Attached files

| file | filename |

|---|---|

| EX-3.2 - Orsus Xelent Technologies Inc | v218698_ex3-2.htm |

| EX-31.1 - Orsus Xelent Technologies Inc | v218698_ex31-1.htm |

| EX-32.1 - Orsus Xelent Technologies Inc | v218698_ex32-1.htm |

| EX-10.4 - Orsus Xelent Technologies Inc | v218698_ex10-4.htm |

| EX-31.2 - Orsus Xelent Technologies Inc | v218698_ex31-2.htm |

| EX-10.3 - Orsus Xelent Technologies Inc | v218698_ex10-3.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______ to ______.

Commission file number: 001-33456

ORSUS XELENT TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction of

incorporation or organization)

|

20-1198142

(I.R.S. Employer

Identification No.)

|

29th Floor, Tower B, Chaowai MEN Office Building

26 Chaowai Street, Chaoyang Disc.

Beijing, People’s Republic Of China 100020

(Address of principal executive offices, including zip code)

86-10-85653777

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, par value $0.001 per share, trading on NYSE Amex Equities

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934.

Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes o No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer o

Non-accelerated filer o Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

As of December 31, 2010, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $5,143,520 based on the closing price as reported on the NYSE Amex Equities exchange. There were a total of 30,256,000 shares of the registrant’s Common Stock, par value $0.001 per share, outstanding as of April 5, 2011.

DOCUMENTS INCORPORATED BY REFERENCE: None.

PART I

Item 1. Business.

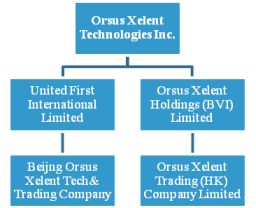

Except as otherwise indicated by the context, references to “we,” “us,” “our,” or the “Company” in this Annual Report are to the combined business of Orsus Xelent Technologies, Inc. and its wholly-owned subsidiaries, including its operating subsidiaries, United First International Limited, Beijing Orsus Xelent Tech& Trading Company (“Xelent”), Orsus Xelent Holdings (BVI) Limited and Orsus Xelent Trading (HK) Company Limited.

Introduction

On March 31, 2005, we completed a stock exchange transaction (“Exchange Transaction”) with the shareholders of United First International Limited (“UFIL”), a company incorporated under the laws of Hong Kong. The Exchange Transaction was consummated under Delaware law and pursuant to the terms of that certain Securities Exchange Agreement dated effective as of March 31, 2005 (“Exchange Agreement”).

Pursuant to the Exchange Agreement, we issued shares of our common stock to the shareholders of UFIL in exchange for 100% of the outstanding capital stock of UFIL and UFIL became a wholly-owned subsidiary of the Company. We carry on our business through UFIL’s wholly owned subsidiary, Xelent.

Description of Business

Since May of 2003 we have, through the operations of Xelent, been engaged in the business of designing, and distributing economically priced cellular phones for retail and wholesale distribution. We outsource manufacturing to third party factories. In February 2004, Xelent registered "ORSUS" with the State Administration for Industry and Commerce in the People’s Republic of China (“PRC”) as its product trademark. The Company is also known as “Orsus Cellular” within the industry.

The Company has established an industrial design department for the purpose of developing proprietary mobile phones that will be attractive to our PRC customers. Most of the mobile phones we design are for the Company’s exclusive sale and distribution; the remainder are developed in conjunction with outside design firms. The long-term partners and manufacturers we employ to produce our cell phones and accessories are the same experienced Original Equipment Manufacturer (“OEM”) plants used by global brands like Motorola, Nokia and Ericsson. Our current operations include the outsourcing of manufacturing and customization, oversight of production and quality control at our OEM factories, and coordination of the distribution of our products to retailers and customers. In an effort to reduce our reliance on third-party manufacturers, we plan, eventually, to acquire a factory that will give us the capacity to produce our own phones and accessories.

Organizational Structure

The Company has a linear organizational structure comprised of nine separate departments that have been developed to ensure proper project management and control. The departments are:

|

|

·

|

Project Management Department, which is responsible for coordinating the management of cellular phone projects, exchanging concepts and ideas with our research and development team, providing weekly project reports and supervising project schedules;

|

|

|

·

|

Technology Support and Quality Control Department, which is responsible for providing technical support for our software and hardware designs, checking and auditing our industrial and mechanical designs (“ID/IM”), and assisting with tooling engineering and quality control during mass production;

|

|

|

·

|

Business Management Department, which is responsible for purchasing materials; managing supply chains; coordinating Company business; and evaluating and signing business agreements, contracts, and other documents for our business partners;

|

|

|

·

|

Planning and Finance Department, which is responsible for overall accounting matters including oversight of accounting methods and processes, managing expenses, auditing Company records, and compiling financial plans and monthly/quarterly/yearly budgets and financial statements;

|

|

|

·

|

Human Resources Department, which is responsible for managing our employment-related matters, including hiring and termination of staff;

|

|

|

·

|

Financing and Investment Department, which is responsible for overall accounting and financial matters as well as investment research and analysis;

|

1

|

|

·

|

Customer Service Department, which is responsible for facilities maintenance; ordering spare parts; authorized network management; after-sale data analysis and service charge fees return; operating a hotline service center and customer service training center; and providing technical support and after-sale service quality assurance systems;

|

|

|

·

|

Research & Development (“R&D”) Department, which is responsible for researching new mobile phone models and developing new technologies; and

|

|

|

·

|

Marketing Development Department, which is responsible for helping the Company to find new business partners who will act as countryside distributors, provincial dealers, and/or overseas wholesalers. The Marketing Development Department also helps the Company’s long-term partners to establish market campaigns and business models that incorporate the Company’s products.

|

Market Overview and Strategic Partners

Data from 2010 captured in the charts below show that development of the cellular phones industry in the PRC has been maintaining a modest growth level for the whole of 2010. This is probably the result of the global economic recovery as well as restructuring among the PRC telecom carriers during this period.

The below data is market size of fiscal year 2010. (Number of end-users; data in thousands)

|

Market Volume

|

|

Jan

|

Feb

|

March

|

April

|

May

|

June

|

July

|

August

|

Sep

|

Oct

|

Nov

|

Dec

|

TTL

|

||||||||||||||||||||||||||||

|

TTL

|

2009

|

14,323 | 12,936 | 13,352 | 12,260 | 14,209 | 12,329 | 13,027 | 14,384 | 13,958 | 16,378 | 13,279 | 14,570 | 165,006 | ||||||||||||||||||||||||||||

|

2010

|

16,617 | 16,419 | 14,922 | 13,994 | 16,200 | 14,360 | 14,646 | 15,957 | 15,728 | 18,054 | 15,473 | 16,609 | 188,980 | |||||||||||||||||||||||||||||

|

GSM

|

2009

|

12,962 | 11,361 | 11,342 | 10,562 | 12,829 | 10,906 | 11,547 | 12,697 | 12,038 | 14,551 | 11,430 | 12,120 | 144,344 | ||||||||||||||||||||||||||||

|

2010

|

14,140 | 14,045 | 12,416 | 11,562 | 13,784 | 11,866 | 12,425 | 13,588 | 13,373 | 15,519 | 12,622 | 13,691 | 159,030 | |||||||||||||||||||||||||||||

|

CDMA

|

2009

|

1,362 | 1,576 | 2,010 | 1,698 | 1,379 | 1,423 | 1,481 | 1,688 | 1,920 | 1,826 | 1,850 | 2,449 | 20,662 | ||||||||||||||||||||||||||||

|

2010

|

2,478 | 2,374 | 2,506 | 2,432 | 2,416 | 2,494 | 2,220 | 2,370 | 2,356 | 2,535 | 2,851 | 2,918 | 29,950 | |||||||||||||||||||||||||||||

Our relationships with strategic partners including CEC Mobile Co., Ltd. (“CECM”), Beijing Xingwang Shidai Tech & Trading Co., Ltd. (“XWSD”), and CECT-Chinacom Communications Co., Ltd. (“CECT-Chinacom”) have helped us increase our share of the cellular phone market in the PRC. CECM manufactures our cellular phone products and also resells our products to its provincial and national sales distributors and dealers through its own sales network, thereby expanding our avenues for distribution. XWSD, another one of our major agents, sells our cellular phones to provincial distributors, city distributors, and dealers.

The Company has maintained a modest sales level since the launch of our first mobile phones in April 2004. The designs of our mobile phones continue to reflect our consideration and understanding of the habits and tastes of our customers in the PRC. For instance, our products incorporate features that are popular in the PRC such as overlapped dual screens, powerful color messaging, and photography capabilities. The Company’s products are, and have always been, low and moderately priced, but of high quality.

Description of Products and Services

Since 2007, Xelent has developed and launched nearly 30 cellular phone models. We outsource the manufacturing of our products to unaffiliated third parties. Once our products are manufactured, they are delivered to a network of unaffiliated national sales distributors (see Description of Current Business - Market Overview and Strategic Partners) and dealers who, in turn, distribute our products to provincial sales distributors and dealers who distribute our products to retailers throughout the PRC.

The Company established itself in the PRC mobile phone market with the introduction of the first wristphone that combined wrist watch and mobile phone. Then, in response to a rapid increase in demand for color screen mobile products in the PRC, we produced single color dual screen mobiles (models F16 and F18), and a dual screen multi-color screen mobile (model FG25). In response to customer preferences, we also equipped models F16 and F18 with cameras, laying the foundation for our R&D on camera and video functions and the introduction of many models of 300,000 pixel camera mobile products, including models FG830, FG850, OS83, OS85, OS70, OS86 and M851. We also met consumer demand with our launch of the 1M camera mobiles, models OSM62 and OSM72, which reflected a simple design style with multiple functions. We followed these early successes with many more models of multimedia mobiles, such as K600, X188 and D8120. In 2007 we launched our X180 mobile information terminals to meet the market’s demand for information office products, providing swift and convenient mobile terminal products for industrial application and specific customers, such as China Unicom. In addition to the products listed above, we have also developed many models of GSM/GPRS mobiles, including models N3200 and H8801. In 2010, DX796 and DX9188 ranked as our best selling models, by sales, contributing 22.2% and 16.6% respectively, to our total sales revenue of US$24,407 for the year.

2

To meet changing market demands, we will continue to introduce economically-priced, high performance products that reflect our advantages in appearance, design, and functional development and will continue to strengthen our competitiveness in the domestic PRC mobile sector.

Research and Development (R&D)

Our R&D Department is responsible for researching new products and securing new technologies. It has made significant contributions to the Company's ability to adapt our overall strategies and operations to market demand, sustain advanced product development, and, most importantly, enhance the technical strength that lies at the core of the Company’s competitiveness in the market. Most of our patented models and samples are developed exclusively by our R&D Department. Some of our most innovative products include the first telecommunications terminal to fully support the CDMA2000-1X protocol; the first wrist watch style wireless mobile phone; the first mobile phone made in the PRC using three-color OLED organic EL secondary display with TFT main display; the first mobile phone made in the PRC supporting four frequencies (850/900/1800/1900MHz); the first mobile phone made in the PRC with 64 polyphonic melodies; the first mobile phone supporting a USB interface and 16M flash U-disk (NAND-FLASH); and the first mobile phone made in the PRC with an internal 300K camera, Ultra-red, EMS, MMS, JAVA and USB. At the Annual Conference on Network Application Technology held by CCID in Beijing in November 2004, our Model M62 received the Most Fashionable Cell Phone of 2004 award and our Model OS70 won the Best Potential of 2004 award.

We also have agreements to cooperate with professional design houses such as Shanghai Huntel Technology Limited and Tranzda Wireless, with whom we work mainly on the design of MMI (“U2”), software and hardware testing, China Type Approval (“CTA”) certification, acquisition and phone main board updating, and software adaptability testing. We are also working with partners such as Dalian Daxian Telecom Co., Ltd. on matters related to industrial and mechanical design, including the layout of cellular phone main boards. Whenever possible, we use and lease the instruments and equipment of other professional design houses rather than purchasing it ourselves. In the area of software compiling, testing, and updating, we utilize data cables and computers installed with professional software in a testing environment. All the computers and data cables are owned by Xelent.

In general, PRC cell phone manufacturers mainly conduct their research and development based on existing chip functions, a fact which is reflected in the forms of applications chosen and interface-level development. Both application-level and interface-level development are categorized as development of adaptability systems - only protocol stack and source procedure development is recognized as software development. Therefore, there is no exclusive right or limited use of any such systems for these manufacturers, including the Company.

Competition

The Company faces substantial competition from other wireless phone manufacturers such as Nokia, Samsung, and Motorola, who, together, controlled more than half of the PRC cellular market in 2010.

In addition to trying to increase inventory sales and turnover, the Company will continue to pursue its two-year growth strategy, which we believe will result in sound increases in profits and revenues. We also want to launch our own 3G products as soon as possible in order to offer products that meet consumer demands before our competitors. Because the 3G market is virtually wide open and other companies have not yet developed many 3G products, once we develop our own 3G phones, we anticipate being able to secure our share of the market.

Within the domestic market, Huawei and ZTE experienced rapid growth for their low price cellular phones through the support of telecom operator China Mobile such as incentives and allowances on the TD model. As a result, Tianyu, Huawei and ZTE controlled 4.2%,5.3%,and 5.1%, respectively, of the cellular market in the PRC in 2010.

3

Government Regulation

There are limited government regulations that have material effects or create restrictions on Xelent; neither are there judicial orders, writs, judgments, injunctions, decrees, determinations or binding awards against Xelent. One exception is that cellular manufacturers in the PRC are responsible for repair, replacement and return of cellular phone to customers within the warranty period in accordance with certain PRC rules and regulation.

The PRC’s cellular phone industry is one of the most advanced in the world. It has a huge customer base and an established network of manufacturers, distributors, and service providers. The PRC government does not promulgate policies that obstruct entry into the market or regulate it heavily. We expect this relatively free market situation to continue and do not expect government policies to adversely impact the development of our industry.

Intellectual Property and Proprietary Rights

Xelent has been approved to use “ ”as a registered trademark and the China Trademark Agency has distributed a “Notification of Acceptance” of the trademark with serial number ZC3878232SL.

”as a registered trademark and the China Trademark Agency has distributed a “Notification of Acceptance” of the trademark with serial number ZC3878232SL.

”as a registered trademark and the China Trademark Agency has distributed a “Notification of Acceptance” of the trademark with serial number ZC3878232SL.

”as a registered trademark and the China Trademark Agency has distributed a “Notification of Acceptance” of the trademark with serial number ZC3878232SL.In accordance with the governing laws and regulations of the PRC, we utilize the intellectual property of our strategic partners pursuant to our contracts and agreements with these partners.

Employees

We have 26 employees. Of the 26 employees, 6 people serve in management related capacities. All employees are located in nine departments: the Project Management Department employs 2 people, the Technology Support and Quality Control Department employs 3 people, the Business Management Department employs 3 people, the Planning and Finance Department employs 4 people, the Human Resources Department employs 2 people, the Financing and Investment Department employs 2 people, the Customer Service Department employs 5 people, the R&D Department employs 2 people, and the Marketing Development Department employs 3 people.

We believe the Company has a good relationship with our employees and there are no collective bargaining arrangements in place.

Item 1A. Risk Factors.

You should carefully consider the following risks and the other information set forth elsewhere in this Current Report. If any of these risks occur, our business, financial condition and results of operations could be adversely affected. As a result, the trading price of our common stock could decline, perhaps significantly.

Loss of significant or major customers could hurt our business by reducing our revenues and profitability.

Our success depends substantially upon retaining our major clients. We cannot guarantee that we will be able to retain long-term relationships or secure renewals of short-term relationships with our significant clients in the future. For the twelve months ended December 31, 2010, we had one major customer: Beijing Xingwang Shidai Tech & Trading Co., Ltd., which was responsible for over 94.49% of our revenues. We have developed and enhanced our relationship and positioned ourselves for long-term cooperation with them by taking the following steps:

|

|

·

|

assisting the company in coordinating its sales channels and carriers;

|

|

|

·

|

ensuring that the company received high performance products at the specified prices; and

|

|

|

·

|

responding to feedback from the company’s customers regarding our products by adjusting our product lines to better suit their customers’ needs.

|

4

Competition from providers of similar products and services could materially adversely affect our revenues and financial condition.

The industry in which we compete is highly competitive, fragmented, and driven by consumer preferences for quickly-evolving technologies. Our competitors include both international brands like Nokia, Motorola, and Samsung, and domestic brands like Lenovo, Tianyu, Oppo, Changhong and Gionee, among others. We believe competitors in the cell phone industry compete on the following main factors: effective marketing and sales, brand recognition, product quality, product placement and availability, niche marketing and segmentation. We expect competition to intensify in the future due to the increased number of competitors and other factors discussed below. Other companies, foreign and/or domestic, may also enter the PRC market with better products or services, greater financial and human resources and/or greater brand recognition than our Company. Competitors will also continue to improve and expand their current product lines and introduce new products to market. We can make no assurances that we will be able to compete effectively or that we will have the resources needed for the technical innovation, business development, advertising and marketing that are necessary to compete effectively and build awareness of our brand. Staying competitive will require substantial human and capital resources from the Company. We may also have to continue to rely on strategic partnerships for critical branding and relationship leverage; there is no guarantee these partnerships will prove sufficient. We cannot assure that the Company will have enough resources to make these investments or that we will be able to achieve the technological advances necessary to remain competitive. Increased competition may result in price reductions, lower gross margins, and/or loss of market share. Failure to compete successfully against current or future competitors could have a material adverse effect on the Company’s business, operating results and financial condition.

We depend on key personnel for the success of our business. Our business may be severely disrupted if we lose the services of our key executives or employees or fail to add new senior and mid-level managers to our management team.

Our future success depends heavily on the continued service of our key executives. Our future success is also dependent upon our ability to attract and retain qualified senior and middle managers to our management team. If one or more of our current or future key executives or employees is unwilling or unable to continue in their present positions, it may be difficult to replace them, and our business may be severely disrupted. In addition, if any of our key executives or employees joins one of our competitors or forms a competing company, we could lose customers and/or suppliers and incur additional expenses to recruit and train replacement personnel. Each of our executive officers has entered into an employment agreement with us.

We also rely on a number of key technology staff to operate our Company. Given the competitive nature of our industry, the risk of key technology staff leaving our Company is fairly high and could disrupt our operations.

We rely on a third party production center.

We use a third party production center to manufacture our products. Should we be required to use a different production center, our costs could be negatively affected.

The acquisition of a manufacturing facility is costly and such acquisition may not enhance our financial condition.

The process of identifying and consummating the acquisition of our own manufacturing facility could require substantial amounts of cash, which may require issuing new securities, thereby diluting the interests of existing stockholders. Acquiring a manufacturing facility could also expose the Company to potential liabilities, some of which may not be disclosed by the seller. In addition, even if we are successful in acquiring a manufacturing facility, there are no assurances that owning it will enhance our future financial condition. And, to the extent that the business acquired does not remain competitive, some or all of the goodwill related to that acquisition could be charged against our future earnings, if any.

Any acquisitions we undertake could be difficult to integrate, disrupt our business, dilute stockholder value, and harm our operating results.

We plan to review opportunities to buy other businesses or technologies that would complement our current products, expand the breadth of our markets and sales channels, enhance our technical capabilities, or otherwise offer growth opportunities. If we make any future acquisitions, we may issue stock, thereby diluting existing stockholders’ percentage of ownership in the Company; incur substantial debt; or assume contingent liabilities.

Our experience in acquiring other businesses and technologies is limited. Potential acquisitions also involve numerous risks, including:

|

|

·

|

problems integrating the purchased operations, technologies, products, or services with our own;

|

|

|

·

|

unanticipated costs associated with the acquisition;

|

|

|

·

|

diversion of management’s attention from our core businesses;

|

5

|

|

·

|

adverse effects on existing business relationships with suppliers and customers;

|

|

|

·

|

risks associated with entering markets in which we have no or limited prior experience;

|

|

|

·

|

potential loss of key employees and customers of purchased organizations;

|

|

|

·

|

increased costs and efforts required for compliance with Section 404 of the Sarbanes-Oxley Act; and

|

|

|

·

|

risk of impairment charges related to potential write-downs of assets acquired in future acquisitions.

|

Our acquisition strategy entails reviewing and potentially reorganizing acquired business operations, corporate infrastructure and systems, and financial controls. Unforeseen expenses, difficulties, and delays frequently encountered in connection with rapid expansion through acquisitions could inhibit our growth and negatively impact our profitability. We may be unable to identify suitable acquisition candidates or to complete the acquisitions of candidates that we identify. In addition, we may encounter difficulties in integrating the operations of acquired businesses with our own operations or managing acquired businesses profitably without substantial costs, delays, or other operational or financial problems.

Rapid growth and a rapidly changing operating environment may strain our limited resources.

We will need to increase investment in our technological infrastructure, facilities, and other areas of operations, especially in the area of product development. If we are unable to manage our growth and expansion effectively, the quality of our products and services and, in turn, our customer support, could deteriorate and cause our business may suffer. Our future success will depend on, among other things, our ability to:

|

|

·

|

continue to develop technologies that attract PRC consumers;

|

|

|

·

|

continue to train, motivate, and retain our existing employees and attract and integrate new employees, including our senior managers;

|

|

|

·

|

develop and improve our operational, financial, accounting and other internal systems and controls, and

|

|

|

·

|

maintain adequate controls and procedures to ensure that our periodic public disclosures under applicable laws, including U.S. securities laws, are complete and accurate.

|

Unless we are able to take advantage of technological developments on a timely basis, we may experience a decline in a demand for our services or may be unable to implement our business strategy.

Our industry is experiencing rapid change as new technologies are developed that offer consumers an ever-expanding number of ways to meet their communications needs. In order to grow and remain competitive, we will need to adapt to future changes in technology, enhance our existing products, and introduce new products that address our customers’ changing demands. If we are unable to continue developing products that compare favorably to the products of our competitors in terms of technology either on a timely basis and/or at acceptable costs, we could lose customers to our competitors. Technological advances including the introduction of new products, new designs, or new manufacturing techniques could render our inventory obsolete or shift demand into areas in which we are not currently engaged. If we fail to adapt to these types of changing conditions in a timely and efficient manner, our revenues and profits would likely decline. To remain competitive, we must continue to incur significant expenses for product development, equipment, and facilities, and other capital investments. These costs may increase, resulting in greater fixed costs and operating expenses. As a result, we could be required to expend substantial funds for and commit significant resources to the following: research and development required to update existing and potential products; additional engineering and other technical personnel; advanced design, production and test equipment; manufacturing services that meet changing customer needs; and technological changes in manufacturing processes. Our future operating results will depend to a significant extent on our ability to continue to provide new products that compare favorably to those of our competitors in terms of time to market, cost, performance, design, and quality of manufacturing. Should our production costs increase, failure to increase our net sales in a way sufficient to offset these cost increases would reduce our profitability.

6

Our research and development efforts may not lead to successful development of commercially viable or acceptable products, which could cause a decline in customer use of our products.

The markets in which we compete are characterized by:

|

|

·

|

rapidly changing technology;

|

|

|

·

|

evolving industry standards and transmission protocols;

|

|

|

·

|

frequent improvements in products and services; and

|

|

|

·

|

fierce competition from well-funded and technologically advanced companies.

|

To succeed, we must continually improve our current products and develop and introduce new or enhanced products that adequately address the requirements of our customers and are competitive in terms of functionality, performance, quality, and price.

Our ability to generate revenues could suffer if the PRC market for cellular phones does not develop as anticipated.

The market for cellular phones in the PRC has evolved rapidly over the last four years with the introduction of new products, development of consumer preferences, market entry by new competitors, and adaptation of strategies by existing competitors. We expect each of these trends to continue, and we must continue to adapt our strategy to successfully compete in this market. It is extremely difficult to accurately predict consumer acceptance of and demand for both existing and potential technologies and services; neither can we know what the future size, composition, or growth of this market will be.

We may not be able to adequately protect our intellectual property, and we may be exposed to infringement claims by third parties.

We rely on the restrictions on disclosure contained in our business contracts to protect our intellectual property rights. Monitoring unauthorized use of our information services is difficult and costly, and we cannot be certain that the steps we take will effectively prevent misappropriation of our technology and content. In the future, our management may decide to apply for copyright, trademark or trade secret protection if management determines that such protection would be beneficial and cost-effective for the Company.

From time to time, we may have to resort to litigation to enforce our intellectual property rights, which could result in substantial costs and diversion of our resources. In addition, third parties may initiate litigation against us for alleged infringement of their proprietary rights. In the event of a successful infringement claim and our failure or inability to develop non-infringing technology or content or to obtain a license for the infringed or similar technology or content on a timely basis, our business could suffer. Moreover, if this situation were to arise, even if we were able to license the infringed or similar technology or content, license fees we would have to pay to licensors could be substantial or even economically unfeasible.

Our products may be subject to counterfeiting and/or imitation, which could harm our business and our competitive position.

We cannot guarantee that counterfeiting or imitation of our products will not occur in the future or, if it does occur, that we will be able to detect it and deal with it effectively. Any counterfeiting or imitation could negatively impact our corporate and brand image. In addition, counterfeit or imitation products could result in a reduction in our market share, a loss in revenue, or an increase in our administrative expenses due to costs associated with detection or prosecution.

We have limited business insurance coverage.

The insurance industry in the PRC is still at an early stage of development. Insurance companies in the PRC offer limited business insurance products, and do not, to our knowledge, offer business liability insurance. As a result, we do not have any business liability insurance coverage for our operations. Therefore, any business disruption, litigation or natural disaster could result in substantial costs and diversion of Company resources.

7

Product defects or the failure of our products to meet specifications could cause us to lose customers and revenue or to incur unexpected expenses.

If our products do not meet our customers’ needs, our customer relationships may suffer. Also, our products may contain defects or fail to meet product specifications. Any failure or poor performance of our products could result in:

|

|

·

|

delayed market acceptance of our products;

|

|

|

·

|

delayed product shipments;

|

|

|

·

|

unexpected expenses and diversion of resources to replace defective products or identify and correct the source of errors;

|

|

|

·

|

damage to our reputation and our customer relationships;

|

|

|

·

|

delayed recognition of sales or reduced sales; and

|

|

|

·

|

product liability claims or other claims for damages that may be caused by any product defects or performance failures.

|

If the limited warranty provisions in our contracts are unenforceable in a particular jurisdiction or if we are exposed to product liability claims that are not covered by insurance, a claim could harm our business.

We may have difficulty collecting our accounts receivable.

During the normal course of business, we extend unsecured credit to our customers. Typical credit terms require payment to be made within 90 days of the invoice date. We do not require collateral from our customers.

We regularly evaluate and monitor the creditworthiness of each customer on a case-by-case basis. We include any account balances that are determined to be uncollectible in our allowance for doubtful accounts. After all attempts to collect a receivable have failed, the receivable is written off against the allowance. As of December 31, 2010, we recognized an allowance for doubtful accounts in the amount of $33,836,000.

We currently offer and intend to offer open account terms to certain of our customers, which may subject us to credit risks, particularly in the event that any receivables represent sales to a limited number of customers or are concentrated in particular geographic markets. Collection of our accounts receivable and our ability to accelerate our collection cycle through the sale of accounts receivable is affected by several factors, including, but not limited to:

|

|

·

|

our credit granting policies,

|

|

|

·

|

contractual provisions,

|

|

|

·

|

our customers’ and our overall credit rating as determined by various credit rating agencies,

|

|

|

·

|

industry and economic conditions, and

|

|

|

·

|

our recent operating results and our and our customers’ financial position and cash flows.

|

Adverse changes in any of these factors, certain of which may not be wholly in our control, could create delays in collecting or an inability to collect our accounts receivable which could impair our cash flows and our financial position and cause a reduction in our results of operations.

Our financial results may be affected by mandated changes in accounting and financial reporting.

We prepare our financial statements in conformity with accounting principles generally accepted in the United States of America. These principles are subject to interpretation by the Securities and Exchange Commission and various bodies formed to interpret and create appropriate accounting policies. A change in these policies may have a significant effect on our reported results and may even retroactively affect previously reported transactions.

8

The cyclical nature of the aluminum industry causes variability in our production costs and cash flows.

Our costs of production depend on the market for primary aluminum, which is a highly cyclical commodity with prices that are affected by global supply and demand as well as other conditions. Historically, aluminum prices have been volatile and we expect such volatility to continue. These prices are driven, in part, by global demand for aluminum arising from favorable global economic conditions and strong demand in the PRC.

If we are unable to obtain additional funding, we may have going concern issue.

We experienced a net loss of $47,395,000 for the year ended December 31, 2010, of which US$33,836,000 was an allowance for doubtful accounts. The Company is exploring, among other things, a strategic merger possibility and an offering and sale of equity, which, if successful, would improve our cash flow situation. However, in order to realize the prudence principle, we also have the responsibility to disclose the possibility that a complete loss of investment in our common stock exists.

If we are unable to continue as a going concern, investors may face a complete loss of their investment.

Our auditors have included a “going-concern” emphasis paragraph in their audit report relating to our financial statements as of December 31, 2010, indicating that as a result of significant recurring losses, substantial doubt exists about our ability to continue as a going concern.

RISKS RELATED TO DOING BUSINESS IN THE PRC

There are substantial risks associated with doing business in the PRC; these risks are discussed below:

A downturn in the PRC economy may slow down our growth and profitability.

Growth of the PRC economy has been uneven across geographic regions and economic sectors. There can be no assurance that growth of the PRC economy will be steady or that an economic downturn will not have a negative effect on our business because of a decrease in expenditures for wireless services. More specifically, increased penetration of wireless services in the less economically developed central and western provinces of the PRC will depend on those provinces achieving certain income levels so that cellular phones and related services become affordable to a more significant portion of the population living in these areas.

Government regulation of the telecommunications industry may become more complex.

Government regulation of the telecommunications industry is highly complex. New regulations could increase our costs of doing business and prevent us from efficiently delivering our services. These regulations may stop or slow down the expansion of our user base and limit access to our services.

Because we depend on governmental agencies for a portion of our revenue, our inability to win or renew government contracts could harm our operations and reduce our profits.

Our inability to win or renew PRC government contracts could harm our operations and reduce our profits. PRC government contracts are typically awarded through a regulated procurement process. Some PRC government contracts are awarded to multiple competitors, causing increases in overall competition as well as pricing pressure. The competition and pricing pressure, may, in turn, require us to make sustained post-award efforts to reduce costs in order to realize revenues under these contracts. If we are not successful in reducing the costs we anticipate, our ability to profit on these contracts will be negatively impacted. An additional potential risk is that contracts with the PRC government can generally be terminated or modified at the government’s convenience.

We rely on sales to the PRC government and a significant decline in overall government expenditures or a delay in the payment of our invoices by the government could have a negative impact on our future operating results.

We believe that some of the success and growth of our business will continue to depend on our ability to win government contracts. Many of our government customers are subject to budgetary constraints and our continued performance under these contracts, or award of additional contracts from these agencies, could be jeopardized by spending reductions or budget cutbacks at these agencies. Our operating results may also be negatively impacted by other developments that affect these government programs generally, including the following:

|

|

·

|

adoption of new laws or regulations relating to government contracting or changes to existing laws or regulations;

|

9

|

|

·

|

delays or changes in the government appropriations process; and

|

|

|

·

|

delays in the payment of our invoices by government payment offices.

|

The uncertain legal environment in the PRC could limit the legal protections available to us.

The PRC legal system is a civil law system based on written statutes where, unlike in common law systems, legal cases have little value as precedents for future disputes. There are substantial uncertainties regarding the interpretation and application of PRC laws and regulations, including, but not limited to, the laws and regulations governing our business, or the enforcement and performance of our arrangements with customers in the event of the imposition of statutory liens, death of the principal parties to contracts, bankruptcy or criminal proceedings. In the late 1970s, the PRC government began to promulgate a comprehensive system of laws and regulations governing economic matters. The overall effect of legislation enacted over the past 30 years has significantly enhanced the protections afforded to enterprises in the PRC that are funded by foreign investors. However, these laws, regulations and legal requirements are relatively recent are still evolving rapidly, meaning that their interpretation and enforcement involves a significant amount of uncertainty. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively. These uncertainties could limit the legal protections available to foreign investors, such as the right of foreign invested enterprises to hold licenses and permits such as required business licenses.

Any recurrence of severe acute respiratory syndrome, or SARS, or another widespread public health problem, could adversely affect our business and results of operations.

A renewed outbreak of SARS or another widespread public health problem in the PRC, where all of our revenue is derived, and in Beijing where our operations are headquartered, could have a negative effect on our operations. Our operations may be impacted by a number of health-related factors, including the following:

|

|

·

|

quarantines or closures of some of our offices that would severely disrupt our operations,

|

|

|

·

|

the sickness or death of our key officers and employees, and

|

|

|

·

|

a general slowdown in the PRC economy.

|

Any of the foregoing events or other unforeseen consequences of public health problems could adversely affect our business and results of operations.

Changes in the PRC’s political and economic policies could harm our business.

The economy of PRC has historically been a planned economy subject to governmental plans and quotas and has, in certain aspects, been transitioning to a more market-oriented economy. Although we believe that the economic reform and the macroeconomic measures adopted by the PRC government have had a positive effect on the economic development of the PRC, we cannot predict the future direction of these economic reforms or the effects these measures may have on our business, financial position or results of operations. In addition, the PRC economy differs from the economies of most countries belonging to the Organization for Economic Cooperation and Development, or OECD. These differences include:

|

|

·

|

economic structure;

|

|

|

·

|

level of government involvement in the economy;

|

|

|

·

|

level of development;

|

|

|

·

|

level of capital reinvestment;

|

|

|

·

|

control of foreign exchange;

|

|

|

·

|

methods of allocating resources; and

|

|

|

·

|

balance of payments position.

|

10

As a result of these differences, our business may not develop in the same way or at the same rate as might be expected if the PRC economy was more similar to that of an OECD member country. As the PRC economy is transitioning from a planned economy to a more market-oriented economy, the PRC government has implemented various measures to encourage economic growth and guide the allocation of resources by controlling payment of foreign currency-denominated obligations, setting monetary policy and imposing policies that impact particular industries or companies in different ways. While these measures may benefit the overall PRC economy, they may also have a negative effect on our business, especially if such measures create an unfriendly environment for businesses in the technology sector of the economy.

Inflation in the PRC may impair our ability to conduct business profitably in the PRC.

Recently, the PRC economy has experienced periods of rapid expansion. During the past ten years, the rate of inflation in the PRC has been as high as 5.8% and as low as -1.4% . These factors have led to the adoption by the PRC government, from time to time, of various corrective measures designed to limit inflation. High inflation in the future may cause the PRC government to impose controls on credit or prices, or to take other actions which could inhibit economic activity in the PRC, and thereby harm the market for our products.

Likewise, negative inflation could have an unfavorable effect on our business profitability in the PRC. Negative inflation may cause a period where consumers are reluctant to spend, as consumers anticipate lower prices for products in the future. In the event of negative inflation, the PRC government may impose controls on credit or prices, or take other actions which could inhibit economic activity, harming the market for our products.

Restrictions on currency exchange may limit our ability to receive and use our revenues effectively.

The majority of our revenues are recorded in Renminbi and U.S. dollars, and any future restrictions on currency exchanges may limit our ability to use revenue generated in Renminbi to fund any future business activities outside the PRC or to make dividends or other payments in U.S. dollars. Although the PRC government introduced regulations in 1996 to allow greater convertibility of the Renminbi for current account transactions, significant restrictions still remain. For instance, foreign enterprises may only buy, sell or remit foreign currencies after providing valid commercial documents at banks in the PRC authorized to conduct foreign exchange business. In addition, conversion of Renminbi for capital account items, including direct investment and loans, is subject to governmental approval in the PRC, and companies are required to open and maintain separate foreign exchange accounts for capital account items. The PRC regulatory authorities may impose more stringent restrictions on the convertibility of the Renminbi in the future.

We are subject to the United States Foreign Corrupt Practices Act.

We are required to comply with the United States Foreign Corrupt Practices Act, which generally prohibits United States companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. In addition, we are required to maintain records that accurately and fairly represent our transactions and have an adequate system of internal accounting controls. Foreign companies, including some that may compete with us, are not subject to these prohibitions, and therefore may have a competitive advantage over us. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices occur from time-to-time in the PRC, particularly in our industry since it deals with contracts from the PRC Government, and our executive officers and employees have not been subject to the United States Foreign Corrupt Practices Act prior to the completion of the Exchange Agreement (defined herein). If our competitors engage in these practices they may receive preferential treatment from personnel of some companies, giving our competitors an advantage in securing business or from government officials who might give them priority in obtaining new licenses, which would put us at a disadvantage. We can make no assurance that our employees or other agents will not engage in such conduct for which we might be held responsible. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties and other consequences that may have a material adverse effect on our business, financial condition and results of operations.

11

RISKS RELATED TO OUR COMMON STOCK

The market price for our common stock may be volatile.

The market price for our common stock is likely to be highly volatile and subject to wide fluctuations in response to factors including the following:

|

|

·

|

actual or anticipated fluctuations in our quarterly operating results,

|

|

|

·

|

announcements of new products and services by us or our competitors,

|

|

|

·

|

changes in financial estimates by securities analysts,

|

|

|

·

|

changes in the economic performance or market valuations of other companies providing similar products and services,

|

|

|

·

|

announcements by our competitors of significant acquisitions, strategic partnerships, joint ventures or capital commitments,

|

|

|

·

|

additions or departures of key personnel,

|

|

|

·

|

potential litigation, or

|

|

|

·

|

conditions in the cellular phone market.

|

In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are not related to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of our common stock.

Stockholders could experience substantial dilution.

We may issue additional shares of our capital stock to raise additional cash for working capital. If we issue additional shares of our capital stock, our stockholders will experience dilution in their respective percentage ownership in the Company.

We have no present intention to pay dividends.

We have never paid dividends or made other cash distributions on our common stock, and do not expect to declare or pay any dividends in the foreseeable future. We intend to retain future earnings, if any, for working capital and to finance current operations and expansion of our business.

A large portion of our common stock is controlled by a small number of stockholders.

Of the total outstanding common stock, 20.22% is held by our executive officers and directors. As a result, these shareholders could control the outcome of stockholder votes on various matters, including the election of directors and extraordinary corporate transactions including business combinations. In addition, the occurrence of sales of a large number of shares of our common stock, or the perception that these sales could occur, may affect our stock price and could impair our ability to obtain capital through an offering of equity securities. Furthermore, the current ratios of ownership of our common stock reduce the public float and liquidity of our common stock which can in turn affect the market price of our common stock.

Item 1B. Unresolved Staff Comments.

Not applicable.

12

Item 2. Properties.

We lease office space in Beijing. Our Beijing office serves as our corporate headquarters and is responsible for sourcing and coordination with cellular component suppliers, coordination with our research and development partners and following up the hardware and software testing aspects before mass production. The following is relevant information on our Beijing office:

|

Address

|

Office / Production

|

Process / Lease

|

Monthly Rental (RMB)

|

Monthly Rental (USD)

|

Lease period

|

|||||||||||||

|

29th Floor, Tower B, Chaowai MEN Office Building, 26 Chaowai Street, Chaoyang Dist., Beijing (1)

|

Office

|

Lease

|

30,0000.00 | 4,417 | ||||||||||||||

|

No. 1, Fuyou Street, Airport Huoyun Road, Shunyi Dist., Beijing (2)

|

Office

|

— | (2) | — | — | — | ||||||||||||

|

(1)

|

The Company moved into the office space at 29th Floor, Tower B, Chaowai MEN Office Building, 26 Chaowai Street, Chaoyang Dist., Beijing The Company renewed the rental contract recently and the rental for this office space is now US$53,000 per year.

|

|

(2)

|

The office listed as the second address is provided by Beijing Xin Ganxian Logistic Company (a third party) free of charge to the Company.

|

Item 3. Legal Proceedings

We are party to certain litigation/arbitration related to amounts payable to suppliers for goods with which the Company was not satisfied as to quality and timing of delivery. However, the amounts in question are not substantial enough that such litigation/arbitration are material to the Company or would have a material adverse effect on our business. Furthermore, we expect to be able to negotiate resolutions to these issues. Please refer to the detailed description below about the pending legal proceedings.

Legal disputes with two suppliers arose from the defective accessories and materials supplied by Shenzhen Songding Industry Ltd., (“Songding”) and Beijing Baoxin Packing Materials Co., Ltd. (“Baoxin”). The management of Beijing Orsus Xelent Technologies & Trading Co., Ltd. (“BOXT”) decided to withhold payment to Songding and Baoxin as a result of the defective accessories and materials.

The dispute between Baoxin and BOXT has been arbitrated by Beijing Arbitration Commission. The ending balance of account payable to Baoxin as of December 31, 2010 was approximately US$38,000. Currently BOXT and Baoxin are in final negotiations. Baoxin applied to the court for property preservation and, accordingly, one of BOXT’s bank account was blocked until the resolution of this dispute.

Final arbitration for the dispute between Songding and BOXT is pending. The liability in question was recorded as approximately US$56,000 at the end of December 31, 2010. Songding applied to the court for property preservation and, accordingly, one of BOXT’s bank accounts was blocked until the resolution of the dispute.

Item 4. (Removed and Reserved).

13

PART II

Item 5. Market For Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Company common stock has been listed on NYSE Amex Equities exchange (“NYSE Amex”) under the ticker symbol “ORS” since May 10, 2007. The following table sets forth the quarterly average high and low sales prices per share for our common stock during the fiscal years ended December 31, 2010 and December 31, 2009:

|

Common Stock

|

||||||||

|

Fiscal Year Ended

|

High | Low | ||||||

| (US$) | ||||||||

|

December 31, 2009

|

||||||||

|

First Quarter

|

0.58 | 0.11 | ||||||

|

Second Quarter

|

1.20 | 0.33 | ||||||

|

Third Quarter

|

0.98 | 0.51 | ||||||

|

Fourth Quarter

|

1.24 | 0.52 | ||||||

|

December 31, 2010

|

||||||||

|

First Quarter

|

0.69 | 0.39 | ||||||

|

Second Quarter

|

0.55 | 0.22 | ||||||

|

Third Quarter

|

0.33 | 0.13 | ||||||

|

Fourth Quarter

|

0.23 | 0.14 | ||||||

|

First Quarter of 2011

|

0.20 | 0.12 | ||||||

The source of this data is Yahoo! Finance. The data does not reflect inter-dealer prices and the quotations are without retail mark-ups, mark-downs or commissions, may not represent actual transactions, and have not been adjusted for stock dividends or splits.

Holders.

As of December 31, 2010, we had 19 stockholders of our common stock of record, and our common stock had a closing price of US$0.17 per share.

Outstanding Options, Conversions, and Planned Issuance of Common Stock.

As of December 31, 2010, options to purchase 614,000 shares of common stock at an exercise price of US$2.26 (the close price on the grant date, April 2, 2008) were issued under the Company’s 2007 Omnibus Long-Term Incentive Plan. As of April 15, 2011, none of the grantees has exercised these stock options. There are no other warrants or options outstanding.

Preferred Stock.

Our corporate charter permits the Company to issue up to 100 million shares of preferred stock from time to time, as determined by resolutions of our Board of Directors. The issuance of preferred stock may have the effect of delaying, deferring or preventing a change in control of the Company without further action by stockholders and could adversely affect the rights and powers, including voting rights, of holders of common stock, even though the Company is acting in accordance with our corporate charter and bylaws. In certain circumstances, the issuance of preferred stock could depress the market price of the Company’s common stock.

As of April 15, 2011, there are no shares of preferred stock outstanding.

Dividends and Related Policy.

We do not expect to declare or pay any cash dividends on our common stock in the foreseeable future and the Company intends to retain future earnings, if any, to finance the expansion of our business. The decision whether to pay cash dividends on our common stock will be made at the discretion of our Board of Directors and will depend on our financial condition, operating results, capital requirements and other factors that the Board considers significant.

Securities Authorized for Issuance Under Equity Compensation Plans.

As of the fiscal year ended December 31, 2010,

|

Plan category

|

Number of securities to be issued upon exercise of outstanding options, warrants and rights

|

Weighted-average exercise price of outstanding options, warrants and rights

|

Number of securities remaining available for future issuance under equity compensation plans (excluding securities

reflected at left)

|

|||||||||

|

Equity compensation plans approved by security holders

|

614,000 | (1) | 2.26 | (1) | 3,886,000 | |||||||

|

Equity compensation plans not approved by security holders

|

None

|

None

|

None

|

|||||||||

|

Total

|

3,886,000 | |||||||||||

|

(1)

|

As of December 31, 2010, options to purchase 614,000 shares of common stock at an exercise price of US$2.26, the close price on the grant date, April 2, 2008, were issued under the 2007 Omnibus Long-Term Incentive Plan. As of April 15, 2011, none of the grantees has executed these stock options.

|

14

Transfer Agent and Registrar.

Our transfer agent is Corporate Stock Transfer, located at 3200 Cherry Creek Drive South, Suite 430, Denver, Colorado 80209. Their telephone number is (303) 282-4800.

Recent Sales of Unregistered Securities.

On August 25, 2010, the Company entered into a consulting agreement pursuant to which the Company agreed to issue 500,000 shares of its common stock as consideration to a consulting firm for management consulting and advisory services. These shares were issued in reliance on Section 4(2) of the Securities Act of 1933, as amended, as a transaction by an issuer not involving a public offering.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers.

None.

Item 6. Selected Financial Data.

The following selected financial data has been extracted from our financial statements for the year ended December 31, 2010. This selected financial data should be read in conjunction with the consolidated financial statements and the notes to the consolidated financial statements starting on page F-1 and with “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Consolidated Statements of Operations

Year Ended December 31

(in thousands, except share and per share amounts)

|

|

2010

|

2009

|

2008

|

2007

|

2006

|

|||||||||||||||

|

(US$’000)

|

(US$’000)

|

(US$’000)

|

(US$’000)

|

(US$’000)

|

||||||||||||||||

|

Sales

|

24,407 | 77,392 | 107,827 | 89,923 | 68,108 | |||||||||||||||

|

Cost of sales

|

22,579 | 67,970 | 93,298 | 78,368 | 60,102 | |||||||||||||||

|

Other (expenses)/income-net

|

(9,337 | ) | (2,911 | ) | 2,785 | 765 | 75 | |||||||||||||

|

Net income (loss)

|

(47,395 | ) | (6,368 | ) | 11,296 | 9,683 | 6,718 | |||||||||||||

|

Weighted Average Common Shares Outstanding (Basic and diluted)

|

30,256,000 | 29,756,000 | 29,756,000 | 29,756,000 | 29,756,000 | |||||||||||||||

|

Net Earnings/(Loss) Per Common Share – Basic and Diluted

|

(1.55 | ) | (0.21 | ) | 0.38 | 0.33 | 0.23 | |||||||||||||

Consolidated Balance Sheets

Year Ended December 31

(in thousands, except share and per share amounts)

|

|

2010

|

2009

|

2008

|

2007

|

2006

|

|||||||||||||||

|

(US$’000)

|

(US$’000)

|

(US$’000)

|

(US$’000)

|

(US$’000)

|

||||||||||||||||

|

Current Assets

|

71,569 | 91,481 | 93,765 | 66,916 | 45,567 | |||||||||||||||

|

Total Assets

|

71,725 | 95,754 | 94,006 | 67,234 | 45,887 | |||||||||||||||

|

Current Liabilities

|

76,269 | 53,478 | 45,605 | 33,332 | 23,604 | |||||||||||||||

|

Total Liabilities

|

76,269 | 53,478 | 45,605 | 33,337 | 23,604 | |||||||||||||||

|

Total Stockholders’ Equity

|

(4,544 | ) | 42,276 | 48,401 | 33,897 | 22,283 | ||||||||||||||

15

Item 7. Management Discussion and Analysis of Financial Conditions and Results of Operations

Following is management's discussion and analysis of certain significant factors which have affected our financial position and operating results during the periods included in the accompanying consolidated financial statements, as well as information relating to the plans of our current management. This report includes forward-looking statements. Generally, the words "believes," "anticipates," "may," "will," "should," "expect," "intend," "estimate," "continue," and similar expressions or the negative thereof or comparable terminology are intended to identify forward-looking statements. Such statements are subject to certain risks and uncertainties, including the matters set forth in this report or other reports or documents we file with the Securities and Exchange Commission from time to time, which could cause actual results or outcomes to differ materially from those projected. Undue reliance should not be placed on these forward-looking statements which speak only as of the date hereof. We undertake no obligation to update these forward-looking statements.

The following discussion and analysis should be read in conjunction with our consolidated financial statements and the related notes thereto and other financial information contained elsewhere in this Form 10-K.

Overview

The Company was organized under the laws of the State of Delaware in May 2004 under the name “Universal Flirts Corp.” On June 1, 2004, the Company acquired all the issued and outstanding shares of Universal Flirts, Inc., a New York corporation, from its sole shareholder, Darrel Lerner, in consideration for the issuance of 8,500,000 shares of the Company’s common stock to Mr. Lerner pursuant to a stock exchange agreement between Universal Flirts Inc. and the Company. Pursuant to the stock exchange transaction, Universal Flirts Inc. became a wholly-owned subsidiary of the Company.

Pursuant to a Stock Transfer Agreement dated March 29, 2005, the Company transferred all of the common stock of Universal Flirts, Inc. to Mr. Darrell Lerner in exchange for the cancellation of 28,200,000 shares of the Company’s common stock. Immediately following the cancellation, the Company had 14,756,000 shares of its common stock outstanding.

On March 31, 2005, Universal Flirts Corp. completed a stock exchange transaction with the stockholders of United First International Limited (“UFIL”), a company incorporated under the laws of Hong Kong. The exchange was consummated under the laws of the State of Delaware and pursuant to the terms of the Securities Exchange Agreement dated as of March 31, 2005 (“Exchange Agreement”). In connection with its acquisition of UFIL, the Company authorized a 4-1 forward split of its common stock.

Pursuant to the Exchange Agreement, Universal Flirts Corp. issued 15,000,000 shares of its common stock, par value US$0.001 per share, to the stockholders of UFIL, representing approximately 50.41% of the Company’s issued and outstanding common stock, in exchange for the 20,000,000 outstanding shares of UFIL and a cash payment of US$50,000 from UFIL. Immediately after giving effect to the exchange, the Company had 29,756,000 shares of its common stock outstanding. Pursuant to this exchange, UFIL became a wholly-owned subsidiary of the Company and most of the Company’s business operations are now conducted through UFIL’s wholly-owned subsidiary, Beijing Orsus Xelent Technology & Trading Company Limited (“Xelent”).

On April 19, 2005, the Company, formerly known as Universal Flirts Corp., changed its list name to Orsus Xelent Technologies, Inc.

16

In July, 2005, a wholly owned subsidiary of Orsus Xelent Trading (HK) Company Limited (“OXHK”), was incorporated under the laws of Hong Kong. This subsidiary is engaged in the trading of cellular phones and accessories with overseas customers. In September 2005, OXHK commenced its Hong Kong operations to sell and distribute our cellular phone products and technical support services to customers outside the People’s Republic of China (“PRC”). Please refer the following chart for the relationship between the Company’s subsidiaries :

The business operations of UFIL are conducted through its wholly-owned subsidiary, Xelent, also known as “Orsus Cellular” within the cellular phone industry. Xelent sells its handsets and total solutions, including economically priced and fully-loaded cell phones for both Global System for Mobile communications (“GSM”) and Code Division Multiple Access (“CDMA”) platforms, to a diverse base of customers and dealers, such as ordinary users, tailored operators, and specialized users from all fields of business and government. Most of our mobile phone models are either designed by us for both our exclusive distribution and joint sales under established co-brands, or developed in conjunction with outside design firms. In February 2004, Xelent registered “ORSUS” with the PRC State Administration for Industry and Commerce as its product trademark.

Xelent has provided its handsets to many different types of consumers in the market for GSM mobiles devices. At present, the GSM mobile devices constitute a significant percentage of the sales and profit of the Company. In addition, Xelent has emphasized the development of specialized application mobile terminals in accordance with market changes and popular features. The Company has established itself in the specialized application field and made great efforts in its marketing since entering the field in September 2006. Based on its evaluation of the market and the engagement proposals received from its major customers, the Company began to produce GSM model X180 in large volumes starting in April 2007, thereby taking advantage of the opportunity to win establish a presence in the specialized application mobile terminal market.

In April 2007, the Company’s common shares were approved for listing on the American Stock Exchange and began trading on NYSE Amex on May 10, 2007 under the ticker symbol “ORS”. The Company's CUSIP Number is 68749U106.

Business Review

For the overall cell phone market in the PRC, user volume increased over 12.7% in 2010 from 2009, while the GSM market increased by 9.2%. In the GSM market, since the Personal Handy-Phone System was withdrawn from the market for policy reasons per government strategic arrangements, low priced GSM products become the preferred choice of PHP users. At the same time, China Mobile, a telecom operator, provides stronger support to other domestic cell phone producers such as ZTE and Huawei which lead to a rapid growth of low priced GSM cell phones. Middle and high priced GSM products are still controlled by leading multinational cell phone producers. The CDMA market realized a rapid development with 31% increase in users and WCDMA products taking a leading position. Smart phone producers such as Apple have taken advantage of this increased market.

The Company did not reach the objectives established at the beginning of 2010 for its products strategy and operation results. For low priced products, the cost was not low enough to obtain the incentives and support from telecom operators; while for middle and high priced products, the establishment and development of successful sales channels were not strong enough. Looking forward to 2011, we will focus on the R&D of products which match the requirements from telecom operators to maintain an established sales channel.

In the area of marketing development, we will focus on markets in developing regions such as Africa while maintaining our traditional domestic market and creating more commercial opportunities by focusing on the R&D of products which meet the requirements and plans of telecom operators and match market trends.

For the year ended December 31, 2010, we also had a going-concern issue. We experienced a net loss of $47,395,000 for the year ended December 31, 2010. Among this significant loss figure, we recognized US$33,836,000 in allowances for doubt accounts which accounts for 71.5% of the total loss recognized.

17

Under our current business model, it is common to maintain a certain level of accounts receivable to our largest customer. We have confidence that we will be able to collect this significant accounts receivable from our largest customer in installments, given our long term relationship with this customer. However, we still recognized this US$33,836,000 as an allowance for doubt accounts based on the prudence principle for the year ended December 31, 2010.

In the meantime, we are exploring, among other things, a strategic merger possibility and an offering and sale of equity. If we are able to complete a strategic merger or sale of equity, we believe our cash flow situation will be improved significantly. As a further business strategy plan, we also plan to enter into new 3G markets in emerging countries in the coming quarters of 2011.

As explained above, the Company is experiencing cash flow issue, however, we are confident our efforts and solutions will be able to reduce this issue in the coming quarters of 2011. In summary, the Company predicts it will obtain healthy development based on the strengthening of its financial position in the coming fiscal year.

The following table summarizes our operating results for the twelve months ended December 31, 2010 and December 31, 2009, respectively:

|

Year ended

December 31, 2010

|

Year ended

December 31, 2009

|

Comparison

|

||||||||||||||||||||||

|

US$’000

|

% of Revenue

|

US$’000

|

% of Revenue

|

US$’000

|

%

|

|||||||||||||||||||

|

Sales

|

24,407 | 100.00 | % | 77,392 | 100.00 | % | (52,985 | ) | (68.46 | %) | ||||||||||||||

|

Cost of sales

|

22,579 | 92.51 | % | 67,970 | 87.83 | % | (45,391 | ) | (66.78 | %) | ||||||||||||||

|

Selling expenses

|

104 | 0.43 | % | 350 | 0.45 | % | (246 | ) | (70.29 | %) | ||||||||||||||

|

General & admin. expenses

|

420 | 1.84 | % | 831 | 1.07 | % | (381 | ) | (45.85 | %) | ||||||||||||||

|

R&D expenses

|

0 | 0.00 | % | 54 | 0.07 | % | (54 | ) | (100.00 | %) | ||||||||||||||

|

Depreciation

|

26 | 0.11 | % | 64 | 0.08 | % | (38 | ) | (59.38 | %) | ||||||||||||||

|

Loss from write-off trade deposits

|

0 | 0.00 | % | 11,937 | 15.42 | % | (11,937 | ) | (100.00 | %) | ||||||||||||||

|

Allowance for doubtful accounts

|

33,836 | 138.63 | % | 1,914 | 2.47 | % | 31,922 | 1,667.82 | % | |||||||||||||||

|

Interest expenses

|