Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

|

For the fiscal year ended: December 31, 2011

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from __________ to ____________

Commission File Number: 0-12122

Apollo Solar Energy, Inc.

(Exact name of registrant as specified in its charter)

|

(State or other jurisdiction of incorporation or organization)

|

84-0601802

(I.R.S. Employer Identification No.)

|

|

No. 485 Tengfei Third,

Shuangliu Southwest Airport Economic Development Zone,

Shuangliu, Chengdu

People’s Republic of China, 610207

|

|

(Address of principal executive offices)

|

Registrant’s Telephone Number, Including Area Code: +86 (28) 8562-3888

Securities Registered Pursuant to Section 12(b) of the Act: None

Securities Registered Pursuant to Section 12(g) of the Act: Common Stock, $.001 par value.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No £

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Non-accelerated filer o Smaller reporting company ý

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant on June 30, 2011 (the last business day of the registrant’s most recently completed second fiscal quarter), was $20,336,701 based on the closing price of the registrant’s common stock on the OTC Bulletin Board of $1.90 per share.

There were 51,795,961 shares of common stock outstanding as of May 15, 2012.

DOCUMENTS INCORPORATED BY REFERENCE: None.

APOLLO SOLAR ENERGY, INC.

TABLE OF CONTENTS TO ANNUAL REPORT ON FORM 10-K

For the Fiscal Year Ended December 31, 2011

|

ITEM

|

Page

|

||

|

PART I

|

|||

|

Item 1.

|

Business

|

1

|

|

|

Item 1A.

|

Risk Factors

|

13

|

|

|

Item 2.

|

Properties

|

26

|

|

|

Item 3.

|

Legal Proceedings

|

31

|

|

|

Item 4

|

Mine Safety Disclosures

|

31

|

|

|

PART II

|

|||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

31

|

|

|

Item 6.

|

Selected Financial Data

|

32

|

|

|

Item 7.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

33

|

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

38

|

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

38

|

|

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

38

|

|

|

Item 9A.

|

Controls and Procedures

|

38

|

|

|

Item 9B.

|

Other Information

|

40

|

|

|

PART III

|

|||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

40

|

|

|

Item 11.

|

Executive Compensation

|

44

|

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

47

|

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

49

|

|

|

Item 14.

|

Principal Accountant Fees and Services

|

49

|

|

|

PART IV

|

|||

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

51

|

|

|

Signatures

|

52

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The information contained in this Form 10-K, including in the documents incorporated by reference into this Form 10-K, includes some statements that are not purely historical and that are “forward-looking statements.” Such forward-looking statements include, but are not limited to, statements regarding the Company and its management’s expectations, hopes, beliefs, intentions or strategies regarding the future, including its financial condition, and results of operations. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipates,” “believes,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “might,” “plans,” “possible,” “potential,” “predicts,” “projects,” “seeks,” “should,” “will,” “would” and similar expressions, or the negatives of such terms, may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained in this Form 10-K are based on current expectations and beliefs concerning future developments and the potential effects on our Company’s business. There can be no assurance that future developments actually affecting us will be those anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements, including the following:

|

·

|

Vulnerability of our Company’s business to general economic downturns;

|

|

·

|

Fluctuation and unpredictability of costs related to the precious metals and other commodities used to make our products;

|

|

·

|

Changes in the laws of the People’s Republic of China, or the PRC, that affect our operations;

|

|

·

|

Competition from our competitors;

|

|

·

|

Any recurrence of earthquakes in the areas where we operate;

|

|

·

|

Our ability to obtain all necessary government certifications and/or licenses to conduct our business;

|

|

·

|

Development of a public trading market for our securities;

|

|

·

|

The cost of complying with current and future governmental regulations and the impact of any changes in the regulations on our operations;

|

|

·

|

Fluctuation of the foreign currency exchange rate between U.S. Dollars and Renminbi, or RMB, the lawful currency of China; and

|

|

·

|

The other factors referenced in this Form 10-K, including, without limitation, under the sections entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Business.”

|

These risks and uncertainties, along with others, are also described below under Item 1A, “Risk Factors.” Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Unless the context otherwise requires, the terms “we,” the “Company,” “us,” or “Apollo” refers to Apollo Solar Energy, Inc. and our wholly-owned subsidiaries and variable interest entities.

Overview

We are a China-based vertically integrated refiner of tellurium, or Te, and high-purity tellurium-based metals for specific segments of the electronic materials market. Our main expertise is in the production of Te-based compounds used to produce thin-film solar cells, cell modules and solar electronic products. While no reserves under the SEC’s Industry Guide 7 can currently be delineated at our properties, we believe that the tellurium to be used in our products in the future will be primarily sourced from our Dashuigou project located in Sichuan Province, PRC. In addition, we expect to source tellurium from another property in Shimian, Majiagou, PRC, through variable interest entity agreements, or the VIE Agreements, executed in April, 2009, with Sichuan Xinju Mineral Resources Development Corporation and certain of its shareholders holding 51.6619% of its voting stock, which shareholders are our direct or indirect employees. Under the terms of the VIE Agreements, we have been granted the exclusive exploration and mining rights to these two projects in accordance with a license granted by the Chinese government, which extends through January, 2013 for mining activities at our Dashuigou property, through May 2013 for mining activities at our Majiagou property, and through January 2013. for exploration activities at our Dashuigou property, subject to potential renewal thereafter.

Currently, tellurium is produced as a by-product in the process of processing copper and other metals. As a result, costs are high. We believe that the Dashuigou and Majiagou projects are the only two known deposits in the world in which tellurium, one of the rarest metallic elements on earth, is the primary commodity of economic interest. By the end of 2012, we plan to obtain approximately 50% to 60% of the tellurium necessary for our products from the Dashuigou and Majiagou projects and believe this ability to be a significant competitive advantage because the cost of tellurium sourced from our own properties will be substantially lower than that purchased from an outside third party. We will source the remaining 40% to 50% of our tellurium needs from third-party suppliers with whom we have established good business relationships over the past few years. By vertically integrating our processes, we believe we are able to achieve significant operating efficiencies and produce high-quality products that offer cost and quality benefits to our customers. Currently, we are able to procure raw materials from the Dashuigou and Majiagou projects at a significant discount to prevailing market price.

1

Our refining operations are currently based in a 330,000 square foot facility in Chengdu, Sichuan Province, PRC. We expect this facility to eventually have the capacity to produce more than 300 tons of high-purity photovoltaic cell materials and 42 other types of electronic materials. Future expansion of this facility in vacant land leased to the Company will have a capacity to produce up to an additional 350 tons of high-purity photovoltaic cell materials.

We are currently in the exploration stage of operations in accordance with the requirements of SEC Industry Guide 7. However, we believe we are unique in that we expect to both mine and refine our tellurium-based products, with primary refining capabilities as provided by Sichuan Xinju Minteral Resources Development Corporation pursuant to the VIE Agreements, and secondary refining capabilities directly through our Company. Our primary refining capabilities are such that we can treat metal concentrates (containing, for example, as little as 50% of the metals of interest), and extract and refine the metals of interest so that they can be fed to our secondary refining operations, where we attain a higher level of purity. Because we expect to mine the raw material in the future, and perform both refining functions, both directly and through our VIE Arrangement, we consider ourselves a supplier that will in the future have uniquely integrated capabilities. Our end-products are tellurium, cadmium, zinc and related compounds of 99.999% (five nines, or 5N) purity or above. Our products are critical precursors in a number of electronic applications, including the rapidly-expanding thin-film photovoltaic, or PV, market.

Thin film technologies, because of their relatively low usage of raw materials when compared with traditional silicon-based photovoltaic technologies, offer a potential cost advantage in the marketplace. Accordingly, we believe these technologies are beginning to gain an ever increasing foothold in the market.

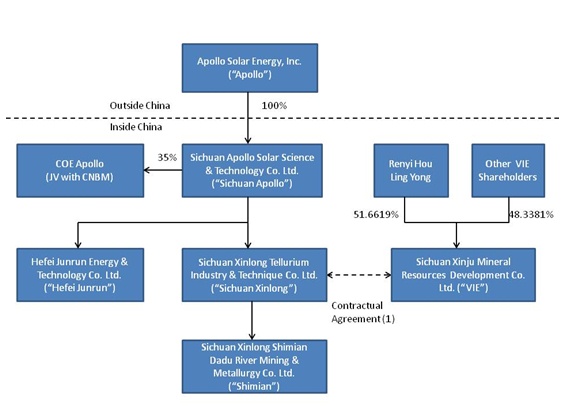

Our Variable Interest Entity Agreements

As illustrated in the diagram below, we entered into various exclusive contractual arrangements on April 10, 2009 with Sichuan Xinju Mineral Resources Development Corporation, or the VIE, and certain of its shareholders who are our direct or indirect employees and who collectively own 51.6619% of the VIE. Among other things, these VIE Agreements granted to our wholly-owned subsidiary a first option to purchase the exploration rights related to the Dashuigou area property and the mining rights related to that certain tellurium and bismuth property in Shimian Majiagou, which rights we collectively referred to as the Exploration Business. Additionally, the VIE and certain of its shareholders who collectively own 51.6619% of the VIE granted to our wholly-owned subsidiary an exclusive right to purchase all of the products produced from the Exploration Business for a specified period of time. As a result, we consolidate the financial results of the VIE related to the Exploration Business pursuant to FASB ASC 810-10, “Consolidation.”

2

(1) Agreements that provide us with effective control over Sichuan Xinju Mineral Resources Development Co. Ltd., or the VIE, include a purchase option agreement, a business operations agreement and an exclusive technical and consulting agreement.

The agreements between the VIE and our other affiliated entities or persons are summarized below:

|

·

|

First Option Exclusive Acquiring Agreement among Sichuan Xinlong Tellurium Industry & Technique Co., Ltd., Sichuan Xinju Mineral Resources Development Co., Ltd., Renyi Hou and Ling Yong, which grants to our wholly-owned subsidiary a first option to purchase the Mining Business at such time as the purchase becomes advisable, permissible and in our best interest.

|

|

·

|

Exclusive Sales Agreement between Sichuan Xinlong Tellurium Industry & Technique Co., Ltd. and Sichuan Xinju Mineral Resources Development Co., Ltd., which grant to our wholly-owned subsidiary the exclusive right to buy all of the output of the Mining Business.

|

|

·

|

Business Operation Agreement among Sichuan Xinlong Tellurium Industry & Technique Co., Ltd., Sichuan Xinju Mineral Resources Development Co., Ltd., Renyi Hou and Ling Yong, which imposes certain restrictions and obligations on the VIE and certain of its shareholders to support the VIE arrangement, including refraining from competing with our business and modifying the business operations of the VIE without the prior consent of our wholly-owned subsidiary.

|

|

·

|

Exclusive Technical and Consulting Agreement between Sichuan Xinlong Tellurium Industry & Technique Co., Ltd. and Sichuan Xinju Mineral Resources Development Co., Ltd., which requires the VIE to provide certain technical and consulting services exclusively to our wholly-owned subsidiary in connection with the Mining Business. Our wholly-owned subsidiary agrees to provide up to $6.0 million in investing funding to the VIE in connection with its operation of the Mining Business, on such terms as the parties shall agree from time to time.

|

3

Renewable Energy Industry

The demand for electricity is steadily increasing as the worldwide economy continues to grow. Global electric power generation is expected to reach 25,000 terawatt hours, or TWh, annually by 2020, according to the Energy Information Administration, or the EIA, of the United States government, up from 17,000 TWh in 2005. According to a study by the European Commission, the market volume of electricity is expected to increase to approximately $75 billion by the end of 2013.

To meet this increasing demand, significant investments are required to ensure that the availability of fossil fuels, which account for approximately 65% of the world’s supply of electricity, is maintained. However, fossil fuels face a number of challenges that limit their availability and result in significant price pressures. The limited availability and rising cost of fossil fuels have stimulated the development of renewable energy technologies and created, in our view, a significant business opportunity.

The challenges facing fossil fuels are creating a growth opportunity for renewable energy. Renewable energy sources for electric power generation include hydroelectric, biomass, geothermal, wind and solar. Among renewable sources of electricity, we believe solar energy has the most potential to meet the world’s growing electricity needs. According to the U.S. Department of Energy, the sun is the only source of renewable energy that has a large enough resource base to meet a significant portion of the world’s electricity needs. A study commissioned in 2002 by the U.S. Department of Energy estimated that, on average, 120,000 trillion Watts, or TW, of solar energy strike the Earth per year, far exceeding the global electricity consumption rate of 14.3TW. At a typical latitude for the United States, a net 10% efficient solar energy “farm” covering 1.6% of the U.S. land area could theoretically meet the country’s entire domestic electricity needs.

Solar electricity is generated using either photovoltaic or solar thermal technology to extract energy from the sun. Photovoltaic, or PV, electricity generating systems directly convert the sun’s energy into electricity, whereas solar thermal systems heat water or other fluids that are then used as sources of energy. PV systems are either grid-connected systems or off-grid systems. Grid-connected systems are connected to the electricity transmission and distribution grid and feed solar electricity into the end-user’s electrical system and/or the grid. Such systems are commonly mounted on the rooftops of buildings, integrated into building facades or installed on the ground using support structures, and range in size from 2-3 kilowatts to multiple MWs. Off-grid PV systems are typically much smaller and are frequently used in remote areas where they may be the only source of electricity for the end-user. PV systems are currently the most widely used method of transforming sunlight into electricity.

4

In an overview of PV market potential, ECN Solar Energy reported in 2008 that the PV sector has grown at a rate of 25% per annum over the preceding two decades and at a rate of 45% per annum over the preceding five years. According to Photon Consulting, a global solar energy research firm, the PV market is expected to grow at approximately this rate for the next several years. The current installed worldwide PV-power generation capacity (that is, the number of installed modules multiplied by their average power rating), is still relatively marginal, representing slightly more than 8 gigawatts in 2006. Although this corresponds to only 0.06% of global electricity consumption, a 2007 report by Photon Consulting suggests that mass substitution by PV modules has begun. In particular, the report predicts that by 2013, PV will represent 12% to 17% of the annual additions of electricity generating capacity and that in selected countries the annual solar capacity additions will exceed those of coal and nuclear energy.

Thin Film Photovoltaic Technologies

Approximately 80% of PV-generated electricity is currently produced using traditional crystalline silicon. This technology requires a significant amount of high-purity silicon. The increase in PV production has resulted in a shortage of this type of silicon, adversely affecting PV growth and costs. Recently, because of over-capacity in silicon wafer, cost of traditional PV has come down significantly. However, thin-film technologies based on either amorphous silicon or Cadmium telluride (CdTe) are rapidly being phased into production because of their potential for further lowering the cost of PV modules. This is largely due to the fact that thin-film-based modules, as their name implies, consume much smaller amounts of the foregoing starting materials, typically only 1% compared to crystalline silicon, and also because they are produced using a continuous manufacturing process which is mass production proven. Additionally, thin film technologies are inherently free from the supply constraints associated with traditional silicon-based photovoltaic technologies, thus offering additional cost advantage in the marketplace. Accordingly, we believe these technologies are beginning to gain a foothold in the market.

Strategy

We seek to become the leading global provider of both high-purity metals and PV products by taking advantage of our high degree of vertical integration, which we believe yields economies of scale and cost savings. We consider ourselves uniquely positioned in China among suppliers of high-purity materials because of our exclusive access to the Dashuigou and Majingou mines.

Our strategy includes the following key elements:

|

·

|

Leverage our cost base . We believe the technical improvements resulting from our research and development efforts have been instrumental in significantly reducing our production costs and increasing our operational efficiency. As we source more tellurium internally, we believe we will be able to achieve significantly higher profit margins than our competitors. We intend to utilize this cost advantage to attract both new customers and larger orders from existing customers.

|

|

··

|

Increase production capacity. The main constraint limiting our sales has been production capacity as customer demand has exceeded the amount of materials we are able to produce. In May 2008, we relocated our operations to a new 330,000 square foot facility in Chengdu, PRC and launched an aggressive expansion project to increase our annual production capacity of high-purity materials to 1,000 tons. Of these 1,000 tons, we plan to increase our capacity to produce tellurium and cadmium telluride. We will continue to closely monitor the progress of this expansion project to avoid risks of over-expansion, while evaluating other available expansion opportunities. We believe expansion of our production capacity is likely to result in greater economies of scale for our operations.

|

5

|

·

|

Penetrate new market segments. Our current key markets are the United States and China, which represented our two largest markets based on revenues in 2011. We are seeking to increase sales in the United States and Japan and to expand into selected countries in Europe, where we believe the PV market is likely to grow significantly in the near term. For example, we entered into 6N sulfur supply contracts with several German companies, including Sulfurcell Solartechnit GmbH, during the last several years. We believe the visibility of our brand name in Germany will help us expand into our new targeted markets in Europe. We also entered into a long-term supply contract with First Solar in November 2010. We plan to seek to strengthen our relationships with existing customers. We also plan to hire additional sales agents to be based in Europe and the Middle East to provide services to our customers in those markets.

|

|

·

|

Expand market share in China. Although the PV market in China is currently smaller than other major PV markets, we believe that the adoption of a series of new laws, regulations and initiatives by the PRC government, including the PRC’s Renewable Energy Law, the Supervision Regulations on the Purchase of All Renewable Energy by Power Grid Enterprises, the National Medium- and Long-Term Programs for Renewable Energy and the recent amendments to the PRC Energy-Saving Law demonstrates the PRC government’s commitment to develop renewable energy sources and may lead to rapid growth in the PV market in China. As a leading supplier of high-purity materials in China, we believe we are well-positioned to capitalize on this growth and capture a significant portion of China’s thin-film PV market.

|

Products

We produce and sell a range of metals and compounds to address the requirements of our customers in the various electronic materials market segments. Our range of products and their typical end-uses are as follows:

|

·

|

Ultra-High Purity Tellurium. These include tellurium in purity levels of 99.999% (5N) to 99.99999% (7N) or more. High purity tellurium is used to manufacture radiation and infrared detectors;

|

|

·

|

CdTe Thin Film Compounds. These are tellurium-based compounds in purity levels ranging from 99.999% (5N) to 99.9999% (6N). These products are primarily used in the production of thin-film solar electric power modules; and

|

|

·

|

Other Commercial-Purity Metals. These include tellurium, selenium, antimony, bismuth, cadmium and zinc in purities ranging from 99.99% (4N) to 99.9999% (6N). These metals find applications in numerous electronic material market segments, including PV, radiation detector, and infrared detection.

|

6

Customers and Main Markets

Our principal customers are manufacturers of thin-film solar cells, cell modules, and solar electronic products. We also serve additional customers involved in various segments of other electronic materials markets. In 2011, approximately 45% of our sales were to three customers: Zhuzhou Jingchang Technology (20%), Redlen Technology (13%) and First Solar (12%). We still expect our sales to continue to be concentrated among a small number of customers. However, we also expect that our significant customers may change from time to time.

In 2011, 72.3 % of our sales were made to customers in Asia, 27% of our sales were made to customers in North America and 0.7% of our sales were made to customers in the rest of the world. In 2010, 31.7% of our sales were made to customers in Asia and 66.8% of our sales were made to customers in North America. Our contracts with major customers are non-cancelable and provide for minimum levels of product sales for the duration of the contract (typically 6 to 12 months) with the potential for higher sales levels depending on such factors as rising market prices, customer’s needs, our available capacity and/or our ability to reach agreement on key terms. Our standard terms for customers require payment 30 days after delivery, although new customers are required to pay on delivery, and some special customers (such as research institutions) are granted 90 to 120 days to make payment due to the complexity of their internal approval procedures. Customers with such extended payment terms represent less than five percent of our sales volume.

Our Customer Supply Agreements

In general, we enter into monthly or semi-annual contracts with customers, most of which are domestic.

We negotiated a five year supply agreement with First Solar in November 2010, and First Solar placed with us a long term purchase order for high purity Te in 2010. In 2011, the price of raw materials of Te increased and, since the output from our own mine is limited, we were not able to pass on the increase in cost to our customers. For that reason, by mutual agreement, the long term purchase order between the Company and First Solar was cancelled in the first quarter of 2012.

We also entered into an agreement in 2008 to appoint CERAC, Inc. as the exclusive distributor to sell our products in North America, excluding sales to First Solar. According to CERAC, however, certain potential North American customers have experienced delays in the development of CdTe based thin film PV panels, which has reduced potential demand for our products in North American. We believe that this softening of demand may last for another year or so into mid 2013.

7

We face competition from producers of raw materials such as Vital Chemicals Co., Xiandao (Qingyuan) Rare Metal and Chemical Co., and Emei Semiconductor Material Co. in China. Overseas we face competition from 5N Plus, Inc. in Canada, Honeywell Electronic Materials in the United States, PPM Pure Metals in Germany and Nikko Materials in Japan. As solar opportunities grow, new entrants are likely to enter the market and our existing customers may begin to backwards integrate. It is also likely that our current suppliers, who are large non-ferrous mining, refining and metal processing companies, will begin to vertically integrate as well. We believe that our complete vertical integration as both a miner and refiner will uniquely positions us to compete effectively.

Competitive Advantages

We believe that we possess significant competitive advantages. These advantages include:

|

·

|

Well-Established Market Position and Significant Barriers to Entry . We believe that we are one of the main suppliers of cadmium, selenium, and tellurium metal and compounds in the markets that we serve. We believe we have a limited number of competitors due to the highly specialized nature of our business. The niche markets we serve require extensive expertise and know-how. Our products must be qualified by customers after long periods of testing. Most of the materials that we produce must also be handled with care because of their environmental and occupational impact, and must be recycled, all of which constitute significant entry barriers for potential competitors.

|

|

·

|

Key Supplier in the Fast-Growing CdTe PV Industry . We are one of the key suppliers of Te to the PV industry. A significant increase in CdTe-based PV production capacity is expected over the next few years and we believe that we are well positioned to be an active participant in the growth of the industry.

|

|

·

|

Stable Stream of Future Revenue . As we have exclusive access to tellurium, this will help us to provide a stable and constant stream of supplies to our customers. Therefore, we anticipate that we will be able to negotiate with our major customers in the future for long-term supply agreements which will lead to stable stream of revenue in future years.

|

|

·

|

Stable Supply of Critical Raw Materials at Competitive Pricing . We have the access to our own tellurium mines and to other sources of feedstock materials that we require. We consider ourselves uniquely positioned in China among suppliers of high-purity materials because of our exclusive access to the Dashuigou and Majiagou mines. We believe we can yield economies of scale and cost savings and thus offer highly competitive pricing to our customers.

|

8

Sales and Marketing

We market and sell our products primarily through our direct sales force to customers in North America, Japan, the rest of Asia, and Europe. Our sales team consists of eight in-house sales managers and one sales director. Our direct sales force includes experienced and technically sophisticated sales professionals and engineers who are knowledgeable in photovoltaics and the various applications in which our products are used. Our sales staff works with customers during all stages of the manufacturing process, from developing the precise composition of the compound through manufacturing and processing to the customer’s exact specifications. We have also appointed CERAC, Inc. to be our exclusive distributor for the North American market, excluding sales to First Solar. However, with the softening of demand as delays from new producers occurred, the contribution from this agreement may not be as high as expected.

A key component of our marketing strategy is developing and maintaining strong relationships with our customers, especially at the senior management level. We seek to achieve this through working closely with our customers to optimize our products for their production processes. In addition, we believe we are able to develop long-term relationships with key customers by offering competitive pricing, delivering high quality products and providing superior customer service. We believe that maintaining close relationships with senior management and providing necessary customer support improves customer satisfaction and provides us with a competitive advantage when selling our products.

In order to increase brand recognition of our products and of Apollo in general, we publish technical articles, advertise in trade journals, distribute promotional materials and participate in industry trade shows and conferences.

Research and Development

We plan to continue to devote a substantial amount of our resources to research and development with the objective of improving our mining output efficiency, and optimizing our extraction and refining steps. We will primarily focus our research and development in the following areas:

|

·

|

Mining output efficiency. Mining is becoming increasingly sophisticated, with some mines now using smart sensors to identify areas to prospect, guide sophisticated equipment used in extracting minerals, and monitor air quality in mines. We are consistently seeking new technologies and techniques to raise efficiency at the Dashuigou and Majiagou mines while concurrently seeking to improve environmental and safety conditions.

|

|

·

|

Mineral processing and refining. We are focusing our efforts on the optimization of both our front-end and back-end processes, namely our primary hydrometallurgical extraction and refining steps (leaching, solid liquid separation and electrowinning), as well as our secondary high-purity refining steps (vacuum distillation and zone refining).

|

As of December 31, 2011, our research and development team consists of 40 full-time employees, which are broken down into four groups:

9

|

·

|

Mineral resources prospecting and development, 22 engineers;

|

|

·

|

Mineral processing, metallurgy, new materials, 6 engineers;

|

|

·

|

New energy development, 8 engineers; and

|

|

·

|

Geologists, 4.

|

Additionally, we have strategic research and development collaborations with various universities including Sichuan University, Chengdu Electronic Engineering University, Chengdu Polytechnic University, Shanghai Technical Physics Institute and China Nonferrous Metal Research Institute.

On March 16, 2010, we entered into a Joint Research Agreement, or the NJIT Agreement, with the New Jersey Institute of Technology, or NJIT, pursuant to which we agreed to pay NJIT sponsorship funds in an aggregate amount of $1,500,000 over a three-year period. Under the terms of the Agreement, NJIT agreed to provide certain laboratory instruments, equipment and personnel to develop novel CdTe thin film PV technology and deliver to us bi-annual reports regarding such projects during the term of the relationship. NJIT granted to us an exclusive option and right of first refusal to receive a royalty-bearing license to any intellectual property rights that NJIT may have related to such projects, which license will be on commercially reasonable terms, as negotiated in good faith by the parties. NJIT also granted to us a right of first refusal to enter into negotiations with NJIT regarding the creation of a separate business entity for the purpose of commercializing any intellectual property resulting from such projects. As of December 31, 2011, the Company had paid US$500,000 in sponsorship fund to NJIT. $500,000 and $375,000 were recorded as Research & Development cost for the years ended December 31, 2011and 2010, respectively in connection with this agreement.

Intellectual Property

Our success depends, in part, on our ability to maintain and protect our proprietary technology and to conduct our business without infringing on the proprietary rights of others. As of December 31, 2011, we held ten Chinese patents with respect to our proprietary refining techniques and had an additional three patent applications pertaining to elements of our unique thin-film solar module manufacturing process pending. In 2010, the Company transferred three patents to the Joint Venture with an approximate appraised value of RMB13,781,300.

With respect to proprietary know-how that is not patentable and processes for which patents are difficult to enforce, we rely on, among other things, trade secret protection and confidentiality agreements to safeguard our interests. All of our research and development personnel have entered into confidentiality and proprietary information agreements with us. These agreements address intellectual property protection issues and require our associates to assign to us all of the inventions, designs and technologies they develop during the course of employment with us. We also require our customers and business partners to enter into confidentiality agreements before we disclose any sensitive aspects of our refining techniques, solar modules, technology or business plans.

Safety Performance

We have received no reports of occupational injuries or other safety accidents with respect to its operations since we received our Safe Production License from the Chinese government on April 11, 2006. We have production staff of 12 persons in Dashuigou that are supervised by our Safety Production Committee which reports directly to our management team. We have also adopted safety production guidelines and procedures that require every member of our production staff to participate in specific safety training programs and to obtain a safety working permit issued by the local governmental authorities prior to commencing such work. Additionally, we provide an annual internal training program to all our employees that details our safety measures and emergency recovery programs currently in place. Each of our employees is covered by a special occupational and health insurance program, and undergoes a regular physical examination.

10

Environmental Regulations

Our Dashuigou and Majiagou mines and high purity material manufacturing facilities are subject to various pollution control regulations with respect to noise, water and air pollution and the disposal of waste and hazardous materials. The basic laws in China governing environmental protection in the mineral industry sector of the economy are the Environmental Protection Law, the Environment Impact Assessment Law and the Mineral Resources Law. The State Administration of Environmental Protection and its provincial counterparts are responsible for the supervision, implementation and enforcement of environment protection laws and regulations. Provincial governments also have the power to implement rules and policies in relation to environmental protection in their respective jurisdictions.

Our material purification process generates gaseous wastes, liquid wastes, waste water, noise and other industrial wastes in various stages of the manufacturing process. We have installed various types of anti-pollution equipment in our production facilities to reduce and treat the wastes generated in our manufacturing process. Our operations are subject to regulation and periodic monitoring by the State Environmental Protection Bureau of the PRC, as well as local environmental protection authorities. The PRC national and local environmental laws and regulations impose fees for the discharge of certain waste substances. If discharges exceed the prescribed levels, excess discharge fees are charged. The PRC national and local governments may at their own discretion assess fines, close or suspend the operation of any facility that fails to comply with orders requiring it to cease or remedy activities causing environmental damage. No such penalties have been imposed on us, and we believe that we have been in material compliance with applicable environmental regulations and standards.

We have obtained the land use permit and the water and soil preservation permit for the Dashuigou and Majiagou mines. We also received ISO 9001:2008 and GB/T19001-2008 certificates which are valid from December, 2011 until December, 2014. This Quality Management System applies in the areas of design, development and production of certain metals and high purity compounds.

Government Regulations

The following is a summary of the principal governmental laws and regulations that are or may be applicable to our operations in the PRC. The scope and enforcement of many of the laws and regulations described below are uncertain. We cannot predict the effect of further developments in the Chinese legal system, including the promulgation of new laws, changes to existing laws or the interpretation or enforcement of laws.

11

Renewable Energy Law and Other Government Directives

In February 2005, the PRC enacted its Renewable Energy Law, which became effective on January 1, 2006. The Renewable Energy Law sets forth policies to encourage the development and use of solar energy and other non-fossil energy. The renewable energy law sets forth the national policy to encourage and support the use of solar and other renewable energy and the use of on-grid generation. It also authorizes the relevant pricing authorities to set favorable prices for the purchase of electricity generated by solar and other renewable power generation systems.

The law also sets forth the national policy to encourage the installation and use of solar energy water-heating systems, solar energy heating and cooling systems, solar photovoltaic systems and other solar energy utilization systems. It also provides financial incentives, such as national funding, preferential loans and tax preferences for the development of renewable energy projects. In January 2006, China’s National Development and Reform Commission promulgated two implementation directives of the Renewable Energy Law. These directives set forth specific measures in setting prices for electricity generated by solar and other renewable power generation systems and in sharing additional expenses incurred. The directives further allocate the administrative and supervisory authorities among different government agencies at the national and provincial levels and stipulate responsibilities of electricity grid companies and power generation companies with respect to the implementation of the renewable energy law.

In November 2005, the PRC’s National Development and Reform Commission promulgated the Renewable Energy Industry Development Guidance Catalogue, where solar power figured prominently. In January 2006, the PRC’s National Development and Reform Commission promulgated an implementation directive for the renewable energy power generation industry. This directive sets forth specific measures for setting the price of electricity generated by solar and other renewable power generation systems and in sharing the costs incurred. The directive also allocates administrative and supervisory authority among different government agencies at the national and provincial levels and stipulates the responsibilities of electricity grid companies and power generation companies with respect to the implementation of the renewable energy law.

On August 31, 2007, the PRC’s National Development and Reform Commission promulgated the Medium and Long-Term Development Plan for the Renewable Energy Industry. This plan sets forth national policy to provide financial allowance and preferential tax regulations for the renewable energy industry. A similar demonstration of PRC government commitment to renewable energy is also stipulated in the Eleventh Five-Year Plan for Renewable Energy Development, which was promulgated by the PRC’s National Development and Reform Commission in March 2008.

The principal regulations governing the mining business in the PRC include:

|

·

|

China Mineral Resources Law, which requires a mining business to have exploration and mining licenses from provincial or local land and resources agencies;

|

|

·

|

China Environmental Law, which requires a mining project to obtain an environmental feasibility study of the project; and

|

|

·

|

China Mine Safety Law, which requires a mining business to have a safe production license and provides for random safety inspections of mining facilities.

|

12

Chinese regulations also require that a mining company have a safety certification from the PRC Administration of Work Safety before it can engage in mining and extracting activities. All of our operating subsidiaries have obtained the necessary licenses and certifications.

Insurance

We have personal injury insurance for our employees and management under a group insurance policy with Ping An Life Insurance Company of China, Ltd. The insurance coverage for our employees includes accidental injury, medical cost for accidental injury, and hospital allowance for accidental injury. In addition to coverage for our employees, insurance for management covers extra car and airplane-related accidents.

Income Tax

The corporate income tax rate applicable to all companies organized in the PRC, including both domestic companies and foreign-invested companies, is 25%. On July 16, 2009, one of our wholly owned subsidiary, Sichuan Xinlong received PRC government approval on the High-Tech Enterprise Certificate which allowed us to enjoy a favorable tax rate of 15% effective January 1, 2009 and through December 31, 2011. The Company is in the process of applying to renew this certificate for 2012 and the following years.

Employees

We employ 150 people. Of our employees, 87 hold university degrees in engineering or physical sciences. A breakdown of our current personnel by category is as follows:

| 62 | ||||

|

Research and Development

|

40 | |||

|

Administration

|

32 | |||

|

Sales and Marketing

|

10 | |||

|

Senior Management

|

6 | |||

|

Total

|

150 |

Any investment in our common stock involves a high degree of risk. Potential investors should carefully consider the material risks described below and all of the information contained in this Form 10-K before deciding whether to purchase any of our securities. Our business, financial condition or results of operations could be materially adversely affected by these risks if any of them actually occur. Some of these factors have affected our financial condition and operating results in the past or are currently affecting our company. This filing also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks faced described below and elsewhere in this Form 10-K.

13

Risks Related To Our Operations

We have accumulated significant losses and we may not be able to generate significant revenue or any net income in the future, which would negatively impact our ability to run our business.

We have accumulated significant net losses from our inception through December 31, 2011 and we may be unable to generate significant revenue or any net income in the future. We cannot predict when, or if, we will become profitable in the future. Even if we achieve profitability, we may not be able to sustain it. We have funded our operations primarily through the issuance of equity and debt securities to investors and may not be able to generate a positive cash flow in the future. If we are unable to generate sufficient cash flow from operations, we will need to seek additional funds through the issuance of additional equity or debt securities or other sources of financing. We may not be able to secure such additional financing on favorable terms, or at all. Any additional financings will likely cause substantial dilution to existing stockholders. If we are unable to obtain necessary additional financing, we may be required to reduce the scope of, or cease, our operations.

Our limited operating history may not serve as an adequate basis to judge our future prospects and results of operations.

We commenced our current line of business operations in 2006. Our limited operating history may not provide a meaningful basis on which to evaluate our business. We expect that our operating expenses will increase as we expand. Any significant failure to realize anticipated revenue growth could result in significant operating losses. We will continue to encounter risks and difficulties frequently experienced by companies at a similar stage of development, including our potential failure to:

| ● |

raise adequate capital for expansion and operations;

|

| ● |

implement our business model and strategy and adapt and modify them as needed;

|

| ● |

increase awareness of our brands, protect our reputation and develop customer loyalty;

|

| ● |

manage our expanding operations and service offerings, including the integration of any future acquisitions;

|

| ● |

maintain adequate control of our expenses;

|

| ● |

anticipate and adapt to changing conditions in the renewable energy market in which we operate as well as the impact of any changes in government regulations, mergers and acquisitions involving our competitors, technological developments and other significant competitive and market dynamics.

|

If we are not successful in addressing any or all of these risks, our business may be materially and adversely affected.

14

Uncertainty in the results of exploration for resources.

Resources and reserves are non-renewable and the exploration of new potential resources is crucial to a mining enterprise. Exploration of mineral resources is speculative in nature, so substantial expenses may be incurred from initial drilling to production. As tellurium is the ninth rarest element on earth and the Dashuigou and Majiagou tellurium mines are the only two tellurium mines known to date, there is also no assurance that exploration can lead to the discovery of new mines or economically feasible reserves. Although the exploration is not the main business of the Company, we expect to continue to search for new tellurium mines. If the Company fails to replenish its mineral resource levels in existing or new mining areas, the Company may not be able to maintain the current production level after the remaining usable life of the existing mining areas.

Fluctuation in the market price of base metals may significantly affect the results of our operations.

The results of our operations are significantly affected by the market price of base metals, which are subject to substantial price fluctuations. Our earnings are particularly sensitive to changes in the market price of tellurium, cadmium, and other metals that we sell. Market prices can be affected by numerous factors beyond our control, including supply and demand for a broad range of industrial reasons, substitution of new or different products in critical applications for our existing products, expectation with respect to the level of fossil fuel price, and speculative activities. If prices should decline below our cash costs of production and remain at such levels for any substantial period, we could determine that it is not economically feasible to continue commercial production at any or all of our mines.

As tellurium is rare and its applications highly specific, there is no known hedging tools for us to utilize to protect us against price fluctuation. As such, our ability to protect our operations performance due to base metal price fluctuation is minimal.

We may face restricted access to markets in the future.

Access to our markets may be subject to ongoing interruptions and trade barriers due to political interference, tariffs imposed by of individual countries, and the actions of certain interest groups to restrict the import of our commodities. Although there are currently no significant trade barriers existing or impending of which we are aware that do, or could, materially affect our access to certain markets, there can be no assurance that our access to these markets will not be restricted in the future.

We may not be able to renew the current license period of mining rights.

Under the PRC’s Mineral Resources Law, all mineral resources of the PRC are owned by the State. The Company may obtain mining rights for conducting mining activities in a specific mining area during the license period. The Company has, under the relevant laws and regulations, and through the VIE Arrangement, obtained valid mining rights to the Dashuigou and Majiagou mines with a validity period of 6 years (with an initial expiration date in January 2013) and may apply to the relevant authorities for extension. The Company will not be able to exploit the entire mineral resources of the mines during the license period. If the Company fails to renew its mining rights upon expiration of the initial license, or it cannot effectively utilize the resources within a license period specified in the mining right, the operation and performance of the Company will be adversely affected.

15

Our performance relies on the operations of two existing mines.

Our principal operating assets are the Dashuigou and Majiagou tellurium mines. We expect a substantial portion of our revenues to be generated from these two mines in the future, both of which are still in development stage. There is no assurance that these, or any of our other developing mineral projects, will perform satisfactorily. If any of our developing mineral projects fail to perform satisfactorily, this may lead to a decrease in the overall profit margin, operating performance and investment return, and may adversely affect our operating results.

Production safety.

We employ the open pit mining method for our two mines. Due to the geographic setting and relatively high elevation difference, there is a possibility of localized mud-rock flow during the rainy season, and a risk of instability of the slopes and subsidence of the working area. As the mining process requires the use of explosives and sodium cyanide, any improper storage or use of these materials could lead to injury or death.

Another earthquake in the region may have negative impact on the operations of our mines and therefore our performance.

A major earthquake measuring 8.1 on the Richter scale took place in the Sichuan province in May, 2008. If such an earthquake were to take place again, the facilities in our mines could be damaged, lead to injury and death of employees, and the complete halt to our mining activities.

Government regulation of the mining industry.

Our mining production is subject to various government policies and regulations in China relating to exploration, development, production, taxation, labor standards, vocational health and safety, waste treatment, environmental monitoring, protection and control, operations management and other problems. Any changes to these policies and regulations may increase our operating costs and may adversely affect our operating results.

The loss of, or a decrease in the amount of business from, our major customers or any default in payment on their part could significantly reduce our net sales and harm our operating results.

In 2011, approximately 45 % of our sales were to three customers. In 2010, our top three customers accounted for 75% of our revenue. In 2009, approximately 90% of sales were to two customers, First Solar and Shaoshan Metals. We have been committing tremendous effort to expanding our customer list, and our results in 2011 reflected a certain level of success. However, the loss of, or a decrease in the amount of business from, one of these customers, or any default in payment on their part, could still significantly reduce our net sales and harm our operating results. For example, in 2011, we found our relationship with First Solar to be economically unfavorable and, by mutual agreement, terminated the relationship in the first quarter of 2012, after sales to First Solar diminished significantly in 2011.

16

We have no assurance of securing additional business from our major customers beyond our long-term supply agreements. We therefore expect that our dependence on our major customers will continue during most of 2012, at which point we intend to further reduce our reliance on our major customers by expanding our production capacity to meet the needs of currently merging manufacturers of CdTe-based PV modules, as well supply the needs of companies active in the medical imaging market.

We may not be able to effectively control and manage our growth.

If our business and markets grow and develop, it will be necessary for us to finance and manage expansion in an orderly fashion. In addition, we may face challenges in managing and expanding facilities and in integrating acquired businesses with our own. Such eventualities will increase demands on our existing management, workforce and facilities. Failure to satisfy such increased demands could interrupt or adversely affect our operations and cause longer operation location completion cycle, and administrative inefficiencies.

We depend on market acceptance of our customers’ products and the technology associated therewith.

We depend on market acceptance of our customers’ products and the technology associated therewith. Any delay or failure by our customers to successfully penetrate their respective markets could lead to a reduction in our sales and operating margins. Most of our products are sold either into emerging markets or alternatively in existing markets, for which they are used to manufacture replacement products intended to represent new and improved technologies. If our customers are unable to meet the performance and cost targets required for commercial viability, their products are subject to regulations which limit their use, or the new or improved technology associated with their products proves unsuitable for widespread adoption, it may have an adverse effect on our sales and operating margins.

More specifically, a significant part of our sales are made in the solar energy market using thin-film technology. First Solar is currently the sole volume manufacturer of thin-film CdTe-based PV modules and its oldest active production line has been in operation only since November 2004. As a result, thin-film technology does not have a sufficient operating history to confirm how PV modules will perform over their estimated useful life of 25 years. Long-term viability of CdTe-based thin film technology will also depend on the manufacturers’ ability to reduce the cost of PV modules to a level at which the technology is competitive with other energy sources without government subsidies. If thin-film technology performs below expectations or if it does not achieve cost competitiveness with conventional or other solar or non-solar renewable energy sources without government subsidies, it could result in the failure of the technology to be widely adopted in the market. This could significantly affect demand for our products and reduce our sales and profit margins.

17

Many other factors may affect the widespread adoption of PV technology and demand for our customers’ products, including the following:

|

·

|

cost-effectiveness of thin film PV modules compared to conventional and other non-solar renewable energy sources and products;

|

|

·

|

performance and reliability of thin film PV modules and thin-film technology compared to conventional and other non-solar renewable energy sources and products;

|

|

·

|

availability of government subsidies and incentives to support the development of the solar energy industry;

|

|

·

|

success of other renewable energy generation technologies, such as hydroelectric, wind, geothermal, solar thermal, concentrated PV and biomass;

|

|

·

|

fluctuations in economic and market conditions that affect the viability of conventional and non-solar renewable energy sources, such as increases or decreases in the prices of oil and other fossil fuels;

|

|

·

|

fluctuations in capital expenditures by end-users of PV modules, which tend to decrease when the economy slows and interest rates increase; and

|

|

·

|

deregulation of the electric power industry and the broader energy industry.

|

A change in environmental regulations could cause serious disruption to operations and negatively impact our results.

Our operations involve the use, handling, generation, processing, storage, transportation, recycling and disposal of hazardous materials and are subject to extensive environmental laws and regulations at the national, provincial, local and international level. These environmental laws and regulations include those governing the discharge of pollutants into the air and water, the use, management and disposal of hazardous materials and wastes, the clean-up of contaminated sites and occupational health and safety. We have incurred and will continue to incur capital expenditures in order to seek to comply with these laws and regulations. In addition, violations of, or liabilities under, environmental laws or permits may result in restrictions being imposed on our operating activities or in our being subject to substantial fines, penalties, criminal proceedings, third party property damage or personal injury claims, clean-up costs or other costs. While we believe that we are currently in compliance with applicable environmental requirements, future developments such as more aggressive enforcement policies, the implementation of new, more stringent laws and regulations, or the discovery of currently unknown environmental conditions may require expenditures, or changes in our operations, that could have a material adverse effect on our business, results of operations and financial condition.

Although China has enacted environmental protection legislation to regulate the mining industry, due to the very short history of this legislation, national and local environmental protection standards are still in the process of being formulated and implemented.

Chinese legislation provides for penalties and other liabilities for the violation of environmental protection standards and establishes, in certain circumstances, obligations to rehabilitate current and former facilities and locations where operations are being or have been conducted.

We believe that there are no outstanding notices, orders or directives from central or local environmental protection agencies or local government authorities alleging any breach of national or local environmental quality standards by us or any other party in respect of our property. Although we intend to fully comply with all environmental regulations, there is a risk that permission to conduct exploration, development and manufacture activities could be withdrawn temporarily or permanently where there is evidence of serious breaches of such standards. In addition, given the relative lack of precedents in enforcing the new environmental protection laws, there are no guarantees that the laws or the interpretation of the laws or regulations, will not materially change, which could require us to substantially change, or entirely cease, our operations in China.

18

Because of growing demand for high-purity metals, we may be subject to more competition in the near future.

The forecasted growth in demand for high-purity metals, especially those used by the solar power industry, is expected to attract more metal refiners into that industry and increase competition. Competition could arise from new low-cost metal refiners or from certain of our customers who could decide to backwards integrate.

Our future success will be dependent upon the efforts of our key personnel.

Our future success depends on our ability to retain our key employees and attract, train, retain and successfully integrate new talent into our management team. We are dependent on the services of our senior management team, including Dr. Jingong Pan, our Chief Executive Officer, Hongwei Ke, our Chief Operating Officer, and Wilson Liu, our Chief Financial Officer. The loss of any of these could have a material adverse effect on us. Our future success also depends, to a significant extent, on our ability to attract, train and retain talented personnel. Recruiting and retaining talented personnel, particularly those with expertise in the electronic materials industry, refining technology and cadmium, tellurium and selenium-based compounds is vital to our success and may prove difficult.

We may incur losses resulting from business interruptions.

We may incur losses resulting from business interruptions. In many instances, especially those related to our long-term contracts, we have contractual obligations to deliver product in a timely manner. Any disruption in our activities which leads to a business interruption could harm our customers’ confidence level and lead to the cancellation of our contracts and legal recourse against us. Although we believe that we have taken reasonable precautions to avoid business interruptions, we could still experience interruptions which would adversely impact our financial results.

Protection of our proprietary processes, methods and other technologies is critical to our business and therefore any failure to protect the use of our existing intellectual property rights could result in the loss of valuable technologies and processes.

Protection of our proprietary processes, methods and other technologies is critical to our business. We rely almost exclusively on a combination of Chinese patents, trade secrets and employee confidentiality agreements to safeguard our intellectual property. Failure to protect and monitor the use of our existing intellectual property rights could result in the loss of valuable technologies and processes and materially adversely affect our business.

If our insurance coverage is unavailable or insufficient to cover future claims against us, our financial resources and results of operations could be adversely affected.

We have limited insurance coverage for a number of risks, including environmental situations and personal injury. Although we believe that the events and amounts of liability covered by our insurance policies are reasonable taking into account the risks relevant to our business as carried out to date, there can be no assurance that such coverage will be available or sufficient to cover all claims to which we may become subject. If insurance coverage is unavailable or insufficient to cover any such claims, our financial resources and results of operations could be adversely affected.

19

We have limited business insurance coverage, and accordingly any business disruption, litigation or natural disaster might result in substantial costs and diversion of resources.

The insurance industry in China is still at an early stage of development. Insurance companies in China offer limited business insurance products, and do not generally, to our knowledge, presently offer business liability insurance. As a result, we do not have any business liability insurance coverage for our operations. Moreover, while business disruption insurance is available, we have determined that the risks of disruption and cost of the insurance are such that we have not obtained such insurance at this time. Any business disruption, litigation or natural disaster might result in substantial costs and diversion of resources.

We are responsible for the indemnification of our officers and directors.

Our Bylaws provide for the indemnification of our directors, officers, employees, and agents, under certain circumstances, against costs and expenses incurred by them in any litigation to which they become a party arising from their association with or activities on behalf of us. This indemnification policy could result in substantial expenditures, which we may be unable to recoup.

Risks Related to Doing Business in the PRC

Government regulations may hinder our ability to function efficiently.

The national, provincial and local governments in the PRC are highly bureaucratized. The day-to-day operations of our business requires frequent interaction with representatives of the Chinese government institutions. The effort to obtain the registrations, licenses and permits necessary to carry out our business activities can be daunting. Significant delays can result from the need to obtain governmental approval of our activities. These delays can have an adverse effect on the profitability of our operations.

The PRC laws and regulations governing our current business operations are sometimes vague and uncertain. Any changes in such PRC laws and regulations or their interpretation and application may have a material and adverse effect on our business.

There are substantial uncertainties regarding the interpretation and application of PRC laws and regulations, including but not limited to the laws and regulations governing our business, or the enforcement and performance of our arrangements with customers in the event of the imposition of statutory liens, death, bankruptcy and criminal proceedings. We and any future subsidiaries are considered foreign persons or foreign-invested enterprises under PRC laws, and as a result, we are required to comply with PRC laws and regulations applicable to such persons or enterprises. These laws and regulations are sometimes vague and may be subject to future changes, and their official interpretation and enforcement may involve substantial uncertainty. The effectiveness of newly enacted laws, regulations or amendments may be delayed, resulting in detrimental reliance by foreign investors. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively. We cannot predict what effect the interpretation or application of existing or new PRC laws or regulations may have on our businesses.

20

A slowdown or other adverse developments in the PRC economy may materially and adversely affect our customers, demand for our services and our business.

We are a holding company and all of our operations are conducted in the PRC. Although the PRC economy has grown significantly in recent years, we cannot assure you that such growth will continue. The solar energy industry in the PRC is encouraged by Chinese government, relatively new and growing, but we do not know how sensitive we are to a slowdown in economic growth or other adverse changes in the PRC economy which may affect demand for our products. A slowdown in overall economic growth, an economic downturn or recession or other adverse economic developments in the PRC may materially reduce the demand for our products and materially and adversely affect our business.

While the PRC economy has experienced rapid growth, such growth has been uneven among various sectors of the economy and in different geographical areas of the country. Rapid economic growth can lead to growth in the money supply and rising inflation. If prices for our products rise at a rate that is insufficient to compensate for the rise in the costs of supplies, it may have an adverse effect on profitability. In order to control inflation in the past, the PRC government has imposed controls on bank credits, limits on loans for fixed assets and restrictions on state bank lending. Such an austerity policy can lead to a slowing of economic growth. Although the People’s Bank of China, the PRC’s central bank, currently keeps the interest rate low, it has indicated an interest rate increase is possible and necessary for the inflationary concerns in the Chinese economy. Repeated rises in interest rates by the central bank would likely slow economic activity in China, which could, in turn, materially increase our costs and also reduce demand for our products.

Capital outflow policies in China may hamper our ability to pay dividends to shareholders in the United States.

The PRC has adopted currency and capital transfer regulations. These regulations require that we comply with complex regulations for the movement of capital. Although Chinese governmental policies were introduced in 1996 to allow the convertibility of RMB into foreign currency for current account items, conversion of RMB into foreign exchange for capital items, such as foreign direct investment, loans or securities, requires the approval of the State Administration of Foreign Exchange. We may be unable to obtain all of the required conversion approvals for our operations, and Chinese regulatory authorities may impose greater restrictions on the convertibility of the RMB in the future. Because most of our future revenues will be in RMB, any inability to obtain the requisite approvals or any future restrictions on currency exchanges will limit our ability to pay dividends to our shareholders.

21

Sichuan Apollo is subject to restrictions on paying dividends and making other payments to us.

We are a holding company incorporated in the State of Nevada and do not have any assets or conduct any business operations other than our investments in our subsidiaries. As a result of our holding company structure, we rely primarily on dividend payments from our indirect wholly owned subsidiaries in China. However, PRC regulations currently permit payment of dividends only out of accumulated profits, as determined in accordance with PRC accounting standards and regulations. Our subsidiaries in China are also required to set aside a portion of their after-tax profits according to PRC accounting standards and regulations to fund certain reserve funds. The PRC government also imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of China. We may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency. See “Government control of currency conversion may affect the value of your investment .” Furthermore, if our subsidiary or affiliated entity in China incurs debt on their own in the future, the instruments governing the debt may restrict their ability to pay dividends or make other payments. If we, or any of our direct or indirect subsidiaries, is unable to receive all of the revenues from our operations through these contractual or dividend arrangements, we may be unable to pay dividends on our common stock.

Governmental control of currency conversion may affect the value of an investment in the Company.

The PRC government imposes controls on the convertibility of RMB into foreign currencies and, in certain cases, the remittance of currency out of the PRC. We receive a significant portion of our revenues in RMB, which is currently not a freely convertible currency. Shortages in the availability of foreign currency may restrict our ability to remit sufficient foreign currency to pay dividends, or otherwise satisfy foreign currency dominated obligations. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from the transaction, can be made in foreign currencies without prior approval from the PRC State Administration of Foreign Exchange by complying with certain procedural requirements. However, approval from appropriate governmental authorities is required where RMB is to be converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of bank loans denominated in foreign currencies.

The PRC government may also at its discretion restrict access in the future to foreign currencies for current account transactions. If the foreign exchange control system prevents us from obtaining sufficient foreign currency to satisfy our currency demands, we may not be able to pay certain of our expenses as they come due.

The fluctuation of the Renminbi may materially and adversely affect an investment in the Company.