Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

|

(X) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

||||

|

For the fiscal year ended December 31, 2010

|

||||

|

or

|

||||

|

( ) TRANSITION REPORT PURSUANT TO SECTION 13 or 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

||||

|

For the transition period from ______ to ______

|

||||

|

Commission file number 0-23863

|

||||

|

PEOPLES FINANCIAL SERVICES CORP.

|

||||

|

(Exact name of registrant as specified in its charter)

|

||||

|

PENNSYLVANIA

|

23-2391852

|

|||

|

(State of incorporation)

|

(IRS Employer Identification No.)

|

|||

|

82 FRANKLIN AVENUE, HALLSTEAD, PA

|

18822

|

|||

|

(Address of principal executive offices)

|

(Zip code)

|

|||

|

(570) 879-2175

|

||||

|

(Registrant’s telephone number including area code)

|

||||

|

Securities registered pursuant to Section 12(b) of the Act:

|

||||

|

Title of each class

|

Name of each exchange on which registered

|

|||

|

None

|

None

|

|||

|

Securities registered pursuant to Section 12(g) of the Act:

|

||||

|

COMMON STOCK ($2 Par Value)

|

||||

|

(Title of Class)

|

||||

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes __ No X

|

||||

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes__ No X

|

||||

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months or for such shorter period that the registrant was required to file such reports, and (2) has been subject to such filing requirements for the past 90 days Yes X No__

|

||||

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months or for such shorter period that the registrant was required to submit and post such files. Yes __ No__

|

||||

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. X

|

||||

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company as defined in Rule 12b-2 of the Exchange Act.

|

||||

|

Large accelerated filer ____

|

Accelerated filer X

|

Non-accelerated filer _____

|

Smaller reporting company _____

|

|

|

Indicate by check mark whether the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Yes __ No X

|

||||

|

State the aggregate market value of the voting common stock held by non-affiliates based on the closing sale price as of the last business day of the registrant’s most recently completed second fiscal quarter: $77,307,854 at June 30, 2010.

|

||||

|

Indicate the number of shares outstanding of the registrant’s common stock, as of the latest practicable date: 3,142,106 at February 28, 2011.

|

||||

|

DOCUMENTS INCORPORATED BY REFERENCE

|

||||

|

Portions of the registrant’s Annual Report to Stockholders for the year ended December 31, 2010, are incorporated by reference in Part II of this Annual Report. Portions of the registrant’s 2011 Proxy Statement are incorporated by reference in Part III of this Annual Report.

|

||||

|

Page 1 of 87

Exhibit Index on Page 86

|

||||

TABLE OF CONTENTS

|

Page

|

|||

|

Part I

|

Number

|

||

|

Item 1

|

Business

|

3

|

|

|

Item 1A

|

Risk Factors

|

14

|

|

|

Item 1B

|

Unresolved Staff Comments

|

16

|

|

|

Item 2

|

Properties

|

16

|

|

|

Item 3

|

Legal Proceedings

|

16

|

|

|

Item 4

|

(Removed and Reserved)

|

16

|

|

|

Part II

|

|||

|

Item 5

|

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

17

|

|

|

Item 6

|

Selected Financial Data

|

19

|

|

|

Item 7

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

20

|

|

|

Item 7A

|

Quantitative and Qualitative Disclosures About Market Risk

|

40

|

|

|

Item 8

|

Financial Statements and Supplementary Data

|

41

|

|

|

Item 9

|

Changes In and Disagreements with Accountants on Accounting and Financial Disclosure

|

83

|

|

|

Item 9A

|

Controls and Procedures

|

83

|

|

|

Item 9B

|

Other Information

|

85

|

|

|

Part III

|

|||

|

Item 10

|

Directors, Executive Officers and Corporate Governance

|

85

|

|

|

Item 11

|

Executive Compensation

|

85

|

|

|

Item 12

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

85

|

|

|

Item 13

|

Certain Relationships and Related Transactions, and Director Independence

|

85

|

|

|

Item 14

|

Principal Accountant Fees and Services

|

85

|

|

|

Part IV

|

|||

|

Item 15

|

Exhibits and Financial Statement Schedules

|

86

|

|

|

|

Signatures

|

87

|

2

PART I

ITEM 1 BUSINESS

BRIEF HISTORY

Peoples Financial Services Corp. (“PFSC” or the “Company”) was incorporated under the laws of the Commonwealth of Pennsylvania on February 6, 1986, and is a one-bank holding company headquartered in Hallstead, Pennsylvania.

The Company is engaged primarily in commercial and retail banking services and in businesses related to banking services through its subsidiaries, Peoples Neighborhood Bank (“PNB” or the “Bank”), Peoples Wealth Management LLC and Peoples Financial Capital Corporation. The Bank has two wholly-owned subsidiaries, Peoples Financial Leasing, LLC and Peoples Investment Holdings, LLC. PNB was chartered in Hallstead, Pennsylvania in 1905 under the name of The First National Bank of Hallstead. In 1965, the Hop Bottom National Bank merged with The First National Bank of Hallstead to form Peoples National Bank of Susquehanna County. In 2001, the Bank changed its name to Peoples National Bank. Effective December 13, 2010, Peoples National Bank converted its charter to a state non-member bank and changed its name to Peoples Neighborhood Bank. Peoples Wealth Management LLC was formed in 2006 as a member-managed limited liability company for the purpose of providing investment advisory services to the general public. Peoples Financial Leasing, LLC, formed in 2007, provides employee leasing services to the Bank. Formed in 2007, Peoples Investment Holdings, LLC, and Peoples Financial Capital Corporation manage intangible investments and collect and distribute income from such investments or from tangible investments located outside of Delaware.

As of December 31, 2010, the Company had 124 full-time equivalent employees. The Company and PNB are not parties to any collective bargaining agreement and employee relations are considered to be good.

OPERATING SEGMENTS

Peoples Financial Leasing, LLC; Peoples Investment Holdings, LLC; Peoples Wealth Management, LLC and Peoples Financial Capital Corporation did not meet the quantitative thresholds for required segment disclosure in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Bank’s eleven community banking offices, all similar with respect to economic characteristics, share a majority of the following aggregation criteria: (i) products and services; (ii) operating processes; (iii) customer bases; (iv) delivery systems; and (v) regulatory oversight. Accordingly, they were aggregated into a single operating segment.

CONCENTRATION

Payment risk is a function of the economic climate in which the Bank’s lending activities are conducted. Economic downturns in the economy generally or in a particular sector could cause cash flow problems for customers and make loan payments more difficult. The Bank attempts to minimize this risk by not being dependent on deposits or exposed by loan concentrations to a single customer or to a group of customers, the loss of any one or more of whom would have a materially adverse effect on our financial condition.

SUPERVISION AND REGULATION

The Company and its subsidiaries are extensively regulated under federal and state law. Generally, these laws and regulations are intended to protect depositors, not shareholders. The following is a summary description of certain provisions of law that affect the regulation of bank holding companies and banks. This discussion is qualified in its entirety by reference to applicable laws and regulations. Changes in law and regulation may have a material effect on the business and prospects of the Company.

The Company is a bank holding company within the meaning of the Bank Holding Company Act of 1956, as amended, and is subject to regulation, supervision, and examination by the Federal Reserve Board (“FRB”). The Company is required to file annual and quarterly reports with the FRB and to provide the FRB with such additional information as the FRB may require. The FRB also conducts examinations of the Company.

With certain limited exceptions, the Company is required to obtain prior approval from the FRB before acquiring direct or indirect ownership or control of more than 5% of any voting securities or substantially all of the assets of a bank or bank holding company, or before merging or consolidating with another bank holding company. Additionally, with certain exceptions, any person or entity proposing to acquire control through direct or indirect ownership of 25% or more of any voting securities of the Company is required to give 60 days written notice of the acquisition to the FRB, which may prohibit the transaction, and to publish notice to the public.

3

The Company’s banking subsidiary is regulated by the Pennsylvania State Department of Banking (‘the State”) and the Federal Deposit Insurance Corporation (“FDIC”). The State may prohibit an institution over which it has supervisory authority from engaging in activities or investments that the agency believes constitute unsafe or unsound banking practices. Federal banking regulators have extensive enforcement authority over the institutions they regulate to prohibit or correct activities that violate law, regulation or a regulatory agreement or which are deemed to constitute unsafe or unsound practices.

Enforcement actions may include:

|

·

|

the appointment of a conservator or receiver;

|

|

·

|

the issuance of a cease and desist order;

|

|

·

|

the termination of deposit insurance, the imposition of civil money penalties on the institution, its directors, officers, employees and institution affiliated parties;

|

|

·

|

the issuance of directives to increase capital;

|

|

·

|

the issuance of formal and informal agreements;

|

|

·

|

the removal of or restrictions on directors, officers, employees and institution-affiliated parties; and

|

|

·

|

the enforcement of any such mechanisms through restraining orders or any other court actions.

|

PNB is subject to certain restrictions on extensions of credit to executive officers, directors, principal shareholders or any related interests of such persons which generally require that such credit extensions be made on substantially the same terms as are available to third persons dealing with PNB and not involving more than the normal risk of repayment. Other laws tie the maximum amount that may be loaned to any one customer and its related interests to capital levels of the Bank.

Limitations on Dividends and Other Payments

The Company’s current ability to pay dividends is largely dependent upon the receipt of dividends from its banking subsidiary, PNB. Both federal and state laws impose restrictions on the ability of the Company to pay dividends. The FRB has issued a policy statement that provides that, as a general matter, insured banks and bank holding companies may pay dividends only out of prior operating earnings. According to regulation, PNB’s ability to pay dividends in any calendar year is restricted to the total of its current year’s net profits and the net profits of the last two years. In addition to these specific restrictions, bank regulatory agencies, in general, also have the ability to prohibit proposed dividends by a financial institution that would otherwise be permitted under applicable regulations if the regulatory body determines that such distribution would constitute an unsafe or unsound practice.

Permitted Non-Banking Activities

Generally, a bank holding company may not engage in any activities other than banking, managing, or controlling its bank and other authorized subsidiaries, and providing service to those subsidiaries. With prior approval of the FRB, the Company may acquire more than 5% of the assets or outstanding shares of a company engaging in non-bank activities determined by the FRB to be closely related to the business of banking or of managing or controlling banks. The FRB provides expedited procedures for expansion into approved categories of non-bank activities.

Subsidiary banks of a bank holding company are subject to certain quantitative and qualitative restrictions:

|

·

|

on extensions of credit to the bank holding company or its subsidiaries;

|

|

·

|

on investments in their securities; and

|

|

·

|

on the use of their securities as collateral for loans to any borrower.

|

These regulations and restrictions may limit the Company’s ability to obtain funds from PNB for its cash needs, including funds for the payment of dividends, interest and operating expenses. Further, subject to certain exceptions, a bank holding company and its subsidiaries are prohibited from engaging in certain tie-in arrangements in connection with any extension of credit, lease or sale of property or furnishing of services. For example, PNB may not generally require a customer to obtain other services from itself or the Company, and may not require that a customer promise not to obtain other services from a competitor as a condition to an extension of credit to the customer.

4

Under FRB policy, a bank holding company is expected to act as a source of financial strength to its subsidiary banks and to make capital injections into a troubled subsidiary bank, and the FRB may charge the bank holding company with engaging in unsafe and unsound practices for failure to commit resources to a subsidiary bank when required. A required capital injection may be called for at a time when the holding company does not have the resources to provide it. In addition, depository institutions insured by the FDIC can be held liable for any losses incurred by, or reasonably anticipated to be incurred by, the FDIC in connection with the default of or assistance provided to, a commonly controlled FDIC-insured depository institution. Accordingly, in the event that any insured subsidiary of the company causes a loss to the FDIC, other insured subsidiaries of the company could be required to compensate the FDIC by reimbursing it for the estimated amount of such loss. Such cross guarantee liabilities generally are superior in priority to the obligation of the depository institutions to its stockholders due solely to their status as stockholders and obligations to other affiliates.

Pennsylvania Law

As a Pennsylvania bank holding company, the Company is subject to various restrictions on its activities as set forth in Pennsylvania law. This is in addition to those restrictions set forth in federal law. Under Pennsylvania law, a bank holding company that desires to acquire a bank or bank holding company that has its principal place of business in Pennsylvania must obtain permission from the Pennsylvania Department of Banking.

Interstate Banking Legislation

The Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994 provides that, among other things, substantially all state law barriers to the acquisition of banks by out-of-state bank holding companies were eliminated. The law also permits interstate branching by banks, subject to the ability of states to opt-out completely or to set an earlier effective date.

Financial Institution Reform, Recovery, and Enforcement Act (“FIRREA”)

FIRREA was enacted into law in order to address the financial condition of the Federal Savings and Loan Insurance Corporation, to restructure the regulation of the thrift industry, and to enhance the supervisory and enforcement powers of the federal bank and thrift regulatory agencies. As the primary federal regulator of the Bank, the FDIC, in conjunction with the State is responsible for the supervision of the Bank. When dealing with capital requirements, those regulatory bodies have the flexibility to impose supervisory agreements on institutions that fail to comply with regulatory requirements. The imposition of a capital plan, termination of deposit insurance, and removal or temporary suspension of an officer, director or other institution-affiliated person may cause enforcement actions.

There are three levels of civil penalties under FIRREA.

|

·

|

The first tier provides for civil penalties of up to $5 thousand per day for any violation of law or regulation.

|

|

·

|

The second tier provides for civil penalties of up to $25 thousand per day if more than a minimal loss or a pattern is involved.

|

|

·

|

Finally, civil penalties of up to $1 million per day may be assessed for knowingly or recklessly causing a substantial loss to an institution or taking action that results in a substantial pecuniary gain or other benefit.

|

Criminal penalties are increased to $1 million per violation and may be up to $5 million for continuing violations or for the actual amount of gain or loss. These penalties may be combined with prison sentences of up to five years.

Federal Deposit Insurance Corporation Improvement Act of 1991 (“FDICIA”)

FDICIA provides for, among other things:

|

·

|

publicly available annual financial condition and management reports for financial institutions, including audits by independent accountants;

|

|

·

|

the establishment of uniform accounting standards by federal banking agencies;

|

|

·

|

the establishment of a “prompt corrective action” system of regulatory supervision and intervention, based on capitalization levels, with more scrutiny and restrictions placed on depository institutions with lower levels of capital;

|

|

·

|

additional grounds for the appointment of a conservator or receiver; and

|

|

·

|

restrictions or prohibitions on accepting brokered deposits, except for institutions which significantly exceed minimum capital requirements.

|

FDICIA also provides for increased funding of the FDIC insurance funds and the implementation of risk-based premiums.

5

A central feature of FDICIA is the requirement that the federal banking agencies take “prompt corrective action” with respect to depository institutions that do not meet minimum capital requirements. Pursuant to FDICIA, the federal bank regulatory authorities have adopted regulations setting forth a five-tiered system for measuring the capital adequacy of the depository institutions that they supervise. Under these regulations, a depository institution is classified in one of the following capital categories:

|

·

|

"well capitalized";

|

|

·

|

"adequately capitalized";

|

|

·

|

"under capitalized";

|

|

·

|

"significantly undercapitalized"; and

|

|

·

|

"critically undercapitalized".

|

PNB was categorized as “well capitalized” under the regulatory framework for prompt corrective action at December 31, 2010, based on the most recent notification from the FDIC. An institution may be deemed by the regulators to be in a capitalization category that is lower than is indicated by its actual capital position if, among other things, it receives an unsatisfactory examination rating with respect to asset quality, management, earnings or liquidity.

FDICIA generally prohibits a depository institution from making any capital distribution including payment of a cash dividend or paying any management fees to its holding company, if the depository institution would thereafter be undercapitalized. Undercapitalized depository institutions are subject to growth limitations and are required to submit capital restoration plans. If a depository fails to submit an acceptable plan, it is treated as if it is “significantly undercapitalized”. Significantly undercapitalized depository institutions may be subject to a number of other requirements and restrictions, including orders to sell sufficient voting stock to become adequately capitalized, requirements to reduce total assets and stop accepting deposits from correspondent banks. Critically undercapitalized institutions are subject to the appointment of a receiver or conservator; generally within 90 days of the date such institution is determined to be critically under capitalized.

FDICIA provides the federal banking agencies with significantly expanded powers to take enforcement action against institutions that fail to comply with capital or other standards. Such actions may include the termination of deposit insurance by the FDIC or the appointment of a receiver or conservator for the institution. FDICIA also limits the circumstances under which the FDIC is permitted to provide financial assistance to an insured institution before appointment of a conservator or receiver.

Under FDICIA, each federal banking agency is required to prescribe, by regulation, non-capital safety and soundness standards for institutions under its authority. The federal banking agencies, including the FDIC, have adopted standards covering:

|

·

|

internal controls;

|

|

·

|

information systems and internal audit systems;

|

|

·

|

loan documentation;

|

|

·

|

credit underwriting;

|

|

·

|

interest rate exposure;

|

|

·

|

asset growth; and

|

|

·

|

compensation fees and benefits.

|

Any institution that fails to meet these standards may be required by the agency to develop a plan acceptable to the agency, specifying the steps that the institutions will take to meet the standards. Failure to submit or implement such a plan may subject the institution to regulatory sanctions. The Company, on behalf of PNB, believes that it meets substantially all the standards that have been adopted. FDICIA also imposed new capital standards on insured depository institutions. Before establishing new branch offices, PNB must meet certain minimum capital stock and surplus requirements and must obtain State approval.

Risk-Based Capital Requirements

The federal banking regulators have adopted certain risk-based capital guidelines to assist in the assessment of the capital adequacy of a banking organization’s operations for both transactions reported on the balance sheet as assets and transactions, such as letters of credit, and recourse agreements, which are recorded as off-balance-sheet items. Under these guidelines, nominal dollar amounts of assets and credit-equivalent amounts of off-balance-sheet items are multiplied by one of several risk adjustment percentages, which range from 0% for assets with low credit risk, such as certain US Treasury securities, to 100% for assets with relatively high credit risk, such as business loans.

6

A banking organization’s risk-based capital ratios are obtained by dividing its qualifying capital by its total risk adjusted assets. The regulators measure risk-adjusted assets, which include off-balance-sheet items, against both total qualifying capital the sum of Tier 1 capital and limited amounts of Tier 2 capital, and Tier 1 capital.

|

·

|

"Tier 1", or core capital, includes common equity, perpetual preferred stock and minority interest in equity accounts of consolidated subsidiaries, less goodwill and other intangibles, subject to certain exceptions.

|

|

·

|

"Tier 2", or supplementary capital, includes, among other things, limited life preferred stock, hybrid capital instruments, mandatory convertible securities, qualifying subordinated debt, and the allowance for loan and lease losses, subject to certain limitations and less restricted deductions. The inclusion of elements of Tier 2 capital is subject to certain other requirements and limitations of the federal banking agencies.

|

Banks and bank holding companies subject to the risk-based capital guidelines are required to maintain a ratio of Tier 1 capital to risk-weighted assets of at least 4% and a ratio of total capital to risk-weighted assets of at least 8%. The appropriate regulatory authority may set higher capital requirements when particular circumstances warrant. As of December 31, 2010, PFSC’s ratio of Tier 1 capital to risk-weighted assets stood at 11.72% and its ratio of total capital to risk-weighted assets stood at 12.68%. In addition to risk-based capital, banks and bank holding companies are required to maintain a minimum amount of Tier 1 capital to total assets, referred to as the leverage capital ratio, of at least 4.00%. As of December 31, 2010, the Company’s leverage-capital ratio was 9.19%.

Failure to meet applicable capital guidelines could subject a banking organization to a variety of enforcement actions including:

|

·

|

limitations on its ability to pay dividends;

|

|

·

|

the issuance by the applicable regulatory authority of a capital directive to increase capital, and in the case of depository institutions, the termination of deposit insurance by the FDIC, as well as to the measures described under FDICIA as applicable to under capitalized institutions.

|

In addition, future changes in regulations or practices could further reduce the amount of capital recognized for purposes of capital adequacy. Such a change could affect the ability of PNB to grow and could restrict the amount of profits, if any, available for the payment of dividends to the Company.

Interest Rate Risk

Regulatory agencies include, in their evaluations of a bank’s capital adequacy, an assessment of the bank’s interest rate risk (“IRR”) exposure. The standards for measuring the adequacy and effectiveness of a banking organization’s IRR management includes a measurement of Board of Directors and senior management oversight, and a determination of whether a banking organization’s procedures for comprehensive risk management are appropriate to the circumstances of the specific banking organization. PNB has internal IRR models that are used to measure and monitor IRR. In addition, PNB utilizes an independent consultant to provide a quarterly assessment of its IRR. Finally, regulatory agencies, as part of the scope of their periodic examinations, evaluate the IRR of PNB. For these reasons, the Company does not expect the IRR evaluation in the agencies’ capital guidelines to result in significant changes in capital requirements for PNB.

FDIC Insurance Assessments

As a FDIC member institution, PNB’s deposits are insured to a maximum of $250 thousand per depositor through the Bank Insurance Fund (“BIF”) that is administered by the FDIC and each institution is required to pay semi-annual deposit insurance premium assessments to the FDIC. The Deposit Insurance Funds Act of 1996 recapitalized the Savings Association Insurance Fund (“SAIF”) and provided that BIF deposits would be subject to one-fifth of the assessment to which SAIF deposits are subject for FICO bond payments. Beginning in 2000, BIF deposits and SAIF deposits were subject to the same assessment for FICO bonds. The FICO assessment for PNB for 2010 was $0.0104 for each $100 of BIF deposits.

The FDIC adopted a risk-based deposit insurance assessment system that requires all FDIC-insured institutions to pay quarterly premiums beginning in 2007. Annual premiums range from 12 and 14 basis points of deposits for well-capitalized banks with the highest examination ratings to 50 basis points for undercapitalized institutions. The Bank pays an insurance premium at levels stated for well-capitalized banks. The FDIC assessment for PNB for 2010 was $0.14 for each $100 of BIF deposits.

7

Entering 2011, the Company anticipates deposit insurance premiums of 10 and 14 basis points. The FDIC has also established a program under which it fully guarantees all non-interest bearing transaction accounts in excess of $250 thousand (“TLGP”) and senior unsecured debt of a bank or its holding company. The Bank elected to opt out of the debt guarantee program but opted into the deposit guarantee program. The additional premium paid in 2010 under the TLGP was $.0015 for each $100 of transaction account deposits in excess of $250 thousand.

On November 12, 2009, the FDIC adopted a final rule that required all insured depository institutions to prepay their estimated quarterly risk-based assessments for the fourth quarter of 2009 and for all of 2010, 2011 and 2012. The FDIC also adopted a uniform increase in assessment rates of $0.03 per $100 of assessable deposits effective on January 1, 2011. In 2009, PNB paid $2.2 million in prepaid deposit insurance assessments.

Community Reinvestment Act

The Community Reinvestment Act of 1977, (“CRA”) is designed to create a system for bank regulatory agencies to evaluate a depository institution’s record in meeting the credit needs of its community. The CRA regulations were completely revised as of July 1, 1995, to establish performance-based standards for use in examining for compliance. The Bank had its last CRA compliance examination in 2008 and received a “satisfactory” rating.

Monetary Policy

The earnings of a bank holding company are affected by the policies of regulatory authorities, including the FRB, in connection with the FRB’s regulation of the money supply. Various methods employed by the FRB are:

|

·

|

open market operations in United States Government securities;

|

|

·

|

changes in the discount rate on member bank borrowings; and

|

|

·

|

changes in reserve requirements against member bank deposits.

|

These methods are used in varying combinations to influence overall growth and distribution of bank loans, investments, and deposits, and their use may also affect interest rates charged on loans or paid on deposits. The monetary policies of the FRB have had a significant effect on the operating results of commercial banks in the past and are expected to do so in the future.

RECENT LEGISLATION

USA Patriot Act of 2001

The Patriot Act contains anti-money laundering and financial transparency laws and imposes various regulations, including standards for verifying client identification at account opening, and rules to promote cooperation among financial institutions, regulators and law enforcement entities in identifying parties that may be involved in terrorism or money laundering.

Financial Services Modernization Legislation

The Gramm-Leach-Bliley Act of 1999, or the GLB, repeals provisions of the Glass-Steagall Act which restricted the affiliation of Federal Reserve member banks with firms “engaged principally” in specified securities activities, and which restricted officer, director or employee interlocks between a member bank and any company or person “primarily engaged” in specified securities activities.

The GLB also permits banks to engage in expanded activities through the formation of financial subsidiaries. A bank may have a subsidiary engaged in any activity authorized for banks directly or any financial activity, except for insurance underwriting, insurance investments, real estate investment or development, or merchant banking, which may only be conducted through a subsidiary of a financial holding company. Financial activities include all activities permitted under new sections of the Bank Holding Company Act or permitted by regulation.

To the extent that the GLB permits banks, securities firms and insurance companies to affiliate, the financial services industry may experience further consolidation. The GLB is intended to grant to community banks certain powers as a matter of right that larger institutions have accumulated on an ad hoc basis and which unitary savings and loan holding companies already possess. Nevertheless, the GLB may have the result of increasing the amount of competition that the Company faces from larger institutions and other types of companies offering financial products, many of which may have substantially more financial resources.

Sarbanes-Oxley Act of 2002

The goals of the Sarbanes-Oxley Act (“SOX”) are to increase corporate responsibility, to provide for enhanced penalties for accounting and auditing improprieties at publicly traded companies and to protect investors by improving the accuracy and reliability of corporate disclosures pursuant to the securities laws.

8

The SOX generally applies to all companies, both U.S. and non-U.S., that file or are required to file periodic reports with the Securities and Exchange Commission (the “SEC”) under the Securities Exchange Act of 1934, or the Exchange Act. The legislation includes provisions, among other things, governing the services that can be provided by a public company’s independent auditors and the procedures for approving such services, requiring the chief executive officer and principal accounting officer to certify certain matters relating to the company’s periodic filings under the Exchange Act, requiring expedited filings of reports by insiders of their securities transactions and containing other provisions relating to insider conflicts of interest, increasing disclosure requirements relating to critical financial accounting policies and their application, increasing penalties for securities law violations, and creating a new public accounting oversight board, a regulatory body subject to SEC jurisdiction with broad powers to set auditing, quality control and ethics standards for accounting firms.

Regulation W

Transactions between a bank and its “affiliates” are quantitatively and qualitatively restricted under the Federal Reserve Act. The Federal Deposit Insurance Act applies Sections 23A and 23B to insured nonmember banks in the same manner and to the same extent as if they were members of the Federal Reserve System. The Federal Reserve Board has also recently issued Regulation W, which co-defies prior regulations under Sections 23A and 23B of the Federal Reserve Act and interpretative guidance with respect to affiliate transactions. Regulation W incorporates the exemption from the affiliate transaction rules but expands the exemption to cover the purchase of any type of loan or extension of credit from an affiliate. Affiliates of a bank include, among other entities, the bank’s holding company and companies that are under common control with the bank. The Company is considered to be an affiliate of the Bank. In general, subject to certain specified exemptions, a bank or its subsidiaries are limited in their ability to engage in “covered transactions” with affiliates:

|

·

|

to an amount equal to 10% of the bank's capital and surplus, in the case of covered transactions with any one affiliate; and

|

|

·

|

to an amount equal to 20% of the bank's capital and surplus, in the case of covered transactions with all affiliates.

|

In addition, a bank and its subsidiaries may engage in covered transactions and other specified transactions only on terms and under circumstances that are substantially the same, or at least as favorable to the bank or its subsidiary, as those prevailing at the time for comparable transactions with nonaffiliated companies. A “covered transaction” includes:

|

·

|

a loan or extension of credit to an affiliate;

|

|

·

|

a purchase of, or an investment in, securities issued by an affiliate;

|

|

·

|

a purchase of assets from an affiliate, with some exceptions;

|

|

·

|

the acceptance of securities issued by an affiliate as collateral for a loan or extension of credit to any party; and

|

|

·

|

the issuance of a guarantee, acceptance or letter of credit on behalf of an affiliate.

|

Regulation W generally excludes all non-bank and non-savings association subsidiaries of banks from treatment as affiliates, except to the extent that the Federal Reserve Board decides to treat these subsidiaries as affiliates.

Concurrently with the adoption of Regulation W, the Federal Reserve Board has proposed a regulation which would further limit the amount of loans that could be purchased by a bank from an affiliate to not more than 100% of the bank’s capital and surplus.

Mortgage Lending Acts

On February 18, 2009, the Federal Government implemented the Homeowner Affordability and Stability Plan (“HASP”), a $75.0 billion federal program intended to support recovery in the housing market and ensure that eligible homeowners are able to continue to fulfill their mortgage obligations. HASP includes the following initiatives:

|

•

|

A refinance option for homeowners that are current in their mortgage payments and whose mortgages are owned by the Federal National Mortgage Association (“FNMA”) or the Federal Home Loan Mortgage Corporation (“FHLMC”);

|

|

•

|

A homeowner stability initiative to prevent foreclosures and help eligible borrowers stay in their homes by offering loan modifications that reduce mortgage payments to more sustainable levels; and

|

|

•

|

An increase in U.S. Treasury funding to FNMA and FHLMC to allow them to lower mortgage rates.

|

HASP also offers monetary incentives to mortgage servicers and mortgage holders for certain modifications of at-risk loans and would establish an insurance fund designed to reduce foreclosures.

9

Credit Card Reform

On May 22, 2009, President Obama signed into law The Credit Card Accountability, Responsibility, and Disclosure Act of 2009 (the “Credit Card Act”). The Credit Card Act is comprehensive credit card legislation that aims to establish fair and transparent practices relating to open end consumer credit plans. The first phase of the legislation began in August 2009, under which the payment period with no late fees was extended from 14 to 21 days, the advance warning period for significant changes to credit card accounts was extended from 15 to 45 days, and opt-out provisions were made available to customers. A second phase began in February 2010, which includes provisions governing when rate increases can be applied on late accounts, requirements for clearer disclosures of terms before opening an account, prohibitions on charging over-limit fees and double-cycle billing, and various other restrictions. Additional rules became effective in July 2010, which deal with interest rate reinstatements on former overdue accounts, gift card expiration dates and inactivity fees.

Overdraft Fee Regulation

On November 12, 2009, the Federal Reserve Board issued a final rule amending Regulation E, Electronic Funds Transfers. According to the final rule, beginning July 1, 2010, banks may not charge fees for paying overdrafts on ATM and debit card transactions unless the customer gives consent, or opts in, to the payment of overdrafts for these transactions. Additional federal legislation has been introduced which would limit the number and amount of overdraft fees which banks can charge, prohibit ordering the posting transactions to cause customers to incur higher fees, prohibit insufficient funds fees on ATM or debit card transactions and require banks to provide a customer notice and opportunity to cancel transactions that would trigger an overdraft.

MARKET AREAS

PNB’s principal market area comprises Susquehanna, Wyoming and Lackawanna Counties of northeastern Pennsylvania and Broome County in the southern tier of New York. In addition, parts of Wayne and Bradford Counties in Pennsylvania that border Susquehanna and Wyoming Counties are also considered part of the PNB market area.

Specifically, PNB’s market area is situated between:

|

·

|

the city of Binghamton, Broome County, New York, located to the north;

|

|

·

|

the city of Scranton, Lackawanna County, Pennsylvania, to the south; and

|

|

·

|

Wilkes-Barre, Luzerne County, Pennsylvania, to the southwest.

|

Susquehanna County could best be described as a bedroom county with a high percentage of its residents commuting to work in Broome County, New York, or Lackawanna County, Pennsylvania. The southern part of Susquehanna County tends to gravitate south for both employment and shopping, while the northern part of the county goes north to Broome County, New York. The western part of Susquehanna County gravitates south and west to and through Wyoming County. Wyoming County is home to a Proctor & Gamble manufacturing facility. This is an economic stimulus to Wyoming County and the surrounding areas.

The majority of our offices are located in counties that would be considered sparsely populated, as they are made up of many small towns and villages. The latest population figures show Susquehanna County at approximately 42,000 and Wyoming County at approximately 28,000 residents. Neither county is experiencing growth. Broome County has approximately 201,000. The economy of Broome County has lost many manufacturing jobs in the past twenty to twenty-five years. Fortunately, the new employment centers are in the Town of Conklin and the neighboring Town of Kirkwood, which border Susquehanna County, Pennsylvania. Lackawanna County has approximately 213,000 residents. Interstate 81 runs north and south through the eastern half of Susquehanna County and has brought an influx of people from New Jersey and the Philadelphia area. These people have purchased homes and land to build homes that are used as vacation/recreation retreats and, quite often, become retirement homes.

BUSINESS

Lending Activities

PNB provides a full range of retail and commercial banking services designed to meet the borrowing and depository needs of small and medium sized businesses and consumers in its market areas. A significant amount of PNB’s loans are to customers located within its service areas. PNB has no foreign loans or highly leveraged transaction loans, as defined by the FRB. Although PNB participates in loans originated by other banks, the majority of loans in PNB’s portfolio have been originated by PNB. Policies adopted by the Board of Directors are the basis by which PNB conducts its lending activities. These loan policies grant lending officers authority to make secured and unsecured loans up to their individual lending limits designated by the Board of Directors. Larger loans must be approved by senior officers or by the Board of Directors. PNB’s management information systems and loan review policies are designed to monitor lending to ensure adherence to PNB’s loan policies.

10

The commercial loans offered by PNB include:

|

·

|

commercial real estate loans;

|

|

·

|

working capital;

|

|

·

|

equipment and other commercial loans;

|

|

·

|

construction loans;

|

|

·

|

SBA guaranteed loans; and

|

|

·

|

agricultural loans.

|

PNB’s commercial real estate loans provide financing for retail operations, manufacturing operations, farming operations, multi-family housing units, and churches. These types of loans are generally written for a term of 15 years or less or amortized over a longer period with balloon payments at shorter intervals. Personal guarantees are obtained on nearly all commercial loans. Credit analysis, loan review, and an effective collections process are also used to minimize any potential losses. PNB employs four full-time commercial lending officers. These four people are augmented by branch managers who are authorized to make smaller, less complex, commercial loans.

Payment risk is a function of the economic climate in which PNB’s lending activities are conducted. Economic downturns, in general, or in a particular sector could cause cash flow problems for customers and make loan payments more difficult. PNB attempts to minimize this risk by avoiding concentrations of credit to a single borrower or borrowers in a particular industry. IRR would occur if PNB were to make loans at fixed rates in an environment in which rates were subject to rise thereby preventing PNB from making loans at higher prevailing rates. PNB attempts to mitigate this risk by making adjustable rate commercial loans and by limiting repricing terms to five years or less for customers requiring fixed rate loans. Finally, collateral risk can occur if PNB’s position in collateral taken as security for loan repayment is not adequate. PNB attempts to minimize collateral risk by avoiding loan concentrations to particular borrowers, by perfecting liens on collateral and by obtaining appraisals on property prior to extending loans.

Consumer loans offered by PNB include:

|

·

|

residential real estate loans;

|

|

·

|

automobile loans;

|

|

·

|

manufactured housing loans;

|

|

·

|

personal installment loans secured and unsecured for almost any purpose;

|

|

·

|

student loans;

|

|

·

|

home equity loans, including fixed-rate term and open ended revolving lines of credit; and

|

|

·

|

credit cards.

|

Risks applicable to consumer lending are similar to those applicable to commercial lending. PNB attempts to mitigate payment risk in consumer lending by limiting consumer lending products to a term of five years or less. PNB attempts to mitigate risks associated with extending unsecured loans through obtaining credit checks and borrower history in all transactions.

Residential mortgage products include adjustable rate as well as conventional fixed rate loans. Terms vary from 1, 5, and 10-year adjustable rate loans to 5, 10, 15, 20, and 30-year fully amortized fixed rate loans. Bi-weekly payment plans are also available. Personal secured and unsecured revolving lines of credit with variable interest rates are offered to credit-worthy customers. The largest segment of PNB’s installment loan portfolio is fixed-rate loans. Most are secured either by automobiles, motorcycles, snowmobiles, boats, other personal property, or by liens filed against real estate. These loans are generally available in terms of up to 15 years. Home equity products include both fixed rate term products and adjustable rate open-end revolving line of credit. The maximum loan-to-value ratio is 80% for home equity loans. A special MGIC program now offered through the Bank, allows for loans of up to 95% of the appreciated value for qualified applicants. Credit checks, credit scoring, and debt-to-income ratios within preset parameters are used to qualify borrowers.

Mortgage loans have historically had a longer average life than commercial or consumer loans. Accordingly, payment and interest rate risks are greater in some respects with mortgage loans than with commercial or consumer lending. Deposits, which are used as the primary source to fund mortgage lending, tend to be of shorter duration than the average maturities on residential mortgage loans and are more susceptible to interest rate changes. Historical records indicate that our mortgage loans, no matter what maturity, have an average life of less than seven years. The Bank sells mortgages in the secondary market. Mortgage lending is also subject to economic downturns, in that increases in unemployment could adversely affect the ability of borrowers to repay mortgage loans and decreases in property values could affect the value of the real estate serving as collateral for the loan.

11

Industry standard debt-to-income ratios and credit checks are used to qualify borrowers on all consumer loans. Managers, assistant managers, and customer service officers have retail lending authorities at each of the full-service branch office locations. PNB has centralized loan administration at its operations/administrative offices where mortgage underwriting and loan review and analysis take place.

Loan Approval

Individual loan authorities are established by PNB’s Board of Directors upon recommendation by the chief credit officer. In establishing an individual’s loan authority, the experience of the lender is taken into consideration, as well as the type of lending in which the individual is involved. The President of PNB, along with members of senior management, comprising the officers’ loan committee, has the authority to approve new loans over $250 thousand up to $2 million and all aggregate relationships of $325 thousand to $2.5 million following an analysis and review by credit analysts and commercial lender. The full Board of Directors review on a monthly basis, all loans approved by individual lenders and the officers’ loan committee. All loan requests which are either complex in nature or exceed $2 million or have an aggregate relationship of $2.5 million must be analyzed and reviewed by the officers’ loan committee and be presented with a recommendation to the full Board of Directors for approval or denial.

PNB generally requires that loans secured by first mortgages or real estate have loan-to-value ratios of less than 80% for loans secured by raw land or improved property. In addition, in some instances for qualified borrowers, private mortgage insurance is available for purchase that allows loan-to-value ratios to go as high as 100%. PNB also participates in a guaranteed mortgage insurance program. This allows PNB to make loans on real estate up to 100% of the value of the property.

Investment Portfolio and Activities

PNB’s investment portfolio has several objectives.

|

·

|

A key objective is to provide a balance in PNB's asset mix of loans and investments consistent with its liability structure, and to assist in management of interest rate risk. The investments augment PNB's capital position in the risk-based capital formula, providing the necessary liquidity to meet fluctuations in credit demands of the community and also fluctuations in deposit levels.

|

|

·

|

In addition, the portfolio provides collateral for pledging against public funds, and reduces PNB’s tax liability

|

|

·

|

Finally, the investment portfolio provides income for PNB.

|

Deposit Activities

PNB offers a full range of deposit and banking services including:

|

·

|

commercial accounts such as checking products, cash management services, remote deposit capture (“RDC”), automated clearing house (“ACH”) originations

|

|

·

|

retirement accounts such as Individual Retirement Accounts (“IRA”)

|

|

·

|

consumer interest bearing deposit services such as certificates of deposit, money market accounts, NOW accounts, and savings accounts

|

|

·

|

a variety of ancillary checking account products such as automated teller machines (“ATM’s”), point of sale (“POS”), as well as other miscellaneous services

|

These miscellaneous services would include:

|

·

|

safe deposit boxes;

|

|

·

|

night depository services;

|

|

·

|

merchant credit cards;

|

|

·

|

direct deposit of payroll and other checks;

|

|

·

|

U.S. Savings Bonds;

|

|

·

|

official bank checks; and

|

|

·

|

money orders.

|

The principal sources of funds for PNB are core deposits that include demand deposits, interest bearing transaction accounts, money market accounts, savings deposits, and certificates of deposit. These deposits are solicited from individuals, businesses, non-profit entities, and government authorities. Substantially all of PNB’s deposits are from the local market areas surrounding each of its offices.

12

Investment Products

In 2005, Peoples Financial Services Corp. formed Peoples Wealth Management, LLC, formerly known as Peoples Advisors, LLC (“Advisors”) as a member-managed limited liability company under the laws of the Commonwealth of Pennsylvania, to be a wholly owned subsidiary of the Corporation, for the purpose of providing investment advisory services to the general public. The Company has subsequently changed the name of the member-managed limited liability company to Peoples Wealth Management, effective January 2011.

Competition

PNB operates in a fairly competitive environment, competing for deposits and loans with commercial banks, thrifts, credit unions, and finance and mortgage companies. Some of these competitors possess substantially greater financial resources than those available to PNB. Also, certain of these institutions have significantly higher lending limits than PNB and may provide various services for their customers that are not presently available at PNB. Principal methods of competing for banking permitted nonbanking services and financial activities include price, nature of product, quality of service and convenience of location. PNB is subject to increasing competition from credit unions, finance companies, and mortgage companies that may not be subject to the same regulatory restrictions and taxations as commercial banks.

PNB’s success is based on its ability to remain competitive with interest rates that it charges on its loans and offers on deposits. It also believes that its success has been, and will continue to be, due to its emphasis on community involvement, customer services, and relationships. With consolidation continuing in the financial industry, and particularly in PNB’s markets, smaller profitable banks are gaining opportunities where larger institutions exit markets that are only marginally profitable for them.

Although the Company has not done so, many bank holding companies have elected to become financial holding companies under the GLB, which gives them a broader range of products in order to compete. Although the long-range effects of this development cannot be predicted, most probably it will further narrow the differences and intensify competition among commercial banks, investment banks, insurance firms and other financial services companies.

SEASONALITY

Management does not feel that the deposits or the business of PNB in general are seasonal in nature. However, with the recent interest in natural gas drilling in PNB’s market area, deposit growth patterns have been influenced somewhat by such activities. In addition, deposits may vary with local and national economic conditions but should not have a material effect on planning and policy making.

CRITICAL ACCOUNTING POLICIES

Disclosure of the Company’s significant accounting policies is included in Note 1 to the Consolidated Financial Statements. Some of these policies are particularly sensitive requiring significant judgments, estimates and assumptions to be made by management. Additional information is contained in Management’s Discussion and Analysis for these issues, including the provision and allowance for loan losses, which are located in Note 3 to the Consolidated Financial Statements; the valuation of real estate acquired in connection with foreclosures or in satisfaction of loans; determination of other-than-temporary impairment losses on securities, which is located in Note 2 to the Consolidated Financial Statements; the valuation of deferred tax assets, which is located in Note 9 to the Consolidated Financial Statements; and the potential impairment of restricted stock, which is located in Note 1 to the Consolidated Financial Statements.

AVAILABLE INFORMATION

The Company files reports, proxy and information statements and other information electronically with the SEC. You may read and copy any materials that the Company files with the SEC at the SEC’s Public Reference Room located at 100 F. Street, N.E., Washington, DC 20549 on official business days between the hours of 10:00am and 3:00pm EST. You can obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically. The SEC’s website address is http://www.sec.gov. Copies of the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed with the SEC may be obtained without charge by writing to Peoples Financial Services Corp., 82 Franklin Avenue, Hallstead, PA 18822, Attn: Investor Relations or through our website at http://www.peoplesnatbank.com.

13

STATISTICAL DISCLOSURES

The following statistical disclosures are included in Management’s Discussion and Analysis, Item 7 hereof, and are incorporated in their entirety by reference under this Item 1:

|

·

|

Interest Rate Sensitivity Analysis;

|

|

·

|

Interest Income and Expense, Volume and Rate Analysis;

|

|

·

|

Investment Portfolio;

|

|

·

|

Loan Maturity and Interest Rate Sensitivity;

|

|

·

|

Loan Portfolio;

|

|

·

|

Allocation of Allowance for Loan Losses;

|

|

·

|

Deposits; and

|

|

·

|

Short-term Borrowings.

|

ITEM 1A RISK FACTORS

Changes in interest rates could reduce our income, cash flows and asset values.

Our income and cash flows and the value of our assets depend to a great extent on the difference between the interest rates we earn on interest-earning assets, such as loans and investment securities, and the interest rates we pay on interest-bearing liabilities such as deposits and borrowings. These rates are highly sensitive to many factors which are beyond our control, including general economic conditions and policies of various governmental and regulatory agencies and, in particular, the FRB. Changes in monetary policy, including changes in interest rates, will influence not only the interest we receive on our loans and investment securities and the amount of interest we pay on deposits and borrowings, but will also affect our ability to originate loans and obtain deposits and the value of our investment portfolio. If the rate of interest we pay on our deposits and other borrowings increases more than the rate of interest we earn on our loans and other investments, our net interest income, and therefore our earnings, could be adversely affected. Our earnings also could be adversely affected if the rates on our loans and other investments fall more quickly than those on our deposits and other borrowings.

Economic conditions either nationally or locally in areas in which our operations are concentrated may adversely affect our business.

Deterioration in local, regional, national or global economic conditions could cause us to experience a reduction in deposits and new loans, an increase in the number of borrowers who default on their loans and a reduction in the value of the collateral securing their loans, all of which could adversely affect our performance and financial condition. Unlike larger banks that are more geographically diversified, we provide banking and financial services locally. Therefore, we are particularly vulnerable to adverse local economic conditions.

Our financial condition and results of operations would be adversely affected if our allowance for loan losses is not sufficient to absorb actual losses or if we are required to increase our allowance.

Despite our underwriting criteria, we may experience loan delinquencies and losses. In order to absorb losses associated with nonperforming loans, we maintain an allowance for loan losses based on, among other things, historical experience, an evaluation of economic conditions, and regular reviews of delinquencies and loan portfolio quality. Determination of the allowance inherently involves a high degree of subjectivity and requires us to make significant estimates of current credit risks and future trends, all of which may undergo material changes. At any time, there are likely to be loans in our portfolio that will result in losses but that have not been identified as non-performing or potential problem credits. We cannot be sure that we will be able to identify deteriorating credits before they become nonperforming assets or that we will be able to limit losses on those loans that are identified. We may be required to increase our allowance for loan losses for any of several reasons. Regulators, in reviewing our loan portfolio as part of a regulatory examination, may request that we increase our allowance for loan losses. Changes in economic conditions affects borrowers, new information regarding existing loans, identification of additional problem loans and other factors, both within and outside of our control, may require an increase in our allowance. In addition, if charge-offs in future periods exceed our allowance for loan losses, we will need additional increases in our allowance for loan losses. Any increase in our allowance for loan losses will result in a decrease in our net income and capital and may materially affect our results of operations in the period in which the allowance is increased.

14

Competition may decrease our growth or profits.

We face substantial competition in all phases of our operations from a variety of different competitors, including commercial banks, credit unions, consumer finance companies, insurance companies and money market funds. There is very strong competition among financial services providers in our principal service area. Our competitors may have greater resources, higher lending limits or larger branch systems than we do. Accordingly, they may be able to offer a broader range of products and services as well as better pricing for those products and services than we can. In addition, some of the financial services organizations with which we compete are not subject to the same degree of regulation as is imposed on federally insured financial institutions. As a result, those non-bank competitors may be able to access funding and provide various services more easily or at less cost than we can, adversely affecting our ability to compete effectively.

We may be adversely affected by government regulation.

The banking industry is heavily regulated. Banking regulations are primarily intended to protect the federal deposit insurance funds and depositors, not shareholders. Changes in the laws, regulations, and regulatory practices affecting the banking industry may increase our cost of doing business or otherwise adversely affect us and create competitive advantages for others. Regulations affecting banks and financial services companies undergo continuous change, and we cannot predict the ultimate effect of these changes, which could have a material adverse effect on our profitability or financial condition.

We rely on our management and other key personnel, and the loss of any of them may adversely affect our operations.

We are, and will continue to be, dependent upon the services of our management team. The unexpected loss of services of any key management personnel could have an adverse effect on our business and financial condition because of their skills, knowledge of our market, years of industry experience and the difficulty of promptly finding qualified replacement personnel.

Environmental liability associated with lending activities could result in losses.

In the course of our business, we may foreclose on and take title to properties securing our loans. If hazardous substances were discovered on any of these properties, we could be liable to governmental entities or third parties for the costs of remediation of the hazard, as well as for personal injury and property damage. Many environmental laws can impose liability regardless of whether we knew of, or were responsible for, the contamination. In addition, if we arrange for the disposal of hazardous or toxic substances at another site, we may be liable for the costs of cleaning up and removing those substances from the site even if we neither own nor operate the disposal site. Environmental laws may require us to incur substantial expenses and may materially limit use of properties we acquire through foreclosure, reduce their value or limit our ability to sell them in the event of a default on the loans they secure. In addition, future laws or more stringent interpretations or enforcement policies with respect to existing laws may increase our exposure to environmental liability.

Failure to implement new technologies in our operations may adversely affect our growth or profits.

The market for financial services, including banking services and consumer finance services, is increasingly affected by advances in technology, including developments in telecommunications, data processing, computers, automation, Internet-based banking and telebanking. Our ability to compete successfully in our markets may depend on the extent to which we are able to exploit such technological changes. However, we can provide no assurance that we will be able to properly or timely anticipate or implement such technologies or properly train our staff to use such technologies. Any failure to adapt to new technologies could adversely affect our business, financial condition or operating results.

An investment in our common stock is not an insured deposit.

Our common stock is not a bank deposit and, therefore, is not insured against loss by the FDIC, or any other deposit insurance fund or by any other public or private entity. Investment in our common stock is subject to the same market forces that affect the price of common stock in any company.

Our legal lending limits are relatively low and restrict our ability to compete for larger customers.

At December 31, 2010, our lending limit per borrower was approximately $7.6 million or approximately 15% of our unimpaired capital. Accordingly, the size of loans that we can offer to potential borrowers, without participation by other lenders, is less than the size of loans that many of our competitors with larger capitalization are able to offer. Our legal lending limit also impacts the efficiency of our lending operation because it tends to lower our average loan size, which means we have to generate a higher number of transactions to achieve the same portfolio volume. We may engage in loan participations with other banks for loans in excess of our legal lending limits. However, there can be no assurance that such participations will be available at all or on terms which are favorable to us and our customers.

15

Market conditions may adversely affect our fee based investment business.

The Company receives fee based revenues from commissions from the sale of securities and investment advisory fees. In the event of decreased stock market activity, the volume of trading facilitated by our Wealth Management subsidiary will in all likelihood decrease resulting in decreased commission revenue on purchases and sales of securities. In addition, investment advisory fees, which are generally based on a percentage of the total value of an investment portfolio, will decrease in the event of decreases in the values of the investment portfolios, for example, as a result of overall market declines.

ITEM 1B UNRESOLVED STAFF COMMENTS

NONE.

ITEM 2 PROPERTIES

PNB has four full-service banking offices in Susquehanna County that are located in:

|

·

|

Borough of Susquehanna Depot;

|

|

·

|

Hallstead Plaza, Great Bend Township;

|

|

·

|

Borough of Hop Bottom; and

|

|

·

|

Montrose, Bridgewater Township.

|

PNB has three full-service banking offices in Wyoming County that are located in:

|

·

|

Borough of Nicholson;

|

|

·

|

Meshoppen Borough; and

|

|

·

|

Tunkhannock Borough.

|

PNB has one full-service banking office in Glenburn Township, Lackawanna County.

PNB has three full-service banking offices in Broome County, New York that are located in:

|

·

|

Town of Conklin;

|

|

·

|

Town of Chenango; and

|

|

·

|

Village of Deposit.

|

The administrative/operations office of the Company and PNB is located at 82 Franklin Avenue, Hallstead, Pennsylvania. The following departments are located at that office:

|

·

|

commercial, mortgage and consumer lending operations;

|

|

·

|

executive offices;

|

|

·

|

marketing department;

|

|

·

|

human resources department;

|

|

·

|

deposit account support services;

|

|

·

|

data processing services; and

|

|

·

|

finance and planning.

|

All offices are owned by PNB with the exception of the Hallstead Plaza and Town of Chenango offices. The Hallstead Plaza office is subject to a ground lease; the Front Street office is subject to a building lease. For additional information with respect to the terms of these leases, refer to Note 4 to the Consolidated Financial Statements filed at Item 8 of this report. Eleven of the twelve offices provide drive-up banking services and ten offices have 24-hour ATM services. All of the Company’s and PNB’s properties are considered suitable and adequate for current and immediate future needs.

ITEM 3 LEGAL PROCEEDINGS

The Company is subject to lawsuits and claims arising out of its business. In the opinion of the Company’s management, after review and consultation with counsel, any proceedings that may arise should not result in judgments, which, in the aggregate, would have a material adverse effect on the Company’s financial condition or operating results.

ITEM 4 (REMOVED AND RESERVED)

16

PART II

ITEM 5 MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The Company’s Common Stock is not listed on an exchange. The Company’s common stock is traded sporadically in the over-the-counter market and, accordingly, there is no established public trading market at this time. The Company’s stock is listed on the OTC Bulletin Board under the symbol PFIS. The cusip number is 711040-10-5. The investment firms of Boenning & Scattergood, Inc. from West Conshohocken, Pennsylvania, and Stifel Nicolaus & Co., Inc. from Livingston, New Jersey, make a limited market in the Company’s common stock. The Company has continuously paid dividends for more than 100 years and it is the intention to pay dividends in the future. However, future dividends must necessarily depend upon earnings, financial condition, appropriate legal restrictions, and other factors at the time that the Board of Directors considers dividend payments. As of December 31, 2010, there were 21,574 outstanding options to purchase the Company’s common stock. See Note 8 of the Consolidated Financial Statements for additional information. As of February 28, 2011, the Company had 1,089 shareholders of record and 3,141,731 shares of Common Stock, par value of $2.00 per share, outstanding.

The following table reflects high and low bid prices for shares of the Company’s Common Stock to the extent such information is available, and the dividends declared with respect thereto during the preceding two years.

|

2010

|

2009

|

|||||||||||||||||||||||

|

Price Range

|

Dividends

|

Price Range

|

Dividends

|

|||||||||||||||||||||

|

Low

|

High

|

Declared

|

Low

|

High

|

Declared

|

|||||||||||||||||||

|

First Quarter

|

$ | 18.05 | $ | 22.00 | $ | .19 | $ | 17.00 | $ | 18.50 | $ | .19 | ||||||||||||

|

Second Quarter

|

21.65 | 26.50 | .20 | 16.75 | 17.40 | .19 | ||||||||||||||||||

|

Third Quarter

|

26.00 | 27.00 | .20 | 16.90 | 17.40 | .19 | ||||||||||||||||||

|

Fourth Quarter

|

$ | 26.60 | $ | 27.40 | $ | .20 | $ | 16.80 | $ | 18.25 | $ | .19 | ||||||||||||

The following table discloses the number of outstanding options, warrants and rights granted by the Company to participants in equity compensation plans, as well as the number of securities remaining available for future issuance under these plans. Securities for future issuance are reserved and issued at the discretion of the Board of Directors on an annual basis. The table provides this information separately for equity compensation plans that have and have not been approved by security holders.

|

Number of securities to be issued upon exercise of outstanding options, warrants and rights

|

Weighted-average exercise price of outstanding options, warrants and rights

|

Number of securities remaining available for future issuance under equity compensation plans

|

||||||||||

|

Equity compensation plans approved by stockholders

|

21,574 | $ | 23.34 | 65,751 | ||||||||

|

Equity compensation plans not approved by stockholders

|

0 | 0 | 0 | |||||||||

|

Total

|

21,574 | $ | 23.34 | 65,751 | ||||||||

On July 2, 2001, the Board of Directors authorized the repurchase of 158,931 shares of the Company’s common stock. There were no purchases made by or on behalf of the Company or any “affiliated purchaser,” as defined in the Exchange Act Rule 10b-18(a) (3), of the Company’s common stock during each of the three months ended December 31, 2010. As of December 31, 2010, there were 65,751 shares available for repurchase under the 2001 Stock Repurchase Program with no expiration date.

17

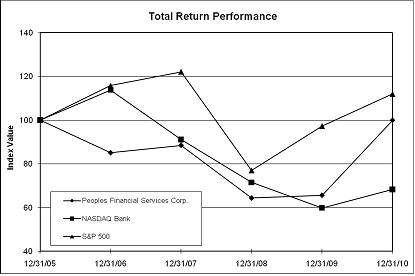

STOCK PERFORMANCE GRAPH

|

Period Ending

|

||||||||||||||||||||||||

|

Index

|

12/31/05

|

12/31/06

|

12/31/07

|

12/31/08

|

12/31/09

|

12/31/10

|

||||||||||||||||||

|

Peoples Financial Services Corp.

|

$ | 100.00 | $ | 85.04 | $ | 88.45 | $ | 64.35 | $ | 65.64 | $ | 99.92 | ||||||||||||

|

NASDAQ Bank

|

$ | 100.00 | $ | 113.82 | $ | 91.16 | $ | 71.52 | $ | 59.87 | $ | 68.34 | ||||||||||||

|

S&P 500

|

$ | 100.00 | $ | 115.79 | $ | 122.16 | $ | 76.96 | $ | 97.33 | $ | 111.99 | ||||||||||||

18

ITEM 6 SELECTED FINANCIAL DATA

|

Consolidated Financial Highlights

|

At and For the Years Ended December 31,

|

|||||||||||||||||||

|

(Dollars In Thousands, except Per Share Data)

|

2010

|

2009

|

2008

|

2007

|

2006

|

|||||||||||||||

|

Financial Position

|