Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Deyu Agriculture Corp. | v226790_8k.htm |

Deyu Agricultural Corp. Releases Report on First Quarter Developments and Future Outlook

BEIJING, CHINA, June 24, 2011 (PRNewswire-Asia) -- Deyu Agriculture Corp. (OTCBB: DEYU.ob - News) (“Deyu” or “the Company”), a Beijing, China based vertically integrated producer and distributor of organic and non-organic grain products, recently released a report analyzing the Company’s progress in the first quarter of 2011 and Deyu’s future prospects. In particular, the report highlights the latest growth in each of the Company’s divisions—corn products and simple and deep processed grain products—as well as Deyu’s future strategies. Deyu’s report is available on the Company’s website: www.deyuagri.com under Investors/Investor Presentation.

Jianming Hao, Deyu’s Chief Executive Officer and Chairman commented, “We are committed to transparent communication and accountability. Specifically, we strive to keep our investors apprised of our developments and inform them of the steps we are taking to maximize shareholder value. In providing this report, we seek to open a dialogue with our investors so that together we can build a better future for the Company and accordingly, for them. Due in large part to the strength of our shareholder base, our Company is quickly emerging in China’s agricultural sector as a prominent supplier of healthy, nutritious grain products. We are very optimistic about our future and we look forward to working with each of our investors to make the best use of our potential and their investments.”

About Deyu Agriculture

Deyu Agriculture Corp. is a vertically integrated producer, processor, marketer and distributor of organic and other agricultural products made from corn and grains operating in the Shanxi Province of the People's Republic of China. The Company has access to over 109,000 acres of farmland in the Shanxi Province for breeding, cultivating, processing, warehousing, and distributing grain and corn products. Deyu’s deep-processed grain division was created in 2010 and its business is conducted through Detian Yu, Deyufarm and its subsidiaries, by producing and distributing instant grain vermicelli, instant millet beverage, and buckwheat tea to wholesalers and supermarkets underneath the brand name, “Deyufang”. Deyu has an extensive retail distribution network of more than 10,000 retail stores across China. The Company’s web site is located at www.deyuagri.com.

Safe Harbor Statements

This press release contains forward-looking statements made under the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward looking statements are based upon the current plans, estimates and projections of Deyu Agriculture's management and are subject to risks and uncertainties, which could cause actual results to differ from the forward looking statements. Such statements include, among others, those concerning market and industry segment growth and demand and acceptance of new and existing products; any projections of sales, earnings, revenue, margins or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements regarding future economic conditions or performance; uncertainties related to conducting business in China, as well as all assumptions, expectations, predictions, intentions or beliefs about future events. Therefore, you should not place undue reliance on these forward-looking statements. The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements: business conditions in China, general economic conditions; geopolitical events and regulatory changes, availability of capital, changes in the agricultural industry, the Company's ability to maintain its competitive position. Additional Information regarding risks can be found in the Company's Quarterly Report on Form 10-Q and in the Company's recently filed Prospectus filed pursuant to Rule 424(b)(3) with the SEC.

|

Investor Contact:

|

|

Mr. Kevin Fickle, President

NUWA Group LLC.

|

|

Tel: +1-925-330-8315

|

|

Email: kevin@nuwagroup.com

|

Company Contact:

Mr. Charlie Lin, Chief Financial Officer

Deyu Agriculture Corp.

Tel: +1-626-242-5292

Email: charlie@china-deyu.com

DEYU AGRICULTURE CORP.

Room 808, Tower A,

Century Centre, 8 North Star Road

Beijing, People’s Republic of China

Website: http://www.deyuagri.com

Dear Shareholders:

To those of you who held on to your shares in Deyu Agriculture through the years, we thank you for your patience and confidence. To those of you who may be returning or to new investors, we welcome you.

Deyu Agriculture is rapidly developing, our operations are expanding and our brand is growing in popularity, and as we strive to become one of China’s leading providers of grain based food products, we want to keep investors apprised of all that is happening within the Company. You will find in this report details about how we run Deyu Agriculture and our plans for achieving the fundamental objective of our business: maximizing shareholder value.

We want to maintain an open dialogue with each and every one of you because we strongly believe that your opinions and insights will help us become a better company and accordingly, better reward all of you as shareholders. Your loyalty and support of Deyu Agriculture has put us in the wonderful position that we are in today—let’s continue to work together to build a great future for the Company and for you.

Sincerely Yours,

Jianming Hao

Chief Executive Officer and Chairman

|

Deyu Agriculture Report

June, 2011

On behalf of all of us at Deyu Agriculture Corp., I would like to thank you for your investments and confidence in our Company. We would like to take this opportunity to communicate our ideas of developing our Company to you and explain some of our past decisions, the window opportunity for growth and change, and our present and future financial and operational conditions to you.

Market Updates

Consumers in China are looking more to wholesome foods products. From 2004 to 2009, sales of healthy foods and beverages in China increased 28 percent to $1.5 billion, according to the market-research firm Euromonitor International. Our Company is benefiting substantially from the increasing health consciousness of the Chinese people and as we believe that this trend will continue in the future, we are taking steps to further capitalize on this fortuitous development. Furthermore, inflation and costs of agricultural products are increasing globally; agricultural products have become investment commodities, not to mention investments in agricultural companies with strong storage capacities.

Simple Processed Products

In addition to providing Chinese consumers with healthy simple/deep processed grain and corn products, many of which are organic, we recently introduced a series of products made from a rare species of grain. The margins for these products are high due to their scarcity; many consumers do not know the value of these rare grains. The sales of these products have been strong as consumers are enticed by the rareness and nutritional content of the grains used to manufacture these goods. So far, we have been able to secure these grains through our strong supply network and in the future, we intend to maintain this supply as well as to find other scarce grains that we can use to make new higher margin products.

At the same time, we intend to focus on producing products derived from more common species of grains. Such grains include corn, millet and mung beans, which are currently in good supply and heavy demand. While the sales of products made from common grains do not provide as high a margin as those goods made from rarer species, we believe strong sales of products made from conventional grains would increase revenues. In the first quarter of 2011, our corn division increased its revenues 87 percent on the strength of robust sales; it is important that we maintain focus on this valuable aspect of our business. By improving our sales of products made from common and rare species of grains, we believe that our overall gross margin and revenue may consequently increase.

“Shop-in-Shop” Model

Our business model includes utilizing a shop-in-shop approach, whereby we buy spaces—primarily counter areas—in supermarkets to display our products. Even though we do not have many executed agreements with these supermarkets, we are still the exclusive seller in many of them, meaning we believe we have no true competition in these shop-in-shop areas. As a result, in many of these supermarkets we believe our products are prominently set apart from our competitors. We intend to build on this branding advantage by launching more shop-in-shops in additional supermarkets.

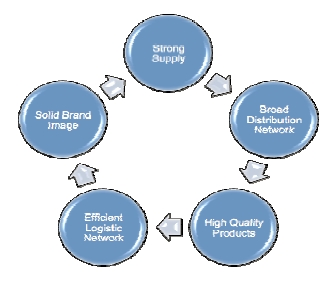

Competitive Strength

As an established agricultural company, we believe the high barrier of entry in China’s agricultural sector serves as another one of our competitive advantages. Currently, China’s government has stopped granting licenses to new corn processing companies. Furthermore, only after years of rigorous development are we now able to supply approximately 10,000 supermarkets and convenience stores in China. Our exclusive access to over 109,000 acres of fertile farmland (19,000 acres of which we hold use rights to), our contracts with more than 200 agencies covering more than 150,000 farmers, our modern logistics center and our agreements with three major Chinese railway lines facilitate our distribution efforts. In addition, we completed the construction of a new storage center in early May 2011 that we believe will reduce the risk associated with raw material seasonality as well as enable us to better meet the growing demand for our products, particularly our corn goods.

With the addition of our new storage center—the warehouse of which is capable of storing 70,000 tons of grains with an annual turnover rate of more than 350,000 tons—our total storage capacity now stands at over 120,000 tons, with an annual turnover rate of more than 600,000 tons. This new facility features advanced corn-drying equipment that we believe will enable us to process 500,000 tons of corn products annually. We also believe that our new storage center will support annual corn sales of $120 million. Even though our new storage center is geared more towards corn production, we aim to be a well-rounded provider of grain products.

We believe that supplying a broad range of products will enable us to secure a larger, more diverse customer base. As we strive to strengthen our brand name in China, we want to be able to fulfill the various demands of Chinese consumers for healthy, delicious grain-based food products.

DeyuFarm Development

For instance, we believe that Deyufarm’s deep processed grain products, such as organic non-fried instant noodles and buckwheat teas, match the needs of China’s urban population, which is characterized by a growing middle class and high-income consumers who tend to have less time to cook and eat. Accordingly, we plan to increase our efforts to enter into supermarkets in tier 1 and tier 2 cities in China, such as Shanghai and Guangzhou of tier 1, and Tianjin, Suzhou, Dalian, Qingdao and Hangzhou of tier 2, frequented by this demographic. We believe that Deyufarm will post profits once its investment period is completed and after we increase our sales channels for these products to include more tier 1 and tier 2 supermarkets.

Presently, Deyufarm is still in its investment period and certain related parties are the only source of financing. These investments will be used for promotion, marketing and capacity expansion. Reputation is key in China’s agricultural sector and we are planning Deyufarm’s future very carefully. We are putting a lot of effort into Deyufarm right now because we believe so strongly in its products. Currently, our existing investors are suffering a loss due to these conditions, but we believe Deyufarm’s products will drive our profits in the future and in the process, help reward our shareholders who stay the course. We believe that Deyufarm will generate greater revenues this year and by the end of 2012, we believe Deyufarm may increase its revenues by many multiples.

Benefiting from Bank Loans

In regards to our bank loans and lines of bank acceptance notes (credit lines), management would like to emphasize to our investors that these loans and credit lines from the banks indicate the strengths and potential growths that the banks see in the Company. These loans and credit lines also demonstrate the commitments of our management team to the Company and our shareholders as several key members of management have pledged their personal assets and provided personal guarantees to secure the loans and credit lines. All of the Company’s loans and credit lines are due in 6 months or 1 year, and approximately $26 million are interest-free lines of bank acceptance notes with finance fees at approximately 0.5 percent. The Company expects to early pay back a certain amount of these loans and credit lines before the due dates and will negotiate with the banks to renew every 6 months or 1 year to support the capital needs for continuously growing inventory purchasing and business promotions that come along with the Company’s market expansion.

These bank loans are necessary to achieve our short and long-term goals as they are enabling us to build an economic scale of our business model and retail network. The bank loans would be used mainly for corn purchases, which require prepayment in advance. In addition, we now have sufficient cash for an acquisition and we would not have to shave capital to purchase another company. As an agricultural company, it is vital that we maintain a solid sales network, a broad range of product categories and economies of scale. These bank loans help us sustain and cultivate these aspects of our business.

Internal Control Improvement

We also want to assure you that we are taking measures to increase the timeliness of future fillings. Like our shareholders, we too were displeased with our late 10-Q filing for the first quarter of 2011. Our audit committee and whole management team have put their full attention in this matter. We are in the process of hiring new employees with Big 4 experience and strengthening our filing and reporting mechanism. For our upcoming second quarter 10-Q, our CFO will arrive in Beijing in early July to strengthen our internal controls and to ensure that our report is filed on time.

I hope this overview answered many of your questions. Below you will find answers to other queries you might have.

Q: Discuss the contraction in your margins in the Simple Processed Grain Division?

A: There are many kinds of grains in China, hundreds of them. What we are most familiar with are millets, green beans, etc. For our packed simple processed grain business, most of our products are those which we are familiar with. Because those are more commonly used and widely known, essentially more competitive, it is harder to increase pricing. In the meantime, all purchased costs of agricultural products have continuously increased. All of these were attributed to lower margins. However, we are finding ways of reversing this trend using the strategies discussed under subtitles of Simple Processed Products and “Shop-in-Shop” Model above.

Q: Describe the pathway to profits in the Deep Processed Division

A: Our two pathways are:

|

1.

|

To boost marketing and advertising efforts to improve sales; and

|

|

2.

|

To maintain sufficient production capacity without too much capacity surplus.

|

Q: Deep Processed Grain. For the last few months, management has stated that this division will generate relative high gross margins around 35%. However, in Q1, this division generated only 1% gross margin. What had happened and will happen in Q2? By which quarter will production be running at a relatively high capacity? When will Deep Process Grain division become profitable?

A: Our Deyufarm products are part of our deep processed grain division and as a result of Deyufarm still being in its investment period, our deep processed grain division did not look to achieve a 35 percent gross margin at the pace we previously projected it would. Normally, sufficient production capacity and market demand ensure the high margins of our deep processed grain goods. In Q1, we were limited by inadequate production capacity and a high percentage of outsourcing. Now, we have completed the construction of our new Beijing production line and we expect approval from the Chinese equivalent of the “FDA” in the third quarter of 2011. The Chinese government has increased its inspection standards and consequently, the approval process takes longer than it did in the past. Once the new production line becomes operational, we believe that our capacity will reach a total output of $40 million. We will continue to look at market demand on a variety of deep processed products to determine how we can best utilize our production lines. With sustained funding and business development, we believe 2012 will be a profitable year.

Q: Deyufarm. Please explain how we could avoid this dilution, balance sheet debt and then later buy Deyufarm for 200mm RMB when it cost 70mm RMB. Why don't we get to buy it for 70mm RMB with shareholders’ capital? What about related-party loans?

A: In fact, the related parties are prepared to agree with Deyufarm and Detian Yu that they will not demand to enforce repayments for the period of the Variable Interest Control Agreements being effective.

Our management’s decision-making has to rely upon concurrent business environment and changing situations. Our intent is always for the best interest of the Company and our shareholders. Since the HaoLiangXin acquisition and the Deyufarm incorporation came with great yet inestimable risks and extensive capital outflows, the Variable Interest Control Agreements were commenced for the sake of entering a new yet unknown business sector. However, we are willing to have an open dialogue on any feasible advice with detailed plans for any possible changes, and would be willing to evaluate a number of options included but not limited to:

|

a)

|

To maintain the status quo by executing new agreements to not enforce repayment of the related-party loans

|

|

b)

|

To terminate the Variable Interest Control Agreements or Deyu management terminating its ownership of Deyufarm in order to eliminate such related-party relationships. However, the financial impact would need to be fully evaluated in both the short term and long term.

|

|

c)

|

To restructure the transaction so that Detain Yu directly owns the equity of Deyufarm via a buyout of Junda and Longyue, except SBCVC with offer price of proportion of callout price of $200 MM RMB according to the Variable Interest Control Agreements. However, in the best interests of Deyu, I am willing to negotiate with Junda and Longyue for them to forgo the agreed callout price and replace it with a fair value price to be determined by independent business valuation professionals. After directly owning Deyufarm, the related-party loans have to be paid back (the proposed loan amendment agreements with Junda and Longyue for loan not being paid back until VIE agreements ineffective is only under current VIE structure). Afterwards, there will be around $15MM needed for this year’s business development and capital expenditures, such as advertisements, branding, market development, factory capacity expansion, etc. How do we come up all of these funds? I simply lay out all the reality and cash need to hope to have a doable agreement for all parties to agree on the details ASAP. I sincerely welcome all suggestions.

|

Q: Farmland Title. When will the title finally transfer for the $7mm farmland purchased in Sept. 2010? As of March 31, 2011 the title transfer was still in process. What is the hold up? Better yet, can the Company rescind this transaction and receive back the $7mm initially paid while securing less expensive farmland alternatives so it can be used for working capital instead?

A: We believe it would not be advantageous to sell the farmland since doing so will negatively affect shareholder value. We believe that this farmland and its resources will eventually benefit our businesses in securing our supply and accordingly maximizing shareholder value, which is our main objective.

Presently, we are working with the local government to transfer the title of the farmland to us. Like many government transactions, farmland title transfers are very involved and time consuming. We believe this long process will be worth it and we want our investors to believe the same. Having a steady supply of crops is critical to our business and we believe obtaining this farmland would substantially enhance our resources and allow us to produce more goods. Additionally, we would be eligible for VAT tax exemptions by virtue of the farmland purchase.

Q: Timber and timberland. Why does the Company have rights to timber and timberland given it is a grain company? How is timber and timberland related to grains? Can the Company sell this right for cash given this is not core to its business?

A: Timber and timberland were the first assets of the Company contributed by the original shareholder of Jinzhong Deyu. Indeed these assets do not belong to our core business. However, it takes time to process the sale of these assets given the unique nature of the assets and the approval process of Chinese government on land transactions, and we do not believe that hastily rushing to sell these assets would be in the best interests of our shareholders. Nonetheless, we will attempt to locate a buyer and try to generate profits from a sale.

Q: You recently installed an ERP system, how is that working out for you and when will it be fixed?

A: We implemented our ERP system in Q1. However, implementation of a smooth running system tends to take months. This is indeed the main reason for our Q1 filing extension. We sincerely apologize to our shareholders. At now, we are giving all our efforts to lower this impact by increasing manpower and extensive training to ensure the quality of parallel run for accuracy and timeliness of our financial reporting.

Q: Recent bank loans and lines of bank acceptance notes. $34mm in new loans were drawn in April and May 2011. Why was so much money borrowed? What is short-term purpose of this?

A: The business model of the Company is: cash purchase—stock—sell—accounts receivable—payment collection. In the meantime, we also need to pay off our selling expenses, administrative expenses and listing fees. Short-term cash is an important aspect of our business model. Cash from these loans provide us with the ability to increase our purchases, pay off our accounts payable and ensure a healthy cushion between our receivable collections. We see our ability to access money from Chinese banking sources as a means to further strengthen our financial position and we believe this is the optimal solution for our cash need since this approach provides us with the ability to expand without diluting our shareholders.

In addition, these bank loans will be mainly used for purchasing corn, which is required by the terms of these loans, and the minority of the loans will be used for working capital. At the same time, we intend to look toward strategic acquisitions with current bank debt and cash flow that could reap considerable benefits for shareholders.

Q: Statement regarding the Company's leverage and encumbrances in regard to the large debts compared to total equity.

A: Deyu has reached its max in terms of total debt on hand. We plan on growing by using bank loans for expansion and then converting our existing assets into generating operating cash flow, then using the cash flow for further growth while repaying debt and increasing the net margins.

By investing in our sales market with these bank loans and cash flow from existing assets, we believe our retail network will become more established. We consider our already strong distribution network an intangible asset of the Company and although it is not reflected on our balance sheet, we believe that enhancing our sales network may add significant value to the Company’s potential and market position.

We are committed to providing the highest level of shareholder satisfaction, and look forward to seeing our shareholders grow with us with prosperity ahead. We will post our next report with further updates and the feedback we receive from you.

Sincerely Yours,

JianMing Hao

Chairman and CEO

Deyu Agriculture Corp.