Attached files

| file | filename |

|---|---|

| EX-21 - EXHIBIT 21 - LEGEND INTERNATIONAL HOLDINGS INC | a6552226ex21.htm |

| EX-31.2 - EXHIBIT 31.2 - LEGEND INTERNATIONAL HOLDINGS INC | a6552226ex31_2.htm |

| EX-32.2 - EXHIBIT 32.2 - LEGEND INTERNATIONAL HOLDINGS INC | a6552226ex32_2.htm |

| EX-31.1 - EXHIBIT 31.1 - LEGEND INTERNATIONAL HOLDINGS INC | a6552226ex31_1.htm |

| EX-32.1 - EXHIBIT 32.1 - LEGEND INTERNATIONAL HOLDINGS INC | a6552226ex32_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment no 1)

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

|

|

ACT OF 1934

|

|

|

For the fiscal year ended: December 31, 2009

|

|

|

or

|

|

| o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

|

|

ACT OF 1934

|

|

|

For the transition period from: _____________ to _____________

|

|

Commission File Number 000-32551

LEGEND INTERNATIONAL HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

23-3067904

|

|

|

(State or Other Jurisdiction

|

(I.R.S. Employer

|

|

|

of Incorporation or Organization)

|

Identification No.)

|

Level 8, 580 St Kilda Road Melbourne, Victoria, 3004, Australia

(Address of Principal Executive Office) (Zip Code)

011 (613) 8532 2866

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

|

Securities registered pursuant to Section 12(b) of the Act: None

|

||

|

Securities registered pursuant to Section 12(g) of the Act:

|

||

|

Title of each class

|

||

|

Common Stock, par value $.001 per share

|

||

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

||||

| o |

Yes

|

x

|

No

|

|

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

|

||||

| o |

Yes

|

x

|

No

|

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

||||

|

x

|

Yes

|

o |

No

|

|

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

|

||

| o | ||

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

|

||||||

|

Large accelerated filer

|

o |

Accelerated filer

|

x

|

|||

|

Non-accelerated filer

|

o |

Smaller reporting company

|

o | |||

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

|

||||

| o |

Yes

|

x

|

No

|

|

|

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

|

||||

|

The aggregate market value based on the average bid and asked price on the over-the-counter market of the Registrant’s common stock, (“Common Stock”) held by non-affiliates of the Company was US$115,089,366 as at June 30, 2009.

There were 226,333,392 outstanding shares of Common Stock as of March 15, 2010.

|

||||

|

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

|

||||

|

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

|

||||

|

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

|

||||

| o |

Yes

|

o |

No

|

|

|

DOCUMENTS INCORPORATED BY REFERENCE

|

||||

|

Not Applicable

|

||||

EXPLANATORY NOTE

We are filing this Amendment to our Form 10-K for the fiscal year ended December 31, 2009 in response to a comment letter from the staff of the Securities and Exchange Commission. In response to the staff’s comments, we have amended certain disclosure in Item 1 (Business) to revise and expand the disclosure concerning the Company’s exploration activities in accordance with SEC Guide 7; Item 1A (Risk Factors)to provide disclosure concerning potential risks associated with the concentration of stock ownership by certain principal stockholders and the Company’s service agreement with AXIS; Item 7A (Quantitative and Qualitative Disclosures About Market Risks) to provide additional information concerning market risks associated with the Company’s foreign currency positions; Item 8 (Financial Statements) to clarify the description of the Company retained deficit and to provide additional information concerning the Company’s relationship with AXIS; Item 10 (Management) to expand the disclosure concerning the qualification of the Company’s directors; Item 11 (Executive Compensation) to expand the discussion of the Company’s executive compensation practices; Item 13 (Certain Relationships and Related Transactions and Director Independence) to provide additional information concerning the Company’s relationship with AXIS and Item 16 (Exhibits) to correct certain references in the Exhibit list.

Except as described above, the remainder of the Form 10-K is unchanged and does not reflect events occurring after the original filing of the Form 10-K with the SEC on March 16, 2010.

| INDEX | ||

|

1

|

||

|

38

|

||

|

42

|

||

|

42

|

||

|

42

|

||

|

43

|

||

|

48

|

||

|

49

|

||

|

58

|

||

|

58

|

||

|

58

|

||

|

58

|

||

|

60

|

||

|

61

|

||

|

65

|

||

|

71

|

||

|

73

|

||

|

76

|

||

|

77

|

||

|

78

|

Information Regarding Forward Looking Statements

This report and other reports, as well as other written and oral statements made or released by us, may contain forward looking statements. Forward looking statements are statements that describe, or that are based on, our current expectations, estimates, projections and beliefs. Forward looking statements are based on assumptions made by us, and on information currently available to us. Forward-looking statements describe our expectations today of what we believe is most likely to occur or may be reasonably achievable in the future, but such statements do not predict or assure any future occurrence and may turn out to be wrong. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. The words "believe," "anticipate," "intend," "expect," "estimate," "project", "predict", "hope", "should", "may", and "will", other words and expressions that have similar meanings, and variations of such words and expressions, among others, usually are intended to help identify forward-looking statements.

Forward-looking statements are subject to both known and unknown risks and uncertainties and can be affected by inaccurate assumptions we might make. Risks, uncertainties and inaccurate assumptions could cause actual results to differ materially from historical results or those currently anticipated. Consequently, no forward-looking statement can be guaranteed. The potential risks and uncertainties that could affect forward looking statements include, but are not limited to:

|

§

|

the risks of mineral exploration stage projects,

|

|

§

|

political risks in foreign countries,

|

|

§

|

risks associated with environmental and other regulatory matters,

|

|

§

|

exploration risks and competitors,

|

|

§

|

the volatility of phosphate, diamond and other mineral prices,

|

|

§

|

movements in foreign exchange rates,

|

|

§

|

increased competition, governmental regulation,

|

|

§

|

performance of information systems,

|

|

§

|

ability of the Company to hire, train and retain qualified employees,

|

|

§

|

the availability of sufficient, transportation, power and water resources, and

|

|

§

|

our ability to enter into key exploration and supply agreements and the performance of contract counterparties.

|

In addition, other risks, uncertainties, assumptions, and factors that could affect the Company's results and prospects are described in this report, including under the heading “Risk Factors” and elsewhere and may further be described in the Company's prior and future filings with the Securities and Exchange Commission and other written and oral statements made or released by the Company.

We caution you not to place undue reliance on any forward-looking statements, which speak only as of the date of this document. The information contained in this report is current only as of its date, and we assume no obligation to update any forward-looking statements.

|

Business.

|

General

The terms “Legend,” “Company,” “we,” “our,” and “us” refer to Legend International Holdings, Inc. unless the context suggests otherwise.

We are an exploration stage company. Our objective is to exploit our interest in certain exploration tenements which are in Queensland and the Northern Territory of Australia. Our principal exploration target is for phosphate, base metals and diamonds and we are seeking to determine whether they are present in commercially economic quantities on our tenements to develop an operating mine.

1

Currency

We use the Australian dollar as our reporting currency, since we are headquartered in Australia and our administrative expenses are incurred in Australian dollars. References to dollars are to Australian dollars (A$) unless otherwise indicated as being United States dollars (US$). For the convenience of the reader, the Australian Dollar figures for the year ended December 31, 2009 have been translated into United States Dollars (“US$”) using the rate of exchange at December 31, 2009 of A$1.00=US$0.8931.

History

Legend was incorporated in the State of Delaware on January 5, 2001 under the name Sundew International, Inc., to engage in the business of selling compatible inkjet cartridges and refill kits on the Internet.

On March 13, 2003, Legend filed for an Amendment to its Certificate of Incorporation (the "Amendment") pursuant to which the name of Sundew International, Inc. was changed to "Legend International Holdings, Inc."

In November 2004, Renika Pty Ltd, an Australian corporation (“Renika”) acquired an 88% interest in Legend from William and Michael Tay (the “Tays”), the Tays resigned as Directors and Officers of Legend, Joseph Gutnick was appointed President, Chief Executive Officer and a Director and Peter Lee was appointed Secretary. The Tays also granted Renika an option to acquire an additional 578,240 shares of Common Stock that Renika exercised in 2005. Commencing in fiscal 2005, Legend has decided to focus its business on mineral exploration activities.

Effective as of March 3, 2006, the Company entered into a Contract for the Sale of Mining Tenements (“Contract”) with Astro Diamond Mines N.L. (“Astro”) an Australian company pursuant to which the Company shall acquire certain diamond exploration tenements in Northern Australia from Astro, which is described above.

In November 2007, Legend acquired a number of phosphate exploration interests in the State of Queensland in Australia.

In August 2009, Legend acquired a controlling interest in North Australian Diamonds Limited (“NADL”), an Australian company with diamond interests in the Northern Territory of Australia.

Legend is an exploration stage company. Legend has not been involved in any bankruptcy, receivership or similar proceeding. Legend has not been involved in any material reclassification, merger consolidation, or purchase or sale of a significant amount of assets not in the ordinary course of business.

SEC Reports

We file annual, quarterly, current and other reports and information with the SEC. These filings can be viewed and downloaded from the Internet at the SEC’s website at www.sec.gov. In addition, these SEC filings are available at no cost as soon as reasonably practicable after the filing thereof on our website at www.lgdi.net. These reports are also available to be read and copied at the SEC’s public reference room located at Judiciary Plaza, 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the public reference room by calling the SEC at 1-800-SEC-0330.

Description of Business

Business

The Company has never generated any significant revenues from operations and is still considered an exploration stage company. The Company was initially formed to engage in the business of selling compatible inkjet cartridges and refill kits on the Internet for the consumer printer market. In March 2003, management of the Company decided to engage in the business of building and acquiring controlling or other interests in one or more companies engaged in the contract sales and distribution of specialty medical products, and raise additional capital for this purpose. Neither business was successful and operations of both were eventually discontinued. During fiscal 2004, management of the Company developed a plan of operations to acquire income-producing real property. The Company did not acquire any properties pursuant to such plan.

2

Following the change of management in November 2004, the Company developed a new plan of operations, which was to engage in mineral exploration activities. Legend's business plan calls for the identification of mineral properties where it can obtain secure title to exploration, development and mining interests.

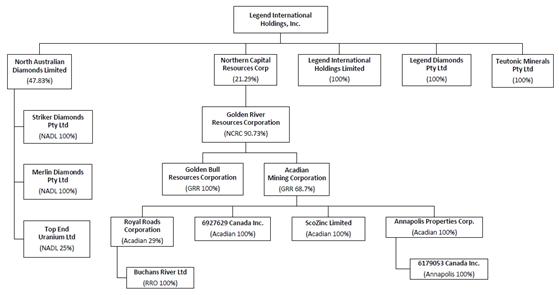

The following chart sets forth the Company’s corporate organization as of December 31, 2009:

2009 Highlights

|

Ø

|

Granting of Exploration Permits for Legend’s flagship phosphate projects at Paradise North and South.

|

|

Ø

|

High grade mineralization defined at both Paradise North and D-Tree phosphate projects.

|

|

Ø

|

Successful progess of phosphate flotation beneficiation flow sheet through bench scale testwork.

|

|

Ø

|

Successful operation of a continuous 4 week pilot plant operation for phosphate flotation beneficiation on bulk samples from Paradise and D-Tree deposits.

|

|

Ø

|

Phosphate rock proven to acidulate to phosphoric acid successfully and make a world class fertilizer product such as DAP, MAP, SSP or TSP etc.

|

|

Ø

|

Strong government support with the granting of industrial zoned land in Mt Isa for the building of a phosphoric acid plant. The land has power, water, relevant permits and is situated on the rail line.

|

|

Ø

|

Memorandum of Understanding signed with P&O Trans Australia for haulage and handling services associated with Legend’s Georgina Basin Phosphate project.

|

|

Ø

|

The Indian Farmers Fertiliser Cooperative (‘IFFCO’), India’s single largest phosphate fertilizer consumer, increases its equity stake in Legend to 15.2%.

|

|

Ø

|

Legend forms a strategic alliance with Wengfu (Group) Co. Ltd, one of China’s largest phosphate fertilizer producers, whereby Wengfu will conduct a feasibility study on all aspects of the project with a view to becoming an equity partner with Legend.

|

Project Strategy

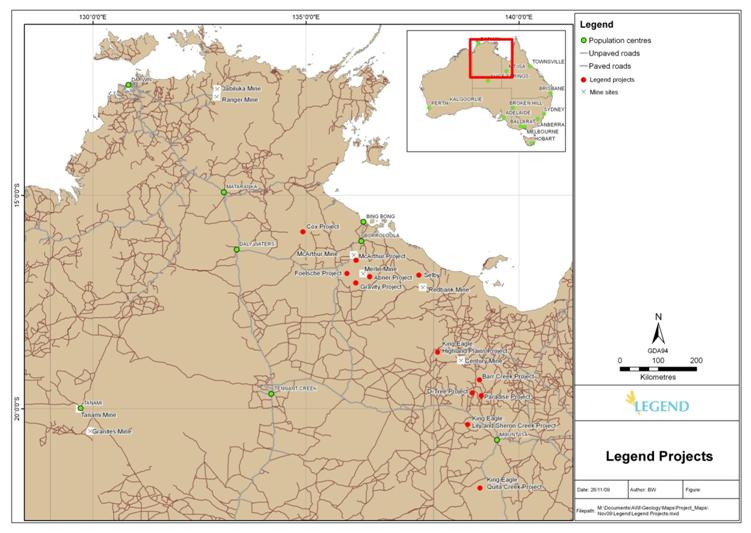

Legend is primarily focused on advancing its significant phosphate deposits in the Georgina Basin of Queensland, Australia (See Figure A) with the aim of becoming a major Australian phosphate rock and phosphate fertilizer producer. Non reserve mineralized material has already been defined and feasibility studies are currently underway. These studies have made significant progress in determining the mining, metallurgical, economic, marketing, legal, environmental, social and governmental factors which will modify the non reserve mineralized material estimates into future estimates of potential Mineral Reserves. These modifiying factors will inform the Company as to which parts of the currently defined non reserve mineralized material will be able to be legally and economically extracted in the future. Currently the Company has no Mineral Reserves as defined by the U.S SEC Industry Guide 7 however the Company’s Phosphate Development Team is working towards this goal. Important strategic alliances have been made with the Indian Farmers Fertiliser Cooperative (IFFCO) and Wengfu (Group) Co. Ltd (Wengfu) to achieve this goal.

3

IFFCO is the single largest consumer of phosphate fertilizers in India and have agreed, subject to the negotiation and execution of a definitive off-take agreement, to offtake up to 5 million tonnes of phosphate rock per year from Legend’s future potential production. IFFCO and Legend have extended the date of executing a definitive rock off-take agreement by a further 2 years to mid 2012. Wengfu is one of China’s largest phosphate fertilizer producers and have significant expertise in developing phosphate deposits and maximizing value through the development of many downstream products. Wengfu currently market their products to over 20 countries worldwide. Wengfu have agreed to conduct a feasibility study on the potential mining, beneficiation, phosphoric acid and phosphate fertilizer production from Legend’s phosphate deposits with a view to becoming an equity partner in Legends Phosphate Project.

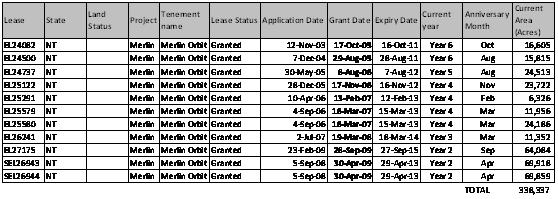

Legend, in accordance with its initial strategy of exploration for various mineral commodities across northern Australia (with a focus on diamond exploration) also controls and maintains landholdings in the Northern Territory of Australia (See Figure A). These interests are managed by Legend through a separate Exploration Team not involved with the Phosphate Project.

During the economic downturn of 2008, Legend also decided that part of the Company strategy should be to invest into undervalued mining projects should opportunities arise. This investment would not detract from Legends primary goal of advancing the Phosphate Project and had the aim of diversifying interests to dilute the effect of identified potential project risks. This was seen as necessary by the Company due to the obviously volatile and unpredictable nature of the commodity markets at the time. Some of these investments include taking a major stake in North Australian Diamonds Ltd (NADL) which controls the Merlin Diamond Mine and includes NADL’s 25% interest (increased to 28% since December 31, 2009) in Top End Uranium Ltd in the Northern Territory, Australia and an investment in Northern Capital Resources Corporation which controls gold and zinc assets in Nova Scotia, Canada. These are outlined in further detail below.

Legend Georgina Basin Phosphate Project

Legend’s initial plan was to advance the phosphate deposits with a staged approach. The initial stage was to focus on phosphate rock material which requires little to no beneficiation, then move towards upgrading the rock to a higher grade concentrate through flotation beneficiation and finally using this material to create value added phosphate fertilizer products. Legend formed a strategic alliance with Wengfu in November 2009 and based on initial recommendations from the work they have conducted so far, the Company will be issuing a revised project timeline and strategy upon completion of the feasibility study in the second quarter of fiscal 2010 which is being conducted by Wengfu. The revised strategy and timeline may involve a different combination or prioritization of the various stages currently being assessed.

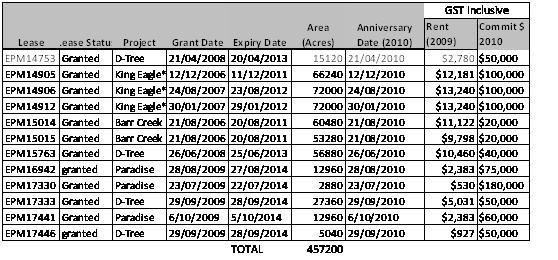

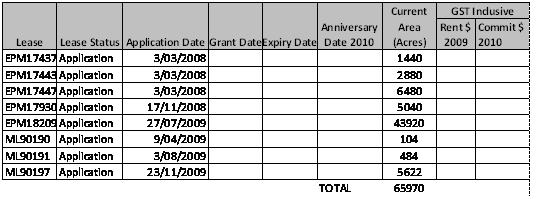

Legend’s Land Holdings and Projects

The Legend landholdings, both granted and under application, prospective for phosphate, diamonds and base metals cover 523,170 acres in Queensland, Australia and over 4,725,098 million acres in the Northern Territory, Australia (refer to tables A,B,C and D). Areas under application are not considered as currently under Legend’s control. Granted landholdings consist of 457,200 acres in Queensland and 1,472,309 acres in the Northern Territory (refer to tables A and C). In Queensland, Legend’s holdings are historical phosphate deposits located in the Mt. Isa district, along the margin of the Georgina Basin which is host to major base metal and phosphate deposits.

4

Legend’s exploration tenements are divided into the following project areas (See Figure A below):

|

●

|

Phosphate Projects:

|

|

§

|

Paradise Phosphate Project, Queensland

|

|

§

|

D-Tree Phosphate Project, Queensland

|

|

§

|

King Eagle Phosphate Project, Queensland

|

|

●

|

Diamond and Phosphate Projects:

|

|

§

|

Barr Creek Project, Queensland

|

|

●

|

Diamond Projects:

|

|

§

|

Glyde River, Northern Territory.

|

|

§

|

Foelsche, Northern Territory

|

|

§

|

Abner Range, Northern Territory.

|

|

§

|

Cox, Northern Territory.

|

|

§

|

Gravity Project, Northern Territory

|

|

●

|

Diamonds and Base Metals

|

|

§

|

McArthur River, Northern Territory

|

|

§

|

Selby Project, Northern Territory

|

The exploration tenements of North Australian Diamonds are discussed separately below.

5

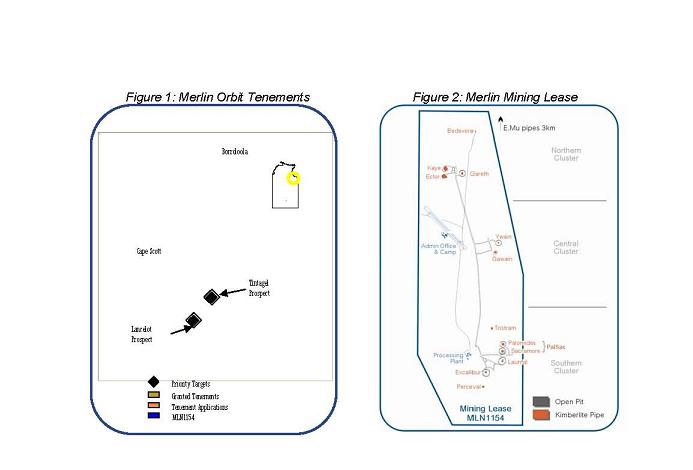

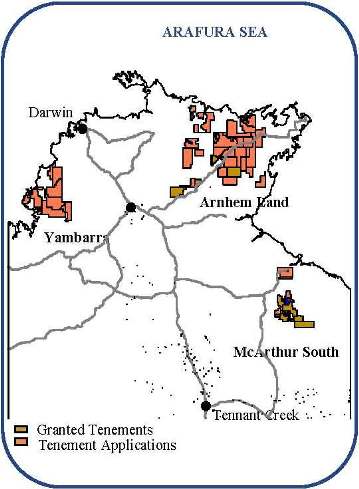

Figure A: Projects in Northern Territory and Queensland, Australia

6

Queensland Projects

Tenement Status, Details & Commitments (Projected) Queensland and Northern Territory, Australia

Table A. Granted Tenements for Queensland Projects

* earning 80% interest

Table B. Tenements under application for Queensland Projects

7

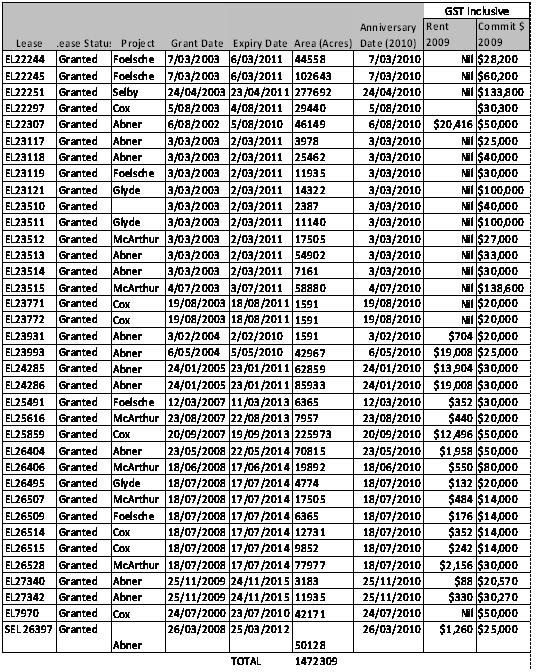

Table C: Granted Tenements for Northern Territory Projects

8

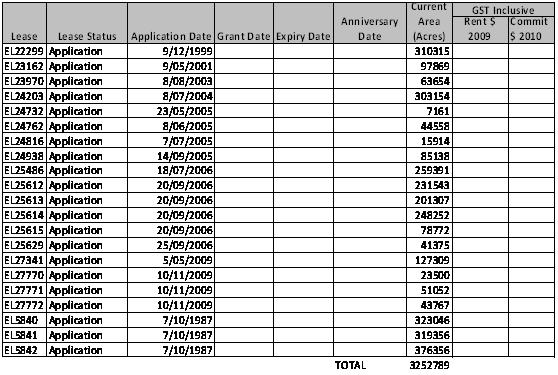

Table D: Tenements under application for Northern Territory Projects

Metallurgy

During 2009, Legend has carried out four stages of bench scale beneficiation test work culminating in a pilot plant study using samples of D-Tree, Paradise North and Paradise South mineralized material. Phosphoric acid testing was also completed on selected samples.

Bench Scale Flotation Test Work

The major aims of the bench scale test program were to develop a beneficiation flow sheet that would recover the most phosphate at the highest grade, without discarding any Ultrafine (-20µm) material. The main findings included:

|

·

|

Both D-Tree and Paradise South ores could be successfully beneficiated,

|

|

·

|

Encouraging flotation of Ultrafine phosphate in a specialized flotation cell.

|

|

·

|

Potential for >80% total P2O5 recoveries at 31-33% P2O5 grade without discarding any -20µm particles.

|

|

·

|

A process flow sheet using a split sized flotation circuit of -150+20µm in conventional flotation cells and -20µm in specialized flotation cells would be successful in recovering >80% P2O5 at about 33% P2O5 concentrate grade.

|

|

·

|

Only a single rod mill would be required, grinding to a P80 of 150µm.

|

|

·

|

A WHIMS unit would not be required to obtain the required Fe2O3 rejection from the concentrates.

|

Bench Scale Data

Stage 1

Location of Samples:

All of the samples were taken from the phosphorite horizons within the Beetle Creek Formation (D-Tree deposit). The Beetle Creek Formation occurs within the Lower Middle Cambrian stratigraphy of the Georgina Basin, Queensland, Australia. Phosphorite at D-Tree occurs predominantly as mudstone and silty mudstone phosphorite with some minor occurrences of pelletal phosphorite. In 2008, Legend completed an extensive drilling program across the D-Tree deposit. Samples chosen for bench scale test work were taken from eleven cored drillholes distributed across a broad area of the D-Tree deposit, and from different intervals of the ore zone so that the abovementioned range of ore types were processed.

9

|

Test ID

|

Original Sample

Size

(Kg)

|

Original Sample

Grade

(% P2O5)

|

Concentrate

Grade

(% P2O5)

|

Calculated

P2O5

Recovery (%)

|

|

1

|

0.16

|

23.0

|

32.6

|

91.1

|

|

2

|

0.23

|

20.1

|

34.8

|

94.9

|

|

3

|

5.0

|

16.4

|

33.8

|

52.0

|

|

4

|

5.5

|

13.6

|

32.7

|

60.5

|

|

5

|

3.96

|

18.2

|

19.1

|

89.7

|

|

6

|

5.0

|

16.3

|

26.5

|

47.6

|

|

7

|

5.5

|

14.5

|

32.4

|

45.6

|

|

8

|

1.0

|

13.85

|

31.67

|

79.3

|

|

9a

|

1.0

|

20.87

|

31.62

|

44.3

|

Table E: Test results of Stage 1 bench scale flotation test work

Stage 2

Location of Samples:

For the Stage 2 flotation test work, a range of samples of different ore character were taken from several cored drillholes positioned across different prospect areas of the D-Tree deposit. All of the samples were taken from the phosphorite horizons within the Beetle Creek Formation (D-Tree deposit). The Beetle Creek Formation occurs within the Lower Middle Cambrian stratigraphy of the Georgina Basin, Queensland, Australia.

|

Test ID

|

Original Sample

Size

(Kg)

|

Original Sample

Grade

(% P2O5)

|

Concentrate

Grade

(% P2O5)

|

Calculated

P2O5

Recovery (%)

|

|

9b

|

0.21

|

20.1

|

36.8

|

50.9

|

|

10

|

0.42

|

20.1

|

34.2

|

88.2

|

|

11

|

0.21

|

20.0

|

34.6

|

82.4

|

|

12

|

0.23

|

21.6

|

32.7

|

57.7

|

|

13

|

0.46

|

21.6

|

29.3

|

86.5

|

|

14

|

0.23

|

21.3

|

30.9

|

88.7

|

|

15

|

0.21

|

20.2

|

32.8

|

94.6

|

|

16

|

0.65

|

20.4

|

36.4

|

94.4

|

|

17

|

0.84

|

20.4

|

34.1

|

94.1

|

|

18

|

0.24

|

15.8

|

33.2

|

28.4

|

|

19

|

0.66

|

15.7

|

30.9

|

53.7

|

|

20

|

0.87

|

15.6

|

30.1

|

49.2

|

|

UQ1375

|

2.23

|

20.2

|

29.5

|

76.2

|

|

UQ1376

|

2.34

|

21.4

|

27.5

|

82.9

|

|

UQ1377

|

2.82

|

22.4

|

30.2

|

67.0

|

|

UQ1380

|

5.90

|

22.4

|

29.7

|

34.9

|

|

UQ1381

|

2.90

|

22.4

|

29.6

|

44.0

|

Table F: Test results of stage 2 bench scale flotation test work.

10

Stage 3

Location of Samples:

Samples used for the Stage 3 test work were taken from both the D-Tree and Paradise South deposits. All of the D-Tree samples were taken from cored drillholes that intersected the phosphorite horizons within the Beetle Creek Formation. Samples from the Paradise South deposit were taken from large ore stockpiles that were left on site from work conducted by Broken Hill South in the late 1960’s and early 1970’s. Broken Hill South conducted detailed metallurgical studies into the phosphate rock at Paradise South (previously known as the Lady Annie phosphate deposit) including the development of an on-site pilot plant. In order to provide phosphate rock for the pilot plant, Broken Hill South excavated nine costeans across a broad area of the Paradise South phosphate deposit. Approximately 64,000 tonne of phosphate rock was excavated from these trenches that sampled the full range of ore types at Paradise South, from all of the main prospect areas across the deposit. The costeans were never rehabilitated and large amounts of the stockpiles were never processed through the pilot plant. Several 100kg samples of Paradise South ore were taken from these stockpiles and used for the Stage 3 metallurgical test work. Before processing was carried out these 100kg samples were riffle split in half where one half was kept at the laboratory for future reference. The sample half that was used had further sub-splits taken from it for head assays and particle size distribution assessment prior to flotation testing.

|

Test ID

|

Original Sample

Size

(Kg)

|

Original Sample

Grade

(% P2O5)

|

Concentrate

Grade

(% P2O5)

|

Calculated

P2O5

Recovery (%)

|

|

21

|

1.09

|

16.2

|

35.1

|

58.0

|

|

23

|

0.99

|

11.0

|

29.6

|

34.0

|

|

24

|

0.87

|

4.7

|

24.6

|

72.4

|

|

25

|

0.97

|

16.5

|

35.1

|

73.7

|

|

26

|

1.05

|

33.2

|

36.4

|

37.2

|

|

27

|

1.10

|

9.6

|

33.4

|

41.7

|

|

28

|

0.95

|

10.1

|

31.2

|

55.0

|

|

29

|

1.02

|

11.1

|

29.0

|

39.0

|

|

30

|

0.87

|

4.7

|

26.0

|

62.9

|

|

31

|

1.03

|

33.7

|

37.0

|

38.4

|

|

32

|

0.87

|

8.5

|

34.8

|

62.1

|

|

33

|

0.97

|

9.5

|

32.3

|

61.9

|

|

34

|

0.93

|

13.1

|

29.7

|

78.8

|

|

35

|

1.10

|

5.1

|

27.4

|

74.4

|

|

36

|

0.99

|

19.6

|

34.8

|

59.9

|

|

37

|

0.83

|

33.2

|

37.1

|

59.2

|

|

38

|

0.91

|

10.5

|

34.9

|

71.8

|

|

39

|

0.88

|

10.2

|

33.2

|

61.8

|

|

UQ1408

|

4.66

|

12.8

|

17.4

|

22.1

|

|

UQ1409

|

4.88

|

20.1

|

22.8

|

54.4

|

|

UQ1410

|

4.57

|

16.5

|

20.0

|

58.9

|

|

UQ1411

|

4.32

|

14.0

|

13.8

|

25.5

|

|

UQ1412

|

3.90

|

29.6

|

30.4

|

71.4

|

Table G: Test results of stage 3 bench scale flotation testwork.

11

Stage 4

Location of Samples:

For the Stage 4 flotation test work, a range of samples of different ore character were taken from several cored drillholes positioned across different prospect areas of the D-Tree deposit. All of the samples were taken from the phosphorite horizons within the Beetle Creek Formation (DTree deposit). The Beetle Creek Formation occurs within the Lower Middle Cambrian stratigraphy of the Georgina Basin, Queensland, Australia.

|

Test ID

|

Original Sample

Size

(Kg)

|

Original Sample

Grade

(% P2O5)

|

Concentrate

Grade

(% P2O5)

|

Calculated

P2O5

Recovery (%)

|

|

1

|

0.86

|

16.7

|

33.4

|

94.7

|

|

2

|

0.88

|

16.6

|

30.3

|

97.4

|

|

3

|

1.03

|

17.1

|

34.2

|

86.5

|

|

4

|

0.93

|

16.9

|

33.8

|

76.2

|

|

5

|

1.03

|

17.0

|

35.6

|

70.8

|

|

6

|

0.98

|

17.1

|

30.9

|

97.6

|

|

7

|

1.03

|

17.1

|

29.8

|

97.1

|

|

8

|

1.02

|

16.9

|

32.2

|

96.9

|

|

9

|

0.97

|

16.7

|

25.9

|

51.4

|

|

10

|

0.95

|

16.1

|

26.0

|

93.8

|

|

11

|

0.98

|

16.7

|

31.3

|

97.5

|

|

12

|

1.02

|

16.6

|

27.3

|

96.0

|

Table H: Test results of stage 4 bench scale flotation test work.

Pilot Plant Flotation Test Work

In August 2009, Legend had sufficient information and confidence in the deposit to design and implement a pilot plant for the beneficiation process. This was carried out through October and November 2009 on larger ore samples, representative of two Paradise South samples and one sample each from Paradise North and D-Tree.

Highlights include:

|

·

|

Confirmation of simple processing circuit with no crushing of ROM ore needed.

|

|

·

|

Paradise South hourly survey concentrate grades up to 34.4% P2O5 were achieved from feed grades between 17% and 20% P2O5. The best hourly survey result of 92% P2O5 recovery at 31.6% P2O5 grade was achieved from a single flotation cell, indicating fast flotation kinetics.

|

|

·

|

A low grade Paradise South hourly survey sampled at 14.3% P2O5 and upgraded to a 31.7% P2O5 concentrate with 75% P2O5 recovery.

|

|

·

|

D-Tree hourly survey concentrate grades up to 35% P2O5 were achieved from feed grades between 16% and 18% P2O5. The best hourly survey recovery of 87% P2O5 was obtained to a concentrate grade of 30.1% P2O5.

|

|

·

|

Most results were achieved without a cleaner flotation stage. This indicates that there is still some potential to obtain higher P2O5 concentrate grades with lower impurities by including cleaning in the flotation circuit.

|

During the operation of the pilot plant it was found that the two flotation circuits that were initially set up to treat the coarse and ultrafine material separately could be simplified to one flotation circuit capable of treating the entire range of particle sizes, without any particle classification. This development together with the elimination of the crushing circuit has potential to save on capital and operating costs, water and power usage.

Pilot Plant Data

Location of Samples:

All samples for DTree, Paradise North and Paradise South were taken from historic trenches from the Beetle Creek formation in the Georgina Basin, Queensland, Australia. Four lots of 40 tonnes were sampled using hand held excavators and were processed through a ten tonne per day pilot plant processing facility in Adelaide, Australia.

12

In the 1970’s numerous large costeans were excavated at the D-Tree, Paradise South and Paradise North deposits. All of these costeans were used to provide phosphate rock for pilot plant studies in the 1970’s and were never rehabilitated. As such, Legend was able to revisit these trenches and sample them thoroughly in 2009. At the D-Tree deposit, two large costeans were sampled to provide 40 tonnes of material for the 2009 pilot plant. The large samples incorporated a range of ore characters.

Two 40 tonne samples were obtained from the stockpiles of six costeans at Paradise South in 2009. One 40 tonne Paradise South sample was taken from costeans located in the Rufous Creek prospect area and incorporated predominantly pelletal ore types of higher grade. The second 40 tonne sample was taken from costeans in the Jessops Creek prospect area and incorporated both mudstone phosphorite and pelletal phosphorite of average P2O5 grades.

At Paradise North, the stockpiles of two costeans were sampled to create a 40 tonne sample. This sample incorporated several different ore types, and one type of ore that is mostly confined to the Paradise North deposit.

|

Test ID

|

Original Sample

Size

(Kg)

|

Original Average

Sample Grade

(% P2O5)

|

Representative

Concentrate Grade

Achieved

(% P2O5)

|

Representative

Calculated

P2O5 Recovery

(%)

|

|

DTree

|

40,000

|

17.8

|

30.1

|

87.3

|

|

Paradise North

|

40,000

|

19.0

|

28.8

|

86.6

|

|

Paradise South 1

|

40,000

|

18.3

|

31.3

|

92.3

|

|

Paradise South 2

|

40,000

|

14.5

|

28.9

|

85.3

|

Table I: Test results of pilot flotation plant samples

Proposed Beneficiation Plant

The proposed Beneficiation Plant Site location is at the site of the historic Pilot Plant which was operated by BH South in the 1970s. This site was also identified by BH South as the most suitable location for their proposed Beneficiation Plant. The area was chosen due to the favourable topography and its location to existing road and power infrastructure in the region. The site was previously sterilised of phosphate mineralisation through drilling by BH South.

The process is capable of treating phosphate ores which contain up to 60 wt% Ultrafines, where Ultrafines is defined as particles smaller than 20 micron in size. The ore as mined is screened at 25mm and the oversize fraction, which is rich in silica, is discarded. The undersize fraction is fed to a rod mill and ground at 63% solids so that 55% of the material is reduced to less than 150 micron in size. During grinding soda ash is added to the mill to provide a slurry pH of between 9 and 10. The slurry is then fed to a hydrocyclone which provides further size classification of the particles so that the cyclone overflow product is at least 80% passing 150 micron and the cyclone underflow is recycled to the rod mill for re-grinding. The cyclone overflow is dewatered using a belt filter so that the solids content is increased to at least 70%. This slurry is then conditioned in a stirred tank with flotation chemicals that provide hydrophobicity to the phosphate bearing minerals, thus enabling them to be separated from silica and carbonate gangue minerals during flotation. After conditioning, the slurry is diluted to approximately 25% solids and is fed to the flotation circuit where flotation cells concentrate the phosphate. The concentrate and tailings are subsequently thickened and dewatered. The concentrate is the final product that becomes the feed to Legend’s phosphoric acid plant and assays at least 32% P2O5. The tailing is fed to the tailings dam and assays approximately 2% P P2O5.

13

Proposed Tailings Dam

A by-product of this flotation process will be a significant quantity of tailings, which will require storage during the life of the potential mine. The broad tailings management strategy will be as follows:

|

·

|

Construct a specially designed Tailings Storage Facility (TSF) to store tailings during the “start-up” period. The duration of this period is nominally 3 to 5 years, and is basically taken to be the time required to;

|

|

·

|

Develop one or more initial tailings storage cells within the proposed mining pits. The remaining life of mine tailings from the beneficiation plant will then be directed to a series of ”inpit” cells, which will be formed, filled and closed in a sequenced manner

|

The preferred site for the Start-up TSF is the valley to the south of the beneficiation plant site. A total of three conceptual options for the configuration of a TSF within this valley have been considered, these being based on “start-up” periods ranging from 2 to 7 years to investigate the optimum efficiency (in terms of costs versus storage capacity).

The general arrangement consists of the down-valley deposition of tailings using two pipe-end discharge points, to a retaining embankment (identified as the “Tailings Embankment”). A decant water system will be installed on the upstream face of the Tailings Embankment, transferring decant and catchment runoff water via a buried pipe to a Decant Pond immediately downstream. The pond will be formed by a water retaining embankment at the southern end (identified as the “Decant Embankment”). The Decant Pond will have a capacity of approximately 400 ML, to provide storage for the TSF design storage allowance.

An emergency spillway will be constructed at the western abutment of the Tailings Embankment, and as an outfall chute on the crest of the Decant Embankment. Both spillways would need to be designed to pass the critical duration, 1 in 10,000 year AEP flood event, assuming that the tailings/decant pond level is at the minimum freeboard level.

Each of the options include Discharge Bunds and Saddle Dams of varying extents, in order to provide the required tailings head of beach, and containment of tailings at the saddles on the eastern side of the valley.

Phosphoric Acid Manufacture

During 2009 Legend supplied a total of five rock samples to CTI laboratories in Belle Chasse USA for the bench scale evaluation of phosphoric acid manufacture. Apart from the one sample from Paradise South, all samples were ‘as sampled’ material (AS) with no flotation beneficiation having taken place. The Paradise South sample was remnant flotation concentrate from an old stockpile from the 1974 pilot plant situated at Lady Annie. One Paradise North sample did have simple washing and screening at 20 microns.

The conclusions of the phosphoric acid manufacture conducted in Belle Chase, U.S.A were as follows:

|

·

|

The Paradise North AS, Paradise North (washed) and Paradise South concentrate rock produced phosphoric acid equal in quality to Florida base rock.

|

|

·

|

The Paradise North AS and the Paradise South rock gave the highest phosphate recovery compared to the Base rock and the Paradise South rock.

|

|

·

|

The Paradise North (washed) rock produced phosphogypsum slurries which filtered around 30% slower than the Florida Base rock.

|

|

·

|

Paradise North AS rock produced phosphogypsum slurries which filtered significantly slower than Base rock slurries.

|

|

·

|

While the Australian rocks contained high levels of SiO2 much of this is in the form of insoluble quartz. The low levels of reactive SiO2 show the need to add reactive silica (for example clay) to handle the fluorine in the rock.

|

|

·

|

The lower CaO/P2O5 ratios in the Australian rocks suggest that around 10 – 15 % less sulphuric acid is required to digest the phosphate in these rocks compared to the Florida Base rock.

|

|

·

|

The basis for designing a continuous pilot plant run based on Wet Screened and Paradise South rock have been successfully demonstrated.

|

|

·

|

The acid produced had minor element ratio’s which would make a world quality Di Ammonium Phosphate (DAP) and therefore other phosphate fertilizer products.

|

14

Phosphoric Acid Data

Location of Samples:

The historic Lady Annie pilot plant, of which remnants still exist at the site now known as Paradise South, processed phosphate rock and produced concentrate in the early 1970’s. Several small stockpiles of the concentrate produced at this pilot plant still exist at the historic pilot plant site. These concentrate stockpiles were sampled for the phosphoric acid test work.

At D-Tree, Paradise South and Paradise North, there are areas and intervals of the deposit that are of a high grade suitable for phosphoric acid manufacture. At D-Tree, the high grade ore occurs in the upper stratigraphy of the northern part of the deposit. These intervals were sampled from several cored drillholes for this test work.

At Paradise North, a large proportion of the deposit is also of a high grade nature. Material of this character was sampled from several cored drillholes across the Paradise North site. At Paradise South, localised areas of the deposit provide high-grade material suitable for phosphoric acid testing. This material was sampled in several cored drillholes as well as historic costean faces.

|

Test ID

|

Original Sample

Size (Gram)

|

Original Sample

Grade

(% P2O5)

|

Acid Grade

(% P2O5)

|

Calculated

P2O5 Recovery

(%)

|

|

Paradise South 1970’s Con

|

80

|

34.23

|

27.65

|

91.4

|

|

DTree AS 1

|

122

|

22.02

|

28.33

|

63.7

|

|

DTree AS 2

|

122

|

28.61

|

27.96

|

71.4

|

|

PNorth Not Deslimed

|

104

|

30.36

|

29.27

|

94.7

|

|

PNorth Deslimed

|

104

|

31.86

|

26.9

|

94.6

|

|

Paradise South A

|

358

|

34.52

|

24.54

|

96.2

|

|

Paradise South B

|

326

|

33.19

|

23.11

|

96.0

|

|

Paradise North

|

462

|

31.81

|

28.16

|

93.6

|

Table J: Test results of phosphoric acid test work.

Transport

During 2009 Legend signed a Memorandum of Understanding with P&O Trans Australia (POTA) for haulage and handling services associated with Legend’s Georgina Basin Phosphate project. POTA’s services are to include:-

|

1.

|

Road cartage from D-Tree and Paradise North tenements, both located approximately 160 kilometers from the deposit to the rail head in Mount Isa;

|

|

2.

|

Rail haulage from Mount Isa to Port of Townsville, approximately 1,000 kilometers; and,

|

|

3.

|

Various storage and material handling tasks.

|

P&O Trans Australia is a business of POTA Holdings Pty Ltd which is the joint venture company of Kaplan (KIL: Kaplan Infrastructure & Logistics Fund & KEL: Kaplan Equity Limited) and DP World (Government Owned Corporation in Dubai). P&O operates a Port precinct based Full and Empty container logistics business working from a total of 16 sites located in the State capital Cities of mainland Australia, a Multi-User Intermodal Terminals business with 6 sites in capital city locations along the Eastern Seaboard of Australia, a Rail Freight business operating Shipping Services between regional, metropolitan and interstate origins and the Ports of Sydney and Melbourne and a Global Freight Forwarding company with a network of offices in Australia and around the World.

15

The Queensland Government also announced in December 2009 that it will commit AUD$102 million to upgrades to the Mt Isa to Townsville rail line over the next two years. These upgrades will be aimed at increasing efficiency and capacity for future demand. This announcement is consistent with Legends own discussions with the Queensland government and in particular the Premier of Queensland who has given the Legend Phosphate project her full support.

Legend also engaged Pipeline Systems International (PSI) to undertaken a conceptual study for assessment of a slurry pipeline to transport the beneficiated phosphate ore from the deposit site to existing rail facilities. The option would involve a dewatering facility at the rail terminal and return water pipelines to the beneficiation plant following the route of the slurry pipeline. The dewatered phosphate concentrate would be loaded into rail wagons and make their way via rail to the Port of Townsville for storage and loading to ship.

Water supply

Three water supply options are under consideration for this project.

|

1.

|

Lake Julius option

|

Legend engaged SunWater to undertake a pre-feasibility study to assess the option of directing up to 10GL of unallocated water from Lake Julius to the proposed mine and beneficiation plant. Lake Julius is located approximately 85 kilometers east southeast of the proposed mine and beneficiation plant. The findings of this study will be compared against the other options presented below but initial findings are that the water supply is available to Legend and it is technically feasible to bring this water to the proposed site.

|

2.

|

Thorntonia Borefield option

|

Legend has commenced commercial negotiations in regard to the lease of an existing borefield water permit. The borefield water will need to be pumped approximately 45 kilometers to the beneficiation plant via an above ground pipeline.

|

3.

|

Upper Battle Creek Dam

|

Legend has investigated the potential to develop new surface water storages in the catchment; Lower Gunpowder Creek, Upper Gunpowder Creek, Battle Creek and Upper Battle Creek. Upper Battle Creek is the preferred site. Conceptual studies including a yield analysis, geotechnical reconnaissance, visual assessment, conceptual design and capital expenditure estimate have been completed.

The dam is intended to supply a proposed phosphate mine for a period of 30 years. With a catchment area of 162 ha, the estimated yield of the storage is 2500 ML/a at 90% reliability, requiring a storage capacity of 10,000 ML.

The spillway excavation will provide all or most of the rock needed for the dam. Subject to drilling, the rock appears to be of high quality. A rock fill dam with a concrete slab on the upstream face is considered the most suitable, requiring much smaller concrete plant.

Legend has estimated the Probable Maximum Flow (PMF) inflow in Upper Battle Creek as 1000 m³/s. Assuming a 75 m wide spillway channel invert, the maximum flood rise would require a dam wall about 20 m high. Increasing the width to 150 m, the flood rise is less and the embankment height (and rock volume) is reduced to 16.5 m. The corresponding volume of rock is about 90,000 m³.

Power supply

Generation

Legend has commenced commercial negotiations with local power generators in regards to the supply of power for the proposed beneficiation plant with a load factor of 80% for a 24 hr-7 day a week operation.

16

Power distribution option

Legend has made a connection enquiry to Ergon Energy for distribution of 8.5MW to the Birla Mt Gordon substation via the Century Zinc 220kV 100MVA transmission line. Legend has been advised that these lines have sufficient capacity to deliver the required power to the Birla Mt Gordon substation from Mt Isa. Legend will need to construct a 2km 66kV 12.5MW transmission line from the existing 66kV line to the proposed beneficiation plant.

For a larger connected load a direct connection to the existing Century Zinc 220kV line is required. Legend has made connection applications to the owner of the Century Zinc 220kV line, Ergon Energy, for the preferred and alternative connection options.

Environment

Legend is currently engaged in environmental approvals of three separate Mine Lease Applications; D-Tree North, Paradise North and Paradise South. Both D-Tree North and Paradise North are to be licensed following agreement of separate Environmental Management Plans. Paradise South is to be licensed following the completion of an Environmental Impact Statement (EIS) which commenced in November 2009. All three Mining Leases have had ecological survey work and cultural heritage clearances completed in 2009 with no impediments to granting of the leases encountered.

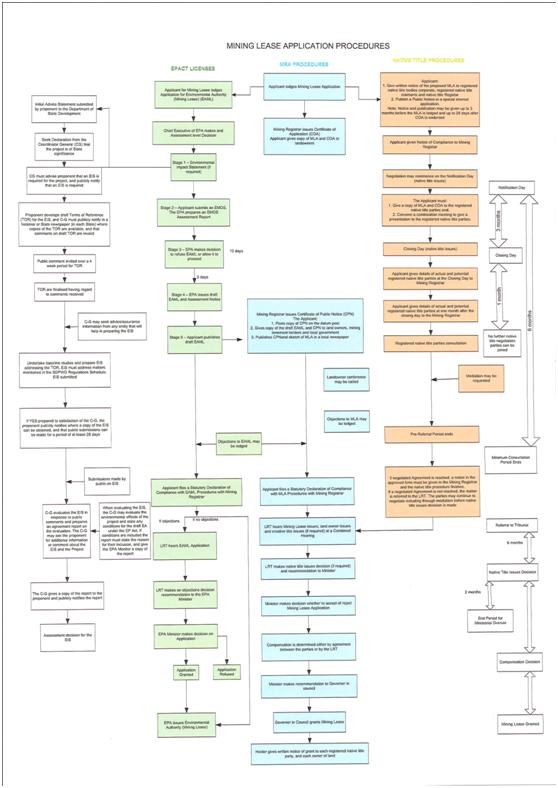

The process of obtaining Mine Lease approval in the State of Queensland, Australia, involves compliance with the Minerals Resources Act (1989), Environmental Protection Act (1994) and Native Title Act (1993). The regulations pertaining to the Minerals Resources Act (1989) and Native Title Act (1993) are administered by the Department of Employment, Economic Development and Innovation (DEEDI). The provisions of the Environmental Protection Act (1994) are administered by the Department of Environment and Resource Management (DERM).

The flow chart below describes the interrelated approval process in accordance with these Acts.

The level of environmental approval required is predicated on the size and nature of the proposed mining operation. Legend’s D-Tree North (ML90190) and Paradise North (ML90191) mine leases have been approved through submission of an Environmental Management Plan (EMP) given that these are small scale operations with minimal ore processing. Legend’s large Paradise South proposed mine operation includes a beneficiation processing plant requiring power and water infrastructure and accordingly is being approved through an Environmental Impact Statement (EIS) with supporting EMP. Legend has voluntarily applied to undertake the EIS for the Paradise South mine lease. The State government provides no indication of expected expenditure for completing an EMP only or EIS with EMP. The studies required in the EMP and EIS include air quality, surface water, groundwater, ecology and geology, as a minimum. The remoteness of sites and availability of historical data greatly influence costs. Legend estimate the total cost of EMP only of US$1 million and EIS with EMP of US$2 million.

17

18

Geology

Geological History of the Georgina Basin of Queensland.

The majority of Australia’s sedimentary phosphorite reserves lie within early Middle Cambrian successions of the Georgina Basin in northwest Queensland and northeast Northern Territory. Some eighteen named, discrete phosphorite deposits occur within the lower Middle Cambrian Beetle Creek Formation, or its stratigraphic equivalent the Border Waterhole Formation, that are basal in the stratigraphy of the Georgina Basin.

In common with many other phosphatic successions, the Georgina Basin phosphorites are associated with carbonates, cherts and organic-rich shales. Phosphorite lithologies are dominantly represented by apatitic peloids and bioclasts within a carbonate matrix or early diagenetic siliceous matrix, with thin interbeds of phosphatic mudstone, commonly referred to as collophane mudstone.

The Paradise South, Paradise North, & D-Tree phosphate deposits lie within the Beetle Creek Formation and its lateral facies equivalents (Howard, 1986). The Cambrian stratigraphy typically associated with the phosphorite deposits is comprised of a sequence of overlying laminated siltstones and shales of the Inca Formation that conformably overlie the Beetle Creek Formation and Thorntonia Limestone. The Thorntonia Limestone is a dolomitic limestone with increasing chert bands towards the top. It is the lateral facies equivalent to the Beetle Creek Formation, with which it intertongues. The Beetle Creek Formation hosts the phosphate deposits, comprised predominately of interbedded coarse to fine grained phosphorites, siltstone, claystone, chert and some discrete carbonate lenses. Locally, karst-like surfaces in the Thorntonia Limestone are filled with chalky high-grade phosphorite that appear to replace the underlying limestone. The Beetle Creek Formation and Thorntonia Limestone units conformably and gradationally overlie the Mt Hendry Formation which is a discontinuous conglomerate and sandstone (Cook & Elgueta, 1986).

The Cambrian sediments may be covered by up to 71 metres of Mesozoic claystone and sandstone in parts of the basin as well as Cainozoic alluvium and elluvium.

All of the phosphorite deposits are thought to have formed under coastal, shallow marine conditions, and consist of three recognised phosphorite ore-types: pelletal, microsphorite and replacement phosphorite (Rogers and Keevers, 1976). Coarse to medium grained skeletal-ovulitic grainstone and packstone pelletal phosphorites are thought to have formed through reworking, transport and accumulation of phosphatic grains. Microsphorite is thought to have formed from the suspension of very fine grained detrital material and/or precipitation of apatite from the water column in very shallow supratidal areas (Cook & Elgueta, 1986). The replacement phosphorite is thought to have formed through post-depositional phosphate replacement of carbonate (Rogers and Keevers, 1976).

Exploration History and Forward Work Program

The Paradise South, Paradise North, & D-Tree phosphate deposits are located approximately 130km north west of Mt Isa in the Georgina Basin. To date, significant exploration has been completed on all deposits, although much of this exploration was conducted in the late 1960’s early 1970’s. Partial revalidation drilling has been conducted by Legend since September 2008.Below is a table (Table K) that outlines the historical non-reserve mineralized material figures as published in freely available documentation1:

19

|

Historic Estimates

|

|||

|

Deposit

|

Classification

|

Estimated

million

tonnes

|

% P2O5

|

|

Paradise South

|

*Non-reserve mineralized material1

|

293

|

16.6

|

|

Paradise North

|

*Non-reserve mineralized material1

|

193

|

17.6

|

|

D-Tree

|

*Non-reserve mineralized material1

|

339

|

16.0

|

|

Lily Creek

|

*Non-reserve mineralized material1

|

191

|

14.9

|

|

Quita Creek

|

*Non-reserve mineralized material1

|

54

|

17.3

|

|

Sherrin Creek

|

*Non-reserve mineralized material1

|

175

|

16.5

|

|

Highland Plains

|

*Non-reserve mineralized material1

|

84

|

13.4

|

|

Total

|

*Non-reserve mineralized material1

|

1,329

|

16.2

|

* Such non-reserve mineralized material would not qualify as a reserve until a comprehensive evaluation based upon unit cost, grade, recoveries and other material factors concludes being both legal and economic feasibility

1 Source of Information

Historically published in Queensland Minerals Mines & Projects, 4th Edition. From:1 1990 Freeman, M.J., Shergold, J.H., Morris, D.G., & Walter, M.R. Late Proterozoic And Palaeozoic Basins of Central and Northern Australia- Regional Geology And Mineralization. 2.1996 Draper, J.J Phosphate- Queensland Mineral Commodity Report, Queensland Government Mining Journal, 97 (1131) 14-25.

Table K: Historic estimations of non-reserve mineralization for the Phosphate deposits controlled by Legend.

Past feasibility studies by BH South Ltd (Rogers J.K, 1988) occurred in 1974 on a phosphate rock beneficiation plant and slurry pipeline to the Queensland coast. Beneficiation test shafts and mining scale trenches were dug. A pilot plant built in 1973 produced 34% P205 concentrate at Paradise South from 17% P205 rock (Cook, P.J. 1989). Feasibility was concluded at that time for a proposed phosphate rock concentrate production rate of 4-5 million tonnes per year (Cook, P.J. 1989).

During 2009 drilling was conducted on the D-Tree, Paradise North and Paradise South deposits. Results are pending for Paradise South.

Metallurgical sampling was also conducted during the year. Metallurgical work completed included both bench scale plants up to pilot plant scale operations. Samples were collected from D-Tree, Paradise North and Paradise South for this work. Metallurgical testwork continues on diamond drill core and these results will be used to inform the mineralized material model for each deposit.

Current Work

A drilling program at the D-Tree deposit commenced in September 2008 with up to 3 drill rigs utilized on the drill program. Drilling was completed during 2009, particularly on the D-Tree North prospect.

During 2009, Legend purchased the Barr Creek project from Elkedra Diamonds N.L and Uramet Minerals Ltd. Barr Creek is located to the east of the current Paradise North deposit. It was decided after a review of historic phosphate drilling in this area to drill a small program of reverse circulation (“RC”) holes to target potential high grade material. During the year the diamond exploration crew also took several Heavy Mineral Analysis (“HMA”) samples from the project.

20

In July 2009, EPM17330 (Paradise North) was granted with drilling commencing soon after that. The aim of the drilling at Paradise North was to target further high grade material, using the historical drill data to target the drilling.

In September 2009, drilling commenced at Paradise South with the intention to target mineralized material suitable for beneficiation. The target was to delineate approximately 40 million tonnes of suitable mineralized material for future processing.

Table L below outlines the total amount of drilling that has been completed at each of the deposits since September 2008.

|

Deposit

|

Drill Type

|

No. of Holes

|

Metres

|

|

Barr Creek

|

RC

|

25

|

780

|

|

D-Tree

|

RC

|

655

|

19,633

|

|

D-Tree

|

Sonic

|

11

|

296.0

|

|

D-Tree

|

Diamond

|

41

|

1,132.8

|

|

Paradise North

|

RC

|

386

|

9,103

|

|

Paradise North

|

Diamond

|

31

|

759.3

|

|

Paradise South

|

RC

|

135

|

4,759

|

|

Paradise South

|

Diamond

|

18

|

658.4

|

|

Lily Creek

|

RC

|

10

|

384

|

|

Total

|

RC

|

1,211

|

34,659

|

|

Total

|

Sonic

|

11

|

296.0

|

|

Total

|

Diamond

|

90

|

2,551

|

Table L: Drill statistics completed by December 31 2009.

Paradise North

Tenement EPM17330 was granted in July 2009, with drilling commencing in early August 2009 with the aim of delineating high grade material. The drilling program was completed in November 2009, with all assays returned by December 2009. High grade material was successfully delineated as reported on the 24th September 2009. An estimate of the tonnes and grade of this high grade core mineralization has been reported March 16, 2010.

Paradise South

The Paradise South exploration licence was granted in late August 2009 and drilling commenced on this deposit in November 2009.

Drilling was completed in December 2009 with a total of 18 diamond drill holes for 658 metres and 135 RC for 4,759 metres of drilling. The combination of RC and diamond drilling results will be used to produce a mineralized material and reserve estimation on beneficiated product. The aim is to delineate an initial 40 million tonnes of phosphate rock in the first phase, with larger tonnages to be defined in subsequent drilling phases.

D-Tree

D-Tree was the first north-west Queensland phosphate deposit drilled by Legend, with drilling commencing in September 2008. There were several drill patterns designed and drilled finishing in mid 2009. In 2009 Legend became manager of the D-Tree West Tenement, located to the west and north-west of the D-Tree Tenement, which gave Legend access to extra historic mineralized material at D-Tree West.

21

In total, 655 RC holes for 19,633 metres were drilled including 41 Diamond holes for 1,132.75 metres and 11 Sonic for 296 metres throughout the deposit. The mineralized material estimation was publically released in May 2009.

Highland Plains

No field work was conducted at Highland Plains during the year, due to the distance from Mt Isa it was decided that the Highland Plains deposit was a lower priority target. During the year further open file data was reviewed. It is planned that a small drill program be completed at Highland Plains in 2010 to test the suitability of the phosphate mineralization to the beneficiation process.

Work completed for 2009 also included a review of the aero-magnetic and radiometric survey completed at Highland Plains in 2008 as flown by Fugro. Grant Archer from Archer Geophysics completed the review with the data now available to assist with drill hole planning.

Lily Creek

A field reconnaissance trip was conducted to Lily Creek later in 2009 to assess the quality of the access tracks and past drilling. It was decided that little work was required to gain access for a small drill program around the higher grade zones at the Lily Creek deposit. A local contractor was employed and the field team prepared for drilling. As drilling continued at the Paradise Project until the beginning of the wet season no drill rigs were available to complete the small program planned for Lily Creek in 2009.

Archer Geophysics also completed a review of the geophysical data for Lily and Sherrin Creek and this information will be used to target drilling with the idea of identifying the phosphatic ore close to surface. The review will also be used to identify areas where the phosphate ore is close to surface for potential rock chip sampling.

In late 2009, a small team was sent to Lily Creek and completed the rehabilitation of all the drilling that was completed in 2008. All drill holes were cut below surface and all sample bags were removed.

Quita Creek

King Eagle Resources, the current Joint Venture partner, conducted a detailed field trip and sampling campaign to Quita Creek with emphasis on base metal and uranium exploration. After reviewing the results of this campaign, Legend performed reconnaissance and field sampling with focus on phosphate mineralization. Two sampling campaigns were completed during the year, the first trip collected around 35 samples (including 2 standards) and the second approximately 110 samples. All samples were submitted to a local commercial lab in Mt Isa for analysis. The rock chip results confirmed the presence of phosphate mineralization which will allow targeting for follow up drilling campaigns later in 2010.

Barr Creek

The Barr Creek projects (EPM’s 15014 and 15015) were purchased during 2009 as they contain both historic phosphate mineralized materials and potential diamond bearing kimberlites. During 2009, a small RC program for 25 holes (780 metres) was completed. Mineralized material was intersected in the drilling and will be included in future estimates of tonnes and grade.

Drilling Techniques

Legend has contracted Downer EDI Mining to carry out the drilling on the Queensland Phosphate tenements. Drilling techniques used include reverse circulation (RC) and Diamond Coring methods. Downer EDI has supplied two UDR 650 rigs (Universal Drill Rigs). One was on a 515 base with tracks and the other rig was mounted on a Twin Steer Volvo truck. Both rigs were dual purpose with RC and Diamond coring capability.

22

Sampling Techniques

All RC sampling was conducted using a commercially available rig mounted static cone splitter. The sampling procedures used were developed by the Legend Geology team and in summary required several steps:

|

·

|

All RC samples were collected for each 1 metre of drilling.

|

|

·

|

All samples for analysis were designed to weigh between 1 and 3 kilograms. This is the standard weight required for sample preparation at commercial laboratories.

|

|

·

|

A second field duplicate was collected at the same time for every sample.

|

|

·

|

All sample reject through the cone splitter was also collected and has been stored in a temporary bag farm on site. These samples may be required for further analysis so have been tagged and stored in order.

|

|

·

|

A combined sample weight was measured using on site scales and logged into the database. Each sample was also weighed for comparison to ensure no bias from the sampling technique.

|

|

·

|

Each sample was tested in the field using the modified Shapiro test for estimated phosphate concentrations. If a sample returned a positive result in the field then it was submitted to the lab for analysis.

|

|

·

|

For each hole two field duplicates were submitted to the lab for analysis. Comparison of assay results from field duplicates is designed to test the suitability and accuracy of the sampling technique.

|

|

·

|

Samples that were not to be analysed due to geological reasons were then coded with a -999 grade for the database. This then ensures each metre of drilling is coded with either a pre-determined code or an assay grade.

|

|

·

|

A set of matrix matched reference standards were inserted into the lab submission for QAQC purposes. Standards were submitted to the lab at a rate of 1 in 25 samples. A coarse blank sample was also inserted for submission at a rate of 1 in 25 samples.

|

|

·

|

Diamond core samples were generally collected in 1.5m core runs, except where ground conditions dictated shorter run lengths. To ensure diamond core sample integrity was maintained, each run of diamond drill core recovered on the rig was transferred from the inner tube to a PVC split. The split would then sit inside the core tray and hold the core in place. This was particularly effective in maintaining the sample integrity of highly oxidised, friable core samples.

|

Drill Sample Recovery

All samples were weighed in the field using calibrated digital scales accurate to the gram. Each sample was weighed, including the original sample, the duplicate and the reject sample. The data was recorded on site and monitored by the field geologist to ensure no great fluctuations occur while drilling.

Recorded sample weights were compared to expected sample weights, as derived by calculating the volume of the cylindrical sample at 1m long and 120-132mm in diameter. The expected weight of the sample was then calculated using the average bulk density value for the sediment type.

The direct comparison of recorded sample weights against expected sample weights highlights whether any potential sample bias has occurred as a result of the drilling or sample collection technique.

All diamond drilling had core recoveries measured and calculated while at the rig. Generally all recoveries for diamond drilling were greater than 85%, but where less than 85% recovery occurred, the main issue noted by the driller’s were cavities that occur in the Beetle Creek Formation. These were identified as drilled, and logged.

Drill Sample Logging

The logging of all RC chips and Diamond core from the deposit was carried out by qualified geologists who provided daily supervision of the rigs for the duration of the program. Logging of chips and core was done in a qualitative manner directly into a field notebook computer and data was entered into the database several times a week. The level of detail obtained from the chips/core during the logging process has been deemed sufficient to support the mineral resource estimation process and metallurgical studies that have been carried out. Whilst in the field, geologists were significantly assisted with regards to assessing P2O5 content of chips/core by using the modified Shapiro test, a chemical visual colorimetric test that was developed in the 1960’s. This allowed a quantitative estimate of phosphate content to be obtained at the time of drilling and that data was subsequently used as a tool to select intervals for assay. Once assays were returned, these definitive results were combined with the geological logs in order to create a model for resource estimation.

23

All logging was conducted using pre-determined codes, as outlined in the Legend ‘Manual of Standardised Geological Procedures’. Lithology codes can only be entered into the database as set, and any non-recognised codes would be rejected when loaded into the database. Any coding errors were sent back to the geologist responsible for correction.

Laboratory sub-sampling techniques and preparation

For typical RC holes, samples were usually a 1-3kg sub-split taken from all chips recovered over any given 1m down-hole sample interval. All sample splits collected were sent to ALS Laboratories in Mt Isa and/or Brisbane or Amdel laboratories in Mt Isa. All samples were split and pulverised, with lab splits taken at the preparation stage for cross-checking of the sample prep stage. All samples were pulverised in a tungsten carbide mill. A quartz wash was processed through the mill between each sample due to the sometimes clayey nature of the phosphorite ore. The quartz wash ensures no inter-sample contamination.

Legend also included a coarse blank sample (glass quality beach sand) to be used to assess the sample preparation stage. These blanks are known to contain P2O5 levels below detection and therefore would identify any preparation contamination.

At all stages through the sampling process a duplicate system was used. The duplicates used and reported at all stages were;

|

·

|

Field duplicate – taken on the drill rig to test sampling technique.

|

|

·

|

Lab Splits – samples taken at the sample preparation stage to ensure prep techniques are suitable.

|

|

·

|

Lab repeats – a repeat assay analysis of the final pulp.

|