Attached files

| file | filename |

|---|---|

| EX-21 - EXHIBIT 21 - LEGEND INTERNATIONAL HOLDINGS INC | a6643680ex21.htm |

| EX-31.2 - EXHIBIT 31.2 - LEGEND INTERNATIONAL HOLDINGS INC | a6643680ex31-2.htm |

| EX-32.1 - EXHIBIT 32.1 - LEGEND INTERNATIONAL HOLDINGS INC | a6643680ex32-1.htm |

| EX-31.1 - EXHIBIT 31.1 - LEGEND INTERNATIONAL HOLDINGS INC | a6643680ex31-1.htm |

| EX-32.2 - EXHIBIT 32.2 - LEGEND INTERNATIONAL HOLDINGS INC | a6643680ex32-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

———————

FORM 10-K

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

|

|

ACT OF 1934

|

|

|

For the fiscal year ended: December 31, 2010

|

|

|

or

|

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

|

|

|

ACT OF 1934

|

|

|

For the transition period from: _____________ to _____________

|

|

Commission File Number 000-32551

LEGEND INTERNATIONAL HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

———————

|

Delaware

|

23-3067904

|

|

|

(State or Other Jurisdiction

|

(I.R.S. Employer

|

|

|

of Incorporation or Organization)

|

Identification No.)

|

Level 8, 580 St Kilda Road Melbourne, Victoria, 3004, Australia

(Address of Principal Executive Office) (Zip Code)

011 (613) 8532 2866

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

———————

|

Securities registered pursuant to Section 12(b) of the Act: None

|

||

|

Securities registered pursuant to Section 12(g) of the Act:

|

||

|

Title of each class

|

||

|

Common Stock, par value $.001 per share

|

||

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

||||||||

|

Yes

|

x

|

No

|

||||||

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

|

||||||||

|

Yes

|

x

|

No

|

||||||

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

||||||||

|

x

|

Yes

|

No

|

||||||

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data file required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for any such shorter period that the registrant was required to submit and post such file).*The registrant has not yet been phased into the interactive data requirements.

|

||||||||

|

Yes

|

No

|

|||||||

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

|

||||||||

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

|

||||||||

|

Large accelerated filer

|

Accelerated filer

|

x

|

||||||

|

Non-accelerated filer

|

Smaller reporting company

|

|||||||

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

|

Yes

|

x

|

No

|

|||||

|

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

|

||||||||

|

The aggregate market value based on the average bid and asked price on the over-the-counter market of the Registrant’s common stock, (“Common Stock”) held by non-affiliates of the Company was US$134,064,506 as at June 30, 2010.

There were 226,399,674 outstanding shares of Common Stock as of March 15, 2011.

|

||||||||

|

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

|

||||||||

|

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

|

||||||||

|

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

|

||||||||

|

Yes

|

No

|

|||||||

|

DOCUMENTS INCORPORATED BY REFERENCE

|

||||||||

|

Not Applicable

|

||||||||

|

INDEX

|

|||||

|

1

|

|||||

|

37

|

|||||

|

40

|

|||||

|

41

|

|||||

|

41

|

|||||

|

42

|

|||||

|

47

|

|||||

|

48

|

|||||

|

57

|

|||||

|

58

|

|||||

|

58

|

|||||

|

58

|

|||||

|

60

|

|||||

|

61

|

|||||

|

65

|

|||||

|

72

|

|||||

|

74

|

|||||

|

76

|

|||||

|

77

|

|||||

|

78

|

|||||

Information Regarding Forward Looking Statements

This report and other reports, as well as other written and oral statements made or released by us, may contain forward looking statements. Forward looking statements are statements that describe, or that are based on, our current expectations, estimates, projections and beliefs. Forward looking statements are based on assumptions made by us, and on information currently available to us. Forward-looking statements describe our expectations today of what we believe is most likely to occur or may be reasonably achievable in the future, but such statements do not predict or assure any future occurrence and may turn out to be wrong. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. The words "believe," "anticipate," "intend," "expect," "estimate," "project", "predict", "hope", "should", "may", and "will", other words and expressions that have similar meanings, and variations of such words and expressions, among others, usually are intended to help identify forward-looking statements.

Forward-looking statements are subject to both known and unknown risks and uncertainties and can be affected by inaccurate assumptions we might make. Risks, uncertainties and inaccurate assumptions could cause actual results to differ materially from historical results or those currently anticipated. Consequently, no forward-looking statement can be guaranteed. The potential risks and uncertainties that could affect forward looking statements include, but are not limited to:

|

|

§

|

the risks of mineral exploration stage projects,

|

|

|

§

|

political risks in foreign countries,

|

|

|

§

|

risks associated with environmental and other regulatory matters,

|

|

|

§

|

exploration risks and competitors,

|

|

|

§

|

the volatility of phosphate, diamond and other mineral prices,

|

|

|

§

|

estimates of proven and probable reserves are subject to considerable uncertainty,

|

|

|

§

|

movements in foreign exchange rates,

|

|

|

§

|

increased competition, governmental regulation,

|

|

|

§

|

performance of information systems,

|

|

|

§

|

ability of the Company to hire, train and retain qualified employees,

|

|

|

§

|

the availability of sufficient, transportation, power and water resources, and

|

|

|

§

|

our ability to enter into key exploration and supply agreements and the performance of contract counterparties.

|

In addition, other risks, uncertainties, assumptions, and factors that could affect the Company's results and prospects are described in this report, including under the heading “Risk Factors” and elsewhere and may further be described in the Company's prior and future filings with the Securities and Exchange Commission and other written and oral statements made or released by the Company.

We caution you not to place undue reliance on any forward-looking statements, which speak only as of the date of this document. The information contained in this report is current only as of its date, and we assume no obligation to update any forward-looking statements.

|

Business.

|

GENERAL

The terms “Legend,” “Company,” “we,” “our,” and “us” refer to Legend International Holdings, Inc. unless the context suggests otherwise.

Legend has been an exploration stage company since August 2006. During February 2011, the Company announced its maiden mineral reserve for its 100% owned Paradise South phosphate project in accordance with SEC Industry Guide 7. As a result of establishing mineral reserve estimates, Legend will be entering into the development stage for this project as it engages in the process of preparing the mineral deposit for extraction, while it continues with its other various exploration activities.

1

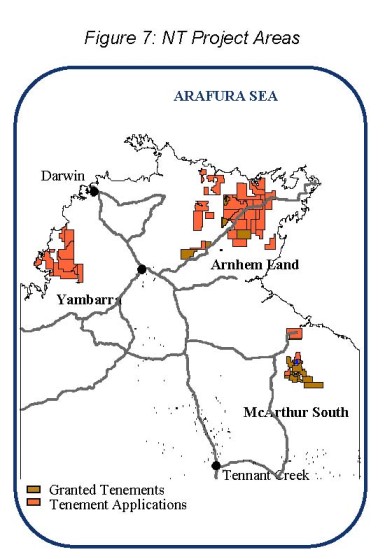

We have an additional objective to exploit our interest in certain exploration tenements which are in Queensland and the Northern Territory of Australia. Our exploration target is for base metals and diamonds and we are seeking to determine whether they are present in commercially economic quantities on our tenements to develop an operating mine.

Currency

We use the Australian dollar as our reporting currency, since we are headquartered in Australia and our administrative expenses are incurred in Australian dollars. References to dollars are to Australian dollars (A$) unless otherwise indicated as being United States dollars (US$). For the convenience of the reader, the Australian Dollar figures for the year ended December 31, 2010 have been translated into United States Dollars (“US$”) using the rate of exchange at December 31, 2010 of A$1.00=US$1.0163.

History

Legend was incorporated in the State of Delaware on January 5, 2001 under the name Sundew International, Inc. On March 13, 2003, Legend filed for an Amendment to its Certificate of Incorporation pursuant to which the name of Sundew International, Inc. was changed to "Legend International Holdings, Inc."

Following the change of management in November 2004, the Company developed a new plan of operations, which was to engage in mineral exploration activities.

Effective as of March 3, 2006, the Company entered into a Contract for the Sale of Mining Tenements (“Contract”) with Astro Diamond Mines N.L. (“Astro”) an Australian company pursuant to which the Company acquired certain diamond exploration tenements in Northern Australia from Astro.

In November 2007, Legend acquired a number of phosphate exploration interests in the State of Queensland in Australia.

In August 2009, Legend acquired a controlling interest in North Australian Diamonds Limited (“NADL”), an Australian company with diamond interests in the Northern Territory of Australia.

During the 2009 year, the Company took a private placement of shares in Northern Capital Resources Corp. (“NCRC”). During the 2010 year, the Company took additional private placements in NCRC to increase its holding to 31.46% at December 31, 2010.

Legend has not been involved in any bankruptcy, receivership or similar proceeding. Legend has not been involved in any material reclassification, merger consolidation, or purchase or sale of a significant amount of assets not in the ordinary course of business.

SEC Reports

We file annual, quarterly, current and other reports and information with the SEC. These filings can be viewed and downloaded from the Internet at the SEC’s website at www.sec.gov. In addition, these SEC filings are available at no cost as soon as reasonably practicable after the filing thereof on our website at www.lgdi.net. These reports are also available to be read and copied at the SEC’s public reference room located at Judiciary Plaza, 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the public reference room by calling the SEC at 1-800-SEC-0330.

DESCRIPTION OF BUSINESS

Business

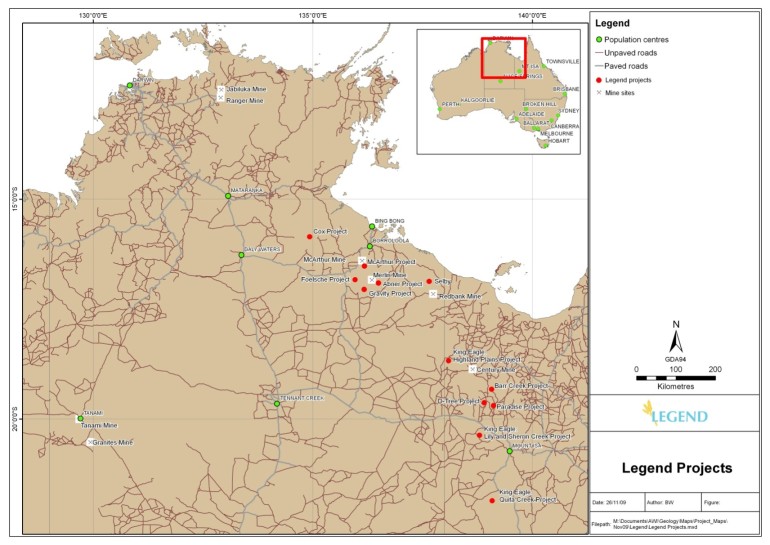

Legend is primarily focused on the development of mining, beneficiation and processing of its 100% owned phosphate mineral reserves near Mount Isa in northwest Queensland, Australia. Legend has a phased implementation plan to become a leading supplier of the high analysis phosphate fertilizers DAP (Diammonium Phosphate) and MAP (Monoammonium Phosphate) and the valuable by-product Aluminum Fluoride (AlF3).

2

Legend has been an exploration stage company since August 2006. During February 2011, the Company announced its maiden mineral reserve for its 100% owned Paradise South phosphate project in accordance with SEC Industry Guide 7. As a result of establishing mineral reserve estimates, Legend will be entering into the development stage for this project as it engages in the process of preparing the mineral deposit for extraction, while it continues with its other various exploration activities.

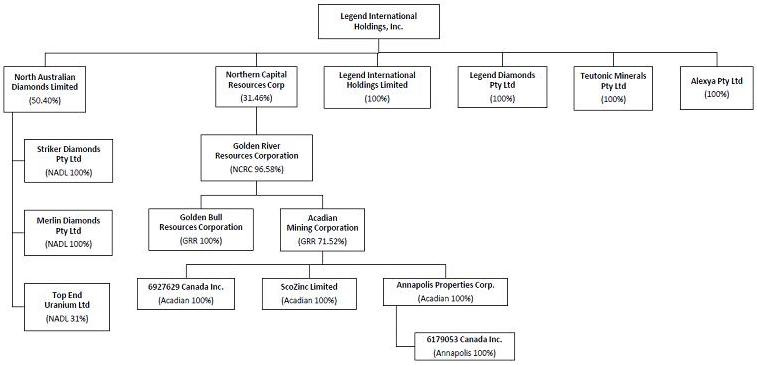

The following chart sets forth the Company’s corporate organization as of December 31, 2010:

Legend’s flagship project is the Paradise South phosphate project in which phosphate mineral reserves have recently been estimated. The Paradise South phosphate project has also been the subject of a detailed feasibility study in 2010 which showed that the project is technically and economically feasible. The phosphate interests are managed by Legend through a dedicated development team.

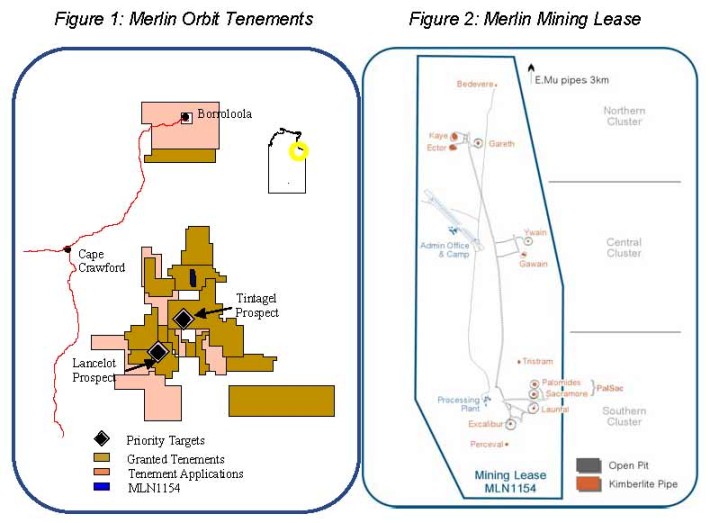

Legend, in accordance with its initial strategy of exploration for various mineral commodities across northern Australia (with a focus on diamond exploration) also controls and maintains landholdings in the Northern Territory of Australia. These interests are managed by Legend through a dedicated exploration team.

Legend owns a controlling interest in North Australian Diamonds Ltd (NADL) which controls the Merlin Diamond Mine in the Northern Territory, Australia and includes NADL’s 31% interest in Top End Uranium Ltd. The Company also has an investment in Northern Capital Resources Corporation which controls gold and zinc assets in Nova Scotia, Canada. These are outlined in further detail below.

PARADISE SOUTH PHOSPHATE PROJECT

During 2010 Legend completed a feasibility study for the Paradise South project and also developed mineral reserve estimates as reported below.

Phosphate Mineral Reserves

In development of the mineral reserve estimate Legend aimed to define reserves for a minimum 30 year mine life to support the base case scenario of producing 600,000 tonnes per year of Diammonium Phosphate (DAP) and Monoammonium Phosphate (MAP) high analysis phosphate fertilizers, for 30 years as covered by Legend’s feasibility study which is further discussed below. The resulting mineral reserve estimate was above expectations with the following highlights:

3

|

|

Ø

|

Proven and probable phosphate rock reserves that will support 59 years of operation for the production of 600,000 tonnes of DAP per year or 29 years at a doubled rate of production.

|

|

|

Ø

|

‘As-mined’ proven and probable ore reserves of phosphorite of 196.2 million tonnes at 14.6% P2O5.

|

|

|

Ø

|

Proven and probable mineral reserves of recoverable, commercially useable and internationally marketable phosphate rock concentrate of 55.5 million tonnes at 33% P2O5 (72 BPL).

|

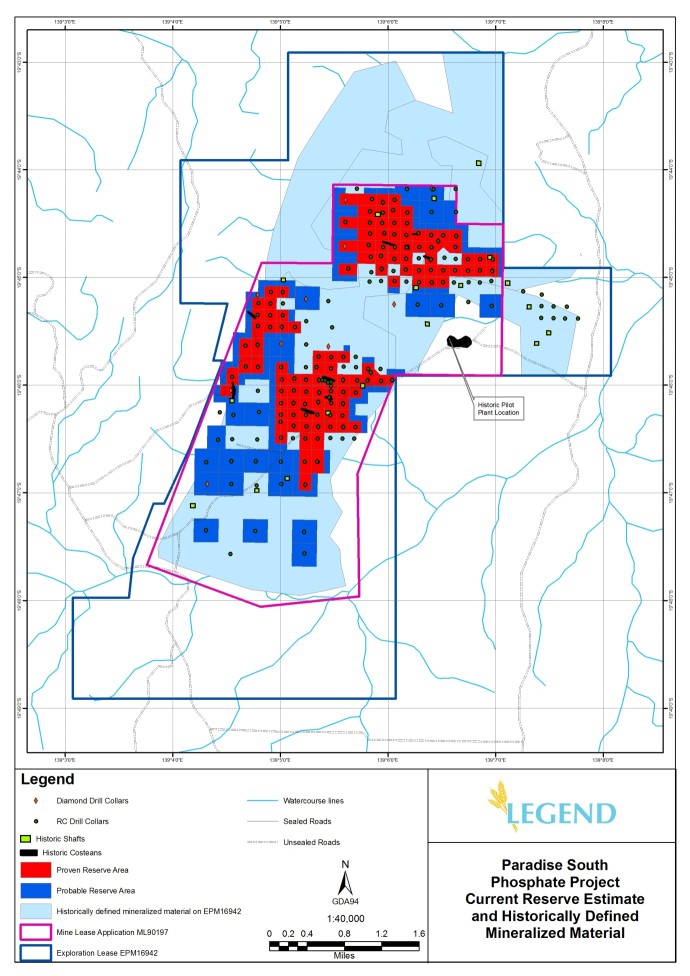

The reserve area targeted by recent drilling within the Paradise South Mining Lease Application (MLA90197 – see Figure 1) equates to only approximately 70% of the area that contains historically defined mineralized material within this lease and only approximately 50% of the area that contains historically defined mineralized material within Legend’s exploration licence EPM16942 (see Figure 2). The current reserve estimates correlate well to historical (1970’s) estimates. This supports potential further increases in reserve tonnage upon successful future drilling results within areas that have not recently been tested with modern drilling techniques but have reported phosphate intersections in historical drilling information.

Paradise South is one of seven phosphate rock deposits being explored or developed by Legend and is the first to have a current mineral reserve estimate reported. All seven deposits however have historically reported mineralized material of significant tonnage.

The reserve estimate is presented below in Table 1 as both “as-mined” ore reserves of phosphorite which will provide feed for the beneficiation plant to be located at Paradise South, and the recoverable commercially useable or marketable phosphate rock concentrate or “product” mineral reserves achievable from the ore reserves. The ore reserves and mineral reserves cannot be aggregated as the mineral reserves represent the recoverable product derived from the ore reserves after beneficiation of the phosphorite. Reserve classifications are as defined in the U.S Securities and Exchange Commission’s Industry Guide No. 7 (see Glossary of Terms).

The “as-mined” proven ore reserves of the Paradise South phosphorite deposit are currently estimated at 98.0 million tonnes of phosphorite at 15.3% P2O5. The Paradise South phosphorite deposit contains additional probable ore reserves estimated at 98.1 million tonnes of phosphorite at 13.9% P2O5. The total proven and probable ore reserves are estimated at 196.1 million tonnes of phosphorite at 14.6% P2O5. These reserves are based on a block model, typical of industry standards, developed from 180 drill holes using reverse circulation drilling technology and 32 cored diamond drill holes.

The recoverable, proven mineral reserves of the Paradise South phosphorite deposit are currently estimated at 28.9 million tonnes of phosphate rock concentrate at 33.1% P2O5 (72.4 BPL). The Paradise South phosphorite deposit contains additional probable mineral reserves estimated at 26.6 million tonnes of phosphate rock concentrates at 32.9% P2O5 (71.8 BPL). The total proven and probable mineral reserves are estimated at 55.5 million tonnes of phosphate rock concentrates at 33.0% P2O5 (72.1 BPL). These reserves are based on a block model, typical of industry standards, developed from 180 drill holes using reverse circulation drilling technology, 32 cored diamond drill holes and a beneficiation process developed specifically for Legend’s phosphorite ore types.

The production scenario of producing 600,000 tonnes per year of DAP fertilizer requires approximately 0.95 million tonnes per annum of phosphate rock concentrate at 33.0% P2O5 to feed Legend’s proposed Mt Isa Fertilizer Complex. The above proven and probable phosphate rock concentrate reserves of 55.5 million tonnes therefore provide a total project life estimated at 59 years. This mine life calculation is based on recovering 93% of the P2O5 from the rock concentrate during the acidulation process and 95% of the P2O5 during the DAP/MAP granulation process. It is also based on producing only DAP containing 46% P2O5. A doubled production scenario would provide an estimated total project mine life of 29 years. Producing both MAP and DAP at a 2:1 production ratio at 600,000 tonnes per year would reduce the total mine life to 54 years due to the higher P2O5 content of MAP (52% P2O5).

Proven reserves are based on an area of influence for each drill hole not to exceed 20 acres (8 hectares). Probable reserves are based on an area of influence for each drill hole not to exceed 40 acres (16 hectares).

It is reasonable to expect that additional fill-in drilling to reduce the drill hole area of influence will result in the reclassification of probable reserves into the proven category. Legend may endeavor to expand the Paradise South proven and probable reserves in future drilling seasons.

4

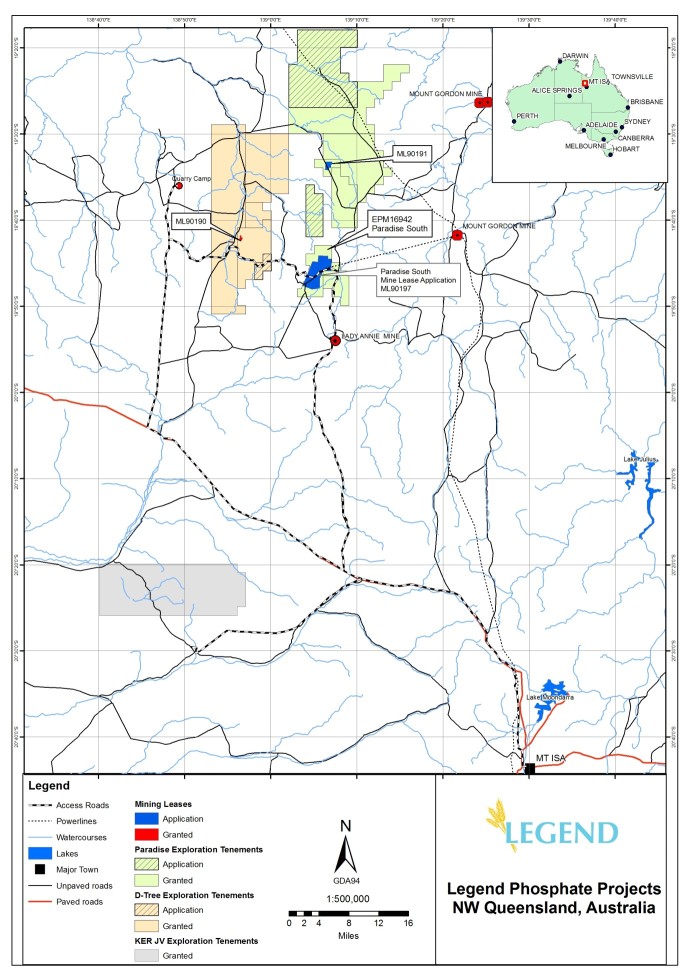

Figure 1 - Location and access to Paradise South.

5

Figure 2 – Paradise South Reserve Blocks

6

Table 1. Ore & Mineral Reserves for the Paradise South Phosphate Rock Deposit.

|

(1) (2) ORE RESERVES - "As-Mined” Phosphorite (Pre Processing)

|

||||||||||

|

Tonnes

(Millions)

|

%P2O5

|

Average BPL

|

%Fe2O3

|

%Al2O3

|

%MgO

|

%CaO

|

||||

|

Proven

|

98.0

|

15.3

|

33.4

|

6.5

|

2.6

|

0.4

|

21.3

|

|||

|

Probable

|

98.1

|

13.9

|

30.4

|

6.1

|

2.4

|

0.4

|

19.3

|

|||

|

Total

|

196.1

|

14.6

|

31.9

|

6.3

|

2.5

|

0.4

|

20.3

|

|||

|

Acres

|

Hectares

|

(3)Overburden

|

(3)Ore

|

(3)Interburden

|

||||||

|

Proven

|

1,277

|

517

|

10.1

|

10.5

|

2.3

|

|||||

|

Probable

|

1,315

|

532

|

13.4

|

10.2

|

3.2

|

|||||

|

Total

|

2,592

|

1,049

|

11.8

|

10.4

|

2.8

|

|||||

|

(4) (2) MINERAL RESERVES - Recoverable Phosphate Rock Concentrate (Post Processing)

|

||||||||||

|

Tonnes

(Millions)

|

%P2O5

|

Average BPL

|

%Fe2O3

|

%Al2O3

|

%MgO

|

%CaO

|

||||

|

Proven

|

28.9

|

33.1

|

72.4

|

(5)3.0

|

0.8

|

0.2

|

47.0

|

|||

|

Probable

|

26.6

|

32.9

|

71.9

|

(5)2.9

|

0.8

|

0.2

|

46.6

|

|||

|

Total

|

55.5

|

33.0

|

72.1

|

(5)2.9

|

0.8

|

0.2

|

46.8

|

|||

|

|

(1)

|

Ore reserves are defined here as the phosphorite ore material for the beneficiation plant. It is “as-mined” material and is before screening and processing in the proposed flotation beneficiation plant to be located at Paradise South. All ore reserves are in areas that are fully accessible for mining; free of surface or subsurface encumbrance, legal setbacks, environmental reserves and other legal restrictions that preclude permittable access for mining; believed by us to be permittable within a reasonable timeframe; and meet specified minimum physical, economic and chemical criteria related to current mining and production practices of the industry.

|

|

|

(2)

|

Proven and Probable Reserves have been estimated by Henry J. Lamb (a member of the American Institute of Professional Geologists and Licensed Professional Geologist Registered in the states of Florida and North Carolina), who has more than 30 years experience in the exploration, development, valuation and operation of phosphorite deposits throughout the world including the United States, Peru, Egypt, Iraq, Uganda, Australia, Jordan, and Kazakhstan. Mr. Lamb is an independent consultant contracted to Legend. During this project, Mr. Lamb had opportunities to observe portions of the drilling and sampling activity, reviewed analytical and metallurgical laboratory procedures, reviewed the geologic database, converted the phosphorite ore information to phosphate rock concentrate (product); reviewed the operating cost model, and independently estimated the proven and probable reserves based on phosphate industry accepted procedures and standards. In preparing this proven and probable phosphate rock concentrate reserve estimate, Mr. Lamb relied upon his independent examination of geologic, metallurgical, and cost estimate data provided by Legend. Throughout the exploration and development program, Mr. Lamb has been an independent Technical Advisor to the Legend staff and project management regarding the exploration and development of the Paradise South Phosphorite Deposit.

|

|

|

(3)

|

Overburden, ore and interburden are reported here as average thicknesses in vertical metres.

|

|

|

(4)

|

Mineral reserves are defined here as the recoverable rock concentrate post screening and processing of the ore through the proposed flotation beneficiation plant to be located at Paradise South. This material is therefore a subset of the ore reserves and cannot be aggregated with the ore reserves. These reserves are in areas that are fully accessible for mining; free of surface or subsurface encumbrance, legal setbacks, environmental reserves and other legal restrictions that preclude permittable access for mining; believed by us to be permittable within a reasonable timeframe; and meet specified minimum physical, economic and chemical criteria related to current mining and production practices of the industry.

|

7

|

|

(5)

|

Please see comments below in the section on Metallurgy titled “Investigative studies on the Fe2O3 content” which details testwork that shows less than 50% of the iron contained in the rock concentrate leaches into the phosphoric acid due to the iron species being less amenable to acidulation than other known iron species.

|

Commodity Pricing

Legend currently intends to use its Paradise South phosphate rock concentrate mineral reserves in its own Mt Isa Fertilizer Complex proposed for construction at the development site in Mt Isa, Queensland, Australia, to produce the high analysis phosphate fertilizers MAP and DAP. Profit will be attributable to the Fertilizer Complex rather than the phosphate rock mine. Legend has therefore optimized the Paradise South reserve estimates with the aim of achieving average mining and processing costs across the life of mine to be consistent with similar new phosphate developments around the world, and within an acceptable range of costs estimated in Legend’s 2010 feasibility study to achieve similar profit margins as estimated in the study.

The feasibility study assumed a long term average DAP selling price equivalent to US$445 per tonne sold FOB Tampa (US$531 FOB Townsville) which reported cash margins of US$210 per tonne of DAP produced. The DAP price FOB Tampa used is within 2% of CRU Group’s(1) long term 10 year average forecast from 2010 to 2019. It is worth noting that current spot prices for DAP are over US$620(2) per tonne FOB Tampa (approx. $706 FOB Townsville) as of 3 March 2011. The 3 year historical average (2008-2010) for DAP FOB Tampa is US$597 per tonne (3) (approx.US$683 FOB Townsville). All Australian dollar costs were converted to USD at a rate of 1.00 AUD = 0.85 USD.

|

|

(1)

|

CRU Group are commodity research analysts who currently publish fertilizer prices in the weekly, industry recognized, publication FERTILIZER WEEK.

|

|

|

(2)

|

Sourced from recognized fertilizer industry weekly price publications.

|

|

|

(3)

|

Data provided by CRU Group.

|

Location and Access

The Paradise South Phosphate deposit is located approximately 130 kilometers to the North West of Mt Isa in north-western Queensland. Access from Mt Isa is via the main Barkly Highway, which connects Mt Isa to Tennant Creek in the Northern Territory, for 67km, then via the McNamara Highway, which is a well maintained haul road used by the Lady Annie Copper Mine, for about 50km, then via farm access roads for a further 10 kilometers (see Figure 1). The farm access roads have been maintained by Legend sub-contractors for the duration of drilling and exploration activities.

Paradise South is part of the EPM16942 lease, which is one of 12 exploration tenements covering 7 phosphate deposits granted to Legend or its joint venture partner King Eagle Resources Ltd, located in Queensland, Australia.

Mining Tenure

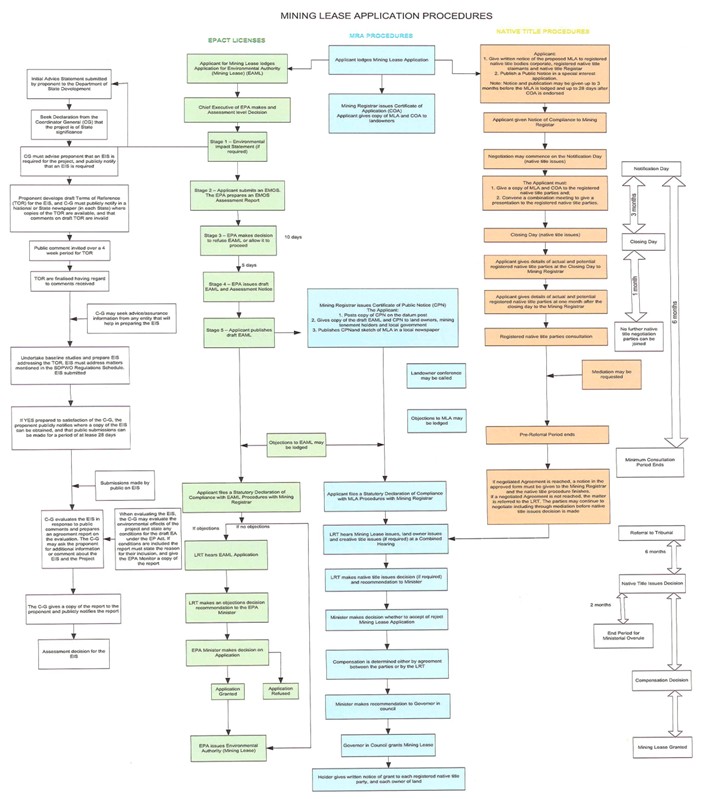

Legend currently has a Mining Lease Application (MLA) being processed by the Queensland Government for MLA 90197, Paradise South (See Figure 1) and a granted exploration permit EPM16942 which encompasses the entire mineral reserve as reported above. The MLA process involves approval through the Environmental Protection (EP) Act, Native Title Act (NTA) and Mineral Resources Act (MRA). The flow chart below (Figure 3) describes the interrelated approval process in accordance with these Acts.

Due to the scale of the proposed Paradise South production, Legend has voluntarily submitted an application to undertake an Environmental Impact Statement (EIS) under the EP Act for the Paradise South mine lease (MLA 90197), beneficiation plant and associated infrastructure. Legend agreed to the Terms of Reference (TOR) for the EIS with the Queensland Government’s Department of Environment & Resource Management (DERM) on June 30, 2010, and these were advertised in a public notice on July 3, 2010. Post wet-season environmental surveys were undertaken in 2010 and all data required for the environmental studies of the EIS is now available. Legend was granted a ‘Right to Negotiate’ under the NTA for the Paradise South mine lease as advertised in a public notice on May 5, 2010. Legend continues to negotiate access and compensation agreements as required by the NTA and MRA for the Paradise South mine lease with the local indigenous group, pastoralists and mining companies – some of which are parties who have already provided consent in respect of the Paradise North mine lease application (MLA90191).

Legend has reasonable expectations that MLA90197 for Paradise South will be granted within approximately 12 months although exact timeframes will not be known until closer to the time of grant. This is well within the current projected timelines for the project development which is currently forecasting mining production to begin in 2017 at this location. Legend has already successfully been granted a Mining Lease (ML90190) over a portion of the D-Tree deposit which demonstrates Legends ability to work within the Queensland Government’s procedures to successfully secure mining tenure. Legend has also submitted a Mining Lease Application for Paradise North (MLA90191) which is anticipated to be granted within the next few months and is the proposed location of initial mining for the project beginning in 2013. Reserves for Paradise North are currently being estimated and will be reported later this year.

8

Figure 3 – Mining Lease Application Procedures

Project History

The Paradise South Mineral Reserve estimate forms part of the historical phosphate deposit known as Lady Annie which was discovered in 1967 by Broken Hill South Ltd (BH South). BH South reported historical tonnages of mineralized material in 1972 using 54,499 meters of rotary percussion drilling, 33 shafts and 10 deep trenches which provided feed to a pilot plant which was constructed on site and operated for 1 year in 1973 processing 64,000 tonnes of material. The phosphate rock concentrate produced from the pilot plant achieved grades between 32% P2O5 and 36% P2O5 and was used to produce DAP and MAP in full scale plant testing by international fertilizer manufacturers (Rogers, J.K. and Keevers, R.E., 1976).

9

Feasibility studies were carried out by BH South with a view to the development of the Lady Annie deposit and included investigation of mining and beneficiation, transportation, port location, power and water supply and townships. Results of these studies were positive however subsequent market events caused development to be postponed.

In 1980 Western Mining Corporation (WMC) and Conzinc Rio Tinto of Australia (CRA) made a successful bid for BH South and in 1990 acquired all the remaining shares in Queensland Phosphates Ltd which was the company holding the phosphate assets in Queensland.

In 2005 WMC was taken over by BHP Billiton Ltd who then sold its Queensland Phosphate assets to Incitec Pivot Ltd in 2006. Legend successfully applied for and was granted the exploration permit in 2007.

Legend commenced drilling at Paradise South in 2009, operated a pilot beneficiation plant in late 2009 and completed a feasibility study in 2010 which has culminated in this initial reserve estimate to support the project defined in the 2010 feasibility study.

Geology

Regional Geology

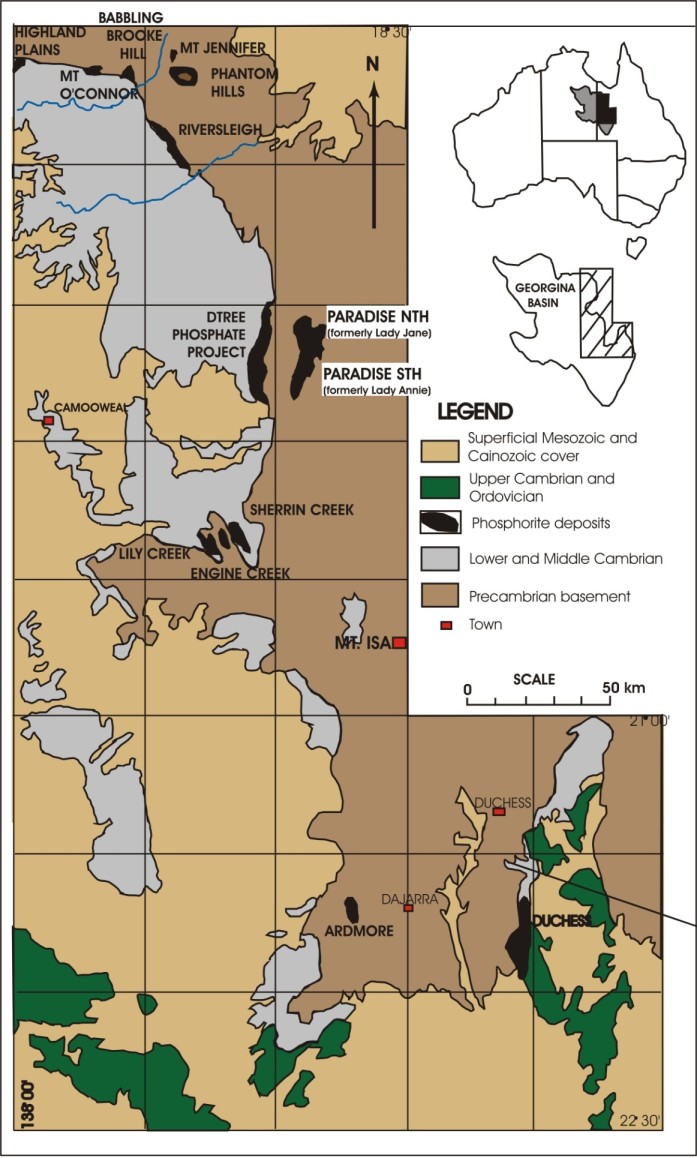

The majority of Australia’s sedimentary phosphorite (phosphate rock ore) reserves lie within early Middle Cambrian successions of the Georgina Basin in northwest Queensland and northeast Northern Territory (see Figure 4). Some eighteen named, discrete phosphorite deposits occur within the lower Middle Cambrian Beetle Creek Formation, or its stratigraphic equivalent the Border Waterhole Formation, that are basal in the stratigraphy of the Georgina Basin.

The Georgina Basin is a broad intracratonic basin covering some 325,000 km2 of western Queensland and east-central Northern Territory (Shergold and Druce, 1980). The basin is bound by Proterozoic basement of the Mount Isa Block and South Nicholson Basin to the east and north; and by the Tennant Creek Block and the Arunta Complex to the west and south.

Sediments within the Georgina Basin consist mainly of Cambrian to Middle Ordovician marine sedimentary rocks. The Cambrian and Early Ordovician sediments are dominated by marine carbonate rocks with minor sandstone and siltstone, while the Middle Ordovician rocks are comprised primarily of siltstone and sandstone. Silurian to Devonian freshwater sandstone and Permian boulder beds overlie the early Palaeozoic Georgina Basin succession and are thought to represent younger successions laid down in later basins. Throughout the basin, sediments have been deformed by minor to moderate folding and faulting, with moderate to strong folding, faulting and overthrusting along the southern margin.

10

Figure 4 - Location of major phosphorite deposits of the Georgina Basin, northwest Queensland (after Rogers and Keevers, 1976).

11

Local Geology

Due to considerable exploration efforts in the 1960’s and 70’s the local geology of the Paradise South area has been well-described in several publications, namely Rogers and Keevers (1976), Thomson and Russell (1971) and Thomson and Rogers (1974). The results of the current drilling program concur with the findings of the historic drilling results and geological interpretation. The geology description herein is derived from both historic and recent observation and results.

The Paradise South phosphorite deposit, discovered in the late 1960’s and formerly known as the Lady Annie phosphorite deposit, is located in an outlier of the Georgina Basin, separated from the D-Tree deposit to the west by outcropping Precambrian sediments (Figure 4). It is confined to an area of low relief, approximately 25 km long and 5 km wide, trending north-south between ridges and hills of Precambrian shales, quartzites, siltstones and dolomite. The sedimentary phosphate rock was deposited in an embayment of the inland sea that covered the Georgina Basin during the early Middle Cambrian.

Stratigraphy of the embayment hosting the Paradise South phosphorite is comprised of sediments of Cambrian and Mesozoic age, with some thin overlying Tertiary and Recent deposits. The phosphatic unit that comprises the reserves defined herein is the Beetle Creek Formation. The most prominent units of the Paradise South project area are as follows:

|

|

●

|

Tertiary laterite and silcrete up to 5m thick.

|

|

|

●

|

Mesozoic quartz sandstones, micaceous mudstone and coarse conglomerate beds. These sediments are mostly confined to the western boundary of the Paradise South project area, adjacent to the Western Fault and can be up to 40m thick.

|

|

|

●

|

The Inca Formation of Middle Cambrian age consists of well-laminated fissile shale with some interbeds of siltstone and minor chert. This unit has a recorded maximum thickness of 24m in the project area.

|

|

|

●

|

The Beetle Creek Formation of Lower Middle Cambrian age consists of beds of phosphorite, siltstone, shale and chert. Phosphorite lithologies include friable pelletal phosphorite and soft clayey phosphatic mudstone. This unit attains a maximum thickness of 46.5m in the Paradise South project area.

|

|

|

●

|

The Thorntonia Limestone underlies the Beetle Creek Formation on the eastern margin of the Paradise South project area. In contrast to the Beetle Creek Formation this unit is characterized by dolomitic limestone containing abundant chert nodules. The thickness of this unit is highly variable and reaches a maximum of 16m.

|

|

|

●

|

The Mt Hendry Formation forms the basal unit of the Cambrian stratigraphy and is typically a 2m thick conglomerate with lesser sandstone.

|

Drilling, Sampling and Metallurgical Testing

Legend has completed 180 reverse circulation (RC) drill holes within the MLA area of the Paradise South Phosphorite Deposit and an additional 32 core diamond drill holes have been completed with 23 of those diamond drill holes being twins to the reverse circulation drill holes.

The cored diamond drill holes were 83mm in diameter and intersected the full thickness of the phosphate rock horizon. Diamond core samples were generally collected in 1.5m core runs, except where ground conditions dictated shorter run lengths. To ensure diamond core sample integrity was maintained, each run of diamond drill core was transferred from the inner tube to a PVC split placed inside the core tray to hold the core in place. This was particularly effective in maintaining the sample integrity of highly oxidised, friable core samples.

12

The RC drill holes were 120mm in diameter and extended to variable depths each of which was sufficient to intersect the anticipated and full thickness of the phosphate rock bearing horizon. RC sampling was conducted using a commercially available rig-mounted static cone splitter. The sampling procedures were developed by the Legend Geology team and required several steps:

|

|

●

|

The RC samples were composites, collected for each 1 metre interval.

|

|

|

●

|

A cone splitter was used to collect a 1 to 3 kilogram subsample for ore interval assaying. A second field duplicate was collected at the same time for future reference.

|

|

|

●

|

All sample reject through the cone splitter was collected, labelled and stored in a temporary storage area at Paradise South and are available for future testing.

|

|

|

●

|

A combined sample weight was measured using on site scales and logged into the database.

|

|

|

●

|

Each sample was tested in the field using the modified Shapiro test for estimating phosphate content. A sample returning a positive field test result was submitted to the analytical laboratory for final analysis.

|

|

|

●

|

For each hole two field duplicates were submitted for analytical testing.

|

|

|

●

|

A set of matrix matched reference standards were inserted into the lab submission for QA/QC purposes. Standards were submitted to the lab at a rate of 1 in 25 samples. A coarse blank sample was also inserted for submission at a rate of 1 in 25 samples.

|

Drill Sample Recovery

All drill samples were weighed in the field using calibrated digital scales accurate to the gram. Each sample was weighed, including the original sample, the duplicate and the reject sample. The data was recorded on site and monitored by the field geologist to ensure no unacceptable fluctuations in sample recovery occurred while drilling.

Recorded sample weights were compared to expected sample weights, as derived by calculating the volume of the cylindrical sample. The expected weight of the sample was then calculated using the average bulk density value for the sediment type. The direct comparison of recorded sample weights against expected sample weights highlights whether any potential sample bias has occurred as a result of the drilling or sample collection technique.

All diamond drilling had core recoveries measured and calculated while at the rig. Generally all recoveries for diamond drilling were greater than 85%, but where less than 85% recovery occurred, the main issue noted by the driller’s were cavities that occur in the Beetle Creek Formation. These were identified as drilled, and logged.

Drill Sample Logging

The logging of all RC chips and Diamond core from the deposit was carried out by qualified geologists who provided daily supervision of the rigs for the duration of the program. Logging of chips and core was done in a qualitative manner directly into a field notebook computer and data was entered into the database several times a week. The level of detail obtained from the chips/core during the logging process has been deemed sufficient to support the mineral reserve estimation process and metallurgical studies that have been carried out. Whilst in the field, geologists were significantly assisted with regards to assessing P2O5 content of chips/core by using the modified Shapiro test, a chemical visual colorimetric test that was developed in the 1960’s. This allowed a quantitative estimate of phosphate content to be obtained at the time of drilling and that data was subsequently used as a tool to select intervals for assay. Once assays were returned, these definitive results were combined with the geological logs in order to create a model for reserve estimation.

13

All logging was conducted using pre-determined codes, as outlined in the Legend ‘Manual of Standardised Geological Procedures’. Lithology codes can only be entered into the database as set, and any non-recognised codes would be rejected when loaded into the database. Any coding errors were sent back to the geologist responsible for correction.

Laboratory sub-sampling techniques and preparation

For typical RC holes, samples were usually a 1-3kg sub-split taken from all chips recovered over any given 1m down-hole sample interval. All sample splits collected were sent to ALS Laboratories in Mt Isa and/or Brisbane or Amdel laboratories in Mt Isa. All samples were split and pulverised, with lab splits taken at the preparation stage for cross-checking of the sample prep stage. All samples were pulverised in a tungsten carbide mill. A quartz wash was processed through the mill between each sample due to the sometimes clayey nature of the phosphorite ore. The quartz wash ensures no inter-sample contamination.

Legend also included a coarse blank sample (glass quality beach sand) to be used to assess the sample preparation stage. These blanks are known to contain P2O5 levels below detection and therefore would identify any preparation contamination.

At all stages through the sampling process a duplicate system was used. The duplicates used and reported at all stages were:

|

|

●

|

Field duplicate – taken on the drill rig to test sampling technique.

|

|

|

●

|

Lab Splits – samples taken at the sample preparation stage to ensure prep techniques are suitable.

|

|

|

●

|

Lab repeats – a repeat assay analysis of the final pulp.

|

All of these duplicates are analysed and reported internally as monthly QA/QC statistics for the deposit.

Where core samples have been submitted for assay, half core samples were taken using a manual diamond blade core saw. Before cutting, diamond cores were metre marked and assessed to make sure all of the pieces of core were positioned to conform to the original orientation, i.e. all core breaks were aligned. Core samples were then crushed at the laboratory prior to being riffle split into sub-samples and prepared for analysis by the same method used for RC samples.

Quality of Assay Data

Samples were assayed by one of two analytical techniques; 1) wavelength dispersive X-ray fluorescence spectrometry and/or 2) an ICP acid digest method that conforms to the internationally accepted analytical method of the Association of Fertiliser and Phosphate Chemists (AFPC).

XRF methodology

The samples were dried at 105°C, pulverised and an aliquot taken for XRF analysis. The pulp was fused using a Lithium-Borate flux mixture with a Sodium-Nitrate oxidant. The fusion disks were analysed using wavelength dispersive X-ray fluorescence spectrometry for the following suite of elements and reported according to their total ‘oxide’ form as follows:

|

|

●

|

P2O5, Fe2O3, Al2O3, MgO, SiO2, CaO and LOI

|

ICP acid digest methodology

The samples are dried at 105°C, pulverised and an aliquot taken for acid digest in two parts nitric acid, two parts water and 1 part hydrochloric acid. The acid digest method conforms to one of the internationally accepted analytical methods of the Association of Fertilizer and Phosphate Chemists (AFPC). The specific method is ICP Method 3D-2. The acid digest is then analysed using the multi-element inductively coupled plasma atomic emission spectrometer (ICP-AES). The standard assay suite for the ICP analytical technique is:

|

|

●

|

P2O5, Al2O3, Fe2O3, MgO, CaO

|

14

The accuracy and precision of the analytical techniques used were tested through the use of standards. The standards used for all of Legend’s drilling programs consist of commercially manufactured, matrix matched, certified standard reference material. The standards were manufactured and supplied by Ore Research & Exploration Pty Ltd based in Bayswater in Melbourne. Each standard was analysed at ten commercial laboratories by lithium borate fusion with XRF or ICP finish.

The material used for these standards was sourced from the Paradise South deposit from several different locations to simulate the different ore types recognised throughout the Georgina Basin. During manufacture two pigeon pair samples of close range were produced. These standards were submitted during drilling. These standards were used as their mean grades (and their ranges) are close together, thus making it harder for a lab to identify which one is being used.

These standards are pre-prepared so require no milling at the lab, therefore they are only used to test the pure analytical technique and not sample preparation. Each standard is individually wrapped and submitted unmarked; therefore the laboratory will not know which standard is being submitted.

Lab Repeats

During analysis each laboratory was required to repeat the analysis on approximately 1 in 25 samples. This is to test the analytical technique at the data capture stage. Once assay analysis was complete all sample rejects and sample pulps were returned to Legend for storage in a secure facility in Mt Isa.

Metallurgy

Beneficiation Process Testing

For the metallurgical test work conducted on the Paradise South phosphorite in 2010, 39 samples were composited from the phosphorite horizon/s from 22 diamond holes and 4 RC holes. Legend processed 32 out of the 39 composited Paradise South drill core and reverse circulation samples through their beneficiation flow sheet to model the relationships between ore and concentrate analyses for P2O5 (See Table 2 below) and the main impurity species Fe2O3, Al2O3, MgO and CaO. Each selected metallurgical diamond and RC drill core was individually dry tumbled and screened at 25mm to remove silica in the +25mm fraction. The -25mm fractions were wet milled to a minimum P80 150 microns and then filtered to at least 75% solids. This slurry was then systematically conditioned with flotation reagents including a collector and an iron depressant at 75% solids before being diluted to approximately 20% solids with water and transferred to the pilot scale flotation cell. Rougher, scavenger and cleaner flotation was completed on each sample, followed by filtering, drying, and weighing of the products. Each product was assayed for P2O5, Fe2O3, Al2O3 and CaO by ICP and MgO and SiO2 by XRF.

The results of this work allowed Legend to calculate the mineral reserve tonnes in terms of phosphate rock concentrate product. These samples provided a full range of phosphorite samples and variations of the primary chemical components (P2O5, Fe2O3, Al2O3, MgO and CaO) in the ore and the resulting primary chemical components after the initial crushing and sizing, in the flotation feed, and in the phosphate rock concentrate. From these metallurgical tests it was possible to develop high-quality, strongly correlated regression formulas to convert the ore assays to reliable estimates of the concentrate chemistry and the amount of recoverable product.

15

Table 2 – Reserve Beneficiation Sample Tests – Original Ore Sample and After Beneficiation Concentrate Grades

|

Sample

|

Drill Hole

|

Original Sample Mass (kg)

|

Original

Sample Grade

(% P2O5)

|

Original

Sample Grade

(% Fe2O3)

|

Original

Sample Grade

(% Al2O3)

|

Original

Sample Grade

(% CaO)

|

Original

Sample Grade

(% MgO)

|

Conc

Sample

Mass (kg)

|

Conc

Sample

Grade

(% P2O5)

|

Conc

Sample

Grade

(% Fe2O3)

|

Conc

Sample

Grade

(% Al2O3)

|

Con

Sample

Grade

(% CaO)

|

Concentrate Sample

Grade (% MgO)

|

|

JC1

|

PSRC0156

|

53.37

|

7.79

|

3.65

|

2.99

|

22.84

|

8.14

|

7.66

|

19.4

|

1.57

|

0.54

|

39.8

|

8.97

|

|

JC2

|

PSRC0157

|

59.44

|

16.75

|

8.47

|

5.65

|

24.22

|

0.76

|

12.41

|

34.4

|

2.48

|

0.86

|

50.1

|

0.54

|

|

JC3

|

PSRC0148

|

57.73

|

19.74

|

6.99

|

5.45

|

27.94

|

0.95

|

12.39

|

36.4

|

2.19

|

0.86

|

50.2

|

0.46

|

|

JC4

|

PSDD0001

|

76.38

|

20.89

|

7.27

|

5.72

|

30.10

|

0.46

|

17.55

|

33.3

|

2.27

|

1.34

|

48.1

|

0.26

|

|

JC5a

|

PSDD0002

|

28.96

|

22.91

|

5.01

|

3.57

|

32.04

|

0.22

|

11.11

|

36.7

|

2.13

|

0.66

|

50.7

|

0.08

|

|

JC5b

|

PSDD0002

|

41.34

|

12.11

|

20.89

|

3.86

|

16.56

|

0.28

|

10.12

|

9.08

|

46.5

|

1.27

|

11.5

|

0.28

|

|

JC6a

|

PSDD0003

|

43.99

|

16.01

|

4.83

|

2.93

|

23.06

|

0.91

|

8.08

|

33.4

|

1.61

|

0.7

|

49

|

1.62

|

|

JC6b

|

PSDD0003

|

31.25

|

4.77

|

0.96

|

1.43

|

29.75

|

14.97

|

13.93

|

4.98

|

0.62

|

0.27

|

33.5

|

17.3

|

|

JC7

|

PSDD0007

|

76.23

|

16.83

|

5.45

|

6.28

|

24.04

|

1.03

|

18.73

|

33

|

3.33

|

1.14

|

47.5

|

1.18

|

|

JC8

|

PSDD0008

|

38.13

|

14.77

|

4.97

|

6.66

|

21.34

|

0.71

|

7.03

|

34.9

|

1.96

|

0.82

|

49.5

|

1.17

|

|

JC9a

|

PSD0009

|

28.15

|

21.68

|

4.49

|

3.01

|

30.42

|

0.34

|

5.28

|

34.8

|

1.93

|

0.69

|

49.6

|

0.28

|

|

JC9b

|

PSD0009

|

31.84

|

8.92

|

6.60

|

8.72

|

12.70

|

0.61

|

9.66

|

27.5

|

7.3

|

1.49

|

39.5

|

0.34

|

|

JC10

|

PSD0010

|

46.7

|

6.92

|

7.32

|

20.26

|

1.23

|

41.24

|

3.34

|

30.4

|

1.98

|

1.01

|

47.8

|

1.17

|

|

JC11a

|

PSD0014

|

46.93

|

7.61

|

2.13

|

5.35

|

9.94

|

0.23

|

5.28

|

29.3

|

4.16

|

1.89

|

40.6

|

0.28

|

|

JC11b

|

PSD0014

|

23.94

|

10.42

|

15.07

|

5.83

|

14.22

|

0.33

|

5.82

|

29.3

|

9.6

|

2.04

|

40.7

|

0.21

|

|

JC12

|

PSD0015

|

23.69

|

14.62

|

7.52

|

3.67

|

20.85

|

0.53

|

11.79

|

30.1

|

3.69

|

1.43

|

43.8

|

0.44

|

|

JC13

|

PSD0016

|

30.63

|

9.77

|

2.99

|

6.94

|

13.89

|

0.55

|

3.61

|

34.3

|

2.05

|

0.94

|

49.4

|

0.59

|

|

JC14

|

PSDD0017

|

30.8

|

9.13

|

7.56

|

4.08

|

14.05

|

1.22

|

3.04

|

30.4

|

2.38

|

0.91

|

45.4

|

1.06

|

|

JC15

|

PSDD0021

|

19.65

|

15

|

7.52

|

3.97

|

20.42

|

0.26

|

3.66

|

27.9

|

8.17

|

2.08

|

38.1

|

0.24

|

|

JC16a

|

PSRC0141

|

62.76

|

17.15

|

16.76

|

3.30

|

23.82

|

0.25

|

9.84

|

34.1

|

5.87

|

1.11

|

46.8

|

0.15

|

|

JC16b

|

PSRC0141

|

54.5

|

17.06

|

16.79

|

3.27

|

23.69

|

0.25

|

28.21

|

33.2

|

6.99

|

1.34

|

45.9

|

0.18

|

|

JC17

|

PSRC0141

|

34.7

|

5.66

|

0.87

|

4.61

|

7.53

|

0.16

|

2.55

|

34.7

|

1.17

|

2.23

|

46.6

|

0.19

|

|

JC18

|

PSRC0151

|

67.9

|

16.26

|

5.44

|

6.31

|

24.33

|

1.69

|

12.81

|

31.6

|

3.62

|

0.9

|

46.7

|

2.24

|

|

JC19

|

PSRC0151

|

42.1

|

12.21

|

12.25

|

5.47

|

18.36

|

1.71

|

3.7

|

32.9

|

4.11

|

1.02

|

46.2

|

1.5

|

|

JC20

|

PSDD0025

|

59.14

|

18.01

|

13.53

|

3.22

|

25.04

|

0.38

|

16.9

|

32.4

|

8.07

|

0.75

|

46.1

|

0.22

|

|

JC21

|

PSDD0022

|

59.11

|

27.06

|

3.36

|

2.70

|

38.04

|

0.26

|

15.59

|

36

|

2.06

|

0.7

|

51

|

0.15

|

|

JC22a

|

PSDD0024

|

69.8

|

30.69

|

3.03

|

1.51

|

41.96

|

0.08

|

15.15

|

37.2

|

2.22

|

0.77

|

50.8

|

0.06

|

|

JC22b

|

PSDD0024

|

37.79

|

10.27

|

5.88

|

4.32

|

14.43

|

0.39

|

3.89

|

33

|

3.99

|

0.98

|

45.3

|

0.15

|

|

JC23a

|

PSDD0042

|

35.17

|

15.76

|

2.57

|

5.00

|

21.77

|

0.37

|

8.39

|

33.9

|

1.79

|

1.08

|

47.1

|

0.23

|

|

JC23b

|

PSDD0042

|

33.8

|

14.34

|

6.72

|

4.01

|

20.16

|

0.43

|

7.98

|

33.2

|

4.02

|

0.67

|

45.6

|

0.2

|

|

JC24a

|

PSDD0144

|

41.4

|

14.18

|

10.85

|

5.06

|

20.96

|

1.32

|

8.34

|

31.3

|

3.95

|

0.77

|

46.4

|

1.52

|

|

JC24b

|

PSDD0144

|

56.1

|

8.85

|

6.84

|

4.98

|

14.00

|

1.85

|

3.88

|

28.6

|

2.79

|

0.89

|

43.6

|

2.64

|

Investigative Studies of the Fe2O3 Content

Many phosphorite deposits in the Georgina Basin have a higher than normal Fe2O3 content when compared to the typical world phosphorite deposits. This results in a higher than normal MER (Minor Element Ratio) defined as the metallic contents of Fe2O3 + Al2O3 + MgO divided by the P2O5. In the case of the Paradise South Deposit, the MER ratio for the phosphate rock concentrates is 0.12 compared to the more common ratio of 0.10.

16

Legend commissioned definitive chemical and mineralogical studies to define the behavior of the Fe2O3 in the Paradise South phosphate rock concentrates. Phosphoric acid testing at an independent laboratory (Crescent Technologies in New Orleans, Louisiana) and at the company laboratories of IFFCO (Indian Farmers Fertilizer Cooperative (India) and Wengfu (China) confirmed that approximately 50% of the iron content was not reporting to the phosphoric acid; therefore, the phosphoric acid MER was acceptable for manufacturing ammoniated granular phosphate-base fertilizers (DAP). Further testing of several phosphate rock concentrate samples with varying Fe2O3 contents were acidulated with the phosphate rock concentrate, the acidulation residue, and the phosphoric acid being assayed and the residue mineralogy being defined by QEM-SCAN (Quantitative Evaluation of Minerals by SCANning electron microscopy). The electron microscopy work clearly indicated than much of the residual solids from the phosphoric acid test was goethite, an iron mineral, which resisted acidulation. Further, the goethite particles contained apatite inclusions and voids that appeared to be similar to the apatite inclusions but indicated that some of the apatite inclusions had been acidulated.

Table 3 below shows some results from these tests and indicates only 29.2%, 11.6% and 21% of the Fe2O3 in these phosphate rock concentrate leaches into the resulting phosphoric acid. Mineralogical examination concluded that the Fe2O3 in Paradise South phosphorite is present as the refractory mineral goethite and does not leach as readily as other Fe2O3 minerals. These three samples were selected for testing due to their higher than typical Fe2O3 contents. Approximately 82 grams were used for the iron leach tests which were split from a 0.5kg sample of concentrate derived from individual composited drill core samples.

Additional tests with samples representing higher Fe2O3 contents are being planned. The results of those tests may result in an increase in the Paradise South reserve tonnage estimate as higher levels of Fe2O3 could potentially be processed.

Table 3- Iron solubilities in phosphoric acid.

|

Sample

|

Rock

Concentrate Units Fe2O3 |

Phosphoric

Acid Units Fe2O3 |

Fe2O3

Extraction % to acid |

|

JC14

|

2.12

|

0.62

|

29.2

|

|

JC19

|

3.20

|

0.37

|

11.6

|

|

JC20

|

6.92

|

1.45

|

21.0

|

Bulk Density Testing

Bulk density and associated tonnage calculations have been determined from a series of diamond holes distributed across the Paradise South phosphorite deposit. A bulk density sampling program was carried out on diamond core samples from 17 locations with a total of 281 samples. In each drill core, samples were taken from each identified lithology, which in most cases involved taking samples at intervals ranging from 0.5 - 2m. Whole drill core samples, typically of minimum 100mm length and up to 350mm in length, were submitted to the laboratory for bulk density analysis using a standard Archimedes method. Dried core samples were coated in paraffin wax and then weighed in air and again in a liquid of known density, i.e. water, and the bulk density calculated from the difference in weights. The dry bulk densities were determined from samples from the mineralized horizon and for host rock and waste rock lithologies.

A review of the bulk density data relative to lithology and assay grades showed that a range of bulk density values were recorded in the ore zone. The bulk density of the ore zone is generally 1.9, and the range in bulk density values may be attributed to the different lithologies that comprise the ore zone. For example, mudstone phosphorite, also known as microsphorite, tends to show lower bulk density than peloidal and replacement phosphorite.

17

Differences in clay content and varying states of oxidation and porosity of the ore zone throughout the deposit, may also contribute to the range in bulk density.

The overburden bulk density is generally quite similar to the phosphate zone, likely reflecting an indistinct boundary and contrast between phosphate and waste lithologies.

Table 4 below gives a statistical summary of the bulk density data from within the ore and waste zones.

For the reserve estimate, a conservative bulk density of 1.8 tonnes per cubic meter was used to convert measured phosphorite volumes to phosphorite tonnes.

Table 4: Statistical summary of bulk density data taken from Paradise South core samples and coded according to the resource model domain for ore composite intervals and waste.

|

Ore

|

Waste

|

|

|

Mean

|

1.89

|

2.04

|

|

Standard Error

|

0.02

|

0.05

|

|

Standard Deviation

|

0.24

|

0.29

|

|

Sample Variance

|

0.06

|

0.09

|

|

Confidence Level (95.0%)

|

0.04

|

0.09

|

Note that bulk density data are given in units of tonnes per cubic metre.

2010 PARADISE FEASIBILITY STUDY

A feasibility study on the Paradise South project was completed in July 2010. The study was based on a project that involves development of a beneficiation plant at Paradise South to upgrade the phosphorite ore into a phosphate rock concentrate suitable for phosphate-based fertilizer manufacture. The phosphate rock concentrate will be transported to Mount Isa for treatment in a purpose built DAP/MAP fertilizer manufacturing facility. The DAP, MAP and AlF3 will be transported from Mount Isa to the Port of Townsville via rail for local and international markets. A feasibility study conducted in 2010 outlined that the project was technically and economically viable for the base case scenario as described below:

|

|

Ø

|

Transport approximately 1 million tonnes of upgraded ore by road from Paradise South to the proposed Mt Isa Fertilizer Complex.

|

|

|

Ø

|

Direct acidulation in Legend’s proposed phosphoric acid plant of upgraded ore to produce approximately 300ktpa phosphoric acid using approximately 800ktpa of sulfuric acid (200ktpa sourced from local smelters and 600ktpa produced in Legend’s sulfuric acid plant, using imported sulfur).

|

|

|

Ø

|

Import of approximately 100ktpa of liquid ammonia (NH3) to combine with phosphoric acid in the ammonium phosphate plant to enable granulation of MAP and DAP in a ratio dependent on market conditions but currently assumed at 400ktpa MAP and 200ktpa DAP.

|

|

|

Ø

|

Production of 15ktpa of aluminum fluoride (AlF3) through Wengfu’s proprietary technology for their self-developed dry process. This marketable chemical product is used in the aluminum industry which currently has a strong demand both locally in Australia and in overseas markets.

|

|

|

Ø

|

Water for the phosphoric acid plant will be sourced from the Lake Julius water allocation. Water will be transferred from Lake Julius to Lake Moondarra via the existing transfer pipeline. An existing pumping station and new pipeline from Lake Moondarra will service the phosphoric acid plant.

|

|

|

Ø

|

Power for phosphoric acid plant will come from the Ergon Energy eastern transmission line near Mica Creek Power Station.

|

|

|

Ø

|

Transport 600ktpa of MAP/DAP and 15ktpa aluminium fluoride in containers on flat bed rail wagons from Mt Isa to the Port of Townsville using 2 train sets for sale on the local and international markets.

|

18

Transport

During 2010, Legend, its rail operator P&O Trans Australia and Queensland Rail commenced negotiations for a rail access agreement for the transport of approximately 700,000 ton per year of phosphate products from Mount Isa to Townsville and the transport of sulfur and ammonia between Townsville and Mount Isa.

Queensland Rail confirmed that subject to the successful execution of an access agreement including agreement of a rail operating plan, the required capacity in the form of train paths is currently available for the proposed operations.

The Mount Isa Line Master Plan released in late 2009 clearly identifies infrastructure solutions available should additional incremental capacity be required. A commitment has been by the Queensland Government to support the first tranche of capacity enhancements. The Queensland Government announced in December 2009 that it will commit AUD$102 million to upgrades to the Mt Isa to Townsville rail line over the next two years. These upgrades will be aimed at increasing efficiency and capacity for future demand. This announcement is consistent with Legends own discussions with the Queensland government and in particular the Premier of Queensland who has given the Legend Phosphate project her full support. Completion of these works will increase current system capacity by approx. 1.5 million tonnes per annum.

Legend also engaged Pipeline Systems International (PSI) to undertaken a conceptual study for assessment of a slurry pipeline to transport the beneficiated phosphate ore from the deposit site to existing rail facilities. The option would involve a dewatering facility at the rail terminal and return water pipelines to the beneficiation plant following the route of the slurry pipeline. The dewatered phosphate concentrate would be loaded into rail wagons and make their way via rail to the Port of Townsville for storage and loading to ship.

Water supply

Beneficiation Plant

Three water supply options are under consideration for the beneficiation plant:

|

|

1.

|

Lake Julius option

|

Legend engaged SunWater to undertake a pre-feasibility study to assess the option of directing up to 10GL of unallocated water from Lake Julius to the proposed mine and beneficiation plant. Lake Julius is located approximately 85 kilometers east southeast of the proposed mine and beneficiation plant. The findings of this study will be compared against the other options presented below but initial findings are that the water supply is available to Legend and it is technically feasible to bring this water to the proposed site.

|

|

2.

|

Thorntonia Borefield option

|

Legend has commenced commercial negotiations in regard to the lease of an existing borefield water permit. The borefield water will need to be pumped approximately 45 kilometers to the beneficiation plant via an above ground pipeline.

|

|

3.

|

Upper Battle Creek Dam

|

Legend has investigated the potential to develop new surface water storages in the catchment; Lower Gunpowder Creek, Upper Gunpowder Creek, Battle Creek and Upper Battle Creek. Upper Battle Creek is the preferred site. Conceptual studies including a yield analysis, geotechnical reconnaissance, visual assessment, conceptual design and capital expenditure estimate have been completed.

19

The dam is intended to supply a proposed phosphate mine for a period of 30 years. With a catchment area of 162 ha, the estimated yield of the storage is 2500 ML/a at 90% reliability, requiring a storage capacity of 10,000 ML.

The spillway excavation will provide all or most of the rock needed for the dam. Subject to drilling, the rock appears to be of high quality. A rock fill dam with a concrete slab on the upstream face is considered the most suitable, requiring much smaller concrete plant.

Legend have estimated the Probable Maximum Flow (PMF) inflow in Upper Battle Creek as 1000 m³/s. Assuming a 75 m wide spillway channel invert, the maximum flood rise would require a dam wall about 20 m high. Increasing the width to 150 m, the flood rise is less and the embankment height (and rock volume) is reduced to 16.5 m. The corresponding volume of rock is about 90,000 m³.

Fertiliser Complex

The water for Mount Isa and its mining industries is sourced from Lake Moondarra on the Leichhardt River. The water supply of Lake Moondarra is sustained in dry years by water pumped from Lake Julius further downstream on the Leichhardt River. The full supply capacities of Lake Moondarra and Lake Julius are 107,000ML and 107,500ML respectively. Water supply licenses from Lake Moondarra are fully allocated. There is 10,800ML per year of unallocated water available from Lake Julius. A 1200ktpa DAP/MAP Fertiliser Complex (doubled production scenario) requires 2,800 ML per year of makeup water.

Water demand for the Mt Isa Plant will be met by unallocated water from Lake Julius. Mount Isa Water Board (MIWB) can provide water for the Fertiliser Complex plant from Lake Julius via the Lake Moondarra transfer system. Supply will be taken at a flange immediately downstream from the Mount Isa Transfer Reservoir and this will be fed to the battery limit of the Fertiliser Complex via a 600mm diameter pipeline.

Power supply

Beneficiation Plant

Generation

Legend has commenced commercial negotiations with local power generators in regards to the supply of power for the proposed beneficiation plant with a load factor of 80% for a 24 hr-7 day a week operation.

Power distribution option

Legend has made a connection enquiry to Ergon Energy for a connected load to the existing Century Zinc 220kV 100 MVA line. This transmission line passes within 40km of the proposed beneficiation plant.

Fertiliser Complex

There are three options for power generation:

|

|

1.

|

Mica Creek is a 325MW natural gas fired power plant, located one kilometre to the north of the proposed Fertiliser Complex site. Legend has received an offer to connect from CS Energy to meet the power requirements for the Fertilizer Complex

|

|

|

2.

|

Legend is one of five Foundation Mining Customers of the CopperString project. The CopperString project is a proposal to construct a transmission line from Woodstock (south of Townsville) to Dajarra Road near Cloncurry in North West Queensland. The proposed transmission line will provide Legend with access to the National Electricity Grid, significantly improving the supply and reliability of electricity to the region.

|

|

|

3.

|

Legend also continues to negotiate with APA regarding its proposed gas-fired power station near the Fertilizer Complex.

|

20

Depending on the generation option a 220kV or 132kV powerline form Mica Creek Substation (or APA substation) will be used to distribute power to an on-site substation. The plants within the Fertilizer Complex operate on a 11kV system.

One waste heat recovery power station is proposed for this project, in which a 25MW and 11.5kV steam turbine generator is provided. During normal operation, the generating unit of the power station can provide approximately 25MW power with a further 36.3MW power required from the external network. In the event that the generator fails the entire power demand of 61.3MW will be sourced from the external grid.

Environment

Mt Isa Fertilizer Complex

Legend has submited a Development Application through Mount Isa City Council to be assessed under the Sustainability Planning Act (2009) with the Department of Environment & Resource Management and Department of Transport & Main Roads as concurrency authorities.

Legend has completed the following studies in relation to the fertilizer complex which have been submitted to the Mount Isa City Council:

|

|

●

|

Road Impact Assessment

|

|

|

●

|

Workforce Management Plan

|

|

|

●

|

Landscape Response

|

|

|

●

|

Quantitative Risk Assessment

|

|

|

●

|

Traffic Management & Carparking

|

|

|

●

|

Environmental Assessment Report

|

|

|

●

|

Air Quality Impact Assessment

|

|

|

●

|

Noise Assessment

|

|

|

●

|

Flood Impact Assessment

|

|

|

●

|