Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - STERLING FINANCIAL CORP /WA/ | d8k.htm |

Sandler O’Neill + Partners

New York City

February 8, 2011

Ticker: STSA

Spokane, Washington

www.sterlingfinancialcorporation-spokane.com

*

*

*

*

*

*

Exhibit 99.1 |

Safe Harbor

(1) The Reform Act defines the term "forward-looking statements"

to include: statements of management plans and objectives, statements regarding the future economic performance, and projections of revenues and

other financial data, among others. The Reform Act precludes liability for

oral or written forward-looking statements if the statement is identified as such and accompanied by "meaningful cautionary statements

identifying important factors that could cause actual results to

differ materially from those made in the forward-looking

statements." In

the

course

of

our

presentation,

we

may

discuss

matters

that

are

deemed

to

be

forward-

looking

statements,

which

are

intended

to

be

covered

by

the

safe

harbor

for

“forward-looking

statements”

provided

by

the

Private

Securities

Litigation

Reform

Act

of

1995

(the

“Reform

Act”)

(1)

.

Forward-looking

statements,

including

those

relating

to

our

position

and

strategy

as

a

result

of

our

recapitalization

transactions

discussed

herein,

involve

substantial

risks

and

uncertainties,

many

of

which

are

difficult

to

predict

and

are

generally

beyond

our

control

and

actual

results

may

differ

from

management’s

view

and

our

projected

financial

results.

For

example,

our

strategy

of

acquiring

troubled

institutions

in

FDIC-assisted

transactions

is

subject

to

the

risk

that

we

remain

not

qualified

to

bid

or

are

otherwise

prohibited

by

regulators

from

bidding.

We

assume

no

obligation

to

update

any

forward-looking

statements

(including

any

projections)

to

reflect

any

changes

or

events

occurring

after

the

date

hereof.

Additional

information

about

risks

of

Sterling

achieving

results

suggested

by

any

forward-

looking

statements

may

be

found

in

Sterling’s

10-K,

10-Q

and

other

SEC

filings,

including

under

the

headings

“Risk

Factors”

and

“Management’s

Discussion

and

Analysis

of

Financial

Condition

and

Results

of

Operations.”

This

presentation

contains

certain

Non-GAAP

financial

measures.

Reconciliations

to

the

comparable

GAAP

measures

are

set

forth

on

page

20.

2 |

Based in Spokane, Wash.,

STSA is one of the largest

commercial banks, by assets,

headquartered in the Pacific

Northwest

(1)

$6.9 billion of deposits with an

average cost of 1.13%

More than 25,000 commercial

accounts and nearly 200,000

retail accounts

J.D. Power and Associates

award winner

for customer

service

(2)

178 branches in 5 states

Source: SNL Financial, Company filings

Note: Financial data as of Dec. 31, 2010.

(1)

Pacific Northwest defined as Idaho, Oregon, and Washington.

(2)

J.D. Power and Associates 2010 Retail Banking Satisfaction Study.

(3)

Deposit market share data as of 6/30/2010.

MONTANA

IDAHO

OREGON

WASHINGTON

San Jose

San

Francisco

Stockton

Sacramento

Santa

Rosa

Eugene

Salem

Portland

Seattle

Spokane

Walla

Great Falls

Helena

Billings

Boise

Major cities

Sterling branches

Key Statistics as of 12/31/2010

(billions)

Total assets:

$9.5

Total deposits

6.9

Net Loans

5.4

Deposit Market Share

(3)

State

Branches

Rank

Market Share

Washington

72

7

3.20%

Oregon

67

7

3.58%

California

13

46

0.14%

Idaho

18

11

2.57%

Montana

8

14

1.21%

Sterling Franchise at a Glance

3 |

2010

Achievements Successful $730 million capital infusion (August

2010) Anchors Warburg Pincus and Thomas H. Lee Partners, plus

additional PIPE investors U.S. Treasury preferred stock ($303

million) converted to common Fortified management and board leadership

driving future success Les Biller, chairman; anchor investors hold

board seats Recent appointments (Howard Behar, Webb Edwards and Pat

Rusnak) pending regulatory approval

Cease and desist order lifted by regulators (September 2010);

replaced with an MOU

Merger of Golf Savings Bank into Sterling Savings Bank

Further reductions in high-risk assets and NPLs

Core earnings power (current EPS generation masked by NPL drag)

4 |

Highlights

Reported Q4 net loss

(1)

of $38 million, or $10 million lower than Q3

Experienced a declining provision for credit losses of $30 million,

compared to $61 million in Q3 and $340 million in Q4 2009

NPLs of $655 million were down from $809 million in Q3,

a decline of 19%

Reduced construction loan exposure

Down $990 million, or 65%, since Dec. 31, 2009

Quality deposit metrics continue to drive down cost of funds

Deposit costs decreased 14bps in Q4 and 63bps during 2010

Stabilizing mix: Reduced brokered deposits; improved funding costs

Adjusted pre-tax, pre-provision earnings of $43 million

(1)

Excludes a one-time, non-cash charge for the conversion of preferred stock

to common stock. The Q4 net loss attributable to common shareholders was $642.7 million or

$12.79 per common diluted share.

5 |

2010 Financial /

Operating Highlights 6 |

Sterling’s

Formula for Success 7

Cost-

effective

Funding

Improved

Asset

Quality

High Quality,

Relationship

Based Asset

Generation

Expense

Control

Profitable

Growth

Focus on Customers

Deliver value to customers through fair pricing and competitive products

and services

Intelligent market segmentation

Increased emphasis on sales and business development

Simplify the Business -

Back to Basics banking drives growth

Strategic Expansion

Expand in key markets and segments

Opportunistic hiring –

e.g. commercial bankers and home loan officers

Manage to potential regulatory changes |

Deposit

Composition 8 |

Loan Portfolio

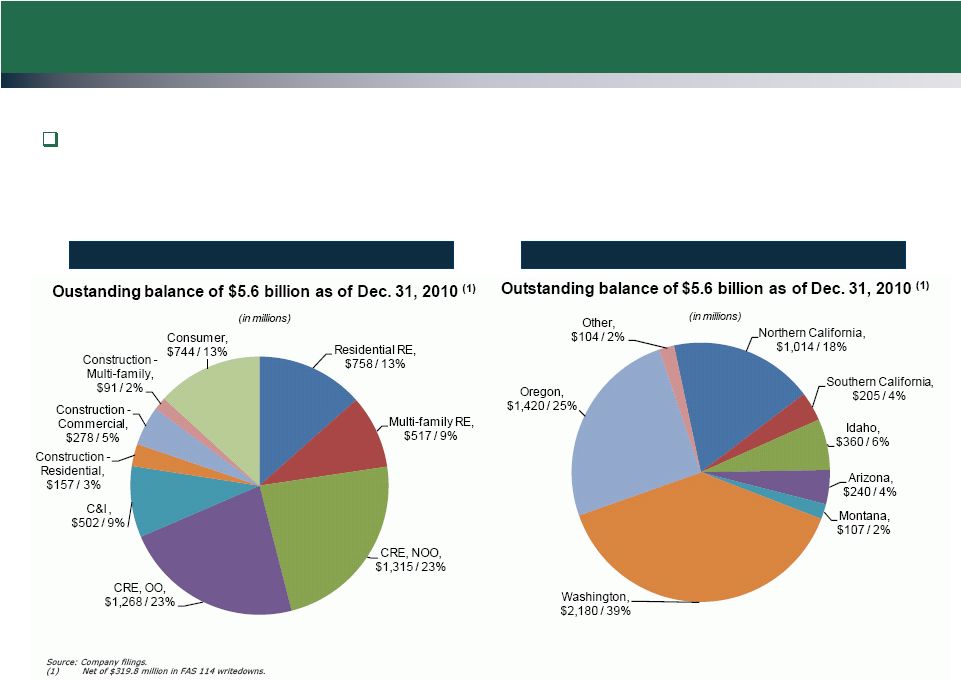

Summary Reducing Construction and Focusing on Relationship-Based Lending

Gross

loans

decreased

by

$288

million

during

Q4

2010

and

by

$2.1

billion

since Q4 2009 –

reductions of 5% and 27%, respectively

Loan mix by geography

Loan mix by category

9 |

Commercial,

$167 / 50%

Multi-family,

$62 / 19%

Residential -

vertical

$48 / 14%

Lots,

$23 / 7%

Raw land

$18 / 5%

A&D

$18 / 5%

Outstanding balance of $336 million as of Dec. 31, 2010

(in millions)

Construction Loan Exposure Decreasing

Construction loans of $526 million (9% of total

loans) as of 12/31/2010

Construction non-performing loans of $336

million (51% of total NPLs) as of 12/31/2010

Aggressively shrinking construction portfolio

Currently 9% of total loans vs. 32% in 4Q 2007

Construction balances have decreased $2.4 billion,

or 82% vs. 4Q 2007

Residential construction concentration reduced to

3% at Q4 2010 from 9% at Q4 2009

Non-performing construction loans

Total construction loans

10

Commercial,

$278 / 53%

Multi-family,

$91 / 17%

Residential -

vertical,

$72 / 14%

Lots,

$40 / 8%

Raw land,

$23 / 4%

A&D,

$22 / 4%

Outstanding balance of $526 million as of Dec. 31, 2010

(in millions)

$158.3

$533.7

$551.9

$639.6

$618.5

$540.4

$458.6

$335.7

$-

$100.0

$200.0

$300.0

$400.0

$500.0

$600.0

$700.0

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

Non-performing construction loans

(in millions) |

Improving Trend

in Classified and Non-Performing Assets 11

|

Non-performing

Loan (NPL) Flow Analysis 12

Year-to-date

(in millions)

3/31/2010

6/30/2010

9/30/2010

12/31/2010

12/31/2010

NPLs beginning-of-period

$895.9

$958.8

$884.2

$809.0

$895.9

Additions/increases

327.3

263.5

171.6

62.5

824.9

Return to accruing status

(28.7)

(45.2)

(16.6)

(11.1)

(101.6)

Charge-offs

(136.5)

(101.8)

(77.1)

(31.4)

(346.8)

Transfer to OREO

(51.0)

(83.1)

(74.3)

(58.6)

(267.0)

Payments/sales

(48.2)

(108.0)

(78.8)

(115.8)

(350.8)

NPLs end of period

$958.8

$884.2

$809.0

$654.6

$654.6

% decline since beginning of year

27%

For the quarter ended |

Summary

Executing on our strategic plan

Strong regional franchise with critical mass

Valuable, core-deposit franchise drives earnings power

Continued improvement in asset quality metrics

High-quality, relationship-driven asset generation

Ongoing expense management

Capitalization

Exceeds regulatory levels required for

“well-capitalized” status

Additional capital in place for opportunistic growth

Strengthened corporate governance

Earnings power continues to progress

Strong core earnings power masked by current NPL drag

Focused on increasing pre-tax, pre-provision earnings

Expected upon realization of Deferred Tax Asset of $359 million

13 |

Appendix

14

*

*

*

*

*

*

* |

Capital Compared

to Peers 15

Source: SNL Financial and company filings. Sterling financial data as of Dec.

31, 2010. Peer group data as of most recent quarter available. (1)

Peers include all U.S. depository institutions with $7 billion -

$25 billion in assets.

12/31/2010

Peer median

(1)

TCE/TA

8.0%

7.5%

Tier 1 leverage:

10.1%

8.9%

Tier 1 risk-based capital

16.2%

13.3%

Total risk-based capital

17.5%

15.3%

NPA/Tier 1 Capital + ALLL

67.2%

n/a |

MBS, $2,089,

74%

Muni bonds, $199,

7%

Corp, $21, 1%

Tax credit, $13,

0%

Other, $1, 0%

Non-agency, $48,

2%

Ginnie Mae,

$234, 8%

Freddie Mac,

$58, 2%

Fannie Mae,

$171, 6%

$2.8 billion total portfolio

(in millions)

High Quality, Low Risk Investment Portfolio

Strategy remains to reduce exposure to 30-yr MBS

and replace with 10-

and 15-year MBS with good

cash flows to fund loan growth

74% FNMA, FHLMC and GNMA pass-throughs

Rise in average life and duration in Q4 attributable

to higher market interest rates and reduction in

balances of short CMO balances

Source: Company filings.

(1)

Durations and average life measures are base case, under current

market rates.

(2)

Yields are quarter-ending yields.

Investment Portfolio

Weighted Avg. Life and Effective Duration

3.21%

overall

portfolio

yield

(2)

MBS Composition

16

4.36

4.12

3.46

4.96

3.52

3.41

2.64

3.64

0

1

2

3

4

5

6

3/31/2010

6/30/2010

9/30/2010

12/31/2010

WA Life-Base case

Eff Dur -

Base case

Yield

(2)

4.58%

4.18% 3.58%

3.12%

$1.60B

$1.49B

$2.28B

$2.60B |

Source: Company filings.

Loan Portfolio –

Construction Summary

Construction (residential, commercial and multi-family) totals $526

million as of 12/31/2010

Decreased by $194 million during Q4 2010, a 27% decline

Concentration reduced to 9% of gross loan portfolio as of 12/31/2010, down

from 20% as of 12/31/2009

Non-performing construction assets represent 53% of all

non-performing assets as of 12/31/2010

Over 90% of commercial construction portfolio re-appraised over the last

12 months 17 |

Loan Portfolio

– CRE Non-Owner Occupied

Includes Multi-family

Non-owner-occupied commercial real estate, including

multi-family portfolio totals $1.8 billion as of 12/31/2010

Decreased by $89 million, or 5% year over year

Concentration is 33% of gross loans as of 12/31/2010, up from 25% at

12/31/2009

8% of non-owner occupied CRE loans were non-performing as of

12/31/2010 Source: Company filings.

18 |

Loan Portfolio

– CRE Owner-Occupied

Includes SBA

Owner-occupied commercial real estate totals $1.27 billion as of

12/31/2010 Decreased by $212 million year over year, a 14%

decline Concentration was 23% of gross loans at 12/31/2010

6% of owner-occupied CRE loans were non-performing at

12/31/2010 SBA loans are $112 million, or 9% of total

owner-occupied CRE loans at 12/31/2010 19 |

Adjusted

Pre-Tax, Pre-Provision Income 20

(1)

Management believes that this presentation of non-GAAP results provides

useful information to investors regarding the effects of the credit cycle on the Company’s reported results of

operations.

(in thousands, unaudited)

Year-to-Date

Mar 31,

June 30,

Sept 30,

Dec 31,

Dec 31,

2010

2010

2010

2010

2010

Loss before income taxes

(84,346)

$

(53,773)

$

(48,022)

$

(38,141)

$

(224,282)

$

Provision for credit losses

88,556

70,781

60,892

30,000

250,229

OREO

10,923

17,206

10,456

23,993

62,578

Interest reversal on non-performing loans

23,721

20,711

17,302

15,527

77,261

Charge on prepayment of debt

0

0

0

11,296

11,296

Total

(1)

38,854

$

54,925

$

40,628

$

42,675

$

177,082

$

Three Months Ended |

Sandler O’Neill + Partners

New York City

February 8, 2010

Ticker: STSA

Spokane, Washington

www.sterlingfinancialcorporation-spokane.com

Investor Contacts

Daniel G. Byrne

David Brukardt

EVP/Corporate Development

EVP/Investor and Corporate Relations

(509) 458-3711

(509) 863-5423

Media Contact

Cara Coon

VP/Communications and Public Affairs Director

(509) 626-5348 |