Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NuStar GP Holdings, LLC | d8k.htm |

9

th

Annual Wells Fargo Pipeline and MLP Symposium

Curt Anastasio, CEO and

President December 7, 2010

Exhibit 99.1 |

Statements contained in this presentation that state management’s

expectations or predictions of the future are forward-looking statements as

defined

by

federal

securities

law.

The

words

“believe,”

“expect,”

“should,”

“targeting,”

“estimates,”

and other similar expressions identify forward-

looking

statements.

It

is

important

to

note

that

actual

results

could

differ

materially from those projected in such forward-looking statements. We

undertake no duty to update any forward-looking statement to conform the

statement to actual results or changes in the company’s expectations.

For more information concerning factors that could cause actual results to

differ from those expressed or forecasted, see NuStar

Energy L.P.’s and NuStar

GP

Holdings,

LLC’s

respective

annual

reports

on

Form

10-K

and

quarterly

reports on Form 10-Q, filed with the Securities and Exchange Commission

and

available

on

NuStar’s

websites

at

www.nustarenergy.com

and

www.nustargpholdings.com.

Forward Looking Statements

2 |

NuStar Overview

3 |

NuStar

Energy L.P. (NYSE: NS) is

a leading publicly traded

partnership with a market

capitalization of around $4.4 billion

and an enterprise value of

approximately $6.3 billion

NuStar

GP Holdings, LLC (NYSE:

NSH) holds the 2% general

partner interest, incentive

distribution rights and 15.6% of the

common units in NuStar

Energy

L.P. with a market capitalization of

around $1.5 billion

Two Publicly Traded Companies

NS

NSH

IPO Date:

4/16/2001

7/19/2006

Unit Price (11/29/10):

$67.43

$35.57

Annual Distribution/Unit:

$4.30

$1.92

Yield (11/29/10):

6.38%

5.40%

Debt Balance (9/30/10)

$1,991 million

$19.5 million

Market Capitalization:

$4,357 million

$1,513 million

Enterprise Value

$6,261 million

$1,526 million

Total Assets (9/30/10)

$5,191 million

$618 million

Debt/Cap. (9/30/10)

42.5%

n/a

Credit Ratings –

Moody’s

Baa3/Stable

n/a

S&P and Fitch

BBB-/Stable

n/a

83.1%

Membership Interest

82.4%

L.P. Interest

Public Unitholders

35.4 Million NSH Units

Public Unitholders

54.3 Million NS Units

16.9%

Membership

Interest

2.0% G.P. Interest

15.6% L.P. Interest

Incentive Distribution Rights

William E. Greehey

7.2 Million NSH Units

NYSE: NSH

NYSE: NS

4 |

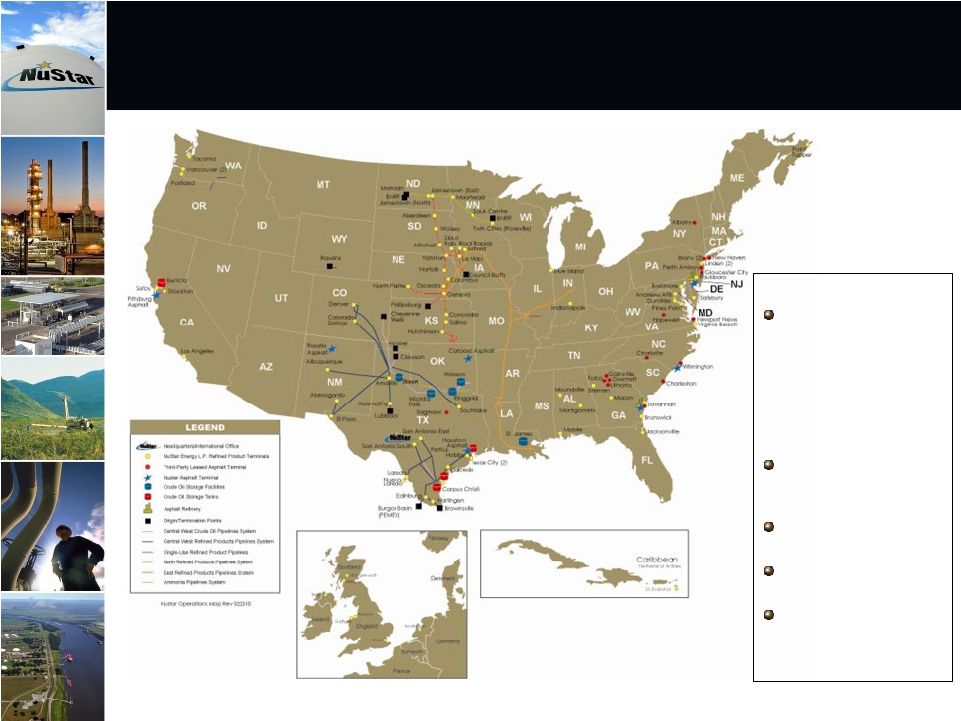

Large

and Diverse Geographic Footprint

with Assets in Key Locations

Asset Stats:

Operations in eight

different countries

including the U.S.,

Mexico, Netherlands,

Netherlands Antilles (i.e.

Caribbean), England,

Ireland, Scotland and

Canada

8,417 miles of crude oil

and refined product

pipelines

Own 88 terminal and

storage facilities

Over 93 million barrels of

storage capacity

2 asphalt refineries on

the U.S. East Coast

capable of processing

104,000 bpd of crude oil

5 |

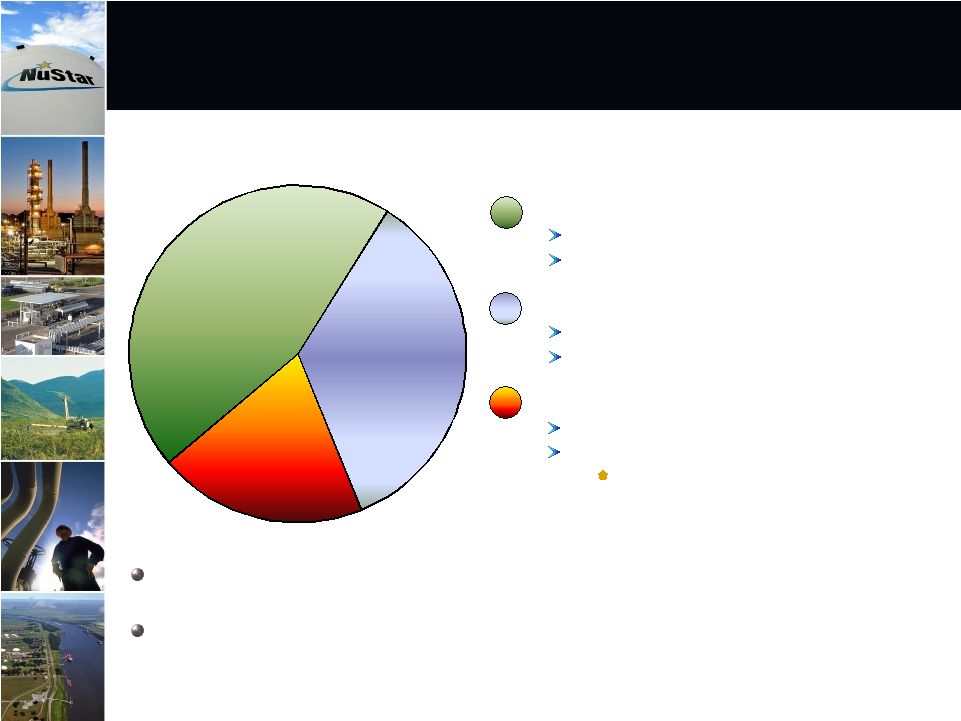

45%

35%

20%

Percentage of 2010 Projected

Segment Operating Income

Approximately 80% of NuStar Energy’s 2010 segment operating income is

projected to come from fee-based transportation and storage segments

Remainder of 2010 segment operating income is projected to relate to

margin- based asphalt and fuels marketing segment

Storage: 45%

Transportation: 35%

Refined Product Terminals

Crude Oil Storage

Refined Product Pipelines*

Crude Oil Pipelines

Asphalt & Fuels Marketing: 20%

Asphalt

Fuels Marketing

Product Supply, Bunkering and Fuel Oil

Marketing

Diversified Operations from Three

Business Segments

* Includes primarily distillates, gasoline, propane, jet fuel, ammonia and

other light products. Does not include natural gas. 6

|

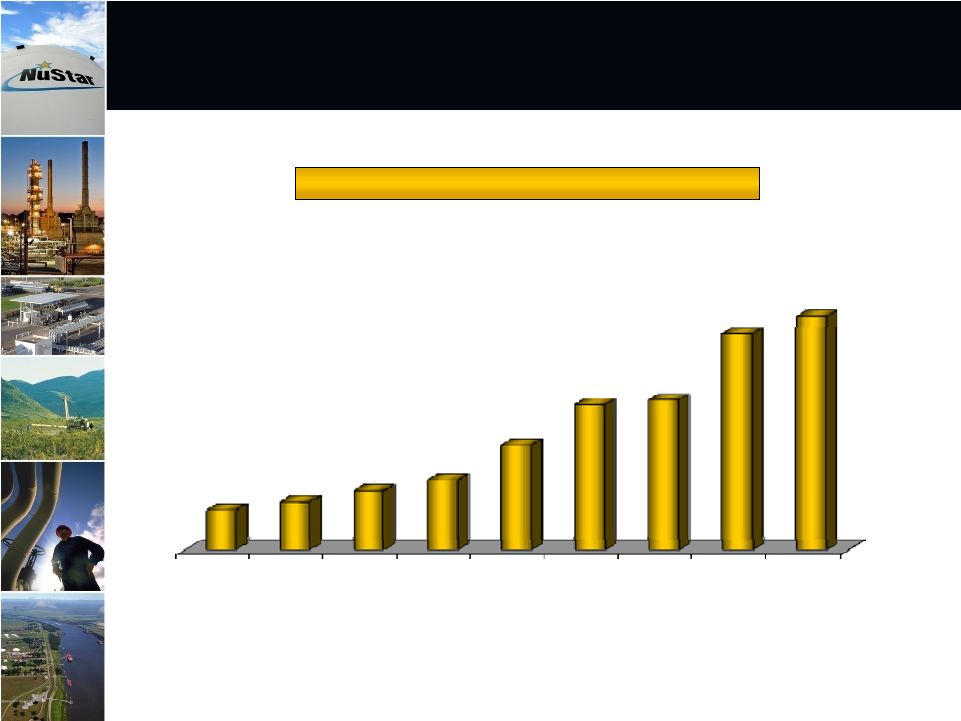

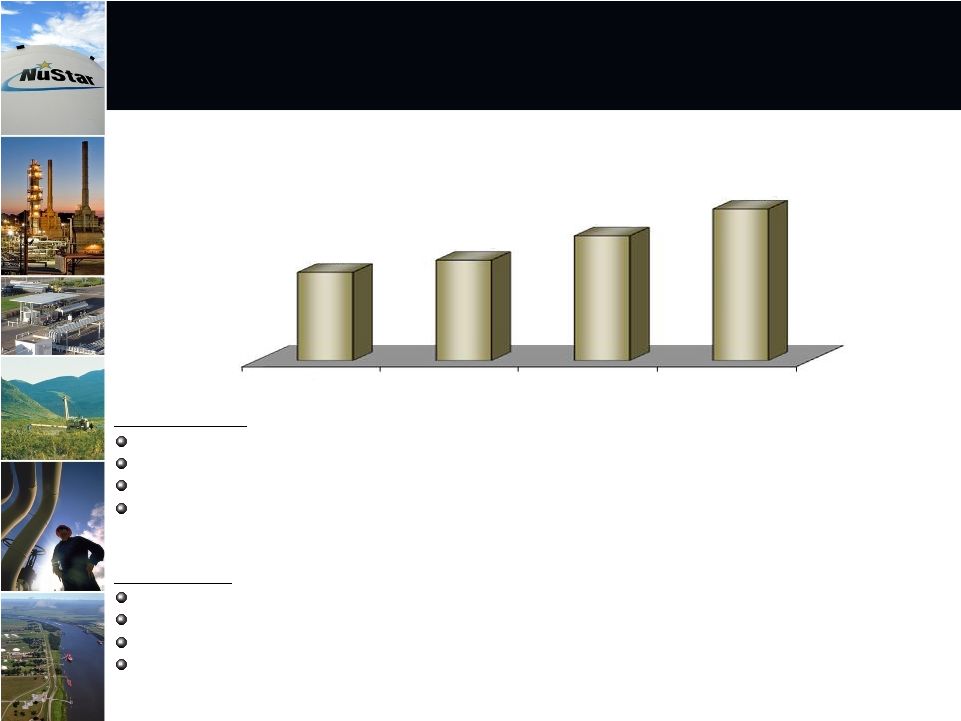

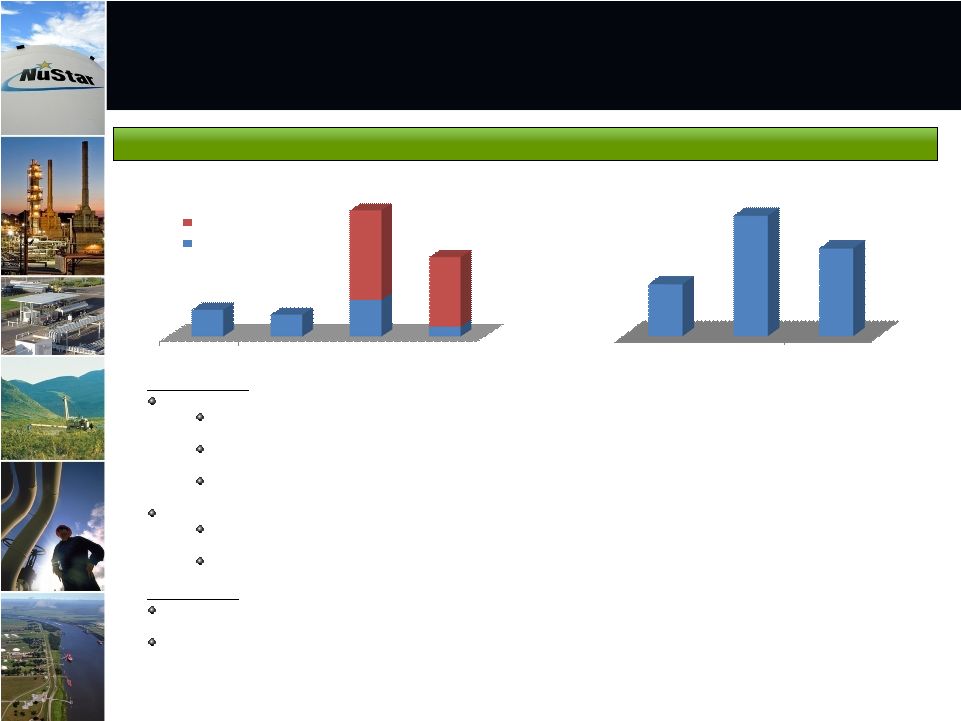

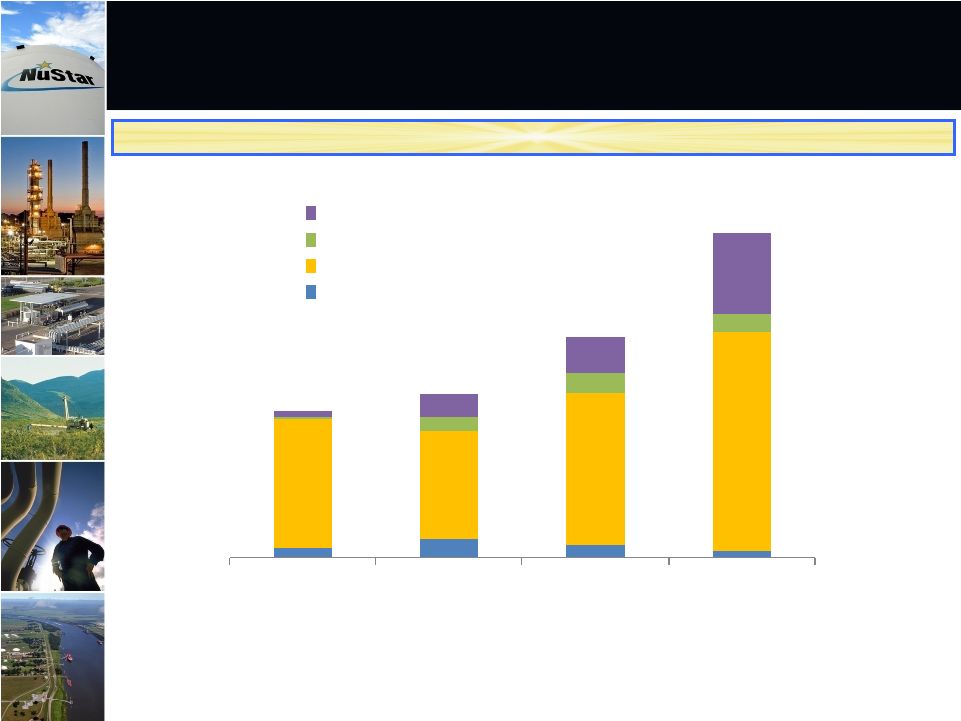

Increasing Distributable Cash Flows

7

NS Distributable Cash Flows ($ in Millions)

2001

2002

2003

2004

2005

2006

2007

2008

2009

$56

$68

$86

$102

$154

$214

$221

$319

$346 |

Transportation Segment

Overview

8 |

9

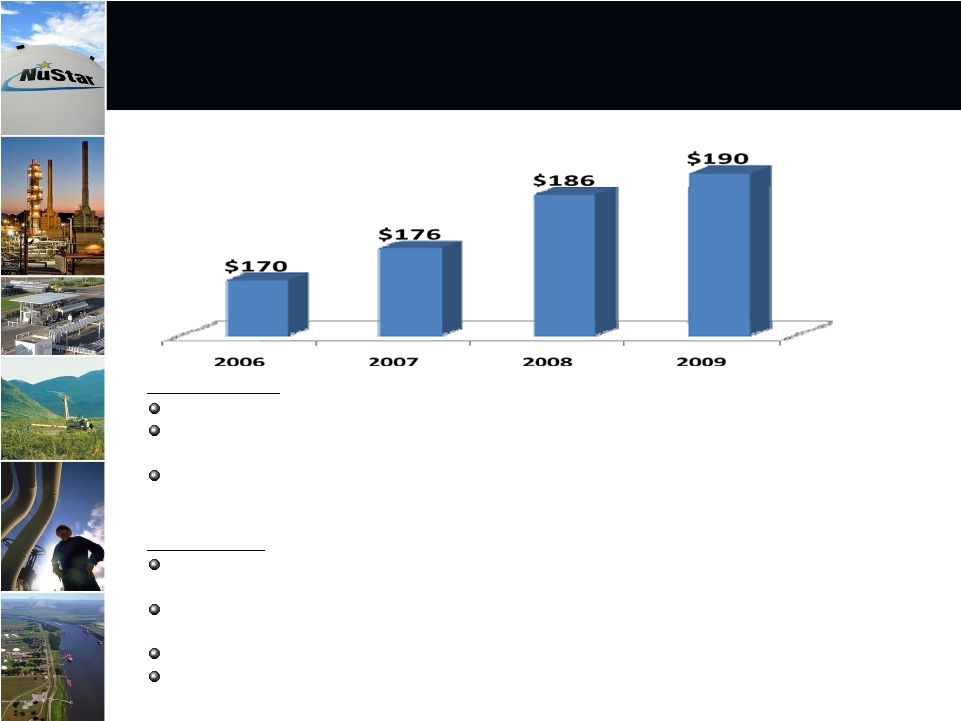

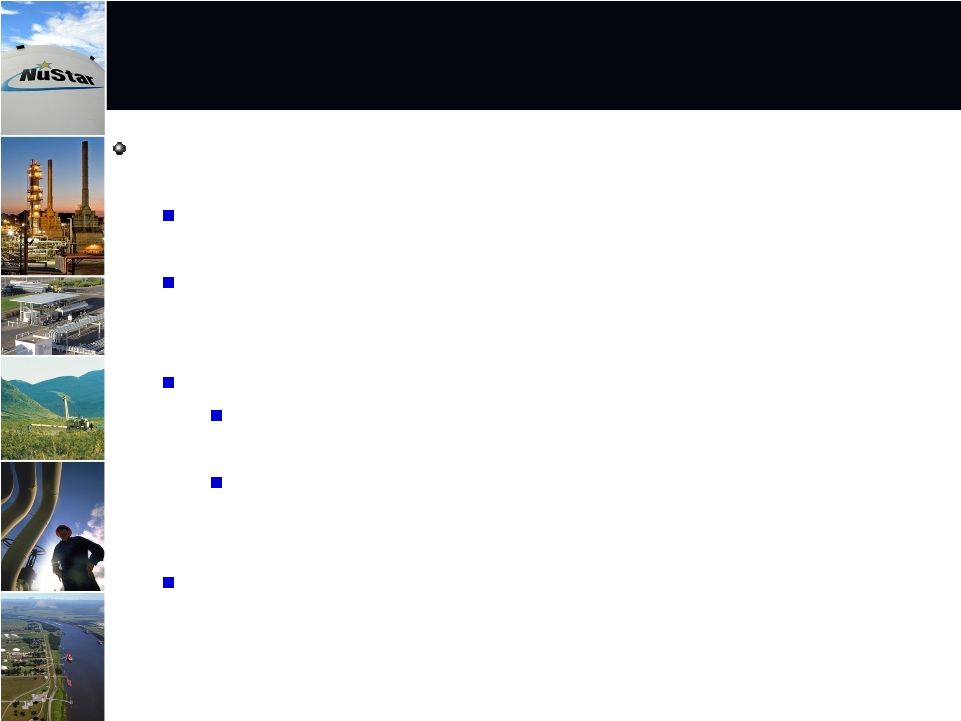

2010 Transportation Segment Results Should be Improved over 2009..

2011 EBITDA Expected to be slightly less than 2010

Transportation Segment EBITDA

(in Millions)

2010 Summary

EBITDA $5-$10 million higher than 2009.

Throughputs higher than 2009. Improving economy and customer turnaround

delayed into 2011.

July 1, 2010 tariff decrease 1.3%. Tariffs were 7.6% higher than 2009 for

the first half of 2010.

2011 Outlook

$1-$5 million of additional EBITDA from internal growth projects.

Recently announced Eagle Ford shale crude project to be completed in

mid-2011. Revised FERC Escalator in place July 1, 2011. Tariffs

projected to be up 4.5%. (Assumed 1.3% FERC Escalator)

Throughputs projected to be down 1.6%.

Segment EBITDA down slightly in 2011. |

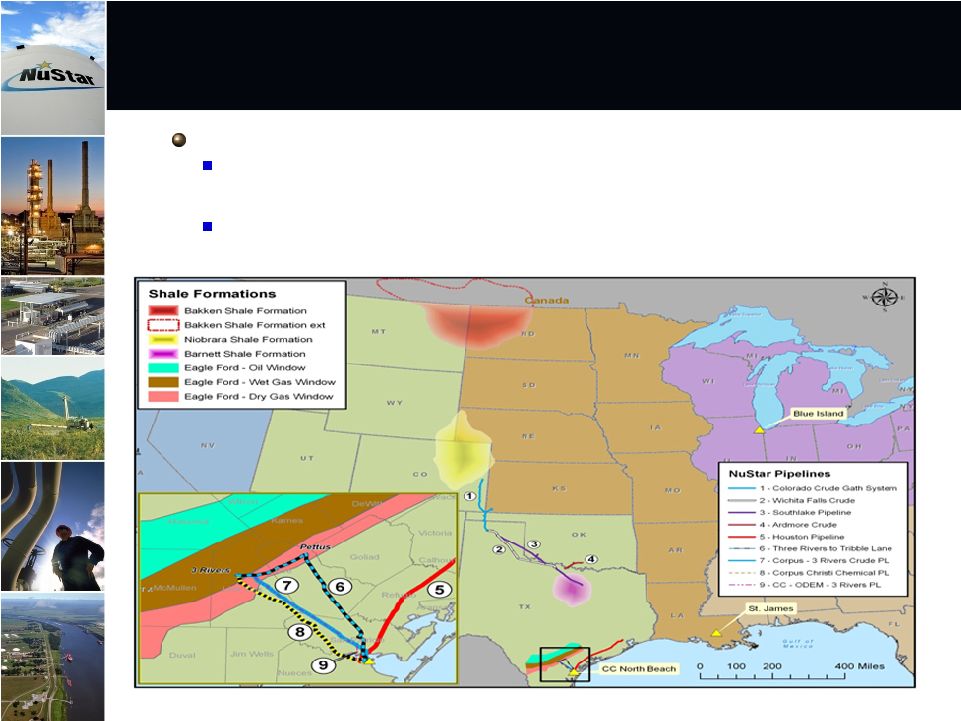

Transportation Segment Assets in close

proximity to key Shale Formations

Transportation Segment Assets in close

proximity to key Shale Formations

Shale Development Strategy

Our strategy is to optimize and grow the existing asset base, and maximize the

value of the assets located in or near shale developments

10

There are four key shale developments located in NuStar’s Mid-Continent and Gulf

Coast regions, including the Bakken, Niobrara, Barnett, and Eagle Ford

developments

|

11

Recently announced agreement with Koch

Pipeline first NuStar project in Eagle Ford Shale

Companies agreed to a pipeline connection and capacity lease

agreement

Allows NuStar to reactivate a 60-mile pipeline that has been idle

since November 2005

Project connects our existing Pettus, Texas to Corpus Christi

pipeline segment to Koch’s existing pipeline

Initial capacity agreement for 30 thousand barrels per day, could

grow to 50 thousand barrels per day

Project cost $5 to $10 million

Expected in-service date mid-2011 |

Storage Segment Overview

12 |

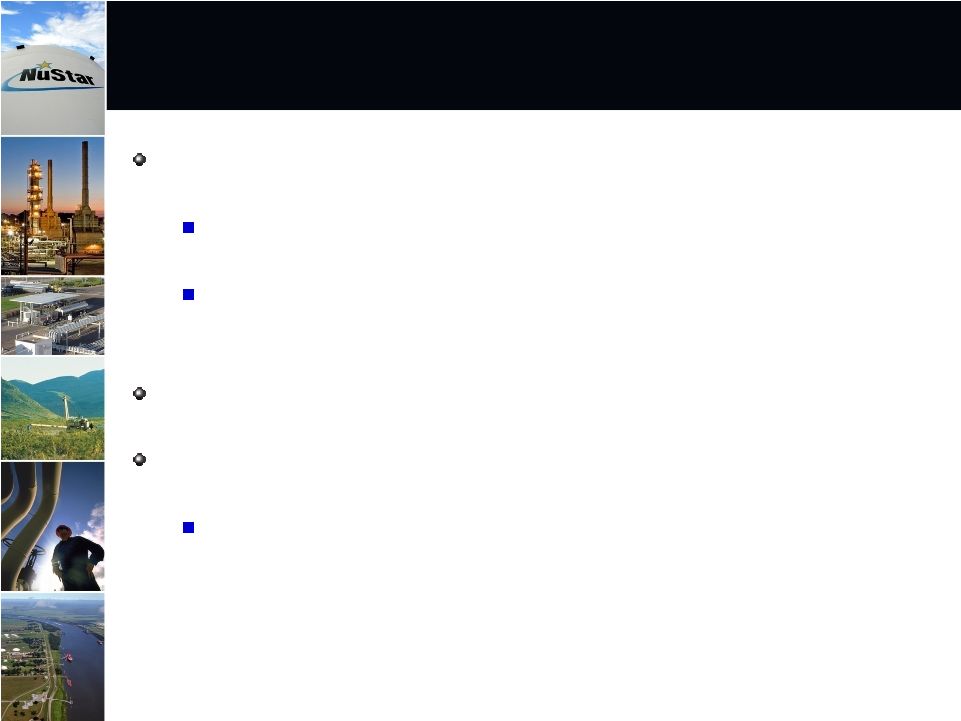

2010

Storage Segment Results Should be Improved over 2009

..2011 EBITDA Expected to be Higher than

2010 due to Benefits from Internal Growth Program

13

Storage Segment EBITDA

(in Millions)

2010 Summary

EBITDA should be $14-$18 million higher than 2009.

Storage tank renewals and escalations increased revenues significantly during the

year. Two

acquisitions

should

be

closed

during

the

year.

(Mobile,

AL.

and

Mersin,

Turkey)

St. Eustatius terminal reconfiguration project and Texas City Strategic Ike

project should be completed in Dec. 2010.

2011 Outlook

Demand for storage should remain strong

Internal growth projects should increase EBITDA by $30 to $40 million

St. James storage expansion project to be completed in August 2011 through January

2012. Full year of EBITDA from two acquisitions, St. Eustatius and

Texas City 2010 projects. 2006

2007

2008

2009

$162

$177

$208

$242 |

Plan

to expand our St. James, Louisiana terminal in two phases

Phase 1 –

Third-Party Crude Oil Storage

Construct 3.1 million barrels of crude oil storage

Projected

CAPEX

of

$110

to

$130

million,

with

projected

average

annual

EBITDA of $15 to $25 million

Expected in-service August 2011 through January 2012

Phase 2 –

Third-Party Crude Oil Storage

Project in early planning stages

Should be similar in size to Phase 1 project

Could grow in size based on customer demand

Expected in-service in 2013

14 |

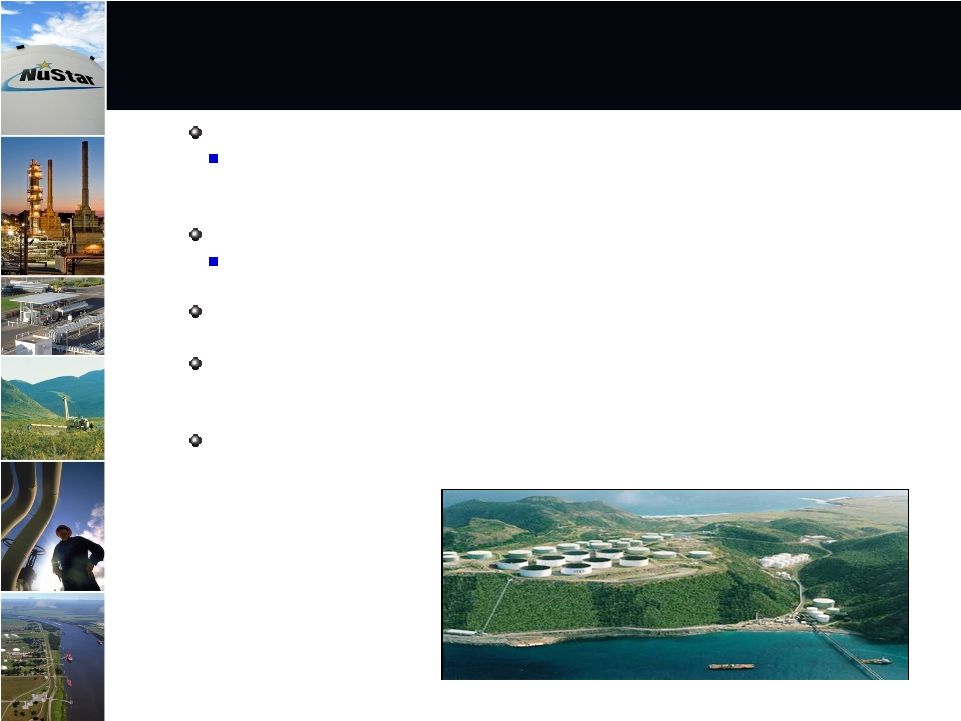

Plan

to convert existing tanks and construct new tanks for distillate service at

our St. Eustatius terminal

Conversion Project

Convert 600,000 barrels of storage from fuel oil to distillate service

to capture higher storage fees

Expansion Project

Construct 900,000 barrels of new storage for distillate service

Interested customers include several national oil companies

Combined conversion and expansion projected CAPEX of $40 to $50

million, with projected average annual EBITDA of $5 to $10 million

Expected in-service by February 2012 (Conversion Project) and

September 2012 (Expansion Project)

15 |

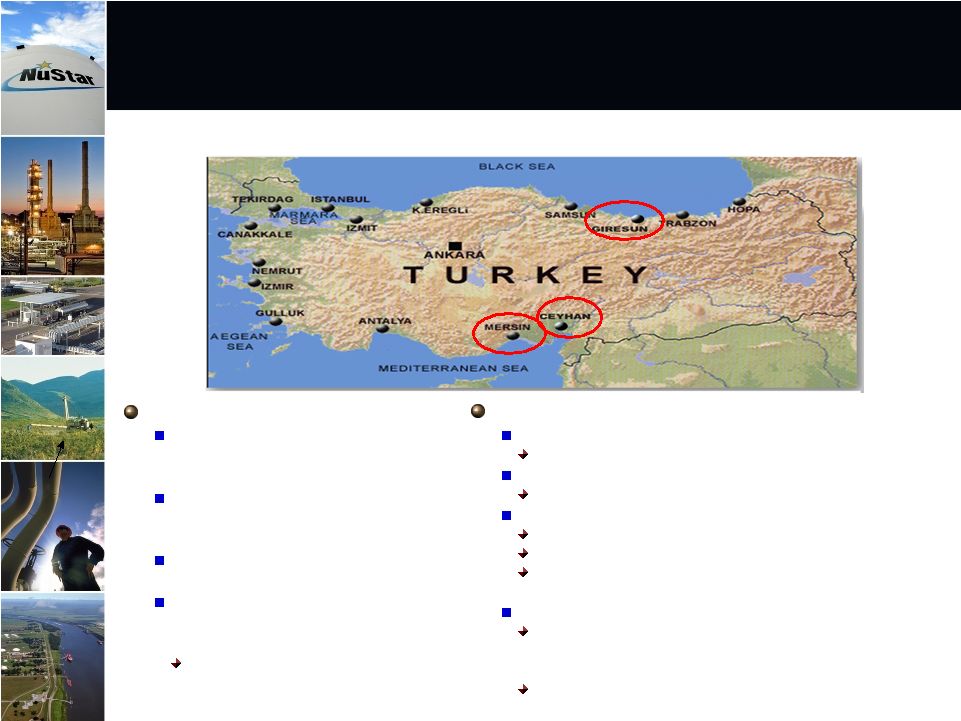

Joint Venture (JV) Overview

NuStar entered into a $50-$60 million

JV agreement with S-Oil and Aves

Oil, two Turkish companies

The JV should own 100% of two

terminals in Mersin and land in

Giresun and Ceyhan

NuStar should own 75% of the JV

and operate the terminals

Both terminals connect via pipeline

to an offshore platform (SAVKA) 5

km off the Turkish coastline

The JV should own 67% of SAVKA

Upon Projected December Closing, Acquired Assets

in Turkey Provide Platform for Internal Growth

Growth Opportunities

Expansion project under development at Mersin

Expands existing storage by about 70 percent

Potential to tie into NATO Pipeline

Provides access to markets for military fuels

New terminal at Giresun

37-acre site with access to Black Sea ports

200,000 barrel fuel oil terminal under development

Second phase build-out to 1.9 million barrels under

evaluation

New terminal at Ceyhan

Ceyhan is the destination for pipelines delivering

crude from northern Iraq and the Caspian area to

the Mediterranean

173 acre property is well-suited for building up to

6.3 million barrels of storage and marine jetty

16 |

Asphalt & Fuels Marketing

Segment Overview

17 |

$3.78

$8.75

$6.37

Improved Earnings in Bunkering, Heavy Fuels, Product and Crude Trading

Operations

Should

cause

Segment

Results

to

be

higher

in

2010…

Segment Should See Slightly Improved Results in 2011

Asphalt & Fuels Marketing

U.S. East Coast Product Margin ($ per barrel)

18

2009

Actual

2008

Actual

2000-2007

Average

2010 Summary

Asphalt results expected to be comparable to 2009.

Due to weak demand in the residential and commercial real estate markets,

private sector industry asphalt demand was down substantially in 2010

Higher refinery margins increased refinery utilization rates higher than expected,

causing VTB and asphalt supply to increase during the year.

During the 3

quarter, pipeline disruptions of Canadian crude reduced heavy crude runs in

the Northeast reducing asphalt supply.

Fuels Marketing portion of segment will be $25 to $35 million higher than

2009. Increased

Bunker

Marketing

earnings

at

St.

Eustatius

as

well

as

higher

sales

volumes

and

increased

margins

at

our Texas City facility contributed to this increase in earnings.

Increased Fuel Oil Trading business at Texas City, also expected to contribute to

year over year increase. 2011 Outlook

Tighter

Asphalt

supply

in

the

last

half

of

2011,

due

to

Conoco

Wood

River coker

coming

on-line,

should

cause

asphalt

operations EBITDA to be improved.

Other operations in this segment should realize comparable results to 2010.

2006

2007

2008

2009

$27

$22

$37

$10

$90

$70

Asphalt

Fuels Marketing

$127

$80

EBITDA (in Millions)

rd |

19

Working to Diversify our Crude Slate from Dependence on

Venezuelan crudes

Current PDV contract ends in the first quarter of 2015

Recently entered into a 10 thousand barrel per day contract to

purchase offshore Brazilian Peregrino crude oil from Statoil.

3-year contract becomes effective late 2011 or early 2012.

Mid-Continent and Gulf Coast Asphalt Marketing dependent on

purchases of finished asphalt and asphalt component blending

Strategy is to negotiate asphalt off-take agreement with regional

suppliers to reduce supply cost and assure availability

Supply Initiatives for Asphalt Operations:

Address Crude Availability/Price and Asphalt Supply Cost

|

Financial Overview

20 |

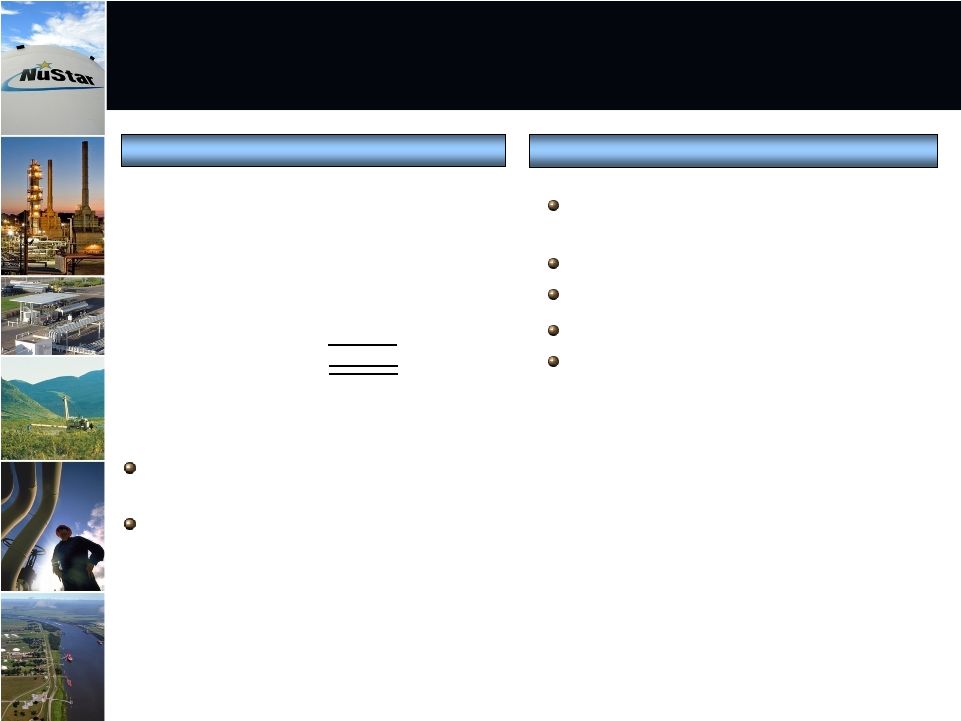

21

9/30/10 Revolver Availability

NuStar

Revolver Availability has increased due to

Equity Issuances and Senior Note Issuance –

Credit Ratings and Metrics have Improved as a Result

Total Bank Credit

$1,210

Less:

Borrowings

(138)

Letters of Credit

Go Zone Financing

(157)

Other

(10)

Revolver Availability

$905

Standard & Poor’s: BBB-

(Stable

Outlook)

Moody’s: Baa3 (Stable Outlook)

Fitch: BBB-

(Stable Outlook)

Debt/EBITDA (9/30/10): 4.6x

Debt/Capitalization (9/30/10): 42.5%

Credit Ratings/Metrics

(Dollars in Millions)

5.0x Revolver Debt/EBITDA covenant limits true Revolver availability to

~$200 million at 9/30/10

All

three

Rating

Agencies

upgraded

NuStar

to

Stable

Outlook

from

Negative Outlook during 2010 |

$1.2 billion Credit

Facility $138

NuStar

Logistics Notes (4.80%)

452

NuStar

Logistics Notes (7.65%)

349

NuStar

Logistics Notes (6.875%)

104

NuStar

Logistics Notes (6.05%)

239

NuStar

Pipeline Notes(5.875%)

256

NuStar

Pipeline Notes (7.75%)

261

Other Debt

192

Total Debt

$1,991

(Dollars in Millions)

No Significant Debt Maturities Until 2012

2010

$0.8

2011

$0.8

2012

$536*

2013

$496

2014

$0

Thereafter

$957

* Primarily includes maturity of $138 million revolver

balance and $366 million of senior notes

9/30/10 Debt Structure

9/30/10 Debt Structure Maturities

22

No significant debt maturities until 2012 at which time the revolver and some

senior notes become due

New Credit Revolver terms and pricing seem to be improving as economy

improves

Current plan is to hold off closing on a new Revolver until 2012

Debt

structure

approximately

50%

fixed

rate

–

50%

variable

rate |

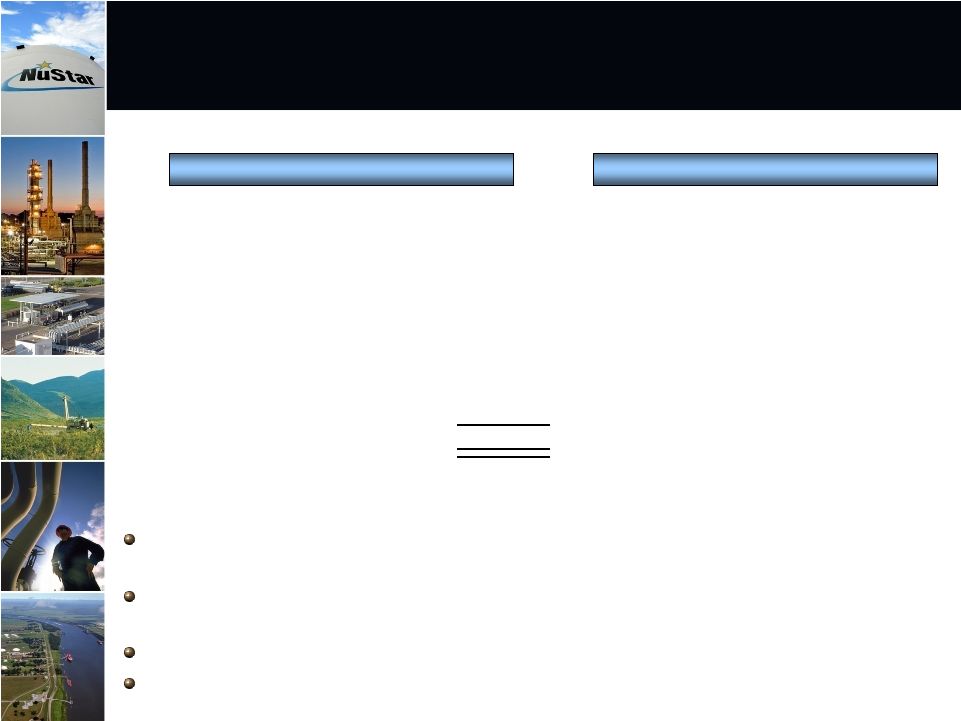

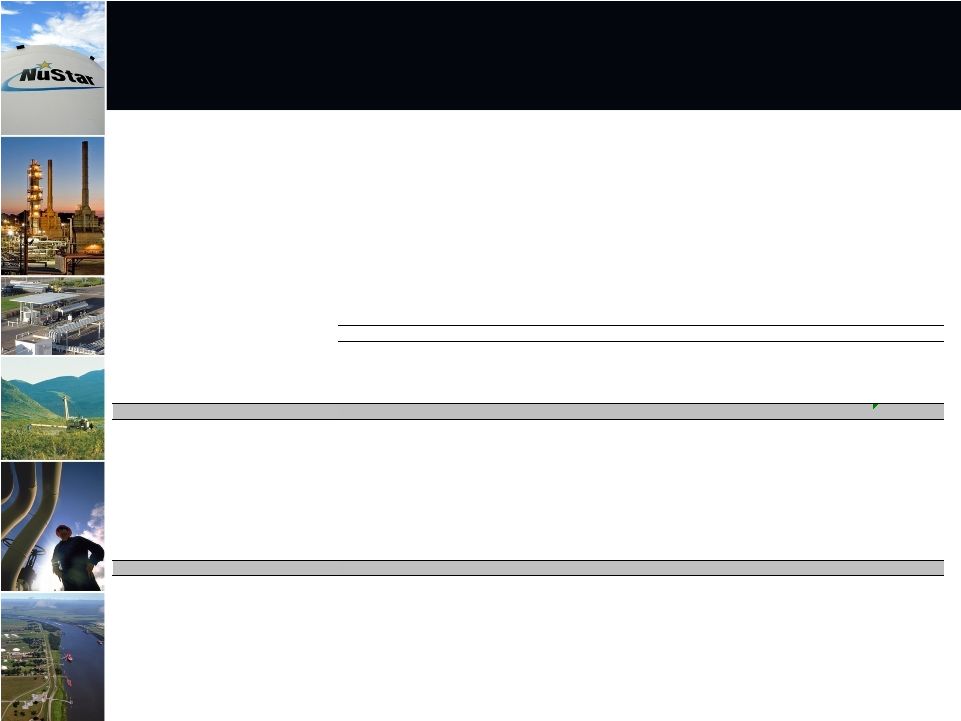

$11

$20

$13

$8

$128

$107

$153

$218

$3

$14

$20

$19

$36

$80

2008 Actual

2009 Actual

2010 Forecast

2011 Forecast

Corporate

Asphalt & Fuels Marketing

Storage

Transportation

Majority of 2011 Internal Growth Capital

Will to be spent in the Storage Segment

23

(

Dollars in Millions)

Annual Internal Growth Spending By Business Segment

$146

$222

$325

$164

$23

$4 |

24

All Three Segments see EBITDA growth in

2010…. Total NuStar

EBITDA should be higher in 2011

EBITDA Guidance Summary

Transportation

up

$5

to

$10

million

in

2010.

Down

slightly

in

2011.

Storage up $14 to $18 million in 2010. Internal growth projects should

add $30 to $40 million to 2011 EBITDA.

Asphalt & Fuels Marketing

Asphalt Refining & Marketing operations for 2010 comparable to

2009. 2011 results should be slightly higher than 2010.

Fuels Marketing 2010 results should be $25 to $35 million higher

than 2009. 2011 results comparable to 2010.

2010

NuStar

EBITDA

projected

to

be

in

the

$480

to

$500

million

range.

2011 EBITDA higher, mostly driven by storage internal growth

projects. |

25

Large internal growth program continues …

NS distribution increase should be higher in 2011

Capital Spending Summary

Reliability capital spending should be $50 to $55 million in 2010 and 2011

Strategic capital spending should be $215 to $225 million in 2010 and

$320 to $330 million in 2011

NS Distribution Growth for 2011 should be higher than 2010

No plans to issue equity or additional debt in the remainder of 2010 and 2011

Plans could change if NuStar closes on a large acquisition

|

|

27

Appendix |

28

Reconciliation of Non-GAAP Financial Information:

EBITDA and Distributable Cash Flow

The following is a reconciliation of net income to EBITDA and distributable cash flow:

2001

2002

2003

2004

2005

2006

2007

2008

2009

Net income

45,873

$

55,143

$

69,593

$

78,418

$

107,675

$

149,906

$

150,298

$

254,018

$

224,875

$

Plus interest expense, net

3,811

4,880

15,860

20,950

41,388

66,266

76,516

90,818

79,384

Plus income tax expense

-

395

-

-

4,713

5,861

11,448

11,006

10,531

Plus depreciation and amortization expense

13,390

16,440

26,267

33,149

64,895

100,266

114,293

135,709

145,743

EBITDA

63,074

76,858

111,720

132,517

218,671

322,299

352,555

491,551

460,533

Less equity earnings from joint ventures

3,179

3,188

2,416

1,344

2,319

5,882

6,833

8,030

9,615

Less interest expense, net

3,811

4,880

15,860

20,950

41,388

66,266

76,516

90,818

79,384

Less reliability capital expenditures

2,786

3,943

10,353

9,701

23,707

35,803

40,337

55,669

45,163

Less income tax expense

-

-

-

-

4,713

5,861

11,448

11,006

10,531

Plus mark-to-market impact on hedge transactions

-

-

-

-

-

-

3,131

(9,784)

19,970

Plus charges reimbursed by general partner

-

-

-

-

-

575

-

-

-

Plus distributions from joint ventures

2,874

3,590

2,803

1,373

4,657

5,141

544

2,835

9,700

Plus other non-cash items

-

-

-

-

2,672

-

-

-

-

Distributable cash flow

56,172

$

68,437

$

85,894

$

101,895

$

153,873

$

214,203

$

221,096

$

319,079

$

345,510

$

Note: 2005 and 2006 distributable cash flow and EBITDA are from continuing operations.

Year Ended December 31,

NuStar Energy L.P. utilizes two financial measures, EBITDA and distributable cash flow, which are not

defined in United States generally accepted accounting principles (GAAP). Management uses these

financial measures because they are a widely accepted financial indicators used by investors to compare

partnership performance. In addition, management believes that these measures provide investors an

enhanced perspective of the operating performance of the partnership's assets and the cash that

the business is generating. Neither EBITDA nor distributable cash flow are intended to represent cash flows for the

period, nor are they presented as an alternative to net income. They should not be considered in

isolation or as a substitute for a measure of performance prepared in accordance with

GAAP. (Unaudited, Dollars in Thousands) |

29

Reconciliation of Non-GAAP Financial Information:

EBITDA

(Unaudited, Dollars in Thousands)

Projected net income range

Plus projected interest expense range

Plus projected income tax expense range

Plus projected depreciation and

amortization expense range

Projected EBITDA range

December 31, 2010

$ 236,000 -

253,000

77,000 -

78,000

14,000 -

15,000

153,000 -

154,000

$ 480,000 -

500,000

Year Ended

NuStar

Energy L.P. utilizes EBITDA, which is not defined in United States generally

accepted accounting principles. Management uses this financial

measure

because

it

is

a

widely

accepted

financial

indicator

used

by

investors

to

compare

partnership

performance.

In

addition,

management

believes

that this measure provides investors an enhanced perspective of the operating

performance of the partnership's assets and the cash that the business is

generating. EBITDA is not intended to represent cash flows for the period or as an

alternative to net income. EBITDA should not be considered in isolation or

as a substitute for a measure of performance prepared in accordance with United States generally accepted accounting principles. |

Reconciliation of Non-GAAP Financial Information:

Transportation Segment

30

(Unaudited, Dollars in Thousands)

The following is a reconciliation of operating income to EBITDA for the

Transportation Segment: 2006

2007

2008

2009

Operating income

122,714

$

126,508

$

135,086

$

139,869

$

Plus depreciation and amortization expense

47,145

49,946

50,749

50,528

EBITDA

169,859

$

176,454

$

185,835

$

190,397

$

Projected incremental operating income range

$ 5,000 -

9,000

Plus projected incremental depreciation and

amortization expense range

0 -

1,000

Projected incremental adjusted EBITDA range

$ 5,000 -

10,000

Projected incremental operating income range

$ 1,000 -

4,000

Plus projected incremental depreciation and

amortization expense range

0 -

1,000

Projected incremental adjusted EBITDA range

$ 1,000 -

5,000

The

following

is

a

reconciliation

of

projected

incremental

operating

income

to

projected

incremental

adjusted

EBITDA

related

to

our

internal

growth

program for the year ended December 31, 2011 compared to the year ended December

31, 2010: Transportation

Segment

Year Ended December 31,

The following is a reconciliation of projected incremental operating income to

projected incremental adjusted EBITDA for the year ended December 31, 2010:

Transportation

Segment

EBITDA in the following reconciliations relate to our reportable segments or a portion of a

reportable segment. We do not allocate general and administrative expenses to our reportable

segments because those expenses relate primarily to the overall management at the entity level. Therefore,

EBITDA reflected in the following reconciliations excludes any allocation of general and

administrative expenses consistent with our policy for determining segmental operating income,

the most directly comparable GAAP measure. EBITDA should not be considered in isolation or as a substitute for a measure

of performance prepared in accordance with GAAP. |

Reconciliation of Non-GAAP Financial Information:

Storage Segment

31

The following is a reconciliation of operating income to EBITDA for the Storage Segment:

2006

2007

2008

2009

Operating income

108,486

$

114,635

$

141,079

$

171,245

$

Plus depreciation and amortization expense

53,121

62,317

66,706

70,888

EBITDA

161,607

$

176,952

$

207,785

$

242,133

$

Projected incremental operating income range

$ 8,000 - 11,000

Plus projected incremental depreciation and

amortization expense range

6,000 - 7,000

Projected incremental adjusted EBITDA range

$ 14,000 - 18,000

Projected incremental operating income range

$ 26,000 - 33,000

Plus projected incremental depreciation and

amortization expense range

4,000 - 7,000

Projected incremental adjusted EBITDA range

$ 30,000 - 40,000

The

following

is

a

reconciliation

of

projected

incremental

operating

income

to

projected

incremental

adjusted

EBITDA

related

to

our

internal

growth

program for the year ended December 31, 2011 compared to the year ended December 31, 2010:

Storage

Segment

Year Ended December 31,

The following is a reconciliation of projected incremental operating income to projected incremental

adjusted EBITDA for the year ended December 31, 2010: Storage

Segment

(Unaudited, Dollars in Thousands)

EBITDA in the following reconciliations relate to our reportable segments or a portion of a

reportable segment. We do not allocate general and administrative expenses to our reportable

segments because those expenses relate primarily to the overall management at the entity level. Therefore,

EBITDA reflected in the following reconciliations excludes any allocation of general and

administrative expenses consistent with our policy for determining segmental operating income,

the most directly comparable GAAP measure. EBITDA should not be considered in isolation or as a

substitute for a measure of performance prepared in accordance with GAAP.

|

Reconciliation of Non-GAAP Financial Information:

Internal Growth Program

St. James, LA

Terminal

Expansion Phase 1

St. Eustatius

Distillate Project

Projected annual operating income range

$ 11,000 - 20,000

$ 4,000 - 8,000

Plus projected annual depreciation and

amortization expense range

4,000 - 5,000

1,000 - 2,000

Projected annual adjusted EBITDA range

$ 15,000 - 25,000

$ 5,000 - 10,000

The

following

is

a

reconciliation

of

projected

annual

operating

income

to

projected

annual

adjusted

EBITDA

for

certain

projects

in

our

storage

segment

related to our internal growth program:

32

EBITDA in the following reconciliations relate to our reportable segments or a portion of a

reportable segment. We do not allocate general and administrative expenses to our reportable

segments because those expenses relate primarily to the overall management at the entity level. Therefore,

EBITDA reflected in the following reconciliations excludes any allocation of general and

administrative expenses consistent with our policy for determining segmental operating income,

the most directly comparable GAAP measure. EBITDA should not be considered in isolation or as a substitute for a

measure of performance prepared in accordance with GAAP.

(Unaudited, Dollars in Thousands) |

Reconciliation of Non-GAAP Financial Information:

Asphalt & Fuels Marketing Segment

33

The following is a reconciliation of operating income to EBITDA for the asphalt and fuels marketing

segment: 2006

2007

2008

2009

Operating income

26,915

$

21,111

$

112,506

$

60,629

$

Plus depreciation and amortization expense

-

423

14,734

19,463

EBITDA

26,915

$

21,534

$

127,240

$

80,092

$

Fuels Marketing

Operations

Asphalt Operations

Asphalt and Fuels

Marketing Segment

Projected incremental operating income range

$ 25,000 - 35,000

-

$

$ 25,000 - 35,000

Plus projected incremental depreciation and

amortization expense range

-

-

-

Projected incremental adjusted EBITDA range

$ 25,000 - 35,000

-

$

$ 25,000 - 35,000

The

following

is

a

reconciliation

of

projected

incremental

operating

income

to

projected

incremental

adjusted

EBITDA

for

the

asphalt

and

fuels

marketing

segment:

Year Ended December 31,

EBITDA in the following reconciliations relate to our reportable segments or a portion of a

reportable segment. We do not allocate general and administrative expenses to our reportable

segments because those expenses relate primarily to the overall management at the entity level. Therefore, EBITDA reflected in

the following reconciliations excludes any allocation of general and administrative expenses

consistent with our policy for determining segmental operating income, the most directly

comparable GAAP measure. EBITDA should not be considered in isolation or as a substitute for a measure of performance

prepared in accordance with GAAP.

(Unaudited, Dollars in Thousands) |