Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

[X]

|

QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the quarterly period ended March 31, 2011

|

[ ]

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ___________ to _____________

Commission File Number: 000-52860

Shrink Nanotechnologies, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

20-2197964

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

4100 Calit2 Bldg

Irvine, CA 92697-2800

(Address of principal executive offices)

Registrant’s telephone number, including area code: (760) 804-8844

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: $.001 par value common stock

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company:

|

Large accelerated filer o

|

Accelerated filer o

|

|

Non-accelerated filer o

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

APPLICABLE ONLY TO CORPORATE ISSUERS

Indicate the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date.

There were a total of 200,345,163 shares of the registrant’s common stock outstanding as of May 23, 2011.

SHRINK NANOTECHNOLOGIES, INC.

MARCH 31, 2011 FORM 10-Q QUARTERLY REPORT

INDEX

|

|

Page

|

|

Forward Looking Statements

|

ii

|

|

Use of Terms

|

ii

|

|

PART I - FINANCIAL INFORMATION

|

F-1

|

|

Item 1. - Financial Statements

|

F-1

|

|

Consolidated Balance Sheets as of March 31, 2011 (unaudited) and December 31, 2010

|

F-1

|

|

Consolidated Statements of Operations for the Three Months Ended March 31, 2011 and 2010 (unaudited)

|

F-2

|

|

Consolidated Statements of Cash Flows for the Three Months Ended March 31, 2011 and 2010 (unaudited)

|

F-3

|

|

Notes to Unaudited Consolidated Financial Statements

|

F-4

|

|

Item 2 – Management's Discussion and Analysis of Financial Condition and Results of Operations

|

1

|

|

Item 3 - Quantitative and Qualitative Disclosures About Market Risk

|

11

|

|

Item 4 - Controls and Procedures

|

11

|

|

PART II - OTHER INFORMATION

|

|

|

Item 1 - Legal Proceedings

|

13

|

|

Item 1A – Risk Factors

|

13

|

|

Item 2 – Unregistered Sales of Equity Securities and Use of Proceeds

|

23

|

|

Item 3 - Defaults Upon Senior Securities

|

23

|

|

Item 4 - Submission of Matters to a Vote of Security Holders

|

23

|

|

Item 5 - Other Information

|

23

|

|

Item 6 - Exhibits

|

24

|

i

FORWARD LOOKING STATEMENTS

Certain information contained in this Quarterly Report on Form 10-Q (this “Report” or “Quarterly Report”) includes forward-looking statements within the meaning of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, (thee “Exchange Act”). These statements are expressed in good faith and based upon information currently available to the Company and management and their interpretation of what are believed to be significant factors affecting the businesses, including many assumptions regarding future events. These forward looking statements can be identified by the use of terms and phrases such as “believe,” “plan,” “intend,” “anticipate,” “target,” “estimate,” “expect,” and the like, and/or future-tense or conditional constructions (“will,” “may,” “could,” “should,” etc.).

Forward-looking statements include statements regarding, without limitation:

|

·

|

the development, commercialization and market acceptance of our “structured” cell culturing devices (StemDisc™) and related software, our microfluidic technology licensed in part from Corning Incorporated and, our shrinkable film based products such as CellAllign™ , NanoShrink™ and Metal-enhanced fluorescence substrates, and the costs related to bringing these technologies and products to market,

|

|

·

|

our immediate and growing need to raise the capital needed or obtain government grants to commercialize our products and implement our business plan,

|

|

·

|

our ability to access cash to fund our ongoing operations,

|

|

·

|

our ability to transition from an R&D company to a company with commercialized products,

|

|

·

|

our ability to innovate using our existing platform technology, a shrinkable plastic film material branded as “NanoShrink™” and to find new market accepted uses for the same,

|

|

·

|

our ability to secure and continue to access economical component and manufacturing sourcing for the various businesses we seek to engage in,

|

|

·

|

our ability to continue funding research and development relationships we have and/or may enter into,

|

|

·

|

our ability to secure certain critical licenses from third parties, some of which may be potential commercial competitors for one or more of our products,

|

|

·

|

our ability to find attractive acquisition candidates in the life sciences business,

|

|

·

|

the progress of our research and development activities,

|

|

·

|

our ability to further acquire, and hold and defend our intellectual property,

|

|

·

|

the projected growth in stem cell research and public policy changes relating to government funding of the same, and

|

|

·

|

the presumed size and growth of the market for lab-on-a-chip devices in life sciences.

|

These forward looking statements should be considered in addition to our risk factors (contained in this Quarterly Report under the heading “Risk Factors”). Additional risks not described above, or unknown to us, may also adversely affect the Company or its results. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including those set forth in the Risk Factors section in this Report.

Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report. We assume no obligation to update any forward-looking statements. Readers are urged to carefully review and consider the various disclosures made by us in our reports filed with the SEC (which shall also include by reference herein and incorporate the same as if fully included in their entirety, all Form 10-Ks, Form 10-Qs, Form 8-Ks and other periodic reports filed by us in the SEC’s EDGAR filing system (www.sec.gov) as may be amended from time to time, which attempt to update interested parties of the risks and factors and other disclosures that may affect our business, financial condition, results of operation and cash flows.

ii

Use of Terms

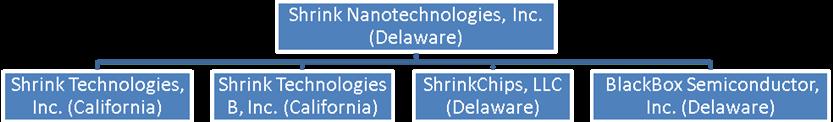

Except as otherwise indicated by the context, references in this report to (i) the “Shrink Parent” or “Parent” or similar terms refer to the publicly traded parent holding company and registrant, Shrink Nanotechnologies, Inc., a Delaware corporation, and “Shrink” refers to our wholly owned subsidiaries, both (a) Shrink Technologies, Inc., a California corporation and (b) Shrink Technologies B, Inc., a California corporation (ii) “Shrink Chips,” “Shrink Solar” and “Blackbox” refer to our recently organized Delaware subsidiaries ShrinkChips LLC, Shrink Solar LLC and Blackbox Semiconductor, Inc., (iii) the “Company”, “we”, “us”, or “our”, refer to the combined business of Shrink Parent, together with its wholly owned subsidiaries, Shrink, ShrinkChips, Shrink Solar and Blackbox, unless the context requires otherwise, (iv) “Forward Split” refers to the 5 for 1 forward split of the Parent’s stock effective as of April 8, 2010, (v) “SEC” are to the United States Securities and Exchange Commission, (vi) “Securities Act” are to Securities Act of 1933, as amended, and (vii) “Exchange Act” are to the Securities Exchange Act of 1934, as amended.

All references to share amounts, exercise, sale or conversion prices in this Report are as adjusted to reflect post-Forward Split amounts and prices.

iii

PART I

Item 1. Financial Statements

|

(A Development Stage Company)

|

||||||

|

CONSOLIDATED - BALANCE SHEETS

|

||||||

|

March 31,

|

December 31,

|

|||||

|

2011

|

2010

|

|||||

|

(Unaudited)

|

||||||

|

ASSETS

|

||||||

|

Current assets

|

||||||

|

Cash

|

$

|

69,609

|

$

|

2,131

|

||

|

Prepaid expenses

|

820

|

29,062

|

||||

|

Total current assets

|

70,429

|

31,193

|

||||

|

Property, plant and equipment, net

|

20,965

|

22,806

|

||||

|

Intangible assets, net

|

51,945

|

52,948

|

||||

|

TOTAL ASSETS

|

$

|

143,339

|

$

|

106,947

|

||

|

LIABILITIES AND STOCKHOLDERS' DEFICIT

|

||||||

|

Current liabilities

|

||||||

|

Accounts payable and accrued expenses

|

$

|

885,054

|

$

|

962,484

|

||

|

Due to related parties

|

669,433

|

606,250

|

||||

|

Convertible debentures, net of discount

|

102,445

|

446,479

|

||||

|

Convertible debentures, net of discount, default - related party

|

283,121

|

238,121

|

||||

|

Total current liabilities

|

1,940,053

|

2,253,334

|

||||

|

TOTAL LIABILITIES

|

1,940,053

|

2,253,334

|

||||

|

COMMITMENTS

|

||||||

|

STOCKHOLDERS' DEFICIT

|

||||||

|

Preferred stock, 25,000,000 shares authorized, $0.001 par value

|

||||||

|

issued and outstanding 20,000,000 and 20,000,000

|

||||||

|

at March 31, 2011 and December 31, 2010, respectively

|

20,000

|

20,000

|

||||

|

Common stock, 475,000,000 shares authorized, $0.001 par value

|

||||||

|

issued and outstanding 200,203,122 and 194,035,408

|

||||||

|

at March 31, 2011 and December 31, 2010, respectively

|

200,203

|

194,035

|

||||

|

Additional paid in capital

|

6,699,573

|

5,982,525

|

||||

|

Accumulated deficit

|

(8,716,490)

|

(8,342,947)

|

||||

|

TOTAL STOCKHOLDERS' DEFICIT

|

(1,796,714)

|

(2,146,387)

|

||||

|

TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIT

|

$

|

143,339

|

$

|

106,947

|

||

|

The accompanying notes are an integral part of these unaudited consolidated financial statements

|

||||||

F-1

|

SHRINK NANOTECHNOLOGIES, INC.

|

|||||||

|

(A Development Stage Company)

|

|||||||

|

CONSOLIDATED - STATEMENTS OF OPERATIONS

|

|||||||

|

(Unaudited)

|

|||||||

|

For the three

|

For the three

|

From Inception

|

|||||

|

months ended

|

months ended

|

January 15, 2008

|

|||||

|

March 31,

|

March 31,

|

through March 31,

|

|||||

|

2011

|

2010

|

2011

|

|||||

|

Revenues:

|

|||||||

|

Revenues, net

|

$

|

-

|

$

|

-

|

$

|

-

|

|

|

Cost of sales

|

-

|

-

|

-

|

||||

|

Gross Profit

|

-

|

-

|

-

|

||||

|

Expenses

|

|||||||

|

Research and development

|

31,442

|

61,034

|

416,524

|

||||

|

Professional fees

|

48,887

|

28,619

|

348,506

|

||||

|

General and administrative

|

152,461

|

1,295,992

|

6,681,922

|

||||

|

Loss on asset impairment

|

-

|

-

|

347,921

|

||||

|

Depreciation and amortization

|

3,820

|

12,598

|

115,349

|

||||

|

Total operating expenses

|

236,610

|

1,398,243

|

7,910,222

|

||||

|

Loss from operations

|

(236,610)

|

(1,398,243)

|

(7,910,222)

|

||||

|

Other Income (Expense)

|

|||||||

|

Interest expense

|

(136,933)

|

(110,610)

|

(831,972)

|

||||

|

Loss from extinguishment of debt

|

-

|

-

|

(118,121)

|

||||

|

Total Other Income (Expense)

|

(136,933)

|

(110,610)

|

(950,093)

|

||||

|

Loss from continuing operations

|

(373,543)

|

(1,508,853)

|

(8,860,315)

|

||||

|

Discontinued Operations

|

|||||||

|

Gain from discontinued operations of Audiostocks business

|

-

|

-

|

143,825

|

||||

|

Income from discontinued operations

|

-

|

-

|

143,825

|

||||

|

(Loss) Before Income Taxes

|

(373,543)

|

(1,508,853)

|

(8,716,490)

|

||||

|

Income Taxes

|

-

|

-

|

-

|

||||

|

NET (LOSS)

|

$

|

(373,543)

|

$

|

(1,508,853)

|

$

|

(8,716,490)

|

|

|

Net income (loss) per common share, basic and diluted:

|

|||||||

|

(Loss) from continuing operations

|

(0.00)

|

(0.01)

|

|||||

|

Income from discontinued operations

|

-

|

-

|

|||||

|

Net (loss) per common share:

|

$

|

(0.00)

|

$

|

(0.01)

|

|||

|

Weighted average common and common equivalent shares outstanding

|

|||||||

|

Basic and diluted

|

198,077,379

|

174,898,673

|

|||||

|

The accompanying notes are an integral part of these unaudited consolidated financial statements

|

|||||||

F-2

|

(A Development Stage Company)

|

|||||||

|

CONSOLIDATED - STATEMENTS OF CASH FLOWS

|

|||||||

|

(Unaudited)

|

|||||||

|

For the three

|

For the three

|

From Inception

|

|||||

|

months ended

|

months ended

|

January 15, 2008

|

|||||

|

March 31,

|

March 31,

|

through March 31,

|

|||||

|

2011

|

2010

|

2011

|

|||||

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

|||||||

|

Net loss

|

$

|

(373,543)

|

$

|

(1,508,853)

|

$

|

(8,716,490)

|

|

|

Adjustments to reconcile net earnings to net cash used

|

|||||||

|

by operating activities:

|

|||||||

|

Depreciation and amortization

|

3,820

|

12,598

|

115,349

|

||||

|

Asset impairment

|

-

|

-

|

347,921

|

||||

|

Debt discount accretion

|

115,965

|

90,228

|

681,277

|

||||

|

Non-cash share-based payments

|

178,215

|

817,292

|

5,015,783

|

||||

|

Loss from extinguishment of debt

|

-

|

-

|

118,121

|

||||

|

Changes in assets and liabilities, net of effects from acquisitions

|

|||||||

|

Prepaid expenses

|

28,242

|

120,242

|

19,430

|

||||

|

Accounts receivable

|

-

|

108,011

|

1,672

|

||||

|

Accounts payable and accrued expenses

|

(14,246)

|

65,039

|

1,328,637

|

||||

|

NET CASH USED IN OPERATING ACTIVITIES

|

(61,547)

|

(295,443)

|

(1,088,300)

|

||||

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

|||||||

|

Cash purchased at acquisition

|

-

|

-

|

62,404

|

||||

|

Additions to equipment

|

(682)

|

-

|

(16,795)

|

||||

|

Additions to intangible assets

|

(294)

|

(1,869)

|

(268,295)

|

||||

|

NET CASH USED IN INVESTING ACTIVITIES

|

(976)

|

(1,869)

|

(222,686)

|

||||

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

|||||||

|

Proceeds from subsidiary prior to merger

|

-

|

-

|

12,500

|

||||

|

Proceeds from common stock to be issued

|

70,000

|

-

|

70,000

|

||||

|

Proceeds from issuance of common stock

|

-

|

-

|

355,001

|

||||

|

Proceeds from convertible debentures

|

60,000

|

335,000

|

943,094

|

||||

|

NET CASH PROVIDED BY FINANCING ACTIVITIES

|

130,000

|

335,000

|

1,380,595

|

||||

|

NET CHANGE IN CASH

|

67,477

|

37,688

|

69,609

|

||||

|

CASH BALANCES

|

|||||||

|

Beginning of period

|

2,131

|

58,539

|

-

|

||||

|

End of period

|

$

|

69,609

|

$

|

96,227

|

$

|

69,609

|

|

|

NON-CASH INVESTING AND FINANCING TRANSACTIONS :

|

|||||||

|

Stock based prepaid expenses

|

$

|

-

|

$

|

2,377,856

|

$

|

-

|

|

|

Stock issued to satisfy convertible debt obligation

|

$

|

527,071

|

$

|

-

|

$

|

527,071

|

|

|

The accompanying notes are an integral part of these unaudited consolidated financial statements

|

|||||||

F-3

SHRINK NANOTECHNOLOGIES, INC.

Notes to the Consolidated Financial Statements

For the three months ended March 30, 2011

(Unaudited)

|

|

NOTE 1. BASIS OF PRESENTATION

|

The accompanying unaudited consolidated financial statements have been prepared in accordance with generally accepted accounting principles for interim financial information and with the instructions to Form 10-Q and Article 8 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by generally accepted accounting principles for complete financial statements. In the opinion of management, all adjustments (consisting of only normal recurring accruals) considered necessary for a fair presentation have been included. Operating results for the three months ended March 31, 2011 are not necessarily indicative of the results that may be expected for the year ended December 31, 2011. For further information, refer to the Company’s audited financial statements and footnotes thereto included in the Company’s annual report on Form 10-K for the year ended December 31, 2010.

NOTE 2. GOING CONCERN

The accompanying financial statements have been prepared assuming the Company will continue as a going concern. Because of the recurring operating losses, no revenues generated to date and the excess of current liabilities over current assets, there is substantial doubt about the Company’s ability to continue as a going concern.

As a result of the aforementioned conditions, the Company may be unable to meet certain obligations to fund future research and development activities. The Company’s continuation as a going concern is dependent on obtaining additional outside financing, as it is not anticipated that the Company will have profitable operations from its research and development activities during the near term. The Company has funded losses from its research and development and other operations primarily from the issuance of debt and equity. The Company believes that through government grants, partnerships and arrangements with universities, and the issuance of equity and debt will continue to fund operating losses in the short-term until the Company can generate revenues sufficient to fund its operations. If management can’t achieve its plans there is a possibility that operations will discontinue.

NOTE 3. INCOME TAXES

Income tax expense is provided for the tax effects of transactions reported in the financial statements and consist of taxes currently due plus deferred taxes. Deferred taxes are recognized for differences between the basis of assets and liabilities for financial statement and income tax purposes. The differences relate primarily to the effects of net operating loss carry forwards and differing basis, depreciation methods, and lives of depreciable assets. The deferred tax assets represent the future tax return consequences of those differences, which will be deductible when the assets are recovered.

No income tax benefit (expense) was recognized for the three months ended March 31, 2011 as a result of tax losses in this period and because deferred tax benefits, derived from the Company’s prior net operating losses, were previously fully reserved, the Company has cumulative net operating losses for tax purposes in excess of $8 million.

The Company and its subsidiaries currently have tax return periods open beginning with December 31, 2008 through December 31, 2010.

NOTE 4. RECENT ACCOUNTING PRONOUNCEMENTS

Recently Adopted Accounting Policies

In January 2010, the FASB issued guidance on improving disclosures about fair value measurements. This guidance requires reporting entities to make new disclosures about recurring or nonrecurring fair value measurements including significant transfers into and out of Level 1 and Level 2 fair value measurements and information on purchases, sales, issuances, and settlements on a gross basis in the reconciliation of Level 3 fair value measurements. This guidance is effective for annual reporting periods beginning after December 15, 2009, except for Level 3 reconciliation disclosures which are effective for annual periods beginning after December 15, 2010. The adoption of this guidance has not had and is not expected to have a material effect on the Company’s consolidated financial position, results of operations, or cash flows.

In March 2010, FASB ratified Emerging Issues Task Force (EITF) guidance related to Revenue Recognition that applies to arrangements with milestones relating to research or development deliverables. This guidance provides criteria that must be met to recognize consideration that is contingent upon achievement of a substantive milestone in its entirety in the period in which the milestone is achieved. The adoption of this guidance has not had and is not expected to have a material effect on the Company’s consolidated financial position, results of operations, or cash flows

F-4

NOTE 5. INTANGIBLE ASSETS

Intangible assets consist of intellectual property rights of an exclusive license to several patent pending inventions surrounding our core technologies and trademarks. Goodwill and other intangible assets are tested on an annual basis for impairment or on an interim basis if an event occurs or circumstances change that would reduce the fair value of a reporting unit below its carrying value. Intangible assets with estimable useful lives and those assets with defined lives due to the legal nature of the asset are amortized over their estimated useful lives, of 8 years, using the straight-line method.

Intangible assets consisted of the following at:

|

March 31,

|

December 31,

|

|||

|

2011

|

2010

|

|||

|

Intangible Assets, net:

|

||||

|

License

|

$

|

42,235

|

$

|

41,997

|

|

Trademarks

|

11,409

|

11,353

|

||

|

Less: Amortization

|

(1,699)

|

(402)

|

||

|

Total

|

$

|

51,945

|

$

|

52,948

|

To date, the Company has not utilized its current intellectual properties to manufacture products/parts for sale, testing and evaluation. When/if we do begin to mass produce products, we will re-evaluate our amortization practice related to these intellectual properties. During three months ended March 31, 2011 and 2010 the Company recorded $1,297 and $1,118 in amortization expense, respectively. At this time, estimated future amortization for the balance of this fiscal year is expected to be $3,960 and amortization of the following amounts for the fiscal years ended on December 31 are expected to be as follows:

|

For the year ending

|

Amount

|

|

|

2012

|

$

|

5,279

|

|

2013

|

5,279

|

|

|

2014

|

5,279

|

|

|

2015

|

5,279

|

|

|

Thereafter

|

26,869

|

NOTE 6. PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment are stated at cost less accumulated depreciation. Depreciation is computed using the straight-line method over estimated useful lives of the asset. During the three months ended March 31, 2011 and 2010 the Company recorded $2,523 and $11,480 in depreciation expense, respectively.

|

March 31,

|

December 31,

|

|||

|

2011

|

2010

|

|||

|

Property Plant and Equipment, net:

|

||||

|

Computer Software and Hardware

|

$

|

9,559

|

$

|

9,559

|

|

Furniture and Equipment

|

28,863

|

28,181

|

||

|

Building and Improvements

|

853

|

853

|

||

|

Accumulated Depreciation

|

(18,310)

|

(15,787)

|

||

|

Total

|

$

|

20,965

|

$

|

22,806

|

F-5

NOTE 7. PREPAID EXPENSES

Prepaid expenses consisted of the following at:

|

March 31,

|

December 31,

|

|||

|

2011

|

2010

|

|||

|

Prepaid stock based consultant fees

|

$

|

-

|

$

|

20,250

|

|

Other prepaid expenses

|

820

|

8,812

|

||

|

Total Current Prepaid Expenses

|

$

|

820

|

$

|

29,062

|

NOTE 8. RESEARCH AND LICENSE AGREEEMENTS

A. Research Agreement UC Regents Irvine Campus (May 2010)

During May, 2010, Shrink entered into the Sponsored Research Agreement with UC Regents on behalf of the Irvine campus. The SRA Agreement is for a term of three years or such time as the research is completed, whichever is longer. The SRA Agreement may be terminated by the Company subject to satisfying appropriate notice requirements required under the agreement.

The SRA Agreement provides, among other things, that the Company will sponsor specified research relating to development of (i) integrated, manufacturable, nanostructured substrates for biosensing and testing of new bioassays as well as assessing viability of other shrinkable materials, and (ii) stem cell tools that use shrinkable plastic microfluidic technologies, each as more fully provided in the SRA Agreement. The SRA Agreement provides that the Company shall sponsor the research costs up to a budget of $632,051, of which $20,000 has been paid to the California Regents. We have exclusive access to license intellectual property from the SRA Agreement beginning from July 1, 2009 forward according to the terms of the SRA Agreement.

The Company’s research sponsorship obligations require it to provide funding (which may be from the Company or other third parties) totaling $632,051 during the three year term of the SRA Agreement. Of this amount $202,796 shall be paid during the 12 month period ended April 30, 2011; $211,311 shall be paid during the 12 month period ended April 30, 2012; and the remaining $217,944 shall be paid during the 12 month period ended April 30, 2013. The foregoing payments are to be paid in quarterly installments of ¼ of the total cash fees payable during such 12 month period.

In the event that research under the SRA Agreement yields additional inventions and intellectual property, we have the right to enter into an additional exclusive license agreement with the UC Regents. In order to exercise its rights, we must not be in default of any payment or funding obligation under the SRA Agreement and, must notify the UC Regents of its intent to license the additional intellectual property within nine (9) months of receipt of notice from the UC Regents of the invention. In addition, among other conditions and limitations, we would be required to pay for patent application and filing costs relating to additional patents licenses and, to prosecute its rights as against third parties.

The license we have the right to enter into under the SRA Agreement, is substantially similar to the previously disclosed license rights we have with the UC Regents above, except that we are not required to pay an initial license issue fee, or initial legal fee reimbursement of $35,000, and the terms of the annual license fee has changed to a fee of $5,000 for rights to each patent license acquired by us, with an overall license maintenance fee of $10,000 per annum commencing the fourth year after entry into the license (the “License Date”). In addition, we are required to pay a fee of 30% of certain income generated from third party sublicenses of the additional intellectual property we license as well as royalty payments of:

|

·

|

2.5% of net sales where the first sale occurs within three years after the License Date;

|

|

·

|

4% of net sales where the first sale occurs between three and six years after the License Date;

|

|

·

|

and 5% of net sales where the first sale occurs beyond six years after the License Date.

|

|

·

|

In each case, the minimum earned royalty payment paid shall be $15,000 commencing the year of the first commercial sale of the licensed technology, subject to increase, if and as we expand the SRA License to include additional patents from time to time.

|

F-6

B. MF3 Membership and DARPA (June 2010)

The Company has become party to a Consortium Agreement (or, the “DARPA Co-Funding Agreement”) among Academic Partners and Sponsors of the Micro/Nano Fluidics Fundamentals Focus MF3 Center, which is headquartered at the UCI, which provides for partial “matched” funding from the Defense Advanced Research Projects Agency. The DARPA Co-Funding Agreement became effective as of June 1, 2010. The terms of the DARPA Co-Funding Agreement provides, among other things, that DARPA will match the Company, dollar for dollar (i.e. will provide 50% of certain funding on a “matched” dollar for dollar basis with third parties, if any), for funding commitments made by the Company, through a sponsored research agreement that is otherwise eligible for DARPA marching funds. We have not received any capital commitments for funding yet and no assurance can be made that we will make or secure additional financing for research projects that qualify for DARPA matching funds, or that we will remain eligible for the same. As a result, for the three months ended March 31, 2011 the Company had not recorded any grant revenues related to this agreement.

C. Research Agreement UC Regents Irvine Campus (September 2010)

As of September 22, 2010, Shrink entered into the Sponsor Research Agreement (or, the “EB Research Agreement”) with UC Regents on behalf of the Irvine Campus (“UCI”). The EB Research Agreement was for a term of three months, retroactively beginning August 1, through October 31, 2010. Although the term end date has passed, this agreement has not been terminated and work is ongoing with the project based on good faith between the two parties. The EB Research Agreement may be terminated by the Company or UCI subject to satisfying the appropriate notice requirements required under the agreement.

The Company’s research sponsorship obligations require it to provide funding (which may be from the Company or other third parties) totaling up to $67,040 during the three month term of the EB Research Agreement.

D. License Agreement with University of Chicago (November 2010)

Effective as of November 30, 2010, through our wholly owned subsidiary, Blackbox Semiconductor, Inc., (“Blackbox”), entered into an exclusive License Agreement (the “Chicago License Agreement”) with the University of Chicago, wherein Blackbox licensed the exclusive, worldwide right to use and sublicense Chicago’s patent-pending Materials and Methods for the Preparation of Nanocomposites (US PTO Application No. PCT/US10/32246, and provisional applications 61/214,434 and 61/264,790) and future patent applications filed by the University of Chicago based on certain other patentable technologies described in the Chicago License Agreement. Blackbox’s license is restricted to fields of use other than thermoelectric applications.

The technology being licensed is based on Assistant Professor of Chemistry Dmitri Talapin’s “electronic glue” chemistry. This technology, management believes, has various commercial applications where more efficient transfer of electrical charges between nanocrystals is desired, such as printed semiconductors, roll-to-roll printed solar cells and printed nano-sensors.

The license granted by the University of Chicago is for worldwide usage by the Blackbox for a period of at least eight years. The term may be terminated for cause or insolvency.

While the license is exclusive to Blackbox within fields of use other than thermoelectric applications, the University of Chicago licensed the patents to a third party for use in thermoelectric applications and reserved the rights in the underlying technology for all educational and non-commercial research purposes. In addition, the University of Chicago may terminate the license if Blackbox does not raise at least $2,000,000 capital prior to November 30, 2012 or if Blackbox does not employ a Suitably Qualified Person (as defined in the Chicago License Agreement) in a full-time executive position prior to February 28, 2011 and maintain a Suitably Qualified Person in a full-time executive position during the term of the license. In February of 2011, the Company hired David Duncan in order to meet its obligations to hire a Suitably Qualified Person (pursuant to the Chicago License Agreement).

The Chicago License Agreement provides for (i) an annual fee to the University of Chicago of $25,000 until the first commercial sale, and (ii) royalty payments to the University of Chicago, for products utilizing the licensed rights, during the royalty term, as more fully detailed in the agreement, of 3% of net sales of products utilizing the University of Chicago’s licensed technologies, subject to reduction (up to 50%) if the product is sold as a combination product with one or more other products that are not covered by the licensed patents. Minimum royalties for any calendar quarter beginning with the calendar quarter of the first commercial sale are $12,500.

The Chicago License Agreement allows Blackbox, during the term, to determine the appropriate course of action to enforce licensed patent rights, and if it does not do so, Chicago reserves the rights to do the same. Blackbox is required to reimburse Chicago for certain prosecution efforts they incur and, Chicago may abandon prosecution of any patent rights in any jurisdiction provided that it provides Blackbox the opportunity to continue prosecution of the same. The Blackbox’s obligation to reimburse prosecution efforts of Chicago terminates during any period that the patent rights become non-exclusive, if ever.

In March 2011, we entered into an agreement in principle to spinoff our Blackbox Semiconductor, Inc. subsidiary into a separate public company as the BlackBox business will require different management and commercial resources and relationships, as well as significant amounts of capital and time to commercialize products. Shrink has negotiated a sale price of $75,000 plus retention of approximately 19.9% of the BlackBox parent company after sale, among other benefits. At March 31, 2011, this spinoff transaction had not been finalized, therefore these financial statements do not include any effects from this spinoff.

F-7

NOTE 9. ACCOUNTS PAYABLE AND ACCRUED EXPENSES

Accounts payable and accrued expenses consisted of the following at:

|

March 31,

|

December 31,

|

|||

|

2011

|

2010

|

|||

|

Accounts payable

|

$

|

515,165

|

$

|

470,469

|

|

Accrued stock based compensation

|

294,880

|

385,255

|

||

|

Accrued payroll

|

-

|

647

|

||

|

Accrued interest

|

75,009

|

106,113

|

||

|

Total

|

$

|

885,054

|

$

|

962,484

|

NOTE 10. COMMITMENTS AND LEASES – RELATED PARTY

During the three months ended the Company received cash advances from Noctua Fund Manager, LLC, in the amount of $3,850. Mark L. Baum, Esq. (“Baum”) our CEO and president, is a managing member of the Noctua Fund Manager, LLC. James B. Panther, (“Panther”), Shrink’s chairman of its Board of Directors, is also a managing member of the Noctua Fund Manager, LLC. As of March 31, 2011, there was $7,100 owed to the Noctua Fund Manager, LLC, $0 had been paid to the Noctua Fund Manager, LLC during the three months ended March 31, 2011. This liability is recorded as due to related parties our balance sheets.

The Company subleased space from Business Consulting Group Unlimited, Inc., an entity owned by Panther and Baum, pursuant to which the Company leased approximately 3,000 square feet of office and administrative space, as well as use of, among other things, internet, postage, copy machines, electricity, furniture, fixtures etc. at a rate of $6,000 per month. The lease with Business Consulting Group Unlimited, Inc. expired April 30, 2010, and continued as a month to month tenancy thereafter. The lease agreement was terminated on January 31, 2011. As of March 31, 2011, $7,333 was owed to Business Consulting Group Unlimited, Inc. and during the three months ended March 31, 2011, $16,667 had been paid to Business Consulting Group Unlimited, Inc. This liability is recorded as due to related parties on our balance sheets.

On May 29, 2009, the Company signed an operating agreement with BCGU, LLC, an entity indirectly controlled by James B. Panther, and Mark L. Baum, Esq., who are two of our directors and majority control persons, for a fee of $6,000 per month. During October 2009, the Company amended the Operating Agreement with BCGU, LLC. The amended Operating Agreement (“the “Amended Operating Agreement”) allows us to retain certain day-to-day administrative services and management in consideration of a monthly fee of $30,000 per month. The Amended Operating Agreement also included a $270,000 signature bonus.

Effective as of January 31, 2011, we entered into the Second Amended Operating Agreement (the “Second Amended Operating Agreement”) with BCGU, LLC which amended the terms of the previously existing First Amended Operating Agreement among the parties, entered into on October 1, 2009. The Amended Operating Agreement provides for a term ending in October 1, of 2012 and provides for services to be provided that include day to day management, provision of bookkeeping and accounting personnel and administrative support staff as well as record keeping and accounting maintenance, in exchange for a new and lesser fee of $20,000 per month. The Company was indebted to BCGU under the old agreement, in the amount of $615,000 which continues to be due and payable as of the date of the Second Amended Operating Agreement.

For the three months ended March 31, 2011, $121,000 had been paid to BCGU, LLC and there was $655,000 owed to BCGU, LLC at March 31, 2011. This liability is recorded as due to a related party payable on our balance sheets. There is an option within the Second Amended Operating Agreement that allows BCGU, LLC to convert outstanding payables related to the Operating Agreements into a convertible note. At March 31, 2011, that option had not been exercised. Because BCGU, LLC is (i) substantially managing the affairs of the company, (ii) is familiar with the affairs of the Company and its strategic direction, (iii) is receiving minimal cash compensation for its efforts and is deferring most payments, the Company believes that the transactions are no less favorable to the Company than would otherwise be available from independent third parties, the Company believes, based on review of its independent directors, that the foregoing transactions and agreements are no less favorable (or even more favorable, given the flexibility) to the Company than would otherwise be available from independent third parties.

Due to related parties consisted of the following at:

F-8

|

March 31,

|

December 31,

|

|||

|

2011

|

2010

|

|||

|

Due to Noctua Fund Manager, LLC

|

$

|

7,100

|

$

|

3,250

|

|

Due to Business Consulting Group Unlimited, Inc.

|

7,333

|

18,000

|

||

|

Due to BCGU, LLC

|

655,000

|

585,000

|

||

|

Total

|

$

|

669,433

|

$

|

606,250

|

The Company entered into a lease at the UCI Tech Portal, beginning on November 1, 2010, for approximately 150 square feet of laboratory space and certain equipment and shared office space that will be used for the Company’s UCI developed patents. The lease is for a minimum of six (6) months and may be extended for another 24 months and may be extended thereafter by the discretion of the parties, and provides for rent to be paid by the Company of $5,400 per year for up to 30 months ($450 per month). The Company is currently occupying the space on month-to-month terms.

The Company’s rent expense for the three months ended March 31, 2011 and 2010 was $7,350 and $18,000, respectively.

At March 31, 2011, the Company did not have any future minimum lease payments for the next 5 years.

NOTE 11. CONVERTIBLE DEBENTURES, PRIVATE PLACEMENT OFFERING

We recognize the advantageous value of conversion rights attached to convertible debt. Such rights give the debt holder the ability to convert the debt into common stock at a price per share that is less than the trading price to the public on the day the loan is made to the Company. The beneficial value is calculated as the intrinsic value (the market price of the stock at the commitment date in excess of the conversion rate) of the beneficial conversion feature of debentures. This feature is recorded as a discount to the related debt and an addition to additional paid in capital. The discount is amortized over the remaining outstanding period of related debt using the interest method.

|

A.

|

Convertible Debentures – Related Party

|

On January 10, 2011, the Company issued a $60,000 14% convertible note to Noctua Fund, LP in exchange of $60,000 cash. The note’s maturity date is October 1, 2012. The note accrues interest at fourteen percent (14%), and interest payments on the note are due monthly. The note is convertible into shares of our common stock at an original conversion price of $.17 per share. The number of shares issuable upon conversion of the notes shall be determined by dividing the outstanding principal amount, together with accrued but unpaid interest, to be converted by the conversion price. At the time of the agreement date the market price of our stock was $.125 per share, therefore there was no beneficial conversion feature that applied to this debenture.

The Company has not made any of the required interest payments and as a result this note was in default and accruing interest at its default rate of 18%.

Baum, our president and CEO, and Panther, a director, are equal indirect beneficial owners of Noctua Fund Manager, LLC, the general partner of Noctua Fund, L.P., and are non-voting minority investors in the Noctua Fund, L.P.

|

B.

|

Private Placement Offering

|

During November of 2009 through early 2010, a confidential private offering (“the Offering”) was made by the Company to various private accredited investors. The principal amount of the Offering was set at $1,000,000 maximum with excess of $1,000,000 accepted at the option of the Company and consists of convertible notes and stock purchase warrants, with $635,000 of Notes and 3,175,000 warrants issued in aggregate. The notes will mature at the one year anniversary of their effective date, be sold at their face value, accrue interest at 12% and have a conversion feature that allows the investor to convert the note and accrued interest into common stock at a price of $0.10 per share. The Company has the option to induce conversion, at which the notes conversion price will be taken at the discounted rate of 80% ($.08 per share). The Series A common stock purchase warrants are exercisable via cashless exercise commencing six months after each respective closing, at $0.20 per share, beginning to expire 3 years from the first closing of this Offering. The investors shall be issued warrants to purchase such number of common stock as equals fifty percent (50%) of the number of common shares underlying the convertible note based on the fixed conversion price. The warrants shall contain a standard cashless provision, which permits the holder to exercise the warrants if the stock price is above the exercise price, by turning in warrants and not paying cash.

From November 12, 2009 through May 7, 2010, the Company issued 12% convertible notes totaling $635,000 and detachable Series A warrants to purchase up 3,175,000 shares of common stock in exchange of cash as part of the Offering. The notes’ maturity dates begin on November 12, 2010 through May 7, 2011. At the time of the issuances, the Company recorded an $87,159 discount, which represents the intrinsic value of the beneficial conversion feature. The discount is being accreted over 12 month life of the notes.

During November 2010, the Company issued, $117,000 in 12% convertible notes and detachable Series B Warrants to purchase up to 585,000 shares of common stock, exercisable at $0.20 per share (or, “Series B Warrants”) as part of the offering for a cash purchase price of $117,000. The 12% notes are due one year from issuance, beginning on November 10, 2011 and are convertible as to principal and interest at $.10 per share and allow the Company the option to induce conversion, at which the notes conversion price will be taken at the discounted rate of 80% ($.08 per share). At the time of the issuances, the Company recorded a $44,400 discount, which represents the intrinsic value of the beneficial conversion feature. The discount is being accreted over 12 month life of the notes. The form of these notes and Series B Warrants are identical in all respects, to the notes and Series A Warrants issued, with the exception of the issuance dates and expiration dates.

F-9

Warrants associated with the offerings were issued to purchase up to 3,760,000 shares at an exercise price of $.20 per share. These warrants are valued at $620,254 and were combined with the beneficial conversion feature of $131,579, to record a total $751,833 discount on the convertible notes. The warrants are exercisable at 6 months following their effective date and begin to expire 11/12/2012. The warrants were valued using a Black-Scholes valuation model. The variables used in this option-pricing model included: (1) discount rates of .77-1.64% (2) expected warrant life is the actual remaining life of the warrant as of each period end, (3) expected volatility of 267-300% and (4) zero expected dividends.

The Company used the effective conversion price based on the proceeds received to compute the intrinsic value of the embedded conversion option. The Company allocated the proceeds received from the offering to the convertible instrument and the detachable warrants included in the exchange on a relative fair value basis. The Company then calculated an effective conversion price and used that price to measure the intrinsic value of the embedded conversion option. The effective conversion price used is equal to $0.08 per share of the Company’s common stock. The number of shares issuable upon conversion of the notes shall be determined by dividing the outstanding principal amount, together with accrued but unpaid interest, to be converted by the conversion price in effect on the conversion date.

During November 2010 through December 2010, the Company received notices of conversion totaling $100,000 of principal balances and $12,923 of accrued interest. The Company converted these debentures into 1,129,226 shares of common stock to satisfy the conversion demand in full.

In January 2011, the Company received conversion demand notices for convertible notes with total principal balances of $475,000 and accrued interest of $52,771. In February 2011, the notes and their accrued interest were converted at $.10 per share into 5,277,714 shares of common stock, and pursuant to the stock issuances considered paid in full.

Notes Payable consists of the following at:

|

March 31,

|

December 31,

|

|||

|

2011

|

2010

|

|||

|

14% convertible notes due October 2012

|

$

|

298,121

|

$

|

238,121

|

|

12% convertible notes due November 2010

|

-

|

-

|

||

|

12% convertible notes due January 2011

|

-

|

225,000

|

||

|

12% convertible notes due February 2011

|

10,000

|

110,000

|

||

|

12% convertible notes due April 2011

|

50,000

|

50,000

|

||

|

12% convertible notes due May 2011

|

-

|

150,000

|

||

|

12% convertible notes due November 2011

|

117,000

|

117,000

|

||

|

Total convertible notes payable

|

$

|

475,121

|

$

|

890,121

|

|

Less: Discount on notes

|

(89,555)

|

(205,521)

|

||

|

Less: Current portion

|

(385,566)

|

(684,600)

|

||

|

Long-term portion

|

$

|

-

|

$

|

-

|

The following represents minimum payments due for notes payable:

|

Amount

|

||

|

2011

|

$

|

475,121

|

|

2012

|

-

|

|

|

2013

|

-

|

|

|

Total

|

$

|

475,121

|

As of March 31, 2011, the Company has notes payable due to a related party in the amount of $298,121 (which are represented on our consolidated balance sheet as $283,121, which is net of a $15,000 discount) with a maturity date of October 1, 2012. These notes are currently in default due to non-payment of monthly interest accruals and are classified as current liabilities on the balance sheet. Interest payments are due monthly on these notes.

F-10

NOTE 12. FAIR VALUE MEASUREMENTS

Fair value measurements are determined based on the assumptions that market participants would use in pricing an asset or liability. US GAAP establishes a hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs be used when available. The established fair value hierarchy prioritizes the use of inputs used in valuation methodologies into the following three levels:

|

·

|

Level 1: Quoted prices (unadjusted) for identical assets or liabilities in active markets. A quoted price in an active market provides the most reliable evidence of fair value and must be used to measure fair value whenever available.

|

|

·

|

Level 2: Significant other observable inputs other than Level 1 prices such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data.

|

|

·

|

Level 3: Significant unobservable inputs that reflect a reporting entity’s own assumptions about the assumptions that market participants would use in pricing an asset or liability. For example, level 3 inputs would relate to forecasts of future earnings and cash flows used in a discounted future cash flows method.

|

NOTE 13. COMMON STOCK

The Company has made various private issuances of securities to fund its operations and satisfy obligations from time to time.

In January 2011, pursuant our 2010 Stock Incentive Plan, the Company issued 750,000 shares valued at $95,625 to Heiner Dreismann, a member of our Board of Directors, for services rendered and as an incentive to remain on the board with the Company. As a result of the Mr. Dreismann’s issuance there are 24,250,000 remaining shares authorized for issuance pursuant to the 2010 Stock Incentive Plan.

In January 2011, the Company received conversion demand notices for convertible notes with total principal balances of $475,000 and accrued interest of $52,071. In February 2011, the notes and their accrued interest were converted at $.10 per share into 5,277,714 shares of common stock, and pursuant to the stock issuances considered paid in full.

In February 2011, the Company issued 140,000 shares valued at $16,330 for payment of professional services provided during the year ended December 31, 2010 and thru February 2011.

In March 2011, the Company received $70,000 in cash. In exchange, the Company agreed to issue 411,764 shares of common stock. At March 31, 2011 these shares had not been issued.

In March 2010, the Company agreed to a vesting agreement whereby the Company issued 600,000 shares of common stock subject to restrictions based on continued services over a 3 year period ended March 1, 2013, valued at $120,000 to an accounting professional for previous and ongoing accounting, SEC compliance and financial statement preparation and compilation and related services. These shares vest as to 125,000 shares on each of the date of the agreement, March 1, 2010, March 1, 2011 and March 1, 2012, with the remaining 225,000 vesting on March 1, 2013. The Company recognized an expense of $6,250 during the three months ended March 31, 2011 as a resulting of the vesting terms.

The Company recognized an expense of $7,939 in earned stock option expenses during the three months ended March 31, 2011.

NOTE 14. WARRANTS

There are 3,175,000 warrants immediately exercisable at March 31, 2011 and December 31, 2010, and 3,760,000 warrants outstanding at March 31, 2011 and December 31, 2010.

The following summarizes stock purchase warrants as of March 31, 2011 and December 31, 2010:

|

Weighted Average

|

|||

|

Amount

|

Exercise Price

|

||

|

Outstanding December 31, 2009

|

500,000

|

$

|

0.20

|

|

Expired/Retired

|

-

|

-

|

|

|

Exercised

|

-

|

-

|

|

|

Issued

|

3,260,000

|

0.20

|

|

|

Outstanding December 31, 2010

|

3,760,000

|

$

|

0.20

|

|

Expired/Retired

|

-

|

-

|

|

|

Exercised

|

-

|

-

|

|

|

Issued

|

-

|

-

|

|

|

Outstanding March 31, 2011

|

3,760,000

|

$

|

0.20

|

There were no changes to in warrants outstanding for the three months ended March 31, 2011.

F-11

NOTE 15. STOCK OPTIONS

The Company has issued stock options to key employees, consultants, and non-employee's advisors and directors of the Company. These issuances shall be accounted for based on the fair value of the consideration received or the fair value of the equity instruments issued, or whichever is more readily determinable. The Company has elected to account for the stock option plan where the compensation to employees should be recognized over the period(s) in which the related services are rendered. The fair value of a stock option granted is estimated using an option-pricing model.

During the three months ended March 31, 2011, 25,000 options were issued to the members of our advisory board. These options are valued at $1,300 and are exercisable for 2 years following their effective date that begin to expire 2/25/2013. During the three months ended March 31, 2011 the Company recorded a stock option expense of $7,939.

The options issued during the three months ended March 31, 2011 valued using a binomial valuation model. The variables used in this option-pricing model included: (1) discount rates of 0.72%, (2) expected option life of 2 years, (3) expected volatility of 115% and (4) zero expected dividends.

The following summarizes options as of March 31, 2011 and December 31, 2010:

|

Weighted Average

|

|||

|

Amount

|

Exercise Price

|

||

|

Outstanding December 31, 2009

|

275,000

|

$

|

0.22

|

|

Expired/Retired

|

-

|

-

|

|

|

Exercised

|

-

|

-

|

|

|

Issued

|

650,000

|

0.19

|

|

|

Outstanding December 31, 2010

|

925,000

|

$

|

0.20

|

|

Expired/Retired

|

-

|

-

|

|

|

Exercised

|

-

|

-

|

|

|

Issued

|

25,000

|

0.10

|

|

|

Outstanding March 31, 2011

|

950,000

|

$

|

0.20

|

The following summarizes the changes in options outstanding at March 31, 2011:

|

Options Outstanding

|

Options Exercisable

|

||||||||

|

Number

|

Weighted

|

Remaining

|

Weighted

|

||||||

|

of

|

Average

|

Exercise Life

|

Number

|

Average

|

Expiration

|

||||

|

Date of Grant

|

Shares

|

Exercise Price

|

in Years

|

Exercisable

|

Exercise Price

|

Date

|

|||

|

First quarter fiscal 2011

|

25,000

|

$

|

0.10

|

1.91

|

25,000

|

$

|

0.10

|

2/25/2013

|

|

NOTE 16. SUBSEQUENT EVENTS

The Company has performed an evaluation of events occurring subsequent to the period end through the issuance date of this report. Based on our evaluation, nothing other than the events described below need to be disclosed.

In April 2011, the Company issued to BCGU, LLC a 4% convertible promissory note with a balance of $675,000. The note was issued under BCGU, LLC’s Operating agreement, and memorializes the unpaid, accrued fees resulting from the Operating Agreement. The Note, is due on April 6, 2012, and is convertible into approximately 11,250,000 shares of common stock ($.06 per share, the closing market price of our stock on the date of issuance).

The Company entered into a Binding Letter of Intent with Nanopoint, Inc. a Delaware corporation with principal offices in Hawaii (“Nanopoint”), calling for the acquisition of 100% of the equity ownership of Nanopoint in exchange for up to 60,000,000 shares of the Company’s common stock to be paid if certain sales milestones are met. In addition, the acquisition is dependent on completion of successful due diligence and contemplates a financing completion of not less than $500,000 and up to $1,000,000. The transaction with Nanopoint, is subject to numerous closing conditions, and is set to close by May 31, 2011. No assurance can be made that the parties will complete satisfactory due diligence, or complete a transaction or satisfy any of the other conditions to closing at this time.

In April 2011, the Company issued 40,000 shares valued at $3,740 for payment of professional services provided during the months of March and April.

In April 2011, the Company issued 102,041 shares valued at $10,000 for payment for consulting services and due diligence research related to certain biotech and biomedical businesses during the month April.

As of the date of this report, the Company had not finalized its agreement to spinoff our Blackbox Semiconductor, Inc. subsidiary (see Note 8.).

F-12

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion and analysis should be read in conjunction with our unaudited consolidated financial statements and related notes included in this Report and the “Forward Looking Statements” section in the forepart of this Report (see page i above) and the “Risk Factors” set forth in Item 1A of Part II below of this Report, as may be amended or updated from time to time. The statements contained in this Report that are not historic in nature, particularly those that utilize terminology such as “may,” “will,” “should,” “expects,” “anticipates,” “estimates,” “believes,” or “plans” or comparable terminology are forward-looking statements based on current expectations and assumptions. No assurance can be made that any of our forward looking statements will materialize as planned. In addition, the below is not intended as a complete business description but rather, supplements and updates information which may be contained in our Annual Report or other reports filed from time to time.

Various risks and uncertainties could cause actual results to differ materially from those expressed in forward-looking statements. For ease of reference we use certain defined terms as defined in “Use of Terms” on page iii above, in the forepart of this Report.

Background

General

We are, with our subsidiaries, dedicated to commercializing biotechnology and other high technology intellectual property, know-how and related products, from universities and medium to large commercial businesses, that may be deployed as commercial products or licensing opportunities in the near (immediate to 2 years) and mid-term (2-4 years). We have also recently undertaken a program to seek to acquire small companies with developed and ready-to-go-to-market products, strong intellectual property portfolios, management and operational infrastructure. Historically, we have primarily focused our resources in the life sciences market; however, we also have successfully acquired technologies in, for example, the semiconductor space. With all technologies we acquire and allocate resources to, our objective is to develop products and intellectual property resources in order to generate cash flow, and ultimately, value for our shareholders.

The Company has undergone, and continues to undergoe, marked changes since October of 2010, as we transition towards commercialization efforts and liquidate undesired assets.

Our business currently consists of four operating units: Cell Culturing Products; Microfluidic Systems and Kits; Special Substrates; and Internal Development and Acquisitions.

Our Cell Culturing Unit is dedicated to the commercialization of our stem cell culture platform known as StemDisc® and its related software, as well as NanoShrink® based tissue engineering substrates known for our Cell Align®. Our Microfluidic Systems and Kits business is seeking to market a unique and patented modular microfluidic system we exclusively licensed from Corning Incorporated, as well as a version of NanoShrink® (metal enhanced fluorescence) that will enable the low cost development of two dimensional microfluidic system prototypes. Our Special Substrates business is developing specialized versions of NanoShrink® substrates that have unique surface plasmon resonance capabilities and which may be integrated into existing market leading devices and systems. Our Internal Development and Acquisitions Unit is actively developing technologies that are a part of a development and commercialization program, as well as engaging in due diligence on technologies and businesses we are in the process of evaluating for acquisition purposes.

Business Focus

The Company intends to direct its focus, and expects to continue to allocate a material portion of its resources, towards (1) the commercialization and development of technologies in its four business units as discussed in greater depth in this Report, and (2) making acquisitions of life sciences companies and high technology companies and technology assets that either supplement or otherwise enhance the Company’s core abilities and interests in the life sciences.

Assets; Intellectual Property and Research Agreements

Our assets include exclusive and non-exclusive patent rights, as more fully described in this Report and in our Annual Report, from agreements with third parties, as follows:

|

·

|

Our exclusive License Agreement with Corning, Inc. (the “Corning License Agreement”) wherein the Company licensed the exclusive worldwide right to use and sublicense Corning’s patent-pending Modular Microfluidic System and Method for Building Modular Microfluidic System.

|

|

·

|

Our two Sponsored Research Agreements with the University of California Regents on behalf of University of California, Irvine campus entered into in May 2010 (the “Biosensing Research Agreement”), and in September 2010 (the “EB Research Agreement”), and rights to acquire additional license rights funded by us under these agreements, (the “Sponsored Research Agreements”).

|

|

·

|

The exclusive License Agreement (the “Chicago License Agreement”) between our wholly-owned subsidiary Blackbox and the University of Chicago (“Chicago”), wherein Blackbox licensed the exclusive, worldwide right to use and sublicense Chicago’s patent-pending Materials and Methods for the Preparation of Nanocomposites (a/k/a “electronic glue” chemistry) for fields of use other than thermoelectric applications. We have entered into an agreement to sell off our BlackBox subsidiary along with this license, and do not intend to invest material amounts into it prior to such time.

|

Page 1

We also entered into other agreements, such as our agreement with the MF3 Consortium, accessing matching funds from MF3’s relationship with DARPA, that provides us with research co-funding agreements as more fully provided below. Finally, we intend to commercialize our assets through relationships with third party manufacturers we contract with. No assurance can be made that the Company will have funds sufficient to further develop and license new technologies or to commercialize the ones we have.

We may, from time-to-time and as a result of rights granted in one or more of our (or our subsidiary’s) licensing agreements, take a license to inventions (and the related license to domestic and international patent application rights) which result from a sponsored research arrangement or private (non-academic sector) license agreement. Doing so may give Shrink the license rights, but will also trigger the payment of certain fees and various ongoing financial commitments, all of which have been negotiated and are disclosed in the license agreement as provided elsewhere in this Report.

The Company regularly reviews its licenses and patents and, as technologies or inventions have been further commercially vetted or newer competing technologies are developed by others, management may determine using its reasonable business judgment, to not continue to support the development of a technology, and may therefore abandon its licensing rights and or intellectual property rights (if not otherwise licensed) with respect to that technology, invention and the related license. The Company may, from time to time, abandon intellectual property rights which it formerly thought would be valuable or which may still have some value but would be too expensive to maintain. These same abandoned intellectual property rights may have been a part of a public announcement and even been a key part of the Company’s operational strategy.

Abandonment or an outright termination of a license to a particular invention may occur more often as Shrink acquires more IP rights, and the same inventions are commercially vetted. License or patent rights may also be abandoned based on no other reason other than limited capital or the Company’s need to expend its capital on other vital needs. To the extent the Company abandons such non-critical IP rights, the Company may not file a specific abandonment notice.

During late 2010, we terminated our research agreement with the UC Merced and the related license agreement with the UC Regents, as management felt that, given our limited funds, the costs of these agreements were cost prohibitive and were yielding unsuccessful results while viable alternative technologies were found elsewhere. As a result, we lost any patent license rights associated with these agreements.

The Company has dissolved its Shrink Solar, LLC entity which had no revenues or assets.

The Company’s BlackBox subsidiary, however, does still maintain its Chicago License Agreement. This license became the core asset of our BlackBox subsidiary. Late in 2010, the Company determined that it does not have sufficient capital or resources to dedicate to the BlackBox business and that further supporting BlackBox would detract from the Company’s other core competencies. The Company has negotiated in principal a spin off transaction to sell its BlackBox business to an entity affiliated with current creditors and principles of the Company, who have agreed to allow the Company to liquidate the assets and and retain approximately 19.9% of the equity in the post-spin-out business (pre dilution) if successful.

Discussion of Business Strategy; Short Term Goals

Although management constantly monitors market trends, as well as available capital and has in the past, and continues to, refine and re-prioritize the Company’s goals, so as to attain commercialization as quickly as possible, the goals we will need to attain for our various businesses are currently: (1) commercialization of existing and newer versions of StemDisc®, Cell Align® and NanoShrink® products; (2) entering into a joint development agreement to commercialize the Corning microfluidic system; (3) joint development of certain materials from our Special Substrates business unit; and (4) entering into technologically accretive and synergistic acquisitions.

We acquired our assets and rights by using a business model that has inexpensively allowed us to license technologies from two primary sources: (1) university laboratories, and (2) “secondary” technologies from very large industrial businesses. Traditionally and historically, university engineering labs have been used as commercial resources for venture capital organizations and other funding sources looking for high quality low cost technology.

We have also recently undertaken a program to develop commercial relationships with larger, multi-national United States-based industrial companies in order to potentially work with their technologies and products which have been abandoned or “orphaned” for one or a number of reasons – primarily due to a limited market opportunity or limited funding at the time of abandonment. We are actively seeking to develop licensing agreements in this regard to provide the right to develop and market these “orphaned” technologies and product lines.

In addition to our licensed technologies, we may develop technologies on our own as a result of our research or joint development activities.

We also have developed a Science Advisory Board (“SAB”). Through the relationships with our SAB members, we have the exclusive right to certain intellectual property rights derived from their respective work for the Company. To date, we have not filed any applications to protect intellectual property rights derived from work provided to the Company by a member of the SAB. Nonetheless, much of the Company’s scientific decision making process is guided in part by our SAB members.