Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - STERLING FINANCIAL CORP /WA/ | d8k.htm |

Annual Meeting

of Shareholders

April 21, 2011

Ticker: STSA

Spokane, Washington

www.sterlingfinancialcorporation-spokane.com

*

*

*

*

*

*

Exhibit 99.1 |

SLIDE 2

Safe Harbor

In

the

course

of

our

presentation,

we

may

discuss

matters

that

are

deemed

to

be

forward-looking

statements,

which

are

intended

to

be

covered

by

the

safe

harbor

for

“forward-looking

statements”

provided

by

the

Private

Securities

Litigation

Reform

Act

of

1995

(the

“Reform

Act”)

(1)

.

Forward-looking

statements,

including

those

relating

to

our

position

and

strategy

as

a

result

of

our

recapitalization

transactions

discussed

herein,

involve

substantial

risks

and

uncertainties,

many

of

which

are

difficult

to

predict

and

are

generally

beyond

our

control

and

actual

results

may

differ

from

management’s

view

and

our

projected

financial

results.

We

assume

no

obligation

to

update

any

forward-looking

statements

(including

any

projections)

to

reflect

any

changes

or

events

occurring

after

the

date

hereof.

Additional

information

about

risks

of

the

company

achieving

results

suggested

by

any

forward-

looking

statements

may

be

found

in

the

company’s

10-K,

10-Q

and

other

SEC

filings,

including

under

the

headings

“Risk

Factors”

and

“Management’s

Discussion

and

Analysis

of

Financial

Condition

and

Results

of

Operations.”

(1) The Reform Act defines the term "forward-looking statements"

to include: statements of management plans and objectives, statements

regarding the future economic performance, and projections of revenues and other financial data,

among others. The Reform Act precludes liability for oral or written

forward-looking statements if the statement is identified as such

and accompanied by "meaningful cautionary statements identifying important factors that could cause

actual results to differ materially from those made in the

forward-looking statements." |

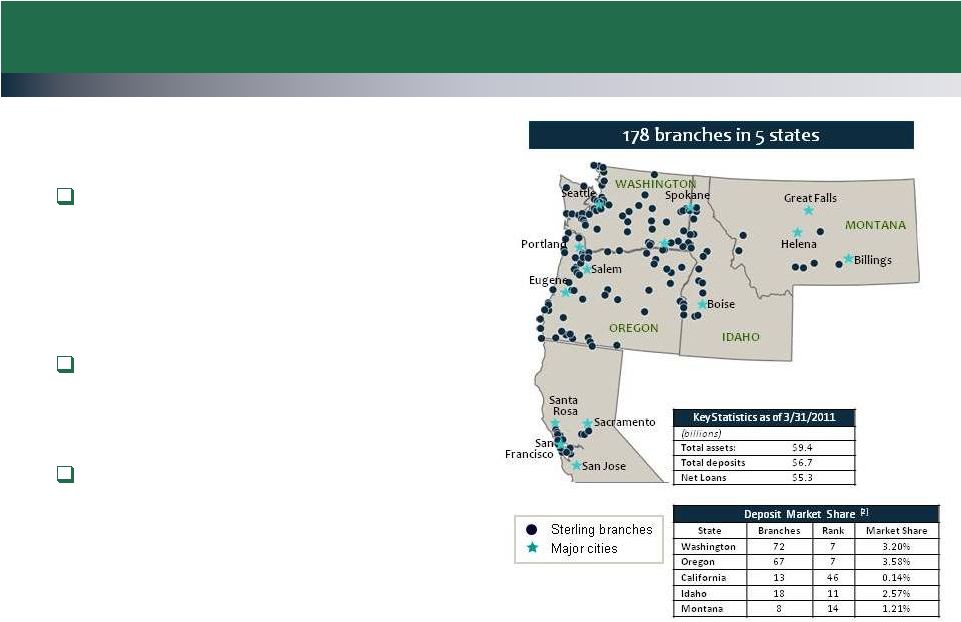

Based in Spokane, Wash.,

Sterling is one of the largest

commercial banks

headquartered in the Pacific

Northwest

(1)

More than 25,000 commercial

accounts and nearly 200,000

retail deposit accounts

$6.7 billion of deposits with an

average cost of 1.01%

(3)

Source: SNL Financial, Company filings

Note: Financial data as of March 31, 2011.

(1)

Pacific Northwest defined as Idaho, Oregon, and Washington.

(2)

Deposit market share data as of 6/30/2010.

(3)

For the quarter ended March 31, 2011

Franchise at a Glance

SLIDE 3 |

STSA: Promises

Delivered 2010/2011 Successful $730 million recapitalization (August

2010) Anchors Warburg Pincus and Thomas H. Lee Partners, plus

approximately 30 additional investors

U.S. Treasury preferred ($303 million) converted to common stock

C&D lifted in September; replaced with MOU

Execution of strategic plan well under way

Cost-effective funding/low-cost deposit initiatives

Improvements in asset quality; reductions in NPLs

Relationship-based, commercial bank focus

Cost control and synergies, including Golf merger into Sterling

Positioned for profitable growth with initial results in

Q1 2011

SLIDE 4 |

STSA: Promises

Delivered 2010/2011 Fortified management and board leadership driving

future success Les Biller, chairman; anchor investors hold board

seats 11-member board with new directors adding banking/financial

experience

New CCO, Dave DePillo; New CFO, Pat Rusnak

SLIDE 5 |

Performance

Highlights - 2010

Quality deposit metrics continued to drive down cost

of funds

Improving mix

Deposit costs decreased 14 bps in Q4 and 73 bps during 2010

Improvements in asset quality

Experienced a reduced Q4 2010 provision for credit losses of $30

million, compared to $340 million in Q4 2009

NPAs at year end were down 17% from prior year end

Construction loan exposure reduced by $990 million, or 65%,

during 2010

Core franchise strength focused on delivering profitability

(1)

Excludes a one-time, non-cash charge for the conversion of preferred stock

to common stock. The Q4 2010 net loss attributable to common shareholders was $642.7

million, or $12.79 per common diluted share. Full-year financial results are

reported in the Annual Report to Shareholders on Form 10-K as filed with the SEC.

SLIDE 6 |

Formula for

Success Cost-

Effective

Funding

Improved

Asset

Quality

High

Quality,

Relationship

Based Asset

Generation

Expense

Control

Profitable

Growth

Focus on Customers

Delivering value proposition to customers

•

Fair pricing

•

Competitive products and services

Resolving credit challenges

Increased emphasis on sales and business development

Intelligent market segmentation

Expense control and organizational efficiency

Simplified, “Back to Basics”

banking drives growth

Strategic expansion in key markets and lines of business

Managing through emerging regulatory changes

SLIDE 7 |

Improving quarterly results

Reported Q1 net income of $5.4 million

Compares to loss of $88.8 million for Q1 2010

Reduced credit provisioning

Provision for Q1 credit losses totaled $10.0 million

Compares to $88.6 million provision for Q1 2010

Declining levels of non-performing loans (NPAs)

NPAs of $628.8 million, reflecting a 41% decline compared to

$1.06 billion of NPAs at March 31, 2010

Focus on liquidating OREO, note sales, short sales and other workouts

Net interest margin of 3.22%, up 37 bps from Q1 2010

Average cost of deposits declined by 44 bps from Q1 2010

SLIDE 8

2011 Q1 Selected Operating Highlights |

Improving Trend

in Classified and Non-Performing Assets SLIDE 9

|

Improving Trends

Summary (Q1 2011 vs. Q1 2010) Improved asset quality and reduced credit

provisioning

Classified assets

50%

Non-performing assets

41%

Non-interest expense

8%

Provision for loan losses

89%

Increased margins and capital

Net interest margin

13%

Non-interest income

19%

Shareholder equity

216%

SLIDE 10 |

Fortified balance sheet

Strong capital position –

exceeds regulatory

level required for “well-capitalized”

status

Reduced construction loans and NPLs

Improved mix of core deposits

Executing on our strategic plan

Core deposit growth will drive

NIM and earnings

Continued reductions in high-risk assets

Working to strengthen profitability in 2011

•

Growth in business and consumer lending

•

Controlled operating expenses

Building one of America’s great

community banks

SLIDE 11

Stability and Platform for Growth |

Annual Meeting

of Shareholders

April 21, 2011

Ticker: STSA

Spokane, Washington

www.sterlingfinancialcorporation-spokane.com

*

*

*

*

*

*

* |