Attached files

Armstrong World Industries

Investor Presentation

February 28, 2011

Exhibit 99.2 |

2

Safe Harbor Statement

This presentation contains “forward-looking statements”

related to Armstrong

World Industries, Inc.’s, future financial performance. Our results could

differ materially from the results discussed in these forward-looking

statements due to known and unknown risks and uncertainties. A more

detailed discussion of the risks and uncertainties that may affect our

ability to achieve the projected performance is included in the “Risk

Factors” and “Management’s Discussion

and Analysis”

sections of our recent reports on Forms 10-K and 10-Q filed with

the SEC. We undertake no obligation to update any forward-looking statement

beyond what is required by applicable securities law.

In addition, we will be referring to non-GAAP financial measures within the

meaning of SEC Regulation G. A reconciliation of the differences

between these

measures with the most directly comparable financial measures calculated in

accordance with GAAP is available on the Investor Relations page

of our

website at www.armstrong.com.

|

3

Company Overview |

4

Armstrong at a Glance

Leading manufacturer of floors and ceilings for use

in renovation and new construction. Significant

U.S. cabinets’

business.

$2.8 billion in sales in 2010

#1 in businesses representing 80% of sales

Serving global customers from eight countries

34 manufacturing locations

Approximately 9,800 employees

Approximately $2.5 billion market capitalization

Strong balance sheet -

$550 million of net debt at 12/31/10

Significant NOL carry forward

58 million diluted shares outstanding

300K average daily trading volume

64% owned by Armstrong Asbestos Trust and Armor TPG

‘AWI’

on the NYSE

Since October 2006 emergence from asbestos-related bankruptcy

Company Overview |

5

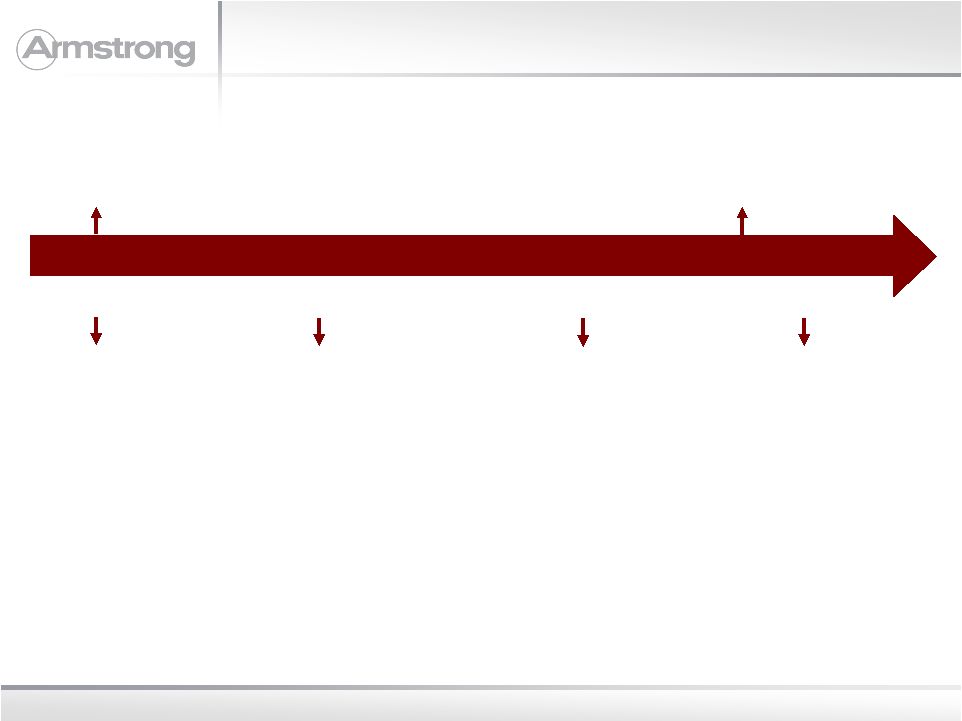

History

1998 Sales Mix:

Residential/Commercial

was 65/35

Significant geographic

and product line

expansion:

•

Hardwood floors

•

Cabinets

•

DLW (European flooring)

Asbestos-related

bankruptcy

Manufacturing and

overhead restructuring

Significant growth in

Commercial products

Strategic review and sale

process in declining residential

market:

•

Improved product mix

•

Increased manufacturing

productivity

•

Commercial volume growth

Strategic focus in soft

residential and declining

commercial markets:

•

Ensure innovation

•

Align costs with

changing environment

Managing for Profitability

1998

2001 -

2006

2007

2008 -

2009

Company Overview

2009 Sales Mix:

Residential/Commercial

was 40/60

•

Expand revenue

opportunities

•

Position company to

deliver sustainable

profitability

•

Deliver earnings growth

•

Ensure ongoing

profitability and

preserve cash |

6

AWI Key Strategies

Company Overview

1

Enhance the Core

Maximize profits in global Floors and

Ceilings

Increase share and mix selectively

2

Expand the Core

Drive growth in China and India

Build ceilings and flooring plants in

China

Expand presence in Eastern

Europe and Middle East

3

Drive Lower Costs

$150 million cost savings program

LEAN investment, SG&A

reduction, procurement savings

Restructure floor Europe

4

Innovation Leadership

Environmental leadership

Unmatched product portfolio

5

Organization Vitality

Attract, retain and develop the best

people in the industry

Organizational processes aligned

with strategic objectives

6

Efficient Balance Sheet

Net debt less than 2x EBITDA

No significant maturities until 2015

Sufficient cash to make organic

investments |

7

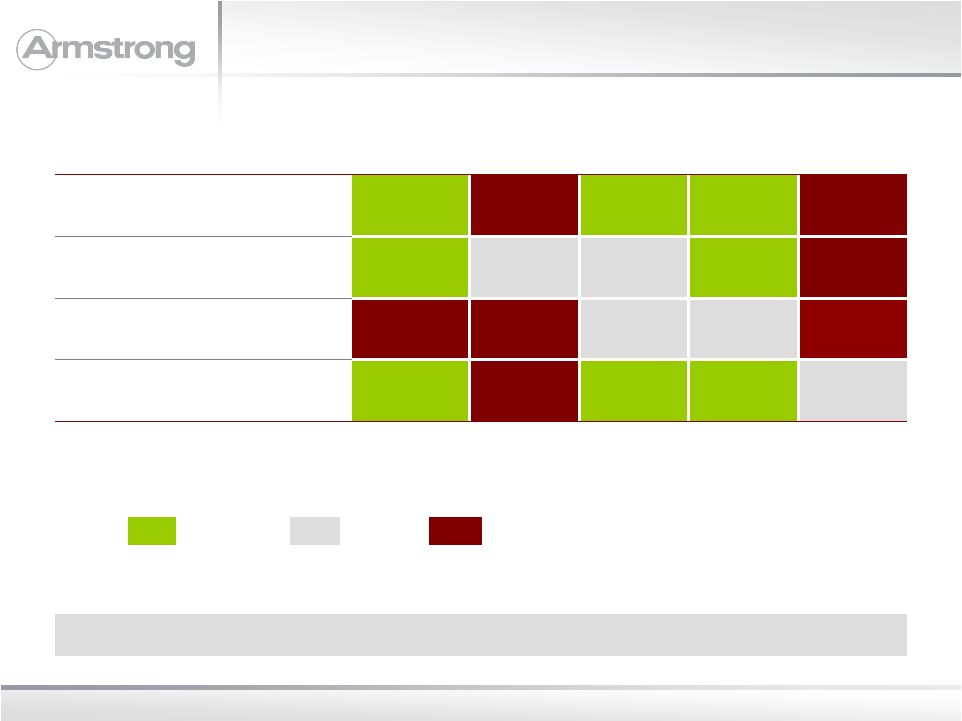

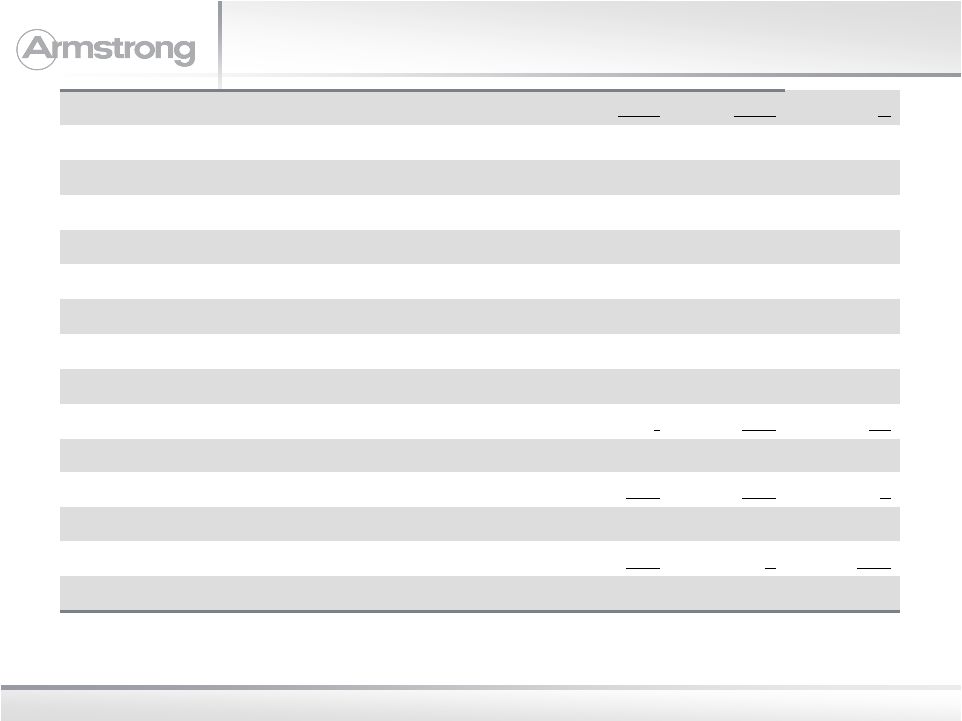

2010 Business Segment and End-Use Profile

Majority of business is renovation –

dampens cycles.

Cabinets

Resilient Flooring

(Int'l)

Resilient Flooring

(N.A.)

Hardwood

Flooring

Building Products

(Ceilings)

Consolidated

Commercial renovation

Commercial new

Residential renovation

Residential new

65%

30%

65%

35%

40%

40%

10%

55%

35%

10%

30%

10%

20%

40%

$1,150

$500

$650

$350

$150

$2,800

5%

10%

50

45

5%

Company Overview

N.A. >75% renovation |

8

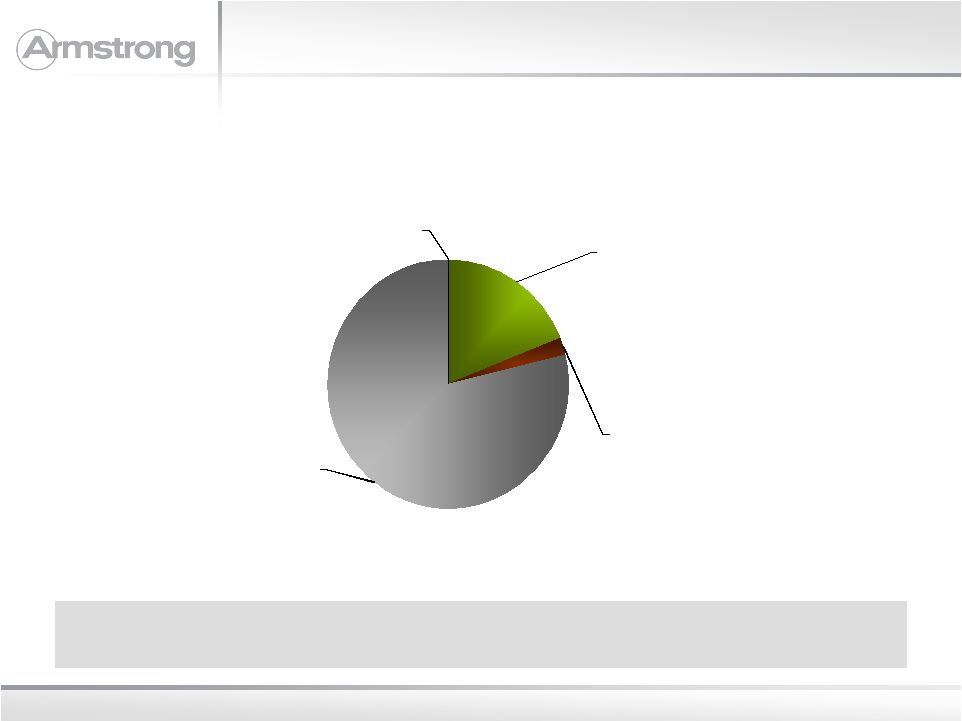

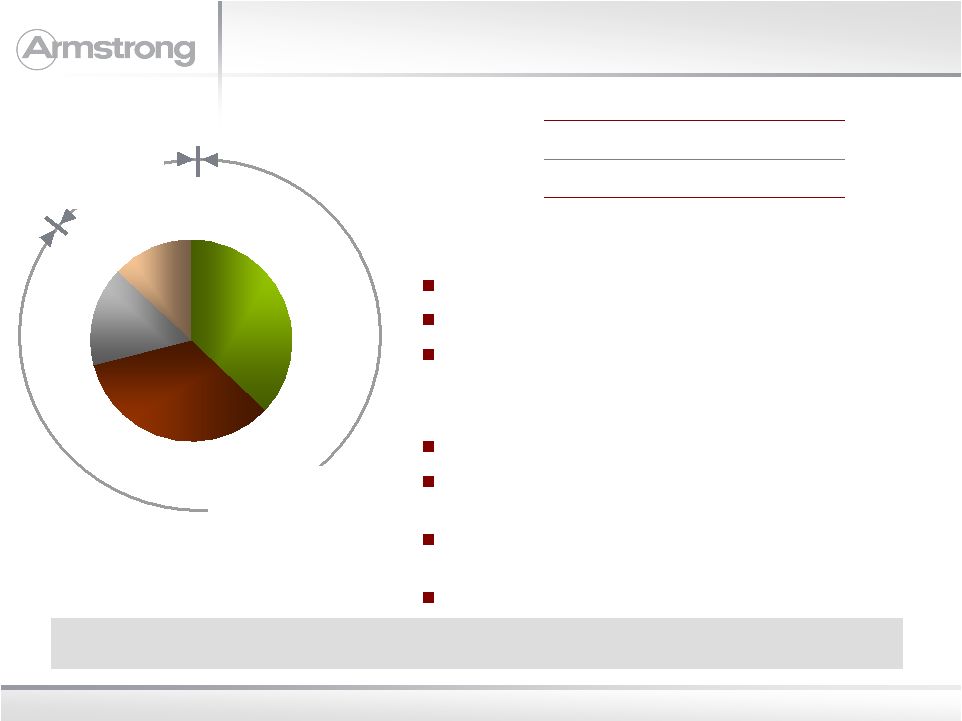

Resilient

Flooring

19%

Wood

Flooring

2%

Building

Products

(Ceilings)

79%

Cabinets

0%

Business Segment Profile

Building Products delivers the bulk of worldwide income and has

remained profitable through the economic cycle.

2010 EBITDA

Adjusted

–

Excludes unallocated corporate expense

Company Overview |

9

Industry Structure/Competitive Position

U.S. Resilient

European

Resilient

Hardwood

Building

Products

Cabinets

Market Leadership

Competitor Concentration

Industry Capacity Utilization

Low-Cost Manufacturer

Armstrong continuously focused on competitive dynamics.

Key

Favorable

Neutral

Unfavorable

Company Overview |

Business Segment Overview |

11

Worldwide Business Overview –

Building Products

Worldwide market leader in suspended ceilings.

Business Segment Overview -

Building Products

North America

Mkt

Size

(B ft

2

)

AWI

Rank

Commercial

1.4

1

Residential

0.4

1

Europe, Africa, Middle-

East

Mkt

Size

(B ft

2

)

AWI

Rank

Western

1.2

1

Eastern

0.5

1

Africa / Mid-

East

0.3

1

Asia, Australia

Mkt

Size

(B ft

2

)

AWI

Rank

China

0.2

1

Australia

0.04

1

India

0.05

1

SE Asia

0.08

1 |

12

ABP Key Strategies

1

Broadest Product Portfolio

Complete product offering

New product pipeline (Metal, Wood)

Win versus soft fiber in Europe

2

Emerging Market Growth

Plant #2 in China

Distribution in Russia, Middle East

Grid plant in India

Business Segment Overview -

Building Products

4

Best-in-Class Service/Quality

Best on-time delivery performance

Lowest claims rate

Best product availability

3

Innovation Leadership

“Sustainability”

leadership

Custom solutions (Metal, Wood)

Recycling program |

13

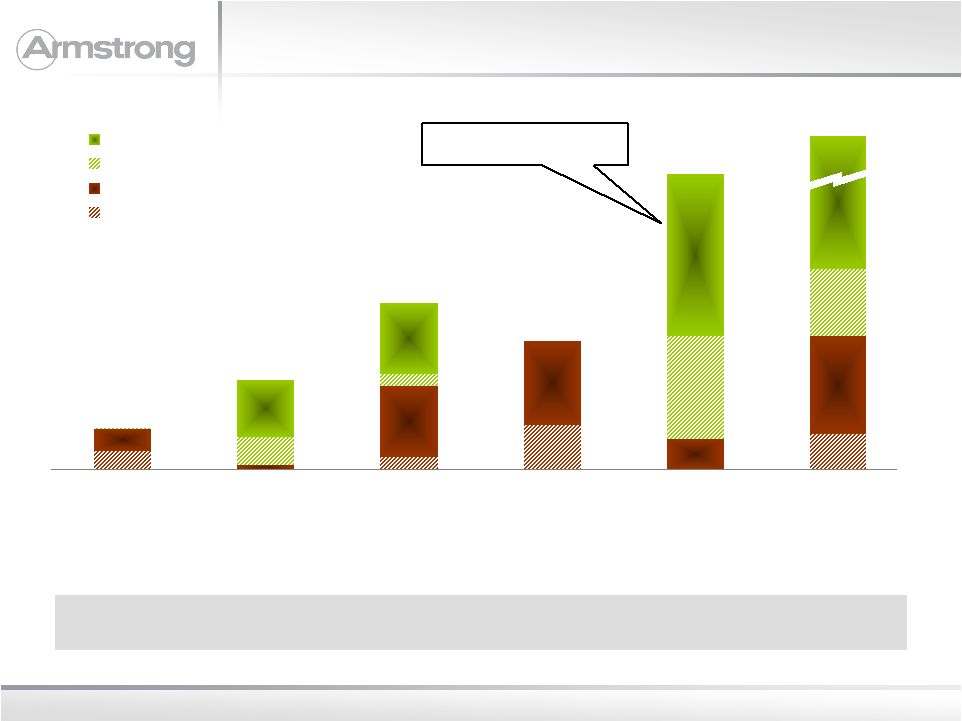

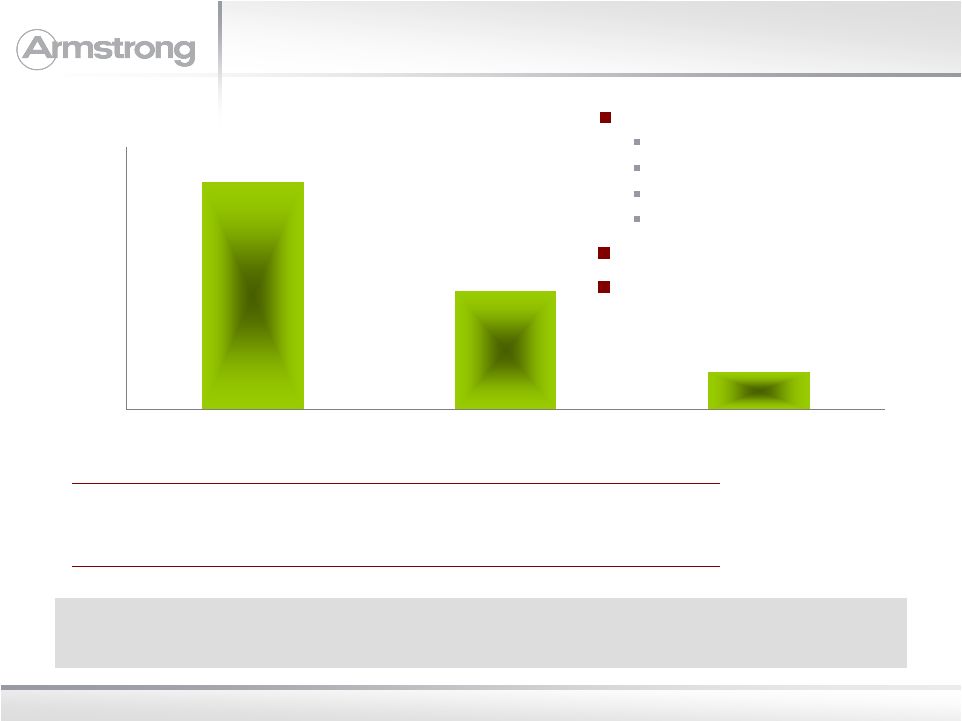

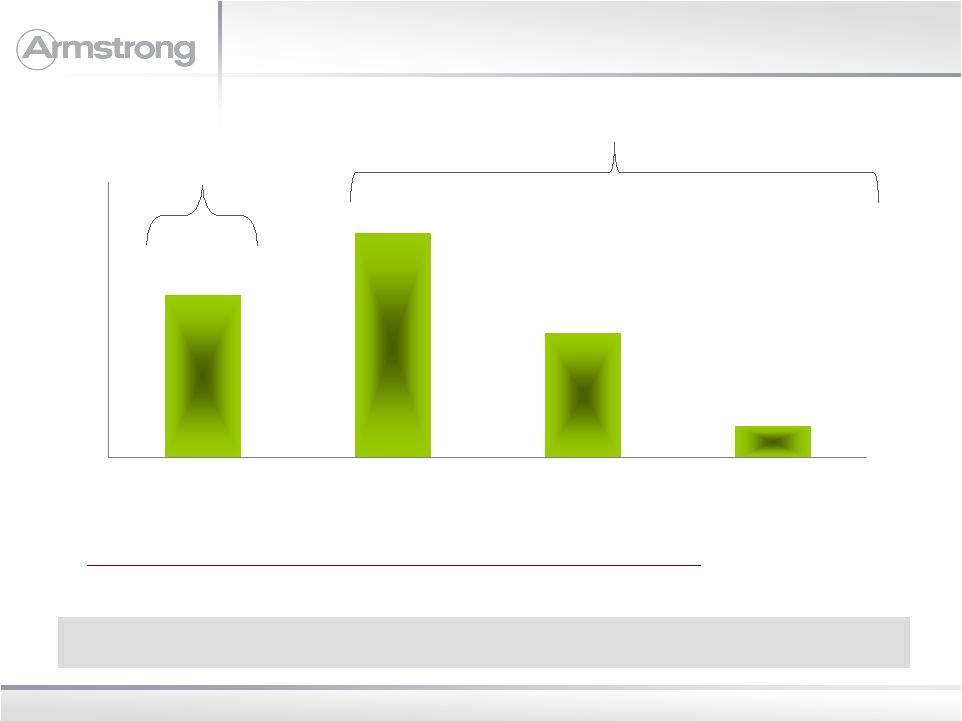

Building Products (ABP) Sales by Geography

695

362

$115

0

200

400

600

800

Americas

Europe

Asia

($-Millions)

Contribution of WAVE JV Profit to Operating Margin

4%

Worldwide EBITDA Margin

25%

New product development and manufacturing

technology managed globally.

Business Segment Overview -

Building Products

Global market leader

Broadest Product Line

Innovation

Go-to-Market

Best cost, quality, service

>90% sales commercial

Grid –

50/50 joint venture

Ceilings & Grid |

14

Worldwide Business Overview –

Floor Products *

Business Segment Overview -

Worldwide Floor Products

Global presence with market leadership in most regions.

Asia, Australia

Mkt

Size

(B ft

2

)

AWI

Rank

China

0.4

2

Australia

0.1

2

India

0.01

1

SE Asia

0.1

1

Europe, Africa,

Middle-East

Mkt

Size

(B ft

2

)

AWI

Rank

Central

0.3

1

Eastern /

Africa /

Mid-East

0.3

5

Western

Europe

0.9

3-5

North America

Mkt

Size

(B ft

2

)

AWI

Rank

Commercial

1.0

1

Residential

2.0

1

Wood

0.6

1

* Market figures exclude segments in which we do not participate.

|

15

AFP Key Strategies

Business Segment Overview -

Worldwide Floor Products

1

Best Product Portfolio

Offer broadest assortment

Drive mix

Quality leadership

2

Complete Market Coverage

Brand leadership

Merchandising presence

Sales coverage effectiveness

3

Low-Cost Manufacturing

Lean deployment

Capability investment, e.g., glass,

wood automation

Rationalize footprint

4

Innovation Leadership

Environmental solutions

Design, performance, and

installation

5

Drive China Growth

Focus on market development

Plant investments to support

growth

6

Restructure Europe

Exit Residential

Simplify Commercial participation

Cost-out …

plant and SG&A |

16

Floor Products (AFP) Sales by Geography

474

654

364

91

0

200

400

600

800

Americas

Americas

Europe

Asia

($-Millions)

Worldwide Adjusted EBITDA Margin

excluding Europe

5%

7%

Continued profitability through bottom of residential downturn.

Business Segment Overview -

Worldwide Floor Products

Resilient & Wood

Wood

Worldwide

Resilient |

17

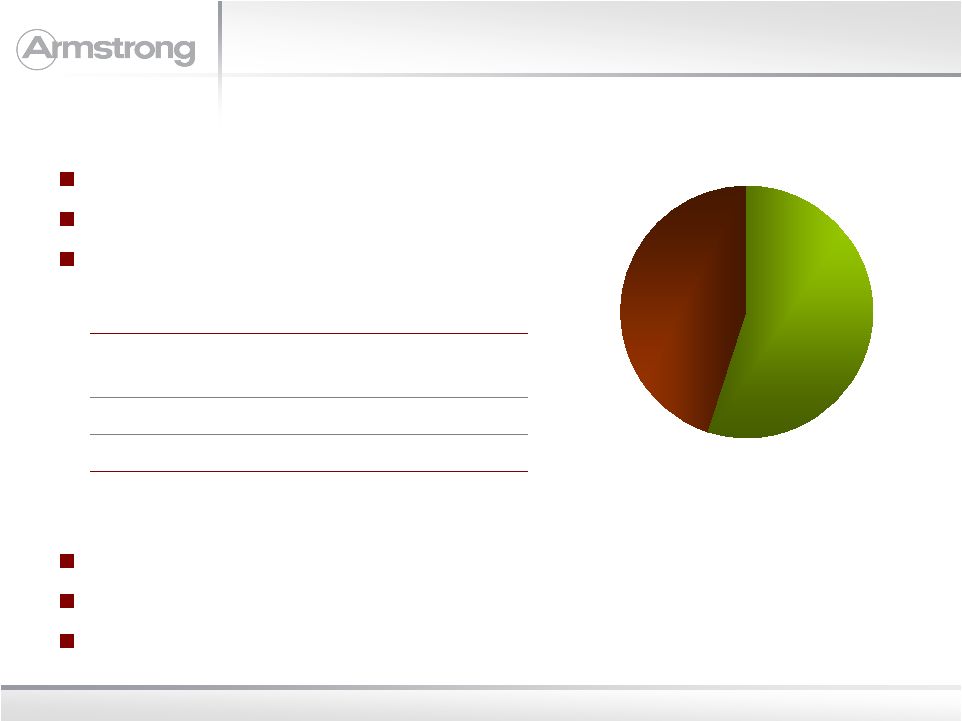

European Floor Products

Linoleum

37%

Vinyl

34%

Other

16%

Vinyl

13%

Commercial

87%

2010

Sales

$364M

Operating Loss

(1)

$ 19M

Business Segment Overview -

European Floor Products

(1)

Excludes restructuring expense

Challenges

Tough markets …

Western Europe

Scale disadvantage in manufacturing and SG&A

Outdated manufacturing processes in all but

linoleum

Solution

Exited Residential segment

Simplified Commercial business …

country and

product participation

Close Teesside Plant (complete) and Holmsund

(Q2, 2011)

SG&A restructuring …

38% decrease in headcount

Committed to eliminating loss in 2011.

Residential

13% |

18

Cabinets

Small player…<5% share

Focus on small-/medium-size builder

Go-to-Market

Current Situation

2010 Sales = $139M

Niche player…

both new and remodel

Restructure costs to reflect market reality

Non-core business

Strategy

Remodel

45%

New

55%

% of Sales

Company-Owned

Service Centers

51%

Distribution

27%

Multi-Family

22%

Business Segment Overview -

Cabinets |

19

Cabinets

Small player…<5% share

Focus on small-/medium-size builder

Go-to-Market

Current Situation

2010 Sales = $139M

Niche player …

both new and remodel

Restructure costs to reflect market reality

Non-core business

Strategy

Remodel

45%

New

55%

% of Sales

Company-Owned

Service Centers

51%

Distribution

27%

Multi-Family

22%

Business Segment Overview -

Cabinets |

Financial Overview |

21

Profitable and cash flow positive through downturn

Focus on cost control / productivity

Strong free cash flow

ROIC greater than cost of capital in 2013, with new home starts at

one million

Continuing to fully invest in businesses

Strong balance sheet: leverage, liquidity and maturity profile

Positioned for considerable operational leverage on modest market

recovery

Financial Summary

Financial Overview |

22

$270

$160

$170

$85

$55

($5)

($385)

($30)

2006 Actual

Price / Mix

Volume

Raw

Materials /

Energy

Mfg Costs

SG&A

WAVE

2009 Actual

(Millions)

Figures rounded to nearest $5 million

Financial Overview

Cost reduction and improved price / mix significantly offset

dramatic volume declines.

Operating Income Bridge (2006-2009) |

23

$157

$188

$15

$48

$20

$5

($26)

( $31)

2009

Price / Mix

Volume

Raw

Materials /

Energy

Mfg Costs

SG&A

WAVE

2010 Mgmt

Acct

(Millions)

Figures rounded to nearest $1 million

Financial Overview

Cost reduction offsets volume and input cost headwinds.

Operating Income Bridge (2009-2010) |

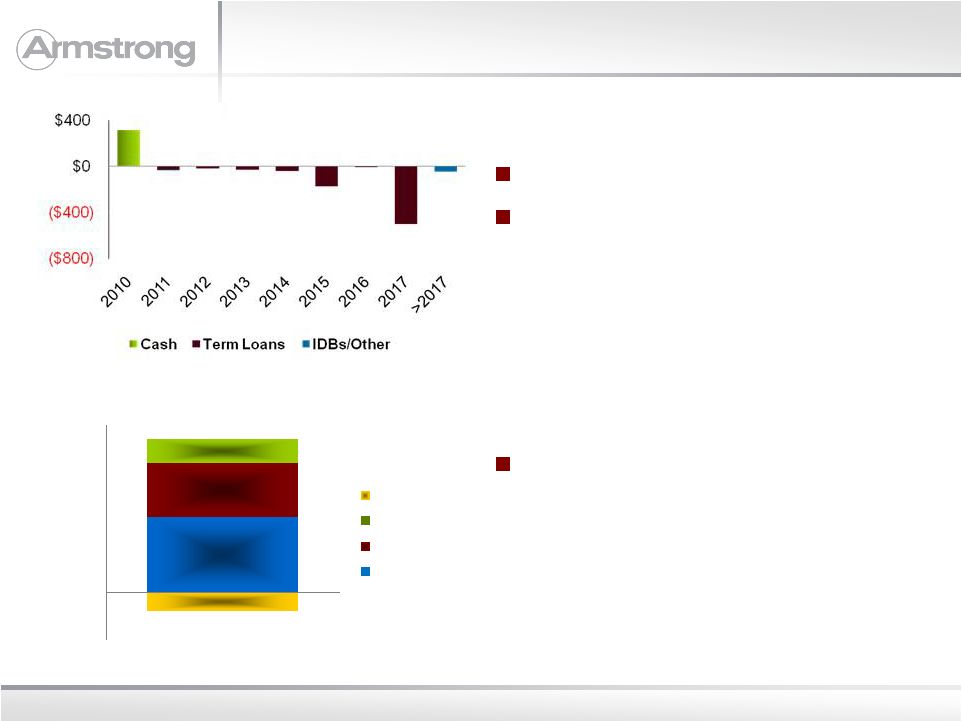

24

315

225

100

(75)

($200)

($100)

$0

$100

$200

$300

$400

$500

$600

$700

LCs

Securitization

Revolver

Cash

Balance Sheet

12/31/2010

(2%)

(14%)

Financial Overview

$565

(Millions)

Maturity Profile

No significant maturities until 2015

Considerable covenant flexibility

Liquidity

Sufficient liquidity to manage

operations, and execute capital

spend and restructuring plans |

Financial Overview Appendix |

26

Key Metrics

(1)

–

Guidance 2011

Financial Overview Appendix

2011

Estimate Range

2010

Variance

Net Sales

2,800

to

3,000

2,766

1%

to

8%

Operating Income

(2)

255

to

305

189

35%

to

62%

EBITDA

360

to

410

303

19%

to

35%

Earnings Per Share

(3), (4)

$2.04

to

$2.53

$1.73

18%

to

47%

Free Cash Flow

70

to

120

180

(61%)

to

(33%)

(1)

Figures exclude non-recurring items such as charges for cost reduction

initiatives, restructuring, etc. (2)

As reported Operating Income: $225 -

275 million in 2011 and $81 million 2010.

(3)

Earnings per share reflect an adjusted tax rate of 42% for both 2011 and

2010. (4)

As reported earnings per share: $1.85 -

$2.34 in 2011 and $0.19 in 2010.

Guidance provided as of February 28, 2011.

We undertake no obligation to update guidance, beyond what is required by securities

law. |

27

2011 Financial Outlook

Financial Overview Appendix

Raw Material & Energy Inflation

$35 -

$45 million increase

Manufacturing Productivity

Gross Margin +100 to +200 bps vs. 2010

U.S. Pension Credit

~$25 million, down ~$25 million vs. 2010

60% manufacturing, 40% SG&A

Earnings from WAVE

$5 -

$10 million vs. 2010

Cash Taxes/ETR

~$15 million. Adjusted ETR of 42%

Q1

Sales $640 –

$705 million

EBITDA $72 –

$88 million

Capital Spending

~$180-$200 million

Exclusions from EBITDA

~$18 -

27 million associated with already

announced actions |

28

Full Year 2010 –

Adjusted Operating Income to

Reported Net Income

Financial Overview Appendix

2010

2009

V

Operating

Income

–

Adjusted

(1)

$188

$157

$31

Foreign Exchange Movements

2

-

2

Laminate Duty Refund

7

-

7

Cost Reduction Initiatives

(50)

(16)

(34)

Asset Impairments

(31)

(18)

(13)

Restructuring

(22)

-

(22)

Executive Transition

(15)

-

(15)

Gain on Settlement of Note Receivable

2

-

2

Accelerated Vesting

-

(32)

32

Operating

Income

–

As

Reported

$81

$91

($10)

Interest (Expense) Income

(14)

(16)

2

EBT

$67

$75

($8)

Tax (Expense) Benefit

(56)

3

(59)

Net Income

$11

$78

($67)

(1)

Figures exclude non-recurring items such as charges for cost reduction

initiatives, restructuring, etc. Figures also exclude the impact of foreign

exchange movements. |

29

Normalized Operating Income to Free Cash Flow

Financial Overview Appendix

2011

Estimate Range

Adjusted Operating Income

255

to

305

D&A

105

Adjusted EBITDA

360

to

410

Changes in Working Capital

10

to

30

Capex

(180)

to

(200)

Pension Credit

(25)

Interest Expense

(50)

Cash Taxes

(15)

Other, including cash payments for

restructuring and one-time items

(30)

Free Cash Flow

70

to

120 |

30

Consolidated Results

Financial Overview Appendix

Fourth Quarter

2010

Reported

Comparability

(1)

Adjustments

FX

(2)

Adj

2010

Adjusted

2009

Reported

Comparability

(1)

Adjustments

FX

(2)

Adj

2009

Adjusted

Net Sales

643

-

9

652

653

-

4

657

Operating Income

(30)

50

(1)

19

(2)

27

-

26

EPS

($0.36)

$0.48

($0.01)

$0.11

($0.07)

$0.30

$ -

$0.23

Full Year 2010

2010

Reported

Comparability

(1)

Adjustments

FX

(2)

Adj

2010

Adjusted

2009

Reported

Comparability

(1)

Adjustments

FX

(2)

Adj

2009

Adjusted

Net Sales

2,766

-

66

2,833

2,780

-

73

2,853

Operating Income

81

108

(2)

188

91

65

1

157

EPS

$0.19

$1.55

($0.02)

$1.72

$1.36

$0.07

$0.01

$1.44

(1)

See earnings press release and 10-K for additional detail on comparability

adjustments (2)

Eliminates impact of foreign exchange movements |

31

Segment Operating Income (Loss)

Financial Overview Appendix

(1)

Eliminates impact of foreign exchange movements and non-recurring items; see

earnings press release and 10-K for additional detail. Fourth

Quarter 2010

Reported

Comparability

(1)

Adjustments

2010

Adjusted

2009

Reported

Comparability

(1)

Adjustments

2009

Adjusted

Resilient Flooring

(2)

3

1

(7)

2

(4)

Wood Flooring

(32)

28

(4)

(10)

20

10

Building Products

16

16

32

24

-

24

Cabinets

(1)

-

(1)

(8)

5

(3)

Unallocated Corporate

(Expense) Income

(12)

(3)

(9)

-

-

-

Full Year 2010

2010

Reported

Comparability

(1)

Adjustments

2010

Adjusted

2009

Reported

Comparability

(1)

Adjustments

2009

Adjusted

Resilient Flooring

13

18

31

-

6

7

Wood Flooring

(46)

39

(7)

(6)

20

14

Building Products

171

27

198

156

1

157

Cabinets

(6)

-

(6)

(18)

6

(12)

Unallocated Corporate

(Expense) Income

(51)

23

(28)

(41)

32

(9) |

32

Cash Flow

Financial Overview Appendix

Fourth Quarter

Full Year

($-millions)

2010

2009

2010

2009

Net Cash From Operations

49

82

190

260

Plus / (Minus) Net Cash from Investing

(37)

(29)

(41)

(41)

Add back / (subtract):

Restricted Cash

30

-

30

-

Divestitures

1

-

1

(8)

Equals Free Cash Flow

43

53

180

211 |