Attached files

Armstrong World Industries

Investor Presentation

Fourth Quarter 2010

February 28, 2011

Exhibit 99.3 |

2

Safe

Harbor

Statement

This presentation contains “forward-looking statements”

related to Armstrong

World Industries, Inc.’s, future financial performance. Our results could

differ materially from the results discussed in these forward-looking

statements due to known and unknown risks and uncertainties. A more

detailed discussion of the risks and uncertainties that may affect our

ability to achieve the projected performance is included in the “Risk

Factors” and “Management’s Discussion

and Analysis”

sections of our recent reports on Forms 10-K and 10-Q filed with

the SEC. We undertake no obligation to update any forward-looking statement

beyond what is required by applicable securities law.

In addition, we will be referring to non-GAAP financial measures within the

meaning of SEC Regulation G. A reconciliation of the differences

between these

measures with the most directly comparable financial measures calculated in

accordance with GAAP is available on the Investor Relations page

of our

website at www.armstrong.com.

|

3

Key Metrics –

Fourth Quarter 2010 Adjusted

(1)

Financial Overview

(1)

Figures exclude non-recurring items such as charges for cost reduction

initiatives, restructuring, etc. Figures also exclude the impact of foreign exchange

movements.

(2)

As reported Net Sales: $643 million in 2010 and $653 million in

2009.

(3)

As reported Operating Loss: ($30 million) in 2010 and ($2 million) in

2009. (4)

As reported EPS: ($0.36) in 2010 and ($0.07) in

2009. (5)

Earnings per share reflect an adjusted tax rate of 42% for both 2010 and

2009. (6)

Total

cash

as

of

December

31,

2010

of

$316

million

was

comprised

of

$36

million

in

domestic

cash

and

$280

million

in

foreign

cash.

Total

cash

as

of

December 31, 2009 of $570 million was comprised of $328 million in domestic cash

and $241 million in foreign cash. Total debt was $875 million in 2010

and $473 million in 2009.

All figures in $ millions unless otherwise noted. Figures may not add due to

rounding. 2010

Actual

2009

Actual

Variance

Net Sales

(2)

$652

$657

(0.7%)

Operating Income

(3)

19

26

(27.6%)

% of Sales

2.9%

3.9%

(100 bps)

EBITDA

47

54

(14.0%)

% of Sales

7.1%

8.2%

(110 bps)

Earnings Per Share

(4), (5)

$0.11

$0.23

($0.12)

Free Cash Flow

43

53

(10)

Net (Cash) Debt

(6)

559

(97)

656 |

4

Q4 2010 –

Adjusted Operating Income to

Reported Net Income

Financial Overview

All figures in $ millions unless otherwise noted. Figures may not add due to

rounding. (1)

Figures exclude non-recurring items such as charges for cost reduction

initiatives, restructuring, etc. Figures also exclude the impact of foreign

exchange movements.

2010

2009

V

Operating Income –

Adjusted

(1)

$19

$26

($7)

Foreign Exchange Movements

1

(1)

2

Cost Reduction Initiatives

(22)

(9)

(13)

Asset Impairments

(22)

(18)

(4)

Restructuring

(7)

-

(7)

Executive Transition

(1)

-

(1)

Gain from Settlement of Note

Receivable

2

-

2

Operating Income –

As Reported

($30)

($2)

($28)

Interest (Expense) Income

(8)

(3)

(5)

EBT

($38)

($5)

($33)

Tax (Expense) Benefit

17

1

16

Net Income

($21)

($4)

($17) |

5

Q4 Sales and Adjusted Operating Income

(1)

by

Segment –

2010 vs. 2009

Financial Overview

All figures in $ millions unless otherwise noted. Figures may not add due to

rounding. (1)

Figures exclude non-recurring items such as charges for cost reduction

initiatives, restructuring, etc. Figures also exclude the impact of foreign

exchange movements. |

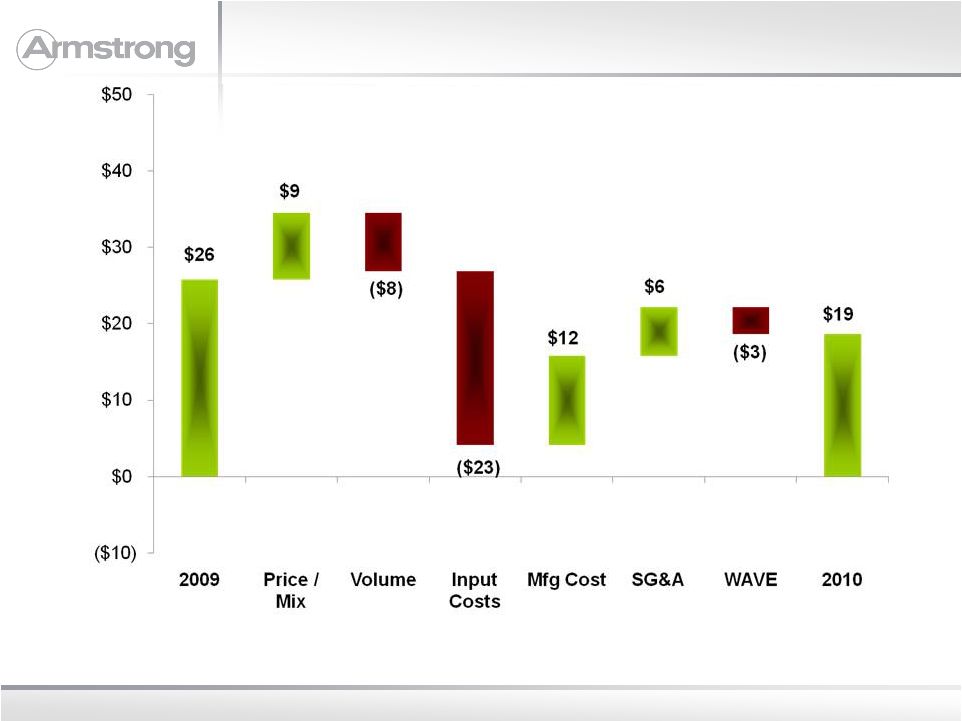

6

Adjusted Operating Income

(1)

Bridge –

Q4 2010 versus Prior Year

Financial Overview

All figures in $ millions unless otherwise noted. Figures may not add due to

rounding. (1)

Figures exclude non-recurring items such as charges for cost reduction

initiatives, restructuring, etc. Figures also exclude the impact of foreign

exchange movements. |

7

Free Cash Flow –

Fourth Quarter 2010

versus Prior Year

Financial Overview

All figures in $ millions unless otherwise noted. Figures may not add due to

rounding. |

8

Key Metrics –

Full Year 2010 Adjusted

(1)

Financial Overview

All figures in $ millions unless otherwise noted. Figures may not add due to

rounding. (1)

Figures exclude non-recurring items such as charges for cost reduction

initiatives, restructuring, etc. Figures also exclude the impact of foreign

exchange movements.

(2)

As reported Net Sales: $2,766 million in 2010 and $2,780 million in

2009. (3)

As reported Operating Income: $81 million in 2010 and $91 million in

2009. (4)

As reported EPS: $0.19 in 2010 and $1.36 in 2009.

(5)

Earnings per share reflect an adjusted tax rate of 42% for both 2010 and

2009. (6)

Total cash in 2010 of $316 million was comprised of $36 million in domestic cash

and $280 million in foreign cash. Total cash in 2009 of $570 million

was

comprised

of:

$328

million

in

domestic

cash

and

$241

million

in

foreign

cash.

Total

debt

was

$875

million

in

2010

and

$473

million

in

2009.

2010

Actual

2009

Actual

Variance

Net Sales

(2)

$2,833

$2,853

(0.7%)

Operating Income

(3)

188

157

20.2%

% of Sales

6.6%

5.5%

110 bps

EBITDA

303

296

2.4%

% of Sales

10.7%

10.4%

30 bps

Earning Per Share

(4), (5)

$1.72

$1.44

$0.28

Free Cash Flow

180

211

(31)

Net (Cash) Debt

(6)

559

(97)

656 |

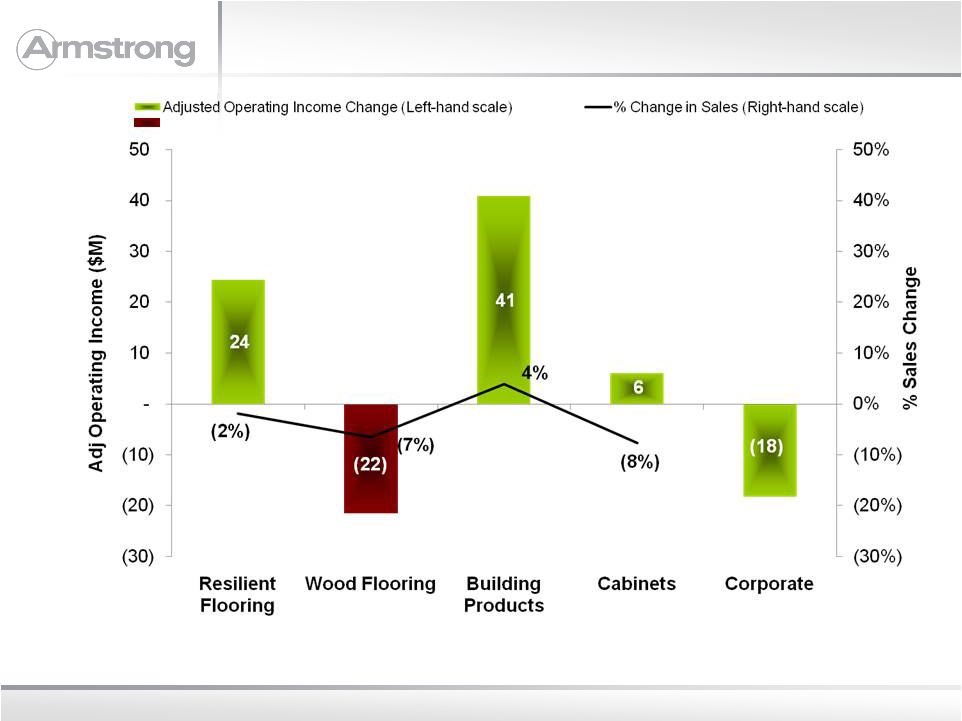

9

Full Year Sales and Adjusted Operating

Income

(1)

by Segment –

2010 vs. 2009

Financial Overview

All figures in $ millions unless otherwise noted. Figures may not add due to

rounding. (1)

Figures exclude non-recurring items such as charges for cost reduction

initiatives, restructuring, etc. Figures also exclude the impact of foreign

exchange movements. |

10

Adjusted Operating Income

(1)

Bridge –

Full Year 2010 versus Prior Year

Financial Overview

All figures in $ millions unless otherwise noted. Figures may not add due to

rounding. (1)

Figures exclude non-recurring items such as charges for cost reduction

initiatives, restructuring, etc. Figures also exclude the impact of foreign

exchange movements. |

11

Free Cash Flow –

Full Year 2010 versus Prior Year

Financial Overview

All figures in $ millions unless otherwise noted. Figures may not add due to

rounding. |

12

Capital Structure as of December 31, 2010

Financial Overview

All figures in $ millions unless otherwise noted. Figures may not add due to

rounding. CASH

Balance ($M)

US Cash

$36

International Cash

280

(1)

TOTAL Cash

$316

DEBT

Balance ($M)

Interest Rate

Maturity

Revolver ($250M)

$25

(1)

3.28%

(2)

2015

A/R Securitization ($100M)

-

1.20%

2013

Term Loan A / B

250 / 550

3.28% / 5.00%

(2)

2015 / 2017

Industrial Development Bond / Other

50

~2.00%

>2025

TOTAL Debt

$875

Net Debt

$559

(1)

In January 2011, a significant amount of international cash was repatriated with

the proceeds used to pay off the revolver. (2)

Term Loan A and the revolver interest rates are LIBOR + 3% and Term Loan B interest

rate is LIBOR + 3.5% with a 1.5% floor. |

13

$150 Million Savings Program

Financial Overview

All figures in $ millions unless otherwise noted. Figures may not add due to

rounding. $150M savings from manufacturing and SG&A, net of

inflation. Will use procurement savings to mitigate strong inflationary

pressure. |

14

AWI -

Return on Invested Capital (ROIC)

Financial Overview

All figures in $ millions unless otherwise noted. Figures may not add due to

rounding. Near term goal is to return at least our cost of capital by 2013,

with domestic housing starts ~ 1 million units.

|

15

Key Metrics

(1)

–

Guidance 2011

Financial Overview

All figures in $ millions unless otherwise noted.

2011

Estimate Range

2010

Variance

Net Sales

2,800

to

3,000

2,766

1%

to

8%

Operating Income

(2)

255

to

305

189

35%

to

62%

EBITDA

360

to

410

303

19%

to

35%

Earnings Per Share

(3),(4)

$2.04

to

$2.53

$1.73

18%

to

47%

Free Cash Flow

70

to

120

180

(61%)

to

(33%)

(1)

Figures exclude non-recurring items such as charges for cost reduction

initiatives, restructuring, etc. (2)

As reported Operating Income: $225 -

275 million in 2011 and $81 million 2010.

(3)

Earnings per share reflect an adjusted tax rate of 42% for both 2011 and

2010. (4)

As reported earnings per share: $1.85 -

$2.34 in 2011 and $0.19 in 2010. |

16

2011 Financial Outlook

Financial Overview

Raw Material & Energy Inflation

$35 -

$45 million increase

Manufacturing Productivity

Gross Margin +100 to +200 bps vs. 2010

U.S. Pension Credit

~$25 million, down ~$25 million vs. 2010

60% manufacturing, 40% SG&A

Earnings from WAVE

$5 -

$10 million vs. 2010

Cash Taxes/ETR

~$15 million. Adjusted ETR of 42%

Q1

Sales $640 –

$705 million

EBITDA $72 –

$88 million

Capital Spending

~$180-$200 million

Exclusions from EBITDA

~$18 -

27 million associated with already

announced actions |

Appendix |

18

Full Year 2010 –

Adjusted Operating Income to

Reported Net Income

Financial Overview Appendix

All figures in $ millions unless otherwise noted. Figures may not add due to

rounding. 2010

2009

V

Operating Income –

Adjusted

(1)

$188

$157

$31

Foreign Exchange Movements

2

-

2

Laminate Duty Refund

7

-

7

Cost Reduction Initiatives

(50)

(16)

(34)

Asset Impairments

(31)

(18)

(13)

Restructuring

(22)

-

(22)

Executive Transition

(15)

-

(15)

Gain on Settlement of Note Receivable

2

-

2

Accelerated Vesting

-

(32)

32

Operating Income –

As Reported

$81

$91

($10)

Interest (Expense) Income

(14)

(16)

2

EBT

$67

$75

($8)

Tax (Expense) Benefit

(56)

3

(59)

Net Income

$11

$78

($67)

(1)

Figures exclude non-recurring items such as charges for cost reduction

initiatives, restructuring, etc. Figures also exclude the impact of foreign

exchange movements. |

19

Normalized Operating Income to Free Cash Flow

Financial Overview Appendix

All figures in $ millions unless otherwise noted.

2011

Estimate Range

Adjusted Operating Income

255

to

305

D&A

105

Adjusted EBITDA

360

to

410

Changes in Working Capital

10

to

30

Capex

(180)

to

(200)

Pension Credit

(25)

Interest Expense

(50)

Cash Taxes

(15)

Other, including cash payments for

restructuring and one-time items

(30)

Free Cash Flow

70

to

120 |

20

Consolidated Results

Financial Overview Appendix

All figures in $ millions unless otherwise noted. Figures may not add due to

rounding. Fourth Quarter

2010

Reported

Comparability

(1)

Adjustments

FX

(2)

Adj

2010

Adjusted

2009

Reported

Comparability

(1)

Adjustments

FX

(2)

Adj

2009

Adjusted

Net Sales

643

-

9

652

653

-

4

657

Operating Income

(30)

50

(1)

19

(2)

27

-

26

EPS

($0.36)

$0.48

($0.01)

$0.11

($0.07)

$0.30

$ -

$0.23

Full Year 2010

2010

Reported

Comparability

(1)

Adjustments

FX

(2)

Adj

2010

Adjusted

2009

Reported

Comparability

(1)

Adjustments

FX

(2)

Adj

2009

Adjusted

Net Sales

2,766

-

66

2,833

2,780

-

73

2,853

Operating Income

81

108

(2)

188

91

65

1

157

EPS

$0.19

$1.55

($0.02)

$1.72

$1.36

$0.07

$0.01

$1.44

(1)

See earnings press release and 10-K for additional detail on comparability

adjustments (2)

Eliminates impact of foreign exchange movements |

21

Segment Operating Income (Loss)

Financial Overview Appendix

All figures in $ millions unless otherwise noted. Figures may not add due to

rounding. (1)

Eliminates impact of foreign exchange movements and non-recurring items; see

earnings press release and 10-K for additional detail. Fourth

Quarter 2010

Reported

Comparability

(1)

Adjustments

2010

Adjusted

2009

Reported

Comparability

(1)

Adjustments

2009

Adjusted

Resilient Flooring

(2)

3

1

(7)

2

(4)

Wood Flooring

(32)

28

(4)

(10)

20

10

Building Products

16

16

32

24

-

24

Cabinets

(1)

-

(1)

(8)

5

(3)

Unallocated Corporate

(Expense) Income

(12)

(3)

(9)

-

-

-

Full Year 2010

2010

Reported

Comparability

(1)

Adjustments

2010

Adjusted

2009

Reported

Comparability

(1)

Adjustments

2009

Adjusted

Resilient Flooring

13

18

31

-

6

7

Wood Flooring

(46)

39

(7)

(6)

20

14

Building Products

171

27

198

156

1

157

Cabinets

(6)

-

(6)

(18)

6

(12)

Unallocated Corporate

(Expense) Income

(51)

23

(28)

(41)

32

(9) |

22

Cash Flow

Financial Overview Appendix

All figures in $ millions unless otherwise noted. Figures may not add due to

rounding. Fourth Quarter

Full Year

($-millions)

2010

2009

2010

2009

Net Cash From Operations

49

82

190

260

Plus / (Minus) Net Cash from Investing

(37)

(29)

(41)

(41)

Add back / (subtract):

Restricted Cash

30

-

30

-

Divestitures

1

-

1

(8)

Equals Free Cash Flow

43

53

180

211 |