Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TIDEWATER INC | d8k.htm |

| EX-99.2 - TRANSCRIPT OF THE PRESENTATION - TIDEWATER INC | dex992.htm |

UBS GLOBAL OIL

AND GAS CONFERENCE

May 26, 2011

QUINN P. FANNING

Executive Vice President , CFO

JOSEPH M. BENNETT

Executive Vice President and

Chief Investor Relations Officer

QUINN P. FANNING

Executive Vice President , CFO

JOSEPH M. BENNETT

Executive Vice President and

Chief Investor Relations Officer

Exhibit 99.1 |

FORWARD-LOOKING STATEMENTS

FORWARD-LOOKING STATEMENTS

FORWARD-LOOKING STATEMENTS

2

In accordance with the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995, the Company notes that certain statements set forth in this

presentation provide other than historical information and are forward looking. The

actual achievement of any forecasted results, or the unfolding of future economic or

business developments in a way anticipated or projected by the Company, involve

numerous risks and uncertainties that may cause the Company’s actual performance

to be materially different from that stated or implied in the forward-looking

statement. Among those risks and uncertainties, many of which are beyond the

control of the Company, include, without limitation, volatility in worldwide energy

demand and oil and gas prices; fleet additions by competitors and industry

overcapacity; changes in capital spending by customers in the energy industry for

offshore

exploration,

field

development

and

production;

changing

customer demands

for vessel specifications, which may make some of our older vessels technologically

obsolete for certain customer projects or in certain markets; uncertainty of global

financial market conditions and difficulty in accessing credit or capital; acts of

terrorism and piracy; significant weather conditions; unsettled political conditions,

war, civil unrest and governmental actions, such as expropriation, especially in higher

risk countries where we operate; foreign currency fluctuations; labor influences

proposed by international conventions; increased regulatory burdens and oversight

following

the

Deepwater

Horizon

incident;

and enforcement of laws related to the

environment,

labor

and

foreign

corrupt

practices.

Readers

should

consider all of these

risk factors as well as other information contained in this report.

Web:

www.tdw.com

Email:

connect@tdw.com

Phone:

504.568.1010

Fax:

504.566.4580 |

KEY

TAKEAWAYS KEY TAKEAWAYS

KEY TAKEAWAYS

3

•

Culture of safety & operating excellence

•

History of earnings growth and solid returns

•

World’s largest and newest fleet provides

basis for continued earnings growth

•

Strong balance sheet allows us to act upon

available opportunities |

SAFETY –

A TOP PRIORITY

SAFETY –

SAFETY –

A TOP PRIORITY

A TOP PRIORITY

4 |

5

0.00

0.25

0.50

0.75

1.00

Total Recordable Incident Rates

Calendar Years

2002

2003

2004

2005

2006

2007

2008

2009

TIDEWATER

DUPONT

DOW CHEMICAL

EXXON MOBIL

SAFETY RECORD RIVALS

SAFETY RECORD RIVALS

LEADING COMPANIES

LEADING COMPANIES |

U.S.

COAST GUARD AWARDS FOR CREW OF M/V DAMON B BANKSTON

U.S. COAST GUARD AWARDS FOR

U.S. COAST GUARD AWARDS FOR

CREW OF M/V DAMON B BANKSTON

CREW OF M/V DAMON B BANKSTON

6

CONFIDENTIAL:

Contains assumptions and alternative projections.

FOR DISCUSSION PURPOSES ONLY

A Proud

Moment

For

Tidewater

Certificate of Valor:

ALWIN JAMES LANDRY

Gold Lifesaving Medal:

ANTHONY ROBERT GERVASIO

Silver Lifesaving Medal:

LOUIS PAUL LONGLOIS

Distinguished Public Service Award:

CREW OF DAMON B BANKSON

April 15, 2011 |

7

32% Six-Year Compounded

Annual Earnings Growth Rate

**

EPS in Fiscal 2004 is exclusive of the $.30 per share after tax impairment charge.

EPS in Fiscal 2006 is exclusive of the $.74 per share after tax gain from the

sale of six KMAR vessels. EPS in Fiscal 2007 is exclusive of $.37 per share of after tax gains from the sale of 14 offshore

tugs. EPS in Fiscal 2010 is exclusive of $.66 per share Venezuelan provision,

a $.70 per share tax benefit related to favorable resolution of tax

litigation and a $0.22 per share charge for the proposed settlement with the SEC of the company’s FCPA matter. EPS in Fiscal 2011

is exclusive of total $0.21 per share charges for settlements with DOJ and Government

of Nigeria for FCPA matters, a $0.08 per share charge related to participation

in a multi-company U.K.-based pension plan and a $0.06 per share impairment charge related to certain

vessels.

Adjusted Return

On Avg. Equity

4.3% 7.2%

12.4%

18.5% 18.3%

19.5%

11.4% 4.0%

HISTORICAL EARNINGS SUMMARY

HISTORICAL EARNINGS SUMMARY

“A Full Cycle”

“A Full Cycle”

$2.40

$5.20

$7.89

$1.03

$1.78

$3.33

$5.94

$6.39

$0.00

$2.00

$4.00

$6.00

$8.00

Fiscal

2004

Fiscal

2005

Fiscal

2006

Fiscal

2007

Fiscal

2008

Fiscal

2009

Fiscal

2010

Fiscal

2011

Adjusted EPS** |

8

Avg. Dayrates

$14,381*

$15,819

(+ 10%)

$17,400

(+ 10%)

85.8%*

85.0%

90.0%

~$4.00

EPS

~$5.60

EPS

~$9.10

EPS

269 vessels assumes (193 current new vessels + 36 under construction + ~ 20

additional new vessels per year for two years).

WHERE COULD FISCAL 2014 FIND US?

WHERE COULD FISCAL 2014 FIND US?

Potential for Earnings Acceleration

Potential for Earnings Acceleration

* 3/31/11 fiscal year actual stats

This info is not meant to be a

prediction of future earnings

performance, but simply an

indication of earning sensitivities

resulting from future fleet

additions and reductions and

varying operating assumptions.

~$400M+

EBITDA

~$520M+

EBITDA

~$730M+

EBITDA |

9

•

Unique global footprint; 50+ years of Int’l

experience

•

Unmatched scale and scope of operations

•

International market opportunities

•

Growth

•

Longer contracts

•

Better utilization

•

Higher dayrates

•

Solid customer base of NOC’s and IOC’s

INTERNATIONAL STRENGTH

INTERNATIONAL STRENGTH |

10

OUR GLOBAL FOOTPRINT

OUR GLOBAL FOOTPRINT

Vessel Distribution by Region

Vessel Distribution by Region

(excludes stacked vessels –

(excludes stacked vessels –

as of 3/31/11)

as of 3/31/11)

International / U.S.

2011: 94% / 6%

2000: 62% / 38%

North America

16

(6%)

Europe / M.E.

40

(14%)

Far East

35

(13%)

West Africa

129

(47%)

Central/South America

54

(20%) |

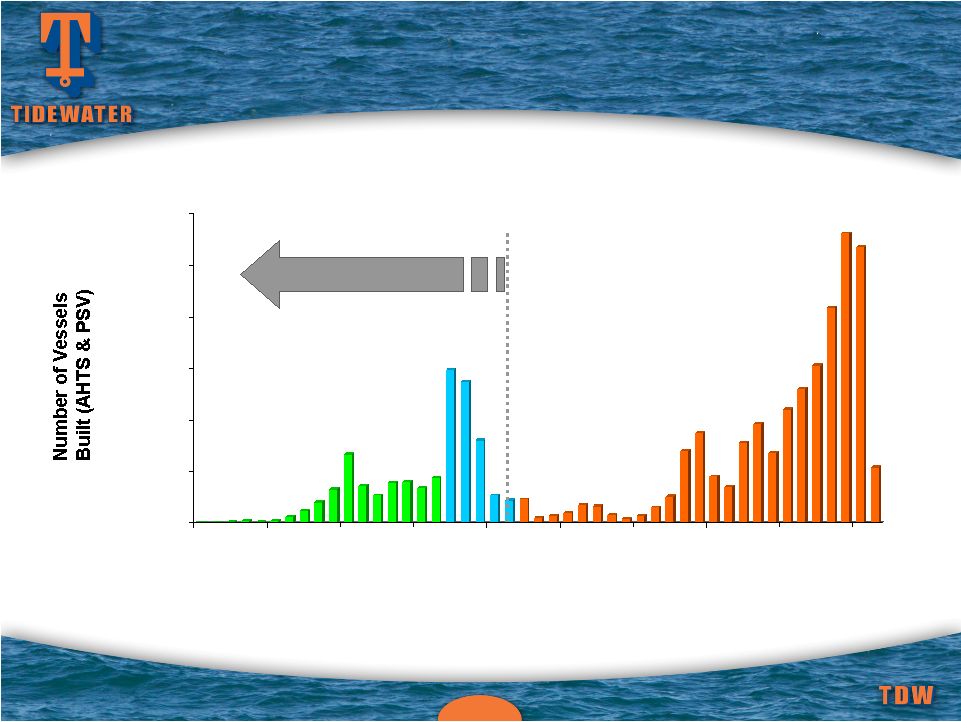

(Includes AHTS and PSV’s only) Estimated as of Early-May 2011

11

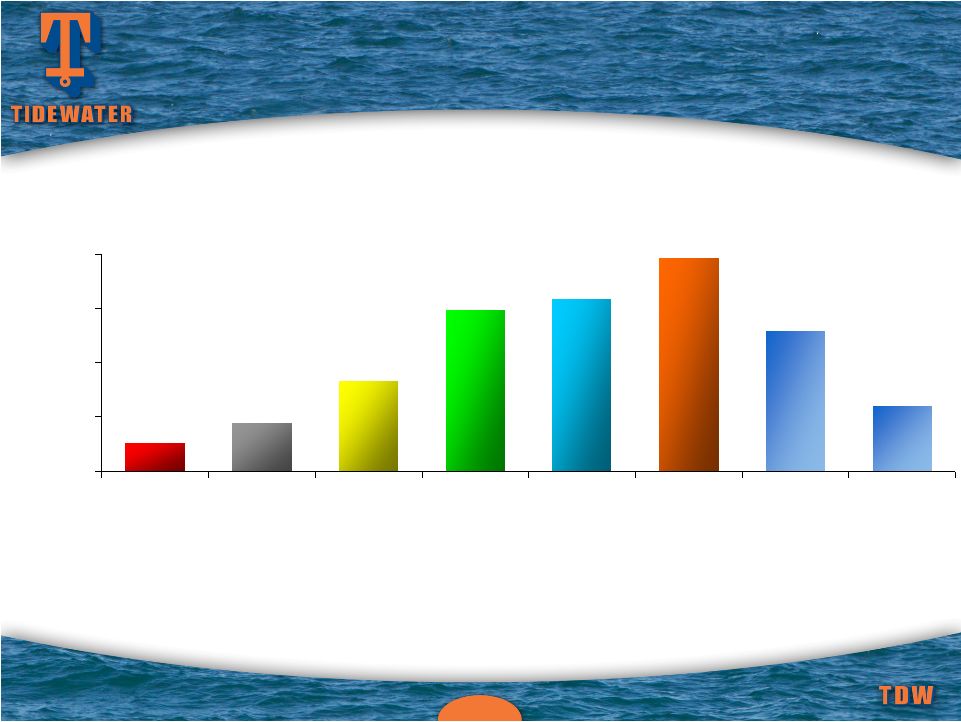

VESSEL POPULATION BY OWNER

VESSEL POPULATION BY OWNER

Source: ODS-Petrodata and Tidewater

Tidewater

Competitor #2

Competitor #3

Competitor #4

Competitor # 5

Competitor #1

Avg.

All Others (1,887

total

vessels for

350+ owners)

5

65

66

73

106

124

281

0

100

200

300

400

500

Tidewater fleet includes 144 vessel additions since 2000

(Includes AHTS and PSV’s only) Estimated as of Early-May 2011

|

12

Our top 10 customers in Fiscal 2011 (5 Super Majors,

3 NOC’s and 2 large independents) accounted for 63% of our revenue

CURRENT REVENUE MIX

CURRENT REVENUE MIX

Quality of Customer Base

Quality of Customer Base

Others

36%

NOC's

28%

Super Majors

36% |

13

Vessel Count

Estimated Cost

AHTS

99

$1,743m

PSV’s

84

$1,755m

Crewboats & Tugs

67

$289m

TOTALS:

250

$3,787m

(1)

(1) $3,293m (87%) funded through 3/31/11

.

THE LARGEST MODERN FLEET

THE LARGEST MODERN FLEET

IN THE INDUSTRY…

IN THE INDUSTRY…

At 3/31/11, 193 new vessels in fleet with ~5.4 year average age

Vessel Commitments

Jan. ’00 –

March ‘11 |

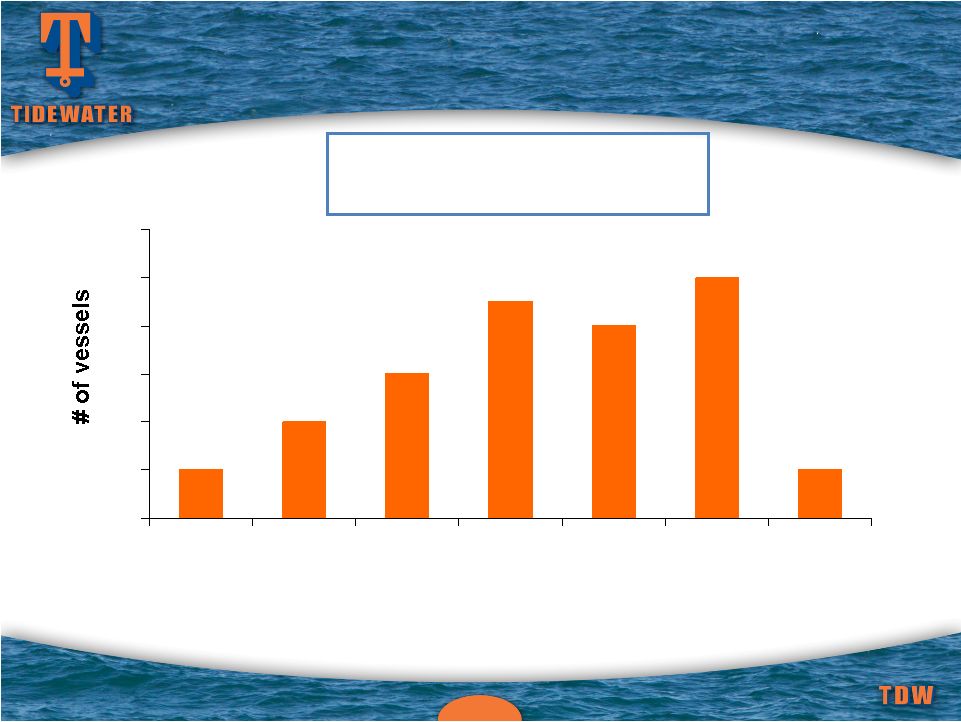

14

0

5

10

15

20

25

30

35

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

Built

Acquired

VESSEL DELIVERIES

VESSEL DELIVERIES

Fiscal Year

Actual deliveries through 3/31/11 and estimated vessel deliveries to build or acquire

as of 3/31/11 At 3/31/11, total 250 vessels with a

capital cost of $3.79 billion |

15

Count

AHTS

15

PSV

20

Crew and Tug

1

Total

36

Vessels Under Construction*

As of March 31, 2011

…

…

AND OUR LEAD IS GROWING

AND OUR LEAD IS GROWING

* Includes eight new vessels committed to purchase as of 3/31/11

Estimated delivery schedule –

25 in FY ‘12, 10 in FY ‘13 and

1 thereafter

CAPX of $368m in FY ‘12, $110m in FY

‘13 and $16m in FY ‘14 |

16

SIGNIFICANT AVERAGE AGE IMPROVEMENT

SIGNIFICANT AVERAGE AGE IMPROVEMENT

Average 45 vessel disposals per year in future (averaged 47 per year last three

years). Includes

36

vessels

under

construction

(including

eight

purchase

commitments) in year delivered plus additional

newbuilds/acquisitions from approximately $500 million per year of future

commitments (average additional 20 vessels per year). Tidewater is not

committed to spending $500 million annually, but this level is used as an assumption in

estimating average fleet age in the future.

20

16

6

The

current

average

“economic

age”

of our

vessel fleet is ~6.2 years (based upon NBV)

0

5

10

15

20

3/31/06

3/31/07

3/31/08

12/31/08

12/31/09

12/31/10

12/31/11

12/31/12

12/31/13

12/31/14

Assumptions:

1)

2) |

17

2

2

4

6

9

8

10

0

2

4

6

8

10

12

9/30/09

Qtr

12/31/09

Qtr

3/31/10

Qtr

6/30/10

Qtr

9/30/10

Qtr

12/31/10

Qtr

3/31/11

Qtr

RECENT VESSEL COMMITMENTS

RECENT VESSEL COMMITMENTS

Amounts

depict

vessel

count

and

total

cost

in

quarter

commitment

was made to acquire (not when delivery or payments were made)

$96M

$55M

$72M

$179M

1 MPSV

1 PSV

4 AHTS

6 AHTS

6 AHTS

3 PSV’s

41 vessels over seven quarters w/

total capital cost of $819 million

$177M

4 PSV’s

4 AHTS

1 PSV

9 AHTS

$139M

$101M

2 PSV’s |

18

Senior Unsecured Notes

$425 million

Average Life to Maturity

~ 9 years

Weighted Average Coupon

4.25%

RECENT FINANCINGS

RECENT FINANCINGS

Term Loan*

$125 million

Revolving Line of Credit

$450 million

Term

Five years

Interest Rate

LIBOR plus 1.5% to 2.25%,

based on leverage

Private Placement Financing:

Private Placement Financing:

New Credit Facilities:

New Credit Facilities:

*

Term loan allows for multiple draws for up to 180 days from 1/27/11

“Only $240M of Total Debt is due through Fiscal 2015”

“Only $240M of Total Debt is due through Fiscal 2015”

|

19

A STRONG BALANCE SHEET

A STRONG BALANCE SHEET

AND READY LIQUIDITY

AND READY LIQUIDITY

March 31, 2011 info:

Cash & Cash Equivalents

$246 million

Total Debt

$700 million

Shareholders Equity

$2,514 million

Net Debt / Net Capitalization

15%

Total Debt / Capitalization

22%

Pro forma liquidity as of 12/31/10 of ~ $825 million,

including $575 million available under credit facilities

|

20

Over

a

12-year

period,

Tidewater

invested

$3.8

billion

in

CAPX

($3.4

billion

in

the

“new”

fleet),

and paid out $994 million through dividends and share repurchases. Over the

same period, CFFO and proceeds from dispositions were $3.4 billion and $677

million, respectively PRIMARY USES OF CASH

PRIMARY USES OF CASH

$0

$100

$200

$300

$400

$500

$600

$700

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

CAPX

Dividend

Share Repurchase

In $ millions

CFFO

Fiscal Year |

$0

$100

$200

$300

$400

$500

$600

$700

$800

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

21

FLEET CASH OPERATING MARGINS

FLEET CASH OPERATING MARGINS

Note: Cash operating margins are defined as

vessel revenue less vessel operating expenses

Total Fleet

Operating Margin %

Traditional Vessels

New Vessels

Fleet

Oper.

Margin

%

38.6%

37.6%

46.5%

41.9%

36.9%

38.7%

49.1%

54.6%

51.9%

51.3%

46.8%

39.3%

Fiscal Years |

22

Maintain

Maintain

Financial Strength

Financial Strength

EVA-Based Investments

EVA-Based Investments

On Through-cycle Basis

On Through-cycle Basis

Deliver Results

Deliver Results

FINANCIAL STRATEGY FOCUSED ON

FINANCIAL STRATEGY FOCUSED ON

CREATING LONG-TERM SHAREHOLDER VALUE

CREATING LONG-TERM SHAREHOLDER VALUE |

UBS GLOBAL OIL

AND GAS CONFERENCE

May 26, 2011

QUINN P. FANNING

Executive Vice President , CFO

JOSEPH M. BENNETT

Executive Vice President and

Chief Investor Relations Officer

QUINN P. FANNING

Executive Vice President , CFO

JOSEPH M. BENNETT

Executive Vice President and

Chief Investor Relations Officer |

24

Appendix

Appendix |

25

RECENT ACCOMPLISHMENTS

RECENT ACCOMPLISHMENTS

•

Had two full years without a lost time accident (two

years ended August 2010) –

None since August 2010

•

Respectable earnings & returns in a trough (tough)

market

•

Selected acquisitions of choice assets

•

Disciplined disposal of traditional equipment

•

Delivery of 74 new vessels over last three fiscal years

•

Balance sheet still solid

•

Strategy working –

Poised to seize opportunities |

26

Years Ended

3/31/11

3/31/10

Revenues

$1,055

$1,169

Adjusted Net Earnings*

$123

$269

Adjusted EPS*

$2.40

$5.20

Net Cash from Operations

$264

$328

Capital Expenditures

$615

$452

* Adjusted Net Earnings and Adjusted EPS for the year ended 3/31/11 exclude an

after-tax $4.35 million, or $0.09 per share, charge related to

settlement with DOJ and an after-tax $6.3 million, or $0.12 per share, charge

related to settlement with the Government of Nigeria for FCPA matters, an

after-tax $3.9 million, or $0.08 per share, charge related to participation in a multi-company U.K.-based pension plan, and an after-tax

$3.0

million,

or

$0.06

per

share,

impairment

charge

related

to

certain

vessels.

Adjusted

net

earnings

and

EPS

for

the

year

ended

3/31/10 exclude

charges of $33.6 million, or $0.66 per share, related to provisions for Venezuelan

operations, $36.1 million, or $0.70 per share, tax benefit related to

favorable resolution of tax litigation and $11.4 million, or $0.22 per share, charge related to settlement with the SEC for FCPA matters.

SELECTED FINANCIAL HIGHLIGHTS

SELECTED FINANCIAL HIGHLIGHTS

$ in Millions,

Except Per Share Data |

(Includes AHTS and PSV’s only) Estimated as of Early-May 2011

27

0

50

100

150

200

250

300

1965

1970

1975

1980

1985

1990

1995

2000

2005

2010

THE WORLDWIDE FLEET -

THE WORLDWIDE FLEET -

RETIREMENTS

RETIREMENTS

EXPECTED TO EXCEED NEW DELIVERIES

EXPECTED TO EXCEED NEW DELIVERIES

Source: ODS-Petrodata and Tidewater

As of early-May 2011, there are approximately 405 additional AHTS and

PSV’s (~16% of the global fleet) under construction.

Global

fleet

estimated

at

2,602

vessels,

including

364 vessels that are

30+

yrs

old

(14%),

and another

415 vessels that are 25-29 yrs old (16%)

Vessels > 25 years old today

(Includes AHTS and PSV’s only) Estimated as of Early-May 2011

|

28

0

100

200

300

400

500

600

Active Fleet

Dispositions

CONTINUALLY ACQUIRING NEW AND

CONTINUALLY ACQUIRING NEW AND

DISPOSING OF MATURE VESSELS

DISPOSING OF MATURE VESSELS

(As of 3/31/11)

(As of 3/31/11)

310

(B)

543

(C)

227 New Vessels (A)

436 Sold

107 Scrapped

(A) Net new vessels added to the fleet since January 2000, including 36 vessels under

construction at 3/31/11. This new vessel total excludes 21 new vessels that

were acquired, then disposed (many to a TDW joint venture.) (B) Total fleet

count excludes 90 stacked vessels as of 3/31/11. (C) 543 vessel dispositions

generated $606 million of proceeds and $279 million of gains over the last 12 years. |

29

50%

60%

70%

80%

90%

3/08

9/08

3/09

9/09

3/10

9/10

3/11

Utilization

$4,000

$6,000

$8,000

$10,000

$12,000

$14,000

Dayrate

* Dayrate and utilization information is for all classes of vessels operating

international INTERNATIONAL VESSELS

INTERNATIONAL VESSELS

Dayrates and Utilization

Dayrates and Utilization

$100 change in dayrate = ~$7.9M in annual revenue

$100 change in dayrate = ~$7.9M in annual revenue

1% change in utilization = ~$15.1M in annual revenue

1% change in utilization = ~$15.1M in annual revenue |

30

INTERNATIONAL VESSEL DAYRATES

INTERNATIONAL VESSEL DAYRATES

* Dayrate and utilization information is for all classes of vessels operating

international $3,000

$6,000

$9,000

$12,000

$15,000

$18,000

03/08

09/08

03/09

09/09

03/10

09/10

03/11

Traditional Vessels

New Vessels |

31

30%

50%

70%

90%

3/08

9/08

3/09

9/09

3/10

9/10

3/11

Utilization

$4,000

$9,000

$14,000

$19,000

Dayrate

DOMESTIC VESSELS

DOMESTIC VESSELS

Dayrates and Utilization

Dayrates and Utilization

* Dayrate and utilization information is for all classes of vessels operating in the

U.S. |

32

DOMESTIC VESSEL DAYRATES

DOMESTIC VESSEL DAYRATES

* Dayrate and utilization information is for all classes of vessels operating in the

U.S. $4,000

$8,000

$12,000

$16,000

$20,000

$24,000

03/08

09/08

03/09

09/09

03/10

09/10

03/11

Traditional Vessels

New Vessels |

33

Source: ODS-Petrodata and Tidewater

WORKING RIG COUNTS

WORKING RIG COUNTS

“Peak to Present”

“Peak to Present”

GOM

accounts

for

30

of

the

58

working

jackup

count

variance

from

June 2008

(Peak) to May 2011 (post-Horizon)

GOM Semi & Drillship count drops by 17 units (from 31 to 14) between April 2010

and May 2011; offset by an increase of 20 units in the rest of world

Jackups

Semis

Drillships

Total

June 2008

(Peak)

379

145

30

554

Late-April 2010

(pre-Horizon)

323

150

46

519

Early-May 2011

(post-Horizon)

321

152

47

520 |

34

Other Operators

Top 10 Customers

Tidewater’s top 10 customers contract ~20% of the working worldwide

jackup fleet and ~47% of the working worldwide floater fleet

Jackups

(321 Working Rigs)

Floater Rigs

(199 Working Rigs)

65

256

94

RIGS CONTRACTED BY OUR

RIGS CONTRACTED BY OUR

TOP 10 CUSTOMERS

TOP 10 CUSTOMERS

Source: ODS-Petrodata and Tidewater

Other Operators

Top 10 customers

105

(Estimated

as

of

Early-May

2011)

(Estimated

as

of

Early-May

2011) |

35

OSX 42%

S&P 500 14%

DJIA 27%

TDW 18%

RETURNS vs the MARKET

RETURNS vs the MARKET

FIVE YEAR STOCKHOLDER RETURN

FIVE YEAR STOCKHOLDER RETURN |