Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - REX ENERGY CORP | d8k.htm |

January,

2011 January, 2011

Corporate Presentation

Corporate Presentation

Exhibit 99.1 |

Forward Looking Statements &

Forward Looking Statements &

Hydrocarbon Volume Estimates

Hydrocarbon Volume Estimates

2

Forward Looking Statements

Except for historical information, statements made in this document, including those relating

to significant potential, future earnings, cash flow, capital expenditures, production

growth and planned number of wells, are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of

the Securities Exchange Act of 1934. These statements are based on assumptions and estimates

that management believes are reasonable based on currently available information;

however, management's assumptions and the company's future performance are subject to a wide range of business risks and uncertainties, and there is no

assurance that these goals and projections can or will be met. Any number of factors could

cause actual results to differ materially from those in the forward-looking

statements, including, but not limited to, uncertainties regarding the economic conditions in

the United States and globally; domestic and global demand for oil and natural gas;

volatility in the prices the company receives for its oil and natural gas; the effects of government regulation, permitting and other legal requirements; the

quality of the company’s properties with regard to, among other things, the existence of

reserves in economic quantities; uncertainties about the estimates of the

company’s oil and natural gas reserves; the company’s ability to increase its

production and oil and natural gas income through exploration and development; the

company’s ability to successfully apply horizontal drilling techniques and tertiary

recovery methods; the number of well locations to be drilled, the cost to drill and the

time frame within which they will be drilled; drilling and operating risks; the availability

of equipment, such as drilling rigs and transportation pipelines; changes in the

company’s drilling plans and related budgets; the adequacy of the company’s capital

resources and liquidity including, but not limited to, access to additional

borrowing capacity; uncertainties associated with the company’s legal proceedings and

their outcome; and other factors discussed under “Risk Factors” in Item 1A of Rex

Energy’s Annual Report on Form 10-K for the year ended December 31, 2009 filed with

the U.S. Securities and Exchange Commission. The company undertakes no obligation to

publicly update or revise any forward-looking statements. Further information on risks and uncertainties is available in the company's filings with the

Securities and Exchange Commission, which are incorporated by reference. The company's

internal estimates of reserves may be subject to revision and may be different from

estimates by the company's external reservoir engineers at year end. Although the company believes the expectations and forecasts reflected in these and other

forward-looking statements are reasonable, it can give no assurance they will prove to

have been correct. They can be affected by inaccurate assumptions or by known or unknown

risks and uncertainties. Hydrocarbon Volume Estimates

This presentation includes management’s estimates of Marcellus Shale potential

recoverable resources, per well EUR (estimated ultimate recovery of resources) and

upside potential of recoverable resources. Except as noted, these have been estimated

internally by the Company without review by independent engineers and do not

necessarily constitute reserves. These estimates are included to demonstrate the

potential for future drilling by the Company. Actual recovery of these potential

volumes is inherently more speculative than recovery of estimated proved reserves.

Estimates of potential recoverable resources, per well EURs and upside potential for

Company oil and gas shale acreage are particularly speculative due to the limited experience

in Marcellus Shale horizontal development, with its limited production history.

Ultimate recoveries will be dependent upon numerous factors including actual encountered geological conditions, the impact of future oil and gas pricing and

exploration costs, and our future drilling decisions and budgets based upon our future

evaluation of risk, returns and the availability of capital and, in many areas, the

outcome of negotiation of drilling arrangements with holders of adjacent or fractional

interest leases. In addition, potential recoverable resources are based on

undesignated future well locations under assumed acreage spacing which may not have been

specifically included in any definitive development plan and ultimately may not be

drilled. Accordingly, such estimates may differ significantly from the hydrocarbon quantities that are ultimately recovered.

SEC rules prohibit a publicly-reporting oil and gas company from including oil and gas

resource estimates in their filings with the SEC, except proved, probable and possible

reserves that meet the SEC’s definitions of such terms. Illinois Basin estimates (including Lawrence Field) of oil in place and other resource volumes, oil in place

and other reserve volumes indicated herein are not based on SEC definitions and

guidelines. Unless otherwise indicated, estimates of non-proved reserves and other

hydrocarbons included herein may not meet specific definitions of reserves or resource

categories within the meaning of the SPE/SPEE/WPC Petroleum Resource Management System.

|

Rex

Energy Overview Rex Energy Overview

3

•

Significant upside in two high growth shale

plays and tertiary oil recovery

o

1.2 –

1.7 Tcfe

in non-proven Marcellus Shale

resource

potential

(1)

o

16 –

27 Mmboe

in non-proven Niobrara Shale

resource

potential

(1)

o

22 –

50 Mmbls

in non-proven Tertiary Recovery

oil resource

potential

(1)

•

Liquids Rich Production & Proven Reserves

o

3,391 BOE

per

day

(20.3

Mmcfe/d)

(2)

–

59% oil and NGLs

o

29.5 Mmbls

proven reserves (177 Bcfe)

(3)

–

48% oil and NGLs

•

Strong

Balance

Sheet

&

Liquidity

(4)

o

Estimated $10.0 million cash

o

$40.9

million

in

Marcellus

drilling

carries

(5)

o

$10 million in debt

o

$125 million line of credit

1. Assumptions based on full development program. Actual results may vary significantly. Not

proved. See “Hydrocarbon Volume Estimates” on page 2. 2. As of Third Quarter

2010. 3. As of June 30, 2010. Mid-year 2010 reserves are internally calculated,

adjusted for the Sumitomo JV, and have not been audited by an independent, third

party. Actual reserves may vary.

4. Estimated as of 12/31/2010

5. Actual as of 11/30/2010 |

Areas of Operation

Areas of Operation

4

•

Appalachian Region

o

55,000 Net Acres in Marcellus Shale

Fairway

(1)

–

64% of acreage in liquids rich portion

of the play

–

Total un-risked resource potential of

1.2 –

1.7 Tcfe

(2)

–

$40.9

million

in

drilling

carries

(3)

•

Rockies Region

o

40,000 Net Acres in Niobrara Shale

Fairway

–

100% of acres in oil window of the

Niobrara fairway in the DJ Basin

–

Total un-risked resource potential of

16 –

27 MMBoe

(2)

•

Illinois Region

o

Tertiary Recovery Oil Projects

–

Total un-risked resource potential of

22

–

50

MMBbls

from

ASP

flooding

in

the Lawrence Field

(2)

1. Excludes approx. 22,000 net acres assigned to Williams and approx. 13,000 net acres

assigned to Sumitomo. 2. Assumptions based on full development program. Actual results

may vary significantly. Not proved. See “Hydrocarbon Volume Estimates” on page 2.

3. Drilling carry as of 11/30/2010 |

Reserve Growth Summary

Reserve Growth Summary

Proved Reserve & PV-10 Growth

5

•

Mid-Year 2010

(1)

o

29.5 Mmboe

(177.0 Bcfe)

o

$357.2 million PV-10

–

50% Proved Developed

–

48% Oil & NGLs

•

Year-End 2009

(2)

o

20.9 Mmboe

(125.2 Bcfe)

o

$190.5 million PV-10

–

54% Proved Developed

–

55% Oil & NGLs

•

Year-End 2008

(3)

o

11.0 Mmboe

(66.0 Bcfe)

o

$84.0 million PV-10

–

65% Proved Developed

–

55% Oil

1. Mid-year 2010 reserves are internally calculated, adjusted for the Sumitomo JV, and

have not been audited by an independent, third party. Actual reserves may vary. Mid-

year 2010 reserves calculated using $ 72.25 per Bbl and $4.10 per Mcf.

2. Year-end 2009 reserves calculated using $57.65 per Bbl and $3.87 per

Mcf. 3.

Year-end 2008 reserves calculated using $41.00 per Bbl and $5.71 per

Mcf. |

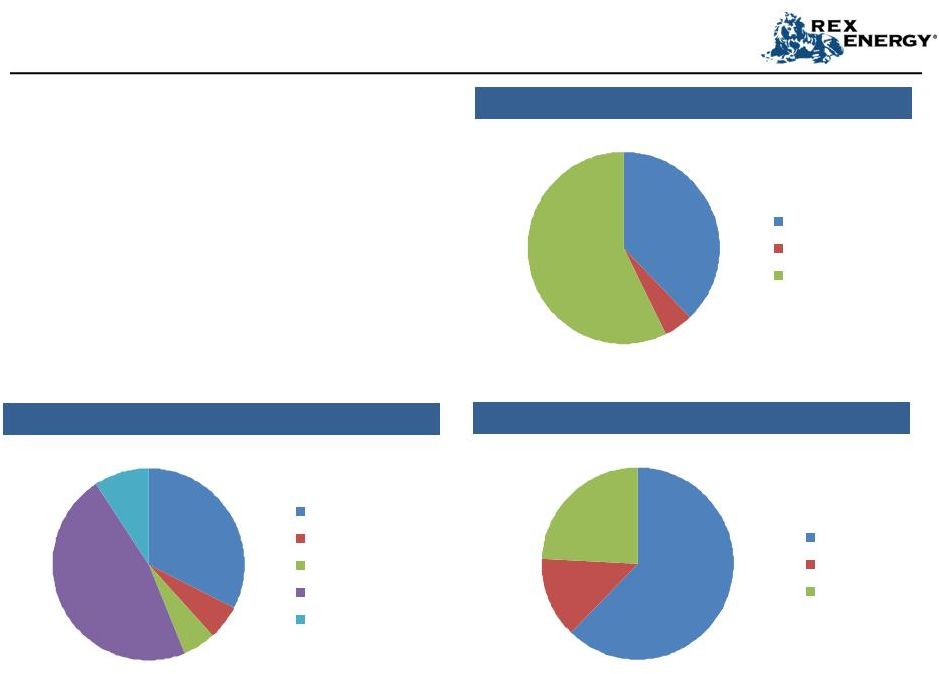

2010 Capital Budget

2010 Capital Budget

6

•

$130.7 million net capital budget

o

95% allocated to oil or liquids rich gas

o

95% allocated to operated properties

o

Capital budget is net of drilling carries

•

Budget funded with cash from

o

1

st

quarter 2010 offering

o

Cash from Sumitomo joint venture

o

Cash flow

32%

6%

6%

47%

9%

Drilling

Tertiary

Facilities & Equip

Land

Midstream

38%

5%

57%

Oil

Dry Gas

Liquids Rich Gas

14%

24%

62%

Appalachia

Illinois

Rockies

Capital Allocation by Activity Type

Capital Allocation by Region

Capital Allocation by Commodity |

2010

2010

Projected

Projected

Production

Production

Profile

Profile

•

2010 Significant Assumptions:

o

3-rig Marcellus horizontal rig program

drilling 26 gross (15 net) wells

o

Butler cryogenic plant commissioned in

4 quarter 2010

o

3 horizontal Niobrara oil wells drilled

in Rockies Region

+44%

7

Projected Daily Exit Production

Daily Average Production

+24%

+43%

Projected Annual Daily Average Production

(1)

Projected Exit Rate Daily Production

(1)

1. Internally estimated projected production. Actual results may vary.

2. Average daily production for month of December 2009. th

|

Current Hedging Summary

Current Hedging Summary

Crude Oil & NGLs

% of Current

with Floor

% of Current

with Ceiling

Avg. Floor

Price

Avg. Ceiling

Price

2011

75%

75%

$ 68.54

$ 104.69

2012

47%

47%

$ 68.00

$ 112.90

2013

N/A

N/A

N/A

N/A

8

Natural Gas

% of Current

with Floor

% of Current

with Ceiling

Avg. Floor

Price

Avg. Ceiling

Price

2011

(2)

108%

63%

$ 5.75

$ 6.51

2012

67%

67%

$ 5.41

$ 5.62

2013

N/A

N/A

N/A

N/A

Current Production Hedged

1. Based on September 2010 average daily production of 21.9 MMcfe/d. Actual results may vary.

2. ~22% of current natural gas production covered in 2011 by put spread with a $3.68

short put price for a $1.32 put spread. |

Marcellus Overview

Marcellus Overview

•

~98,000 gross (55,000 net) acres, all in Pennsylvania

o

64% of net acreage operated by Rex Energy in liquids rich

portion of the play

o

34% of net acreage operated by Williams in dry gas

portion of the shale play

•

3 gross (1.5 net) rigs currently drilling in the play

o

13 gross wells drilled and completed in 2010 (8 operated /

5 non-operated)

o

13 gross wells awaiting completion (7 operated/ 6 non-

operated)

•

Joint Ventures

o

Butler County, PA

–

70% Rex /30% Sumitomo joint venture in Butler County

–

$21.9 million in Sumitomo drilling carries remaining

o

Westmoreland, Clearfield and Centre, PA

–

50% Williams/ 40% Rex/10% Sumitomo joint venture in

Westmoreland, Clearfield and Centre counties

–

JV includes interest in gathering and transportation

–

$19.0 million in Sumitomo drilling carries remaining

o

Butler Midstream

–

60% Stonehenge/28% Rex/ 12% Sumitomo joint venture

–

Operation of

40

Mmcf/d

cryogenic

plant

–

Pipeline infrastructure

Magill 1H

Peak Rate:

3.4 Mmcfe/d

Panizzi

4H

Peak Rate:

4.6 Mmcf/d

Alder Run 1H

Peak Rate:

4.6 Mmcf/d

Marcellus “Fairway”

in Pennsylvania

Resource Potential

Low Case

High Case

Net Acres

~55k

(1)

Assumed % Drilled

75%

Well Spacing

80 acres

Net Potential Wells

515

EUR (Bcfe)

(1)

3.0

4.0

Royalties

15%

Upside Potential (Tcfe)

(2)

1.2

1.7

9

Shannon 1H:

2.2 Mmcfe/d

@

5% load recovery

1. Assumptions based on full development program. Individual well results may vary

significantly. Not proved. See “Hydrocarbon Volume Estimates” on page 2. 2.

Excludes approximately 100 Bcfe of Marcellus Shale proved reserves as of June 30, 2010. |

Marcellus Operated Overview

Marcellus Operated Overview

Butler County, PA

o

Contiguous acreage position 40,000 gross (34,000 net)

acres

–

Allows for minimal rig movement

–

Decreases in drilling time

–

Maximizes unitized acreage

–

Access to infrastructure and pipelines

o

2010 Operational Highlights

–

Currently have 5 gross (3.5 net) wells placed in service

–

Drilled 15 (10.5 net) wells

•

8 gross (6 net) wells fractured and completed

•

7 gross (5 net) wells awaiting fracture & completion

•

Rig in transit to the 3 well Talarico

pad

–

Sarsen

Cryogenic plant operational

•

Current capacity at 24.0 Mmcf/d

•

By the end of January, 2011 expected capacity will be at

32.0 Mmcf/d

•

Expect to be at 40.0 Mmcf/d

by April 30

–

Phase

I

Leasing

–

Sumitomo

Joint

Venture

•

Estimate having 6,500 of the 9,000 acres leased by

12/31

o

2011 Operational Assumptions

–

Drilling the full year with one rig, and second rig by

mid year

–

Construction

of

the

second

40.0

Mmcf/d

cryogenic

plant, proposed commissioning 1 quarter of 2012

–

Primary leasing strategy will fill in future drilling units,

and other contiguous acreage blocks within the core

operational area

Marcellus Operated Area in Pennsylvania

10

th

st |

Marcellus Non Operated Overview

Marcellus Non Operated Overview

Westmoreland, Clearfield and Centre

Counties, PA

oSizeable acreage position with 48,800 gross

(14,860 net) acres o2010

Operational Highlights –

Currently have 12 gross (4.8 net) wells placed in service

(curtailed at 15.0 Mmcf/d)

–

Drilled 11 gross (4.4 net) wells

•

5 gross (2.0 net) wells fractured and completed

•

6 gross (2.4 net) wells awaiting fracture &

completion

–

Two

rigs

currently

drilling

the

Androstic

3

well

pad

and

the

second

Uschack

4

well

pad

–

Transportation & Gathering

•

Westmoreland

o

14.0 Mmcf/d

current capacity through

Dominion at the Ecker

tap

o

Additional 24.0 Mmcf/d

capacity to the

Equitrans

expected May 1

•

Clearfield

o

Firm 10.0 Mmcf/d

transportation with Columbia

Gas in Clearfield. An additional 30.0 Mmcf/day

through Columbia is also available

o2011 Operational Assumptions

–

Two rig program for the full year

–

Primary leasing strategy will fill in future drilling units,

and other contiguous acreage blocks within the core

operational area

Marcellus Non Operated Area in Pennsylvania

11

st |

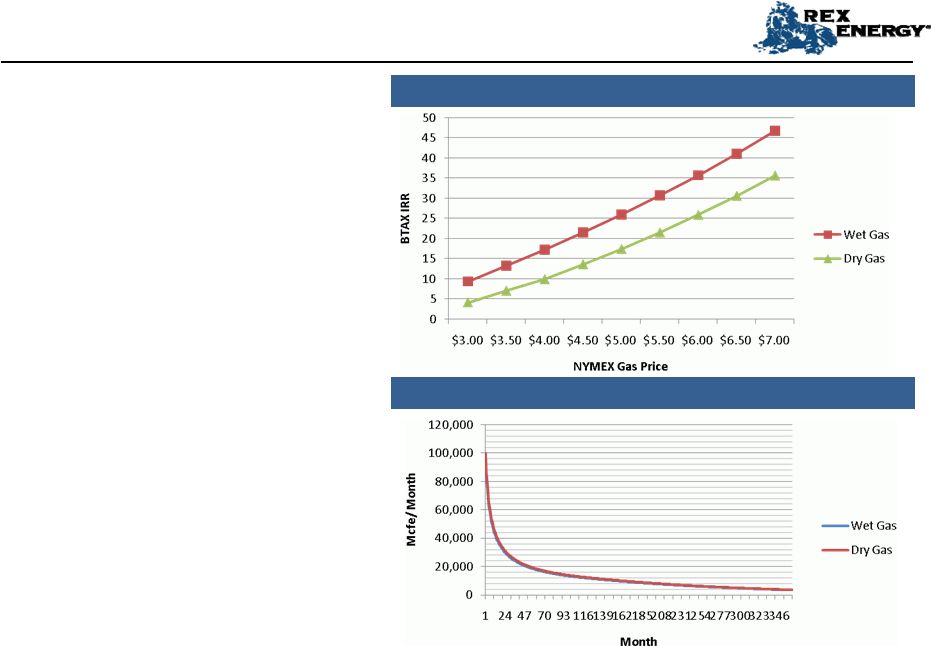

Conceptual

Conceptual

Marcellus

Marcellus

Economics

Economics

(1)

(1)

1. Assumptions

based

on

full

development

program.

Individual

well

results

may

vary

significantly.

Not

proved.

See

“Hydrocarbon

Volume

Estimates”

on

page 2.

•

Butler County (Wet Gas) Assumptions

o

2.5 MMcf/d

initial 30-day rate

o

4.3 Bcfe

gross EUR

o

$4.7 million D&C Costs

o

15% royalties

o

Gas Price Basis Adjustment: $0.15/Mcf

o

NGL & Condensate Volumes: 1.8 Gallons per

Mcf

(~46 Bbls

per MMcf)

o

NGL Price Assumptions: $0.90/gal

o

Gathering Transportation & Operating

Expenses: $1.48/Mcf

o

Gas Price BTU Adjustment: +10% (Based on

1,100 BTU post processing gas)

•

Westmoreland & Central PA (Dry Gas)

Assumptions

o

3.5 MMcf/d

initial 30-day rate

o

3.0 Bcf

gross EUR

o

$4.7 million D&C Costs

o

15% royalties

o

Gas Price Basis Adjustment: $0.15/Mcf

o

Gathering Transportation & Operating

Expenses: $0.58/Mcf

12

Before Tax IRR

Type Curves |

Niobrara Overview

Niobrara Overview

•

~56,000 gross (40,000 net) acres

o

3 horizontal wells drilled, fractured

and recovering load

o

4 additional wells permitted

•

DJ Basin Niobrara Summary

o

Thick “Source Rock”

–

300+ ft.

o

High Total Organic Content (TOC’s) of

2-10%

o

Strong matrix contribution from high

porosity chalks

o

Production likely influenced by faults

and fractures

o

Mature over large areal extent

o

Expected

well

costs

of

$3.5

-

$4.2

MM

DJ Basin

13

SM Energy

Atlas 1-19H

Peak Rate: 1,000+

Bbls/d

EOG

Elmber

8-31H

Peak Rate: 730

Bbls/d

EOG

Red Poll 10-16H

Peak Rate: 730

Bbls/d

EOG

Jake 2-1H

Peak Rate: 1,500+

Bbls/d

Rex Energy

Silo State 41-22H

Recovering Load

Rex Energy

Herrington Farms 1H

Drilled and Completed,

Recovering Load

Rex Energy

BJB #1H

Drilled and Completed,

Recovering Load

Resource Potential

(1)

Low Case

High Case

Net Acres

~40k

Assumed % Drilled

75%

Well Spacing

320 acres

Net Potential Wells

94

EUR (MBoe)

(1)

200

350

Royalties

17%

Upside Potential (MMBoe)

15.6

27.3

1.

Assumptions

based

on

full

development

program.

Actual

results

may

vary

significantly.

Not

proved.

See

“Hydrocarbon

Volume

Estimates”

on

page

2. |

Conceptual

Conceptual

Niobrara

Niobrara

Economics

Economics

(1)

(1)

14

Before Tax IRR

Type Curve

•

Niobrara Horizontal Well Assumptions

o

300 Bbls/d

IP

o

Gas not included in economics

o

$4.2 million D&C Costs

o

17% royalties

o

Oil Price Basis Adjustment: -$11.00/Bbls

o

Gathering Transportation & Operating

Expenses: $13.00/Bbls

o

Severance & Ad Valorem Taxes: 13%

1. Assumptions based on full development program. Individual well results may vary

significantly. Not proved. See “Hydrocarbon Volume Estimates” on page 2. |

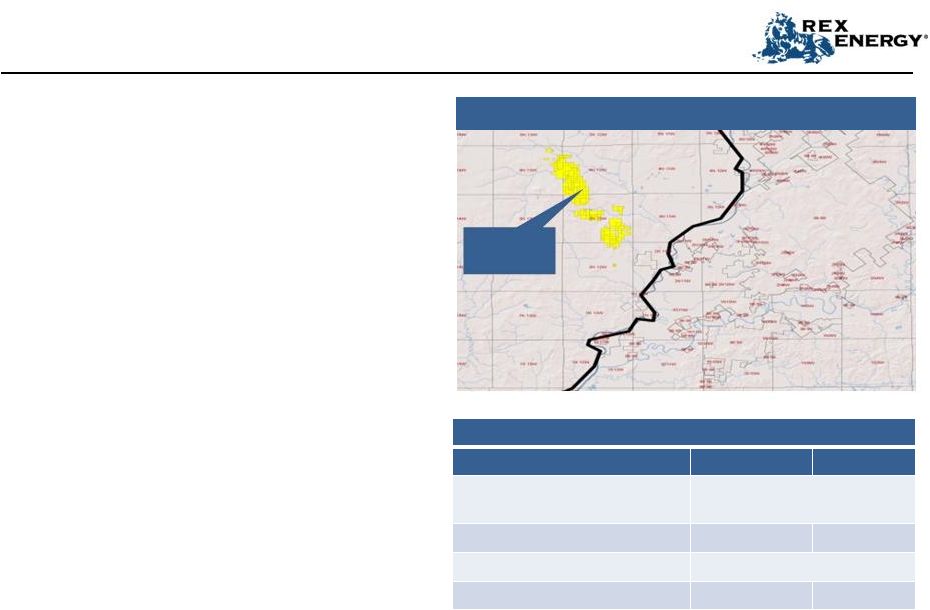

Lawrence Field ASP Overview

Lawrence Field ASP Overview

•

~13,000 gross (13,000 net) acres in Lawrence Field

o

1 Billion Barrels of Original-Oil-in-Place

o

Field has produced 400 MMBbls

since 1906

o

Wateflooded

in the 1950’s

o

Two successful surfactant-polymer flood pilots

completed by Marathon with 15-20% of OOIP recovered

o

Field currently produces ~1,500 gross barrels per day

under waterflood

•

ASP Project Summary

o

ASP stands for Alkali-Surfactant-Polymer flood

o

Alkali-Surfactant mix reduces interfacial tension allowing

remaining oil to flow easier through the formation

o

Polymer improves sweep efficiency by forcing fluid into

parts of the field not effectively swept by the waterflood

o

Based on a geological analysis and high grading of the

acreage, 27 separate ASP units have been designed to

date.

o

Laboratory analysis on the effect of ASP flooding of cores

from the field recovered 23% of original-oil-in-place (16%

PV Recovery)

o

Single well pilot test of ASP flooding in the field

recovered 27% of original-oil-in-place (20% PV Recovery)

o

Injecting chemicals on 15-acre unit with initial response

expected in late first quarter 2011 to early second

quarter 2011

o

Currently at 25% of pore volume injected ASP slug,

currently injecting Polymer Push

Lawrence

Field

Illinois Basin

Indiana

Illinois

15

Resource Potential

Low Case

High Case

Residual Oil in Designed Units

(MMBls)

~311

PV Recovery Assumed

(1)

8%

20%

Royalties

22%

Upside Potential (MMBls)

~22

~50

1. Assumptions based on full development program. Individual ASP unit results may vary

significantly. Not proved. See “Hydrocarbon Volume Estimates” on page 2. |

ASP Conceptual Economics

ASP Conceptual Economics

Potential: (Netherland, Sewell & Associates

ASP Evaluation, December 2009)

o

Rex Energy and Netherland, Sewell &

Associates have built a 3-dimensional

geological model over 5,000 well logs from

the field and reservoir simulator to identify

ASP units and estimate recoverable ASP

reserves.

o

North & Central areas of the field have been

analyzed to date (~75% of the field)

•

Identified 18 target continuous

sandbodies

and broke these down into 27

separate flood units (15 Bridgeport/12

Cypress)

•

Base Case Potential Reserves in Identified

Floodable Sands: 39.4 MMBbls

(1)

in the

Northern & Central areas of the field at a

13% PV Recovery

16

Typical ASP Flood IRR vs

Oil Price at Various PV Recoveries

Total ASP Potential Reserves at Various PV Recoveries

1. Estimated by Netherland, Sewell & Associates, Inc. Does not represent proved reserves.

See “Hydrocarbon Volume Estimates” on page 2. |