Attached files

| file | filename |

|---|---|

| 8-K - OVERSEAS SHIPHOLDING GROUP INC | osg4q20108k.htm |

| EX-99 - OVERSEAS SHIPHOLDING GROUP INC | osg4q20108kex991.htm |

Exhibit 99.2

Fourth Quarter and Fiscal Year 2010

Conference Call

Conference Call

February 28, 2011

page 2

This presentation contains forward-looking statements regarding the Company's prospects, including the outlook

for tanker and articulated tug barge markets, changing oil trading patterns, anticipated levels and timing of

newbuilding and scrapping, prospects for certain strategic alliances and investments, forecasted newbuilding

delivery schedule for 2011 through 2013, projected scheduled drydock and off hire days for 2011, projected

locked-in charter revenue and locked-in time charter days for 2011 through 2015 and thereafter, forecasted 2011

vessel expenses, charter hire expenses, depreciation and amortization, general and administrative expenses,

interest expense, and levels of equity income and capital expenditures, the profitability in 2011 of certain business

units and the Company’s two FSOs, ability to meet refinancing obligations in 2011 and 2012, the sustainability of

OSG’s annual dividend, prospects of OSG’s strategy of being a market leader in the segments in which it

competes and the forecast of world economic activity and oil demand. These statements are based on certain

assumptions made by OSG management based on its experience and perception of historical trends, current

conditions, expected future developments and other factors it believes are appropriate in the circumstances.

Forward-looking statements are subject to a number of risks, uncertainties and assumptions, many of which are

beyond the control of OSG, which may cause actual results to differ materially from those implied or expressed by

the forward-looking statements. Factors, risks and uncertainties that could cause actual results to differ from the

expectations reflected in these forward-looking statements are described in the Company’s Annual Report for

2009 on Form 10-K and those risks discussed in the other reports OSG files with the Securities and Exchange

Commission.

for tanker and articulated tug barge markets, changing oil trading patterns, anticipated levels and timing of

newbuilding and scrapping, prospects for certain strategic alliances and investments, forecasted newbuilding

delivery schedule for 2011 through 2013, projected scheduled drydock and off hire days for 2011, projected

locked-in charter revenue and locked-in time charter days for 2011 through 2015 and thereafter, forecasted 2011

vessel expenses, charter hire expenses, depreciation and amortization, general and administrative expenses,

interest expense, and levels of equity income and capital expenditures, the profitability in 2011 of certain business

units and the Company’s two FSOs, ability to meet refinancing obligations in 2011 and 2012, the sustainability of

OSG’s annual dividend, prospects of OSG’s strategy of being a market leader in the segments in which it

competes and the forecast of world economic activity and oil demand. These statements are based on certain

assumptions made by OSG management based on its experience and perception of historical trends, current

conditions, expected future developments and other factors it believes are appropriate in the circumstances.

Forward-looking statements are subject to a number of risks, uncertainties and assumptions, many of which are

beyond the control of OSG, which may cause actual results to differ materially from those implied or expressed by

the forward-looking statements. Factors, risks and uncertainties that could cause actual results to differ from the

expectations reflected in these forward-looking statements are described in the Company’s Annual Report for

2009 on Form 10-K and those risks discussed in the other reports OSG files with the Securities and Exchange

Commission.

Forward-Looking Statements

page 3

< Fourth quarter results reflected continued weakness across our markets

• TCE revenues were $183M, down 10% from $204M in 4Q2009

• Reported net loss of $55.3M or $1.83 per diluted share

• Adjusted net loss was $59.0M or $1.96 per diluted share

< Fiscal 2010 results

• TCE revenues $853M, down 10% vs. 2009

• Reported net loss $134M; Adjusted net loss $98M

< TCE revenues impacted by weak spot rates, increased spot exposure

• Spot rates remained under pressure across all market segments

• Factors include excess tonnage supply, continued impact on ton-mile demand of China

sourcing more crude from the Middle East vs. West Africa, inventory drawdowns

sourcing more crude from the Middle East vs. West Africa, inventory drawdowns

• Time charters and VLCC forward cover that benefited 2009 results has rolled off

• VLCC TCE rate achieved in 4Q2010 (spot + fixed) was 55% below 4Q2009

Financial Highlights

page 4

1 Delivered February 2011

Fleet Expansion and U.S. Flag Turnaround Program

< Crude - turnaround of FSO JV

• Q4 was first full quarter both FSOs were on contract -

JV now a reliable contributor

< Products - averaging down on capital and charter-in

costs

costs

• Overseas Kythnos (MR) purchased and bareboat charter

cancelled

cancelled

• Two time-chartered MRs delivered - Carina and Atlantic

Grace 1

Grace 1

• Orderbook swap concluded - Two LR1s (3Q2011) out, two

2013 Aframaxes in, with improved value/cost tradeoff

2013 Aframaxes in, with improved value/cost tradeoff

< U.S. Flag - fleet modernization solidifies market position

• Overseas Chinook delivered; now under conversion to

shuttle tanker with 4-year time charter to Petrobras to

commence in 2Q2011

shuttle tanker with 4-year time charter to Petrobras to

commence in 2Q2011

• Delaware Bay lightering fleet renewal almost complete with

March delivery of OSG 351 - term contract cover in place

(through 2020)

March delivery of OSG 351 - term contract cover in place

(through 2020)

• Last three single hull vessel vessels sold or under sale

contract - 100% double hull by end of 1H2011

contract - 100% double hull by end of 1H2011

page 5

1 Projected estimates only. 2010 includes mark-to-market losses on the FSO Africa interest rate swap.

2 Includes all expenses, including allocated G&A.

In 2010 we have executed according to plan on a number of initiatives that are expected

to result in material improvement in financial performance in 2011 and beyond

to result in material improvement in financial performance in 2011 and beyond

2010 Accomplishments to Benefit 2011 Results

< Full year contribution from both FSOs expected to turn a $7M loss in

2010 to a $14M profit in 20111 - a $21M swing

2010 to a $14M profit in 20111 - a $21M swing

< U.S. Flag unit turnaround underway

- Positive contribution expected in 2011 from an operating loss of $35M 2 in 2010

< G&A initiative will continue in 2011 - further savings expected

- Approximately $95M overall spend for 2011 vs. $100M in 2010

< Holding the line on vessel expenses in 2011

< We expect no vessel impairments in 2011 compared with $29M in 2010

< We have continued to strengthen our commercial platforms

- Important contracts in Tankers International, Aframax International, and both

International and U.S. Flag lightering have been renewed

International and U.S. Flag lightering have been renewed

- We have added pool partners and vessels in Tankers International, Suezmax

International and Clean Products International

International and Clean Products International

page 6

Disciplined Expense Management

< G&A reduction program has borne fruit

• Savings are permanent

• Continued cost discipline in 2011 and

beyond

beyond

< OSG reduced daily vessel operating

expense from 2008 to 2010 on

international flag vessels while

improving operational performance

expense from 2008 to 2010 on

international flag vessels while

improving operational performance

• We expect to hold 2011 daily Opex below

2008 levels

2008 levels

• Daily Opex control achieved without

sacrificing safety, quality and environmental

oversight

sacrificing safety, quality and environmental

oversight

Operating Expense per Day 1

International Fleet

G&A Expenses

(~34%)

($ in millions)

1 Does not reflect offsetting impact of payments received on two U.S. Flag vessels trading internationally and one Canadian flag vessel.

page 7

|

Covenants on $1.8B facility 2

|

||

|

Covenant 4Q2010 Capacity

|

||

|

Maximum Leverage 3

< 60% |

43%

|

$2.0B add’l debt

|

|

Minimum Net Worth 4

³ $1.2B

|

$2.5B

|

$1.3B in losses

|

|

Minimum

Unencumbered Assets 5

³ 150%

|

235%

|

$0.8B new secured

debt on $1.1B of vessels |

1 Liquidity consists of Cash & Cash Equivalents, Short Term Investments and committed availability under bank facilities (does not reflect $150M reduction

in revolving credit facility effective in February 2011). 2 Preliminary figures. 3 Funded indebtedness to total capitalization. 4 Tangible net worth.

in revolving credit facility effective in February 2011). 2 Preliminary figures. 3 Funded indebtedness to total capitalization. 4 Tangible net worth.

5Unencumbered tangible assets to unsecured debt; capacity assumes 70% advance ratio.

Debt Repayment and Capital Commitments

Conservative financial policy creates financial flexibility and

the ability to execute on attractive growth opportunities

the ability to execute on attractive growth opportunities

< Strong liquidity and balance sheet

profile

profile

• $1.3B in liquidity 1

• Long term debt to capital = 48.0%

• Manageable debt and refinancing

obligations over next two years

obligations over next two years

• Future construction commitments of

$222M are fully funded

$222M are fully funded

• Ample room within covenants

< Recent capital raises have:

• Extended debt maturity profile

• Diversified capital sources

• Strengthened balance sheet

< Large unsecured asset base

• 70% of Vessel NBV is unsecured

page 8

2011 Outlook - Crude & Products

< Crude

• Demand picture is encouraging

• Net fleet growth in 2011 to exceed demand growth

• Slow steaming is growing in acceptance - benefits are significant

• Many wildcards - most are positive

< Products

• Vessel supply is being absorbed, while MR orders are being delayed, converted

to dry, or cancelled

to dry, or cancelled

• Clean product demand increasing at faster pace than overall oil demand

• Ton-mile growth expected to continue from longer-haul trading patterns

• Ton-mile growth in the MR sector expected to exceed supply growth in 2011

page 9

2011 Outlook - U.S. Flag

< Jones Act fleet expected to decline further

• 8 newbuilds delivering through 2014 will be more than offset by

mandated/expected retirements (including OSG’s last two single-hulls in 2011)

mandated/expected retirements (including OSG’s last two single-hulls in 2011)

< Refinery expansion in the Mid-continent and Gulf Coast to result in more

product available on Gulf Coast

product available on Gulf Coast

• Pipeline capacity to Northeast is limited - some will be exported (diesel to

Europe)

Europe)

• Balance will displace imports and generate coastwise movements

• Revival of Upcoast Jones Act movements in 4Q2010 continues in 2011

• Exports to Mexico via Brownsville pipeline growing with falling Mexican

production

production

< Delaware City refinery to reopen in 2Q2011 - will provide incremental

lightering volumes

lightering volumes

page 10

In Summary

< We have remained focused on executing our strategy during this

downturn

downturn

• We have further enhanced our commercial platforms

• We have reduced costs at sea and ashore

• We have continued to modernize and optimize our fleet

- Challenging shipyard projects are operational with attractive contract cover in

place - FSOs, lightering ATBs and U.S. Flag shuttle tankers

place - FSOs, lightering ATBs and U.S. Flag shuttle tankers

• We have maintained financial flexibility through the downturn and will

outlast it

outlast it

- Capital markets transactions have de-risked the firm and better positioned us to

seize opportunities, especially relative to our competition

seize opportunities, especially relative to our competition

• We have maintained discipline in pursuing our balanced growth strategy

- It has paid to wait

< By following a consistent strategy throughout this difficult period, OSG

is positioned to emerge ahead of the pack when markets recover

is positioned to emerge ahead of the pack when markets recover

• Spot exposure provides upside to upturn, balanced with contract cover

page *

Financial Review

Myles Itkin, CFO

page 12

59% of TCE revenues derived from spot market compared

with 45% in 2009. Expiring fixed rate business was

replaced at lower spot rates

with 45% in 2009. Expiring fixed rate business was

replaced at lower spot rates

Both FSOs fully employed for quarter and earned service

level bonuses. OSG’s share of FSO JV income was $5.2M,

which included $1.9M related to interest rate swaps that are

marked-to-market through earnings. LNG - $1.8M; ATC -

$2.8M

level bonuses. OSG’s share of FSO JV income was $5.2M,

which included $1.9M related to interest rate swaps that are

marked-to-market through earnings. LNG - $1.8M; ATC -

$2.8M

Debt maturity extended by issuing $300M of Notes due

2018 which resulted in $5M increase in interest expense,

net of reduction in expense achieved by repaying $42M in

secured loans with an average interest rate of 6%; average

amount of debt increased $233M quarter-over-quarter

2018 which resulted in $5M increase in interest expense,

net of reduction in expense achieved by repaying $42M in

secured loans with an average interest rate of 6%; average

amount of debt increased $233M quarter-over-quarter

Reflects 604 more charter-in days during 4Q2010

Reflects $2.6M reduction in Compensation costs; $1.2M

reduction in T&E, consulting and legal fees from expense

reduction programs; $7.6M in non-recurring expenses in

2009

reduction in T&E, consulting and legal fees from expense

reduction programs; $7.6M in non-recurring expenses in

2009

Prior year’s quarter tax benefit related to 2009 tax loss

carryback as a result of tax law change. No similar

carryback available for 2010

carryback as a result of tax law change. No similar

carryback available for 2010

Financial Review - Income Statement

page 13

Raised $450M in capital market transactions in Q1; net

reduction in outstanding balances under revolving credit

facilities of $176M; vessel expenditures totaled $421M

and $98M net advances to FSO joint venture

reduction in outstanding balances under revolving credit

facilities of $176M; vessel expenditures totaled $421M

and $98M net advances to FSO joint venture

Includes CIP of $807M for 9 vessels

Represents Overseas New Orleans under contract of

sale

sale

Funding conversion of FSOs and FSO Africa operating

and debt service costs prior to commencement of charter

($98M); net operating income ($3.6M); offset by

distributions ($10.3M)

and debt service costs prior to commencement of charter

($98M); net operating income ($3.6M); offset by

distributions ($10.3M)

Includes $41M tax refund received in January 2011

1 Short term investments consists of time deposits with maturities greater than 3 months

Financial Review - Balance Sheet

page 14

2011 Guidance

< Estimated vessel expenses $295M to $310M

< Time and bareboat charter hire expenses $380M to $395M

< Depreciation and amortization $185M to $195M

< G&A $95M to $100M

< Equity income of affiliated companies $20M to $25M

< Interest expense $95M to $110M

(assumes additional facilities and changes to the unsecured revolver)

< Capital expenditures

– Drydock costs $43M (on 29 vessels)

(Q1 $7M; Q2 $11M; Q3 $12M; Q4 $13M)

– Newbuild progress payments, vessel $176M

improvements and capitalized interest (Q1 $76M; Q2 $60M; Q3 $17M; Q4 $23M)

page *

Appendix

page 16

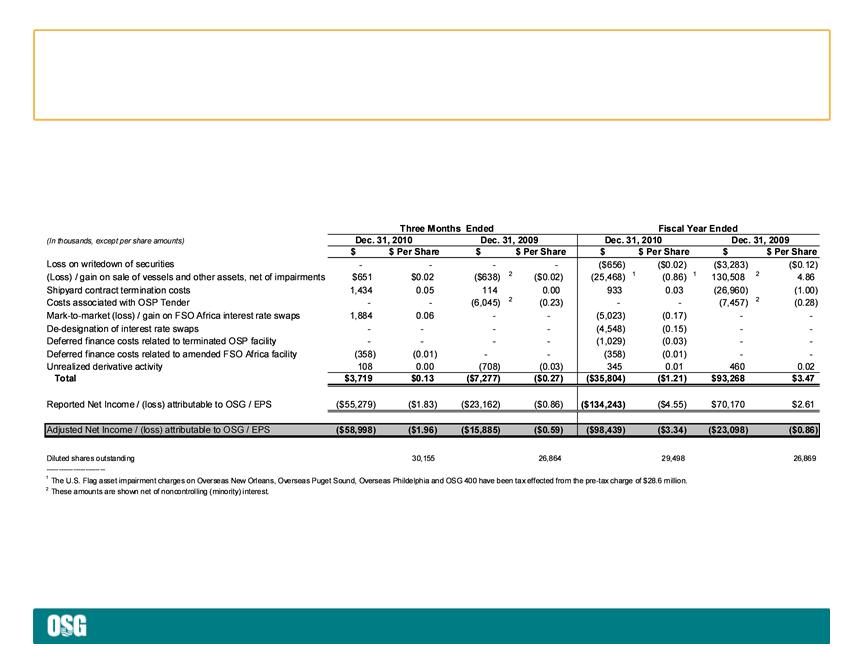

Special Items Affecting Net Income/(Loss)

Set forth below are significant items of income and expense that affected the Company’s results for the three months and fiscal year ended

December 31, 2010 and 2009, all of which are typically excluded by securities analysts in their published estimates of the Company’s financial

results.

December 31, 2010 and 2009, all of which are typically excluded by securities analysts in their published estimates of the Company’s financial

results.

Reconciling Items

page 17

EBITDA

TCE Revenues

Reconciling Items (cont’d)

page 18

|

|

Owned

|

Chartered-in

|

Total

|

Newbuild

|

Total

|

|

VLCC

|

9

|

6

|

15

|

2

|

17

|

|

FSO

|

2

|

-

|

2

|

-

|

2

|

|

Suezmax

|

-

|

2

|

2

|

-

|

2

|

|

Aframax

|

6

|

4

|

10

|

2

|

12

|

|

Panamax

|

9

|

-

|

9

|

-

|

9

|

|

Lightering

|

2

|

4

|

6

|

-

|

6

|

|

Total Crude

|

28

|

16

|

44

|

4

|

48

|

|

LR2

|

-

|

-

|

-

|

-

|

-

|

|

LR1

|

2

|

2

|

4

|

2

|

6

|

|

MR*

|

15

|

19

|

34

|

3

|

37

|

|

Total Products

|

17

|

21

|

38

|

5

|

43

|

|

Handysize

|

4

|

9

|

13

|

1

|

14

|

|

ATB

|

7

|

-

|

7

|

-

|

7

|

|

Lightering

|

3

|

-

|

3

|

1

|

4

|

|

Total U.S. Flag

|

14

|

9

|

23

|

2

|

25

|

|

Total Gas

|

4

|

-

|

4

|

-

|

4

|

|

TOTAL

|

63

|

46

|

109

|

11

|

120

|

* Products operating fleet Includes 2 owned U.S. Flag MRs that trade internationally and a car carrier; Products MR newbuild fleet includes a chemical

tanker.

tanker.

Fleet Composition - As of February 23, 2011

page 19

Off Hire and Scheduled Drydock

In addition to regular inspections by OSG personnel, all vessels are subject to periodic drydock, special survey and other scheduled or known

maintenance and repairs. The table below sets forth actual days off hire for the fourth quarter of 2010 and anticipated days off hire for the

above-mentioned events by vessel class for each quarter in 2011.

maintenance and repairs. The table below sets forth actual days off hire for the fourth quarter of 2010 and anticipated days off hire for the

above-mentioned events by vessel class for each quarter in 2011.

1 Includes one time chartered-in vessel that is expected to be off-hire for purposes of TCE revenue and charter hire expense.

2 Includes conversion of Overseas Chinook to shuttle tanker

Off Hire Schedule

page 20

For the Quarter Ended December 31, 2010

($ in thousands)

Note: Vessels chartered-in for less than one year are not on the Company’s fleet list. During the second quarter, the Gas segment chartered in an LPG

carrier for an initial term that was less than one year.

carrier for an initial term that was less than one year.

Charter Hire Expense by Segment

page 21

Locked-in Time Charter

Days by Segment

Days by Segment

Locked-in Time Charter

Revenue by Segment

Revenue by Segment

Locked-in

Charter Revenue

Charter Revenue

Note: Locked-in time charter days for 2011 are as of 12/31/10 and will differ from a more current date used in Appendices 3 and 4 in the quarterly

earnings press release. 1 Excludes $12M in time charter contracts, which were cancelled in February 2011.

earnings press release. 1 Excludes $12M in time charter contracts, which were cancelled in February 2011.

Future Revenue $/Days by Segment - As of 12/31/10

page *

www.osg.com