Attached files

| file | filename |

|---|---|

| EX-23.1 - Orsus Xelent Technologies Inc | v181109_ex32-1.htm |

| EX-21.1 - Orsus Xelent Technologies Inc | v181109_ex21-1.htm |

| EX-31.2 - Orsus Xelent Technologies Inc | v181109_ex31-2.htm |

| EX-31.1 - Orsus Xelent Technologies Inc | v181109_ex31-1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-K

x ANNUAL REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For

the fiscal year ended December 31, 2009

o TRANSITION REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For

the transition period from ______ to ______.

Commission

file number: 001-33456

ORSUS

XELENT TECHNOLOGIES, INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

20-1198142

|

|

|

(State

or other jurisdiction of

|

(I.R.S.

Employer Identification No.)

|

|

|

incorporation

or organization)

|

29th Floor,

Tower B, Chaowai MEN Office Building

26

Chaowai Street, Chaoyang Disc.

Beijing,

People’s Republic Of China 100020

(Address

of principal executive offices, including zip code)

86-10-85653777

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

Common

Stock, par value $0.001 per share

Securities

registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act.

Yes o No x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Securities Exchange Act of

1934. Yes o No x

Indicate

by check mark whether the registrant: (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes x No o

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such

files). Yes o

No x

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant's knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

|

Large

accelerated filer o

|

Accelerated

filer o

|

|

|

Non-accelerated

filer o

|

Smaller

reporting company x

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act). Yes o No x

As

of June 30, 2009, the aggregate market value of the registrant’s common stock

held by non-affiliates of the registrant was $11,465,298 based on the closing

price as reported on the American Stock Exchange.

There

were a total of 29,756,000 shares of the registrant’s Common Stock, par

value $0.001 per share, outstanding as of April 15, 2010.

DOCUMENTS

INCORPORATED BY REFERENCE: None.

PART

I

|

Item

1.

|

Business.

|

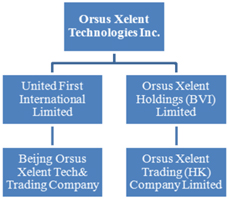

Except as

otherwise indicated by the context, references to “we,” “us,” “our,” or the

“Company” in this Annual Report are to the combined business of Orsus Xelent

Technologies, Inc. and its wholly-owned subsidiaries, including its operating

subsidiaries, United First International Limited, Beijng Orsus Xelent Tech&

Trading Company (“Xelent”), Orsus Xelent Holdings (BVI) Limited and Orsus Xelent

Trading (HK) Company Limited.

Introduction

On March

31, 2005, we completed a stock exchange transaction (“Exchange Transaction”) with

the shareholders of United First International Limited (“UFIL”), a company

incorporated under the laws of Hong Kong. The Exchange Transaction

was consummated under Delaware law and pursuant to the terms of that certain

Securities Exchange Agreement dated effective as of March 31, 2005 (“Exchange

Agreement”).

Pursuant

to the Exchange Agreement, we issued shares of our common stock to the

shareholders of UFIL in exchange for

100% of the outstanding capital stock of UFIL and UFIL became a wholly-owned

subsidiary of the Company. We carry on our business through UFIL’s

wholly owned subsidiary, Xelent.

Description

of Business

Since May

of 2003 we have, through the operations of Xelent, been engaged in the business

of designing, and distributing economically priced cellular phones for retail

and wholesale distribution. We outsourced manufacturing to third

party factories. In February 2004, Xelent registered "ORSUS" with the

State Administration for Industry and Commerce in the People’s Republic of China

(“PRC”) as its product

trademark. The Company is also known as “Orsus Cellular” within the

industry. In January 2007, the trademark “PROXLINK” was registered for the

Company's specialized application mobile series. Between April 2004

and the end of 2009, we have sold over 3.75 million mobile phones.

Our

cellular phones are equipped with many cutting-edge features such as 1.8 to

2.8-inch CSTN (Color Super Twisted Nematic) and TFT (Thin Film Transistor)

dual-color displays; capabilities for up to 160 minutes of video recording and

up to 3 million pixel photography; Moving Picture Experts Group Audio Layer III

(“MP3”), Moving Picture

Experts Group Audio Layer IV (“MPEG4”) and Universal disk

(“U disk”) support;

dual stereo speakers; e-mail and multimedia messaging; between 40 and 64

polyphonic ring tones; slim bar-phone and flip-phone technology with ultra-thin

lightweight design; and handwriting and PDA functions – all at low to moderate

price points.

The

Company has established an industrial design department for the purpose of

developing proprietary mobile phones that will be attractive to our PRC

customers. Most of the mobile phones we design are for the Company’s

exclusive sale and distribution; the remainder are developed in conjunction with

outside design firms. The long-term partners and manufacturers we

employ to produce our cell-phones and accessories are the same

experienced Original Equipment Manufacturer (“OEM”) plants used by

global brands like Motorola, Nokia and Ericsson. Our current operations include

the outsourcing of manufacturing and customization, oversight of production and

quality control at our OEM factories, and coordination of the distribution of

our products to retailers and customers. In an effort to reduce our reliance on

third-party manufacturers, we plan, eventually, to acquire a factory that will

give us the capacity to produce our own phones and accessories.

The

market for cellular phones in the PRC for has continued to expand and we have

taken advantage of that expansion with our 2.5G wireless products. As the new

Third Generation (“3G”)

standard matures, we anticipate producing 3G products as well. Our 3G

products will be developed based on our own research as well as the knowledge we

have gained from our cooperative efforts with strategic partners in the

industry.

Organizational

Structure

The

Company has a linear organizational structure comprised of nine separate

departments that have been developed to ensure proper project management and

control. The departments are:

1

|

|

·

|

Project

Management Department, which is responsible for coordinating the

management of cellular phone projects, exchanging concepts and ideas with

our research and development team, providing weekly project reports and

supervising project schedules;

|

|

|

·

|

Technology

Support and Quality Control Department, which is responsible for providing

technical support for our software and hardware designs, checking and

auditing our industrial and mechanical designs (“ID/IM”), and assisting

with tooling engineering and quality control during mass

production;

|

|

|

·

|

Business

Management Department, which is responsible for purchasing materials;

managing supply chains; coordinating Company business; and evaluating and

signing business agreements, contracts, and other documents for our

business partners;

|

|

|

·

|

Planning

and Finance Department, which is responsible for overall accounting

matters including oversight of accounting methods and processes, managing

expenses, auditing Company records, and compiling financial plans and

monthly/quarterly/yearly budgets and financial

statements;

|

|

|

·

|

Human

Resources Department, which is responsible for managing our

employment-related matters, including hiring and termination of

staff;

|

|

|

·

|

Financing

and Investment Department, which is responsible for overall accounting and

financial matters as well as investment research and

analysis;

|

|

|

·

|

Customer

Service Department, which is responsible for facilities maintenance;

ordering spare parts; authorized network management; after-sale data

analysis and service charge fees return; operating a hotline service

center and customer service training center; and providing technical

support and after-sale service quality assurance

systems;

|

|

|

·

|

Research

& Development (“R&D”) Department,

which is responsible for researching new mobile phone models and

developing new technologies; and

|

Marketing

Development Department, which is responsible for helping the Company to find new

business partners who will act as countryside distributors, provincial dealers,

and/or overseas wholesalers. The Marketing Development Department

also helps the Company’s long-term partners to establish market campaigns and

business models that incorporate the Company’s products.

Market

Overview and Strategic Partners

In 2006,

about 35% of the population of the PRC subscribed to a mobile phone service.

According to statistics issued by the PRC’s Ministry of Information Industry, by

July 23, 2007, that figure had increased by almost 40 million to approximately

502 million mobile subscribers, representing about 38% of the PRC’s

population. Nokia, currently the industry’s most competitive mobile

manufacturer and supplier, has estimated that there will be about 630 million

mobile phone service subscribers in the PRC by 2010.

According

to In-Stat, a market research service provider, 165 million multimedia

phones will be sold in the PRC by 2011, representing a market penetration rate

of 81%. Around 70% of the current owners of music phones and camera

phones in the PRC express strong interest in more high-end equipment. And,

because PRC mobile users show a strong preference for combined MP3

players/mobile phones, phone makers targeting PRC customers are likely to focus

on producing these types of phones in the future.

Despite

these projections, data from 2009 captured in the charts below show that

development of the cellular phones industry in the PRC has been maintaining a

modest growth level for the whole of 2009. This is probably the

result of the global economic recovery as well as restructuring among the PRC

telecom carriers during this period.

The below

data is market size of fiscal year 2009. (The end-users developed.)

(Data in

thousands)

|

Jan

2009

|

Feb

2009

|

Mar

2009

|

Apr

2009

|

May

2009

|

Jun

2009

|

Jul

2009

|

Aug

2009

|

Sep

2009

|

Oct

2009

|

Nov

2009

|

Dec

2009

|

|||||||||||||||||||||||||||||||||||||

|

GSM

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

Market

|

12,945 | 11,192 | 11,023 | 10,022 | 11,453 | 10,074 | 10,995 | 12,337 | 11,686 | 13,628 | 10,879 | 10,815 | ||||||||||||||||||||||||||||||||||||

|

Size

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

CDMA

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

Market

|

1,876 | 2,122 | 2,740 | 2,504 | 2,012 | 2,010 | 2,178 | 2,409 | 2,874 | 2,676 | 2,700 | 3,427 | ||||||||||||||||||||||||||||||||||||

|

Size

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

Total

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

Market

|

14,822 | 13,313 | 13,763 | 12,526 | 13,465 | 12,083 | 13,173 | 14,746 | 14,559 | 16,304 | 13,579 | 14,242 | ||||||||||||||||||||||||||||||||||||

|

Size

|

||||||||||||||||||||||||||||||||||||||||||||||||

Source:

SINO Market Research March 2010

On

February 26, 2006, the TD-SCDMA technology standard was officially announced as

the Third Generation (“3G”) standard in the

PRC. However, sales of 3G products have not developed as rapidly as

was generally anticipated (it was thought that 3G network construction and

issuance of 3G licenses would be approved by the end of 2006) and telecom

operators are having to keep trying to promote the 3G network’s commercial

utility. In the meantime, the Company has started developing our own

3G cellular phone products based on our existing technologies as well as

resources we have as a result of our cooperation with 3G solution and chips

providers. We are working towards obtaining 3G manufacturing licenses

from the PRC government and are planning to join the TD-SCDMA Industry

League.

Our

relationships with strategic partners including CEC Mobile Co., Ltd. (“CECM”), Beijing Xingwang

Shidai Tech & Trading Co., Ltd. (“XWSD”), and CECT-Chinacom

Communications Co., Ltd. (“CECT-Chinacom”) have helped

us increase our share of the cellular phone market in the PRC. CECM

manufactures our cellular phone products and also resells our products to its

provincial and national sales distributors and dealers through its own sales

network, thereby expanding our avenues for distribution. XWSD, another one of

our major agents, sells our cellular phones to provincial distributors, city

distributors, and dealers.

The

Company has maintained a modest sales level since the launch of our

first mobile phones in April 2004. The designs of our mobile phones

continue to reflect our consideration and understanding of the habits and tastes

of our customers in the PRC. For instance, our products incorporate

features that are popular in the PRC such as overlapped dual screens, powerful

color messaging, and photography capabilities. The Company’s products

are, and have always been, low and moderately priced, but of high quality. On

November 23, 2004, the premier consulting firm, CCIDNET Information Technology

Co., Ltd. granted the “2004 Prize for the Most Potential Wireless Terminal” to the Company’s mobile

phone model OS70 during its Annual Exhibition in the PRC. At the same

exhibition, our M62 model was awarded the “2004 Prize for the Most Fashionable

Wireless Terminal” in the high performance category. These awards are evidence

of public and industry appreciation and acceptance of the Company’s mobile

phones.

Building

on our success in 2004, the Company began to focus on our R&D efforts and

expand our sales channels. In 2005, the Company added various

multimedia features to our products in response to changes in consumer

preferences; the multimedia phones showed strong sales. We also

developed super-thin mobile phones which sold even more successfully than our

multimedia phones. We positioned ourselves well for the introduction of “smart

mobile” phones in 2007, partly because of a Letter of Intent for mobile

subscriptions that we executed with Unicom Huasheng, a wholly-owned subsidiary

of China Unicom. In 2008, we successfully launched products that are

adaptable to China Mobile Media Broadcasting (“CMMB”). In 2009, we will

continue to develop our product sales channels, cooperate with domestic mobile

operators, and focus our efforts on technology for business functions such as

embedded Global Positioning Systems (“GPS”), PUSH Mail, and

products related to information safety.

Description

of Products and Services

Since

2007, Xelent has developed and launched nearly 30 cellular phone

models. We outsource the manufacturing of our products to

unaffiliated third parties. Once our products are manufactured, they are

delivered to a network of unaffiliated national sales distributors (see Description of Current Business -

Market Overview and Strategic Partners) and dealers who, in turn,

distribute our products to provincial sales distributors and dealers who

distribute our products to retailers throughout the PRC.

2

The

Company established itself in the PRC mobile phone market with the introduction

of the first wristphone that combined wrist watch and mobile phone. Then, in

response to a rapid increase in demand for color screen mobile products in the

PRC, we produced single color dual screen mobiles (models F16 and F18), and a

dual screen multi-color screen mobile (model FG25). In response to

customer preferences, we also equipped models F16 and F18 with cameras, laying

the foundation for our R&D on camera and video functions and the

introduction of many models of 300,000 pixel camera mobile products, including

models FG830, FG850, OS83, OS85, OS70, OS86 and M851. We also met consumer

demand with our launch of the 1M camera mobiles, models OSM62 and OSM72, which

reflected a simple design style with multiple functions. We followed these early

successes with many more models of multimedia mobiles, such as K600, X188 and

D8120. In 2007 we launched our X180 mobile information terminals to

meet the market’s demand for information office products, providing swift and

convenient mobile terminal products for industrial application and specific

customers, such as China Unicom. In addition to the products listed

above, we have also developed many models of GSM/GPRS mobiles, including models

N3200 and H8801. In 2009, T303 and X780 ranked as our best selling

models, contributing 15.6% and 17.2% respectively, to our total sales revenue of

US$77,392 for the year. (by volume)

To meet

changing market demands, we will continue to introduce economically-priced, high

performance products that reflect our advantages in appearance, design, and

functional development and will continue to strengthen our competitiveness in

the domestic PRC mobile sector.

Research

and Development (R&D)

Our

R&D Department is responsible for researching new products and securing new

technologies. It has made significant contributions to the Company's

ability to adapt our overall strategies and operations to market demand, sustain

advanced product development, and, most importantly, enhance the technical

strength that lies at the core of the Company’s competitiveness in the market.

Most of our patented models and samples are developed exclusively by our R&D

Department. Some of our most innovative products include the first

telecommunications terminal to fully support the CDMA2000-1X protocol; the first

wrist watch style wireless mobile phone; the first mobile phone made in the PRC

using three-color OLED organic EL secondary display with TFT main display; the

first mobile phone made in the PRC supporting four frequencies

(850/900/1800/1900MHz); the first mobile phone made in the PRC with 64

polyphonic melodies; the first mobile phone supporting a USB interface and 16M

flash U-disk (NAND-FLASH); and the first mobile phone made in the PRC with an

internal 300K camera, Ultra-red, EMS, MMS, JAVA and USB. At the

Annual Conference on Network Application Technology held by CCID in Beijing in

November 2004, our Model M62 received the Most Fashionable Cell Phone of 2004

award and our Model OS70 won the Best Potential of 2004 award.

While 3G

technology is becoming the mainstream in the PRC, we anticipate developing our

own 3G cellular phones based on Company R&D efforts as well as cooperative

development efforts with our strategic industry partners. We plan to

develop products that will operate with the TD-SCDMA and WCDMA standards and

have established a technology development team that includes members of our

product planning division, project management division and industrial design

center. Our product planning division is responsible for constructing our

medium-term strategic plans and setting up schedules for our research and

development projects. Our project management division administers our R&D

efforts, oversees manufacturing and quality control of our products, and

monitors costs, including human resources costs. Our industrial design center is

responsible for evaluating design plans provided by the R&D Department or by

third party industrial design companies, confirming model configurations and

supervising module production and quality.

Additionally,

we have continued to negotiate with several parties to prepare for the launch of

3G services in the PRC next year. These parties include foreign 3G

technology providers such as Spreadtrum Communication (Shanghai) Inc. (“SCI”), and several 3G chipset

and solution providers. Our strategic partners, such as SCI, develop

2.5G and 3G integrated circuits and provide 2.5G GPRS and 3G TD-SCDMA chipset

and software development platforms and solutions. The Company

believes our negotiations with these 3G technology providers and our cooperation

with other companies on future R&D projects will help facilitate our entry

into the 3G wireless market.

We also

have agreements to cooperate with professional design houses such as Shanghai

Huntel Technology Limited and Tranzda Wireless, with whom we work mainly on the

design of MMI (“U2”),

software and hardware testing, China Type Approval (“CTA”) certification,

acquisition and

phone main board updating, and software

adaptability testing. We are also working with partners such as

Dalian Daxian Telecom Co., Ltd. on matters related to industrial and mechanical

design, including the layout of cellular phone main boards. Whenever

possible, we use and lease the instruments and equipment of other professional

design houses rather than purchasing it ourselves. In the area of software

compiling, testing, and updating, we utilize data cables and computers installed

with professional software in a testing environment. All the computers and data

cables are owned by Xelent.

3

In

general, PRC cellphone manufacturers mainly conduct their research and

development based on existing chip functions, a fact which is reflected in the

forms of applications chosen and interface-level development. Both

application-level and interface-level development are categorized as development

of adaptability systems - only protocol stack and source procedure development

is recognized as software development. Therefore, there is no exclusive right or

limited use of any such systems for these manufacturers, including the

Company.

Competition

The

Company faces substantial competition from other wireless phone manufacturers

such as Nokia, Samsung, and Motorola, who, together, controlled more than half

of the PRC cellular market in 2009. In addition, we face competition

from the domestic cellular phone producers, such as Tianyu, Huawei, Lenovo and

ZTE, who controlled 4.7%, 4.4%, 4.3% and 2.9%, respectively, of the cellular

market in the PRC in 2009. (From Sino Market Research, March 2010.)

In

addition to trying to increase inventory sales and turnover, the Company will

continue to pursue its two-year growth strategy, which we believe will result in

sound increases in profits and revenues. We also want to launch our

own 3G products as soon as possible in order to offer products that meet

consumer demands before our competitors. Because the 3G market is

virtually wide open and other companies have not yet developed many 3G products,

once we develop our own 3G phones, we anticipate being able to secure our share

of the market.

Government

Regulation

There are

limited government regulations that have material effects or create restrictions

on Xelent; neither are there judicial orders, writs, judgments, injunctions,

decrees, determinations or binding awards against Xelent. One

exception is that cellular manufacturers in the PRC are responsible for repair,

replacement and return of cellular phone to customers within the warranty period

in accordance with certain PRC rules and regulation.

The PRC’s

cellular phone industry is one of the most advanced in the world. It

has a huge customer base and an established network of manufacturers,

distributors, and service providers. The PRC government does not

promulgate policies that obstruct entry into the market or regulate it

heavily. We expect this relatively free market situation to continue

and do not expect government policies to adversely impact the development of our

industry.

Intellectual

Property and Proprietary Rights

Xelent

has been approved to use “ ”as a registered trademark

and the China Trademark Agency has distributed a “Notification of Acceptance” of

the trademark with serial number ZC3878232SL. Xelent has also applied to use

“Proxlink” as a trademark and the Company expects that Proxlink will become a

registered trademark following the customary two year waiting period, as

verified by the China Trademark Agency.

”as a registered trademark

and the China Trademark Agency has distributed a “Notification of Acceptance” of

the trademark with serial number ZC3878232SL. Xelent has also applied to use

“Proxlink” as a trademark and the Company expects that Proxlink will become a

registered trademark following the customary two year waiting period, as

verified by the China Trademark Agency.

”as a registered trademark

and the China Trademark Agency has distributed a “Notification of Acceptance” of

the trademark with serial number ZC3878232SL. Xelent has also applied to use

“Proxlink” as a trademark and the Company expects that Proxlink will become a

registered trademark following the customary two year waiting period, as

verified by the China Trademark Agency.

”as a registered trademark

and the China Trademark Agency has distributed a “Notification of Acceptance” of

the trademark with serial number ZC3878232SL. Xelent has also applied to use

“Proxlink” as a trademark and the Company expects that Proxlink will become a

registered trademark following the customary two year waiting period, as

verified by the China Trademark Agency.In

accordance with the governing laws and regulations of the PRC, we utilize the

intellectual property of our strategic partners pursuant to our contracts and

agreements with these partners.

Employees

We have

26 employees. Of the 26 employees, 6 people serve in management related

capacities. All employees are located in nine departments: the

Project Management Department employs 2 people, the Technology Support and

Quality Control Department employs 3 people, the Business Management Department

employs 3 people, the Planning and Finance Department employs 4 people, the

Human Resources Department employs 2 people, the Financing and Investment

Department employs 2 people, the Customer Service Department employs 5 people,

the R&D Department employs 2 people, and the Marketing Development

Department employs 3 people.

4

We

believe the Company has a good relationship with our employees and there are no

collective bargaining arrangements in place.

|

Item

1A.

|

Risk

Factors.

|

You

should carefully consider the following risks and the other information set

forth elsewhere in this Current Report. If any of these risks occur,

our business, financial condition and results of operations could be adversely

affected. As a result, the trading price of our common stock could

decline, perhaps significantly.

Loss

of significant or major customers could hurt our business by reducing our

revenues and profitability.

Our

success depends substantially upon retaining our major clients. We cannot

guarantee that we will be able to retain long-term relationships or secure

renewals of short-term relationships with our significant clients in the

future. For the twelve months ended December 31, 2009, we had one

major customer: Beijing Xingwang Shidai Tech & Trading Co., Ltd.,

which was responsible for over 90.6% of our revenues. We have developed and

enhanced our relationship and positioned ourselves for long-term cooperation

with them by taking the following steps:

|

|

·

|

assisting

the company in coordinating its sales channels and

carriers;

|

|

|

·

|

ensuring

that the company received high performance products at the specified

prices; and

|

|

|

·

|

responding

to feedback from the company’s customers regarding our products by

adjusting our product lines to better suit their customers’

needs.

|

Competition

from providers of similar products and services could materially adversely

affect our revenues and financial condition.

The

industry in which we compete is highly competitive, fragmented, and driven by

consumer preferences for quickly-evolving technologies. Our competitors include

both international brands like Nokia, Motorola, and Samsung, and domestic brands

like Lenovo, Tianyu, Oppo, Changhong and Gionee, among others. We believe

competitors in the cell phone industry compete on the following main factors:

effective marketing and sales, brand recognition, product quality, product

placement and availability, niche marketing and segmentation. We

expect competition to intensify in the future due to the increased number of

competitors and other factors discussed below. Other companies, foreign and/or

domestic, may also enter the PRC market with better products or services,

greater financial and human resources and/or greater brand recognition than our

Company. Competitors will also continue to improve and expand their current

product lines and introduce new products to market. We can make no

assurances that we will be able to compete effectively or that we will have the

resources needed for the technical innovation, business development, advertising

and marketing that are necessary to compete effectively and build awareness of

our brand. Staying competitive will require substantial human and capital

resources from the Company. We may also have to continue to rely on

strategic partnerships for critical branding and relationship leverage; there is

no guarantee these partnerships will prove sufficient. We cannot assure that the

Company will have enough resources to make these investments or that we will be

able to achieve the technological advances necessary to remain

competitive. Increased competition may result in price reductions,

lower gross margins, and/or loss of market share. Failure to compete

successfully against current or future competitors could have a material adverse

effect on the Company’s business, operating results and financial

condition.

We

depend on key personnel for the success of our business. Our business may be

severely disrupted if we lose the services of our key executives or employees or

fail to add new senior and mid-level managers to our management

team.

Our

future success depends heavily on the continued service of our key executives.

Our future success is also dependent upon our ability to attract and retain

qualified senior and middle managers to our management team. If one or more of

our current or future key executives or employees is unwilling or unable to

continue in their present positions, it may be difficult to replace them, and

our business may be severely disrupted. In addition, if any of our key

executives or employees joins one of our competitors or forms a competing

company, we could lose customers and/or suppliers and incur additional expenses

to recruit and train replacement personnel. Each of our executive

officers has entered into an employment agreement with us.

5

We also

rely on a number of key technology staff to operate our Company. Given the

competitive nature of our industry, the risk of key technology staff leaving our

Company is fairly high and could disrupt our operations.

We

rely on a third party production center.

We use a

third party production center to manufacture our products. Should we be required

to use a different production center, our costs could be negatively

affected.

The

acquisition of a manufacturing facility is costly and such acquisition may not

enhance our financial condition.

The

process of identifying and consummating the acquisition of our own manufacturing

facility could require substantial amounts of cash, which may require issuing

new securities, thereby diluting the interests of existing

stockholders. Acquiring a manufacturing facility could also expose

the Company to potential liabilities, some of which may not be disclosed by the

seller. In addition, even if we are successful in acquiring a

manufacturing facility, there are no assurances that owning it will enhance our

future financial condition. And, to the extent that the business

acquired does not remain competitive, some or all of the goodwill related to

that acquisition could be charged against our future earnings, if

any.

Any

acquisitions we undertake could be difficult to integrate, disrupt our business,

dilute stockholder value, and harm our operating results.

We plan

to review opportunities to buy other businesses or technologies that would

complement our current products, expand the breadth of our markets and sales

channels, enhance our technical capabilities, or otherwise offer growth

opportunities. If we make any future acquisitions, we may issue stock, thereby

diluting existing stockholders’ percentage of ownership in the Company; incur

substantial debt; or assume contingent liabilities.

Our

experience in acquiring other businesses and technologies is limited. Potential

acquisitions also involve numerous risks, including:

|

|

·

|

problems

integrating the purchased operations, technologies, products, or services

with our own;

|

|

|

·

|

unanticipated

costs associated with the

acquisition;

|

|

|

·

|

diversion

of management’s attention from our core

businesses;

|

|

|

·

|

adverse

effects on existing business relationships with suppliers and

customers;

|

|

|

·

|

risks

associated with entering markets in which we have no or limited prior

experience;

|

|

|

·

|

potential

loss of key employees and customers of purchased

organizations;

|

|

|

·

|

increased

costs and efforts required for compliance with Section 404 of the

Sarbanes-Oxley Act; and

|

|

|

·

|

risk

of impairment charges related to potential write-downs of assets acquired

in future acquisitions.

|

Our

acquisition strategy entails reviewing and potentially reorganizing acquired

business operations, corporate infrastructure and systems, and financial

controls. Unforeseen expenses, difficulties, and delays frequently encountered

in connection with rapid expansion through acquisitions could inhibit our growth

and negatively impact our profitability. We may be unable to identify suitable

acquisition candidates or to complete the acquisitions of candidates that we

identify. In addition, we may encounter difficulties in integrating the

operations of acquired businesses with our own operations or managing acquired

businesses profitably without substantial costs, delays, or other operational or

financial problems.

6

Rapid growth and a rapidly changing

operating environment may strain our limited resources.

We will

need to increase investment in our technological infrastructure, facilities, and

other areas of operations, especially in the area of product development. If we

are unable to manage our growth and expansion effectively, the quality of our

products and services and, in turn, our customer support, could deteriorate and

cause our business may suffer. Our future success will depend on, among other

things, our ability to:

|

|

·

|

continue

to develop technologies that attract PRC

consumers;

|

|

|

·

|

continue

to train, motivate, and retain our existing employees and attract and

integrate new employees, including our senior managers, most of whom have

been with the Company for less than three

years;

|

|

|

·

|

develop

and improve our operational, financial, accounting and other internal

systems and controls, and

|

|

|

·

|

maintain

adequate controls and procedures to ensure that our periodic public

disclosures under applicable laws, including U.S. securities laws, are

complete and accurate.

|

Unless

we are able to take advantage of technological developments on a timely basis,

we may experience a decline in a demand for our services or may be unable to

implement our business strategy.

Our

industry is experiencing rapid change as new technologies are developed that

offer consumers an ever-expanding number of ways to meet their communications

needs. In order to grow and remain competitive, we will need to adapt to future

changes in technology, enhance our existing products, and introduce new products

that address our customers’ changing demands. If we are unable to continue

developing products that compare favorably to the products of our competitors in

terms of technology either on a timely basis and/or at acceptable costs, we

could lose customers to our competitors. Technological advances including the

introduction of new products, new designs, or new manufacturing techniques could

render our inventory obsolete or shift demand into areas in which we are not

currently engaged. If we fail to adapt to these types of changing conditions in

a timely and efficient manner, our revenues and profits would likely decline. To

remain competitive, we must continue to incur significant expenses for product

development, equipment, and facilities, and other capital investments. These

costs may increase, resulting in greater fixed costs and operating expenses. As

a result, we could be required to expend substantial funds for and commit

significant resources to the following: research and development required to

update existing and potential products; additional engineering and other

technical personnel; advanced design, production and test equipment;

manufacturing services that meet changing customer needs; and technological

changes in manufacturing processes. Our future operating results will depend to

a significant extent on our ability to continue to provide new products that

compare favorably to those of our competitors in terms of time to market, cost,

performance, design, and quality of manufacturing. Should our

production costs increase, failure to increase our net sales in a way sufficient

to offset these cost increases would reduce our profitability.

Our

research and development efforts may not lead to successful development of

commercially viable or acceptable products, which could cause a decline in

customer use of our products.

The

markets in which we compete are characterized by:

|

|

·

|

rapidly

changing technology;

|

|

|

·

|

evolving

industry standards and transmission

protocols;

|

|

|

·

|

frequent

improvements in products and services;

and

|

|

|

·

|

fierce

competition from well-funded and technologically advanced

companies.

|

7

To

succeed, we must continually improve our current products and develop and

introduce new or enhanced products that adequately address the requirements of

our customers and are competitive in terms of functionality, performance,

quality, and price. We are currently developing new 3G products, however, our

research and development efforts may not lead to any new or enhanced products or

generate sufficient market share to justify commercialization. 3G is

a new and evolving technology and we may not be able to recoup our research and

development costs and expenses or may not be able to serve our customers’ 3G

needs, leading customers to purchase competitors’ products instead of our

own.

Changes

in industry standards and technologies, customer preferences and government

regulation could limit our ability to sell our products.

The

mobile phone market is characterized by changing consumer demands for cellular

telephone functions and applications, rapid product obsolescence and price

erosion, intense competition, evolving industry standards, and wide fluctuations

in product supply and demand. These factors require us to continuously develop

new products and enhance our existing products to stay

competitive. In order to encourage widespread market adoption of 2G,

2.5G, 2.75G and 3G technologies, efforts have been made to develop industry

standards, and we have designed our products to comply with these standards.

Changes in industry standards, or the development of new industry standards, may

make our existing products obsolete or negate the cost advantages we believe we

have in our products.

Our

business, operating results, financial condition, and cash flows could be

adversely affected by declining demand for our existing products; the

introduction of products and technologies by our competitors that serve as

replacements, substitutes, or improvements over our existing products;

technological innovations or new standards that our existing products do not

address; or an inability to release enhanced versions of our existing products

on a timely basis. We have begun to offer products based on the 3G standard

promoted by the PRC government, and are focusing a significant portion of our

product design and sales and marketing efforts on products that comply with this

standard. We also are devoting significant resources to the

development of solutions that will support either the 2.5G or 2.75G wireless

standards. If the wireless standards for which we are developing products are

not widely adopted by the market, we may not be able to sell these 2.5G and

2.75G-oriented products and our revenue could decline. Because it is not

practicable to develop products that comply with all of the current standards

and standards that may be adopted in the future, our ability to compete

effectively will depend on our success at selecting the industry standards that

will be widely adopted by the market and designing our products to support those

standards. We may be required to devote significant expenses to redesigning our

products in order to address relevant standards. We may not have the financial

resources to fund future innovations. If our products do not meet relevant

industry standards that are widely adopted for a significant period of time, our

revenue would decline, adversely affecting our operating results, and future

prospects.

If the PRC’s wireless communication

sector does not maintain its current pace of growth, or the PRC government does

not issue the Company a 3G license in the near future, the profitability and

future prospects of our business and our liquidity could be materially and

adversely affected.

Our

future success depends on the continued growth of the PRC wireless communication

industry. A slowdown in the development of the wireless communication industry

in the PRC or reduction in our customers’ expenditures on mobile phone products

and services may reduce market demand for our products and services.

Alternatively, if the PRC government or other relevant regulatory authorities

fail to allow construction of new wireless communication networks, or decide to

terminate, delay or suspend construction or extension of new or existing

wireless communication networks, the profitability and future prospects for our

business could be materially and adversely affected.

The third

generation wireless communication, or 3G, network deployment will require

significant capital investment by PRC telecommunication operators, including

investments in wireless coverage products and services, RF parts and components

and wireless communication systems. Therefore, we believe that issuance of 3G

licenses will in general have a positive impact on the growth of our business.

Until we receive our 3G license from the PRC government, the expected return on

our investments in 3G technology is uncertain. Continued delay in the issuance

of 3G licenses will negatively impact our business growth and

liquidity.

8

Our ability to generate revenues

could suffer if the PRC market for cellular phones does not develop as

anticipated.

The

market for cellular phones in the PRC has evolved rapidly over the last four

years with the introduction of new products, development of consumer

preferences, market entry by new competitors, and adaptation of strategies by

existing competitors. We expect each of these trends to continue, and we must

continue to adapt our strategy to successfully compete in this market. It is

extremely difficult to accurately predict consumer acceptance of and demand for

both existing and potential technologies and services; neither can we know what

the future size, composition, or growth of this market will be.

We may not be able to adequately

protect our intellectual property, and we may be exposed to infringement claims

by third parties.

We rely

on the restrictions on disclosure contained in our business contracts to protect

our intellectual property rights. Monitoring unauthorized

use of our information services is difficult and costly, and we cannot be

certain that the steps we take will effectively prevent misappropriation of our

technology and content. In the future, our management may

decide to apply for copyright, trademark or trade secret protection if

management determines that such protection would be beneficial and

cost-effective for the Company.

From time

to time, we may have to resort to litigation to enforce our intellectual

property rights, which could result in substantial costs and diversion of our

resources. In addition, third parties may initiate litigation against us for

alleged infringement of their proprietary rights. In the event of a successful

infringement claim and our failure or inability to develop non-infringing

technology or content or to obtain a license for the infringed or similar

technology or content on a timely basis, our business could suffer. Moreover, if

this situation were to arise, even if we were able to license the infringed or

similar technology or content, license fees we would have to pay to licensors

could be substantial or even economically unfeasible.

Our

products may be subject to counterfeiting and/or imitation, which could harm our

business and our competitive position.

We cannot

guarantee that counterfeiting or imitation of our products will not occur in the

future or, if it does occur, that we will be able to detect it and deal with it

effectively. Any counterfeiting or imitation could negatively impact our

corporate and brand image. In addition, counterfeit or imitation products could

result in a reduction in our market share, a loss in revenue, or an increase in

our administrative expenses due to costs associated with detection or

prosecution.

We have limited business insurance

coverage.

The

insurance industry in the PRC is still at an early stage of

development. Insurance companies in the PRC offer limited business

insurance products, and do not, to our knowledge, offer business liability

insurance. As a result, we do not have any business liability insurance coverage

for our operations. Therefore, any business disruption, litigation or

natural disaster could result in substantial costs and diversion of Company

resources.

Product

defects or the failure of our products to meet specifications could cause us to

lose customers and revenue or to incur unexpected expenses.

If our

products do not meet our customers’ needs, our customer relationships may

suffer. Also, our products may contain defects or fail to meet product

specifications. Any failure or poor performance of our products could result

in:

|

|

·

|

delayed

market acceptance of our products;

|

|

|

·

|

delayed

product shipments;

|

|

|

·

|

unexpected

expenses and diversion of resources to replace defective products or

identify and correct the source of

errors;

|

|

|

·

|

damage

to our reputation and our customer

relationships;

|

|

|

·

|

delayed

recognition of sales or reduced sales;

and

|

9

|

|

·

|

product

liability claims or other claims for damages that may be caused by any

product defects or performance

failures.

|

If the

limited warranty provisions in our contracts are unenforceable in a particular

jurisdiction or if we are exposed to product liability claims that are not

covered by insurance, a claim could harm our business.

We

may have difficulty collecting our accounts receivable.

During

the normal course of business, we extend unsecured credit to our customers.

Typical credit terms require payment to be made within 90 days of the invoice

date. We do not require collateral from our customers.

We

regularly evaluate and monitor the creditworthiness of each customer on a

case-by-case basis. We include any account balances that are determined to be

uncollectible in our allowance for doubtful accounts. After all attempts to

collect a receivable have failed, the receivable is written off against the

allowance. Based on the information available to management, the Company

believes that no allowance for doubtful accounts receivable is required as of

December 31, 2009 and December 31, 2008.

We

currently offer and intend to offer open account terms to certain of our

customers, which may subject us to credit risks, particularly in the event that

any receivables represent sales to a limited number of customers or are

concentrated in particular geographic markets. Collection of our

accounts receivable and our ability to accelerate our collection cycle through

the sale of accounts receivable is affected by several factors, including, but

not limited to:

|

|

·

|

our

credit granting policies,

|

|

|

·

|

contractual

provisions,

|

|

|

·

|

our

customers’ and our overall credit rating as determined by various credit

rating agencies,

|

|

|

·

|

industry

and economic conditions, and

|

|

|

·

|

our

recent operating results and our and our customers’ financial position and

cash flows.

|

Adverse

changes in any of these factors, certain of which may not be wholly in our

control, could create delays in collecting or an inability to collect our

accounts receivable which could impair our cash flows and our financial position

and cause a reduction in our results of operations.

Our

financial results may be affected by mandated changes in accounting and

financial reporting.

We

prepare our financial statements in conformity with accounting principles

generally accepted in the United States of America. These principles are subject

to interpretation by the Securities and Exchange Commission and various bodies

formed to interpret and create appropriate accounting policies. A change in

these policies may have a significant effect on our reported results and may

even retroactively affect previously reported transactions.

The

cyclical nature of the aluminum industry causes variability in our production

costs and cash flows.

Our costs

of production depend on the market for primary aluminum, which is a highly

cyclical commodity with prices that are affected by global supply and demand as

well as other conditions. Historically, aluminum prices have been volatile and

we expect such volatility to continue. These prices are driven, in part, by

global demand for aluminum arising from favorable global economic conditions and

strong demand in the PRC.

RISKS

RELATED TO DOING BUSINESS IN THE PRC

There are

substantial risks associated with doing business in the PRC; these risks are

discussed below:

10

A

downturn in the PRC economy may slow down our growth and

profitability.

Growth of

the PRC economy has been uneven across geographic regions and economic sectors.

There can be no assurance that growth of the PRC economy will be steady or that

an economic downturn will not have a negative effect on our business because of

a decrease in expenditures for wireless services. More specifically, increased

penetration of wireless services in the less economically developed central and

western provinces of the PRC will depend on those provinces achieving certain

income levels so that cellular phones and related services become affordable to

a more significant portion of the population living in these areas.

Government regulation of the

telecommunications industry may become more complex.

Government

regulation of the telecommunications industry is highly complex. New

regulations could increase our costs of doing business and prevent us from

efficiently delivering our services. These regulations may stop or slow down the

expansion of our user base and limit access to our services.

Because

we depend on governmental agencies for a portion of our revenue, our inability

to win or renew government contracts could harm our operations and reduce our

profits.

Our

inability to win or renew PRC government contracts could harm our operations and

reduce our profits. PRC government contracts are typically awarded through a

regulated procurement process. Some PRC government contracts are

awarded to multiple competitors, causing increases in overall competition as

well as pricing pressure. The competition and pricing pressure, may, in turn,

require us to make sustained post-award efforts to reduce costs in order to

realize revenues under these contracts. If we are not successful in reducing the

costs we anticipate, our ability to profit on these contracts will be negatively

impacted. An additional potential risk is that contracts with the PRC government

can generally be terminated or modified at the government’s

convenience.

We

rely on sales to the PRC government and a significant decline in overall

government expenditures or a delay in the payment of our invoices by the

government could have a negative impact on our future operating

results.

We

believe that some of the success and growth of our business will continue to

depend on our ability to win government contracts. Many of our government

customers are subject to budgetary constraints and our continued performance

under these contracts, or award of additional contracts from these agencies,

could be jeopardized by spending reductions or budget cutbacks at these

agencies. Our operating results may also be negatively impacted by other

developments that affect these government programs generally, including the

following:

|

|

·

|

adoption

of new laws or regulations relating to government contracting or changes

to existing laws or regulations;

|

|

|

·

|

delays

or changes in the government appropriations process;

and

|

|

|

·

|

delays

in the payment of our invoices by government payment

offices.

|

The

uncertain legal environment in the PRC could limit the legal protections

available to us.

The PRC

legal system is a civil law system based on written statutes where, unlike in

common law systems, legal cases have little value as precedents for future

disputes. There are substantial uncertainties regarding the interpretation and

application of PRC laws and regulations, including, but not limited to, the laws

and regulations governing our business, or the enforcement and performance of

our arrangements with customers in the event of the imposition of statutory

liens, death of the principal parties to contracts, bankruptcy or criminal

proceedings. In the late 1970s, the PRC government began to promulgate a

comprehensive system of laws and regulations governing economic matters. The

overall effect of legislation enacted over the past 20 years has significantly

enhanced the protections afforded to enterprises in the PRC that are funded by

foreign investors. However, these laws, regulations and legal

requirements are relatively recent are still evolving rapidly, meaning that

their interpretation and enforcement involves a significant amount of

uncertainty. New laws and regulations that affect existing and proposed future

businesses may also be applied retroactively. These uncertainties

could limit the legal protections available to foreign investors, such as the

right of foreign invested enterprises to hold licenses and permits such as

required business licenses.

11

Any

recurrence of severe acute respiratory syndrome, or SARS, or another widespread

public health problem, could adversely affect our business and results of

operations.

A renewed

outbreak of SARS or another widespread public health problem in the PRC, where

all of our revenue is derived, and in Beijing where our operations are

headquartered, could have a negative effect on our operations. Our operations

may be impacted by a number of health-related factors, including the

following:

|

|

·

|

quarantines

or closures of some of our offices that would severely disrupt our

operations,

|

|

|

·

|

the

sickness or death of our key officers and employees,

and

|

|

|

·

|

a

general slowdown in the PRC

economy.

|

Any of

the foregoing events or other unforeseen consequences of public health problems

could adversely affect our business and results of operations.

Changes in the PRC’s political and

economic policies could harm our business.

The

economy of PRC has historically been a planned economy subject to governmental

plans and quotas and has, in certain aspects, been transitioning to a more

market-oriented economy. Although we believe that the economic reform and the

macroeconomic measures adopted by the PRC government have had a positive effect

on the economic development of the PRC, we cannot predict the future direction

of these economic reforms or the effects these measures may have on our

business, financial position or results of operations. In addition, the PRC

economy differs from the economies of most countries belonging to the

Organization for Economic Cooperation and Development, or OECD. These

differences include:

|

|

·

|

economic

structure;

|

|

|

·

|

level

of government involvement in the

economy;

|

|

|

·

|

level

of development;

|

|

|

·

|

level

of capital reinvestment;

|

|

|

·

|

control

of foreign exchange;

|

|

|

·

|

methods

of allocating resources; and

|

|

|

·

|

balance

of payments position.

|

As a

result of these differences, our business may not develop in the same way or at

the same rate as might be expected if the PRC economy was more similar to that

of an OECD member country. As the PRC economy is transitioning from a planned

economy to a more market-oriented economy, the PRC government has implemented

various measures to encourage economic growth and guide the allocation of

resources by controlling payment of foreign currency-denominated obligations,

setting monetary policy and imposing policies that impact particular industries

or companies in different ways. While these measures may benefit the overall PRC

economy, they may also have a negative effect on our business, especially if

such measures create an unfriendly environment for businesses in the technology

sector of the economy.

Inflation

in the PRC may impair our ability to conduct business profitably in the

PRC.

Recently,

the PRC economy has experienced periods of rapid expansion. During the past ten

years, the rate of inflation in the PRC has been as high as 5.8% and as low as

-1.4% . These factors have led to the adoption by the PRC government, from time

to time, of various corrective measures designed to limit inflation. High

inflation in the future may cause the PRC government to impose

controls on credit or prices, or to take other actions which could inhibit

economic activity in the PRC, and thereby harm the market for our

products.

12

Likewise,

negative inflation could have an unfavorable effect on our business

profitability in the PRC. Negative inflation may cause a period where consumers

are reluctant to spend, as consumers anticipate lower prices for products in the

future. In the event of negative inflation, the PRC government may

impose controls on credit or prices, or take other actions which could inhibit

economic activity, harming the market for our products.

Restrictions

on currency exchange may limit our ability to receive and use our revenues

effectively.

The

majority of our revenues are recorded in Renminbi and U.S. dollars, and any

future restrictions on currency exchanges may limit our ability to use revenue

generated in Renminbi to fund any future business activities outside the PRC or

to make dividends or other payments in U.S. dollars. Although the PRC government

introduced regulations in 1996 to allow greater convertibility of the Renminbi

for current account transactions, significant restrictions still remain. For

instance, foreign enterprises may only buy, sell or remit foreign currencies

after providing valid commercial documents at banks in the PRC authorized to

conduct foreign exchange business. In addition, conversion of Renminbi for

capital account items, including direct investment and loans, is subject to

governmental approval in the PRC, and companies are required to open and

maintain separate foreign exchange accounts for capital account items. The PRC

regulatory authorities may impose more stringent restrictions on the

convertibility of the Renminbi in the future.

We

are subject to the United States Foreign Corrupt Practices Act.

We are

required to comply with the United States Foreign Corrupt Practices Act, which

generally prohibits United States companies from engaging in bribery or other

prohibited payments to foreign officials for the purpose of obtaining or

retaining business. In addition, we are required to maintain records that

accurately and fairly represent our transactions and have an adequate system of

internal accounting controls. Foreign companies, including some that may compete

with us, are not subject to these prohibitions, and therefore may have a

competitive advantage over us. Corruption, extortion, bribery, pay-offs, theft

and other fraudulent practices occur from time-to-time in the PRC, particularly

in our industry since it deals with contracts from the PRC Government, and our

executive officers and employees have not been subject to the United States

Foreign Corrupt Practices Act prior to the completion of the Exchange Agreement

(defined herein). If our competitors engage in these practices they may receive

preferential treatment from personnel of some companies, giving our competitors

an advantage in securing business or from government officials who might give

them priority in obtaining new licenses, which would put us at a disadvantage.

We can make no assurance that our employees or other agents will not engage in

such conduct for which we might be held responsible. If our employees or other

agents are found to have engaged in such practices, we could suffer severe

penalties and other consequences that may have a material adverse effect on our

business, financial condition and results of operations.

RISKS

RELATED TO OUR COMMON STOCK

The market price for our common stock

may be volatile.

The

market price for our common stock is likely to be highly volatile and subject to

wide fluctuations in response to factors including the following:

|

|

·

|

actual

or anticipated fluctuations in our quarterly operating

results,

|

|

|

·

|

announcements

of new products and services by us or our

competitors,

|

|

|

·

|

changes

in financial estimates by securities

analysts,

|

|

|

·

|

changes

in the economic performance or market valuations of other companies

providing similar products and

services,

|

|

|

·

|

announcements

by our competitors of significant acquisitions, strategic partnerships,

joint ventures or capital

commitments,

|

|

|

·

|

additions

or departures of key personnel,

|

13

|

|

·

|

potential

litigation, or

|

|

|

·

|

conditions

in the cellular phone market.

|

In

addition, the securities markets have from time to time experienced significant

price and volume fluctuations that are not related to the operating performance

of particular companies. These market fluctuations may also materially and

adversely affect the market price of our common stock.

Stockholders could experience

substantial dilution.

We may

issue additional shares of our capital stock to raise additional cash for

working capital. If we issue additional shares of our capital stock, our

stockholders will experience dilution in their respective percentage ownership

in the Company.

We have no present intention to pay

dividends.

We have

never paid dividends or made other cash distributions on our common stock, and

do not expect to declare or pay any dividends in the foreseeable future. We

intend to retain future earnings, if any, for working capital and to finance

current operations and expansion of our business.

A large portion of our common stock

is controlled by a small number of stockholders.

Of the

total outstanding common stock, 20.56% is held by our executive officers and

directors. As a result, these shareholders could control the outcome of

stockholder votes on various matters, including the election of directors and

extraordinary corporate transactions including business combinations. In

addition, the occurrence of sales of a large number of shares of our common

stock, or the perception that these sales could occur, may affect our stock

price and could impair our ability to obtain capital through an offering of

equity securities. Furthermore, the current ratios of ownership of our common

stock reduce the public float and liquidity of our common stock which can in

turn affect the market price of our common stock.

|

Item

1B.

|

Unresolved

Staff Comments.

|

Not

applicable.

|

Item

2.

|

Properties.

|

We lease

office space in Beijing. Our Beijing office serves as our corporate headquarters

and is responsible for sourcing and coordination with cellular component

suppliers, coordination with our research and development partners and following

up the hardware and software testing aspects before mass production. The

following is relevant information on our Beijing office:

|

Address

|

Office

/

Production

|

Process

/

Lease

|

Monthly

Rental

(rmb)

|

Monthly

Rental

(usd)

|

Lease

period

|

||||||

|

29th

Floor, Tower B, Chaowai

MEN

Office Building, 26

Chaowai

Street, Chaoyang

Dist.,

Beijing (1)

|

Office

|

Lease

|

30,0000.00 |

4,309

|

January

2009 to December 2010

|

||||||

|

No.

1, Fuyou Street, Airport

Huoyun

Road, Shunyi Dist.,

Beijing

(2)

|

Office

|

—(2)

|

—

|

—

|

—

|

|

|

(1)

|

The

Company moved into the office space at 29th

Floor, Tower B, Chaowai MEN Office Building, 26 Chaowai Street, Chaoyang

Dist., Beijing The Company renewed the rental contract recently

and the rental for this office space is now US$53,000 per

year.

|

| (2) |

The

office listed as the second address is provided by Beijing Xin Ganxian

Logistic Company (a third party) free of charge to the

Company.

|

14

|

Item

3.

|

Legal

Proceedings

|

We are

party to certain litigation/arbitration related to amounts payable to suppliers

for goods with which the Company was not satisfied as to quality and timing of

delivery. However, the amounts in question are not substantial

enough that such litigation/arbitration are material to the Company or would

have a material adverse effect on our business. Furthermore, we

expect to be able to negotiate resolutions to these issues. Please refer to the

detailed description below about the pending legal

proceedings.

Legal

disputes with two suppliers arose from the unqualified accessories

andmaterials supplied by Shenzhen Songding Industry Ltd., (“Songding”) and

Beijing Baoxin Packing Materials Co., Ltd. (“Baoxin”). The management of Beijing

Orsus Xelent Techonologies & Trading Co., Ltd. (“BOXT”) decided to cease the

payment to Songding and Baoxin as a result of the unqualified accessories and

materials.

The

dispute between Baoxin and BOXT has been arbitrated by Beijing Arbitration

Commission. The ending balance of account payable to Baoxin as of December 31,

2009 was approximately US$36,000. Currently BOXT and Baoxin are processing the

final negotiation, as such, Baoxin applied for the property preservation to the

court and, accordingly, one of BOXT’s bank account was blocked until the

resolution of this dispute.

Final

arbitration for the dispute between Songding and BOXT is pending. The liability

in question was recorded as approximately US$54,000 at the end of December 31,

2009. Songding applied for the property preservation to the court and,

accordingly, one of BOXT’s bank accounts was blocked until the resolution of the

dispute.

|

Item

4.

|

Removed

and Reserved

|

PART

II

|

Item

5.

|

Market

For Registrant’s Common Equity, Related Stockholder Matters andIssuer

Purchases of Equity Securities.

|

Company

common stock has been listed on the American Stock Exchange (“AMEX”) under the

ticker symbol “ORS” since May 10, 2007. The following table sets

forth the quarterly average high and low sales prices per share for our common

stock during the fiscal years ended December 31, 2008 and December 31,

2009:

|

Common Stock

|

||||||||

|

High

|

Low

|

|||||||

|

Fiscal