Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - VERIFONE SYSTEMS, INC. | d8k.htm |

Financial Results for the

Quarter Ended January 31,

2011

Exhibit 99.1 |

Forward-Looking Statements

Today’s

discussion

may

include

“forward-looking

statements”

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

Such

statements relate to future events and expectations and involve known

and unknown risks and uncertainties. VeriFone’s actual results or

actions may differ materially from those projected in the forward-looking

statements. For a summary of the specific risk factors that could cause

results to differ materially from those expressed in the forward-looking

statements, please refer to VeriFone’s filings with the Securities and

Exchange Commission, including its annual report on Form 10-K and

quarterly reports on Form 10-Q. VeriFone is under no obligation to, and

expressly disclaims any obligation to, update or alter its

forward-looking statements, whether as a result of new information,

future events, changes in assumptions or otherwise.

2

2 |

Important Information

In connection with the proposed Hypercom transaction, VeriFone has filed with

the Securities and Exchange Commission (“SEC”) a registration statement on

Form S-4 that includes a proxy statement/prospectus relating to the proposed

transaction. Investors are urged to read the form S-4 and proxy

statement/prospectus (and all amendments and supplements thereto) and any

other relevant documents filed with the SEC because they contain important

information about VeriFone, Hypercom and the proposed transaction. You can

obtain copies of the S-4 and proxy statement/prospectus, as well as

VeriFone’s other filings, free of charge at the website maintained by the SEC

at www.sec.gov. In addition, you may obtain documents filed with

the SEC by VeriFone free of charge by visiting our website (www.verifone.com) or by

directing a request in writing to: VeriFone, Attention: Investor Relations, 2099

Gateway Place, Suite 600, San Jose, CA 95110, by phone to (408) 232-7979

or by e-mail to ir@verifone.com. You may obtain documents filed with the

SEC by Hypercom free of charge at Hypercom’s website

(www.hypercom.com) or by directing a request in writing to Hypercom

Corporation, Attention: Investor Relations, 8888 East Raintree Drive, Suite 300, Scottsdale,

Arizona 85260, by phone to (480) 642-5000, or by e-mail to stsujita@hypercom.com. 3

3 |

Non-GAAP Financial Measures

With respect to any Non-GAAP financial measures presented in the

information, reconciliations of Non-GAAP to GAAP financial measures

may be found in VeriFone’s quarterly earnings release as filed with the

Securities and Exchange Commission. Management uses Non-GAAP

financial measures only in addition to and in conjunction with results

presented in accordance with GAAP. Management believes that these

Non-GAAP financial measures help it to evaluate VeriFone’s

performance and to compare VeriFone’s current results with those for

prior periods as well as with the results of peer companies. These Non-

GAAP financial measures contain limitations and should be considered

as a supplement to, and not as a substitute for, or superior to,

disclosures made in accordance with GAAP.

4

4 |

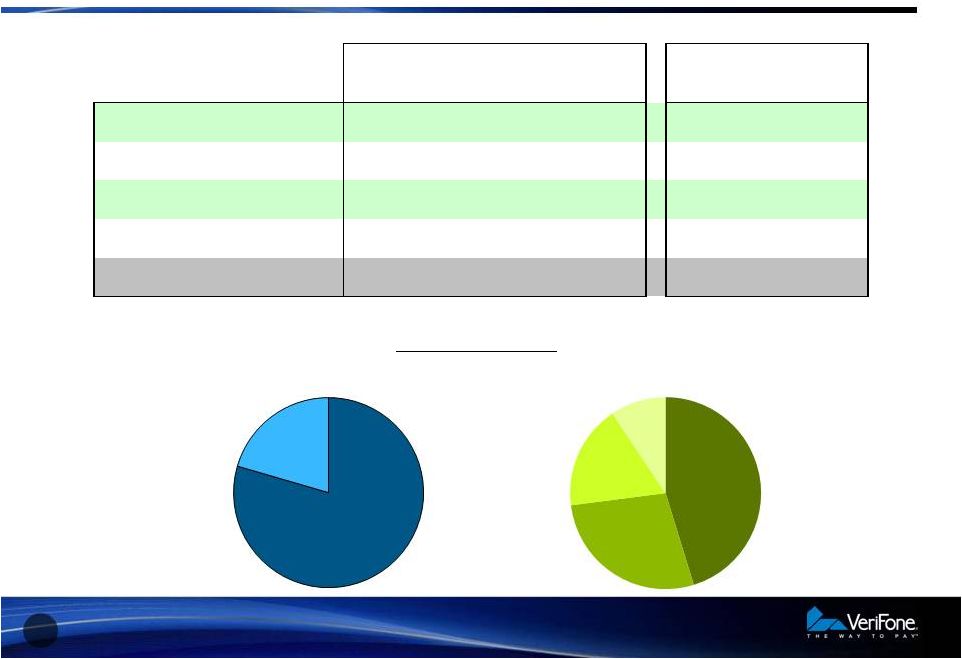

Non-GAAP Profit & Loss Overview

5

5

($ in thousands, except EPS)

Q110

Q410

Q111

% SEQ

Inc(Dec)

% YoY

Inc(Dec)

Revenue

223,400

276,000

283,940

2.9%

27.1%

Gross Margin

87,631

110,262

116,944

6.1%

33.5%

Gross Margin %

39.2%

40.0%

41.2%

Operating Expense

51,911

61,697

63,990

3.7%

23.3%

Operating Expense %

23.2%

22.4%

22.5%

Operating Profit

35,720

48,565

52,954

9.0%

48.2%

Operating Margin %

16.0%

17.6%

18.6%

Net Interest and Other

(4,451)

(3,388)

(3,529)

4.2%

-20.7%

Pre-tax Profit

31,269

45,177

49,425

9.4%

58.1%

Taxes

8,755

9,035

9,885

9.4%

12.9%

Net Income

22,514

36,142

39,540

9.4%

75.6%

Net Income %

10.1%

13.1%

13.9%

EPS

0.26

0.40

0.43

7.5%

65.4%

Q111 |

6

6

Non-GAAP Revenue Profile

Services

20.5%

System

Solutions

79.5%

Q111 Revenue

LAC

17.7%

NA

45.2%

Asia

9.4%

Europe

27.7%

($ in thousands)

Q110

Q410

Q111

% SEQ

Inc(Dec)

% YoY

Inc(Dec)

North America

89,613

122,139

128,479

5.2%

43.4%

Europe

69,374

70,165

78,707

12.2%

13.5%

Latin America

40,623

53,887

50,131

-7.0%

23.4%

Asia

23,790

29,809

26,623

-10.7%

11.9%

Total

223,400

276,000

283,940

2.9%

27.1%

Q111 |

PAYware

Mobile Enterprise •

Selected as Top 5 New Technology for

2011 by National Retail Federation

•

Securely Enables Multiple New Mobile Services for Large Retailers

–

Roaming POS

–

Personal Shopping

–

Out of Store Sales

–

Inventory Control

–

Loyalty Programs

•

PCI-Approved Mobile Solution Incorporating End-to-End Encryption

and Tokenization for Use with Smart Mobile Devices

7

7 |

Financial Results and

Guidance

8

8 |

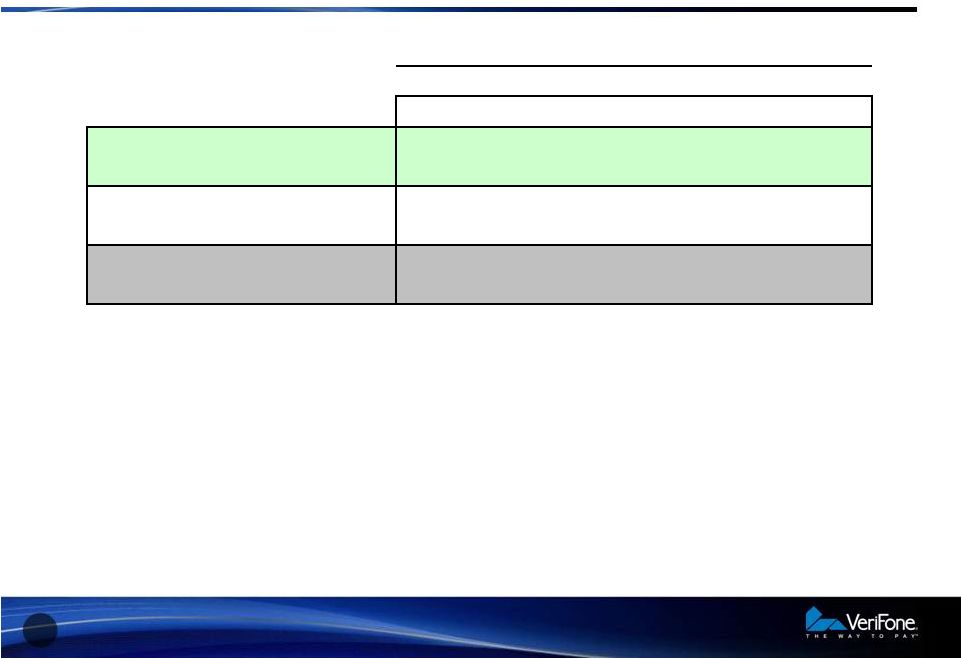

Non-GAAP Gross Margin Review

9

9

Q110

Q410

Q111

System Solutions

39.0%

38.7%

40.1%

Services

40.5%

46.0%

45.3%

Total

39.2%

40.0%

41.2%

% of Revenue |

Non-GAAP Operating Expenses

10

10

Q110

Q410

Q111

Research and Development

7.2%

7.1%

7.3%

Sales and Marketing

8.3%

8.7%

8.8%

G&A

7.7%

6.6%

6.4%

Total

23.2%

22.4%

22.5%

Non-GAAP Operating Expenses as

Reported ($M)

51.9

61.7

64.0

Non-GAAP Operating Expenses,

Constant Currency ($M)

52.2

62.3

64.0

% of Revenue |

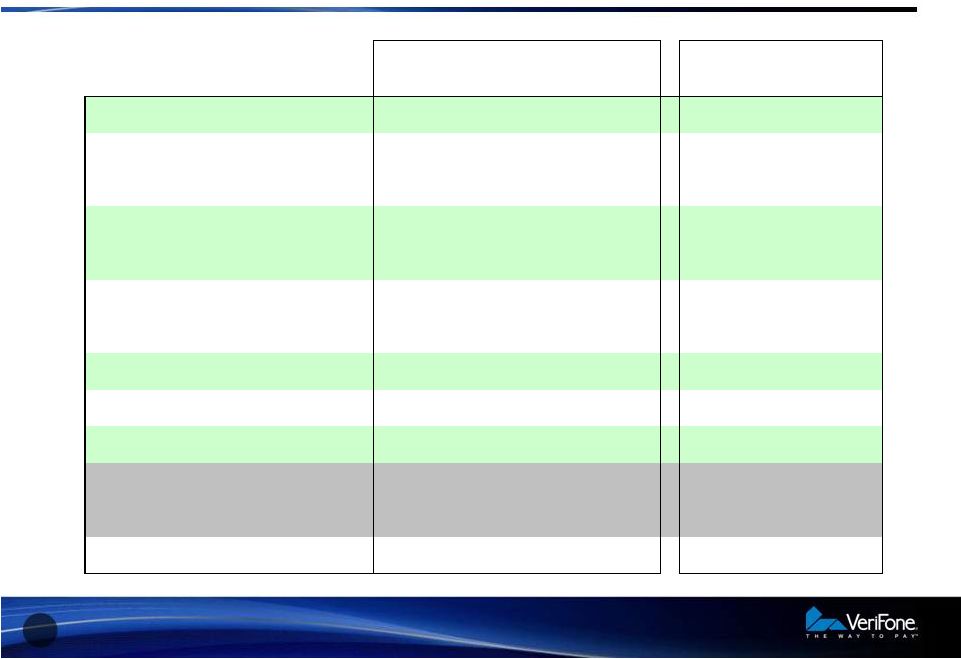

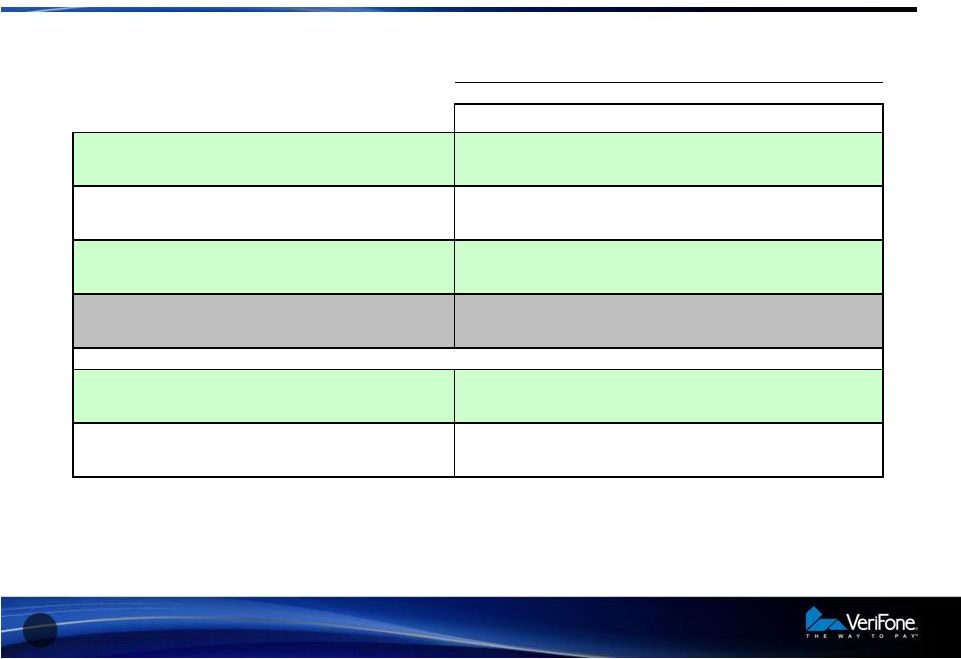

Cash

Flow and Balance Sheet 11

11

($ in thousands, except Days)

$

$

$

Cash Flow from Operations before

Changes in Working Capital

34,324

51,716

50,800

Cash Flow from Operations

55,316

54,038

30,409

Key Balance Sheet Items:

Cash

374,617

445,137

479,167

Accounts Receivables, net

152,471

64

132,988

46

164,830

54

Accounts Receivables Reserves

(3,813)

(5,862)

(5,771)

Inventories, net

94,496

63

111,901

61

112,084

60

Inventories Reserves

(29,485)

(23,257)

(27,294)

Accounts Payable

88,194

58

64,016

35

77,596

42

Deferred Revenue, net

66,366

77,607

78,494

Note: Accounts Receivable Days Sales Outstanding is

calculated based on Gross Accounts Receivable Net of Reserve for Product

Returns. Days in Inventory is calculated as Average Net Inventory divided by

Total Cost of Goods Sold. Days in Accounts Payable is calculated as Accounts

Payable divided by Total Cost of Goods Sold. Q111

Days

Q110

Days

Q410

Days |

Guidance

•

For the second quarter ending April 30, 2011, VeriFone expects net

revenues to be between $280 million and $284 million. Non-GAAP

net income per share is projected to be in the range of $0.42 to

$0.43.

•

For the full year of fiscal 2011, VeriFone expects net revenues to be

between $1,150 million and $1,160 million. Non-GAAP net income

per share is projected to be in the range of $1.75 to $1.80 for the

same time period.

12

12 |

13

13

NFC Enabled Mobile Commerce Gaining Momentum |

Fundamental Rules for the Success of Mobile Commerce

1.

The point of sale becomes the hub of systems complexity

2.

Consumers

must

see

“real

value”

from

these

new

ways

to

pay

3.

Retailers will not tolerate special purpose lanes for smart-phone shoppers

4.

Mobile commerce must be ubiquitous to be successful

5.

Plastic cards won’t disappear any time soon

6.

Security must be ironclad

14

14 |

15

15

Financial Results for the

Quarter Ended January 31,

2011 |

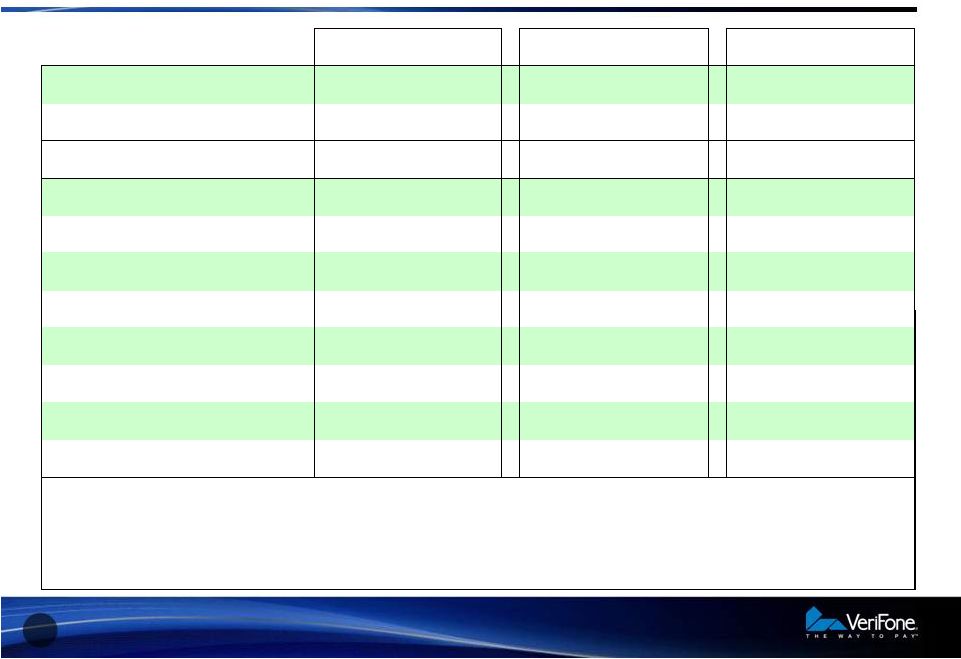

VERIFONE SYSTEMS, INC. AND SUBSIDIARIES

RECONCILIATIONS OF CERTAIN NON-GAAP FINANCIAL MEASURES

(IN THOUSANDS, EXCEPT PER SHARE DATA AND PERCENTAGES)

(UNAUDITED)

| Three Months Ended January 31, | ||||||||

| 2011 | 2010 | |||||||

| GAAP Net revenues - System Solutions |

$ | 225,707 | $ | 188,014 | ||||

| Amortization of step-down in deferred revenue on acquisition |

— | — | ||||||

| Non-GAAP Net revenues - System Solutions |

$ | 225,707 | $ | 188,014 | ||||

| GAAP Net revenues - Services |

$ | 58,058 | $ | 35,386 | ||||

| Amortization of step-down in deferred revenue on acquisition |

175 | — | ||||||

| Non-GAAP Net revenues - Services |

$ | 58,233 | $ | 35,386 | ||||

| GAAP Net revenues |

$ | 283,765 | $ | 223,400 | ||||

| Amortization of step-down in deferred revenue on acquisition |

175 | — | ||||||

| Non-GAAP Net revenues |

$ | 283,940 | $ | 223,400 | ||||

| GAAP Cost of net revenues - System Solutions |

$ | 140,140 | $ | 120,085 | ||||

| Stock-based compensation |

(351 | ) | (340 | ) | ||||

| Acquisition related and Restructuring costs |

(26 | ) | (134 | ) | ||||

| Amortization of purchased intangible assets |

(4,636 | ) | (4,893 | ) | ||||

| Non-GAAP Cost of net revenues - System Solutions |

$ | 135,127 | $ | 114,718 | ||||

| GAAP Cost of net revenues - Services |

$ | 32,134 | $ | 21,409 | ||||

| Stock-based compensation |

(47 | ) | (54 | ) | ||||

| Acquisition related and Restructuring costs |

5 | (95 | ) | |||||

| Amortization of purchased intangible assets |

(223 | ) | (209 | ) | ||||

| Non-GAAP Cost of net revenues - Services |

$ | 31,869 | $ | 21,051 | ||||

| GAAP Gross profit - System Solutions |

$ | 85,567 | $ | 67,929 | ||||

| Amortization of step-down in deferred revenue on acquisition |

— | — | ||||||

| Stock-based compensation |

351 | 340 | ||||||

| Acquisition related and Restructuring costs |

26 | 134 | ||||||

| Amortization of purchased intangible assets |

4,636 | 4,893 | ||||||

| Non-GAAP Gross profit - System Solutions |

$ | 90,580 | $ | 73,296 | ||||

| GAAP System Solutions gross margins |

37.9 | % | 36.1 | % | ||||

| Amortization of step-down in deferred revenue on acquisition as a % of System Solutions net revenues |

0.0 | % | 0.0 | % | ||||

| Stock-based compensation as a % of System Solutions net revenues |

0.2 | % | 0.2 | % | ||||

| Acquisition related and Restructuring costs as a % of System Solutions net revenues |

0.0 | % | 0.1 | % | ||||

| Amortization of purchased intangible assets as a % of System Solutions net revenues |

2.1 | % | 2.6 | % | ||||

| Non-GAAP System Solutions gross margins |

40.1 | % | 39.0 | % | ||||

| GAAP Gross profit - Services |

$ | 25,924 | $ | 13,977 | ||||

| Amortization of step-down in deferred revenue on acquisition |

175 | — | ||||||

| Stock-based compensation |

47 | 54 | ||||||

| Acquisition related and Restructuring costs |

(5 | ) | 95 | |||||

| Amortization of purchased intangible assets |

223 | 209 | ||||||

| Non-GAAP Gross profit - Services |

$ | 26,364 | $ | 14,335 | ||||

VERIFONE SYSTEMS, INC. AND SUBSIDIARIES

RECONCILIATIONS OF CERTAIN NON-GAAP FINANCIAL MEASURES

(IN THOUSANDS, EXCEPT PER SHARE DATA AND PERCENTAGES)

(UNAUDITED)

| Three Months Ended January 31, | ||||||||

| 2011 | 2010 | |||||||

| GAAP Services gross margins |

44.7 | % | 39.5 | % | ||||

| Amortization of step-down in deferred revenue on acquisition as a % of Services net revenues |

0.3 | % | 0.0 | % | ||||

| Stock-based compensation as a % of Services net revenues |

0.1 | % | 0.2 | % | ||||

| Acquisition related and Restructuring costs as a % of Services net revenues |

0.0 | % | 0.3 | % | ||||

| Amortization of purchased intangible assets as a % of Services net revenues |

0.4 | % | 0.6 | % | ||||

| Non-GAAP Services gross margins |

45.3 | % | 40.5 | % | ||||

| GAAP Gross profit |

$ | 111,491 | $ | 81,906 | ||||

| Amortization of step-down in deferred revenue on acquisition |

175 | — | ||||||

| Stock-based compensation |

398 | 394 | ||||||

| Acquisition related and Restructuring costs |

21 | 229 | ||||||

| Amortization of purchased intangible assets |

4,859 | 5,102 | ||||||

| Non-GAAP Gross profit |

$ | 116,944 | $ | 87,631 | ||||

| GAAP Gross margins |

39.3 | % | 36.7 | % | ||||

| Amortization of step-down in deferred revenue on acquisition as a % of net revenues |

0.1 | % | 0.0 | % | ||||

| Stock-based compensation as a % of net revenues |

0.1 | % | 0.2 | % | ||||

| Acquisition related and Restructuring costs as a % of net revenues |

0.0 | % | 0.1 | % | ||||

| Amortization of purchased intangible assets as a % of net revenues |

1.7 | % | 2.3 | % | ||||

| Non-GAAP Gross margins |

41.2 | % | 39.2 | % | ||||

| GAAP Research and development |

$ | 21,642 | $ | 17,100 | ||||

| Stock-based compensation |

(876 | ) | (937 | ) | ||||

| Acquisition related and Restructuring costs |

(4 | ) | — | |||||

| Non-GAAP Research and development |

$ | 20,762 | $ | 16,163 | ||||

| GAAP Sales and marketing |

$ | 28,306 | $ | 20,475 | ||||

| Stock-based compensation |

(3,030 | ) | (1,825 | ) | ||||

| Acquisition related and Restructuring costs |

(167 | ) | — | |||||

| Non-GAAP Sales and marketing |

$ | 25,109 | $ | 18,650 | ||||

| GAAP General and administrative and amortization of purchased intangible assets |

$ | 26,332 | $ | 24,973 | ||||

| Stock-based compensation |

(3,138 | ) | (1,527 | ) | ||||

| Other charges - SOX remediation |

— | (1,094 | ) | |||||

| Acquisition related and Restructuring costs |

(2,759 | ) | (762 | ) | ||||

| Amortization of purchased intangible assets |

(2,316 | ) | (4,492 | ) | ||||

| Non-GAAP General and administrative |

$ | 18,119 | $ | 17,098 | ||||

VERIFONE SYSTEMS, INC. AND SUBSIDIARIES

RECONCILIATIONS OF CERTAIN NON-GAAP FINANCIAL MEASURES

(IN THOUSANDS, EXCEPT PER SHARE DATA AND PERCENTAGES)

(UNAUDITED)

| Three Months Ended January 31, | ||||||||

| 2011 | 2010 | |||||||

| GAAP Operating expenses |

$ | 76,280 | $ | 62,548 | ||||

| Stock-based compensation |

(7,044 | ) | (4,289 | ) | ||||

| Other charges - SOX remediation |

— | (1,094 | ) | |||||

| Acquisition related and Restructuring costs |

(2,930 | ) | (762 | ) | ||||

| Amortization of purchased intangible assets |

(2,316 | ) | (4,492 | ) | ||||

| Non-GAAP Operating expenses |

$ | 63,990 | $ | 51,911 | ||||

| GAAP Operating income |

$ | 35,211 | $ | 19,358 | ||||

| Amortization of step-down in deferred revenue on acquisition |

175 | — | ||||||

| Stock-based compensation |

7,442 | 4,683 | ||||||

| Other charges - SOX remediation |

— | 1,094 | ||||||

| Acquisition related and Restructuring costs |

2,951 | 991 | ||||||

| Amortization of purchased intangible assets |

7,175 | 9,594 | ||||||

| Non-GAAP Operating income |

$ | 52,954 | $ | 35,720 | ||||

| GAAP Operating margin |

12.4 | % | 8.7 | % | ||||

| Amortization of step-down in deferred revenue on acquisition as a % of net revenues |

0.1 | % | 0.0 | % | ||||

| Stock-based compensation as a % of net revenues |

2.6 | % | 2.1 | % | ||||

| Other charges - SOX remediation as a % of net revenues |

0.0 | % | 0.5 | % | ||||

| Acquisition related and Restructuring costs as a % of net revenues |

1.0 | % | 0.4 | % | ||||

| Amortization of purchased intangible assets as a % of net revenues |

2.5 | % | 4.3 | % | ||||

| Non-GAAP Operating margin |

18.6 | % | 16.0 | % | ||||

| GAAP Interest expense |

$ | (7,570 | ) | $ | (7,254 | ) | ||

| Acquisition related interest charges |

466 | 414 | ||||||

| Non-cash interest expense |

3,819 | 3,571 | ||||||

| Non-GAAP Interest expense |

$ | (3,285 | ) | $ | (3,269 | ) | ||

| GAAP Interest income |

$ | 283 | $ | 296 | ||||

| Non-GAAP Interest income |

$ | 283 | $ | 296 | ||||

| GAAP Other income (expense), net |

$ | 1,651 | $ | (1,760 | ) | |||

| Other charges - acquisitions related and other |

(2,178 | ) | 343 | |||||

| Gain on debt extinguishment |

— | (61 | ) | |||||

| Non-GAAP Other expense, net |

$ | (527 | ) | $ | (1,478 | ) | ||

VERIFONE SYSTEMS, INC. AND SUBSIDIARIES

RECONCILIATIONS OF CERTAIN NON-GAAP FINANCIAL MEASURES

(IN THOUSANDS, EXCEPT PER SHARE DATA AND PERCENTAGES)

(UNAUDITED)

| Three Months Ended January 31, | ||||||||

| 2011 | 2010 | |||||||

| Non-GAAP Income before income taxes |

$ | 49,425 | $ | 31,269 | ||||

| GAAP Provision for (benefit from) income taxes |

$ | (2,456 | ) | $ | 19 | |||

| Income tax effect of non-GAAP exclusions |

12,341 | 8,736 | ||||||

| Non-GAAP Provision for income taxes (1) |

$ | 9,885 | $ | 8,755 | ||||

| Non-GAAP Income tax rate (1) |

20 | % | 28 | % | ||||

| GAAP Net income |

$ | 32,031 | $ | 10,621 | ||||

| Amortization of step-down in deferred revenue on acquisition |

175 | — | ||||||

| Stock-based compensation |

7,442 | 4,683 | ||||||

| Other charges - SOX remediation, acquisitions related and other |

(1,712 | ) | 1,851 | |||||

| Acquisition related and Restructuring costs |

2,951 | 991 | ||||||

| Amortization of purchased intangible assets |

7,175 | 9,594 | ||||||

| Non-cash interest expense |

3,819 | 3,571 | ||||||

| Gain on debt extinguishment |

— | (61 | ) | |||||

| Income tax effect of non-GAAP exclusions |

(12,341 | ) | (8,736 | ) | ||||

| Total Non-GAAP Net income |

$ | 39,540 | $ | 22,514 | ||||

| Non-GAAP Net income per share: |

||||||||

| Basic |

$ | 0.45 | $ | 0.27 | ||||

| Diluted |

$ | 0.43 | $ | 0.26 | ||||

| Weighted average shares used in computing Non-GAAP net income per share: |

||||||||

| Basic |

87,090 | 84,690 | ||||||

| Diluted |

91,321 | 86,610 | ||||||

| GAAP Net income as a % of net revenues |

11.3 | % | 4.8 | % | ||||

| Amortization of step-down in deferred revenue on acquisition as a % of net revenues |

0.1 | % | 0.0 | % | ||||

| Stock-based compensation as a % of net revenues |

2.6 | % | 2.1 | % | ||||

| Other charges - SOX remediation, acquisitions related and other as a % of net revenues |

-0.6 | % | 0.8 | % | ||||

| Acquisition related and Restructuring costs as a % of net revenues |

1.0 | % | 0.4 | % | ||||

| Amortization of purchased intangible assets as a % of net revenues |

2.5 | % | 4.3 | % | ||||

| Non-cash interest expense as a % of net revenues |

1.3 | % | 1.6 | % | ||||

| Gain on debt extinguishment as a % of net revenues |

0.0 | % | 0.0 | % | ||||

| Income tax effect of non-GAAP exclusions as a % of net revenues |

-4.3 | % | -3.9 | % | ||||

| Total Non-GAAP Net income as a % of non-GAAP net revenues |

13.9 | % | 10.1 | % | ||||

| (1) | The Non-GAAP tax rate used in our Non-GAAP reconciliation was changed beginning the fiscal third quarter 2010 from 28% to 20%. |