Attached files

| file | filename |

|---|---|

| 8-K - MAXIMUS, INC. 8-K - MAXIMUS, INC. | a6602888.htm |

| EX-99.1 - EXHIBIT 99.1 - MAXIMUS, INC. | a6602888-ex991.htm |

Exhibit 99.2

Conference Call Transcript

MMS - Q1 2011 MAXIMUS, Inc. Earnings Conference Call

Event Date/Time: Feb 03, 2011 / 02:00PM GMT

CORPORATE PARTICIPANTS

Rich Montoni

MAXIMUS, Inc. - President, CEO

Bruce Caswell

MAXIMUS, Inc. - President of Health Services

David Walker

MAXIMUS, Inc. - CFO

Lisa Miles

MAXIMUS, Inc. - IR

CONFERENCE CALL PARTICIPANTS

James Kumpel

Madison Williams - Analyst

Brian Kinstlinger

Sidoti & Company - Analyst

Torin Eastburn

CJS Securities - Analyst

PRESENTATION

Operator

Greetings, and welcome to the MAXIMUS first quarter conference call. At this time, all participants are in a listen-only mode. A brief question and answer session will follow the following presentation. (Operator Instructions)As a reminder, this conference is being recorded. It is now my pleasure to introduce your host Lisa Miles, Vice President Investor Relations for MAXIMUS. Thank you Ms. Miles, you may begin.

Lisa Miles - MAXIMUS, Inc. - IR

(technical difficulty) today's conference call.I would like to point out that we've posted a presentation to our website under the Investor Relations page to assist you in following along with today's call. With me today is Rich Montoni, Chief Executive Officer, and David Walker, Chief Financial Officer. Following Rich's prepared comments, we will open the call up for Q and A. Before we being, I would like to remind everyone that a number of statements being made today will be forward-looking in nature. Please remember that such statements are only predictions, and actual events and results may differ materially as a result of risks we face, including those discussed in Exhibit 99.1 out of our SEC filings. We encourage you to review the summary of these risks in our most recent 10-K filed with the SEC. The company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances. And with that, I'll turn the call over to Dave.

David Walker - MAXIMUS, Inc. - CFO

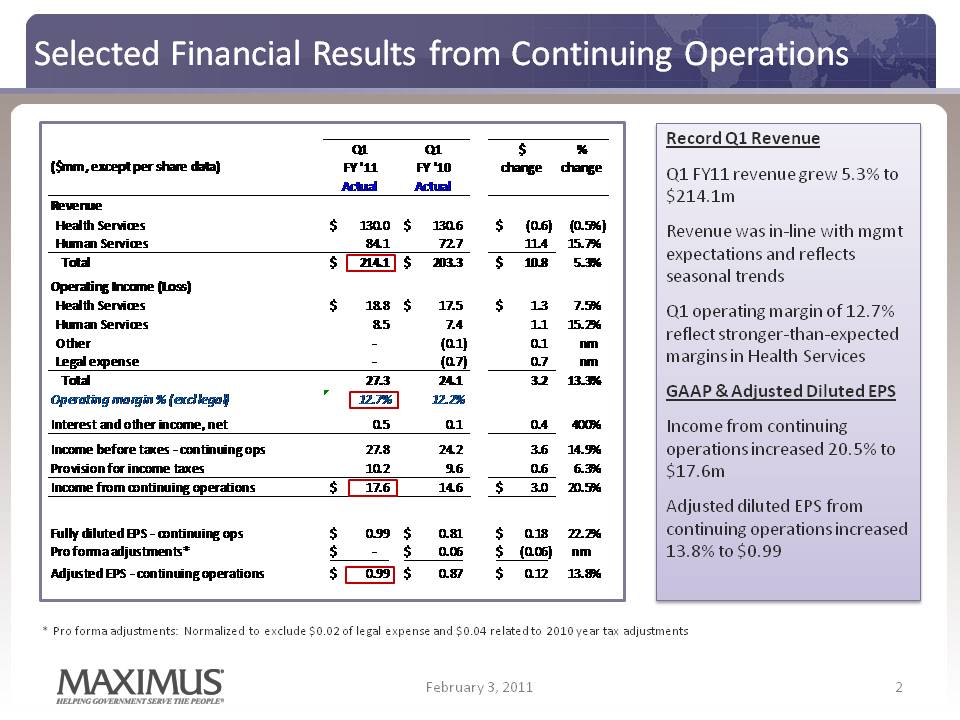

Thanks, Lisa. This morning MAXIMUS reported record first-quarter revenue from continuing operations, up $214.1 million, an increase of 5.3% or 3.6% on a constant-currency basis compared to the same period last year. Top line growth was driven by the international employment services business within the Human Services segment. Revenue in the period was in line with company expectations and consistent with historical trends, reflecting seasonally lower revenue in the first fiscal quarter compared to the remainder of the year. We remain on track to achieve our full-year revenue estimates.

MAXIMUS delivered an operating margin of 12.7 % for the first quarter, which reflected better-than-expected margins in the Health Services segment. For the first quarter of fiscal 2011, income from continuing operations grew year over year to $17.6 million driven by business and profit expansion, as well as a lower tax rate from an increasing mix of international business. Diluted earnings per share from continuing operations for the first quarter increased 13.8% to $0.99, compared to adjusted diluted EPS of $0.87 last year.We've provided a supplemental pro forma table on the last page of the press release, where we normalize the prior period to exclude $0.02 of legal expense and $0.04 related to 2010 year-end tax adjustments. Overall, we are pleased with the results in the quarter as we continue our expansion of new profitable work.

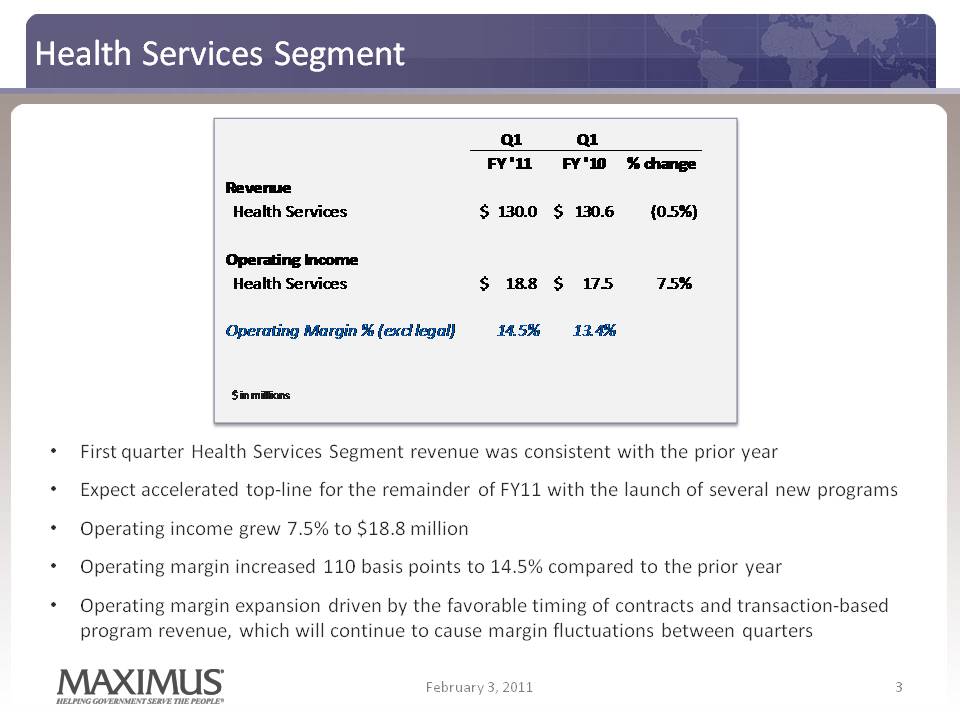

Let's turn our attention to financial results by segment starting with Health Services. The Health Services segment delivered revenue of $130 million for the first quarter, which is comparable with the same period last year. This segment's top-line growth is expected to accelerate for the remainder of fiscal 2011 with a launch of several new programs, which include two state high risk pool contracts, modernization efforts in New York and Colorado, and expansion in current programs. For the fiscal 2011 first quarter, operating income for the Health Services segment grew 7.5% to $18.8 million, compared to $17.5 million in the first quarter of fiscal 2010. The Health Services segment delivered an operating margin of 14.5% in the quarter, which was 110 basis points higher compared to the prior year. This operating margin expansion was driven by the favorable timing of contracts and transaction-based program revenue, such as call volumes, mailings and open enrollments. As a reminder, the timing of these items will continue to cause margin fluctuations between quarters.

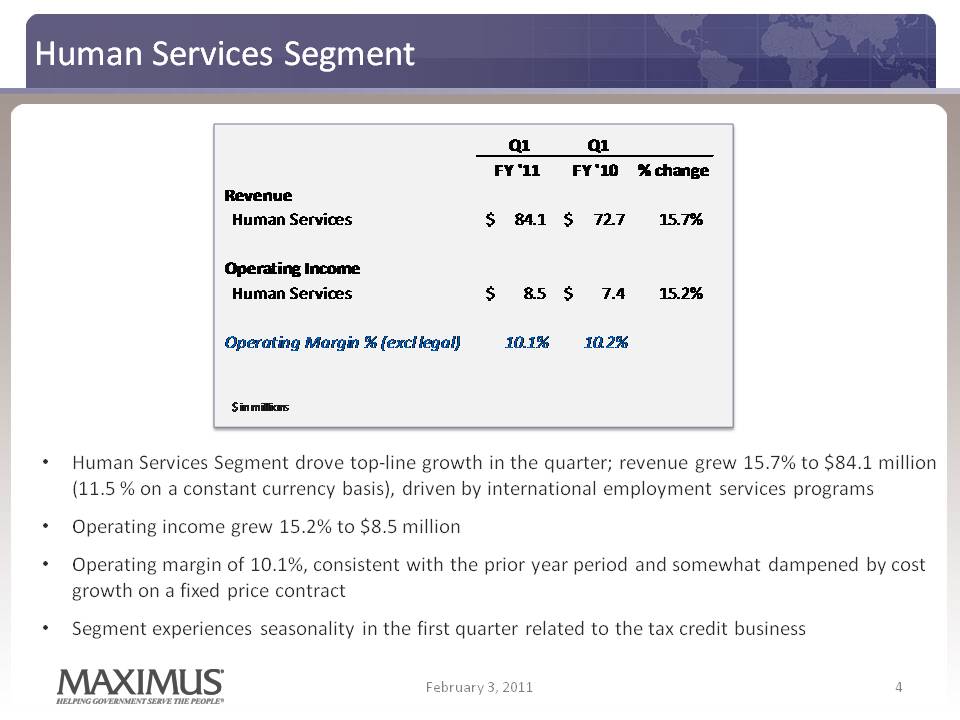

Let's turn our attention to financial results for the Human Services segment, which drove top-line growth in the quarter. For the first quarter, revenue for the Human Services segment grew 15.7% to $84.1 million, or 11.5% on a constant currency basis compared to last year. As expected, growth was driven by our employment services programs in Australia and the United Kingdom. Both programs are now fully ramped and contributing at normalized run rates. Segment operating income grew 15.2% to $8.5 million compared to $7.4 million in the prior year period. Operating margin in the quarter was consistent with the prior year at 10.1% and somewhat dampened by cost growth on a domestic fixed-price contract. As we discussed in our last call, the Human Services segment experiences seasonality in the first fiscal quarter related to the tax credit business. This business line produces losses in the first half of the fiscal year and becomes highly accretive in the second half, predominantly in the fourth quarter. The magnitude of the swing is significant so investors should expect this seasonal trend in operating margin to continue. Overall, we are very pleased with the results by segment and they continue to trend as expected.

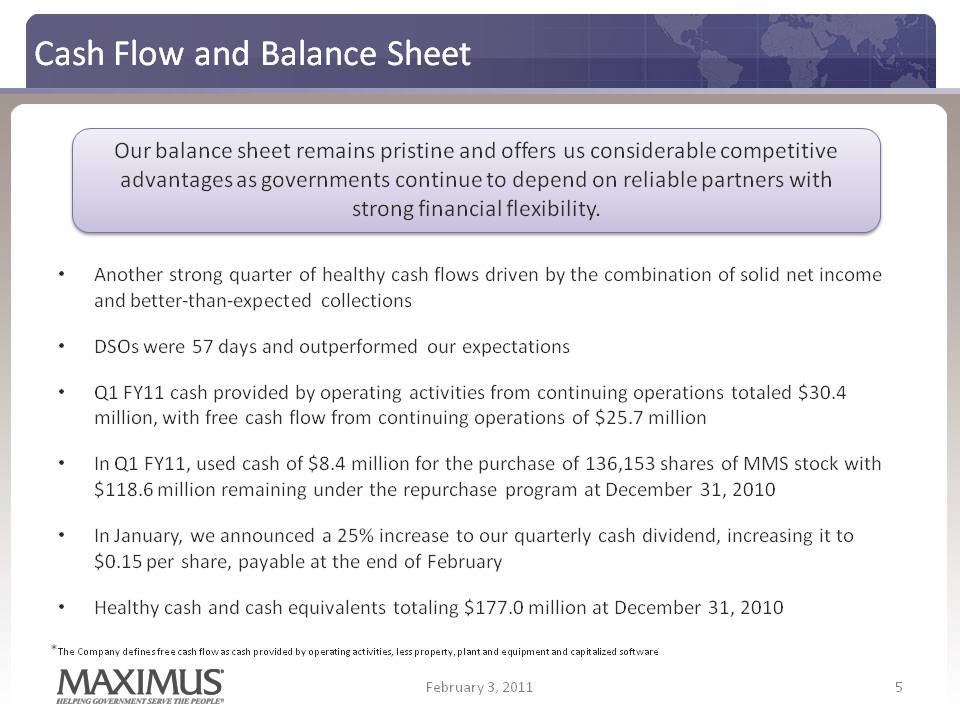

Moving on to cash flow and balance sheet items. The Company delivered another strong quarter of healthy cash flows driven by the combination of solid net income and better-than-expected collections. For the first quarter, day sales outstanding were 57 days, which outperformed our expectations. For the three months ended December 31, cash provided by operating activities from continuing operations totalled $30.4 million with free cash flow from continued operations of $25.7 million. We continue to invest in the business to drive growth and are actively pursuing selective acquisition opportunities both of which are top priorities for cash deployment.

We also remain committed to returning capital to shareholders through repurchases and dividend payments. In Q1, we repurchased 136,153 shares of MAXIMUS common stock for $8.4 million. At December 31st, $118.6 million remained available for repurchases under our Board-authorized program. Also in the quarter, we paid a quarterly cash dividend for a total of $2.1 million. In January, we announced a 25% increase to our quarterly cash dividend, increasing it to $0.15 per share payable at the end of February. With $177 million in cash and cash equivalents and minimal debt, our balance sheet remains pristine and offers us considerable competitive advantages as governments continue to depend on reliable partners with strong financial flexibility. We know this was a key differentiator in the Phase 1 bidding process in the United Kingdom. The Department of Works and Pensions narrowed down the list of preferred suppliers to those vendors who have a demonstrated track record and the financial strength to execute in such an important government initiative.

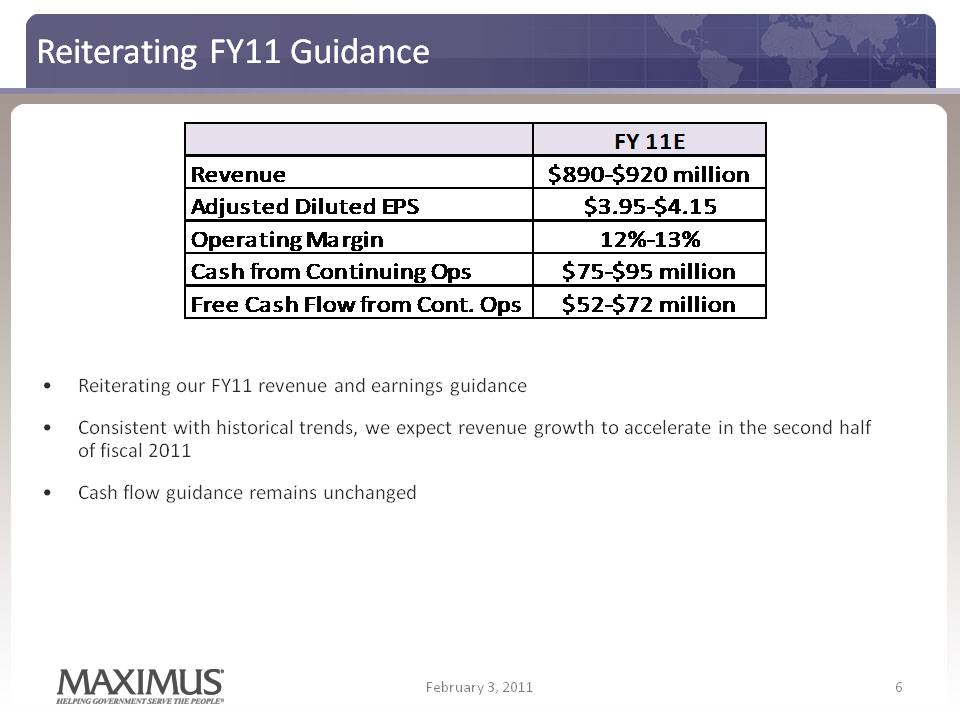

Moving on to guidance, as noticed in this morning's press release, we are reiterating our fiscal 2011 revenue and earnings guidance. To recap, we expect revenue in the range of $890 million to $920 million with growth coming from both segments. Consistent with historical trends, we expect revenue growth to accelerate in the second half of the year. On the bottom line, we expect adjusted diluted EPS from continuing operations for fiscal 2011 to range between $3.95 and $4.15; and we still expect operating margin to range between 12% and 13% for the full year.

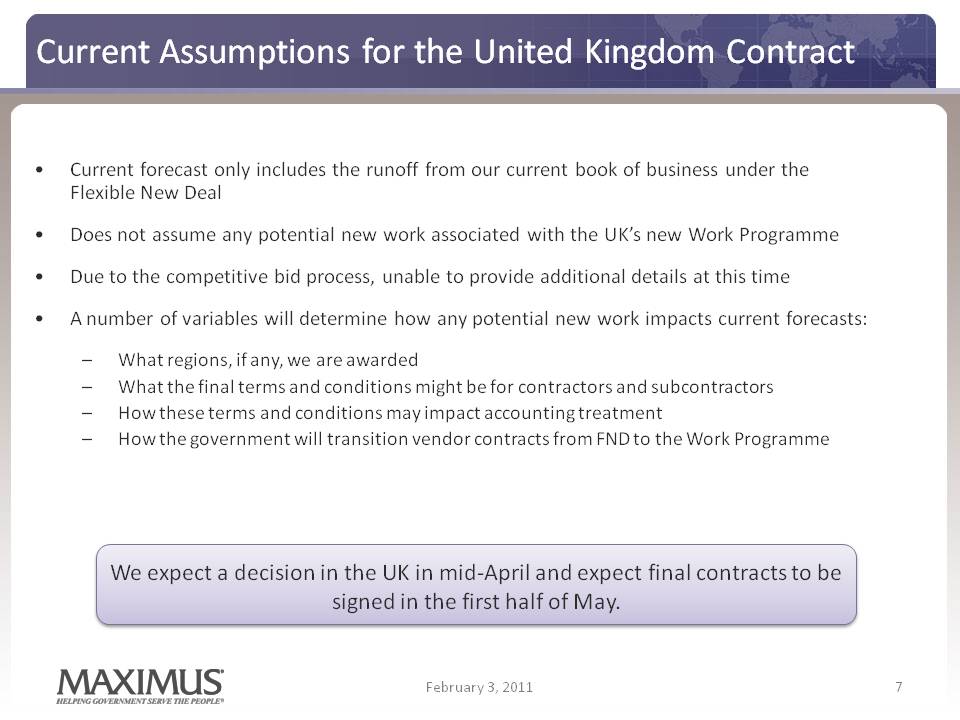

Moving on to cash flows, cash flows in the quarter exceeded our expectations driven by favorable DSO levels. For the remainder of the year, we also expect continued reductions in deferred revenue. Our guidance remains unchanged; and we continue to expect cash provided by operating activities derived from continuing operations to be in the range of $75 million to $95 million for fiscal 2011. We expect free cash flow from continuing operations in the range of $52 million to $72 million. Before I hand the call over to Rich, I want to specifically address how we are handling our forecast for the United Kingdom contract. Our current forecast only includes the runoff from our current book of business under the flexible new deal, and does not assume any potential new work associated with the UK's work program.

As you know, we are participating in a competitive bid process; and as a result, we are unable to provide additional details at this time. What we can tell you is that there are a number of variables that will determine how any potential new work impacts current forecast. These variables include what regions, if any, we are awarded, what the final terms and conditions might be for contractors and subcontractors, how these terms and conditions may impact accounting treatment and how the government will transition vendor contracts from FND to the work program contract. We expect a decision in the UK in mid-April, and we expect final contracts to be signed in the first half of May. Thanks for joining us this morning. And now I'll turn the call over to Rich.

Rich Montoni - MAXIMUS, Inc. - President, CEO

Thanks, David. And good morning, everyone. We're coming off a very solid performance for the first quarter. This positions us quite well for the balance of the fiscal year. We had significant accomplishments, including the signing of two major contract renewals and important progress on a large international opportunity. In addition, through our extensive marketing efforts, we have further distinguished MAXIMUS as the go-to partner for governments as they seek to reduce costs, improve the quality of services, and increase accountability.

Despite the legal challenges to the Affordable Care Act, we continue to see positive developments in the overall domestic health environment. Most press reports have focused primarily on the legal decisions. Yet several news pieces highlighted the practical realities of how implementation efforts continue to progress. Tuesday's political article titled States Still Implementing Reform noted that observers on both sides of the aisle expect implementation to move forward largely despite Monday's ruling. The Congressional quarterly article titled After Ruling in Health Care Law Case, Questions About Implementation stated that most states are moving ahead on planning for Medicaid expansion, state-based exchanges, new medical payout standards, and other provisions.

These statements are consistent with our observations in the market, as we continue to see active planning by states in preparation for the forthcoming establishment phase. At the same time, various polls show bipartisan and public support for many of the individual components of the law. For example, the US Department of Health and Human Services recently reported as many as 129 million Americans under the age of 65 have preexisting medical conditions. Provisions of the new law, such as the ban on denying coverage to individuals with pre-existing conditions, remain popular with voters and are unlikely to change. With these ongoing legal and legislative dynamics, we continue to work hard to stay ahead of the curve as states continue towards the implementation requirements of health care reform in 2014.

With our established presence, we have a firm understanding of how states are approaching the planning and establishment phases required under the law. We have demonstrated success with helping California and New York establish their high-risk pools. These are part of the first wave of requirements enacted under health care reform. During the quarter, we launched a market-leading modernization effort in Colorado, the first of its kind, where the state implemented a new model for eligibility and enrollment into its public health insurance programs. New York is engaged in a similar effort where we are currently in the start-up phase and expect to launch the program in the second half of the fiscal year.

These states are early adopters of a model that is expected to serve as a blueprint for the required health insurance exchanges. These efforts have not gone unnoticed as more than half of all states are proactively evaluating modernization programs as a way to reduce costs, improve the quality of service delivery, and simplify enrollment. A recent Kaiser commission report on Medicaid showed that even during the current tough fiscal environment, 27 states plan to expand or simplify their eligibility processes in 2011 and 2012, a move that could qualify them for additional funding. Some states like Colorado are implementing broader reforms and eligibility expansions. Others, like Ohio, Pennsylvania, Georgia, New Hampshire, and Utah, are looking to modernize their current Medicaid programs by streamlining processes and capturing new efficiencies.

We are also seeing increased activity at the state level removing Medicaid recipients from fee-for-service models to managed care, which is typically more cost-effective. In fact, the move by Texas to transition a large number of additional Medicaid beneficiaries into managed care has received a significant amount of press and analyst coverage. The state has taken steps to improve the overall quality and effectiveness of its programs with several other initiatives underway. Texas already issued a request for proposal, two dental plans, as the state intends to move nearly 3 million children from fee-for-service plans into managed care.

Under our current contracts, MAXIMUS will serve as the enrollment broker for this transition, which is expected to occur in 2012. As Medicaid programs become larger, more complex and costly, additional states will look to new models. States that have traditionally only offered fee-for-service Medicaid are taking major steps towards managed care, which represents new growth opportunities for MAXIMUS. The most recent numbers from CMS indicate that nearly a third of Medicaid beneficiaries are still enrolled in traditional programs.

While we recognize that not all of the 13.7 million beneficiaries still on traditional Medicaid will ultimately transition to managed care, more than 80% of all Medicaid spending remains in the fee-for-service category. According to Medicaid Health Plans of America, moving these beneficiaries into managed care reduces costs over the long run, with some studies showing up to a 20% savings for individual states. Transitioning beneficiaries to managed care also establishes the infrastructure needed for the expected expansion of Medicaid in 2014. As an example, Kentucky recently issued six requests for information for Medicaid-managed care initiatives as a method for controlling cost. That state is taking several steps to balance the budget while continuing to provide care to its more than 800,000 Medicaid beneficiaries.

These measures include establishing a Medicaid managed care oversight branch and using public-private partnerships to implement cost-saving innovations. States like Kentucky, which have relied primarily on traditional fee-for-service models and handle the administration of their Medicaid programs in-house, are now looking to proven partners in the private sector to help make their programs run more efficiently. Kentucky is just one of 20 states implementing or expanding managed care in the near term. This is according to the Kaiser Commission. South Carolina, Mississippi, Illinois and Minnesota have already announced a move to managed care. In addition, state legislatures in Texas and Florida are voting on expanding current managed care programs.

Maine is studying a type of managed care based on risk levels, while the government of Arkansas recently spoke of possible pilot programs to move away from an unsustainable fee-for-service model. California just received a waiver from CMS to transition portions of the elderly and disabled Medicaid population into managed care. Overall, any shift towards managed care would be a net positive for MAXIMUS, and offers new opportunities in our core markets to serve more beneficiaries and enroll them in the managed care plans. So for practical purposes, market demand for our Health Services solutions remains robust, and we continue to see real meaningful growth opportunities in the short term as well as the longer term. More importantly, we fully expect the politics around the Affordable Care Act to remain fluid, but the need for states to address the rising cost of health care will not go away. We believe, no matter the political outcome, the need for our services continues to grow.

Turning now to our international markets, during the quarter we made further progress in our efforts to bid work under the United Kingdom's welfare reform effort. The new work program consolidates existing welfare-to-work programs into a single back-to-work program. MAXIMUS is named as a preferred supplier for seven of the 11 regions, the maximum number allowed under the buying framework. As a reminder, our current contract in the UK is expected to end on June 30 as the government transitions over to the new work program. The UK team is hard at work on our bids, which we expect to submit later this month.

Under the current timeframe, the government expects to make the awards in mid-April and expects final contracts to be signed in the first half of May. As David noted, there are many variables to the new program, but we remain optimistic on our prospects and look forward to providing you with an update once the awards have been made. I want to point out that fiscal 2010 was a year of extraordinary international revenue growth for MAXIMUS with major contract expansion and wins in both Australia and the United Kingdom. While we're not expecting the same rate of revenue growth year over year in fiscal '11, we remain bullish on our international prospects. We are pursuing the work program opportunity in the UK and also evaluating opportunities in other countries where we don't currently operate, but where market conditions are encouraging.

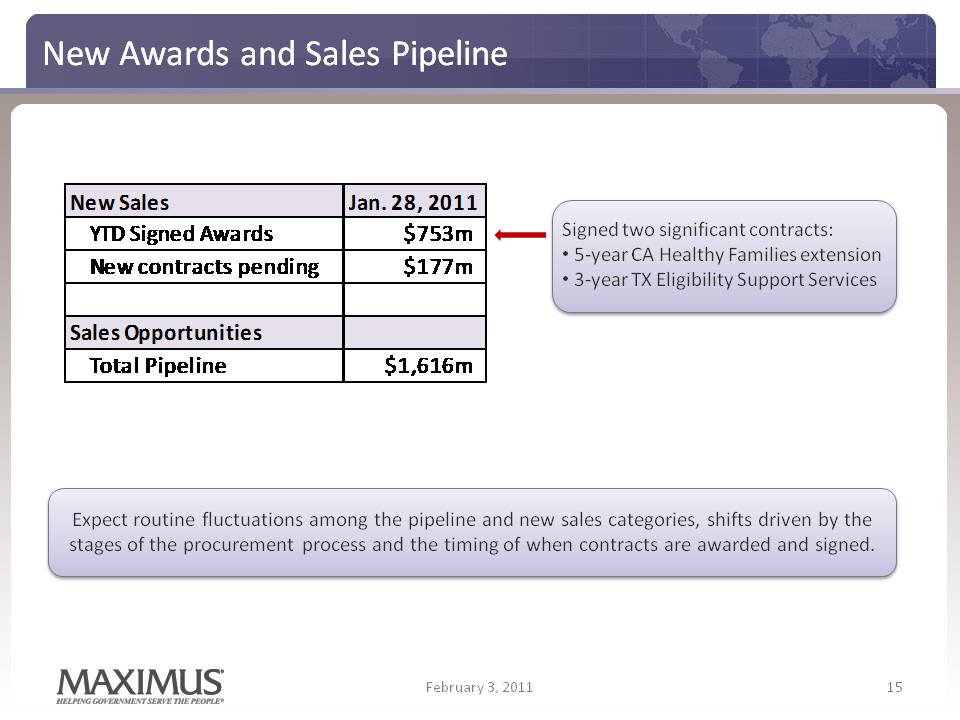

Moving to new awards and sales pipeline, at January 28 our fiscal year-end signed contract wins totals $753 million compared to $183 million reported last year. During the quarter, we signed two significant contracts, the extension of our California Healthy Families contract and the renewal of our Texas Eligibility Support Services contract. This is a great start to contract signings within our base business early on in the year. New contracts pending -- those that are awarded but unsigned -- totalled $177 million compared to $347 million last year. Our pipeline of sales opportunities at January 28 remain strong at $1.6 billion and is consistent with last year. As a reminder, investors should expect routine fluctuations among the pipeline in new sales categories. These shifts are driven by the stages of the procurement process, as well as the timing of when contracts are awarded, and ultimately signed.

In closing, we are off to a strong start in fiscal 2011 with two important contract renewals signed and our inclusion in the bidding process for the large UK opportunity. As many of you know, we have worked hard over the last several years to best position the Company in the Health and Human Services business process outsourcing, or BPO markets.Our timely and well-placed efforts to help states address health care reform requirements are now bearing fruit.

In the short term, we continue to see states implement program improvements, like eligibility modernization and shifts towards Medicaid-managed care. In the long-term, we are preparing for the larger opportunities as part of the full rollout in 2014. At the same time, our demonstrated success in the US and Australian welfare-to-work markets has led to new promising opportunities. Our commitment to deliver exceptional service and improve quality in a cost-effective manner sets us apart. Our recent successes coupled with the strong demand we see in the market are cause for us to be optimistic about our short-term as well as our long-term growth prospects. With that, let's open it up for questions. Operator?

QUESTION AND ANSWER

Operator

Thank you. We'll now be conducting the question-and-answer session. (Operator Instructions)Thank you. Our first question is from James Kumpel of Madison Williams. Please proceed with your question.

James Kumpel - Madison Williams - Analyst

Good morning. Rich, can you talk a little bit about the nature of states' current positioning for health exchanges? You obviously talked about Colorado and administrative simplification and efforts later this year in helping New York, but can you give us the sense of what states in particular seem to be looking most aggressively into that amongst your existing customer base, and how you see that playing out over the next two years or so?

Rich Montoni - MAXIMUS, Inc. - President, CEO

Good morning, Jim. Let me take a pass at it. Let me take a crack at it. First off, from a general perspective, you gathered the tone on the call notes that as a general rule we see the states moving forward despite the recent court ruling in Florida. And we pulse it, as you know, state by state. We maintain a 50-state call program. We focus on our large customers, which are obviously the larger customers -- larger states in the United States, so I think we've got a very close handle on all of those states and which ones are moving forward. I don't want to get into state plans and specifics just out of respect from the customer's perspective, but I do think we've touched upon it in terms of California, Texas being two of the larger states with specific initiatives and well down the path in terms of planning for health care reform. Bruce Caswell is here who runs -- he's the President of our health segment. Bruce and his team focus day in and day out in working with these clients. Bruce, is there anything you could add to this?

Bruce Caswell - MAXIMUS, Inc. - President of Health Services

Rich, I think you hit it well. I would just say, every state is in some form of planning right now. As you know, Jim, there were 48 planning grants given to the states and the CMS in [OSIO] have moved forward with providing further funding vehicles now that are available to states to extend their planning activities and then ultimately move into the establishment phase. So the infrastructure, if you will, for federal funding is being clarified and made available to states. There were five states in particular, including one consortium, that applied for early adopter grants that are to be awarded in February. So I think the best way to characterize it is, as Rich has, where there's a level of planning going on in each state and some states are just ahead of others.

James Kumpel - Madison Williams - Analyst

And I guess on the same topic, have you gotten a sense that any of the states are looking to basically do a fall-back on whatever federal alternative there may be, or are you getting a sense that really states still want to basically control their own destiny on this front?

Bruce Caswell - MAXIMUS, Inc. - President of Health Services

Jim, I think that it's more the latter than the former. We have not heard of any specific states that would opt for a federally-run exchange at this point. I think that across party lines there's a desire -- I think you put it well -- to control their own destiny.

James Kumpel - Madison Williams - Analyst

Okay.

Rich Montoni - MAXIMUS, Inc. - President, CEO

Jim, to close out your earlier question, we did note in our call notes that there are 27 states, according to our inventory, that are moving forward with considering modernization efforts as it relates to eligibility in 2011 and 2012 and we mentioned a few of them, including Ohio, Pennsylvania, Georgia, New Hampshire, and Utah, in addition to Colorado.

James Kumpel - Madison Williams - Analyst

Can you actually offer up a little bit more color on the state of affairs in Texas, where basically the government is moving to shift a whole bunch of folks in the border areas into managed care, where that stands, how that's playing out for you, and if that is incremental revenues we ought to be considering or if it's sort of baked into guidance?

Rich Montoni - MAXIMUS, Inc. - President, CEO

That's a great question. And I do see Texas as perhaps the leading example of what we see as a very significant trend of states in an effort to better manage cost and the quality and balance cost and quality of health care, which is -- it's just a universal issue. We see a very significant trend of states moving populations off fee-for-service to Medicaid; and Texas has taken this very, very seriously. They are moving forward expeditiously. I understand the legislature has passed a bill this session to expand it. The numbers vary in terms of whose estimate you use, but it ranges from 600,000 to 900,000 moving in the valley from fee-for-service to Medicaid; and it's the MAXIMUS program that's expected to handle this additional population. It's just additional volume on our existing contract.

We have factored this into our expectations for fiscal 2011. But I will say one thing you need to keep in mind, and it's a good thing, we have a number of programs that are actually operating in partial-year mode in fiscal 2011, and these initiatives, the nature of these initiatives, are such that they should continue into the future, so you may be looking at a full year in fiscal 2012 versus a partial year in fiscal 2011.

James Kumpel - Madison Williams - Analyst

David, I'm just going to close out with my final question here. Can you give a sense of what, if anything, you did special in the quarter on SG&A? Is this sort of a return to normal seasonality in that front or were there some things relative to the fiscal third and fourth quarters that you've done to basically ratchet the number to a better place?

David Walker - MAXIMUS, Inc. - CFO

Well, we always tell all our investors be careful of focusing too much on SG&A, because we've put a bit in proposal dollars in SG&A, so the nature of operational people is sometimes they're working on the contracts so it can affect gross profit, or sometimes they're working on proposals so it can move to SG&A. So we really will first of all focus you on the operating margin, and we're within our expectations. So we're happy with our SG&A rate. We're happy with how we managed indirect costs, but it will fluctuate from quarter to quarter and it's certainly consistent with our internal plans.

James Kumpel - Madison Williams - Analyst

Fair enough. Thank you very much.

Rich Montoni - MAXIMUS, Inc. - President, CEO

Thank you, Jim.

Operator

Thank you. Our next question is coming from Torin Eastburn of CJS Securities. Please state your question.

Torin Eastburn - CJS Securities - Analyst

Good morning.

Rich Montoni - MAXIMUS, Inc. - President, CEO

Good morning, Torin.

Torin Eastburn - CJS Securities - Analyst

My first question is about the renewals you renewed, California and Texas this quarter. Are there any other big ones coming up?

Rich Montoni - MAXIMUS, Inc. - President, CEO

Boy, I think for think for the year those are the two big ones, above and beyond the United Kingdom, but those would be the big three, I believe. We also have an additional one in New York, New York program, but certainly those are two of the top five large ones.

Torin Eastburn - CJS Securities - Analyst

Okay. I'm still trying to get a sense of the seasonality in the new segments. You had great growth in Human Services this quarter. I gather it's going to taper off throughout the year. Do you expect to see net revenue growth in Human Services in the second half?

David Walker - MAXIMUS, Inc. - CFO

We actually expect revenue growth year over year across all our segments, but it will be -- but a slight advantage in the health area. What you're seeing a lot of the Human Services is just the full year ramp-up, but there is some seasonality, particularly in the tax credit business that tends to favor the back end, not just in revenue, but in operating margin, okay, in the Human Services area. In the health area -- and we talked about this -- the expansion is coming from a lot of the new programs for the high risk pools, the two new modernization programs, Colorado and New York and expansion of current programs.

Rich Montoni - MAXIMUS, Inc. - President, CEO

So to emphasize what David has said from a segment perspective -- and I think he's talked about the second half of the year -- In terms of the growth expectations there. Most of the second half of the year growth is going to be driven by the Health Services segment.

Torin Eastburn - CJS Securities - Analyst

Okay. Understood. Looking at the balance sheet for a second, you continue to build up cash, you seem to be generating it faster than you can use it in your business and almost faster that you can buy back shares. Do you have any updated thoughts on what potential uses are?

Rich Montoni - MAXIMUS, Inc. - President, CEO

Semantically, our intent is to continue, first off, Management and the Board are very respectful of the significance of repatriating earnings to our shareholders. As a result we're very keen on the share repurchase program. On the dividend program -- and I know that you've noted we increased the dividend this past quarter. I think the increase was 25%. We took it from $0.12 a share per quarter to $0.15 per share per quarter, so I think those programs will continue to remain very popular at MAXIMUS. In addition, we are also very focused on mergers and acquisitions. We are very active in that arena, domestically and internationally. That being said, we're very particular as well. We simply don't want to go out and acquire for the sake of being acquisitive. We've got attributes, M&A attributes and targets that are very important so we will respect those as well.

Torin Eastburn - CJS Securities - Analyst

Last question, you have a lot of visibility in your business. What should we be keeping in mind as far as changes in 2012 versus what you think will be happening in your business this year?

Rich Montoni - MAXIMUS, Inc. - President, CEO

Boy, in 2012, we're not in the guidance mode yet for 2012. I would tell you from a macro perspective, the things in 2012 that obviously will be very, very important will be what's happening internationally as governments seek to restructure their health and human services programs, the United Kingdom awards, which we've talked about them being made this spring, will be very, very important; and they'll probably have more of an impact, the award event, is a 2011 situation. The financial impacts of that award will clearly be full-year in 2012 and beyond, so we should pay attention to that. We'll have full-year, as I mentioned earlier, in a couple of the new programs this year, Colorado and New York, so that provides some important positive dynamics for 2012.

Torin Eastburn - CJS Securities - Analyst

Okay.

Rich Montoni - MAXIMUS, Inc. - President, CEO

Helpful?

Torin Eastburn - CJS Securities - Analyst

Yes, thank you.

Operator

Thank you. (Operator Instructions)Our next question is from Brian Kinstlinger with Sidoti & Company. Please state your questions.

Brian Kinstlinger - Sidoti & Company - Analyst

Good morning, how are you?

Rich Montoni - MAXIMUS, Inc. - President, CEO

Great, Brian. I hope you are too.

Brian Kinstlinger - Sidoti & Company - Analyst

Thanks. The first question I had -- most of mine are follow-ups now to others, but the profit -- the price points or the contribution margins on your recompetes, how do they look compared to the old contracts? Did you see relatively flat pricing? Up, down, maybe direction to help us out.

Rich Montoni - MAXIMUS, Inc. - President, CEO

I would say as a rule, my impression is relatively flat pricing, which I think is good. One thing we're seeing in this environment, is a tendency not to go to rebid. We've had a couple of situations where clients have just chosen in this environment to continue their service plan. That was the case with, certainly, our large contract in California. And I think that's driven by a couple of things. One, governments, frankly, they've had some reductions in head counts, so they don't have necessarily the resources to go through a strenuous rebid process. Two, I do think that this health care reform -- and there's so much heavy lifting that has to occur -- I think governments are reluctant to change out vendors. I think they've established trusted vendors in this regard. They've very much looked to those trusted vendors to add value to their situation in dealing with health care reform initiatives, and certainly if they intend -- and most do intend to build upon a current infrastructure to handle the additional burdens of health care reform. It all plays into an environment where between now and 2014, you're going to see a lot of these customers stick with their existing trusted vendors and for those situations where, and MAXIMUS I think is fortunate to be in that circumstance, we have a very significant share of those customers; I think that's a good situation.

Brian Kinstlinger - Sidoti & Company - Analyst

Now, in many states, and obviously publicized in California, others are proposing to cut benefits as Medicaid costs are skyrocketing for the states. Have you at all heard any way that they are coming after the vendors, because obviously in the recompetes they weren't, but is there any discussion around any of your existing clients where they want you to take lower pricing on future contracts, that you're hearing?

Rich Montoni - MAXIMUS, Inc. - President, CEO

As a general rule, no. We've had a couple of situations during this past recession and in prior recessions where governments will have cuts in their budgets, a couple of situations where clients have said, we need to reduce our spend on this administrative aspect by 5%, as an example, and our general approach is to work with our customers and negotiate scope adjustments to accommodate their need to reduce their spend and sometimes it will come back, sometimes it won't. All of this is baked into our guidance. I think it's normal stuff across the board. So I don't think we see that as a pervasive trend. I think the reason being is that as a general rule, when governments seek to deal with the cost of these programs, there's not a whole lot of significant savings in the administrative costs, which is the function that we run. Generally it's less than 5% of the total program spend.

The big spend really are the four levers, as we've talk about, and that is basically who's entitled to the services, what the co-pays might be, what they'll pay the providers for their services. Those tend to be -- and the services themselves to which the beneficiaries are entitled. Those are the four big levers that governments tend to look at; and oftentimes, you'll see them look at a combination of adjustments there, but not in the administrative spend. In fact, a lot of our customers feel that they would be ill-advised to spend less on the administration because when you tend to do that, there's an offsetting -- more than offsetting risk in terms of fraud, waste and abuse, or reduced services to the beneficiaries.

Brian Kinstlinger - Sidoti & Company - Analyst

And I think there's just over half of the states outsource enrollments. I'm wondering if there is a trend for more states do you think will be outsourcing enrollments? And when you look at the health care exchanges as well, do you think that it's really just those 26 or 27 states that outsource enrollments now that will be the major opportunities or do you think more and more states will begin to outsource more?

Rich Montoni - MAXIMUS, Inc. - President, CEO

I wouldn't limit your purview to outsourcing enrollments. Actually what we do is, sometimes it's enrollment assist, but there's a whole supply chain of services. I would look at it as really that whole supply chain of services and the propensity of these governments to outsource; and I do think there's a general trend in terms of governments to outsource. Bruce, is that your observation on the marketplace as well in terms of those that we've talked about, there's some states that currently don't outsource that are giving serious consideration to it?

Bruce Caswell - MAXIMUS, Inc. - President of Health Services

Yes, Rich. Our observation is that the confluence, if you will, of the tight budget pressures on states that continue, the aging work force and population in the states that in many ways will limit ultimately the available pool of knowledge workers to self-administer programs, and then the impending volume increases that health care reform presents and, in a number of instances, could push states over that tipping point, to consider a partnership with a private vendor.

Brian Kinstlinger - Sidoti & Company - Analyst

Great. Two more, I have, if you could. The first one is related to the pipeline. You mentioned more than half the states are thinking about projects in modernization. What's the sort of timing or do we have to wait for that early adopter grants to come through before the RFPs come out or maybe can you quantify what the pipeline looks like in the near term for some of those contracts in quantifying it?

Bruce Caswell - MAXIMUS, Inc. - President of Health Services

This is Bruce. I would just say that these types of initiatives follow a fairly well-worn path from a state procurement standpoint. They begin often with requests for information from the vendor community and will lead to an RFP process and that RFP process will lead to awards. It's not uncommon to see that run in the 12-month to 18-month range.And they waterfall each other, so you always have -- you're kind of at a different state or a different stage with each state along the way.

Brian Kinstlinger - Sidoti & Company - Analyst

And are they $5 million and $10 million of annual revenue generally -- I mean, depending on size of the state, but is that about roughly the average?

Bruce Caswell - MAXIMUS, Inc. - President of Health Services

Yes, that's right. It really does vary by state, obviously, and the population that's being served. But if you wanted to use that as a rough metric, that's probably a fair metric.

Rich Montoni - MAXIMUS, Inc. - President, CEO

Yes, it depends upon, obviously, the state and the nature of the services. It's quite a range. It could be several million dollars to several tens of millions of dollars per year. And if you wanted to take a conservative average, $5 million is probably a good number, Brian.

Brian Kinstlinger - Sidoti & Company - Analyst

Last question I have, Rich, I think it was about two or three quarters ago, you talked about Canada as being a big opportunity for growth for you. We haven't heard about that in a while. Maybe update us on the pipeline you've got there, and is that pipeline moving closer to some fruition and contract awards?

Rich Montoni - MAXIMUS, Inc. - President, CEO

I'd be glad to do that. We did and we do believe Canada is a great opportunity for growth for MAXIMUS. You're familiar with the BC program that we have, and we've received additional work for that government. It still remains very, very robust in several provinces. We do have one particular thing we can talk about in the quarter. Bruce, why don't you share a little bit about this Nova Scotia award, which is really an award under DeltaWare, which we acquired last year; and we're very pleased to have that award.

Bruce Caswell - MAXIMUS, Inc. - President of Health Services

That's right. Very briefly, as I think you may be familiar, DeltaWare provides in Canada one of three certified drug information systems that conform to the pan-Canadian standard HL7V4 for messaging for drug information systems. And in fact, it's the only one that's been implemented completely, was the first to market. That, if you will, strategic advantage led to an award by the Nova Scotia government to DeltaWare in the range of about a $4 million project to implement the drug information system in Nova Scotia, which is a nice growth, if you will, off of the existing install base.

Brian Kinstlinger - Sidoti & Company - Analyst

Great. Thank you.

Rich Montoni - MAXIMUS, Inc. - President, CEO

Okay.

Operator

Thank you. Our next question is a follow-up from James Kumpel of Madison Williams. Please proceed with your question.

James Kumpel - Madison Williams - Analyst

On the international theme, we certainly look to Australia and the UK as great examples and reference sites for potentially other international opportunities. Can you tell us if it's still way out on the horizon or if there's more activity on the continent picking up?

Rich Montoni - MAXIMUS, Inc. - President, CEO

Where we are in terms of other opportunities on the continent, we've done country-specific reviews where we continue to monitor developments and look for a change that might be about in that country and a propensity to change their welfare system or their health system. We've identified several; and obviously, for competitive reasons, I'm not going to share with you which countries those might be. So we're in active in-country investigations, so I think there's a good likelihood we'll find some appropriate opportunities over the next 12 months for MAXIMUS to seriously move forward with. So I'd say stay tuned. We're pretty excited about it, Jim.

James Kumpel - Madison Williams - Analyst

This may be a little bit out there, in that, David Cameron's government, looks like they're trying to pursue their own health reform in the UK, do you see opportunities within your Health Services business to take your capabilities that you've demonstrated here and to benefit somehow from some of the contemplated changes in the health system out in the UK?

Rich Montoni - MAXIMUS, Inc. - President, CEO

No doubt about it. When it boils down to fundamental, what's involved in running these programs, a lot of what we do here in the US is applicable in other programs. And those government officials tend to be very interested in learning from us what we perceive to be best practices and those practices that they should avoid, so absolutely we should and will take a look at what they're doing in the United Kingdom with their health reform program.

James Kumpel - Madison Williams - Analyst

Okay, we'll stay tuned on that deal. Okay, great.

Operator

Thank you. We have reached the end of our allotted time for questions as well as today's teleconference. This now concludes today's teleconference. You may disconnect your lines at this time. Thank you for your participation.

|

Thomson Reuters reserves the right to make changes to documents, content, or other information on this web site without obligation to notify any person of such changes.

In the conference calls upon which Event Transcripts are based, companies may make projections or other forward-looking statements regarding a variety of items. Such forward-looking statements are based upon current expectations and involve risks and uncertainties. Actual results may differ materially from those stated in any forward-looking statement based on a number of important factors and risks, which are more specifically identified in the companies' most recent SEC filings. Although the companies mayindicate and believe that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate or incorrect and, therefore, there can be no assurance that the results contemplated in the forward-looking statements will be realized.

THE INFORMATION CONTAINED IN EVENT TRANSCRIPTS IS A TEXTUAL REPRESENTATION OF THE APPLICABLE COMPANY'S CONFERENCE CALL AND WHILE EFFORTS ARE MADE TO PROVIDE AN ACCURATE TRANSCRIPTION, THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES IN THE REPORTING OF THE SUBSTANCE OF THE CONFERENCE CALLS. IN NO WAY DOES THOMSON REUTERS OR THE APPLICABLE COMPANY OR THE APPLICABLE COMPANY ASSUME ANY RESPONSIBILITY FOR ANY INVESTMENT OR OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED ON THIS WEB SITE OR IN ANY EVENT TRANSCRIPT. USERS ARE ADVISED TO REVIEW THE APPLICABLE COMPANY'S CONFERENCE CALL ITSELF AND THE APPLICABLE COMPANY'S SEC FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER DECISIONS.

© 2011 Thomson Reuters. All Rights Reserved. |

David N. Walker Chief Financial Officer and Treasurer First Quarter – Fiscal Year 2011February 3, 2011 A number of statements being made today will be forward-looking in nature. Such statements are only predictions and actual events or results may differ materially as a result of risks we face, including those discussed in our SEC filings. We encourage you to review the summary of these risks in Exhibit 99.1 to our most recent Form 10-K filed with the SEC. The Company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances. Helping Government Serve the People

Selected Financial Results from Continuing Operations Q1 Q1 $ % FY '11 FY '10 change change Actual Actual ($mm, except per share data) Record Q1 Revenue Q1 FY11 revenue grew 5.3% to $214.1m Health Services 130.0 $ 130.6 $ (0.6) $ (0.5%) Human Services 84.1 72.7 11.4 15.7% Total 214.1 $ 203.3 $ 10.8 $ 5.3% Operating Income (Loss) Health Services 18 8 $ 17 5 $ 1 3 $ 7 5% Revenue was in‐line with mgmt expectations and reflects seasonal trends Q1 ti i f 12 7% 18.8 17.5 1.3 7.5% Human Services 8.5 7.4 1.1 15.2% Other ‐ (0.1) 0.1 nm Legal expense ‐ (0.7) 0.7 nm Total 27.3 24.1 3.2 13.3% Operating margin % (excl legal) 12.7% 12.2% operating margin of 12.7% reflect stronger‐than‐expected margins in Health Services GAAP & Adjusted Diluted EPS Interest and other income, net 0.5 0.1 0.4 400% Income before taxes ‐ continuing ops 27.8 24.2 3.6 14.9% Provision for income taxes 10.2 9.6 0.6 6.3% Income from continuing operations 17.6 $ 14.6 3.0 $ 20.5% Income from continuing operations increased 20.5% to $17.6m Adjusted diluted EPS from Fully diluted EPS ‐ continuing ops 0.99 $ 0.81 $ 0.18 $ 22.2% Pro forma adjustments* ‐ $ 0.06 $ (0.06) $ nm Adjusted EPS ‐ continuing operations 0.99 $ 0.87 $ 0.12 $ 13.8% j continuing operations increased 13.8% to $0.99 2 February 3, 2011 * Pro forma adjustments: Normalized to exclude $0.02 of legal expense and $0.04 related to 2010 year tax adjustments 2

Health Services Segment 3 FY '11 FY '10 % change Revenue $ $ ( %) Health Services 130.0 130.6 0.5%) Operating Income Health Services 18.8 $ 17.5 $ 7.5% Operating Margin % (excl legal) 14.5% 13.4% $ in millions Q1 First quarter Health Services Segment revenue was consistent with the prior year Expect accelerated top-line for the remainder of FY11 with the launch of several new programs Operating income grew 7.5% to $18.8 million Operating margin increased 110 basis points to 14.5% compared to the prior year Operating margin expansion driven by the favorable timing of contracts and transaction-based program revenue, which will continue to cause margin fluctuations between quarters February 3, 2011 4

Human Services Segment 4 Q1 Q1 FY '11 FY '10 % change Revenue Human Services 84.1 $ 72.7 $ 15.7% Operating Income Human Services 8.5 $ 7.4 $ 15.2% Operating Margin % (excl legal) 10.1% 10.2% $ in millions Human Services Segment drove top-line growth in the quarter; revenue grew 15.7% to $84.1 million (11.5 % on a constant currency basis), driven by international employment services programs Operating income grew 15.2% to $8.5 million Operating margin of 10.1%, consistent with the prior year period and somewhat dampened by cost growth on a fixed price contract Segment experiences seasonality in the first quarter related to the tax credit business February 3, 2011

Cash Flow and Balance Sheet 5 Another strong quarter of healthy cash flows driven by the combination of solid net income and better-than-expected collections DSOs were 57 days and outperformed our expectations Q1 FY11 cash provided by operating activities from continuing operations totaled $30.4 million, with free cash flow from continuing operations of $25.7 million In Q1 FY11, used cash of $8.4 million for the purchase of 136,153 shares of MMS stock with $118.6 million remaining under the repurchase program at December 31, 2010 In January, we announced a 25% increase to our quarterly cash dividend, increasing it to $0.15 per share, payable at the end of February Healthy cash and cash equivalents totaling $177.0 million at December 31, 2010 *The Company defines free cash flow as cash provided by operating activities, less property, plant and equipment and capitalized software Our balance sheet remains pristine and offers us considerable competitive advantages as governments continue to depend on reliable partners with strong financial flexibility. February 3, 2011

Reiterating FY11 Guidance FY 11E Revenue $890‐$920 million Adjusted $3 95 $4 15 Diluted EPS 3.95‐$4.15 Operating Margin 12%‐13% Cash from Continuing Ops $75‐$95 million Free Cont $52‐$ Cash Flow from Cont. Ops 52 $72 million Reiterating our FY11 revenue and earnings guidance Consistent with historical trends, we expect revenue growth to accelerate in the second half of fiscal 2011 Cash flow guidance remains unchanged 6 February 3, 2011

February 3, 2011 7 Current Assumptions for the United Kingdom Contract Current forecast only includes the runoff from our current book of business under the Flexible New Deal Does not assume any potential new work associated with the UK’s new Work Programme Due to the competitive bid process, unable to provide additional details at this time A number of variables will determine how any potential new work impacts current forecasts: What regions, if any, we are awarded What the final terms and conditions might be for contractors and subcontractors How these terms and conditions may impact accounting treatment How the government will transition vendor contracts from FND to the Work Programme We expect a decision in the UK in mid-April and expect final contracts to be signed in the first half of May.

Richard A. Montoni President and Chief Executive Officer 8 First Quarter – Fiscal Year 2011 February 3, 2011 Helping Government Serve the People

A very solid performance for the first quarter, which positions us well for the balance of FY11 Several significant accomplishments, including the signing of two major contract renewals and important progress on a large international opportunity Further distinguished MAXIMUS as the go-to partner for governments as they seek to reduce costs, improve the quality of services, and increase accountability February 3, 2011 9 A Solid Start to Fiscal Year 2011

Despite legal challenges to the Affordable Care Act (ACA), we continue to see positive developments in the overall domestic health environment Most press reports focused primarily on the legal decisions, but several news pieces highlighted the practical realities of how implementation efforts continue to progress We continue to see active planning by states in preparation for the forthcoming establishment phase Various polls show bipartisan and public support for many of the individual components of the law, such as the ban on denying coverage to individuals with pre-existing conditions February 3, 2011 10 Domestic Health Developments “Most states are moving ahead on planning for Medicaid expansion, state-based exchanges, new medical payout standards and other provisions.” - Congressional Quarterly article, “After Ruling in Health Care Law Case, Questions About Implementation” “Observers on both sides of the aisle expect implementation to move forward largely despite Monday’s ruling.” Politico article, “States Still Implementing Reform”

Health Services Business Development 11 Demonstrated success with helping CA and NY establish their state high risk pools, part of the first wave of requirements under HCR Launched a market-leading modernization effort for public health insurance programs in CO and in the start-up phase for a similar effort in NY; both models expected to serve as a blueprint for the health insurance exchanges More than half of all states proactively evaluating modernization programs as a way to reduce costs, improve the quality of service delivery, and simplify enrollment Like Colorado, even in a tough fiscal environment, 27 states plan to expand or simplify their eligibility process in 2011 and 2012 (including OH, PA, GA, NH and UT) MAXIMUS has a firm understanding of how states are approaching the planning and establishment phases required under Health Care Reform. February 3, 2011

New Opportunities with Medicaid Managed Care 12 Texas is moving nearly three million children from fee-for-service dental plans into managed care and MAXIMUS will serve as the enrollment broker for that transition As Medicaid programs become larger, more complex and costly, states look to new models; states taking steps towards managed care represents new opportunities for MAXIMUS CMS estimates that nearly a third of Medicaid beneficiaries still enrolled in traditional programs; more than 80% of all Medicaid spending remains in the fee-for service category According to Medicaid Health Plans of America (MHPA), moving beneficiaries into managed care reduces cost over the long-run and establishes the infrastructure needed for the expected Medicaid expansion in 2014 States that have relied on traditional fee-for-service models and handled the administration of their Medicaid programs in-house, are now looking to proven partners in the private sector to help make their programs run more efficiently Kentucky just one of 20 states implementing or expanding managed care in the near term (other states include SC, MS, IL, MN, TX, FL, ME, AR and CA) February 3, 2011 Market demand remains robust with real meaningful growth opportunities. The need to address rising costs does not go away and the need for our services continues to grow.

United Kingdom Update 13 Made further progress in our efforts to bid work under the UK’s new Work Programme MAXIMUS named as a preferred supplier for seven of the 11 regions, the maximum number allowed under the buying framework Current FND contract in the UK is expected to end on June 30th as the government transitions over to the new Work Programme UK team is hard at work on our bids, which we expect to submit later this month UK government expects to make the awards in mid-April and final contracts to be signed in the first half of May. We look forward to providing an update once awards have been made There are many variables to the new Work Programme, but we remain optimistic on our prospects in the United Kingdom. February 3, 2011

14 International Environment FY10 was a year of extraordinary international growth with major contract expansion and wins in both Australia and the UK While not expecting the same rate of revenue growth year-over-year in FY11, we remain bullish on our international prospects Pursuing the Work Programme opportunity in the UK and evaluating opportunities in other countries with encouraging market conditions February 3, 2011

New Awards and Sales Pipeline 15 February 3, 2011 New Sales Jan 28 2011 New Sales Jan. 28, YTD Signed Awards $753m New contracts pending $177m Signed two significant contracts: • 5‐year CA Healthy Families extension • 3‐year TX Eligibility Support Services Sales Opportunities Total Pipeline $1,616m Expect routine fluctuations among the pipeline and new sales categories, shifts driven by the stages of the procurement process and the timing of when contracts are awarded and signed. 15

Conclusion 16 Worked hard to best position the Company in the health and human services BPO markets Timely and well-placed efforts to help states address HCR requirements bearing fruit Short-term, seeing states implement program improvements like eligibility modernization and shift towards Medicaid managed care Long-term, preparing for the larger opportunities with the full roll out in 2014 Demonstrated success in the U.S. and Australian welfare-to-work markets led to many new promising opportunities Commitment to deliver exceptional service and improve quality in a cost effective manner sets us apart from the competition Optimistic about short-term and long-term growth prospects Strong start in FY11 with two important contract renewals signed and encouraging progress on the large UK opportunity with our inclusion in the bidding process. February 3, 2011