Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Williams Industrial Services Group Inc. | d8k.htm |

| EX-99.1 - PRESS RELEASE - Williams Industrial Services Group Inc. | dex991.htm |

1

Investor Presentation

Exhibit 99.2 |

2

This presentation contains "forward-looking statements" within the meaning of

that term set forth in the Private Securities Litigation Reform Act of 1995.

These statements reflect our current views of future events and financial performance

including, without limitations, our outlook and are subject to a number of risks and

uncertainties. Our actual results, performance or achievements may differ

materially from those expressed or implied in the forward-looking

statements. Risks and uncertainties that could cause or contribute to such material

differences include, but are not limited to: decreased demand for new gas turbine

power plants; reduced demand for, or increased regulation of, nuclear power; loss of

any of our major customers; cost increases

and

project

cost

overruns;

unforeseen

schedule

delays;

poor

performance

by

our

subcontractors; cancellation of projects; competition for the sale of our products and

services; shortages in, or increases in prices for, energy and materials such as steel

that we use to manufacture our products; damage to our reputation; warranty or product

liability claims; increased exposure to environmental or other liabilities; failure to

comply with various laws and regulations; failure to attract and retain

highly-qualified personnel; volatility of our stock price; deterioration or

uncertainty of credit markets; and changes in the economic, social and political

conditions in the United States and other countries in which we operate, including

fluctuations in foreign currency exchange rates, the banking environment or monetary

policy. Other important factors that may cause actual results to differ

materially from those expressed in the forward- looking statements are discussed in

our filings with the Securities and Exchange Commission, including the section of our

Annual Report on Form 10-K titled "Risk Factors." This presentation

speaks only as of the date hereof. We undertake no obligation to publicly update or

revise any forward-looking statements, whether as a result of new information,

future events or otherwise, and we caution you not to rely upon them unduly.

Forward-Looking Statements |

Market

Overview Market Overview

1.

Power Generation equipment and service is one of the largest industries worldwide

2.

Technology is stable

–

owners are conservative due to the large capital investments

3.

Economics of power generation plants are dynamic due to fluctuating fuel prices and

environmental compliance costs

4.

Service market is stable / slow growth and consistently profitable

5.

OEM / new equipment market is global, cyclical and generates higher risks and earnings

swings

Global Power

Mission Statement

Mission Statement

We

will

safely

provide

superior

engineered

products

and

services

that

exceed

customer standards while affording employees opportunities for career growth and

earning our investors a superior rate of return on their investment. 3

|

4

Global Power

What we do

Global

Power

Equipment

Group

Inc.

is

a

comprehensive

provider

of

power

generation

equipment

and

maintenance

services

for

customers

in

the

domestic

and

international

energy, power infrastructure and service industries. |

5

Global Power

Executive management

Tracy Pagliara

General Counsel, Secretary &

VP Business Development

25 yrs experience

David Willis

CFO & SVP

17 yrs experience

Ken Robuck

SVP & President of Services

28 yrs experience

Dean Glover

SVP & President of Products

20 yrs experience

David Keller

President & CEO

30 yrs experience |

6

A Global Presence

Cost effective / low risk OEM model takes us worldwide

Global Power Operations

Subcontract Fabricators |

Financial Overview

12/31/10 Snapshot

Market cap (3/9/11):

$356 million

Total unrestricted cash:

$55 million

Cash position net of term loan:

$56

million

Total backlog:

$349 million

Fully diluted shares:

16.3 million

Operating revenues:

$520

million

Net income:

$41

million

Earnings per fully diluted share:

$2.49

Consolidated operating EBITDA:

$54

million

Fiscal Year

2010

As of

12/31/10

Backlog and EBITDA are non-GAAP measures. See appendix for

reconciliation of EBITDA to net income and following slide

for additional information on backlog.

7 |

8

Snapshot of Backlog

Historical Backlog

Historical Backlog

Backlog (12/31/10)

Backlog (12/31/10)

$377

$333

$315

$349

Backlog is a non-GAAP measure and our methodology for determining backlog may

vary from the methodology used by other companies to determine their backlog. Backlog may not

be indicative of future operating results and projects in our backlog may be

cancelled, modified or otherwise altered by our customers. |

9

Blue Chip Customer Base

Bad debt expense and warranty claims from top 10 customers

represent 0.204% of consolidated revenues from 2007

– 2010

1) Issuer ratings published on various dates; above reflects most recent ratings as

of March 2011 2) Bond issue rating

Credit

% of GPEG

Bad Debt

Warranty

Relationship

Rating [1]

Revenue

Exp

Claims

Tenure

($ in 000's)

($ in 000's)

1.

General Electric

AA+ / stable

43 years

2.

Southern Company

A / stable

41 years

3.

Entergy

BBB / stable

2 years

4.

Tennessee Valley Authority

A / stable [2]

35 years

5.

Florida Power & Light Group

A- / stable

35 years

6.

Energy Northwest

AA / stable [2]

6 years

7.

Siemens

A+ / stable

40 years

8.

Jacksonville Electric Authority

A+ / stable [2]

20 years

9.

Alstom

BBB+ / Neg

19 years

10.

Mitsubishi

A+ / stable

17 years

Subtotal - Top Customers

79%

1,386

$

2,742

$

All Others

21%

Total Revenue

100%

Customer

2007 - 2010 |

10

Strategic Overview

Where we have been

Global Power has strengthened and repositioned itself over the last four

years Exited large-scale HRSG

product line

Divested foreign subsidiary

Successfully exited Chapter 11

Additional equity capital

Commenced trading under

“GLPW”

on Pink Sheets

Entered into $150m exit

facility:

-

$90m term loan

-

$60m revolver facility

New management

Successfully re-listed on NASDAQ to

capitalize on strong performance and

position company for growth

Solid financials/Operating Performance

(across 2008-10)

-

Unrestricted cash of $55.5m

-

Term loan repaid in full; access to

$25m under cash sub-facility of

revolver

Improving management systems and

controls |

11

Strategic Overview

Where we are going

Organic Outlook

Organic Outlook

2010 consolidated

operating income included in excess of $12 million of non-recurring positive gains

Products

OEM market expected to stabilize in 2011 resulting in increasing bookings activity for

revenues recognized in subsequent periods

-

2011 revenues expected to increase back to levels realized in 2009, but

-

2011 gross margins anticipated to reflect competitive market pricing conditions throughout

2010 with reported margins 2-3% below 2009 levels

Services

is positioned to pursue more capital projects; shift in mix from maintenance and modification

work could result in “lumpy”

bookings activity

-

2011

revenues

anticipated

to

reflect

upper

single

digit

declines

compared

to

2010

due

to

the

completion of a large capital project

-

2011

margins

anticipated

to

stabilize

at

historical

run

rates

of

10%

-

13%

2011 consolidated

operating expenses as a percentage of revenues expected to remain in line with 2010

ratios |

12

Strategic Overview

Where we are going

(cont’d) Acquisition Prospects

Acquisition Prospects

Products

acquisition potential targets include:

-

Bolt-on product lines

-

Product offerings that complement existing markets or broaden exposure beyond OEM

gas turbine cycle

Services

acquisitions potential targets include:

-

Specialty services that enhance our current capabilities

-

Engineering and design capabilities open additional EPC project opportunities (we

currently participate in this space through alliances with engineering firms or through

subcontract relationships)

Opportunities will be prioritized based on a disciplined valuation approach, strategic fit and

timeline for accretion to shareholders |

13

Global Power

Strong fundamental structure for a growing industry

Strong commercial risk / reward profile

Flexible manufacturing model

Geographic and end-market diversity

Long-standing relationships with a blue-chip customer base

Strong free cash flow generation

Favorable end-market dynamics

Acquisition growth opportunities |

14

Industry |

15

Poised For Growth

In a changing industry

Source: EIA, DOE Annual Energy Outlook, December, 2009

* Includes storage

1,008

Gigawatts

250

Gigawatts

Natural gas-fired plants utilizing gas turbine power generation equipment are expected

to account for 46% of capacity additions through 2035

Environmental concerns favor gas-fired generation, especially in countries with a high

dependence on coal-fired output

Nuclear

20%

Other

Renewables

10%

Coal

47%

Natural Gas

23%

2009 Capacity

Nuclear

3%

Other

Renewables

37%

Other

1%

Natural Gas

46%

Coal

13%

Hydropower*

0.4%

Capacity Additions through 2035 |

16

Comparative Economics

Source: Compiled by FERC staff from various sources

FERC forecast data demonstrates gas is expected to be a compelling fuel source for power

generation capacity additions

Nuclear

Conventional Coal

IGCC Coal

Combined Cycle (Gas)

Combustion Turbine (Gas)

Wind

2003-04

Geothermal

2008

Concentrated Solar

$/kw

$6,000

$7,000

$8,000

$0

$1,000

$2,000

$3,000

$4,000

$5,000 |

17

Coal to Gas Trend

Aging coal retirements should benefit gas

Source: Ventyx, DBCCA analysis 2010

…many of which are expected to be replaced by natural gas plants:

Almost half the U.S. coal fleet is old and inefficient with significant retirements

anticipated… Gas

Coal

Gas

Coal

Gas

Coal

Capacity (GW)

454.6

337.3

480.6

185.6

26

(151.7)

% of US Supply

23%

47%

35%

22%

12%

(25%)

2009

2030 Est.

Inc. / (Dec.)

Source: EIA, DBCCA analysis 2010

Anticipated Future

Coal Retirements

Total GW

Avg. Age

(years)

% of Existing

Capacity

2010 - 2020 period

60

62

2020 - 2030 period

92

47

45% |

United

States

currently

has

104

operating

nuclear

reactors

at

65

plant

sites

that

generate

about

20%

of

electricity used in the US. These plants have been in operation for an average of 30 years and

are operating at close to 90% capacity.

In 2000, the NRC issued the first license renewal to a nuclear power plant, extending its

license for an additional 20 years beyond its original 40-year license.

Capacity Factor Trend

Source: Department of Energy

Maintenance: A Multi-Billion Dollar Industry

Aging nuclear fleet that requires extensive ongoing services

18 |

19

Services Spectrum 2011

Nuclear Power

Plant

Maintenance

Fossil Fuel,

Hydroelectric

Power Plant

Maintenance

Industrial

Painting and

Coatings

Insulation

Roofing

Systems

Abatement

Valve Services

What it is

Performed during

outages,

decommissioning

services

Routine maintenance,

repair and capital project

services

Clearing, surface

preparation, coatings

application, quality

control and inspection

testing

Industrial insulation

services commonly

packaged with industrial

coatings projects

Replace, repair and

upgrade industrial facility

roofing systems

Removal of asbestos

and heavy metal based

coatings such as lead

paint

Inspection, preventative

maintenance, repair of

valves and actuators

Nature of

contract award

Primarily Cost Plus

Primarily Cost Plus

Cost Plus

Cost Plus

Cost Plus

Cost Plus

Cost Plus/Fixed Price

Key Players

Bartlett, Day &

Zimmerman,

Shaw Group,

URS

Alstom,

Babcock & Wilcox,

Foster

Wheeler,

Jingoli, Kiweit, Matrix,

Shaw Group, Southern

Industrial, URS, WW

Gay,

Yates

Brock,

K2 Industrial,

Manta

Brock,

K2 Industrial, LVI,

Shook and Fletcher,

Vulcan

Brock,

Denard, K2

Industrial

K2 Industrial, LVI,

Shook

and Fletcher, Vulcan

Day & Zimmerman,

Ames,

Crane |

20

Products Spectrum 2011

Filter Houses

Inlet Systems

Exhaust Systems

Diverter Dampers

HRSGs

Specialty Boilers

What it is

Cleans debris and dirt from

air that enters gas turbine

Connects the filter house to

gas turbine and provides

noise control

Directs hot exhaust from the

turbine to the atmosphere

Diverts hot exhaust from

the gas turbine into a HRSG

at a CCS facility, or into

exhaust stack at a simple

cycle facility

Boiler that creates steam to

drive a steam turbine used

for industrial processing

Highly customized system

to capture waste heat and

convert it to steam

Nature of

contract award

Fixed Price

Fixed Price

Fixed Price

Fixed Price

Fixed Price

Fixed Price

Key Players

AAF,

BHA/Altair, Camfill

Farr Eng,

Donaldson,

J&G

Steel, Bilfinger & Burger,

G&H

AAF,

BHA/Altair, Camfill

Farr Eng, Donaldson, J&G

Steel,

Bilfinger & Burger AAF, Atco/Higgot Kane,

Bachmann, Camfill Farr

Eng,

G&H, NEM Power

Systems

,

Peerless

Bachmann,

Camfill Farr

Eng,

Donaldson, NEM Power Systems

, Stejasa

EIT,

Vogt, Aalborg, NEM

Power Systems,

Nooter

Erikson

Rentech,

NEM Power Systems

, Technotherm |

21

Operating Divisions |

22

Braden

Headquarters in Tulsa, OK and

Herleen, The Netherlands

Global sales representatives located in

the US, The Netherlands, Egypt, Korea

and China

Braden engineers work exclusively on

gas turbine plan designs

Highly flexible outsourced

manufacturing model

-

25-30% In-house

-

70-75% Outsourced |

23

Supplied Filter Houses and Exhaust

Systems for 2 X 7FA Gas Turbine Power

Plant in Florida

All fabrication completed in house by

Braden Mexico

Stringent low noise acoustical

requirements

Two Customers:

-

Filter Houses Supplied to Turbine

OEM

-

Exhaust System supplied to the EPC

Braden

Greenland Energy Center Project -

Florida |

24

One of the world’s largest natural gas transmission projects; 12,000 miles across

China

71 gas turbine exhaust systems; 100% market share

Order executed in local currency using Braden Shanghai Office

Fabricated In China using local fabrication partners and locally

available material,

100% on time

Braden

West to East Gas Pipeline Project -

China |

Braden

The value model…attractive margins / low cost base

•

Proprietary designs

•

Extensive operating track record

•

High end quality

•

Commercial savvy

•

Low capital asset base

•

Low cost fabrication

•

Absence of performance

guarantees

Pricing Leverage

Attractive Profit Margins

Favorable Cost

Position

25 |

Braden

Industry

Braden primarily serves the

worldwide gas turbine market

Natural gas-fired plants expected

to account for 46% of capacity

additions, as compared with 37%

for renewables, 12% for coal-fired

power plants and 3% for nuclear

through 2035

Upwards trend on average revenue

per new unit shipped

Average Revenue per Turbine Shipped

*Information per internal company estimates; 2005 is unaudited

Source: DOE Annual Energy Outlook 2010

Braden Revenue & EBITDA

26 |

27

Williams

Headquarters in Tucker, GA

Seasoned Management/Project

Supervisory Staff

Top 5% in Industrial Safety Performance

Primarily Services US Nuclear Power

Plants

Multi-year Contracts for Nuclear Outage

Maintenance and Modification Work

Provider of Specialty Services at Nuclear and

Industrial Sites

-

On 35 of 65 Nuclear Plant Sites |

Williams

Value proposition

Client Benefits

28 |

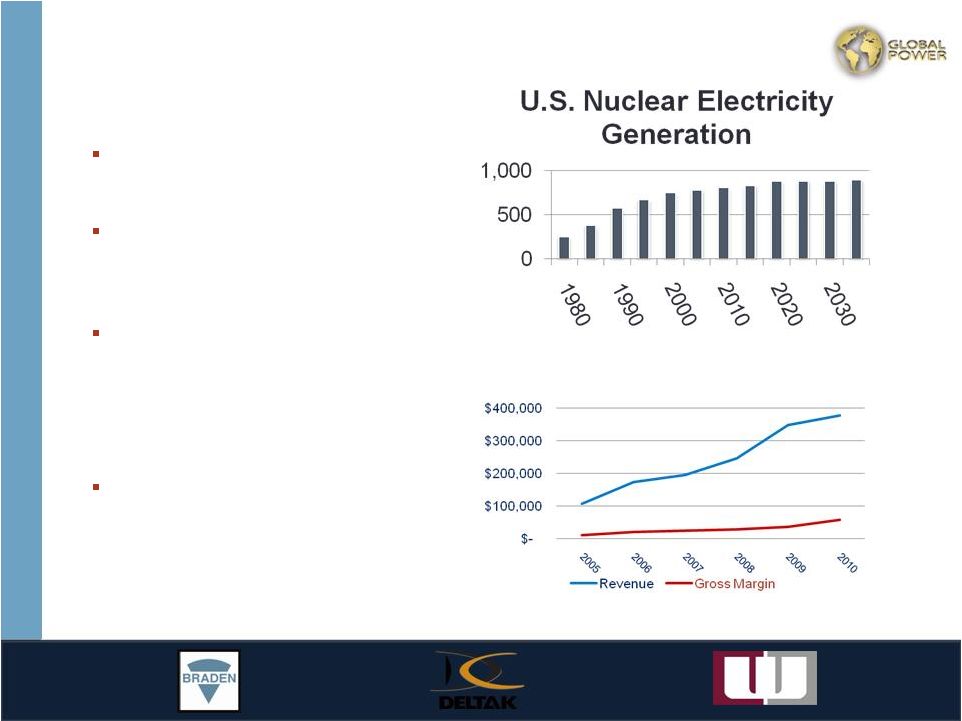

Williams

Industry

Williams primarily services U.S.

nuclear power plants

Nuclear power is a significant

component of the U.S. power

supply

Electricity generation from

nuclear power plants is expected

to grow from 806 billion kilowatt-

hours in 2008 to 898 billion

kilowatt-hours in 2035

The mix of future investments in

new power plants expected to

include fewer coal-fired plants

than other fuel technologies

Source: EIA Outlook, December 2009

*2005

is

unaudited;

reflects

results

post

acquisition

from

4/5/05

–

12/31/05

Billion

kwh

Williams Revenue & Gross Margin

29 |

Security

upgrades

for

entire

nuclear

fleet

–

North

and

South

Integrated design / build contract

ENERCON has design scope

Williams has construction, purchasing, and

subcontracts

Cameras, fencing, observation towers and other

security upgrades

Williams/ENERCON

Alliance for nuclear capital project

30 |

31

Williams

Energy Northwest reactor siding project

An excellent safety record with zero

recordables

while

working

200’

in

the

air

Only re-siding project in the world that was

performed while the station was on-line

Provided the client with specialized

methods for accessing the work area

Delivered the project under the estimated

funding and ahead of schedule

Completed extended condition repairs to

other buildings |

32

Williams

Company information

Employees

-

Approximately 250 FT

-

Up to 6,000 Craft

-

(Average 3,000)

Work Type

-

60% maintenance

-

30% capital projects

-

10% new construction

Double-breasted

-

Union labor

-

Non-union labor

Customers

-

70% private sector

-

65% repeat business |

33

Deltak

Headquarters in Plymouth, MN

Majority of manufacturing is completed

in-house for domestic projects

Specialty boiler systems for municipal

waste incinerators and chemical processes

Mid-sized HRSGs (<85MW) for power

applications, industrial process and

enhanced oil recovery |

34

Deltak

Industry

Industrial and utility markets which include refineries, petrochemical,

pharmaceutical, paper and pulp and steel companies, in addition to

utilities, account for the bulk of the market for cogeneration equipment

Deltak anticipates growth in the mid-sized HRSG and CHP markets

General shift towards lowering carbon off take adding momentum to

generation

Sweet spot refineries |

35

Global Power

Strong fundamental structure for a growing industry

Strong commercial risk / reward profile

Flexible manufacturing model

Geographic and end-market diversity

Long-standing relationships with a blue-chip customer base

Strong free cash flow generation

Favorable end-market dynamics

Acquisition growth opportunities |

36

David L. Keller

President and Chief Executive Officer

David

L.

Keller

served

as

the

President

and

Chief

Operating

Officer

of

The

Babcock

&

Wilcox

Company

(B&W), a wholly owned subsidiary of McDermott International, Inc., from March 2001 until

his retirement in June 2007. B&W, a company with approximately $2 billion in

revenues in 2006, supplies fossil-fuel fired boilers, commercial nuclear steam

generators, environmental equipment and components, and boiler auxiliary equipment and

provides related services, including construction services.

Mr.

Keller’s

prior

position

was

President

of

Diamond

Power

International,

Inc.,

a

wholly

owned subsidiary of B&W, from March 1998 to February 2001. During his tenure with B&W,

Mr.

Keller served as a Board Chairman or Director of subsidiaries and joint ventures in the

Peoples Republic of China, Denmark, the United Kingdom, Australia and South Africa. He

holds a Bachelor of Science degree in Mathematics from the University of Akron.

David L. Willis

Chief Financial Officer and Senior Vice President

•

David L. Willis has a broad range of leadership experience across a range of industries:

restructuring advisory services, telecommunications, energy companies and public

accounting. From October 2001 to

January

2008,

he

was

with

the

restructuring

practice

of

Alvarez

&

Marsal

LLC,

a

global

professional

services firm, where he served clients in advisory and interim management capacities, most

recently as Senior Director, overseeing the development and implementation of

initiatives to improve operational and financial performance. Prior to Alvarez &

Marsal, Mr. Willis held positions with The Williams Communications Group and Ernst

& Young. Mr. Willis received his Bachelor of Business Administration degree from

the Price College of Business at the University of Oklahoma and holds an M.B.A. from

the University of Tulsa. He is a Certified Public Accountant and has a Certified Insolvency

and Restructuring Advisor certification (inactive).

Management

Years of

Experience

30

17 |

37

Tracy D. Pagliara

General Counsel, Secretary and VP of Business Development

•

Tracy

D.

Pagliara

served

as

the

Chief

Legal

Officer

of

Gardner

Denver,

Inc.,

a

leading

global

manufacturer of highly engineered compressors, blowers, pumps and other fluid transfer

equipment, from

August

2000

through

August

2008.

He

also

had

responsibility

for

other

roles

during

his

tenure

with

Gardner

Denver,

including

Vice

President

of

Administration,

Chief

Compliance

Officer,

and

Corporate

Secretary.

Prior

to

joining

Gardner

Denver,

Mr.

Pagliara

held

positions

of

increasing

responsibility in the legal departments of Verizon Communications/GTE Corporation from August

1996 to August 2000 and Kellwood Company from May 1993 to August 1996, ultimately

serving in the role of

Assistant

General

Counsel

for

each

company.

Mr.

Pagliara

has

a

B.S.

in

Accounting

and

a

J.D.

from

the University of Illinois. He is a member of the Missouri and Illinois State Bars and a

Certified Public Accountant.

Kenneth W. Robuck

Senior Vice President and President of the Services Division

•

Kenneth W. Robuck originally joined the Williams Group in 1995; he left the company for a

brief period and

returned

in

2005

to

run

Williams

Plant

Services,

LLC,

the

largest

of

the

Williams’

subsidiaries,

which is responsible for all major maintenance and construction services work. In early 2006,

Mr. Robuck assumed the additional responsibility of Chief Operating Officer and was

appointed President of

the

Williams

Group

in

October

2007.

Mr.

Robuck

has

over

27

years

experience

in

the

nuclear

power,

fossil-fuel

power,

petrochemical

and

related

industrial

industries.

Mr.

Robuck

is

a

graduate

of

Auburn

University with a B.S. in Civil Engineering.

Management

Years of

Experience

25

28 |

38

Dean J. Glover

Senior Vice President and President of the Products Division

Dean J. Glover joined Braden Manufacturing in December 2005 as Chief Operating Officer and was

promoted

to

his

positions

at

Global

Power

and

Deltak

in

September

2008.

Mr.

Glover

has

extensive

international experience having lived in various international locations for most of his

career. Mr. Glover has over 18 years of commercial and technical experience in the

power industry. Prior to joining Global Power, Mr. Glover led the global supply chain,

including manufacturing for Diebold Inc. Prior to this, Mr. Glover spent 13 years with

General Electric in various managerial and technical roles and is a certified Six Sigma

Master Blackbelt. Mr. Glover holds a Bachelors Degree in Mechanical Engineering from the

University of Nebraska and an M.B.A. from the Kellogg Graduate School of Management,

Northwestern University.

•

Management

Years of

Experience

20 |

39

Appendix

Company history

The Braden Group founded as Braden Steel in 1923 in Tulsa

Various owners over the next six decades, vast assortment of products spanning several

industry sectors:

-

Metal buildings, air inlet and exhaust systems, large mining trucks, pump jacks, magnetic

containment enclosures, industrial incinerators, heat recovery boilers

The Williams Group formed in 1958 as a family owned specialty painting business

The Deltak Group formed in 1969 and spun out to employees in 1972

The Braden Group sold to Jason Incorporated in 1989, which also purchased the Deltak Group in

1994, forming Global Power’s predecessor, Jason Power Systems

GEEG Holdings L.L.C. created through leveraged buyout in 1998

-

Private equity sponsor —

Sawmill Capital

-

GEEG purchased by Harvest Partners in August 2000

-

Purchased Consolidated Fabricators in September 2000

Global Power Equipment Group formed through IPO in May, 2001

-

Purchased Deltak Power Equipment China (“DPEC”) in July

2004* -

Purchased the Williams Group in April 2005

* Sold in 2007 when Deltak exited the large-scale HRSG business

|

40

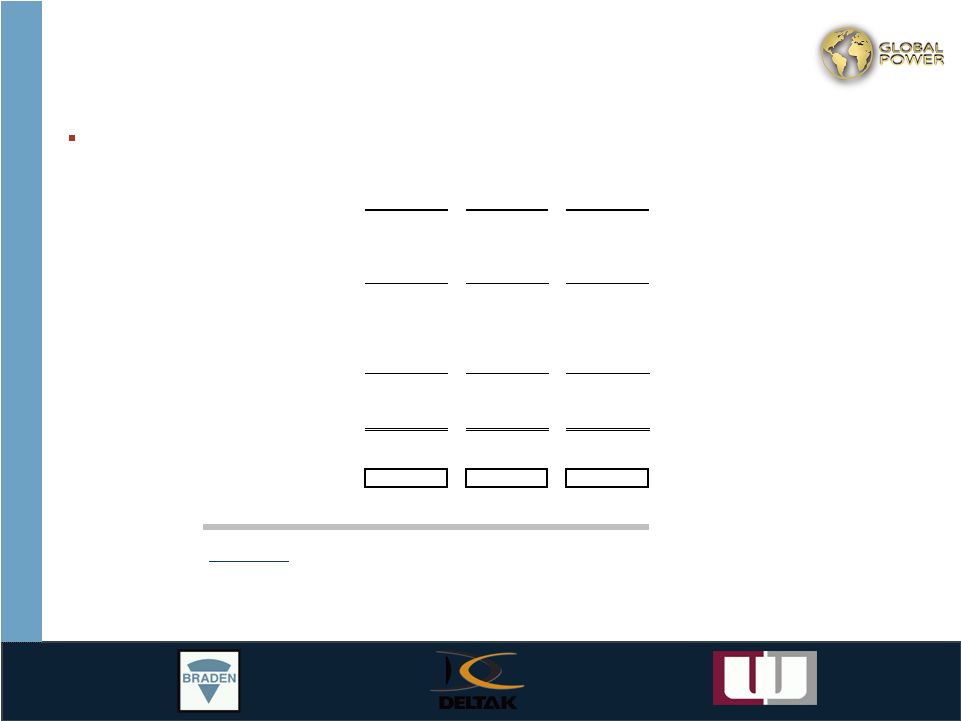

Appendix

Balance sheet highlights

GPEG has strengthened its balance by building cash and paying down debt since the

emergence from Chapter 11 in January 2008

NOTE: Certain prior period balances have been reclassified to conform to current period

presentation.

Cumulative

(in thousands)

3/31/08

12/31/08

12/31/09

12/31/10

Variances

Unrestricted Cash

36,540

$

57,633

$

103,220

$

55,474

$

$ 18,934

Restricted Cash

3,006

3,013

2,018

1,019

Other Current Assets

138,092

124,154

106,565

101,946

Current Assets

177,638

184,800

211,803

158,439

Fixed Assets

12,639

12,610

12,945

12,234

Goodwill & Intangibles

98,414

96,909

95,149

93,389

Other Assets

6,227

6,720

6,114

1,663

Total Assets

294,918

301,039

326,011

265,725

Accounts Payable / Accruals

44,665

42,588

59,392

43,377

Deferred Revenue

17,895

8,695

3,006

-

Other Current Liabilities

53,222

44,174

42,511

21,178

Current Liabilities

115,782

95,457

104,909

64,555

Term Debt (including current portion)

88,750

85,000

65,325

-

$ (88,750)

Other Long-Term Liabilities

19,379

15,309

19,299

22,114

Total Liabilities

223,911

195,766

189,533

86,669

Stockholders Equity

71,007

105,273

136,478

179,056

$ 108,049

Total Liabilities & Equity

294,918

$

301,039

$

326,011

$

265,725

$ |

41

Appendix

Operations highlights

Over this period, GPEG’s Products and Services platforms have balanced one another

through the recent cycle in the gas turbine OEM space

EBITDA is a non-GAAP measure; see following page for reconciliation to net

income. (in thousands)

2008

2009

2010

Revenue

556,764

$

540,610

$

520,144

$

Cost of Sales

456,784

460,185

417,623

Gross Profit

99,980

80,425

102,521

% of Revenue

18.0%

14.9%

19.7%

Operating Expenses

50,418

46,664

52,872

% of Revenue

9.1%

8.6%

10.2%

Operating Profit (Loss)

49,562

33,761

49,649

% of Revenue

8.9%

6.2%

9.5%

EBITDA

53,354

$

37,912

$

53,709

$

% of Revenue

9.6%

7.0%

10.3%

Revenue Mix

Products

56%

36%

27%

Services

44%

64%

73% |

42

Appendix

Reconciliation of EBITDA to net income

(in thousands)

2008

2009

2010

EBITDA

$ 53,354

$ 37,912

$ 53,709

Less:

Income tax provision

(3,151)

(5,282)

(6,410)

Interest expense

(11,667)

(9,667)

(7,052)

Depreciation and amortization

(3,792)

(4,151)

(4,060)

Reorganization items

(23,574)

(1,030)

1,477

Add:

Income from discontinued operations

23,668

10,105

2,971

Net Income

$ 34,838

$ 27,887

$ 40,635

NOTE: EBITDA reflected above excludes restructuring charges and

varies from EBITDA from Continuing Operations as

defined in our quarterly and annual press releases. |