Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EL PASO ELECTRIC CO /TX/ | d8k.htm |

| EX-99.01 - PRESS RELEASE - EL PASO ELECTRIC CO /TX/ | dex9901.htm |

El Paso Electric Company

4th Quarter 2010 Earnings Conference Call

4th Quarter 2010 Earnings Conference Call

February 22, 2011

February 22, 2011

Exhibit 99.02 |

El Paso Electric

R

February 22, 2011

Investor Relations

2

Statements in this presentation, other than statements of historical information,

are forward-looking statements that are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act of 1995 (the

“act”). Such statements are intended to be made as of the date of

this presentation, and the company does not undertake to update any such

forward-looking statement. Forward-looking statements involve known and

unknown

risks

and

other

factors

that

may

cause

actual

results

to

differ

materially

from

those

expressed

in

this

presentation. In connection with the safe-harbor provisions of the act,

the company has set forth below a number of important risks and factors

that could cause actual results to differ materially from forward-looking information.

Factors that could cause or contribute to such differences include, but are not

limited to: Increased prices for fuel and purchased power and the

possibility that regulators may not permit El Paso Electric (EE) to pass

through all such increased costs to customers or to recover previously incurred fuel

costs in rates

The ability to recover capital investments and operating costs through rates in

Texas and New Mexico Uncertainties and instability in the general economy

and the resulting impact on EE’s sales and profitability Unanticipated

increased costs associated with scheduled and unscheduled outages The

size

of

our

construction

program

and

our

ability

to

complete

construction

on

budget

and

on

time

The costs at Palo Verde (PV)

Deregulation and competition in the electric utility industry

Possible increased costs of compliance with environmental or other laws,

regulations and policies Possible income tax and interest payments as a

result of audit adjustments proposed by the IRS Uncertainties and

instability in the financial markets and the resulting impact on EE’s ability to access the

capital and credit markets

Other factors detailed by EE in its public filings with the Securities and

Exchange Commission. Please refer to EE’s 2009 Form 10K and

other 1934 Act Filings Safe Harbor Statement |

El Paso Electric

R

February 22, 2011

Investor Relations

3

Solid 4

th

quarter and strong YTD earnings results due to increased

retail kWh sales growth, improved economic conditions, favorable

weather, and rate increases which were necessary to allow us to

begin recovering capital investments we have made in the last

several years to meet customer growth

–

2.0 percent increase in retail kWh sales in 4th quarter

–

4.4 percent increase in retail kWh sales in 2010

During the 4th quarter of 2010, EE repurchased approximately

134,000 shares at a total cost of $3.5mm

PV Unit 3 planned refueling/maintenance

outage completed in 39

days

Highlights for the 4th Quarter 2010 –

David Stevens |

El Paso Electric

R

February 22, 2011

Investor Relations

4

EE stock was the best performing investor-owned utility stock in 2010 with a

total return of 36 percent

Earnings

per

share

increased

by

approximately

39

percent

in

2010

when

compared

to 2009

EE

satisfactorily

settled

the

first

Texas

Rate

Case

in

more

than

15

years

providing

clarity for shareholders and removing regulatory uncertainty

EE implemented new rates in its New Mexico service territory

During 2010, EE repurchased approximately 1.5mm shares at a total cost of

$33.7mm, including commissions

EE issued $110 million of private placement senior notes at an average rate of 4.6

percent and with an average tenor of 8 years to finance nuclear fuel

On September 23, 2010, EE completed the refinancing of the $200 million revolving

credit facility with a four-year term and an option to increase the

size to $300 million Significantly enhanced the level of available liquidity

for the Company from $185mm at December 31, 2009 to $275mm at December 31,

2010 2010 Accomplishments -

Financial |

El Paso Electric

R

February 22, 2011

Investor Relations

5

EE attained a record native system peak of 1,616 MW on August 23,

2010 and surpassed the 2009 native system peak of 1,571 MW set

on July 15, 2009

EE and the IBEW Local 960 successfully negotiated a new 3-year

agreement

EE completed the Customer Care & Billing System installation on

time and under-budget

2010 Accomplishments -

Operating |

El Paso Electric

R

February 22, 2011

Investor Relations

6

In

2010,

PV

produced

more

than

31

million

MWh’s

and

attained

a

capacity factor of 90.4 percent

–

All three PV units achieved 100 days of continuous run operation

during

the summer months of 2010

PV Unit 3 planned refueling/maintenance outage began on October

2, 2010 and was completed on November 10, 2010 (39 days)

PV Unit 2 planned refueling/maintenance outage scheduled for April

2011

NRC is currently reviewing the 20 year license extension application

that was filed in December 2008

–

Anticipate

obtaining

final

approval

in

the

2

nd

Quarter

of

2011

Palo Verde Update |

El Paso Electric

R

February 22, 2011

Investor Relations

7

Anticipate completion of Phase II of Newman 5 before summer 2011

–

Project is on track and remains under-budget

Obtain regulatory approval in 2011 for 87MW aero derivative

peaking unit at the Rio Grande site; on-line date of 2013

No rate cases are anticipated for 2011 at this time in either Texas or

New Mexico

2011 Initiatives |

El Paso Electric

R

February 22, 2011

Investor Relations

8

4th

Quarter

2010

(Basic)

EPS

-

$0.18,

compared

to

4th

Quarter

2009 (Basic) EPS of $0.18

YTD

2010

GAAP

(Basic)

EPS

-

$2.32

after

extraordinary

item

YTD

2010

GAAP

(Basic)

EPS

-

$2.08

before

extraordinary

item,

compared to YTD 2009 (Basic) EPS of $1.50

4th Quarter and YTD 2010 Financial

Results –

David Carpenter |

El Paso Electric

R

February 22, 2011

Investor Relations

9

Retail non-fuel base revenues increased by $5.2mm pre-tax or $0.08 per

share due to new non-fuel base rates in NM and TX and a 2.0 percent

increase in kWh sales as a result of an expanding customer base

AFUDC and capitalized interest increased by $3.0mm pre-tax or $0.06 per

share in 2010 due to higher balances of construction work in progress

PV operations and maintenance costs declined by $3.5mm and contributed

$0.05 per share due to a reduction in maintenance costs and reduced

property insurance and benefit expenses

Offsets to the above amounts include:

–

Decreased investment and interest income due to realized gains on sales

of investments in our PV decommissioning trust in 2009 ($0.04)

–

Lower off-system sales margins due to increased sharing ($0.04)

–

Higher revenue related and property taxes ($0.03)

–

Higher depreciation expense, increased customer accounts and service,

and decreased PV3 revenues due to the planned outage ($0.06)

4th Quarter 2010 Financial Results -

Key Drivers |

El Paso Electric

R

February 22, 2011

Investor Relations

10

Retail non-fuel base revenues increased $53.0mm pre-tax or $0.77 per share

due to new rates in NM and TX and a 4.4 percent increase in kWh sales

AFUDC and capitalized interest increased by $3.7mm pre-tax or $0.07 per share

due to higher balances of construction work in progress

PV operations and maintenance costs declined by $4.4mm or $0.06 per share due to

decreased maintenance costs at units 2 & 3 during scheduled refueling

outages Deregulated PV3 revenues increased by $2.0mm pre-tax or $0.03

per share due to increased PV3 generation and higher proxy prices in

2010 Offsets to the above amounts include:

–

Increased income tax expense due to the elimination of the Medicare Part D

subsidy ($0.11)

–

Higher depreciation expense due to higher plant balances ($0.09)

–

Increased administrative and general expense primarily due to higher pension

costs related to revised actuarial assumptions ($0.08)

–

Lower retained off-system sales margins due to increased sharing ($0.08)

YTD 2010 Financial Results –

Key

Drivers |

El Paso Electric

R

February 22, 2011

Investor Relations

11

MWh’s by Class –

4th Quarter & YTD

2010

MWh Sales by Class

Q4

%

Change

YTD

%

Change

Residential

550,164

5.0%

2,508,834

6.2%

C&I Small

533,313

1.6%

2,295,537

2.0%

C&I Large

260,860

-2.6%

1,087,413

6.2%

Other Public

362,167

1.9%

1,542,389

4.0%

Total Retail Sales

1,706,504

2.0%

7,434,173

4.4%

Heating Degree Days

795

-22.8%

2,273

6.0%

Cooling Degree Days

131

12.0%

2,738

-1.1%

Average Number of Retail Customers

375,317

1.6%

373,155

1.7%

Year-end Retail Customers

376,822

1.9%

376,822

1.9% |

El Paso Electric

R

February 22, 2011

Investor Relations

12

2011 Earnings Guidance range of $2.00 to $2.40 per basic share

2011 Earnings Guidance |

El Paso Electric

R

February 22, 2011

Investor Relations

13

Capital Expenditures

Primary additions to rate base

through 2014 include:

–

Completion of generation plant

additions

–

T&D construction necessary to meet

customer growth

Construction work in progress of

$285mm at December 31, 2010

Capital Expenditures are expected

to average approximately $209mm

annually through 2014

(1) Does not include acquisition costs for nuclear fuel

(2) Includes $289mm for new generating capacity of which $19mm is allocated

for the completion of Newman 5, $73mm for an 87 MW peaking unit

at the Rio Grande Station, $174mm for a new 288 MW combined

cycle unit, $11mm for anticipated renewable projects, and $12mm for other

generation projects |

El Paso Electric

R

February 22, 2011

Investor Relations

14

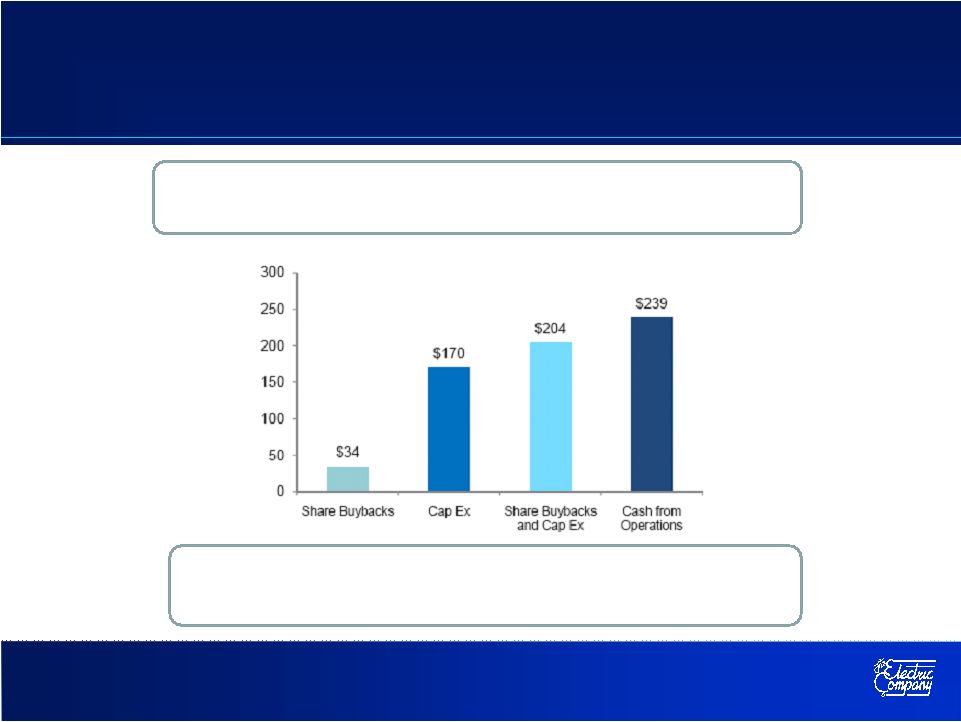

2010 Liquidity

Sufficient Cash Flow to Fund Capital Expenditures

Anticipate having adequate liquidity to fund capital expenditures

through 2011 without having to access capital markets

|

El Paso Electric

R

February 22, 2011

Investor Relations

15

During 2010, EE repurchased 1.5mm shares at a total cost of $33.7mm

During the 4th Quarter of 2010, EE repurchased approximately 134,000

shares at a total cost of $3.5mm

Since the beginning of the repurchase program in 1999, annual stock

repurchases have averaged 3.55% of outstanding shares

Approximately 676,000 shares remain available for repurchase under

current authorization

Criteria for share repurchases:

–

Adequate liquidity to fund capital expenditures

–

Appropriate equity ratio for financial and regulatory purposes

–

Cash performance consistent with or better than planned

Share Repurchase Program |

February 22, 2011

Investor Relations

16

Questions and Answers |