Attached files

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

S ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 - For the fiscal year ended December 31, 2010

Commission file number 1-3919

|

Keystone Consolidated Industries, Inc.

|

|

(Exact name of Registrant as specified in its charter)

|

|

Delaware

|

37-0364250

|

|

|

(State or other jurisdiction of

Incorporation or organization)

|

(IRS Employer

Identification No.)

|

|

5430 LBJ Freeway, Suite 1740,

Three Lincoln Centre, Dallas, Texas

|

75240-2697

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Registrant’s telephone number, including area code:

|

(972) 458-0028

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

None.

|

|

Securities registered pursuant to Section 12(g) of the Act:

|

Title of each class

|

|

Common Stock, $.01 par value

|

Indicate by check mark:

If the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes £ No S

If the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes £ No S

Whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days. Yes S No £

If disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. S

Whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company (as defined in Rule 12b-2 of the Act).

Large accelerated filer £ Accelerated filer £ Non-accelerated filer S Smaller reporting company £

Whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes £ No S

-1-

The aggregate market value of the 4.6 million shares of voting stock held by nonaffiliates of the Registrant, as of June 30, 2010 (the last business day of the Registrant’s most-recently completed second fiscal quarter), was approximately $22.2 million.

Whether the Registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes S No £

As of March 17, 2011, 12,101,932 shares of common stock were outstanding.

Documents incorporated by reference

The information required by Part III is incorporated by reference from the Registrant’s definitive proxy statement to be filed with the Commission pursuant to Regulation 14A not later than 120 days after the end of the fiscal year covered by this report.

-2-

PART I

This Annual Report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements in this Annual Report on Form 10-K that are not historical in nature are forward-looking and are not statements of fact. Some statements found in this report including, but not limited to, statements found in Item 1 – "Business", Item 1A – "Risk Factors", Item 3 – "Legal Proceedings", Item 7 – "Management’s Discussion and Analysis of Financial Condition and Results of Operations" and Item 7A – "Quantitative and Qualitative Disclosures About Market Risk" are forward-looking statements that represent our beliefs and assumptions based on currently available information. In some cases you can identify these forward-looking statements by the use of words such as "believes", "intends", "may", "should", "could", "anticipates", "expected" or comparable terminology, or by discussions of strategies or trends. Although we believe the expectations reflected in forward-looking statements are reasonable, we do not know if these expectations will be correct. Forward-looking statements by their nature involve substantial risks and uncertainties that could significantly impact expected results. Actual future results could differ materially from those predicted. While it is not possible to identify all factors, we continue to face many risks and uncertainties. Among the factors that could cause our actual future results to differ materially from those described herein are the risks and uncertainties discussed in this Annual Report and those described from time to time in our other filings with the Securities and Exchange Commission (“SEC”) including, but not limited to, the following:

|

·

|

Future supply and demand for our products (including cyclicality thereof),

|

|

·

|

Customer inventory levels,

|

|

·

|

Changes in raw material and other operating costs (such as ferrous scrap and energy),

|

|

·

|

The possibility of labor disruptions,

|

|

·

|

General global economic and political conditions,

|

|

·

|

Competitive products (including low-priced imports) and substitute products,

|

|

·

|

Customer and competitor strategies,

|

|

·

|

The impact of pricing and production decisions,

|

|

·

|

Environmental matters (such as those requiring emission and discharge limits for existing and new facilities),

|

|

·

|

Government regulations and possible changes thereof,

|

|

·

|

Significant increases in the cost of providing medical coverage to employees,

|

|

·

|

The ultimate resolution of pending litigation, U.S. Environmental Protection Agency (“U.S. EPA”) investigations and audits conducted by the Internal Revenue Service,

|

|

·

|

International trade policies of the United States and certain foreign countries,

|

|

·

|

Operating interruptions (including, but not limited to, labor disputes, fires, explosions, unscheduled or unplanned downtime, supply disruptions and transportation interruptions),

|

|

·

|

Our ability to renew or refinance credit facilities,

|

|

·

|

The ability of our customers to obtain adequate credit, and

|

|

·

|

Any possible future litigation.

|

Should one or more of these risks materialize, if the consequences worsen, or if the underlying assumptions prove incorrect, actual results could differ materially from those forecasted or expected. We disclaim any intention or obligation to update or revise any forward-looking statement whether as a result of changes in information, future events or otherwise.

-3-

|

ITEM 1.

|

BUSINESS.

|

Keystone Consolidated Industries, Inc. (“KCI”) is a leading domestic producer of steel fabricated wire products, industrial wire and wire rod. We also manufacture wire mesh, coiled rebar, steel bar and other products. Our products are used in the agricultural, industrial, cold drawn, construction, transportation, original equipment manufacturer and retail consumer markets. We are vertically integrated, converting substantially all of our products from billet produced in our steel mini-mill. Historically, our vertical integration has allowed us to benefit from the higher and more stable margins associated with fabricated wire products and wire mesh as compared to wire rod, as well as from lower costs of billet and wire rod as compared to bar manufacturers and wire fabricators that purchase billet and wire rod in the open market. Moreover, we believe our downstream fabricated wire products, wire mesh, coiled rebar and industrial wire businesses are better insulated from the effects of wire rod imports as compared to non-integrated wire rod producers.

Our operating segments are organized by our manufacturing facilities and include three reportable segments:

|

·

|

Keystone Steel & Wire (“KSW”), located in Peoria, Illinois, operates an electric arc furnace mini-mill, rod mill, industrial wire mill and wire product fabrication facilities and manufactures and sells wire rod, coiled rebar, industrial wire, fabricated wire and other products to agricultural, industrial, construction, commercial, original equipment manufacturers and retail consumer markets;

|

|

·

|

Engineered Wire Products, Inc. (“EWP”), located in Upper Sandusky, Ohio, manufactures and sells wire mesh in both roll and sheet form that is utilized as reinforcement in concrete construction products including pipe, pre-cast boxes and applications for use in roadways, buildings and bridges; and

|

|

·

|

Keystone-Calumet, Inc. (“Calumet”), located in Chicago Heights, Illinois, manufactures and sells merchant and special bar quality products and special sections in carbon and alloy steel grades for use in agricultural, cold drawn, construction, industrial chain, service centers and transportation applications as well as in the production of a wide variety of products by original equipment manufacturers.

|

Calumet’s primary raw material is billet and EWP’s primary raw material is wire rod. Both Calumet and EWP source the majority of their primary raw material requirements from KSW.

For additional information about our segments see “Part II – Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 3 to our Consolidated Financial Statements.

We are the successor to Keystone Steel & Wire Company, which was founded in 1889. At December 31, 2010, Contran Corporation (“Contran”) owned approximately 62% of our outstanding common stock. In March 2011, Contran completed a tender offer in which it purchased 1.6 million shares of our common stock. Following completion of such purchase under the tender offer, Contran owns approximately 75% of our outstanding shares. Substantially all of Contran's outstanding voting stock is held by trusts established for the benefit of certain children and grandchildren of Harold C. Simmons (for which Mr. Simmons is the sole trustee) or is held directly by Mr. Simmons or other persons or companies related to Mr. Simmons. Consequently, Mr. Simmons may be deemed to control Contran and us.

-4-

Unless otherwise indicated, references in this report to "we", "us" or "our" refer to KCI and its subsidiaries, taken as a whole.

Manufacturing

Overview

Our manufacturing operations consist of an electric arc furnace mini-mill, a rod mill, a wire mill, an industrial wire mill and three steel product fabrication facilities as outlined in our segment discussion above. The manufacturing process commences at KSW where ferrous scrap is melted in an electric arc furnace, converted into molten steel and then transferred to a ladle refining furnace where chemistries and temperatures are monitored and adjusted to specifications prior to casting. The molten steel is transferred from the ladle refining furnace into a six-strand continuous casting machine which produces five-inch square strands, referred to as billets, that are cut to predetermined lengths. These billets are then either transferred to the adjoining rod mill, shipped to Calumet for the production of steel bars or sometimes sold to third party customers.

Upon entering the rod mill, the billets are brought to rolling temperature in a reheat furnace and are fed through the rolling mill, where they are rolled into either wire rod or coiled rebar in a variety of diameters, surface characteristics and specifications. After rolling, the wire rod or rebar is coiled and cooled. After cooling, the coiled wire rod or rebar passes through inspection stations for metallurgical, surface and diameter checks. Finished coils are compacted and tied. Coiled rebar is shipped to customers and wire rod is either further processed into industrial wire, wire mesh and fabricated wire products at KSW’s industrial wire mill and wire product fabrication facilities at KSW or EWP, or shipped to wire rod customers.

While we do not maintain a significant "shelf" inventory of finished wire rod, we generally have on hand approximately a one-month supply of industrial wire, wire mesh, coiled rebar, fabricated wire products and steel bars inventory which enables us to fill customer orders and respond to shifts in product demand.

Raw Materials and Energy

The primary raw material used in our operations is ferrous scrap. Our steel mill is located close to numerous sources of high density automobile, industrial and railroad ferrous scrap. Currently all of these sources are readily available and we believe they will continue to be available for the foreseeable future. We believe we are one of the largest recyclers of ferrous scrap in Illinois. The purchase of ferrous scrap is highly competitive and its price volatility is influenced by periodic shortages, export activity, freight costs, weather and other conditions beyond our control. The cost of ferrous scrap can fluctuate significantly and product selling prices cannot always be adjusted, especially in the short-term, to recover the costs of increases in ferrous scrap prices. We have not entered into any hedging programs or long-term contracts for the purchase or supply of ferrous scrap; therefore, we are subject to the price fluctuation of ferrous scrap.

Our manufacturing processes consume large amounts of energy in the form of electricity and natural gas. Electricity in Illinois is not regulated. KSW and Calumet have energy service agreements whereby, on a daily basis for electricity and on a monthly basis for natural gas, we are required to notify the utility providers of the amount of energy we expect to consume on the next day or over the next month, respectively. The price we pay for energy is determined when we provide notification based on the forecasted hourly energy market rate for the next day or the next month for electricity and gas, respectively. All other tariff, transmission and utility charges are passed through at cost and the supplier adds a per energy unit charge for administration and margin. Any difference between our forecasted consumption and actual consumption is billed or credited to our account based on the actual hourly market rate. However, to allow us to avoid pricing fluctuations, the contracts allow us, at our discretion, to purchase blocks of energy for future usage at prices negotiated at the time of purchase. We could sell any unused quantities under such contracts at market rates such that our only exposure on fixed price quantities is the difference between the contracted price and the market price.

-5-

The power supply at our KSW facility is interruptible and we agreed to a minimum interruption period of 4 hours per occurrence and at least 5 or more interruption events during the summer season. We would be compensated for each interruption based on market rates and the difference between our forecasted and actual consumption for the interruption period. We incurred no such interruptions during 2008, 2009 or 2010.

Employment

As of December 31, 2010, we employed 974 people as follows:

|

·

|

6 at our corporate office;

|

|

·

|

820 at KSW, of which 672 are represented by the Independent Steel Workers’ Alliance (the “ISWA”) under an agreement expiring in May 2012;

|

|

·

|

76 at EWP, of which 62 are represented by Local Union #40, an Affiliate to the International Brotherhood of Teamsters' Chauffeurs Warehousemen and Helpers of America (the “AFL-CIO”), under an agreement expiring in November 2011; and

|

|

·

|

72 at Calumet.

|

We believe our labor relations are good.

Products, Markets and Distribution

The following table sets forth certain information with respect to our product mix in each of the last three years.

|

Years Ended December 31,

|

||||||||||||||||||||||||

|

2008

|

2009

|

2010

|

||||||||||||||||||||||

|

Product

|

Percent

of Tons

Shipped

|

Percent

of

Sales

|

Percent

of Tons

Shipped

|

Percent

of

Sales

|

Percent

of Tons

Shipped

|

Percent

of

Sales

|

||||||||||||||||||

|

Wire rod

|

58.5 | % | 48.8 | % | 60.8 | % | 46.0 | % | 63.8 | % | 52.6 | % | ||||||||||||

|

Fabricated wire products

|

14.7 | 21.3 | 15.6 | 28.2 | 12.2 | 20.8 | ||||||||||||||||||

|

Industrial wire

|

10.4 | 12.1 | 8.2 | 9.6 | 8.8 | 10.7 | ||||||||||||||||||

|

Wire mesh

|

9.2 | 11.3 | 9.7 | 11.7 | 7.9 | 9.3 | ||||||||||||||||||

|

Bar

|

3.1 | 3.0 | 3.2 | 3.3 | 4.0 | 4.8 | ||||||||||||||||||

|

Coiled rebar

|

2.6 | 2.3 | 1.2 | 0.8 | 1.2 | 1.0 | ||||||||||||||||||

|

Other

|

1.5 | 1.2 | 1.3 | 0.4 | 2.1 | 0.8 | ||||||||||||||||||

| 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | |||||||||||||

Wire Rod. We produce primarily low carbon wire rod and some higher carbon wire rod at KSW’s rod mill. Low carbon wire rod, with carbon content of up to 0.38%, is more easily shaped and formed than higher carbon wire rod and is suitable for a variety of applications where ease of forming/manipulation is a consideration while higher carbon steel is stronger. Our higher carbon wire rod business represented 10% of wire rod production during 2010, and we expect it to grow during 2011 in order to meet the developing U.S. demand for high carbon steel. During 2010, we used approximately 32% of the wire rod we manufactured to produce our industrial wire, wire mesh and fabricated wire products. The remainder of our wire rod production was sold directly to producers of construction products, fabricated wire products and industrial wire, including products similar to those we manufacture.

-6-

Fabricated Wire Products. KSW is one of the leading U.S. manufacturers of agricultural fencing, barbed wire, stockade panels and a variety of woven wire, fabric and netting for agricultural and industrial applications. We sell these products to agricultural, industrial, consumer do-it-yourself and other end-user markets, which we believe are less cyclical than many steel consuming end-use markets such as the automotive, construction, appliance and machinery manufacturing industries. We serve these markets through distributors, agricultural retailers, building supply centers and consumer do-it-yourself chains such as Tractor Supply Co. and Lowe's Companies, Inc. We believe our ability to service these customers with a wide range of fabricated wire products through multiple distribution locations provides a competitive advantage in accessing these growing and less cyclical markets. As part of our marketing strategy, we provide category management recommendations based on a data collection and analysis tool we created and we design merchandise packaging and supportive product literature for marketing many of these products to the retail consumer market.

KSW also manufactures products for residential and commercial construction, including rebar ty wire and stucco netting. The primary customers for these products are construction contractors and building materials manufacturers and distributors.

We believe our fabricated wire products are less susceptible to selling price changes caused by the cyclical nature of the steel business than industrial wire, coiled rebar or wire rod because the commodity-priced raw materials used in these products, such as ferrous scrap, represent a lower percentage of the total cost of these value-added products.

Industrial Wire. KSW is one of the largest manufacturers of industrial wire in the United States. We produce custom-drawn industrial wire in a variety of gauges, finishes and packages for further consumption by our fabricated wire products operations or for sale direct to industrial fabrication and original equipment manufacturer customers, who are generally not our competitors. Our industrial wire is used by customers in the production of a broad range of finished goods, including nails, coat hangers, barbecue grills, air conditioners, tools, containers, refrigerators and other appliances.

Wire mesh. EWP manufactures a wide variety of wire mesh rolls and sheets used to form wire reinforcement in concrete construction projects such as pipe, precast boxes and other applications, including use in roadways, buildings and bridges. Our wire mesh customers include pipe manufacturers, culvert manufacturers, rebar fabricators and steel reinforcing distributors. Like our fabricated wire products, we believe our wire mesh products are also less susceptible to selling price changes caused by the cyclical nature of the steel business than industrial wire, coiled rebar or wire rod because the commodity-priced raw materials used in these products, such as ferrous scrap, represent a lower percentage of the total cost of such value-added products when compared to wire rod or other less value-added products.

Bar. Calumet manufactures merchant and special bar quality products and special sections in carbon and alloy steel grades, offering a broad range of value-added products for use in agricultural, cold drawn, construction, industrial chain, service centers and transportation applications as well as in the production of a wide variety of products by original equipment manufacturers. Calumet’s product line consists primarily of angles, flats, channels, rounds, squares and other related products.

-7-

Coiled Rebar. We produce several sizes of coiled rebar at KSW’s rod mill. The coils are typically used by fabricators who will process the material as straightened and cut-to-length bars or fabricated shapes for specific reinforcement applications such as building and road construction.

Trademarks

Many of our fencing and related fabricated wire products are marketed under our RedBrand® label, a widely recognized brand name in the agricultural fencing and construction marketplaces for more than 85 years. RedBrand® sales represented approximately 77% of our fabricated wire products net sales in 2010. We also maintain other trademarks for various products that are promoted in their respective markets.

Customers

Our customers are primarily located in the Midwestern, Southwestern and Southeastern regions of the United States. Our customers vary considerably by product. We believe our ability to offer a broad range of products represents a competitive advantage in servicing the diverse needs of our customers.

Our segments are not dependent upon a single customer or a few customers, and the loss of any one, or a few, would not have a material adverse effect on our business. The percentage of external sales related to (1) our segments’ ten largest customers and (2) the customers at each of our segments that accounted for more than 10% of that segment’s external sales during 2010 (one customer at KSW and two customers at EWP)is set forth in the following table:

|

KSW

|

EWP

|

Calumet

|

||||||||||

|

Ten largest customers:

|

||||||||||||

|

% of segments’ sales

|

62 | % | 51 | % | 50 | % | ||||||

|

% of consolidated sales

|

53 | % | 5 | % | 3 | % | ||||||

|

Customers > 10%:

|

||||||||||||

|

% of segments’ sales

|

12 | % | 24 | % | - | |||||||

|

% of consolidated sales

|

10 | % | 2 | % | - | |||||||

Seasonality

Historically, we have experienced greater sales and profits during the second and third quarters of each year due to the seasonality of sales in principal fabricated wire products and wire mesh markets, including the agricultural and construction markets.

Backlog

Our backlog of unfilled, cancelable steel products purchase orders approximated $25.9 million and $62.3 million at December 31, 2009 and 2010, respectively. We do not believe backlog is a significant factor in our business, and we expect all of the backlog at December 31, 2010 will be shipped during 2011.

Industry and Competition

The fabricated wire products, wire mesh, industrial wire, bar, coiled rebar and wire rod businesses in the United States are highly competitive and are comprised primarily of several large mini-mill wire rod producers, many small independent wire companies and a few large diversified wire producers. We also face significant foreign competition. Lower wage rates, less regulatory requirements and foreign cost discrepancies sometimes result in market prices that significantly reduce or even eliminate the profitability of certain products.

-8-

We believe we are well positioned to compete effectively due to:

|

·

|

the breadth of our fabricated wire products, wire mesh, industrial wire and bar offerings;

|

|

·

|

our ability to service diverse geographic and product markets;

|

|

·

|

the relatively low cost of our internal supply of billet and wire rod; and

|

|

·

|

our reputation for superior product quality.

|

We believe our facilities are well located to serve the Midwestern, Southwestern and Southeastern regions of the United States. Close proximity to our customer base provides us with certain advantages over foreign and certain domestic competition including reduced shipping costs, improved customer service and shortened delivery times.

Wire Rod. Since wire rod is a commodity steel product, we believe the wire rod market is more competitive than the fabricated wire products and industrial wire markets, and price is the primary competitive factor. Among our principal domestic competitors in these markets are Gerdau Ameristeel and Rocky Mountain Steel. We also face significant foreign competition. The domestic steel industry continues to experience consolidation. During the last ten years, we and the majority of our major domestic competitors have either filed for protection under Federal bankruptcy laws and discontinued operations, were acquired, or reduced or completely shut-down operations. We believe these shut-downs or production curtailments represent a significant decrease in estimated domestic annual capacity. However, worldwide overcapacity in the steel industry continues to exist and imports of wire rod have become much more substantial in recent years and increased significantly from 2009 to 2010.

Fabricated Wire Products and Industrial Wire. Our principal competitors in the fabricated wire products and industrial wire markets are Leggett & Platt, Deacero, Oklahoma Steel and Wire and Davis Wire. Competition in the fabricated wire products and industrial wire markets is based on a variety of factors, including distribution channels, price, delivery performance, product quality, service and brand name preference. Our RedBrand® label has been a widely recognized brand name in the agricultural fencing and construction marketplaces for more than 85 years. Additionally, we believe higher transportation costs and the lack of local distribution centers tend to limit foreign producers' penetration into our principal fabricated wire products and industrial wire markets, but we do not know if this will continue to be the case.

Wire mesh. Our principal competitor in our wire mesh markets is Insteel Wire Products. We also face competition from smaller regional manufacturers and wholesalers of wire mesh products. We believe EWP’s superior products and renowned customer service distinguish EWP from its competitors. In addition, we believe our vertical integration enhances EWP’s ability to compete more effectively in the market as EWP can rely on a more stable supply of wire rod. Competitors of EWP have at times faced raw material shortages that have negatively impacted their daily production capability and delivery reliability.

Bar. Our principal competitors in our bar business include Gerdau Ameristeel, Nucor Corporation and Alton Steel. The primary competitive factors are delivered price and the breadth of product within the production capability of the mill. Calumet frequently conducts trials for different customer-specific products which usually results in new customers and increased sales volume. Calumet’s mill location in Chicago Heights, Illinois is well suited to serve the bar market in the upper Midwest.

-9-

Coiled Rebar. The principal competitors for our assortment of coiled rebar products include Gerdau Ameristeel, Rocky Mountain Steel and Nucor Connecticut. The primary competitive factors of the coiled rebar business are delivered price, coil size and product quality. Due to our location, we believe we can effectively serve customers in the Midwestern region of the United States.

Environmental Matters

Our production facilities are affected by a variety of environmental laws and regulations, including laws governing the discharge of water pollutants and air contaminants, the generation, containment, transportation, storage, treatment and disposal of solid wastes and hazardous substances and the handling of toxic substances, including certain substances used in, or generated by, our manufacturing operations. Many of these laws and regulations require permits to operate the facilities to which they pertain. Denial, revocation, suspension, delay in modification or expiration of such permits could impair the ability of the affected facility to continue operations.

We record liabilities related to environmental issues when information becomes available and is sufficient to support a reasonable estimate of a range of probable loss. If we are unable to determine that a single amount in an estimated range is more likely, the minimum amount of the range is recorded. At December 31, 2010, the upper end of the range of reasonably possible costs to us for sites where we have been named a defendant is approximately $2.1 million, including our recorded accrual of $.7 million.

We believe our current operating facilities are in material compliance with all presently applicable federal, state and local laws regulating the discharge of materials into the environment, or otherwise relating to the protection of the environment. Environmental legislation and regulations change rapidly and we may be subject to increasingly stringent environmental standards in the future.

Information in Note 8 to our Consolidated Financial Statements is incorporated herein by reference.

Financing and Other Activities

We routinely compare our liquidity requirements against our estimated future cash flows. As a result of this process, we have in the past and may in the future seek to raise additional capital, refinance or restructure indebtedness, consider the sale of interests in subsidiaries, business units or other assets, or take a combination of such steps or other steps, to increase liquidity, reduce indebtedness and fund future activities. Such activities have in the past and may in the future involve related companies. From time to time, we and related entities also evaluate the restructuring of ownership interests among our subsidiaries and related companies and expect to continue this activity in the future and may in connection with such activities, consider issuing additional equity securities and increasing our indebtedness.

On August 31, 2005 we emerged from Chapter 11 proceedings that began in 2004. During 2007, the final pending claims of our bankruptcy were settled or fully adjudicated. However, at that time, an amendment to one of our postretirement benefit plans was in negotiation. Upon finalization of that amendment in 2008, we sought final closure of our bankruptcy case and on September 11, 2008, the United States Bankruptcy Court for the Eastern District of Wisconsin issued our final decree.

-10-

Availability of Company Reports Filed with the SEC

Our fiscal year is 52 or 53 weeks and ends on the Sunday closest to December 31 of each year. We furnish our stockholders with annual reports containing audited financial statements. In addition, we file annual, quarterly and current reports, proxy and information statements and other information with the SEC. We also make our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments thereto, available free of charge through our website at www.keystoneconsolidated.com as soon as reasonably practical after they have been filed with the SEC. We also provide to anyone, without charge, copies of such documents upon written request. Requests should be directed to the attention of the Corporate Secretary at our address on the cover page of this Form 10-K.

The general public may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. We are an electronic filer. The SEC maintains an Internet website at www.sec.gov that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC, including us.

|

ITEM 1A.

|

RISK FACTORS.

|

Listed below are certain risk factors associated with our businesses. In addition to the potential effect of these risk factors discussed below, any risk factor which could result in reduced earnings or operating losses, or reduced liquidity, which could in turn adversely affect our ability to service our liabilities or adversely affect the quoted market prices for our publicly-traded securities.

Our leverage may impair our financial condition or limit our ability to operate our businesses.

We fund our operations primarily through cash from operations and borrowings on our revolving credit facility. Our revolving credit facility requires us to use our daily cash receipts to reduce outstanding borrowings, which results in us maintaining zero cash balances when there are balances outstanding under the credit facility. The amount of available borrowings under our revolving credit facility is based on formula-determined amounts of trade receivables and inventories.

Our revolving credit facility requires us to maintain a minimum fixed charge coverage ratio, as defined in the agreement, of 1.0 if excess availability falls below $10.0 million. At December 31, 2010 excess availability was $38.8 million. Current forecasts indicate that we will be able to maintain excess availability of at least $10.0 million throughout 2011. However, if future operating results differ materially from our predictions and excess availability falls below $10.0 million, we could violate our fixed charge coverage ratio requirement if the fixed charge coverage ratio at such time is less than 1.0. The credit facility is collateralized by substantially all of our operating assets and failure to comply with the covenants contained in the credit facility could result in the acceleration of the outstanding balance under the facility prior to its stated maturity date. Additionally, our lender can restrict our ability to incur additional secured indebtedness and can declare a default under the credit facility in the event of, among other things, a material adverse change in our business. In the event of an uncured default of our credit facility agreement, we would seek to refinance the facility with a new group of lenders or, if required, we will use other existing liquidity resources (which could include funds provided by our affiliates). However, there is no assurance that such financing could be obtained, or if obtained that it would not be on terms that would result in higher costs to us (such as a higher interest rate on outstanding borrowings). If we were unable to obtain such financing, our liquidity could be negatively affected.

-11-

Our dependence on borrowing availability from our revolving credit facility could have important consequences to our stockholders and creditors, including:

|

·

|

making it more difficult for us to satisfy our obligations with respect to our liabilities;

|

|

·

|

increasing our vulnerability to adverse general economic and industry conditions;

|

|

·

|

requiring a portion of our cash flow from operations be used for the payment of interest on our debt, therefore reducing our ability to use our cash flow to fund working capital, capital expenditures, acquisitions and general corporate requirements;

|

|

·

|

limiting our ability to obtain additional financing to fund future working capital, capital expenditures, acquisitions and general corporate requirements;

|

|

·

|

limiting our flexibility in planning for, or reacting to, changes in our business, regulatory requirements and the industry in which we operate; and

|

Demand for, and prices of, certain of our products are cyclical and we are currently operating in depressed market conditions, which may result in reduced earnings or operating losses.

A significant portion of our revenues are attributable to sales of products into the agricultural and construction industries. These two industries themselves are cyclical and changes in those industries’ economic conditions can significantly impact our earnings and operating cash flows. We believe these industries were at the lowest point of their business cycle during 2009 and began a modest recovery during 2010. However, we are unable to predict with a high degree of certainty when demand will return to the levels experienced prior to the fourth quarter of 2008. Our operating results and our business and financial condition could be adversely affected by, among other things, economic conditions, availability of credit to fund agricultural and construction projects, short and long-term weather patterns, interest rates and embargos placed by foreign countries on U.S. agricultural products.

We sell the majority of our products in mature and highly competitive industries and face price pressures in the markets in which we operate, which may result in reduced earnings or operating losses.

The markets in which we operate our businesses are highly competitive. Competition is based on a number of factors, such as price, product quality, delivery times and service. Some of our competitors may be able to drive down prices for our products because the competitors’ costs are lower than our costs. In addition, some of our competitors’ financial, technological and other resources may be greater than our resources, and such competitors may be better able to withstand negative changes in market conditions. Our competitors may be able to respond more quickly than we can to new or emerging technologies and changes in customer requirements. Further, consolidation of our competitors or customers in any of the industries in which we compete may result in reduced demand for our products. Additionally, in some of our businesses new competitors could emerge by modifying their existing production facilities so they could manufacture products that compete with our products. The occurrence of any of these events could result in reduced earnings or operating losses.

-12-

Many of EWP’s products are ultimately used in infrastructure projects by local, state or federal governments.

Such projects are impacted by the availability of governmental funding for such projects. A decline in the availability of governmental funds for such projects could ultimately result in a decline in demand or selling prices of EWP’s products. Such a decline could result in reduced earnings or operating losses.

Wire rod continues to be imported into the U.S. Global producers of wire rod are able to import their products into the U.S. with minimal tariffs and duties.

Many of these global wire rod producers are able to produce wire rod at costs lower than we incur in our production. As such, these wire rod imports are often able to be priced at lower levels than similar products manufactured by us. In addition, we believe certain foreign governments subsidize their local wire rod producers. These events can adversely impact our shipment levels and pricing decisions and, as such, could result in reduced earnings or operating losses.

Higher costs or limited availability of ferrous scrap may decrease our liquidity.

The cost of ferrous scrap, our primary raw material, can fluctuate significantly and our product selling prices cannot always be adjusted, especially in the short-term, to recover the costs of increases in ferrous scrap prices. Additionally, should our local ferrous scrap suppliers not be able to meet their contractual obligations, we may incur higher costs for ferrous scrap.

Climate change legislation could negatively impact our financial results or limit our ability to operate our businesses.

We believe all of our production facilities are in substantial compliance with applicable environmental laws. Proposed legislation is being considered to limit green house gases through various means, including emissions permits and/or energy taxes. Our production facilities consume large amounts of energy, including electricity and natural gas. To date the permit system in effect has not had a material adverse effect on our financial results. However, future green house gas legislation could negatively impact our future results from operations through increased costs of production, particularly as it relates to our energy requirements. If such increased costs of production were to materialize, we may be unable to pass price increases on to our customers to compensate for increased production costs, which may decrease our liquidity, operating income and results of operations.

-13-

|

ITEM 1B.

|

UNRESOLVED STAFF COMMENTS.

|

None.

|

ITEM 2.

|

PROPERTIES.

|

Our principal executive offices are located in leased space at 5430 LBJ Freeway, Suite 1740, Dallas, Texas 75240-2697.

Our production facilities utilize approximately 2.3 million square feet for manufacturing, approximately 85% of which is located at our Peoria, Illinois facility.

The following table sets forth the location, size and general product types produced for each of our manufacturing facilities as of December 31, 2010, all of which are owned by us:

|

Facility Name

|

Location

|

Approximate

Size

(Square Feet)

|

Primary Products Produced for External Sales

|

||||

|

Keystone Steel & Wire

|

Peoria, IL

|

1,951,000 |

Fabricated wire products, industrial wire and wire

rod

|

||||

|

Engineered Wire Products

|

Upper Sandusky, OH

|

126,000 |

Wire mesh

|

||||

|

Keystone-Calumet

|

Chicago Heights, IL

|

216,000 |

Steel bar

|

||||

| 2,293,000 | |||||||

We believe all of our facilities are adequately maintained and are satisfactory for their intended purposes.

|

ITEM 3.

|

LEGAL PROCEEDINGS.

|

We are also involved in various legal proceedings. Information required by this Item is included in Notes 8 and 9 to our Consolidated Financial Statements, which information is incorporated herein by reference.

|

ITEM 4.

|

RESERVED.

|

-14-

PART II

|

ITEM 5.

|

MARKET FOR REGISTRANT'S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS.

|

Our common stock trades on the OTC Bulletin Board (Symbol: KYCN).

At December 31, 2010, Contran owned approximately 62% of our outstanding common stock. In March 2011, Contran completed a tender offer in which it purchased 1.6 million shares of our common stock. Following completion of such purchase under the tender offer, Contran owns approximately 75% of our outstanding shares.

As of March 10, 2011, we had approximately 1,178 holders of record of our common stock at a closing price of $6.35. The following table sets forth the high and low closing per share sales prices for our common stock for the periods indicated:

|

High

|

Low

|

|||||||

|

Year ended December 31, 2009

|

||||||||

|

First quarter

|

$ | 6.25 | $ | 2.80 | ||||

|

Second quarter

|

$ | 3.32 | $ | 2.25 | ||||

|

Third quarter

|

$ | 4.11 | $ | 2.70 | ||||

|

Fourth quarter

|

$ | 5.05 | $ | 3.50 | ||||

|

Year ended December 31, 2010

|

||||||||

|

First quarter

|

$ | 5.50 | $ | 4.00 | ||||

|

Second quarter

|

$ | 5.97 | $ | 4.65 | ||||

|

Third quarter

|

$ | 6.05 | $ | 4.55 | ||||

|

Fourth quarter

|

$ | 5.75 | $ | 4.55 | ||||

|

First quarter 2011 through March 10, 2011

|

$ | 6.55 | $ | 4.70 | ||||

Historically, we have not paid cash dividends on our common stock as we have chosen to retain all earnings to fund working capital requirements, capital expenditures and scheduled debt repayments.

-15-

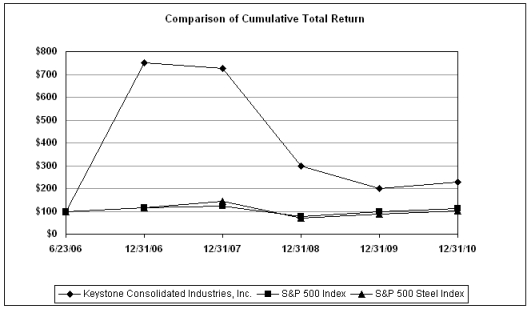

Performance Graph - Set forth below is a line graph comparing the change in our cumulative total stockholder return on our common stock against the cumulative total return of the S&P 500 Index and the S&P 500 Steel Index for the period from June 23, 2006 (the first date on which our common stock began public trading following our emergence from Chapter 11 bankruptcy protection) through December 31, 2010. The graph shows the value at December 31 of each year assuming an original investment of $100 at June 23, 2006.

|

June 23,

|

December 31,

|

|||||||||||||||||||||||

|

2006

|

2006

|

2007

|

2008

|

2009

|

2010

|

|||||||||||||||||||

|

Keystone common stock

|

$ | 100 | $ | 750 | $ | 725 | $ | 300 | $ | 200 | $ | 228 | ||||||||||||

|

S&P 500 Index

|

100 | 115 | 121 | 76 | 97 | 111 | ||||||||||||||||||

|

S&P 500 Steel Index

|

100 | 117 | 142 | 69 | 88 | 101 | ||||||||||||||||||

-16-

|

ITEM 6.

|

SELECTED FINANCIAL DATA.

|

The following selected consolidated financial data should be read in conjunction with our Consolidated Financial Statements and Item 7. "Management's Discussion and Analysis Of Financial Condition And Results Of Operations."

|

Years ended December 31,

|

||||||||||||||||||||

|

2006

|

2007

|

2008

|

2009

|

2010

|

||||||||||||||||

|

(In thousands, except per share and per ton amounts)

|

||||||||||||||||||||

|

Statement of Operations Data:

|

||||||||||||||||||||

|

Net sales

|

$ | 440,540 | $ | 451,178 | $ | 562,693 | $ | 322,347 | $ | 450,745 | ||||||||||

|

Operating income

|

79,750 | 97,972 | 110,493 | 3,209 | 16,462 | |||||||||||||||

|

Defined benefit pension credit (expense)

|

55,978 | 80,443 | 73,923 | (5,887 | ) | 4,654 | ||||||||||||||

|

OPEB credit

|

8,297 | 8,526 | 8,474 | 4,748 | 5,258 | |||||||||||||||

|

Operating income before pension and OPEB (1)

|

15,475 | 9,003 | 28,096 | 4,348 | 6,550 | |||||||||||||||

|

Gain on cancellation of debt

|

- | 10,074 | - | - | - | |||||||||||||||

|

Gain on legal settlement

|

- | 5,400 | - | - | - | |||||||||||||||

|

Provision for income taxes

|

(17,055 | ) | (37,619 | ) | (40,014 | ) | (2,292 | ) | (6,493 | ) | ||||||||||

|

Net income

|

$ | 57,732 | $ | 64,765 | $ | 66,114 | $ | 241 | $ | 8,743 | ||||||||||

|

Basic and diluted income per share

|

$ | 5.77 | $ | 6.48 | $ | 5.73 | $ | 0.02 | $ | 0.72 | ||||||||||

|

Basic and diluted weighted average shares outstanding (2)

|

10,000 | 10,000 | 11,533 | 12,102 | 12,102 | |||||||||||||||

|

Other Operating Data:

|

||||||||||||||||||||

|

Shipments (000 tons):

|

||||||||||||||||||||

|

Wire rod

|

349 | 395 | 343 | 257 | 381 | |||||||||||||||

|

Fabricated wire products

|

112 | 103 | 86 | 66 | 73 | |||||||||||||||

|

Industrial wire

|

75 | 66 | 61 | 34 | 52 | |||||||||||||||

|

Wire mesh

|

67 | 58 | 54 | 41 | 47 | |||||||||||||||

|

Bar

|

- | 9 | 18 | 13 | 24 | |||||||||||||||

|

Coiled rebar

|

1 | 15 | 15 | 5 | 7 | |||||||||||||||

|

Other

|

71 | 2 | 9 | 6 | 12 | |||||||||||||||

|

Total

|

675 | 648 | 586 | 422 | 596 | |||||||||||||||

|

Per-ton selling prices:

|

||||||||||||||||||||

|

Wire rod

|

$ | 500 | $ | 548 | $ | 797 | $ | 575 | $ | 618 | ||||||||||

|

Fabricated wire products

|

1,037 | 1,089 | 1,380 | 1,373 | 1,277 | |||||||||||||||

|

Industrial wire

|

726 | 763 | 1,103 | 897 | 915 | |||||||||||||||

|

Wire mesh

|

870 | 896 | 1,168 | 916 | 878 | |||||||||||||||

|

Bar

|

- | 663 | 946 | 782 | 888 | |||||||||||||||

|

Coiled rebar

|

529 | 563 | 841 | 540 | 622 | |||||||||||||||

|

All products in total

|

645 | 690 | 955 | 760 | 749 | |||||||||||||||

|

Average per-ton ferrous scrap cost of goods sold

|

$ | 210 | $ | 235 | $ | 368 | $ | 262 | $ | 294 | ||||||||||

|

Increase (decrease) in LIFO reserve and cost of

goods sold (3)

|

$ | 3,367 | $ | 5,713 | $ | 10,142 | $ | (15,200 | ) | $ | 5,423 | |||||||||

|

Other Financial Data:

|

||||||||||||||||||||

|

Capital expenditures

|

$ | 18,739 | $ | 16,602 | $ | 13,298 | $ | 9,000 | $ | 14,937 | ||||||||||

|

Depreciation and amortization

|

15,222 | 15,434 | 15,164 | 13,584 | 12,062 | |||||||||||||||

-17-

|

As of December 31,

|

||||||||||||||||||||

|

2006

|

2007

|

2008

|

2009

|

2010

|

||||||||||||||||

|

(In thousands)

|

||||||||||||||||||||

|

Balance Sheet Data:

|

||||||||||||||||||||

|

Working capital

|

$ | 31,776 | $ | 20,630 | $ | 55,886 | $ | 49,063 | $ | 55,095 | ||||||||||

|

Property, plant and equipment, net

|

88,695 | 92,469 | 89,987 | 85,169 | 88,009 | |||||||||||||||

|

Total assets

|

763,936 | 763,023 | 249,733 | 265,084 | 357,217 | |||||||||||||||

|

Total debt

|

76,448 | 91,577 | 31,630 | 25,370 | 28,681 | |||||||||||||||

|

Stockholders’ equity (2)

|

403,662 | 404,694 | 119,644 | 147,770 | 191,736 | |||||||||||||||

|

(1)

|

Because pension and other postretirement benefit (“OPEB”) expense or credits are unrelated to the operating activities of our businesses, we measure and evaluate the performance of our businesses using operating income before pension and OPEB credit or expense. As such, we believe the presentation of operating income before pension and OPEB credit or expense provides more useful information to investors. Operating income before pension and OPEB credit or expense is a non-GAAP measure of profitability that is not in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and it should not be considered in isolation or as a substitute for a measure prepared in accordance with GAAP. A reconciliation of operating income as reported to operating income adjusted for pension and OPEB expense or credit is set forth in the following table.

|

|

Years ended December 31,

|

||||||||||||||||||||

|

2006

|

2007

|

2008

|

2009

|

2010

|

||||||||||||||||

|

(In thousands)

|

||||||||||||||||||||

|

Operating income as reported

|

$ | 79,750 | $ | 97,972 | $ | 110,493 | $ | 3,209 | $ | 16,462 | ||||||||||

|

Defined benefit pension expense (credit)

|

(55,978 | ) | (80,443 | ) | (73,923 | ) | 5,887 | (4,654 | ) | |||||||||||

|

OPEB credit

|

(8,297 | ) | (8,526 | ) | (8,474 | ) | (4,748 | ) | (5,258 | ) | ||||||||||

|

Operating income before pension/OPEB

|

$ | 15,475 | $ | 9,003 | $ | 28,096 | $ | 4,348 | $ | 6,550 | ||||||||||

|

(2)

|

On March 24, 2008 we issued 2.5 million shares of our common stock and received net proceeds of $24.7 million pursuant to a subscription rights offering.

|

|

(3)

|

We use the last-in-first-out (“LIFO”) method to determine the cost of the majority of our productive inventories. Changes in LIFO reserves are reflected in cost of goods sold.

|

-18-

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

|

RESULTS OF OPERATIONS

Business Overview

Recent Developments

Due to competitive pressures, we experienced significant margin compression during 2010 as we were not able to implement selling price increases sufficient to entirely recover increases in operating costs. We implemented selling price increases on selected products in December 2010 and throughout the first quarter of 2011 as ferrous scrap market prices continued to escalate. We currently believe we will be able to maintain positive overall margins on our products throughout 2011. However, we do not know when or if market conditions will allow us to raise selling prices sufficient enough to increase profitability to historical levels.

Customer orders were strong at the end of 2010 and based on current expectations that the economy will continue to recover at a modest pace, we believe 2011 shipment volumes will approximate 2010 shipment volumes.

Results of Operations

Our profitability is primarily dependent on sales volume, per-ton selling prices and per-ton ferrous scrap and energy costs.

Operating income before pension and OPEB for 2010 was slightly higher than 2009 primarily due to the net effects of the following factors:

|

·

|

increased selling prices for wire rod, industrial wire, bar and coiled rebar;

|

|

·

|

lower selling prices for fabricated wire products and mesh as competitive conditions in those markets resulted in an inability to raise selling prices;

|

|

·

|

increased sales volume during 2010 as economic conditions during the first half of 2009 resulted in a sharp reduction of customer orders;

|

|

·

|

higher production levels during the first half of 2010 as we operated our facilities on substantially reduced production schedules during the first half of 2009 given the sharp reduction in demand, which resulted in a much higher percentage of fixed costs being included in cost of goods sold during 2009 as these costs could not be capitalized into inventory (fixed costs as a percentage of sales were 6.1% during 2010 as compared to 8.2% during 2009);

|

|

·

|

increased electricity costs at our largest manufacturing facility during 2010;

|

|

·

|

increased maintenance costs during 2010 due to increased production;

|

|

·

|

decreases in our LIFO reserve and cost of goods sold during 2009 of $15.2 million as compared to a $5.4 million increase in our LIFO reserve and cost of goods sold during 2010 as discussed in Note 3 to our Consolidated Financial Statements;

|

|

·

|

impairment charges of $2.8 million to reduce certain inventories to net realizable value during 2009 compared to nominal similar charges during 2010;

|

|

·

|

bad debt expense of $2.9 million during 2009 primarily due to the Chapter 11 proceedings of one of our customers compared to nominal similar amounts during 2010;

|

|

·

|

higher incentive compensation expense during 2010 due to increased profitability; and

|

|

·

|

a $4.2 million credit to general and administrative expense during 2009 related to the release of accrued environmental costs for certain inactive waste management units.

|

-19-

Operating income before pension and OPEB for 2009 was significantly worse than 2008 primarily due to the net effects of the following factors:

|

·

|

lower shipment volumes due to the economic conditions of 2009;

|

|

·

|

lower selling prices during 2009;

|

|

·

|

reduced production volumes during 2009 as discussed above, which resulted in a higher percentage of fixed costs included in cost of goods sold (fixed costs as a percentage of sales were 8.2% during 2009 as compared to 5.8% during 2008);

|

|

·

|

increased variable costs of production during 2009 due to frequent mill changes as customers began to manage their inventory by ordering much smaller quantities of our many different products;

|

|

·

|

increased variable costs of production as idle production facilities were difficult to re-start given cold winter temperatures during the first quarter of 2009;

|

|

·

|

decreased cost of ferrous scrap during 2009;

|

|

·

|

decreased cost of electricity and natural gas during 2009;

|

|

·

|

decreases in our LIFO reserve and cost of goods sold during 2009 of $15.2 million as compared to a $10.1 million increase in our LIFO reserve and cost of goods sold during 2008 as discussed in Note 3 to our Consolidated Financial Statements;

|

|

·

|

decreased workers compensation expense during 2009;

|

|

·

|

a $2.8 million impairment charge to reduce certain inventories to net realizable value during 2009 as compared to a $1.2 million impairment charge during 2008;

|

|

·

|

bad debt expense during 2009 of $2.9 million primarily due to the Chapter 11 proceedings of one of our customers compared to nominal similar amounts during 2008;

|

|

·

|

decreased employee incentive compensation accruals during 2009 resulting from lower profitability; and

|

|

·

|

a $4.2 million credit to general and administrative expense during 2009 related to the release of accrued environmental costs as discussed above.

|

Segment Operating Results

Our operating segments are organized by our manufacturing facilities and include three reportable segments:

|

·

|

KSW, located in Peoria, Illinois, operates an electric arc furnace mini-mill, rod mill, industrial wire mill and wire product fabrication facilities and manufactures and sells wire rod, industrial wire, coiled rebar, fabricated wire and other products to agricultural, industrial, construction, commercial, original equipment manufacturers and retail consumer markets;

|

|

·

|

EWP, located in Upper Sandusky, Ohio, manufactures and sells wire mesh in both roll and sheet form that is utilized as reinforcement in concrete construction products including pipe, pre-cast boxes and applications for use in roadways, buildings and bridges; and

|

-20-

|

·

|

Calumet, located in Chicago Heights, Illinois, manufactures and sells merchant and special bar quality products and special sections in carbon and alloy steel grades for use in agricultural, cold drawn, construction, industrial chain, service centers and transportation applications as well as in the production of a wide variety of products by original equipment manufacturers.

|

Calumet’s primary raw material is billet and EWP’s primary raw material is wire rod. Both Calumet and EWP source the majority of their primary raw material requirements from KSW.

Our consolidated net sales, cost of goods sold, operating costs and operating performance before pension and OPEB by segment are set forth in the following table:

|

KSW

|

EWP

|

Calumet

|

Other(1)

|

Total

|

||||||||||||||||

|

(In thousands)

|

||||||||||||||||||||

|

For the year ended December 31, 2008:

|

||||||||||||||||||||

|

Net sales

|

$ | 542,106 | $ | 63,433 | $ | 17,165 | $ | (60,011 | ) | $ | 562,693 | |||||||||

|

Cost of goods sold

|

(494,776 | ) | (54,676 | ) | (18,981 | ) | 57,236 | (511,197 | ) | |||||||||||

|

Gross margin (loss)

|

47,330 | 8,757 | (1,816 | ) | (2,775 | ) | 51,496 | |||||||||||||

|

Selling and administrative expense

|

(15,156 | ) | (3,419 | ) | (1,113 | ) | (3,712 | ) | (23,400 | ) | ||||||||||

|

Operating income (loss) before pension/OPEB

|

$ | 32,174 | $ | 5,338 | $ | (2,929 | ) | $ | (6,487 | ) | $ | 28,096 | ||||||||

|

For the year ended December 31, 2009:

|

||||||||||||||||||||

|

Net sales

|

$ | 298,219 | $ | 37,575 | $ | 11,127 | $ | (24,574 | ) | $ | 322,347 | |||||||||

|

Cost of goods sold

|

(279,380 | ) | (33,572 | ) | (14,350 | ) | 27,515 | (299,787 | ) | |||||||||||

|

Gross margin (loss)

|

18,839 | 4,003 | (3,223 | ) | 2,941 | 22,560 | ||||||||||||||

|

Selling and administrative expense

|

(12,863 | ) | (2,598 | ) | (480 | ) | (2,271 | ) | (18,212 | ) | ||||||||||

|

Operating income (loss) before pension/OPEB

|

$ | 5,976 | $ | 1,405 | $ | (3,703 | ) | $ | 670 | $ | 4,348 | |||||||||

|

For the year ended December 31, 2010:

|

||||||||||||||||||||

|

Net sales

|

$ | 433,729 | $ | 41,310 | $ | 22,987 | $ | (47,281 | ) | $ | 450,745 | |||||||||

|

Cost of goods sold

|

(408,971 | ) | (40,170 | ) | (22,028 | ) | 47,828 | (423,341 | ) | |||||||||||

|

Gross margin

|

24,758 | 1,140 | 959 | 547 | 27,404 | |||||||||||||||

|

Selling and administrative expense

|

(14,154 | ) | (2,418 | ) | (862 | ) | (3,420 | ) | (20,854 | ) | ||||||||||

|

Operating income (loss) before pension/OPEB

|

$ | 10,604 | $ | (1,278 | ) | $ | 97 | $ | (2,873 | ) | $ | 6,550 | ||||||||

(1) Other items primarily consist of the elimination of intercompany sales, the elimination of intercompany profit or loss on ending inventory balances and general corporate expenses.

-21-

Keystone Steel & Wire

|

2008

|

% of

sales

|

2009

|

% of

sales

|

2010

|

% of

sales

|

|||||||||||||||||||

|

($ in thousands)

|

||||||||||||||||||||||||

|

Net sales

|

$ | 542,106 | 100.0 | % | $ | 298,219 | 100.0 | % | $ | 433,729 | 100.0 | % | ||||||||||||

|

Cost of goods sold

|

(494,776 | ) | (91.3 | ) | (279,380 | ) | (93.7 | ) | (408,971 | ) | (94.3 | ) | ||||||||||||

|

Gross margin

|

47,330 | 8.7 | 18,839 | 6.3 | 24,758 | 5.7 | ||||||||||||||||||

|

Selling and administrative

|

(15,156 | ) | (2.8 | ) | (12,863 | ) | (4.3 | ) | (14,154 | ) | (3.3 | ) | ||||||||||||

|

Operating income before pension/OPEB

|

$ | 32,174 | 5.9 | % | $ | 5,976 | 2.0 | % | $ | 10,604 | 2.4 | % | ||||||||||||

The primary drivers of sales, cost of goods sold and the resulting gross margin are as follows:

|

2008

|

2009

|

2010

|

||||||||||

|

Sales volume (000 tons):

|

||||||||||||

|

Wire rod

|

398 | 291 | 429 | |||||||||

|

Fabricated wire products

|

86 | 66 | 73 | |||||||||

|

Industrial wire

|

61 | 34 | 52 | |||||||||

|

Billet

|

35 | 16 | 45 | |||||||||

|

Coiled rebar

|

15 | 5 | 7 | |||||||||

|

Total

|

595 | 412 | 606 | |||||||||

|

Per-ton selling prices:

|

||||||||||||

|

Wire rod

|

$ | 797 | $ | 575 | $ | 620 | ||||||

|

Fabricated wire products

|

1,380 | 1,373 | 1,277 | |||||||||

|

Industrial wire

|

1,103 | 897 | 915 | |||||||||

|

Billet

|

657 | 366 | 452 | |||||||||

|

Coiled rebar

|

841 | 540 | 622 | |||||||||

|

All products

|

906 | 720 | 712 | |||||||||

|

Average per-ton ferrous scrap cost of goods sold

|

$ | 368 | $ | 262 | $ | 294 | ||||||

|

Increase (decrease) in LIFO reserve and cost of goods sold

|

$ | 6,588 | $ | (9,125 | ) | $ | 4,506 | |||||

|

Average electricity cost per kilowatt hour

|

$ | 0.05 | $ | 0.03 | $ | 0.04 | ||||||

|

Kilowatt hours consumed (000 hours)

|

485,446 | 341,392 | 478,641 | |||||||||

|

Average natural gas cost per therm

|

$ | 0.95 | $ | 0.50 | $ | 0.50 | ||||||

|

Natural gas therms consumed (000 therms)

|

19,380 | 14,115 | 18,134 | |||||||||

-22-

KSW’s operating income before pension and OPEB for 2010 as compared to 2009 was also impacted by the following:

|

·

|

higher production levels during the first half of 2010 as KSW operated on substantially reduced production schedules during the first half of 2009 given the sharp reduction in demand caused by economic conditions, which resulted in a higher percentage of fixed costs being included in cost of goods sold during 2009 as these costs could not be capitalized into inventory (fixed costs as a percentage of sales were 6.3% during 2010 compared to 8.7% during 2009);

|

|

·

|

increased maintenance costs during 2010 due to increased production;

|

|

·

|

bad debt expense of $2.9 million during 2009 primarily due to the Chapter 11 proceedings of one of KSW’s customers compared to nominal similar amounts during 2010;

|

|

·

|

higher incentive compensation expense during 2010 due to increased profitability; and

|

|

·

|

a $4.2 million credit during 2009 related to the release of accrued environmental costs as discussed above.

|

KSW’s operating income before pension and OPEB for 2009 as compared to 2008 was also impacted by the following:

|

·

|

substantially reduced production volumes during the first half of 2009 as discussed above which resulted in a higher percentage of fixed costs included in cost of goods sold (fixed costs as a percentage of sales were 8.7% during 2009 as compared to 6.2% during 2008);

|

|

·

|

increased variable costs of production during 2009 due to frequent mill changes as customers began managing their inventory by ordering much smaller quantities of KSW’s many different product lines;

|

|

·

|

increased variable costs of production as idle production facilities were difficult to re-start given cold winter temperatures during the first quarter of 2009;

|

|

·

|

decreased workers compensation expense during 2009;

|

|

·

|

bad debt expense of $2.9 million during 2009 primarily due to the Chapter 11 proceedings of one of KSW’s customers as compared to nominal similar amounts during 2008;

|

|

·

|

decreased employee incentive compensation accruals during 2009 due to lower profitability; and

|

|

·

|

the $4.2 million credit related to the release of accrued environmental costs during 2009 as discussed above.

|

-23-

Engineered Wire Products, Inc.

|

2008

|

% of

sales

|

2009

|

% of

sales

|

2010

|

% of

sales

|

|||||||||||||||||||

|

($ in thousands)

|

||||||||||||||||||||||||

|

Net sales

|

$ | 63,433 | 100.0 | % | $ | 37,575 | 100.0 | % | $ | 41,310 | 100.0 | % | ||||||||||||

|

Cost of goods sold

|

(54,676 | ) | (86.2 | ) | (33,572 | ) | (89.4 | ) | (40,170 | ) | (97.2 | ) | ||||||||||||

|

Gross margin

|

8,757 | 13.8 | 4,003 | 10.6 | 1,140 | 2.8 | ||||||||||||||||||

|

Selling and administrative

|

(3,419 | ) | (5.4 | ) | (2,598 | ) | (6.9 | ) | (2,418 | ) | (5.9 | ) | ||||||||||||

|

Operating income (loss) before pension/OPEB

|

$ | 5,338 | 8.4 | % | $ | 1,405 | 3.7 | % | $ | (1,278 | ) | (3.1 | )% | |||||||||||

The primary drivers of sales, cost of goods sold and the resulting gross margin are as follows:

|

2008

|

2009

|

2010

|

||||||||||

|

Sales volume (000 tons) - Wire mesh

|

54 | 41 | 47 | |||||||||

|

Per-ton selling prices - Wire mesh

|

$ | 1,168 | $ | 916 | $ | 878 | ||||||

|

Average per-ton wire rod cost of goods sold

|

$ | 713 | $ | 710 | $ | 634 | ||||||

|

Increase (decrease) in LIFO reserve and cost of goods sold

|

$ | 3,554 | $ | (6,075 | ) | $ | 917 | |||||

The wire rod market increased to unprecedented price levels during the second and third quarters of 2008 and due to low shipment volumes during the fourth quarter of 2008 and the first quarter of 2009, the average per-ton wire rod costs included in the products EWP sold during 2009 of $710 was not consistent with KSW’s 2009 average per-ton wire rod selling price of $575.

EWP’s operating performance during 2009 as compared to 2008 was also impacted by the following:

|

·

|

significantly higher percentage of fixed costs included in cost of goods sold during the first quarter of 2009 due to substantially reduced production volumes as discussed above (fixed costs as a percentage of sales were 4.9% during 2009 as compared to 3.1% during 2008);

|

|

·

|

increased variable costs of production during 2009 due to frequent mill changes as customers began managing their inventory by ordering much smaller quantities of EWP’s different products; and

|

|

·

|

decreased employee incentive compensation accruals during 2009 as discussed above.

|

-24-

Keystone-Calumet, Inc.

|

2008

|

% of

sales

|

2009

|

% of

sales

|

2010

|

% of

sales

|

|||||||||||||||||||

|

($ in thousands)

|

||||||||||||||||||||||||

|

Net sales

|

$ | 17,165 | 100.0 | % | $ | 11,127 | 100.0 | % | $ | 22,987 | 100.0 | % | ||||||||||||

|

Cost of goods sold

|

(18,981 | ) | (110.6 | ) | (14,350 | ) | (129.0 | ) | (22,028 | ) | (95.8 | ) | ||||||||||||

|

Gross margin (loss)

|

(1,816 | ) | (10.6 | ) | (3,223 | ) | (29.0 | ) | 959 | 4.2 | ||||||||||||||

|

Selling and administrative

|

(1,113 | ) | (6.5 | ) | (480 | ) | (4.3 | ) | (862 | ) | (3.8 | ) | ||||||||||||

|

Operating income (loss) before pension/OPEB

|

$ | (2,929 | ) | (17.1 | )% | $ | (3,703 | ) | (33.3 | )% | $ | 97 | 0.4 | % | ||||||||||

The primary drivers of sales, cost of goods sold and the resulting gross margin are as follows:

|

2008

|

2009

|

2010

|

||||||||||

|

Sales volume (000 tons) - Bar

|

18 | 13 | 24 | |||||||||

|

Per-ton selling prices - Bar

|

$ | 946 | $ | 782 | $ | 888 | ||||||

|

Average per-ton billet cost of goods sold

|

$ | 549 | $ | 447 | $ | 507 | ||||||

Throughout 2009 and 2010, Calumet has been conducting trials for many new products. In addition, Calumet expanded its sales force during 2010. Both of these developments are contributing to new customers and increased sales volume. We believe increased sales volume will allow Calumet to operate on a 24-hour basis and thereby achieve certain economies of scale which are key to this segment’s profitability. Calumet was able to occasionally operate on a 24-hour basis during the fourth quarter of 2010, and currently expects to begin doing so on a continual basis during the first quarter of 2011.

Substantially reduced production volumes during the first half of 2009 resulted in a much higher percentage of fixed costs included in cost of goods sold during 2009 as compared to 2008 and 2010 (fixed costs as a percentage of sales were 8.0% during 2009 as compared to 4.2% during 2008 and 4.3% during 2010).

During the fourth quarter of 2008 and throughout 2009, Calumet determined it would not be able to recover the cost of certain inventory items in future selling prices and recognized impairment charges of $1.2 million and $2.8 million, respectively, to reduce the inventory to its net realizable value. Nominal impairment charges were incurred during 2010. These impairment charges are included in cost of goods sold.

The higher selling and administrative expenses during 2010 as compared to 2009 were primarily due to the expansion of Calumet’s sales force and increased incentive compensation accruals in 2010 as a result of better operating performance. The lower selling and administrative expenses during 2009 as compared to 2008 were primarily due to severance expense and relocation expenses incurred in 2008 that weren’t incurred in 2009 as well as lower incentive compensation accruals in 2009.

-25-

Calumet’s operating performance during 2009 as compared to 2008 was also impacted by the following:

|

·

|

increased variable costs of production due to frequent mill changes as customers began managing their inventory by ordering much smaller quantities of Calumet’s many different product lines;

|

|

·

|

increased variable costs of production as idle production facilities were difficult to re-start given cold winter temperatures during the first quarter of 2009; and

|

|

·

|

decreased cost of electricity and natural gas.

|

Pension Credits and Expense

During 2008 and 2010, we recorded a defined benefit pension credit of $73.9 million and $4.7 million, respectively. During 2009, we recorded defined benefit pension expense of $5.9 million. The fluctuations in the pension credit or expense were primarily the result of a decrease in our plans’ assets of $510 million during 2008 and an increase in our plans’ assets of $58 million during 2009. These fluctuations in plan assets impact the subsequent year’s defined benefit pension credit or expense by (i) changing the expected return on plan assets as the plan assets multiplied by the assumed long-term rate of return is higher or lower than the prior year and (ii) changing the amortization of unrealized net gains or losses as any differences between the expected return on plan assets and the actual return on plan assets are deferred and amortized into income over future periods.

Our plans’ assets increased by approximately $87 million during 2010 and we currently expect to record a defined benefit pension credit of $19.0 million during 2011. See Note 7 to our Consolidated Financial Statements.

OPEB Credits

We recorded an OPEB credit of $8.5 million during 2008, $4.7 million during 2009 and $5.3 million during 2010. The decrease in the OPEB credit during 2009 was primarily due to an amendment of one of our OPEB plans during 2008 which, among other things, significantly increased fixed monthly benefits. We currently expect to record a $5.2 million OPEB credit during 2011. See Note 7 to our Consolidated Financial Statements.

Interest Expense

Interest expense during 2008, 2009 and 2010 as well as the primary drivers of interest expense are presented in the following table.

|

2008

|

2009

|

2010

|

||||||||||

|

($ in thousands)

|

||||||||||||

|

Interest expense

|

$ | 3,798 | $ | 1,725 | $ | 1,863 | ||||||

|

Average balance of total debt

|

$ | 68,169 | $ | 35,129 | $ | 36,983 | ||||||

|

Average balance of revolver

|

35,030 | 17,889 | 28,662 | |||||||||

|

Weighted average interest rate

|