Attached files

| file | filename |

|---|---|

| 8-K - WaferGen Bio-systems, Inc. | v205599_8k.htm |

| EX-99.1 - WaferGen Bio-systems, Inc. | v205599_ex99-1.htm |

| EX-10.2 - WaferGen Bio-systems, Inc. | v205599_ex10-2.htm |

| EX-10.1 - WaferGen Bio-systems, Inc. | v205599_ex10-1.htm |

|

|

Dated

December 14, 2010

Between

Wafergen

Bio-Systems (M) Sdn Bhd

and

Wafergen

Bio-Systems Inc

and

Malaysian

Technology Development Corporation

Sdn

Bhd

and

Prima

Mahawangsa Sdn Bhd

amended

and restated

Shareholders’

Agreement

Wafergen

Biosystems (M) Sdn Bhd

Contents

|

Recitals

|

1

|

||||

|

1

|

Definitions

and Interpretations

|

2

|

|||

|

1.1

|

Definitions

|

2

|

|||

|

1.2

|

Interpretation

|

4

|

|||

|

2.

|

[Deleted]

|

5

|

|||

|

3.

|

[Deleted]

|

5

|

|||

|

4.

|

[Deleted]

|

5

|

|||

|

5.

|

Undertakings,

Warranties and Representations by the Parties

|

5

|

|||

|

6.

|

Management

of the Company

|

6

|

|||

|

6.1

|

Board

of Directors

|

6

|

|||

|

6.2

|

Board

Meetings

|

7

|

|||

|

6.3

|

Provisions

in respect of meetings

|

7

|

|||

|

6.4

|

Resolutions

|

7

|

|||

|

6.5

|

Circular

resolution

|

7

|

|||

|

6.6

|

No

shareholding requirement

|

8

|

|||

|

6.7

|

Management

|

8

|

|||

|

6.8

|

Nominees

|

8

|

|||

|

7.

|

General

meetings

|

8

|

|||

|

7.1

|

General

meetings

|

8

|

|||

|

7.2

|

Quorum

|

8

|

|||

|

7.3

|

Decisions

at meetings of the Shareholders

|

8

|

|||

|

7.3.1

|

Ordinary

Resolution

|

8

|

|||

|

7.3.2

|

Special

Resolution

|

9

|

|||

|

7.4

|

Shareholder

Reserve Matters

|

9

|

|||

|

8.

|

Business

of the Company

|

9

|

|||

|

9

|

New

Issues of Shares

|

11

|

|||

|

9.1

|

New

Issues by Company

|

11

|

|||

|

9.2

|

Offer

to Shareholders

|

11

|

|||

|

9.3

|

Waiver

|

11

|

|||

|

10.

|

Transfers,

Acquisitions and Disposal of Shares

|

11

|

|||

|

10.1

|

Pre-emption

Rights

|

11

|

|||

|

11

|

Put

Options

|

13

|

|||

|

11.1

|

Investors’

Put Right for shares in the Existing Shareholder

|

13

|

|||

|

11.2

|

Investors’

Put Option for Series A RCPS or Conversion Shares

|

14

|

|||

|

12.

|

Duration

and Termination

|

14

|

|||

|

13.

|

Previous

Agreements and Prevalence of Agreement

|

14

|

|||

|

14.

|

Remedy

on an Event of Default

|

15

|

|||

|

15.

|

Confidentiality

|

16

|

|||

|

16.

|

Deadlock

|

16

|

|||

|

16.1

|

Disputes

|

16

|

|||

|

17.

|

Further

Assurance

|

16

|

|||

Page

| i

|

18.

|

Remedies

|

16

|

||

|

19.

|

Waiver

and Variation

|

17

|

||

|

19.1

|

Rights

not affected

|

17

|

||

|

19.2

|

Cumulative

rights and remedies

|

17

|

||

|

19.3

|

Variation

|

17

|

||

|

20.

|

Severability

|

17

|

||

|

21.

|

Continuing

Effect

|

17

|

||

|

22.

|

Time

|

17

|

||

|

23.

|

Legal

Relationship

|

17

|

||

|

24.

|

Costs

and Expenses

|

17

|

||

|

25.

|

Assignment;

Successors

|

18

|

||

|

25.1

|

Assignment |

18

|

||

|

25.2

|

Successors and assigns |

18

|

||

|

26.

|

Notices

|

18

|

||

|

27.

|

Entire

agreement

|

20

|

||

|

28.

|

Counterparts

|

20

|

||

|

29.

|

Governing

Law and Jurisdiction

|

20

|

||

|

SCHEDULE

1

|

21

|

|||

|

1.

|

Subscription

Price and par value

|

21

|

||

|

2.

|

Premium

|

21

|

||

|

3.

|

Dividend

Provision

|

21

|

||

|

4.

|

Liquidation

Preference

|

21

|

||

|

5.

|

Conversion

|

21

|

||

|

6.

|

[Deleted]

|

23

|

||

|

7.

|

Redemption

Rights

|

23

|

||

|

8.

|

Voting

Rights

|

23

|

||

|

9.

|

Protective

Provisions

|

23

|

||

|

10.

|

No

Variation

|

24

|

||

|

SCHEDULE

2

|

25

|

|||

|

1.

|

Representations

and Warranties by the Investors

|

25

|

||

|

2.

|

Representations

and Warranties by the Existing Shareholder and the Company

|

25

|

||

|

SCHEDULE

3

|

27

|

|||

|

1.

|

Subscription

Price and par value

|

27

|

||

|

2.

|

Premium

|

27

|

||

|

3.

|

Dividend

Provision

|

27

|

||

|

4.

|

Liquidation

Preference

|

27

|

||

|

5.

|

Conversion

|

27

|

||

|

6.

|

[Deleted]

|

29

|

||

|

7.

|

Redemption

Rights

|

29

|

||

|

8.

|

Voting

Rights

|

29

|

||

|

9.

|

Protective

Provisions

|

29

|

||

|

10.

|

No

Variation

|

30

|

||

Page

| ii

|

SCHEDULE

4

|

31

|

|||

|

1.

|

Subscription

Price and par value

|

31

|

||

|

2.

|

Premium

|

31

|

||

|

3.

|

Dividend

Provision

|

31

|

||

|

4.

|

Liquidation

Preference

|

31

|

||

|

5.

|

Conversion

|

31

|

||

|

6.

|

[Deleted]

|

32

|

||

|

7.

|

Redemption

Rights

|

32

|

||

|

8.

|

Voting

Rights

|

32

|

||

|

9.

|

Protective

Provisions

|

32

|

||

|

10.

|

No

Variation

|

33

|

||

Page

| iii

This

Agreement is made on December 14, 2010 between:

|

(1)

|

Wafergen

Biosystems (M) Sdn Bhd (Company No 795066-H), a company

incorporated in Malaysia with a registered address at Suite 2-1, 2nd

Floor, Menara Penang Garden, 42A, Jalan Sultan Ahmad Shah, 10050 Penang,

Malaysia. (“Company”);

|

and

|

(2)

|

Wafergen

Bio-Systems, Inc (WGBS.OB), a Nevada USA incorporated company with a

registered address and place of business at 7400 Paseo Padre Parkway,

Fremont, CA 94555, USA (“Existing

Shareholder”);

|

and

|

(3)

|

Malaysian

Technology Development Corporation Sdn Bhd (Company No 235796-U), a

company incorporated in Malaysia with a registered address at Level 8,

Menara Yayasan Tun Razak, Jalan Bukit Bintang, 55100 Kuala Lumpur (“MTDC);

|

and

|

(4)

|

Prima

Mahawangsa Sdn Bhd (Company No. 833152-M), a company incorporated in

Malaysia with a registered address at 5th Floor, Bangunan CIMB, Jalan

Semantan, Damansara Heights, 50490 Kuala Lumpur (“PMSB”).

|

(The

Company, the Existing Shareholder, MTDC and PMSB are collectively referred to as

“Parties” and each as a

“Party”).

Recitals

|

(A)

|

Pursuant

to a Share Subscription and Shareholders’ Agreement dated 8 May 2008

between the Company, the Existing Shareholder and MTDC (“Shareholders’

Agreement”), MTDC agreed to subscribe for 888,888 redeemable

convertible preference shares of RM0.01 each in the capital of the Company

(“Series A RCPS”)

and the Company, the Existing Shareholder and MTDC agreed to regulate the

affairs and their relationship in the Company in accordance with the

Shareholders’ Agreement.

|

|

(B)

|

The

Existing Shareholder, the Company, Prima Mahawangsa Sdn Bhd (“PMSB”) and Expedient

Equity Ventures Sdn Bhd (“EEV”) entered into a

Share Subscription Agreement (“Subscription Agreement”)

and Deed of Adherence (“DA”) both dated 3 April

2009 where PMSB agreed to subscribe for 444,444 Series B Redeemable

Convertible Preference Shares (“Series B RCPS”) in the

Company and EEV agreed to subscribe for 222,222 Series B RCPS, pursuant to

the terms and conditions in the Subscription Agreement and Deed of

Adherence.

|

|

(C)

|

The

Existing Shareholder, the Company and Kumpulan Modal Perdana Sdn Bhd

(“KMP”) entered

into a Share Subscription Agreement (“KMP SSA”) and Deed of

Adherence (“KMP

DA”) both dated 1 July 2009 where KMP agreed to subscribe for

188,057 Series

B RCPS pursuant to the terms and conditions in the KMP SSA and KMP

DA.

|

Page

| 1

|

(D)

|

The

Existing Shareholder, the Company and MTDC have entered into this

Agreement simultaneously with a Share Subscription Agreement

dated December

2010 (“Series C

Subscription Agreement”) where MTDC agreed to subscribe for

3,233,734 Series C Redeemable Convertible Preference Shares (“Series C RCPS”) in the

Company with an option to subscribe for a further 1,077,911 Series C RCPS

pursuant to the terms and conditions in the Series C Subscription

Agreement.

|

|

(E)

|

EEV

and KMP have exercised their put option under the relevant put agreements

and exchanged the Series B RCPS held with the Existing Shareholder for

shares in the Existing Shareholder and as at the date of this Agreement,

EEV and KMP have ceased to be Series B RCPS holders in the

Company.

|

|

(F)

|

The

remaining shareholders, that is the Existing Shareholder, MTDC and PMSB

are desirous of undertaking the Business through the Company and agree to

regulate their relationship as shareholders of the Company in accordance

with the terms and conditions of this

Agreement.

|

|

(G)

|

Clause

11 is applicable only to MTDC.

|

|

(H)

|

The

current shareholding in the Company is as

follows:

|

|

Shareholder

|

Shares

|

Series A RCPS

|

Series B RCPS

|

||||||

|

Existing

Shareholder

|

300,000

|

-

|

410,279

|

||||||

|

MTDC

|

-

|

888,888

|

-

|

||||||

|

PMSB

|

-

|

-

|

444,444

|

It

is agreed as follows:

|

1

|

Definitions

and Interpretations

|

|

1.1

|

Definitions

|

In this

Agreement, unless the context otherwise requires:

|

Act

|

means

the Companies Act 1965;

|

|

Articles

|

means

the articles of association of the Company;

|

|

Board

|

means

the board of directors of the Company;

|

|

Business

|

means

the business of the Company as defined in Clause 8.1;

|

|

Conversion

Shares

|

means

the Shares resulting from the conversion of the RCPS, such Conversion

Shares to rank pari passu in all respects with all other then existing

Shares, and “Conversion Share” means one (1) of the Conversion

Shares;

|

|

Director

|

means

any director of the Company appointed on the Board including, where

applicable, any alternate

director;

|

Page

| 2

|

Encumbrance

|

means

any mortgage, charge, pledge, lien, assignment, hypothecation, security

interest, title retention, right of first refusal, pre-emption right,

option, preferential right or trust arrangement or other security

arrangement or agreement conferring a right to a priority of

payment;

|

|

Investors

|

means

MTDC, PMSB and any other person acceding to this

Agreement;

|

|

IPO

|

means

the listing of the Company on any approved stock

exchange;

|

|

Parties

|

means

the Existing Shareholder, MTDC, PMSB, and the Company, and “Party” refers

to any one (1) of them;

|

|

PMSB

|

means

Prima Mahawangsa Sdn Bhd (Company No. 833152-M), a company incorporated in

Malaysia with a registered address at 5th Floor, Bangunan CIMB, Jalan

Semantan, Damansara Heights , 50490 Kuala Lumpur;

|

|

Public

Authorities

|

includes:

(a) any

government in any jurisdiction, whether federal, state, provisional,

territorial or local;

(b) any

minister, department, officer, commission, delegate, instrumentality,

agency, board, authority or organisation of any government or in which any

government is interested;

(c) any

non-government regulatory authority; or

(d) any

provider of public utility services, whether or not government owned or

controlled;

|

|

Put

Agreement

|

means

the Put Agreement dated 28 May 2008 entered into by MTDC with the Existing

Shareholder;

|

|

RCPS

|

means

Series A RCPS, Series B RCPS and/or Series C RCPS;

|

|

RM

|

means

the lawful currency of Malaysia;

|

|

Series

A Director

|

means

the director as defined in Clause 6.1(a);

|

|

Series

B Director

|

means

the director as defined in Clause 6.1(c);

|

|

Series

C Director

|

means

the director as defined in Clause 6.1(a);

|

|

Series

A RCPS

|

means

Series A Redeemable Convertible Preference Shares of the Company with

principal terms as set out in Schedule

1;

|

Page

| 3

|

Series

B RCPS

|

means

Series B Redeemable Convertible Preference Shares of the Company with

principal terms as set out in Schedule 3;

|

|

Series

C RCPS

|

means

Series C Redeemable Convertible Preference Shares of the Company with

principal terms as set out in Schedule 4;

|

|

Shareholders

|

means

the shareholders of the Company from time to time;

|

|

Shares

|

means

ordinary shares of RM1.00 each in the share capital of the Company, and

“Share” refers to

any one (1) of them;

|

|

Subscription

Price

|

means

the Ringgit Malaysia equivalent to the subscription price paid in USD for

the RCPS calculated at the prevailing exchange rate on the

date payment of the Subscription Price is effected, paid by the

respective Investors for each RCPS, out of which RM0.01 is to be paid

towards the par value of each RCPS and the difference between the

Subscription Price and the par value of RM0.01 (constituting the

subscription premium) is to be credited to the share premium account of

the Company;

|

|

USD

|

means

the lawful currency of United States of America; and

|

|

Warranties

|

means

the representations and warranties made by the Investors, the

Existing Shareholder and the Company, as set out in Schedule

2.

|

|

1.2

|

Interpretation

|

In this

Agreement, unless the context otherwise requires:

|

|

(a)

|

headings

and underlining are for convenience only and do not affect the

interpretation of this Agreement;

|

|

|

(b)

|

words

importing the singular include the plural and vice

versa;

|

|

|

(c)

|

words

importing a gender include any

gender;

|

|

|

(d)

|

an

expression importing a natural person includes any corporation or other

body corporate, partnership, association, governmental agency, two or more

persons having a joint or common interest, or any other legal or

commercial entity or undertaking;

|

|

|

(e)

|

a

reference to a party to a document includes that party's successors and

permitted assigns;

|

|

|

(f)

|

any

part of speech or grammatical form of a word or phrase defined in this

Agreement has a corresponding meaning;

and

|

Page

| 4

|

|

(g)

|

a

warranty, representation, covenant or agreement on the part of two or more

persons binds them jointly and

severally.

|

|

2.

|

[Deleted]

|

|

3.

|

[Deleted]

|

|

4.

|

[Deleted]

|

|

4A.

|

Effective

Date

|

Notwithstanding

that this Agreement is executed simultaneously with the Series C Subscription

Agreement, the Parties agree that this Agreement shall only take effect on the

Initial Closing Date (as defined in the Series C Subscription

Agreement).

|

5.

|

Undertakings,

Warranties and Representations by the

Parties

|

|

5.1

|

Subject

to any exceptions expressly and specifically disclosed in any

correspondence, communication, document or information in writing prior to

the execution of this Agreement, the Parties warrant to each other that

the information and statements set out in the Warranties are true,

accurate and correct in all respects at the date of this

Agreement.

|

|

5.2

|

The

Parties acknowledge and agree that each of them entered into this

Agreement and the subscription by the Investors for the RCPS is in

reliance on the Warranties.

|

|

5.3

|

Each

of the Warranties is separate and is to be construed independently of the

others and is not limited by reference to any of the other

Warranties.

|

Save as

disclosed to the Investors in any correspondence, communication, document or

information in writing prior to the execution of this Agreement, no information

relating to the RCPS or the Company will limit the nature of the Warranties

given by the Company under this Agreement, or will prejudice any claim to be

made by the Investors against the Company for any breach of the

Warranties.

Each of

the Party will indemnify and will keep the other Parties indemnified against all

losses, damages, costs and expenses which the other Parties may incur or be

liable for in respect of any claim, demand, liability, action, proceedings or

suits arising out of or in connection with:

|

|

(a)

|

a

breach of a Warranty;

|

|

|

(b)

|

any

Warranty not being true and correct in all respects;

or

|

|

|

(c)

|

any

Warranty being misleading in any

respect,

|

save and

except where any of the matters set out in paragraphs 5.1 to 5.3 above shall

have been apparent in any correspondence, communication, document or information

in writing and disclosed or provided to the Investors prior to the

execution of this Agreement.

Page

| 5

|

6.

|

Management

of the Company

|

|

6.1

|

Board

of Directors

|

The Board

shall comprise 8 directors of which:

|

|

(a)

|

MTDC

shall have the right to appoint two (2) directors comprising one Series A

Director and 1 Series C Director. MTDC shall procure that (if relevant),

the Series A Director and Series C Director shall, prior to his

appointment as a director of the Company, provide a confidentiality and

non-competition undertaking to the

Company;

|

|

|

(b)

|

the

Existing Shareholder shall have the right to appoint five (5) directors

and such right shall include the appointment of the Chief Executive

Officer; and

|

|

|

(c)

|

PMSB

shall have the right to appoint one (1) director (“Series B Director”) and

PMSB shall procure that (if relevant), the Series B Director shall, prior

to his appointment as a director of the Company, provide a confidentiality

and non-competition undertaking to the

Company.

|

MTDC

shall have the right to nominate an alternate to the Series A Director and

Series C Director and the Existing Shareholder shall have the right to nominate

an alternate director to such directors appointed under paragraph 6.1(b). PMSB

shall have the right to nominate an alternate to the Series B

Director.

MTDC and

the Existing Shareholder will jointly appoint an independent director to the

Board with the requirement that the independent director has relevant

international industry experience in the Business and if such independent

director is appointed, the Existing Shareholder may only then appoint 4

directors.

The right

of appointment of the Series A Director and Series C Director shall include the

right for MTDC to remove such persons at any time from such office and also the

right to determine from time to time the period which such persons shall hold

office as the Series A Director and Series C Director. Upon MTDC

ceasing to be a shareholder in the Company, MTDC shall simultaneously procure

the resignation of the Series A Director and Series C Director . The Series A

Director and Series C Director may not be removed by the Existing Shareholder or

any other party except when MTDC ceases to be a shareholder in the

Company. Any appointment or removal of the Series A Director

and/or Series C Director by MTDC shall be made in writing and shall

be delivered to the registered office of the Company.

The right

of appointment of the Series B Director shall include the right for PMSB to

remove such person at any time from such office and also the right to determine

from time to time the period which such person shall hold office as the Series B

Director. Upon PMSB ceasing to be a shareholder in the Company, PMSB

shall simultaneously procure the resignation of the Series B Director. The

Series B Director may not be removed by the Existing Shareholder or any other

party except when PMSB ceases to be a shareholder in the Company. Any

appointment or removal of the Series B Director by PMSB shall be made in writing

and shall be delivered to the registered office of the

Company.

Page

| 6

|

6.2

|

Board

Meetings

|

The

quorum at all meetings shall be at least four (4) Directors and must include one

(1) Series A Director (or his alternate) or Series C Director (or his alternate)

and one (1) Series B Director (or his alternate). If a quorum is not

present within forty-five (45) minutes after the time appointed for the

commencement of a meeting of the Board, that meeting shall be adjourned to the

same time, seven (7) days after that meeting at the same place, provided that at

such adjourned meeting (for the same agenda), the quorum shall be any three (3)

Directors and must include one (1) Series A Director (or his alternate) or one

(1) Series C Director ( or his alternate).

The

Directors may meet together either in person or by telephone, radio, video

conference or similar communication equipment or any other form of audio or

audio-visual instantaneous communication by which all persons participating in

the meeting are able to hear and be heard by all other participants and

participation in a meeting pursuant to this provision shall constitute presence

in person at such meeting.

The

Company’s Articles shall be amended to provide that a quorum of the Board must

include at least one (1) Series A Director or one (1) Series C Director,

including at any adjourned meeting.

|

6.3

|

Provisions

in respect of meetings

|

Any

Director may at any time request for a meeting to be convened, subject to the

Board meeting at least once quarterly, unless otherwise agreed to by a vote of a

majority of Directors including at least one vote from a Series A Director

or Series C Director and at least one (1) vote from a Series B

Director. The request for a meeting must be made in writing and delivered to the

company secretary of the Company.

Upon

receiving the request, the company secretary is to issue a notice, giving at

least seven (7) days’ prior written notice to all Directors and their

alternates. The notice shall set out the date, time, venue and the agenda or

matters to be discussed for the Board meeting. Such notice shall not

be required if all Directors are present or represented at the meeting or if the

absent Directors agree in writing to waive the requirement of such

notice.

|

6.4

|

Resolutions

|

So long

as a quorum is present throughout the meeting of the Board in accordance with

clause 6.2, all resolutions or decisions of the Board are to be by a simple

majority of all the Directors present and capable of voting at the meeting of

the Board.

|

6.5

|

Circular

resolution

|

A written

resolution or minute of a decision made by the Board which is signed by all the

Directors is regarded as valid and effectual as if it had been passed at a duly

convened Board meeting. Any such written resolution or minute may consist of

several documents (or facsimiles thereof) in like form or in one or more

counterparts, each signed by one or more of the Directors, and all counterparts

taken together constitute one document.

Page

| 7

|

6.6

|

No

shareholding requirement

|

The

Directors need not be shareholders of the Company and are not liable to retire

by rotation until removed/replaced by the Party nominating them.

|

6.7

|

Management

|

The

operations of the Company will be managed by the Board, but the day to day

administration or management of the Company may be vested in a management

committee (“Management

Committee”) appointed by the Board from time to time who shall at all

times be responsible and subject to the control of the Board. The Management

Committee may comprise members of the Board.

|

6.8

|

Nominees

|

The

parties acknowledge that as the Series A Director and Series C Director

are nominees of MTDC and that the Series B Director is a nominee of

PMSB, the Series A Director, Series C and the Series B Director shall be

entitled to report all matters concerning the Company, including but not limited

to matters discussed at any meeting of the Board, to MTDC and PMSB and their

shareholders respectively and that the Series A Director and Series C Director

may take advice and obtain instructions from MTDC whereas the Series B Director

may take advice and obtain instructions from PMSB.

The

Company agrees to indemnify and keep the Series A Director, Series C Director

and Series B Director indemnified, subject to section 140 of the

Act.

|

7.

|

General

meetings

|

|

7.1

|

General

meetings

|

Annual

general meetings and extraordinary general meetings are to be held in accordance

with the provisions of the Act.

|

7.2

|

Quorum

|

The

quorum for all general meetings is two (2) persons being present throughout the

meeting, consisting of the holders of the Shares or their respective proxy,

attorney or authorised representative.

|

7.3

|

Decisions

at meetings of the Shareholders

|

|

7.3.1

|

Ordinary

Resolution

|

So long

as a quorum is present throughout the meeting of the holders of the Shares in

accordance with clause 7.2, subject to clause 7.4, a simple majority vote of

those present and voting suffices to pass an ordinary

resolution.

Page

| 8

|

7.3.2

|

Special

Resolution

|

The

approval of the holders of the Shares by way of special resolution (as defined

in the Act) is required for matters which require a special resolution to be

passed as specified in the Act.

|

7.4

|

Shareholder

Reserve Matters

|

The

resolutions in relation to the following matters require approval from all

holders of Shares present and voting at a general meeting or by circular

resolution (signed by all the holders of the Shares):

|

|

(a)

|

any

amendment to the Memorandum and Articles of Association of the

Company;

|

|

|

(b)

|

the

appointment or removal of any Director or senior management of the Company

other than the Investors’ nominated directors;

and

|

|

|

(c)

|

the

declaration of dividends by the

Company.

|

|

8.

|

Business

of the Company

|

|

8.1

|

The

core business of the Company, unless otherwise agreed in writing by the

Investors, shall be developing, manufacturing, and distributing state of

the art solutions for Gene Analysis (Gene Expression, and Genotyping) and

stem cell research and cell biology (“Business”). The

Company will not engage in any other business which detracts from, or is

not complementary to, the Business.

|

|

8.2

|

The

Business is to be carried out in accordance with all applicable laws and

requirements.

|

|

8.3

|

The

Shareholders shall use its reasonable endeavours without being required to

incur any further financial obligation (other than as expressly set out in

this Agreement) to promote the interests of the Company. The Business is

to be conducted in the Shareholders’ and the Company’s best interests on

sound commercial profit-making principles so as to generate the maximum

achievable maintainable profits available for distribution, and otherwise

in accordance with the general principles as varied from time to time by

agreement in writing between the

Parties.

|

|

8.4

|

The

Company shall not, and the Existing Shareholder shall ensure that the

Company shall not, without the prior written consent of the Investors or

as expressly stated in this

Agreement:

|

|

|

(a)

|

cease

to conduct or carry on its Business substantially as now conducted and/or

acquire or dispose of or dilute any interest in any other business,

company, partnership or sole proprietorship;

and

|

|

|

(b)

|

purchase,

sell, mortgage or charge any substantial asset, or property or any

material interest in those assets or property or sell or dispose of the

whole or a substantial part of the undertaking and goodwill or the assets

of the Company.

|

Page

| 9

|

8.5

|

The

Existing Shareholder and/or the Company shall ensure

that:

|

|

|

(a)

|

the

Company shall at all times carry on and conduct its business in a proper

and efficient manner;

|

|

|

(b)

|

each

employee and consultant of the Company enters into a confidential

information and inventions agreement (in a form acceptable to the

Investors) with the Company;

|

|

|

(c)

|

the

Company shall submit to the Investors without being formally

requested:

|

|

|

(i)

|

an

annual budget and operating plan no later than sixty (60) days prior to

the commencement of each fiscal

year;

|

|

|

(ii)

|

an

annual business plan;

|

|

|

(iii)

|

audited

financial statements on an interim and annual basis;

and

|

|

|

(iv)

|

monthly

reports, including financial reports, bank statements and technical

reports.

|

The

obligation of the Company to furnish the information set out in paragraph 8.5(c)

will cease when the Company completes its IPO or becomes subject to the

reporting provisions of any applicable stock exchange requirements or all of the

Investors cease to be a shareholder in the Company.

|

|

(d)

|

at

all times keep true accurate and up to date books and records of all the

affairs of the Company;

|

|

|

(e)

|

supply

to the Investors such information relating to the Company as it may

require and without prejudice to the foregoing shall keep the Investors

fully and promptly informed as to all material developments regarding the

Company’s financial and business affairs and promptly notify the Investors

of any significant litigation or arbitration affecting or likely to affect

the Company and of any bona fide offer to purchase or subscribe any share

capital of the Company;

|

|

|

(f)

|

at

all times be adequately insured in respect of the assets of the company

which are of an insurable nature and obtain life insurance for the core

management team of the Company, the proceeds of which are payable to the

Company; and

|

|

|

(g)

|

upon

the Company’s receipt of reasonable notice, the Investors may have access

during normal business hours to relevant non-confidential information

and/or non-competitive information requested by the Investors including

the right to visit the Company’s business premises and inspect the

Company’s record books.

|

Page

| 10

|

9

|

New

Issues of Shares

|

|

9.1

|

New

Issues by Company

|

The

Shareholders agree that any new Shares and/or RCPS issued by the Company must be

with the prior approval of the Shareholders (“Offered Shares”) and the

Offered Shares shall be first offered to each of the Shareholders in proportion

to each of their shareholding in the Company at the time of the proposed new

issue other than:

|

|

(i)

|

for

the initial issuance of the Series A RCPS to MTDC and Series B RCPS to

PMSB, EEV and KMP;

|

|

|

(ii)

|

the

issuance of the Series C RCPS pursuant to the Series C Subscription

Agreement;

|

|

|

(iii)

|

the

Conversion Shares, where

applicable;

|

|

|

(iv)

|

Shares

issued pursuant to employee share option plans approved by a majority of

the Board;

|

|

|

(v)

|

Shares

issued for merger or acquisition transactions;

or

|

|

|

(vi)

|

any

issuance excepted from the right of first refusal by a majority of the

Board.

|

|

|

(vii)

|

any

issue of new Shares to the Existing Shareholder for consideration in cash

or in kind of up to 1,000,000 Shares, in addition to the initial share

capital of RM300,000 contributed by the Existing Shareholder and for the

avoidance of doubt, any such consideration in kind may comprise

capitalization of the value (or part of the value) of intellectual

property or other rights granted or undertakings pursuant to the product

licensing agreement between the Existing Shareholder and the Company based

on the valuation of USD10,000,000 agreed by the

parties.

|

|

9.2

|

Offer

to Shareholders

|

An offer

of the Offered Shares shall be made by notice specifying the number of new

Shares and/or RCPS offered, the subscription price and limiting a period (not

being less than thirty (30) days) within which the offer, if not accepted, will

be deemed to be declined. Upon the expiration of such period the Board shall

offer the Offered Shares so declined to the other Shareholders who have notified

their willingness to take all or any of such Offered Shares in accordance with

the terms of the offer and in case of competition, pro rata (as nearly as

possible) according to the number of Shares and RCPS held by the other

Shareholders.

|

9.3

|

Waiver

|

The

Existing Shareholder and PMSB irrevocably confirm their waiver of all rights of

pre-emption whatsoever that they may have in connection with the issue and

conversion of the Series C RCPS to MTDC pursuant to the terms of this Agreement

and the Series C Subscription Agreement.

|

10.

|

Transfers,

Acquisitions and Disposal of Shares

|

|

10.1

|

Pre-emption

Rights

|

|

10.1.1

|

The

rights of the Shareholders to sell, transfer, assign, pledge, charge,

encumber or otherwise dispose of their shareholding in the Company (or any

part thereof) shall be subject to the restrictions and provisions set out

below:

|

Page

| 11

|

|

(a)

|

In

the event any Shareholder desires to dispose of all or any portion of

their shareholding in the Company pursuant to a bona-fide third party

offer for the shares (“Transferor”), the

Transferor shall first afford the other Shareholders (“the Transferees”) a

right of first refusal with regard to those shares (“the Relevant Shares”) in

proportion to such Transferee’s shareholding in the Company. In this

regard, the Transferor shall give the Transferees written notice

(hereinafter called a “Transfer Notice”) of the

Transferor’s intention to dispose of the Relevant Shares, which notice

shall include the proposed transferee, the number of shares to be

transferred, the price per share, and the terms of

payment.

|

|

|

(b)

|

Upon

receipt of the Transfer Notice, the Transferees shall have the option, but

not the obligation, to purchase the Relevant Shares at either (i) the same

terms and conditions price for the Relevant Shares as set forth in the

Transfer Notice, or (ii) to request that the Shareholders appoint an

independent firm (at the cost and expense of the Transferor) to determine

the sale price per Relevant Share in accordance with the shareholders

funds or the net tangible assets (whichever is lower) of the Company as at

the date of the Transfer Notice (“the Prescribed

Price”).

|

|

|

(c)

|

In

the event the Transferees determine to accept the terms contained in the

Transfer Notice or upon the determination of and purchase of the Relevant

Shares at the Prescribed Price, the Relevant Shares shall promptly be

offered by the Transferor by notice in writing to the Transferees (and if

there is more than one Transferee, to each Transferee in proportion to

such Transferee’s shareholding in the Company) for purchase. Such offer

shall be open for acceptance at any time within the Prescribed Period. The

Prescribed Period shall commence on the date

that:

|

|

|

(i)

|

the

Transferees notify the Transferor of their acceptance of the offer to

purchase the Relevant Shares on the terms contained in the Transfer

Notice; or

|

|

|

(ii)

|

the

Prescribed Price is determined;

|

and will

expire sixty (60) days thereafter, after either (i) or (ii) as applicable. The

Transferee(s) so accepting the offer shall hereinafter be called the

“Purchaser(s)”.

|

|

(d)

|

If

there is more than one (1) Purchaser, each Purchaser shall have the right

to purchase the Relevant Shares pro rata in accordance with the ratio that

his shareholding bears to the aggregate shareholdings of all the

Purchasers provided that the said Purchaser must purchase all the Relevant

Shares offered to him. Upon acceptance of such offer by the Purchasers

within the Prescribed Period, the Transferor shall be bound to sell the

Relevant Shares to the Purchasers as set forth above. The sale and

purchase of the Relevant Shares shall be completed in accordance with the

provisions herein.

|

|

|

(e)

|

If

the offer of the Relevant Shares shall not be accepted by the Transferees,

then the Transferor shall be at liberty to transfer or dispose of the

Relevant Shares within a period of three (3) months from the expiry of the

Prescribed Period to the person identified in the Transfer Notice and in

accordance with the terms thereof, subject to Clause 10.1.2

below.

|

Page

| 12

|

|

(f)

|

Any

transfer, disposal or sale of shares contemplated by this Clause 10.1.1

shall be subject to the approval(s) of the Public Authorities should such

approval be required in law or in practice. Completion and payment of the

Prescribed Price shall take place not less than three (3) days nor more

than ten (10) Business Days after the date of the receipt of such

approval(s) of the Public

Authorities.

|

|

|

(g)

|

Any

transfer, disposal or sale of shares contemplated by Clause 10.1.1(e) to a

third party purchaser shall be further subject to such third party

purchaser entering into a deed or other suitable documentation agreeing to

be bound by all the terms of this

Agreement.

|

|

|

(h)

|

Notwithstanding

anything contained herein, the restrictions on transfer of shares

contained in this Clause 10 shall not apply in the case where the entire

shareholdings or part thereof is to be transferred by MTDC to any of its

holding company, subsidiaries or associated companies or any such transfer

undertaken by MTDC pursuant to any internal restructuring scheme of MTDC

and the consents of the other shareholders of the Company are deemed to be

given for such transfer of shares by MTDC pursuant to this

Clause.

|

|

|

(i)

|

The

procedures and pre-emption rights under this Clause 10 may be waived in

writing by the Shareholders.

|

|

10.1.2

|

Pursuant

to Clause 10.1.1(e), if the Existing Shareholder wishes to sell its shares

to a third party, the Existing Shareholder shall ensure that the Investors

be entitled (but not obliged) to sell any part of its holding of Shares to

the third party on no less favourable terms and conditions as are

applicable to the Existing Shareholder. Upon any exercise by

the Investors of this entitlement within thirty (30) days from the date of

notice by the Existing Shareholder of such entitlement of the Investors,

the Existing Shareholder shall not transfer or sell any of its shares to

the third party unless the relevant shares of Investors are so purchased

by the third party.

|

|

10.1.3

|

All

third parties who acquire shares in the Company under this Clause 10shall

enter into a deed of ratification and accession under which the third

party shall agree to be bound by the obligations, and shall be entitled to

the benefit, of this Agreement.

|

|

11

|

Put

Options

|

|

11.1

|

Investors’

Put Right for shares in the Existing

Shareholder

|

The

Existing Shareholder has granted to MTDC an option to sell all the Series A RCPS

held by MTDC to the Existing Shareholder upon the terms and conditions of the

Put Agreement entered into between the Existing Shareholder and

MTDC.

Page

| 13

|

11.2

|

Investors’

Put Option for Series A RCPS or Conversion

Shares

|

MTDC

shall have the option to require the Existing Shareholder to purchase all (but

not less than all) of the Conversion Shares or Series A RCPS held by MTDC, upon

thirty (30) days’ notice in writing to the Existing Shareholder. The price

payable for each Conversion Share shall be calculated based on the formula for

the issue price per Conversion Share set out in paragraph 5 of Schedule 1 of

this Agreement whereas the price payable for each Series A RCPS is USD2.25, such

price compounded at the rate of 8% per annum with yearly rests, up to the date

of exercise of the option, and at the discretion of MTDC, may be satisfied by

either cash or the issuance of shares in the Existing Shareholder. The option

shall be exercisable as follows:

|

|

(a)

|

any

time after the Initial Closing of the Series A Subscription Agreement for

as long as MTDC is the holder of Series A RCPS in the Company, in the

event there is a material breach or default by the Company or the Existing

Shareholder in any of their representations, warranties, undertakings,

covenants and obligations under this Agreement which has not been remedied

after thirty (30) days written notice of such material breach or default;

or

|

|

|

(b)

|

any

time between 1 January 2011 and 31 December 2011 and subject to the

following:

|

|

|

(i)

|

the

share price of the Existing Shareholder’s shares is below USD2.25;

or

|

|

|

(ii)

|

due

to any breach or default attributable to the Existing Shareholder, the

Investor is unable to exercise its rights under the Put

Agreement.

|

This

clause applies only to any Conversion Shares resulting from the conversion of

the Series A RCPS.

|

12.

|

Duration

and Termination

|

Subject

to the provisions of this Clause 12, this Agreement shall take effect without

limit in point of time. If the Investors or the Existing Shareholder

sells or transfers all of its shares in the Company or if the Investors redeems

or exchanges all the RCPS to the shares in the Existing Shareholder, in

accordance with the provisions of this Agreement or the Articles (to the extent

not inconsistent with this Agreement) or the Put Agreement respectively, it

shall be released from all of its rights and obligations under this Agreement

and cease to be a party to this Agreement, and all obligations of that Party and

all entitlements and requirements relating to that Party under this Agreement

will cease. If following any such sale, transfer, redemption or

exchange, two (2) or more parties continue to be bound by this Agreement, this

Agreement shall continue in full force and effect as between those

parties.

|

13.

|

Previous

Agreements and Prevalence of

Agreement

|

|

13.1

|

This

Agreement constitutes the entire agreement between the Parties with

respect of the matters dealt with here and the Parties hereby mutually

agree and confirm that the Shareholders’ Agreement, DA and KMP DA shall be

terminated with effect from the date of this Agreement and be superseded

by this Agreement.

|

Page

| 14

|

13.2

|

This

Agreement and the documents referred to in its provisions are in

substitution for all previous agreements between all or any of the Parties

and contain the whole agreement between the Parties relating to the

subject matter of this Agreement.

|

|

13.3

|

If,

during the continuance of this Agreement, there is any conflict between

this Agreement and the Articles, the provisions of this Agreement shall

prevail between the Parties. In the event of such conflict

arising, the Parties shall procure and take all necessary steps including

effecting such alteration to the Articles as may be necessary to resolve

such conflict.

|

|

14.

|

Remedy

on an Event of Default

|

|

14.1

|

Each

of the following will be regarded as an Event of

Default:

|

|

|

(a)

|

any

of the Shareholders committing a breach of its obligations under this

Agreement and, in the case of a breach capable of remedy, failing to

remedy the same within twenty one (21) days of being specifically required

in writing so to do by the other Shareholder;

or

|

|

|

(b)

|

any

distress, execution, sequestration or other process being levied or

enforced upon or sued out against the property of any of the Shareholders

which is not discharged within ten (10) days;

or

|

|

|

(c)

|

any

encumbrancer taking possession of or a receiver or trustee being appointed

over the whole or any part of the undertaking, property or assets of any

of the Shareholders; or

|

|

|

(d)

|

the

making of an order or the passing of a resolution for the winding up of

any of the Shareholders, otherwise than for the purpose of a

reconstruction or amalgamation without insolvency or previously approved

by the other Shareholder (such approval not to be unreasonably

withheld).

|

|

14.2

|

In

the event of an Event of Default taking

place,

|

|

|

(a)

|

the

non-defaulting Shareholder shall be entitled to terminate this Agreement;

or

|

|

|

(b)

|

the

deadlock provisions referred to in clause 16 shall

apply,

|

|

|

without

prejudice to any rights or remedies the non-defaulting Shareholder may

have against the defaulting Shareholder for any antecedent

breach.

|

|

14.3

|

Notwithstanding

any provision in this Agreement to the contrary, this Agreement shall

remain in full force and effect for so long as shall be necessary to

fulfil and give effect to the arrangements and undertakings contained in

this Agreement.

|

|

14.4

|

Termination

of this Agreement for any cause in accordance with the provisions of this

Agreement shall not release any Shareholder from any liability which at

the time of termination has already accrued to the other or which

thereafter may accrue in respect of any act or omission prior to such

termination or which has accrued in consequence of this

clause.

|

Page

| 15

|

15.

|

Confidentiality

|

Parties

shall:

|

|

(a)

|

ensure

the confidentiality of this Agreement and the transactions contemplated in

this Agreement;

|

|

(b)

|

not

disclose any provision of this Agreement

except:

|

|

|

(i)

|

where

required by law or any relevant governmental regulatory body or competent

authority;

|

|

(ii)

|

to

any financier or professional adviser acting for the party;

or

|

|

|

(iii)

|

the

information is public knowledge otherwise than as a consequence of breach

of this Clause.

|

The

Existing Shareholder and the Company are permitted to disclose the names of the

Parties or make reference to the Parties contributions to the Company. For

purposes deemed necessary for the furtherance of the Business, the

confidentiality obligation in this Agreement does not cover the names of the

Parties and their respective interests in the Company.

This

restriction continues to apply after the expiration or sooner termination of

this Agreement without limit in point of time but ceases to apply to information

or knowledge which may properly come into the public domain through no fault of

the Party so restricted.

|

16.

|

Deadlock

|

|

16.1

|

Disputes

|

If the

Shareholders or their respective representatives are unable to reach agreement

in relation to any reserved matter provided for in Clause 7.4 or there is an

Event of Default pursuant to Clause 14 or otherwise in relation to any matter of

material importance to the future conduct of the Business, the meeting at which

such resolution is tabled shall be adjourned for 30 days (or such other number

of days as the Parties may agree) during which the Parties, through Alnoor

Shivji and the Chief Executive Officer of MTDC, shall mutually discuss in order

to resolve the deadlock. Alnoor Shivji and the

Chief Executive Officer of MTDC shall endeavour to resolve any disagreement in

the best interest of the Company as a whole.

|

17.

|

Further

Assurance

|

Each

party shall execute and do all such documents and things as are necessary to

carry this Agreement into effect or to give full effect to this

Agreement.

|

18.

|

Remedies

|

If a

Party does not comply with its obligations under this Agreement, the other Party

is entitled to the remedy of specific performance and injunctive relief (as may

be applicable), and monetary compensation by itself is not an adequate

remedy.

Page

| 16

|

19.

|

Waiver

and Variation

|

|

19.1

|

Rights

not affected

|

The

rights which each Party has under this Agreement shall not be prejudiced or

restricted by any delay in exercising or failure to exercise any right or remedy

under this Agreement. Unless otherwise agreed in writing, no waiver

by any Party in respect of a breach shall operate as a waiver in respect of any

subsequent breach.

|

19.2

|

Cumulative

rights and remedies

|

The

rights and remedies provided in this Agreement are in addition to, and do not

exclude or limit, any rights or remedies provided by law.

|

19.3

|

Variation

|

This

Agreement shall not be varied unless the variation is expressly agreed in

writing by each Party.

|

20.

|

Severability

|

If any

provision of this Agreement is void or unenforceable, by operation of law or by

any reason whatsoever, it shall be regarded as deleted from this Agreement, and

the remaining provisions shall continue to apply.

|

21.

|

Continuing

Effect

|

Notwithstanding

the completion of the transaction contemplated in this Agreement, the provisions

of this Agreement shall continue to survive or subsist so long as may be

necessary for the purpose of giving effect to each of them.

|

22.

|

Time

|

Time

wherever mentioned in this Agreement shall be of the essence of this

Agreement.

|

23.

|

Legal

Relationship

|

Nothing

in this Agreement shall create, or be regarded as creating, a partnership or the

relationship of employer and employee between the Parties. Neither Party has any

authority to bind the other in any way.

|

24.

|

Costs

and Expenses

|

Each

Party shall bear its own costs (including legal fees) and expenses in respect of

the preparation and execution of this Agreement.

Page

| 17

|

25.

|

Assignment;

Successors

|

|

25.1

|

Assignment

|

Parties

shall not assign or otherwise deal with its respective rights or benefits under

this Agreement without the prior written consent of the other

Parties.

|

25.2

|

Successors

and assigns

|

This

Agreement shall be binding upon the Parties and their respective successors,

permitted assigns and personal representatives.

|

26.

|

Notices

|

|

Without

affecting any other effective mode of service, any notice given under this

Agreement:

|

|

|

(a)

|

must

be in writing and may be delivered personally or sent by registered post

to the intended recipient at the address shown below or the address last

notified by the intended recipient to the

sender:

|

For the

Investors:

MTDC

Level

8-9, Menara Yayasan Tun Razak,

Jalan

Bukit Bintang,

55100

Kuala Lumpur

Attn:

Norhalim Bin Yunus , Chief Executive Officer

Tel:

03-2172 6000

Fax:

03-2163 7542

PMSB

5th

Floor, Bangunan CIMB,

Jalan

Semantan, Damansara Heights,

50490

Kuala Lumpur

Attn:

Darawati Hussain

Tel: +603

2084 8888

Fax: +603

2093 9688

or

c/o

Trupartners

Sdn Bhd

M-2-1,

Block M,

Plaza

Damas,

Page

| 18

60 Jalan

Sri Hartamas 1,

54080

Kuala Lumpur

Attn:

Norazharuddin Abu Talib

Tel: +603

6203 3030

Fax: +603

6203 3131

For the

Existing Shareholder:

Wafergen

Bio-Systems Inc

7400

Paseo Padre Parkway

Fremont,

CA 94555, USA

Attn:

Alnoor Shivji

Tel: +1

(510) 468-0546

Fax: +1

(510) 651-4599

For the

Company:

Wafergen Biosystems (M) Sdn

Bhd

Suite

B.3(2), Ground Floor

KHTP

Business Centre

KHTP,

09000 Kulim

Kedah

Darul Aman, Malaysia

Tel:

+6019 312 4751

Fax: +604

402 3305

Attn:

Nazri Said

|

|

(b)

|

must

be signed; and

|

|

|

(c)

|

will

be taken to be duly given or made:

|

|

|

(i)

|

(in

the case of delivery in person) when delivered, received or left at the

above address; and

|

|

|

(ii)

|

(in

the case of delivery by registered post) 48 hours after posting, and in

proving service it shall only be necessary to prove that the communication

was contained in an envelop which was duly addressed and posted in

accordance with this Clause,

|

but if

delivery, receipt or service occurs, or will be taken to occur, on a day on

which business is not generally carried on in the place to which the

communication is sent or is later than 4 p.m. (local time) it will be taken to

have been duly given or made at the commencement of business on the next day on

which business is generally carried on in the place.

Page

| 19

|

27.

|

Entire

agreement

|

This

Agreement is the entire agreement between the Parties in respect of its subject

matter and supersedes all previous agreements with respect to its subject

matter.

|

28.

|

Counterparts

|

This

Agreement may be executed in any number of counterparts, and all counterparts

taken together constitute one and the same instrument.

|

29.

|

Governing

Law and Jurisdiction

|

This

Agreement is governed by the laws of Malaysia, and each party submits to the

non-exclusive jurisdiction of the courts exercising jurisdiction in

Malaysia.

Page

| 20

SCHEDULE

1

Principal

Terms of the Series A RCPS

|

1.

|

Subscription

Price and par value

|

The

subscription price for each Series A RCPS shall be Ringgit Malaysia equivalent

to USD2.25 calculated at the prevailing exchange rate on the on the date payment

of the Subscription Price is effected . Each Series A RCPS shall have

a par value of RM0.01.

|

2.

|

Premium

|

Each

Series A RCPS shall be issued at a premium being the difference between the

Subscription Price and the par value of RM0.01.

|

3.

|

Dividend

Provision

|

There is

no specific dividend rate attached to the Series A RCPS and the Company is not

obliged to declare and pay any dividend while the Investors are holding the

Series A RCPS.

|

4.

|

Liquidation

Preference

|

In the

event of any liquidation, dissolution or winding up of the Company, the holders

of the Series A RCPS will be entitled to receive only in preference to the

holders of Shares, and not the Series B RCPS (which rank pari passu for the

purposes of this provision), the relevant Subscription Price paid for the Series

A RCPS plus all accrued but unpaid dividends and dividends in arrears, if

any.

|

5.

|

Conversion

|

Each

holder of the Series A RCPS will have the right, at the option of the holder at

any time, to convert all or part of the Series A RCPS into such number of Shares

as may be determined in accordance with the following formula:

|

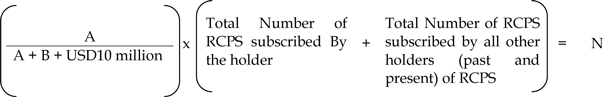

|

A

|

represents

the aggregate original investment amount in USD (comprising the

subscription moneys paid to the Company for subscription for RCPS) of the

holder in the Company

|

|

|

B

|

represents

the aggregate original investment amount in USD (comprising the

subscription moneys paid to the Company for subscription for RCPS) of all

other holders (past and present) of RCPS in the

Company

|

Page

| 21

The

conversion is to be effected by and subject to the redemption of the Series A

RCPS from funds legally available for distribution at the redemption price of

USD2.25 per Series A RCPS and the issuance of such number of new Shares to the

holder with the issue price based on the following formula:

|

Issue

price per Share

|

=

|

A

|

|

|

N

|

and

applying the redemption monies towards such issue price.

PROVIDED

THAT

|

|

(i)

|

where

N includes any fractions, N is to be rounded downwards to the nearest

whole number

|

|

|

(ii)

|

where

the number of new Shares to be issued includes any fractions, such number

of new Shares is to be rounded downwards to the nearest whole

number

|

|

|

(iii)

|

where

the issue price includes any fractions of sen, the issue price is to be

rounded downwards to the nearest

sen

|

|

|

For

the purposes of this provision:

|

|

|

(a)

|

the

amount in USD of the investment amount is based on the value in USD of the

subscription moneys as at the respective date(s) of the relevant

subscription(s).

|

|

|

(b)

|

for

the avoidance of doubt, where any RCPS has been held by more than one

holder, such RCPS and investment amount in relation to the RCPS, is to be

counted only once.

|

To effect

the above conversion, a conversion notice shall be sent by the holder(s) of the

Series A RCPS to the Company not less than thirty (30) days before the intended

date of conversion. Such notice shall be in writing and shall fix the

date and the time for the conversion.

The

Company may from time to time consult with, and make proposals to, the holder(s)

of Series A RCPS in relation to the exercise of the holder(s)’ entitlement to

convert the Series A RCPS.

Completion

of the conversion of the Series A RCPS into Conversion Shares shall be effected

at the registered office of the Company unless agreed otherwise by the holder(s)

of the Series A RCPS and the Company. On the date fixed for

conversion, the holder(s) of the Series A RCPS shall deliver to the Company the

share certificate(s) for the relevant Series A RCPS in exchange for share

certificates in relation to the relevant amount of Conversion Shares resulting

from the conversion of those Series A RCPS. If any share certificate

so delivered to the Company relates to any Series A RCPS which are not to be

converted on that day, a fresh share certificate for those Series A RCPS shall

be immediately issued by the Company to such holder(s).

Page

| 22

|

6.

|

[Deleted]

|

|

7.

|

Redemption

Rights

|

The

holders of the Series A RCPS may at any time after 31 December 2011, subject to

the completion of the PMSB Subsequent Closing or EEV Subsequent Closing (where

relevant), by giving a thirty (30) day notice of redemption in such form as may

be acceptable to the Company (“Notice of Redemption”), redeem

any or all Series A RCPS registered in the name of the holder of the Series A

RCPS. The RCPS will be redeemable from funds legally available for distribution

at the redemption price (“Redemption Price”) which

comprises a par value of RM0.01 with redemption premium equivalent to the

difference between (i) the aggregate of the Subscription Price and such price

multiplied at the rate of 20% per annum prorated by day, up to the date of the

redemption based on a 365-days year (and without any compounding or addition to

the principal Subscription Price) and (ii) the par value of RM0.01 per Series A

RCPS plus all accrued but unpaid dividends and dividends in arrears, if

any.

All

redemption of the Series A RCPS shall be effected at the registered office of

the Company unless agreed otherwise by the holder(s) of the Series A RCPS and

the Company. On the date fixed for redemption, the holder(s) of the

Series A RCPS shall deliver to the Company the share certificate(s) for the

relevant Series A RCPS in exchange for payment in cash (by way of bank draft or

any other manner acceptable to the holder(s)) by the Company of the aggregate

Redemption Price for the time being payable for those Series A

RCPS. If any share certificate so delivered to the Company relates to

any Series A RCPS which are not to be redeemed on that day, a fresh share

certificate for those Series A RCPS shall be issued by the Company to such

holder(s).

No Series

A RCPS redeemed by the Company shall be capable of reissue.

|

8.

|

Voting

Rights

|

The

holder of the Series A RCPS will be entitled to the voting rights as referred to

in Section 148(2) of the Act.

|

9.

|

Protective

Provisions

|

Without

the approval of the holders of at least a majority of the Series A RCPS, the

Company will not take any action, whether by merger, consolidation or otherwise,

that:

|

|

(a)

|

effects

a sale, lease, license or other disposition of all or substantially all of

the Company’s assets, property or business or undertakings in excess of

RM250,000.00,

|

|

|

(b)

|

effects

or enters into any agreement regarding any transaction, or series of

transactions, which results in the holders of the Series A RCPS prior to

the transaction owning less than 50% of the voting power of the Company’s

Series A RCPS after the

transaction(s),

|

|

|

(c)

|

alters

or changes the rights, preferences or privileges of the Series A

RCPS,

|

|

|

(d)

|

increases

or decreases the number of authorized Series A

RCPS,

|

Page

| 23

|

|

(e)

|

authorises

the issuance of securities having a preference over or on a parity with

the Series A RCPS,

|

|

|

(f)

|

changes

the number of directors,

|

|

|

(g)

|

amends,

modifies or repeals the Memorandum of Association and/or Articles of the

Company in a manner which adversely affects the holders of the Series A

RCPS,

|

|

|

(h)

|

effects

any recapitalization or reorganization, or any voluntary or involuntary

liquidation under applicable bankruptcy or reorganization legislation, or

any dissolution, liquidation, or winding up of the

Company,

|

|

|

(i)

|

declares

or pays dividends on or makes any distributions with respect to any share

capital of the Company.

|

For

purposes of these protective provisions, any reference to the Company will be

deemed to include any subsidiary of the Company.

|

10.

|

No

Variation

|

The

rights attached to the Series A RCPS shall not be varied, modified or deleted

unless in accordance with paragraph 9 above.

[The remainder of this page is

intentionally left blank]

Page

| 24

SCHEDULE

2

Representations

and Warranties

|

1.

|

Representations

and Warranties by the Investors

|

The

Investors warrant to the Company as follows.

|

|

1.1

|

Capacity and

Authority

|

The

Investors are duly incorporated and validly exist under the laws of Malaysia and

has the power to own its assets and carry on its business as now being

conducted.

|

|

1.2

|

Power to execute this

Agreement

|

|

|

(a)

|

The

Investors have the right, power and authority, and have taken or will take

all action necessary, to validly execute, deliver and exercise its right,

and perform its obligations under this

Agreement;

|

|

|

(b)

|

Other

than those set out in this Agreement, no other consent, approval,

authorization or other order of any court, regulatory body, administrative

agency or other order of any other governmental body is required for the

execution and delivery by the Investors of this Agreement or the

performance by the Investors of the transactions contemplated under this

Agreement;

|

|

|

(c)

|

This

Agreement is a valid and binding obligation of the Investors and is

enforceable against the Investors in accordance with its

terms;

|

|

|

(d)

|

The

execution, delivery and performance of this Agreement will not violate any

judgment, order or decree to which the Investors are subject and will not

be inconsistent with any constitutional documents or contracts to which

the Investors are a party to or otherwise binding on the Investors;

and

|

|

|

(e)

|