Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT ON FORM 8-K - DELTA AIR LINES, INC. | delta_8k-121510.htm |

Exhibit 99.1

Delta: State of the Airline

Richard Anderson

Chief Executive Officer

Delta: Building a Better Airline

Ed Bastian

President

2

Delta: Building A Better Airline

Higher revenues plus solid cost performance

drive $2.6 billion year-over-year improvement in

profitability for 2010

drive $2.6 billion year-over-year improvement in

profitability for 2010

Aggressively reducing debt using ~$2 billion

annual free cash flow

annual free cash flow

Addressing gaps in customer product,

technology, facilities and fleet is key to

generating superior revenues and returns

technology, facilities and fleet is key to

generating superior revenues and returns

Note: All results exclude special items

A successful 2010 with

room to improve in 2011

room to improve in 2011

Derisking the business

through balance sheet

improvements

through balance sheet

improvements

While making long-term

investments in the

business

investments in the

business

3

Meeting Our Commitments Led To Successful 2010

|

• Improve financial performance

|

|

Increased pre-tax income $2.6 billion and

operating margin 8 points |

|

• Complete merger integration and deliver

$1.3 billion in synergies |

|

Technology integration complete, single

operating certificate achieved and $1.5 billion in synergies realized |

|

• Reallocate our fleet across the

integrated network |

|

Matched supply with demand, improved

margins and reduced fleet by 90 aircraft |

|

• Enhance the quality of our product

|

|

Initiated $1 billion product investment,

revamped delta.com, and broke ground on new JFK terminal |

|

• Maintain best-in-class cost structure

|

|

Kept consolidated ex-fuel unit costs flat to

2009 and consistent with 2007 levels |

|

• Use free cash flow to aggressively

reduce debt |

|

Reduced adjusted net debt from $17 billion to

$15 billion |

|

• Target 10% return on invested capital

|

|

Will earn 10% ROIC in 2010

|

What We Said

What We Did

ü

ü

ü

ü

ü

ü

ü

4

December Quarter In Line With Expectations

|

|

|

December Quarter 2010

|

|

|

|

Operating margin

|

6 - 7%

|

|

|

|

|

Fuel price

|

$2.45

|

|

|

|

|

Total unrestricted liquidity

|

$5.3 billion

|

|

|

|

|

|

|

|

|

|

|

|

|

December Quarter 2010 vs.

December Quarter 2009 |

|

|

|

Consolidated non-fuel unit cost

|

Down 3 - 4%

|

|

|

|

|

|

|

|

|

|

|

System capacity

|

Up 7%

|

|

|

|

|

|

Domestic

|

Up 5%

|

|

|

|

|

International

|

Up 11%

|

|

|

Note: Unit costs exclude profit sharing expense

5

Achieved 2010 Return on Invested Capital Target

|

|

|

2009

|

|

2010

|

|

Operating Income

|

|

$0.1 billion

|

|

$2.7 billion

|

|

Market value of equity (assuming

$14/share) |

|

$11.8 billion

|

|

$11.8 billion

|

|

Adjusted net debt

|

|

$16.8 billion

|

|

$15.8 billion

|

|

Total invested capital

|

|

$28.6 billion

|

|

$27.6 billion

|

|

Return on invested capital

|

|

0.3%

|

|

9.8%

|

Note: All results exclude special items

6

Strengthen Balance

Sheet

Sheet

Top-Line Profitable

Growth

Growth

2011: Building A Better Airline

Focus ~$2 billion annual free cash flow toward net

debt reduction

debt reduction

Invest For The Future

Higher revenues and improved productivity from

targeted investments in airport facilities,

technology and on-board products

targeted investments in airport facilities,

technology and on-board products

Improved economic environment, increased

corporate business and capacity discipline to

drive solid top-line growth

corporate business and capacity discipline to

drive solid top-line growth

7

Economic

Growth

Growth

Passenger

Revenue

Revenue

Ancillary

Businesses

Businesses

• Macro environment

continues to improve

continues to improve

• Global Insights projects

worldwide GDP of 3%

worldwide GDP of 3%

– U.S. growth of 2 - 3%

– Stronger growth

expected in Asia-

Pacific

expected in Asia-

Pacific

• Delta’s planned system

capacity increase of 1 - 3%

in line with GDP forecasts

capacity increase of 1 - 3%

in line with GDP forecasts

• Solid passenger revenue

growth driven by unit

revenue increases

combined with higher

capacity

growth driven by unit

revenue increases

combined with higher

capacity

• PRASM expected to meet

2008 levels, despite

pressure from eliminating

smaller, high-RASM aircraft

2008 levels, despite

pressure from eliminating

smaller, high-RASM aircraft

• Expecting non-passenger

revenue to grow 5 - 10%

year over year

revenue to grow 5 - 10%

year over year

• More than $2 billion from

unbundled fees and

services

unbundled fees and

services

• Double digit revenue

improvements from

Commercial Aviation

Services businesses

improvements from

Commercial Aviation

Services businesses

Revenue Environment Continues to Improve

Economic momentum, company actions combine for profitable top line growth

8

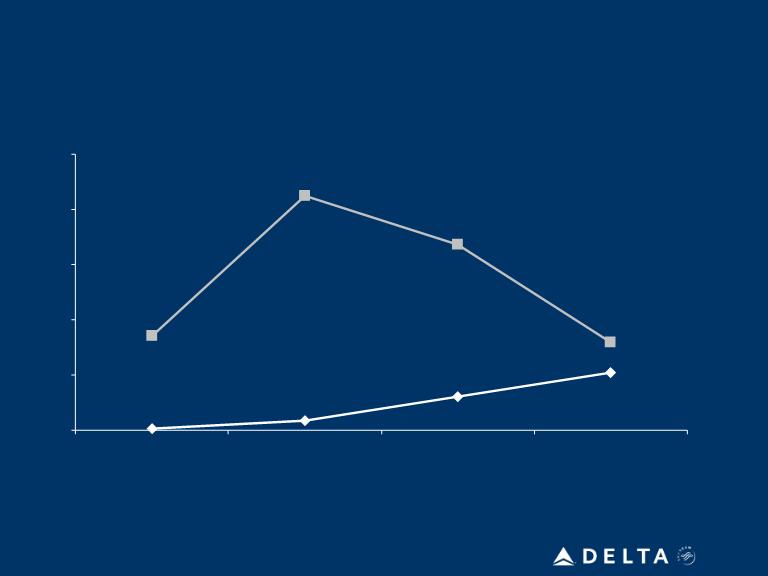

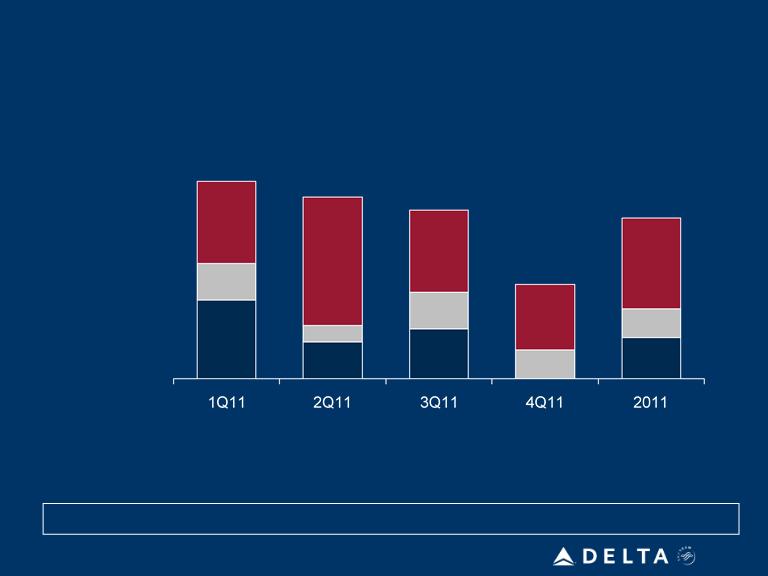

Passenger Revenue Momentum Continues

Passenger Unit Revenue Change

2010 vs. 2007

(9%)

(5%)

(2%)

(5%)

(9%)

flat

+1%

(4%)

Revenue

vs. 2007

vs. 2007

Capacity

vs. 2007

vs. 2007

0%

5%

10%

15%

20%

25%

1Q10

2Q10

3Q10

4Q10

2010 vs. 2009

9

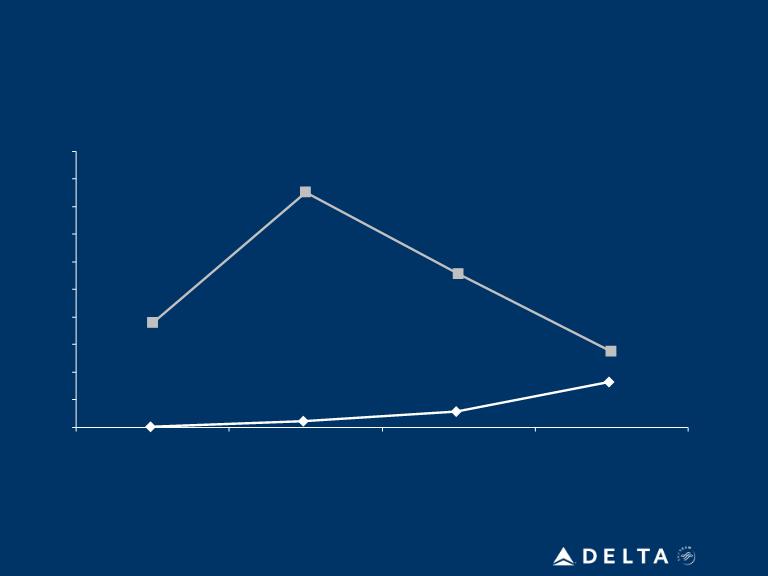

Domestic Revenue Momentum

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

20%

1Q10

2Q10

3Q10

4Q10

2010 vs. 2007

(13%)

(10%)

(8%)

(10%)

(13%)

(7%)

(6%)

(9%)

Revenue

vs. 2007

vs. 2007

Capacity

vs. 2007

vs. 2007

Domestic Passenger Unit Revenue Change

2010 vs. 2009

10

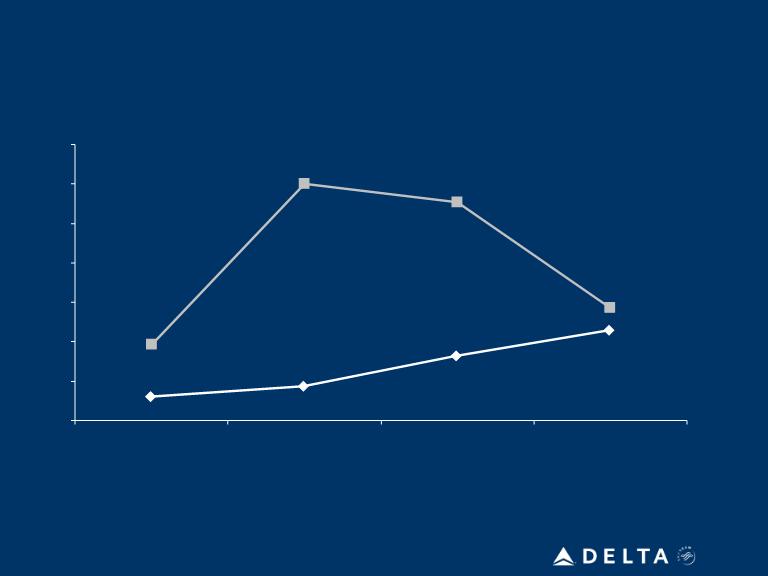

0%

5%

10%

15%

20%

25%

30%

35%

1Q10

2Q10

3Q10

4Q10

International Revenue Momentum

2010 vs. 2007

(1%)

+4%

+7%

+3%

+2%

+16%

+16%

+7%

Revenue

vs. 2007

vs. 2007

Capacity

vs. 2007

vs. 2007

International Passenger Unit Revenue Change

2010 vs. 2009

11

Pacific

Transatlantic

Latin

Domestic

Capacity

GDP

Responsible Deployment of Capacity in 2011

Additions to key restricted business markets drive international growth

Majority of international

growth from additions to

Heathrow, Haneda, Beijing

and Shanghai

growth from additions to

Heathrow, Haneda, Beijing

and Shanghai

Restricted Market Capacity

Projected system capacity growth of 1 - 3%

12

Aggressively pursuing

corporate contracts

corporate contracts

Corporate travel

momentum

momentum

Strong Traction With Corporate Revenue

Improved customer

service and support

service and support

• Broad sector strength has brought corporate

revenues back to 2007 levels

revenues back to 2007 levels

• Notable improvements in Autos and Banking

Broad sector strength, improved competitive position driving revenue growth

• Captured 2 pt. share increase vs. pre-merger levels

• Achieved targeted merger synergies

• $300 million in new contracts post-merger

• All contracts incorporate AF/KL joint venture

• Contracts in place with all Fortune 100 companies

• Ranked #1 in 3 of 5 categories in Morgan Stanley

Annual Global Travel Survey

Annual Global Travel Survey

• Most improved airline in Business Travel News survey

• Voted Best Airline for Travel Agent Support by

Recommend Magazine

Recommend Magazine

13

Ancillary Businesses

expected to generate 5-10%

revenue growth for 2011

expected to generate 5-10%

revenue growth for 2011

Ancillary Businesses Showing Strong Performance

Commercial

Aviation Services

Aviation Services

$1.5 billion

Cargo

$900 million

SkyMiles

$1.6 billion

Unbundled

Ticketing

Ticketing

$2.1 billion

Diversified revenue base reduces economic volatility

14

Factors Point To Solid Earnings Growth for 2011

Solid earnings

improvement for 2011

improvement for 2011

• Profitable top line growth

• System capacity growth of 1 -

3%

3%

• Manageable non-fuel unit cost

increases of 1 - 2%

increases of 1 - 2%

• Fuel volatility creates

headwind - however, solid

hedge book in place

headwind - however, solid

hedge book in place

• Non-operating expense

savings from debt reduction

savings from debt reduction

15

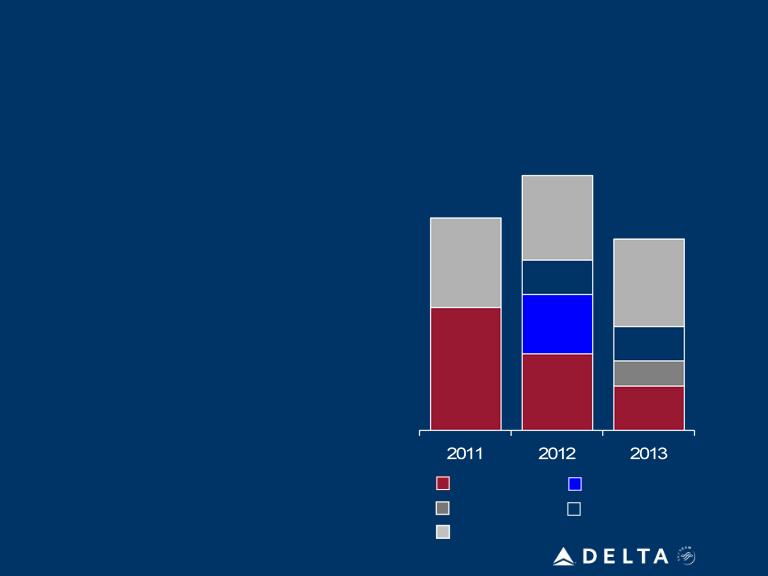

Operating Cash Flow

Capital Expenditures

$3 - $4 billion

Total Three-Year Projection

2010 - 2012

$9 - $10 billion

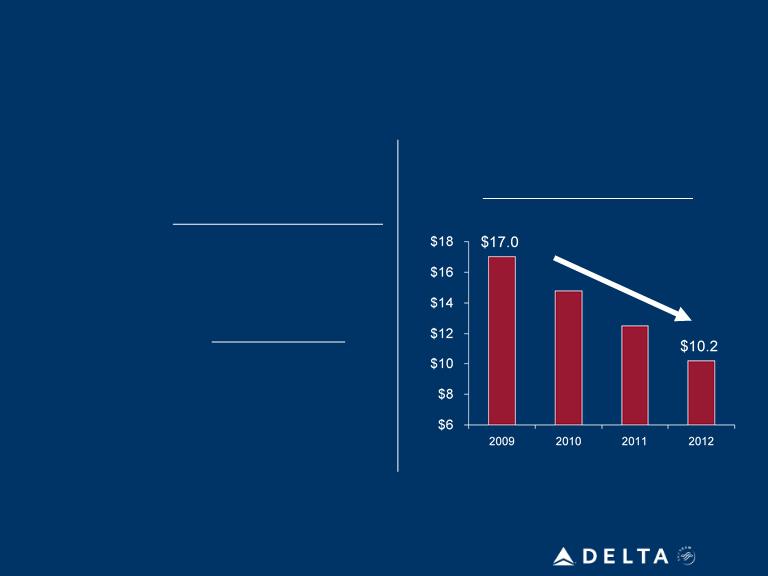

Adjusted Net Debt ($B)

Free Cash Flow

~$6 - 7 billion

Strong operating cash flow covers investments in product, facilities and fleet

Committed to Aggressive Debt Reduction

16

International

Domestic

Mainline

Mainline

Regional Aircraft

• 175 aircraft

• Average age: 11 years

• Investment to create high

quality product (flat bed

seats, in-seat video)

quality product (flat bed

seats, in-seat video)

• No imminent fleet renewal

needs

needs

• 542 aircraft

• Average age: 15 years

• Investment in seating

capacity and winglets to drive

increased efficiency

capacity and winglets to drive

increased efficiency

• Using secondary market to

backfill capacity from

retirements, but will assess

our options beyond 2012

backfill capacity from

retirements, but will assess

our options beyond 2012

• 626 aircraft

• Average age: 7 years

• Investment in product to

create a consistent

experience (first class, wi-fi)

create a consistent

experience (first class, wi-fi)

• Continuing to reduce

turboprops and 50-seat jets

turboprops and 50-seat jets

Addressing Our Fleet Needs

17

Encouraged with progress, but more work remains to achieve this goal

10 - 12% operating margin

$5 billion EBITDAR

Minimize capital reinvestment

requirements

requirements

Use cash to delever the balance

sheet

sheet

Generate sustainable 10%+ return on invested capital

Path To Improving Shareholder Returns

Delta: Transforming Our Network

Glen Hauenstein

Executive Vice President - Network and Revenue

Management

Management

19

What We Fly

• Transform domestic fleet and enhance ability

to compete in key, high-demand markets

to compete in key, high-demand markets

• Focus on maximum return

Where We Fly

• Win in New York

• International growth in restricted access

markets

markets

• Utilize alliances to maximize global reach

• Monetize First Class product

• Capitalize on point-of-sale opportunities with

Joint Venture partners

Joint Venture partners

• Position for increased ancillary revenues

How We Sell

Delta: Transforming Our Network

20

Transforming the Domestic Fleet

• Post-merger fleet optimization

allows Delta to maintain footprint

with 9% fewer aircraft

allows Delta to maintain footprint

with 9% fewer aircraft

• Backfilling retired planes with

MD-90s, with 17 deliveries

scheduled for 2011

MD-90s, with 17 deliveries

scheduled for 2011

• Evolving fleet enhances Delta’s

ability to compete in key high-

demand markets due to

preferred product, larger gauge

and best-in-class cost structure

ability to compete in key high-

demand markets due to

preferred product, larger gauge

and best-in-class cost structure

Domestic Fleet

Single Class

Regionals

1,262

1,148

December

2009

December

2011

Serving the domestic network more efficiently while providing a superior product

Avg. Seats

% of Aircraft

With First Class

With First Class

92 95

57% 69%

Two Class

Regionals

Mainline

9%

reduction

21

|

|

Change

|

|

Total Rev

|

5%

|

|

Total Cost

|

(14%)

|

|

Profit

|

$0.5M

|

|

Margin

|

21 pts

|

|

Unit Cost

|

(15%)

|

|

ASMs

|

1%

|

|

Passengers

|

1%

|

|

Load Factor

|

(0.6 pts)

|

Market Example: Atlanta to Daytona Beach

August 2009

Flights per Day: 7

Average Gauge: 66

August 2010

Flights per Day: 5

Average Gauge: 96

Schedule Change

Results

Atlanta to Daytona Beach reduced to 4 daily flights in September 2010 with an average

gauge of 138 seats, further improving market performance

gauge of 138 seats, further improving market performance

Refleeting to a Higher Gauge Improves Market

Profitability

Profitability

22

Improving Fleet Economics and Customer

Experience

Experience

• Expanding first class seating on

more than 60% of the mainline

domestic fleet

more than 60% of the mainline

domestic fleet

• No reduction to economy seat pitch

• Removal of unused galleys enables

additional seating, Improving

domestic fleet profitability

additional seating, Improving

domestic fleet profitability

• Increased first class seating

compliments other domestic

customer experience

improvements, including:

– Refurbished aircraft interiors

– Wi-Fi

– Seat-back entertainment

23

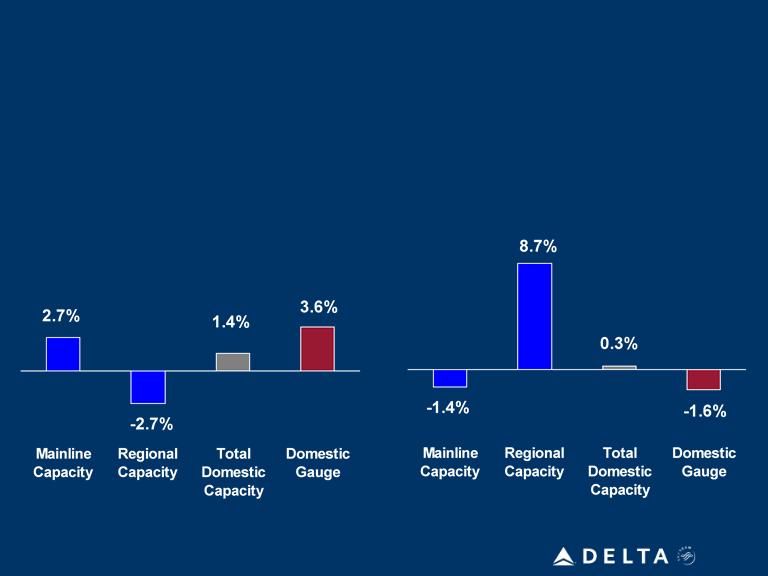

Delta Domestic Growth,

1st Half 2011 vs. 1st Half 2009

ATA Carrier Domestic Growth,

1st Half 2011 vs. 1st Half 2009

1st Half 2011 vs. 1st Half 2009

Increasing gauge on domestic flying

Delta’s Fleet Mix Change is Unique to the Industry

24

Become New

York Airline of

Choice

York Airline of

Choice

Implement JFK

Facility Solution

Facility Solution

Enhance Domestic

Network

Network

• Focus on high-value business

travelers with enhanced

SkyPriority services

travelers with enhanced

SkyPriority services

• Work closely with JV

operations team to improve on

-time performance, baggage

claims and passenger

misconnects

operations team to improve on

-time performance, baggage

claims and passenger

misconnects

• Establish Delta / Air France /

KLM / Alitalia Joint Venture as

the premiere alliance in JFK

KLM / Alitalia Joint Venture as

the premiere alliance in JFK

• $1.2B expansion and

enhancement to Terminal 4

with inter-terminal connections

to Terminal 3

enhancement to Terminal 4

with inter-terminal connections

to Terminal 3

• Relocation of Terminal 3

operations to Terminal 4 in

May 2013

operations to Terminal 4 in

May 2013

• Increase number of flights with

two-class product in LGA and

on JFK feeder flights

two-class product in LGA and

on JFK feeder flights

• Work towards LGA slot

transfer solution

transfer solution

Grow share in world’s premiere market

Win in New York

25

LHR

Atlanta

Detroit

New York

Minneapolis

Boston

Miami

Existing Service

Enhanced Service

New Service

London-Heathrow and Tokyo-Haneda are unique opportunities to expand in the

world’s richest business markets

world’s richest business markets

Tokyo-Haneda

London-Heathrow

Los Angeles

Detroit

HND

International Growth Centered on Highly Restricted

Markets

Markets

26

|

|

Delta

|

Delta with Partners

|

|

Destinations

|

363

|

1,071

|

|

Countries Served

|

67

|

181

|

|

Daily Flights

|

6,103

|

16,212

|

Global Alliances Maximize Global Reach

27

Capitalize on point-of-sale

opportunities with JV partners

opportunities with JV partners

• Leverage established relationship to expand

North Atlantic customer base

North Atlantic customer base

• Improve Italy share through Alitalia’s entry into

the JV

the JV

Monetize First Class Product

• Increase percentage of first class up-sells

– Currently in the test phase, with positive

results

results

– Full implementation scheduled for 2Q11

• Enhance delta.com shopping experience to

better capture up-sell opportunities

better capture up-sell opportunities

• Restructure fare products to better align value

of product attributes and fare paid

of product attributes and fare paid

• New e-commerce platform increases potential

for merchandising and other revenue benefits

for merchandising and other revenue benefits

Position for increased ancillary

revenues

revenues

Improving Revenue Production through Innovation

28

What We Fly

Focus on improving

margin

margin

• Domestic focus on

largest markets,

including New York

largest markets,

including New York

• International growth in

richest business

markets with limited

access

richest business

markets with limited

access

• Transform domestic

fleet, increasing gauge

and reducing unit cost

fleet, increasing gauge

and reducing unit cost

• Increase flights with

two-class product to

meet needs of

business travelers

two-class product to

meet needs of

business travelers

• Increase percentage of

first class seats sold

first class seats sold

• Capitalize on point-of-

sale opportunities with

JV partners

sale opportunities with

JV partners

• Position for increased

ancillary revenues

ancillary revenues

Where We Fly

How We Sell

Delta: Transforming Our Network

Delta: Enhancing the Customer Experience

Tim Mapes

Senior Vice President - Marketing

30

Enhancing the Customer Experience

Safe, clean, on-time, with your bags -

and a smile

and a smile

Products, services designed

for the HVC

for the HVC

People, technology centered

on customer needs

on customer needs

Greater speed, customer recognition,

productivity-enabling tools, and unconditional

protection if things go wrong

productivity-enabling tools, and unconditional

protection if things go wrong

Basics done well, consistently

Professionally-trained staff and intuitive,

industry-leading technology

industry-leading technology

31

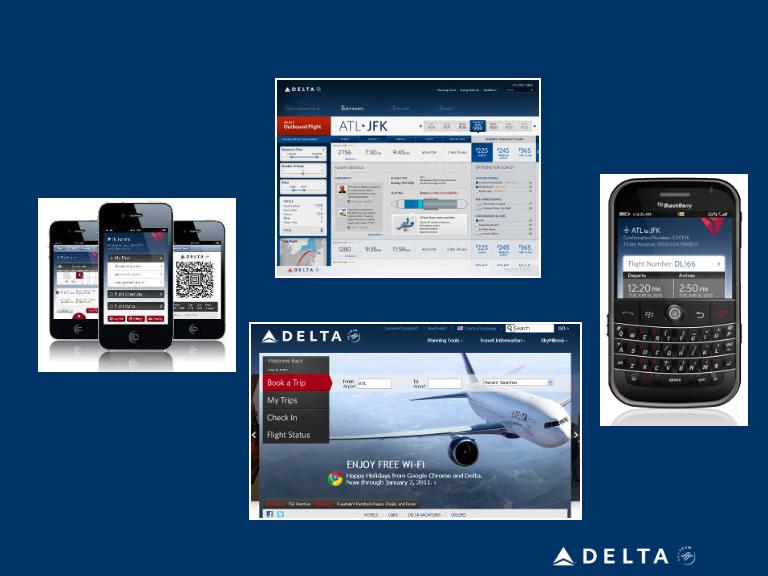

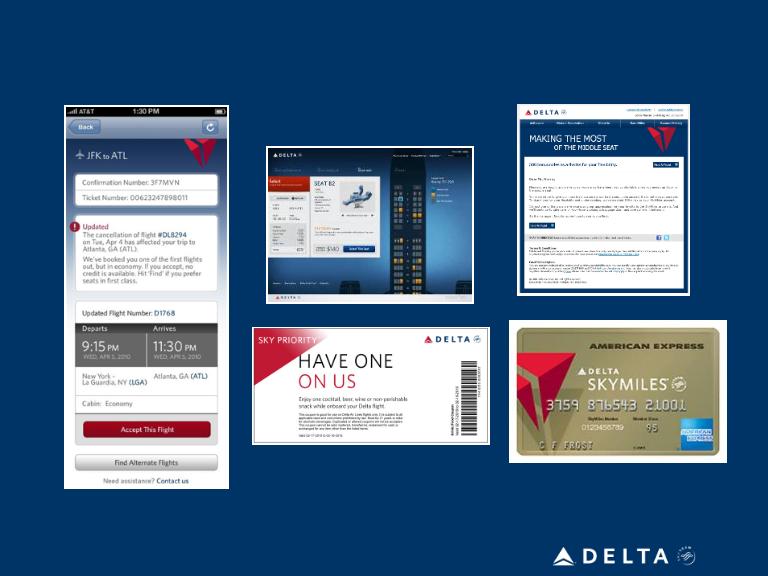

Enhancing the Customer Experience

At Booking

iPhone app

delta.com

Blackberry app

Merchandising

32

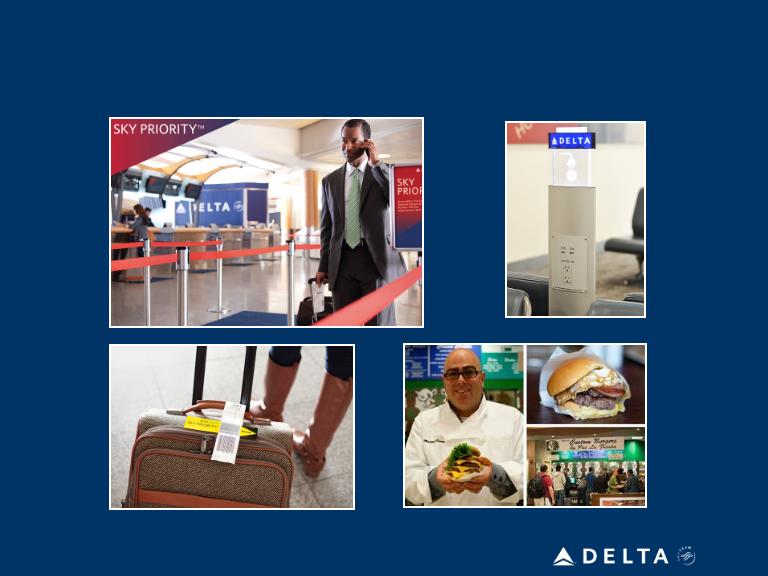

Enhancing the Customer Experience

On the Ground

33

Enhancing the Customer Experience

On the Ground

Sky Club lounges

34

Enhancing the Customer Experience

In Flight

Flat bed seats

First Class on RJ’s

Seat-back AVOD

35

Enhancing the Customer Experience

Customer Service & CRM

1st Bag Free

36

In Summary

• In order to achieve superior rates of revenue

growth, a superior ratio of “promoters” to

“detractors” (net promoters) is required

growth, a superior ratio of “promoters” to

“detractors” (net promoters) is required

• Delta has been making targeted investments

in the elements of the customer experience

high-value customers (HVC) value most

in the elements of the customer experience

high-value customers (HVC) value most

• Every 1% of share gain from the HVC market

segment = $130 million

segment = $130 million

Delta: Unlocking Innovation with Technology

Theresa Wise

Senior Vice President - Chief Information Officer

38

Information Technology Integration Successfully

Complete

Complete

• Balanced speed with differentiation

• Expedited results and minimized risks with simple, disaggregated

solutions

solutions

• Completed without disruption to Delta and its Customers

• Integration was a significant focus through mid-2010

– 1,130 man-years in IT alone

– Delivery momentum will carry over to next generation solutions

39

Network &

Revenue

Management

Sales &

Customer

Retention

Delivering a

Premium Travel

Experience

Operational

Excellence

Ongoing Information Technology Investments

• Investments target returns related to revenue, cost efficiency,

operational excellence and customer experience

operational excellence and customer experience

• Development pace has accelerated June-December 2010 as focus

shifted from integration to strategic business needs

shifted from integration to strategic business needs

• $190M of IT investments are planned for 2011 focused on key

strategic initiatives and returns of over $500M annually as projects

complete

strategic initiatives and returns of over $500M annually as projects

complete

• Strategic areas of focus:

40

• Further optimization of pricing and inventory management

• Tools that support further segmenting the market with flexible product

and service offerings

and service offerings

• Integrated technology to support world-class joint ventures and alliances

• Simplified, next-generation reservations and ticketing

• Intuitive sales and customer relationship management

• Next-generation airport agent tools that simplify processes and improve

service

service

• Immediate, intelligent and intuitive self-service options that empower

customers throughout each journey

customers throughout each journey

• World-class service recovery during irregular operations

• Next generation operations control and flight planning

• Real-time event data, infused with customer impact, for better, more

proactive operational decisions

proactive operational decisions

• Modular, nimble crew scheduling and communication

Network &

Revenue

Management

Sales &

Customer

Retention

Delivering a

Premium Travel

Experience

Operational

Excellence

Information Technology: Strategic Focus Areas

Delta: Improving Operational Performance

Steve Gorman

Chief Operating Officer

42

Service Recovery

• Proactive compensation at First Point of Contact

• Irregular ops service centers

• Over 1,400 handheld units

• Automated standby rebooking

• Mishandled bag notification

Reducing

Misconnections

Misconnections

• Decision matrix for gate hold control

• Focus on international to domestic and regional

to mainline

to mainline

Customer Service

Training

Training

• Trained over 20,000 flight attendants, 3,000

pursers and 11,000 airport agents

pursers and 11,000 airport agents

• Basic principles of customer service and problem

-solving

-solving

Cabin Condition &

Cleaning

Cleaning

• Reduced service intervals

• Outside auditors

Differentiating Overall Customer Experience

43

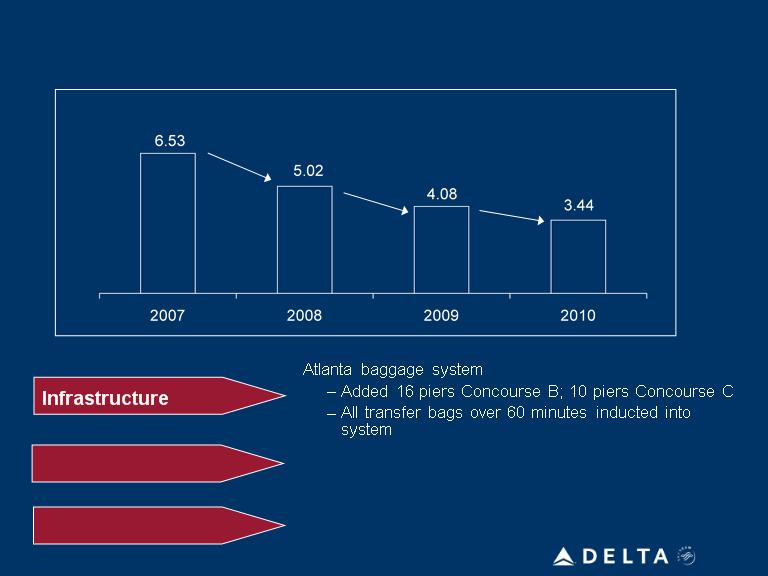

Technology

Process

– Scanner usage

– Real-time staffing and dispatching

– Dedicated transfer drivers at hubs

– Revised bag loading protocol

DOT Mishandled Baggage Rate

-23%

-19%

-16%

Baggage Claims Steadily Decreasing

Delta: Reinforcing the Financial Foundation

Hank Halter

Chief Financial Officer

45

• Maintaining best-in-class unit cost

structure

structure

• Utilize business leverage to mitigate

cost increases

cost increases

• Targeted investments in customer service

and operational improvements

and operational improvements

• Limited capital investment for aircraft and

aircraft modifications

aircraft modifications

• Targeting significant operating cash

flow which will enable strategic capital

investments

flow which will enable strategic capital

investments

• Strong free cash flow will fund further

delevering of the balance sheet

delevering of the balance sheet

Continued Cost

Leadership

Leadership

Disciplined Capital

Spending

Spending

Prudent Balance

Sheet Management

Sheet Management

Generate sustainable returns on invested capital

Delta: Reinforcing the Financial Foundation

46

Note: All figures exclude special items and profit sharing

Delta has 9% cost advantage compared to network peers

• Consolidated non-fuel unit costs

flat to 2009 resulting in 9% Delta

advantage versus industry

flat to 2009 resulting in 9% Delta

advantage versus industry

– Fleet retirements

– Technology functionality

– Divisional productivity

– Operational efficiency

2009

2010

2010

Network Average

excluding Delta

Network Average

excluding Delta

9% Advantage

Delta

Delta Maintains Cost Advantage to Network Peers

47

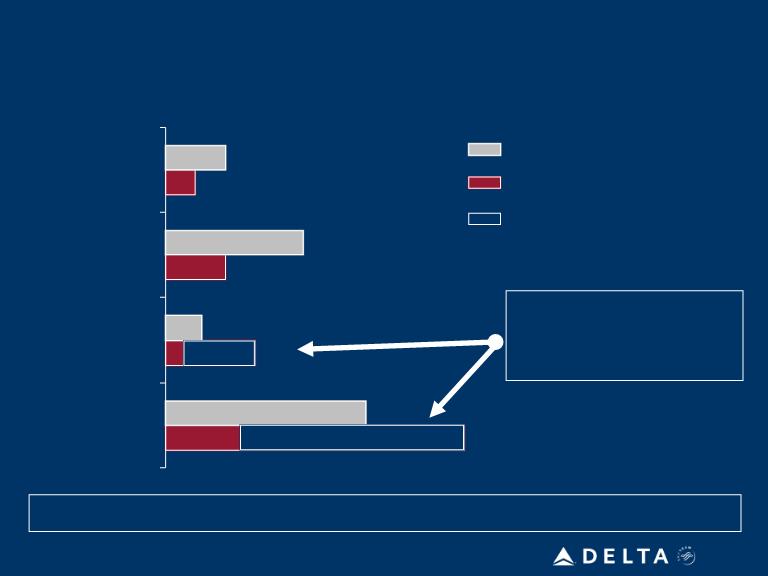

Critical that Delta maintains its cost advantage to network peers

Best-In-Class Cost Structure is Key Strength

Consolidated September YTD 2010

Non-Fuel Unit Cost (¢)

Non-Fuel Unit Cost (¢)

% Change vs.

September YTD 2009

September YTD 2009

6.42

6.62

7.34

8.18

8.58

9.15

9.30

7%

4%

5%

3%

1%

3%

0%

Note: All figures exclude special items and profit sharing

48

Delta Consolidated Non-Fuel CASM (¢)

2009

8.24

8.28

2010

2011

Expected cost pressures:

• Selling and revenue-related

• Customer and product investment

• Maintenance volume timing

Key productivity initiatives:

• Limit variable and fixed cost increases

as capacity growth resumes to

generate business leverage

as capacity growth resumes to

generate business leverage

• Invest in productivity-enhancing

technology

technology

• Grow operational efficiencies

• Fleet efficiencies through retirements

Targeted investments in product, employees and maintenance

Note: All figures exclude special items and profit sharing

+ 1-2%

Manageable Cost Increases Expected for 2011

49

% of Fuel Consumption Hedged

Note: Hedging portfolio data as of December 3, 2010. Portfolio value is prior to premium expense.

Average Crude Call

49%

39%

23%

41%

44%

Collars

Swaps

Call options

$85

$83

$85

$86

$86

Downside Participation

83%

72%

87%

79%

93%

At current forward curve, Delta’s 2011 portfolio valued at $365 million

Projected Fuel Price

$2.47

$2.43

$2.46

$2.48

$2.51

Managing fuel price risk and volatility

Fuel Hedging Remains Important Strategy

50

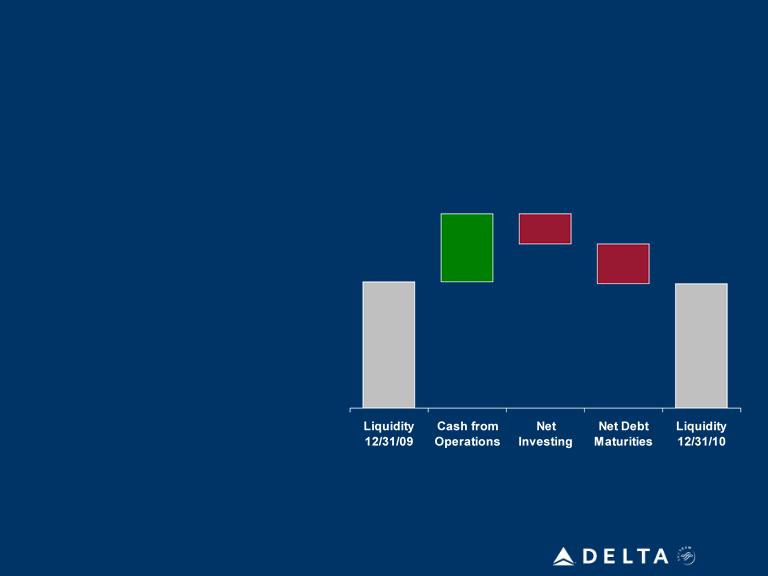

Balance Sheet Repair and Strengthening Underway

2010 accomplishments:

• Projected to generate operating

cash flow of $2.9 billion

cash flow of $2.9 billion

• $1.3 billion capital investments

– 17 aircraft deliveries

– Technology enhancements

– Onboard product

improvements

improvements

– Facility and infrastructure

renewal

renewal

• Paid down $1.7 billion debt

– $750 million delevering

initiatives in the September

quarter

initiatives in the September

quarter

Note: Liquidity includes cash, short term investments and undrawn credit facilities

Unrestricted Liquidity

December 2010 vs. December 2009 ($B)

December 2010 vs. December 2009 ($B)

$5.4

$2.9

($1.3)

($1.7)

$5.3

51

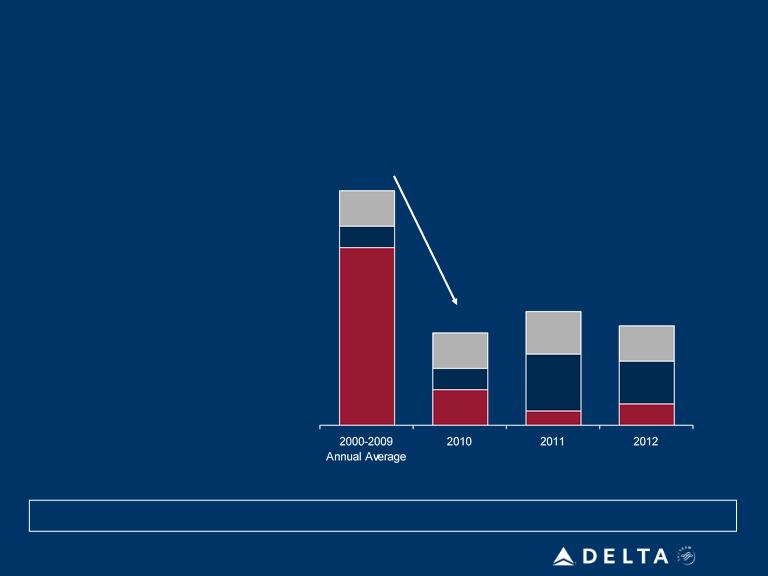

Disciplined Capital Spending Plan

Limited aircraft capex requirements enable targeted investments in customer and

operational efficiency/productivity and maximize free cash flow

operational efficiency/productivity and maximize free cash flow

• No near-term new aircraft

deliveries

deliveries

• Strategic acquisitions of cost

effective used MD-90 aircraft

effective used MD-90 aircraft

• Focused investments in customer

products and productivity-

enhancing tools

products and productivity-

enhancing tools

• Facility and infrastructure

investments

investments

Capital Spending ($B)

Dramatic reduction in capital spending versus prior decade

$3.3

$1.4

$1.5

$1.3

Ground/

technology

technology

Modifications

Aircraft

52

Scheduled Debt Maturities ($B)

• Scheduled debt maturities, combined

with delevering initiatives, will

strengthen Delta’s balance sheet and

reduce non-operating burden

with delevering initiatives, will

strengthen Delta’s balance sheet and

reduce non-operating burden

• Free cash flow is expected to fund

Delta’s scheduled debt maturities

Delta’s scheduled debt maturities

• Delevering initiatives

– Repurchasing debt

– Open market transactions and

private purchases

private purchases

– Opportunistic refinancing using

lower effective current interest

rates

lower effective current interest

rates

Balance Sheet Strengthening and Delevering

Underway

Underway

$1.9

$2.1

$2.5

EETC

Pacific routes

Other debt / capital leases

Exit facility

Amex

53

Delta Continues Prudent Balance Sheet Management

Note: Liquidity includes cash, short term investments and undrawn revolving credit facilities

Unrestricted Liquidity December 2011 vs. December 2010 ($B)

Liquidity

12/31/10

Liquidity

12/31/11

Net Debt

Maturities

$5.3

$5.3

($1.8)

Net Investing

($1.5)

$3.3

Cash From

Operations

Operating cash flow enables strategic capital investment and delevering

Targeting positive free cash flow of $1.8B in 2011

54

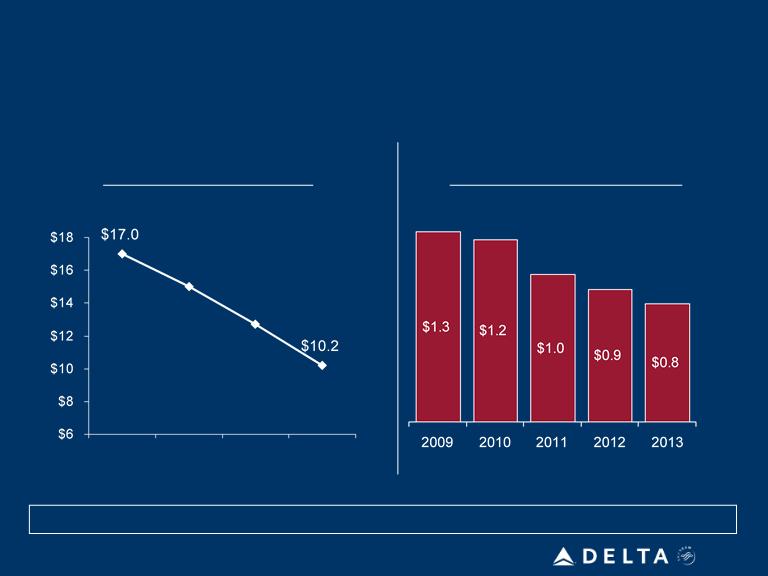

Adjusted Net Debt ($B)

12/31/09

12/31/12

Lower non-operating burden reduces earnings volatility and enhances cash flow

Net Interest Expense ($B)

12/31/10

$15.0

$15.0

Debt reductions and delevering actions drive $500 million in earnings improvement

Debt Reduction Drives Significant Earnings

Improvement

Improvement

55

Targeting Sustainable Returns on Invested Capital

Building a Better

Airline

Airline

Transforming Our

Network

Network

Enhancing the

Customer Experience

Customer Experience

Unlocking Productivity

with Technology

with Technology

Creating a Great

Place to Work

Place to Work

Reinforcing the

Financial Foundation

Financial Foundation

Improving Operational

Performance

Performance

|

Non-GAAP Financial Measures

|

||||||||||

|

We sometimes use information that is derived from our Condensed Consolidated Financial Statements, but that is not presented in accordance with accounting principles generally accepted in the U.S. (“GAAP”). Certain of this information is considered “non-GAAP financial measures” under the U.S. Securities and Exchange Commission rules. The non-GAAP financial measures should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP results.

|

||||||||||

|

Delta is unable to reconcile certain forward-looking projections to GAAP, including (1) projected free cash flow, (2) earnings before interest, taxes, depreciation, amortization and aircraft rent (EBITDAR) and (3) consolidated non-fuel cost per available seat mile (CASM), as the nature or amount of special items cannot be estimated at this time.

|

||||||||||

|

Delta excludes special items because management believes the exclusion of these items is helpful to investors to evaluate the company’s recurring operational performance.

|

||||||||||

|

Delta presents net investing activities because management believes this metric is helpful to investors to evaluate the company’s investing activities.

|

||||||||||

|

Delta presents net debt maturities because management believes this metric is helpful to investors to evaluate the company’s debt-related activities.

|

||||||||||

|

Delta uses adjusted total debt, including aircraft rent, in addition to long-term adjusted debt and capital leases, to present estimated financial obligations. Delta reduces adjusted total debt by cash, cash equivalents and short-term investments, resulting in adjusted net debt, to present the amount of additional assets needed to satisfy the debt.

|

||||||||||

|

Delta presents return on invested capital (ROIC) as management believes it is helpful to investors in assessing the company's ability to generate returns using its invested capital. ROIC represents operating income excluding special items divided by the sum of average market value of equity and average adjusted net debt.

|

||||||||||

|

Delta presents consolidated CASM excluding aircraft fuel and related taxes because management believes the volatility in fuel prices impacts the comparability of year-over-year financial performance.

|

||||||||||

|

Consolidated CASM excludes ancillary businesses not associated with the generation of a seat mile. These businesses include aircraft maintenance and staffing services Delta provides to third parties, Delta’s vacation wholesale operations and its dedicated freighter operations, which we discontinued on December 31, 2009.

|

||||||||||

|

Delta excludes profit sharing expense from consolidated CASM because management believes the exclusion of this item provides a more meaningful comparison of the company’s results to the airline industry and prior year results.

|

||||||||||

|

Delta presents free cash flow because management believes this metric is helpful to investors to evaluate the company’s ability to generate cash.

|

||||||||||

|

Delta presents EBITDAR as management believes it is helpful to investors in utilizing EBITDAR as a proxy for operating cash flow on a period over period basis.

|

||||||||||

56

|

Pre-Tax Income

|

||||||||

|

Full Year 2010

|

Full Year

|

|||||||

|

(in millions)

|

Projection

|

2009

|

||||||

|

Pre-tax income (loss)

|

$ | 0.7 | $ | (1.6 | ) | |||

|

Items excluded:

|

||||||||

|

Loss on extinguishment of debt

|

0.4 | 0.1 | ||||||

|

Restructuring and merger-related items

|

0.4 | 0.4 | ||||||

|

Pre-tax income (loss) excluding special items

|

$ | 1.5 | $ | (1.1 | ) | |||

57

|

Operating Income & Margin

|

||||||||

|

Full Year 2010

|

Full Year

|

|||||||

|

(in billions)

|

Projection

|

2009

|

||||||

|

Operating income (loss)

|

$ | 2.3 | $ | (0.3 | ) | |||

|

Item excluded:

|

||||||||

|

Restructuring and merger-related items

|

0.4 | 0.4 | ||||||

|

Operating income excluding special items

|

$ | 2.7 | $ | 0.1 | ||||

|

Total operating revenue

|

$ | 31.8 | $ | 28.1 | ||||

|

Operating margin excluding special items

|

8.5% | 0.3% | ||||||

58

|

Non-Fuel CASM

|

||||||||||||||||

|

Full Year 2010

|

Full Year

|

Nine Months Ended September 30,

|

||||||||||||||

|

Projection

|

2009

|

2010

|

2009

|

|||||||||||||

|

CASM

|

12.66 | ¢ | 12.32 | ¢ | 12.55 | ¢ | 12.17 | ¢ | ||||||||

|

Items excluded:

|

||||||||||||||||

|

Ancillary businesses

|

(0.27 | ) | (0.31 | ) | (0.27 | ) | (0.32 | ) | ||||||||

|

Profit sharing

|

(0.14 | ) | - | (0.16 | ) | - | ||||||||||

|

Restructuring and merger-related items

|

(0.19 | ) | (0.18 | ) | (0.19 | ) | (0.16 | ) | ||||||||

|

Aircraft fuel and related taxes

|

(3.82 | ) | (3.55 | ) | (3.75 | ) | (3.53 | ) | ||||||||

|

CASM excluding certain items

|

8.24 | ¢ | 8.28 | ¢ | 8.18 | ¢ | 8.16 | ¢ | ||||||||

59

|

Net Investing Activities

|

||||

|

Full Year 2010

|

||||

|

(in billions)

|

Projection

|

|||

|

Net cash used in investing activities (GAAP)

|

$ | 1.9 | ||

|

Items excluded:

|

||||

|

Purchase of short-term investments, net

|

(0.6 | ) | ||

|

Net investing activities

|

$ | 1.3 | ||

60

|

Net Debt Maturities

|

||||

|

Full Year 2010

|

||||

|

(in billions)

|

Projection

|

|||

|

Net cash used in financing activities (GAAP)

|

$ | 2.6 | ||

|

Items excluded:

|

||||

|

Pay down of revolving credit facility

|

(0.9 | ) | ||

|

Net debt maturities

|

$ | 1.7 | ||

61

|

Adjusted Net Debt

|

||||||||||||||||||||||||||||||||

|

December 31, 2010

|

||||||||||||||||||||||||||||||||

|

(in billions)

|

Projection

|

September 30, 2010

|

June 30, 2010

|

March 31, 2010

|

||||||||||||||||||||||||||||

|

Debt and capital lease obligations

|

$ | 15.1 | $ | 15.4 | $ | 15.8 | $ | 16.9 | ||||||||||||||||||||||||

|

Plus: unamortized discount, net from purchase accounting and fresh start reporting

|

0.7 | 0.7 | 1.0 | 1.1 | ||||||||||||||||||||||||||||

|

Adjusted debt and capital lease obligations

|

$ | 15.8 | $ | 16.1 | $ | 16.8 | $ | 18.0 | ||||||||||||||||||||||||

|

Plus: 7x last twelve months' aircraft rent

|

2.8 | 3.0 | 3.2 | 3.3 | ||||||||||||||||||||||||||||

|

Adjusted total debt

|

18.6 | 19.1 | 20.0 | 21.3 | ||||||||||||||||||||||||||||

|

Less: cash, cash equivalents and short-term investments

|

(3.6 | ) | (3.9 | ) | (4.4 | ) | (4.9 | ) | ||||||||||||||||||||||||

|

Adjusted net debt

|

$ | 15.0 | $ | 15.2 | $ | 15.6 | $ | 16.4 | ||||||||||||||||||||||||

|

(in billions)

|

December 31, 2009

|

September 30, 2009

|

June 30, 2009

|

March 31, 2009

|

December 31, 2008

|

|||||||||||||||||||||||||||||||||||

|

Debt and capital lease obligations

|

$ | 17.2 | $ | 17.7 | $ | 16.6 | $ | 16.6 | $ | 16.6 | ||||||||||||||||||||||||||||||

|

Plus: unamortized discount, net from purchase accounting and fresh start reporting

|

1.1 | 1.2 | 1.3 | 1.4 | 1.5 | |||||||||||||||||||||||||||||||||||

|

Adjusted debt and capital lease obligations

|

$ | 18.3 | $ | 18.9 | $ | 17.9 | $ | 18.0 | $ | 18.1 | ||||||||||||||||||||||||||||||

|

Plus: 7x last twelve months' aircraft rent

|

3.4 | 3.4 | 3.4 | 3.5 | 3.4 | |||||||||||||||||||||||||||||||||||

|

Adjusted total debt

|

21.7 | 22.3 | 21.3 | 21.5 | 21.5 | |||||||||||||||||||||||||||||||||||

|

Less: cash, cash equivalents and short-term investments

|

(4.7 | ) | (5.5 | ) | (4.9 | ) | (4.5 | ) | (4.5 | ) | ||||||||||||||||||||||||||||||

|

Adjusted net debt

|

$ | 17.0 | $ | 16.8 | $ | 16.4 | $ | 17.0 | $ | 17.0 | ||||||||||||||||||||||||||||||

62