Attached files

Rex

Energy Rex Energy

Year End 2010 Conference Call

Year End 2010 Conference Call

Rex Energy Corporation | 476 Rolling Ridge Drive | State College, PA 16801

P: (814) 278-7267 | F: (814) 278-7286

E: InvestorRelations@RexEnergyCorp.com

www.rexenergy.com

Together We Can Make A Difference

Exhibit 99.2 |

Forward

Looking Statements Except for historical information, statements made in this

release, including those relating to significant potential, future earnings, cash flow, capital expenditures,

production growth and planned number of wells (as well as the timing of rig operations,

natural gas processing plant commissioning and operations, fracture stimulation

activities and the completion of wells and the expected dates that wells are producing hydrocarbons that are sold), are forward-looking statements

within

the

meaning

of

Section

27A

of

the

Securities

Act

of

1933,

as

amended,

and

Section

21E

of

the

Securities

Exchange

Act

of

1934,

as

amended.

These

forward-

looking

statements

are

indicated

by

words

such

as

“expected”,

“expects”,

“anticipates”

and

similar

words.

These

statements

are

based

on

assumptions

and

estimates that management believes are reasonable based on currently available

information; however, management's assumptions and the company's future

performance are subject to a wide range of business risks and uncertainties, and there is

no assurance that these goals and projections can or will be met. Any number of

factors could cause actual results to differ materially from those in the forward-looking statements, including (without limitation) the following:

•adverse economic conditions in the United States and globally;

•the difficult and adverse conditions in the domestic and global capital and credit

markets; •domestic and global demand for oil and natural gas;

•sustained

or

further

declines

in

the

prices

the

company

receives

for

oil

and

natural

gas;

•the

effects

of

government

regulation,

permitting

and

other

legal

requirements;

•the geologic quality of the company’s properties with regard to, among other things, the existence of hydrocarbons in economic

quantities; •uncertainties about the estimates of the company’s oil and natural gas reserves;

•the company’s ability to increase production and oil and natural gas income through exploration and

development; •the company’s ability to successfully apply horizontal drilling techniques and tertiary recovery

methods; •the number of well locations to be drilled, the cost to drill and the time frame within

which they will be drilled; •the effects of adverse weather on operations;

•drilling and operating risks;

•the ability of contractors to timely and adequately perform their drilling, construction,

well stimulation, completion and production services;

•the availability of equipment, such as drilling rigs and transportation pipelines;

•changes in the company’s drilling plans and related budgets;

•the adequacy of capital resources and liquidity including (without limitation) access to

additional borrowing capacity; and •uncertainties associated with our legal proceedings and the outcome.

The company undertakes no obligation to publicly update or revise any forward-looking

statements. Further information on the company’s risks and uncertainties is

available in the company's filings with the Securities and Exchange Commission.

The company's internal estimates of reserves may be subject to revision and may be

different from estimates by the company's external reservoir engineers at year

end. Although the company believes the expectations and forecasts reflected in these and other forward-looking statements are reasonable, it can give no

assurance they will prove to have been correct. They can be affected by inaccurate

assumptions or by known or unknown risks and uncertainties. 2

Forward Looking Statements

Forward Looking Statements |

Hydrocarbon Volume Estimates

This presentation includes management’s estimates of Marcellus Shale potential

recoverable resources, per well EUR (estimated ultimate recovery of resources)

and

upside

potential

of

recoverable

resources.

Except

as

noted,

these

have

been

estimated

internally

by

the

Company

without

review

by

independent

engineers and do not necessarily constitute reserves. These estimates are included

to demonstrate the potential for future drilling by the Company. Actual

recovery of these potential volumes is inherently more speculative than recovery of

estimated proved reserves. Estimates of potential recoverable resources,

per well EURs and upside potential for Company oil and gas shale acreage are

particularly speculative due to the limited experience in Marcellus Shale

horizontal development, with its limited production history. Ultimate recoveries will be dependent upon numerous factors including actual

encountered geological conditions, the impact of future oil and gas pricing and

exploration costs, and our future drilling decisions and budgets based upon our

future evaluation of risk, returns and the availability of capital and, in many areas, the outcome of negotiation of drilling arrangements with holders of

adjacent or fractional interest leases. In addition, potential recoverable

resources are based on undesignated future well locations under assumed acreage

spacing which may not have been specifically included in any definitive development plan

and ultimately may not be drilled. Accordingly, such estimates may differ

significantly from the hydrocarbon quantities that are ultimately recovered. SEC

rules prohibit a publicly-reporting oil and gas company from including oil and gas resource estimates in their filings with the SEC, except proved, probable

and

possible

reserves

that

meet

the

SEC’s

definitions

of

such

terms.

Illinois

Basin

estimates

(including

Lawrence

Field)

of

oil

in

place

and

other

resource

volumes,

oil

in

place

and

other

reserve

volumes

indicated

herein

are

not

based

on

SEC

definitions

and

guidelines.

Unless

otherwise

indicated,

estimates

of

non-proved reserves and other hydrocarbons included herein may not meet specific

definitions of reserves or resource categories within the meaning of the

SPE/SPEE/WPC Petroleum Resource Management System. Hydrocarbon Value Estimates

Hydrocarbon Value Estimates

3 |

Key

Takeaways Key Takeaways

4

th

Quarter Highlights

•

Average

Daily

Production:

Up

12%

from

3

rd

quarter

•

Oil

&

Gas

Revenue:

Up

14%

from

3

rd

quarter

•

Lease

Operating

Expense

per

Mcfe:

down

11%

compared

to

3

rd

quarter

due to increased production

•

EBITDAX:

Up

42%

from

3

rd

Quarter

2010 Highlights

•

Full year average daily production increased 26%

over 2009 average daily production

•

Operating

revenue

including

cash

settled

derivatives

increased

28%

over

2009

(1)

•

EBITDAX: Up 17% compared to 2009

•

Proved reserves increased 61% (net) over previous year

•

Total reserve replacement of 1,560%, with an increase to

201.7 Bcfe

of proved reserves

•

Historical reserve CAGR of 75%

•

Drill Bit F&D of $0.68/ Mcfe

2011 Outlook

•

Full year production expected to grow 71% -

95%

over 2010

•

74% of 2011 capital budget allocated to oil and liquids-rich

production areas

1-

Excludes $4.6M cash settled derivative unwind in first quarter,

2009

4 |

Daily

Production & Pricing Daily Production & Pricing

1

st

Quarter

2010

2

nd

Quarter

2010

3

rd

Quarter

2010

4

th

Quarter

2010

Quarter to Quarter

Change %

Change Production

–

Average

Per

Day

Oil (Bbls)

1,886

1,856

1,912

1,924

12

1%

Gas (Mcf)

7,394

7,357

8,415

10,647

2,232

27%

Natural Gas Liquids (Bbls)

58

51

77

94

17

22%

Mcfe

19,059

18,799

20,346

22,755

2,409

12%

Average Crude Oil Price per Bbl

Realized Price (Before Derivatives)

$ 74.99

$ 74.80

$ 72.60

$ 81.59

$ 9.99

12%

Realized Impact From Cash Settled Derivatives

$ (4.91)

$ (5.12)

$ (3.58)

$ (8.65)

$ 5.07

142%

Effective Realized Price

$ 70.08

$ 69.68

$ 69.02

$ 72.94

$ 3.92

6%

Average Natural Gas Price per Mcf

Realized Price (Before Derivatives)

$ 5.44

$ 4.10

$ 4.49

$ 4.03

$ 0.46

10%

Realized Impact From Cash Settled Derivatives

$ 0.90

$ 1.80

$ 1.36

$ 1.85

$ 0.49

33%

Effective Realized Price

$ 6.34

$ 5.90

$ 5.85

$ 5.88

$ 0.03

1%

Average Natural Gas Liquid Price per Bbl

Realized Price

$ 32.02

$ 32.65

$ 24.53

$ 42.48

$ 17.95

73%

5 |

Selected

Financial Highlights Selected Financial Highlights

(in millions except per share data)

1

st

Quarter

2010

2

nd

Quarter

2010

3

rd

Quarter

2010

4

th

Quarter

2010

Quarter to Quarter

Change % Change

Operating Revenue

$ 16.8

$ 15.7

$ 16.9

19.5

$ 2.6

15%

Gain (Loss) on Oil & Gas Cash Settled Derivatives

$ (0.2)

$ 0.3

$ 0.4

$0.3

$ 0.1

25%

Total Revenue & Cash Settled Derivatives

$ 16.6

$ 16.0

$ 17.3

$19.8

$ 2.5

14%

Lease Operating Expense

$ 5.9

$ 5.8

$ 6.5

$6.5

$ 0.0

0%

General & Administrative

$ 4.2

$ 4.6

$ 5.0

$4.2

$ 0.8

16%

Loss (Gain) on Sale of Assets & Impairment

$ 0.6

$ 0.6

$ (14.1)

$5.4

$ 19.5

138%

Exploration Expense (Income)

$ 1.1

$ 2.3

$ (0.5)

$2.3

$ 2.8

560%

DD&A & Accretion

$ 5.1

$ 5.1

$ 5.0

$6.6

$ 1.6

32%

Interest Expense

$ 0.1

$ 0.4

$ 0.6

$0.3

$ 0.3

50%

Net Earnings (Loss) Comparable to Analysts’

Estimates

$ 0.0

$ (1.7)

$ 0.4

$(0.7)

$(1.1)

275%

Net Earnings (Loss) Comparable to Analysts’

Estimates per Share

$ 0.00

$ (0.04)

$ 0.01

$(0.02)

$ (0.03)

300

%

EBITDAX

$ 6.7

$ 5.8

$ 5.7

$8.1

$ 2.4

42%

6 |

Current

Hedging Summary Current Hedging Summary

Current Production Hedged

•

Percentage of production hedged based on December,

2010 exit rate with built in decline

7

1. ~30% of current natural gas production covered in 2011 by putspread with a $3.84 short put

price for a $1.04 put spread 2. ~21% of current natural gas production covered in

2011 and 2012 by put spread with a $4.00 short put price for a $1.75 put spread |

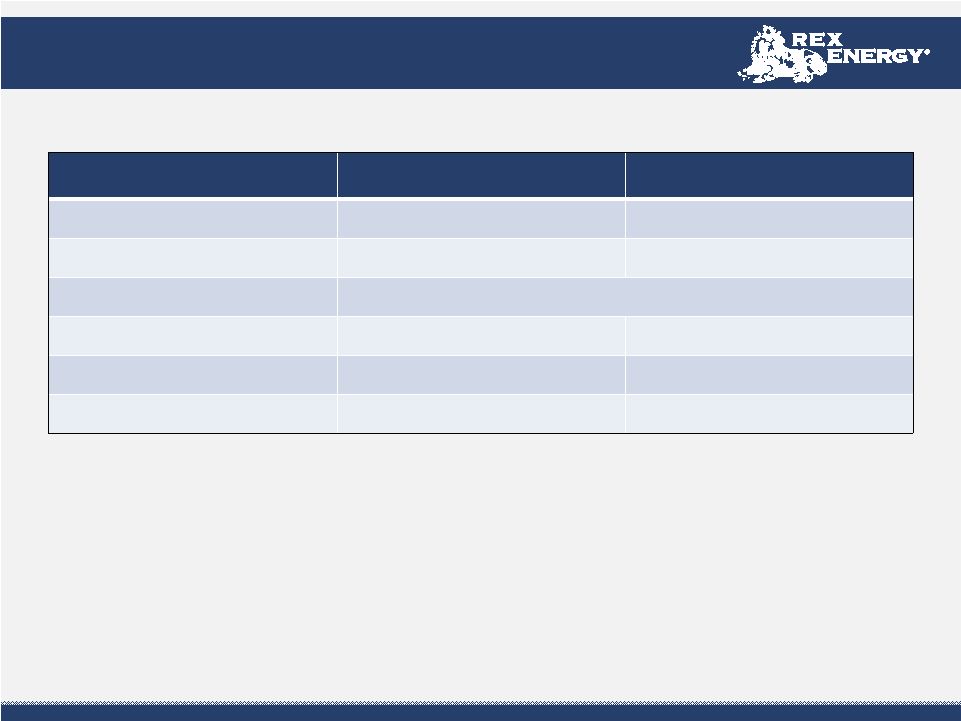

Balance

Sheet Balance Sheet

($ in millions)

Dec. 31, 2010

Dec. 31, 2010

Assets

Cash & Cash Equivalents

11.0

Other Current Assets

34.8

Net Property and Equipment

322.7

Other Net Assets

37.5

Total Assets

406.0

Liabilities

and

Owners’

Equity

Current Liabilities

62.3

Senior Secured Line of Credit and Long Term Debt

10.0

Other Long-Term Liabilities

29.0

Total Liabilities

101.3

Total Owners’

Equity

304.7

Total

Liabilities

and

Owners’

Equity

406.0

Debt to Owners’

Equity Ratio

0.03x

Additional Liquidity Availability

Net Borrowing Base Availability

115.0

Remaining on Sumitomo Carry

28.8

8 |

Guidance

Guidance

1st Quarter 2011

Full Year 2011

Production

25.8 –

27.3 MMcfe/d

34.7 –

39.4 MMcfe/d

% Production Oil

~ 40%

~ 34%

Exit Rate (December 2011 Production)

40.7 –

48.5 MMcfe/d

Lease Operating Expenses

$ 6.7 –

7.2 million

$ 32.0 –

37.0 million

Cash General & Administrative

$ 4.9 –

5.3 million

$ 20.0 –

21.0 million

Capital Expenditures

$ 20.4 million

$ 148.8 million

9 |

Marcellus

Projects: Butler Marcellus Projects: Butler

~34,100 net acres -

70% Rex Energy / 30% Sumitomo

E&P

•

Inception to date, currently have 11 gross (7.7

net) wells in service

o

5 well Drushel

pad awaiting fracture

stimulation estimated to begin March 1

st

o

Drilling lateral on second well of three

on Talarico

pad

•

25 gross (16 net) wells planned to be drilled

in 2011

•

Second rig expected in the area early

2

nd

Quarter 2011

Midstream

•

Sarsen

Plant –

40 MMcf/d

cryogenic facility

o

Operating at ~20.0 Mmcf

/d with current

capacity of 30 Mmcf

/d

o

Additional capacity of 10 Mmcf/d

is

available through additional compressor

•

Second cryogenic plant in permitting process

and is expected to be commissioned by 1Q 2012

Leasing

•

Company has completed and is in the process of

closing the 9,000 acres required under Sumitomo

Joint Venture agreement

10 |

2011

Butler Drilling Schedule 2011 Butler Drilling Schedule

Rig

Pad

Pad

Gross Well

Gross Well

Count

Count

Net Well

Net Well

Count

Count

Status

Status

UDI 54

Drushel¹

5

3.5

Awaiting fracture and completion in 1Q11

UDI 54

Talarico

3

2.1

Horizontal rig currently drilling second

of three wells to fracture and complete in 2Q11

UDI 54

Grosick

7

3.0

Pilot holes drilled, awaiting horizontal rig

UDI 54

Gilliland

6

4.2

Currently drilling last

of six pilot holes with vertical rig,

included is one horizontal Upper Devonian well

21

12.8

UDI 52

McElhinney

2

1.4

Awaiting vertical and horizontal rig

UDI 52

Behm

3

2.1

Awaiting vertical and horizontal rig

UDI 52

Grahm

3

2.1

Awaiting vertical and horizontal rig

8

5.6

11

•UDI 54 rig is currently drilling

onsite •Expect to

pick up UDI 52 rig in the second quarter of 2011 1. Four of the five Drushel

wells were drilled in 2010 |

Marcellus

Projects: Westmoreland Marcellus Projects: Westmoreland

Operated by Williams Appalachia, LLC

~8,600 net acres / 40% working interest

E&P

•

Inception to date, currently have 9 gross

(3.6 net) wells placed in service

o

5 Uschak

#2 wells drilled awaiting

fracture stimulation

o

H&P 287 Rig currently drilling last

of three Androstic

wells

o

Patterson 480 Rig currently drilling

last of four Uschak

#1 wells

•

20 gross (8 net) wells expected to be

drilled in 2011

Midstream

•

Currently constrained at ~14 gross

MMcf

per day

•

Jointly owned gathering system being

constructed to Equitrans

with completion

expected in May 2011

o

Additional gathering system

will increase capacity to

26 –

38 Mmcf/d

12 |

Rig

Pad

Pad

Gross Well

Gross Well

Count

Count

Net Well

Net Well

Count

Count

Status

Status

H&P 287

Uschak

#2

1

5

2

Drilled, awaiting fracture and

completion

H&P 287

Androstic

3

1.2

Currently drilling last of three wells

H&P 287

National Metals

2

0.8

Awaiting drilling rig

H&P 287

Frye

2

0.8

Awaiting drilling rig

H&P 287

McBroom

2

0.8

Awaiting drilling rig

H&P 287

Skacel

2

0.8

Awaiting drilling rig

16

6.4

Patterson 480

Uschak #1

4

1.6

Currently drilling last of

four wells

Patterson 480

Marco

3

1.2

Awaiting drilling rig

7

2.8

2011 Westmoreland Drilling Schedule

2011 Westmoreland Drilling Schedule

1. Four of the five Uschak wells were drilled in 2010.

13 |

Marcellus

Projects: Central Marcellus Projects: Central

Centre & Clearfield Counties, Pennsylvania

Operated by Williams Appalachia, LLC

~11,300 net acres / 40% working interest

E&P

•

Inception to date, currently have 4 gross

(1.6 net) wells placed in service

•

Vertical Rig drilling first of four wells on

Resource Recovery #3 pad

Midstream

•

Gathering system to Columbia Pipeline

complete

o

Current capacity at 10 Mmcf/d with

current option to add an additional

30 Mmcf/d

14 |

Lawrence

Field ASP Update Lawrence Field ASP Update

Project Update

•

Completed a 25% pore volume injection of ASP slug, and

currently at 10% pore volume

o

Initial results expected during late first quarter 2011 to

early second quarter 2011

Phase I: (Middagh Unit)

•

Objectives:

o

Test University of Texas chemical recipe in the Bridgeport

Sandstone

o

Optimize drilling/completion procedure

o

Optimize reservoir flow conformance

o

Provide relatively rapid response time; economics

secondary

o

Optimize well pattern

o

Determine economic quantity of chemicals required for

future floods

Middagh Unit Design

15 |

Niobrara

Overview Niobrara Overview

•

~65,400 gross (45,000 net) acres

•

3 horizontal wells drilled and fractured , all recovering

load

•

Silo State 41-22H:

o

Drilled to a total measured depth of 11,700 ft.

(3,560 ft. lateral length)

o

Controlled test rates of 201 gross BOE/d

(153 Bop/d & 288 Mcf/d)

o

On electric submersible pump (ESP) since 1/30/2011 with

48% of frac load recovered

•

Herrington 41-26H:

o

Drilled to a total measured depth of 11,950 ft.

(4,706 ft. lateral length)

o

Controlled test rates of 450 gross BOE/d

(408 BOE/d & 253 Mcf/d)

o

On ESP since 2/4/2011 with 51% of frac load recovered

•

BJB 34-14H:

o

Drilled to total measured depth of 10,800 ft.

(3,348 ft. lateral length)

o

Currently recovering fracture stimulation load

o

Showing similar production characteristics as Herrington

41-26H well

o

On ESP since 1/27/2011 with 30% of frac load recovered

•

Currently analyzing 3-D seismic in the Silo area

•

Resume drilling in the second quarter 2011

•

11 Additional Drilling Locations Identified

DJ Basin

Rex Energy

Silo State 41-22H

201 BOE/d Test Rate

Rex Energy

BJB #1H

Drilled and Completed,

Recovering Load

Rex Energy

Herrington Farms 1H

450 BOE/d Test Rate

16 |

17

1)

Maintain a safe workplace, free of injury and

environmental damage.

2)

Fill the Sarsen plant as soon as possible.

3)

Complete our Butler County drilling program in

anticipation of having additional midstream capacity

from the Bluestone Plant early next year.

4)

Improve production on each Marcellus well by using

our experience to improve our drilling and frac

techniques while reducing F&D costs.

5)

Continue to arrest production declines and improve

lease operating expense in Illinois and Indiana.

6)

Complete our Lawrence Field ASP Pilot in the Middagh

Unit, and prepare the Perkins-Smith Unit for the next

ASP flood.

7)

Review our Silo Field seismic to top grade drilling

locations and execute our 5 well Niobrara plan for

2011.

2011 Focus

2011 Focus |

Rex

Energy Rex Energy

Appendix: Non-GAAP Reconciliation Tables

Appendix: Non-GAAP Reconciliation Tables

Together We Can Make A Difference |

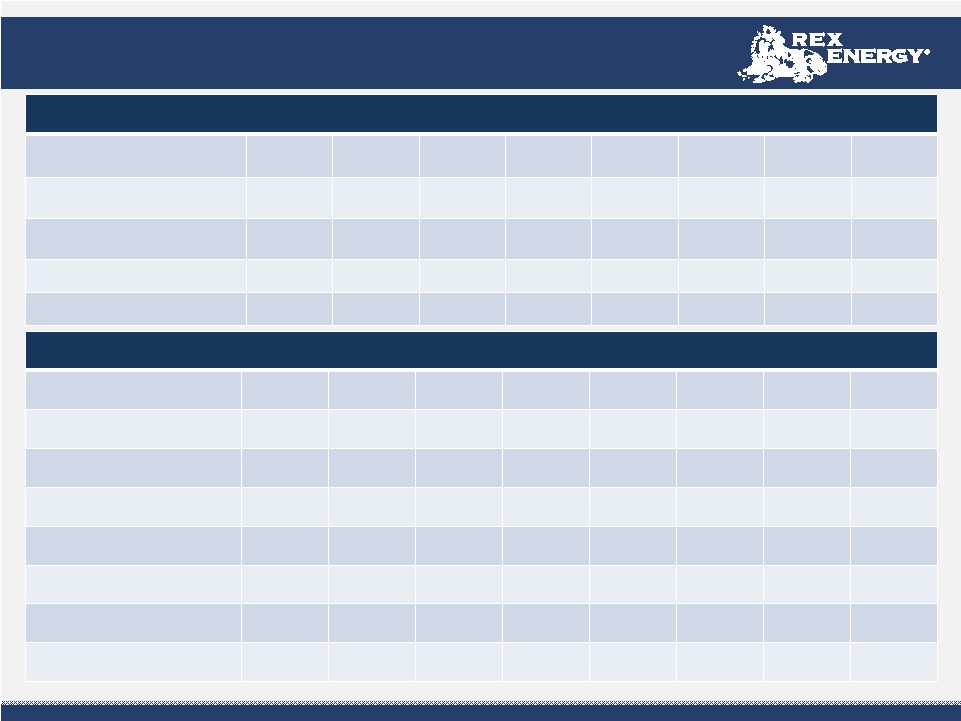

Current

Hedging Summary Current Hedging Summary

(1)

(1)

Crude Oil

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

Collar Contracts

Volume Hedged

144,000

144,000

144,000

144,000

135,000

135,000

135,000

135,000

Ceiling

$ 104.69

$ 104.69

$ 104.69

$ 104.69

$ 112.03

$ 112.03

$ 112.03

$ 112.03

Floor

$ 68.54

$ 68.54

$ 68.54

$ 68.54

$ 67.10

$ 67.10

$ 67.10

$ 67.10

19

1. Includes hedging position as of fiscal year end December 31, 2010 as well as

two additional natural gas hedges added in January, 2011. Natural Gas Hedges

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

Swap Contracts

Volume

260,000

300,000

300,000

300,000

330,000

330,000

330,000

330,000

Price

$ 5.09

$ 5.03

$ 5.03

$ 5.03

$ 5.58

$ 5.58

$ 5.58

$ 5.58

Collar Contracts

Volume

330,000

330,000

330,000

330,000

330,000

330,000

330,000

330,000

Ceiling

$ 7.18

$ 7.18

$ 7.18

$ 7.18

$ 7.07

$ 7.07

$ 7.07

$ 7.07

Floor

$ 5.18

$ 5.18

$ 5.18

$ 5.18

$5.09

$ 5.09

$5.09

$ 5.09 |

Current

Hedging Summary Current Hedging Summary

(1)

(1)

1. Includes hedging position as of fiscal year end December 31, 2010 as well as

two additional natural gas hedges added in January, 2011. Natural Gas Hedges

Cont’d 1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

Put Contracts

Volume

180,000

180,000

180,000

180,000

-

-

-

-

Floor

$ 8.00

$ 8.00

$ 8.00

$ 8.00

-

-

-

-

Put Contracts with Short

Volume

180,000

180,000

180,000

180,000

-

-

-

-

Floor

$ 5.00

$ 5.00

$ 5.00

$ 5.00

-

-

-

-

Short Put

$ 3.68

$ 3.68

$ 3.68

$ 3.68

-

-

-

-

Collar Contracts with Short

Volume

120,000

180,000

180,000

180,000

180,000

180,000

180,000

180,000

Ceiling

$ 5.25

$ 5.25

$ 5.25

$ 5.25

$ 5.25

$ 5.25

$ 5.25

$ 5.25

Floor

$ 4.75

$ 4.75

$ 4.75

$ 4.75

$ 4.75

$ 4.75

$ 4.75

$ 4.75

Short Put

$4.00

$4.00

$4.00

$4.00

$4.00

$4.00

$4.00

$4.00 |

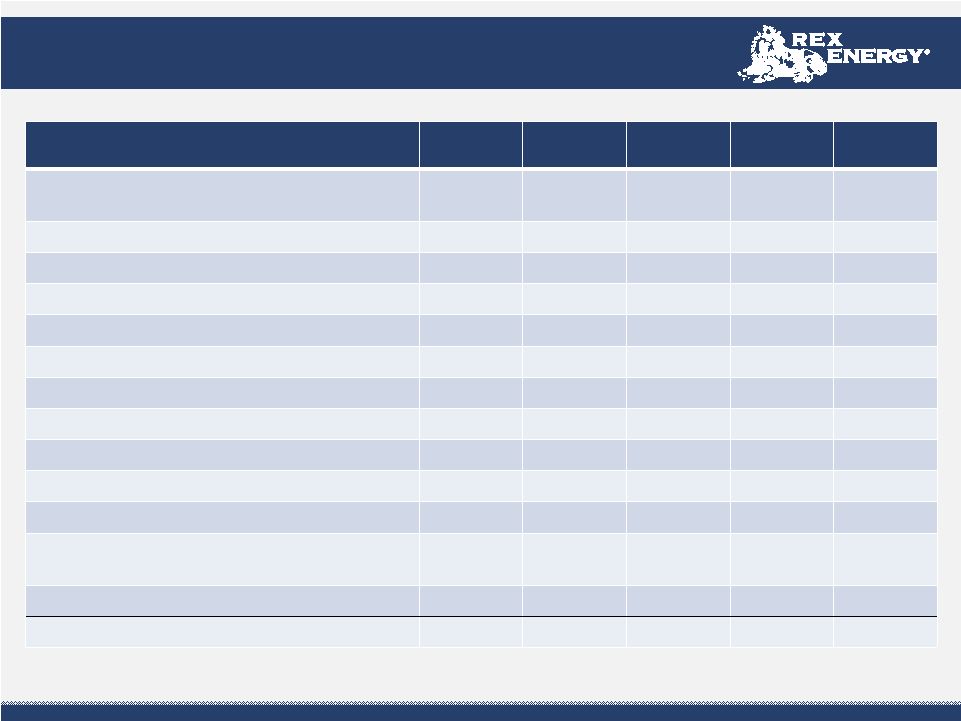

EBITDAX

EBITDAX

(in thousands)

1

st

Quarter

2010

2

nd

Quarter

2010

3

rd

Quarter

2010

4

th

Quarter

2010

Full Year

2010

Net Income (Loss) from Continuing Operations

$ 1,992

$ 813

$ 9,540

$(6,559)

$5,783

Add Back (Less):

DD&A & Accretion

5,092

5,139

4,979

6,595

21,806

Non-Cash Compensation

433

521

213

(254)

914

Interest Expense

164

167

430

310

1,071

Impairment Expense

571

577

2,419

5,296

8,863

Exploration Expense (Income)

1,135

2,311

(474)

2,270

5,242

Interest Income

(35)

(16)

(6)

(12)

(68)

Realized Loss on Interest Rate Swap

196

195

196

123

710

Loss (Gain) on Disposal of Assets

2

(10)

(16,485)

98

(16,395)

Unrealized (Gain) Loss on Derivatives

(4,223)

(4,112)

(1,764)

4,140

(5,960)

Non-controlling Interest Share of Net Gain

56

64

88

45

253

Income Tax Expense (Benefit)

1,281

143

6,610

(3,959)

4,075

EBITDAX from Continuing Operations

$ 6,664

$ 5,792

$ 5,746

$8,093

$26,294

21 |

Clean

Earnings Clean Earnings

(in thousands)

1

st

Quarter

2010

2

nd

Quarter

2010

3

rd

Quarter

2010

4

th

Quarter

2010

Full Year

2010

Income (Loss) From Continuing Operations Before Income Taxes, as

reported

$ 3,273

$ 956

$ 16,150

$ (10,518)

$ 9,858

Add Back (Less):

Unrealized Loss (Gain) on Derivatives

(4,223)

(4,112)

(1,764)

4,140

(5,960)

Non-Cash Compensation

433

521

213

(254)

914

Loss (Gain) on Disposal of Assets

2

(10)

(16,485)

98

(16,395)

Impairment of Unproved Properties

571

577

2,419

5,296

8,863

Loss Attributable to Noncontrolling

Interests

56

64

88

45

253

Loss From Continuing Operations Before Income Taxes, adjusted

$ 112

$ (2,004)

$ 621

$ (1,193)

$ (2,467)

Income Tax Benefit (Expense), adjusted

(1)

(44)

301

(254)

451

993

Clean Earnings (Loss) from Continuing Operations

$ 68

$ (1,703)

$ 367

$ (742)

$ (1,474)

1. Income tax adjustment represents the effect of our effective tax rate on Income (Loss) From

Continuing Operations Before Income Taxes, adjusted 22

|