Attached files

| file | filename |

|---|---|

| 8-K - BLAST ENERGY SERVICES, INC. 8-K FILED 1.6.11 - PEDEVCO CORP | form8k.htm |

Guijarral Hills Field

Exploitation Project

Safe Harbor Disclosure

An investment in Blast Energy Services, Inc. (the “Company”) involves a

high degree of risk and is suitable only for investors with substantial

means who have no need for liquidity in their investments. No one

should invest in the Company’s securities who cannot afford to lose their

entire investment.

high degree of risk and is suitable only for investors with substantial

means who have no need for liquidity in their investments. No one

should invest in the Company’s securities who cannot afford to lose their

entire investment.

In making any investment decision in the Company, investors must rely

on their examination of the Company and the terms of any offering,

including the merits and risks involved. This presentation contains

forward-looking statements. Actual results, events or conditions could

differ materially from those projected by the Company due to a variety of

factors, some of which are beyond the control of the Company.

on their examination of the Company and the terms of any offering,

including the merits and risks involved. This presentation contains

forward-looking statements. Actual results, events or conditions could

differ materially from those projected by the Company due to a variety of

factors, some of which are beyond the control of the Company.

Neither the United States Securities and Exchange Commission (the

“SEC”) nor any state securities administrator has approved or

disapproved any securities of the Company nor has the SEC or any

state securities administrator passed upon the adequacy or accuracy of

the disclosures contained herein or the merits of an investment in the

Company. Any representation to the contrary is a criminal offense.

“SEC”) nor any state securities administrator has approved or

disapproved any securities of the Company nor has the SEC or any

state securities administrator passed upon the adequacy or accuracy of

the disclosures contained herein or the merits of an investment in the

Company. Any representation to the contrary is a criminal offense.

Guijarral Hills Field Exploitation Project

ü Blast is seeking an initial $3M investment in the form

of debt financing to “farmin” or invest in drilling one

well on the initial prospect in the Guijarral Hills in

Central California

of debt financing to “farmin” or invest in drilling one

well on the initial prospect in the Guijarral Hills in

Central California

ü By participating in the initial well, Blast expects to

realize a 34.5% interest in the program’s entire 2,543

acre position where four target zones are known to

produce - the initial well is planned to penetrate all

four zones to obtain rights

realize a 34.5% interest in the program’s entire 2,543

acre position where four target zones are known to

produce - the initial well is planned to penetrate all

four zones to obtain rights

ü Most promising initial well site has been identified and

permitted through extensive geological evaluation and

study of adjacent wells drilled by Chevron & Union Oil

amongst others in over 100 wells drilled in the area

permitted through extensive geological evaluation and

study of adjacent wells drilled by Chevron & Union Oil

amongst others in over 100 wells drilled in the area

Guijarral Hills Field Exploitation Project

ü Unique opportunity to invest in California “in-field”

drilling project

drilling project

ü Adjacent fields exploited by Chevron and Union Oil in

1940s and 1950s

1940s and 1950s

ü Leases originally held by Chevron and Cal Minerals -

never exploited

never exploited

ü Project lies between two fields that produced over

50M barrels of oil

50M barrels of oil

ü Along this trend over 2Bn barrels of oil produced from

four major fields

four major fields

ü Every one of the four target zones has produced oil in

adjacent wells

adjacent wells

ü First well in this Project is permitted and ready to drill

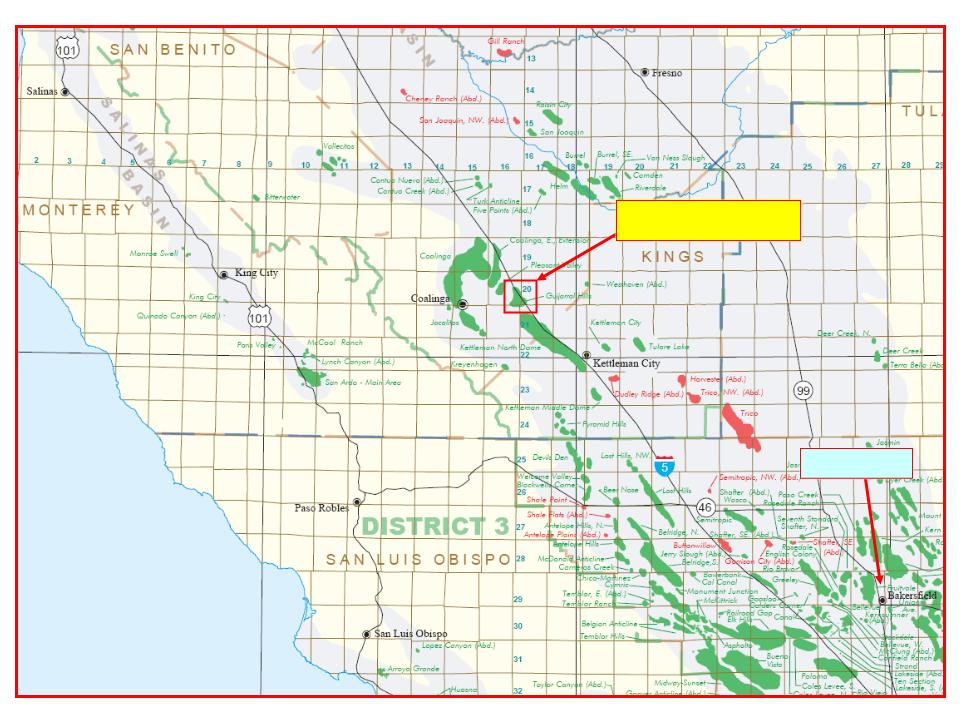

Bakersfield

Guijarral Hills Field

Project Area

Project Area

From: DOGGR Oil and Gas Fields of California

Guijarral Hills Field Exploitation Project

Project Highlights

Project Highlights

ü Up to 25 Million barrel reserve potential.

ü Within 1000 feet of production from a 50 Million barrel

oil field.

oil field.

ü Potential production from four reservoirs proven

productive within the field.

productive within the field.

ü Multiple targets can be tested with one well.

ü On the nose of a Guijarral Hills/Coalinga anticline.

ü Oil is migrating in the present day.

ü 25 - 40 API gravity oil

Guijarral Hills Field Exploitation Project

Objective Drilling Zones

Objective Drilling Zones

ü Temblor: Up to 10 million barrels of oil in place

– Smith sand:

» Porosity: 15 - 23%

» Permeability 50 - 100 md

– Allison sand:

» Porosity 20%

» Permeability 100 - 200 md

– Leda sand:

» Porosity 15 - 20%

» Permeability 50 - 400 md

ü Avenal/Gatchell: Up to 20 million barrels of oil in place

– Porosity: 10 - 15

– Permeability: 10 - 300 md

ü All these zones were proven to be productive at the nearby

Guijarral Hills Field

Guijarral Hills Field

Guijarral Hills Field Exploitation Project

Economic Assumptions

Economic Assumptions

ü Assumes $80/bbl oil price with an initial flow rate of

435 equivalent bbls/day.

435 equivalent bbls/day.

ü Expenses assume that wells flow for two years before

requiring pumps to be installed.

requiring pumps to be installed.

ü Under the terms of the proposed farmin, Blast will

have a 67% working interest in the costs to bring the

initial well on to production - which then drops to 50%

on future wells and capital costs in the project.

have a 67% working interest in the costs to bring the

initial well on to production - which then drops to 50%

on future wells and capital costs in the project.

ü Assumes first revenue in June 2011.

Guijarral Hills Field Exploitation Project

Economic Impact

Economic Impact

ü Successful outcome in the first well has an estimated

Net Present Value at 10% to Blast of $17,604 MM.

Net Present Value at 10% to Blast of $17,604 MM.

ü A successful initial well is projected to generate six

times more revenue annually than our current base

business.

times more revenue annually than our current base

business.

ü Projected initial investment payout reached within one

year.

year.

ü Assumes completion in only the Leda sand, one of

four potential zones in the well.

four potential zones in the well.

ü Does not include any economic benefit from

additional development wells that may be drilled on

this section or the acreage sections earned in the

Project by participating in the initial well.

additional development wells that may be drilled on

this section or the acreage sections earned in the

Project by participating in the initial well.

Guijarral Hills Exploitation Project

Use Of Proceeds and Collateral Available

Use Of Proceeds and Collateral Available

Gross Proceeds $3,000,000

Cost to Drill Initial Well $1,540,000

Cost to Complete Well 600,000

Repayment of Sun Resources Note 270,000

Escrow of 1st Year Interest 240,000

Commission, Fees and Attorneys 350,000

Total Uses $3,000,000

Security for Senior Loan

1. Lawsuit settlement due September 2011 for $1,440,000

2. Sugar Valley Field valued at PV10 of $1.2M, cash flowing

approx. $50,000 per quarter

approx. $50,000 per quarter

Guijarral Hills Field Exploitation Project

Upside Potential

Upside Potential

Twelve Well Case:

ü Development drilling following a successful initial well

could support up to eleven additional wells being

drilled to exploit all four zones on this one tract.

could support up to eleven additional wells being

drilled to exploit all four zones on this one tract.

ü In this case, Blast may need to seek additional funds

of up to $24 MM over the next two years.

of up to $24 MM over the next two years.

Thirty Well Case:

ü Development and exploratory drilling on the other

tracts in the Project could result in an additional 18

wells being drilled.

tracts in the Project could result in an additional 18

wells being drilled.

ü In this case, Blast may need to seek additional funds

of up to $60 MM over the next three to four years.

of up to $60 MM over the next three to four years.

Blast Energy Services, Inc.

Capitalization Table

Capitalization Table

|

|

Preferred

|

Common

|

|

Authorized

|

20,000,000

|

180,000,000

|

|

Issued and Outstanding*

|

6,000,000

|

**66,759,238

|

|

|

|

|

|

Reserved for Unexercised Warrants

|

|

***11,495,089

|

|

|

|

|

|

Reserved for Unexercised Options

|

|

2,593,959

|

|

|

|

|

|

Total Outstanding and Reserved

|

6,000,000

|

80,848,286

|

|

|

|

|

|

* Includes 6,000,000 preferred shares and 14,481,534 common shares owned by Clyde Berg, Eric McAfee and their

affiliates |

||

|

** Excludes 1,150,000 shares approved but not yet issued under the terms of the 2005 class action settlement

|

||

|

*** Includes warrants to purchase 6,090,000 @ $1.44 per share and 1,555,089 @ $0.01 per share owned by Laurus

Master Fund and warrants to purchase 2,000,000 shares owned by Berg McAfee affiliates. |

||

Guijarral Hills Field

Exploitation Project