided that such exemption shall not prevent the application of any tax payable in accordance with the provisions of the Land Tax Act, 1967 or otherwise payable in relation to land in Bermuda leased to us.

We are required to pay an annual government fee (the “AGF”), which is determined on a sliding scale by reference to our authorized share capital and share premium account, with a minimum fee of $1,995 Bermuda Dollars and a maximum fee of $31,120 Bermuda Dollars. The Bermuda Dollar is treated at par with the U.S. Dollar. The AGF is payable each year on or before the end of January and is based on the authorized share capital and share premium account on August 31 of the preceding year.

In Bermuda, stamp duty is not chargeable in respect of the incorporation, registration, licensing of an exempted company or, subject to certain minor exceptions, on their transactions.

Employees

As of December 31, 2016, we employed 169 people in Turkey, including 62 with TBNG, 28 people in Addison, Texas and 6 people in Bulgaria. Approximately 40 of our employees at one of our subsidiaries operating in Turkey were represented by collective bargaining agreements with the Petroleum, Chemical and Rubber Workers Union of Turkey (“PETROL-IS”). Approximately 40 of our employees at another of our subsidiaries operating in Turkey were represented by a separate collective bargaining agreement with PETROL-IS.

Following the sale of TBNG on February 24, 2017, we employed 111 people in Turkey and approximately 40 at one of our subsidiaries operating in Turkey were represented by collective bargaining agreements with PETROL-IS. We consider our employee relations to be satisfactory.

Formation

We were incorporated under the laws of British Columbia, Canada on October 1, 1985 under the name Profco Resources Ltd. and continued to the jurisdiction of Alberta, Canada under the Business Corporations Act (Alberta) on June 10, 1997. Effective December 2, 1998, we changed our name to TransAtlantic Petroleum Corp. Effective October 1, 2009, we continued to the jurisdiction of Bermuda under the Bermuda Companies Act 1981 under the name TransAtlantic Petroleum Ltd.

Available Information

Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are made available free of charge on our website at www.transatlanticpetroleum.com as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC.

Our common shares are listed on the NYSE MKT LLC (“NYSE MKT”). Section 110 of the NYSE MKT company guide permits the NYSE MKT to consider the laws, customs and practices of foreign issuers in relaxing certain NYSE MKT listing criteria, and to grant exemptions from NYSE MKT listing criteria based on these considerations. A description of the significant ways in which our governance practices differ from those followed by US domestic companies pursuant to NYSE MKT standards is available on our website, www.transatlanticpetroleum.com, under Corporate Governance page, which is accessible under the About heading on the home page.

10

Executive Officers of the Registrant

The following table and text sets forth certain information with respect to our executive officers as of March 1, 2017:

|

Name |

|

Age |

|

Positions |

|

N. Malone Mitchell 3rd |

|

55 |

|

Chairman and Chief Executive Officer |

|

Todd C. Dutton |

|

63 |

|

President |

|

Christopher R. Elmore |

|

38 |

|

Interim Principal Accounting and Financial Officer |

|

Chad D. Burkhardt |

|

43 |

|

Vice President, General Counsel and Corporate Secretary |

|

Harold “Lee” Muncy |

|

64 |

|

Vice President of Geosciences |

N. Malone Mitchell 3rd has served as our chief executive officer since May 2011, as a director since April 2008 and as our chairman since May 2008. Since 2005, Mr. Mitchell has served as the president of Riata Corporate Group, LLC and Longfellow Energy, LLC, a Dallas-based private oil and natural gas exploration and production company. From June to December 2006, Mr. Mitchell served as president and chief operating officer of SandRidge Energy, Inc. (formerly Riata Energy, Inc.), an independent oil and natural gas company concentrating in exploration, development and production activities. Until he sold his controlling interest in Riata Energy, Inc. in June 2006, Mr. Mitchell also served as president, chief executive officer and chairman of Riata Energy, Inc., which Mr. Mitchell founded in 1985 and built into one of the largest privately held energy companies in the United States.

Todd C. Dutton has served as our president since May 2014. Mr. Dutton has served as president of Longfellow Energy, LP ("Longfellow"), a Dallas, Texas-based independent oil and natural gas exploration and production company owned by the Company's chairman and chief executive officer, N. Malone Mitchell 3rd and his family, since January 2007, where his primary responsibility is to originate and develop oil and natural gas projects. He brings 39 years of experience in the oil and natural gas industry, focusing on exploration, acquisitions and property evaluation. He has served in various supervisory and management roles at Texas Pacific Oil Company, Coquina Oil Corporation, BEREXCO INC. and Riata Energy, Inc. Mr. Dutton earned a B.B.A. in Petroleum Land Management from the University of Oklahoma.

Christopher R. Elmore has served as interim principal accounting and financial officer since September 2016, and as vice president accounting and corporate controller since May 2013. Mr. Elmore previously served as an audit senior manager with KPMG LLP, where he worked for twelve years in positions of increasing responsibility in the Dallas, Texas audit practice and KPMG LLP’s U.S. accounting and reporting groups in Zurich and London. Mr. Elmore holds a B.S. degree in Accounting and Finance from Florida State University and is a certified public accountant.

Chad D. Burkhardt has served as the Company’s vice president, general counsel and corporate secretary since August 2015. From 2008 until August 2015, Mr. Burkhardt served as partner in the corporate department of Baker Botts L.L.P., where he advised clients on various corporate transactions including corporate securities offerings, mergers and acquisitions and various public company filings. Mr. Burkhardt brings significant cross-border and international transaction experience from a variety of industries ranging from oil and gas exploration, midstream, and oil field services to high-tech and start-up transactions. Mr. Burkhardt is a graduate of Texas A&M University and Duke University School of Law.

Harold “Lee” Muncy has served as the Company’s vice president of geosciences since June 2014. Mr. Muncy previously served as vice president, exploration for the Bass Companies, a group of Fort Worth, Texas-based independent oil and natural gas exploration and production companies, where he worked from 2000 to 2012. He brings more than 35 years of geological experience in the oil and natural gas industry, where he has focused on exploration, exploitation and worldwide transactions. He began his career as a geologist with Mobil Oil Corporation and served as exploration manager for Fina Oil & Chemical Company and vice president of exploration and land for TransTexas Gas Corp. Mr. Muncy earned a B.S. and an M.S. in Geology & Mineralogy from The Ohio State University.

11

Risks Related to Our Business

Virtually all of our operations are conducted in Turkey and Bulgaria, and we are subject to political, economic and other risks and uncertainties in these countries.

Virtually all of our international operations are performed in the emerging markets of Turkey and Bulgaria, which may expose us to greater risks than those associated with U.S. or Canadian markets. Due to our foreign operations, we are subject to the following issues and uncertainties that can adversely affect our operations:

|

|

• |

the risk of, and disruptions due to, expropriation, nationalization, war, terrorism, revolution, election outcomes, economic instability, political instability, or border disputes; |

|

|

• |

the uncertainty of local contractual terms, renegotiation or modification of existing contracts and enforcement of contractual terms in disputes before local courts; |

|

|

• |

the risk of import, export and transportation regulations and tariffs, including boycotts and embargoes; |

|

|

• |

the risk of not being able to procure residency and work permits for our expatriate personnel; |

|

|

• |

the requirements or regulations imposed by local governments upon local suppliers or subcontractors, or being imposed in an unexpected and rapid manner; |

|

|

• |

taxation and revenue policies, including royalty and tax increases, retroactive tax claims and the imposition of unexpected taxes or other payments on revenues; |

|

|

• |

exchange controls, currency fluctuations and other uncertainties arising out of foreign government sovereignty over foreign operations; |

|

|

• |

laws and policies of the United States, including the U.S. Foreign Corrupt Practices Act, (“FCPA”) and of the other countries in which we operate affecting foreign trade, taxation and investment, including anti-bribery and anti-corruption laws; |

|

|

• |

our internal control policies may not protect us from reckless and criminal acts committed by our employees or agents, including violations or alleged violations of the FCPA; |

|

|

• |

the possibility of being subjected to the exclusive jurisdiction of foreign courts in connection with legal disputes and the possible inability to subject foreign persons to the jurisdiction of courts in the United States; and |

|

|

• |

the possibility of restrictions on repatriation of earnings or capital from foreign countries. |

To manage these risks, we sometimes form joint ventures and/or strategic partnerships with local private and/or governmental entities. Local partners provide us with local market knowledge. However, there can be no assurance that changes in conditions or regulations in the future will not affect our profitability or ability to operate in such markets.

Acts of violence, terrorist attacks or civil unrest in Turkey and nearby countries could adversely affect our business.

During 2016, we derived substantially all of our revenue from our continuing operations in Turkey and substantially all of our oil production was derived from Southeastern Turkey. Historically, the southeastern area of Turkey and nearby countries such as Iran, Iraq and Syria have occasionally experienced political, social, security and economic problems, terrorist attacks, insurgencies, war and civil unrest. Since December 2010, political instability has increased in a number of countries in the Middle East and North Africa. As a result of the civil war in Syria, hundreds of thousands of Syrian refugees have fled to Turkey and more can be expected to cross the border if the conflict continues. Moreover, tensions continue between Turkey and Syria. More recently, Turkey has experienced terrorist attacks in Istanbul, and in July 2016, there was a failed attempt to overthrow the government of President Recep Tayyip Erdoğan.

The current conflict with the terrorist group Islamic State in Iraq and Syria (“ISIS”), the tension in and involving the Kurdish regions of northern Iraq, which are contiguous to the region where our Southeast Turkey licenses are located, and the aftermath the attempted coup d’etat may have political, social or security implications in Turkey or otherwise have a negative impact on the Turkish economy.

Turkey has also experienced problems with domestic terrorist and ethnic separatist groups. For example, Turkey has been in conflict for many years with the People’s Congress of Kurdistan (formerly known as the PKK), an organization that is listed as a terrorist organization by states and organizations, including Turkey, the European Union and the United States.

12

The potential impact on our business from such events, conditions and conflicts in these countries is uncertain. We may be unable to access the locations where we conduct operations or transport oil to our offtakers in a reliable manner. In those locations where we have employees or operations, we may incur substantial costs to maintain the safety of our personnel and our operations.

We have a history of losses and may not achieve consistent profitability in the future.

We have incurred substantial losses in prior years. During 2016, we generated a net loss from continuing operations of $22.4 million. We will need to generate and sustain increased revenue levels in future periods in order to become consistently profitable, and even if we do, we may not be able to maintain or increase our level of profitability. We may incur losses in the future for a number of reasons, including the risks described herein, unforeseen expenses, difficulties, complications and delays, and other unknown risks.

We depend on the services of our chairman and chief executive officer.

We depend on the performance of Mr. Mitchell, our chairman and chief executive officer. The loss of Mr. Mitchell could negatively impact our ability to execute our strategy. We do not maintain a key person life insurance policy on Mr. Mitchell.

We could lose permits or licenses on certain of our properties in Turkey unless the permits or licenses are extended or we commence production and convert the permits or licenses to production leases or concessions.

At December 31, 2016, of our total net undeveloped acreage, 22.2% and 12.8% will expire during 2017 and 2018, respectively, unless we are able to extend the permits or licenses covering this acreage or commence production on this acreage and convert the permits or licenses into production leases or concessions. If our permits or licenses expire, we will lose our right to explore and develop the related properties. Our drilling plans for these areas are subject to change based upon various factors, including factors that are beyond our control. Such factors include drilling results, oil and natural gas prices, the availability and cost of capital, drilling and production costs, availability of drilling services and equipment, gathering system and pipeline transportation constraints, and regulatory approvals. In addition, if our liquidity continues to be constrained and we are not able to access additional capital, we may be unable to fund the drilling of some or all of our obligation wells, and we could lose some or all of our licenses.

The majority of our oil is sold to one customer, and the loss of this customer could have a material adverse impact on our results of operations.

TUPRAS purchases the majority of our oil production from Turkey, representing 76.1% of our total revenues in 2016. If TUPRAS reduces its oil purchases or fails to purchase our oil production, or there is a material non-payment, our results of operations could be materially and adversely affected. TUPRAS may be subject to its own operating risks that could increase the risk that it could default on its obligations to us. Under Turkish law, TUPRAS is obligated to purchase all of our oil production in Turkey, and we are prohibited from selling any of our oil produced in Turkey to any other customer. Pursuant to a purchase and sale agreement with TUPRAS, the price of oil delivered to TUPRAS is determined under the Petroleum Market Law No. 5015 under the laws of the Republic of Turkey. Changes to Turkish law could adversely affect our business and results of operations.

A significant failure of our computer systems may increase our operating costs or otherwise adversely affect our business.

We depend upon our computer systems to perform accounting and administrative functions as well as manage other aspects of our operations. We maintain normal backup polices with respect to our computer systems and networks. Nevertheless, our computer systems and networks are subject to risks that may cause interruptions in service, including, but not limited to, security breaches, physical damage, power loss, software defects, hacking attempts, computer viruses and malware, lost data and programming and/or human errors. Significant interruptions in service, security breaches or lost data may have a material adverse effect on our business, financial condition or results of operations.

Our indebtedness could adversely affect our financial condition and prevent us from fulfilling our debt service and other obligations.

Our indebtedness could have significant effects on our business. For example, it could:

|

|

• |

make it more difficult for us to satisfy our financial obligations, including with respect to our indebtedness, and any failure to comply with the obligations of any of our debt agreements, including financial and other restrictive covenants, could result in an event of default under the agreements governing our indebtedness; |

|

|

• |

increase our vulnerability to general adverse economic, industry and competitive conditions, especially declines in oil and natural gas prices; |

13

|

|

• |

limit our financial flexibility |

Each of these factors may have a material and adverse effect on our financial condition and viability. Our ability to make payments with respect to our indebtedness and to satisfy any other debt obligations will depend on commodity prices and our future operating performance, which will be affected by prevailing economic conditions and financial, business and other factors affecting our company and industry, many of which are beyond our control.

We could experience labor disputes that could disrupt our business in the future.

As of February 27, 2017, approximately 40 of our employees at one of our subsidiaries operating in Turkey were represented by collective bargaining agreements with PETROL-IS. Potential work disruptions from labor disputes with these employees could disrupt our business and adversely affect our financial condition and results of operations.

We could be assessed for Canadian federal tax as a result of our 2009 continuance under the Bermuda Companies Act 1981.

For Canadian tax purposes, we were deemed, immediately before the completion of our 2009 continuance under the Bermuda Companies Act 1981, to have disposed of each property owned by us for proceeds equal to the fair market value of that property, and will be subject to tax on any resulting net income. In addition, we were required to pay a special “branch tax” equal to 25% of any excess of the fair market value of our property over the “paid-up capital” (as defined in the Income Tax Act (Canada)) of our outstanding common shares and our liabilities. However, management, together with its professional advisors, has determined that the paid-up capital of our common shares and our liabilities exceeded the fair market value of our property, resulting in no “branch tax” being payable. The Canada Revenue Agency (“CRA”) may not accept our determination of the fair market value of our property. In the event that CRA’s determination of fair market value is significantly higher than our valuation and such determination is final, we may be subject to material amounts of tax resulting from the deemed disposition.

Risks Related to the Oil and Natural Gas Industry

Oil and natural gas prices are volatile. Continued or further declines in prices could adversely affect our financial condition, results of operations, cash flows, access to capital, and ability to grow.

Oil and natural gas prices historically have been volatile and may continue to be volatile in the future. Therefore, even if oil prices recover for a period of time, volatility will remain, and prices could move downward or upward on a rapid or repeated basis. The decline since late 2014 in oil and natural gas prices has reduced our revenue, cash flows and access to capital and, unless commodity prices improve, this trend will likely continue or worsen. Lower oil and natural gas prices also potentially reduce the amount of oil and natural gas that we can economically produce resulting in a reduction in the proved oil and natural gas reserves we could recognize. Thus, significant and sustained commodity price reductions could materially and adversely affect our financial condition and results of operations which could impact our ability to maintain or increase our current levels of borrowing, our ability to repay current or future indebtedness, our ability to refinance our current indebtedness or obtain additional capital on attractive terms.

The markets for crude oil and natural gas have historically been, and are likely to continue to be, volatile and subject to wide fluctuations in response to numerous factors, including the following:

|

|

• |

worldwide and domestic supplies of oil and gas, and the productive capacity of the oil and gas industry as a whole; |

|

|

• |

changes in the supply and the level of consumer demand for such fuels; |

|

|

• |

overall global and domestic economic conditions; |

|

|

• |

political conditions in oil, natural gas, and other fuel-producing and fuel-consuming areas; |

|

|

• |

the availability and capacity of gathering, transportation, processing, and/or refining facilities in regional or localized areas that may affect the realized price for crude oil or natural gas; |

|

|

• |

the price and level of imports of crude oil, refined petroleum products, and liquefied natural gas; |

|

|

• |

weather conditions, including effects of weather conditions on prices and supplies in worldwide energy markets; |

|

|

• |

technological advances affecting energy consumption and conservation; |

|

|

• |

the ability of the members of the Organization of Petroleum Exporting Countries and other exporting countries to agree to and maintain crude oil prices and production controls; |

14

|

|

• |

the competitive position of each such fuel as a source of energy as compared to other energy sources; |

|

|

• |

strengthening and weakening of the U.S. Dollar relative to other currencies; and |

|

|

• |

the effect of governmental regulations and taxes on the production, transportation, and sale of oil, natural gas, and other fuels. |

These factors and the volatility of the energy markets make it extremely difficult to predict future oil and gas price movements with any certainty, but in general we expect oil and gas prices to continue to fluctuate significantly.

Reserves estimates depend on many assumptions that may turn out to be inaccurate.

Any material inaccuracies in our reserves estimates or underlying assumptions could materially affect the quantities and present values of our reserves. The process of estimating oil and natural gas reserves is complex. It requires interpretations of available technical data and various assumptions, including assumptions relating to economic factors. Any significant inaccuracies in these interpretations or assumptions could materially affect the estimated quantities and present value of reserves that we may report. In order to prepare these estimates, we must project production rates and timing of development expenditures. We must also analyze available geological, geophysical, production and engineering data, and the extent, quality and reliability of this data can vary. The process also requires economic assumptions relating to matters such as oil and natural gas prices, drilling and operating expenses, capital expenditures, taxes and availability of funds.

Actual future production, oil and natural gas prices, revenues, taxes, development expenditures, operating expenses and quantities of recoverable oil and natural gas reserves most likely will vary from our estimates. Any significant variance could materially affect the estimated quantities and pre-tax net present value of reserves that we may report. In addition, we may adjust estimates of proved, probable and possible reserves to reflect production history, results of exploration and development, prevailing oil and natural gas prices and other factors, many of which are beyond our control. Moreover, there can be no assurance that our reserves will ultimately be produced or that our proved undeveloped, probable and possible reserves will be developed within the periods anticipated. Any significant variance in the assumptions could materially affect the estimated quantity and value of our reserves.

Investors should not assume that the pre-tax net present value of our proved, probable and possible reserves is the current market value of our estimated oil and natural gas reserves. We base the pre-tax net present value of future net cash flows from our proved, probable and possible reserves on prices and costs on the date of the estimate. Actual future prices, costs, and the volume of produced reserves may differ materially from those used in the pre-tax net present value estimate.

Future commodity price declines may result in write-downs of our asset carrying values.

We follow the successful efforts method of accounting for our oil and gas operations. Under this method, all property acquisition costs and costs of exploratory and development wells are capitalized when incurred, pending determination of whether proved reserves have been discovered. If proved reserves are not discovered with an exploratory well, the costs of drilling the well are expensed.