Attached files

| file | filename |

|---|---|

| 8-K - CTWS FORM 8-K MAY 17, 2011 - CONNECTICUT WATER SERVICE INC / CT | form_8-k.htm |

| EX-99.2 - PRESS RELEASE - CONNECTICUT WATER SERVICE INC / CT | exhibit-99_2.htm |

Connecticut Water Service, Inc.

2011 Annual Meeting

of Shareholders

May 12, 2011

Forward Looking Statements

Except for the historical statements and

discussions, some statements contained in this

report constitute “forward looking statements”

within the meaning of Section 27A of the Securities

Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. These forward looking

statements are based on current expectations and

rely on a number of assumptions concerning future

events, and are subject to a number of

uncertainties and other factors, many of which are

outside our control, that could cause actual results

to differ materially from such statements.

discussions, some statements contained in this

report constitute “forward looking statements”

within the meaning of Section 27A of the Securities

Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. These forward looking

statements are based on current expectations and

rely on a number of assumptions concerning future

events, and are subject to a number of

uncertainties and other factors, many of which are

outside our control, that could cause actual results

to differ materially from such statements.

2010 Recap

2010 - $66.4M

2009 - $59.4M

Revenue

2010 - $239.7M

2009 - $201.0M

Rate Base

Net Income

2009 - $10.1M

2010 - $9.8M

2010 Performance

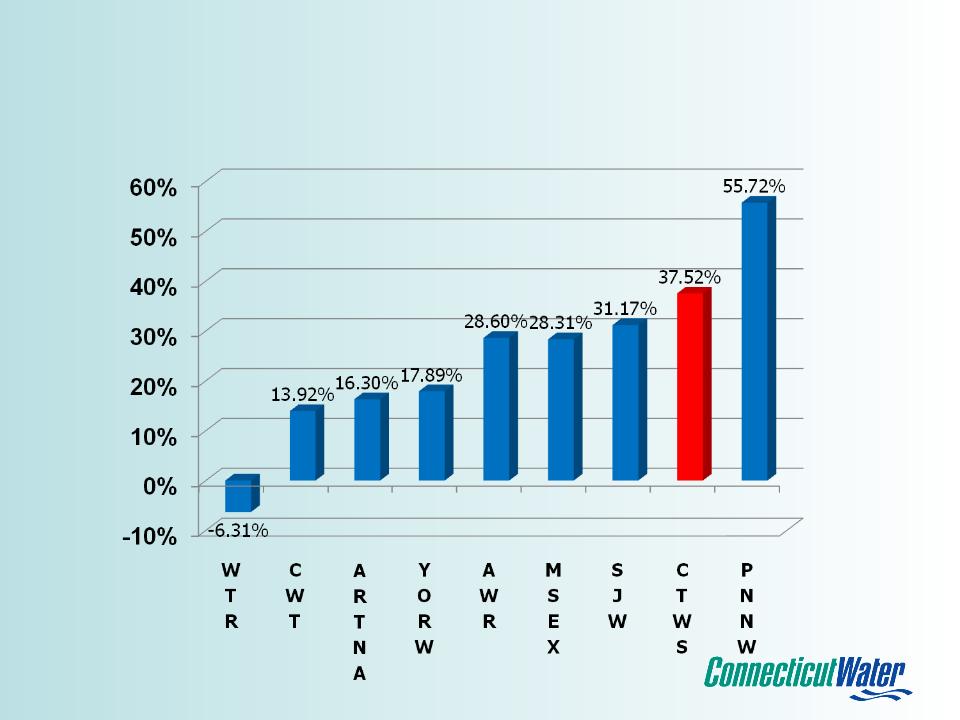

Water Utility Peer Group

2008-2010

Water Utility Peer Group

2006-2010

Regulatory Results

• July 2010 Decision

– Received $8.0 million

– 100% of Capital Investment

Allowed

– No Stay-out Provision

• WICA Surcharge

– 1.69% Additional Increase

in January 2011

– Next Filing - Fall 2011

Capital Expenditures

* 2011 Projected

Financial Priorities

• Growth

– Acquisitions

– Capital Investment

– Unregulated - Leverage Strength

• Manage Costs

• Capital Remains Available

1st Quarter EPS

2011 vs 2010

2011 vs 2010

EPS

Connecticut Water Service, Inc.

2011 Annual Meeting

of Shareholders

May 12, 2011

Water Touches Everything

We Care About…

We Care About…

Water Touches Everything

We Care About…

We Care About…

Water Touches Everything

We Care About…

We Care About…

Water Touches Everything

We Care About…

We Care About…

• Honesty

• Trust

• Respect

• Service

• Teamwork

• Positive Attitude

• Communication

• Accountability

• Organized in 1956

• 55 Towns

• Serving 300,000 people

– 90% Residential

• 199 Employees

Your Company…

Our Strategy…

• High Quality Water

• Reliable

• Efficient

• Responsive &

Courteous Service

Customer Strategy

• EPA Partnership Award

• H2O Assistance Program

• > 90% Customer Satisfaction

– World Class ! - 5 years

• Public Officials @ 92.9%

Customer Service

New Web site

www.ctwater.com

www.ctwater.com

Social Media

Facebook, Twitter, YouTube

Facebook, Twitter, YouTube

• Corporate Responsibility Committee

• Open Space Land Strategy

• Forest Management Plans

• Water Supply Planning

– Forecast & Plan supply for next 50 years

• Hybrid vehicles, videoconferencing, energy efficiency

Environmental Stewardship

• Water for People

• United Way

• Special Olympics

• SARAH

• The Kate (Old Saybrook)

• Infrastructure Investment

and Recovery

and Recovery

• Acquisitions

• Service Offerings

Growth Strategy

Water Main Replacement

• 1500 miles of pipe

• Infrastructure Investment

– 5% annual cap

– 7.5% maximum adjustment

• $13 - 15 million in

Capital Expenditure

• Current surcharge - 1.69%

• Water & Waste Water

– Connecticut

– New England

– Atlantic Coast States

• Fair Regulation

• 61 Acquisitions in 21 years

• Hawk’s Nest - Old Lyme

– Agreement reached

(pending DPUC approval)

• Green Springs Water Co. - Madison

– Completed March 2011

• 80 client contracts

– O&M

– Compliance Reporting

• University of Connecticut

Linebacker® Plans

Service Line Protection

Sewer/Septic Lines

Home Plumbing

2010

2009

2008

2007

2006

2005

• Employer of choice

• Our Culture…Values based

• Employee Satisfaction

– Exec Comp Metric

• “Satisfied Employees

Satisfy Customers”

Employee Strategy

Shareholder Strategy

• Strong Dividend Yield

• High Earnings Quality

• Strong Balance Sheet

Performance

• Total Shareholder Return

– Ranked #1 - 2008 - 2010

– Ranked #2 - 2006 - 2010

• Dividends

– Yield 3.7%

– Paid since 1956

– Increased 41 years

Analysts Remarks…

• “Boasting a stable business model, steadily growing dividends, and low

stock price volatility, Connecticut Water is a compelling story for

investors…” (Janney, April 2011).

stock price volatility, Connecticut Water is a compelling story for

investors…” (Janney, April 2011).

• Rate relief and operating discipline drive significantly improved EPS in 1Q11.

(Baird, May 2011).

(Baird, May 2011).

• CTWS posted FQ1 quarter earnings solidly above B&S and consensus

estimates…we note CTWS strong management team and 3.7% dividend

yield. (Boenning, May 2011).

estimates…we note CTWS strong management team and 3.7% dividend

yield. (Boenning, May 2011).

Thank you for your support

Your Questions & Feedback…