Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[Mark One]

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ____________

Commission File Number: 000-53159

United Development Funding III, L.P.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

|

20-3269195

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

1301 Municipal Way, Suite 100, Grapevine, Texas 76051

(Address of principal executive offices)

(Zip Code)

Registrant’s telephone number, including area code: (214) 370-8960

Securities registered pursuant to section 12(b) of the Act:

None

Securities registered pursuant to section 12(g) of the Act:

Units of Limited Partnership Interest

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No x

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer o

Non-accelerated filer x Smaller reporting company o

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

While there is no established market for the Registrant’s units of limited partnership interest, the Registrant has made an initial public offering of its units of limited partnership interest pursuant to a Registration Statement on Form S-11. The Registrant ceased offering units of limited partnership interest in its primary offering on April 23, 2009. The last price paid to acquire a unit in the Registrant’s primary public offering was $20.00. On October 22, 2010, the general partner of the Registrant approved an estimated value per unit of the Registrant’s limited partnership interests of $20.00 derived from the estimated value of the Registrant’s assets, less the estimated value of the Registrant’s liabilities, and the execution of the Registrant’s business model, divided by the number of units outstanding. There were approximately 17,491,423 units of limited partnership interest held by non-affiliates at June 30, 2010, the last business day of the Registrant’s most recently completed second fiscal quarter.

As of March 25, 2011, the Registrant had 17,919,420 units of limited partnership interest outstanding.

UNITED DEVELOPMENT FUNDING III, L.P.

FORM 10-K

Year Ended December 31, 2010

|

PART I

|

||

|

Page

|

||

|

Item 1.

|

Business.

|

3 |

|

Item 1A.

|

Risk Factors.

|

11 |

|

Item 1B.

|

Unresolved Staff Comments.

|

35 |

|

Item 2.

|

Properties.

|

35 |

|

Item 3.

|

Legal Proceedings.

|

35 |

|

Item 4.

|

[Reserved]

|

35 |

|

PART II

|

||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

36 |

|

Item 6.

|

Selected Financial Data.

|

41 |

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

41 |

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk.

|

57 |

|

Item 8.

|

Financial Statements and Supplementary Data.

|

58 |

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

|

58 |

|

Item 9A.

|

Controls and Procedures.

|

58 |

|

Item 9B.

|

Other Information.

|

58 |

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance.

|

59 |

|

Item 11.

|

Executive Compensation.

|

62 |

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

|

62 |

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence.

|

64 |

|

Item 14.

|

Principal Accounting Fees and Services.

|

71 |

|

PART IV

|

||

|

Item 15.

|

Exhibits, Financial Statement Schedules.

|

72 |

|

Signatures.

|

73 | |

2

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements, including discussion and analysis of United Development Funding III, L.P. (which may be referred to as the “Partnership,” “we,” “us,” “our,” or “UDF III”) and our subsidiaries, our financial condition, our investment objectives, amounts of anticipated cash distributions to our limited partners in the future and other matters. These forward-looking statements are not historical facts but are the intent, belief or current expectations of our management based on their knowledge and understanding of the business and industry. Words such as “may,” “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “would,” “could,” “should” and variations of these words and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of the future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements.

Forward-looking statements that were true at the time made may ultimately prove to be incorrect or false. We caution investors not to place undue reliance on forward-looking statements, which reflect our management’s view only as of the date of this Form 10-K. We undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results. The forward-looking statements should be read in light of the risk factors identified in the “Risk Factors” section of this Annual Report on Form 10-K.

Item 1. Business.

General

United Development Funding III, L.P. was organized on June 13, 2005 as a Delaware limited partnership. Our principal purpose is to originate, acquire, service, and otherwise manage, either alone or in association with others, a diversified portfolio of mortgage loans that are secured by real property or equity interests in entities that hold real property already subject to other mortgages (including mortgage loans that are not first in priority) and participation interests in mortgage loans, and to issue or acquire an interest in credit enhancements to borrowers, such as guarantees or letters of credit.

We concentrate on making development loans to single-family lot developers who sell their lots to national and regional home builders, as well as making loans to national home builders and entities created by home builders in conjunction with our general partner or affiliates of our general partner for the acquisition of property and development of residential lots. We seek to make or acquire loans primarily with respect to projects where the completed subdivision will consist of homes at or below the median price of the U.S. housing market.

Our general partner is UMTH Land Development, L.P., a Delaware limited partnership (“Land Development”). Land Development is responsible for our overall management, conduct and operation. Our general partner has authority to act on our behalf in all matters respecting us, our business and our property. The limited partners take no part in the management of our business or transact any business for us and have no power to sign for or bind us; provided, however, that the limited partners, by a majority vote and without the concurrence of the general partner, have the right to: (a) amend the Agreement of Limited Partnership, as amended (the “Partnership Agreement”), governing the Partnership, (b) dissolve the Partnership, (c) remove the general partner or any successor general partner, (d) elect a new general partner, and (e) approve or disapprove a transaction entailing the sale of all or substantially all of the real properties acquired by the Partnership.

3

On May 15, 2006, our Registration Statement on Form S-11, covering an initial public offering (the “Offering”) of up to 12,500,000 units of limited partnership interest at a price of $20 per unit, was declared effective under the Securities Act of 1933, as amended. The Registration Statement also covered up to 5,000,000 units of limited partnership interest to be issued pursuant to our distribution reinvestment plan (“DRIP”) for $20 per unit. We had the right to reallocate the units of limited partnership interest we were offering between the primary offering and our DRIP, and pursuant to Supplement No. 8 to our prospectus regarding the Offering, which was filed with the Securities and Exchange Commission on September 4, 2008, we reallocated the units being offered such that 16,250,000 units were offered pursuant to the primary offering and 1,250,000 units were offered pursuant to the DRIP. Pursuant to Supplement No. 11 to our prospectus regarding the Offering, which was filed with the Securities and Exchange Commission on March 6, 2009, we further reallocated the units being offered to be 16,500,000 units offered pursuant to the primary offering and 1,000,000 units offered pursuant to the DRIP. The aggregate offering price for the units was $350 million. The primary offering component of the Offering was terminated on April 23, 2009. We extended the offering of our units of limited partnership interest pursuant to our DRIP until the earlier of the sale of all units of limited partnership interest being offered pursuant to our DRIP or May 15, 2010; provided, however, that our general partner was permitted to terminate the offering of units pursuant to our DRIP at any earlier time.

On June 9, 2009, we held a Special Meeting of our limited partners as of April 13, 2009, at which our limited partners approved three proposals to amend certain provisions of our Partnership Agreement for the purpose of making available additional units of limited partnership interest for sale pursuant to an Amended and Restated Distribution Reinvestment Plan (“Secondary DRIP”). On June 12, 2009, we registered 5,000,000 additional units to be offered pursuant to our Secondary DRIP for $20 per unit in a Registration Statement on Form S-3 (File No. 333-159939). As such, we ceased offering units under the DRIP portion of the Offering as of July 21, 2009 and concurrently commenced our current offering of units pursuant to the Secondary DRIP. The aggregate offering price for the units being offered pursuant to the Secondary DRIP is $100,000,000. The Secondary DRIP will be available until we sell all $100,000,000 worth of units being offered; provided, however, that our general partner may terminate the offering of units pursuant to the Secondary DRIP at any earlier time.

Our initial public subscribers were accepted as limited partners on July 3, 2006. As of December 31, 2010, we had issued an aggregate of 17,782,903 units of limited partnership interest in the Offering and the Secondary DRIP, consisting of 16,499,994 units that have been issued to our limited partners pursuant to our primary offering in exchange for gross proceeds of approximately $330.3 million, 716,260 units of limited partnership interest issued to limited partners in accordance with our DRIP in exchange for gross proceeds of approximately $14.3 million, and 884,886 units of limited partnership interest issued to limited partners in accordance with our Secondary DRIP in exchange for gross proceeds of approximately $17.7 million, minus 318,237 units of limited partnership interest that have been repurchased pursuant to our unit redemption program for approximately $6.4 million. Our limited partnership units are not currently listed on a national exchange, and we do not expect any public market for the units to develop.

Our Partnership Agreement provides that we will continue in existence until December 31, 2028, unless sooner terminated as provided in the Partnership Agreement or unless such term is extended by the general partner and the majority vote of the limited partners.

Loan Portfolio

As of December 31, 2010, we had originated 58 loans (24 of which were repaid in full by the respective borrowers) with an aggregate principal amount of approximately $456.9 million. As of December 31, 2010, there are approximately $65.9 million of commitments to be funded, including approximately $54.5 million to related parties, under the terms of mortgage notes receivable and participation interests.

4

Approximately 96% of the outstanding aggregate principal amount of mortgage notes originated by us are secured by properties located throughout Texas, approximately 3% are secured by properties located in Colorado and approximately 1% are secured by properties located in Arizona. Approximately 59% of the outstanding aggregate principal amount of mortgage notes originated by us as of December 31, 2010 are secured by properties located in the Dallas, Texas area; approximately 21% are secured by properties located in the Austin, Texas area; approximately 8% are secured by properties located in the Houston, Texas area; approximately 6% are secured by properties located in the Lubbock, Texas area; approximately 2% are secured by properties located in the San Antonio, Texas area; approximately 3% are secured by properties located in the Denver, Colorado area; and approximately 1% are secured by properties located in the Kingman, Arizona area. Security for such loans takes the form of either a direct security interest represented by a first or second lien on the respective property and/or an indirect security interest represented by a pledge of the ownership interests of the entity which holds title to the property. 15 of the 34 loans outstanding as of December 31, 2010, representing approximately 81% of the aggregate principal amount of the outstanding loans, are made with respect to projects that are presently selling finished home lots to national public or regional private homebuilders, or are made with respect to a project in which one of these homebuilders holds an option to purchase the finished home lots and has made a significant forfeitable earnest money deposit. 21 of the 34 loans outstanding as of December 31, 2010, representing approximately 67% of the aggregate principal amount of the outstanding loans, are made to developer entities which hold ownership interests in projects other than the project funded by us. 10 of the 34 loans outstanding as of December 31, 2010, representing approximately 79% of the aggregate principal amount of the outstanding loans, are secured by multiple single-family residential communities. 13 of the 34 loans outstanding as of December 31, 2010, representing approximately 61% of the aggregate principal amount of the outstanding loans, are secured by a personal guarantee of the developer in addition to a lien on the real property or the equity interests in the entity that holds the real property.

The average interest rate payable with respect to the 34 loans outstanding as of December 31, 2010 is 14%, and the average term of each loan is approximately 26 months.

Investment Objectives and Policies

Principal Investment Objectives

Our principal investment objectives are:

|

|

·

|

to make, originate or acquire a participation interest in mortgage loans (secured by first priority or junior priority liens against real property or liens against equity interests of entities that hold real property) typically in the range of $500,000 to $10 million, and to provide credit enhancements to real estate developers and regional and national homebuilders who acquire real property, subdivide such real property into single-family residential lots and sell such lots to homebuilders or build homes on such lots;

|

|

|

·

|

to produce net interest income from the interest on loans that we originate or purchase or in which we acquire a participation interest;

|

|

|

·

|

to produce a profitable fee from our credit enhancement transactions;

|

|

|

·

|

to produce income through origination, commitment and credit enhancement fees charged to borrowers;

|

|

|

·

|

to maximize distributable cash to investors; and

|

|

|

·

|

to preserve, protect and return capital contributions.

|

5

Investment Policy

We derive a substantial portion of our income by originating, purchasing, participating in and holding for investment mortgage and mezzanine loans made directly by us or indirectly through our affiliates to persons and entities for the acquisition and development of parcels of real property as single-family residential lots that will be marketed and sold to home builders. We also offer credit enhancements to developers in the form of loan guarantees to third-party lenders, letters of credit issued for the benefit of third-party lenders and similar credit enhancements. In the typical credit enhancement transaction, we charge the borrower a credit enhancement fee generally equal to 3% to 7% of the projected maximum amount of our outstanding credit enhancement obligation for each 12-month period such obligation is outstanding, in addition to any costs that we may incur in providing the credit enhancement. We cannot guarantee that we will obtain a 3% to 7% credit enhancement fee. The actual amount of such charges will be based on the risk perceived by our general partner to be associated with the transaction, the value of the collateral associated with the transaction, our security priority as to the collateral associated with the transaction, the form and term of the credit enhancement, and our overall costs associated with providing the credit enhancement.

We intend to reinvest the principal repayments we receive on loans to create or invest in new loans during the term of the Partnership. However, following the seventh anniversary of the effectiveness of the Offering on May 15, 2006, a limited partner may elect to receive his or her pro rata share of any loan principal repayments. Any capital not reinvested will be used first to return our limited partners’ capital contributions and then to pay distributions to our limited partners. Within 20 years after termination of the Offering, we will either (1) make an orderly disposition of investments and distribute the cash to investors or (2) upon approval of limited partners holding more than 50% of the outstanding units, continue the operation of the Partnership for the term approved by the limited partners.

Cash available for distributions consists of the funds received by us from operations (other than proceeds from a capital transaction or a liquidating distribution), less cash used by us to pay our expenses, debt payments, and amounts set aside to create a retained earnings reserve (currently at 9.5% of our net income; the retained earnings reserve is intended to recover some of the organization and offering expenses incurred in connection with the Offering). Our general partner receives a monthly distribution for promotional and carried interest from the cash available for distributions. Monthly distributions are currently paid to the limited partners as a 9.75% annualized return on a pro rata basis based on the number of days the limited partner has been invested in the Partnership. Retained earnings would contain a surplus if the cash available for distribution less the 9.5% reserve exceeded the monthly distributions to the general partner and limited partners. Retained earnings would contain a deficit if cash available for distributions less the 9.5% reserve is less than the monthly distributions to the general partner and limited partners. It is the intent of management to monitor and distribute such surplus on an annual basis. The chart below summarizes the approximate amount of distributions to our general partner and limited partners, the retained earnings reserve and the retained earnings deficit as of December 31, 2010 and 2009:

|

As of December 31,

|

||||||||||||||||

|

2010

|

2009

|

|||||||||||||||

|

General Partner

|

$ | 10,919,000 | (1) | $ | 6,789,000 | |||||||||||

|

Limited Partners

|

89,358,000 | (2) | 55,337,000 | (3) | ||||||||||||

|

Retained Earnings Reserve

|

2,663,000 | 844,000 | ||||||||||||||

|

Retained Earnings Deficit

|

(7,402,000 | ) | (5,413,000 | ) | ||||||||||||

________________

(1) approximately $7.9 million paid in cash and $3 million has been declared, but not paid.

|

|

(2) approximately $57.4 million paid in cash and approximately $32.0 million reinvested in 1,601,146 units of limited partnership interest under the DRIP and Secondary DRIP.

|

|

|

(3) approximately $34.8 million paid in cash and approximately $20.5 million reinvested in 1,026,716 units of limited partnership interest under the DRIP and Secondary DRIP.

|

6

Security

Our mortgage notes receivable are generally secured by:

|

|

·

|

the parcels of land to be developed;

|

|

|

·

|

in certain cases, a pledge of some or all of the equity interests in the developer entity;

|

|

|

·

|

in certain cases, additional assets of the developer, including parcels of undeveloped and developed real property; and

|

|

|

·

|

in certain cases, personal guarantees of the principals of the developer entity.

|

If there is no third-party financing for a development project, our lien on the subject parcels is a first priority lien. If there is third-party financing, our lien on the subject parcels is subordinate to such financing. We enter each loan prepared to assume or retire any senior debt if necessary to protect our capital. We seek to enter into agreements with third-party lenders that require the third-party lenders to notify us of a default by the developer under the senior debt and allow us to assume or retire the senior debt upon any default under the senior debt. As of December 31, 2010, 13% of the aggregate principal amount of mortgage notes we have originated was in a first lien position and 87% of the aggregate principal amount of mortgage notes we have originated was secured by a subordinate lien position, a pledge of partnership interests, or by both.

Most of our real estate loans, including loans made to entities affiliated with our general partner, have the benefit of unconditional guarantees of the developer and/or its parent company and pledges of additional assets of the developer.

Underwriting Criteria

When selecting mortgage loans and investments that we intend to originate or purchase, our general partner adheres to the following underwriting criteria:

|

|

·

|

Liens. All loans and investments made by us must be evidenced by a note and must be secured (1) by a first or second lien that is insured by a title insurance company, (2) by a pledge of the partnership interests in the special purpose entity holding the property or by both a subordinate lien position and a pledge of the partnership interests in the special purpose entity, or (3) by a commitment as to the priority of the loan or the condition of title. In addition, our loans and investments may be secured by a pledge of additional ownership interests of the developer and its affiliates in other development projects.

|

|

|

·

|

Interest Rate. We seek to originate loans bearing interest at rates ranging from 10% to 16% per annum.

|

|

|

·

|

Term and Amortization. We currently do not have a policy that establishes a minimum or maximum term for the loans we may make, nor do we intend to establish one. Loans typically are structured as interest-only notes with balloon payments or reductions to principal tied to net cash from the sale of developed lots and the release formula created by the senior lender, i.e., the conditions under which principal is repaid to the senior lender, if any.

|

|

|

·

|

Geographical Boundaries. We may buy or originate loans in any of the 48 contiguous United States. As of December 31, 2010, we have originated loans in Texas, Colorado, Arizona and New Mexico.

|

7

Credit Facility

On September 21, 2009, the Partnership entered into a Loan and Security Agreement (the “Loan Agreement”) with Wesley J. Brockhoeft (the “Lender”) pursuant to which the Lender has provided the Partnership with a revolving credit facility in the maximum principal amount of $15 million (the “Brockhoeft Credit Facility”). The interest rate on the Brockhoeft Credit Facility is equal to 10% per annum. Accrued interest on the outstanding principal amount of the Brockhoeft Credit Facility is payable monthly. The Brockhoeft Credit Facility is secured by a first priority lien on all of the Partnership’s existing and future assets. In consideration of the Lender originating the Brockhoeft Credit Facility, the Partnership paid the Lender an origination fee in the amount of $300,000. On June 21, 2010, the Partnership entered into the First Amendment to Loan and Security Agreement (the “Amended Loan Agreement”). Pursuant to the Amended Loan Agreement, the maturity date on the Brockhoeft Credit Facility was extended from September 20, 2010 to June 21, 2012. In addition, in accordance with the Amended Loan Agreement, the Partnership’s existing and future assets secure our guaranty of a $15 million loan (the “UDF I – Brockhoeft Loan”) from the Lender in favor of United Development Funding, L.P., an affiliated Delaware limited partnership (“UDF I”). The Amended Loan Agreement also provides for cross-default of the Brockhoeft Credit Facility with the UDF I – Brockhoeft Loan. In consideration for amending the loan, the Partnership paid the Lender an amendment fee in the amount of $150,000.

The intent of the Brockhoeft Credit Facility is to utilize it as transitory indebtedness to provide liquidity and to reduce and avoid the need for large idle cash reserves, including usage to fund identified investments pending receipt of proceeds from the partial or full repayment of loans. The Partnership does not intend to use the Brockhoeft Credit Facility to provide long-term or permanent leverage on Partnership investments. Proceeds from the operations of the Partnership will be used to repay the Brockhoeft Credit Facility. As of December 31, 2010, $15 million in principal was outstanding under the Brockhoeft Credit Facility. Interest expense associated with the Brockhoeft Credit Facility was approximately $1.5 million for the year ended December 31, 2010.

Borrowing Policies

The Partnership Agreement authorizes us to borrow funds up to an amount equal to 70% of the aggregate fair market value of all of our mortgage notes receivable. We are permitted by our Partnership Agreement to borrow money to:

|

|

·

|

acquire or make mortgage loans;

|

|

|

·

|

prevent defaults under senior loans or discharge them entirely if that becomes necessary to protect our interests; or

|

|

|

·

|

assist in the development or sale of any real property that we have taken over as a result of default.

|

If our general partner determines it is advantageous to us, we may borrow money only if such borrowings do not constitute “acquisition indebtedness” as such term is defined in Section 514 of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), and the Treasury Regulations and rulings thereunder. Our use of leverage increases our risk of loss, however, because defaults on indebtedness secured by our assets may result in lenders initiating foreclosure of our assets.

Investment Limitations

We have not invested as a general or limited partner in other limited partnerships, even though we are permitted to do so under limited circumstances, as provided by our Partnership Agreement and the North American Securities Administrators Association (“NASAA”) Mortgage Program Guidelines.

We do not underwrite securities of other issuers or invest in securities of other issuers for the purpose of exercising control. Notwithstanding the foregoing, we may invest in joint ventures or partnerships and in corporations in which real estate is the principal asset, provided that such acquisition can best be effected by the acquisition of the securities of such corporation, subject to the limitations set forth below.

We will not engage in the following activities:

|

|

·

|

acquire assets in exchange for units of limited partnership interest;

|

|

|

·

|

issue units of limited partnership interest after the termination of the Offering; or

|

|

|

·

|

make loans to our general partner or its affiliates except as permitted by our Partnership Agreement and the NASAA Mortgage Program Guidelines. Such loans are permitted under our Partnership Agreement and the NASAA Mortgage Program Guidelines if an independent advisor issues an opinion to the effect that the proposed loan is fair and at least as favorable to us as a loan to an unaffiliated borrower in similar circumstances.

|

8

Our general partner continually reviews our investment activity to attempt to ensure that we do not come within the application of the Investment Company Act of 1940, as amended. Among other things, our general partner monitors the proportion of our portfolio that is placed in various investments so that we do not come within the definition of an “investment company” under the Investment Company Act. See “Item 1A, Risk Factors – Risks Related to Our Business in General – Limited partners’ returns will be reduced if we are required to register as an investment company under the Investment Company Act of 1940.”

Conflicts of Interest

We do not have any officers, employees or directors, and we depend entirely on our general partner and its affiliates to manage our operations. As a result, we are subject to various conflicts of interest arising out of our relationship with our general partner and its affiliates, including conflicts related to the arrangements pursuant to which our general partner and its affiliates will be compensated by us. All of our agreements and arrangements with our general partner and its affiliates, including those relating to compensation, are not the result of arm’s length negotiations.

Our general partner, who makes all of our investment decisions, is responsible for managing our affairs on a day-to-day basis and for identifying and making loans on our behalf. UMT Holdings, L.P. (“UMT Holdings”) holds 99.9% of the limited partnership interests in our general partner. UMT Services, Inc. (“UMT Services”) owns the remaining 0.1% of the limited partnership interests in our general partner and serves as its general partner. Theodore “Todd” F. Etter, Jr. and Hollis M. Greenlaw, who are directors of UMT Services, own 100% of the equity interests in UMT Services.

Our general partner was organized in March 2003 and serves as the asset manager for UDF I and United Development Funding II, L.P. (“UDF II”), each a Delaware limited partnership and related party. An affiliate of our general partner serves as the advisor to United Mortgage Trust (“UMT”) and United Development Funding IV (“UDF IV”), each of which is a Maryland real estate investment trust. Our general partner serves as the asset manager for UDF IV. Our general partner manages and is also the general partner of United Development Funding Land Opportunity Fund, L.P., a Delaware limited partnership and related party (“UDF LOF”). UDF I, UDF II, UDF LOF and UDF IV are real estate finance companies that engage in the business in which we engage and in which we intend to engage.

Because we were organized and will be operated by our general partner, conflicts of interest will not be resolved through arm’s length negotiations but through the exercise of our general partner’s judgment consistent with its fiduciary responsibility to the limited partners and our investment objectives and policies. See Item 13, “Certain Relationships and Related Transactions, and Director Independence – Policies and Procedures for Transactions with Related Persons,” for a discussion of our policies and procedures for resolving potential conflicts of interest.

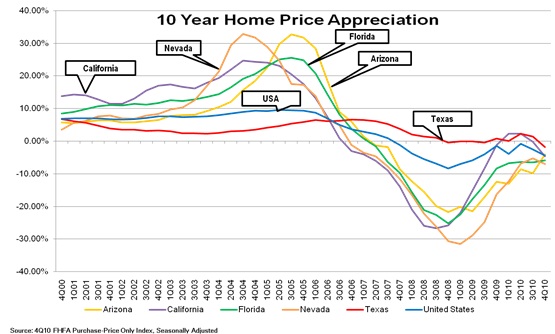

Housing Industry

The U.S. housing market has suffered declines over the past four years, particularly in geographic areas that had previously experienced rapid growth, steep increases in property values and speculation. In 2009, the homebuilding industry was focused on further reducing supply and inventory overhang of new single-family homes. In 2010, national and regional homebuilders began increasing the number of homes constructed from the number constructed in 2009. We believe that while demand for new homes has been affected across the country by the general decline of the housing industry, the housing markets in the geographic areas in which we have invested and intend to invest have not been impacted as greatly. Further, we believe that, as a result of the inventory reductions and corresponding lack of development over the past few years, the supply of new homes and finished lots have generally aligned with market demand in most real estate markets; more homes will be started in 2011 than in 2010; and we will likely see continued demand for our products in 2011.

9

Competition

Real estate financing is a very competitive industry. Our principal competitors are mortgage banks and other lenders. We compete with many other entities engaged in real estate investment activities, including individuals, corporations, bank and insurance company investment accounts, real estate investment trusts, other real estate limited partnerships and other entities engaged in real estate investment activities, many of which have greater resources than we do. Banks and larger real estate programs may enjoy significant competitive advantages that result from, among other things, a lower cost of capital and enhanced operating efficiencies. In addition, the proliferation of the Internet as a tool for loan origination has made it very inexpensive for new competitors to participate in the real estate finance industry. We believe that the demand for development loans is increasing, which may cause more lenders and equity participants to enter this market. Our ability to make or purchase a sufficient number of loans and investments to meet our objectives will depend on the extent to which we can compete successfully against these other lenders, including lenders that may have greater financial or marketing resources, greater name recognition or larger customer bases than we have. Our competitors may be able to undertake more effective marketing campaigns or adopt more aggressive pricing policies than we can, which may make it more difficult for us to attract customers. Increased competition could result in lower revenues and higher expenses, which would reduce our profitability.

Regulations

All real property and the operations conducted on real property are subject to federal, state and local laws, ordinances and regulations relating to environmental protection and human health and safety. These laws and regulations generally govern wastewater discharges, air emissions, the operation and removal of underground and above-ground storage tanks, the use, storage, treatment, transportation and disposal of solid and hazardous materials, and the remediation of contamination associated with disposals. Under limited circumstances, a secured lender, in addition to the owner of real estate, may be liable for clean-up costs or have the obligation to take remedial actions under environmental laws, including, but not limited to, the Federal Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended, or CERCLA. Some of these laws and regulations may impose joint and several liability for the costs of investigation or remediation of contaminated properties, regardless of fault or the legality of the original disposal. In addition, the presence of these substances, or the failure to properly remediate these substances, may adversely affect our ability to sell such property or to use the property as collateral for future borrowing.

Employees

We have no employees; however, our general partner and an affiliate of our general partner have a staff of employees who perform a range of services for us, including originations, acquisitions, asset management, accounting, legal and investor relations.

Financial Information About Industry Segments

Our current business consists only of originating, acquiring, servicing and managing mortgage loans on real property, acquiring participation interests in third-party mortgage loans on real property and issuing or acquiring an interest in credit enhancements to borrowers. We internally evaluate our activities as one industry segment, and, accordingly, we do not report segment information.

Available Information

We electronically file an annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports with the Securities and Exchange Commission (“SEC”). Copies of our filings with the SEC may be obtained from the web site maintained by our sponsor at http://www.udfonline.com or at the SEC’s website, at http://www.sec.gov. Access to these filings is free of charge. We are not incorporating our sponsor’s website or any information from the website into this Annual Report on Form 10-K.

10

Item 1A. Risk Factors.

The factors described below represent our principal risks. Other factors may exist that we do not consider to be significant based on information that is currently available or that we are not currently able to anticipate.

Risks Related to an Investment in UDF III

There is no public trading market for our units; therefore, it will be difficult for limited partners to sell their units.

There is no public trading market for our units of limited partnership interest, and we do not expect one to ever develop. Our Partnership Agreement restricts our ability to participate in a public trading market or anything substantially equivalent to a public trading market by providing that any transfer that may cause us to be classified as a publicly traded partnership as defined in Section 7704 of the Internal Revenue Code shall be deemed void and shall not be recognized by us. Because our classification as a publicly traded partnership may significantly decrease the value of limited partners’ units, our general partner intends to use its authority to the maximum extent possible to prohibit transfers of units that could cause us to be classified as a publicly traded partnership. As a result, it will be difficult for limited partners to sell their units.

Our units have limited transferability and lack liquidity.

Except for certain intra-family transfers, limited partners are limited in their ability to transfer their units. Our Partnership Agreement and certain state regulatory agencies have imposed restrictions relating to the number of units limited partners may transfer. In addition, the suitability standards imposed on prospective investors also apply to potential subsequent purchasers of our units. If limited partners are able to find a buyer for their units, they may not sell their units to such buyer unless the buyer meets the suitability standards applicable to him or her. Accordingly, it will be difficult for a limited partner to sell their units promptly or at all. Limited partners may not be able to sell their units in the event of an emergency, and if they are able to sell their units, they may have to sell them at a substantial discount. It is also likely that the units would not be accepted as the primary collateral for a loan.

Limited partners will not have the opportunity to evaluate our loans prior to their origination or purchase.

We invest substantially all of the Offering and Secondary DRIP proceeds available for investments, after the payment of fees and expenses, in the financing of raw or partially developed land for residential use, although we are not limited to such investments. Loans that we originate and/or purchase must meet our underwriting criteria. We rely entirely on our general partner with respect to the acquisition of our investments, and limited partners are not able to evaluate such investments. We cannot be sure that we will be successful in obtaining suitable investments. If we are unable to identify loans that satisfy our underwriting criteria or we are unable to invest in loans that satisfy our underwriting criteria in a timely fashion, our business strategy and operations may be adversely affected.

If we, through our general partner, are unable to find suitable investments, then we may not be able to achieve our investment objectives or pay distributions.

Our ability to achieve our investment objectives and to pay distributions is dependent upon the performance of our general partner in the identification of real estate loans and the determination of any financing arrangements. Investors must rely entirely on the management ability of our general partners. We cannot be sure that our general partner will be successful in obtaining suitable investments on financially attractive terms or at all, or that, if it makes investments on our behalf, our objectives will be achieved. If we, through our general partner, are unable to find suitable investments, it will be solely at the discretion of our general partner what action, if any, will be taken. In such an event, our ability to achieve our investment objectives and pay distributions to our limited partners would be adversely affected.

11

Competition with third parties in financing properties may reduce our profitability and the return on our limited partners’ investments.

Real estate financing is a very competitive industry. Our principal competitors are mortgage banks and other lenders. We also compete with many other entities engaged in real estate investment activities, including individuals, corporations, bank and insurance company investment accounts, real estate investment trusts, other real estate limited partnerships and other entities engaged in real estate investment activities, many of which have greater resources than we do. Banks and larger real estate programs may enjoy significant competitive advantages that result from, among other things, a lower cost of capital and enhanced operating efficiencies. In addition, the proliferation of the Internet as a tool for loan origination has made it very inexpensive for new competitors to participate in the real estate finance industry. Our ability to make or purchase a sufficient number of loans and investments to meet our objectives will depend on the extent to which we can compete successfully against these other lenders, including lenders that may have greater financial or marketing resources, greater name recognition or larger customer bases than we have. Our competitors may be able to undertake more effective marketing campaigns or adopt more aggressive pricing policies than we can, which may make it more difficult for us to attract customers. Increased competition could result in lower revenues and higher expenses, which would reduce our profitability.

The homebuilding industry has undergone a significant downturn, and its duration and ultimate severity are uncertain. Further deterioration in industry or economic conditions or in the broader economic conditions of the markets where we operate could further decrease demand and pricing for new homes and residential home lots and have additional adverse effects on our operations and financial results.

Developers to whom we make loans and with whom we enter into subordinate debt positions use the proceeds of our loans and investments to develop raw real estate into residential home lots. The developers obtain the money to repay our development loans by reselling the residential home lots to homebuilders or individuals who build single-family residences on the lots. The developer’s ability to repay our loans is based primarily on the amount of money generated by the developer’s sale of its inventory of single-family residential lots.

The homebuilding industry is cyclical and is significantly affected by changes in industry conditions, as well as in general and local economic conditions, such as:

|

·

|

employment levels and job growth;

|

|

·

|

demographic trends, including population increases and decreases and household formation;

|

|

·

|

availability of financing for homebuyers;

|

|

·

|

interest rates;

|

|

·

|

affordability of homes;

|

|

·

|

consumer confidence;

|

|

·

|

levels of new and existing homes for sale, including foreclosed homes; and

|

|

·

|

housing demand.

|

These may occur on a national scale or may affect some of the regions or markets in which we operate more than others. An oversupply of alternatives to new homes, such as existing homes, including homes held for sale by investors and speculators, foreclosed homes, and rental properties, can also reduce the homebuilder’s ability to sell new homes, depress new home prices, and reduce homebuilder margins on the sales of new homes, which likely would reduce the amount and price of the residential home lots sold by the developers to which we have loaned money and/or increase the absorption period in which such home lots are purchased.

12

Also, historically, the homebuilding industry uses expectations for future volume growth as the basis for determining the optimum amount of land and lots to own. In light of the much weaker market conditions encountered in 2006, which further deteriorated in 2007 and 2008 before bottoming in 2009, we believe that expectations have changed and that the homebuilding industry significantly slowed its purchases of land and lots as part of its strategy to reduce inventory to reflect the reduced rate of production.

We believe that the difficult conditions within the homebuilding industry reached a bottom in early 2009 and demand continues to be challenged in many markets. According to a joint release from the U.S. Department of Housing and Urban Development and the Census Bureau, the sale of new single-family homes in December 2010 was estimated to be at a seasonally-adjusted rate of 325,000, 8.7% below the December 2009 estimate. The median sales price of new homes sold in December 2010 was $235,000; the average sales price was $290,700. The seasonally-adjusted estimate of new houses for sale at the end of December 2010 was 189,000, representing a supply of 7.0 months at the December 2010 sales rate.

In such a business climate, developers to which we have loaned money may be unable to generate sufficient income from the resale of single-family residential lots to repay our loans. Accordingly, continued or further deterioration of homebuilding conditions or in the broader economic conditions of the markets where we operate could cause the number of homebuyers to decrease, which would increase the likelihood of defaults on our development loans and, consequently, reduce our ability to pay distributions to our limited partners.

We believe that housing market conditions remain challenging, and we cannot predict the duration or ultimate severity of such conditions. However, it is our intention to invest in stable markets demonstrating strong housing fundamentals and correcting markets with strong housing fundamentals. Our operations could be negatively affected to the extent that the housing industry downturn is prolonged or becomes more severe.

The reduction in availability of mortgage financing and the volatility and reduction in liquidity in the financial markets have adversely affected our business, and the duration and ultimate severity of the effects are uncertain.

Since 2007, the mortgage lending industry has experienced significant instability due to, among other things, defaults on subprime loans and a resulting decline in the market value of such loans. In light of these developments, lenders, investors, regulators and other third parties questioned the adequacy of lending standards and other credit requirements for several loan programs made available to borrowers in recent years. This has led to reduced investor demand for mortgage loans and mortgage-backed securities, tightened credit requirements, reduced liquidity and increased credit risk premiums. Deterioration in credit quality among subprime and other nonconforming loans has caused almost all lenders to eliminate subprime mortgages and most other loan products that are not conforming loans, FHA/VA-eligible loans or jumbo loans (which meet conforming underwriting guidelines other than loan size). Fewer loan products and tighter loan qualifications and any other limitations or restrictions on the availability of those types of financings in turn make it more difficult for some borrowers to finance the purchase of new homes and for some buyers of existing homes from move-up new home buyers to finance the purchase of the move-up new home buyer’s existing home. These factors have served to reduce the affordability of homes and the pool of qualified homebuyers and made it more difficult to sell to first time and first time move-up buyers which have long made up a substantial part of the affordable housing market. These reductions in demand increase the likelihood of defaults on our development loans and, consequently, reduce our ability to pay distributions to our limited partners. The duration and severity of such effects remain uncertain.

13

We also believe that the liquidity provided by Fannie Mae (Federal National Mortgage Association) and Freddie Mac (Federal Home Loan Mortgage Corporation) (“Government Sponsored Enterprises” or “GSEs”) to the mortgage industry is very important to the housing market. These entities have reported severe losses as a result of deteriorating housing and credit market conditions. These losses have reduced their equity and limited their ability to acquire mortgages. The director of the Federal Housing Finance Agency (“FHFA”), James B. Lockhart III, on September 7, 2008 announced his decision to place Fannie Mae and Freddie Mac into a conservatorship run by FHFA. That plan contained three measures: an increase in the line of credit available to the GSEs from the U.S. Treasury, so as to provide liquidity; the right of the U.S. Treasury to purchase equity in the GSEs, so as to provide capital; and a consultative role for the Federal Reserve in a reformed GSE regulatory system. The U.S. Treasury later announced a further increase in the line of credit available to the GSEs, providing guaranteed backing for all losses that they suffer. The U.S. Treasury’s support of the two GSEs while under conservatorship of the FHFA is intended to promote stability in the secondary mortgage market and lower the cost of funding. The GSEs modestly increased their mortgage-backed securities portfolios through the end of 2009. Then, to address systemic risk, their portfolios have begun to be gradually reduced, largely through natural run off, and will eventually stabilize at a lower, less risky size. To further support the availability of mortgage financing for millions of Americans, the U.S. Treasury initiated a temporary program to purchase GSE mortgage-backed securities, which expired with the U.S. Treasury’s temporary authorities in December 2009. Coinciding with the Treasury purchase program was the Federal Reserve, which purchased $1.25 trillion worth of mortgage-backed securities through the end of March 2010. This program ended on March 31, 2010, as scheduled by the Federal Reserve. As of the date of this annual report, the 30-year fixed-rate single-family residential mortgage interest rate remains below the rate that was available at the conclusion of the period of Federal Reserve purchases. We believe that such stability at low rates indicates that the secondary residential mortgage market is operating smoothly independent of the support previously provided by the Federal Reserve. However, any limitations or restrictions on the availability of financing or on the liquidity provided by the GSEs could adversely affect interest rates and mortgage availability and could cause the number of homebuyers to decrease, which would increase the likelihood of defaults on our loans and, consequently, reduce our ability to pay distributions to our limited partners.

The homebuilding industry’s strategies in response to the adverse conditions in the industry have had limited success, and the continued implementation of these and other strategies may not be successful.

Since the downturn began, most homebuilders have been focused on generating positive operating cash flow, resizing and reshaping their product for a more price-conscious consumer and adjusting finished new home inventories to meet demand, and did so in many cases by significantly reducing the new home prices and increasing the level of sales incentives. Notwithstanding these sales strategies, homebuilders continued to experience an elevated rate of sales contract cancellations in 2010 after briefly falling in the months before the expiration of the federal homebuyer tax credit. We believe that the heightened cancellation rate is largely due to a decrease in consumer confidence, due principally to the constant and negative national housing, financial industry, and economic news. A more restrictive mortgage lending environment, unemployment and the inability of some buyers to sell their existing homes have also impacted cancellations. Many of the factors that affect new sales and cancellation rates are beyond the control of the homebuilding industry.

A decrease in the number of new homes sold would increase the likelihood of defaults on our loans and, consequently, reduce our ability to pay distributions to our limited partners. It is uncertain how long the reduction in sales and the increased level of cancellations will continue.

14

Increases in interest rates, reductions in mortgage availability or increases in other costs of owning a home could prevent potential customers from buying new homes and adversely affect our business or our financial results.

Most new home purchasers finance their home purchases through lenders providing mortgage financing. Prior to the recent volatility in the financial markets, interest rates were at historical lows and a variety of mortgage products were available. As a result, homeownership became more accessible. The mortgage products available included features that allowed buyers to obtain financing for a significant portion or all of the purchase price of the home, had very limited underwriting requirements or provided for lower initial monthly payments. As a result, more people were able to qualify for mortgage financing.

Since 2007, the mortgage lending industry has experienced significant instability, beginning with increased defaults on subprime loans and other nonconforming loans and compounded by expectations of increasing interest payment requirements and further defaults. This in turn resulted in a decline in the market value of many mortgage loans and related securities. Lenders, regulators and others questioned the adequacy of lending standards and other credit requirements for several loan products and programs offered in recent years. Credit requirements tightened, and investor demand for mortgage loans and mortgage-backed securities declined. The deterioration in credit quality has caused almost all lenders to eliminate subprime mortgages and most other loan products that are not eligible for sale to Fannie Mae or Freddie Mac or loans that do not meet Federal Housing Administration (“FHA”) and Veterans Administration (“VA”) requirements. In general, fewer loan products, tighter loan qualifications and a reduced willingness of lenders to make loans in turn make it more difficult for many buyers to finance the purchase of homes. These factors serve to reduce the pool of qualified homebuyers and made it more difficult to sell to first time and move-up buyers.

We believe that the liquidity provided by Fannie Mae and Freddie Mac to the mortgage industry has been very important to the housing market. These entities have required substantial injections of capital from the federal government. These injections have been accompanied by criticism that the pool of homebuyers these institutions seek to assist should be reduced. Any reduction in the availability of the financing provided by these institutions could adversely affect interest rates, mortgage availability and the sales of new homes and mortgage loans.

In recent years, a growing number of homebuyers used down payment assistance programs, which allowed them to receive gift funds from non-profit corporations as a down payment. Homebuilders had been a source of funding for these programs. However, the American Housing Rescue and Foreclosure Prevention Act of 2008 eliminated seller-funded down payment assistance on FHA-insured loans approved on or after October 1, 2008. With the elimination of these gift fund programs, we expect that homebuilders will seek other financing alternatives to assist their customers, and seek down payment programs for those customers who meet applicable guidelines. There can be no assurance, however, that any such alternative programs are available or as attractive to homebuyers as the programs previously offered, and new home sales could suffer.

Because of the decline in the availability of other mortgage products, FHA and VA mortgage financing support has become a more important factor in marketing new homes. The American Housing Rescue and Foreclosure Prevention Act of 2008, however, includes a provision that increases a buyer’s down payment from at least 3% to at least 3.5% of the appraised value of the property on FHA-insured loans. This down payment requirement may impact the ability of homebuilders that meet the FHA guidelines to obtain financing. Additionally, this limitation and other limitations or restrictions on the availability of FHA and VA financing could adversely affect interest rates, mortgage availability and new home sales and mortgage loans.

We believe that the availability of FHA and VA mortgage financing is an important factor in marketing affordable homes. Any limitations or restrictions on the availability of the financing provided by them could adversely affect interest rates, mortgage financing and new homes sales.

Even if potential customers do not need financing, changes in interest rates and the availability of mortgage financing products may make it harder for them to sell their current homes to potential buyers who need financing.

A reduction in the demand for new homes may reduce the amount and price of the residential home lots sold by the developers to which we have loaned money and/or increase the absorption period in which such home lots are purchased and, consequently, increase the likelihood of defaults on our development loans.

15

We may suffer from delays in locating suitable investments, particularly as a result of the current economic environment and capital constraints, which could adversely affect the return on limited partners’ investments.

We could suffer from delays in locating suitable investments, particularly as a result of the current economic environment, capital constraints and our reliance on our general partner. Capital constraints at the heart of the current credit crisis have reduced the number of real estate lenders able or willing to finance development, construction and the purchase of homes, thus reducing the number of homebuilders and developers that are able to receive such financing. In the event that homebuilders and developers fail or reduce the number of their development and homebuilding projects, resulting in a reduction of new loan applicants, the availability of investments for us would also decrease. Such decreases in the demand for secured loans could leave us with excess cash. In such instances, we plan to make short-term, interim investments with proceeds available from sales of units and hold these interim investments, pending investment in suitable loans. Interest returns on these interim investments are usually lower than on secured loans, which may reduce our ability to pay distributions to our limited partners, depending on how long these interim investments are held.

When we invest in short-term, interim investments using proceeds from the sale of units, those limited partners will nevertheless participate pro rata in our distributions of income with holders of units whose sale proceeds have been invested in secured loans. This will favor, for a time, holders of units whose purchase monies were invested in interim investments, to the detriment of holders of units whose purchase monies are invested in normally higher-yielding secured loans.

Increases in interest rates could increase the risk of default under our development loans.

Developers to whom we make loans and with whom we enter into subordinate debt positions will use the proceeds of our loans and investments to develop raw real estate into residential home lots. The developers obtain the money to repay our development loans by reselling the residential home lots to home builders or individuals who build a single-family residence on the lot. The developer’s ability to repay our loans is based primarily on the amount of money generated by the developer’s sale of its inventory of single-family residential lots. If interest rates increase, the demand for single-family residences is likely to decrease. In a climate of higher interest rates, developers to which we have loaned money may be unable to generate sufficient income from the resale of single-family residential lots to repay our loans. Accordingly, increases in single-family mortgage interest rates could cause the number of homebuyers to decrease, which would increase the likelihood of defaults on our development loans and, consequently, reduce our ability to pay distributions to our limited partners.

Adverse market and economic conditions will negatively affect our returns and profitability.

Our results are sensitive to changes in market and economic conditions such as the level of employment, consumer confidence, consumer income, the availability of consumer and commercial financing, interest rate levels, supply of new and existing homes, supply of finished lots and the costs associated with constructing new homes and developing land. We may be affected by market and economic challenges, including the following, any of which may result from a continued or exacerbated general economic slowdown experienced by the nation as a whole or by the local economies where properties subject to our mortgage loans may be located:

|

·

|

poor economic conditions may result in a slowing of new home sales and corresponding lot purchases by builders resulting in defaults by borrowers under our mortgage loans;

|

|

·

|

job transfers and layoffs may cause new home sales to decrease;

|

|

·

|

lack of liquidity in the secondary mortgage market;

|

|

·

|

tighter credit standards for home buyers;

|

|

·

|

general unavailability of commercial credit; and

|

|

·

|

illiquidity of financial institutions.

|

The length and severity of any economic downturn cannot be predicted. Our operations could be negatively affected to the extent that an economic downturn is prolonged or becomes more severe.

16

The loans we make will have a higher risk than conventional real estate loans on residential properties.

We originate and purchase loans in respect of affiliated and unaffiliated third parties which are used by the borrowers to develop vacant parcels. Improvements made by such borrowers may, but will not necessarily, increase the value of the subject parcels. The loans are represented by notes that are secured by either a subordinated lien on the parcel if the developer has a development loan senior to our loan, or a first lien if we are the senior lender. In some instances where the subject parcel is encumbered by a lien in favor of a third party, we may, at our option, become the senior lender in order to protect the priority of our lien on the parcels. Our loans may also be secured by other assets of the developer. While we seek to obtain an unconditional guarantee of the developer and/or its parent companies to further secure the developer’s obligations to us, we cannot assure limited partners that we will obtain such an unconditional guarantee in all cases. If a default occurs under one or more of our loans, payments to us could be reduced or postponed. Further, in the event of a default, we may be left with a security or ownership interest in an undeveloped or partially developed parcel of real estate, which may have less value than a developed parcel. The guarantee of the developer and/or its parent companies and other pledged assets, if any, may be insufficient to compensate us for any difference in the amounts due to us under a development loan and the value of our interest in the subject parcel.

Decreases in the value of the property underlying our loans may decrease the value of our assets.

All of the loans we have made and, we expect, all of the loans we will make, are or will be secured by (1) an underlying lien on the real property to be developed, (2) a pledge of some or all of the equity interests in the developer entity, (3) personal guarantees of the principals of the developer entity, and/or (4) by a pledge of other assets owned by the developer or of ownership interests in the developer entity. To the extent that the value of the property that serves as security for these loans or investments is lower than we expect, the value of our assets, and consequently our ability to pay distributions to our limited partners, will be adversely affected.

We are subject to the general market risks associated with real estate development.

Our financial performance depends on the successful development and sale of the real estate parcels that serve as security for the loans we make to developers. As a result, we are subject to the general market risks of real estate development, including weather conditions, the price and availability of materials used in the development of the lots, environmental liabilities and zoning laws, and numerous other factors that may materially and adversely affect the success of the development projects. In the event the market softens, the developer may require additional funding and such funding may not be available. In addition, if the market softens, the amount of capital required to be advanced and the required marketing time for such development may both increase, and the developer’s incentive to complete a particular real estate development may decrease. Such circumstances may reduce our profitability and the return on the limited partners’ investments.

17

The prior performance of real estate investment programs sponsored by affiliates of our general partner may not be an indication of our future results.

We were formed in June 2005 and our general partner was formed in March 2003. Although key personnel of our general partner are experienced in operating businesses similar to our business, investors should not rely on the past performance of any other businesses of our key personnel, general partner, or affiliates to predict our future results. To be successful in this market, we must, among other things:

|

|

·

|

identify and acquire investments that further our investment strategy;

|

|

|

·

|

increase awareness of the United Development Funding name within the investment products market;

|

|

|

·

|

establish and maintain our network of licensed securities brokers and other agents;

|

|

|

·

|

attract, integrate, motivate and retain qualified personnel to manage our day-to-day operations;

|

|

|

·

|

respond to competition both for investment opportunities and potential investors in us; and

|

|

|

·

|

continue to build and expand our operations structure to support our business.

|

We cannot guarantee that we will succeed in achieving these goals, and our failure to do so could cause limited partners to lose all or a portion of their investment.

Limited partners must rely on our general partner for management of our business and will have no right or power to take part in our management.

Our future success will depend on the continued services of our general partner and its key personnel to manage the Partnership. Our general partner will provide all management and administrative services to us, and our limited partners will have no right or power to take part in our management. Our Partnership Agreement does not require our general partner to dedicate a minimum amount of time to the management of our business. Moreover, without the consent of our limited partners, our general partner may assign its general partnership interest in us to any person or entity that acquires substantially all of our general partners’ assets or equity interests. In the event that our general partner is unable or unwilling to continue to provide management services to us, our ability to execute our strategy and meet our business objectives could be materially adversely affected.

If we lose or are unable to obtain key personnel, our ability to implement our investment strategy could be delayed or hindered.

Our success depends on the diligence, experience and skill of the officers and employees of our general partner. Although our general partner or its affiliates have employment contracts with key personnel, these agreements are terminable at will, and we cannot guarantee that such persons will remain affiliated with our general partner or its affiliates. Our general partner, or affiliates of our general partner, has obtained key person life insurance policies on Mr. Hollis M. Greenlaw, Mr. Todd F. Etter and Mr. Ben L. Wissink. We have not obtained life insurance policies on any other key personnel involved in our operations and, therefore, have no insulation against extraneous events that may adversely affect their ability to implement our investment strategies. We believe that our future success depends, in large part, upon our general partner’s ability to hire and retain highly skilled managerial, operational and marketing personnel. Competition for highly skilled managerial, operational and marketing personnel is intense, and we cannot assure limited partners that we will be successful in attracting and retaining such personnel. The loss of any key person could harm our business, financial condition, cash flow and results of operations. If we lose or are unable to obtain the services of key personnel, our ability to implement our investment strategy could be delayed or hindered.

Our rights and the rights of our limited partners to recover claims against our general partner are limited.

Our Partnership Agreement provides that our general partner will have no liability, and that we will indemnify our general partner for any obligations, losses, damages, costs or other liabilities, arising out of any action or failure to act that the general partner in good faith determines was in our best interest, provided its action or failure to act did not constitute negligence or misconduct. As a result, we and our limited partners may have more limited rights against our general partner than might otherwise exist under common law. In addition, we may be obligated to fund the defense costs incurred by our general partner in some cases.

18

Risks Related to Conflicts of Interest

We will be subject to conflicts of interest arising out of our relationships with our general partner and its affiliates, including the material conflicts discussed below. When conflicts arise between us and our general partner and its affiliates, they may not be resolved in our favor, which could cause our operating results to suffer.

Our general partner has equity interests and/or profit participations in developments we finance and may have a greater incentive to make loans with respect to such development, which may or may not be subordinate to our mortgage loans, to preserve and/or enhance its economic interests in such development.

We have made loans and provided credit enhancement transactions and may continue to make loans and provide credit enhancement transactions to affiliates of our general partner. Any mortgage loan or any credit enhancement to any affiliate or our general partner must meet certain requirements, including receipt of a fairness opinion from an independent advisor as to the fairness of such mortgage loan or credit enhancement. Our general partner may choose to deploy and allocate funds for mortgage loans or credit enhancement transactions to affiliates of our general partner rather than to loans or credit enhancement transactions to unaffiliated third parties that may offer less risk of loss. If an affiliate of our general partner has an equity interest or participation interest in a development that requires a loan or credit enhancement, then our general partner may have a greater incentive to make a loan with respect to such development to preserve and/or enhance its economic interest in such development. Moreover, so long as it determines that it is advisable to do so in the exercise of its fiduciary duties to us, the general partner may cause us to make a loan or provide a credit enhancement to one of its affiliates in connection with a development in which such affiliates of our general partner hold an interest instead of another development in which affiliates of the general partner do not hold an interest.

Our general partner is the general partner for UDF LOF. An affiliate of our general partner is the advisor to UMT and UDF IV. Our general partner is an affiliate of the general partner of UDF I and UDF II and provides asset management services to UDF I, UDF II, UDF IV and UDF LOF. Our general partner may not always be able to allocate investment opportunities on a pro rata basis among us, UDF I, UDF II, UDF IV and UDF LOF.

Our general partner seeks to equitably apportion among us and the other United Development Funding programs all suitable investment opportunities of which it becomes aware. We entered into a participation agreement with UDF I, UDF II, UDF LOF and UDF IV pursuant to which we invest in the same loans and transactions as UDF I, UDF II, UDF LOF and UDF IV on a pro rata basis based on the amount of capital held by each entity that is available for investment. However, circumstances may arise, due to availability of capital or other reasons, when it is not possible for us to make an investment on such a pro rata basis. Our general partner may determine not to invest in otherwise suitable investments in which other United Development Funding programs will participate in order for us to avoid unrelated business taxable income, or “UBTI,” which is generally defined as income derived from any unrelated trade or business carried on by a tax-exempt entity or by a partnership of which it is a member, and which is generally subject to taxation. We cannot assure limited partners that we will be able to invest in all investment opportunities of which our general partner becomes aware that may be suitable for us on a pro rata basis or otherwise.

19