UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(AMENDMENT NO. 1)

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d) of the

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): June 3, 2011

Parametric Technology Corporation

(Exact name of registrant as specified in its charter)

|

Massachusetts

|

04-2866152

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification Number)

|

140 Kendrick Street, Needham, MA 02494

(Address of principal executive offices, including zip code)

(781) 370-5000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

EXPLANATORY NOTE

As reported in the Current Report on Form 8-K filed by Parametric Technology Corporation (“PTC”) on June 3, 2011 (the “Initial Form 8-K”), PTC, through PTC NS ULC, a wholly-owned subsidiary of PTC (“Purchaser”), completed the acquisition of MKS Inc. (“MKS”) on May 31, 2011. The acquisition was completed pursuant to the terms of an Arrangement Agreement dated as of April 6, 2011 by and among PTC, Purchaser and MKS (the “Arrangement Agreement”).

Item 9.01 Financial Statements and Exhibits.

(a) Financial Statements of Business Acquired

The audited consolidated financial statements of MKS Inc. as of April 30, 2011 and 2010 and for the years then ended are attached hereto as Exhibit 99.1 and incorporated herein by reference.

(b) Pro Forma Financial Information

The unaudited pro forma combined condensed financial information for PTC and MKS required by Article 11 of Regulation S-X is attached hereto as Exhibit 99.2 and incorporated herein by reference.

(d) Exhibits

|

10.1

|

Arrangement Agreement dated as of April 6, 2011 by and among Parametric Technology Corporation (“PTC”), PTC NS ULC (“Acquireco”), and MKS Inc. (“MKS”) (filed as Exhibit 10.1 to our Current Report on Form 8-K filed on April 7, 2011 (File No. 0-18059) and incorporated herein by reference).

|

|

10.2

|

Voting Agreement dated as of April 6, 2011 between Parametric Technology Corporation (“PTC”), PTC NS ULC (“Acquireco”), and MKS Inc. (“MKS”) (filed as Exhibit 10.2 to our Current Report on Form 8-K filed on April 7, 2011 (File No. 0-18059) and incorporated herein by reference).

|

|

23.1

|

Consent of KPMG, LLP

|

|

99.1

|

Audited consolidated financial statements of MKS Inc. for the years ended April 30, 2011 and 2010.

|

|

99.2

|

Unaudited pro forma combined condensed consolidated financial information.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Parametric Technology Corporation

|

||||

|

Date: August 9, 2011

|

By:

|

/s/ Jeffrey D. Glidden

|

||

|

Jeffrey D. Glidden

|

||||

|

Executive Vice President and Chief Financial Officer

|

||||

EXHIBIT 23.1

Consent of Independent Auditor

We consent to the use of our report dated July 19, 2011, with respect to the consolidated financial statements of MKS Inc., (the “Company”) which comprise the consolidated balance sheets as at April 30, 2011, and 2010, and the consolidated statements of operations, shareholders’ equity and cash flows for the years then ended, appearing in this Amendment No. 1 to Current Report on Form 8-K of Parametric Technology Corporation filed on June 3, 2011 and incorporated by reference in the Registration Statements on Form S-8(Nos. 333-172689, 333-01299, 333-22169, 333-56287, 333-141112 and 333-159194).

| /s/ KPMG LLP |

Chartered Accountants, Licensed Public Accountants

Toronto, Canada

August 8, 2011

EXHIBIT 99.1

Independent Auditors’ Report

To the Board of Directors of MKS Inc.

We have audited the accompanying consolidated balance sheets of MKS Inc. and subsidiaries as of April 30, 2011 and 2010, and the consolidated statements of operations, shareholders' equity and cash flows for the years then ended. These consolidated financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with U.S. generally accepted auditing standards. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of MKS Inc. and subsidiaries as of April 30, 2011 and 2010, and the results of their operations and their cash flows for the years then ended in conformity with U.S. generally accepted accounting principles.

| /s/ KPMG LLP |

Chartered Accountants, Licensed Public Accountants

Toronto, Canada

July 19, 2011

MKS Inc.

Consolidated Balance Sheets

(US dollars, thousands)

|

As at April 30

|

2011

|

2010

|

|||||||

|

Assets:

|

|||||||||

|

Current assets:

|

|||||||||

|

Cash and cash equivalents (note 2)

|

$ | 39,627 | $ | 24,755 | |||||

|

Accounts receivable, net of allowances for doubtful accounts

|

|||||||||

| of $185 (2010 – $124) | 8,838 | 10,685 | |||||||

|

Income taxes receivable

|

934 | 556 | |||||||

|

Deferred income taxes (note 4)

|

2,385 | 2,540 | |||||||

|

Prepaid expenses and other assets

|

2,338 | 1,643 | |||||||

|

Total current assets

|

54,122 | 40,179 | |||||||

|

Fixed assets (note 3)

|

5,202 | 3,632 | |||||||

|

Intangible assets (note 3)

|

5 | 15 | |||||||

|

Goodwill

|

2,424 | 2,424 | |||||||

|

Income taxes receivable

|

2,785 | 3,019 | |||||||

|

Deferred income taxes (note 4)

|

5,447 | 4,522 | |||||||

|

Total assets

|

$ | 69,985 | $ | 53,791 | |||||

|

Liabilities and shareholders’ equity:

|

|||||||||

|

Current liabilities:

|

|||||||||

|

Accounts payable

|

$ | 4,083 | $ | 2,028 | |||||

|

Accrued liabilities

|

7,184 | 4,163 | |||||||

|

Deferred loss on forward contracts

|

– | 488 | |||||||

|

Income taxes payable

|

1,926 | 959 | |||||||

|

Deferred revenue

|

21,566 | 17,221 | |||||||

|

Total current liabilities

|

34,759 | 24,859 | |||||||

|

Deferred income taxes (note 4)

|

1,413 | 1,007 | |||||||

|

Total long term liabilities

|

1,413 | 1,007 | |||||||

|

Shareholders’ equity:

|

|||||||||

|

Share capital (note 6)

|

59,323 | 57,926 | |||||||

|

Accumulated other comprehensive loss

|

(152 | ) | (113 | ) | |||||

|

Accumulated deficit

|

(25,358 | ) | (29,888 | ) | |||||

|

Total shareholders’ equity

|

33,813 | 27,925 | |||||||

|

Total liabilities and shareholders’ equity

|

$ | 69,985 | $ | 53,791 | |||||

|

Commitments (note 5)

|

|||||||||

See accompanying Notes to Consolidated Financial Statements

MKS Inc.

Consolidated Statements of Operations

(US dollars, thousands, except per share data)

|

Years ended April 30

|

2011

|

2010

|

||||||

|

Revenue:

|

||||||||

|

License

|

$ | 31,958 | $ | 21,219 | ||||

|

Maintenance

|

32,421 | 30,270 | ||||||

|

Service

|

14,258 | 11,437 | ||||||

| 78,637 | 62,926 | |||||||

|

Operating expenses:

|

||||||||

|

Cost of product and support

|

6,230 | 5,418 | ||||||

|

Cost of service

|

9,542 | 7,518 | ||||||

|

Sales and marketing

|

25,189 | 20,549 | ||||||

|

Research and development

|

15,120 | 12,270 | ||||||

|

General and administrative

|

9,893 | 8,776 | ||||||

|

Foreign exchange (gain)

|

(798 | ) | (236 | ) | ||||

| 65,176 | 54,295 | |||||||

|

Operating income

|

13,461 | 8,631 | ||||||

|

Interest income, net

|

11 | 11 | ||||||

|

Income before income taxes

|

13,472 | 8,642 | ||||||

|

Income tax provision (recovery) (note 4):

Current

|

1,570 | (2,669 | ) | |||||

|

Deferred

|

(389 | ) | (1,296 | ) | ||||

|

Income tax provision (recovery)

|

1,181 | (3,965 | ) | |||||

|

Net income

|

$ | 12,291 | $ | 12,607 | ||||

|

Earnings per share (note 8):

|

||||||||

|

Basic

|

$ | 1.19 | $ | 1.25 | ||||

|

Diluted

|

1.14 | 1.23 | ||||||

|

Weighted average number of shares outstanding

|

10,331 | 10,098 | ||||||

|

Diluted weighted average number of shares outstanding

|

10,752 | 10,229 | ||||||

See accompanying Notes to Consolidated Financial Statements

MKS Inc.

Consolidated Statements of Shareholders’ Equity

(US dollars, thousands)

|

Common

Shares

(#)

|

Common

Shares

($)

|

Additional

Paid in

Capital

|

Accumulated

Other

Compre-

hensive Loss

|

Accumulated

Deficit

|

Total

|

|||||||||||||||||||

|

Balances at April 30, 2009

|

9,978 | $ | 52,825 | $ | 2,802 | $ | (2,076 | ) | $ | (36,924 | ) | $ | 16,627 | |||||||||||

|

Issuance of common shares

|

246 | 1,931 | (292 | ) | – | – | 1,639 | |||||||||||||||||

|

Stock-based compensation

|

– | – | 660 | – | – | 660 | ||||||||||||||||||

|

Dividends paid

|

– | – | – | – | (5,571 | ) | (5,571 | ) | ||||||||||||||||

|

Comprehensive income:

|

||||||||||||||||||||||||

|

Unrealized foreign exchange loss on hedged derivative contracts, net of taxes of $146

|

– | – | – | (425 | ) | – | (425 | ) | ||||||||||||||||

|

Foreign currency translation adjustment, net of taxes of nil

|

– | – | – | 2,388 | – | 2,388 | ||||||||||||||||||

|

Net income

|

– | – | – | – | 12,607 | 12,607 | ||||||||||||||||||

|

Comprehensive income

|

– | – | – | 1,963 | 12,607 | 14,570 | ||||||||||||||||||

|

Balances at April 30, 2010

|

10,224 | 54,756 | 3,170 | (113 | ) | (29,888 | ) | 27,925 | ||||||||||||||||

|

Issuance of common shares

|

236 | 1,693 | (222 | ) | – | – | 1,471 | |||||||||||||||||

|

Shares purchased and held in

treasury for restricted share units

|

(61 | ) | (734 | ) | – | – | – | (734 | ) | |||||||||||||||

|

Stock-based compensation

|

– | – | 660 | – | – | 660 | ||||||||||||||||||

|

Dividends paid

|

– | – | – | – | (7,761 | ) | (7,761 | ) | ||||||||||||||||

|

Comprehensive income:

|

||||||||||||||||||||||||

|

Unrealized foreign exchange gain on hedged derivative contracts, net of taxes of $168

|

– | – | – | 488 | – | 488 | ||||||||||||||||||

|

Foreign currency translation adjustment, net of taxes of nil

|

– | – | – | (527 | ) | – | (527 | ) | ||||||||||||||||

|

Net income

|

– | – | – | – | 12,291 | 12,291 | ||||||||||||||||||

|

Comprehensive income

|

– | – | – | (39 | ) | 12,291 | 12,252 | |||||||||||||||||

|

Balances at April 30, 2011

|

10,399 | $ | 55,715 | $ | 3,608 | $ | (152 | ) | $ | (25,358 | ) | $ | 33,813 | |||||||||||

See accompanying Notes to Consolidated Financial Statements

MKS Inc.

Consolidated Statements of Cash Flows

(US dollars, thousands)

|

Years ended April 30

|

2011

|

2010

|

||||||

|

Cash flows provided by operating activities:

|

||||||||

|

Net income

|

$ | 12,291 | $ | 12,607 | ||||

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

||||||||

|

Depreciation of fixed assets

|

1,339 | 1,405 | ||||||

|

Amortization of intangible assets

|

10 | 54 | ||||||

|

Stock-based compensation

|

660 | 660 | ||||||

|

Deferred income taxes

|

(389 | ) | (1,296 | ) | ||||

|

Loss on disposal of fixed assets

|

149 | 169 | ||||||

|

Change in operating assets and liabilities:

|

||||||||

|

Accounts receivable

|

1,847 | (3,281 | ) | |||||

|

Prepaid expenses and other assets

|

(695 | ) | (491 | ) | ||||

|

Accounts payable

|

2,055 | 945 | ||||||

|

Accrued liabilities

|

3,021 | 1,597 | ||||||

|

Income taxes payable

|

823 | (3,273 | ) | |||||

|

Deferred revenue

|

4,345 | 1,051 | ||||||

|

Net cash provided by operating activities

|

25,456 | 10,147 | ||||||

|

Cash flows (used for) investing activities:

|

||||||||

|

Purchase of fixed assets

|

(3,086 | ) | (948 | ) | ||||

|

Proceeds on sale of fixed assets

|

28 | – | ||||||

|

Net cash (used for) investing activities

|

(3,058 | ) | (948 | ) | ||||

|

Cash flows provided by (used for) financing activities:

|

||||||||

|

Proceeds on issuance of common shares

|

1,471 | 1,639 | ||||||

|

Common shares purchased for restricted share units granted

|

(734 | ) | – | |||||

|

Payment of dividends

|

(7,761 | ) | (5,571 | ) | ||||

|

Net cash (used for) financing activities

|

(7,024 | ) | (3,932 | ) | ||||

|

Effect of exchange rate changes on cash and cash equivalents

|

(502 | ) | 2,390 | |||||

|

Change in cash and cash equivalents balances

|

14,872 | 7,657 | ||||||

|

Cash and cash equivalents, beginning of year

|

24,755 | 17,098 | ||||||

|

Cash and cash equivalents, end of year

|

$ | 39,627 | $ | 24,755 | ||||

|

Supplemental cash flow information:

|

||||||||

|

Interest received

|

$ | 11 | $ | 11 | ||||

|

Interest paid

|

– | – | ||||||

|

Income taxes paid

|

1,040 | 933 | ||||||

|

Income tax refund received

|

133 | 322 | ||||||

See accompanying Notes to Consolidated Financial Statements

MKS Inc. (“MKS” or the “Company”) is a provider of software products and services in the application development and deployment (software “Application Lifecycle Management” or “ALM”) and cross-platform development and systems administration (“Interoperability” or “IO”) markets. The Company’s products are designed to increase development team productivity while improving the quality, reliability and availability of business critical software as it is developed and maintained, and to reduce development costs and time to market while enabling enhanced performance.

|

1.

|

Significant accounting policies:

|

|

a)

|

Basis of presentation:

|

These consolidated financial statements have been prepared in accordance with United States generally accepted accounting principles (US GAAP). Subsequent events have been evaluated to July 19, 2011, being the date the Board of Directors approved the financial statements.

|

b)

|

Principles of consolidation:

|

The consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries. All significant intercompany transactions and balances have been eliminated upon consolidation.

| c) |

Revenue recognition:

|

The Company’s revenues are derived from license elements, maintenance elements, and service elements. License elements include software license fees for the Company’s products and are generally recognized at the inception of an arrangement, upon the delivery of the software licenses, where all other revenue recognition criteria have been satisfied. Maintenance elements include post-contract customer support and product upgrades (on a ‘when and if available’ basis) related to the Company’s products which are generally paid in advance, are non-refundable, and are recognized ratably over the term of the agreement, which is typically twelve months. Service elements include fees for implementation and training related to the Company’s products and are recognized as the services are performed. Fees for service elements are generally billed separately from licenses for the Company’s products.

Revenue from arrangements that, directly or indirectly, include multiple elements is allocated between the elements to the extent of their fair values where vendor specific objective evidence (“VSOE”) exists. VSOE on maintenance elements is generally established based on the amounts customers pay for renewal maintenance contracts. VSOE for service elements is generally established based on the amounts customers pay for similar services when they are sold separately. VSOE does not exist for license elements, as they are not sold separately, and accordingly, revenue is allocated to license elements under the residual method. If VSOE does not exist for an undelivered element of a multiple element arrangement, all revenue from the arrangement is deferred until the undelivered element has been delivered. In determining the appropriate revenue recognition for multiple element arrangements, the Company considers whether the license, maintenance and service elements to each arrangement represent a separate unit of accounting.

Revenue from all elements are recognized pursuant to a contract or purchase order, when each element is delivered to the customer, the fee is fixed and determinable, and collection of the related receivable is deemed probable by management. When all criteria other than the fee being fixed and determinable exist for license elements, revenue is recognized as payments are due. Provisions for product returns and sales allowances are estimated and provided for at the time of sale. Such provisions are based upon management’s evaluation of historical experience and current industry trends.

Elements that have been prepaid but do not yet qualify for recognition as revenue under the Company’s revenue recognition policy are reflected as deferred revenue on the Company’s balance sheet.

|

d)

|

Research and development costs:

|

Research and development costs related to software products are expensed in the period incurred unless criteria for capitalization under US GAAP are met.

Based on the Company’s product development process, technological feasibility is established once a working model has been produced and tested. To date, development costs incurred between the completion of a working model and the point where a product is released have been insignificant. Accordingly, research and development costs have been charged to the consolidated statements of operations in the year in which they were incurred.

|

e)

|

Use of estimates:

|

Management of the Company has made a number of estimates and assumptions relating to the reporting of assets, liabilities, the disclosure of contingent assets and liabilities and the reported amounts of revenues and expenses during the year to prepare these consolidated financial statements in conformity with US GAAP. Significant items subject to such estimates and assumptions include the assessment of the carrying amount of goodwill, the determination of share-based payment amounts, revenue recognition and the valuation of allowances for receivables and income tax assets. Actual results could differ from these estimates.

|

f)

|

Financial instruments:

|

The Company determines the fair value of its financial instruments based on quoted market values or discounted cash flow analyses. The recorded amounts of financial instruments in these consolidated financial statements approximate their fair values.

Financial instruments potentially exposing the Company to a concentration of credit risk principally consist of cash and cash equivalents and accounts receivable. Cash and cash equivalent balances consist of deposits with major commercial banks, the maturities of which are less than 90 days from the date of purchase. The Company performs ongoing credit evaluations of its customers’ financial condition and establishes allowances for potential losses. Allowances are maintained for potential credit losses consistent with the credit risk of specific customers. At April 30, 2011, no customer accounted for over 10% of accounts receivable. At April 30, 2010, two customers accounted for approximately 22% and 10% of accounts receivable, respectively.

|

g)

|

Accounting for foreign currencies:

|

The functional currency of MKS Inc. is the United States dollar. The financial statements of subsidiaries whose functional currency is not the United States dollar are translated to United States dollars at the period end rate for assets and liabilities and at the average rate for the period for revenue and expense amounts (including depreciation and amortization). The unrealized translation gains and losses on the net investment in those operations, including long-term intercompany advances forming part of the net investment, are accumulated as a component of accumulated other comprehensive loss within the shareholders’ equity section of the consolidated balance sheet.

Foreign currency balances of the Company and its subsidiaries are translated into the relevant functional currency at period end rates for assets, liabilities, foreign currency revenue, and expense amounts are translated at the exchange rate prevailing at the time of the transaction. Exchange gains and losses resulting from the translation of foreign currency transactions are reflected in the consolidated statement of operations in the year in which they occurred. During the year ended April 30, 2011, a foreign exchange gain of $798 was included in operating expenditures related to such foreign currency transactions (2010: $236).

|

h)

|

Prepaid expenses and other assets:

|

This amount is comprised of advance royalty payments made to third parties for the licensing of technology used directly or indirectly in the Company’s products, rent and lease deposits and other prepaid expenses. Third party licensing and technology amounts are amortized over their applicable periods, which approximate the useful life of the asset. Rent and lease deposits are fixed in nature and are recoverable. Other prepaid expenses are expensed in the period in which the cost relates.

|

i)

|

Fixed assets:

|

Fixed assets are recorded at cost and are depreciated over their estimated useful lives. Leasehold improvements are recorded at cost and depreciated over the lesser of their useful lives or the term of the related lease.

Expenditures for maintenance and repairs have been charged to the consolidated statements of operations as incurred. The depreciation policies for fixed assets by category are as follows:

| Asset | Basis | Rate | |

| Computer equipment | Declining balance | 20% | |

| Applications software | Straight-line | 3 1/3 years | |

| Office furniture and equipment | Declining balance | 20% |

|

j)

|

Goodwill:

|

The Company accounts for goodwill by allocating its goodwill to reporting units as of the date of the business combination. Goodwill has an indefinite life, is not amortized, and is subject to an impairment test at least annually. An impairment loss is determined under this test by comparing the book value of goodwill to the fair value of the reporting unit to which the goodwill relates.

The Company’s policy is to review for impairment of goodwill annually at April 30, based on a residual enterprise value method. Based on this review, the Company has determined that no impairment exists.

|

k)

|

Impairment of long-lived assets:

|

The Company accounts for the impairment and disposal of long-lived assets by reviewing for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. The recoverability of an asset is measured by comparing expected future cash flows to the carrying amount of the asset. If their carrying value exceeds the amount recoverable, a write down equal to the excess of their carrying value over their fair value is charged to the consolidated statement of operations.

|

l)

|

Income taxes:

|

The Company accounts for income taxes using the asset and liability method of tax allocation. Under this method, differences between financial reporting and tax bases of assets and liabilities are measured at tax rates expected to be in effect when the differences reverse. The effect of a change in tax rate is recognized in the year of enactment.

Valuation allowances are established when necessary to reduce deferred tax assets to the amounts expected to be realized. In establishing the appropriate income tax valuation allowances, the Company assesses the realizability of its net deferred tax assets quarterly and, based on all available evidence, both positive and negative, determines whether it is more likely than not that the net deferred tax assets, or a portion thereof, will be realized.

|

m)

|

Comprehensive income:

|

Comprehensive income includes net income and ‘other comprehensive items’, which refer to changes in the balances of assets and liabilities due to transactions with non-owner sources that have been excluded from net income and revenues, expenses, gains and losses that are recorded directly as a separate component of shareholders’ equity.

|

n)

|

Earnings per share:

|

Basic earnings per share have been computed by dividing net income by the weighted average number of Common Shares outstanding for the year. Diluted earnings per share include the effect, if any, of securities with dilutive potential on the Company’s Common Shares. The treasury stock method is used for the calculation of the dilutive effect of stock options and warrants.

|

o)

|

Stock based compensation:

|

The Company applies the fair value method of accounting for its employee stock based compensation plans. The Company expenses stock-based compensation on a straight-line basis over the vesting period for each grant.

|

p)

|

Derivative Instruments and Hedging Activities

|

The Company accounts for derivatives and hedging activities by recognizing all derivative instruments as either assets or liabilities in the balance sheet at their respective fair values. For derivatives designated as hedges, changes in the fair value are either offset against the change in fair value, for the risk being hedged, of the assets and liabilities through earnings, or recognized in accumulated other comprehensive income until the hedged item is recognized in earnings.

The Company only enters into derivative contracts that it intends to designate as a hedge of a forecasted transaction or the variability of cash flows to be received or paid related to a recognized asset or liability (cash flow hedge). For all hedging relationships the Company formally documents the hedging relationship and its risk-management objective and strategy for undertaking the hedge, the hedging instrument, the hedged item, the nature of the risk being hedged, how the hedging instrument’s effectiveness in offsetting the hedged risk will be assessed prospectively and retrospectively, and a description of the method of measuring ineffectiveness. The Company also formally assesses, both at the hedge’s inception and on an ongoing basis, whether the derivatives that are used in hedging transactions are highly effective in offsetting cash flows of hedged items. Changes in the fair value of a derivative that is highly effective and that is designated and qualifies as a cash-flow hedge are recorded in accumulated other comprehensive income to the extent that the derivative is effective as a hedge, until earnings are affected by the variability in cash flows of the designated hedged item. The ineffective portion of the change in fair value of a derivative instrument that qualifies as a cash-flow hedge is reported in earnings.

The Company discontinues hedge accounting prospectively when it determines that the derivative is no longer effective in offsetting cash flows of the hedged item, the derivative expires or is sold, terminated, or exercised, the derivative is de-designated as a hedging instrument because it is unlikely that a forecasted transaction will occur, or management determines that designation of the derivative as a hedging instrument is no longer appropriate.

In all situations in which hedge accounting is discontinued and the derivative is retained, the Company continues to carry the derivative at its fair value on the balance sheet and recognizes any subsequent changes in its fair value in earnings. When it is probable that a forecasted transaction will not occur, the Company discontinues hedge accounting and recognizes immediately in earnings gains and losses that were accumulated in other comprehensive income.

|

q)

|

Recent Accounting Pronouncements:

|

Disclosures about Finance Receivables and Allowance for Credit Losses

In July 2010, the FASB issued Accounting Standard Update (ASU) No. 2010-20, Disclosures about the Credit Quality of Financing Receivables and the Allowance for Credit Losses. ASU No. 2010-20 requires disclosure about the credit quality of accounts receivables with terms exceeding one year and any related allowance for credit losses. These new disclosures are required for interim and fiscal periods ending after December 15, 2010 (our third quarter of fiscal 2011). We do not expect that the adoption of this standard will have an impact on our consolidated financial position, results of operations and cash flows.

|

r)

|

Reclassifications:

|

Certain prior year amounts have been reclassified to conform to current year financial statement presentation.

|

2.

|

Cash and cash equivalents:

|

Included in the balance of cash and cash equivalents at April 30, 2011 is $nil (April 30, 2010 - $1,818) of cash and cash equivalents held as a security deposit by the counterparty to forward foreign exchange contracts entered into by the Company.

|

3.

|

Fixed assets and intangible assets:

|

| a) |

Fixed assets:

|

|

April 30, 2011

|

Cost

|

Accumulated

Depreciation

|

Net Book

Value

|

|||||||||

|

Computer equipment

|

$ | 5,908 | $ | 2,702 | $ | 3,206 | ||||||

|

Applications software

|

1,547 | 1,294 | 253 | |||||||||

|

Office furniture and equipment

|

1,103 | 289 | 814 | |||||||||

|

Leasehold improvements

|

2,239 | 1,310 | 929 | |||||||||

|

|

$ | 10,797 | $ | 5,595 | $ | 5,202 | ||||||

|

April 30, 2010

|

Cost

|

Accumulated

Depreciation

|

Net Book

Value

|

|||||||||

|

Computer equipment

|

$ | 5,306 | $ | 2,560 | $ | 2,746 | ||||||

|

Applications software

|

1,447 | 1,096 | 351 | |||||||||

|

Office furniture and equipment

|

922 | 689 | 233 | |||||||||

|

Leasehold improvements

|

2,025 | 1,723 | 302 | |||||||||

|

|

$ | 9,700 | $ | 6,068 | $ | 3,632 | ||||||

|

b)

|

Intangible assets:

|

|

April 30, 2011

|

Cost

|

Accumulated

Depreciation

|

Net Book

Value

|

|||||||||

|

Purchased software and technology, gross

|

$ | 681 | $ | 681 | $ | – | ||||||

|

Other intangible assets, gross

|

297 | 292 | 5 | |||||||||

| $ | 978 | $ | 973 | $ | 5 | |||||||

|

April 30, 2010

|

Cost

|

Accumulated

Depreciation

|

Net Book

Value

|

|||||||||

|

Purchased software and technology, gross

|

$ | 681 | $ | 681 | $ | – | ||||||

|

Other intangible assets, gross

|

297 | 282 | 15 | |||||||||

| $ | 978 | $ | 963 | $ | 15 | |||||||

Intangible assets are amortized on a straight-line basis over their expected lives, periods ranging from 3 to 5 years.

|

4.

|

Income taxes:

|

|

a)

|

Income tax provision (recovery):

|

The income tax provision (recovery) consists of the following:

|

Years ended April 30

|

2011

|

2010

|

||||||

|

Current:

|

||||||||

|

Canadian

|

$ | (71 | ) | $ | (3,781 | ) | ||

|

Foreign

|

1,641 | 1,112 | ||||||

|

Total current taxes

|

1,570 | (2,669 | ) | |||||

|

Deferred:

|

||||||||

|

Canadian

|

260 | 1,698 | ||||||

|

Foreign

|

(649 | ) | (2,994 | ) | ||||

|

Total deferred taxes

|

(389 | ) | (1,296 | ) | ||||

|

Income tax provision (recovery)

|

$ | 1,181 | $ | (3,965 | ) | |||

|

b)

|

Income tax reconciliation:

|

The effective income tax rate differs from the statutory rate that would be obtained by applying the combined Canadian basic federal and provincial income tax rate to net income before income taxes. These differences result from the following items:

|

Years ended April 30

|

2011

|

2010

|

||||||

|

Income before income taxes

|

$ | 13,772 | $ | 8,642 | ||||

|

Combined basic Federal and Provincial rates

|

29.8 | % | 32.7 | % | ||||

|

Computed expected tax expense (recovery)

|

$ | 4,104 | $ | 2,826 | ||||

|

Increase (decrease) resulting from:

|

||||||||

|

Losses not recognized for accounting

|

– | 4 | ||||||

|

Benefit of Canadian investment tax credits

|

(608 | ) | (2,619 | ) | ||||

|

Utilization of tax assets not previously recognized

|

(1,796 | ) | (83 | ) | ||||

|

Change in valuation allowance

|

(1,600 | ) | (4,141 | ) | ||||

|

Foreign rate differences

|

531 | (154 | ) | |||||

|

Permanent difference related to stock-based compensation

|

197 | 216 | ||||||

|

Other permanent differences

|

365 | (45 | ) | |||||

|

Other

|

(12 | ) | 31 | |||||

|

Income tax provision (recovery)

|

$ | 1,181 | $ | (3,965 | ) | |||

During the year the Company reduced the valuation allowance against certain deferred tax assets in certain jurisdictions, as it is more likely than not that these losses will be utilized.

|

c)

|

Components of the deferred tax asset:

|

The components of the temporary differences, which have created the deferred tax asset, are as follows:

|

Years ended April 30

|

2011

|

2010

|

||||||

|

Tax depreciation greater than accounting depreciation

|

$ | 1,412 | $ | 2,277 | ||||

|

Provisions not yet deducted for tax purposes

|

2,525 | 1,240 | ||||||

|

Losses carried forward

|

4,202 | 6,649 | ||||||

| 8,139 | 10,166 | |||||||

|

Less: Valuation allowance

|

(307 | ) | (2,800 | ) | ||||

|

Deferred tax asset

|

7,832 | 7,366 | ||||||

|

Less: Deferred tax liability:

|

||||||||

|

Investment tax credits not yet included for tax purposes

|

(1,413 | ) | (1,311 | ) | ||||

|

Net deferred tax asset

|

$ | 6,419 | $ | 6,055 | ||||

A valuation allowance of $307 has been recorded for a portion of the deferred tax asset attributable to certain tax losses carried forward as it is more likely than not that the income tax benefit will not be realized.

Realization of the net deferred tax assets is dependent on generating sufficient taxable income in certain legal entities. Although realization is not assured, the Company believes it is more likely than not that the net amount of the deferred tax asset will be realized. However, this estimate could change in the near term as future taxable income in these certain legal entities changes.

|

d)

|

Income tax losses available for carry forward:

|

The Company has no domestic income tax losses available for carry forward. In addition, the Company has $11,500 of foreign income tax losses available of which $7,250 expire between 2022 and 2027 with the remaining $4,250 having no expiry date.

|

e)

|

Current income tax provision (recovery):

|

|

Years ended April 30

|

2011

|

2010

|

||||||

|

Gross current income tax provision

|

$ | 2,726 | $ | 1,222 | ||||

|

Less: Investment tax credits realized

|

(866 | ) | (3,891 | ) | ||||

|

Net current income tax provision (recovery)

|

$ | 1,860 | $ | (2,669 | ) | |||

The Company qualifies for certain investment tax credits related to its research and development activities. These investment tax credits have been accounted for as a reduction of the Company’s current income tax provision or recovery.

|

f)

|

Uncertain tax positions:

|

The Company accounts for uncertainty in income taxes recognized in its consolidated financial statements under a recognition threshold of more-likely-than-not to be sustained upon examination.

The Company’s policy is to include interest and penalties related to gross unrecognized tax benefits within its income tax provision.

The Company is subject to income taxes in a number of jurisdictions due to its international operations. During the year ended April 30, 2011, the Company reduced tax reserves related to prior tax years by $780, primarily due to the completion of a transfer pricing audit of the Company’s German subsidiary of its 2005 to 2009 tax years with no adjustments proposed by the taxing authority.

In July 2010, the Company received final assessments from the Canadian tax authorities related to the Company’s 2006 and 2007 tax years, including adjustments primarily related to transfer pricing with its subsidiaries, resulting in an increase the Company’s taxable income for the Canadian legal entity. In November 2010, the Company made administrative filings to seek relief from double taxation in the corresponding foreign jurisdictions, and upon its ultimate resolution, the Canadian assessments are not expected to have a material impact to the consolidated financial statements of the Company.

The major tax jurisdictions the Company operates within and open tax years in each of those jurisdictions is indicated in the following table:

|

Major Tax Jurisdiction

|

Open Tax Years

|

|

|

Canada

|

2007 to 2011

|

|

|

United States

|

2008 to 2011

|

|

|

United Kingdom

|

2007 to 2011

|

|

|

Germany

|

2010 to 2011

|

|

|

Japan

|

2009 to 2011

|

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows:

| Balance at April 30, 2010 | $ | 1,259 | |

| Increases related to prior year tax positions | |||

| Decreases related to prior year tax positions | (732 | ) | |

| Increases related to current year tax positions | 138 | ||

| Settlements | – | ||

| Lapse of statute | – | ||

| Impact of foreign exchange | – | ||

| Balance at April 30, 2011 | $ | 665 |

|

5.

|

Commitments, contingencies and guarantees:

|

|

a)

|

Commitments:

|

Future minimum lease payments under non-cancelable operating leases for the year ended April 30, 2011 are as follows:

| 2012 | $ | 2,271 | |

| 2013 | 1,901 | ||

| 2014 | 1,432 | ||

| 2015 | 1,149 | ||

| 2016 | 1,075 | ||

| Thereafter | 4,913 | ||

| Total minimum lease payments | $ | 12,741 |

Rent expense for fiscal 2011 and 2010 was $1,724 and $1,570, respectively. These amounts are net of sublease income of $255 and $240 for each of fiscal 2011 and 2010, respectively. The Company is also responsible for certain common area costs at its various leased premises.

|

b)

|

Guarantees:

|

The Company’s standard warranty covers up to a 90-day period and warrants against substantial nonconformance of the Company’s software to the published documentation at time of delivery. The Company has not experienced any material returns where it was under obligation to honor this standard warranty, and as such, there is no warranty provision recorded in the consolidated financial statements.

The Company’s software license agreements generally include certain provisions for indemnifying customers against liabilities if the Company’s software products infringe a third party’s intellectual property rights. To date, the Company has not incurred any material costs attributable to such indemnification and has not accrued any liabilities related to such obligations in the consolidated financial statements.

The Company has provided standard indemnifications to its landlords under certain property lease agreements for claims by third parties in connection with the Company’s use of the premises. In addition, the Company may from time to time, in the normal course of business provide indemnifications with respect to the procurement and provision of products and services. The maximum amount of these indemnifications cannot be reasonably estimated due to their nature. Historically, the Company has not made any payments relating to such indemnifications.

|

6.

|

Shareholders’ equity:

|

|

a)

|

Share capital:

|

|

As at April 30

|

2011

|

2010

|

||||||

|

Common shares:

|

||||||||

|

Authorized – unlimited

|

||||||||

|

Issued and outstanding – 10,399

(2010 –10,224), no par value

|

$ | 56,227 | $ | 54,756 | ||||

|

Additional paid in capital

|

3,830 | 3,170 | ||||||

|

Treasury shares held – 61 (April 30, 2010 – nil)

|

(734 | ) | – | |||||

|

Preferred shares:

|

||||||||

|

Authorized – unlimited, issuable in series

|

||||||||

|

Issued and outstanding – nil

|

– | – | ||||||

|

Total share capital

|

$ | 59,323 | $ | 57,926 | ||||

The Preferred Shares are non-voting, unless dividends are in arrears, and rank in priority to the Common Shares in respect of the payment of dividends and as to the distribution of assets in the event of liquidation, dissolution or wind-up of the Company.

|

b)

|

Transactions:

|

Fiscal 2011: The Company issued 159 Common Shares to employees on the exercise of stock options for aggregate proceeds of $1,281. The Company issued 16 Common Shares to employees under the ESPP for aggregate proceeds of $190. The Company purchased 61 Common Shares and held them in treasury to fund Restricted Stock Units issued to employees during the year for aggregate cost of $734.

Fiscal 2010: The Company issued 219 Common Shares to employees on the exercise of stock options for aggregate proceeds of $1,443. The Company issued 27 Common Shares to employees under the ESPP for aggregate proceeds of $196.

|

c)

|

Stock option plans:

|

The Company’s stock option plans are intended to encourage ownership of the Company by directors, officers and employees of the Company and its subsidiaries. The maximum number of Common Shares that may be issued under the plans is 2,638 shares, provided that the Board of Directors of the Company has the right, from time to time, to increase such number subject to the approval of the shareholders of the Company when required by law or regulatory authority. The maximum number of Common Shares that may be reserved for issuance to any one person under the plans is 5% of the Common Shares outstanding at the time of the grant. Generally, options issued under the plans vest annually over a four-year period. Any option granted which, for any reason, is cancelled or terminated prior to its exercise will again become available for grant under the plans. In accordance with the plans, the exercise price of options is determined based on the fair value of the Company’s Common Shares at the date of grant.

Options granted under the plans may be exercised during a period not exceeding seven years from the date of grant, subject to earlier termination upon the optionee ceasing to be a director, officer or employee of the Company or any of its subsidiaries, as applicable. Options issued under the plans are non-transferable.

|

d)

|

Continuity of options issued under the plans:

|

A summary of the status of the plans as of April 30, 2011 and 2010 is presented below:

|

As at April 30

|

2011

|

2010

|

||||||||||||||

|

Options

|

Weighted Average Exercise Price

|

Options

|

Weighted Average Exercise Price

|

|||||||||||||

|

Outstanding, beginning of year

|

1,227 |

Cdn$8.45

|

1,289 |

Cdn$8.333

|

||||||||||||

|

Granted

|

101 | 12.33 | 180 | 7.96 | ||||||||||||

|

Exercised

|

(159 | ) | 8.64 | (219 | ) | 7.44 | ||||||||||

|

Forfeited

|

(40 | ) | 10.21 | (23 | ) | 7.71 | ||||||||||

|

Outstanding, end of year

|

1,129 |

Cdn$8.70

|

1,227 |

Cdn$8.455

|

||||||||||||

|

Options exercisable, end of year

|

882 |

Cdn$8.42

|

900 |

Cdn$8.600

|

||||||||||||

|

e)

|

Summary of the balances of options issued under the plans at April 30, 2011:

|

|

Range of

Exercise Prices

|

Number

Outstanding

|

Weighted Average

Remaining

Contractual Life

|

Weighted

Average

Exercise Price

|

Number

Exercisable

|

Weighted

Average

Exercise Price

|

|||||||||||||||||

|

Cdn$ 4.80–6.85

|

333 |

0.9 years

|

Cdn$ 6.52

|

331 |

Cdn$ 6.52

|

|||||||||||||||||

| 7.30–9.90 | 541 | 3.8 | 8.11 | 397 | 8.17 | |||||||||||||||||

| 11.85–13.75 | 255 | 3.8 | 12.81 | 154 | 13.13 | |||||||||||||||||

| 1,129 |

3.0 years

|

Cdn$ 8.70

|

882 |

Cdn$ 8.42

|

||||||||||||||||||

|

f)

|

Impact of stock compensation:

|

The amount of stock compensation included in each financial statement caption is as follows:

|

Years ended April 30

|

2011

|

2010

|

||||||

|

Cost of product and support

|

$ | 10 | $ | 15 | ||||

|

Cost of service

|

33 | 18 | ||||||

|

Sales and marketing

|

139 | 174 | ||||||

|

Research and development

|

152 | 149 | ||||||

|

General and administrative

|

326 | 304 | ||||||

| $ | 660 | $ | 660 | |||||

The fair value of option grants were estimated using the Black-Scholes option pricing model with the assumptions as specified in the following table:

|

Year ended April 30

|

2011

|

2010

|

||||||

|

Weighted average grant date fair value of options granted during the year

|

Cdn$3.51

|

Cdn$2.34

|

||||||

|

Risk free interest rate

|

1% | 2% | ||||||

|

Dividend yield

|

7% | 9% | ||||||

|

Expected lives of options

|

5 years

|

5 years

|

||||||

|

Expected volatility

|

57% | 63% | ||||||

The fair value of options applicable to non-vested awards at April 30, 2011 was $452 and the weighted-average period over which those non-vested awards are expected to be recognized is 1.1 years.

|

g)

|

Employee share purchase plan:

|

In 2006, the Company’s shareholders approved an Employee Share Purchase Plan (ESPP) in order to encourage the Company’s employees and directors to invest in its shares. The ESPP allows participants to contribute a specified percentage of their base salary, generally through payroll deductions, for the purposes of purchasing shares in the Company from treasury. The ESPP provides for quarterly purchases to be at the share’s market value at the time of purchase less 15%.

During the year ended April 30, 2011, 16 shares (2010 - 27) were issued under the ESPP for aggregate proceeds of $190 (2010 - $196). A stock-based compensation charge of $31 was charged related to the discount provided to ESPP participants during the year ended April 30, 2011 (2010 - $34).

|

7.

|

Financial Instruments, Derivatives and Hedging Activities:

|

The Company holds foreign exchange rate related derivative instruments to manage its exposure to foreign currency price fluctuations. The Company does not enter into derivative instruments for any purpose other than cash-flow-hedging. The Company does not speculate using derivative instruments.

By using derivative financial instruments to hedge exposures to changes in foreign exchange rates, the Company exposes itself to credit risk and market risk.

Credit risk is the failure of the counterparty to perform under the terms of the derivative contract. When the fair value of a derivative contract is positive, the counterparty owes the Company, which creates credit risk for the Company. When the fair value of a derivative contract is negative, the Company owes the counterparty and, therefore, it does not possess credit risk. The Company minimizes the credit risk in derivative instruments by entering into transactions with high-quality counterparties.

Market risk is the adverse effect on the value of a derivative instrument that results from a change in interest rates, currency exchange rates, or other factors that affects prices.

The Company assesses foreign exchange rate cash flow risk by continually identifying and monitoring cash flows in various currencies that may adversely affect expected future cash flows in US Dollars and by evaluating hedging opportunities. The Company maintains risk management control systems to monitor foreign exchange rate cash flow risk attributable to the Company’s forecasted non-US Dollar cash flows as well as the Company’s offsetting hedge positions.

The Company has historically entered into cash flow hedges to purchase Canadian Dollars at times in the future to help mitigate foreign exchange fluctuations between the Canadian and United States dollars. Those hedges have been accounted for as designated cash flow hedges. During the year ended April 30, 2011, the hedges were discontinued and the related forward contracts closed out and accordingly, there was no unrealized gain or loss related to forward contracts at that date. The discontinuance of the contracts had no impact on the accounting for the hedge as the gain on the hedges remains deferred until the time when the original contracts would have matured. As at April 30, 2011, related to the historic hedges, the Company recorded an unrealized gain (loss) in Other Comprehensive Income (Loss) of $nil (2010 - $(488)) and a realized gain of $1,181 (2010 -$2,232). Any ineffective portion of the hedges would be reflected in net income for the applicable period.

As of April 30, 2011, $nil (2010 - $207) of the unrealized losses on derivative instruments that were deferred in other comprehensive income (loss) are expected to be reclassified to earnings during the next 12 months and $1,157 (2010 - $1,537) of the realized gains deferred in other comprehensive income are expected to be reclassified to earnings during the next 12 months, as the derivative contracts are executed. There were no cash flow hedges discontinued during 2010.

A 5% weakening of the US Dollar against the Canadian Dollar, UK Pound and Euro would have resulted in a decrease in net income for the year ended April 30, 2011 of $161 (2010 – $71), assuming that all other variables remained constant. A 5% strengthening of the US Dollar would have an equal, but opposite effect.

Fair value:

The fair value of the Company’s financial instruments measured at fair value has been segregated into three levels as follows:

|

·

|

Level 1 – fair value determined by reference to quoted prices in active markets for identical assets and liabilities

|

|

·

|

Level 2 – fair value determined by reference to significant observable inputs

|

|

·

|

Level 3 – fair value determined by reference to significant unobservable inputs

|

The company has no financial instruments measured at fair value included in Level 1 and Level 3. Financial instruments measured at fair value included in Level 2 at April 30, 2011 consist of foreign exchange forward contracts.

The carrying values of cash and cash equivalents, accounts receivable, accounts payable and accrued liabilities approximate their fair value due to the relatively short period to maturity of the instruments.

|

8.

|

Earnings per share:

|

Basic and diluted earnings per share are calculated as follows:

|

Years ended April 30

|

2011

|

2010

|

||||||

|

Net income

|

$ | 12,291 | $ | 12,607 | ||||

|

Weighted average number of shares outstanding

|

10,331 | 10,098 | ||||||

|

Incremental shares from assumed conversion of stock options

|

421 | 131 | ||||||

|

Adjusted weighted average number of shares outstanding

|

10,752 | 10,229 | ||||||

|

Earnings per share:

|

||||||||

|

Basic

|

$ | 1.19 | $ | 1.25 | ||||

|

Diluted

|

$ | 1.14 | $ | 1.23 | ||||

|

9.

|

Segmented information:

|

The Company evaluates operational performance based on a single operating segment: software Application Lifecycle Management (ALM). The ALM segment develops and markets software solutions that assist programmers in the creation of traditional and Web-based software, and in the management of the software development process.

The following schedules provide required enterprise-wide disclosure.

|

Years ended April 30

|

2011

|

2010

|

||||||

|

Revenue:

|

||||||||

|

Canada

|

$ | 10,256 | $ | 11,124 | ||||

|

United States

|

28,040 | 28,804 | ||||||

|

Germany

|

17,804 | 14,703 | ||||||

|

Japan

|

13,857 | 3,556 | ||||||

|

United Kingdom

|

7,642 | 4,594 | ||||||

|

Other

|

1,038 | 145 | ||||||

|

Total revenue

|

$ | 78,637 | $ | 62,926 | ||||

|

As at April 30

|

2011 | 2010 | ||||||

|

Long-lived assets:

|

||||||||

|

Canada

|

$ | 4,098 | $ | 2,774 | ||||

|

United States

|

2,808 | 2,823 | ||||||

|

Other

|

725 | 474 | ||||||

|

Total revenue

|

$ | 7,631 | $ | 6,071 | ||||

During the year ended April 30, 2011, one customer accounted for approximately 14% of revenue and during the year ended April 30, 2010 another customer accounted for approximately 12% of revenue.

Geographic segmentation of revenue is determined based on the location of the customer.

|

10.

|

Subsequent event:

|

On April 6, 2011, the Company entered into a plan of arrangement under the Business Corporations Act (Ontario) that was successfully completed on May 31, 2011. The arrangement resulted in the acquisition, by PTC NS ULC, an indirect, wholly-owned subsidiary of Parametric Technology Corporation (“PTC”), of all of the outstanding common shares of the Company for Cdn$26.20 in cash per common share. Effective July 1, 2011, the Company and PTC NS ULC were amalgamated and the combined entity is currently known as MKS Corporation.

On the successful completion of the plan of arrangement by PTC, the Company ceased to exist as an independent public company and the transaction resulted in the de-listing of the Company’s common shares from trading on the Toronto Stock Exchange.

Costs related to the plan of arrangement incurred by the Company amounted to $5,963 (with $1,158 included in the determination of net income for the year ended April 30, 2011).

PARAMETRIC TECHNOLOGY CORPORATION

MKS INC.

Unaudited Pro Forma

Combined Condensed Financial Statements

On May 31, 2011 (the “Effective Date”), Parametric Technology Corporation (“PTC”) completed the acquisition of publicly held MKS Inc. (“MKS”), through PTC NS ULC, a wholly-owned subsidiary of PTC (“Purchaser”). The acquisition was completed pursuant to the terms of an Arrangement Agreement dated as of April 6, 2011 by and among PTC, Purchaser and MKS (the “Arrangement Agreement”) for approximately CDN$290 million (US$298 million) in cash. Pursuant to the terms of the Arrangement Agreement, each of the 10,399,316 outstanding common shares of MKS was transferred to Purchaser in exchange for CDN$26.20 per share, without interest (the “Per Share Consideration”), each of the outstanding vested stock options of MKS was cash settled on the basis of the Per Share Consideration, and the unvested stock options of MKS were converted into options to buy 146,998 shares of PTC common stock. PTC borrowed US$250 million under its existing credit facility and used approximately US$48 million of available cash to fund the acquisition.

The unaudited combined condensed pro forma balance sheet as of April 2, 2011 is based on the individual balance sheets of PTC as of April 2, 2011 and MKS as of April 30, 2011 and prepared as if the acquisition of MKS had occurred on April 2, 2011. The unaudited pro forma combined condensed statement of operations of PTC and MKS for the year ended September 30, 2010 is presented as if the acquisition had taken place on October 1, 2009 and, due to different fiscal period ends of the companies, combines the historical results of operations of PTC for the fiscal year ended September 30, 2010 with the historical results of operations of MKS for the twelve months ended October 31, 2010. The twelve months ended October 31, 2010 were derived by combining the interim period six months ended October 31, 2010 with the twelve months ended April 30, 2010 less the interim period six months ended October 31, 2009.

The unaudited pro forma combined condensed statement of operations of PTC and MKS for the interim period six months ended April 2, 2011 is presented as if the acquisition had taken place on October 1, 2009 and, due to different fiscal period ends of the companies, combines the historical results of operations of PTC for the interim period six months ended April 2, 2011 with the historical results of operations of MKS for the six months ended April 30, 2011 derived from the twelve months ended April 30, 2011 less the interim period six months ended October 31, 2010.

The unaudited pro forma adjustments are based upon available information and assumptions that PTC believes are reasonable. The unaudited pro forma combined condensed consolidated financial statements and related notes thereto should be read in conjunction with PTC’s historical consolidated financial statements included in its filings with the Securities and Exchange Commission (the “SEC”) of the Annual Report on Form 10-K for the fiscal year ended September 30, 2010, and the Quarterly Report on Form 10-Q filed on May 11, 2011 for the quarterly period ended April 2, 2011. In addition, this unaudited combined condensed pro forma information should be read in conjunction with the historical consolidated financial statements of MKS included within this Amendment No. 1 to Current Report on Form 8-K.

These unaudited combined condensed pro forma financial statements and interim period financial statements are prepared for informational purposes only in accordance with Article 11 of Regulation S-X and are not necessarily indicative of future results or of actual results that would have been achieved had the acquisition of MKS been consummated (i) as of October 1, 2009 for the unaudited combined condensed pro forma statements of operations and (ii) as of April 2, 2011 for the unaudited combined condensed pro forma balance sheet. The unaudited pro forma financial statements do not give effect to any cost savings or incremental costs that may result from the integration of PTC and MKS.

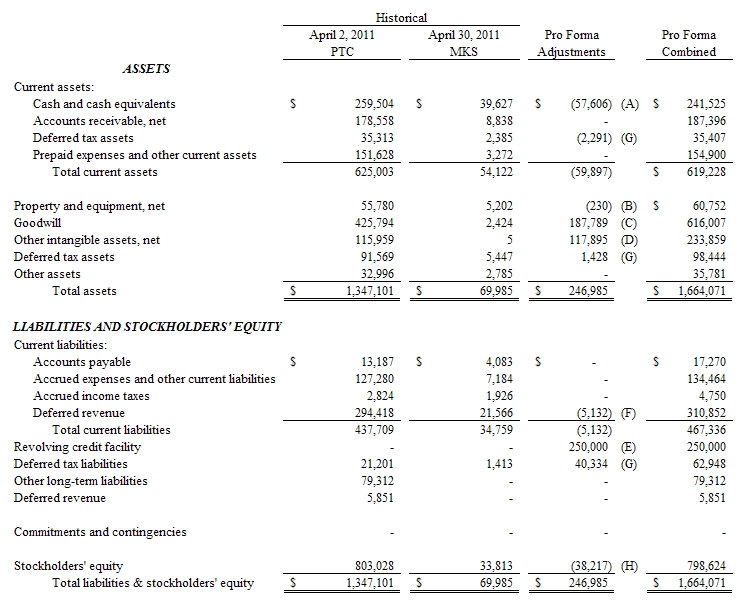

PARAMETRIC TECHNOLOGY CORPORATION

MKS INC.

Unaudited Pro Forma

Combined Condensed Balance Sheet

As of April 2, 2011

(in thousands)

See accompanying notes to unaudited pro forma combined condensed financial statements.

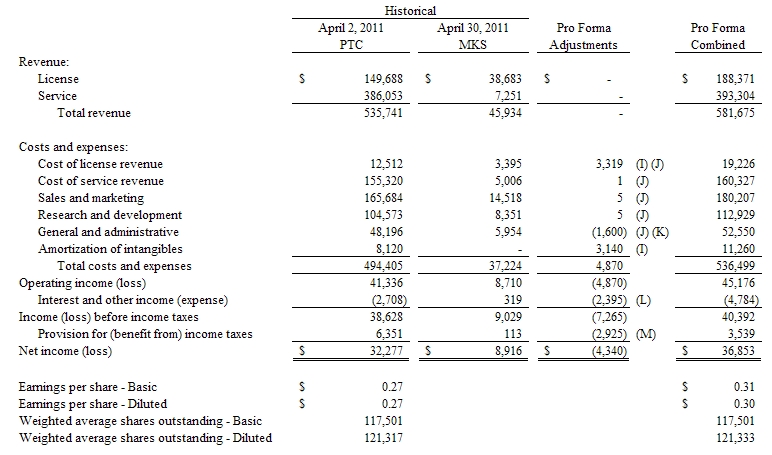

PARAMETRIC TECHNOLOGY CORPORATION

MKS INC.

Unaudited Pro Forma

Combined Condensed Statement of Operations

For the Six Months Ended April 2, 2011

(in thousands, except per share data)

See accompanying notes to unaudited pro forma combined condensed financial statements.

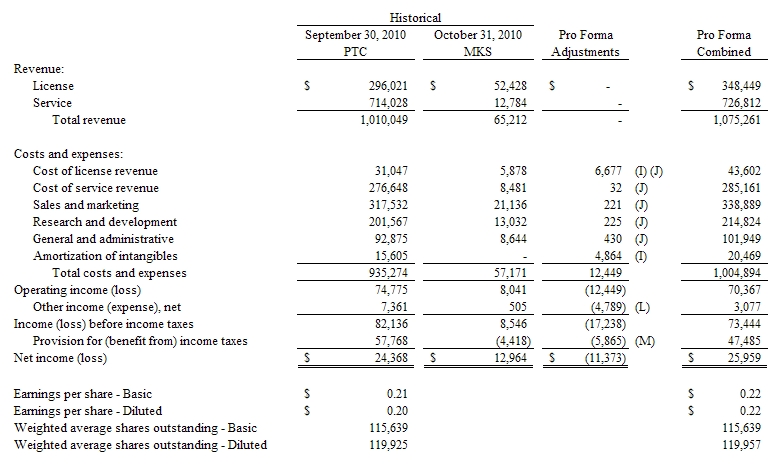

PARAMETRIC TECHNOLOGY CORPORATION

MKS INC.

Unaudited Pro Forma

Combined Condensed Statement of Operations

For the Twelve Months Ended September 30, 2010

(in thousands, except per share data)

See accompanying notes to unaudited pro forma combined condensed financial statements.

PARAMETRIC TECHNOLOGY CORPORATION

MKS INC.

Notes to Unaudited Pro Forma Condensed Combined Financial Statements

|

(1)

|

Basis of Pro Forma Presentation

|

The unaudited pro forma combined condensed balance sheet as of April 2, 2011 and the unaudited pro forma combined condensed statement of operations for the year ended September 30, 2010 and six months ended April 2, 2011 are based on the historical financial statements of PTC and MKS as of and for the period ending on their respective fiscal period-end dates after giving effect to PTC’s acquisition of MKS and the assumptions and adjustments described in the notes herein. MKS’s fiscal year ends on April 30; PTC’s fiscal year ends on September 30. In addition, certain historical MKS balances have been reclassified to conform to the pro forma combined presentation. Transactions between PTC and MKS were nominal during the periods presented. No pro forma adjustments were necessary in order to conform MKS’s accounting policies to PTC’s accounting policies.

The unaudited pro forma combined condensed balance sheet as of April 2, 2011 is presented as if the acquisition had occurred on April 2, 2011 and, due to the different fiscal period ends of the companies, combines the historical balance sheet for PTC at April 2, 2011 with the historical balance sheet of MKS at April 30, 2011.

The unaudited pro forma combined condensed statement of operations of PTC and MKS for the year ended September 30, 2010 is presented as if the acquisition had taken place on October 1, 2009 and, due to different fiscal period ends of the companies, combines the historical results of operations of PTC for the fiscal year ended September 30, 2010 with the historical results of operations of MKS for the twelve months ended October 31, 2010. The twelve months ended October 31, 2010 was derived by combining the interim period six months ended October 31, 2010 with the twelve months ended April 30, 2010 less the interim period six months ended October 31, 2009.

The unaudited pro forma combined condensed statement of operations of PTC and MKS for the interim period six months ended April 2, 2011 is presented as if the acquisition had taken place on October 1, 2009 and, due to different fiscal period ends of the companies, combines the historical results of operations of PTC for the interim period six months ended April 2, 2011 with the historical results of operations of MKS for the six months ended April 30, 2011 derived from the twelve months ended April 30, 2011 less the interim period six months ended October 31, 2010.

The unaudited pro forma combined condensed financial statements are not intended to represent or be indicative of the consolidated results of operations or financial position of PTC that would have been reported had the acquisition been completed as of the dates presented, and should not be taken as representative of the future consolidated results of operations or financial position of PTC. The unaudited pro forma financial statements do not reflect any cost savings or incremental costs that may result from the integration of PTC and MKS. The unaudited pro forma combined condensed financial statements should be read in conjunction with the historical consolidated financial statements and accompanying notes of PTC included in its Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission.

|

(2)

|

MKS Acquisition

|

Pursuant to the Arrangement Agreement dated April 6, 2011, PTC acquired all of the outstanding shares of common stock of MKS on May 31, 2011. MKS’s results of operations have been included in PTC’s consolidated financial statements beginning May 31, 2011.

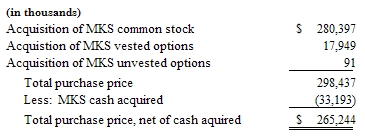

The acquisition of MKS has been accounted for as a business combination. Assets acquired and liabilities assumed were recorded at their fair values as of the acquisition date. The total purchase price for the acquisition was approximately $298.4 million ($265.2 million, net of cash acquired) primarily in cash and is comprised of:

PARAMETRIC TECHNOLOGY CORPORATION

MKS INC.

Notes to Unaudited Pro Forma Condensed Combined Financial Statements

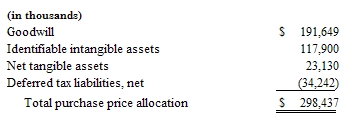

The total purchase price has been allocated to MKS’s tangible assets, identifiable intangible assets and assumed liabilities based on their estimated fair values as of May 31, 2011. The excess of the purchase price over the tangible assets, identifiable intangible assets and assumed liabilities will be recorded as goodwill. Our estimates and assumptions in determining the estimated fair values of certain assets and liabilities are subject to change within the measurement period (up to one year from the acquisition date). The primary areas of the purchase price allocation that are not yet finalized relate to income taxes and the amount of resulting goodwill. The total purchase price was allocated as follows:

Goodwill amounts are not amortized, but rather are tested for impairment at least annually. If PTC determines that the value of goodwill has become impaired, PTC will incur an accounting charge for the amount of impairment during the fiscal quarter in which such determination is made. Identifiable intangible assets acquired consist of developed technology, customer relationships and tradenames. There was no in-process research and development identified.

Net tangible assets consist of the fair values of tangible assets less the fair values of assumed liabilities and obligations. Except for property and equipment, deferred revenue, and deferred taxes, net tangible assets were valued at their respective carrying amounts recorded by MKS as PTC believes that their carrying value amounts approximate their fair values at the acquisition date.

Property and equipment were reduced by $0.2 million in the pro forma combined condensed balance sheet, to adjust the assets to an amount equivalent to the fair market value of these assets as of April 2, 2011. The change in depreciation expense is not materially different.

Deferred revenues were reduced by $5.1 million in the pro forma combined condensed balance sheet, to adjust deferred revenue to an amount equivalent to the estimated cost plus an appropriate profit margin to perform the services related to MKS’s software support contracts as of April 2, 2011.

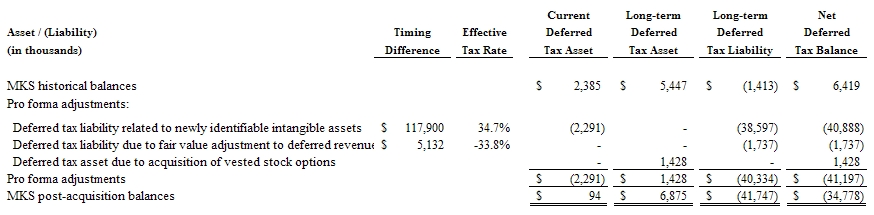

Net deferred tax liabilities include tax effects of fair value adjustments related to identifiable intangible assets, and deferred revenues.

|

(3)

|

Acquisition-related transaction and integration costs

|

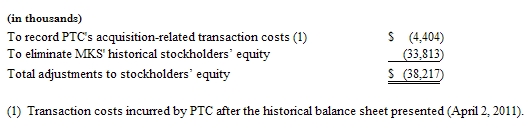

Transaction costs incurred after the PTC and MKS historical balance sheets presented totaled $9.3 million representing MKS transaction costs of $4.9 million (incurred after April 30, 2011) and PTC transaction costs of

$4.4 million (incurred after April 2, 2011). Transaction costs represent professional fees, primarily investment banking fees. Transaction costs incurred by PTC in the six month period ended April 2, 2011 were $0.5 million. Transaction costs incurred by MKS in the six month period ended April 30, 2011 were $1.1 million.

PTC is still assessing the expected amount of future costs associated with integrating MKS. No adjustment has been included in the pro forma combined condensed financial statements related to any potential costs. Such costs will be reported in PTC’s statements of operations when incurred. PTC incurred approximately $1.6 million of integration costs during the three months ended July 2, 2011.

|

(4)

|

Pro Forma Adjustments

|

The following pro forma adjustments are included in the unaudited pro forma combined condensed financial statements:

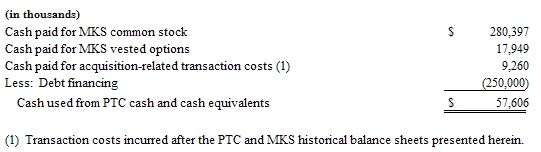

|

(A)

|

To record the following adjustments to cash:

|

|

(B)

|

To record the fair value adjustment related to the existing MKS property and equipment resulting in a decrease to the value of property and equipment of $0.2 million.

|

|

(C)

|

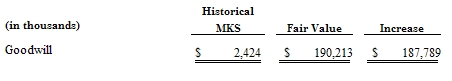

To eliminate MKS’s historical goodwill and record fair value of goodwill:

|

|

(D)

|

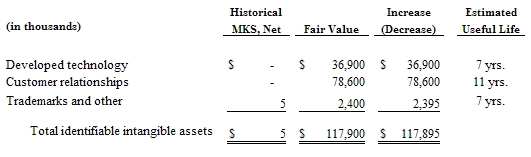

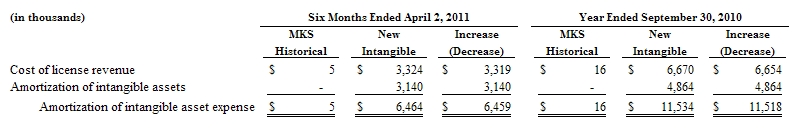

To record the difference between the fair value and historical amount of intangible assets. PTC expects to amortize the acquired identifiable intangible assets over the estimated useful lives based upon the pattern in which economic benefits related to such assets are expected to be realized indicated below:

|

|

(E)

|

PTC borrowed $250 million under its existing credit facility to fund the acquisition. This amount was borrowed at an annual interest rate of 2.1%. The interest rate will reset after three months. The credit facility matures August 2014. PTC is currently paying a commitment fee of 0.30% per annum on the undrawn portion of the credit facility. For purposes of these pro forma financial statements, no interest rate resets were assumed; the above stated rate was assumed constant for the full year. If the rate was to increase or decrease by 0.125%, there would be a change in interest expense annually of approximately $0.3 million.

|

|

(F)

|

To record the fair value adjustment to deferred revenue acquired. The fair value represents an amount equivalent to the estimated cost plus an appropriate profit margin to perform the services related to MKS’s software support contracts based on deferred revenue balances of MKS as of May 31, 2011. The historical value of deferred revenue as of May 31, 2011 was $21.9 million, the fair value is $16.8 million, resulting in a decrease to the value of total deferred revenue of $5.1 million. The majority of the deferred revenue is related to MKS’s software support contracts. The deferred revenue fair value adjustment is not reflected in the income statement as it is a non-recurring charge.

|

|

(G)

|

To record deferred tax liabilities related to the fair value adjustments for identifiable intangible assets and deferred revenue as follows:

|

|

(H)

|

To record the following adjustments to equity:

|

|

(I)

|

To record higher overall amortization expense related to intangible assets acquired (see Note D) to the following line items:

|

|

(J)

|

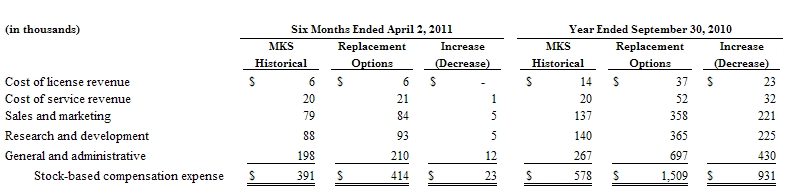

To reverse MKS historical stock-based compensation expense and record stock-based compensation expense based on the fair value of the replacement stock options granted for unvested MKS stock options (see Note N below). The adjustments are as follows:

|

|

(K)

|

To eliminate the transaction costs included in historical results. Transaction costs incurred by PTC in the six month period ended April 2, 2011 were $0.5 million. Transaction costs incurred by MKS in the six month period ended April 30, 2011 were $1.1 million.

|

|

(L)

|

To record the following adjustments to other income (expense), net:

|

|

(M)

|

To record a tax benefit on the net amount of total pro forma adjustments of $2.9 million and $5.9 million for the six month period ended April 2, 2011 and the year ended September 30, 2010, respectively. The pro forma combined provision for income taxes does not reflect the amounts that would have resulted had PTC and MKS filed consolidated tax returns during the periods presented.

|

|

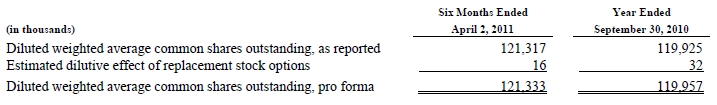

(N)

|

Pro forma basic and diluted earnings per share amounts are computed using the weighted average number of common shares outstanding and are adjusted for additional stock options granted as replacement stock-based awards for unvested MKS stock options pursuant to the treasury stock method as if those awards had been assumed as they stood at the acquisition date as of the beginning of each period presented without consideration for any subsequent award activity such as exercises and cancellations. Our acquisition of MKS had no impact to our basic weighted average common shares outstanding calculations for the pro forma condensed combined statements of operations for the periods presented.

|