Attached files

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

x ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For the

fiscal year ended: December 31,

2009

¨ TRANSITION REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For the

transition period from ____________ to _____________

Commission

File Number: 000-52860

Shrink

Nanotechnologies, Inc.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

20-2197964

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

(I.R.S.

Employer

Identification

No.)

|

|

2038

Corte del Nogal, Suite 110

Carlsbad,

California 92011

|

(760)

804-8844

(Registrant’s

telephone number, including area code)

|

|

(Address

of principal executive offices)

|

Securities

registered pursuant to Section 12(b) of the

Act: None

Securities

registered pursuant to Section 12(g) of the Exchange

Act: Common Stock, par value $0.001 per

share

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes ¨ No x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes x No

¨

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Website, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files). Yes No

x

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K.

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. (See the definitions of “large accelerated

filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act.)

Large

Accelerated

Filer

Accelerated Filer

Non-Accelerated

Filer (Do

not check if a smaller reporting

company)

Smaller reporting company

Indicate

by check mark whether registrant is a shell company (as defined in Rule 12b-2 of

the Act). Yes No x

As of

June 30, 2009 (the last business day of the registrant’s most recently completed

second fiscal quarter), the aggregate market value of the shares of the

registrant’s common stock held by non-affiliates (based upon the closing price

of such shares as reported on the Over-the-Counter Bulletin Board) was

approximately $1,700,000.

Shares of

the registrant’s common stock held by each executive officer and director and

each by each person who owns 10% or more of the outstanding common stock have

been excluded from the calculation in that such persons may be deemed to be

affiliates of the registrant. This determination of affiliate status is not

necessarily a conclusive determination for other purposes.

There

were a total of 191,303,985 shares of the registrant’s common stock outstanding

as of April 14, 2010 (post stock split).

SHRINK

NANOTECHNOLOGIES, INC.

Annual

Report on FORM 10-K

For

the Fiscal Year Ended December 31, 2009

|

TABLE

OF CONTENTS

|

Page

|

|

|

PART

I

|

1

|

|

|

ITEM

1.

|

BUSINESS

|

1

|

|

ITEM

1A.

|

RISK FACTORS

|

13

|

|

ITEM

1B.

|

UNRESOLVED

STAFF COMMENTS

|

25

|

|

ITEM

2.

|

PROPERTIES

|

25

|

|

ITEM

3.

|

LEGAL

PROCEEDINGS

|

25

|

|

PART

II

|

26

|

|

|

ITEM

4.

|

MARKET

FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER

PURCHASES OF EQUITY SECURITIES

|

28

|

|

ITEM

5.

|

SELECTED

FINANCIAL DATA

|

28

|

|

ITEM

6.

|

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

|

29

|

|

ITEM

6A.

|

QUANTITATIVE

AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

29

|

|

ITEM

7.

|

FINANCIAL

STATEMENTS AND SUPPLEMENTARY DATA

|

F-1

- F-39

|

|

ITEM

8.

|

CHANGES

IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL

DISCLOSURE

|

40

|

|

ITEM

9A.

|

CONTROLS

AND PROCEDURES

|

41

|

|

ITEM

9B.

|

OTHER

INFORMATION

|

41

|

|

PART

III

|

42

|

|

|

ITEM

10.

|

DIRECTORS,

EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

|

42

|

|

ITEM

11.

|

EXECUTIVE

COMPENSATION

|

45

|

|

ITEM

12.

|

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED

STOCKHOLDER MATTERS

|

47

|

|

ITEM

13.

|

CERTAIN

RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR

INDEPENDENCE

|

49

|

|

ITEM

14.

|

PRINCIPAL

ACCOUNTANT FEES AND SERVICES

|

50

|

|

PART

IV

|

51

|

|

|

ITEM

15.

|

EXHIBITS,

FINANCIAL STATEMENT SCHEDULES

|

51

|

|

SIGNATURES

|

52

|

PART

I

|

ITEM

1.

|

BUSINESS

|

FORWARD

LOOKING STATEMENTS

Certain

information contained in this Annual Report on Form 10-K (this “Report” or

“Annual Report”) includes forward-looking statements within the meaning of the

Securities Act, and Section 21E of the Securities Exchange Act of 1934, as

amended, (thee “Exchange Act”). These statements are expressed in

good faith and based upon what we believe are reasonable assumptions, but there

can be no assurance that these expectations will be achieved or

accomplished. These forward looking statements can be identified by

the use of terms and phrases such as “believe,” “plan,” “intend,” “anticipate,”

“target,” “estimate,” “expect,” and the like, and/or future-tense or conditional

constructions (“will,” “may,” “could,” “should,” etc.).

The

statements herein which are not historical reflect our current expectations and

projections about the Company’s future results, performance, liquidity,

financial condition, prospects and opportunities and are based upon information

currently available to the Company and management and their interpretation of

what are believed to be significant factors affecting the businesses, including

many assumptions regarding future events. Such forward-looking

statements include statements regarding, without limitation:

|

·

|

the

development, commercialization and market acceptance of our recently

acquired microfluidic, “shrinkable plastic” and solar concentrator

technologies, and other related technologies, and the related costs to us

for the foregoing,

|

|

·

|

the

market acceptance of our technologies to develop lower cost microfluidic

chips and related devices and

systems,

|

|

·

|

our

immediate and growing need to raise the capital needed or obtain

government or educational grants to implement our business

plan,

|

|

·

|

items

contemplating or making assumptions about the progress of our research and

development activities,

|

|

·

|

our

ability to further acquire, hold and defend our intellectual

property,

|

|

·

|

the

projected growth in stem cell

research,

|

|

·

|

alternative

energy demands (specifically, products ultimately derived from our solar

concentrator technology) and our ability to fund our solar chip

products,

|

|

·

|

the

presumed size and growth of the market for lab-on-a-chip devices,

and

|

|

·

|

liquidity

and sufficiency of existing cash.

|

These

forward looking statements should be considered in addition to our risk factors

(contained in this Annual Report under the heading “Risk

Factors”). Additional risks not described above, or unknown to us,

may also adversely affect the Company or its results.

Additional

risks not described above, or unknown to us, may also adversely affect the

Company or its results. Readers are urged not to place undue reliance on these

forward-looking statements, which speak only as of the date of this Annual

Report. We assume no obligation to update any forward-looking

statements in order to reflect any event or circumstance that may arise after

the filing date of this Annual Report, other than as may be required by

applicable law or regulation. Readers are urged to carefully review

and consider the various disclosures made by us in our reports filed with the

SEC (which shall also include by reference herein and incorporate the same as if

fully included in there entirety, all Form 10-Ks, Form 10-Qs, Form 8-Ks and

other periodic reports filed by us in the SEC’s EDGAR filing system

(www.sec.gov)) which attempt to update interested parties of the risks and

factors and other disclosures that may affect our business, financial condition,

results of operation and cash flows.

Our

actual results could differ materially from those anticipated in these

forward-looking statements as a result of various factors, including those set

forth in the Risk Factors section in this Annual Report.

1

Use

of Terms

Except as

otherwise indicated by the context, references in this report to (i) the “Shrink

Parent” or “Parent” or similar terms refer to the publicly traded parent holding

company and registrant, Shrink Nanotechnologies, Inc., a Delaware

corporation, (ii) the “Company”, “we”, “us”, or “our”,

refer to the combined business of Shrink Parent, together with its wholly owned

subsidiary, Shrink, a California corporation, unless the context requires

otherwise, (iii) “Shrink” refers to Shrink Technologies, Inc., a California

corporation acquired by us in May 2010, inclusive of its R&D activities

through universities or third parties, (iv) “Forward Split” refers to the 5 for

1 forward split of the Parent’s stock effective as of April 8, 2010, (v) “SEC”

are to the United States Securities and Exchange Commission, (vi) “Securities

Act” are to Securities Act of 1933, as amended, and (vii) “Exchange Act” are to

the Securities Exchange Act of 1934, as amended.

Business

Overview

General. We are,

through our subsidiary, a research, design and development company dedicated to

the commercialization of a nanotechnology platform called the ShrinkChip

Manufacturing Solution™, which we believe represents a new low cost alternative

for fabrication of otherwise costly diagnostic chips and other nano-size

devices. Our technology can be used to manufacture chips and other

devices used as measuring tools and energy and content transfer devices for a

wide range of applications from the life sciences, drug and chemical analysis

industries to the optoelectronics components and solar/renewable energy

businesses.

Platform

Focus. Our core shrink-film technology is a “platform

technology” which is to say that it has a variety of applications in numerous

fields that relate to the use of and functionalization of nano-sized structures,

including channels, tubes, holes, wrinkles as well as “cracked”

surfaces. We are focusing on commercializing and developing our

technologies in three specific business segments which are discussed in greater

depth in this Annual Report: (1) our NanoShrink business, (2) our StemDisc

business and (3) our Solar Concentrator and related solar

business. All of these business segments are relatively immature and

require additional development before products may ultimately reach a commercial

customer.

Core Ability. Out

technologies allow for the flexible and rapid design, prototyping and

manufacture of certain complex chips, microfluidic diagnostic tools and

measuring devices. This is made possible by our ability to design at

a larger scale and then use the inherent properties of our NanoShrink™ plastic

material to functionalize a device by controllably shrinking the same by a

factor of up to 95%, through a proprietary process. While the markets

for what we can do is meaningful, we believe that our “shrinkable technology”

offers, if successfully accepted, a low cost and flexible replacement for

existing chips and related devices manufactured through very expensive and

relatively inflexible manufacturing processes.

Technology and Intellectual

Property. We own, or license through various agreements with

the University of California, Merced (“UC Merced”) and the University of UC

Regents (the “UC Regents”), various patent applications and rights relating to

the ShrinkChip Manufacturing Solution™. A description of these

agreements and related technologies, applications and cost estimates is provided

below along with a list of patents and other intellectual property owned by, or

licensed to us. Additionally, we have filed applications with the US

Patent and Trademark Office (“USPTO”) and we possess significant know-how as it

relates to using shrinkable films in the manner in which we seek to design and

build products for our focused markets.

Corporate

History and Structure

General.

We were

incorporated in the state of Delaware on January 15, 2002 as Jupiter Processing,

Inc. On January 13, 2005, the Company changed its name to

Audiostocks, Inc. On May 14, 2009, the Parent company changed its

name to Shrink Nanotechnologies, Inc. in anticipation of its acquisition of

Shrink Technologies, Inc. On May 29, 2009, the Company entered into

and completed a share exchange agreement with the former principals of Shrink

Technologies, Inc., for the acquisition of Shrink which held and continues to

hold, most of our related business assets and has agreements with both UC Merced

and the UC Regents granting the Company the exclusive rights to the Shrink

related technologies discussed herein.

The

exchange of shares with Shrink’s owner has been accounted for as a reverse

acquisition under the purchase method of accounting with the business of Shrink

Technologies, Inc. as the surviving company for accounting and financial

reporting purposes.

2

We have

limited liquidity and our funds are allocated towards research, development and

commercialization of our technologies and products, identifying and retaining

executive management that will be able to clear the Company’s path into the life

sciences industry.

We have

been continually disposing of our Audiostocks related operations and

assets. The Company intends to liquidate any remaining assets

relating to its AudioStocks business. Nonetheless, certain

information relating to our previous AudioStocks business is contained towards

the end of this “Business” section, below but should not be relied upon as

meaningful in assessing our new Shrink operations.

Our

common stock was quoted on the Over-the-Counter Bulletin Board under the symbol

“INKN” through Tuesday, April 13, 2010. On April 14, 2010, the

Company was notified by FINRA that its 5 for 1 forward stock split was accepted

and that on April 15, 2010, the Company’s common stock would trade, for 20

business days, under the stock symbol “INKND” and that immediately subsequent to

the 20th business day following April 15, 2010, our stock symbol would revert

back to INKN (see “Recent Developments” at the end of this “Business” section,

below.) All references to share amounts, exercise, sale or conversion

prices in this Annual Report are as adjusted to reflect post Forward Split

amounts and prices.

Our

principal offices are located at 2038 Corte Del Nogal, Suite 110, Carlsbad,

California, 92011, Phone No. 760-804-8844, Contact person Mark L. Baum,

Esq. Our website is www.shrinknano.com.

Our

License Agreements

Research

Agreement

When we

acquired our Shrink subsidiary in May 2009, Shrink was and continues to be, a

party to a research agreement (the “Research Agreement”) with UC

Merced. Pursuant to the Research Agreement, UC Merced agreed to

undertake a research project and Shrink agreed to reimburse it for all direct

and indirect costs incurred in connection with the research, up to the amount of

$640,935 and in accordance with an agreed-upon budget. The Research

Agreement provides Shrink with the right to elect to receive an exclusive

royalty-bearing license to make, use, sell, offer for sale and import any

products and practice any methods in the inventions or discoveries conceived and

reduced to practice in the performance of the research conducted under the

Research Agreement. We have exercised our rights under the Research

Agreement and entered into a license agreement with the UC

Regents. As of the date of this filing, the Research Agreement

remains in tact and valid.

Our

Exclusive License Agreement with the UC Regents; Exclusive Patent

Licenses

The

underlying intellectual property and patent rights to Shrink’s proprietary

technologies are owned by the UC Regents. On April 29, 2009 and

pursuant to the terms of the Research Agreement, Shrink and the UC Regents

entered into an Exclusive License Agreement for Processes for Microfluidic

Fabrication and Other Inventions (the “License Agreement”). The

License Agreement licenses a broad array of intellectual property and inventions

vital to our planned operations. As of the date of this filing, the

License Agreement remains in tact and valid.

The

following description of the License Agreement is a summary only, and is

qualified in its entirety by the actual agreement which has been filed in our

public filings and which is incorporated herein.

In

accordance with the License Agreement, we will be required to pay royalties

based on net sales of each licensed product, licensed method or licensed service

by the Shrink, any of its affiliates or joint-ventures. Specific

details relating to the economic terms of our License Agreement with the UC

Regents is provided below, in this Report, under the section titled “Item 7.

Management’s Discussion and Analysis of Financial Condition and Results of

Operations” below.

The term

of the License Agreement commenced April 29, 2009, and will continue in effect

until the expiration or abandonment of the last patent covered by the agreement,

unless we terminate it on 60 days’ notice or the UC Regents terminated it on 60

days’ notice if we default on our obligations under the License Agreement and

fail to cure such default during the 60 day period.

3

Pursuant

to the License Agreement, Shrink acquired, subject to certain limitations, an

exclusive license to the UC Regents’ rights in and to specified patents, patent

applications and intellectual property for which patent applications have not

yet been filed relating to various inventions (the “Licensed

Rights”). Under the License Agreement, Shrink is permitted to make,

use, sell, offer for sale the licensed intellectual property and import licensed

products and services and to practice licensed methods in all fields and in all

locations in which the UC Regents may lawfully grant the Licensed Rights. The

patents, patent applications and other intellectual property licensed were

originally developed by Dr. Michelle Khine and others in the course of research

which took place primarily at the UC Merced and at University of California,

Berkeley. A list of these patent applications follows:

|

Shrink

Reference Number

|

Filing Date

|

USPTO

Application Number

|

Title

|

|

1

|

11/13/2007

|

61/003,113

|

Processes

for Microfluidic Fabrication

|

|

2

|

1/3/2008

|

61/018,881

|

Processes

for Microfluidic Fabrication

(Petition

to Amend Inventorship under 37 CFR 1.48(d))--adding Luke Lee as

inventor

|

|

3

|

11/12/2008

|

PCT/US2008/083283

|

Processes

for Rapid Microfabrication Using Thermoplastics and Devices

Thereof

|

|

4

|

3/18/2009

|

61/161,388

|

Honeycomb

Shrink Wells For Stem Cell Culture

|

|

5

|

3/19/2009

|

61/161,738

|

Aligning

Cells on Wrinkled Surface

|

|

6

|

3/25/2009

|

61/163,343

|

Quantum

Dot Solar Concentrator

|

|

7

|

5/12/2009

|

61/177,402

|

Aligning

Cells on Wrinkled Surface

|

|

8

|

5/13/2009

|

61/177,871

|

Honeycomb

Shrink Wells For Stem Cell Culture

|

|

9

|

5/13/2009

|

61/177,916

|

Textured

Metal Nanopetals

|

|

10

|

5/13/2009

|

61/177,952

|

Thermoplastic

Substrates with Wrinkled Metallic Surfaces for Chemical and Biological

Sensing

|

|

11

|

5/13/2009

|

61/177,990

|

High

Resolution Light Emitting Devices

|

|

12

|

5/13/2009

|

61/178,005

|

Metal-Coated

Shrinkable Polystyrene and Methods for Using

Same

|

There is

a difference between a patent application and a full patent

filing. The above items (save Shrink Reference Number 3) relates only

to patent applications. These patent applications are designed to be

protective of ideas and intellectual property and expire after one

year. At or prior to the expiration of the patent applications, to

the extent the Company believes there is merit to incur the additional expense

in making a full patent application filing, we will agree to incur the costs of

doing so, and request that the UC Regents, file full applications. To

the extent we decide not to make these requests, we may lose our rights to the

same under our License Agreement (because we agreed to pay for all costs of

filing patent applications and related costs). To date, the UC

Regents have filed full patent applications on Shrink Reference Numbers

1-8. Items 9, 10, 11 and 12, as well as applications we have made

(which are referenced below) remain subject to the same deadlines and costs,

except that we would be the owner, in whole or in part, in some cases, of the

patent rights. To date, we have not made any full patent application

filings.

Inventions

or intellectual property rights which constitute advancements, developments or

improvements in which the UC Regents acquires rights, whether or not patentable

or subject to a patent application, are not automatically covered by the

license. The License Agreement must be amended to add such

intellectual property and we are required to pay a $5,000 fee for the addition

to the license. However, we have a one year option to license any

such intellectual property if it was developed under the terms of the Research

Agreement.

As is

common with license agreements with educational institutions, the License

Agreement permits the UC Regents to use or exploit any Licensed Rights for

educational, clinical or research purposes, including, without limitation, any

sponsored research performed for or on behalf of commercial entities and for

publication or other communication of any research results. In

addition, to the extent that an invention or technology discovered by them is

not part of the Licensed Rights, the UC Regents may exploit (or sublicense) such

technology and rights to third parties.

While we

may sublicense our rights, we may only do so in writing. Among other

conditions, any sublicense must include all of the rights of, and require the

performance of all the obligations due to the UC Regents, except for certain

payment obligations. To the extent we own any undivided interest in

any Licensed Right with the UC Regents, we cannot grant any third-party a

license to such Licensed Right unless we also grant a license to the UC

Regents. The license to the UC Regents would have to be on the same

terms and conditions set forth in the License Agreement on which we are entitled

to grant licenses in the Licensed Rights which we do not have an ownership

interest.

4

Intellectual

Property We Own (in Whole or in Part)

In

addition to the patents acquired through our License Agreement with UC Merced

and the UC Regents, in August through September of 2009, we filed and obtained

four (4) additional provisional patents as originally more fully disclosed in

our Current Report on Form 8-K dated August 31, 2009, the provisions of which

are incorporated by reference herein and described below:

|

Shrink

Reference Number

|

Filing Date

|

Application Number

|

Title

|

|

13

|

8/26/2009

|

61/237,224

|

Quantum

Dot Solar Concentrator

|

|

14

|

8/26/2009

|

61/237,245

|

Aligning

Cells On Wrinkled Surface

|

|

15

|

8/27/2009

|

61/237,623

|

High

Resolution Light Emitting Devices

|

|

16

|

9/4/2009

|

61/240,129

|

High

Surface Area Micro and Nano Beads

|

|

17

|

10/13/2009

|

61/251,242

|

Process

for Fabrication of Nanoholes, Related Structures, and Devices

Thereof

|

Trademarks

We hold a

number of trade or service marks and have been using most since late 2008 to

early 2009. These marks have also been filed with the USPTO and

include the following:

|

Trademark

|

Shrink

Trademarks:

|

Date

of Filing

|

|

T06435US0

|

StemDisc™

|

9/4/2009

|

|

T06438US0

|

CellAlign™

|

9/4/2009

|

|

T06439US0

|

PolyShrink™

|

9/4/2009

|

|

T0644OUS0

|

MetalFluor™

|

9/4/2009

|

|

T06437US0

|

OptiSol™

|

9/4/2009

|

|

T06441US0

|

ShrinkPatch™

|

9/4/2009

|

|

T06436US0

|

Quantumsol™

|

9/4/2009

|

|

T06434US0

|

ShrinkChip™

|

9/4/2009

|

|

T06433US0

|

Shrink™

|

9/4/2009

|

|

T06433US0

|

ShrinkNano™

|

9/4/2009

|

Our

Patent Filing Policy

We are

required by the License Agreement to pay the costs of obtaining patents and the

Company’s board of directors along with the Shrink Scientific Advisory Board,

intend to regularly reassess the technologies and applications we have, develop,

or acquire an interest in to determine, in good faith, whether the benefits of

obtaining a patent outweigh the costs of obtaining it and the resulting public

disclosure of our processes, technologies or proprietary

technologies.

No

assurance can be made that the Company will be able to assess the

patent-worthiness of all its products, or, if a patent is desirable, that the

Company will have sufficient funds or wherewithal to secure or prosecute its

intellectual property rights.

Technology

Description Overview

The heart

of our technology is our use of polystyrene and other pliant and pre-stressed

materials used in numerous industrial applications. Our material

which we use is branded as NanoShrink™. The use of NanoShrink within

our systems allows for the ultra-rapid direct patterning of complex or even

three dimensional, stacked polystyrene micro and nanostructures. The

benefits of using a shrinkable medium, such as NanoShrink™, result in part from

its ability, through our patent-pending processes, to uniformly shrink during

heating. Our patent-pending shrinkable chip technology is a “platform

technology” with potential applicability to a number of different business and

scientific areas.

5

Our

technologies, primarily owned or licensed by Shrink, involves the creation and

manufacture of certain complex chips or microfluidic diagnostic tools and

measuring devices on a larger micro-scale on shrinkable, pre-stressed

polystyrene sheets (or other plastic-derived materials such as NanoShrink™) and

then shrinking them down significantly in size through a patent-pending

process. Our research indicates, to date, that the technology and

materials under development by Shrink result in a relatively “uniform” shrinking

process, resulting in a “true” and relatively undisturbed end product that

retains its vital properties even at the micro or

nano-scale. We sometimes refer to this platform, system and

technology as the Shrink Chip Manufacturing Solution™.

Shrink

has successfully created a number of highly complex prototype chips including

microfluidic chips and components for integrated circuitry systems, solar cell

concentrators, metal-enhanced fluorescent diagnostic and biological testing

chips, “lab-on-a-chip” systems, as well as three dimensional multi-level chip

designs.

Our

Shrink Chip Manufacturing Solution™ technology, if further developed,

commercialized and applied properly, will not only allow for the inexpensive

development of innovative and complex chips that can be used in a broad range of

applications, from (i) chemical, biological and environmental measuring tools

for the life and environmental science industries to (ii) use in electronic

components, but also allows for the manufacture of related devices and systems

to be completed without the high capital costs and laborious processing steps

traditionally associated with micro fabrication, such as “clean rooms” and

complex robotics.

Our

Proprietary Material

NanoShrink™

and other shrinkable plastic substrates that we use are used in countless

industrial applications because of there flexible material properties and

relative material stability. By taking advantage of these inherent

characteristics, NanoShrink allows for the ultra-rapid direct patterning of

complex, even three-dimensional, stacked polystyrene micro- and nanostructures

as well as advanced optoelectronic devices. Management believes that

NanoShrink™ and similar materials readily available at economic rates both in

the US and abroad.

Advantages

of Our Manufacturing Process and Technologies

What

follows are some examples of technological and/or cost benefits of our

shrinkable polystyrene and plastic-based technologies over other competing

technologies.

Quicker

Manufacturing. Developing intricate

micro patterns into substrates of silicon, glass, or quartz requires large

investments in capital equipment, manufacturing “clean rooms”, and costly

consumables. The soft lithography processes which we use, we believe,

can accelerates chip fabrication from months (using standard silicon technology)

to typically less than 2 days. This process still requires patterning

of a silicon wafer (see Figure A. below). This wafer is used as the

mold, with expensive photo-sensitive polymers that define the features by

photolithography.

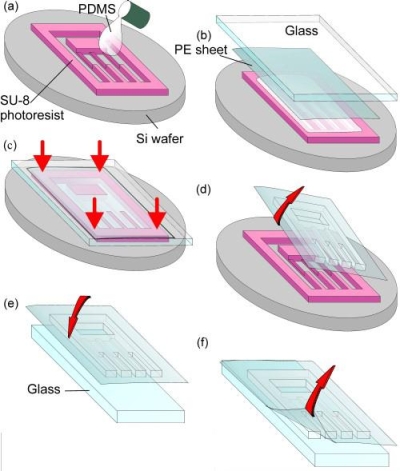

Figure A:

6

Reduced Capital

Costs. We believe that Shrink’s technology obviates the

requirement for high cost manufacturing equipment, the need for multiple and

complex micro fabrication designs, and the use of high stringent environments

and clean rooms. Due to ease of use, the Company will also be able to

rapidly integrate into most pre-existing manufacturing lines. With

the relative ease of prototype design and creation, Shrink is able to accelerate

research and development time without the added cost of resources or

manpower.

Better Material

Characteristics. We believe that our shrinkable

technology using

NanoShrink is

advantageous over other substrates such as silicon because of its desirable flow

characteristics in microfluidic applications. Microfluidic devices

typically require dimensions in the 100 μm range, whereas we are able to achieve

resolutions near 70 μm in width and operate well within the requirements and

capabilities of current lithography techniques. So far,

testing indicates that NanoShrink™ is not as easily impacted by solvents or

environmental factors such as extreme heat, cold or physical

impact. For this reason as well as the other reasons relating to ease

and economics in manufacture, we believe that shrinkable polystyrene materials

(such as NanoShrink™) are an ideal material for products such as cell-culture

dishes and plates used in drug discovery. Many hydrophobic molecules

absorb easily into the porous PDMS matrix of computing technologies, potentially

affecting results which have intolerable in many analytical

applications. We believe that this is one property that links

industry adoption of PDMS for applications in drug discovery and other sensitive

assays.

Design and Manufacturing

Efficiencies; Three Dimensional Structures. Traditional photolithography creates

planar or 2-dimensional structures. Rounded and/or multi-height

features are therefore difficult to create and require additional processing

steps. To achieve multi-heights, several masks and high precision

alignment are required. Our processes, we believe, creates inherently

rounded features, and multi-heights are easily achievable. Additionally, because

of the unique characteristics of our shrinkable polystyrene technologies, design

and fabrication can occur sequentially, with immediate results allowing for

quick turn-around prototype

testing.

Rapid Deployment. Shrink’s Shrink technologies

allow for the quick and easily delivery of custom microfluidic chips for low

volume prototype or manufacturing needs. Through the integrated

website we are developing, www.ShrinkChip.com,

users will be able to establish a secure account and in a few steps upload,

store and manage their computer assisted drawing, or CAD, of micro-chip

patterns, select the size, quantity and other characteristics, receive a price

quote, place the order, and have the chips shipped directly to their

lab. Shrink intends to continue to make use of industry-standard

xerography printing machines to provide prospective customers the highest levels

of quality control.

Business

Strategy

Our

business strategy, based on the FIGA™ model (www.figa.org), is to use outside

experts from various industries in order to meet commercial ends. We

execute on our strategy by funding research in outside (typically academic)

research labs, all of which we have established technology licensing

arrangements with. Around our “hub” of mainly academic research

relationships, we connect teams consisting of people with financial, related

industry (physical or life sciences) and government (typically regulatory)

backgrounds. We use these teams to vet technology that is produced

and patentable to first determine the commercial viability of the technology,

and then to create specific commercialization plans for the same

technology.

To date,

we have used our business model to create three businesses, which we continue to

develop:

NanoShrink™

Our

NanoShrink™ business (“NanoShrink™”) seeks to exploit a proprietary polymer

material which we seek to sell to academic labs and research organizations

around the world. NanoShrink™ can be used as a flexible platform to

create a myriad of life science and physical science

applications. NanoShrink™ will eventually be operated as a separate

subsidiary entity with a dedicated management team.

StemDisc™

Our

StemDisc™ business (“StemDisc™”) is based on a biomedical research tools

platform designed to grow and differentiate various biological samples,

including embryoid bodies (EBs), human and animal single cell studies, human

embryonic stem cells (HESCs) and the new and growing field of induced

pluri-potent stem cells (IPSCs). Our StemDisc business will

eventually be operated as a separate subsidiary entity with a dedicated

management team.

Shrink

Solar™

Our

Shrink Solar business (“Shrink Solar™”) seeks to design and market optical solar

concentrators based on a version of NanoShrink™ material which is “doped” with a

proprietary blend of photovoltaic nanoparticles called quantum

dots. The balance of the Shrink Solar system, which in total

comprises the finished products we seek to sell, will be used to solarize

surfaces, including turning windows into solar collection devices and as a low

cost replacement to and even accessory item for traditional flat panel

crystalline silicon solar cells. Our technology does not require

mirrors, lens or tracking devices. We believe the final commercial

products we will seek to sell will be extremely low in cost, relatively equal to

existing technologies in terms of efficiency and will offer advantages that will

allow for system upgrades as technology improves. Our Shrink Solar

business will eventually be operated as a separate subsidiary entity with a

dedicated management team.

7

Product

Commercialization and Marketing

We will

require substantial additional capital to further develop and commercialize our

manufacturing processes. In each of our businesses, consisting of

NanoShrink™, StemDisc™ and Shrink Solar™, we have established relationships with

contract suppliers of the products we seek to market. In each

business, and presuming adequate funding and that no unusual impediments are

incurred, we do not foresee any limitation on our ability to continue to design

and eventually market the related products for the businesses.

Strategic

Marketing Agreement with Inabata

In

September of 2009, we entered into a Strategic Marketing and Development

Agreement (the “Marketing Agreement”) with Inabata America Corporation

(“Inabata”), a subsidiary of Inabata & Co. Ltd., which provides for the

appointment of Inabata as the Company’s non-exclusive representative

for the purposes of marketing and promoting the Company’s solar concentrator

technology and ShrinkChip™ RPS solar products to third parties (the “Solar

Products”). Pursuant to the Marketing Agreement, Inabata is required

to use best efforts in, among other things, introducing the Solar Products to

potential purchasers, licensees, customers, development partners or possible

funding sources, and to provide certain technical assistance and

training. In exchange therefore, Inabata was granted a good faith

right of first negotiation to act as non-exclusive distributor of the Solar

Products. In addition, the Marketing Agreement provides for fees to

be paid to Inabata if it introduces a funding, grant or development funding

source which completes a capital transaction with the Company up to 50% of which

may be paid in stock, at the sole discretion of the Company.

Research

and Development Priorities and Expenditures

We

estimated that Shrink has invested approximately $122,416 into its technologies

in 2009, primarily from government and university grants, and $79,352

into its technologies in 2008, most of which has stemmed from payments from

Shrink through UC Merced or, to a limited extent, CIRM. (See “Item

7. Management’s Discussion and Analysis of Financial Condition and

Results of Operations” below).

In

determining our allocation of resources, we assess which fields we believe are

closer to commercial development and which we believe hold greater financial and

strategic potential for us. Our goal is to penetrate those areas that

we are most prepared to commercialize and that have the fewest relative barriers

to market acceptance. In order to best describe the fields and the

relative priority of each to us at this time, what follows is a summary of

applications currently being pursued in order of currently intended

priority.

Specifically,

Shrink has focused its early development towards metal-enhanced fluorescence

diagnostic systems, stem cell research, cellular

growth substrates, Lab-on-a-Chip devices and our solar concentrator

technologies. Our StemDiscTM

product is about to enter “second generation” testing, and comprehensive R&D

trials will be performed and analyzed by Shrink’s scientific

partners.

Employees

We

currently do not have any full time employees for Shrink Nanotechnologies, Inc.,

including its subsidiaries. We obtain administrative services from

BCGU, LLC (“BCGU”), an entity indirectly controlled by James B. Panther II, and

Mark L. Baum, Esq., who are two of our directors, for a fee of $30,000 per month

pursuant to an operating agreement. In the past, because we have not

had the cash on hand to pay BCGU, we have accrued these amounts

owed. The foregoing is a summary only of our operating agreement with

BCGU, LLC, a copy of which is attached as an Exhibit to our Current Report on

Form 8-K, Filed June 5, 2009.

We hire

independent contractor labor for executive management, legal, accounting and

other administrative functions, on an as needed basis and have entered into

consulting arrangements with certain directors and advisory board members in

exchange for stock or derivative securities. We have not entered into a

collective bargaining agreement with any union.

8

Prospective

Business Goals

The goals

we will need to attain for our various businesses are currently, as follows

(although management constantly monitors market trends, as well as available

capital and has in the past, and continues to, refine and re-prioritize the

Company’s goals, so as to attain commercialization as quickly as

possible):

NanoShrink™

Business

|

·

|

Finish

development on the first iteration of the NanoShrink™ product

line.

|

|

·

|

Complete

the protection of our NanoShrink™ intellectual property

and know how as well as optimize the propriety of the ancillary devices we

wish to make available in order to enhance the value of using

NanoShrink™ and

the balance of the systems we intend to commercially

offer.

|

|

·

|

Enter

into a joint development agreement to develop additional NanoShrink™ films (plain), as

well as single, multi-layered metalized films and structured

NanoShrink™ films

for diagnostic assays and biomedical research

applications.

|

|

·

|

Build

a web platform to allow researchers and users of the products to provide

feedback, order products and collaborate with other user researchers

around the world.

|

|

·

|

Seed

ideas to our NanoShrink™ user community, post

research results and publish in academic journals in order to spread the

word about the flexibility and usefulness of the NanoShrink™ platform for

diagnostic and microfluidic assay

prototyping.

|

|

·

|

Continued

academic publishing related to the uses of NanoShrink™.

|

StemDisc™

Business

|

·

|

Develop

the StemDisc “family of products” for biological materials as small as the

single cell – all the way up to products that foster research on full

scale patches of tissue (cardiac patches,

etc.).

|

|

·

|

Create

a product development advisory committee (the “PDAC”) to distribute our

products to leading researchers and receive feedback regarding the use of

the materials and ways to be design the

product.

|

|

·

|

Develop

scalable commercial quality manufacturing processes for StemDisc

devices.

|

|

·

|

Commercially

manufacture StemDisc devices.

|

|

·

|

OEM

StemDisc products through one of several large multi-national

distributors.

|

Solar

Concentrator

|

·

|

Unveil

our initial working prototype devices and discuss efficiency of the device

as well as potential scaled cost per watt

calculations,

|

|

·

|

Improve

and optimize our solar concentrator

technology,

|

|

·

|

Commence

to develop a branding strategy for the

technology,

|

|

·

|

Accessing

adequate supply arrangements for

components,

|

|

·

|

Develop

reliable commercial scale “solarizable” film and plastic sheet

relationships,

|

|

·

|

Secure

supply arrangements for system connector

components,

|

|

·

|

Establish

relationships with market leading product design and manufacturing

entities – in the window covering, residential and commercial window

manufacturing, siding, roof tile and conventional solar panel businesses

to integrate our products and systems into their designs to in effect

“solarize” previously non-energy producing

surfaces.

|

9

Competition

There are

numerous competitors in every space/market we seek to exploit, with the

strongest competitors in the life sciences industry boasting large market

capitalizations and liquidity, as well as scientific and marketing resources and

recognition.

While

competing technologies and companies exist for all of our products, we believe

that we have certain opportunities that we can exploit which may increase our

opportunity to be successful in the markets we seek to

exploit. However, even if our technologies are successful, no

assurance can be made that we will be able to compete effectively and yield

significant or sustained value for our shareholders.

|

NanoShrink

|

The

business itself is what may reasonably be referred to as an attempt to

shift the paradigm in the manner in which prototype devices are made in

the physical and life sciences. The idea of designing and

printing at the macro scale and then shrinking (a polymer), resulting in

feature diminution, leaving a functional device with micro or nano scale

features, is a relatively new concept and there are not any direct

competitors in this field other than those companies which offer more

traditional methods of device prototyping.

The

pool of potential dollars flowing into this “market” is relatively finite

– although it does increase and decrease as research and academic,

governmental and commercial research and development budgets ebb and

flow.

Here

is a partial list of entities competing for these dollars:

· TransLume

(http://www.translume.com)

· Micralyne

(http://www.micralyne.com)

· Siloam Biosciences

(http://www.siloambio.com)

· Stanford

Rapid Prototyping Laboratory, Microfluidics Foundry etc.

· Dr.

George M. Whitesides, a legend in the microfluidics area, has proposed a

similar shrink based technology in 1997, but has not initiated

commercialization.

|

|

StemDisc

|

The

stem cell research tools business is a relatively new, dynamic and growing

field. As such, we are aware of several companies who directly

compete in the market we seek to enter. A few of these

companies are listed below. Additionally, we are aware of many

academic laboratories around the United States (and we are sure there are

many more around the world) who are dedicating resources to building newer

technologies that may compete with and potentially displace any interest

in our devices.

· Stem Cell Technologies

(http://www.stemcell.com)

· PicoVitro

(http://www.picovitro.com)

· Nunc (http://www.nunc.com)

|

|

Shrink

Solar

|

The

solar field is extremely crowded with numerous different technologies

competing for a growing market for renewable energy investment, including

power generation, power conservation and in general, “green(er)

technologies.”

Below

is a list of a few companies in the solar space that offer products in the

market we seek to enter:

· Covalent Solar

(http://www.covalentsolar.com/)

· Morgan Solar

(http://www.morgansolar.com/)

· SolarWorld

(http://www.solarworld-usa.com/

· Kyocera

(http://www.kyocera.com/)

· SunPower

(http://www.sunpower.com/)

· Dow Chemical (http://www.dowsolar.com/)

|

10

Government

Regulation

Shrink is

a research and development business and to date, has not commercialized or sold

any products using its technologies. Therefore, the Company cannot be

certain exactly which governmental regulations will ultimately be applicable to

the final products. However, certain of our products and manufacturing

processes will be subject to regulation under various portions of the

U.S. Federal Food, Drug and Cosmetic Act, to the extent they are used in or

as part of medical devices or in vitro diagnostic devices. The effects of

this are that, among other things, our manufacturing facilities, when and if

created, may be subject to periodic inspection by the U.S. Food and Drug

Administration, or FDA, other product-oriented federal agencies and various

state and local authorities in the U.S. for compliance with the requirements of

the FDA’s Quality System Regulation (formerly known as Good Manufacturing

Practices), other federal, state and local regulations and other quality

standards such as ISO 9001 or ISO 13485.

To the

extent our products are used in medical devices or other regulated applications,

our products may be subject to extensive medical, FDA or other government

regulation, testing and pre-market approval or clearance processes. Prior

to application for approval or clearance, we may need to conduct clinical trials

to test the safety and efficacy of our products or we may be required to

identify predicate devices to which we can establish substantial

equivalence. In addition, we may be required to satisfy testing criterion

or submit product applications in other countries where we intend to market our

goods. These processes may take an extensive period of time and would

necessarily require significant capital outlays, which we have no commitments

for at this time.

We do not

use and we anticipate that we will not utilize, manufacture or operate with

substances deemed controlled under the Controlled Substances Act, administered

by the Drug Enforcement Agency, or DEA, and therefore, no special procedures

need be in place.

Because

we do not actually do any material amount of testing, but rather, the

manufacturing of devices that will be used as “tools”, we do not employ Centers

for Disease Control/National Institutes of Health, Guidelines for Research

Involving Recombinant DNA Molecules, Biosafety in Microbiological and Biomedical

Laboratories, but, if and as our operations expand, may be required to do so in

the future.

We are

subject to federal, state, and local laws and regulations regulating the

discharge of materials into the environment, or otherwise relating to the

protection of the environment, in those jurisdictions where we operate or

maintain facilities. Our operations to date have only been R&D and

within universities in the State of California. Therefore, we do not

believe that any liability arising under, or compliance with, these laws and

regulations will have a material effect on our business, and no material capital

expenditures are expected for environmental control.

Certain

Regulation Relating To Our License Agreement

Because

certain inventions licensed to us under the License Agreement were funded by

CIRM grants, as discussed above and in “Item 7. Management’s

Discussion and Analysis of Financial Condition and Results of Operations.”

Below, we are subject to the terms of the State of California’s CIRM’s

Intellectual Property requirements for Non-Profit Organizations (17 Cal. Code of

Regs. Section 1003000, et.

seq.

The

license granted by the License Agreement is also subject to the obligations to

the U.S. government, under 35 U.S.C. Sections 200-212, including the obligations

to report on utilization of inventions under 37 CFR 401.14(h), and is subject to

the National Institute Of Health’s “Principals and Guidelines for Recipients of

NIH Research Grants and Contracts on Obtaining and Disseminating Biomedical

Research Resources” (64 F.R. 72090 Dec. 1999, as amended).

We do not

believe, based on our existing Research Agreement and License Agreement, that

any of our funding grants to date involved the use of federal

funds. U.S. Federal rules relating to ownership of intellectual

property may be applicable to our intellectual property. In the

event that we accept federally funded grants or projects in the future, which we

hope to do, our use of technologies developed will be subject to strict

licensing guidelines and rules.

AudioStocks

and Previous Business Revenues

In 2008

and 2009, we continued to wind down our AudioStocks business. We do

not anticipate any material revenues from our AudioStocks business in 2010 as we

completed the sale of our AudioStocks business and related assets in

2009. Because we no longer operate in this segment, management

believes that extensive disclosure on this business is not material to an

understanding of our new Shrink business.

11

Recent

Developments

Forward

Split and Increase in Capitalization

Effective

as of April 8, 2010, we filed a Certificate of Amendment to our Certificate of

Incorporation (the “Certificate of Amendment”) which both:

|

·

|

increased

our authorized capital from 100,000,000 shares of which 95,000,000 shares

are common stock, par value $0.001 per share and 5,000,000 are preferred

stock, par value $0.001per share, to 500,000,000 shares, of which

475,000,000 are shares of Common Stock, par value $0.001 per share and

25,000,000 are preferred stock (the “Capitalization Increase”);

and

|

|

·

|

effectuated

a forward split of our outstanding common stock on a 5 for 1 basis,

increasing our issued and outstanding shares of common stock from

38,260,797 to 191,303,985 shares, par value $0.001 (the “Forward

Split”).

|

The

Forward split had a pari

pasu effect on our 4,000,000 shares of outstanding Series A Preferred

Stock, which is now increased to 20,000,000 shares of Series A Preferred

Stock.

As a

result of the Forward Split and Capitalization Increase, we now have remaining

283,696,015 shares of Common Stock authorized, but unissued and available for

issuance, and an additional 5,000,000 shares of “blank check” preferred stock

authorized, which have not been designated or reserved for issuance by the

board.

All

references in this Annual Report to share amounts, exercise or conversion prices

reflect post split numbers and amounts, unless expressly indicated

otherwise.

Convertible

Note Financing

During

the months of January and February of 2010, the Company issued, on a private

basis, $335,000 in 12% convertible notes initially convertible at $.10 per

share, and 1,675,000 Series A Common Stock Purchase Warrants, exercisable at

$0.20 per share as part of a confidential private financing in exchange for

$335,000. The notes and warrants are identical to $100,000 of 12%

notes and warrants issued in November of 2009 (i.e. an aggregate of $435,000

principal amount of convertible notes and warrants). The notes are

repayable one year from issuance and the warrants are exercisable commencing 6

months from issuance and expire 36 months from issuance. In the event

of a default, or in certain other events, the notes become exercisable at 80% of

the then effective conversion price (initially $.08 per share), and the Company

may force conversion at the discounted rate at such time.

When

combined with notes and warrants sold during fiscal 2009 (and not including any

prior 14% convertible notes issued to Noctua Fund, L.P.) the following is a

brief summary of the notes and warrants outstanding:

|

·

|

$435,000

principal amount 12% convertible notes, currently convertible at $.10 per

share into an aggregate of 4,350,000 shares of common stock (plus shares

issuable as interest), payable one year from their respective issuance

dates, and

|

|

·

|

2,175,000

Series A Common Stock Purchase Warrants, exercisable at $.20 per share,

and expiring three years from their respective issuance

dates.

|

The

foregoing is a summary only of the note and warrant

financing. Details of the same may be found below in this Annual

Report in the section titled “Item 5. Market for Registrant’s Common Equity,

Related Stockholder Matters and Issuer Purchases of Equity

Securities.”

Issuances

of Shares to Consultants

As part

of the Company’s business plan and when feasible, it regularly elects to pay

consulting fees in stock, as opposed to shares, to professionals so as to

conserve capital. In particular, during March of 2010, the

Company issued an aggregate of 18,382,500 shares of restricted common stock to

seven consultants and professional service providers for services

rendered. Additional information relating to these issuances and the

underlying agreements and details can be found below in this Annual Report in

the section titled “Item 5. Market for Registrant’s Common Equity, Related

Stockholder Matters and Issuer Purchases of Equity Securities” and “Item

7. Management Discussion and Analysis of Financial Condition and

Results of Operations” below.

12

|

ITEM

1A.

|

RISK

FACTORS

|

We

have not yet commercialized our ShrinkChip™ related technologies and have not

attained revenues from them. The nature of our business activities

subjects us to certain hazards and risks and uncertainties. We are a

research and development stage company that will need substantial additional

capital and development to be able to commercialize and gain market acceptance

for our innovative products. You should carefully consider the risk

factors and all of the other information included in, or incorporated by

reference into, this Annual Report or any supplement, including those included

in our most recent Reports or documents provided as exhibits to this Report or

other Reports as may be incorporated from time to time.

Our

independent accounting firm and our board of directors, given the present

resources and condition of the company agree that our internal controls are

ineffective and that we may not be able to continue as a going

concern. We are taking steps to correct our internal controls and are

also moving to improve the financial condition of the company.

General

Risks:

You

will suffer immediate and subsequent dilution and the costs of the securities

you may purchase at exceed the price paid by current principal

shareholders.

Many of

the present owners of our issued and outstanding securities acquired such

securities at a cost substantially less than that of the open

market. In addition, the Company currently is indebted to Noctua

Fund, LP for loans made to the Company or Shrink since 2008, as reflected on two

14% convertible promissory notes in the aggregate initial principal amounts of

$118,121.28 and $100,000, respectively, plus interest, which are convertible at

$.04 per share based on conversion prices at the times of the loans

(approximately 5,848,725 shares, in aggregate as of April 10, 2010), both of

which are currently in default. Therefore, the shareholders will bear

a substantial portion of the risk of dilution and losses.

Some

of our debt is in default and could result in us losing some or all of our

assets.

The

“default” status with respect to the notes owned by Noctua Fund L.P., an

affiliate of certain management, provides them with the right to take

potentially aggressive actions, including levying on some or all of our assets,

in order to recover monies owed.

We

may not be able to continue operations as a going concern and we need

substantial additional capital to continue our research and development

activities and begin commercialization plans. Research and

Development costs of Shrink have been completely paid for to date by the UC

Regents, and to a lesser extent, CIRM and, we do not have any capital

commitments at this time.

Our

independent auditors have expressed doubt about ability to continue as a going

concern. Shrink is currently a research and development company

only. We do not have grant or capital commitments at this time and

previous Shrink research has been funded by the UC Regents and

CIRM. We do not believe that the sale of our remaining AudioStocks

business related assets or from recent capital raises will be sufficient to fund

our operations or research to any material degree. Nonetheless, we

have no further commitments for grants and grant funds cannot, generally, be

used towards commercialization and manufacturing

efforts. Accordingly, the corporation will be dependent on obtaining

additional external sources of capital in order to fund its operations or even

continue as a going concern.

A future

capital raise could involve a private or public sales of equity securities or

the incurrence of additional indebtedness. Additional funding may not be

available on favorable terms, or at all. If we borrow additional

funds, we likely will be obligated to make periodic interest or other debt

service payments and may be subject to additional restrictive covenants. If we

fail to obtain sufficient additional capital in the future, we could be forced

to curtail our growth strategy by reducing or delaying capital expenditures,

selling assets or downsizing or restructuring our operations. If we

raise additional funds through public or private sales of equity securities, the

sales may be at prices below the market price of our stock, and our shareholders

may suffer significant dilution as a result of such sale.

13

Management

owns a controlling interest of our stock, including, without limitation, our

Series A Preferred Stock; the existence of these derivative securities, may

adversely affect your stock price and our ability to raise capital or into

business ventures and transactions.

Currently,

twenty million shares (20,000,000) of Series A Preferred Stock are issued

and outstanding and held by certain principal shareholders or their

affiliates. These shares are all convertible and contain strict anti

dilution provisions and other restrictive covenants. As a result,

over 90% of our voting control is vested in three beneficial

owners. Moreover, as shares of preferred stock are converted and

sold, such sales are likely to have a highly dilutive effect on our stock

price.

Additionally,

the existence of our outstanding preferred stock may hinder our ability to raise

capital at favorable prices if and as needed, or to make

acquisitions.

As a result, these members of

management will be able to:

|

·

|

control

the composition of our board of directors; control our management and

policies;

|

|

·

|

determine

the outcome of significant corporate transactions, including changes in

control that may be beneficial to stockholders;

and

|

|

·

|

act

in each of their own interests, which may conflict with, or be different

from, the interests of each other or the interests of the other

stockholders.

|

Our

principal stockholders have the ability to exert significant control in matters

requiring stockholder vote and could delay, deter or prevent a change in control

of our company.

Since our

stock ownership is concentrated among a limited number of holders, those holders

have significant influence over all actions requiring stockholder approval,

including the election of our board of directors. Specifically, these

members of management are Marshall Khine, Esq., Mark L. Baum and James B.

Panther, II (director only). Through their concentration of voting

power, they could delay, deter or prevent a change in control of our company or

other business combinations that might otherwise be beneficial to our other

stockholders. In deciding how to vote on such matters, they may be

influenced by interests that conflict with other stockholders. Accordingly,

investors should not invest in the Company’s securities without being willing to

entrust the Company’s business decisions to such persons.

Conflicts

of interest between the stockholders and our company or our directors could

arise because we do not comply with the listing standards of any exchange with

regard to director independence.

There are

a variety of conflicts of interests and related party transactions with members

of management, which control the vast majority of our shares and our

board. We are not listed on a stock exchange and our Board of

Directors does not comply with the independence and committee requirements which

would be imposed upon us if we were listed on an exchange. In the absence

of a majority of independent directors, our directors could establish policies

and enter into transactions without independent review and approval. This could

present the potential for a conflict of interest between the stockholders and

our company or our directors.

14

We

have a significant amount of preferred stock, convertible debt and warrants

outstanding, all of which have anti dilution provisions. If we issue

additional shares or derivative securities as we raise capital, the notes are

converted or the warrants are exercised, or if the conversion prices are

adjusted downward as a result of a stock issuance at our current market rates,

you will suffer immediate and substantial dilution to your common

stock.

The

bylaws allow the board to issue common shares without stockholder

approval. Currently, the board is authorized to issue a total of

475,000,000 common shares, of which less than 45% have been issued or reserved

for issuance as of April 2010. In addition, the board is authorized

to issue up to 25,000,000 preferred shares of which 20,000,000 are already

designated and issue and an addition 5,000,000 “blank check” preferred may be

issued. Currently, 191,303,985 shares of common stock are issued and

outstanding and, the following securities with anti-dilution provisions are

outstanding:

|

·

|

20,000,000

shares of Series A Preferred Stock, owned primarily by Messers Baum and

Panther, II, convertible on a one-for-one basis into common

stock,

|

|

·

|

$435,000

principal amount of unsecured 12% convertible notes, initially convertible

at $.10 per share, into an aggregate of 4,350,000, in addition to shares

that may be issued in respect of interest payments,

and

|

|

·

|

2,175,000

shares issuable upon exercise of Series A Common Stock Purchase Warrants

issued between November 2009 and April of 2010, at $.20 per share,

and

|

|

·

|

$118,121.28

principal amount of 14% convertible promissory note, issued to Noctua

Fund, L.P. in May 2009, an affiliate of Messers Baum and Panther, II,

convertible at $.04 per share into an aggregate of 2,953,032 shares (or

3,223,725 inclusive of 270,693 shares underlying $10,827.72 or accrued

interest, through April 10, 2010), which note is currently in

default,

|

|

·

|

$100,000

principal amount of 14% convertible promissory Note issued to Noctua Fund,

L.P., an affiliate of Messers Baum and Panther, II, reflecting loans made

by it in 2008 and 2009, convertible at $0.04 per share into an aggregate

of 2,500,000 shares (or 2,625,000 shares inclusive of 125,000 shares

underlying $5,000 of accrued interest, through April 10, 2010), which note

is also currently in default,

|

Sales of

a substantial number of shares of our common stock in the public market could

depress the market price of our common stock and impair our ability to raise

capital through the sale of additional equity securities.

In

addition, it is not likely that we will be able to raise convertible debt or

equity financing without issuing shares at or below market rates, which, in

addition to obvious dilution to existing shareholders, would reduce the

conversion and exercise prices of the above securities causing further dilution

to shareholders. Our board of directors has the authority, without

the consent of any of the stockholders, to cause us to issue more shares or our

common stock and shares of our preferred stock at such prices and on such terms

and conditions as are determined by the Board in our sole

discretion.

Moreover,

anti-dilution provisions in warrants have an additional adverse effect on the

Company in that we would be required to reflect the value of such warrants as a

potential liability to the Company. No assurance can be made,

therefore, that we will be able to raise capital, or, if we do, that the same

will not have a material adverse effect on our capitalization or to our balance

sheet.

If

additional funds are raised through the issuance of equity securities, the

percentage of equity ownership of the existing stockholders will be reduced. The

issuance of additional shares of capital stock by us would materially dilute the

stockholders’ ownership in us.

Presently,

we have under-qualified management operating the company.

The

present management team is not experienced enough and sufficient in number to

realize the potential of Shrink. It is very likely that more

qualified additional managers, with significantly more specific experience in

the businesses we seek to engage in, will need to be hired. The

sooner we can hire these people the better. These persons will likely

require substantial salaries and compensation packages that the company cannot

presently afford. Additionally, there may be substantial fees

associated with recruiting new additional or replacement managers. To

the extent that we are unable to ultimately bring managers into the company who

are more qualified than our present team, the company and it’s shareholders will

be negatively impacted.

15

Risks

Relating to an Investment in Our Securities:

Anti-takeover

provisions in our organizational documents and Delaware law may limit the

ability of our stockholders to control our policies and effect a change of

control of our company and may prevent attempts by our stockholders to replace

or remove our current management, which may not be in your best

interests.

There are

provisions in our certificate of incorporation and bylaws that may discourage a

third party from making a proposal to acquire us, even if some of our

stockholders might consider the proposal to be in their best interests, and may

prevent attempts by our stockholders to replace or remove our current

management. These provisions include the following:

|

·

|

Currently,

we have 20 million shares of Series A Preferred Stock outstanding (post

Forward Split) and owned primarily by management, all of which contain

significant anti-takeover and change of control

deterrents. Additionally, our certificate of incorporation